On Sundays, admiring the gleaming, polished cars in the local dealership through the showroom windows and dreaming of owning a factory-fresh new car is almost a German tradition. However, for Chinese manufacturers, the traditional dealership model is not the preferred option due to numerous obstacles.

They are exploring alternative ways to introduce their EVs to the German market, as Julia Fiedler reports. So far, this transition has not always been smooth sailing. The challenges faced by manufacturers in distribution stem from cultural differences, and many have also underestimated German bureaucracy. However, sales are expected to pick up soon, partly due to innovative distribution hubs that also function as co-working spaces and hang-out spots.

In Chinese metropolises, modern skyscrapers collide with ancient temples. Architect Stephan Schuetz, from GMP Architects, has been involved in numerous prestigious construction projects in China. In a conversation with Christian Domke Seidel, he shares his experiences of navigating the quest for a national identity in his projects in China. Moreover, he is confident that it’s only a matter of time before Chinese construction firms become active in Germany as well.

The container has landed, the cars have been unloaded: 3,000 brand-new BYD EVs are ready in Bremerhaven. The quality and price are right. Beijing’s leadership has also encouraged manufacturers to export, seeing Chinese EVs as a positive calling card for the People’s Republic. And German customers? They want affordable EVs. Especially younger buyers are experimentally inclined toward the brand if the price-performance ratio is right.

However, Chinese cars and German customers have not quite come together yet. This is also due to teething problems in distribution. While the good old car dealership is still the number one point of contact in Germany, some Chinese brands are opting for direct sales. Others would like to rely on the spaces of established dealers, but these are overwhelmed by the unfamiliar brands. Fleet operators, on the other hand, are wary of the risk. Nevertheless, Chinese brands are on the verge of breaking through, experts say.

In the registration statistics of the Federal Motor Transport Authority, the SAIC brand MG is the undisputed number one among Chinese manufacturers: 21,232 vehicles were registered from January to December 2023. MG relies on the traditional way of car sales in Germany. The brand has consistently built up a sales and service network over several years. This includes shop-in-shop solutions and now also its own showrooms. The volumes per sales location are good.

Great Wall Motors also did well in 2023 with 4,660 vehicles sold. The company from Hebei, founded in 1984 and China’s first private car manufacturer, brought the Emil Frey Group on board early for distribution, Europe’s largest car dealer and successful importer, including Mitsubishi. Emil Frey owns nearly 700 locations and distributes the brands Ora and Wey from GWM.

A similar number of vehicles were sold by BYD in 2023. Thus, China’s market leader is still far from achieving its self-set goal of being among Europe’s top 5 automotive brands. But the company, founded in Shenzhen in 2023, has only been active in Germany since the end of 2022 – and has teamed up with strong partners. Among others, with the car dealership chain Sternauto and with Senger Mobility. However, there are only 25 sales and service locations in Germany so far. Another success for BYD: Sixt plans to take over a total of 100,000 vehicles from the Chinese by 2028.

Other manufacturers are opting for a different type of distribution that is supposedly easier to set up and also saves distribution costs: Direct sales via the internet. For example, Nio sells its vehicles this way. The Nio houses in Germany are modeled after the stores in China. Because unlike here, in metropolises like Beijing and Shanghai, it has long been customary to display vehicles in chic stores in the city center.

The Nio House in Berlin is located near the shopping mile Kurfürstendamm and invites passers-by to experience the cars and Nio lifestyle on three floors. While the impressive supercar EP9 can only be admired from a distance by incoming passers-by, the models ET5 or ET7 can be sat in. Vehicles are also available for test drives in the underground car park by appointment.

But the brand also wants to convey the sense of community it has successfully built up in China. That is why there is a foosball table in the basement of the Nio House, lectures and yoga are offered, bookable via the Nio app. Upstairs, there are free coworking spaces and a lounge with a bookshelf, where you can observe the colorful hustle and bustle on cozy sofas directly opposite the Kaiser Wilhelm Memorial Church. The atmosphere is elegant and inviting. However, Nio’s registration numbers in 2023 fell short of expectations.

The concept is not bad at all, says Frederik Gollob, partner at the market entry consultancy QÌ Advisory, who as head of dealer network development at Mercedes-Benz in China helped set up several such spaces – Mercedes-me Stores. From his point of view, the low sales reflect the “distribution hell” that first movers among Chinese automakers are currently going through. They pay the tuition fees, while the second wave of manufacturers will find it easier. The next brands can learn from the experiences of the pioneers. Additionally, customers will have already become accustomed to the idea of buying a Chinese brand.

