The European Union wants its voice to be heard in the world – a legitimate aim. The only problem is that the EU rarely speaks with one voice – more often in a polyphonic confusion. When it comes to countervailing duties on Chinese electric cars, the bloc is as torn as a hippie’s jeans. So whose voice should be listened to?

From a purely formal perspective, that of the EU Commission. However, the People’s Republic of China naturally pays very close attention to who has voted in its favor and against it. It will use this rift to play the individual EU players off against each other. It once again highlights the great weakness of the European Union, which simply does not seem capable of acting as a unanimous choir. Julia Fiedler discussed this problem in detail with Abigaël Vasselier from Merics.

She believes that Germany’s voting behavior has damaged Europe’s credibility vis-à-vis China by showing that the EU Commission’s stance and Germany’s wishes are far apart. Consequently, China could use Germany and some German companies to break European unity.

Ms. Vasselier, what do you think of the current customs decision on electric cars from China?

First of all, it’s a good day for Europe! We managed to pass the tariffs, which means that we’ve managed to be more consequential vis-à-vis China. We’ve shown that Europe can respond to the distortions created by China. These measures are not US-style tariffs; they’re a European-style response. And then there is a second layer to this decision, of how to do European China policy with 27 diverging national interests. It’s a pretty unique situation, as we got to see the way the vote was unfolding and how pressure was working. Usually, you don’t get that level of granularity.

