Half of the magnesium processed in Germany comes from China. The dependence on China for rare earth elements is similarly high. And indirectly much higher, because the German industry is dependent on primary products from other EU countries, which obtain even more raw materials from the Asian world market leader. Nico Beckert analyzes why it is so difficult to get away from the proven supplier. As long as everything is fine on the global political stage, it doesn’t make sense to accept higher costs for diversification. The competition is not doing it either. A far-sighted risk management would be in order here.

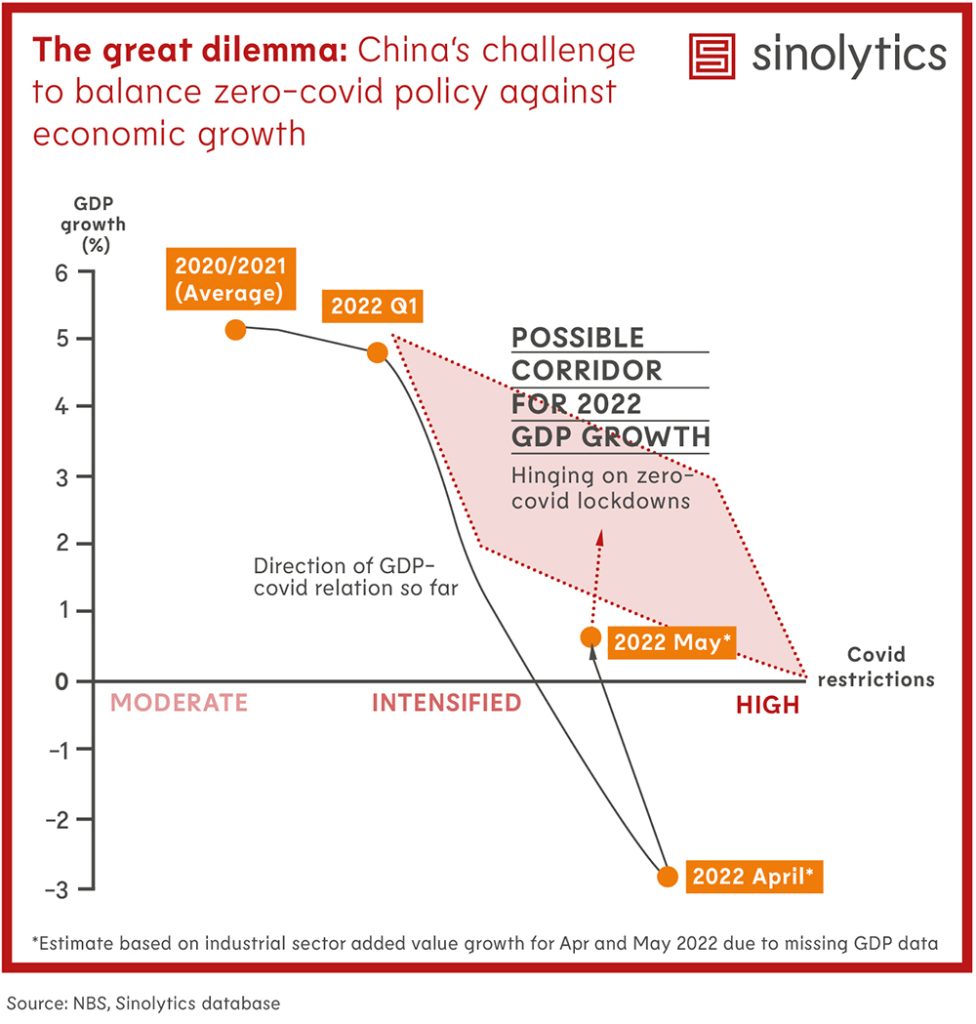

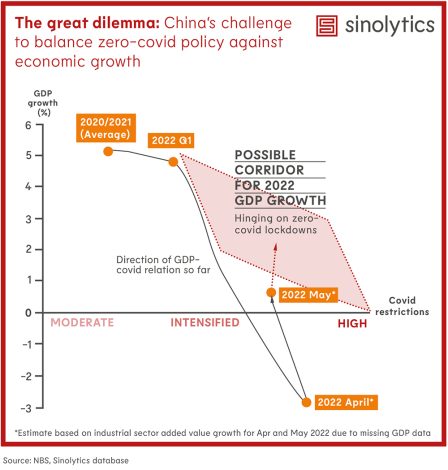

The question of actual risks also arises for small banks deep in the countryside. The payment defaults in Henan are just the tip of the iceberg, analyzes our team in Beijing. The people there are already boiling with rage because customers have not received their money for days. For a long time, the headquarters in Beijing simply overlooked the problem of very small credit cooperatives. But in fact, they have a major role in the system, providing capital for small and medium-sized businesses. Bank failures are now also a side effect of the bitter COVID medicine the government has to deal with.

