China’s vast food reserves prove to be the Communist Party’s secret weapon against inflation. They were created to ensure a steady supply of food in the event of crop failures, and that is precisely the function they currently perform after the record drought. But by allowing state planners to keep supplies high in times of crisis, they also curb price fluctuations, analyzes Ning Wang. China has the world’s largest food stockpiles including wheat and pork.

However, if the world continues to experience extremely dry weather year after year, then even the high reserves will no longer be of any use at some point. At the height of the Covid pandemic, President Xi Jinping already proposed a solution: China’s citizens should eat less. Those who waste food will be fined. In case of doubt, however, China will once again buy on the world market – and drive up prices in other regions.

Meanwhile, visionaries of the so-called metaverse are designing a brave new world of a different kind. The term describes a virtual reality in which we humans lead a second life in digital space in the form of avatars. Once it is finalized, the Metaverse will primarily be a new economic space. Companies and individuals will be able to invest, buy, sell and earn money for services here. That China will also follow its own approach here seems likely. The gaming and social media giant Tencent in particular has the know-how to create its own parallel online world. The company from Shenzhen will probably set standards early on, reports Frank Sieren. However, unlike in the past, Beijing will know how to undermine monopolies at an early stage. China is already setting narrow limits for the digital space of tomorrow.

Heat waves have been plaguing large parts of China for weeks. Temperatures climbed to 44 degrees Celsius on several days (China.Table reported). While the heat is expected to gradually ease in some regions by the end of August, farmers in many provinces are in despair. The drought is raising concerns about crop damages or even whole crop failures. “Autumn grain output accounts for three-quarters of the total annual grain output,” Vice Premier Hu Chunhua said, joining a chain of official voices that openly warn about the impending consequences of the climate: How can food shortages be prevented?

As recently as mid-August, Liu Weiping, China’s vice minister of water resources, warned, “Rice and other autumn crops were now at a critical period when it comes to irrigation.” The low levels of the Yangtze River (China.Table reported) damaged more than 800,000 hectares of farmland in the Yangtze basin, according to Liu. More than 800,000 people in the region struggle to access clean water.

Damage to crops and water scarcity could “spread to other food-related sectors, resulting in a substantial price increase or a food crisis in the most severe case”, said Lin Zhong, a professor at City University of Hong Kong who has studied the impact of climate change on agriculture in China. Experts expect China to buy even more food on the global market to increase its stockpiles and meet its supply targets set by the political leadership.

President and party leader Xi Jinping addressed the issue of self-sufficiency in a keynote speech: “In the future, the demand for food will continue to increase, and the balance between supply and demand will become tighter and tighter,” he said in a speech published in the Party magazine Qiushi in late March. Hu Chunhua, Xi Jinping and Liu Weiping were born in 1963 and 1953, respectively, so they were born well within reach of the 1950s famine. Mao Zedong’s “Great Leap Forward” campaign was intended to boost steel and agricultural production. It led to the biggest crop failures in recent history. Such trauma has long-lasting effects.

The “Great Leap Forward” was also the beginning of China’s dependence on imports. According to Scott Rozelle, a development economist at Stanford University, China’s dependence on food imports stands at around ten percent. Compared to the high import dependency of neighboring Japan, this is a rather low number. However, the USA and the EU, as well as Canada and Australia, have surpluses and do not see their supply security at risk for the time being, even in the face of crises.

The investment bank Goldman Sachs recently informed investors that six provinces accounted for half of the country’s rice production last year. All six are now particularly affected by the drought. These are Sichuan, Chongqing, Hubei, Henan, Jiangxi and Anhui.

Most recently, the winter wheat crop was in short supply in the spring due to a crop failure (China.Table reported). In 2021, heavy rainfall caused floods in the affected areas, and planting seeds had to be postponed. The shortages in the country were then offset by sourcing on the world market. This, in turn, contributes to the price hikes that now fuel inflation in wealthy countries and leave poor countries struggling to make ends meet.

However, China’s government is massively hoarding a whole range of staple foods. For example, the People’s Republic now stores about 50 percent of global wheat stocks, and as much as 70 percent of corn (China.Table reported). As recently as mid-August, China Enterprise United Grain Reserve Ltd. Company 中企联合粮食储备有限公司 was formed from a merger of Sinograin and COFCO, one of the largest state-owned food processing holding companies, “to manage China’s national grain reserve,” according to a recent report by the Beijing-based German-Chinese Agricultural Center.

The details of the state reserves are probably one of the Communist Party’s best-kept secrets. Not even their location is usually revealed, presumably to protect them from looting. Michaela Boehme, an agricultural and food expert and China analyst at the German-Chinese Agricultural Center in Beijing, has collected what little information is available in a paper.

China operates several food reserve systems, according to Boehme’s report. Provinces are required to hold minimum levels of the following commodities:

The provinces are supposed to dump these goods on the market when prices rise to balance out fluctuations for consumers. “These reserves are released through an auction system when the availability of grains and oilseeds on the domestic market decreases after the harvest,” Boehme explains the structures of the national food reserves in her report.

Strategic pork reserves are also held to offset import dependence. Reserves for both live pigs and frozen pork have been maintained since 2007. When African swine fever (ASF) hit in 2019, pork prices rose by more than 110 percent in some cases, as the People’s Republic had to cull up to 40 percent of its pig livestock. At the time, that was equivalent to about one-fifth of the global pig population.

China’s growing food stocks are drawing criticism from other countries. After all, they exacerbate global shortages. Meanwhile, China remains largely unaffected by inflation. One reason for this is the government’s food stockpiles. By opening up its reserves, Beijing also controls prices on the market and thus curbs price inflation (China.Table reported).

But there are first indications that this is no longer enough in light of failed harvests. At the height of the pandemic in the summer of 2020, State and Party leader Xi Jinping urged citizens to restrain their food consumption (China.Table reported). “It is necessary to further enhance public awareness, effectively cultivate thrifty habits and foster a social environment where wasting is shameful and thriftiness is applaudable,” was the motto of the campaign personally proclaimed by Xi.