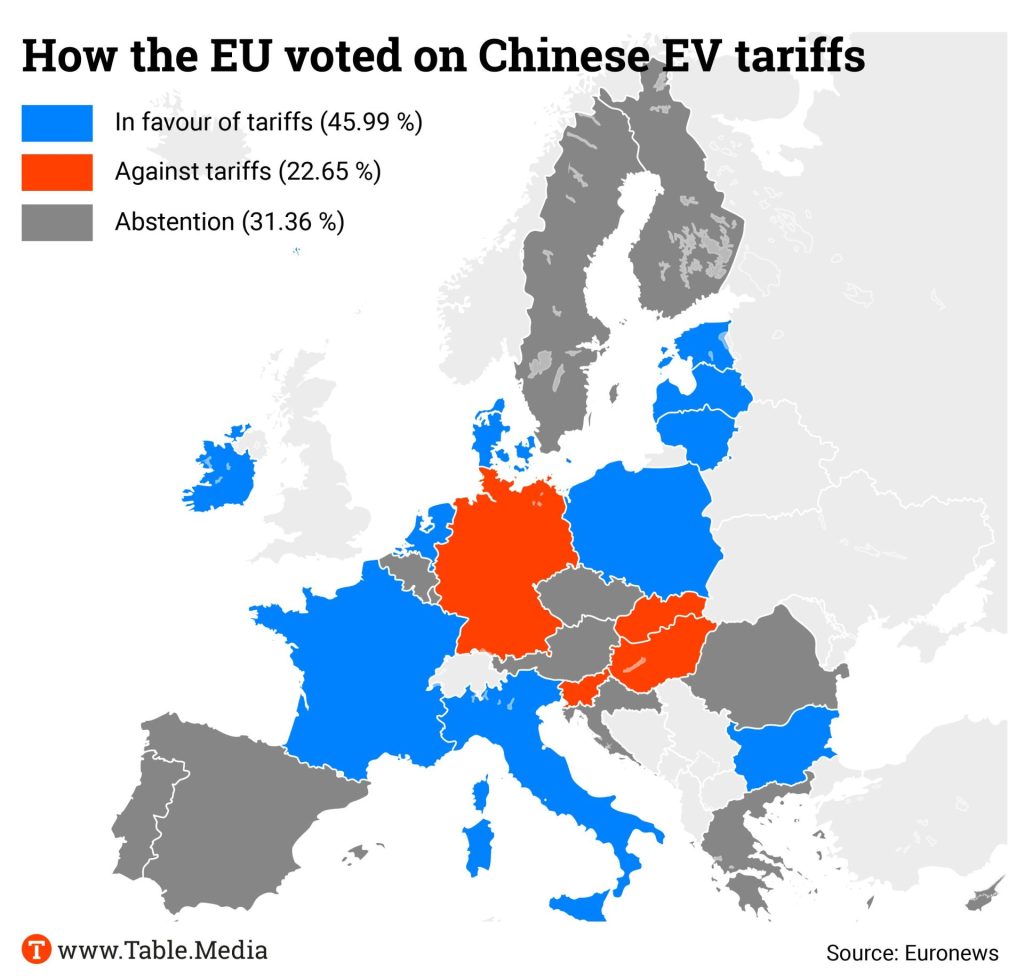

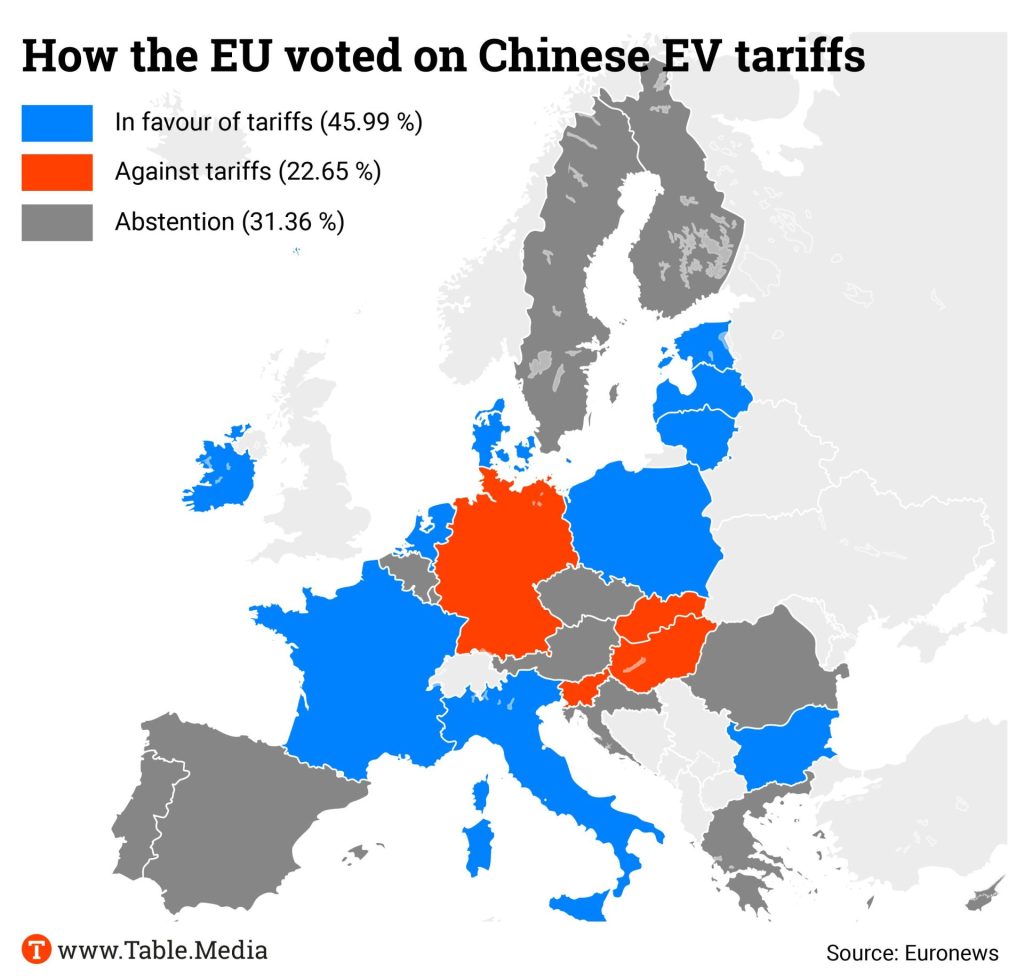

What does the voting behavior of the member states show us?

In the case of Spain – and this concerns half of the countries that abstained – we can see how China manages to create a fear of retaliation, with which it can change the position of governments. A very important takeaway from this is: We need to prepare our member states for the fact that there might be more tariffs in the future, as Europe is going to be more consequential. There might be more tit-for-tat and more retaliation coming from China, be it real or just threats for retaliation. Europeans need to better understand how China is playing retaliation and how we can prepare for retaliation measures - whether at the government or company level. There also needs to be an honest reflection on what kind of economic model we want for Europe.

What could a future economic model for Europe look like?

It’s for sure a future where tariffs are normalized, where all actors will increasingly weaponize trade, and economic coercion is going to become a feature of our economic and trade relationships.

What do you think of the German debate about the tariffs and how the country voted?

Just one year after the China strategy was published, with just one vote the Chancellor showed how fragmented the government is.

Are you saying Germany‘s China strategy isn’t working?

Germany’s China strategy was a very positive exercise in terms of creating coherence in a country, where there are such divergent interests regarding China. The strategy managed to bring Germany behind one voice. With the vote against the EV tariffs, how much debate and how many divergent voices we’ve now seen, and also the fact that Olaf Scholz went against the coalition, it shows one thing: We have moved from a very good process of bringing coherence, to a vote, that completely put these efforts down. The second element is the fact that the government moved from abstention to voting against. This happened in a constellation, where they knew they would not have the majority when voting No, and that the tariffs would pass.

How do you interpret this voting behavior?

The signaling of this is extremely important. Voting No in such a constellation signals that Germany is breaking European unity. For the past six years, we have enjoyed a very good degree of unity. But my sense is by Germany taking a stand and saying: I’m against, and I’m going to make clear that everyone knows, it’s undermining our unity over the long term – not just in this case but also in the future. Berlin is opening a Pandora’s box: How much unity are we going to have in European China policy in the future?

Has Scholz also sent a signal to China?

I think it’s clearly a signal to China: Germany will ensure our trade relationship is not so politicized, which is what China is asking. The consequence is that the Chinese now see that they can leverage Germany and some German companies to break European unity. By voting against it, Germany is also undermining European credibility vis-a-vis China because it shows that there is a big divergence in terms of the stance taken by the EU Commission and what Germany wants.

There has been a lot of friction between China and the EU. How can we create a functioning relationship?

I think what China wants is for Europe to keep its market open and to take a slightly divergent approach from the one of the US in terms of openness. However, this is clearly not happening, as we see now with the tariffs. There will be some sort of closure or at least a rise in the cost for China to access the European markets. As for the European side, I think Europe expects that the trade relation it’s enjoying with China – which Europe also needs to have with China – can take place under conditions that are fair, reciprocal and non-distortive. But with the current trajectory of the Chinese economic model, that’s not going to happen. That’s why there’s a mismatch of expectations that China cannot address and cannot do what Europe wants it to do, and vice versa. Neither of us will be able to respond to what the other wants in this situation. This is why I think it’s clear that the trade frictions and political frictions will continue escalating.

