Almost every year, the Chinese government uses the Christmas calm in the West for all-out attacks on dissidents in its own country. Human rights experts cynically refer to this as the ‘Jingle Bells’ tactic. What has long been routine on the Chinese mainland has now also spread over to Hong Kong shortly before the turn of the year. With the shutdown of the online portal Stand News during the Holidays, authorities silenced one of the city’s last critical voices. And the work of Western journalists is increasingly slandered, writes Marcel Grzanna in his sobering situation report.

Meanwhile, investors who put their money into Chinese stocks require nerves of steel. In 2021, Beijing put entire industries in a headlock with new regulations on an almost weekly basis. The tech sector in particular had to bleed. Giants like Alibaba lost nearly 50 percent of their value. Despite the uncertainty caused by this downslide, analysts remain optimistic for this year. “History teaches us that these are usually the periods that offer the most attractive opportunities,” our Beijing team quotes one expert as saying in their stock market outlook. Especially the sector of renewable energies is worth keeping an eye on.

Another thing that will also please investors is the negative list for foreign investment that came into force on January 1. Despite its somewhat unpleasant name, the document reveals that China continues to tear down market entry barriers in more and more sectors. However, despite deregulating measures, entering the Chinese market is still anything but a cakewalk.

Critical Hong Kong media has already been eliminated. Now, the city’s government is beginning to slander foreign media. Security chief John Lee attacked Wall Street Journal for its criticism of the arrests of seven current and former employees of the online portal Stand News shortly before the new year. In familiar CP fashion, Lee ranted that the newspaper was spreading false information and that its coverage had reached “new levels of nastiness”.

In the People’s Republic, the Communist Party has organized aggressive campaigns against the work of foreign journalists for years. As its authoritarian grip on the Special Administrative Region grows, Beijing’s strategy is spreading over to Hong Kong. “If you are genuinely interested in press freedom, you should support actions against people who have unlawfully exploited the media as a tool to pursue their political or personal gains,” Lee wrote to the paper. For its part, the Wall Street Journal had called the December 28 crackdown on Stand News “nasty”.

The measures taken by the authorities were reminiscent of the case of the newspaper Apple Daily, which had already ceased operations in the spring of last year (China.Table reported). Once again, editorial offices were searched, documents and computers were confiscated, and funds were frozen. Like Apple Daily, Stand News immediately ceased production to protect its remaining employees from possible prosecution. Shortly thereafter, Citizen News, a project founded five years ago as a collective of government-critical journalists, also decided to back out (China.Table reported).

This has made any form of critical political reporting by Hong Kong’s media impossible. The South China Morning Post, which has remained independent for many years, is gradually adopting the government’s line. In a commentary, its chief news editor Yonden Lhatoo accused the West of double standards for preaching freedom of the press while Wikileaks founder Julian Assange is facing trial in the United States.

The German government had criticized the recent crackdown on pro-democracy forces in Hong Kong as a “steady erosion” of pluralism, freedom of expression, and freedom of the press. In a statement, the Foreign Office blamed the introduction of the National Security Law in particular for this development. Indeed, the law, which came into force in 2020, has dramatically increased the scope for arbitrary action by authorities. However, in the case of Stand News, the authorities are not invoking the National Security Act at all, but an outdated clause of the legal ordinance dating back to colonial times.

The clause had not been used for decades until 2020 because it conflicted with international human rights standards. In 2003, the Hong Kong government itself had identified this discrepancy. This provision enables authorities to brand and punish even peaceful expression that merely promotes democracy in general as seditious activity. “With the Stand News arrests, the government is effectively returning to a pre-Basic Law, pre-constitutional rights, pre-Bill of Rights Ordinance understanding of sedition, one that equates negative press attention with criminal activity,” commented Tom Kellogg of the Asian Law Center at Georgetown University in Washington.

Kellogg believes that by applying the aforementioned clause, authorities aim to prevent local media from reporting on Hong Kong activists working against the government from their exiles overseas. “It wants to take steps to expurgate key activist leaders (now in exile or jail) from all aspects of HK civic and public life, including erasing them from the pages (screens) of HK news outlets,” Kellogg wrote on Twitter.

The fact that the crackdown on Stand News took place last week is no coincidence. Each year, the Chinese government uses the Christmas season to take decisive action against critical voices in the country. Many foreign correspondents are back in their home countries over the holidays, foreign newsrooms are usually short-staffed, and the awareness of Western news audiences for developments in China and elsewhere is limited during this time.

Under these conditions, arrests of Chinese dissidents or court sentences against activists generate less echo and outrage. This practice has proven effective in China for many years. In 2007, for example, authorities in Beijing arrested Sakharov Prize winner Hu Jia shortly before the new year. In 2009, Nobel Peace Prize laureate Liu Xiaobo was sentenced to eleven years in prison on Christmas Day. Liu did not live to see freedom again. He died eight years later of liver cancer. A more recent example is blogger Zhang Zhan, who was sentenced to four years in prison by a Shanghai court in late December 2020.

The so-called “jingle bells” tactic is now establishing itself in Hong Kong as well, where the Communist Party, contrary to its pledge, barely grants the people democratic civil rights and demands unconditional obedience from the Hong Kong government.

Two years ago, the security forces already used the collective Western downtime around the festival of love to launch an unprecedented wave of arrests of supporters of the pro-democracy protest movement. 336 arrests were made in four days during Christmas week. This nasty game continued last month. Hong Kong University had to remove the “Pillar of Shame” commemorating the 1989 Tiananmen Square massacre from its campus “for legal reasons”. Then, on Christmas Eve, the “Goddess of Democracy” was also removed from the premises of the Chinese University of Hong Kong.

Investors of Chinese stocks had to have strong nerves in 2021. While global stock markets rose sharply, many Chinese stocks fell. The MSCI China index plunged 19 percent last year, while the global MSCI World index managed a 17 percent gain. Chinese tech companies, which were barraged by government regulatory measures that year, were primarily responsible for the poor performance.

E-commerce giant Alibaba, which was the first to feel the hammer of regulators, lost almost 50 percent of its stock market value in just one year. Meituan, China’s largest food delivery service, lost a good 25 percent. Uber competitor DiDi also took a steep tumble as Beijing objected to the company’s IPO in New York in the summer. This is now forcing DiDi to relocate to the Hong Kong stock exchange.

