Because Xi Jinping’s flagship projects, such as the global Belt and Road Initiative or the mega-city Xiong’an, have attracted criticism and, in some cases, are even stagnating, China’s head of state is relying on proven strategies. Last week, Xi embarked on a three-day trip to the south – not entirely in the tradition of reformer Deng Xiaoping but still carrying some ambitious ideas.

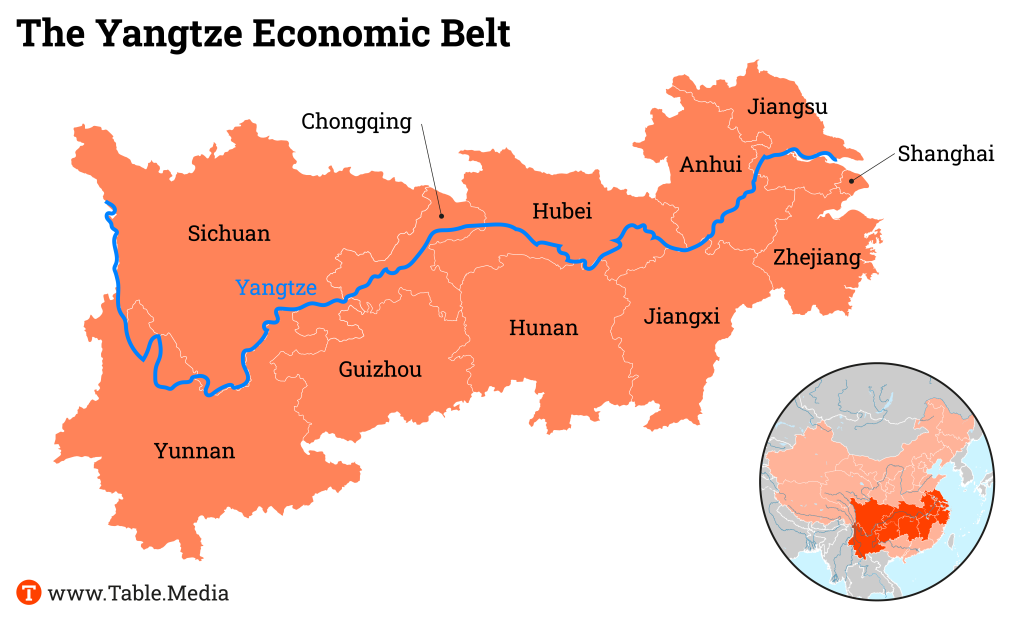

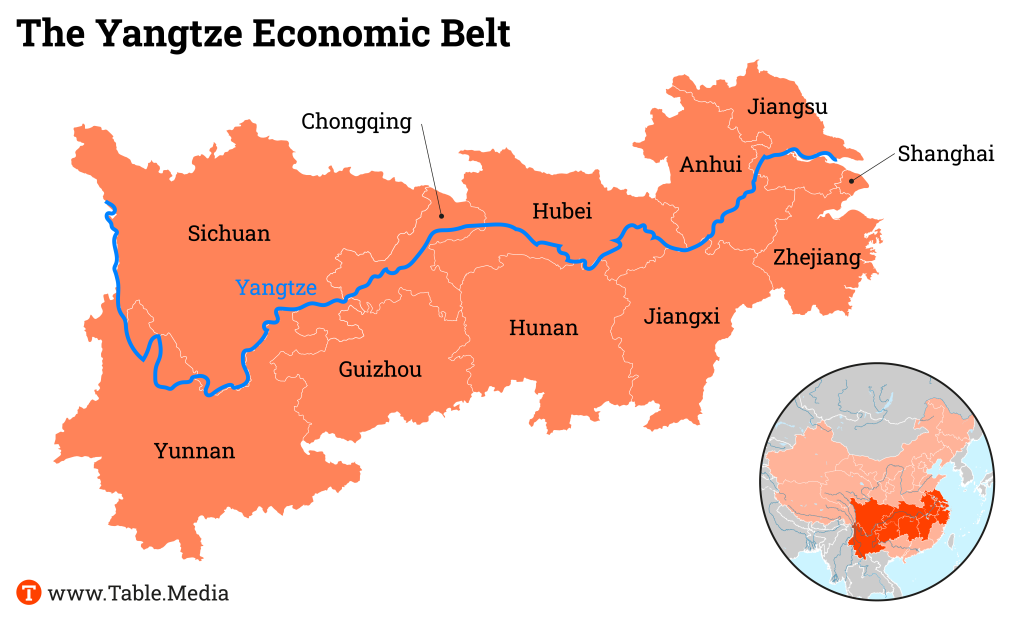

Xi aims not only to strengthen the innovation capabilities of the financial metropolis Shanghai but also to catapult the competitiveness of the entire Yangtze River Delta to new heights. The economic belt spanning eleven provinces is crucial for the “rejuvenation” of the Chinese nation and the “exploration of building a modern civilization”, says Xi. These are new tones. While Xi was once the party chief of Shanghai, he had long treated the region somewhat neglectfully as president.

The development of the chip industry plays a significant role in China’s path to becoming a world power. Huawei recently celebrated a milestone with the development of a high-end chip in the seven-nanometer scale, despite US sanctions.

However, this is not yet a true game-changer, explains Glenn Tiffert in a conversation with Michael Radunski. The China expert from Stanford University believes that these chips cannot compete with established provider TSMC from Taiwan for a long time. You can find the details in our Feature.

In terms of price and computing speed, China is also lagging behind. The country lacks engineers in this field. Huge amounts of state capital will not change that, at least not overnight.

Huawei just announced the development of a new high-end chip – besides all US-sanctions. Is China winning the semiconductor war against the US?

Well, the ability to make this particular chip is capacity that China already had before the US export controls. So, it’s no surprise that they were able to build a chip at the seven nanometer scale. By the way, all of the key machinery is foreign. That shows that China is highly dependent on support from foreign companies. The fact that they built it, is less significant than the fact that it is actually not a competitive chip globally.

Why that?

It’s unclear what their yields are. If the yields are low, then the price point is high. So, it probably could not compete with the chips that TSMC makes, for example, for Qualcomm and for Apple. Also, the initial specs suggest that the Huawei chip operates at maybe 60 percent the speed of the latest chips from Apple and Qualcomm.

You’ve mentioned yield and price point, but in the end money doesn’t play a role for China. If Beijing wants to achieve a certain goal, money certainly is not a problem.

That’s right. China’s strengths are mobilizing immense amounts of capital and mobilizing people. So any problem that can be solved with brute force China will excel at. But semiconductor technology is different. So much of it resides in the experience of engineers who’ve done this for years, which is why Taiwan can do it better than anyone else in the world. China responded in the 2000s by hiring as many Taiwanese and Korean engineers as they could and bringing them back to China. That helped China make significant progress. But China still can’t leap anywhere close to where Taiwan and Korea are. They’re simply not innovative enough.

