Is it the all-clear? According to a new economic study, profit flows from China to Germany are not as high as the dependency debate would suggest. In some years it was only in the single-digit billions. The study was conducted by the Bertelsmann Foundation, IW, Merics and BDI, some of the most important actors for economic policy assessments on China. Moreover, since German companies generate the capital for investments in China’s domestic market, no funds flow out of Germany.

But the all-clear is only half the truth. Important customers of medium-sized enterprises are often located in the Far East. Moreover, a significant part of Germany’s China business is conducted as an intra-Chinese game: German brands produce for Chinese customers in local factories. If this part of the business were to disappear, the balance sheet would be skewed. Not to mention the loss of international relevance. Then there is China’s role as a production base for non-EU countries. What’s more, large companies often do not disclose crucial financial risks, writes Christiane Kuehl.

The study therefore also calls for corporations to be more transparent. Politicians can only make the right decisions, and economists can only provide the right advice if they have reliable data to work with.

A slim data basis is often also an obstacle when assessing Chinese foreign lending. Today we report on an event organized by the IfW Kiel on loans to African countries. The bottom line puts China in a good light, writes Michael Radunski. Although there is still not enough capital flowing to Africa to take its development to the next level, China and its generous lending are at least helping to finally improve the infrastructure a bit. More than the Europeans, at least. The fact that borrowed money has to be paid back eventually should not come as a surprise to anyone involved.

According to a new study, Germany’s economy is far less dependent on China in most sectors than is generally assumed. This is the conclusion of a study published on Thursday by the Bertelsmann Foundation, the German Economic Institute (IW), the China Institute Merics and the Federation of German Industries. The study systematically analyzed the profit situation of German companies in China – according to its own information for the first time ever – including special analyses of Bundesbank data.

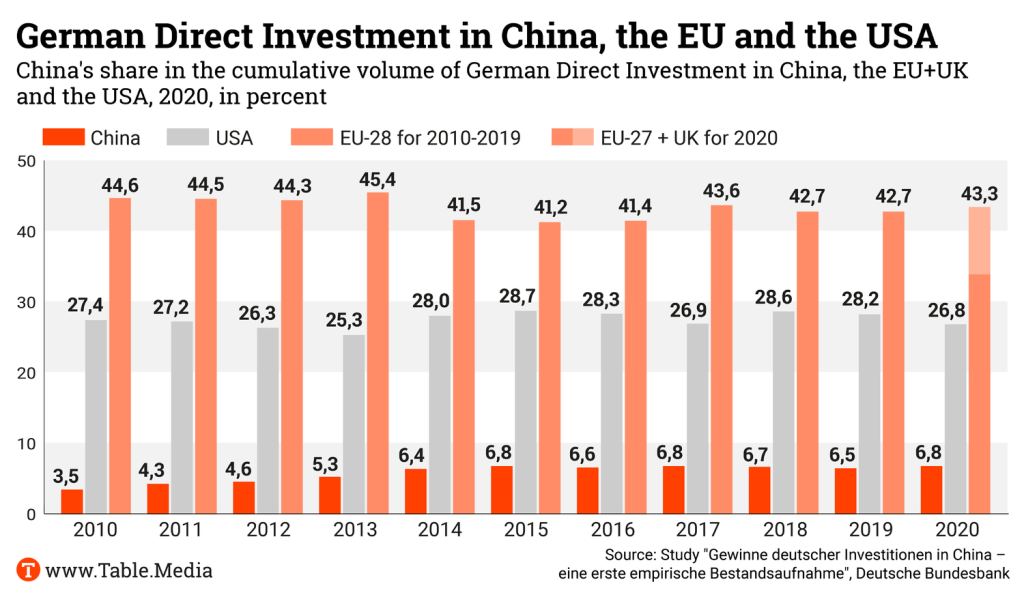

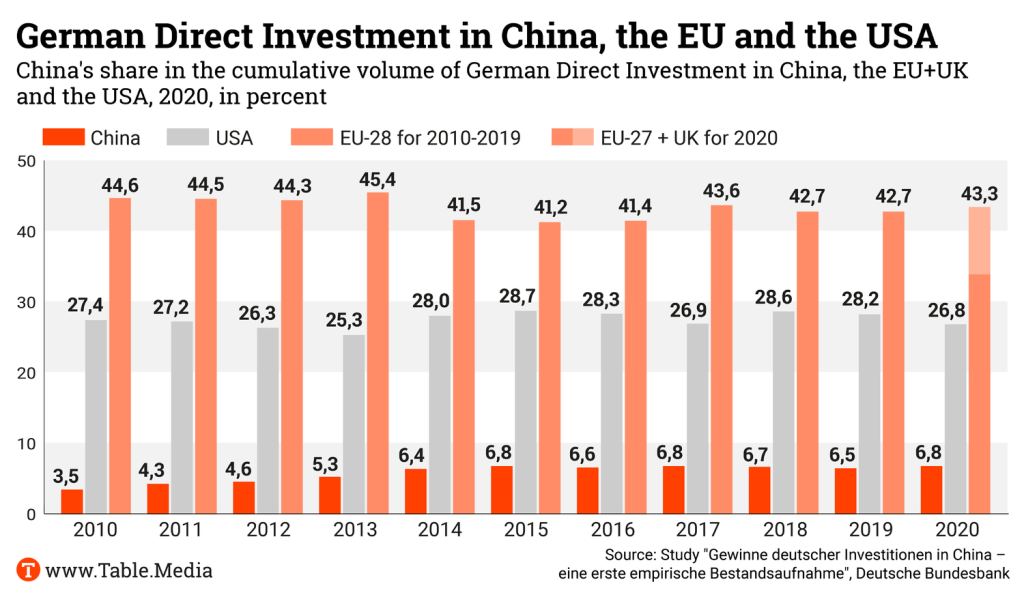

Between 2017 and 2021, profits amounting to seven to eleven billion euros flowed back to Germany each year from the direct investments of German companies in China. This puts China’s significance at about the same level as the USA, with a share of 12 to 16 percent of companies’ foreign profit returns. The EU’s share, however, was significantly higher at an average of 56 percent. The overall economic significance of the profits generated by German companies in China is relevant, but limited.