But after the downward slide, many analysts expect things to pick up again in 2022. US bank JPMorgan even expects the MSCI China to rise by around 40 percent over the next twelve months, outpacing the rest of the world. Optimistic tones are also heard at asset manager Fidelity. “History teaches us that these are usually the periods that offer the most attractive opportunities,” Fidelity China analyst Dale Nicholls recently told Bloomberg. Market observers see plenty of potential. They expect the tech crackdown in China to lose momentum in the coming year. Moreover, authorities signaled a relaxation of monetary policy in order to support the economy, which has been weakening somewhat of late. At the same time, observers expect the boom in green shares in China to continue.

CSI New Energy, a stock index that groups major Chinese companies in this field, bucked the trend and rose 37 percent in 2021. This example shows that the Chinese government’s current interventions are not directed across the board against the stock market and private-sector activities. While Internet companies are groaning under the stricter rules, manufacturers of solar panels, wind turbines, and electric cars are benefiting from the ambitious climate plans of the Chinese leadership (China.Table reported).

China’s President Xi Jinping pledged last year that China wants to reach carbon neutrality before 2060. Emissions of climate gasses are to peak before 2030. Climate policy is also a key component of the government’s 14th Five-Year Plan, which is currently underway. “The political risks for the industry are low,” Hong Kong analyst Stanley Chan recently told the South China Morning Post. Investors have shown considerable interest in recent months for example in China Longyuan Power Group, China’s largest wind farm operator. The world’s largest battery manufacturer CATL and the Chinese solar producer Longi also recently reached new highs on the stock market. The outlook for Chinese EV manufacturers such as Nio and BYD also remains positive.

Analysts expect the Chinese stock markets to recover in the new year. However, there is also a major unknown quantity. For example, the question of what will happen next in China’s real estate market continues to cause considerable uncertainty. The Evergrande case has long been creating outgrowths: Most recently, the US rating agency Fitch also downgraded the smaller real estate developer Kaisa. And the Aoyuan Group also recently reported financial difficulties. Rating agency S&P expects that there will be more defaults among Chinese real estate developers in the coming months. Gregor Koppenburg/Joern Petring