But the people of China need not worry about hunger in the foreseeable future. It is a core goal of the Party never to repeat the disasters of the Mao era. The reserves are high, and the country’s financial strength is gargantuan. It could also tap the global market at prices several times higher than current levels to feed its own population. Still, to ensure a stable food supply, the country needs to quickly adapt to the new conditions of climate change.

In October 2021, Facebook CEO Mark Zuckerberg abruptly announced the concept of the Metaverse by renaming his company Meta. In an hour-and-a-half-long video, he detailed his vision of a “successor to the mobile Internet”. In Zuckerberg’s Metaverse, people no longer interact and consume via screens and keyboards, but in the form of an avatar that has a second home in a digital parallel world and whose skin can be virtually slipped into. One thing is certain: The real and virtual worlds will continue to merge. But everything else is still open.

China immediately embraced the Western idea of a Metaverse. Within three months of Zuckerberg’s announcement, the number of patents in China related to the Metaverse tripled to 8,500. Given the size of the population, China is undoubtedly an attractive market for establishing a Metaverse.

In the meantime, China is already several steps ahead of the West into the Metaverse in terms of access to Big Data, tech talent pools, and well-developed hardware supply chains. And the digital payment systems of super apps like WeChat and Alipay are already bridging the digital and physical worlds. As an interface for the Metaverse, they are essential.

However, no other company in the world is as well-prepared for the Metaverse as Tencent, which is one of the world’s ten most valuable companies, even ahead of Meta. This is because no other company has both the experience and data of a super app like WeChat, with a good 1.2 billion regular users, and the know-how in developing the world’s most successful computer games. US financial services group Morningstar also notes that “Tencent is best positioned to be a first-mover in the metaverse space given that it is extremely strong in developing content, tapping into old and new users, designing games, and is the second-largest cloud player in China.”

A few months before Zuckerberg’s Metaverse presentation, Tencent CEO Pony Ma publicly presented a vision for building a so-called “Quan Zhen” Internet, which translates to “all-real” web and is similar to Zuckerberg’s Metaverse concept. With Roblox and Fortnite, Tencent already has gaming platforms in its repertoire that allow users to navigate virtual worlds. Tencent is also backing game developer Epic Games and instant messaging service Discord, which brings together one of the largest tech-savvy communities in gaming. Tim Sweeney, the founder of Fortnite studio Epic Games, is already working on a Metaverse. The investment: $1 billion. Tencent holds a 48 percent stake in Epic.

In early 2022, Tencent already introduced a new feature called Super QQ Show on its QQ messaging platform. It is a 3D interactive space where users can socialize, watch shows and play games together. In March, the company also filed patents for virtual concerts with China’s intellectual property authority. At the end of 2021, Tencent had already hosted China’s first virtual music festival, which reportedly peaked at 100,000 simultaneous users.

The more interactive video games become, the more suitable they are as a basis for Metaverse infrastructures. According to Niko Partners, Tencent is the market leader on the Chinese gaming market with a share of 43 percent in 2020.

In July, Tencent also announced the creation of a new extended reality (“XR”) department that will focus on the Metaverse. Until now, Tencent focused primarily on software. It will be interesting to see what hardware the company might use to expand its gaming world and its social media applications such as WeChat. For example, Tencent still lacks smart glasses for the Metaverse world. However, the company is investing in this area as well: Earlier this year, Tencent acquired Xiaomi-backed Black Shark Gaming for about $470 million. The company will now develop and manufacture virtual reality headsets for its new owner.

Two insiders stated that Tencent’s new XR division will have more than 300 employees – a high number considering that the company had cut its running costs and laid off many employees after the government tech crackdown. 5,500 employees had to leave between March and the end of June alone. The XR team is now expected to lead the software company stronger into the hardware business.

All these apps, games, devices, and technologies could merge into a Metaverse that clearly bears Tencent’s mark. But no longer as a quasi-monopolist. In the Metaverse, the government will tighten the reins right from the start. The new antitrust law ensures more competition on the market. This is unlikely to slow down the speed of development, if anything, it is more likely to promote it.

Unlike in Europe, China’s politicians see the opportunities presented by Metaverse technology when it comes to connecting the country’s 1.4 billion people more closely and real without them having to travel to each other. And Communist Party cadres are also hoping for the Metaverse because it could make the sometimes dull day-to-day life of the Party more attractive. Virtual reality company Mengke VR shows what the CP Metaverse could look like. Patriotic users meet in its metaverse to “build the Chinese Communist Party”.

Here, 3D avatars stroll through exhibitions highlighting the achievements of the Communist Party. They bear titles such as “The Great New Era – Major Achievements of the Party” or “The Code of Leadership of the Communist Party of China”. But even that is unlikely to lead the gaming-enthusiastic youth flocking in masses into the arms of the CP. Political apathy not only plagues the West.