Despite its growing importance, the People’s Republic continues to play a relatively minor role as a destination for foreign direct investment compared to the EU, the authors write. They argue that Germany’s economic dependence on China is not critical. This is a rather surprising conclusion given the heated debate about excessive dependence on China.

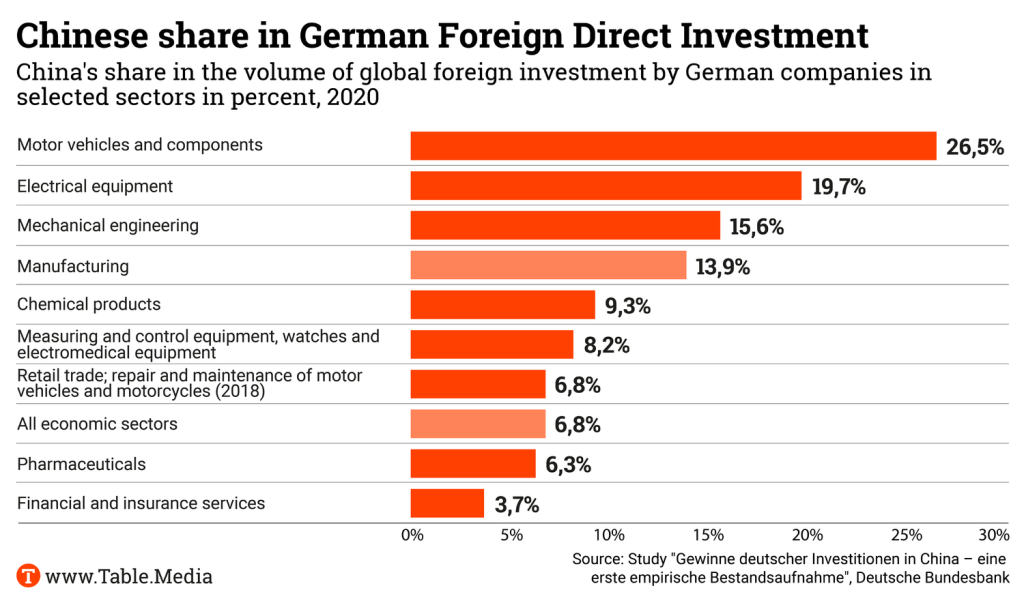

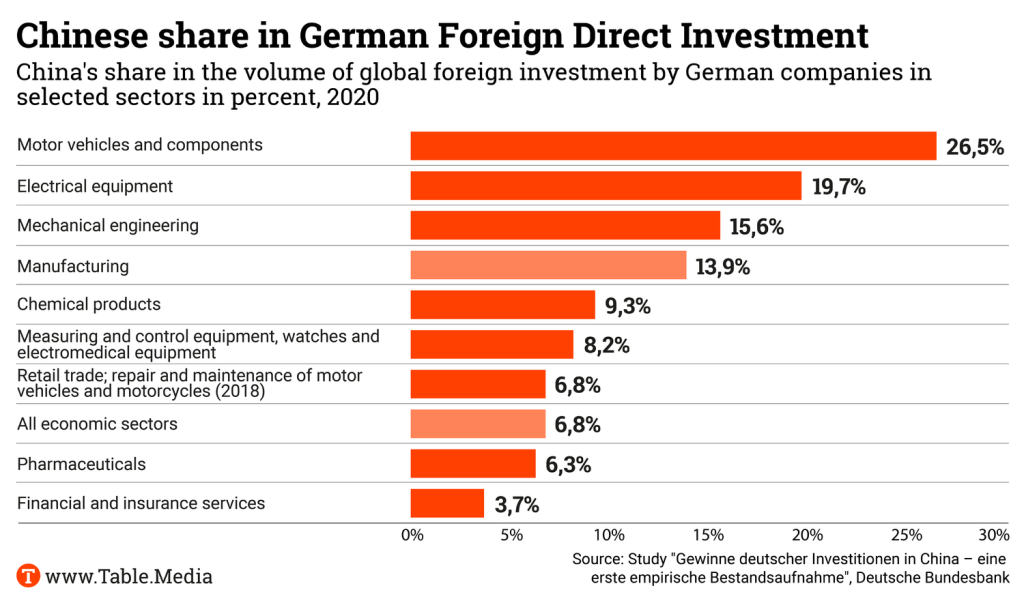

The authors see their findings as an all-clear signal. According to the study, China accounted for only 6.8 percent of German foreign direct investment in 2020, at around 90 billion euros – compared to 34 percent for the EU including the UK and 27 percent for the USA.

Below are some of the key findings of the study:

Especially large corporations like Volkswagen, Mercedes-Benz, BMW and BASF continue their investments in China regardless of the discussion about China in Europe. VW has been calling China its “second home market” for years; BASF is currently building a large Verbund site in southern China.

“More transparency is required here, also at the level of German companies particularly exposed to China,” demands Juergen Matthes, Head of the Global and Regional Markets Department at the IW. “Investors should have an interest in learning more about such cluster risks.” It is “in the overall interest of the German economy that affected large companies safeguard their own existence against geopolitical worst-case scenarios (such as an invasion of Taiwan by China),” the authors warn in the study.

But the investment flow could even rise further. A clear majority of the companies surveyed in the study want to replace exports from Germany with local production by 2030. The trend is well known – in this way, companies are following Chinese demands for more localization, among other things.

“These plans threaten to weaken Germany’s future export prospects. In the medium term, this could be to the detriment of Germany as a business location and the jobs that depend on exports to China and Asia,” warns Merics head economist Max Zenglein. The previously accepted thesis that investments in China automatically benefit Germany as a business location no longer necessarily applies, he says.

The authors provide recommendations for the German government’s economic policy and China strategy. “Germany’s new China policy should be oriented independently of individual corporate and sectoral interests,” says Cora Jungbluth, China expert at the Bertelsmann Stiftung. “Securing prosperity for the entire German business location should be the main focus.”