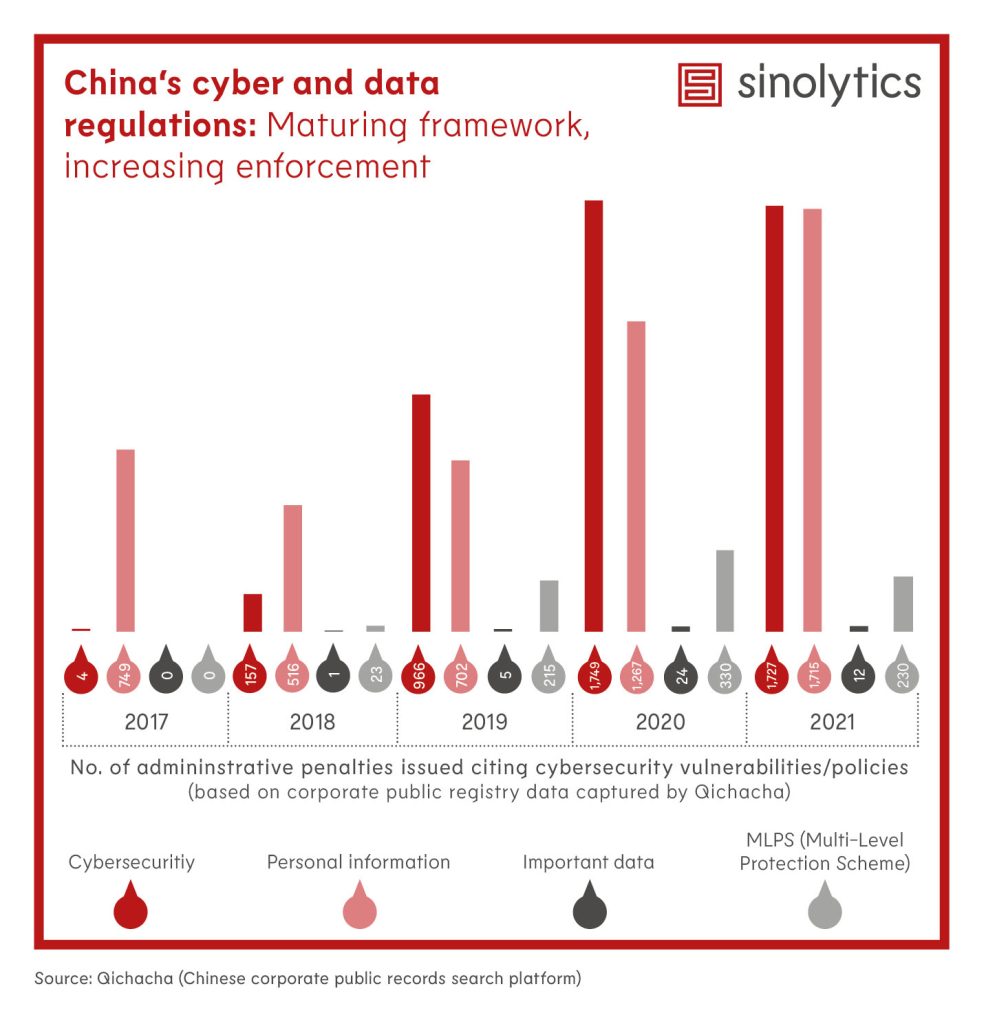

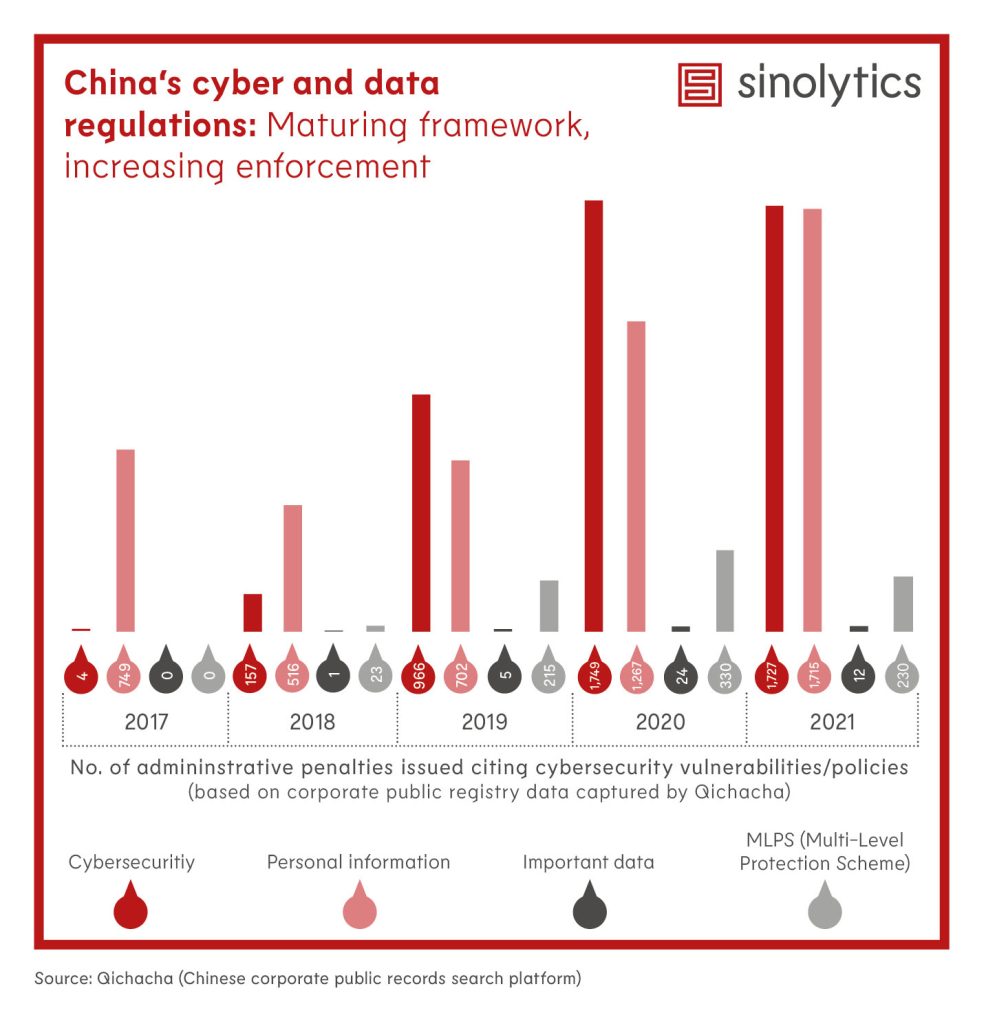

Sinolytics is a European consulting and analysis company that focuses on China. It advises European companies on their strategic orientation and concrete business activities in China.

After the metropolis of Xi’an, another major Chinese city has imposed a complete lockdown. The 1.17 million citizens of Yuzhou in the central Chinese province of Henan have not been allowed to leave their houses and apartments since Monday evening. According to local authorities, guards are ensuring compliance with the curfew.

In Yuzhou, a mere three new Covid cases had been reported in recent days. China continues to pursue a strict zero-covid strategy. Even low numbers of new cases result in curfews, travel restrictions, contact tracing, and mass testing.

The northern metropolis of Xi’an has been under complete lockdown for two weeks. In December, the city experienced the largest Covid outbreak in China since the beginning of the pandemic. In total, the city recorded more than 1,600 infections. According to official data, however, the number of new infections is declining again. fpe

In the trade dispute with China, Lithuania’s President Gitanas Nausėda has openly criticized his own government for opening a “Taiwan office” in Vilnius. Opening the Taiwanese trade representation under that name was a mistake, Nausėda said in an interview with radio station Žinių Radijas on Tuesday. While both Lithuania and Taiwan could open representative offices that do not have diplomatic status, “the name of the office became a key factor that now has a very strong impact on our relations with China,” Nausėda said.“I believe the name was the spark, and now we have to deal with the consequences” the president said. Moreover, he claims to have not been informed about the title, said Nausėda, who represents Lithuania as head of state at EU summits, among other things.

China has been blocking the import of Lithuanian goods since early December. The trade dispute had begun after the EU state approved the opening of a “Taiwan office” in its capital Vilnius (China.Table reported). The president’s public statement now shows the first divide between him and the cabinet of the head of government Ingrida Šimonytė. While Nausėda has now called it a wrong decision for the first time, Lithuania’s government is firmly standing by its decision and is seeking to close ranks with Brussels and Washington. What is also to consider about Nausėda’s statements is that the president and head of government Šimonytė belong to different political camps. Vilnius had announced that it would provide financial support to affected companies (China.Table reported).

Taiwan, meanwhile, is also trying to limit the damage. The state-owned liquor company TTL has purchased several thousand bottles of rum from Lithuania to prevent the goods from being blocked by Chinese customs. Taiwan Tobacco and Liquor, as the company is known by its full name, has bought 20,400 bottles of dark rum destined for the Chinese market from Lithuania’s MV Group Production, several media outlets reported, citing a statement from TTL. According to the statement, the company, which is wholly owned by Taiwan’s Ministry of Finance, said the rum was purchased in mid-December, shortly before the shipment was due to reach a Chinese mainland port. This was to prevent the shipment from being stranded at sea.

“TTL stood up at the right time, purchased the rum and brought it to Taiwan,” the company said in a statement. The rum is now supposed to be labeled with Chinese labels and then brought on the market. “Lithuania supports us and we support Lithuania – TTL calls for a toast to that” the group publicly announced. Earlier, there had been a plea for help regarding the rum shipment by the manufacturer. Beer shipments from Lithuania had also been diverted to Taiwan. According to reports, Lithuanian brewer Volfas Engelman was particularly affected by the trade dispute with China. The brewery had suffered a loss of €500,000 due to the sudden cancellation of all Chinese orders. ari

Electric car manufacturer Tesla is facing criticism for opening a showroom in the Chinese province of Xinjiang. The US company announced the opening last week on the Chinese short message service Weibo. Human rights organizations and politicians from the US and Europe accused the company and its founder Elon Musk of a lack of sensitivity. “In the shadow of concentration camps, Tesla is opening a car dealership with great fanfare. The pact between Western billionaires and the Chinese regime is going well in 2022,” French MEP Raphaël Glucksmann wrote on Twitter.

Council on American-Islamic Relations (CAIR), the largest US-Muslim advocacy group, said Tesla was supporting the “genocide” of the Uyghurs. “Elon Musk must close Tesla’s Xinjiang showroom,” CAIR demanded on Twitter. Similar comments were made by a leading business association and Republican Senator Marco Rubio. He accused international corporations of helping the Chinese Communist Party cover up genocide and slave labor in the region.

