We kick off today’s issue with some good news for all those who want to enter China. The German Chamber of Commerce AHK has organized four additional charter flights from Frankfurt to Qingdao. The first will take off in just under a month, on November 24. Further details as well as a link to the corresponding AHK website can be found in our news section. Meanwhile, an entire metropolis, Lanzhou, has been quarantined due to the ongoing Covid outbreak in China. Beijing is sticking to its zero-tolerance line.

Charlotte Wirth analyses why the planned EU supply chain law will still take a while. The law on corporate due diligence was supposed to be presented today. But it will not happen, because the Commission apparently cannot agree on key issues. One of the topics causing heated debates is the issue of forced labor. And this also affects China with the persistent allegations of forced labor in Xinjiang.

Meanwhile, China’s oldest state-owned carmaker FAW is setting out to bring an electric model of its luxury Hongqi brand – which translates to “Red Flag” and is the state vehicle of the political elite – to markets overseas. The gateway to Europe, as for other electric carmakers, is to be Norway. Frank Sieren explains what the new luxury car is all about and what quality buyers around the world can expect from it.

And there’s plenty else going on in and around China, too. So we wish you an exciting read!

For months, observers and companies have been waiting for the European Commission’s legislative proposal on the EU Supply Chain Law. The EU Commission planned to present a proposal on this on Wednesday. The paper is supposed to specifically describe what the EU supply chain law will look like in the opinion of the Brussels authorities. But the Commission is breaking the deadline. It cannot find common ground on key issues, such as the future scope of the text. There is a “Cold War” between the responsible directorates-general, the one for the internal market (DG Grow) and the one for justice (DG Just), according to sources.

Now the Commission does not want to deliver until December 8th. But at least it intends to submit its revised impact assessment to the Regulatory Scrutiny Board this week. As an independent body, the Regulatory Scrutiny Board reviews all initiatives of the EU Commission. It is already clear that the member states will be responsible for the subsequent implementation of the supply chain law. It is still open, however, which stages of supply chains the law will regulate at all, to what extent it will give victims access to the EU courts, and whether and how the individual liability of company executives will be implemented (Europe.Table reported). These are indeed important questions.

And now Ursula von der Leyen has added another item to the list of issues: The import ban on products made under forced labor. The head of Commission had announced such a plan in this year’s State of the European Union address (China.Table reported): “We will propose a ban on products in our market that have been made by forced labor.. Human rights are not for sale – at any price,” von der Leyen said in September. But what she didn’t say – and probably didn’t know – was how exactly she would enforce the ban. And the responsible commissioners, above all Trade Commissioner Valdis Dombrovskis, were apparently not informed about her advance.

The obvious solution would be to implement the import ban via an independent trade instrument, which would then fall outside the framework of the EU Supply Chain Law. For example, there could be a regulation that would allow customs to intercept products that have been manufactured using forced labor. The US Tariff Act, for example, allows customs authorities to seize any products that are suspected to have been manufactured from forced labor. In July, U.S. authorities suspended imports of human hair products from Xinjiang in this way. Washington also plans to implement a law specifically targeting China, the Uyghur Forced Labor Prevention Act.

But von der Leyen has not reckoned with her trade commissioner. Dombrovskis has so far blocked the push. His Directorate-General for Trade (DG Trade) has been reviewing the implementation of an import ban for some time – so far without success. A law based on the US model is not possible, as the European tariffs work differently, according to internal circles. Moreover, it is feared that such a proposal would not conform with the rules of the World Trade Organization (WTO). At least not if the import ban were implicitly directed against a single country, namely China.

A study commissioned by the Greens last February, however, comes to a different conclusion. According to it, a Europeanized “Tariff Act” would be entirely possible. This could be modeled on an existing regulation for customs authorities to take action against goods suspected of infringing certain intellectual property rights. Anahita Thoms, partner at the law firm Baker McKenzie and an expert in trade law, also does not rule out such an implementation. It would be conceivable, for example, to integrate the issue of trade in products from forced labor into free trade agreements between the EU and partner countries.

However, the EU Commission President had passed the ball for the import ban to the EU Commissioner for the Internal Market, Thierry Breton, and the Justice Commissioner, Didier Reynders, instead of Trade Commissioner Dombrovskis. What is significant about this is that integrating the import ban into the Supply Chain Law would mean that the responsibility ultimately lies with companies. Companies would be mandated to pull any products suspected to have been sourced by suppliers from problematic regions like Xinjiang.

Attorney Thoms is critical of this plan and believes von der Leyen’s push may further delay the already delayed Supply Chain Law. “It’s a big challenge as it is. Why complicate the legislative project on such short notice with a proposal whose implementation in practice is uncertain?” asks Thoms.

There are several obstacles to the rapid implementation of an import ban, such as the complexity of the products circulating on the European market. The components often come from different countries of origin. Individual parts are processed into finished products in a third country. But what if about ten percent of a product happens to come from a “problematic” region, while the rest does not? If every single part of a complexly assembled product were to fall under an import ban, this could, in practice, “cause immense challenges for companies”, warns Thoms.

The implementation of the import ban via the regulation on corporate due diligence – i.e. the Supply Chain Law – would also have a major impact on the draft of the regulation, the lawyer points out. It is not yet clear which stages of the supply chain will be subject to due diligence and whether companies will only have to check their direct suppliers, for example. This discussion, however, would be rendered obsolete with an import ban: “If a company has to ensure that a product originating from forced labor does not enter the European market in the first place, then the entire supply chain will have to be reviewed as a result,” says Thoms.

The decision on where to hang the issue of forced labor, therefore, has quite serious practical consequences for companies operating in China, for example.

At the same time, the EU Supply Chain Law, at least in a strict interpretation, which Justice Commissioner Reynders envisions, aims to prevent human rights violations anyway- including forced labor. After all, companies are required to review their supply chains and adjust them if they detect human rights violations. In this sense, a strict law would implicitly ensure that products from forced labor do not end up on the European market.

However, complementary measures targeting non-EU companies would also be thinkable, says Anahita Thoms. These could prevent products from third countries that contain components made from slave labor from entering the European market. Then again, the responsibility would have to lie with customs. In other words, the ball would be back in the court of Trade Commissioner Vladis Dombrovskis.