The authors make further recommendations:

Whenever China’s role in Africa is discussed, one term is almost inevitably mentioned: debt trap. Behind this is the accusation that China will first lend African countries enormous sums of money to subsequently take advantage of the newly created financial dependency. But is this really the case? What is so different about loans from China compared to other donors?

These and other intriguing questions were the focus of the 20th “Global China Conversations” of the Kiel Institute for the World Economy (IfW) on Thursday. Titled “Hidden Debts and Defaults: A Chinese Debt Trap for Africa?”, Christoph Trebesch and Hannah Ryder examined the topic from different angles. Despite all the advantages and disadvantages of Chinese loans, it became clear that there is a huge problem underlying the sometimes inaccurate accusation of a debt trap: How are African countries supposed to finance their development?

Trebesch emphasized China’s outstanding role as the most important donor: the People’s Republic has long since risen to become the world’s biggest creditor – even ahead of the World Bank and the International Monetary Fund, explained the head of the International Financial Markets and Macroeconomics Research Centre at the IfW Kiel.

To speak of a possible debt trap for this reason alone is wrong, Trebesch argues. Rather, it is a normal process that a rising power is becoming more important, not only in military, trade and science but also in credit and finance.

But: “The Chinese credit boom vis-à-vis developing countries is over,” explains Trebesch. In recent years, more money has flowed back from the developing countries to the People’s Republic than new loans have been granted.

Nevertheless, Chinese loans do have some special aspects that should be scrutinized. According to Trebesch, China is:

Debt restructuring is probably the biggest problem for African countries: They urgently need new money to service existing loans, on the one hand, and to be able to finance new development projects, on the other. This also became clear last week at the spring meeting of the World Bank and IMF.

Hannah Ryder then provided an important perspective change at the IfW event. The Managing Director of the African consulting firm “Development Reimagined” was named one of the 100 most influential Africans in 2021, and on Thursday she turned the spotlight to the other side: How do African governments see the situation? Their most important task is to obtain funding for the development of their own countries.

And here Ryder bluntly noted: There is no real sign of a credit boom. “There was never enough money for a comprehensive development of the African countries – neither with nor without China.” In this respect, it should be noted that China is only one of many donors, but all of them are urgently needed. According to Ryder, the World Bank has not financed a single train connection on the African continent since 2002. China is now stepping in. That is why many African countries are first and foremost grateful that an actor like China has become active.

Ryder, who previously headed the United Nations Development Programme (UNDP), highlighted the benefits of Chinese loans. China’s loans are

Most importantly, however, China is also an important alternative. “22 African countries do not have access to private loans,” Ryder explained.

This is perhaps the decisive point in the discussion. As debatable as Chinese financial behavior may be in some countries – and in these cases the problems should certainly be pointed out – it would be important to offer countries in Africa, Latin America or Southeast Asia alternatives.

They should not follow a downward spiral in order to undercut environmental and occupational health and safety standards. Rather, it should be about quick and simple agreements. So that it is no longer China handing out money and the West just promises.

China.Table is the media partner of the Global China Conversations event series of the Kiel Institute for the World Economy.

April 25, 2023; 12:30 p.m. CET

Kiel Institute for the World Economy, Research Seminar: The Macroeconomics of Trade Credit – Luigi Bocola More

April 25, 2023; 7 p.m. CET

Sinema Transtopia Berlin, Film Screening & Talk: Asian Presences in the Colonial Metropolis of Berlin – The Girlfriend of the Yellow Man More

April 26, 2023; 6:30 p.m. CST

German Chamber of Commerce in China, Suzhou, Networking Event: GCC Social Community – White Asparagus Dinner More

April 26, 2023, 6 p.m. (London time)

SOAS China Institute (SCI) London, Seminar &; Film Screening: Discoveries in the Digital Archives of Early Chinese Cinema More

April 27, 2023; 10 a.m. CET (4 p.m. CST)

Dezan Shira & Associates, Webinar: PIPL Compliance for Internet Activities in China More

April 27, 2023; 10 a.m. CET (4 p.m. CST)

EU SME Centre, Webinar: Cross-Border Data Transfers: Carve Out a Safe Business Success in China More

BMW is currently facing a shitstorm in China in connection with the Shanghai auto show. As Reuters reports, Chinese Internet users are outraged about an incident involving the booth of BWM’s Mini brand at the Shanghai auto show. The company reportedly offered free ice cream on Wednesday, but favored foreign guests. China’s social media groups are now speaking of discrimination.

With over 93 million hits, the hashtag “BMW Mini” briefly became one of the most searched keywords on China’s Twitter equivalent Weibo. Users shared pictures and videos with mostly negative comments. In one clip, two Chinese booth employees can be seen telling local visitors that the free ice cream has run out, only to offer a Western visitor a cup shortly afterward.

Mini issued an apology a short time later. In a statement on the brand’s official Weibo account, it stated that the incident was caused by poor internal management and that employee training was being improved.

BMW has been on the Chinese market since 1994 and still enjoys great prestige here as a luxury car brand. However, as the online platform What’s on Weibo reports, the Bavarian car company has repeatedly had to contend with negative headlines, even if the company is usually not directly involved. In recent years, for example, there have been repeated hit-and-run accidents in China involving BMW cars. As a result, many Chinese have developed the idea that BMW drivers are nouveau riche who consider themselves unassailable, writes the online portal, which deals primarily with Chinese Internet phenomena. China’s Internet users have therefore joked for years that the brand initials actually stand for “Bié Mō Wǒ” (别摸我) – “Don’t touch me.” rtr/fpe

The US government has imposed a hefty fine on storage media manufacturer Seagate for supplying the Chinese technology company Huawei despite sanctions. The legal basis for this is the export control law and the classification of Huawei as a threat to the security of the USA. The fine totals 300 million US dollars. That is presumably twice the amount that Seagate earned with the hard drive deliveries. Seagate itself portrays the process as an “agreement” with the government.