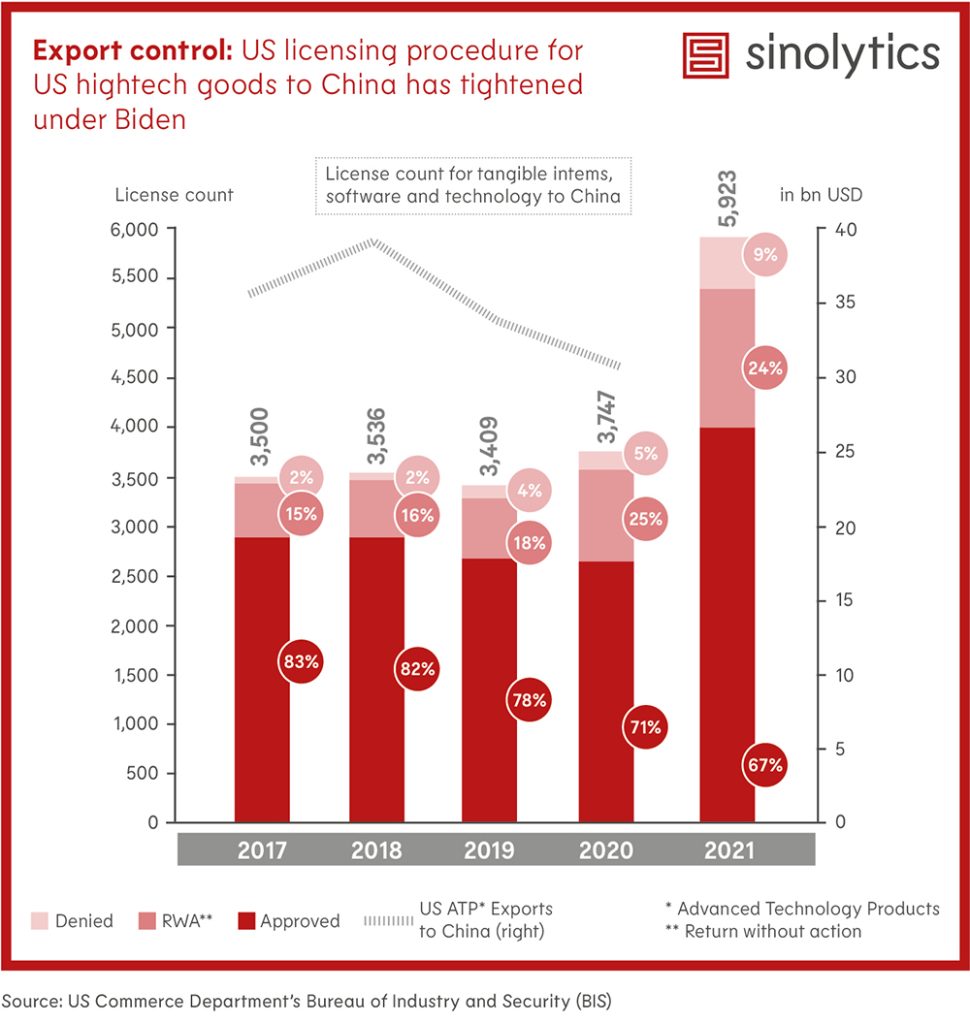

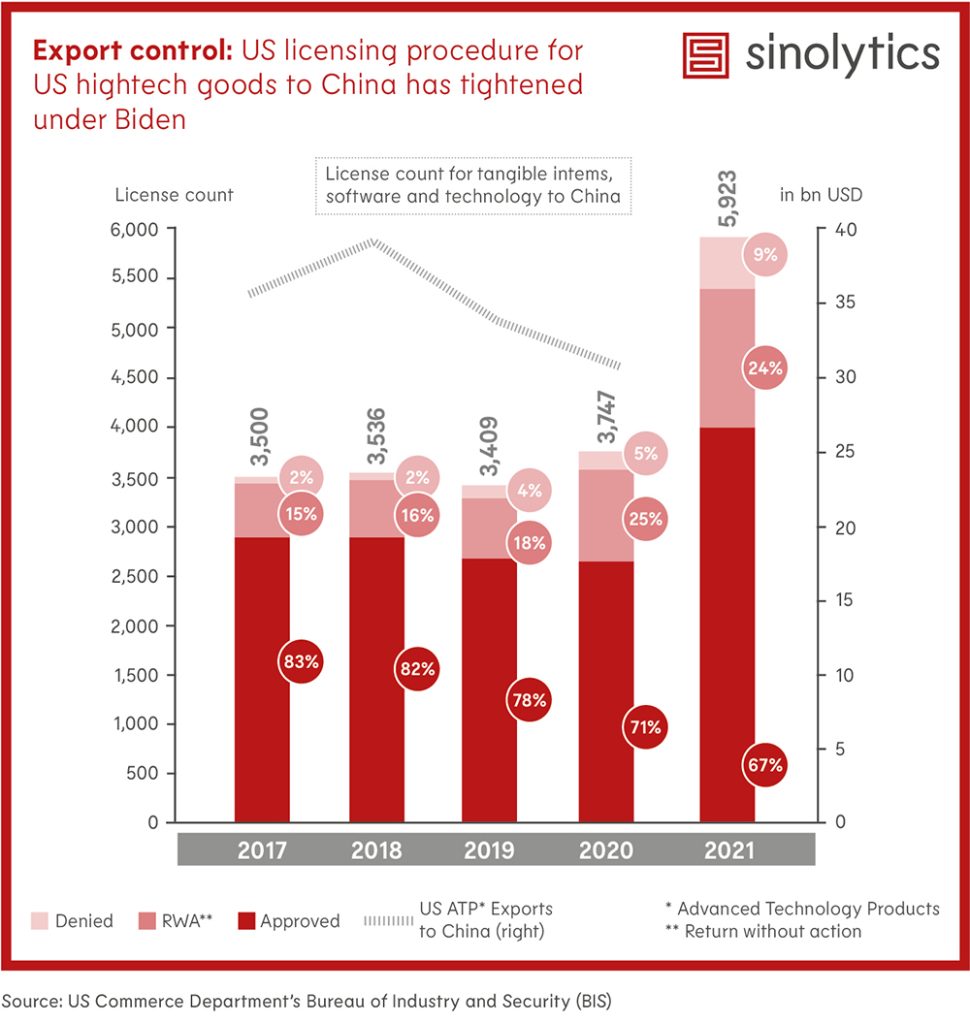

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and business activities in the People’s Republic.

According to a report by Politico, the US government plans to supply Taiwan with weapons worth about $1.1 billion. The package includes 60 anti-ship missiles and 100 air-to-air missiles. The deal only requires congressional approval, Politico writes, citing people familiar with the process. A spokeswoman for the U.S. State Department declined to comment on the report.

The arms deal is said to be aimed at preserving Taiwan’s defense capabilities, rather than expanding the island’s military capabilities. Either way, the deal – if it goes through – is likely to cause further tensions between China and the US. fpe

The Party congress in Beijing is still 47 days away, but the political leadership does not want to take any chances and has once again tightened the Covid measures in the country. In the province of Hebei, bordering the 22-million-metropolis Beijing, about four million people have to stay in quarantine from Tuesday evening until the end of the week.

