The Smart car brand has already undergone several reincarnations. But never before has the small car from Mercedes been revamped so radically: The new Smart #1, which was created under the auspices of Chinese car-magnate Geely and major Daimler shareholder Li Shufu, has little in common with the original model. The all-electric mini SUV is bigger, heavier and more digital.

What is truly special, however, is that the car does not want to be either a Chinese or a European product. Mercedes provides the brand, the design and the distribution, the rest comes from Geely. It is the first time that a European manufacturer produces in China for the European market and, in return, hands over considerable parts of research, development and production, writes Christian Domke-Seidel. A concept that will set a precedent?

China’s new rules for regulating algorithms could also set a precedent. The People’s Republic is the first country to allow its citizens to disable certain algorithms in their apps on their own initiative. Big tech platforms like Tencent and Facebook have built their business model on recommendation algorithms that keep users hooked with customized offers. Officials say that this reform of the manipulative system should bring more transparency and self-determination.

But freedom and self-determination remain tightly constrained on China’s Internet, writes Frank Sieren. After all, the regulation also allows Chinese authorities to restrict content recommendations that “influence public opinion” or “mobilize” people. As long as the Party is in charge, the net will remain patriotic.

Mercedes has often turned its Smart brand inside out. Even before its initial launch, the company scrapped plans to make it an electric car. At the time, this drove away ex-partner Nicolas Hayek, the inventor of the Swatch watch brand. Then followed a rescue attempt through cooperation with Nissan. And even the revival of the Smart car with the French did not lead to success. Subsequently, Mercedes sold 50 percent of the brand to Geely. And no wonder: Geely’s founder Li Shufu is the second-largest Mercedes shareholder.

With this strategy change, however, Mercedes not only turns the brand upside down, it also transforms certainties of the global car market in the process. For the first time, a European manufacturer produces in China for the European market, outsources considerable parts of R&D and production, and then imports the vehicles to Europe. The fruit of this liaison is the Smart #1, an electric SUV that clearly shows that Mercedes is serious about rebooting the vehicle.

Apart from the brand name, everything has changed. From a visual perspective alone, the car now looks more like a Mini Countryman. And on the technical side, too, the vehicle is completely unrecognizable. And Mercedes has practically revolutionized even the strategy behind the vehicle this time around. A feat that would have been almost unthinkable without a Chinese partner. The two companies have invested €355 million each in the joint project (China.Table reported).

The Smart #1 is 4.27 meters long (almost two meters longer than the original namesake), making it a compact car on a par with the VW Golf. The electric motor has 272 hp – the first Smart from 1998 had between 41 and 75 hp. The curb weight grew to 1,850 kilograms. Just 20 years ago, it was just 750 kilograms. Clearly, Mercedes and Geely have left no stone unturned.

And not behind the scenes, either. Mercedes provides the brand, design and distribution, the rest comes from Geely. A first. And a pointer to the future. Until recently, European manufacturers were required to enter into joint ventures. The Communist Party wanted to ensure that know-how and value creation remained in the country. This protected the domestic auto industry. The result quickly became apparent. Cars from NIO or Aiways that are available in Europe play in the same league as the European competition when it comes to the quality of their cars (China.Table reported).

What’s more: Massive EV subsidies and a digitally savvy clientele turned the Chinese car market upside down. And at a pace that was too fast for many European and German manufacturers (China.Table reported). Electric start-ups from the People’s Republic knew domestic customers better. While European manufacturers simply swapped combustion engines with electric motors and installed large touchscreens, Chinese manufacturers developed smart, networked, and thoroughly digitized sure-fire hits.

European manufacturers simply need the help of Chinese companies to put modern EVs on the road. The Smart #1 shares the technical platform with other Geely models. So on the one hand, the model benefits from economies of scale, but it is also no longer manufactured in Europe. Mercedes sold its plant in Hambach, Germany to Ineos Automotive, the automotive offshoot of a British chemicals group, a long time ago. Here, the latter wants to manufacture its off-road vehicle, the Grenadier – in addition to contract manufacturing for Mercedes.

The strategy behind Smart is based on two pillars. First, an entire product family is to be created, and second, Mercedes wants to focus on Europe and China – the two largest EV markets. The first goal is to nearly quadruple sales from currently 39,000 cars per year to 150,000. Auto analyst Arndt Ellinghorst of Evercore ISI estimates that Smart currently generates an annual loss of €500 million to €700 million for its parent company. That is supposed to change.

Mercedes and Geely will pursue the “dual home” strategy with the Smart. “We define this product as neither Chinese nor European. Like the Smart brand itself, the new Smart #1 is a global product,” a company spokesperson told Table.Media. Without, however, offering it globally.

Since Chinese manufacturers have long been met with prejudice in Europe, but especially in Germany, on account of supposedly poor quality, Smart wants to do everything right, especially in this regard. “Smart partners with trusted, top-tier international suppliers, all of whom are required to implement a quality management system in accordance with IATF16949 and are responsible for meeting the zero-defect target,” the spokesperson continues. Continental, Magna, Hella, Qualcomm and Bosch are among those involved.

The second aspect is a diversification of the model range. “Smart has evolved from a one-car brand in the micro-segment to one with a multi-product portfolio,” explains the company spokesperson. So far, this statement is false. There is only one SUV to date. But at the presentation of the Smart #1, Dirk Adelmann, CEO of Smart Europa GmbH, already proclaimed, “We’re planning other products relatively concretely.” Geely’s platform would make it possible to expand the Smart in an uncomplicated way.

The Smart #1 also takes a big leap on the technical level. For example, the car can be opened, closed and launched via an app. This means that owners of the Smart #1 could even run their own little car-sharing service if they wanted to. Buttons and switches in the interior are scarce. A huge monitor dominates the center console and is strongly reminiscent of Tesla models, and certainly not by accident. A self-learning AI takes care of voice commands and is displayed via an avatar. The 66 kWh battery can be charged with up to 22 kW at charging stations. The standard for electric cars is 11 kW.

