Foundations are an essential part of the socio-political network of the free world. It is, therefore, more than astonishing that a passage crept into the CAI investment agreement that leaves China considerable influence over local branches. The uncertainty among those affected is greater than ever – but at least Brussels is trying to mitigate the damage, writes Amelie Richter. However, an explanation of how the toxic phrases found their way into the treaty in the first place has yet to be provided.

The financial world and the world of civil libertarians probably don’t have much overlap anywhere in the world. But in Hong Kong, their disconnect is taking on extreme proportions: While the rule of law is being choked off, investment is soaring to record levels. Yet both once had the same foundations: Sound British law set the framework for the money economy to thrive but also guaranteed freedom of expression. Now one seems to work without the other, writes Frank Sieren.

The Asia-Pacific Committee of German Business published a comprehensive position paper. It is intended to provide political decision-makers with guidance for the realignment of their Far East strategy. A separate chapter is devoted to diversification: The current debate is too focused on China. On the one hand, today, the real markets of the future are in other emerging markets, while on the other hand, old partners such as Japan and Australia have by no means been phased out. This is a continuation of a trend towards skepticism about China that crept into the association’s work in Berlin in recent years.

One alleged detail in the controversial investment agreement between the European Union and China (CAI) continues to fuel debate: the annex’s treatment of non-governmental organizations (NGOs) and political foundations in the People’s Republic. One sentence, in particular, is causing concern among those affected. This concerns the filling of leadership positions. China reserves the right to fill executive positions with Chinese citizens. If the authorities were to actually apply this, it would go well beyond the already strict NGO law of the People’s Republic.

Brussels is now trying to mitigate the damage: The controversial paragraph in the annex to the CAI will not lead to an amendment of the existing NGO law, EU Commission circles stressed on Wednesday. The Commission is thus reacting to alarming reports in the German media. The hastily added explanations, however, leave open why the paragraph ended up in the CAI annex in the first place, although foundations and NGOs, as non-commercial enterprises, do not pursue any economic interests or activities and are thus not actually subject to the agreement.

At the moment, it looks as if the paragraph slipped through due to carelessness during the years of negotiations on the investment agreement. In any case, the answer to the question why it was not addressed or prevented from the EU side remains non-committal: The talks were about market access and investment, not political freedoms. According to EU sources, the CAI does not represent a political position on the treatment of non-profit organizations in the People’s Republic. They did not react to the critical statement that, by ratifying the agreement, Brussels was indirectly accepting the sentence in question and its possible consequences.

At the end of March, it came as a surprise to foundation representatives and members of the European Parliament that the passage is included in the CAI. The decisive passage is in the ninth entry of Annex II in the CAI (page 60). China reserves the right to “adopt or maintain the following measures”: Unless approved by the Chinese government, foreign investors cannot invest in “non-profit organizations within the territory of China. Further, non-profit organizations established outside of China are actually not allowed to establish representative offices or branches in China.

Accordingly, only foreign NGOs that want to conduct temporary activities in China are permitted. However, they must cooperate with “domestic entities.” This cooperation is then limited to one year – up to this point, the CAI paragraph corresponds to the requirements of the “Law on the Administration of Activities of Overseas Nongovernmental Organizations in the Mainland of China”, which has been in force since 2017. The particularly poisonous passage now causing confusion was added: Senior NGO executives who are allowed to work in China have to be Chinese citizens.

Annex II of the agreement functions via a so-called negative list. In such a list, the contracting parties can list sectors or subsectors to which the agreement applies only to a limited extent or not at all. NGOs and foundations appear once in the CAI investment agreement but are not mentioned in the main text. Beijing left itself “room” at this point with regard to non-profit organizations, the EU circles explained. The People’s Republic followed the approach of a negative list for the first time in the CAI and proceeded “rather cautiously.” The sentence regarding the occupation of leading positions had been introduced into an agreement by China for the first time, but this was also due to the negative list approach.

The EU admitted that this sentence was formulated in a rather “clumsy way.” In the English version of the text published so far, the modal verb “shall” is used (“The senior executives of non-profit organizations which have been approved to be established within the territory of China shall be Chinese citizens”), which can be read as a mere possibility, but also as an instruction. However, the EU sources stressed that this does not constitute a legal obligation. The hope that the sentence could still be changed during the ongoing formal legal examination, the so-called “legal scrubbing”, was, however, rejected by Brussels: there would be no further renegotiations. But: What is mentioned on the negative list does not fall under the scope of the treaty and will thus “perhaps never be used.”

This approach has been sharply criticized in German foundation circles: This attitude is “maximum naivety” regarding China’s dealings with foreign non-profit organizations. Within the framework of the CAI, one foundation representative emphasized China.Table that they jointly agreed on the leeway that they would allow the other side. It is unlikely that China will not use it at any point in time, he added. On Friday of this week, the EU Commission will also talk to foundations and NGOs about the background to the passage, as foundation circles confirmed. Expectations for the virtual meeting are, therefore, not particularly high.

Experts also criticized the EU’s approach. “The European Commission’s line of defense seems to consist of emphasizing that foundations and non-profit investments are not affected by the CAI,” explains Bertram Lang, a political scientist specializing in East Asia and China at Goethe University in Frankfurt. But according to Lang, this is precisely the problem: Unlike commercial activities, non-profit investments are explicitly excluded from protection under the agreement and continue to be subject to discriminatory treatment. This is perhaps why it was important for China to raise the issue again in the annexes.