In the port city of Tianjin, more than 13 million people had to line up for PCR testing. Previously, 80 Covid cases had been reported in the city. Also in the port city of Dalian, in the northeast, the main districts for about three million residents were sealed off and quarantined until Sunday, according to Reuters. In the tech metropolis of Shenzhen, some stores were forced to close on Tuesday evening local time on orders of authorities. At last count, new infections were reported in more than 20 provinces. Government advisers believe the number of infections could rise to 10,000 a day this week.

Experts warn of the consequences for global supply chains: According to the Kiel Institute for Economic Research (IfW), municipal lockdowns are already exacerbating bottlenecks along global supply chains. However, the current measures in Shenzhen and other cities are not yet comparable to the drastic lockdown in Shanghai last spring. “However, if COVID-19 cases continue to rise, a hard lockdown, especially in and around Shenzhen, could weigh on supply chains and the Christmas shopping season,” warned IfW trade expert Vincent Stamer. “Because the province of Guangdong around the metropolises of Guangzhou and Shenzhen on the Pearl River Delta is the strongest export province in China. Many consumer goods for the German market are also manufactured there.” niw/rtr

Roughly three months after the controversial security agreement with China was signed, the Solomon Islands have begun to show growing rejection of US naval vessels. After a US Coast Guard vessel had been denied entry last week, authorities in the Pacific island nation now imposed a complete halt to naval visits. “We have requested our partners to give us time to review, and put in place our new processes, before sending further requests for military vessels to enter the country,” Prime Minister Manesseh Sogavare said in a statement.

These new rules reportedly apply to naval vessels of all countries, the prime minister said. He did not address accusations from the US that the docking ban was the result of Chinese influence. In April, the Solomon Islands signed a controversial security deal with China (China.Table reported). The agreement states that China can assist the Solomon Islands in “maintaining social order”. Australia, the US and other Western countries had subsequently expressed concern that China could establish a permanent military presence in the area (China.Table reported). A military base on the strategically located islands would be an important step for Beijing to strengthen its own position in the Pacific. Sogavare recently assured Australia’s prime minister that there would be no permanent Chinese presence. niw

An article published on the German news portal Spiegel Online raises hopes for supplies of liquefied natural gas (LNG) from China. However, the report is based solely on an article in the British newspaper Financial Times (FT), which in turn draws on a report in the Japanese business newspaper Nikkei, to whose publishing group the FT also belongs. And the Nikkei report is also founded on very little new information.

China could ship LNG to Europe from its own well-stocked reserves this winter. Nikkei cites an anonymous source at the Chinese commodity trading house Jovo Group in Guangzhou as the main evidence of this. The latter reports having already sold “one shipment” to an EU buyer. Oil and gas producer Sinopec also officially reported selling excess LNG stocks to the global market.

However, the possible resale of Russian gas and oil by China has caused debates since the beginning of the war (China.Table reported), without any concrete ideas so far. Russia sells a large share of what no longer goes to Europe at a discount to China, India and other loyal buyers. In theory, nothing stands in the way of resale: Russia cannot dictate to China how it uses the LNG. However, there are significant bottlenecks in practice:

So while Chinese LNG deliveries are highly welcome in Europe and will ultimately happen, they will probably not be a decisive factor in overcoming the current acute energy crisis in Germany. fin

Since the days of Deng Xiaoping, economic growth has mattered more than anything for China’s leaders. The 10 percent annualized hyper-growth from 1980 to 2010 was widely seen as the antidote to the relative stasis of the Mao era, when the economy grew by only about 6 percent. But under President Xi Jinping, the pendulum has swung back, with 6.6 percent average growth from 2013 to 2021 much closer to the trajectory under Mao than under Deng.

Some of the slowdown was inevitable, partly reflecting the law of large numbers: Small economies are better able to sustain rapid growth rates. As China’s economy grew – from 2 percent of world GDP in 1980 at the time of the Deng takeoff to 15 percent when Xi assumed power in 2012 – an arithmetic slowdown became only a matter of time. The surprise was that it took so long to occur.

It is possible to quantify the foregone Chinese output from the slowdown. Had annual real GDP growth remained on the 10 percent trajectory under Xi, rather than slowing by nearly 3.5 percentage points since 2012, the Chinese economy today would be a little more than 40 percent larger than it is.

Yet the China slowdown is far more than an arithmetic event. Three powerful forces are also at work – a structural transformation of the economy, payback for past excesses, and a profound shift in the ideological underpinnings of Chinese governance.

The structural explanation puts an optimistic spin on the slowdown by framing it as the byproduct of a strategy aimed to improve the quality of economic growth. By staying the course of hyper-growth for too long, China became increasingly afflicted with the “four uns” of former Premier Wen Jiabao – an economy that was unstable, unbalanced, uncoordinated, and (ultimately) unsustainable. Rebalancing was the only way out – especially if it led to greener, consumer-led, and services-intensive growth that addressed the twin goals of balance and sustainability. If slower growth was the price, it was well worth paying it.

For a while, the structural slowdown appeared to be on track. Services-led growth boosted job creation and urbanization provided a powerful impetus to real incomes. Even though consumption was still lagging due to a weak social safety net that spawned excess precautionary saving, there was good reason to believe in the likelihood of a structural transformation. But the case for a structural slowdown was not without its downside – especially a worrisome weakening in Chinese total factor productivity growth, as well as stiff demographic headwinds from the one-child family-planning policy in effect between 1980 and 2015.

But there is good reason to believe that China’s slowdown may also be more of an unavoidable payback for the excesses of the hyper-growth era. This line of reasoning was, in fact, telegraphed in 2016 by a high-profile interview with an “authoritative person” published on the front page of the Communist Party’s organ, People’s Daily, which warned of the potential Japanization of an increasingly debt-intensive, bubble-supported Chinese economy. An overly leveraged Chinese property sector fits this script, as does the debt-fueled expansion of state-owned enterprises since the 2008-09 global financial crisis. For China, this became the case for deleveraging, well worth the short-term price to avoid the longer-term stagnation of Japan-like lost decades.