China is not innovative – that view is probably outdated. China has shown that they indeed made a lot of progress in different fields.

The most dynamic part of the semiconductor industry in China are private companies. And private companies in China do what private companies anywhere in the world do: They go after the best vendors they can find. So they’ve gone to Taiwan to have them build the chips. This inhibited the growth of certain technologies and certain capabilities within China. They made great progress in China but not in advanced semiconductor manufacturing.

In China, it’s not only private firms. The state and the provinces are also involved.

Likewise, when the state made huge amounts of capital available for the creation of domestic chip fabs, provincial governments choose the best option: So, instead of looking around at untested domestic companies, they spent those subsidies luring Intel, Micron and other companies to build fabs in China. For example, SK Hynix, the South Korean DRAM manufacturer, 50 percent of its manufacturing capability is located in China, which produces high-end chips. Those factories are in China, but the IP and the chief engineers are all Korean.

Interesting that you make the distinction between state-owned and private companies. The US always claims: In China in the end it comes all to the state and the Communist Party. So what is true?

In the last several years in China, the party has been exerting greater control over even firms that behaved more like private firms. No large firm in China is truly private because the state wouldn’t allow it to be. The party must control everything. Xi Jinping is locking the entire country down. Just look at Alibaba, for example, how Jack Ma disappeared for six months. It is the party takeover of the most dynamic sectors of the economy. Also Huawei deliberately obfuscates what it is. But if you can’t determine the extent to which it’s private and non-private, that’s not a trustworthy entity.

I’ve been at Huawei in Shenzhen. They’ve showed me around and said, here is our phone, here are our chips, please check. Is there any proof that there is a backdoor?

The question of Huawei posing security risks is something that our intelligence agencies are best poised to answer. There are strong suggestions. I’ve looked at Huawei code – and there’s a question of interpretation: Is it just sloppily written or is it deliberately creating backdoors?

What’s your assessment?

At a certain point, I’m not sure it matters. If it’s sloppily written, that means that everyone can actually have a backdoor to it. That works to the advantage of every intelligence agency in the world, including the Chinese. And if it’s deliberately written with a back door, then that’s meant to privilege Chinese actors. But I’m not qualified to comment on that.

China is praising Huawei as its national champion. Should the West also do more to support its companies?

I will tell you this, that if we compete using exactly the same playbook that we’ve used for the last several decades against a China that has proven that this playbook doesn’t work, we’ll continue to lose. We do need to change the playbook. China will be China. We have to accept China as it is, it will not follow the free market principles that are dominant in your country and my country.

With which consequences?

There are good estimates that, for example, every electric vehicle that is made by some of China’s leading manufacturers loses about 30 to $35000. But China will continue to pour money into that to the point where it drives Volkswagen, BMW, Ford and GM out of business. If we continue to behave as if that’s not a risk, then GM and Volkswagen will be driven out of business. So we need to develop new tools because the old ones are probably not going to work, in the same way that Germany used to have a solar industry and it doesn’t anymore.

Any suggestions?

I resist the idea that we should become like China, but we do need creative thinking here. There are tools, such as anti-dumping strategies. Also more cooperation across the Atlantic to develop strategies that do not actually cannibalize each other’s efforts, and to create pathways for the rest of the world to cooperate with us instead of China and Russia.

Coming back to where we started: Are sanctions then the right way to win this competition?

I think sanctions are a useful tool. But sanctions tend to lag behind where the threat is and they tend to be rigid. So we need to be more adaptive. That means that, for example, our businesses, our universities also need to build in risk management processes so that they can ensure that their collaborations with China comport with their values, their own interests and national interests as well.

Sanctions are also not only between the US and China, a lot of different other players are involved, like Taiwan with TSCM or the Netherlands with ASML. Private companies which are relying on the Chinese market.

The Chinese market is not a huge market actually, for TSMC. If I recall correctly, it is somewhere in the teens as a percentage of their sales. It’s a share that they can live without, because there is such a huge appetite for their products everywhere else in the world. China actually is a giant is in the assembly of electronics. And that’s where our most urgent point of supply chain risk is: Apple can’t exist without the assembly plants in China. But it’s not necessarily that China is producing the most important technology in those phones.

We’ve just seen how CEOs from international companies celebrated Xi Jinping with standing ovations. How to keep all these players in the American team?

It’s not an American team. It should be a Western team. It should be a team that stands for a certain vision of the world, whether you call it rules based international order, whether you call it democracy.

But with the US is in lead?

Look, the United States has a different relationship than Germany does to East Asia. We have mutual defense treaties with Japan, Korea, the Philippines or Australia. So for us, China’s capacity to acquire militarily applicable technologies like high-end semiconductors that can be used in ballistic missiles is of great concern to us. In a way that may be less urgent for Europeans, but we’re all in this together in the same way that the United States is here in Europe helping with the Ukraine war. We would hope that our European allies and partners would support us with regard to our strategic objectives to maintain peace and security in East Asia. Our strategic thinkers really hope that Europeans will be there for us as we have been there for them historically.

Glenn Tiffert, Distinguished Research Fellow at the Hoover Institution at Stanford University.

Five years after creating a new artificial economic center in the northern Xiong’an and a year and a half after the devastating lockdowns in Shanghai, President Xi Jinping rediscovers the Yangtze River region as an economic locomotive. The ongoing economic crisis might be the reason. His own favorite projects lack traction, so he is pushing established growth drivers forward.

In the past two months, Xi Jinping has convened a series of high-level conferences, each aimed at firmly anchoring the status of the Yangtze Delta and upstream Yangtze Economic Belt in the country’s national strategies.

The Yangtze Delta consists of Shanghai and 26 other major cities in the neighboring provinces of Jiangsu, Zhejiang, and Anhui. The Yangtze Economic Belt extends over eleven provinces from the estuary to the west to Guizhou and Yunnan.

Xi spoke highly of the region, which he had previously treated somewhat neglectfully. The innovation and competitiveness of the Yangtze Delta are crucial for the “rejuvenation” of the Chinese nation and the “exploration of building a modern civilization,” according to official media quoting Xi at a symposium on the integrated development of the Yangtze Delta. “Quality and integration are the keywords here,” he said at the end of a three-day visit to the financial metropolis Shanghai.

This may sound like Xi’s usual grand speeches, but the use of the top keywords of his ideology reveals a genuine interest in the Yangtze region as an economic engine, especially compared to previous somewhat depreciative statements.

Xi also sounded an alarm and warned of various dangers. He urged the Yangtze estuary region to “keep a close eye on the technological, industrial, and financial sectors, as well as the important infrastructure related to both national and regional security.”

He also called for giving great attention to the security of international business of Chinese companies. Chinese companies “should be guided to expand their industrial chains abroad in a reasonable and orderly manner”.