Tesla did not immediately respond to a request for comment, as Reuters reported. The US carmaker is currently facing other problems in China: Around 200,000 models have to be recalled due to potential safety risks. Reuters reported that the recall has been issued at the China Market Regulatory Commission for about 20,000 imported Model S and 36,000 imported Model 3. In addition, around 144,000 Model 3 produced in Shanghai are said to be affected. Such models are also shipped to Europe. Tesla already had to announce a recall in the USA last week. ari. ari

The municipal government of Beijing has presented new data on the city’s air quality over the past year. According to this data, the capital met all six targets for better air quality for the first time. The goal of reducing the proportion of very small particles – particulate matter with a diameter of 2.5 micrometers and smaller – to below 35 micrograms per cubic meter was also achieved for the first time. Experts see this as major progress, as the value was still 100 micrograms a few years ago.

On the other hand, this level of particulate matter in Beijing is still seven times higher than the level recommended by the World Health Organization. The still high level of particulate matter is associated with a 45 percent higher risk of lung cancer, a 40 percent higher risk of strokes and adult-onset diabetes, and a 70 percent higher risk of heart disease, an expert said on Twitter.

Li Shuo of Greenpeace East Asia commented on the data from Beijing: “Progress is possible if political will is there. Meanwhile, it is still miserable in much of Hebei, Henan, Shanxi, Shandong, and Sichuan. Air pollution is a national problem, which is made more true by these new figures from Beijing.” nib

On Tuesday, Uyghur and Tibetan activist groups campaigned worldwide for a political boycott of the Winter Olympics in Beijing (February 4-20). Exactly one month before the opening ceremony, thousands of demonstrators gathered in Berlin, New York, Paris, Washington, Brussels, London, Brisbane, Chicago, and other cities to draw attention to the dramatic human rights situation in the People’s Republic.

In Berlin, around 300 participants from various organizations marched from the Brandenburg Gate to the Federal Foreign Office. Under the slogan #NoBeijing2022, the International Campaign for Tibet Germany (ICT) and the World Uyghur Congress (WUC), as well as the Society for Threatened Peoples and representatives of Muslim associations and the Hong Kong exile population, took part in the protest.

“Human rights policy does not just mean voicing criticism, but drawing consequences. Only then is human rights policy credible,” said ICT Germany Managing Director Kai Mueller in an interview with China.Table. Critical words would not be taken seriously by Beijing. That is why action would have to follow. Above all, the German government is called upon to lead the way in Europe. Especially since foreign countries expect Berlin to be more willing to use its political power.

Mueller also spoke out against a sporting boycott of the Winter Games. The athletes themselves were affected and should not be punished for mistakes made by sports federations. “The repeated awarding of the Olympic Games to Beijing was irresponsible and the result of a lack of reappraisal of the human rights violations in Tibet in the run-up to the 2008 Summer Games,” Müller said. grz

On 9 October 2021 China’s top economic planning body, the National Development and Reform Commission (NDRC), published its annual update of the Negative List for Market Access (the “Negative List 2021“) for public comments.

Once made legally binding, it would be the fourth Negative List for Market Access with nationwide effect, by which both domestic and foreign investors should abide. The implementation of the Negative List 2021 and its previous versions reflects the efforts of the Chinese government to further liberalize the market with less administrative intervention. For both domestic and foreign investors, the Negative List 2021 offers greater investment potential and more business opportunities for the latter.

A Negative List for Market Entry, as the name suggests, is a catalogue containing detailed business areas in which investments are prohibited or only possible with specific approval and admission. China had a long-standing practice of market regulation with a positive list for market entry until 2015. Contrary to a negative list, a positive list decides in which business fields investments are permitted. In 2015 the “Negative List for Market Entry” was introduced as a pilot project in Tianjin, Shanghai, the Fujian Province and the Guangdong Province. Feedback from the market and the outcome was quite positive. Thus, a nationwide “Negative List for Market Entry” was implemented three years later in 2018.

While there were 328 business fields listed in the initial Negative List for Market Entry in 2018 (96 as prohibited, 232 as approval and admission required), the Negative List 2021 will be much shorter with 117 business fields (6 as prohibited, 111 as approval and admission required). Listed as “prohibited” remain, among others, certain business activities in the area of financial services, internet operational services and publishing.

Since cryptocurrency trading and mining were already banned by the regulators earlier this year, the Negative List 2021 proposes to include cryptocurrency trading and mining into its sub-list of prohibited items. Listed as “eligible for approval and admission” are particular business activities in what the country considers the most important economic sectors such as agriculture, manufacturing, energy infrastructure, transportation, hotel business, information technology and software services, and real estate business.

Compared to 2020 Negative List, this year’s list lifts approval and admission requirements for specific business activities such as:

By doing so, the Chinese government encourages entrepreneurs in the mentioned sectors to enter the Chinese market in order to develop such sectors further. There are also areas in which new restrictions have been posted, for example the provision of news services, operation of social media platforms, production and transportation of certain chemicals.

Ancillary to the scheme of Negative List for Market Access, the Chinese government has also introduced a negative list for foreign investments. When considering an investment in Mainland China, foreign investors should pay special attention to the most up-to-date negative list for foreign investments, which bans or imposes restrictions on market entry in further business areas, such as the requirement of establishing a Sino-foreign joint venture when investing into medical institutions and telecom services. The negative list for foreign investments will be reviewed and updated annually. The latest negative list for foreign investments was issued shortly before the end of 2021 and has been in effect as of January 1, 2022

As envisaged by the regulatory body, the latest list lifted the joint venture requirements for foreign investors when investing into the automobile industry. A larger scale of investment in this sector by foreign car manufacturers can be expected in the near future. Limitations for foreign investments in manufacturing of ground receiving facilities and key components for satellite television broadcast have as well been deleted from the current effective negative list for foreign investments.

Parallel to the Negative List for Foreign Investments, a more liberal negative list for foreign investments is tailor-made for and applies in more than 20 Pilot Free Trade Zones across 21 provinces in China. As a cherry on top, the whole Hainan Island was designated as a special Pilot Free Trade Zone in 2018. There is a negative list for foreign investments applied only to Hainan Pilot Free Trade Zone (the “Hainan Negative List“), which lifts even more curbs for foreign investors. For example, the currently effective Hainan Negative List provides a higher level of relaxation for foreign investment in the areas of mining, manufacturing, telecom services, business services (including legal advisory services, market research services and social research services) and education.

The implementation of the N scheme demonstrates the commitment of the Chinese government to intensify their efforts to open the domestic market, to offer more legal certainty and a leveled playing field for both domestic and foreign market players. As supporting measures, the administration has been working on streamlining administrative processes, to ensure investments can be brought forward smoothly, whether they are subject to the negative list or not. For foreign investors the Negative List 2021 offers more market access opportunities, enabling the entry into the world’s second largest economy with an enormous customer base of more than 1.4 billion people.