Finally, a major reversal in the ideological underpinnings of governance is also at play. As the revolutionary founder of a new Chinese state, Mao emphasized ideology over development. For Deng and his successors, it was the opposite: De-emphasis of ideology was viewed as necessary to boost economic growth through market-based “reform and opening up”.

Then came Xi. Initially, there was hope that his so-called “Third Plenum Reforms” of 2013 would usher in a new era of strong economic performance. But the new ideological campaigns carried out under the general rubric of Xi Jinping Thought, including a regulatory clampdown on once-dynamic Internet platform companies and associated restrictions on online gaming, music, and private tutoring, as well as a zero-COVID policy that has led to never-ending lockdowns, have all but dashed those hopes.

Equally important has been Xi’s fixation on national rejuvenation, an outgrowth of his so-called Chinese Dream that has led to a far more muscular Chinese foreign policy, in sharp contrast to Deng’s more passive “hide and bide” stance. Not by coincidence, this has fueled the trade and tech wars with the United States, given rise to China’s “unlimited partnership” with Russia, and stoked tension over Taiwan – all of which point to the unwinding of globalization, which had long benefited China more than any other country.

My mistake was to give China too much credit for devising a structural antidote to Wen’s “four uns.” That led me to place too much weight on the benign forces of rebalancing as a rationale for higher quality economic growth. I worried a lot about Japanization risks, but mainly as symptoms of a failed rebalancing. That led me to double down on rebalancing, arguing that structural transformation was China’s only real option.

My biggest mistake was to minimize the consequences of Xi Jinping Thought. Xi’s focus on ideology speaks much more to the resurrection of Mao’s legacy than to continuity with the Deng era. Under Xi, China’s new era is more about the supremacy of the Party, with an associated emphasis on power, control, and ideological constraints on the economy.

Unlike the China of Mao, when there wasn’t much growth to sacrifice, there is far more at stake today for the world’s second-largest economy. With the upcoming 20th Party Congress likely to usher in an unprecedented third five-year term for Xi, there is good reason to believe that China’s growth sacrifice has only just begun.

Stephen S. Roach, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of the forthcoming Accidental Conflict: America, China, and the Clash of False Narratives (Yale University Press, November 2022).

Copyright: Project Syndicate, 2022.

www.project-syndicate.org

Eduardo Thamm has taken on the position of Senior Manager R&D Driving Dynamics at BMW China. The manager with China experience has been working for BMW in product development since 2010. His specialty is coordinating multicultural, cross-functional teams. For his new post, Thamm moved from Shenyang to Beijing.

Björn Giner has assumed the position of Senior Engineer at Schaeffler in Shanghai in August. The Schaeffler Group is a listed German supplier to the automotive and mechanical engineering industries. Previously, Giner worked for three years as a project manager at the company’s headquarters in Herzogenaurach.

Is something changing in your organization? Why not let us know at heads@table.media!

This gentleman once again receives an explicit warning from the authorities: Torrential rains and flash floods are forecast for Chongqing. In the meantime, Germany has also learned how dangerous floods caused by climate change can be. Especially if, like this resident of the western Chinese metropolis, you do not live in a properly reinforced house. He has built his hut under an elevated highway. Here, he is preparing his breakfast.

China’s vast food reserves prove to be the Communist Party’s secret weapon against inflation. They were created to ensure a steady supply of food in the event of crop failures, and that is precisely the function they currently perform after the record drought. But by allowing state planners to keep supplies high in times of crisis, they also curb price fluctuations, analyzes Ning Wang. China has the world’s largest food stockpiles including wheat and pork.

However, if the world continues to experience extremely dry weather year after year, then even the high reserves will no longer be of any use at some point. At the height of the Covid pandemic, President Xi Jinping already proposed a solution: China’s citizens should eat less. Those who waste food will be fined. In case of doubt, however, China will once again buy on the world market – and drive up prices in other regions.

Meanwhile, visionaries of the so-called metaverse are designing a brave new world of a different kind. The term describes a virtual reality in which we humans lead a second life in digital space in the form of avatars. Once it is finalized, the Metaverse will primarily be a new economic space. Companies and individuals will be able to invest, buy, sell and earn money for services here. That China will also follow its own approach here seems likely. The gaming and social media giant Tencent in particular has the know-how to create its own parallel online world. The company from Shenzhen will probably set standards early on, reports Frank Sieren. However, unlike in the past, Beijing will know how to undermine monopolies at an early stage. China is already setting narrow limits for the digital space of tomorrow.

Heat waves have been plaguing large parts of China for weeks. Temperatures climbed to 44 degrees Celsius on several days (China.Table reported). While the heat is expected to gradually ease in some regions by the end of August, farmers in many provinces are in despair. The drought is raising concerns about crop damages or even whole crop failures. “Autumn grain output accounts for three-quarters of the total annual grain output,” Vice Premier Hu Chunhua said, joining a chain of official voices that openly warn about the impending consequences of the climate: How can food shortages be prevented?

As recently as mid-August, Liu Weiping, China’s vice minister of water resources, warned, “Rice and other autumn crops were now at a critical period when it comes to irrigation.” The low levels of the Yangtze River (China.Table reported) damaged more than 800,000 hectares of farmland in the Yangtze basin, according to Liu. More than 800,000 people in the region struggle to access clean water.

Damage to crops and water scarcity could “spread to other food-related sectors, resulting in a substantial price increase or a food crisis in the most severe case”, said Lin Zhong, a professor at City University of Hong Kong who has studied the impact of climate change on agriculture in China. Experts expect China to buy even more food on the global market to increase its stockpiles and meet its supply targets set by the political leadership.

President and party leader Xi Jinping addressed the issue of self-sufficiency in a keynote speech: “In the future, the demand for food will continue to increase, and the balance between supply and demand will become tighter and tighter,” he said in a speech published in the Party magazine Qiushi in late March. Hu Chunhua, Xi Jinping and Liu Weiping were born in 1963 and 1953, respectively, so they were born well within reach of the 1950s famine. Mao Zedong’s “Great Leap Forward” campaign was intended to boost steel and agricultural production. It led to the biggest crop failures in recent history. Such trauma has long-lasting effects.