So Geely is also helping Mercedes to become more digital and no longer consider EVs to be merely converted gasoline-powered cars. This is precisely where German manufacturers have been failing in the eyes of Chinese customers (China.Table reported). The car is scheduled to launch on the German market in the second half of 2022 and will then be sold via the Mercedes sales network. In the People’s Republic, the Smart #1 costs between €27,000 and €33,000.

China has passed a law that will allow users to disable recommendations by algorithms in apps and online platforms. This is a global novelty. Tech companies are now required to notify users “in a conspicuous way” when algorithms are used to recommend content to users, the law states. Article 17 explains that users will be “allowed to opt-out of being targeted with algorithmic recommendations”.

The law, titled “Internet Information Service Algorithmic Recommendation Management,” was drafted by China’s Cyberspace Administration (CAC) and four other government bodies. The algorithm rules were loosely based on the EU’s AI law. “This policy marks the moment that China’s tech regulation is not simply keeping pace with data regulations in the European Union but has gone beyond them,” said Kendra Schaefer, head of tech policy research at Beijing-based consultancy Trivium China.

Scientists from Tsinghua University also helped draft it. According to the Cyberspace Administration, the law aims to “protect the legitimate rights and interests of citizens and promote the healthy development of Internet information services.” But it also gives the state new powers to meddle in citizens’ online activities.

According to the authority, the 30-point text is directed not least against algorithms that “promote addictive behavior or excessive consumption”. Particularly noteworthy is the Article 15 requirement for operators to disclose the “basic principles, intentions and modes of operation” of the recommendation algorithm. Algorithms that analyze user behavior, and create individual user-profiles and recommend web content, are one of the most important cornerstones for the success of big tech companies. The more effective the algorithms, the greater the likelihood that users will spend more time on the respective platform and return.

Services like TikTok and YouTube now mainly use algorithms to keep their users engaged. In China, digital groups such as Douyin operator ByteDance – Douyin is the Chinese version of TikTok – or WeChat operator Tencent are particularly hit by the new law. In addition to their core social media business, both companies also own algorithm-based news apps: Jinri Toutiao and Tencent News. However, e-commerce companies such as Alibaba, car-hailing provider DiDi Chuxing, and food delivery companies such as Meituan or Ele.me are also affected.

And it is also increasingly affecting operators of self-driving cars, which are becoming more and more rooted in everyday life in China. With autonomous driving, the trend is moving more and more toward checking the health data of car passengers, for example. Data that customers definitely want to control. In the end, autonomous driving is nothing more than a moving information platform that must constantly coordinate with other information platforms. Recommendation algorithms can play a role here as well. For example, an autonomous cab has the option of driving past the passenger’s favorite restaurant if two routes are the same length. The vehicle can ask the passenger if he or she would like to stop briefly to pick up his or her favorite food.

“Algorithms must be regulated,” says Zuo Xiaodong, Vice President of the China Information Security Research Institute in an article published by CAC. “Some platforms might say that algorithms are their intellectual properties and business secrets, so they cannot make them available to the public,” Zuo was quoted as saying. “This kind of language has no solid basis now, and algorithms need to be transparent.”

Greater control of algorithms should also help ensure that on-demand digital contract workers such as delivery drivers on China’s roads are no longer put under time pressure by algorithms. In the past, it was common that delivery times were so unrealistic that workers were forced to break traffic rules. The new rules could help make delivery drivers’ work lives more bearable. “Service providers need to put a mechanism in place to ensure that assignments, payments, work hours, rewards and punishments are allocated appropriately,” according to a CAC post.

The legislation in China could also have an impact on Western tech laws and radically change the tech landscape. Corporations like Facebook would be forced to change their business model if the model catches on. So far, this is not the case in Europe or the US. The state does not intervene in companies’ algorithms.

In fact, this is why users’ own choices are becoming less and less important on many platforms today. The computer thinks it knows us better than we do. The result is that we find it even harder than before to see beyond the AI-generated horizon and become stuck in our filter bubbles more than ever.

China’s Internet regulators cite the spread of biased “fake news” as a reason for the implementation of the new law. The law empowers Chinese authorities to crack down on content recommendations that have the potential to “influence public opinion” or “mobilize” people. In other words, algorithms are supposed to actively promote “positive” content that follows the Party line. This includes patriotic, family-friendly, and in line with the CCP’s “socialist core values.” For example, depictions of violence, sexual promiscuity, “obsessive” worship of celebrities or “political activism” are undesirable.

A new Covid Omicron subvariant has been detected for the first time in China. The variant, named BA.2.12.1, was recently detected and is considered to be more immune-resistant and transmissible than other Omicron variants. According to authorities, the subvariant was first found in a 27-year-old Chinese man who entered the country from Kenya, as reported by the Chinese business portal Caixin.

According to the report, the subvariant has been detected in at least 23 countries, including the United States and Hong Kong. The World Health Organization (WHO) has urged countries around the globe to closely monitor the spread of BA.2.12.1. The variant reportedly shows stronger immune resilience, even in boosted individuals. Its transmission is a good 25 percent faster, studies show.

Meanwhile, Beijing authorities have widened the regional lockdown. In seven connected neighborhoods in the Fengtai district, citizens are now no longer allowed to leave their homes. The cause is a Covid cluster that traces back to a wholesale food market. Although the number of new Covid infections is not rising sharply in the Chinese capital, new infection clusters appear in different parts of the city. nib

China’s authorities have issued a warning of severe flooding during the upcoming wet season. The north and south of the People’s Republic could be hit as hard as last year, reports the National Climate Center. Last year, some regions experienced torrential rains and flooding of entire cities. Hundreds of people died. Larger areas of arable land were flooded (China.Table reported). According to China’s National Climate Institute, this year’s floods will be “relatively worse” and “more extreme” than the historical average, Bloomberg reports.

Stronger and more frequent extreme weather events are considered a consequence of climate change. The warmer atmosphere holds more humidity, so heavy rains, for example, occur more frequently. According to the report, the Ministry of Housing and Urban-Rural Development and the National Development and Reform Commission warned in April that cities must remain vigilant for increased extreme weather events caused by climate change.