Investors from around the world have the chance to expand their business in China, especially for those whose business matches the economical hot spots. In the next five years (2021 to 2025), China aims to upgrade the economic structure within the fourteenth ‘Five-Years Plan for the National Economic and Social Development’. In the light of tackling climate change challenges and building up a digitalized society, the focus has been put on digitalization and development of ‘green’ technology to achieve the goal of carbon neutrality. Foreign investors are most welcome as they could bring along advanced technology and management experience. Comprehensive and substantive reforms of the legal system have been reinforced to enhance the protection of intellectual property (IP), which will provide more comfort for foreign investors who have concerns about safeguarding of their own IP rights.

As a further incentive, the Chinese government has also introduced a Catalogue of Industries for Encouraging Foreign Investment (the “Encouraged Industries Catalogue“). In the currently effective version, as amended in 2020, there are 480 business fields across 13 industrial sectors that the foreign investors are encouraged to participate in nationwide. The Encouraged Industries Catalogue also includes a list with additional encouraged business fields for foreign investments in Middle and Western China. Favorable conditions under the framework of the Encouraged Industries Catalogue include:

However, challenges for foreign investors still exist, especially for those who have limited experience in doing business in China. Despite the government’s efforts to provide more comfort to foreign investors, the Chinese legal rules and regulations on investments are still quite complicated for new comers, not to mention the language barriers and the cultural differences. Understanding the local culture plays an important part in market penetration and cooperation with the Chinese counterparts. Attention should also be paid to the market research regarding Chinese rivals. After years of development, many Chinese companies have already gathered enough business power to challenge their foreign peers. It is therefore very advisable to engage experienced and knowledgeable professional advisors to support the envisaged market expansion.

China has already been on a fast track of development and its government has been working on adapting and optimizing policies to support the economy boom. Although there are still quite a lot and comprehensive off-limits and restrictions for investing in China, the market is expected to continue to liberalize in the coming years. The market entry regulations, including the Negative List for Market Access and the encouraged industry catalogue, should be monitored thoroughly by foreign investors in order to seize future business potential.

Reed Smith is a dynamic international law firm with more than 1,700 lawyers in 30 offices across Europe, the US, the Middle East and Asia. For more information, please visit www.reedsmith.com. Florian Hirschmann advises clients on corporate law, in particular on domestic and international private equity and M&A transactions, venture capital and joint ventures. Siling Zhong is a paralegal in the Munich office and a member of the Global Corporate Group and the Reed Smith China Desk Team.

Hu Henghua will become the new mayor of Chongqing, a metropolis of 31 million people in southwest China. The 58-year-old previously served as a local cadre in his home province of Hunan for 37 years.

Daniel Nordberg has been appointed Vice President for the Asia Pacific & Indian Subcontinent region at Norderstedt-based GAC Marine Logistics GmbH. He has been General Manager of GAC Qatar since 2016. GAC is a global provider of shipping, logistics, and maritime services.

Motorsport is on the rise in China. This year, a Chinese driver will compete in Formula 1 for the first time. At the Dakar Rally, on the other hand, Chinese drivers and vehicles have been part of the race for quite some time. Ranked 24th, Zhang Guoyu and his co-driver Pan Hongyu in their BAIC BJ40 are in the midfield of the classification after the 3rd stage of the desert chase.

Almost every year, the Chinese government uses the Christmas calm in the West for all-out attacks on dissidents in its own country. Human rights experts cynically refer to this as the ‘Jingle Bells’ tactic. What has long been routine on the Chinese mainland has now also spread over to Hong Kong shortly before the turn of the year. With the shutdown of the online portal Stand News during the Holidays, authorities silenced one of the city’s last critical voices. And the work of Western journalists is increasingly slandered, writes Marcel Grzanna in his sobering situation report.

Meanwhile, investors who put their money into Chinese stocks require nerves of steel. In 2021, Beijing put entire industries in a headlock with new regulations on an almost weekly basis. The tech sector in particular had to bleed. Giants like Alibaba lost nearly 50 percent of their value. Despite the uncertainty caused by this downslide, analysts remain optimistic for this year. “History teaches us that these are usually the periods that offer the most attractive opportunities,” our Beijing team quotes one expert as saying in their stock market outlook. Especially the sector of renewable energies is worth keeping an eye on.

Another thing that will also please investors is the negative list for foreign investment that came into force on January 1. Despite its somewhat unpleasant name, the document reveals that China continues to tear down market entry barriers in more and more sectors. However, despite deregulating measures, entering the Chinese market is still anything but a cakewalk.

Critical Hong Kong media has already been eliminated. Now, the city’s government is beginning to slander foreign media. Security chief John Lee attacked Wall Street Journal for its criticism of the arrests of seven current and former employees of the online portal Stand News shortly before the new year. In familiar CP fashion, Lee ranted that the newspaper was spreading false information and that its coverage had reached “new levels of nastiness”.

In the People’s Republic, the Communist Party has organized aggressive campaigns against the work of foreign journalists for years. As its authoritarian grip on the Special Administrative Region grows, Beijing’s strategy is spreading over to Hong Kong. “If you are genuinely interested in press freedom, you should support actions against people who have unlawfully exploited the media as a tool to pursue their political or personal gains,” Lee wrote to the paper. For its part, the Wall Street Journal had called the December 28 crackdown on Stand News “nasty”.

The measures taken by the authorities were reminiscent of the case of the newspaper Apple Daily, which had already ceased operations in the spring of last year (China.Table reported). Once again, editorial offices were searched, documents and computers were confiscated, and funds were frozen. Like Apple Daily, Stand News immediately ceased production to protect its remaining employees from possible prosecution. Shortly thereafter, Citizen News, a project founded five years ago as a collective of government-critical journalists, also decided to back out (China.Table reported).

This has made any form of critical political reporting by Hong Kong’s media impossible. The South China Morning Post, which has remained independent for many years, is gradually adopting the government’s line. In a commentary, its chief news editor Yonden Lhatoo accused the West of double standards for preaching freedom of the press while Wikileaks founder Julian Assange is facing trial in the United States.

The German government had criticized the recent crackdown on pro-democracy forces in Hong Kong as a “steady erosion” of pluralism, freedom of expression, and freedom of the press. In a statement, the Foreign Office blamed the introduction of the National Security Law in particular for this development. Indeed, the law, which came into force in 2020, has dramatically increased the scope for arbitrary action by authorities. However, in the case of Stand News, the authorities are not invoking the National Security Act at all, but an outdated clause of the legal ordinance dating back to colonial times.