Huawei constantly requires large quantities of hard disks for servers, for example, for its cloud services. However, there are only three hard disk manufacturers left in the world: Seagate and Western Digital from the US and Toshiba from Japan. Western Digital and Toshiba ceased supplying Huawei in 2020, complying with US sanction regulations. Seagate, on the other hand, had continued sales for another year.

Seagate argued that it would only supply hard disks from non-US production to its Chinese partner. The Bureau of Industry and Security (BIS) did not follow this argumentation. A hard disk developed in the USA and protected by patents of a US company was an American product and could not be supplied to Huawei, it said. fin

Chinese EV battery manufacturer CATL reported a six-fold increase in profit for the first three months of the year. In the first quarter, net profit was 9.8 billion yuan (1.3 billion euros) – compared to 1.5 billion yuan in the same period last year, the company said. CATL is the world’s leading battery manufacturer, supplying a wide range of carmakers, from BMW and Volkswagen to Tesla and Toyota.

With a revenue increase of 82.9 percent to 89 billion yuan, the Ningde-based company also significantly exceeded its own forecast, which it had set at 75.1 billion yuan. The company did not provide any information on how the massive increase in profits was achieved.

In January, the company opened its first plant in Europe, in Arnstadt, just south of the German city of Erfurt. In addition, the largest factory for electric batteries is to be built in Hungary. flee

The Russian mercenary group Wagner asked China for weapon supplies earlier this year, according to a leaked US intelligence report – but apparently unsuccessfully. Representatives of the Wagner group requested “ammunition and equipment” from Beijing in early 2023, the Financial Times quotes from the document. But as of early January, China had had no contact with Wagner regarding arms supplies, the report adds.

The US repeatedly warned China could supply Russia with weapons. So far, however, there are no reports suggesting any actual deliveries. rtr

A group of Republicans in the US House of Representatives have called on the US State Department to invite Taiwan’s President Tsai Ing-wen to this year’s Asia-Pacific Economic Cooperation (Apec) summit. The 21 congressmen voiced the demand in a letter sent to US Secretary of State Antony Blinken on Wednesday. The Apec summit is scheduled for Nov. 12 in San Francisco.

“Given Taiwan’s important economic, cultural, and technological contributions to the region, we believe … Tsai deserves our full respect as much as Taiwan deserves fair and equal treatment on par with those of other recognition and standing in Apec member states,” states the letter by Texas congressman Lance Gooden. Excluding Taiwan at Beijing’s behest “sends the wrong message” and is tantamount to the US asking China for permission to have certain bilateral foreign relations, he wrote.

Taiwan, which joined Apec in 1991 under the name “Chinese Taipei,” previously did not send a head of state to the annual summit. Wang Ting-yu, a deputy from the ruling Democratic Progressive Party (DPP), said the US, as this year’s Apec host country, would have more say over Tsai’s participation. Commenting on the Republicans’ proposal, Taiwan’s Foreign Minister Joseph Wu said Thursday that Taiwan had “its own way of taking part in the summit”. Discussions will be held with other countries and the best arrangements will be made, Wu said. rtr/fpe

The foreign ministries of Germany and France on Thursday condemned the long prison sentences handed down against two Chinese civil rights activists. “We are appalled by the sentencing of human rights defender Xu Zhiyong and lawyer Ding Jiaxi to 14 and 12 years in prison respectively,” the joint statement said.

The two lawyers were sentenced last week for undermining the authority of the state. Their trial had been held last year in closed session. It is unknown where the civil rights activists are being detained.

Xu and Ding were members of the New Civil Rights Movement, which in 2012 demanded the disclosure of assets of top officials and their families. In 2013, the two activists had been detained and sentenced to several years in prison. After their release in 2017, they continued their work fighting for civil rights, which China’s constitution guarantees but which are disregarded by the CCP.

Germany and France also called for an end to any reprisals against human rights activists in China. On the sidelines of a visit by members of the European External Action Service (EEAS) on Friday, Chinese authorities placed several prominent human rights activists under house arrest on their way to meet the EU delegation in Beijing, including the winner of the Franco-German Human Rights Award Yu Wensheng and his wife Xu Yan. grz

Four women who were arrested after last November’s White Paper protests in Beijing were released on bail Thursday. This was reported by the news agency AP, citing a Chinese activist who wished to remain anonymous.

The released women include editor Cao Zhixin, who recorded a video before her arrest that later went viral on social media. The other three women are said to be Li Yuanjing, Zhai Dengrui and Li Siqi. Beijing accuses them of “picking quarrels and provoking trouble,” a vague charge often leveled against dissidents, according to Human Rights Watch.

Hundreds of people took to the streets across the country during the protests, whose symbol was a blank sheet of paper. It was sparked by a high-rise fire in Ürümqi in the Xinjiang autonomous region. At least ten people died in the fire because they were unable to leave the building due to the government’s strict Covid measures. fpe

From May 1, tourists from China will again be able to enter Germany. A negative Covid PCR test will no longer be required, according to the German representations in China. To get an appointment for a tourist visa, however, some waiting time must be expected. Due to the Covid pandemic, the visa offices are reportedly understaffed. ari

A group suicide of four earlier this month prompted on Chinese social media a wave of laments and sympathetic comments on the hard life experienced by billions of Chinese seeing no hope in life.

Three of the four jumped from a glass “skywalk” in Zhang Jia Jie, a popular tourist attraction, in central China’s Hunan Province, on April 4. Astounded people nearby stopped the fourth from jumping. However, she still passed away because she, like the other three, had swallowed poison beforehand.

The four people, aged between 23 and 34, come from different provinces. According to the police, they met on the Internet. All four left similar suicide notes in which they explained that they had taken their own lives out of their own free will and that it had nothing to do with others. However, they did not reveal why they decided to leave this world.

Beijing-based Lifeweek was the only media news organization to publish a relatively detailed report, after interviewing relatives and acquaintances of the four. According to the report, they all came from poor backgrounds in the countryside and have worked as migrant workers in the cities.

While the exact reason for their suicide is still not clear – and probably never will be, as the government is unlikely to allow more details about such a negative event – commentators in self-media (自媒体 zì méitǐ) and other Internet users already suspect that despair over their hard life was the reason.