China faces long-term economic costs in the trillions as a result of climate change. In recent years, the costs have already amounted to $50 billion a year. If the climate crisis intensifies, the costs could add up to $190 trillion by 2100, according to a study by Tsinghua University (China.Table reported). These include:

China’s megacities also rank among the most threatened cities in the world by rising sea levels. In Shanghai, a temperature rise of two degrees would put a good 40 percent of the population at risk. nib

China’s Jiangsu Province will provide financial support to companies regarding maternity leave. Companies will receive subsidies for paying insurance premiums for female employees during their second and third maternity leaves, the South China Morning Post reports. According to the report, authorities will reimburse 50 to 80 percent of social security payments for women who have a second and third child, respectively. The reimbursements will be paid for six months. Jiangsu is the first province to introduce such a measure.

China faces a declining birth rate and an aging society. Experts say that China’s population could peak as early as this year (China.Table reported). Even after the abolition of the one-child and the two-child policy later, birth rates have not increased. Since then, authorities in the People’s Republic have been trying to convince families to have children by offering financial incentives. In various regions, tax cuts, direct payments and subsidies for the purchase of real estate have been introduced. nib

A mass shooting at a church in the US state of California that left one person dead and five others injured has raised questions about a possible political motivation of the alleged perpetrator. According to the local sheriff, the attack was a “politically motivated” hate crime against Taiwanese. This was reportedly revealed by handwritten notes found on the person of a 68-year-old suspect. He is said to have been “upset about political tensions between China and Taiwan” and attacked the church congregation last weekend.

The suspect, identified by US authorities as David Chou, who left on Saturday from his Las Vegas home for the town of Laguna Woods about 70 kilometers southeast of Los Angeles, allegedly carried two legally purchased firearms and four Molotov cocktail-type firebombs. Before opening fire, he allegedly used chains and nails to block the doors of the church, where the Irvine Taiwanese Presbyterian Church was holding a service. Chou was put on trial on Tuesday.

The case, like Chou’s background, is the subject of controversy in the US-Chinese community. It was initially believed that the perpetrator was a Chinese immigrant. Now, however, it seems clear that Chou is a US citizen who was born in Taiwan in 1953 after his family was forced to move from the Mainland following the Chinese Civil War.

Taiwan’s President Tsai Ing-wen issued a statement condemning “all forms of violence” and expressed her condolences to the victims and their families. A deputy of her ruling party had previously stated that Chinese propaganda could have been a decisive factor in the rampage. There is currently no proof of this. fpe

After two months of speculation, evidence is mounting that China Eastern Airlines flight MU5735 was intentionally crashed. The crash was the result of deliberate action by the pilot, the Wall Street Journal reported on Tuesday, citing US crash investigators. The US National Transportation Safety Board (NTSB) is currently working with China’s Civil Aviation Administration (CAAC) to determine the cause of the March 21 crash (China.Table reported).

The aircraft had not transmitted any error messages before it suddenly went into a vertical dive and hit a mountainous area en route from Kunming to Guangzhou. No one survived. Shortly after the tragedy, rumors of mental instability of one of the pilots made the rounds. Until now, however, there was no circumstantial evidence to suggest the crash was deliberate. Investigators have now leaked that the plane turned its nose steeply downward in response to control inputs from the cockpit. However, it is also possible that someone forcibly gained access to the cockpit and subdued the pilots, according to the media report. fin