The clause had not been used for decades until 2020 because it conflicted with international human rights standards. In 2003, the Hong Kong government itself had identified this discrepancy. This provision enables authorities to brand and punish even peaceful expression that merely promotes democracy in general as seditious activity. “With the Stand News arrests, the government is effectively returning to a pre-Basic Law, pre-constitutional rights, pre-Bill of Rights Ordinance understanding of sedition, one that equates negative press attention with criminal activity,” commented Tom Kellogg of the Asian Law Center at Georgetown University in Washington.

Kellogg believes that by applying the aforementioned clause, authorities aim to prevent local media from reporting on Hong Kong activists working against the government from their exiles overseas. “It wants to take steps to expurgate key activist leaders (now in exile or jail) from all aspects of HK civic and public life, including erasing them from the pages (screens) of HK news outlets,” Kellogg wrote on Twitter.

The fact that the crackdown on Stand News took place last week is no coincidence. Each year, the Chinese government uses the Christmas season to take decisive action against critical voices in the country. Many foreign correspondents are back in their home countries over the holidays, foreign newsrooms are usually short-staffed, and the awareness of Western news audiences for developments in China and elsewhere is limited during this time.

Under these conditions, arrests of Chinese dissidents or court sentences against activists generate less echo and outrage. This practice has proven effective in China for many years. In 2007, for example, authorities in Beijing arrested Sakharov Prize winner Hu Jia shortly before the new year. In 2009, Nobel Peace Prize laureate Liu Xiaobo was sentenced to eleven years in prison on Christmas Day. Liu did not live to see freedom again. He died eight years later of liver cancer. A more recent example is blogger Zhang Zhan, who was sentenced to four years in prison by a Shanghai court in late December 2020.

The so-called “jingle bells” tactic is now establishing itself in Hong Kong as well, where the Communist Party, contrary to its pledge, barely grants the people democratic civil rights and demands unconditional obedience from the Hong Kong government.

Two years ago, the security forces already used the collective Western downtime around the festival of love to launch an unprecedented wave of arrests of supporters of the pro-democracy protest movement. 336 arrests were made in four days during Christmas week. This nasty game continued last month. Hong Kong University had to remove the “Pillar of Shame” commemorating the 1989 Tiananmen Square massacre from its campus “for legal reasons”. Then, on Christmas Eve, the “Goddess of Democracy” was also removed from the premises of the Chinese University of Hong Kong.

Investors of Chinese stocks had to have strong nerves in 2021. While global stock markets rose sharply, many Chinese stocks fell. The MSCI China index plunged 19 percent last year, while the global MSCI World index managed a 17 percent gain. Chinese tech companies, which were barraged by government regulatory measures that year, were primarily responsible for the poor performance.

E-commerce giant Alibaba, which was the first to feel the hammer of regulators, lost almost 50 percent of its stock market value in just one year. Meituan, China’s largest food delivery service, lost a good 25 percent. Uber competitor DiDi also took a steep tumble as Beijing objected to the company’s IPO in New York in the summer. This is now forcing DiDi to relocate to the Hong Kong stock exchange.

But after the downward slide, many analysts expect things to pick up again in 2022. US bank JPMorgan even expects the MSCI China to rise by around 40 percent over the next twelve months, outpacing the rest of the world. Optimistic tones are also heard at asset manager Fidelity. “History teaches us that these are usually the periods that offer the most attractive opportunities,” Fidelity China analyst Dale Nicholls recently told Bloomberg. Market observers see plenty of potential. They expect the tech crackdown in China to lose momentum in the coming year. Moreover, authorities signaled a relaxation of monetary policy in order to support the economy, which has been weakening somewhat of late. At the same time, observers expect the boom in green shares in China to continue.

CSI New Energy, a stock index that groups major Chinese companies in this field, bucked the trend and rose 37 percent in 2021. This example shows that the Chinese government’s current interventions are not directed across the board against the stock market and private-sector activities. While Internet companies are groaning under the stricter rules, manufacturers of solar panels, wind turbines, and electric cars are benefiting from the ambitious climate plans of the Chinese leadership (China.Table reported).

China’s President Xi Jinping pledged last year that China wants to reach carbon neutrality before 2060. Emissions of climate gasses are to peak before 2030. Climate policy is also a key component of the government’s 14th Five-Year Plan, which is currently underway. “The political risks for the industry are low,” Hong Kong analyst Stanley Chan recently told the South China Morning Post. Investors have shown considerable interest in recent months for example in China Longyuan Power Group, China’s largest wind farm operator. The world’s largest battery manufacturer CATL and the Chinese solar producer Longi also recently reached new highs on the stock market. The outlook for Chinese EV manufacturers such as Nio and BYD also remains positive.

Analysts expect the Chinese stock markets to recover in the new year. However, there is also a major unknown quantity. For example, the question of what will happen next in China’s real estate market continues to cause considerable uncertainty. The Evergrande case has long been creating outgrowths: Most recently, the US rating agency Fitch also downgraded the smaller real estate developer Kaisa. And the Aoyuan Group also recently reported financial difficulties. Rating agency S&P expects that there will be more defaults among Chinese real estate developers in the coming months. Gregor Koppenburg/Joern Petring

Sinolytics is a European consulting and analysis company that focuses on China. It advises European companies on their strategic orientation and concrete business activities in China.

After the metropolis of Xi’an, another major Chinese city has imposed a complete lockdown. The 1.17 million citizens of Yuzhou in the central Chinese province of Henan have not been allowed to leave their houses and apartments since Monday evening. According to local authorities, guards are ensuring compliance with the curfew.

In Yuzhou, a mere three new Covid cases had been reported in recent days. China continues to pursue a strict zero-covid strategy. Even low numbers of new cases result in curfews, travel restrictions, contact tracing, and mass testing.

The northern metropolis of Xi’an has been under complete lockdown for two weeks. In December, the city experienced the largest Covid outbreak in China since the beginning of the pandemic. In total, the city recorded more than 1,600 infections. According to official data, however, the number of new infections is declining again. fpe

In the trade dispute with China, Lithuania’s President Gitanas Nausėda has openly criticized his own government for opening a “Taiwan office” in Vilnius. Opening the Taiwanese trade representation under that name was a mistake, Nausėda said in an interview with radio station Žinių Radijas on Tuesday. While both Lithuania and Taiwan could open representative offices that do not have diplomatic status, “the name of the office became a key factor that now has a very strong impact on our relations with China,” Nausėda said.“I believe the name was the spark, and now we have to deal with the consequences” the president said. Moreover, he claims to have not been informed about the title, said Nausėda, who represents Lithuania as head of state at EU summits, among other things.