Xi also upgraded the inland regions along the river. The Yangtze Economic Belt extends far inland from Shanghai. The Belt should play a greater role in China’s pursuit of grain security, energy, key industrial supply chains, and logistics chains, as well as water resources, said Xi on Oct. 12 in Nanchang, Jiangxi.

Xi outlined key tasks for the further integration of the Delta, including:

In addition to Shanghai, the Yangtze Delta has other economically strong cities such as Suzhou, Hangzhou, Nanjing, Ningbo and Wuxi. It is home to some of China’s most well-known companies like Alibaba, Pinduoduo and its overseas brand, Temu. It is also the headquarters of some of the country’s largest chip and EV manufacturers and many of the country’s top universities in high technology and business.

West of the Delta in the Yangtze River Belt are some of China’s most important grain-producing areas, the gigantic Three Gorges Dam hydroelectric power plant and major economic centers like Wuhan and Chongqing.

Since taking office as party secretary in 2012, Xi has launched five national strategies for regional development.

He chaired meetings every three to five years to review progress and give instructions for the next steps. This time, the tone he struck for the Delta and the Belt was unexpectedly positive.

The prosperity of Guangdong is still often attributed to Deng Xiaoping, who, in the early days of China’s opening, made the groundbreaking decision to establish special economic zones in Shenzhen, Zhuhai and Shantou. However, although Xi was also Shanghai’s party chief from 2007 to 2008 for almost a year, the success of Shanghai and its surroundings is often seen as the legacy of Jiang Zemin and Zhu Rongji.

To pursue his own projects, Xi launched the Belt and Road Initiative (BRI) in 2013. The following year, he introduced the Beijing-Tianjin-Hebei strategy. It wasn’t a brand-new idea, but he managed to put a deep personal stamp on it by designing a centerpiece for it, the Xiong’an New Area.

Located about 100 kilometers south of Beijing and opened in 2017, it was conceived as a super-modern mega-city designed to boost growth in Hebei while also hosting selected government organs, state-owned enterprises and universities that have moved away from Beijing.

The city is already half-finished. But few people really want to live there. To make matters worse, the devastating floods in the region this summer revealed a major, neglected flaw in the project: Xiong’an is only 10 meters above sea level. The plan needs some modification, most likely with a hefty cost increase.

Apart from the botched Xiong’an, the Beijing-Tianjin-Hebei scheme, in general, did not make much progress. The economic gap between Hebei and the two big brothers is simply too large. Hebei’s per capita GDP in 2022 was 8,440 dollars, ranking it 26th out of 31 Chinese provinces. Liu Yi

Belarusian President Alexander Lukashenko traveled to Beijing on Sunday to hold talks with Chinese President Xi Jinping. It is his second trip to China this year. Lukashenko is a close ally of Russian President Vladimir Putin.

The visit on Sunday is described as a “working visit”, as reported by the state Belarusian news agency BelTA. “Trade, economic, investment, and international cooperation issues are on the agenda,” BelTA said, citing Lukashenko’s press service.

During his first official visit from Feb. 28 to March 2, Lukashenko was received in China’s capital with salutes and military honors. After the talks, Xi declared that the friendship between China and Belarus was “unbreakable” and both sides should “constantly strengthen mutual political trust and remain true friends and good partners“.

Like Xi, Lukashenko did not condemn Russia’s invasion of Ukraine in February 2022. The Belarusian president also allowed Moscow to use his territory for the war. There is agreement on many critical issues between Lukashenko and Xi. After their meeting on March 1, both called for a “speedy” peace agreement for Ukraine. rtr

The five largest German car manufacturers filed almost 2,000 patents for EVs in China last year. This is revealed by an analysis by the Munich law firm Gruenecker. Compared to 2018, the number of filed patents has more than doubled, according to Handelsblatt, which had a preview of the analysis. EV manufacturers from the USA, Korea and Japan reportedly filed significantly fewer patents in China. In terms of patent applications in China, BMW and Volkswagen, in particular, have caught up. Both companies recently announced new investments and joint ventures on-site.

At the same time, Chinese brands in 2022, for the first time, filed more patents in the field of electromobility than the Germans, according to the law firm, which has been analyzing patent applications in the Chinese auto industry for years. “Lithium-ion battery technology is in Chinese hands,” says lawyer Jens Koch, who participated in the analysis. However, German automakers are strong in connecting batteries to cars and developing electric motors. “German car manufacturers occupy many important technologies for EVs with their own patents,” says Koch.

Who will emerge as the long-term winner remains open, explains the patent attorney. With innovations that border on the Chinese-dominated electric vehicle battery, good positions can still be built. fpe

According to statements from senior officials and diplomats, China and Vietnam are working on a possible improvement of their railway connections. Specifically, this involves the expansion of a route leading from Kunming in Yunnan to Haiphong, Vietnam’s main northern port.

The route traverses Vietnam’s heartland, where rare earth deposits are located. Chinese refinery companies play a crucial role in processing rare earths from Vietnam. Last week, Chinese and Vietnamese experts on rare earths discussed increased collaboration in processing minerals, as reported by Vietnamese state media.

Discussions about the railway connections are part of the preparations for a possible visit by Chinese President Xi Jinping to Hanoi in the coming weeks, said officials and diplomats. The visit would further confirm Vietnam’s increasingly strategic role in global supply chains.

For Vietnam, China is the most important trading partner. Vietnamese Prime Minister Pham Minh Chinh and Chinese officials have emphasized the importance of infrastructure expansion. Vietnam has railway connections to China, but the system is old, and the capacity on the Vietnamese side is limited. Additionally, the two systems currently do not align – trains must stop at the border for passengers and goods to switch to domestic trains.

Expanding the route could boost tourism and exports from Vietnam to China, mainly consisting of agricultural products. The manufacturing sectors of both countries could also become more closely linked. rtr

Agnes Chow, a core member of the Demosisto party, announced late Sunday on her Instagram account that she has left Hong Kong to study in Canada. The 27-year-old is one of the most prominent democracy activists in Hong Kong. She was detained as part of the security measures imposed by China. The authorities’ pressure has triggered psychological problems for her, wrote Chow. rtr/fin