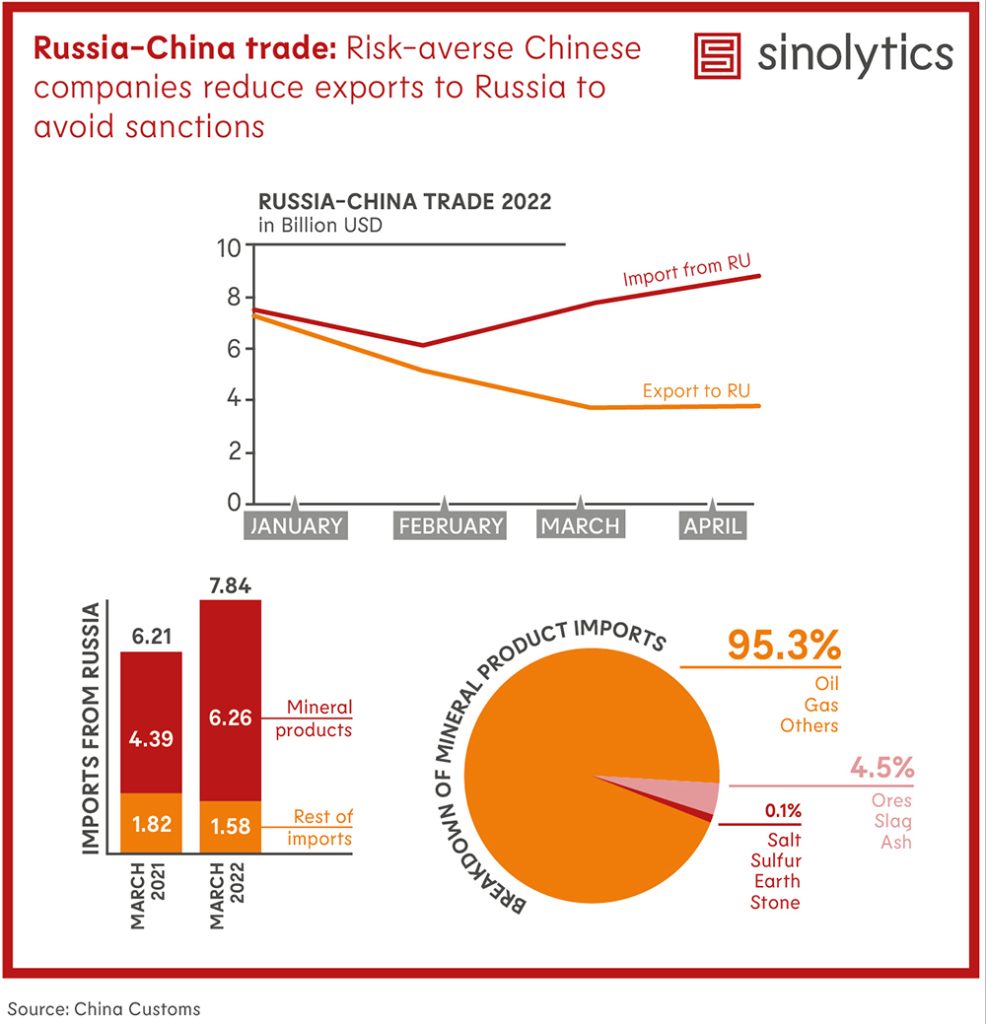

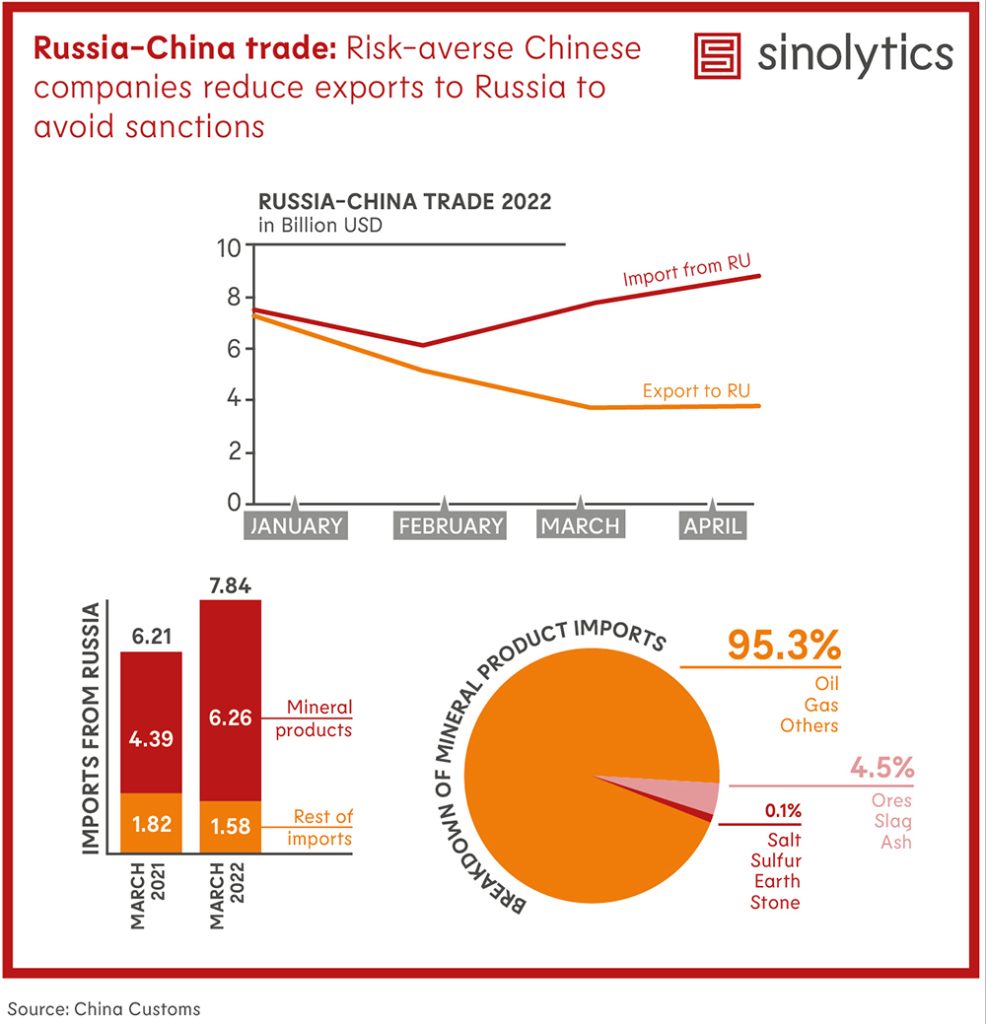

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

The semiconductor value chain is incredibly complex and global in scope: not only is the production of semiconductors one of the most R&D-intensive activities, but it also spans several specialised tasks performed by different companies around the world. The largest semiconductor vendors are predominantly based in the United States, Korea, Europe, and Japan (e.g. Intel, Samsung, Infineon, and Kioxia), but many outsource capital-intensive manufacturing and assembly & testing activities to specialised firms located in Chinese Taipei, China, and Singapore. Some, like TSMC, have gone on to become technological leaders in providing the advanced chip-manufacturing services on which so much of the world’s smartphones and computers hinge upon. Companies like TSMC depend in turn on key suppliers of specialised, precision equipment such as Dutch company ASML, which produces the lithography machines that semiconductor foundries rely on.

Because chip production is innovation-driven, capital-intensive, and strategic, government involvement has long been a feature in the semiconductor industry. By the early 1960s, NASA had become the major customer for integrated circuits, ensuring robust demand for US producers. Around the same time, Chinese authorities established Wuxi Factory No. 742 as the state training ground for semiconductor engineers. In 1967, France created the CEA-Leti, a public research centre specialised in microelectronics, followed, in the 1970s and 1980s, by authorities in Japan, Korea, and Chinese Taipei who all supported semiconductor research and development (R&D) through public institutes such as ETRI and ITRI. Likewise, the United States established the Very High Speed Integrated Circuit programme in 1980 and the Sematech research and development consortium in 1987.

A recent OECD report on semiconductors found that between 2014 and 2018, 21 of the largest semiconductor firms worldwide received more than USD 50 billion in government support. Of this amount, two-thirds took the form of government grants and tax concessions, including more than USD 15 billion in support of R&D spending and USD 20 billion in the form of concessionary income-tax rates and investment incentives. Another third of the support took the form of below-market finance, i.e. loans and equity obtained by firms at below-market conditions.

While all sampled firms enjoyed R&D support and some amount of tax concessions, below-market finance appears to be largely a Chinese phenomenon. This is especially the case following China’s decision to establish in 2014 a national integrated circuit investment fund and sister funds at provincial and municipal levels. These funds have since injected fresh equity into a number of important Chinese producers of semiconductors, including SMIC, Hua Hong, and Tsinghua Unigroup and their subsidiaries. There notably appears to be a direct connection between equity injections by China’s government funds and the construction of new semiconductor fabs in the country.