What conclusions do you draw from this situation?

We need to build resilience on the European level, not just economically, but also by becoming a geopolitical player. There have been existential issues in our relationship with China before. But the EV issue is different: It touches European prosperity. Europe has imposed sanctions against Chinese actors related to security concerns in the case of cyber-attacks or serious human rights violations. While negotiations were difficult, we managed to create unity. However, regarding the question of electric vehicles, we are most divided. The case of tariffs on electric vehicles is so special because it touches Germany’s unique economic position vis-a-vis China and future trade relations with China.

Understandably so: The German automotive industry’s sales and market share in China have declined lately, and the German economy is dependent on the automotive industry.

I think we need to accept that we are now in a systemic competition at the economic level. But if you put yourself in the shoes of the car industry and you look at your short-term profit, probably there is still some to make and that’s a business decision.

But one that is not sustainable?

I thought we had come to a common understanding of China’s economic trajectory and the challenges our companies were facing in China but also in third markets. It seems that we lack a common assessment of China’s economic trajectory, how it impacts Europe, and most importantly, the realization that we are in a systemic competition with China. The next fight on European-China policy will not take place in Brussels. It will take place in European capitals, and it will take place with all the stakeholders. Not only the government, but with companies and with citizens.

Do you mean that this is the beginning of fragmentation?

Yes. The German case shows how deep fragmentation can become. So far, we have observed strong divisions between the coalition members and with the most prominent German companies. The moment the trade unions realize that we will lose jobs because of China, that’s the moment we are going to have a different set of conversations. When people will feel the costs of the decisions taken on China, pay more for their products or when they lose their job because of the competition with China, that’s when we will see a bigger level of fragmentation. And I think it’s going to come.

Abigaël Vasselier heads the Foreign Relations team at the Mercator Institute for China Studies (Merics) in Berlin. Previously, she worked as Deputy Head of Division for China, Hong Kong, Macao, Taiwan and Mongolia at the European External Action Service (EEAS) and Policy Fellow and Program Coordinator at the Asia Programme of the European Council on Foreign Relations (ECFR). She studied Chinese at China Foreign Affairs University in Beijing.

Brussels will be able to impose additional tariffs, despite Germany’s opposition. The EU member states did not reach a sufficient majority against the plan – but there was also no clear vote in favor of the tariffs. This means the Brussels authority can decide whether the duties will be introduced.

The EU Council’s vote is a crushing defeat for German Chancellor Olaf Scholz. He and his close advisors had campaigned extensively in recent weeks for other EU heads of state and government to oppose the tariffs. They only managed to convince Slovenia. Apart from Germany, three other countries already rejected the tariffs in July voted against. Cyprus voted “no” in July. The country has now abstained.

The countries that voted in favor: Italy, France, Netherlands, Estonia, Latvia, Lithuania, Poland, Bulgaria, Ireland, Denmark

Abstentions: Belgium, Czech Republic, Greece, Spain, Croatia, Cyprus, Luxembourg, Austria, Portugal, Romania, Sweden, Finland

Voting against: Germany, Hungary, Malta, Slovenia, Slovakia

Up to now, Chinese EVs have already been subject to an import duty of ten percent. The extra tariffs have various dimensions depending on the manufacturer and will now be applied on top. The EU rewards manufacturers’ willingness to cooperate in the investigation procedure by imposing lower surcharges. In the version agreed on Friday, the following tariffs now apply:

The additional tariffs apply for five years from the day after publication in the EU Official Journal. It is not yet clear when this will happen. A deadline for possible negotiations is October 30. The official deadline for the introduction of the duties is November 4, 13 months after the start of the EU investigation. The provisional countervailing duties in force since July continue to exist as bank guarantees. If a manufacturer does not honor agreements, the extra tariffs can still be applied at a later date.

VW CEO Oliver Blume told the Bild am Sonntag newspaper that there is still time until the end of October before the planned additional tariffs on Chinese cars come into force. However, the negotiations could also lead to Chinese companies producing EVs in Germany. BMW CEO Oliver Zipse called the vote a fatal signal for the European automotive industry. “Now a quick solution is needed between the European Commission and China to prevent a trade conflict that will ultimately only have losers.” According to a spokesperson, Mercedes-Benz also believes that punitive tariffs would harm the industry’s competitiveness in the long term.

The European Chamber of Commerce in China has called for dialogue. This is “the preferred way to resolve trade disputes,” the Chamber said. “The relationship between Europe and China has created immense value in the past and has significant potential for future value creation. Therefore, the Chamber of Commerce supports the EU and China to consider a negotiated solution with a view to ensuring a level-playing field in the relationship and addressing imbalances.” The Chinese Chamber of Commerce to the EU called the EU investigation “a politically motivated and unjustified protectionist measure.” It will closely monitor the ongoing negotiations, the Chamber announced.

China wants to continue negotiations. Beijing’s Ministry of Commerce accuses the EU of shaking and hindering the confidence and determination of Chinese companies to invest in and cooperate with the EU rather than solve problems. It said both sides had expressed their willingness to find a solution in the negotiations over the past few weeks, and technical teams from both sides will continue the talks on October 7. Should an agreement be reached in the coming weeks, the EU Council would have to vote again on a revised agreement.

The EU Commission remained tight-lipped on Friday. Minimum prices from Chinese manufacturers and volume caps are on the table. However, a large agreement cannot simply be concluded here. Minimum prices must be negotiated individually with the manufacturers. State interference is problematic within the World Trade Organisation (WTO) guidelines.