China has been blocking the import of Lithuanian goods since early December. The trade dispute had begun after the EU state approved the opening of a “Taiwan office” in its capital Vilnius (China.Table reported). The president’s public statement now shows the first divide between him and the cabinet of the head of government Ingrida Šimonytė. While Nausėda has now called it a wrong decision for the first time, Lithuania’s government is firmly standing by its decision and is seeking to close ranks with Brussels and Washington. What is also to consider about Nausėda’s statements is that the president and head of government Šimonytė belong to different political camps. Vilnius had announced that it would provide financial support to affected companies (China.Table reported).

Taiwan, meanwhile, is also trying to limit the damage. The state-owned liquor company TTL has purchased several thousand bottles of rum from Lithuania to prevent the goods from being blocked by Chinese customs. Taiwan Tobacco and Liquor, as the company is known by its full name, has bought 20,400 bottles of dark rum destined for the Chinese market from Lithuania’s MV Group Production, several media outlets reported, citing a statement from TTL. According to the statement, the company, which is wholly owned by Taiwan’s Ministry of Finance, said the rum was purchased in mid-December, shortly before the shipment was due to reach a Chinese mainland port. This was to prevent the shipment from being stranded at sea.

“TTL stood up at the right time, purchased the rum and brought it to Taiwan,” the company said in a statement. The rum is now supposed to be labeled with Chinese labels and then brought on the market. “Lithuania supports us and we support Lithuania – TTL calls for a toast to that” the group publicly announced. Earlier, there had been a plea for help regarding the rum shipment by the manufacturer. Beer shipments from Lithuania had also been diverted to Taiwan. According to reports, Lithuanian brewer Volfas Engelman was particularly affected by the trade dispute with China. The brewery had suffered a loss of €500,000 due to the sudden cancellation of all Chinese orders. ari

Electric car manufacturer Tesla is facing criticism for opening a showroom in the Chinese province of Xinjiang. The US company announced the opening last week on the Chinese short message service Weibo. Human rights organizations and politicians from the US and Europe accused the company and its founder Elon Musk of a lack of sensitivity. “In the shadow of concentration camps, Tesla is opening a car dealership with great fanfare. The pact between Western billionaires and the Chinese regime is going well in 2022,” French MEP Raphaël Glucksmann wrote on Twitter.

Council on American-Islamic Relations (CAIR), the largest US-Muslim advocacy group, said Tesla was supporting the “genocide” of the Uyghurs. “Elon Musk must close Tesla’s Xinjiang showroom,” CAIR demanded on Twitter. Similar comments were made by a leading business association and Republican Senator Marco Rubio. He accused international corporations of helping the Chinese Communist Party cover up genocide and slave labor in the region.

Tesla did not immediately respond to a request for comment, as Reuters reported. The US carmaker is currently facing other problems in China: Around 200,000 models have to be recalled due to potential safety risks. Reuters reported that the recall has been issued at the China Market Regulatory Commission for about 20,000 imported Model S and 36,000 imported Model 3. In addition, around 144,000 Model 3 produced in Shanghai are said to be affected. Such models are also shipped to Europe. Tesla already had to announce a recall in the USA last week. ari. ari

The municipal government of Beijing has presented new data on the city’s air quality over the past year. According to this data, the capital met all six targets for better air quality for the first time. The goal of reducing the proportion of very small particles – particulate matter with a diameter of 2.5 micrometers and smaller – to below 35 micrograms per cubic meter was also achieved for the first time. Experts see this as major progress, as the value was still 100 micrograms a few years ago.

On the other hand, this level of particulate matter in Beijing is still seven times higher than the level recommended by the World Health Organization. The still high level of particulate matter is associated with a 45 percent higher risk of lung cancer, a 40 percent higher risk of strokes and adult-onset diabetes, and a 70 percent higher risk of heart disease, an expert said on Twitter.

Li Shuo of Greenpeace East Asia commented on the data from Beijing: “Progress is possible if political will is there. Meanwhile, it is still miserable in much of Hebei, Henan, Shanxi, Shandong, and Sichuan. Air pollution is a national problem, which is made more true by these new figures from Beijing.” nib

On Tuesday, Uyghur and Tibetan activist groups campaigned worldwide for a political boycott of the Winter Olympics in Beijing (February 4-20). Exactly one month before the opening ceremony, thousands of demonstrators gathered in Berlin, New York, Paris, Washington, Brussels, London, Brisbane, Chicago, and other cities to draw attention to the dramatic human rights situation in the People’s Republic.

In Berlin, around 300 participants from various organizations marched from the Brandenburg Gate to the Federal Foreign Office. Under the slogan #NoBeijing2022, the International Campaign for Tibet Germany (ICT) and the World Uyghur Congress (WUC), as well as the Society for Threatened Peoples and representatives of Muslim associations and the Hong Kong exile population, took part in the protest.

“Human rights policy does not just mean voicing criticism, but drawing consequences. Only then is human rights policy credible,” said ICT Germany Managing Director Kai Mueller in an interview with China.Table. Critical words would not be taken seriously by Beijing. That is why action would have to follow. Above all, the German government is called upon to lead the way in Europe. Especially since foreign countries expect Berlin to be more willing to use its political power.

Mueller also spoke out against a sporting boycott of the Winter Games. The athletes themselves were affected and should not be punished for mistakes made by sports federations. “The repeated awarding of the Olympic Games to Beijing was irresponsible and the result of a lack of reappraisal of the human rights violations in Tibet in the run-up to the 2008 Summer Games,” Müller said. grz

On 9 October 2021 China’s top economic planning body, the National Development and Reform Commission (NDRC), published its annual update of the Negative List for Market Access (the “Negative List 2021“) for public comments.

Once made legally binding, it would be the fourth Negative List for Market Access with nationwide effect, by which both domestic and foreign investors should abide. The implementation of the Negative List 2021 and its previous versions reflects the efforts of the Chinese government to further liberalize the market with less administrative intervention. For both domestic and foreign investors, the Negative List 2021 offers greater investment potential and more business opportunities for the latter.

A Negative List for Market Entry, as the name suggests, is a catalogue containing detailed business areas in which investments are prohibited or only possible with specific approval and admission. China had a long-standing practice of market regulation with a positive list for market entry until 2015. Contrary to a negative list, a positive list decides in which business fields investments are permitted. In 2015 the “Negative List for Market Entry” was introduced as a pilot project in Tianjin, Shanghai, the Fujian Province and the Guangdong Province. Feedback from the market and the outcome was quite positive. Thus, a nationwide “Negative List for Market Entry” was implemented three years later in 2018.