One crucial issue from a policy standpoint relates to the lack of transparency on government support and below-market finance more specifically. Many governments fail to disclose the subsidies they provide, but this problem is exacerbated in the case of below-market finance as demonstrating the existence of such support requires comparison with a market benchmark, detailed methodologies for which have yet to be established or agreed. Information is also sometimes lacking on the ownership structure of firms, which can hide the true extent of government ownership of industrial producers.

Some forms of subsidies may be necessary, and this is true in semiconductors as in other sectors. Yet even R&D subsidies can distort markets if poorly designed and implemented. Analysis by Boeing and Peters shows, for example, that the R&D subsidies that China provided between 2001-11 were at times misused, thus undermining the effectiveness of R&D policies and implying that some amount of R&D support may have ‘leaked’ to other purposes such as production capacity expansion. While there are good economic arguments for supporting R&D, care should be taken to design R&D measures in a manner that improves societal benefits (i.e. innovation efforts that can increase productivity and well-being) while containing costs (i.e. competitive distortions).

While government equity injections in the semiconductor value chain have implications for trade and global competition, what they mean for trade rules, and subsidy disciplines more specifically, warrants closer investigation. By its very nature, below-market equity is probably among the hardest forms of support to identify and quantify. Enhanced transparency is therefore necessary and should focus, in particular, on:

At a broader level, the OECD’s work also raises questions about the role and effectiveness of government support in R&D-intensive industries characterised by short product cycles. This discussion has a particular resonance for China, which is trailing in semiconductor foundry technology despite relatively large government support, and which has long had policies that explicitly seek to support the development of the domestic integrated-circuit industry.

Jehan Sauvage currently serves as a Policy Analyst in the Trade and Agriculture Directorate of the OECD, where he specialises in questions related to market distortions and government subsidies in industrial sectors.

Christian Steidl is a Policy Analyst at the OECD, working on the analysis of various forms of government support for industrial companies.

This contribution is prepared in the context of the event series “Global China Conversations” of the Kiel Institute for the World Economy (IfW). On Thursday Dr. Sophia Helmrich (BDI), Jehan Sauvage (OECD), and Christian Steidl (OECD) will discuss the topic: “The Race for Technology Sovereignty: The Case of Government Support in the Semiconductor Industry”. China.Table is media partner of this event series.

The authors are writing in a strictly personal capacity. The views expressed are theirs only, and do not reflect in any way those of the OECD Secretariat or the member countries of the OECD.

Marie von Mallinckrodt will become ARD correspondent in Beijing on August 1. The 44-year-old succeeds Daniel Satra. From 2014 to 2020, von Mallinckrodt was a correspondent in the ARD capital studio.

Christoph Braun has been appointed Head of Innovation & Development China at German automotive supplier Carcoustics this month. Previously, Braun worked for the Leverkusen-based company as Global Head of Material Development & Material Lab. He will continue to work from Shanghai.

This pizza from the fast-food chain Pizza Hut currently turns heads in Taiwan: It is topped with breaded popcorn chicken, squid rings, tempura – and Oreo cookies with Parmesan. The unusual combination has been available for a good week. First food reviews are even surprisingly fond of the cookie-cheese crust.

The Smart car brand has already undergone several reincarnations. But never before has the small car from Mercedes been revamped so radically: The new Smart #1, which was created under the auspices of Chinese car-magnate Geely and major Daimler shareholder Li Shufu, has little in common with the original model. The all-electric mini SUV is bigger, heavier and more digital.

What is truly special, however, is that the car does not want to be either a Chinese or a European product. Mercedes provides the brand, the design and the distribution, the rest comes from Geely. It is the first time that a European manufacturer produces in China for the European market and, in return, hands over considerable parts of research, development and production, writes Christian Domke-Seidel. A concept that will set a precedent?

China’s new rules for regulating algorithms could also set a precedent. The People’s Republic is the first country to allow its citizens to disable certain algorithms in their apps on their own initiative. Big tech platforms like Tencent and Facebook have built their business model on recommendation algorithms that keep users hooked with customized offers. Officials say that this reform of the manipulative system should bring more transparency and self-determination.

But freedom and self-determination remain tightly constrained on China’s Internet, writes Frank Sieren. After all, the regulation also allows Chinese authorities to restrict content recommendations that “influence public opinion” or “mobilize” people. As long as the Party is in charge, the net will remain patriotic.

Mercedes has often turned its Smart brand inside out. Even before its initial launch, the company scrapped plans to make it an electric car. At the time, this drove away ex-partner Nicolas Hayek, the inventor of the Swatch watch brand. Then followed a rescue attempt through cooperation with Nissan. And even the revival of the Smart car with the French did not lead to success. Subsequently, Mercedes sold 50 percent of the brand to Geely. And no wonder: Geely’s founder Li Shufu is the second-largest Mercedes shareholder.

With this strategy change, however, Mercedes not only turns the brand upside down, it also transforms certainties of the global car market in the process. For the first time, a European manufacturer produces in China for the European market, outsources considerable parts of R&D and production, and then imports the vehicles to Europe. The fruit of this liaison is the Smart #1, an electric SUV that clearly shows that Mercedes is serious about rebooting the vehicle.

Apart from the brand name, everything has changed. From a visual perspective alone, the car now looks more like a Mini Countryman. And on the technical side, too, the vehicle is completely unrecognizable. And Mercedes has practically revolutionized even the strategy behind the vehicle this time around. A feat that would have been almost unthinkable without a Chinese partner. The two companies have invested €355 million each in the joint project (China.Table reported).

The Smart #1 is 4.27 meters long (almost two meters longer than the original namesake), making it a compact car on a par with the VW Golf. The electric motor has 272 hp – the first Smart from 1998 had between 41 and 75 hp. The curb weight grew to 1,850 kilograms. Just 20 years ago, it was just 750 kilograms. Clearly, Mercedes and Geely have left no stone unturned.