EU sources expect China to implement possible steps in early November, when the EV tariffs will likely come into force. Tariffs on French cognac are an obvious option. Investigations into European pork imports are underway on the Chinese side, as are investigations into dairy products. Further restrictions on critical minerals are also conceivable.

It remains to be seen how it will be handled if Chinese EVs are imported into the EU from neighboring non-EU countries where the additional tariffs do not apply. For example, from Switzerland, which has a free trade agreement with China. However, Serbia and the United Kingdom could also be of interest. The Brussels authority did not comment on this on Friday.

German trade associations have reacted differently to the EU member states’ decision to impose countervailing duties on Chinese EVs. The Federation of German Industries (BDI) considers the decision correct in principle, but is calling on both sides to continue negotiations and prevent an escalating trade conflict.

“The BDI generally supports the use of trade defense instruments to protect the European market economy from state market distortions if the conditions are met. At the same time, however, the interests of the European industry in stable economic relations with China must also be taken into account,” said BDI Managing Director Tanja Goenner.

As China’s largest trading partner and export market, the EU can continue to confidently pursue talks with Beijing. According to Goenner, China also needs good trade relations with Europe. China’s growth model, which is driven by investment and exports, is also under pressure, said Goenner. More and more countries are resisting market distortions by the Chinese state.

The German Economic Institute (IW) also points out that the EU’s countervailing duties on electric cars from China are legitimate and in line with trade law, but also warns against an escalating trade conflict. The IW said countermeasures were imminent, even if escalation was not in China’s interests.

The German Chamber of Industry and Commerce (DIHK) was more critical, with its head of foreign trade Volker Treier fearing a tariff spiral. “The decoupling between Europe and China is already putting a strain on global trade and weakening the competitiveness of large parts of the German economy,” said Treier. The DIHK believes countering increasing protectionism with trade incentives would make more sense than new barriers. grz

More and more Germans could imagine buying a Chinese car. This was the result of a representative survey by the German automobile club ADAC. According to the survey, 59 percent of respondents stated that they would generally consider buying a Chinese car manufacturer.

Chinese brands are developing into an alternative, especially among younger drivers. 74 percent of 30 to 39-year-olds and 72 percent of 18 to 29-year-olds said they could imagine buying a car from a Chinese manufacturer. In contrast, only 31 percent of over 70-year-olds say the same.

When it comes to fully electric cars, as many as 80 percent of respondents said they would consider buying a Chinese car. However, one in three respondents who plan to buy a car in the next three years wants a gasoline car.

Respondents stated that the low price was the main reason for buying a Chinese car brand. 83 percent cited this as a purchase argument, followed by the innovative technology (55 percent) and the appealing design (37 percent).

As reasons against a purchase, the respondents cited general reservations about Chinese cars (54 percent), the limited repair shop and dealer network (40 percent), poor quality (39 percent) and data privacy (26 percent). For the survey, “ADAC Markt- und Meinungsforschung” interviewed 1079 drivers aged 18 and over with their primary residence in Germany in July. mcl

Chinese hackers accessed the networks of US broadband providers and obtained information from systems the federal government uses for court-authorized wiretapping, the Wall Street Journal reported on Saturday. Verizon Communications, AT&T and Lumen Technologies are among the telecoms companies whose networks were breached by the recently discovered intrusion, the newspaper said, citing people familiar with the matter.

The hackers might have held access for months to network infrastructure used by the companies to cooperate with court-authorized US requests for communications data. China’s foreign ministry responded on Sunday that it was not aware of the attack described in the report but said the United States had “concocted a false narrative” to “frame” China in the past. rtr

Taiwan’s President William Lai Ching-te has sharply rejected Beijing’s claims to sovereignty over the island state, citing historical reasons. It is “impossible” for the People’s Republic of China to become Taiwan’s motherland, as Taiwan has older political roots, said President Lai a few days before Taiwan’s National Day.

He said the island is a country called the Republic of China, whose origins date back to the 1911 revolution that overthrew the last imperial dynasty. The republican government fled to Taiwan in 1949 after losing the civil war against Mao Zedong’s communists.

Taiwan will celebrate its 113th founding anniversary on January 10, while the People’s Republic celebrated its 75th anniversary last week. “In terms of age, it is absolutely impossible for the People’s Republic of China to become the motherland of the Republic of China’s people. On the contrary, the Republic of China may be the motherland of the people of the People’s Republic of China who are over 75 years old,” said Lai, who urged his compatriots that “we must remember that we are a sovereign and independent country.”

Lai, who took office in May, is considered a “separatist” by Beijing. Last month, he said that if China’s claims to Taiwan were about territorial integrity, then China would also have to reclaim land from Russia that was signed over to it by the last Chinese dynasty in the 19th century. rtr/grz

Deng Hongbo has been China’s highest representative in Berlin since September. In his inaugural speech, the 59-year-old said he was proud to be sent to Germany as ambassador by President Xi Jinping at such an important time. And indeed, the fact that Deng, of all people, is taking over from Wu Ken, who held the post for five years, shows the priorities Beijing is currently pursuing with regard to Germany and Europe.

Deng Hongbo is by no means a seasoned expert on local customs. Unlike his predecessors, he does not speak German and has hardly spent any time in Germany. Instead, he is regarded as a USA expert. He is rumored to be tasked with softening the transatlantic alliance between Germany and the USA in favor of China.