While there were 328 business fields listed in the initial Negative List for Market Entry in 2018 (96 as prohibited, 232 as approval and admission required), the Negative List 2021 will be much shorter with 117 business fields (6 as prohibited, 111 as approval and admission required). Listed as “prohibited” remain, among others, certain business activities in the area of financial services, internet operational services and publishing.

Since cryptocurrency trading and mining were already banned by the regulators earlier this year, the Negative List 2021 proposes to include cryptocurrency trading and mining into its sub-list of prohibited items. Listed as “eligible for approval and admission” are particular business activities in what the country considers the most important economic sectors such as agriculture, manufacturing, energy infrastructure, transportation, hotel business, information technology and software services, and real estate business.

Compared to 2020 Negative List, this year’s list lifts approval and admission requirements for specific business activities such as:

By doing so, the Chinese government encourages entrepreneurs in the mentioned sectors to enter the Chinese market in order to develop such sectors further. There are also areas in which new restrictions have been posted, for example the provision of news services, operation of social media platforms, production and transportation of certain chemicals.

Ancillary to the scheme of Negative List for Market Access, the Chinese government has also introduced a negative list for foreign investments. When considering an investment in Mainland China, foreign investors should pay special attention to the most up-to-date negative list for foreign investments, which bans or imposes restrictions on market entry in further business areas, such as the requirement of establishing a Sino-foreign joint venture when investing into medical institutions and telecom services. The negative list for foreign investments will be reviewed and updated annually. The latest negative list for foreign investments was issued shortly before the end of 2021 and has been in effect as of January 1, 2022

As envisaged by the regulatory body, the latest list lifted the joint venture requirements for foreign investors when investing into the automobile industry. A larger scale of investment in this sector by foreign car manufacturers can be expected in the near future. Limitations for foreign investments in manufacturing of ground receiving facilities and key components for satellite television broadcast have as well been deleted from the current effective negative list for foreign investments.

Parallel to the Negative List for Foreign Investments, a more liberal negative list for foreign investments is tailor-made for and applies in more than 20 Pilot Free Trade Zones across 21 provinces in China. As a cherry on top, the whole Hainan Island was designated as a special Pilot Free Trade Zone in 2018. There is a negative list for foreign investments applied only to Hainan Pilot Free Trade Zone (the “Hainan Negative List“), which lifts even more curbs for foreign investors. For example, the currently effective Hainan Negative List provides a higher level of relaxation for foreign investment in the areas of mining, manufacturing, telecom services, business services (including legal advisory services, market research services and social research services) and education.

The implementation of the N scheme demonstrates the commitment of the Chinese government to intensify their efforts to open the domestic market, to offer more legal certainty and a leveled playing field for both domestic and foreign market players. As supporting measures, the administration has been working on streamlining administrative processes, to ensure investments can be brought forward smoothly, whether they are subject to the negative list or not. For foreign investors the Negative List 2021 offers more market access opportunities, enabling the entry into the world’s second largest economy with an enormous customer base of more than 1.4 billion people.

Investors from around the world have the chance to expand their business in China, especially for those whose business matches the economical hot spots. In the next five years (2021 to 2025), China aims to upgrade the economic structure within the fourteenth ‘Five-Years Plan for the National Economic and Social Development’. In the light of tackling climate change challenges and building up a digitalized society, the focus has been put on digitalization and development of ‘green’ technology to achieve the goal of carbon neutrality. Foreign investors are most welcome as they could bring along advanced technology and management experience. Comprehensive and substantive reforms of the legal system have been reinforced to enhance the protection of intellectual property (IP), which will provide more comfort for foreign investors who have concerns about safeguarding of their own IP rights.

As a further incentive, the Chinese government has also introduced a Catalogue of Industries for Encouraging Foreign Investment (the “Encouraged Industries Catalogue“). In the currently effective version, as amended in 2020, there are 480 business fields across 13 industrial sectors that the foreign investors are encouraged to participate in nationwide. The Encouraged Industries Catalogue also includes a list with additional encouraged business fields for foreign investments in Middle and Western China. Favorable conditions under the framework of the Encouraged Industries Catalogue include:

However, challenges for foreign investors still exist, especially for those who have limited experience in doing business in China. Despite the government’s efforts to provide more comfort to foreign investors, the Chinese legal rules and regulations on investments are still quite complicated for new comers, not to mention the language barriers and the cultural differences. Understanding the local culture plays an important part in market penetration and cooperation with the Chinese counterparts. Attention should also be paid to the market research regarding Chinese rivals. After years of development, many Chinese companies have already gathered enough business power to challenge their foreign peers. It is therefore very advisable to engage experienced and knowledgeable professional advisors to support the envisaged market expansion.

China has already been on a fast track of development and its government has been working on adapting and optimizing policies to support the economy boom. Although there are still quite a lot and comprehensive off-limits and restrictions for investing in China, the market is expected to continue to liberalize in the coming years. The market entry regulations, including the Negative List for Market Access and the encouraged industry catalogue, should be monitored thoroughly by foreign investors in order to seize future business potential.

Reed Smith is a dynamic international law firm with more than 1,700 lawyers in 30 offices across Europe, the US, the Middle East and Asia. For more information, please visit www.reedsmith.com. Florian Hirschmann advises clients on corporate law, in particular on domestic and international private equity and M&A transactions, venture capital and joint ventures. Siling Zhong is a paralegal in the Munich office and a member of the Global Corporate Group and the Reed Smith China Desk Team.

Hu Henghua will become the new mayor of Chongqing, a metropolis of 31 million people in southwest China. The 58-year-old previously served as a local cadre in his home province of Hunan for 37 years.

Daniel Nordberg has been appointed Vice President for the Asia Pacific & Indian Subcontinent region at Norderstedt-based GAC Marine Logistics GmbH. He has been General Manager of GAC Qatar since 2016. GAC is a global provider of shipping, logistics, and maritime services.

Motorsport is on the rise in China. This year, a Chinese driver will compete in Formula 1 for the first time. At the Dakar Rally, on the other hand, Chinese drivers and vehicles have been part of the race for quite some time. Ranked 24th, Zhang Guoyu and his co-driver Pan Hongyu in their BAIC BJ40 are in the midfield of the classification after the 3rd stage of the desert chase.