The “Great Leap Forward” was also the beginning of China’s dependence on imports. According to Scott Rozelle, a development economist at Stanford University, China’s dependence on food imports stands at around ten percent. Compared to the high import dependency of neighboring Japan, this is a rather low number. However, the USA and the EU, as well as Canada and Australia, have surpluses and do not see their supply security at risk for the time being, even in the face of crises.

The investment bank Goldman Sachs recently informed investors that six provinces accounted for half of the country’s rice production last year. All six are now particularly affected by the drought. These are Sichuan, Chongqing, Hubei, Henan, Jiangxi and Anhui.

Most recently, the winter wheat crop was in short supply in the spring due to a crop failure (China.Table reported). In 2021, heavy rainfall caused floods in the affected areas, and planting seeds had to be postponed. The shortages in the country were then offset by sourcing on the world market. This, in turn, contributes to the price hikes that now fuel inflation in wealthy countries and leave poor countries struggling to make ends meet.

However, China’s government is massively hoarding a whole range of staple foods. For example, the People’s Republic now stores about 50 percent of global wheat stocks, and as much as 70 percent of corn (China.Table reported). As recently as mid-August, China Enterprise United Grain Reserve Ltd. Company 中企联合粮食储备有限公司 was formed from a merger of Sinograin and COFCO, one of the largest state-owned food processing holding companies, “to manage China’s national grain reserve,” according to a recent report by the Beijing-based German-Chinese Agricultural Center.

The details of the state reserves are probably one of the Communist Party’s best-kept secrets. Not even their location is usually revealed, presumably to protect them from looting. Michaela Boehme, an agricultural and food expert and China analyst at the German-Chinese Agricultural Center in Beijing, has collected what little information is available in a paper.

China operates several food reserve systems, according to Boehme’s report. Provinces are required to hold minimum levels of the following commodities:

The provinces are supposed to dump these goods on the market when prices rise to balance out fluctuations for consumers. “These reserves are released through an auction system when the availability of grains and oilseeds on the domestic market decreases after the harvest,” Boehme explains the structures of the national food reserves in her report.

Strategic pork reserves are also held to offset import dependence. Reserves for both live pigs and frozen pork have been maintained since 2007. When African swine fever (ASF) hit in 2019, pork prices rose by more than 110 percent in some cases, as the People’s Republic had to cull up to 40 percent of its pig livestock. At the time, that was equivalent to about one-fifth of the global pig population.

China’s growing food stocks are drawing criticism from other countries. After all, they exacerbate global shortages. Meanwhile, China remains largely unaffected by inflation. One reason for this is the government’s food stockpiles. By opening up its reserves, Beijing also controls prices on the market and thus curbs price inflation (China.Table reported).

But there are first indications that this is no longer enough in light of failed harvests. At the height of the pandemic in the summer of 2020, State and Party leader Xi Jinping urged citizens to restrain their food consumption (China.Table reported). “It is necessary to further enhance public awareness, effectively cultivate thrifty habits and foster a social environment where wasting is shameful and thriftiness is applaudable,” was the motto of the campaign personally proclaimed by Xi.

But the people of China need not worry about hunger in the foreseeable future. It is a core goal of the Party never to repeat the disasters of the Mao era. The reserves are high, and the country’s financial strength is gargantuan. It could also tap the global market at prices several times higher than current levels to feed its own population. Still, to ensure a stable food supply, the country needs to quickly adapt to the new conditions of climate change.

In October 2021, Facebook CEO Mark Zuckerberg abruptly announced the concept of the Metaverse by renaming his company Meta. In an hour-and-a-half-long video, he detailed his vision of a “successor to the mobile Internet”. In Zuckerberg’s Metaverse, people no longer interact and consume via screens and keyboards, but in the form of an avatar that has a second home in a digital parallel world and whose skin can be virtually slipped into. One thing is certain: The real and virtual worlds will continue to merge. But everything else is still open.

China immediately embraced the Western idea of a Metaverse. Within three months of Zuckerberg’s announcement, the number of patents in China related to the Metaverse tripled to 8,500. Given the size of the population, China is undoubtedly an attractive market for establishing a Metaverse.

In the meantime, China is already several steps ahead of the West into the Metaverse in terms of access to Big Data, tech talent pools, and well-developed hardware supply chains. And the digital payment systems of super apps like WeChat and Alipay are already bridging the digital and physical worlds. As an interface for the Metaverse, they are essential.

However, no other company in the world is as well-prepared for the Metaverse as Tencent, which is one of the world’s ten most valuable companies, even ahead of Meta. This is because no other company has both the experience and data of a super app like WeChat, with a good 1.2 billion regular users, and the know-how in developing the world’s most successful computer games. US financial services group Morningstar also notes that “Tencent is best positioned to be a first-mover in the metaverse space given that it is extremely strong in developing content, tapping into old and new users, designing games, and is the second-largest cloud player in China.”

A few months before Zuckerberg’s Metaverse presentation, Tencent CEO Pony Ma publicly presented a vision for building a so-called “Quan Zhen” Internet, which translates to “all-real” web and is similar to Zuckerberg’s Metaverse concept. With Roblox and Fortnite, Tencent already has gaming platforms in its repertoire that allow users to navigate virtual worlds. Tencent is also backing game developer Epic Games and instant messaging service Discord, which brings together one of the largest tech-savvy communities in gaming. Tim Sweeney, the founder of Fortnite studio Epic Games, is already working on a Metaverse. The investment: $1 billion. Tencent holds a 48 percent stake in Epic.

In early 2022, Tencent already introduced a new feature called Super QQ Show on its QQ messaging platform. It is a 3D interactive space where users can socialize, watch shows and play games together. In March, the company also filed patents for virtual concerts with China’s intellectual property authority. At the end of 2021, Tencent had already hosted China’s first virtual music festival, which reportedly peaked at 100,000 simultaneous users.