“Nowadays there are few people without food, but there are too many seeing no hope in life,” writes Xiang Dongliang, a former journalist who runs a channel on the social media platform WeChat, commenting on social issues. “The work that many people have to do to survive is simply unbearable,” he said in his article.

Indeed, people in Beijing and Shanghai don’t have to travel to poor villages to see how unbearable life can be. They encounter Les Misérables in the cities every day.

Delivery drivers rushing to deliver groceries and online shopping packages are an everyday scene in cities. They work at least ten hours a day – twelve hours or even more, are not uncommon. When on electric bicycles, they neglect traffic lights; when on foot, they sprint. The reason for their frantic working style is simple: There are so many things to deliver and they are punished heavily for being slow. If a customer files a complaint about the service, which often happens, punishment will be even more severe. Most of them earn between 7,500 and 9,000 Yuan (1,000-1,200 Euro) a month.

Everyday between 14:30 and 16:30 in some quiet corners of malls with many restaurants, small groups of delivery men, exhausted and in dirty clothing with logos of delivery companies, can be seen sitting on simple chairs dosing away. They are having their precious afternoon naps before dinner time starts.

The majority of drivers of DiDi, the Chinese answer to Uber, work long hours similar to delivery drivers and the net pay is similar. Workers at construction sites toil around the clock, their pay is somewhat better, but the job is even harder and not stable, especially in the current sluggish real estate sector. These workers all work for private personal contractors, who often postpone and cut their pay.

All of these above have no social insurance and health insurance.

If you talk to the people in these hard jobs, each has a story to tell: Old parents at home, a sick family member or a child of school age. For the younger ones, it’s often for the ultimate dream of buying or building a house, a prerequisite for marrying. In addition to the new house, a proposing man in the countryside and small cities must give the woman’s parents a dowry ranging mostly between 50,000 Yuan and 500,000 Yuan (7,000 Euro to 70,000 Euro).

But the reality is, the everyday struggle is more about how to have enough money to survive. After basic expenses are spent, not much is left.

So when somebody is hit by a serious illness, the whole family will be plunged into dire straits. When you are no longer able to work, the prospects are also bleak. According to Chinese scholars, the suicide rate of rural residents over the age of 60 is much higher than the global average for the same age group.

The fact that China has lifted 800 million people out of absolute poverty has become something like a fixture in any article on its achievement in the past 40 years. However, ex-premier Li Keqiang also said in 2020 that more than 40 percent of China’s 1.4 population still live on 1,000 yuan (137 euros) per month or less. The World Bank said in 2022 almost 20 percent of the population lived under a major technical poverty line of 6.85 US dollars per day, which is about 190 euros a month.

The two estimates don’t seem to be compatible with each other. But the message is the same: Poverty in China remains a problem not to be ignored.

However, for many people who are better off, life is also not easy. In February this year, the average weekly working time in Chinese firms stood at 48 hours, according to the National Bureau of Statistics. Except for a very small group of the privileged, professionals in China also have to deal with great pressure and long hours to keep their job. Life is mostly about endless work.

And that is a key reason why they can relate to the hardships experienced by the very unfortunate ones.

Louisa de Fallois is the Regional Manager Greater China & Mongolia at the German Asia-Pacific Business Association OAV. The Hamburg-based east Asia association promotes economic relations between the countries of the Asia-Pacific region and Germany. Fallois spent a year studying at Peking University.

Christin Schuster has taken over the division of PR Learning & Talent Management for the Greater China region at Schaeffler. Schuster has been working for the Bavarian automotive and mechanical engineering supplier for five years. For her new post, she is moving from Herzogenaurach to Shanghai this month.

Is something changing in your organization? Let us know at heads@table.media!

The exhibition “Virtually Versailles,” which opened in Hong Kong on Wednesday, brings the palace of Sun King Louis XIV to Asia. There, visitors can view holograms of baroque statues, for example, or even take a bike tour through the gardens of the sprawling estate. What this looks like is shown by this visitor on an ergometer placed on artificial grass.

Is it the all-clear? According to a new economic study, profit flows from China to Germany are not as high as the dependency debate would suggest. In some years it was only in the single-digit billions. The study was conducted by the Bertelsmann Foundation, IW, Merics and BDI, some of the most important actors for economic policy assessments on China. Moreover, since German companies generate the capital for investments in China’s domestic market, no funds flow out of Germany.

But the all-clear is only half the truth. Important customers of medium-sized enterprises are often located in the Far East. Moreover, a significant part of Germany’s China business is conducted as an intra-Chinese game: German brands produce for Chinese customers in local factories. If this part of the business were to disappear, the balance sheet would be skewed. Not to mention the loss of international relevance. Then there is China’s role as a production base for non-EU countries. What’s more, large companies often do not disclose crucial financial risks, writes Christiane Kuehl.

The study therefore also calls for corporations to be more transparent. Politicians can only make the right decisions, and economists can only provide the right advice if they have reliable data to work with.

A slim data basis is often also an obstacle when assessing Chinese foreign lending. Today we report on an event organized by the IfW Kiel on loans to African countries. The bottom line puts China in a good light, writes Michael Radunski. Although there is still not enough capital flowing to Africa to take its development to the next level, China and its generous lending are at least helping to finally improve the infrastructure a bit. More than the Europeans, at least. The fact that borrowed money has to be paid back eventually should not come as a surprise to anyone involved.

According to a new study, Germany’s economy is far less dependent on China in most sectors than is generally assumed. This is the conclusion of a study published on Thursday by the Bertelsmann Foundation, the German Economic Institute (IW), the China Institute Merics and the Federation of German Industries. The study systematically analyzed the profit situation of German companies in China – according to its own information for the first time ever – including special analyses of Bundesbank data.

Between 2017 and 2021, profits amounting to seven to eleven billion euros flowed back to Germany each year from the direct investments of German companies in China. This puts China’s significance at about the same level as the USA, with a share of 12 to 16 percent of companies’ foreign profit returns. The EU’s share, however, was significantly higher at an average of 56 percent. The overall economic significance of the profits generated by German companies in China is relevant, but limited.