For decades, it was unthinkable that Russia would eventually stop supplying gas to Germany. Now Vladimir Putin has cut gas supplies. German ministries are developing emergency plans for the winter. Not only private households are affected, but also the industry, which will almost certainly have to curb production.

This also draws attention to other dependencies: China is the largest supplier of important raw materials such as rare earth elements and magnesium. For other raw materials, the People’s Republic is among the top 5 exporters worldwide. There is now growing concern among managers, economists, and politicians about the consequences of a conflict with China, which would hit Germany hard economically in several respects.

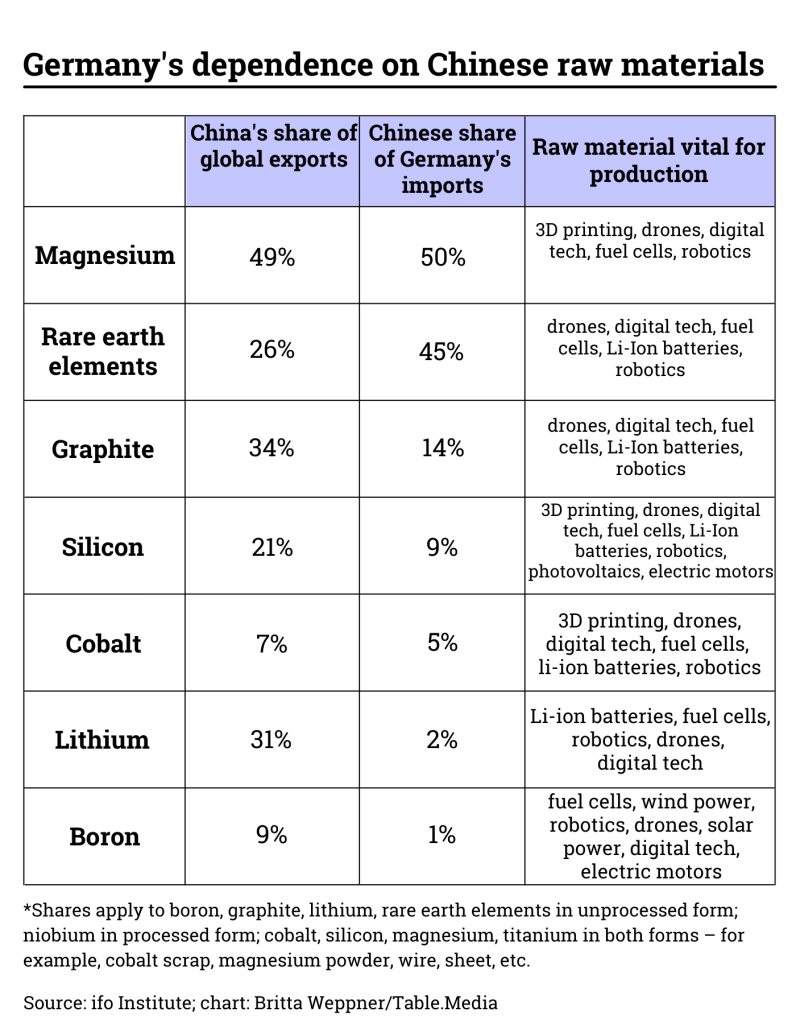

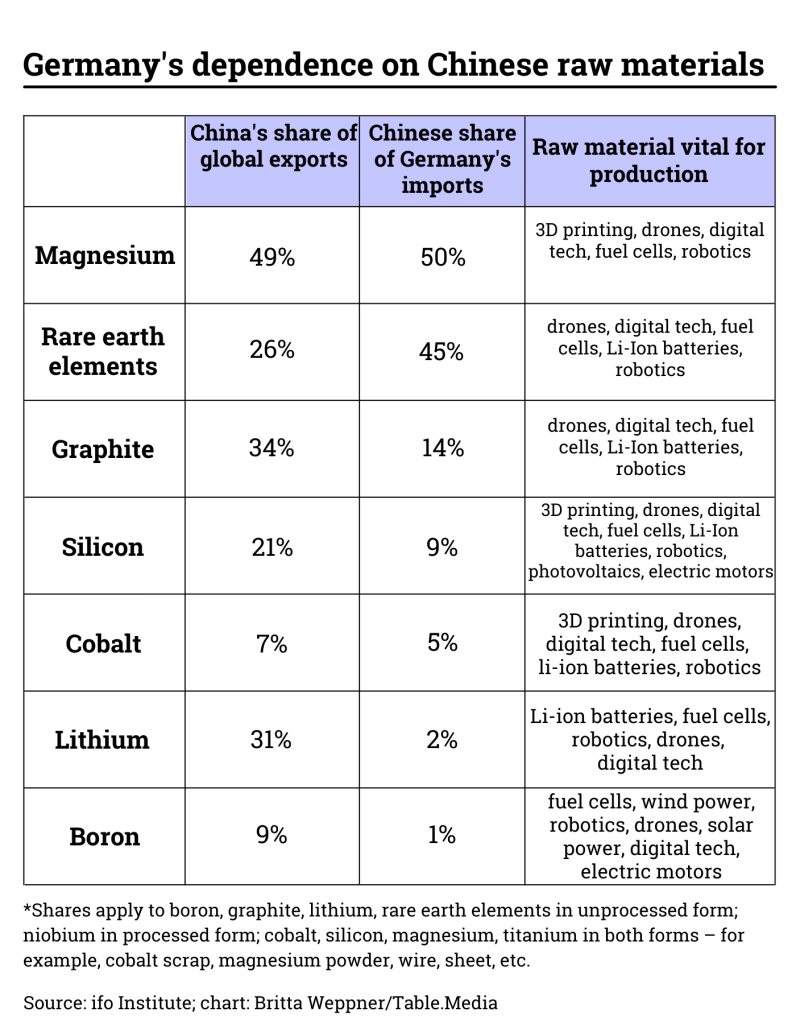

Half of Germany’s magnesium imports and 45 percent of its imports of rare earth elements come from the People’s Republic, according to a new study by the Ifo Institute. The metals are used in important future technologies such as fuel cells, electric motors, wind turbines, digital technology, and robots.

There are already concrete warning signs. At the end of last year, China curbed magnesium production due to the power crisis. The European industry, which is dependent on magnesium from the People’s Republic for aluminum production, suffered as a result (China.Table reported). The problem was quickly resolved but shows the dependencies very clearly.

In the meantime, China temporarily had a quasi-monopoly on rare earth elements. In 2011, the country accounted for 97 percent of global production. Since then, China’s share of global production has fallen but is still around 58 percent. Since the People’s Republic consumes a lot, the export share is lower and amounts to 26 percent. There were already warning signs for rare earths as well. At the end of 2010, China restricted exports to Japan for several weeks due to diplomatic disagreements.

According to Ifo researchers, rare earth elements and magnesium are among the “raw materials with critical dependencies”. They are important for many key technologies and are only mined and exported on a large scale by few countries.