The more interactive video games become, the more suitable they are as a basis for Metaverse infrastructures. According to Niko Partners, Tencent is the market leader on the Chinese gaming market with a share of 43 percent in 2020.

In July, Tencent also announced the creation of a new extended reality (“XR”) department that will focus on the Metaverse. Until now, Tencent focused primarily on software. It will be interesting to see what hardware the company might use to expand its gaming world and its social media applications such as WeChat. For example, Tencent still lacks smart glasses for the Metaverse world. However, the company is investing in this area as well: Earlier this year, Tencent acquired Xiaomi-backed Black Shark Gaming for about $470 million. The company will now develop and manufacture virtual reality headsets for its new owner.

Two insiders stated that Tencent’s new XR division will have more than 300 employees – a high number considering that the company had cut its running costs and laid off many employees after the government tech crackdown. 5,500 employees had to leave between March and the end of June alone. The XR team is now expected to lead the software company stronger into the hardware business.

All these apps, games, devices, and technologies could merge into a Metaverse that clearly bears Tencent’s mark. But no longer as a quasi-monopolist. In the Metaverse, the government will tighten the reins right from the start. The new antitrust law ensures more competition on the market. This is unlikely to slow down the speed of development, if anything, it is more likely to promote it.

Unlike in Europe, China’s politicians see the opportunities presented by Metaverse technology when it comes to connecting the country’s 1.4 billion people more closely and real without them having to travel to each other. And Communist Party cadres are also hoping for the Metaverse because it could make the sometimes dull day-to-day life of the Party more attractive. Virtual reality company Mengke VR shows what the CP Metaverse could look like. Patriotic users meet in its metaverse to “build the Chinese Communist Party”.

Here, 3D avatars stroll through exhibitions highlighting the achievements of the Communist Party. They bear titles such as “The Great New Era – Major Achievements of the Party” or “The Code of Leadership of the Communist Party of China”. But even that is unlikely to lead the gaming-enthusiastic youth flocking in masses into the arms of the CP. Political apathy not only plagues the West.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and business activities in the People’s Republic.

According to a report by Politico, the US government plans to supply Taiwan with weapons worth about $1.1 billion. The package includes 60 anti-ship missiles and 100 air-to-air missiles. The deal only requires congressional approval, Politico writes, citing people familiar with the process. A spokeswoman for the U.S. State Department declined to comment on the report.

The arms deal is said to be aimed at preserving Taiwan’s defense capabilities, rather than expanding the island’s military capabilities. Either way, the deal – if it goes through – is likely to cause further tensions between China and the US. fpe

The Party congress in Beijing is still 47 days away, but the political leadership does not want to take any chances and has once again tightened the Covid measures in the country. In the province of Hebei, bordering the 22-million-metropolis Beijing, about four million people have to stay in quarantine from Tuesday evening until the end of the week.

In the port city of Tianjin, more than 13 million people had to line up for PCR testing. Previously, 80 Covid cases had been reported in the city. Also in the port city of Dalian, in the northeast, the main districts for about three million residents were sealed off and quarantined until Sunday, according to Reuters. In the tech metropolis of Shenzhen, some stores were forced to close on Tuesday evening local time on orders of authorities. At last count, new infections were reported in more than 20 provinces. Government advisers believe the number of infections could rise to 10,000 a day this week.

Experts warn of the consequences for global supply chains: According to the Kiel Institute for Economic Research (IfW), municipal lockdowns are already exacerbating bottlenecks along global supply chains. However, the current measures in Shenzhen and other cities are not yet comparable to the drastic lockdown in Shanghai last spring. “However, if COVID-19 cases continue to rise, a hard lockdown, especially in and around Shenzhen, could weigh on supply chains and the Christmas shopping season,” warned IfW trade expert Vincent Stamer. “Because the province of Guangdong around the metropolises of Guangzhou and Shenzhen on the Pearl River Delta is the strongest export province in China. Many consumer goods for the German market are also manufactured there.” niw/rtr

Roughly three months after the controversial security agreement with China was signed, the Solomon Islands have begun to show growing rejection of US naval vessels. After a US Coast Guard vessel had been denied entry last week, authorities in the Pacific island nation now imposed a complete halt to naval visits. “We have requested our partners to give us time to review, and put in place our new processes, before sending further requests for military vessels to enter the country,” Prime Minister Manesseh Sogavare said in a statement.

These new rules reportedly apply to naval vessels of all countries, the prime minister said. He did not address accusations from the US that the docking ban was the result of Chinese influence. In April, the Solomon Islands signed a controversial security deal with China (China.Table reported). The agreement states that China can assist the Solomon Islands in “maintaining social order”. Australia, the US and other Western countries had subsequently expressed concern that China could establish a permanent military presence in the area (China.Table reported). A military base on the strategically located islands would be an important step for Beijing to strengthen its own position in the Pacific. Sogavare recently assured Australia’s prime minister that there would be no permanent Chinese presence. niw

An article published on the German news portal Spiegel Online raises hopes for supplies of liquefied natural gas (LNG) from China. However, the report is based solely on an article in the British newspaper Financial Times (FT), which in turn draws on a report in the Japanese business newspaper Nikkei, to whose publishing group the FT also belongs. And the Nikkei report is also founded on very little new information.

China could ship LNG to Europe from its own well-stocked reserves this winter. Nikkei cites an anonymous source at the Chinese commodity trading house Jovo Group in Guangzhou as the main evidence of this. The latter reports having already sold “one shipment” to an EU buyer. Oil and gas producer Sinopec also officially reported selling excess LNG stocks to the global market.

However, the possible resale of Russian gas and oil by China has caused debates since the beginning of the war (China.Table reported), without any concrete ideas so far. Russia sells a large share of what no longer goes to Europe at a discount to China, India and other loyal buyers. In theory, nothing stands in the way of resale: Russia cannot dictate to China how it uses the LNG. However, there are significant bottlenecks in practice:

So while Chinese LNG deliveries are highly welcome in Europe and will ultimately happen, they will probably not be a decisive factor in overcoming the current acute energy crisis in Germany. fin

Since the days of Deng Xiaoping, economic growth has mattered more than anything for China’s leaders. The 10 percent annualized hyper-growth from 1980 to 2010 was widely seen as the antidote to the relative stasis of the Mao era, when the economy grew by only about 6 percent. But under President Xi Jinping, the pendulum has swung back, with 6.6 percent average growth from 2013 to 2021 much closer to the trajectory under Mao than under Deng.