MEPs are increasingly appalled by what is happening. “The EU Commission is going to great lengths to justify a passage in the CAI investment agreement that would be likely to further restrict the scope for action of European NGOs in China,” says Green MEP and Chairman of the China delegation, Reinhard Bütikofer. He now sees it as the duty of the Brussels authority to make improvements. “You can ask the question quite simply: Why didn’t the Commission at least insist that no regulations going beyond the current Chinese law be included?”

The European Parliament, which already suspended work on the CAI since the imposition of sanctions against several European politicians, scientists, and organizations, intends to lend weight to its criticism in a joint resolution today, on Thursday.

Any consideration of the CAI investment agreement, as well as any discussion of ratification by the European Parliament, had “rightly been frozen” because of the Chinese sanctions, the paper says. However, the joint resolution makes the lifting of sanctions a less binding precondition for the start of work on the CAI than some of the group drafts. Accordingly, the EU parliamentarians call on China to lift the sanctions before the European Parliament deals with the CAI – but without making any claims on the final outcome of the ratification process. In several drafts of the political groups, the end of sanctions was mentioned as an explicit precondition, only the conservative EPP chose a milder approach.

The joint draft also “expects the EU Commission to consult the European Parliament” before taking steps to conclude or sign the CAI. The EU Commission is also urged to “use the debate on CAI as a lever to improve the protection of human rights and support for civil society in China.”

The joint resolution paper also reiterates “that violations in Xinjiang constitute crimes against humanity.” The EU Parliament already adopted a corresponding position in December 2020, a few days before the political agreement on the CAI. The draft also calls for closer cooperation with the US and advocates decoupling CAI ratification and other trade and investment agreements with regional partners, including Taiwan. These should “not be held hostage.” A result of the vote in the European Parliament is expected on Thursday afternoon.

Since the beginning of the year, the sale of shares by listed companies in Hong Kong has had an upswing. Sales of various types of company shares by major shareholders amounted to $ 47 billion from Jan. 1 to the end of April 2021, nearly matching the $ 47.8 billion raised in the whole of 2020, according to data from the UK financial market platform Dealogic. That’s four times the volume of business in the same period of the last Covid year.

According to the Hong Kong Stock Exchange, initial listings in Hong Kong also got off to a record start this year, with volumes rising ninefold in the first three months compared with the same period last year. According to the data, tech stocks accounted for half of the secondary offering from January to April, followed by those in the healthcare, automotive, and consumer goods sectors. So $16 billion, just over a third, came from Chinese companies.

The Hong Kong branches of investment banks Goldman Sachs and Morgan Stanley rose to the top of the Asian industry rankings due to the high volume of listings. Goldman plans to increase its Hong Kong staff by nearly a fifth from a year earlier. Morgan Stanley has already doubled its hiring pace this year. Thomas Gottstein, Credit Suisse’s Chief Executive, said in mid-March that the bank would triple its job recruiting across China.

Citi bank also announced up to 1700 new hires in Hong Kong this year alone. “It’s a one-party state, but they are pragmatic. They don’t want to damage business,” says Fred Hu, the former Head of Goldman Sachs in China. He is now the founder and CEO of the private equity firm Primavera Capital Group.

However, the Hang Seng Index as a whole is now moving sideways after a sharp rise in January and the following slump. It is at about the same level as in mid-January. Since the beginning of March, nine of the 14 new listings in Hong Kong are trading below their issue price, according to stock market data.

Last year already marked a record year with $52 billion worth of new Hong Kong shares, partly due to Chinese firms’ reluctance to invest in New York because of political tensions.

Many countries relied on loose monetary policy and low-interest rates in their stimulus plans to contain the impact of the pandemic. In turn, low-interest rates around the world are boosting global liquidity and investor demand. Chinese assets benefited from China’s faster economic recovery following the Covid pandemic.

The People’s Republic is the only major economy in the world that grew in 2020. Analysts surveyed by the business newspaper Nikkei even predict that the Chinese economy could grow by 8.5 percent in 2021.

That is translating into brisk demand for individual stocks. Amsterdam-listed investment group Prosus sold a two percent stake in Chinese internet conglomerate Tencent Holdings for $14.7 billion last month, the largest secondary-share sale this year. Prosus is the largest B2C internet company in Europe and one of the largest tech investors in the world. Even after the sale, Prosus remains Tencent’s largest shareholder with a 28.9 percent stake.

Other deals included the $7 billion bid by Chinese food supplier Meituan last month and the $3.9 billion new-share sale of Chinese EV maker BYD in January.

Meanwhile, Hong Kong publisher and pro-democracy campaigner Jimmy Lai is currently in court in his second trial, where he could face up to seven years in prison. He has already been sentenced to 14 months for attending an unauthorized gathering. Activist Joshua Wong, already in prison, was sentenced to an additional ten months for “unauthorized assembly” on June 4, 2020, commemorating the bloody crackdown on the Tiananmen Square protest movement, after already being sentenced to just over 13 months without parole.

Some 20 other pro-democracy activists are still awaiting trial. Other pro-independence campaigners, Agnes Chow and Ivan Lam have also been sentenced to ten and seven months in prison, respectively. One percent of the population has left Hong Kong in recent months because of the political situation.

So the parallel worlds in Hong Kong continue to drift apart: The booming financial industry promoted by Beijing on the one hand and the protest movement on the other. “Beijing’s signal to the business world is very simple,” says Michael Tien, a devout Catholic, fashion entrepreneur, and moderate figure in Hong Kong’s pro-Beijing camp: “Stay out of business.”

Fred Hu sums up the situation similarly: “As a banker or stock trader, you also have political views, but you are not a political activist.” It is also obvious that the new US administration under Joe Biden has no interest in putting a political brake on the activities of the American investment banks to send a signal in favor of the protest movement.