The EU Parliament has shown little support for a ban on imports via a Supply Chain Law. French socialist MEP Raphael Glucksmann, who is closely monitoring the situation of the Uighurs in Xinjiang, strictly opposes the idea: “It would postpone the enforcement of the ban and make the due diligence directive more complicated than it is already. Due diligence focuses on companies; the ban focuses on products and has to be enforced as a trade regulation” Green MEP Anna Cavazzini shares his concerns. Implementing it through due diligence would only further complicate the process. Human rights organizations like Global Witness also think little of von der Leyen’s move and call on the Commission to draft a separate proposal for an import ban.

While the EU Commission itself has not yet made clear how it intends to implement von der Leyen’s import ban, it counts the planned EU Supply Chain Law among the possible avenues. A central point of the proposal is “effective action” and “enforcement mechanisms” when companies identify problems in their supply chains – such as forced labor, says a spokeswoman. But she leaves open what those mechanisms might look like. In case of a regulation, member states have the final say on this anyway.

Breton and Reynders might not agree on any other aspect of the proposed law, they stick together on the import ban. They don’t want to introduce any specific bans or penalties. It looks like only one person is convinced by the idea of introducing the import ban via supply chains: EU Commission President von der Leyen.

The “Hongqi” – which translates to “Red Flag” – is the most symbolic car brand in the People’s Republic. Even Mao Zedong had himself driven around in a black state car from Hongqi. And even today, the Hongqi is the vehicle of choice for the party elite. The cars are regularly seen near Beijing’s government district, as well as at military parades. The open car in which State and Party leader Xi Jinping takes his military parades is a Hongqi. US presidents and German chancellors have also been picked up from the airport in cars of this make.

A noble version of the “Red Flag” is now set to conquer the world: The “communist luxury brand” has recently begun exporting Chinese-made Hongqi electric SUVs to Norway. At the beginning of October, FAW announced it had already received 500 orders for the E-HS9 electric SUV from the Scandinavian country, which is known to be a stronghold of electric mobility.

But the market entry into Europe will not be quite so easy. The ideological-historical appeal of Hongqi may work in places in China, but in the West, it’s just another Chinese car.

Hongqi belongs to the state-owned corporation First Automobile Works (FAW), which is also a joint venture partner of VW and Audi. The company was founded in 1953 with Soviet support as China’s first automobile factory in Changchun in the northeastern province of Jilin.

The 5.2-meter-long E-HS9 is now the company’s flagship. Visually, the vehicle is reminiscent of cars from the Rolls-Royce brand. That’s no coincidence: because it was designed by Giles Taylor, who was previously head of design at Rolls-Royce and has been on assignment as Global Vice President of Design and Chief Creative Officer at Hongqi since 2018. The move made perfect sense for him. While the brand isn’t as prestigious, the job is all the more exciting. Taylor was allowed to set up a design center in Munich for Hongqi and FAW, among others. Hongqi is currently the only domestic super-luxury brand in the world’s largest automotive market. And FAW still has a lot of plans for this brand.

The Hongqi E-HS9 is based on the FMA platform and is available in two different configurations. The base version comes as a 6- or 7-seater. It has two 160 kW engines and an 84 kWh battery pack. The range is at least 460 km, while the top-end configuration, available in 6- and 4-seater versions, utilizes a 160-kW and a 245-kW engine, and a 99-kWh battery pack. The E-HS9 supports wireless charging technology that can fully charge the SUV in 8.4 hours. Level 3+ autonomous driving maneuvers are also said to be possible. If desired, the car is even available with an illuminated, crystal-studded gearshift.

Norway currently has the best infrastructure for electric cars in Europe. This also makes it the gateway for other Chinese electric brands, such as NIO, Xpeng, and BYD. FAW also wants to establish the Hongqi brand in Europe with the launch of its E-HS9 in Norway. FAW plans to expand the availability of the Hongqi range to the rest of the world in the future. The company already established a presence in Dubai’s high-priced automotive market.

To sell the car, FAW has therefore teamed up with the local car dealer Motor Gruppen – a renowned car dealer with 45 years of experience. Motor Gruppen takes care of both the sale and service of the Hongqi vehicles. Prices are expected to range between €57,000 and €66,000.

In China, Hongqi’s sales have climbed steadily in recent years thanks to the introduction of new models and the expansion of its distribution network. Between January and July of this year, the company sold over 170,600 vehicles, 95 percent more than the previous year, despite curbed sales by Covid restrictions. Currently, Hongqi offers a total of twelve models. FAW aims to increase sales to 400,000 units in 2022, 600,000 in 2025, and a whopping 800,000 to 1 million in 2030.

The most expensive model available to private individuals is the Hongqi L5. It costs up to $1.2 million, six times as much as a Mercedes-Maybach S-Class. The message: China can also build desirable luxury sedans. However, the main reason for its steep price is probably because the luxury cars are “so unique, so rare,” as Forbes magazine puts it. Its design is imposing, a successful blend between Rolls-Royce appeal and Hongqi tradition. But when it comes to the workmanship of the interior, the Hongqi doesn’t even come close to a Maybach. This shows what decades of experience in this field are worth. But such problems are not unsolvable.

Another special limited edition of 99 units was unveiled at Auto Shanghai 2021 in the spring. With its red paintwork and sleek body, the S9 sports car is reminiscent of models from Ferrari or Lamborghini. It was designed by Walter de Silva, who previously worked for car companies like Alfa Romeo and Audi. At Ingolstadt, he was responsible for Audi’s R8 sports car and the Audi subsidiary Lamborghini.

The S9 features a plug-in hybrid system with a V8 internal combustion engine under the hood that produces 1,420 horsepower (1,044 kilowatts). Reportedly, the S9 is capable of reaching 100 km/h (62 mph) from a standstill in just 1.9 seconds. The top speed is said to be 402 km/h, while the all-electric range is 40 kilometers. In the future, the S9 will also be available as a pure electric car.

The hybrid hypercar S9 was developed in collaboration with the Italian engineering and design startup Silk EV. The investment in the joint venture is over one billion euros. According to reports, the S9 will be assembled in Modena, Italy, because the desired quality cannot be reached at FAW in China. Production is set to start in 2022, with the runabout expected to be priced at around $1.4 million. This car no longer has much in common with a state car.