According to Gollob, it is therefore essential for the Chinese to understand distribution in Germany. Here are two numbers to help: 36,420 car dealerships and automotive workshops, 434,000 employees – this is how huge the infrastructure for sales, maintenance and repair of cars is in Germany. Even if it’s old school – many Germans still trust the family-run car dealership in the village for a major investment like a car, where they have always found a solution together for all automotive questions and concerns. But the small local dealer at the entrance to the village does not exist in China. Therefore, the German distribution landscape is unfamiliar to Chinese brands.

Also important for Chinese brands: being ready for lengthy bureaucratic processes. Many vehicles in Germany are not bought but leased, or taken over by fleet operators. However, this requires managing risks. Therefore, elaborate damage classifications and residual value assessments must be made. This takes time. Many Chinese manufacturers have underestimated this, says Gollob. There is no shortcut here.

However, how much and how quickly sales for Chinese manufacturers will pick up in Germany depends not only on the brands themselves but also on another important group: the car dealers. Before a contract is signed with a brand and the vehicles take up valuable space on the sales floor, dealer groups analyze which brands are worth investing in. However, for many, the sheer multitude of new, completely unknown carmakers here is a mystery. Which manufacturers are reliable, also in terms of spare parts supply? Which ones are likely to go bankrupt soon?

When it comes to risk, a distinction can be made between state-owned Chinese car manufacturers such as SAIC, and purely private ones, which usually include younger EV start-ups, says Daniel Kirchert, an automotive expert with nearly 20 years of experience in leadership positions at international car manufacturers in China and founder of the start-up Noyo Mobility, a digital sales platform where mainly Chinese manufacturers can sell their EVs in Europe.

“Only a handful of the ‘traditional’ Original Equipment Manufacturers (OEMs) in China, those that are 20 years or older, are private,” says Kirchert. “These include, for example, BYD or Geely. The majority of OEMs are state-owned enterprises: Dongfeng, FAW and Changan are under the central government, and all others under provincial governments. With the large provincial companies, it is unlikely that they will go bankrupt or consolidate because strong local interests are behind them.”

Because every province wants its automotive success story and will spare no expense for it – whether it makes economic sense or not, says Kirchert. “I believe that after consolidation, there will be 25 or 35 companies left, simply because each of China’s 32 provinces will do everything it can to keep its own automotive industry running.”

No car manufacturer can avoid stationary trade; pure online distribution will not work with German customers, says Christian Voßkamp, one of the managing directors of the Bleker Group, which operates 14 car dealerships. The conditions for this are currently optimal. Many car dealerships have vacant spaces because traditional manufacturers like the Stellantis group have reduced their requirements for exhibition space. However, his company has only been approached by one Chinese manufacturer so far, Voßkamp wonders.

Whether he would cooperate with a Chinese manufacturer, the car dealer is still not sure: Due to possible EU tariffs, the risk for collaboration with Chinese car manufacturers is currently difficult to assess. Voßkamp also fears a negative image transfer. Because although he does not deal intensively with China, he is unsettled by the media coverage. What if customers stop buying Chinese cars due to political developments? “If I had put Ladas on the floor, I would have a problem now,” says Voßkamp.

To successfully establish themselves in the German market, Chinese automakers need to take the following steps, according to consultant Gollob:

However, one thing is clear for the automotive expert: “The Chinese have long announced that they want to be successful in our market, they have repeatedly pointed this out in five-year plans: We will not attack you with internal combustion engines but with a new drive train. When someone announces what they are doing, and then does it very precisely year after year, then it must be assumed that the overall goal will also be achieved.”

Whether it will be a “tsunami” remains to be seen. But it is to be expected that the sales of Chinese manufacturers will soon pick up in Germany as well.

What projects are you currently working on in China?

The range extends from projects for the public sector – such as train stations, museums, sports facilities and more – to private and semi-private investors, for whom we design and plan office and business complexes including high-rise projects. To mention a particularly outstanding example: In Zhengzhou, we are currently building a National Museum for the Culture of the Yellow River. It is completely integrated into the riverine landscape as a landscaped park.

Mao said, “China is a blank sheet of paper on which the most beautiful characters can be painted.” What strokes have you left on the cityscape that you are particularly proud of?

That is the quote of a revolutionary who sees the blank canvas as a metaphorical projection surface of his visions. As an architect, I see it differently. We work in a culture thousands of years old, thus within a complex contextual framework.

How do you take this into account in your work?

I’ll give you an example, the expansion of the Chinese National Museum at Tiananmen Square. We were dealing with a building from the 1950s, erected under Mao Zedong. Every Chinese schoolchild knows this museum and its architecture. I realized during work on this project how deeply the Chinese have internalized their own history and the resulting historical narrative, and how much the search for a national identity arises from this knowledge. All of this had to be taken into account in our work.

How does a European integrate into the Chinese narrative?