Germany’s dependence on China is less pronounced for seven other critical raw materials. Only in the case of graphite does the share of imports from China exceed 10 percent. Nevertheless, the rest of the world as a whole is even more dependent on China than Germany. This is reflected in the data. Globally, the share of imports from China is usually higher than the German figure. “German imports are more diversified than the average global trade,” says Lisandra Flach, one of the authors of the Ifo study.

But that only applies to direct dependencies. China is the world’s largest producer and consumer of raw materials. “Any change in China that is relevant to raw materials, for example, cyclical fluctuations in demand, affects the global raw materials markets and price developments,” says Yun Schueler-Zhou, China expert at the German Mineral Ressources Agency (DERA). Because Germany is dependent on raw material imports, price fluctuations have a major impact on the German industry. “This indirect dependence on China is much more far-reaching than the direct supply dependence,” Schueler-Zhou says.

In addition, there are dependencies due to branched supply chains. “The dependency along the value chain can be even greater than shown in our study,” says Flach. When other EU countries import raw materials from China, process them, and then export them to Germany in intermediate goods, there is an indirect dependence on China, she said. This is particularly striking in the case of rare earth elements. EU countries import 98 percent of their demand from China.

China is often not the only country that has certain raw material deposits. But due to price advantages, producers from other countries have sometimes been forced out of the market. The best example of this is rare earth elements. Contrary to what the name suggests, these 17 metals are not rare in the earth’s crust. But: “China is dominant in the mining of rare earths because environmental and health standards are low,” says Michael Reckordt, raw materials expert at the NGO PowerShift.