Deng was born in Sichuan province in July 1965. After graduating from China’s diplomatic forge, the Beijing Foreign Language University, he joined the Chinese Foreign Ministry in 1987, where he initially held various low-level posts. In 1989, he was sent to Vietnam as a consultant for four years. His next stop was the Ministry’s North America Department, which sent him to Washington in 1999. Upon his return, he became the department’s deputy director. From May 2009 to September 2010, he served as ambassador to Kenya, and from 2010, he served for another four years as deputy ambassador to Washington.

Since the late 2010s, Deng has been Deputy Director of the Office of the Foreign Affairs Commission of the Central Committee of the Communist Party of China (CPC). This commission plays a pivotal role in shaping and coordinating Chinese foreign policy at the party level and works closely with the Ministry of Foreign Affairs. He is said to have been appointed to the post on the recommendation of Yang Jiechi, the CCP’s leading foreign policy expert at the time.

In the past, Deng was even considered a possible candidate for the foreign minister’s post, especially as he represented current chief diplomat Wang Yi for a long time. In this way, Beijing has positioned one of its most senior party cadres in a key foreign policy role, which underlines his importance for China’s strategic focus in Europe.

At his first public appearance as ambassador, Deng Hongbo praised a German-Chinese school choir from North Rhine-Westphalia as a prime example of Sino-German exchange. Singer Peng Liyuan, wife of party leader Xi, had already visited the choir on the fringes of her husband’s state visit. Around three years earlier, Deng’s predecessor Wu had also referred to the same choir in flowery rhetoric and hailed it as a model of “mutual trust between peoples.”

China and Germany are both countries with a deep cultural heritage that have never stopped appreciating, attracting and learning from each other, explained Deng. “We are in a time full of opportunities and challenges, and the world needs to strengthen exchange and cooperation more than ever,” he said, referring to the fact that Germany is now also the country with the second-largest number of Confucius Institutes. Like them, he strives to “raise the mutually beneficial cooperation between China and Germany to a higher level.” However, this level has taken a dive in light of the recent espionage cases and cyberattacks. Choir singing and institute lectures alone will hardly be able to raise it. Fabian Peltsch

Zhao Laihong will become General Manager at Bridgestone on January 1. The global tire manufacturer intends to further expand its high-end products in China, particularly after recently withdrawing from the Chinese bus and truck segment.

Andreas Klein has been Director of Finance at Delta Pronatura China since August. The Egelsbach-based company specializes in care and cleaning products. Klein was most recently responsible for finance at Volkswagen Powertrain in Shanghai. He will be based in Nanjing.

Is something changing in your organization? Let us know at heads@table.media!

What looks like the Peruvian Nazca lines from above are actually tons of red chilies under the sun of the Gobi Desert. The farmers in Hami/Xinjiang lay out the pods to dry after harvesting, which in autumn temperatures of around 35 degrees gives them a clear competitive advantage over less warm regions of the world, where the chilies have to be dried using additional energy. Production costs are correspondingly lower, and China’s share of the global chili market is accordingly high at around 20 percent. However, the concern that Uyghurs help with the harvest is not entirely unjustified, as they either do not do so voluntarily or only for meager wages. Agriculture in Xinjiang is one of China’s high-risk industries.

The European Union wants its voice to be heard in the world – a legitimate aim. The only problem is that the EU rarely speaks with one voice – more often in a polyphonic confusion. When it comes to countervailing duties on Chinese electric cars, the bloc is as torn as a hippie’s jeans. So whose voice should be listened to?

From a purely formal perspective, that of the EU Commission. However, the People’s Republic of China naturally pays very close attention to who has voted in its favor and against it. It will use this rift to play the individual EU players off against each other. It once again highlights the great weakness of the European Union, which simply does not seem capable of acting as a unanimous choir. Julia Fiedler discussed this problem in detail with Abigaël Vasselier from Merics.

She believes that Germany’s voting behavior has damaged Europe’s credibility vis-à-vis China by showing that the EU Commission’s stance and Germany’s wishes are far apart. Consequently, China could use Germany and some German companies to break European unity.

Ms. Vasselier, what do you think of the current customs decision on electric cars from China?

First of all, it’s a good day for Europe! We managed to pass the tariffs, which means that we’ve managed to be more consequential vis-à-vis China. We’ve shown that Europe can respond to the distortions created by China. These measures are not US-style tariffs; they’re a European-style response. And then there is a second layer to this decision, of how to do European China policy with 27 diverging national interests. It’s a pretty unique situation, as we got to see the way the vote was unfolding and how pressure was working. Usually, you don’t get that level of granularity.

What does the voting behavior of the member states show us?

In the case of Spain – and this concerns half of the countries that abstained – we can see how China manages to create a fear of retaliation, with which it can change the position of governments. A very important takeaway from this is: We need to prepare our member states for the fact that there might be more tariffs in the future, as Europe is going to be more consequential. There might be more tit-for-tat and more retaliation coming from China, be it real or just threats for retaliation. Europeans need to better understand how China is playing retaliation and how we can prepare for retaliation measures - whether at the government or company level. There also needs to be an honest reflection on what kind of economic model we want for Europe.

What could a future economic model for Europe look like?

It’s for sure a future where tariffs are normalized, where all actors will increasingly weaponize trade, and economic coercion is going to become a feature of our economic and trade relationships.

What do you think of the German debate about the tariffs and how the country voted?