And not behind the scenes, either. Mercedes provides the brand, design and distribution, the rest comes from Geely. A first. And a pointer to the future. Until recently, European manufacturers were required to enter into joint ventures. The Communist Party wanted to ensure that know-how and value creation remained in the country. This protected the domestic auto industry. The result quickly became apparent. Cars from NIO or Aiways that are available in Europe play in the same league as the European competition when it comes to the quality of their cars (China.Table reported).

What’s more: Massive EV subsidies and a digitally savvy clientele turned the Chinese car market upside down. And at a pace that was too fast for many European and German manufacturers (China.Table reported). Electric start-ups from the People’s Republic knew domestic customers better. While European manufacturers simply swapped combustion engines with electric motors and installed large touchscreens, Chinese manufacturers developed smart, networked, and thoroughly digitized sure-fire hits.

European manufacturers simply need the help of Chinese companies to put modern EVs on the road. The Smart #1 shares the technical platform with other Geely models. So on the one hand, the model benefits from economies of scale, but it is also no longer manufactured in Europe. Mercedes sold its plant in Hambach, Germany to Ineos Automotive, the automotive offshoot of a British chemicals group, a long time ago. Here, the latter wants to manufacture its off-road vehicle, the Grenadier – in addition to contract manufacturing for Mercedes.

The strategy behind Smart is based on two pillars. First, an entire product family is to be created, and second, Mercedes wants to focus on Europe and China – the two largest EV markets. The first goal is to nearly quadruple sales from currently 39,000 cars per year to 150,000. Auto analyst Arndt Ellinghorst of Evercore ISI estimates that Smart currently generates an annual loss of €500 million to €700 million for its parent company. That is supposed to change.

Mercedes and Geely will pursue the “dual home” strategy with the Smart. “We define this product as neither Chinese nor European. Like the Smart brand itself, the new Smart #1 is a global product,” a company spokesperson told Table.Media. Without, however, offering it globally.

Since Chinese manufacturers have long been met with prejudice in Europe, but especially in Germany, on account of supposedly poor quality, Smart wants to do everything right, especially in this regard. “Smart partners with trusted, top-tier international suppliers, all of whom are required to implement a quality management system in accordance with IATF16949 and are responsible for meeting the zero-defect target,” the spokesperson continues. Continental, Magna, Hella, Qualcomm and Bosch are among those involved.

The second aspect is a diversification of the model range. “Smart has evolved from a one-car brand in the micro-segment to one with a multi-product portfolio,” explains the company spokesperson. So far, this statement is false. There is only one SUV to date. But at the presentation of the Smart #1, Dirk Adelmann, CEO of Smart Europa GmbH, already proclaimed, “We’re planning other products relatively concretely.” Geely’s platform would make it possible to expand the Smart in an uncomplicated way.

The Smart #1 also takes a big leap on the technical level. For example, the car can be opened, closed and launched via an app. This means that owners of the Smart #1 could even run their own little car-sharing service if they wanted to. Buttons and switches in the interior are scarce. A huge monitor dominates the center console and is strongly reminiscent of Tesla models, and certainly not by accident. A self-learning AI takes care of voice commands and is displayed via an avatar. The 66 kWh battery can be charged with up to 22 kW at charging stations. The standard for electric cars is 11 kW.

So Geely is also helping Mercedes to become more digital and no longer consider EVs to be merely converted gasoline-powered cars. This is precisely where German manufacturers have been failing in the eyes of Chinese customers (China.Table reported). The car is scheduled to launch on the German market in the second half of 2022 and will then be sold via the Mercedes sales network. In the People’s Republic, the Smart #1 costs between €27,000 and €33,000.

China has passed a law that will allow users to disable recommendations by algorithms in apps and online platforms. This is a global novelty. Tech companies are now required to notify users “in a conspicuous way” when algorithms are used to recommend content to users, the law states. Article 17 explains that users will be “allowed to opt-out of being targeted with algorithmic recommendations”.

The law, titled “Internet Information Service Algorithmic Recommendation Management,” was drafted by China’s Cyberspace Administration (CAC) and four other government bodies. The algorithm rules were loosely based on the EU’s AI law. “This policy marks the moment that China’s tech regulation is not simply keeping pace with data regulations in the European Union but has gone beyond them,” said Kendra Schaefer, head of tech policy research at Beijing-based consultancy Trivium China.

Scientists from Tsinghua University also helped draft it. According to the Cyberspace Administration, the law aims to “protect the legitimate rights and interests of citizens and promote the healthy development of Internet information services.” But it also gives the state new powers to meddle in citizens’ online activities.

According to the authority, the 30-point text is directed not least against algorithms that “promote addictive behavior or excessive consumption”. Particularly noteworthy is the Article 15 requirement for operators to disclose the “basic principles, intentions and modes of operation” of the recommendation algorithm. Algorithms that analyze user behavior, and create individual user-profiles and recommend web content, are one of the most important cornerstones for the success of big tech companies. The more effective the algorithms, the greater the likelihood that users will spend more time on the respective platform and return.

Services like TikTok and YouTube now mainly use algorithms to keep their users engaged. In China, digital groups such as Douyin operator ByteDance – Douyin is the Chinese version of TikTok – or WeChat operator Tencent are particularly hit by the new law. In addition to their core social media business, both companies also own algorithm-based news apps: Jinri Toutiao and Tencent News. However, e-commerce companies such as Alibaba, car-hailing provider DiDi Chuxing, and food delivery companies such as Meituan or Ele.me are also affected.

And it is also increasingly affecting operators of self-driving cars, which are becoming more and more rooted in everyday life in China. With autonomous driving, the trend is moving more and more toward checking the health data of car passengers, for example. Data that customers definitely want to control. In the end, autonomous driving is nothing more than a moving information platform that must constantly coordinate with other information platforms. Recommendation algorithms can play a role here as well. For example, an autonomous cab has the option of driving past the passenger’s favorite restaurant if two routes are the same length. The vehicle can ask the passenger if he or she would like to stop briefly to pick up his or her favorite food.