This is a competitive advantage that can depress prices. Mines in the USA have had to close for this reason. Companies are often simply not willing to pay a higher price for raw materials. This shows a parallel to Russian gas: Instead of looking to other suppliers and LNG at an early stage, German companies have become dependent on Russia. As long as the supply was plentiful and cheap, the problems with this strategy were not noticeable.

Although there have been regular complaints about dependencies on raw materials from China for years, they remain disturbingly high. In the case of rare earths, according to the Info-Institute, the share was

It is unclear whether the recent decline represents a trend reversal, as China’s COVID policy has also affected the mining sector. For magnesium, there has actually been a slight increase in China’s import share over the past few years, from 40 percent in 2017 to 51 percent in 2021. For other metals, imports have actually increased dramatically. These include chromium, bismuth, zirconium, indium, and many iron and steel products, according to Schueler-Zhou of DERA.

It is difficult to assess whether enough has been done to reduce dependencies. “The efforts usually happen at the plant or company level,” says raw materials expert Reckordt. In addition, Malaysia and Myanmar are also not ideal suppliers of rare earth elements. “Thus, the list of alternatives is very quickly reduced to the US,” Reckordt says.

According to experts, dependence on China also comes with political risks. “Trade relations with China could be interrupted in the course of foreign policy conflicts,” says Schueler-Zhou. Strategic raw materials such as rare earth elements are now far more politically relevant than normal economic goods, she says. “Their importance for the energy transition in China and Western countries has increased. This increases competition and the potential for conflict,” Schueler-Zhou says.

As an export-oriented industrialized country, Germany remains dependent on imports of raw materials from other countries, especially from China. Reducing dependencies – as in the case of Russian gas dependency – will be accompanied by higher costs. In other regions of the world, higher environmental and social standards apply. However, if the German industry is serious about reducing the risks of excessive dependency, it will have to accept higher prices.

There is finally some good news for hundreds of duped bank customers in Henan. On Sunday, angry protesters gathered at the local branch of the central bank in the provincial capital of Zhengzhou (China.Table reported). They demanded their bank deposits back, which have been frozen for months, from at least four troubled institutions. Security forces dispersed the angry crowd.

Nevertheless, the demonstrators were able to make their voices heard. According to announcements on Monday and Tuesday, the authorities assured to compensate the customers at least partially. Regional banks had been infiltrated by a gang of fraudsters and used for illegal business, they said. Among other things, the criminals had used financial platforms on the Internet to collect money from investors and set up dummy companies to which they then extended fictitious loans.

All of this sounds rather bizarre. But what the bank customers in Henan experienced is not an isolated case in China. There are always irregularities in the banking system, even though the government started cleaning up the financial system years ago. Perhaps this is precisely why there are more scandals. Like, in 2019 with Mongolia’s Baoshang Bank, where the state took control because of “serious credit risks” (China.Table reported). The bailout made headlines around the world, with funding costs for smaller Chinese banks jumping and Chinese bank stocks plummeting.

The financial markets are generally less concerned about the actual economic damage because both Baoshang Bank and the institutions now affected in Henan have relatively small balance sheets. Rather, there is a fear that the problems of individual institutions could be just the tip of an iceberg. For years, doubt has been cast over the official figures, particularly on the share of non-performing loans (NPLs) in banks’ outstanding receivables. Across all banks in China, this recently stood at just 1.9 percent. That would be a similar level to that in the very developed financial markets of the USA and the EU.

However, international rating agencies have long expressed the suspicion that the mountain of bad loans in China is actually much larger. The high debts are a consequence of economic and monetary policy decisions taken after the 2008 banking crisis. The Chinese government launched a huge stimulus program to support the economy during the downturn. In addition, banks loosened their lending policies at the time. Bank managers took bribes and concealed risks, many of which may not have come to light even today.

Beijing is admittedly eager to push ahead with debt reduction. The authorities are merging small regional banks into larger institutions that are easier to control. But local governments, in particular, always have to weigh the pros and cons: How much can they turn off the credit tap, and how closely can they control it so as not to depress an already weakening economy?

Beijing also admits that not all problems have been resolved yet. Although the financial risks associated with small and medium-sized banks are “generally controllable,” China’s Banking and Insurance Regulatory Commission (CBIRC) announced just a few days ago that some lenders are suspected of having committed crimes, according to Xiao Yuanqi, the agency’s Vice Chief.

The country’s relatively economically weak northeast is notorious for banking corruption and its troubled financial institutions. Last year, in Liaoning province alone, authorities initiated disciplinary action against 63 executives of small and medium-sized banks. The province has 75 regional institutions. Even according to official statistics, non-performing loans currently account for 5.11 of their books – far more than the national average.