The prerequisite is a willingness to dialogue. For the National Museum, we had a Chinese partner office, without whose involvement we would probably have failed. Through our cooperation, we were able to overcome difficult situations in the course of the project, such as interventions from higher authorities to modify our competition design. The background was that around 2005, there was an atmosphere of change in China, which led, among other things, to numerous foreign architectural firms presenting spectacular designs. However, the policy directive was that no purely Western-influenced architecture should be built at Tiananmen Square, but something that, with an awareness of its significance, continues the existing. Just with contemporary means.

As a German architectural firm, do you experience advantages when building in China? Especially in terms of speed and regulations?

In terms of speed, a lot has changed in recent years. When we planned an opera house, a train station, or an airport ten or twenty years ago, it was always associated with the expectation of a “landmark” that should shape the identity of the place. Many of these large buildings were completed at breathtaking speed. Today, the tasks have partially shifted. They have become more fragmented, and the preparation of projects is more intense and precise. Construction in the West and in the East has become more similar, and the speed in China has been slowed down.

Has the crisis in the real estate sector accelerated this change?

The fact that economic development in China has slowed down leads, in my view, directly to doubts whether meteoric growth is the only way. The country is well advised to take a more moderate course in urban development that is more oriented towards the needs of the local people.

What does this mean for German architecture firms in China?

In China, much more quality is being built than before – that’s the result of “learning by doing” on a scale unimaginable to us. Over the past decades, the People’s Republic has built up enormous capacity in the construction industry: Every second house built worldwide is constructed in China. The question of whether we make the urgently needed step in terms of climate change and resource conservation through more sustainable urban development and alternative construction methods will be decided in China. Therefore, it is extremely important that we contribute our experience and expertise in this area. I consider the risks to be manageable. Although we generously share our knowledge, the opportunities outweigh them.

Will Chinese construction companies also come to Germany?

Chinese construction companies are now working internationally, and they will expand this. They have been little active in Germany so far, but this is only a matter of time.

Would you say that local architecture firms are now preferred in China?

Whenever a Chinese architectural company wins a major public tender, it is easy to believe that this happens for political reasons. However, since all construction projects of a certain scale are awarded through competitions, we see from the decisions that foreign offices can still prevail.

Stephan Schuetz is an Executive Partner at the architectural firm GMP, Gerkan, Marg and Partner. China has become a kind of jewel box for them. Some architecturally unique buildings in the People’s Republic originate from their desks. These include the Grand Theater in Qingdao or the CYTS Plaza office building. Also, the Yellow River National Museum in Zhengzhou will open later this year. Schuetz has been involved in all of these works.

The proposed EU Supply Chain Act has once again failed to gain sufficient support among member states. This was announced by the Belgian presidency on Wednesday. “We must now assess the situation and see if it is possible to address the concerns raised by the member states in consultation with the European Parliament.” This leaves open the question of whether the proposal, which could have significant implications for trade with China, will need to be renegotiated, even though there was already a compromise between negotiators from the two EU institutions in December.

The law aims to hold large companies accountable if they profit from practices such as child labor or forced labor outside the EU. In the case of China, this would mainly affect the Xinjiang region and possibly other regions where Uyghur forced labor is used. In general, larger companies must develop a plan to ensure that their business model and strategy are in line with the Paris Agreement on climate change. Within the German government, the FDP also pushed for Germany not to support the proposal. ari

China is sending its senior diplomat Li Hui again this week to mediate in finding a solution to end the Ukraine war. As announced by the Foreign Ministry in Beijing on Wednesday, Beijing’s special envoy for Eurasia will travel to Ukraine and Russia, and meet with EU representatives starting from Saturday. Meetings in Brussels, Poland, France, and Germany are also planned.

The trip is described as “the second round of shuttle diplomacy to promote a political solution to the Ukrainian crisis,” said Foreign Ministry spokesperson Mao Ning. Over the past two years, China has never given up its peace efforts and has never stopped advocating for talks. Li Hui had already traveled to Ukraine and Moscow for talks in May of last year, but without visible progress. All talks took place behind closed doors at that time.

As early as February 2023, China presented a position paper on the war in Ukraine, calling for respect for sovereignty, a ceasefire, and the resumption of peace negotiations. However, critics still doubt China’s impartial intentions. China’s strategic interests in this conflict are much stronger with Russia than with Ukraine. fpe

Eleven Chinese navy ships have been spotted near Taiwan, Taiwan’s Ministry of National Defense reported on Wednesday. Additionally, China has sent 30 fighter jets and a surveillance balloon into the airspace around the democratically governed island. The number is unusually high, explained Taiwan’s Ministry of National Defense. Normally, four to six ships are spotted within a 24-hour window.