“Algorithms must be regulated,” says Zuo Xiaodong, Vice President of the China Information Security Research Institute in an article published by CAC. “Some platforms might say that algorithms are their intellectual properties and business secrets, so they cannot make them available to the public,” Zuo was quoted as saying. “This kind of language has no solid basis now, and algorithms need to be transparent.”

Greater control of algorithms should also help ensure that on-demand digital contract workers such as delivery drivers on China’s roads are no longer put under time pressure by algorithms. In the past, it was common that delivery times were so unrealistic that workers were forced to break traffic rules. The new rules could help make delivery drivers’ work lives more bearable. “Service providers need to put a mechanism in place to ensure that assignments, payments, work hours, rewards and punishments are allocated appropriately,” according to a CAC post.

The legislation in China could also have an impact on Western tech laws and radically change the tech landscape. Corporations like Facebook would be forced to change their business model if the model catches on. So far, this is not the case in Europe or the US. The state does not intervene in companies’ algorithms.

In fact, this is why users’ own choices are becoming less and less important on many platforms today. The computer thinks it knows us better than we do. The result is that we find it even harder than before to see beyond the AI-generated horizon and become stuck in our filter bubbles more than ever.

China’s Internet regulators cite the spread of biased “fake news” as a reason for the implementation of the new law. The law empowers Chinese authorities to crack down on content recommendations that have the potential to “influence public opinion” or “mobilize” people. In other words, algorithms are supposed to actively promote “positive” content that follows the Party line. This includes patriotic, family-friendly, and in line with the CCP’s “socialist core values.” For example, depictions of violence, sexual promiscuity, “obsessive” worship of celebrities or “political activism” are undesirable.

A new Covid Omicron subvariant has been detected for the first time in China. The variant, named BA.2.12.1, was recently detected and is considered to be more immune-resistant and transmissible than other Omicron variants. According to authorities, the subvariant was first found in a 27-year-old Chinese man who entered the country from Kenya, as reported by the Chinese business portal Caixin.

According to the report, the subvariant has been detected in at least 23 countries, including the United States and Hong Kong. The World Health Organization (WHO) has urged countries around the globe to closely monitor the spread of BA.2.12.1. The variant reportedly shows stronger immune resilience, even in boosted individuals. Its transmission is a good 25 percent faster, studies show.

Meanwhile, Beijing authorities have widened the regional lockdown. In seven connected neighborhoods in the Fengtai district, citizens are now no longer allowed to leave their homes. The cause is a Covid cluster that traces back to a wholesale food market. Although the number of new Covid infections is not rising sharply in the Chinese capital, new infection clusters appear in different parts of the city. nib

China’s authorities have issued a warning of severe flooding during the upcoming wet season. The north and south of the People’s Republic could be hit as hard as last year, reports the National Climate Center. Last year, some regions experienced torrential rains and flooding of entire cities. Hundreds of people died. Larger areas of arable land were flooded (China.Table reported). According to China’s National Climate Institute, this year’s floods will be “relatively worse” and “more extreme” than the historical average, Bloomberg reports.

Stronger and more frequent extreme weather events are considered a consequence of climate change. The warmer atmosphere holds more humidity, so heavy rains, for example, occur more frequently. According to the report, the Ministry of Housing and Urban-Rural Development and the National Development and Reform Commission warned in April that cities must remain vigilant for increased extreme weather events caused by climate change.

China faces long-term economic costs in the trillions as a result of climate change. In recent years, the costs have already amounted to $50 billion a year. If the climate crisis intensifies, the costs could add up to $190 trillion by 2100, according to a study by Tsinghua University (China.Table reported). These include:

China’s megacities also rank among the most threatened cities in the world by rising sea levels. In Shanghai, a temperature rise of two degrees would put a good 40 percent of the population at risk. nib

China’s Jiangsu Province will provide financial support to companies regarding maternity leave. Companies will receive subsidies for paying insurance premiums for female employees during their second and third maternity leaves, the South China Morning Post reports. According to the report, authorities will reimburse 50 to 80 percent of social security payments for women who have a second and third child, respectively. The reimbursements will be paid for six months. Jiangsu is the first province to introduce such a measure.

China faces a declining birth rate and an aging society. Experts say that China’s population could peak as early as this year (China.Table reported). Even after the abolition of the one-child and the two-child policy later, birth rates have not increased. Since then, authorities in the People’s Republic have been trying to convince families to have children by offering financial incentives. In various regions, tax cuts, direct payments and subsidies for the purchase of real estate have been introduced. nib

A mass shooting at a church in the US state of California that left one person dead and five others injured has raised questions about a possible political motivation of the alleged perpetrator. According to the local sheriff, the attack was a “politically motivated” hate crime against Taiwanese. This was reportedly revealed by handwritten notes found on the person of a 68-year-old suspect. He is said to have been “upset about political tensions between China and Taiwan” and attacked the church congregation last weekend.

The suspect, identified by US authorities as David Chou, who left on Saturday from his Las Vegas home for the town of Laguna Woods about 70 kilometers southeast of Los Angeles, allegedly carried two legally purchased firearms and four Molotov cocktail-type firebombs. Before opening fire, he allegedly used chains and nails to block the doors of the church, where the Irvine Taiwanese Presbyterian Church was holding a service. Chou was put on trial on Tuesday.

The case, like Chou’s background, is the subject of controversy in the US-Chinese community. It was initially believed that the perpetrator was a Chinese immigrant. Now, however, it seems clear that Chou is a US citizen who was born in Taiwan in 1953 after his family was forced to move from the Mainland following the Chinese Civil War.

Taiwan’s President Tsai Ing-wen issued a statement condemning “all forms of violence” and expressed her condolences to the victims and their families. A deputy of her ruling party had previously stated that Chinese propaganda could have been a decisive factor in the rampage. There is currently no proof of this. fpe

After two months of speculation, evidence is mounting that China Eastern Airlines flight MU5735 was intentionally crashed. The crash was the result of deliberate action by the pilot, the Wall Street Journal reported on Tuesday, citing US crash investigators. The US National Transportation Safety Board (NTSB) is currently working with China’s Civil Aviation Administration (CAAC) to determine the cause of the March 21 crash (China.Table reported).