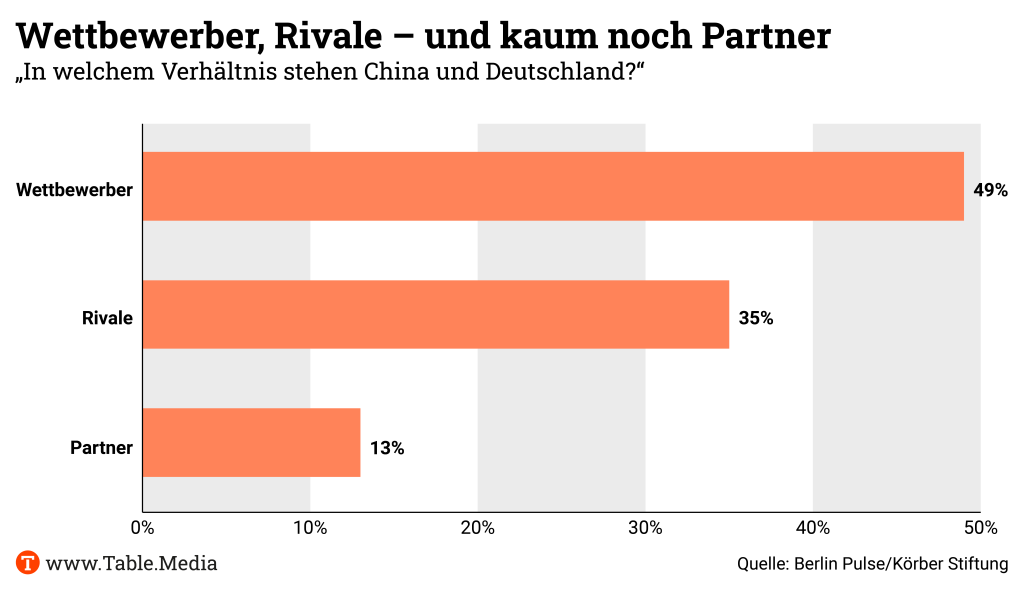

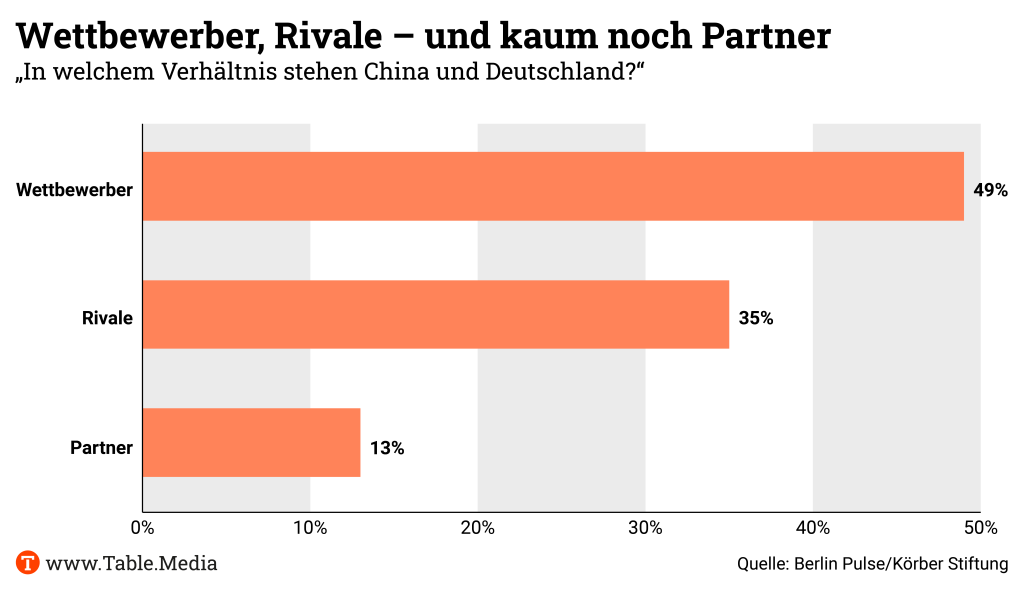

China is a partner, economic competitor and rival for Germany and the European Union. This triad does not sit well with Chinese government officials and diplomats from China. They often respond by saying that China is not a rival but a reliable partner. However, our representative survey, “The Berlin Pulse“, shows that only 13 percent of Germans see China as a partner, while 84 percent consider China an economic threat.