The increased activity is likely related to an incident in mid-February when a Chinese fishing boat unlawfully entered a restricted area in Taiwanese waters. While fleeing from the coast guard, it capsized near the Taiwan-controlled Kinmen Islands, which are only a few kilometers from the Chinese mainland. Two of the four fishermen lost their lives. According to Chinese media reports, the boat was rammed – according to Taiwanese accounts, the coast guard acted lawfully. The government in Beijing referred to it as a “malicious incident” and announced increased patrols in the waters around Taiwan. fpe

Tuvalu remains committed to Taiwan even with a new government. On Wednesday, Feleti Teo, the Prime Minister of the Pacific state, reaffirmed his country’s “long-term and enduring special relationship” with Taiwan. Tuvalu is one of only twelve states that maintain official diplomatic relations with Taiwan. Approximately 11,000 people live on the island.

The new government, led by the 61-year-old lawyer who took office on Monday after the election, also stated its intention to “reassess the options” to “strengthen and enhance” relations with Taiwan and to build “a more permanent and mutually beneficial relationship”. Taiwan’s Ministry of Foreign Affairs, in turn, announced that Deputy Chief Diplomat Tien Chung-kwang would soon travel to Tuvalu with a delegation.

Beijing seeks to expand its influence in the Pacific region by presenting itself as a partner to island states such as Samoa, Tonga, or Vanuatu. The stance of Tuvalu was criticized by Foreign Ministry spokesperson Mao Ning, who remarked that countries friendly to Taiwan should make decisions “in line with their long-term interests”. fpe

China’s largest private property developer, Country Garden, faces the threat of insolvency due to unpaid credit payments. A creditor, Ever Credit Limited, has filed a corresponding petition against the company, Country Garden announced in a statement to the Hong Kong Stock Exchange on Wednesday, where the corporation is listed. It concerns the repayment of a loan amounting to 1.6 billion Hong Kong dollars (approximately 188 million euros). The court has scheduled the first hearing for May 17, as indicated in a stock exchange filing by Country Garden on Wednesday.

The company stated that it would “vigorously resist” the petition. “The radical actions of a single creditor will not have significant impact on the guaranteed delivery of buildings, normal operations, and the overall restructuring of our company’s overseas debt,” Country Garden told Reuters news agency. Country Garden’s shares plummeted by around twelve percent on Wednesday.

At the end of January, a Hong Kong court ordered the liquidation of China Evergrande, the world’s most indebted real estate company with over 300 billion dollars. Economists have been warning of overheating in the Chinese real estate market for years. The real estate sector accounts for about a fifth of China’s annual economic output. rtr/fpe

Volkswagen’s software subsidiary, Cariad, has appointed a new CEO for its operations in China. Frank Han, who comes from the Chinese automaker Changan, will assume leadership on Friday, the company announced on Wednesday. Han, succeeding the former software chief Chang Qing, is tasked with focusing on the rapid integration of new technologies into vehicles of the Volkswagen Group for the Chinese market.

Last year, Cariad established a joint venture with the Chinese technology group Thundersoft to gain more expertise for tailored offerings. Weak sales of EVs in China and slow software development have been ongoing challenges within the Volkswagen Group. Digital services are a key competitive factor in China, where drivers have particularly high expectations for vehicle connectivity. fpe/rtr

Florian Hobelsberger took over as CEO of Diehl Controls Asia, which has plants in Nanjing and Qingdao, at the turn of the year. He had been CFO at the electronics supplier for household appliances and HVAC/R since 2020. Gerhard Teschl, who previously held this role, is now CEO of Diehl Controls Americas.

Kari Hakala is the new Sales Marketing Manager at Sunwell Carbon Fiber Composite Corporation (SWCFC) in Jiangsu. He previously worked for Swancor Highpolymer Co. in Shanghai.

Is something changing in your organization? Let us know at heads@table.media!

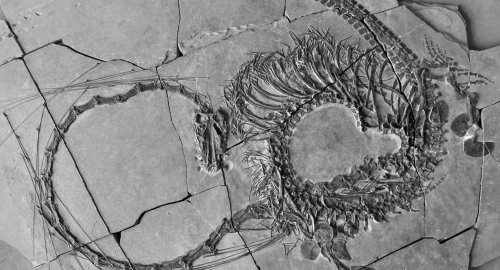

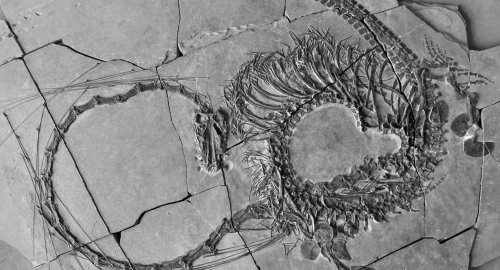

In line with the Year of the Dragon, scientists at the National Museum of Scotland have announced the discovery of a Chinese dinosaur fossil that bears a striking resemblance to the mythical creature. The remains of the five-meter-long reptile, known by its Latin name Dinocephalosaurus orientalis, were found in Guizhou Province. The 240 million-year-old fossil is remarkably well-preserved, according to paleontologists involved in the excavation from Scotland, Germany, the USA and China. Even fossilized fish were found in the stomach region of the marine reptile.