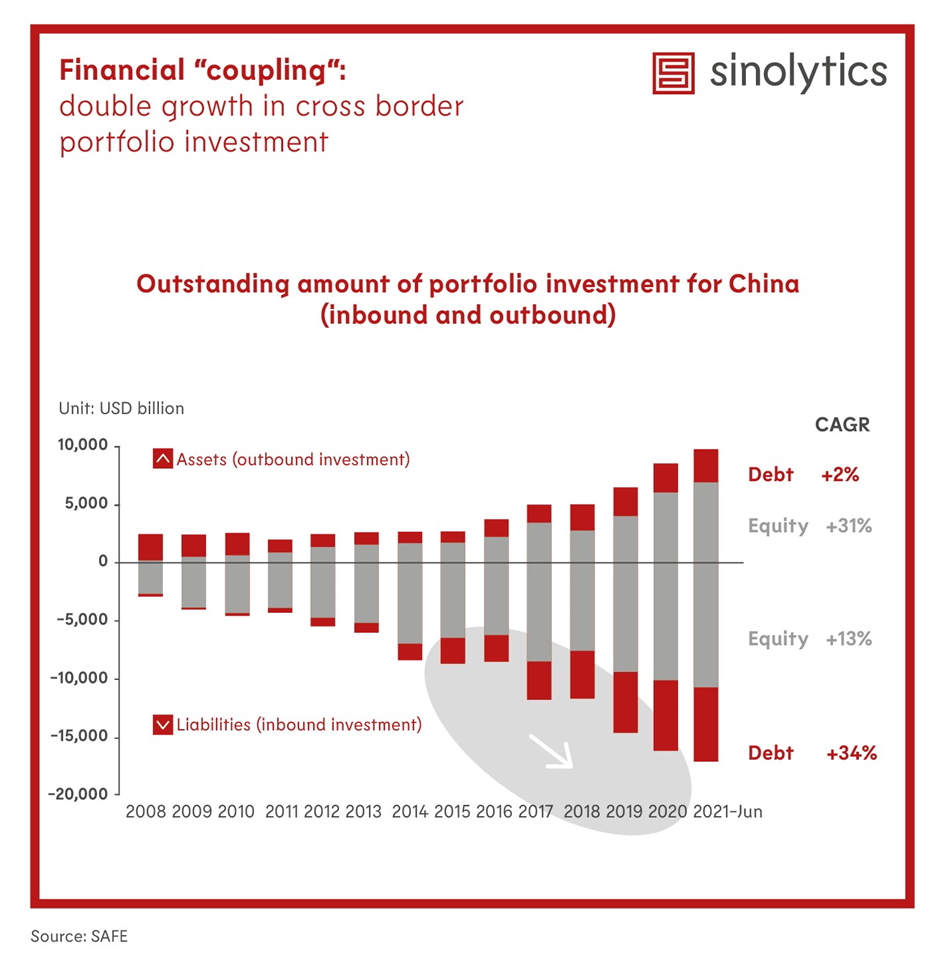

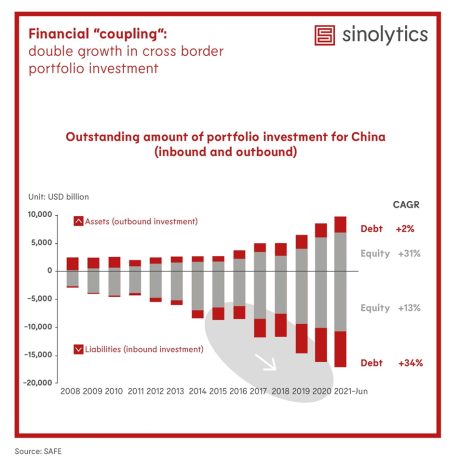

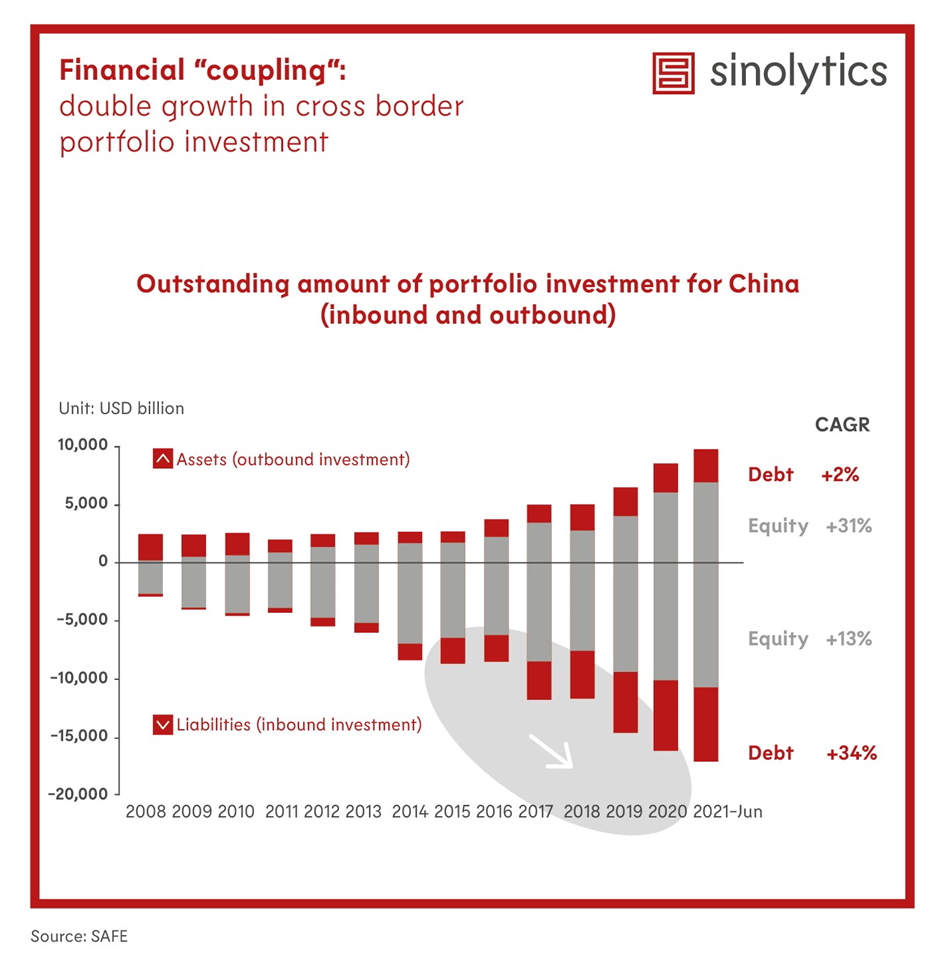

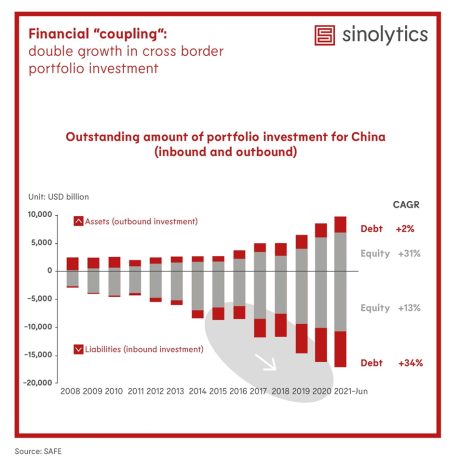

Sinolytics is a European consulting and analysis company that focuses entirely on China. It advises European companies on strategic orientation and specific business activities in China.