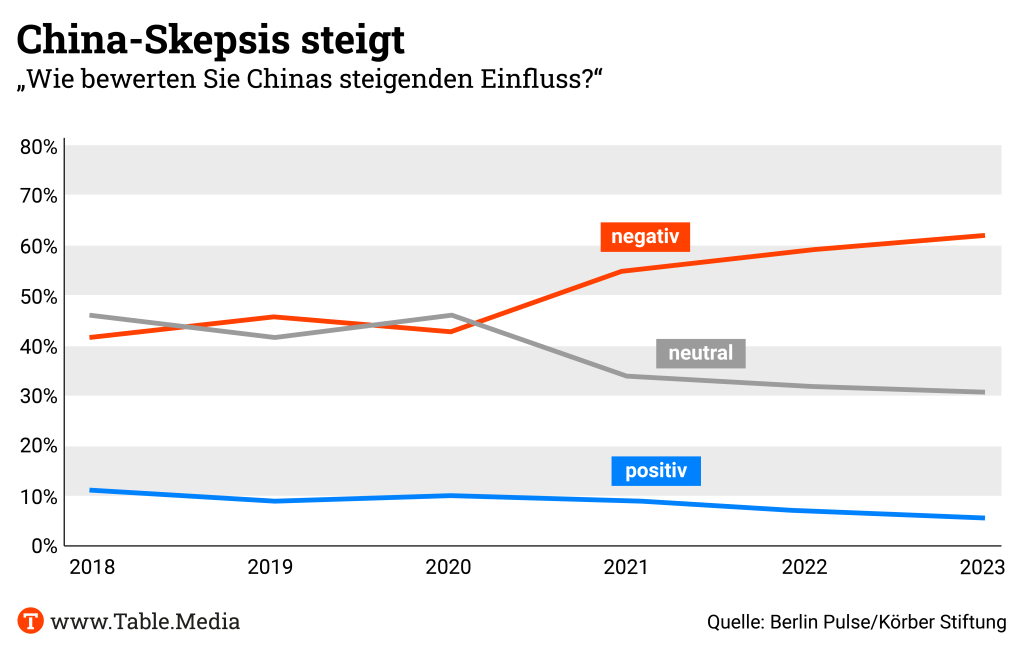

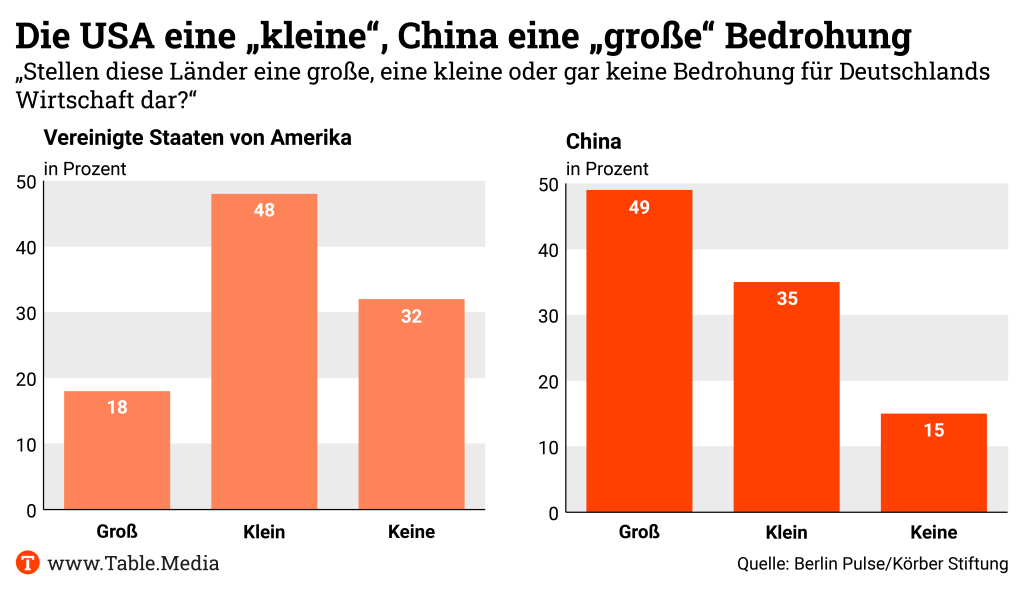

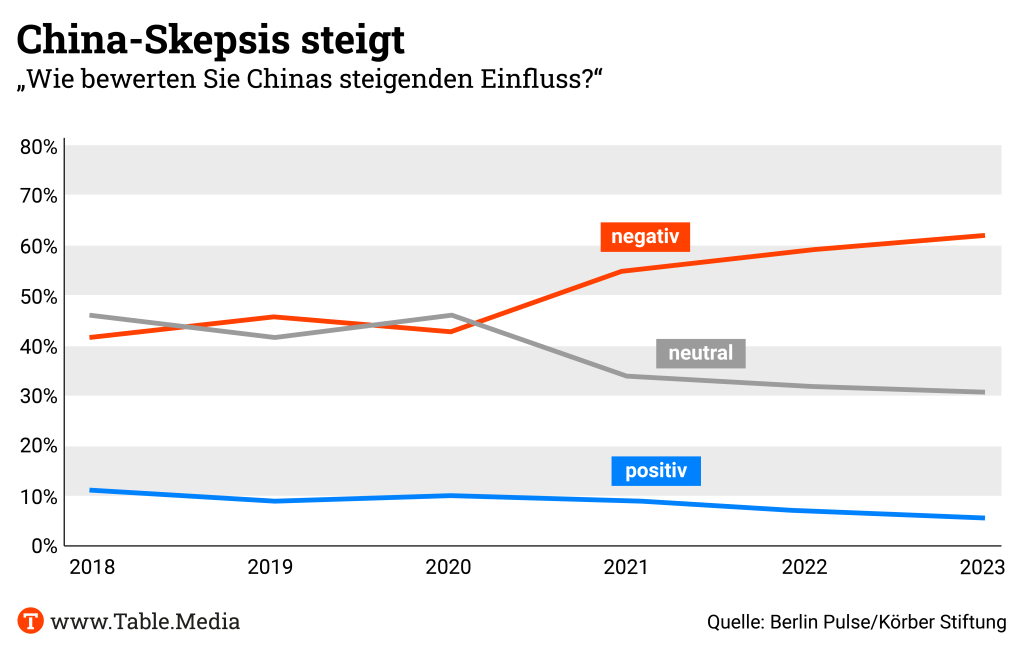

What happened? German-Chinese relations have deteriorated in recent years, and public sentiment has become more critical of China. China’s economic rise has produced a more powerful and outwardly bold China; skepticism toward Beijing has grown. This is clearly reflected in our survey data.

Sixty-two percent of Germans view China’s influence in the world negatively – the highest value since the Körber Foundation began its annual survey in 2017. Especially since the outbreak of the Covid-19 pandemic and China’s ambivalent stance on Russia’s invasion of Ukraine, the perception of China’s role in the world has significantly worsened in the eyes of the German population, raising the question: Should Germany remain economically as closely intertwined with China as before, given increasing political differences?

The German government’s China strategy answered this question with a “yes and no”. The paper reveals that economic relations with China will not be severed, but diversification is sought in certain sectors. Greater independence from China is particularly aimed at critical areas such as the pharmaceutical industry, raw material extraction (rare earths) and electronics.

In our publication, “The Berlin Pulse”, we asked the population about their stance on so-called de-risking. Sixty percent of Germans support a reduction in economic dependence on China, even if it could lead to economic losses and job losses.

Why is that? Perhaps the dependence on Russian gas has shown many Germans how limited Berlin’s political options are in the event of a military escalation.

Is there the same danger with China? A look at the latest study by the German Economic Institute reveals that there were no significant advances in reducing critical dependencies in the first half of 2023. Admittedly, building new supply chains takes time and capital. But anyone listening to Mercedes-Benz CEO Ola Källenius begins to doubt whether the top executives of large companies understand the same thing about de-risking as outlined in Berlin and Brussels strategy papers: “For us, de-risking doesn’t mean reducing our presence in China but increasing it. We are investing more,” said the CEO in November at the China Congress of the CDU-CSU faction.

Our survey shows that 55 percent of Germans see China as a military threat and consider it the fourth-largest foreign policy challenge for Germany, ahead of climate change.

These figures illustrate the discrepancy between the interests of business representatives and public opinion. And it becomes clear that the federal government could score points in public discourse by taking measures to reduce dependence on China because de-risking is not only government policy but is also supported by the population.

Reducing critical dependencies also includes the relocation of production and supply chains to other countries. We asked Germans about their attitude toward emerging middle powers in Asia, Africa and South America -countries like India and Brazil with strong growth or large markets. Fifty-one percent of our respondents have a positive view of the increasing influence of such countries.

Germany’s approach to a changing China must build on more China savviness. Therefore, it is good that travel to China will soon become easier so that not only business representatives but also citizens from Europe can explore the country that has become so unfamiliar to us in the last two years.

Jakob Kuneth has been appointed Head of Purchasing at Volkswagen in Chengdu for the Jetta brand (which has been rejuvenated since 2019). He was already based in Beijing until October 2022 and has been working at the headquarters in Wolfsburg in the meantime.

Jonathan Deinhard works as a dual student at the VW software subsidiary Cariad in Beijing. He is studying vehicle informatics in Ingolstadt.

Is something changing in your organization? Let us know at heads@table.media!

At the second Global Digital Trade Expo in Hangzhou, Zhejiang, this man demonstrates that, thanks to technology, intricate calligraphy is possible even when hands alone might not be able to achieve it.

Because Xi Jinping’s flagship projects, such as the global Belt and Road Initiative or the mega-city Xiong’an, have attracted criticism and, in some cases, are even stagnating, China’s head of state is relying on proven strategies. Last week, Xi embarked on a three-day trip to the south – not entirely in the tradition of reformer Deng Xiaoping but still carrying some ambitious ideas.