On Sundays, admiring the gleaming, polished cars in the local dealership through the showroom windows and dreaming of owning a factory-fresh new car is almost a German tradition. However, for Chinese manufacturers, the traditional dealership model is not the preferred option due to numerous obstacles.

They are exploring alternative ways to introduce their EVs to the German market, as Julia Fiedler reports. So far, this transition has not always been smooth sailing. The challenges faced by manufacturers in distribution stem from cultural differences, and many have also underestimated German bureaucracy. However, sales are expected to pick up soon, partly due to innovative distribution hubs that also function as co-working spaces and hang-out spots.

In Chinese metropolises, modern skyscrapers collide with ancient temples. Architect Stephan Schuetz, from GMP Architects, has been involved in numerous prestigious construction projects in China. In a conversation with Christian Domke Seidel, he shares his experiences of navigating the quest for a national identity in his projects in China. Moreover, he is confident that it’s only a matter of time before Chinese construction firms become active in Germany as well.

The container has landed, the cars have been unloaded: 3,000 brand-new BYD EVs are ready in Bremerhaven. The quality and price are right. Beijing’s leadership has also encouraged manufacturers to export, seeing Chinese EVs as a positive calling card for the People’s Republic. And German customers? They want affordable EVs. Especially younger buyers are experimentally inclined toward the brand if the price-performance ratio is right.

However, Chinese cars and German customers have not quite come together yet. This is also due to teething problems in distribution. While the good old car dealership is still the number one point of contact in Germany, some Chinese brands are opting for direct sales. Others would like to rely on the spaces of established dealers, but these are overwhelmed by the unfamiliar brands. Fleet operators, on the other hand, are wary of the risk. Nevertheless, Chinese brands are on the verge of breaking through, experts say.

In the registration statistics of the Federal Motor Transport Authority, the SAIC brand MG is the undisputed number one among Chinese manufacturers: 21,232 vehicles were registered from January to December 2023. MG relies on the traditional way of car sales in Germany. The brand has consistently built up a sales and service network over several years. This includes shop-in-shop solutions and now also its own showrooms. The volumes per sales location are good.

Great Wall Motors also did well in 2023 with 4,660 vehicles sold. The company from Hebei, founded in 1984 and China’s first private car manufacturer, brought the Emil Frey Group on board early for distribution, Europe’s largest car dealer and successful importer, including Mitsubishi. Emil Frey owns nearly 700 locations and distributes the brands Ora and Wey from GWM.

A similar number of vehicles were sold by BYD in 2023. Thus, China’s market leader is still far from achieving its self-set goal of being among Europe’s top 5 automotive brands. But the company, founded in Shenzhen in 2023, has only been active in Germany since the end of 2022 – and has teamed up with strong partners. Among others, with the car dealership chain Sternauto and with Senger Mobility. However, there are only 25 sales and service locations in Germany so far. Another success for BYD: Sixt plans to take over a total of 100,000 vehicles from the Chinese by 2028.

Other manufacturers are opting for a different type of distribution that is supposedly easier to set up and also saves distribution costs: Direct sales via the internet. For example, Nio sells its vehicles this way. The Nio houses in Germany are modeled after the stores in China. Because unlike here, in metropolises like Beijing and Shanghai, it has long been customary to display vehicles in chic stores in the city center.

The Nio House in Berlin is located near the shopping mile Kurfürstendamm and invites passers-by to experience the cars and Nio lifestyle on three floors. While the impressive supercar EP9 can only be admired from a distance by incoming passers-by, the models ET5 or ET7 can be sat in. Vehicles are also available for test drives in the underground car park by appointment.

But the brand also wants to convey the sense of community it has successfully built up in China. That is why there is a foosball table in the basement of the Nio House, lectures and yoga are offered, bookable via the Nio app. Upstairs, there are free coworking spaces and a lounge with a bookshelf, where you can observe the colorful hustle and bustle on cozy sofas directly opposite the Kaiser Wilhelm Memorial Church. The atmosphere is elegant and inviting. However, Nio’s registration numbers in 2023 fell short of expectations.