China has unveiled a climate action plan for the years leading up to the 2030 peak in CO2 emissions. This action plan is the first in a series of sectoral plans that follow the “supreme planning document” published on Sunday to achieve climate targets (China.Table reported).

Overall, the action plan identifies nine overarching areas where emissions are to be reduced. These include:

However, the action plan does not name any new climate targets, but rather reaffirms what is already known: Coal consumption is to be “strictly controlled” and reduced from 2026 on. By 2030, the share of non-fossil energy consumption is to reach 25 percent. Carbon dioxide emissions per unit of GDP are to drop by more than 65 percent by 2030 compared to 2005.

The action plan also emphasizes the issue of power security, which is currently the focus of much attention. China is rich in coal and poor in oil and gas. The plan, therefore, calls for a “steady and orderly, safe carbon reduction”. nib

China’s central government wants to regulate the currently soaring prices for coal more closely. The National Development and Reform Commission plans the introduction of a mechanism to prevent the price of coal from fluctuating too much. Accordingly, there is to be a reference price and a certain margin that the price may fluctuate around the reference price. The government is looking at the profitability and costs of coal producers to develop the mechanism, Reuters reports.

China’s coal prices have risen by 150 percent since the beginning of the year. They are one of the central causes of the current power crisis. Because electricity rates were set by the state, many power plants were no longer profitable in the face of horrendous coal prices (China.Table reported). They curbed production while power demand surged due to the economic boom in the wake of the Covid pandemic. After peaking, prices recently fell slightly after the government announced measures.

In recent days, the People’s Republic has also ordered the expansion of coal production. Likewise, an electricity rates reform has been implemented (China.Table reported). Nevertheless, power plants are still struggling to replenish their supplies, as Reuters reports. According to the report, analysts expect coal consumption to increase from mid-November due to the onset of winter. Mining and shipping of coal will then slow down due to bad weather. nib

The German Chamber of Commerce in China (AHK) is launching several charter flights to China. Starting on November 24, four flights will take off from Frankfurt am Main to Qingdao. The second flight will be on December 15, the third on January 5, 2022, and the last for now on January 26. As with past flights, however, the AHK gives no guarantee that the flights will take place as planned.

Tied to the flights is a fast-track channel for faster issuance of PU letters and visas needed for entry. Chinese authorities, however, must sign off on the passenger list. For the entry itself, rules are as strict as for all arrivals: Two negative PCR tests and one negative antigen test are mandatory before departure. Further testing is done during quarantine – this also applies to those who have been vaccinated. However, a Covid vaccination is not a prerequisite for the green health certificate that all travelers need. China does not recognize western vaccines like Biontech/Pfizer anyway.

The tickets cost €2,800 for AHK members or €3,200 for non-members. The price includes the organization of the minimum 14-day quarantine after arrival in Qingdao, but not the stay itself. For this, the chamber estimates around ¥1,000 per night including meals, the equivalent of around €135.

A rather expensive undertaking. However, there are still expats or family members of expats who currently have no other way to travel to China – and thus either cannot begin their job in China or cannot live together with their partner or parents. The AHK flights can at least now help some of them. All information about the flights can be found on the AHK website. ck

China is resorting to increasingly drastic measures in fear of a new Covid wave. On Tuesday, authorities quarantined an entire city: The four million citizens of Lanzhou on the Yellow River in northwestern China are only allowed to leave their apartment complexes in emergencies or to buy food, the city government explained. Entrances and exits of the housing complexes are to be monitored. Earlier on Tuesday, China reported a full 29 new local Covid infections, including six in the province of Gansu, of which Lanzhou is the capital. Within eight days (Monday to Monday), the People’s Republic had reported 195 new domestically transmitted symptomatic infections.

In Beijing, too, the restrictions are getting tougher. On Monday, residents of the capital were asked to leave Beijing only in urgent cases and to refrain from large gatherings of people. Since Sunday, all residents of an apartment complex in the northwest of the city have been isolated due to a positive Covid case among residents. People are not allowed to enter the capital from regions with registered infections, for the time being, not even residents. In Beijing, authorities are especially nervous because of the upcoming Winter Olympics. New guidelines issued Monday require all unvaccinated Olympic athletes to be quarantined for 21 days after arriving in Beijing. Exceptions will be considered only in individual cases, for example, if someone cannot be vaccinated for medical reasons. ck

Tesla has set up an R&D center in Shanghai. It is the first R&D site outside the US, Bloomberg reports. The reason is the usual one for locating research capabilities in China: The site aims to “bring products and services that are more in line with the needs of the Chinese consumer,” Tesla announced. In addition to the R&D center, a data center has also been built in Shanghai. Both will be operational soon.

Tesla had sold over 56,000 cars in the Chinese market in September, marking a new sales record (China.Table reported). One of the benefits Tesla enjoys in China is the national emission points system. Under this system, carmakers have to buy up emission points from other manufacturers if they sell too few EVs themselves. Tesla was able to earn over 330 million euros through this emissions trading system (China.Table reported). On Monday, Tesla’s stock market value had risen to over one trillion US dollars. nib

The Chinese shipping company Cosco has increased its shares in the Greek port of Piraeus. Cosco has increased its stake in the operating company Piraeus Port Authority (PPA) to 67 percent, state news agency Xinhua reported. Cosco previously held 51 percent, giving it a majority stake in the Mediterranean port since 2016. According to media reports, Greek authorities had agreed to cede a further 16 percent to Cosco this summer.

The port of Piraeus, near the Greek capital of Athens, has an annual throughput of 7.2 million standard containers (TEUs), according to Xinhua data. It is the largest seaport in Greece and one of the largest in the Mediterranean. The increase in Cosco’s share coincides with a high-ranking visit: China’s Foreign Minister Wang Yi is expected in Athens on Wednesday at the invitation of his Greek counterpart Nikos Dendias.