The latent problems were recently compounded by pandemic-related difficulties in Henan. The profitability of the mini-institutions in the countryside is low. They do play an important role by granting loans to small and medium-sized companies. But according to analysts at the Australian banking firm ANZ, the return on investment with this business model is well below one percent. They did not have a buffer for fluctuations resulting from COVID measures. Joern Petring/Gregor Koppenburg

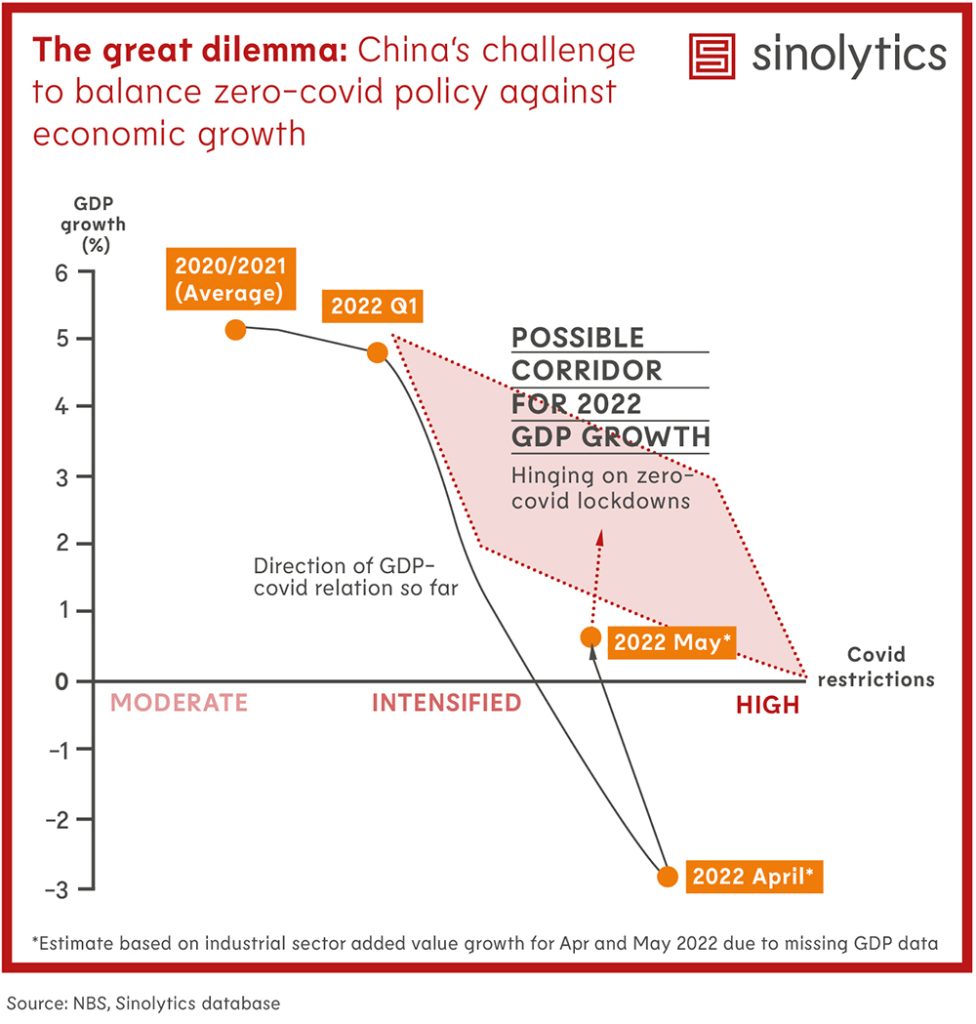

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

After a break of about two years, a trade dialogue between the EU and China will take place next week. Commissioner for Trade and EU Executive Vice-President Valdis Dombrovskis will meet with China’s Vice Premier Liu He in a video conference on July 19, the EU Directorate-General for Trade confirmed. Commissioner for Financial Services Mairead McGuinness and representatives of several EU Directorates-General and Chinese ministries will also participate.

According to the Trade Directorate, the agenda includes topics such as the global energy and food crises. Supply chains and “bilateral trade and investment relations” will be discussed. There is a whole range of unresolved issues between the EU and the People’s Republic:

The last trade dialogue took place in July 2020. The EU-China summit in April this year was a failure: Brussels wanted to talk about China’s role in the war against Ukraine, and Beijing about trade.