Just one year after the China strategy was published, with just one vote the Chancellor showed how fragmented the government is.

Are you saying Germany‘s China strategy isn’t working?

Germany’s China strategy was a very positive exercise in terms of creating coherence in a country, where there are such divergent interests regarding China. The strategy managed to bring Germany behind one voice. With the vote against the EV tariffs, how much debate and how many divergent voices we’ve now seen, and also the fact that Olaf Scholz went against the coalition, it shows one thing: We have moved from a very good process of bringing coherence, to a vote, that completely put these efforts down. The second element is the fact that the government moved from abstention to voting against. This happened in a constellation, where they knew they would not have the majority when voting No, and that the tariffs would pass.

How do you interpret this voting behavior?

The signaling of this is extremely important. Voting No in such a constellation signals that Germany is breaking European unity. For the past six years, we have enjoyed a very good degree of unity. But my sense is by Germany taking a stand and saying: I’m against, and I’m going to make clear that everyone knows, it’s undermining our unity over the long term – not just in this case but also in the future. Berlin is opening a Pandora’s box: How much unity are we going to have in European China policy in the future?

Has Scholz also sent a signal to China?

I think it’s clearly a signal to China: Germany will ensure our trade relationship is not so politicized, which is what China is asking. The consequence is that the Chinese now see that they can leverage Germany and some German companies to break European unity. By voting against it, Germany is also undermining European credibility vis-a-vis China because it shows that there is a big divergence in terms of the stance taken by the EU Commission and what Germany wants.

There has been a lot of friction between China and the EU. How can we create a functioning relationship?

I think what China wants is for Europe to keep its market open and to take a slightly divergent approach from the one of the US in terms of openness. However, this is clearly not happening, as we see now with the tariffs. There will be some sort of closure or at least a rise in the cost for China to access the European markets. As for the European side, I think Europe expects that the trade relation it’s enjoying with China – which Europe also needs to have with China – can take place under conditions that are fair, reciprocal and non-distortive. But with the current trajectory of the Chinese economic model, that’s not going to happen. That’s why there’s a mismatch of expectations that China cannot address and cannot do what Europe wants it to do, and vice versa. Neither of us will be able to respond to what the other wants in this situation. This is why I think it’s clear that the trade frictions and political frictions will continue escalating.

What conclusions do you draw from this situation?

We need to build resilience on the European level, not just economically, but also by becoming a geopolitical player. There have been existential issues in our relationship with China before. But the EV issue is different: It touches European prosperity. Europe has imposed sanctions against Chinese actors related to security concerns in the case of cyber-attacks or serious human rights violations. While negotiations were difficult, we managed to create unity. However, regarding the question of electric vehicles, we are most divided. The case of tariffs on electric vehicles is so special because it touches Germany’s unique economic position vis-a-vis China and future trade relations with China.

Understandably so: The German automotive industry’s sales and market share in China have declined lately, and the German economy is dependent on the automotive industry.

I think we need to accept that we are now in a systemic competition at the economic level. But if you put yourself in the shoes of the car industry and you look at your short-term profit, probably there is still some to make and that’s a business decision.

But one that is not sustainable?

I thought we had come to a common understanding of China’s economic trajectory and the challenges our companies were facing in China but also in third markets. It seems that we lack a common assessment of China’s economic trajectory, how it impacts Europe, and most importantly, the realization that we are in a systemic competition with China. The next fight on European-China policy will not take place in Brussels. It will take place in European capitals, and it will take place with all the stakeholders. Not only the government, but with companies and with citizens.

Do you mean that this is the beginning of fragmentation?

Yes. The German case shows how deep fragmentation can become. So far, we have observed strong divisions between the coalition members and with the most prominent German companies. The moment the trade unions realize that we will lose jobs because of China, that’s the moment we are going to have a different set of conversations. When people will feel the costs of the decisions taken on China, pay more for their products or when they lose their job because of the competition with China, that’s when we will see a bigger level of fragmentation. And I think it’s going to come.

Abigaël Vasselier heads the Foreign Relations team at the Mercator Institute for China Studies (Merics) in Berlin. Previously, she worked as Deputy Head of Division for China, Hong Kong, Macao, Taiwan and Mongolia at the European External Action Service (EEAS) and Policy Fellow and Program Coordinator at the Asia Programme of the European Council on Foreign Relations (ECFR). She studied Chinese at China Foreign Affairs University in Beijing.

Brussels will be able to impose additional tariffs, despite Germany’s opposition. The EU member states did not reach a sufficient majority against the plan – but there was also no clear vote in favor of the tariffs. This means the Brussels authority can decide whether the duties will be introduced.

The EU Council’s vote is a crushing defeat for German Chancellor Olaf Scholz. He and his close advisors had campaigned extensively in recent weeks for other EU heads of state and government to oppose the tariffs. They only managed to convince Slovenia. Apart from Germany, three other countries already rejected the tariffs in July voted against. Cyprus voted “no” in July. The country has now abstained.