New investment funds, including many US ones, are also flocking to Hong Kong after authorities removed some regulatory barriers in August, with government data showing 154 new funds registered since then.

On average, mainland investors account for ten percent of placements of more than $2 billion. According to Dealogic, Chinese companies that sold new shares on the Hong Kong Stock Exchange last year brought in a record $52 billion.

While the amount of equity issuance in Hong Kong is breaking records in absolute terms in the first quarter of this year, they are still well below the 2016 peak and the average of the past decade as a proportion of total market capitalization. Year-to-date, new capital raised amounted to 2.1 percent of total market capitalization, down from 3.4 percent in 2016 and the average of 2.4 percent since 2011.

But this is a similar phenomenon to China’s growth: While the growth percentage is falling, it is getting bigger in absolute terms. Beijing actually wants to increase Hong Kong’s financial attractiveness even further. The Hong Kong administration already launched a new law at the end of January that reduces taxes on investment profits in Hong Kong.

The Asia-Pacific Committee of German Business (APA) advocates a broader spread of German involvement in the Far East. Germany should not consider the People’s Republic as the only growth market but take a look at the Asian region as a whole, it said. “If we want to maintain the level of prosperity in Germany and the EU for the future, we must participate more in the high development dynamics in Asia-Pacific,” APA Chairman Joe Kaeser said on the publication of an APA position paper on Wednesday. “This applies particularly to safeguarding European interests in the competition between the two economies of China and the US.”

The lobby group’s new paper is intended to “provide an impetus for the implementation of the Indo-Pacific Guidelines of the Federal Government” presented last year. The APA argues that the focus should not be on China alone. However, the diversification strategy should not be aimed at relocating production from China. Rather, it is a matter of not missing out on the development of other future markets. fin

After six years, China has overtaken the USA again as the largest foreign market for German mechanical engineering companies. This is according to data published by the VDMA industry association on Wednesday. The reason for this is also the Covid crisis: While other markets such as France and the USA were still suffering considerably from the pandemic, China quickly put the slump behind it. “Already last year, many companies there felt a high investment dynamic,” said VDMA Chief Economist Ralph Wiechers. Capacity utilization in China reached an all-time high in the spring, he added. In the first quarter of 2021, exports to China rose by 20 percent to €4.9 billion. The US was close behind with €4.7 billion. In view of positive signals from the USA, however, it remains to be seen whether China will maintain its lead in the further course of the year. fin