Chinese shareholding is always a cause for debate. Cosco also has a 35 percent stake in a German container terminal in Hamburg Tollerort. (China.Table reported). The takeover is currently still awaiting approvals under competition and foreign trade law. ari

A reading of a biography of Xi Jinping in the German city of Duisburg will take place after all – but not by the Confucius Institute affiliated with the university. Instead, the event will be organized by the university’s East Asia Institute itself, as reported by dpa. Initially, the event had been canceled due to Chinese pressure (China.Table reported). A host for a similar reading in Hanover has not yet been found. However, according to the news agency, the local university is in talks with the publisher of the book “Xi Jinping – der mächtigste Mann der Welt” (Xi Jinping – the most powerful man in the world) by authors Stefan Aust and Adrian Geiges. nib

China’s development cooperation with the Global South has gained the attention of Western media. However, growing attention has not always led to growing understanding. Many media outlets, for example, speak of China’s “credit trap” and “debt-trap diplomacy”. At the same time, for example, Deborah Brautigam, a professor at Johns Hopkins University, and Meg Rithmire, an associate professor at Harvard Business School, argue: “The narrative wrongfully portrays both Beijing and the developing countries it deals with.” Is the charge of “debt-trap diplomacy” justified?

It is difficult to find answers to such a question. The reasons are twofold: A lack of sufficient data and lack of understanding of the inner workings of China’s foreign aid system. The lack of sufficient data is due in no small part to the absence of comprehensive reporting systems for China’s development projects. While Germany, like many other countries, reports its projects to the OECD, which prepares the information for all to access, China does not provide comparable data. In the absence of a reliable, official source, it has been difficult to paint a comprehensive picture of Beijing’s foreign development activities.

Initiatives like AidData at the College of William & Mary have attempted to fill this gap. Since 2013, AidData, led by Dr. Brad Parks, has been tracking official financial transfers from China to developing countries using their so-called TUFF methodology. TUFF stands for Tracking Underreported Financial Flows. To do this, AidData brings together unstructured, freely accessible, project-related data published by a wide variety of sources and standardizes and simplifies the data. Based on this methodology, AidData initially began publishing region-specific datasets. In 2017, AidData unveiled the first dataset covering the entire Global South. Updated recently in September, the dataset covers 13,427 projects worth $843 billion in 165 countries in all major world regions over an 18-year period.

The combination of comprehensive data collection and sinological methods make it possible to improve the understanding of China’s foreign development cooperation. For Germany and the European Union as stakeholders, it is crucial that we get a clear picture of the working mechanisms and scope of Chinese development cooperation.

Under the title “Making Chinese Foreign Aid Transparent – What is Hidden in Data and Policy Documents?”, Dr. Brad Parks from AidData and Dr. Marina Rudyak from Heidelberg University will debate this topic on Thursday as part of the Kiel Institute China Initiative’s third Global China Conversation. China.Table is a media partner of the event series.

Prof. Andreas Fuchs heads the Kiel China Initiative of the Kiel Institute for the World Economy and is a Professor of Development Economics at the University of Goettingen. His research studies trade, investment, and development policies using quantitative methods and a special focus on China and other emerging economies.

Wang Jianjun, former chairman of the Shenzhen Stock Exchange, has been appointed Vice Chairman of the China Securities Regulatory Commission (CSRC), the country’s top securities regulator. Wang will oversee the departmens of IPO’s, investor protection and market operations. Caixin had reported this, citing people familiar with the matter.

Harvest season is dry season: Farmers in the village of Butangkou in the province of Jiangxi arrange fruits of the camellia tree (Camellia Oleifera) in a traditional spiral shape for drying. The seeds, which contain a lot of oil, are then extracted from the fruits. Camellia oil is used in Asia in nutrition, as well as a high-quality skin and hair care product. Camellia Oleifera is considered the hardiest species among the camellias.

We kick off today’s issue with some good news for all those who want to enter China. The German Chamber of Commerce AHK has organized four additional charter flights from Frankfurt to Qingdao. The first will take off in just under a month, on November 24. Further details as well as a link to the corresponding AHK website can be found in our news section. Meanwhile, an entire metropolis, Lanzhou, has been quarantined due to the ongoing Covid outbreak in China. Beijing is sticking to its zero-tolerance line.

Charlotte Wirth analyses why the planned EU supply chain law will still take a while. The law on corporate due diligence was supposed to be presented today. But it will not happen, because the Commission apparently cannot agree on key issues. One of the topics causing heated debates is the issue of forced labor. And this also affects China with the persistent allegations of forced labor in Xinjiang.

Meanwhile, China’s oldest state-owned carmaker FAW is setting out to bring an electric model of its luxury Hongqi brand – which translates to “Red Flag” and is the state vehicle of the political elite – to markets overseas. The gateway to Europe, as for other electric carmakers, is to be Norway. Frank Sieren explains what the new luxury car is all about and what quality buyers around the world can expect from it.

And there’s plenty else going on in and around China, too. So we wish you an exciting read!

For months, observers and companies have been waiting for the European Commission’s legislative proposal on the EU Supply Chain Law. The EU Commission planned to present a proposal on this on Wednesday. The paper is supposed to specifically describe what the EU supply chain law will look like in the opinion of the Brussels authorities. But the Commission is breaking the deadline. It cannot find common ground on key issues, such as the future scope of the text. There is a “Cold War” between the responsible directorates-general, the one for the internal market (DG Grow) and the one for justice (DG Just), according to sources.

Now the Commission does not want to deliver until December 8th. But at least it intends to submit its revised impact assessment to the Regulatory Scrutiny Board this week. As an independent body, the Regulatory Scrutiny Board reviews all initiatives of the EU Commission. It is already clear that the member states will be responsible for the subsequent implementation of the supply chain law. It is still open, however, which stages of supply chains the law will regulate at all, to what extent it will give victims access to the EU courts, and whether and how the individual liability of company executives will be implemented (Europe.Table reported). These are indeed important questions.

And now Ursula von der Leyen has added another item to the list of issues: The import ban on products made under forced labor. The head of Commission had announced such a plan in this year’s State of the European Union address (China.Table reported): “We will propose a ban on products in our market that have been made by forced labor.. Human rights are not for sale – at any price,” von der Leyen said in September. But what she didn’t say – and probably didn’t know – was how exactly she would enforce the ban. And the responsible commissioners, above all Trade Commissioner Valdis Dombrovskis, were apparently not informed about her advance.