Despite its growing importance, the People’s Republic continues to play a relatively minor role as a destination for foreign direct investment compared to the EU, the authors write. They argue that Germany’s economic dependence on China is not critical. This is a rather surprising conclusion given the heated debate about excessive dependence on China.

The authors see their findings as an all-clear signal. According to the study, China accounted for only 6.8 percent of German foreign direct investment in 2020, at around 90 billion euros – compared to 34 percent for the EU including the UK and 27 percent for the USA.

Below are some of the key findings of the study:

Especially large corporations like Volkswagen, Mercedes-Benz, BMW and BASF continue their investments in China regardless of the discussion about China in Europe. VW has been calling China its “second home market” for years; BASF is currently building a large Verbund site in southern China.

“More transparency is required here, also at the level of German companies particularly exposed to China,” demands Juergen Matthes, Head of the Global and Regional Markets Department at the IW. “Investors should have an interest in learning more about such cluster risks.” It is “in the overall interest of the German economy that affected large companies safeguard their own existence against geopolitical worst-case scenarios (such as an invasion of Taiwan by China),” the authors warn in the study.

But the investment flow could even rise further. A clear majority of the companies surveyed in the study want to replace exports from Germany with local production by 2030. The trend is well known – in this way, companies are following Chinese demands for more localization, among other things.

“These plans threaten to weaken Germany’s future export prospects. In the medium term, this could be to the detriment of Germany as a business location and the jobs that depend on exports to China and Asia,” warns Merics head economist Max Zenglein. The previously accepted thesis that investments in China automatically benefit Germany as a business location no longer necessarily applies, he says.

The authors provide recommendations for the German government’s economic policy and China strategy. “Germany’s new China policy should be oriented independently of individual corporate and sectoral interests,” says Cora Jungbluth, China expert at the Bertelsmann Stiftung. “Securing prosperity for the entire German business location should be the main focus.”

The authors make further recommendations:

Whenever China’s role in Africa is discussed, one term is almost inevitably mentioned: debt trap. Behind this is the accusation that China will first lend African countries enormous sums of money to subsequently take advantage of the newly created financial dependency. But is this really the case? What is so different about loans from China compared to other donors?

These and other intriguing questions were the focus of the 20th “Global China Conversations” of the Kiel Institute for the World Economy (IfW) on Thursday. Titled “Hidden Debts and Defaults: A Chinese Debt Trap for Africa?”, Christoph Trebesch and Hannah Ryder examined the topic from different angles. Despite all the advantages and disadvantages of Chinese loans, it became clear that there is a huge problem underlying the sometimes inaccurate accusation of a debt trap: How are African countries supposed to finance their development?

Trebesch emphasized China’s outstanding role as the most important donor: the People’s Republic has long since risen to become the world’s biggest creditor – even ahead of the World Bank and the International Monetary Fund, explained the head of the International Financial Markets and Macroeconomics Research Centre at the IfW Kiel.

To speak of a possible debt trap for this reason alone is wrong, Trebesch argues. Rather, it is a normal process that a rising power is becoming more important, not only in military, trade and science but also in credit and finance.

But: “The Chinese credit boom vis-à-vis developing countries is over,” explains Trebesch. In recent years, more money has flowed back from the developing countries to the People’s Republic than new loans have been granted.

Nevertheless, Chinese loans do have some special aspects that should be scrutinized. According to Trebesch, China is:

Debt restructuring is probably the biggest problem for African countries: They urgently need new money to service existing loans, on the one hand, and to be able to finance new development projects, on the other. This also became clear last week at the spring meeting of the World Bank and IMF.

Hannah Ryder then provided an important perspective change at the IfW event. The Managing Director of the African consulting firm “Development Reimagined” was named one of the 100 most influential Africans in 2021, and on Thursday she turned the spotlight to the other side: How do African governments see the situation? Their most important task is to obtain funding for the development of their own countries.

And here Ryder bluntly noted: There is no real sign of a credit boom. “There was never enough money for a comprehensive development of the African countries – neither with nor without China.” In this respect, it should be noted that China is only one of many donors, but all of them are urgently needed. According to Ryder, the World Bank has not financed a single train connection on the African continent since 2002. China is now stepping in. That is why many African countries are first and foremost grateful that an actor like China has become active.

Ryder, who previously headed the United Nations Development Programme (UNDP), highlighted the benefits of Chinese loans. China’s loans are

Most importantly, however, China is also an important alternative. “22 African countries do not have access to private loans,” Ryder explained.

This is perhaps the decisive point in the discussion. As debatable as Chinese financial behavior may be in some countries – and in these cases the problems should certainly be pointed out – it would be important to offer countries in Africa, Latin America or Southeast Asia alternatives.

They should not follow a downward spiral in order to undercut environmental and occupational health and safety standards. Rather, it should be about quick and simple agreements. So that it is no longer China handing out money and the West just promises.

China.Table is the media partner of the Global China Conversations event series of the Kiel Institute for the World Economy.

April 25, 2023; 12:30 p.m. CET

Kiel Institute for the World Economy, Research Seminar: The Macroeconomics of Trade Credit – Luigi Bocola More

April 25, 2023; 7 p.m. CET

Sinema Transtopia Berlin, Film Screening & Talk: Asian Presences in the Colonial Metropolis of Berlin – The Girlfriend of the Yellow Man More

April 26, 2023; 6:30 p.m. CST

German Chamber of Commerce in China, Suzhou, Networking Event: GCC Social Community – White Asparagus Dinner More

April 26, 2023, 6 p.m. (London time)

SOAS China Institute (SCI) London, Seminar &; Film Screening: Discoveries in the Digital Archives of Early Chinese Cinema More

April 27, 2023; 10 a.m. CET (4 p.m. CST)

Dezan Shira & Associates, Webinar: PIPL Compliance for Internet Activities in China More

April 27, 2023; 10 a.m. CET (4 p.m. CST)

EU SME Centre, Webinar: Cross-Border Data Transfers: Carve Out a Safe Business Success in China More

BMW is currently facing a shitstorm in China in connection with the Shanghai auto show. As Reuters reports, Chinese Internet users are outraged about an incident involving the booth of BWM’s Mini brand at the Shanghai auto show. The company reportedly offered free ice cream on Wednesday, but favored foreign guests. China’s social media groups are now speaking of discrimination.