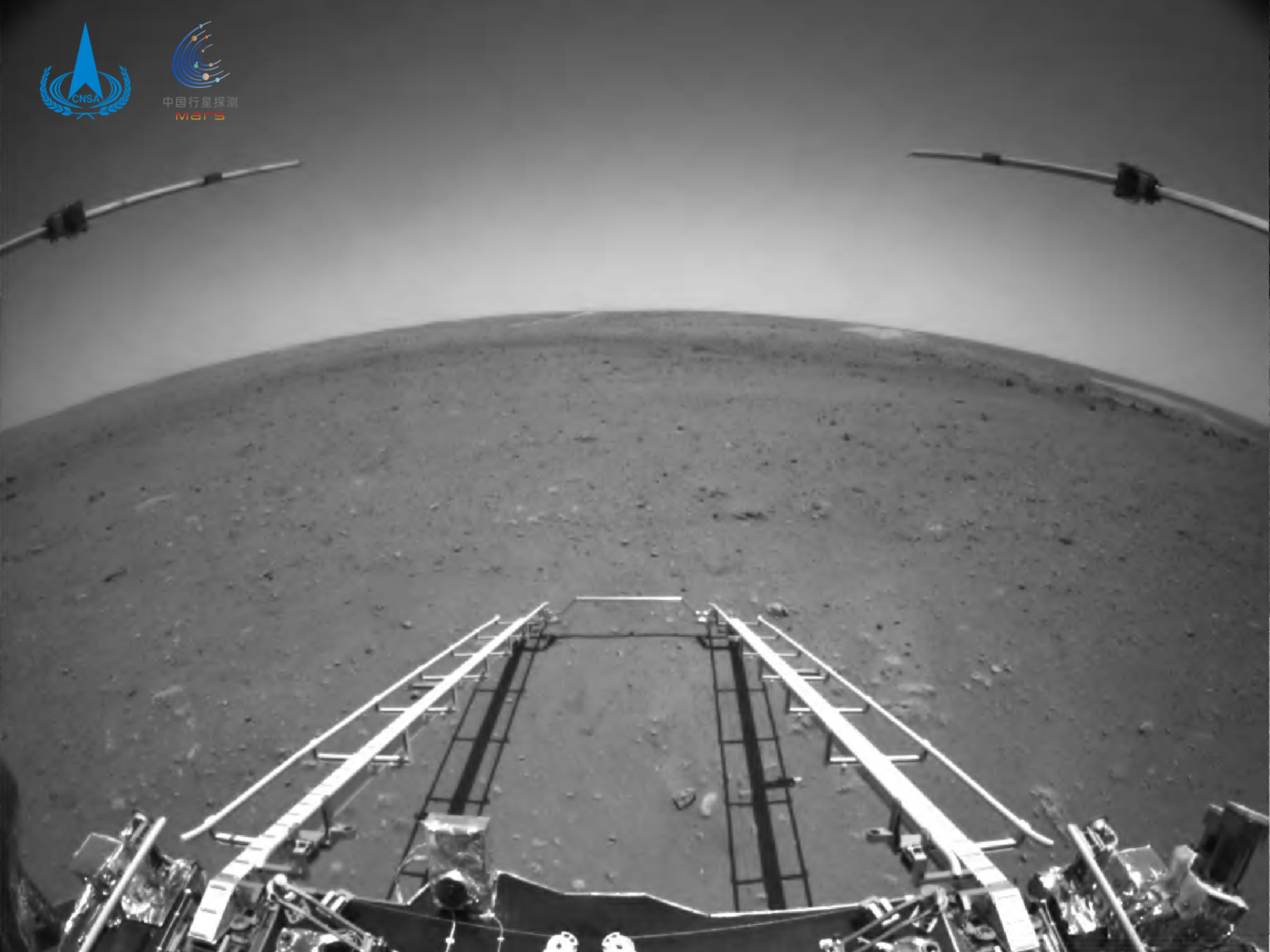

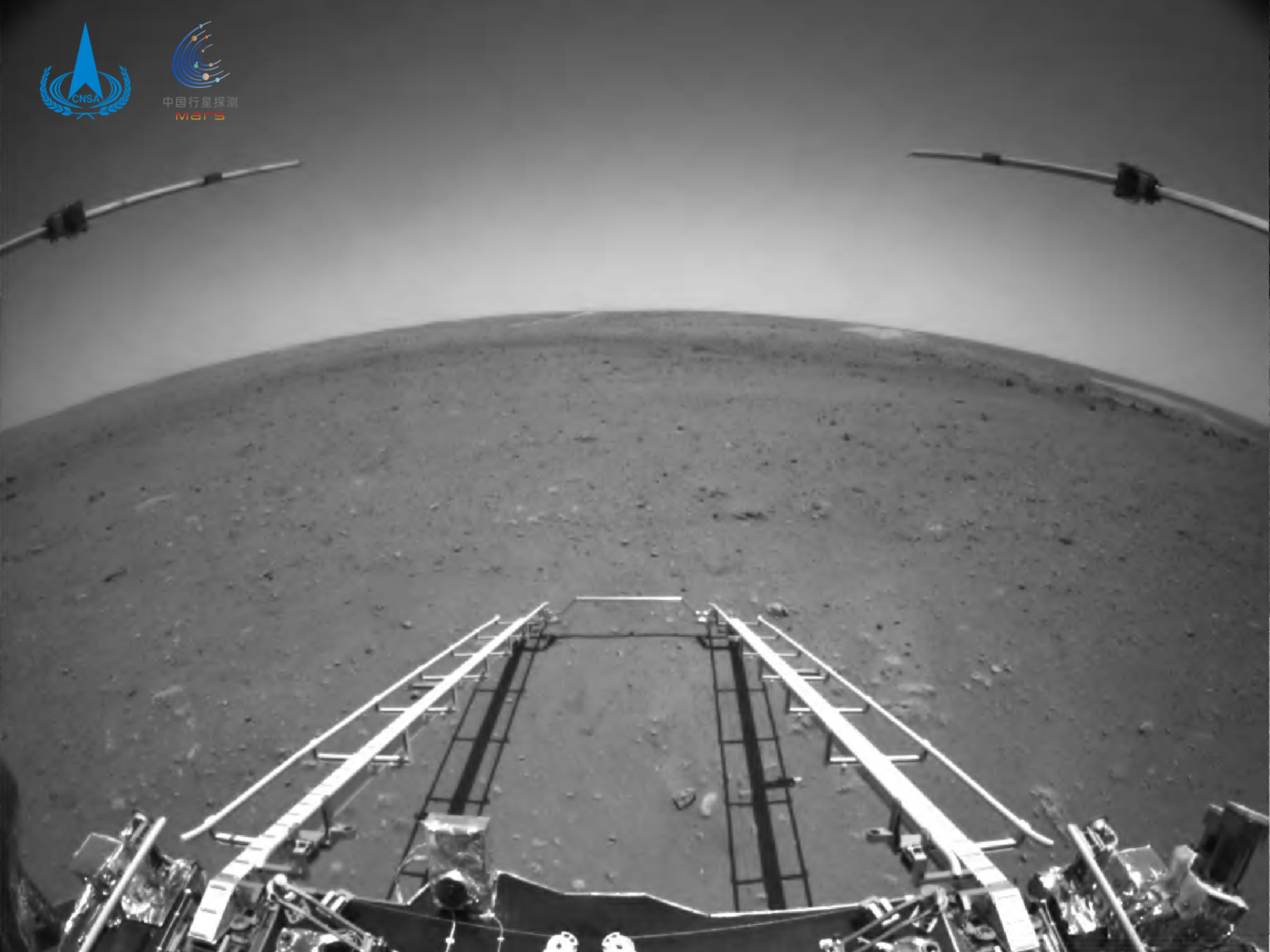

China’s Zhurong Mars rover activated as planned and radioed photos of the Martian surface to Earth. The first images released by the space agency CNSA showed the automated vehicle rolling out of the landing capsule. This was initially followed by a black-and-white photo of a rocky, dusty plain stretching to the horizon of the alien planet. The images are transmitted via the Tianwen-1 satellite, which orbits Mars and maintains contact with the exploration vehicle. Zhurong is now expected to take measurements and send images for three months. fin

The heads of state Xi Jinping and Vladimir Putin sealed the construction of four nuclear reactors in Chinese-Russian cooperation. The two leaders attended the ceremony via video, Chinese media reported Wednesday. According to the statement, the Tianwen power plant complex in Jiangsu province and Xudapu in Liaoning will each receive two new units using Russian technology. The project is part of a $3.1 billion contract signed three years ago. China is counting on a rapid expansion of nuclear power to come close to its climate targets despite a growing hunger for energy. Although the country developed its own nuclear reactor technology, it is also ordering new plants from international suppliers. fin

The ups and downs of the Bitcoin price should be familiar to holders of this best-known and most widespread cryptocurrency. But the fact that the price would plummet so drastically within a short period of time cost even shrewd investors some nerves: The valuation plunged 25 percent to just under $30,000 on Wednesday afternoon, its lowest level since the beginning of the year.