The obvious solution would be to implement the import ban via an independent trade instrument, which would then fall outside the framework of the EU Supply Chain Law. For example, there could be a regulation that would allow customs to intercept products that have been manufactured using forced labor. The US Tariff Act, for example, allows customs authorities to seize any products that are suspected to have been manufactured from forced labor. In July, U.S. authorities suspended imports of human hair products from Xinjiang in this way. Washington also plans to implement a law specifically targeting China, the Uyghur Forced Labor Prevention Act.

But von der Leyen has not reckoned with her trade commissioner. Dombrovskis has so far blocked the push. His Directorate-General for Trade (DG Trade) has been reviewing the implementation of an import ban for some time – so far without success. A law based on the US model is not possible, as the European tariffs work differently, according to internal circles. Moreover, it is feared that such a proposal would not conform with the rules of the World Trade Organization (WTO). At least not if the import ban were implicitly directed against a single country, namely China.

A study commissioned by the Greens last February, however, comes to a different conclusion. According to it, a Europeanized “Tariff Act” would be entirely possible. This could be modeled on an existing regulation for customs authorities to take action against goods suspected of infringing certain intellectual property rights. Anahita Thoms, partner at the law firm Baker McKenzie and an expert in trade law, also does not rule out such an implementation. It would be conceivable, for example, to integrate the issue of trade in products from forced labor into free trade agreements between the EU and partner countries.

However, the EU Commission President had passed the ball for the import ban to the EU Commissioner for the Internal Market, Thierry Breton, and the Justice Commissioner, Didier Reynders, instead of Trade Commissioner Dombrovskis. What is significant about this is that integrating the import ban into the Supply Chain Law would mean that the responsibility ultimately lies with companies. Companies would be mandated to pull any products suspected to have been sourced by suppliers from problematic regions like Xinjiang.

Attorney Thoms is critical of this plan and believes von der Leyen’s push may further delay the already delayed Supply Chain Law. “It’s a big challenge as it is. Why complicate the legislative project on such short notice with a proposal whose implementation in practice is uncertain?” asks Thoms.

There are several obstacles to the rapid implementation of an import ban, such as the complexity of the products circulating on the European market. The components often come from different countries of origin. Individual parts are processed into finished products in a third country. But what if about ten percent of a product happens to come from a “problematic” region, while the rest does not? If every single part of a complexly assembled product were to fall under an import ban, this could, in practice, “cause immense challenges for companies”, warns Thoms.

The implementation of the import ban via the regulation on corporate due diligence – i.e. the Supply Chain Law – would also have a major impact on the draft of the regulation, the lawyer points out. It is not yet clear which stages of the supply chain will be subject to due diligence and whether companies will only have to check their direct suppliers, for example. This discussion, however, would be rendered obsolete with an import ban: “If a company has to ensure that a product originating from forced labor does not enter the European market in the first place, then the entire supply chain will have to be reviewed as a result,” says Thoms.

The decision on where to hang the issue of forced labor, therefore, has quite serious practical consequences for companies operating in China, for example.

At the same time, the EU Supply Chain Law, at least in a strict interpretation, which Justice Commissioner Reynders envisions, aims to prevent human rights violations anyway- including forced labor. After all, companies are required to review their supply chains and adjust them if they detect human rights violations. In this sense, a strict law would implicitly ensure that products from forced labor do not end up on the European market.

However, complementary measures targeting non-EU companies would also be thinkable, says Anahita Thoms. These could prevent products from third countries that contain components made from slave labor from entering the European market. Then again, the responsibility would have to lie with customs. In other words, the ball would be back in the court of Trade Commissioner Vladis Dombrovskis.

The EU Parliament has shown little support for a ban on imports via a Supply Chain Law. French socialist MEP Raphael Glucksmann, who is closely monitoring the situation of the Uighurs in Xinjiang, strictly opposes the idea: “It would postpone the enforcement of the ban and make the due diligence directive more complicated than it is already. Due diligence focuses on companies; the ban focuses on products and has to be enforced as a trade regulation” Green MEP Anna Cavazzini shares his concerns. Implementing it through due diligence would only further complicate the process. Human rights organizations like Global Witness also think little of von der Leyen’s move and call on the Commission to draft a separate proposal for an import ban.

While the EU Commission itself has not yet made clear how it intends to implement von der Leyen’s import ban, it counts the planned EU Supply Chain Law among the possible avenues. A central point of the proposal is “effective action” and “enforcement mechanisms” when companies identify problems in their supply chains – such as forced labor, says a spokeswoman. But she leaves open what those mechanisms might look like. In case of a regulation, member states have the final say on this anyway.

Breton and Reynders might not agree on any other aspect of the proposed law, they stick together on the import ban. They don’t want to introduce any specific bans or penalties. It looks like only one person is convinced by the idea of introducing the import ban via supply chains: EU Commission President von der Leyen.

The “Hongqi” – which translates to “Red Flag” – is the most symbolic car brand in the People’s Republic. Even Mao Zedong had himself driven around in a black state car from Hongqi. And even today, the Hongqi is the vehicle of choice for the party elite. The cars are regularly seen near Beijing’s government district, as well as at military parades. The open car in which State and Party leader Xi Jinping takes his military parades is a Hongqi. US presidents and German chancellors have also been picked up from the airport in cars of this make.

A noble version of the “Red Flag” is now set to conquer the world: The “communist luxury brand” has recently begun exporting Chinese-made Hongqi electric SUVs to Norway. At the beginning of October, FAW announced it had already received 500 orders for the E-HS9 electric SUV from the Scandinavian country, which is known to be a stronghold of electric mobility.

But the market entry into Europe will not be quite so easy. The ideological-historical appeal of Hongqi may work in places in China, but in the West, it’s just another Chinese car.

Hongqi belongs to the state-owned corporation First Automobile Works (FAW), which is also a joint venture partner of VW and Audi. The company was founded in 1953 with Soviet support as China’s first automobile factory in Changchun in the northeastern province of Jilin.

The 5.2-meter-long E-HS9 is now the company’s flagship. Visually, the vehicle is reminiscent of cars from the Rolls-Royce brand. That’s no coincidence: because it was designed by Giles Taylor, who was previously head of design at Rolls-Royce and has been on assignment as Global Vice President of Design and Chief Creative Officer at Hongqi since 2018. The move made perfect sense for him. While the brand isn’t as prestigious, the job is all the more exciting. Taylor was allowed to set up a design center in Munich for Hongqi and FAW, among others. Hongqi is currently the only domestic super-luxury brand in the world’s largest automotive market. And FAW still has a lot of plans for this brand.