The countries that voted in favor: Italy, France, Netherlands, Estonia, Latvia, Lithuania, Poland, Bulgaria, Ireland, Denmark

Abstentions: Belgium, Czech Republic, Greece, Spain, Croatia, Cyprus, Luxembourg, Austria, Portugal, Romania, Sweden, Finland

Voting against: Germany, Hungary, Malta, Slovenia, Slovakia

Up to now, Chinese EVs have already been subject to an import duty of ten percent. The extra tariffs have various dimensions depending on the manufacturer and will now be applied on top. The EU rewards manufacturers’ willingness to cooperate in the investigation procedure by imposing lower surcharges. In the version agreed on Friday, the following tariffs now apply:

The additional tariffs apply for five years from the day after publication in the EU Official Journal. It is not yet clear when this will happen. A deadline for possible negotiations is October 30. The official deadline for the introduction of the duties is November 4, 13 months after the start of the EU investigation. The provisional countervailing duties in force since July continue to exist as bank guarantees. If a manufacturer does not honor agreements, the extra tariffs can still be applied at a later date.

VW CEO Oliver Blume told the Bild am Sonntag newspaper that there is still time until the end of October before the planned additional tariffs on Chinese cars come into force. However, the negotiations could also lead to Chinese companies producing EVs in Germany. BMW CEO Oliver Zipse called the vote a fatal signal for the European automotive industry. “Now a quick solution is needed between the European Commission and China to prevent a trade conflict that will ultimately only have losers.” According to a spokesperson, Mercedes-Benz also believes that punitive tariffs would harm the industry’s competitiveness in the long term.

The European Chamber of Commerce in China has called for dialogue. This is “the preferred way to resolve trade disputes,” the Chamber said. “The relationship between Europe and China has created immense value in the past and has significant potential for future value creation. Therefore, the Chamber of Commerce supports the EU and China to consider a negotiated solution with a view to ensuring a level-playing field in the relationship and addressing imbalances.” The Chinese Chamber of Commerce to the EU called the EU investigation “a politically motivated and unjustified protectionist measure.” It will closely monitor the ongoing negotiations, the Chamber announced.

China wants to continue negotiations. Beijing’s Ministry of Commerce accuses the EU of shaking and hindering the confidence and determination of Chinese companies to invest in and cooperate with the EU rather than solve problems. It said both sides had expressed their willingness to find a solution in the negotiations over the past few weeks, and technical teams from both sides will continue the talks on October 7. Should an agreement be reached in the coming weeks, the EU Council would have to vote again on a revised agreement.

The EU Commission remained tight-lipped on Friday. Minimum prices from Chinese manufacturers and volume caps are on the table. However, a large agreement cannot simply be concluded here. Minimum prices must be negotiated individually with the manufacturers. State interference is problematic within the World Trade Organisation (WTO) guidelines.

EU sources expect China to implement possible steps in early November, when the EV tariffs will likely come into force. Tariffs on French cognac are an obvious option. Investigations into European pork imports are underway on the Chinese side, as are investigations into dairy products. Further restrictions on critical minerals are also conceivable.

It remains to be seen how it will be handled if Chinese EVs are imported into the EU from neighboring non-EU countries where the additional tariffs do not apply. For example, from Switzerland, which has a free trade agreement with China. However, Serbia and the United Kingdom could also be of interest. The Brussels authority did not comment on this on Friday.

German trade associations have reacted differently to the EU member states’ decision to impose countervailing duties on Chinese EVs. The Federation of German Industries (BDI) considers the decision correct in principle, but is calling on both sides to continue negotiations and prevent an escalating trade conflict.

“The BDI generally supports the use of trade defense instruments to protect the European market economy from state market distortions if the conditions are met. At the same time, however, the interests of the European industry in stable economic relations with China must also be taken into account,” said BDI Managing Director Tanja Goenner.

As China’s largest trading partner and export market, the EU can continue to confidently pursue talks with Beijing. According to Goenner, China also needs good trade relations with Europe. China’s growth model, which is driven by investment and exports, is also under pressure, said Goenner. More and more countries are resisting market distortions by the Chinese state.

The German Economic Institute (IW) also points out that the EU’s countervailing duties on electric cars from China are legitimate and in line with trade law, but also warns against an escalating trade conflict. The IW said countermeasures were imminent, even if escalation was not in China’s interests.

The German Chamber of Industry and Commerce (DIHK) was more critical, with its head of foreign trade Volker Treier fearing a tariff spiral. “The decoupling between Europe and China is already putting a strain on global trade and weakening the competitiveness of large parts of the German economy,” said Treier. The DIHK believes countering increasing protectionism with trade incentives would make more sense than new barriers. grz

More and more Germans could imagine buying a Chinese car. This was the result of a representative survey by the German automobile club ADAC. According to the survey, 59 percent of respondents stated that they would generally consider buying a Chinese car manufacturer.

Chinese brands are developing into an alternative, especially among younger drivers. 74 percent of 30 to 39-year-olds and 72 percent of 18 to 29-year-olds said they could imagine buying a car from a Chinese manufacturer. In contrast, only 31 percent of over 70-year-olds say the same.

When it comes to fully electric cars, as many as 80 percent of respondents said they would consider buying a Chinese car. However, one in three respondents who plan to buy a car in the next three years wants a gasoline car.

Respondents stated that the low price was the main reason for buying a Chinese car brand. 83 percent cited this as a purchase argument, followed by the innovative technology (55 percent) and the appealing design (37 percent).

As reasons against a purchase, the respondents cited general reservations about Chinese cars (54 percent), the limited repair shop and dealer network (40 percent), poor quality (39 percent) and data privacy (26 percent). For the survey, “ADAC Markt- und Meinungsforschung” interviewed 1079 drivers aged 18 and over with their primary residence in Germany in July. mcl

Chinese hackers accessed the networks of US broadband providers and obtained information from systems the federal government uses for court-authorized wiretapping, the Wall Street Journal reported on Saturday. Verizon Communications, AT&T and Lumen Technologies are among the telecoms companies whose networks were breached by the recently discovered intrusion, the newspaper said, citing people familiar with the matter.