The reason: Three of China’s largest banking associations pointed out that cryptocurrencies are “not real foreign exchange” and warned against “speculation” in this context. They also called on their members to neither accept nor use cryptocurrencies as a means of payment. China’s central bank also pointed out in a brief statement that payments with digital currencies are prohibited in China.

China views cryptocurrency investments with great suspicion and cracked down on their proliferation on several occasions. Nevertheless, China is believed to have provided the most investors, at least for a time. The exact number is not known. At the same time, the leadership itself is working on a digital variant of its national currency, the yuan, and is already conducting initial field tests (China.Table reported). The sell-off on Wednesday was so great after the warning from the Chinese banking associations that the world’s best-known trading place for cryptocurrencies in the US, Coinbase, was temporarily inaccessible for many users. flee

In auditing and accounting, the world is often rendered too simply, thinks Wan-Hsin Liu. Numbers often speak a clear language: right or wrong. “But I don’t have much use for such strict black-and-white thinking,” says Liu, looking back on her studies. The 41-year-old Taiwanese studied accounting in her country of birth. When she minored in economics, she realized, “I can do more with that.”

Without further ado, she decided to come to Germany to study economics. “I quickly realized that I wanted to study in Europe because I was interested in the introduction of the Euro and economic integration in Europe,” says Liu. She wanted to explore whether the EU could serve as a model for East Asian countries. She began studying in Münster in 2003 and now works as a senior researcher at the Kiel Institute for the World Economy.

There, says Liu, she was the only Asian scientist among more than 170 employees for a time. As a result, she still often takes on a special role. “In discussions, especially when it comes to taking a critical look at China’s economic measures, I often bring a perspective that goes beyond dry numbers,” she says. “My knowledge of Chinese culture, language, and mentality, which I have been able to gather through my background over the years, is immensely helpful.” Her differentiated perspective also helps her assess developments that are viewed critically in Europe, she adds.

Especially when it comes to deriving economic policy measures from research, she says, it is immensely important to allow different perspectives. “And who knows best about China? The Chinese, of course. If you research China, you can’t do that from Germany alone.” It was Liu who began to initiate collaborations with high-ranking Chinese research institutes and universities. These include the renowned Tsinghua University in Beijing and the Institute of World Economics and Politics at the Chinese Academy of Social Science. That was in 2011. She received her doctorate a year later, by which time she had already been conducting research in Kiel for four years.

Today, Liu’s work focuses on direct investment and global supply chains. She recently conducted research on the Chinese government’s ambitious five-year plan. In it, the country’s leadership announced that China’s industry would focus on decoupling itself from foreign countries more quickly than it already does. What is already working well with digital technologies – China has the largest e-commerce market in the world – is also set to affect other sectors. And at a fast pace.

Is this a cause for concern for Europe and export giant Germany? Liu does not think so – at least not in the coming years, when China will be even more dependent on Europe, and especially on Germany’s cutting-edge research, to bring expertise into its own country. “It’s true: China wants to become more independent, and in the long term some export sectors will suffer as a result,” says Liu. “But that doesn’t mean China is closing itself off to the world at all.” But foreign companies will have to build their factories locally more than before to play a role in the Chinese market, and also face increasingly fierce competition from local Chinese rivals.

Under normal circumstances, Liu would be traveling the world for her research on the five-year plan and many other projects. In the past, she said, she would be in China once or twice a year for several weeks. Normal, however, is little right now, even though China has a better handle on the pandemic than Europe. “That makes it all the more important to maintain good relations with our Chinese partner institutes virtually.” Leon Kirschgens

Did Putin wrap Xi in plastic? This time, our dessert is not from China, but from Paris. There the Musée Grévin reopened after the pandemic – a wax museum.

Foundations are an essential part of the socio-political network of the free world. It is, therefore, more than astonishing that a passage crept into the CAI investment agreement that leaves China considerable influence over local branches. The uncertainty among those affected is greater than ever – but at least Brussels is trying to mitigate the damage, writes Amelie Richter. However, an explanation of how the toxic phrases found their way into the treaty in the first place has yet to be provided.

The financial world and the world of civil libertarians probably don’t have much overlap anywhere in the world. But in Hong Kong, their disconnect is taking on extreme proportions: While the rule of law is being choked off, investment is soaring to record levels. Yet both once had the same foundations: Sound British law set the framework for the money economy to thrive but also guaranteed freedom of expression. Now one seems to work without the other, writes Frank Sieren.

The Asia-Pacific Committee of German Business published a comprehensive position paper. It is intended to provide political decision-makers with guidance for the realignment of their Far East strategy. A separate chapter is devoted to diversification: The current debate is too focused on China. On the one hand, today, the real markets of the future are in other emerging markets, while on the other hand, old partners such as Japan and Australia have by no means been phased out. This is a continuation of a trend towards skepticism about China that crept into the association’s work in Berlin in recent years.

One alleged detail in the controversial investment agreement between the European Union and China (CAI) continues to fuel debate: the annex’s treatment of non-governmental organizations (NGOs) and political foundations in the People’s Republic. One sentence, in particular, is causing concern among those affected. This concerns the filling of leadership positions. China reserves the right to fill executive positions with Chinese citizens. If the authorities were to actually apply this, it would go well beyond the already strict NGO law of the People’s Republic.