The Hongqi E-HS9 is based on the FMA platform and is available in two different configurations. The base version comes as a 6- or 7-seater. It has two 160 kW engines and an 84 kWh battery pack. The range is at least 460 km, while the top-end configuration, available in 6- and 4-seater versions, utilizes a 160-kW and a 245-kW engine, and a 99-kWh battery pack. The E-HS9 supports wireless charging technology that can fully charge the SUV in 8.4 hours. Level 3+ autonomous driving maneuvers are also said to be possible. If desired, the car is even available with an illuminated, crystal-studded gearshift.

Norway currently has the best infrastructure for electric cars in Europe. This also makes it the gateway for other Chinese electric brands, such as NIO, Xpeng, and BYD. FAW also wants to establish the Hongqi brand in Europe with the launch of its E-HS9 in Norway. FAW plans to expand the availability of the Hongqi range to the rest of the world in the future. The company already established a presence in Dubai’s high-priced automotive market.

To sell the car, FAW has therefore teamed up with the local car dealer Motor Gruppen – a renowned car dealer with 45 years of experience. Motor Gruppen takes care of both the sale and service of the Hongqi vehicles. Prices are expected to range between €57,000 and €66,000.

In China, Hongqi’s sales have climbed steadily in recent years thanks to the introduction of new models and the expansion of its distribution network. Between January and July of this year, the company sold over 170,600 vehicles, 95 percent more than the previous year, despite curbed sales by Covid restrictions. Currently, Hongqi offers a total of twelve models. FAW aims to increase sales to 400,000 units in 2022, 600,000 in 2025, and a whopping 800,000 to 1 million in 2030.

The most expensive model available to private individuals is the Hongqi L5. It costs up to $1.2 million, six times as much as a Mercedes-Maybach S-Class. The message: China can also build desirable luxury sedans. However, the main reason for its steep price is probably because the luxury cars are “so unique, so rare,” as Forbes magazine puts it. Its design is imposing, a successful blend between Rolls-Royce appeal and Hongqi tradition. But when it comes to the workmanship of the interior, the Hongqi doesn’t even come close to a Maybach. This shows what decades of experience in this field are worth. But such problems are not unsolvable.

Another special limited edition of 99 units was unveiled at Auto Shanghai 2021 in the spring. With its red paintwork and sleek body, the S9 sports car is reminiscent of models from Ferrari or Lamborghini. It was designed by Walter de Silva, who previously worked for car companies like Alfa Romeo and Audi. At Ingolstadt, he was responsible for Audi’s R8 sports car and the Audi subsidiary Lamborghini.

The S9 features a plug-in hybrid system with a V8 internal combustion engine under the hood that produces 1,420 horsepower (1,044 kilowatts). Reportedly, the S9 is capable of reaching 100 km/h (62 mph) from a standstill in just 1.9 seconds. The top speed is said to be 402 km/h, while the all-electric range is 40 kilometers. In the future, the S9 will also be available as a pure electric car.

The hybrid hypercar S9 was developed in collaboration with the Italian engineering and design startup Silk EV. The investment in the joint venture is over one billion euros. According to reports, the S9 will be assembled in Modena, Italy, because the desired quality cannot be reached at FAW in China. Production is set to start in 2022, with the runabout expected to be priced at around $1.4 million. This car no longer has much in common with a state car.

Sinolytics is a European consulting and analysis company that focuses entirely on China. It advises European companies on strategic orientation and specific business activities in China.

China has unveiled a climate action plan for the years leading up to the 2030 peak in CO2 emissions. This action plan is the first in a series of sectoral plans that follow the “supreme planning document” published on Sunday to achieve climate targets (China.Table reported).

Overall, the action plan identifies nine overarching areas where emissions are to be reduced. These include:

However, the action plan does not name any new climate targets, but rather reaffirms what is already known: Coal consumption is to be “strictly controlled” and reduced from 2026 on. By 2030, the share of non-fossil energy consumption is to reach 25 percent. Carbon dioxide emissions per unit of GDP are to drop by more than 65 percent by 2030 compared to 2005.

The action plan also emphasizes the issue of power security, which is currently the focus of much attention. China is rich in coal and poor in oil and gas. The plan, therefore, calls for a “steady and orderly, safe carbon reduction”. nib

China’s central government wants to regulate the currently soaring prices for coal more closely. The National Development and Reform Commission plans the introduction of a mechanism to prevent the price of coal from fluctuating too much. Accordingly, there is to be a reference price and a certain margin that the price may fluctuate around the reference price. The government is looking at the profitability and costs of coal producers to develop the mechanism, Reuters reports.

China’s coal prices have risen by 150 percent since the beginning of the year. They are one of the central causes of the current power crisis. Because electricity rates were set by the state, many power plants were no longer profitable in the face of horrendous coal prices (China.Table reported). They curbed production while power demand surged due to the economic boom in the wake of the Covid pandemic. After peaking, prices recently fell slightly after the government announced measures.

In recent days, the People’s Republic has also ordered the expansion of coal production. Likewise, an electricity rates reform has been implemented (China.Table reported). Nevertheless, power plants are still struggling to replenish their supplies, as Reuters reports. According to the report, analysts expect coal consumption to increase from mid-November due to the onset of winter. Mining and shipping of coal will then slow down due to bad weather. nib

The German Chamber of Commerce in China (AHK) is launching several charter flights to China. Starting on November 24, four flights will take off from Frankfurt am Main to Qingdao. The second flight will be on December 15, the third on January 5, 2022, and the last for now on January 26. As with past flights, however, the AHK gives no guarantee that the flights will take place as planned.

Tied to the flights is a fast-track channel for faster issuance of PU letters and visas needed for entry. Chinese authorities, however, must sign off on the passenger list. For the entry itself, rules are as strict as for all arrivals: Two negative PCR tests and one negative antigen test are mandatory before departure. Further testing is done during quarantine – this also applies to those who have been vaccinated. However, a Covid vaccination is not a prerequisite for the green health certificate that all travelers need. China does not recognize western vaccines like Biontech/Pfizer anyway.

The tickets cost €2,800 for AHK members or €3,200 for non-members. The price includes the organization of the minimum 14-day quarantine after arrival in Qingdao, but not the stay itself. For this, the chamber estimates around ¥1,000 per night including meals, the equivalent of around €135.