Xi aims not only to strengthen the innovation capabilities of the financial metropolis Shanghai but also to catapult the competitiveness of the entire Yangtze River Delta to new heights. The economic belt spanning eleven provinces is crucial for the “rejuvenation” of the Chinese nation and the “exploration of building a modern civilization”, says Xi. These are new tones. While Xi was once the party chief of Shanghai, he had long treated the region somewhat neglectfully as president.

The development of the chip industry plays a significant role in China’s path to becoming a world power. Huawei recently celebrated a milestone with the development of a high-end chip in the seven-nanometer scale, despite US sanctions.

However, this is not yet a true game-changer, explains Glenn Tiffert in a conversation with Michael Radunski. The China expert from Stanford University believes that these chips cannot compete with established provider TSMC from Taiwan for a long time. You can find the details in our Feature.

In terms of price and computing speed, China is also lagging behind. The country lacks engineers in this field. Huge amounts of state capital will not change that, at least not overnight.

Huawei just announced the development of a new high-end chip – besides all US-sanctions. Is China winning the semiconductor war against the US?

Well, the ability to make this particular chip is capacity that China already had before the US export controls. So, it’s no surprise that they were able to build a chip at the seven nanometer scale. By the way, all of the key machinery is foreign. That shows that China is highly dependent on support from foreign companies. The fact that they built it, is less significant than the fact that it is actually not a competitive chip globally.

Why that?

It’s unclear what their yields are. If the yields are low, then the price point is high. So, it probably could not compete with the chips that TSMC makes, for example, for Qualcomm and for Apple. Also, the initial specs suggest that the Huawei chip operates at maybe 60 percent the speed of the latest chips from Apple and Qualcomm.

You’ve mentioned yield and price point, but in the end money doesn’t play a role for China. If Beijing wants to achieve a certain goal, money certainly is not a problem.

That’s right. China’s strengths are mobilizing immense amounts of capital and mobilizing people. So any problem that can be solved with brute force China will excel at. But semiconductor technology is different. So much of it resides in the experience of engineers who’ve done this for years, which is why Taiwan can do it better than anyone else in the world. China responded in the 2000s by hiring as many Taiwanese and Korean engineers as they could and bringing them back to China. That helped China make significant progress. But China still can’t leap anywhere close to where Taiwan and Korea are. They’re simply not innovative enough.

China is not innovative – that view is probably outdated. China has shown that they indeed made a lot of progress in different fields.

The most dynamic part of the semiconductor industry in China are private companies. And private companies in China do what private companies anywhere in the world do: They go after the best vendors they can find. So they’ve gone to Taiwan to have them build the chips. This inhibited the growth of certain technologies and certain capabilities within China. They made great progress in China but not in advanced semiconductor manufacturing.

In China, it’s not only private firms. The state and the provinces are also involved.

Likewise, when the state made huge amounts of capital available for the creation of domestic chip fabs, provincial governments choose the best option: So, instead of looking around at untested domestic companies, they spent those subsidies luring Intel, Micron and other companies to build fabs in China. For example, SK Hynix, the South Korean DRAM manufacturer, 50 percent of its manufacturing capability is located in China, which produces high-end chips. Those factories are in China, but the IP and the chief engineers are all Korean.

Interesting that you make the distinction between state-owned and private companies. The US always claims: In China in the end it comes all to the state and the Communist Party. So what is true?

In the last several years in China, the party has been exerting greater control over even firms that behaved more like private firms. No large firm in China is truly private because the state wouldn’t allow it to be. The party must control everything. Xi Jinping is locking the entire country down. Just look at Alibaba, for example, how Jack Ma disappeared for six months. It is the party takeover of the most dynamic sectors of the economy. Also Huawei deliberately obfuscates what it is. But if you can’t determine the extent to which it’s private and non-private, that’s not a trustworthy entity.

I’ve been at Huawei in Shenzhen. They’ve showed me around and said, here is our phone, here are our chips, please check. Is there any proof that there is a backdoor?

The question of Huawei posing security risks is something that our intelligence agencies are best poised to answer. There are strong suggestions. I’ve looked at Huawei code – and there’s a question of interpretation: Is it just sloppily written or is it deliberately creating backdoors?

What’s your assessment?

At a certain point, I’m not sure it matters. If it’s sloppily written, that means that everyone can actually have a backdoor to it. That works to the advantage of every intelligence agency in the world, including the Chinese. And if it’s deliberately written with a back door, then that’s meant to privilege Chinese actors. But I’m not qualified to comment on that.

China is praising Huawei as its national champion. Should the West also do more to support its companies?

I will tell you this, that if we compete using exactly the same playbook that we’ve used for the last several decades against a China that has proven that this playbook doesn’t work, we’ll continue to lose. We do need to change the playbook. China will be China. We have to accept China as it is, it will not follow the free market principles that are dominant in your country and my country.

With which consequences?

There are good estimates that, for example, every electric vehicle that is made by some of China’s leading manufacturers loses about 30 to $35000. But China will continue to pour money into that to the point where it drives Volkswagen, BMW, Ford and GM out of business. If we continue to behave as if that’s not a risk, then GM and Volkswagen will be driven out of business. So we need to develop new tools because the old ones are probably not going to work, in the same way that Germany used to have a solar industry and it doesn’t anymore.

Any suggestions?

I resist the idea that we should become like China, but we do need creative thinking here. There are tools, such as anti-dumping strategies. Also more cooperation across the Atlantic to develop strategies that do not actually cannibalize each other’s efforts, and to create pathways for the rest of the world to cooperate with us instead of China and Russia.

Coming back to where we started: Are sanctions then the right way to win this competition?

I think sanctions are a useful tool. But sanctions tend to lag behind where the threat is and they tend to be rigid. So we need to be more adaptive. That means that, for example, our businesses, our universities also need to build in risk management processes so that they can ensure that their collaborations with China comport with their values, their own interests and national interests as well.

Sanctions are also not only between the US and China, a lot of different other players are involved, like Taiwan with TSCM or the Netherlands with ASML. Private companies which are relying on the Chinese market.

The Chinese market is not a huge market actually, for TSMC. If I recall correctly, it is somewhere in the teens as a percentage of their sales. It’s a share that they can live without, because there is such a huge appetite for their products everywhere else in the world. China actually is a giant is in the assembly of electronics. And that’s where our most urgent point of supply chain risk is: Apple can’t exist without the assembly plants in China. But it’s not necessarily that China is producing the most important technology in those phones.

We’ve just seen how CEOs from international companies celebrated Xi Jinping with standing ovations. How to keep all these players in the American team?

It’s not an American team. It should be a Western team. It should be a team that stands for a certain vision of the world, whether you call it rules based international order, whether you call it democracy.

But with the US is in lead?