Brussels is now trying to mitigate the damage: The controversial paragraph in the annex to the CAI will not lead to an amendment of the existing NGO law, EU Commission circles stressed on Wednesday. The Commission is thus reacting to alarming reports in the German media. The hastily added explanations, however, leave open why the paragraph ended up in the CAI annex in the first place, although foundations and NGOs, as non-commercial enterprises, do not pursue any economic interests or activities and are thus not actually subject to the agreement.

At the moment, it looks as if the paragraph slipped through due to carelessness during the years of negotiations on the investment agreement. In any case, the answer to the question why it was not addressed or prevented from the EU side remains non-committal: The talks were about market access and investment, not political freedoms. According to EU sources, the CAI does not represent a political position on the treatment of non-profit organizations in the People’s Republic. They did not react to the critical statement that, by ratifying the agreement, Brussels was indirectly accepting the sentence in question and its possible consequences.

At the end of March, it came as a surprise to foundation representatives and members of the European Parliament that the passage is included in the CAI. The decisive passage is in the ninth entry of Annex II in the CAI (page 60). China reserves the right to “adopt or maintain the following measures”: Unless approved by the Chinese government, foreign investors cannot invest in “non-profit organizations within the territory of China. Further, non-profit organizations established outside of China are actually not allowed to establish representative offices or branches in China.

Accordingly, only foreign NGOs that want to conduct temporary activities in China are permitted. However, they must cooperate with “domestic entities.” This cooperation is then limited to one year – up to this point, the CAI paragraph corresponds to the requirements of the “Law on the Administration of Activities of Overseas Nongovernmental Organizations in the Mainland of China”, which has been in force since 2017. The particularly poisonous passage now causing confusion was added: Senior NGO executives who are allowed to work in China have to be Chinese citizens.

Annex II of the agreement functions via a so-called negative list. In such a list, the contracting parties can list sectors or subsectors to which the agreement applies only to a limited extent or not at all. NGOs and foundations appear once in the CAI investment agreement but are not mentioned in the main text. Beijing left itself “room” at this point with regard to non-profit organizations, the EU circles explained. The People’s Republic followed the approach of a negative list for the first time in the CAI and proceeded “rather cautiously.” The sentence regarding the occupation of leading positions had been introduced into an agreement by China for the first time, but this was also due to the negative list approach.

The EU admitted that this sentence was formulated in a rather “clumsy way.” In the English version of the text published so far, the modal verb “shall” is used (“The senior executives of non-profit organizations which have been approved to be established within the territory of China shall be Chinese citizens”), which can be read as a mere possibility, but also as an instruction. However, the EU sources stressed that this does not constitute a legal obligation. The hope that the sentence could still be changed during the ongoing formal legal examination, the so-called “legal scrubbing”, was, however, rejected by Brussels: there would be no further renegotiations. But: What is mentioned on the negative list does not fall under the scope of the treaty and will thus “perhaps never be used.”

This approach has been sharply criticized in German foundation circles: This attitude is “maximum naivety” regarding China’s dealings with foreign non-profit organizations. Within the framework of the CAI, one foundation representative emphasized China.Table that they jointly agreed on the leeway that they would allow the other side. It is unlikely that China will not use it at any point in time, he added. On Friday of this week, the EU Commission will also talk to foundations and NGOs about the background to the passage, as foundation circles confirmed. Expectations for the virtual meeting are, therefore, not particularly high.

Experts also criticized the EU’s approach. “The European Commission’s line of defense seems to consist of emphasizing that foundations and non-profit investments are not affected by the CAI,” explains Bertram Lang, a political scientist specializing in East Asia and China at Goethe University in Frankfurt. But according to Lang, this is precisely the problem: Unlike commercial activities, non-profit investments are explicitly excluded from protection under the agreement and continue to be subject to discriminatory treatment. This is perhaps why it was important for China to raise the issue again in the annexes.

MEPs are increasingly appalled by what is happening. “The EU Commission is going to great lengths to justify a passage in the CAI investment agreement that would be likely to further restrict the scope for action of European NGOs in China,” says Green MEP and Chairman of the China delegation, Reinhard Bütikofer. He now sees it as the duty of the Brussels authority to make improvements. “You can ask the question quite simply: Why didn’t the Commission at least insist that no regulations going beyond the current Chinese law be included?”

The European Parliament, which already suspended work on the CAI since the imposition of sanctions against several European politicians, scientists, and organizations, intends to lend weight to its criticism in a joint resolution today, on Thursday.

Any consideration of the CAI investment agreement, as well as any discussion of ratification by the European Parliament, had “rightly been frozen” because of the Chinese sanctions, the paper says. However, the joint resolution makes the lifting of sanctions a less binding precondition for the start of work on the CAI than some of the group drafts. Accordingly, the EU parliamentarians call on China to lift the sanctions before the European Parliament deals with the CAI – but without making any claims on the final outcome of the ratification process. In several drafts of the political groups, the end of sanctions was mentioned as an explicit precondition, only the conservative EPP chose a milder approach.

The joint draft also “expects the EU Commission to consult the European Parliament” before taking steps to conclude or sign the CAI. The EU Commission is also urged to “use the debate on CAI as a lever to improve the protection of human rights and support for civil society in China.”

The joint resolution paper also reiterates “that violations in Xinjiang constitute crimes against humanity.” The EU Parliament already adopted a corresponding position in December 2020, a few days before the political agreement on the CAI. The draft also calls for closer cooperation with the US and advocates decoupling CAI ratification and other trade and investment agreements with regional partners, including Taiwan. These should “not be held hostage.” A result of the vote in the European Parliament is expected on Thursday afternoon.