A rather expensive undertaking. However, there are still expats or family members of expats who currently have no other way to travel to China – and thus either cannot begin their job in China or cannot live together with their partner or parents. The AHK flights can at least now help some of them. All information about the flights can be found on the AHK website. ck

China is resorting to increasingly drastic measures in fear of a new Covid wave. On Tuesday, authorities quarantined an entire city: The four million citizens of Lanzhou on the Yellow River in northwestern China are only allowed to leave their apartment complexes in emergencies or to buy food, the city government explained. Entrances and exits of the housing complexes are to be monitored. Earlier on Tuesday, China reported a full 29 new local Covid infections, including six in the province of Gansu, of which Lanzhou is the capital. Within eight days (Monday to Monday), the People’s Republic had reported 195 new domestically transmitted symptomatic infections.

In Beijing, too, the restrictions are getting tougher. On Monday, residents of the capital were asked to leave Beijing only in urgent cases and to refrain from large gatherings of people. Since Sunday, all residents of an apartment complex in the northwest of the city have been isolated due to a positive Covid case among residents. People are not allowed to enter the capital from regions with registered infections, for the time being, not even residents. In Beijing, authorities are especially nervous because of the upcoming Winter Olympics. New guidelines issued Monday require all unvaccinated Olympic athletes to be quarantined for 21 days after arriving in Beijing. Exceptions will be considered only in individual cases, for example, if someone cannot be vaccinated for medical reasons. ck

Tesla has set up an R&D center in Shanghai. It is the first R&D site outside the US, Bloomberg reports. The reason is the usual one for locating research capabilities in China: The site aims to “bring products and services that are more in line with the needs of the Chinese consumer,” Tesla announced. In addition to the R&D center, a data center has also been built in Shanghai. Both will be operational soon.

Tesla had sold over 56,000 cars in the Chinese market in September, marking a new sales record (China.Table reported). One of the benefits Tesla enjoys in China is the national emission points system. Under this system, carmakers have to buy up emission points from other manufacturers if they sell too few EVs themselves. Tesla was able to earn over 330 million euros through this emissions trading system (China.Table reported). On Monday, Tesla’s stock market value had risen to over one trillion US dollars. nib

The Chinese shipping company Cosco has increased its shares in the Greek port of Piraeus. Cosco has increased its stake in the operating company Piraeus Port Authority (PPA) to 67 percent, state news agency Xinhua reported. Cosco previously held 51 percent, giving it a majority stake in the Mediterranean port since 2016. According to media reports, Greek authorities had agreed to cede a further 16 percent to Cosco this summer.

The port of Piraeus, near the Greek capital of Athens, has an annual throughput of 7.2 million standard containers (TEUs), according to Xinhua data. It is the largest seaport in Greece and one of the largest in the Mediterranean. The increase in Cosco’s share coincides with a high-ranking visit: China’s Foreign Minister Wang Yi is expected in Athens on Wednesday at the invitation of his Greek counterpart Nikos Dendias.

Chinese shareholding is always a cause for debate. Cosco also has a 35 percent stake in a German container terminal in Hamburg Tollerort. (China.Table reported). The takeover is currently still awaiting approvals under competition and foreign trade law. ari

A reading of a biography of Xi Jinping in the German city of Duisburg will take place after all – but not by the Confucius Institute affiliated with the university. Instead, the event will be organized by the university’s East Asia Institute itself, as reported by dpa. Initially, the event had been canceled due to Chinese pressure (China.Table reported). A host for a similar reading in Hanover has not yet been found. However, according to the news agency, the local university is in talks with the publisher of the book “Xi Jinping – der mächtigste Mann der Welt” (Xi Jinping – the most powerful man in the world) by authors Stefan Aust and Adrian Geiges. nib

China’s development cooperation with the Global South has gained the attention of Western media. However, growing attention has not always led to growing understanding. Many media outlets, for example, speak of China’s “credit trap” and “debt-trap diplomacy”. At the same time, for example, Deborah Brautigam, a professor at Johns Hopkins University, and Meg Rithmire, an associate professor at Harvard Business School, argue: “The narrative wrongfully portrays both Beijing and the developing countries it deals with.” Is the charge of “debt-trap diplomacy” justified?

It is difficult to find answers to such a question. The reasons are twofold: A lack of sufficient data and lack of understanding of the inner workings of China’s foreign aid system. The lack of sufficient data is due in no small part to the absence of comprehensive reporting systems for China’s development projects. While Germany, like many other countries, reports its projects to the OECD, which prepares the information for all to access, China does not provide comparable data. In the absence of a reliable, official source, it has been difficult to paint a comprehensive picture of Beijing’s foreign development activities.

Initiatives like AidData at the College of William & Mary have attempted to fill this gap. Since 2013, AidData, led by Dr. Brad Parks, has been tracking official financial transfers from China to developing countries using their so-called TUFF methodology. TUFF stands for Tracking Underreported Financial Flows. To do this, AidData brings together unstructured, freely accessible, project-related data published by a wide variety of sources and standardizes and simplifies the data. Based on this methodology, AidData initially began publishing region-specific datasets. In 2017, AidData unveiled the first dataset covering the entire Global South. Updated recently in September, the dataset covers 13,427 projects worth $843 billion in 165 countries in all major world regions over an 18-year period.

The combination of comprehensive data collection and sinological methods make it possible to improve the understanding of China’s foreign development cooperation. For Germany and the European Union as stakeholders, it is crucial that we get a clear picture of the working mechanisms and scope of Chinese development cooperation.

Under the title “Making Chinese Foreign Aid Transparent – What is Hidden in Data and Policy Documents?”, Dr. Brad Parks from AidData and Dr. Marina Rudyak from Heidelberg University will debate this topic on Thursday as part of the Kiel Institute China Initiative’s third Global China Conversation. China.Table is a media partner of the event series.

Prof. Andreas Fuchs heads the Kiel China Initiative of the Kiel Institute for the World Economy and is a Professor of Development Economics at the University of Goettingen. His research studies trade, investment, and development policies using quantitative methods and a special focus on China and other emerging economies.

Wang Jianjun, former chairman of the Shenzhen Stock Exchange, has been appointed Vice Chairman of the China Securities Regulatory Commission (CSRC), the country’s top securities regulator. Wang will oversee the departmens of IPO’s, investor protection and market operations. Caixin had reported this, citing people familiar with the matter.

Harvest season is dry season: Farmers in the village of Butangkou in the province of Jiangxi arrange fruits of the camellia tree (Camellia Oleifera) in a traditional spiral shape for drying. The seeds, which contain a lot of oil, are then extracted from the fruits. Camellia oil is used in Asia in nutrition, as well as a high-quality skin and hair care product. Camellia Oleifera is considered the hardiest species among the camellias.