With over 93 million hits, the hashtag “BMW Mini” briefly became one of the most searched keywords on China’s Twitter equivalent Weibo. Users shared pictures and videos with mostly negative comments. In one clip, two Chinese booth employees can be seen telling local visitors that the free ice cream has run out, only to offer a Western visitor a cup shortly afterward.

Mini issued an apology a short time later. In a statement on the brand’s official Weibo account, it stated that the incident was caused by poor internal management and that employee training was being improved.

BMW has been on the Chinese market since 1994 and still enjoys great prestige here as a luxury car brand. However, as the online platform What’s on Weibo reports, the Bavarian car company has repeatedly had to contend with negative headlines, even if the company is usually not directly involved. In recent years, for example, there have been repeated hit-and-run accidents in China involving BMW cars. As a result, many Chinese have developed the idea that BMW drivers are nouveau riche who consider themselves unassailable, writes the online portal, which deals primarily with Chinese Internet phenomena. China’s Internet users have therefore joked for years that the brand initials actually stand for “Bié Mō Wǒ” (别摸我) – “Don’t touch me.” rtr/fpe

The US government has imposed a hefty fine on storage media manufacturer Seagate for supplying the Chinese technology company Huawei despite sanctions. The legal basis for this is the export control law and the classification of Huawei as a threat to the security of the USA. The fine totals 300 million US dollars. That is presumably twice the amount that Seagate earned with the hard drive deliveries. Seagate itself portrays the process as an “agreement” with the government.

Huawei constantly requires large quantities of hard disks for servers, for example, for its cloud services. However, there are only three hard disk manufacturers left in the world: Seagate and Western Digital from the US and Toshiba from Japan. Western Digital and Toshiba ceased supplying Huawei in 2020, complying with US sanction regulations. Seagate, on the other hand, had continued sales for another year.

Seagate argued that it would only supply hard disks from non-US production to its Chinese partner. The Bureau of Industry and Security (BIS) did not follow this argumentation. A hard disk developed in the USA and protected by patents of a US company was an American product and could not be supplied to Huawei, it said. fin

Chinese EV battery manufacturer CATL reported a six-fold increase in profit for the first three months of the year. In the first quarter, net profit was 9.8 billion yuan (1.3 billion euros) – compared to 1.5 billion yuan in the same period last year, the company said. CATL is the world’s leading battery manufacturer, supplying a wide range of carmakers, from BMW and Volkswagen to Tesla and Toyota.

With a revenue increase of 82.9 percent to 89 billion yuan, the Ningde-based company also significantly exceeded its own forecast, which it had set at 75.1 billion yuan. The company did not provide any information on how the massive increase in profits was achieved.

In January, the company opened its first plant in Europe, in Arnstadt, just south of the German city of Erfurt. In addition, the largest factory for electric batteries is to be built in Hungary. flee

The Russian mercenary group Wagner asked China for weapon supplies earlier this year, according to a leaked US intelligence report – but apparently unsuccessfully. Representatives of the Wagner group requested “ammunition and equipment” from Beijing in early 2023, the Financial Times quotes from the document. But as of early January, China had had no contact with Wagner regarding arms supplies, the report adds.

The US repeatedly warned China could supply Russia with weapons. So far, however, there are no reports suggesting any actual deliveries. rtr

A group of Republicans in the US House of Representatives have called on the US State Department to invite Taiwan’s President Tsai Ing-wen to this year’s Asia-Pacific Economic Cooperation (Apec) summit. The 21 congressmen voiced the demand in a letter sent to US Secretary of State Antony Blinken on Wednesday. The Apec summit is scheduled for Nov. 12 in San Francisco.

“Given Taiwan’s important economic, cultural, and technological contributions to the region, we believe … Tsai deserves our full respect as much as Taiwan deserves fair and equal treatment on par with those of other recognition and standing in Apec member states,” states the letter by Texas congressman Lance Gooden. Excluding Taiwan at Beijing’s behest “sends the wrong message” and is tantamount to the US asking China for permission to have certain bilateral foreign relations, he wrote.

Taiwan, which joined Apec in 1991 under the name “Chinese Taipei,” previously did not send a head of state to the annual summit. Wang Ting-yu, a deputy from the ruling Democratic Progressive Party (DPP), said the US, as this year’s Apec host country, would have more say over Tsai’s participation. Commenting on the Republicans’ proposal, Taiwan’s Foreign Minister Joseph Wu said Thursday that Taiwan had “its own way of taking part in the summit”. Discussions will be held with other countries and the best arrangements will be made, Wu said. rtr/fpe

The foreign ministries of Germany and France on Thursday condemned the long prison sentences handed down against two Chinese civil rights activists. “We are appalled by the sentencing of human rights defender Xu Zhiyong and lawyer Ding Jiaxi to 14 and 12 years in prison respectively,” the joint statement said.

The two lawyers were sentenced last week for undermining the authority of the state. Their trial had been held last year in closed session. It is unknown where the civil rights activists are being detained.

Xu and Ding were members of the New Civil Rights Movement, which in 2012 demanded the disclosure of assets of top officials and their families. In 2013, the two activists had been detained and sentenced to several years in prison. After their release in 2017, they continued their work fighting for civil rights, which China’s constitution guarantees but which are disregarded by the CCP.

Germany and France also called for an end to any reprisals against human rights activists in China. On the sidelines of a visit by members of the European External Action Service (EEAS) on Friday, Chinese authorities placed several prominent human rights activists under house arrest on their way to meet the EU delegation in Beijing, including the winner of the Franco-German Human Rights Award Yu Wensheng and his wife Xu Yan. grz

Four women who were arrested after last November’s White Paper protests in Beijing were released on bail Thursday. This was reported by the news agency AP, citing a Chinese activist who wished to remain anonymous.