The concept is not bad at all, says Frederik Gollob, partner at the market entry consultancy QÌ Advisory, who as head of dealer network development at Mercedes-Benz in China helped set up several such spaces – Mercedes-me Stores. From his point of view, the low sales reflect the “distribution hell” that first movers among Chinese automakers are currently going through. They pay the tuition fees, while the second wave of manufacturers will find it easier. The next brands can learn from the experiences of the pioneers. Additionally, customers will have already become accustomed to the idea of buying a Chinese brand.

According to Gollob, it is therefore essential for the Chinese to understand distribution in Germany. Here are two numbers to help: 36,420 car dealerships and automotive workshops, 434,000 employees – this is how huge the infrastructure for sales, maintenance and repair of cars is in Germany. Even if it’s old school – many Germans still trust the family-run car dealership in the village for a major investment like a car, where they have always found a solution together for all automotive questions and concerns. But the small local dealer at the entrance to the village does not exist in China. Therefore, the German distribution landscape is unfamiliar to Chinese brands.

Also important for Chinese brands: being ready for lengthy bureaucratic processes. Many vehicles in Germany are not bought but leased, or taken over by fleet operators. However, this requires managing risks. Therefore, elaborate damage classifications and residual value assessments must be made. This takes time. Many Chinese manufacturers have underestimated this, says Gollob. There is no shortcut here.

However, how much and how quickly sales for Chinese manufacturers will pick up in Germany depends not only on the brands themselves but also on another important group: the car dealers. Before a contract is signed with a brand and the vehicles take up valuable space on the sales floor, dealer groups analyze which brands are worth investing in. However, for many, the sheer multitude of new, completely unknown carmakers here is a mystery. Which manufacturers are reliable, also in terms of spare parts supply? Which ones are likely to go bankrupt soon?

When it comes to risk, a distinction can be made between state-owned Chinese car manufacturers such as SAIC, and purely private ones, which usually include younger EV start-ups, says Daniel Kirchert, an automotive expert with nearly 20 years of experience in leadership positions at international car manufacturers in China and founder of the start-up Noyo Mobility, a digital sales platform where mainly Chinese manufacturers can sell their EVs in Europe.

“Only a handful of the ‘traditional’ Original Equipment Manufacturers (OEMs) in China, those that are 20 years or older, are private,” says Kirchert. “These include, for example, BYD or Geely. The majority of OEMs are state-owned enterprises: Dongfeng, FAW and Changan are under the central government, and all others under provincial governments. With the large provincial companies, it is unlikely that they will go bankrupt or consolidate because strong local interests are behind them.”

Because every province wants its automotive success story and will spare no expense for it – whether it makes economic sense or not, says Kirchert. “I believe that after consolidation, there will be 25 or 35 companies left, simply because each of China’s 32 provinces will do everything it can to keep its own automotive industry running.”

No car manufacturer can avoid stationary trade; pure online distribution will not work with German customers, says Christian Voßkamp, one of the managing directors of the Bleker Group, which operates 14 car dealerships. The conditions for this are currently optimal. Many car dealerships have vacant spaces because traditional manufacturers like the Stellantis group have reduced their requirements for exhibition space. However, his company has only been approached by one Chinese manufacturer so far, Voßkamp wonders.

Whether he would cooperate with a Chinese manufacturer, the car dealer is still not sure: Due to possible EU tariffs, the risk for collaboration with Chinese car manufacturers is currently difficult to assess. Voßkamp also fears a negative image transfer. Because although he does not deal intensively with China, he is unsettled by the media coverage. What if customers stop buying Chinese cars due to political developments? “If I had put Ladas on the floor, I would have a problem now,” says Voßkamp.

To successfully establish themselves in the German market, Chinese automakers need to take the following steps, according to consultant Gollob:

However, one thing is clear for the automotive expert: “The Chinese have long announced that they want to be successful in our market, they have repeatedly pointed this out in five-year plans: We will not attack you with internal combustion engines but with a new drive train. When someone announces what they are doing, and then does it very precisely year after year, then it must be assumed that the overall goal will also be achieved.”

Whether it will be a “tsunami” remains to be seen. But it is to be expected that the sales of Chinese manufacturers will soon pick up in Germany as well.

What projects are you currently working on in China?

The range extends from projects for the public sector – such as train stations, museums, sports facilities and more – to private and semi-private investors, for whom we design and plan office and business complexes including high-rise projects. To mention a particularly outstanding example: In Zhengzhou, we are currently building a National Museum for the Culture of the Yellow River. It is completely integrated into the riverine landscape as a landscaped park.

Mao said, “China is a blank sheet of paper on which the most beautiful characters can be painted.” What strokes have you left on the cityscape that you are particularly proud of?

That is the quote of a revolutionary who sees the blank canvas as a metaphorical projection surface of his visions. As an architect, I see it differently. We work in a culture thousands of years old, thus within a complex contextual framework.

How do you take this into account in your work?