Last week, EU Climate Commissioner Frans Timmermans and Vice Premier Han Zheng already met for an online summit. “There are many opportunities for the EU and China to work more closely together“, Timmermans tweeted after the meeting. For example, on clean energy and hydrogen, and carbon markets. The latter is particularly interesting given the EU’s planned carbon border adjustment. Negotiations on this are currently underway between the European Parliament, the Commission, and the EU Council. ari

Taiwanese Vice President Lai Ching-te (William Lai) attended the funeral of assassinated top Japanese politician Shinzo Abe. Lai described the visit to the neighboring country as a private “show of respect for a friend.” Foreign trips by Taiwanese officials are rare, especially since Taiwan does not maintain official diplomatic relations with most countries. Lai is a possible candidate to succeed incumbent President Tsai Ing-wen.

China protested the visit. “After the assassination attempt on former Prime Minister Shinzo Abe, Taiwan authorities latched onto the opportunity for political manipulation,” a Foreign Ministry spokesman said. Taiwan cannot have a vice president at all because it is part of the People’s Republic of China, he said. fin

Foreign companies tend to react very differently to public criticism in China. There are subtle differences for which controversies they apologize for and for which they do not, according to a study by the Stockholm-based National China Centre. The independent think tank found that 80 percent of companies publicly apologize more often for statements about the territorial integrity of Taiwan, Hong Kong, and Tibet than for criticism related to human rights violations in Xinjiang. According to the study, only about one-third of the companies there apologize publicly after a shitstorm.

The think tank attributes the difference in apology rates in part to the fact that the forced labor issue in Xinjiang has recently shifted into the focus of politics in Europe and North America (China.Table reported). While companies could cope with a loss of image in the West over Taiwan’s sovereignty, “it is much harder to imagine that they would be comfortable with accusations of being implicated in what some western parliaments and governments have labeled genocide,” the study said.

The think tank examined boycott incidents between 2008 and 2021, with companies from the US, Japan, and France being the most affected. Companies that publicly kowtowed included Walmart, Daimler, and Nike (China.Table reported). Most calls for boycotts were in the food sector, luxury goods, and the automotive industry – in particular sectors with strong local alternatives.

In addition to a general exacerbation of nationalism among China’s consumers (China.Table reported), the study also found that boycotts peaked in 2019 during the trade dispute with Donald Trump and that China’s government added fuel to the fire in at least one-third of cases with state media reports. fpe

Hydropower is currently providing welcome relief in the fight against emissions in China: Thanks to abundant rain, the reservoirs are well filled, and the turbines are achieving record output. In the first five months of the year, electricity production at dams in southern China rose by 18 percent, Greenpeace China reports. In May, hydropower electricity generation jumped 27 percent nationwide. In 2021 alone, 23 gigawatts of hydropower capacity have been added through the construction of new dams. Southern China experienced its heaviest rainfall in 60 years in March and May. fin/rtr

India could overtake China as the world’s most populous country as early as next year. This is according to the World Population Prospects, an annual demographic report on the state of the world’s population, published by the UN on Monday. India and China would then each have more than 1.4 billion inhabitants. In China, population growth is stagnating at a low level, while in India it is falling from a high level. India’s population is therefore still growing, while it may already be shrinking in China. In a 2022 census in India, the population was still 1.21 billion.

China’s birth rate is at its lowest level since the founding of the People’s Republic in 1949. According to official figures, the number of newborns fell by 11.5 percent to 10.6 million in 2021 (China.Table reported). Soon, the country may not have enough workers to care for a growing number of elderly. India’s birth rate is also already declining. However, since India’s population is still quite young, it continues to grow rapidly.

According to United Nations estimates, the world’s population will reach a new record high of eight billion by November 15 this year. If there is no change in global striving rates, there could then be 8.5 billion people by 2030 and over 10 billion by 2100. According to the UN report, the world’s future population growth through 2050 will be concentrated primarily in eight countries: the Democratic Republic of Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines, and Tanzania. fpe

“I’m interested in many things,” says Maja Linnemann, “but cemeteries have always had a special effect on me.” Two years ago, Linnemann’s book “Letzte Dinge. Tod und Bestattungskultur in China” was published by Drachenhaus Verlag, the same year she started the blog “Friedhofswelten.” “The ancient culture of China permeates everywhere, including in the way death is dealt with.”

Linnemann studied sinology in Bremen, Chengdu, Hamburg, and London and lived in Beijing for 14 years. During this time, she worked, among other things, as editor-in-chief of CHINA Nachrichten and a German-Chinese online feuilleton of the Goethe-Institut. When a neighbor of her Chinese father-in-law died a little more than ten years ago, she attended a traditional village funeral for the first time. “I will never forget that experience,” she says today.