Look, the United States has a different relationship than Germany does to East Asia. We have mutual defense treaties with Japan, Korea, the Philippines or Australia. So for us, China’s capacity to acquire militarily applicable technologies like high-end semiconductors that can be used in ballistic missiles is of great concern to us. In a way that may be less urgent for Europeans, but we’re all in this together in the same way that the United States is here in Europe helping with the Ukraine war. We would hope that our European allies and partners would support us with regard to our strategic objectives to maintain peace and security in East Asia. Our strategic thinkers really hope that Europeans will be there for us as we have been there for them historically.

Glenn Tiffert, Distinguished Research Fellow at the Hoover Institution at Stanford University.

Five years after creating a new artificial economic center in the northern Xiong’an and a year and a half after the devastating lockdowns in Shanghai, President Xi Jinping rediscovers the Yangtze River region as an economic locomotive. The ongoing economic crisis might be the reason. His own favorite projects lack traction, so he is pushing established growth drivers forward.

In the past two months, Xi Jinping has convened a series of high-level conferences, each aimed at firmly anchoring the status of the Yangtze Delta and upstream Yangtze Economic Belt in the country’s national strategies.

The Yangtze Delta consists of Shanghai and 26 other major cities in the neighboring provinces of Jiangsu, Zhejiang, and Anhui. The Yangtze Economic Belt extends over eleven provinces from the estuary to the west to Guizhou and Yunnan.

Xi spoke highly of the region, which he had previously treated somewhat neglectfully. The innovation and competitiveness of the Yangtze Delta are crucial for the “rejuvenation” of the Chinese nation and the “exploration of building a modern civilization,” according to official media quoting Xi at a symposium on the integrated development of the Yangtze Delta. “Quality and integration are the keywords here,” he said at the end of a three-day visit to the financial metropolis Shanghai.

This may sound like Xi’s usual grand speeches, but the use of the top keywords of his ideology reveals a genuine interest in the Yangtze region as an economic engine, especially compared to previous somewhat depreciative statements.

Xi also sounded an alarm and warned of various dangers. He urged the Yangtze estuary region to “keep a close eye on the technological, industrial, and financial sectors, as well as the important infrastructure related to both national and regional security.”

He also called for giving great attention to the security of international business of Chinese companies. Chinese companies “should be guided to expand their industrial chains abroad in a reasonable and orderly manner”.

Xi also upgraded the inland regions along the river. The Yangtze Economic Belt extends far inland from Shanghai. The Belt should play a greater role in China’s pursuit of grain security, energy, key industrial supply chains, and logistics chains, as well as water resources, said Xi on Oct. 12 in Nanchang, Jiangxi.

Xi outlined key tasks for the further integration of the Delta, including:

In addition to Shanghai, the Yangtze Delta has other economically strong cities such as Suzhou, Hangzhou, Nanjing, Ningbo and Wuxi. It is home to some of China’s most well-known companies like Alibaba, Pinduoduo and its overseas brand, Temu. It is also the headquarters of some of the country’s largest chip and EV manufacturers and many of the country’s top universities in high technology and business.

West of the Delta in the Yangtze River Belt are some of China’s most important grain-producing areas, the gigantic Three Gorges Dam hydroelectric power plant and major economic centers like Wuhan and Chongqing.

Since taking office as party secretary in 2012, Xi has launched five national strategies for regional development.

He chaired meetings every three to five years to review progress and give instructions for the next steps. This time, the tone he struck for the Delta and the Belt was unexpectedly positive.

The prosperity of Guangdong is still often attributed to Deng Xiaoping, who, in the early days of China’s opening, made the groundbreaking decision to establish special economic zones in Shenzhen, Zhuhai and Shantou. However, although Xi was also Shanghai’s party chief from 2007 to 2008 for almost a year, the success of Shanghai and its surroundings is often seen as the legacy of Jiang Zemin and Zhu Rongji.

To pursue his own projects, Xi launched the Belt and Road Initiative (BRI) in 2013. The following year, he introduced the Beijing-Tianjin-Hebei strategy. It wasn’t a brand-new idea, but he managed to put a deep personal stamp on it by designing a centerpiece for it, the Xiong’an New Area.

Located about 100 kilometers south of Beijing and opened in 2017, it was conceived as a super-modern mega-city designed to boost growth in Hebei while also hosting selected government organs, state-owned enterprises and universities that have moved away from Beijing.

The city is already half-finished. But few people really want to live there. To make matters worse, the devastating floods in the region this summer revealed a major, neglected flaw in the project: Xiong’an is only 10 meters above sea level. The plan needs some modification, most likely with a hefty cost increase.

Apart from the botched Xiong’an, the Beijing-Tianjin-Hebei scheme, in general, did not make much progress. The economic gap between Hebei and the two big brothers is simply too large. Hebei’s per capita GDP in 2022 was 8,440 dollars, ranking it 26th out of 31 Chinese provinces. Liu Yi

Belarusian President Alexander Lukashenko traveled to Beijing on Sunday to hold talks with Chinese President Xi Jinping. It is his second trip to China this year. Lukashenko is a close ally of Russian President Vladimir Putin.

The visit on Sunday is described as a “working visit”, as reported by the state Belarusian news agency BelTA. “Trade, economic, investment, and international cooperation issues are on the agenda,” BelTA said, citing Lukashenko’s press service.

During his first official visit from Feb. 28 to March 2, Lukashenko was received in China’s capital with salutes and military honors. After the talks, Xi declared that the friendship between China and Belarus was “unbreakable” and both sides should “constantly strengthen mutual political trust and remain true friends and good partners“.

Like Xi, Lukashenko did not condemn Russia’s invasion of Ukraine in February 2022. The Belarusian president also allowed Moscow to use his territory for the war. There is agreement on many critical issues between Lukashenko and Xi. After their meeting on March 1, both called for a “speedy” peace agreement for Ukraine. rtr

The five largest German car manufacturers filed almost 2,000 patents for EVs in China last year. This is revealed by an analysis by the Munich law firm Gruenecker. Compared to 2018, the number of filed patents has more than doubled, according to Handelsblatt, which had a preview of the analysis. EV manufacturers from the USA, Korea and Japan reportedly filed significantly fewer patents in China. In terms of patent applications in China, BMW and Volkswagen, in particular, have caught up. Both companies recently announced new investments and joint ventures on-site.

At the same time, Chinese brands in 2022, for the first time, filed more patents in the field of electromobility than the Germans, according to the law firm, which has been analyzing patent applications in the Chinese auto industry for years. “Lithium-ion battery technology is in Chinese hands,” says lawyer Jens Koch, who participated in the analysis. However, German automakers are strong in connecting batteries to cars and developing electric motors. “German car manufacturers occupy many important technologies for EVs with their own patents,” says Koch.

Who will emerge as the long-term winner remains open, explains the patent attorney. With innovations that border on the Chinese-dominated electric vehicle battery, good positions can still be built. fpe

According to statements from senior officials and diplomats, China and Vietnam are working on a possible improvement of their railway connections. Specifically, this involves the expansion of a route leading from Kunming in Yunnan to Haiphong, Vietnam’s main northern port.