I’ll give you an example, the expansion of the Chinese National Museum at Tiananmen Square. We were dealing with a building from the 1950s, erected under Mao Zedong. Every Chinese schoolchild knows this museum and its architecture. I realized during work on this project how deeply the Chinese have internalized their own history and the resulting historical narrative, and how much the search for a national identity arises from this knowledge. All of this had to be taken into account in our work.

How does a European integrate into the Chinese narrative?

The prerequisite is a willingness to dialogue. For the National Museum, we had a Chinese partner office, without whose involvement we would probably have failed. Through our cooperation, we were able to overcome difficult situations in the course of the project, such as interventions from higher authorities to modify our competition design. The background was that around 2005, there was an atmosphere of change in China, which led, among other things, to numerous foreign architectural firms presenting spectacular designs. However, the policy directive was that no purely Western-influenced architecture should be built at Tiananmen Square, but something that, with an awareness of its significance, continues the existing. Just with contemporary means.

As a German architectural firm, do you experience advantages when building in China? Especially in terms of speed and regulations?

In terms of speed, a lot has changed in recent years. When we planned an opera house, a train station, or an airport ten or twenty years ago, it was always associated with the expectation of a “landmark” that should shape the identity of the place. Many of these large buildings were completed at breathtaking speed. Today, the tasks have partially shifted. They have become more fragmented, and the preparation of projects is more intense and precise. Construction in the West and in the East has become more similar, and the speed in China has been slowed down.

Has the crisis in the real estate sector accelerated this change?

The fact that economic development in China has slowed down leads, in my view, directly to doubts whether meteoric growth is the only way. The country is well advised to take a more moderate course in urban development that is more oriented towards the needs of the local people.

What does this mean for German architecture firms in China?

In China, much more quality is being built than before – that’s the result of “learning by doing” on a scale unimaginable to us. Over the past decades, the People’s Republic has built up enormous capacity in the construction industry: Every second house built worldwide is constructed in China. The question of whether we make the urgently needed step in terms of climate change and resource conservation through more sustainable urban development and alternative construction methods will be decided in China. Therefore, it is extremely important that we contribute our experience and expertise in this area. I consider the risks to be manageable. Although we generously share our knowledge, the opportunities outweigh them.

Will Chinese construction companies also come to Germany?

Chinese construction companies are now working internationally, and they will expand this. They have been little active in Germany so far, but this is only a matter of time.

Would you say that local architecture firms are now preferred in China?

Whenever a Chinese architectural company wins a major public tender, it is easy to believe that this happens for political reasons. However, since all construction projects of a certain scale are awarded through competitions, we see from the decisions that foreign offices can still prevail.

Stephan Schuetz is an Executive Partner at the architectural firm GMP, Gerkan, Marg and Partner. China has become a kind of jewel box for them. Some architecturally unique buildings in the People’s Republic originate from their desks. These include the Grand Theater in Qingdao or the CYTS Plaza office building. Also, the Yellow River National Museum in Zhengzhou will open later this year. Schuetz has been involved in all of these works.

The proposed EU Supply Chain Act has once again failed to gain sufficient support among member states. This was announced by the Belgian presidency on Wednesday. “We must now assess the situation and see if it is possible to address the concerns raised by the member states in consultation with the European Parliament.” This leaves open the question of whether the proposal, which could have significant implications for trade with China, will need to be renegotiated, even though there was already a compromise between negotiators from the two EU institutions in December.

The law aims to hold large companies accountable if they profit from practices such as child labor or forced labor outside the EU. In the case of China, this would mainly affect the Xinjiang region and possibly other regions where Uyghur forced labor is used. In general, larger companies must develop a plan to ensure that their business model and strategy are in line with the Paris Agreement on climate change. Within the German government, the FDP also pushed for Germany not to support the proposal. ari

China is sending its senior diplomat Li Hui again this week to mediate in finding a solution to end the Ukraine war. As announced by the Foreign Ministry in Beijing on Wednesday, Beijing’s special envoy for Eurasia will travel to Ukraine and Russia, and meet with EU representatives starting from Saturday. Meetings in Brussels, Poland, France, and Germany are also planned.

The trip is described as “the second round of shuttle diplomacy to promote a political solution to the Ukrainian crisis,” said Foreign Ministry spokesperson Mao Ning. Over the past two years, China has never given up its peace efforts and has never stopped advocating for talks. Li Hui had already traveled to Ukraine and Moscow for talks in May of last year, but without visible progress. All talks took place behind closed doors at that time.