She remembers almost life-sized colorful paper figurines representing horses, cars, and other things that were carried through the village in a procession. “Everything that people thought the dead person would need in the afterlife,” she explains. “The most strange thing for me was the big celebration in the evening on the village sports field. There were performances and live music, children played in the middle of it, it was loud and boisterous.”

Many of China’s burial traditions have been carried out in just this way for more than 1,000 years, dating back to Chinese philosopher Zhu Xi’s collection of writings called “Family Rituals,” which was widely read. “The ancient traditions, however, are contrasted by a government that now also regulates dying,” Linnemann says.

In cities such as Beijing or Shanghai, burial in the ground has been banned for reasons of space, and the same is true in many rural regions. “There are some Chinese who resist this and bury their relatives on their own land. Time and again, this leads to heavy fines or even public agencies digging up the buried again.”

The fact that government-imposed changes in China sometimes have a radical effect and often happen rapidly was something Linnemann also had to experience when she lived in Beijing. “I loved this city, but then large parts of the traditional, single-story buildings were torn down and entire neighborhoods disappeared.” Small alleys were replaced by wide streets, and car traffic increased massively after the turn of the millennium. “I always thought of Beijing as a bicycle city. The many cars and the noise were a big reason why I didn’t want to live there anymore.”

Today, Linnemann says she has lost her adopted home. In 2013, she returned to Bremen and built up the Confucius Institute there as Executive Director. “Even if I went back, it just wouldn’t be the same.” For the past four years, she has worked independently as a translator and author. In a few weeks, the novel she translated, “Compassion,” by author Lu Nei, will be published by Drachenhaus Verlag. Later this year, one of her translations will also be published as part of the Max Planck Institute’s research project “China – Norms, Ideas, Practices.” Svenja Napp

Angela Wei Dong is moving up the board at US cosmetics company Estée Lauder. Dong currently serves as Managing Director of Nike China. Previously, she worked at Coca-Cola.

Ben Yue has moved up from Head of Fixed Income to Chief Financial Officer (CIO) at the Bank of China in Hong Kong. Yue has previously worked for HSBC and USB.

Is something changing in your organization? Why not let us know at heads@table.media!

On shaky legs, a tiger cub born in April made its first public appearance at the South China Tiger Breeding Station in Suzhou on Monday. In the wild, there has been no trace of the South China tiger “Panthera tigris amoyensis” for more than 20 years.

Half of the magnesium processed in Germany comes from China. The dependence on China for rare earth elements is similarly high. And indirectly much higher, because the German industry is dependent on primary products from other EU countries, which obtain even more raw materials from the Asian world market leader. Nico Beckert analyzes why it is so difficult to get away from the proven supplier. As long as everything is fine on the global political stage, it doesn’t make sense to accept higher costs for diversification. The competition is not doing it either. A far-sighted risk management would be in order here.

The question of actual risks also arises for small banks deep in the countryside. The payment defaults in Henan are just the tip of the iceberg, analyzes our team in Beijing. The people there are already boiling with rage because customers have not received their money for days. For a long time, the headquarters in Beijing simply overlooked the problem of very small credit cooperatives. But in fact, they have a major role in the system, providing capital for small and medium-sized businesses. Bank failures are now also a side effect of the bitter COVID medicine the government has to deal with.

For decades, it was unthinkable that Russia would eventually stop supplying gas to Germany. Now Vladimir Putin has cut gas supplies. German ministries are developing emergency plans for the winter. Not only private households are affected, but also the industry, which will almost certainly have to curb production.

This also draws attention to other dependencies: China is the largest supplier of important raw materials such as rare earth elements and magnesium. For other raw materials, the People’s Republic is among the top 5 exporters worldwide. There is now growing concern among managers, economists, and politicians about the consequences of a conflict with China, which would hit Germany hard economically in several respects.

Half of Germany’s magnesium imports and 45 percent of its imports of rare earth elements come from the People’s Republic, according to a new study by the Ifo Institute. The metals are used in important future technologies such as fuel cells, electric motors, wind turbines, digital technology, and robots.

There are already concrete warning signs. At the end of last year, China curbed magnesium production due to the power crisis. The European industry, which is dependent on magnesium from the People’s Republic for aluminum production, suffered as a result (China.Table reported). The problem was quickly resolved but shows the dependencies very clearly.