The released women include editor Cao Zhixin, who recorded a video before her arrest that later went viral on social media. The other three women are said to be Li Yuanjing, Zhai Dengrui and Li Siqi. Beijing accuses them of “picking quarrels and provoking trouble,” a vague charge often leveled against dissidents, according to Human Rights Watch.

Hundreds of people took to the streets across the country during the protests, whose symbol was a blank sheet of paper. It was sparked by a high-rise fire in Ürümqi in the Xinjiang autonomous region. At least ten people died in the fire because they were unable to leave the building due to the government’s strict Covid measures. fpe

From May 1, tourists from China will again be able to enter Germany. A negative Covid PCR test will no longer be required, according to the German representations in China. To get an appointment for a tourist visa, however, some waiting time must be expected. Due to the Covid pandemic, the visa offices are reportedly understaffed. ari

A group suicide of four earlier this month prompted on Chinese social media a wave of laments and sympathetic comments on the hard life experienced by billions of Chinese seeing no hope in life.

Three of the four jumped from a glass “skywalk” in Zhang Jia Jie, a popular tourist attraction, in central China’s Hunan Province, on April 4. Astounded people nearby stopped the fourth from jumping. However, she still passed away because she, like the other three, had swallowed poison beforehand.

The four people, aged between 23 and 34, come from different provinces. According to the police, they met on the Internet. All four left similar suicide notes in which they explained that they had taken their own lives out of their own free will and that it had nothing to do with others. However, they did not reveal why they decided to leave this world.

Beijing-based Lifeweek was the only media news organization to publish a relatively detailed report, after interviewing relatives and acquaintances of the four. According to the report, they all came from poor backgrounds in the countryside and have worked as migrant workers in the cities.

While the exact reason for their suicide is still not clear – and probably never will be, as the government is unlikely to allow more details about such a negative event – commentators in self-media (自媒体 zì méitǐ) and other Internet users already suspect that despair over their hard life was the reason.

“Nowadays there are few people without food, but there are too many seeing no hope in life,” writes Xiang Dongliang, a former journalist who runs a channel on the social media platform WeChat, commenting on social issues. “The work that many people have to do to survive is simply unbearable,” he said in his article.

Indeed, people in Beijing and Shanghai don’t have to travel to poor villages to see how unbearable life can be. They encounter Les Misérables in the cities every day.

Delivery drivers rushing to deliver groceries and online shopping packages are an everyday scene in cities. They work at least ten hours a day – twelve hours or even more, are not uncommon. When on electric bicycles, they neglect traffic lights; when on foot, they sprint. The reason for their frantic working style is simple: There are so many things to deliver and they are punished heavily for being slow. If a customer files a complaint about the service, which often happens, punishment will be even more severe. Most of them earn between 7,500 and 9,000 Yuan (1,000-1,200 Euro) a month.

Everyday between 14:30 and 16:30 in some quiet corners of malls with many restaurants, small groups of delivery men, exhausted and in dirty clothing with logos of delivery companies, can be seen sitting on simple chairs dosing away. They are having their precious afternoon naps before dinner time starts.

The majority of drivers of DiDi, the Chinese answer to Uber, work long hours similar to delivery drivers and the net pay is similar. Workers at construction sites toil around the clock, their pay is somewhat better, but the job is even harder and not stable, especially in the current sluggish real estate sector. These workers all work for private personal contractors, who often postpone and cut their pay.

All of these above have no social insurance and health insurance.

If you talk to the people in these hard jobs, each has a story to tell: Old parents at home, a sick family member or a child of school age. For the younger ones, it’s often for the ultimate dream of buying or building a house, a prerequisite for marrying. In addition to the new house, a proposing man in the countryside and small cities must give the woman’s parents a dowry ranging mostly between 50,000 Yuan and 500,000 Yuan (7,000 Euro to 70,000 Euro).

But the reality is, the everyday struggle is more about how to have enough money to survive. After basic expenses are spent, not much is left.

So when somebody is hit by a serious illness, the whole family will be plunged into dire straits. When you are no longer able to work, the prospects are also bleak. According to Chinese scholars, the suicide rate of rural residents over the age of 60 is much higher than the global average for the same age group.

The fact that China has lifted 800 million people out of absolute poverty has become something like a fixture in any article on its achievement in the past 40 years. However, ex-premier Li Keqiang also said in 2020 that more than 40 percent of China’s 1.4 population still live on 1,000 yuan (137 euros) per month or less. The World Bank said in 2022 almost 20 percent of the population lived under a major technical poverty line of 6.85 US dollars per day, which is about 190 euros a month.

The two estimates don’t seem to be compatible with each other. But the message is the same: Poverty in China remains a problem not to be ignored.

However, for many people who are better off, life is also not easy. In February this year, the average weekly working time in Chinese firms stood at 48 hours, according to the National Bureau of Statistics. Except for a very small group of the privileged, professionals in China also have to deal with great pressure and long hours to keep their job. Life is mostly about endless work.

And that is a key reason why they can relate to the hardships experienced by the very unfortunate ones.

Louisa de Fallois is the Regional Manager Greater China & Mongolia at the German Asia-Pacific Business Association OAV. The Hamburg-based east Asia association promotes economic relations between the countries of the Asia-Pacific region and Germany. Fallois spent a year studying at Peking University.

Christin Schuster has taken over the division of PR Learning & Talent Management for the Greater China region at Schaeffler. Schuster has been working for the Bavarian automotive and mechanical engineering supplier for five years. For her new post, she is moving from Herzogenaurach to Shanghai this month.

Is something changing in your organization? Let us know at heads@table.media!

The exhibition “Virtually Versailles,” which opened in Hong Kong on Wednesday, brings the palace of Sun King Louis XIV to Asia. There, visitors can view holograms of baroque statues, for example, or even take a bike tour through the gardens of the sprawling estate. What this looks like is shown by this visitor on an ergometer placed on artificial grass.