Some of the slowdown was inevitable, partly reflecting the law of large numbers: Small economies are better able to sustain rapid growth rates. As China’s economy grew – from 2 percent of world GDP in 1980 at the time of the Deng takeoff to 15 percent when Xi assumed power in 2012 – an arithmetic slowdown became only a matter of time. The surprise was that it took so long to occur.

It is possible to quantify the foregone Chinese output from the slowdown. Had annual real GDP growth remained on the 10 percent trajectory under Xi, rather than slowing by nearly 3.5 percentage points since 2012, the Chinese economy today would be a little more than 40 percent larger than it is.

Yet the China slowdown is far more than an arithmetic event. Three powerful forces are also at work – a structural transformation of the economy, payback for past excesses, and a profound shift in the ideological underpinnings of Chinese governance.

The structural explanation puts an optimistic spin on the slowdown by framing it as the byproduct of a strategy aimed to improve the quality of economic growth. By staying the course of hyper-growth for too long, China became increasingly afflicted with the “four uns” of former Premier Wen Jiabao – an economy that was unstable, unbalanced, uncoordinated, and (ultimately) unsustainable. Rebalancing was the only way out – especially if it led to greener, consumer-led, and services-intensive growth that addressed the twin goals of balance and sustainability. If slower growth was the price, it was well worth paying it.

For a while, the structural slowdown appeared to be on track. Services-led growth boosted job creation and urbanization provided a powerful impetus to real incomes. Even though consumption was still lagging due to a weak social safety net that spawned excess precautionary saving, there was good reason to believe in the likelihood of a structural transformation. But the case for a structural slowdown was not without its downside – especially a worrisome weakening in Chinese total factor productivity growth, as well as stiff demographic headwinds from the one-child family-planning policy in effect between 1980 and 2015.

But there is good reason to believe that China’s slowdown may also be more of an unavoidable payback for the excesses of the hyper-growth era. This line of reasoning was, in fact, telegraphed in 2016 by a high-profile interview with an “authoritative person” published on the front page of the Communist Party’s organ, People’s Daily, which warned of the potential Japanization of an increasingly debt-intensive, bubble-supported Chinese economy. An overly leveraged Chinese property sector fits this script, as does the debt-fueled expansion of state-owned enterprises since the 2008-09 global financial crisis. For China, this became the case for deleveraging, well worth the short-term price to avoid the longer-term stagnation of Japan-like lost decades.

Finally, a major reversal in the ideological underpinnings of governance is also at play. As the revolutionary founder of a new Chinese state, Mao emphasized ideology over development. For Deng and his successors, it was the opposite: De-emphasis of ideology was viewed as necessary to boost economic growth through market-based “reform and opening up”.

Then came Xi. Initially, there was hope that his so-called “Third Plenum Reforms” of 2013 would usher in a new era of strong economic performance. But the new ideological campaigns carried out under the general rubric of Xi Jinping Thought, including a regulatory clampdown on once-dynamic Internet platform companies and associated restrictions on online gaming, music, and private tutoring, as well as a zero-COVID policy that has led to never-ending lockdowns, have all but dashed those hopes.

Equally important has been Xi’s fixation on national rejuvenation, an outgrowth of his so-called Chinese Dream that has led to a far more muscular Chinese foreign policy, in sharp contrast to Deng’s more passive “hide and bide” stance. Not by coincidence, this has fueled the trade and tech wars with the United States, given rise to China’s “unlimited partnership” with Russia, and stoked tension over Taiwan – all of which point to the unwinding of globalization, which had long benefited China more than any other country.

My mistake was to give China too much credit for devising a structural antidote to Wen’s “four uns.” That led me to place too much weight on the benign forces of rebalancing as a rationale for higher quality economic growth. I worried a lot about Japanization risks, but mainly as symptoms of a failed rebalancing. That led me to double down on rebalancing, arguing that structural transformation was China’s only real option.

My biggest mistake was to minimize the consequences of Xi Jinping Thought. Xi’s focus on ideology speaks much more to the resurrection of Mao’s legacy than to continuity with the Deng era. Under Xi, China’s new era is more about the supremacy of the Party, with an associated emphasis on power, control, and ideological constraints on the economy.

Unlike the China of Mao, when there wasn’t much growth to sacrifice, there is far more at stake today for the world’s second-largest economy. With the upcoming 20th Party Congress likely to usher in an unprecedented third five-year term for Xi, there is good reason to believe that China’s growth sacrifice has only just begun.

Stephen S. Roach, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of the forthcoming Accidental Conflict: America, China, and the Clash of False Narratives (Yale University Press, November 2022).

Copyright: Project Syndicate, 2022.

www.project-syndicate.org

Eduardo Thamm has taken on the position of Senior Manager R&D Driving Dynamics at BMW China. The manager with China experience has been working for BMW in product development since 2010. His specialty is coordinating multicultural, cross-functional teams. For his new post, Thamm moved from Shenyang to Beijing.

Björn Giner has assumed the position of Senior Engineer at Schaeffler in Shanghai in August. The Schaeffler Group is a listed German supplier to the automotive and mechanical engineering industries. Previously, Giner worked for three years as a project manager at the company’s headquarters in Herzogenaurach.

Is something changing in your organization? Why not let us know at heads@table.media!

This gentleman once again receives an explicit warning from the authorities: Torrential rains and flash floods are forecast for Chongqing. In the meantime, Germany has also learned how dangerous floods caused by climate change can be. Especially if, like this resident of the western Chinese metropolis, you do not live in a properly reinforced house. He has built his hut under an elevated highway. Here, he is preparing his breakfast.