Since the beginning of the year, the sale of shares by listed companies in Hong Kong has had an upswing. Sales of various types of company shares by major shareholders amounted to $ 47 billion from Jan. 1 to the end of April 2021, nearly matching the $ 47.8 billion raised in the whole of 2020, according to data from the UK financial market platform Dealogic. That’s four times the volume of business in the same period of the last Covid year.

According to the Hong Kong Stock Exchange, initial listings in Hong Kong also got off to a record start this year, with volumes rising ninefold in the first three months compared with the same period last year. According to the data, tech stocks accounted for half of the secondary offering from January to April, followed by those in the healthcare, automotive, and consumer goods sectors. So $16 billion, just over a third, came from Chinese companies.

The Hong Kong branches of investment banks Goldman Sachs and Morgan Stanley rose to the top of the Asian industry rankings due to the high volume of listings. Goldman plans to increase its Hong Kong staff by nearly a fifth from a year earlier. Morgan Stanley has already doubled its hiring pace this year. Thomas Gottstein, Credit Suisse’s Chief Executive, said in mid-March that the bank would triple its job recruiting across China.

Citi bank also announced up to 1700 new hires in Hong Kong this year alone. “It’s a one-party state, but they are pragmatic. They don’t want to damage business,” says Fred Hu, the former Head of Goldman Sachs in China. He is now the founder and CEO of the private equity firm Primavera Capital Group.

However, the Hang Seng Index as a whole is now moving sideways after a sharp rise in January and the following slump. It is at about the same level as in mid-January. Since the beginning of March, nine of the 14 new listings in Hong Kong are trading below their issue price, according to stock market data.

Last year already marked a record year with $52 billion worth of new Hong Kong shares, partly due to Chinese firms’ reluctance to invest in New York because of political tensions.

Many countries relied on loose monetary policy and low-interest rates in their stimulus plans to contain the impact of the pandemic. In turn, low-interest rates around the world are boosting global liquidity and investor demand. Chinese assets benefited from China’s faster economic recovery following the Covid pandemic.

The People’s Republic is the only major economy in the world that grew in 2020. Analysts surveyed by the business newspaper Nikkei even predict that the Chinese economy could grow by 8.5 percent in 2021.

That is translating into brisk demand for individual stocks. Amsterdam-listed investment group Prosus sold a two percent stake in Chinese internet conglomerate Tencent Holdings for $14.7 billion last month, the largest secondary-share sale this year. Prosus is the largest B2C internet company in Europe and one of the largest tech investors in the world. Even after the sale, Prosus remains Tencent’s largest shareholder with a 28.9 percent stake.

Other deals included the $7 billion bid by Chinese food supplier Meituan last month and the $3.9 billion new-share sale of Chinese EV maker BYD in January.

Meanwhile, Hong Kong publisher and pro-democracy campaigner Jimmy Lai is currently in court in his second trial, where he could face up to seven years in prison. He has already been sentenced to 14 months for attending an unauthorized gathering. Activist Joshua Wong, already in prison, was sentenced to an additional ten months for “unauthorized assembly” on June 4, 2020, commemorating the bloody crackdown on the Tiananmen Square protest movement, after already being sentenced to just over 13 months without parole.

Some 20 other pro-democracy activists are still awaiting trial. Other pro-independence campaigners, Agnes Chow and Ivan Lam have also been sentenced to ten and seven months in prison, respectively. One percent of the population has left Hong Kong in recent months because of the political situation.

So the parallel worlds in Hong Kong continue to drift apart: The booming financial industry promoted by Beijing on the one hand and the protest movement on the other. “Beijing’s signal to the business world is very simple,” says Michael Tien, a devout Catholic, fashion entrepreneur, and moderate figure in Hong Kong’s pro-Beijing camp: “Stay out of business.”

Fred Hu sums up the situation similarly: “As a banker or stock trader, you also have political views, but you are not a political activist.” It is also obvious that the new US administration under Joe Biden has no interest in putting a political brake on the activities of the American investment banks to send a signal in favor of the protest movement.

New investment funds, including many US ones, are also flocking to Hong Kong after authorities removed some regulatory barriers in August, with government data showing 154 new funds registered since then.

On average, mainland investors account for ten percent of placements of more than $2 billion. According to Dealogic, Chinese companies that sold new shares on the Hong Kong Stock Exchange last year brought in a record $52 billion.

While the amount of equity issuance in Hong Kong is breaking records in absolute terms in the first quarter of this year, they are still well below the 2016 peak and the average of the past decade as a proportion of total market capitalization. Year-to-date, new capital raised amounted to 2.1 percent of total market capitalization, down from 3.4 percent in 2016 and the average of 2.4 percent since 2011.

But this is a similar phenomenon to China’s growth: While the growth percentage is falling, it is getting bigger in absolute terms. Beijing actually wants to increase Hong Kong’s financial attractiveness even further. The Hong Kong administration already launched a new law at the end of January that reduces taxes on investment profits in Hong Kong.

The Asia-Pacific Committee of German Business (APA) advocates a broader spread of German involvement in the Far East. Germany should not consider the People’s Republic as the only growth market but take a look at the Asian region as a whole, it said. “If we want to maintain the level of prosperity in Germany and the EU for the future, we must participate more in the high development dynamics in Asia-Pacific,” APA Chairman Joe Kaeser said on the publication of an APA position paper on Wednesday. “This applies particularly to safeguarding European interests in the competition between the two economies of China and the US.”