The route traverses Vietnam’s heartland, where rare earth deposits are located. Chinese refinery companies play a crucial role in processing rare earths from Vietnam. Last week, Chinese and Vietnamese experts on rare earths discussed increased collaboration in processing minerals, as reported by Vietnamese state media.

Discussions about the railway connections are part of the preparations for a possible visit by Chinese President Xi Jinping to Hanoi in the coming weeks, said officials and diplomats. The visit would further confirm Vietnam’s increasingly strategic role in global supply chains.

For Vietnam, China is the most important trading partner. Vietnamese Prime Minister Pham Minh Chinh and Chinese officials have emphasized the importance of infrastructure expansion. Vietnam has railway connections to China, but the system is old, and the capacity on the Vietnamese side is limited. Additionally, the two systems currently do not align – trains must stop at the border for passengers and goods to switch to domestic trains.

Expanding the route could boost tourism and exports from Vietnam to China, mainly consisting of agricultural products. The manufacturing sectors of both countries could also become more closely linked. rtr

Agnes Chow, a core member of the Demosisto party, announced late Sunday on her Instagram account that she has left Hong Kong to study in Canada. The 27-year-old is one of the most prominent democracy activists in Hong Kong. She was detained as part of the security measures imposed by China. The authorities’ pressure has triggered psychological problems for her, wrote Chow. rtr/fin

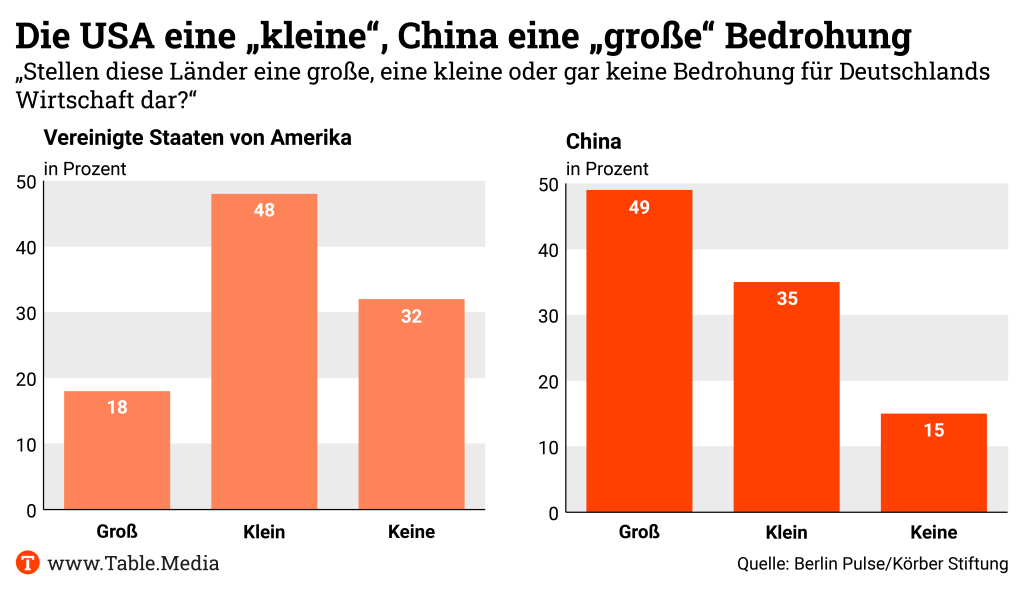

China is a partner, economic competitor and rival for Germany and the European Union. This triad does not sit well with Chinese government officials and diplomats from China. They often respond by saying that China is not a rival but a reliable partner. However, our representative survey, “The Berlin Pulse“, shows that only 13 percent of Germans see China as a partner, while 84 percent consider China an economic threat.

What happened? German-Chinese relations have deteriorated in recent years, and public sentiment has become more critical of China. China’s economic rise has produced a more powerful and outwardly bold China; skepticism toward Beijing has grown. This is clearly reflected in our survey data.

Sixty-two percent of Germans view China’s influence in the world negatively – the highest value since the Körber Foundation began its annual survey in 2017. Especially since the outbreak of the Covid-19 pandemic and China’s ambivalent stance on Russia’s invasion of Ukraine, the perception of China’s role in the world has significantly worsened in the eyes of the German population, raising the question: Should Germany remain economically as closely intertwined with China as before, given increasing political differences?

The German government’s China strategy answered this question with a “yes and no”. The paper reveals that economic relations with China will not be severed, but diversification is sought in certain sectors. Greater independence from China is particularly aimed at critical areas such as the pharmaceutical industry, raw material extraction (rare earths) and electronics.

In our publication, “The Berlin Pulse”, we asked the population about their stance on so-called de-risking. Sixty percent of Germans support a reduction in economic dependence on China, even if it could lead to economic losses and job losses.

Why is that? Perhaps the dependence on Russian gas has shown many Germans how limited Berlin’s political options are in the event of a military escalation.

Is there the same danger with China? A look at the latest study by the German Economic Institute reveals that there were no significant advances in reducing critical dependencies in the first half of 2023. Admittedly, building new supply chains takes time and capital. But anyone listening to Mercedes-Benz CEO Ola Källenius begins to doubt whether the top executives of large companies understand the same thing about de-risking as outlined in Berlin and Brussels strategy papers: “For us, de-risking doesn’t mean reducing our presence in China but increasing it. We are investing more,” said the CEO in November at the China Congress of the CDU-CSU faction.

Our survey shows that 55 percent of Germans see China as a military threat and consider it the fourth-largest foreign policy challenge for Germany, ahead of climate change.

These figures illustrate the discrepancy between the interests of business representatives and public opinion. And it becomes clear that the federal government could score points in public discourse by taking measures to reduce dependence on China because de-risking is not only government policy but is also supported by the population.

Reducing critical dependencies also includes the relocation of production and supply chains to other countries. We asked Germans about their attitude toward emerging middle powers in Asia, Africa and South America -countries like India and Brazil with strong growth or large markets. Fifty-one percent of our respondents have a positive view of the increasing influence of such countries.

Germany’s approach to a changing China must build on more China savviness. Therefore, it is good that travel to China will soon become easier so that not only business representatives but also citizens from Europe can explore the country that has become so unfamiliar to us in the last two years.

Jakob Kuneth has been appointed Head of Purchasing at Volkswagen in Chengdu for the Jetta brand (which has been rejuvenated since 2019). He was already based in Beijing until October 2022 and has been working at the headquarters in Wolfsburg in the meantime.

Jonathan Deinhard works as a dual student at the VW software subsidiary Cariad in Beijing. He is studying vehicle informatics in Ingolstadt.

Is something changing in your organization? Let us know at heads@table.media!

At the second Global Digital Trade Expo in Hangzhou, Zhejiang, this man demonstrates that, thanks to technology, intricate calligraphy is possible even when hands alone might not be able to achieve it.