As early as February 2023, China presented a position paper on the war in Ukraine, calling for respect for sovereignty, a ceasefire, and the resumption of peace negotiations. However, critics still doubt China’s impartial intentions. China’s strategic interests in this conflict are much stronger with Russia than with Ukraine. fpe

Eleven Chinese navy ships have been spotted near Taiwan, Taiwan’s Ministry of National Defense reported on Wednesday. Additionally, China has sent 30 fighter jets and a surveillance balloon into the airspace around the democratically governed island. The number is unusually high, explained Taiwan’s Ministry of National Defense. Normally, four to six ships are spotted within a 24-hour window.

The increased activity is likely related to an incident in mid-February when a Chinese fishing boat unlawfully entered a restricted area in Taiwanese waters. While fleeing from the coast guard, it capsized near the Taiwan-controlled Kinmen Islands, which are only a few kilometers from the Chinese mainland. Two of the four fishermen lost their lives. According to Chinese media reports, the boat was rammed – according to Taiwanese accounts, the coast guard acted lawfully. The government in Beijing referred to it as a “malicious incident” and announced increased patrols in the waters around Taiwan. fpe

Tuvalu remains committed to Taiwan even with a new government. On Wednesday, Feleti Teo, the Prime Minister of the Pacific state, reaffirmed his country’s “long-term and enduring special relationship” with Taiwan. Tuvalu is one of only twelve states that maintain official diplomatic relations with Taiwan. Approximately 11,000 people live on the island.

The new government, led by the 61-year-old lawyer who took office on Monday after the election, also stated its intention to “reassess the options” to “strengthen and enhance” relations with Taiwan and to build “a more permanent and mutually beneficial relationship”. Taiwan’s Ministry of Foreign Affairs, in turn, announced that Deputy Chief Diplomat Tien Chung-kwang would soon travel to Tuvalu with a delegation.

Beijing seeks to expand its influence in the Pacific region by presenting itself as a partner to island states such as Samoa, Tonga, or Vanuatu. The stance of Tuvalu was criticized by Foreign Ministry spokesperson Mao Ning, who remarked that countries friendly to Taiwan should make decisions “in line with their long-term interests”. fpe

China’s largest private property developer, Country Garden, faces the threat of insolvency due to unpaid credit payments. A creditor, Ever Credit Limited, has filed a corresponding petition against the company, Country Garden announced in a statement to the Hong Kong Stock Exchange on Wednesday, where the corporation is listed. It concerns the repayment of a loan amounting to 1.6 billion Hong Kong dollars (approximately 188 million euros). The court has scheduled the first hearing for May 17, as indicated in a stock exchange filing by Country Garden on Wednesday.

The company stated that it would “vigorously resist” the petition. “The radical actions of a single creditor will not have significant impact on the guaranteed delivery of buildings, normal operations, and the overall restructuring of our company’s overseas debt,” Country Garden told Reuters news agency. Country Garden’s shares plummeted by around twelve percent on Wednesday.

At the end of January, a Hong Kong court ordered the liquidation of China Evergrande, the world’s most indebted real estate company with over 300 billion dollars. Economists have been warning of overheating in the Chinese real estate market for years. The real estate sector accounts for about a fifth of China’s annual economic output. rtr/fpe

Volkswagen’s software subsidiary, Cariad, has appointed a new CEO for its operations in China. Frank Han, who comes from the Chinese automaker Changan, will assume leadership on Friday, the company announced on Wednesday. Han, succeeding the former software chief Chang Qing, is tasked with focusing on the rapid integration of new technologies into vehicles of the Volkswagen Group for the Chinese market.

Last year, Cariad established a joint venture with the Chinese technology group Thundersoft to gain more expertise for tailored offerings. Weak sales of EVs in China and slow software development have been ongoing challenges within the Volkswagen Group. Digital services are a key competitive factor in China, where drivers have particularly high expectations for vehicle connectivity. fpe/rtr

Florian Hobelsberger took over as CEO of Diehl Controls Asia, which has plants in Nanjing and Qingdao, at the turn of the year. He had been CFO at the electronics supplier for household appliances and HVAC/R since 2020. Gerhard Teschl, who previously held this role, is now CEO of Diehl Controls Americas.

Kari Hakala is the new Sales Marketing Manager at Sunwell Carbon Fiber Composite Corporation (SWCFC) in Jiangsu. He previously worked for Swancor Highpolymer Co. in Shanghai.

Is something changing in your organization? Let us know at heads@table.media!

In line with the Year of the Dragon, scientists at the National Museum of Scotland have announced the discovery of a Chinese dinosaur fossil that bears a striking resemblance to the mythical creature. The remains of the five-meter-long reptile, known by its Latin name Dinocephalosaurus orientalis, were found in Guizhou Province. The 240 million-year-old fossil is remarkably well-preserved, according to paleontologists involved in the excavation from Scotland, Germany, the USA and China. Even fossilized fish were found in the stomach region of the marine reptile.