The lobby group’s new paper is intended to “provide an impetus for the implementation of the Indo-Pacific Guidelines of the Federal Government” presented last year. The APA argues that the focus should not be on China alone. However, the diversification strategy should not be aimed at relocating production from China. Rather, it is a matter of not missing out on the development of other future markets. fin

After six years, China has overtaken the USA again as the largest foreign market for German mechanical engineering companies. This is according to data published by the VDMA industry association on Wednesday. The reason for this is also the Covid crisis: While other markets such as France and the USA were still suffering considerably from the pandemic, China quickly put the slump behind it. “Already last year, many companies there felt a high investment dynamic,” said VDMA Chief Economist Ralph Wiechers. Capacity utilization in China reached an all-time high in the spring, he added. In the first quarter of 2021, exports to China rose by 20 percent to €4.9 billion. The US was close behind with €4.7 billion. In view of positive signals from the USA, however, it remains to be seen whether China will maintain its lead in the further course of the year. fin

China’s Zhurong Mars rover activated as planned and radioed photos of the Martian surface to Earth. The first images released by the space agency CNSA showed the automated vehicle rolling out of the landing capsule. This was initially followed by a black-and-white photo of a rocky, dusty plain stretching to the horizon of the alien planet. The images are transmitted via the Tianwen-1 satellite, which orbits Mars and maintains contact with the exploration vehicle. Zhurong is now expected to take measurements and send images for three months. fin

The heads of state Xi Jinping and Vladimir Putin sealed the construction of four nuclear reactors in Chinese-Russian cooperation. The two leaders attended the ceremony via video, Chinese media reported Wednesday. According to the statement, the Tianwen power plant complex in Jiangsu province and Xudapu in Liaoning will each receive two new units using Russian technology. The project is part of a $3.1 billion contract signed three years ago. China is counting on a rapid expansion of nuclear power to come close to its climate targets despite a growing hunger for energy. Although the country developed its own nuclear reactor technology, it is also ordering new plants from international suppliers. fin

The ups and downs of the Bitcoin price should be familiar to holders of this best-known and most widespread cryptocurrency. But the fact that the price would plummet so drastically within a short period of time cost even shrewd investors some nerves: The valuation plunged 25 percent to just under $30,000 on Wednesday afternoon, its lowest level since the beginning of the year.

The reason: Three of China’s largest banking associations pointed out that cryptocurrencies are “not real foreign exchange” and warned against “speculation” in this context. They also called on their members to neither accept nor use cryptocurrencies as a means of payment. China’s central bank also pointed out in a brief statement that payments with digital currencies are prohibited in China.

China views cryptocurrency investments with great suspicion and cracked down on their proliferation on several occasions. Nevertheless, China is believed to have provided the most investors, at least for a time. The exact number is not known. At the same time, the leadership itself is working on a digital variant of its national currency, the yuan, and is already conducting initial field tests (China.Table reported). The sell-off on Wednesday was so great after the warning from the Chinese banking associations that the world’s best-known trading place for cryptocurrencies in the US, Coinbase, was temporarily inaccessible for many users. flee

In auditing and accounting, the world is often rendered too simply, thinks Wan-Hsin Liu. Numbers often speak a clear language: right or wrong. “But I don’t have much use for such strict black-and-white thinking,” says Liu, looking back on her studies. The 41-year-old Taiwanese studied accounting in her country of birth. When she minored in economics, she realized, “I can do more with that.”

Without further ado, she decided to come to Germany to study economics. “I quickly realized that I wanted to study in Europe because I was interested in the introduction of the Euro and economic integration in Europe,” says Liu. She wanted to explore whether the EU could serve as a model for East Asian countries. She began studying in Münster in 2003 and now works as a senior researcher at the Kiel Institute for the World Economy.

There, says Liu, she was the only Asian scientist among more than 170 employees for a time. As a result, she still often takes on a special role. “In discussions, especially when it comes to taking a critical look at China’s economic measures, I often bring a perspective that goes beyond dry numbers,” she says. “My knowledge of Chinese culture, language, and mentality, which I have been able to gather through my background over the years, is immensely helpful.” Her differentiated perspective also helps her assess developments that are viewed critically in Europe, she adds.

Especially when it comes to deriving economic policy measures from research, she says, it is immensely important to allow different perspectives. “And who knows best about China? The Chinese, of course. If you research China, you can’t do that from Germany alone.” It was Liu who began to initiate collaborations with high-ranking Chinese research institutes and universities. These include the renowned Tsinghua University in Beijing and the Institute of World Economics and Politics at the Chinese Academy of Social Science. That was in 2011. She received her doctorate a year later, by which time she had already been conducting research in Kiel for four years.

Today, Liu’s work focuses on direct investment and global supply chains. She recently conducted research on the Chinese government’s ambitious five-year plan. In it, the country’s leadership announced that China’s industry would focus on decoupling itself from foreign countries more quickly than it already does. What is already working well with digital technologies – China has the largest e-commerce market in the world – is also set to affect other sectors. And at a fast pace.

Is this a cause for concern for Europe and export giant Germany? Liu does not think so – at least not in the coming years, when China will be even more dependent on Europe, and especially on Germany’s cutting-edge research, to bring expertise into its own country. “It’s true: China wants to become more independent, and in the long term some export sectors will suffer as a result,” says Liu. “But that doesn’t mean China is closing itself off to the world at all.” But foreign companies will have to build their factories locally more than before to play a role in the Chinese market, and also face increasingly fierce competition from local Chinese rivals.

Under normal circumstances, Liu would be traveling the world for her research on the five-year plan and many other projects. In the past, she said, she would be in China once or twice a year for several weeks. Normal, however, is little right now, even though China has a better handle on the pandemic than Europe. “That makes it all the more important to maintain good relations with our Chinese partner institutes virtually.” Leon Kirschgens

Did Putin wrap Xi in plastic? This time, our dessert is not from China, but from Paris. There the Musée Grévin reopened after the pandemic – a wax museum.