The aircraft had not transmitted any error messages before it suddenly went into a vertical dive and hit a mountainous area en route from Kunming to Guangzhou. No one survived. Shortly after the tragedy, rumors of mental instability of one of the pilots made the rounds. Until now, however, there was no circumstantial evidence to suggest the crash was deliberate. Investigators have now leaked that the plane turned its nose steeply downward in response to control inputs from the cockpit. However, it is also possible that someone forcibly gained access to the cockpit and subdued the pilots, according to the media report. fin

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

The semiconductor value chain is incredibly complex and global in scope: not only is the production of semiconductors one of the most R&D-intensive activities, but it also spans several specialised tasks performed by different companies around the world. The largest semiconductor vendors are predominantly based in the United States, Korea, Europe, and Japan (e.g. Intel, Samsung, Infineon, and Kioxia), but many outsource capital-intensive manufacturing and assembly & testing activities to specialised firms located in Chinese Taipei, China, and Singapore. Some, like TSMC, have gone on to become technological leaders in providing the advanced chip-manufacturing services on which so much of the world’s smartphones and computers hinge upon. Companies like TSMC depend in turn on key suppliers of specialised, precision equipment such as Dutch company ASML, which produces the lithography machines that semiconductor foundries rely on.

Because chip production is innovation-driven, capital-intensive, and strategic, government involvement has long been a feature in the semiconductor industry. By the early 1960s, NASA had become the major customer for integrated circuits, ensuring robust demand for US producers. Around the same time, Chinese authorities established Wuxi Factory No. 742 as the state training ground for semiconductor engineers. In 1967, France created the CEA-Leti, a public research centre specialised in microelectronics, followed, in the 1970s and 1980s, by authorities in Japan, Korea, and Chinese Taipei who all supported semiconductor research and development (R&D) through public institutes such as ETRI and ITRI. Likewise, the United States established the Very High Speed Integrated Circuit programme in 1980 and the Sematech research and development consortium in 1987.

A recent OECD report on semiconductors found that between 2014 and 2018, 21 of the largest semiconductor firms worldwide received more than USD 50 billion in government support. Of this amount, two-thirds took the form of government grants and tax concessions, including more than USD 15 billion in support of R&D spending and USD 20 billion in the form of concessionary income-tax rates and investment incentives. Another third of the support took the form of below-market finance, i.e. loans and equity obtained by firms at below-market conditions.

While all sampled firms enjoyed R&D support and some amount of tax concessions, below-market finance appears to be largely a Chinese phenomenon. This is especially the case following China’s decision to establish in 2014 a national integrated circuit investment fund and sister funds at provincial and municipal levels. These funds have since injected fresh equity into a number of important Chinese producers of semiconductors, including SMIC, Hua Hong, and Tsinghua Unigroup and their subsidiaries. There notably appears to be a direct connection between equity injections by China’s government funds and the construction of new semiconductor fabs in the country.

One crucial issue from a policy standpoint relates to the lack of transparency on government support and below-market finance more specifically. Many governments fail to disclose the subsidies they provide, but this problem is exacerbated in the case of below-market finance as demonstrating the existence of such support requires comparison with a market benchmark, detailed methodologies for which have yet to be established or agreed. Information is also sometimes lacking on the ownership structure of firms, which can hide the true extent of government ownership of industrial producers.

Some forms of subsidies may be necessary, and this is true in semiconductors as in other sectors. Yet even R&D subsidies can distort markets if poorly designed and implemented. Analysis by Boeing and Peters shows, for example, that the R&D subsidies that China provided between 2001-11 were at times misused, thus undermining the effectiveness of R&D policies and implying that some amount of R&D support may have ‘leaked’ to other purposes such as production capacity expansion. While there are good economic arguments for supporting R&D, care should be taken to design R&D measures in a manner that improves societal benefits (i.e. innovation efforts that can increase productivity and well-being) while containing costs (i.e. competitive distortions).

While government equity injections in the semiconductor value chain have implications for trade and global competition, what they mean for trade rules, and subsidy disciplines more specifically, warrants closer investigation. By its very nature, below-market equity is probably among the hardest forms of support to identify and quantify. Enhanced transparency is therefore necessary and should focus, in particular, on:

At a broader level, the OECD’s work also raises questions about the role and effectiveness of government support in R&D-intensive industries characterised by short product cycles. This discussion has a particular resonance for China, which is trailing in semiconductor foundry technology despite relatively large government support, and which has long had policies that explicitly seek to support the development of the domestic integrated-circuit industry.

Jehan Sauvage currently serves as a Policy Analyst in the Trade and Agriculture Directorate of the OECD, where he specialises in questions related to market distortions and government subsidies in industrial sectors.

Christian Steidl is a Policy Analyst at the OECD, working on the analysis of various forms of government support for industrial companies.

This contribution is prepared in the context of the event series “Global China Conversations” of the Kiel Institute for the World Economy (IfW). On Thursday Dr. Sophia Helmrich (BDI), Jehan Sauvage (OECD), and Christian Steidl (OECD) will discuss the topic: “The Race for Technology Sovereignty: The Case of Government Support in the Semiconductor Industry”. China.Table is media partner of this event series.

The authors are writing in a strictly personal capacity. The views expressed are theirs only, and do not reflect in any way those of the OECD Secretariat or the member countries of the OECD.

Marie von Mallinckrodt will become ARD correspondent in Beijing on August 1. The 44-year-old succeeds Daniel Satra. From 2014 to 2020, von Mallinckrodt was a correspondent in the ARD capital studio.

Christoph Braun has been appointed Head of Innovation & Development China at German automotive supplier Carcoustics this month. Previously, Braun worked for the Leverkusen-based company as Global Head of Material Development & Material Lab. He will continue to work from Shanghai.

This pizza from the fast-food chain Pizza Hut currently turns heads in Taiwan: It is topped with breaded popcorn chicken, squid rings, tempura – and Oreo cookies with Parmesan. The unusual combination has been available for a good week. First food reviews are even surprisingly fond of the cookie-cheese crust.