The hackers might have held access for months to network infrastructure used by the companies to cooperate with court-authorized US requests for communications data. China’s foreign ministry responded on Sunday that it was not aware of the attack described in the report but said the United States had “concocted a false narrative” to “frame” China in the past. rtr

Taiwan’s President William Lai Ching-te has sharply rejected Beijing’s claims to sovereignty over the island state, citing historical reasons. It is “impossible” for the People’s Republic of China to become Taiwan’s motherland, as Taiwan has older political roots, said President Lai a few days before Taiwan’s National Day.

He said the island is a country called the Republic of China, whose origins date back to the 1911 revolution that overthrew the last imperial dynasty. The republican government fled to Taiwan in 1949 after losing the civil war against Mao Zedong’s communists.

Taiwan will celebrate its 113th founding anniversary on January 10, while the People’s Republic celebrated its 75th anniversary last week. “In terms of age, it is absolutely impossible for the People’s Republic of China to become the motherland of the Republic of China’s people. On the contrary, the Republic of China may be the motherland of the people of the People’s Republic of China who are over 75 years old,” said Lai, who urged his compatriots that “we must remember that we are a sovereign and independent country.”

Lai, who took office in May, is considered a “separatist” by Beijing. Last month, he said that if China’s claims to Taiwan were about territorial integrity, then China would also have to reclaim land from Russia that was signed over to it by the last Chinese dynasty in the 19th century. rtr/grz

Deng Hongbo has been China’s highest representative in Berlin since September. In his inaugural speech, the 59-year-old said he was proud to be sent to Germany as ambassador by President Xi Jinping at such an important time. And indeed, the fact that Deng, of all people, is taking over from Wu Ken, who held the post for five years, shows the priorities Beijing is currently pursuing with regard to Germany and Europe.

Deng Hongbo is by no means a seasoned expert on local customs. Unlike his predecessors, he does not speak German and has hardly spent any time in Germany. Instead, he is regarded as a USA expert. He is rumored to be tasked with softening the transatlantic alliance between Germany and the USA in favor of China.

Deng was born in Sichuan province in July 1965. After graduating from China’s diplomatic forge, the Beijing Foreign Language University, he joined the Chinese Foreign Ministry in 1987, where he initially held various low-level posts. In 1989, he was sent to Vietnam as a consultant for four years. His next stop was the Ministry’s North America Department, which sent him to Washington in 1999. Upon his return, he became the department’s deputy director. From May 2009 to September 2010, he served as ambassador to Kenya, and from 2010, he served for another four years as deputy ambassador to Washington.

Since the late 2010s, Deng has been Deputy Director of the Office of the Foreign Affairs Commission of the Central Committee of the Communist Party of China (CPC). This commission plays a pivotal role in shaping and coordinating Chinese foreign policy at the party level and works closely with the Ministry of Foreign Affairs. He is said to have been appointed to the post on the recommendation of Yang Jiechi, the CCP’s leading foreign policy expert at the time.

In the past, Deng was even considered a possible candidate for the foreign minister’s post, especially as he represented current chief diplomat Wang Yi for a long time. In this way, Beijing has positioned one of its most senior party cadres in a key foreign policy role, which underlines his importance for China’s strategic focus in Europe.

At his first public appearance as ambassador, Deng Hongbo praised a German-Chinese school choir from North Rhine-Westphalia as a prime example of Sino-German exchange. Singer Peng Liyuan, wife of party leader Xi, had already visited the choir on the fringes of her husband’s state visit. Around three years earlier, Deng’s predecessor Wu had also referred to the same choir in flowery rhetoric and hailed it as a model of “mutual trust between peoples.”

China and Germany are both countries with a deep cultural heritage that have never stopped appreciating, attracting and learning from each other, explained Deng. “We are in a time full of opportunities and challenges, and the world needs to strengthen exchange and cooperation more than ever,” he said, referring to the fact that Germany is now also the country with the second-largest number of Confucius Institutes. Like them, he strives to “raise the mutually beneficial cooperation between China and Germany to a higher level.” However, this level has taken a dive in light of the recent espionage cases and cyberattacks. Choir singing and institute lectures alone will hardly be able to raise it. Fabian Peltsch

Zhao Laihong will become General Manager at Bridgestone on January 1. The global tire manufacturer intends to further expand its high-end products in China, particularly after recently withdrawing from the Chinese bus and truck segment.

Andreas Klein has been Director of Finance at Delta Pronatura China since August. The Egelsbach-based company specializes in care and cleaning products. Klein was most recently responsible for finance at Volkswagen Powertrain in Shanghai. He will be based in Nanjing.

Is something changing in your organization? Let us know at heads@table.media!

What looks like the Peruvian Nazca lines from above are actually tons of red chilies under the sun of the Gobi Desert. The farmers in Hami/Xinjiang lay out the pods to dry after harvesting, which in autumn temperatures of around 35 degrees gives them a clear competitive advantage over less warm regions of the world, where the chilies have to be dried using additional energy. Production costs are correspondingly lower, and China’s share of the global chili market is accordingly high at around 20 percent. However, the concern that Uyghurs help with the harvest is not entirely unjustified, as they either do not do so voluntarily or only for meager wages. Agriculture in Xinjiang is one of China’s high-risk industries.