In the meantime, China temporarily had a quasi-monopoly on rare earth elements. In 2011, the country accounted for 97 percent of global production. Since then, China’s share of global production has fallen but is still around 58 percent. Since the People’s Republic consumes a lot, the export share is lower and amounts to 26 percent. There were already warning signs for rare earths as well. At the end of 2010, China restricted exports to Japan for several weeks due to diplomatic disagreements.

According to Ifo researchers, rare earth elements and magnesium are among the “raw materials with critical dependencies”. They are important for many key technologies and are only mined and exported on a large scale by few countries.

Germany’s dependence on China is less pronounced for seven other critical raw materials. Only in the case of graphite does the share of imports from China exceed 10 percent. Nevertheless, the rest of the world as a whole is even more dependent on China than Germany. This is reflected in the data. Globally, the share of imports from China is usually higher than the German figure. “German imports are more diversified than the average global trade,” says Lisandra Flach, one of the authors of the Ifo study.

But that only applies to direct dependencies. China is the world’s largest producer and consumer of raw materials. “Any change in China that is relevant to raw materials, for example, cyclical fluctuations in demand, affects the global raw materials markets and price developments,” says Yun Schueler-Zhou, China expert at the German Mineral Ressources Agency (DERA). Because Germany is dependent on raw material imports, price fluctuations have a major impact on the German industry. “This indirect dependence on China is much more far-reaching than the direct supply dependence,” Schueler-Zhou says.

In addition, there are dependencies due to branched supply chains. “The dependency along the value chain can be even greater than shown in our study,” says Flach. When other EU countries import raw materials from China, process them, and then export them to Germany in intermediate goods, there is an indirect dependence on China, she said. This is particularly striking in the case of rare earth elements. EU countries import 98 percent of their demand from China.

China is often not the only country that has certain raw material deposits. But due to price advantages, producers from other countries have sometimes been forced out of the market. The best example of this is rare earth elements. Contrary to what the name suggests, these 17 metals are not rare in the earth’s crust. But: “China is dominant in the mining of rare earths because environmental and health standards are low,” says Michael Reckordt, raw materials expert at the NGO PowerShift.

This is a competitive advantage that can depress prices. Mines in the USA have had to close for this reason. Companies are often simply not willing to pay a higher price for raw materials. This shows a parallel to Russian gas: Instead of looking to other suppliers and LNG at an early stage, German companies have become dependent on Russia. As long as the supply was plentiful and cheap, the problems with this strategy were not noticeable.

Although there have been regular complaints about dependencies on raw materials from China for years, they remain disturbingly high. In the case of rare earths, according to the Info-Institute, the share was

It is unclear whether the recent decline represents a trend reversal, as China’s COVID policy has also affected the mining sector. For magnesium, there has actually been a slight increase in China’s import share over the past few years, from 40 percent in 2017 to 51 percent in 2021. For other metals, imports have actually increased dramatically. These include chromium, bismuth, zirconium, indium, and many iron and steel products, according to Schueler-Zhou of DERA.

It is difficult to assess whether enough has been done to reduce dependencies. “The efforts usually happen at the plant or company level,” says raw materials expert Reckordt. In addition, Malaysia and Myanmar are also not ideal suppliers of rare earth elements. “Thus, the list of alternatives is very quickly reduced to the US,” Reckordt says.

According to experts, dependence on China also comes with political risks. “Trade relations with China could be interrupted in the course of foreign policy conflicts,” says Schueler-Zhou. Strategic raw materials such as rare earth elements are now far more politically relevant than normal economic goods, she says. “Their importance for the energy transition in China and Western countries has increased. This increases competition and the potential for conflict,” Schueler-Zhou says.

As an export-oriented industrialized country, Germany remains dependent on imports of raw materials from other countries, especially from China. Reducing dependencies – as in the case of Russian gas dependency – will be accompanied by higher costs. In other regions of the world, higher environmental and social standards apply. However, if the German industry is serious about reducing the risks of excessive dependency, it will have to accept higher prices.

There is finally some good news for hundreds of duped bank customers in Henan. On Sunday, angry protesters gathered at the local branch of the central bank in the provincial capital of Zhengzhou (China.Table reported). They demanded their bank deposits back, which have been frozen for months, from at least four troubled institutions. Security forces dispersed the angry crowd.

Nevertheless, the demonstrators were able to make their voices heard. According to announcements on Monday and Tuesday, the authorities assured to compensate the customers at least partially. Regional banks had been infiltrated by a gang of fraudsters and used for illegal business, they said. Among other things, the criminals had used financial platforms on the Internet to collect money from investors and set up dummy companies to which they then extended fictitious loans.

All of this sounds rather bizarre. But what the bank customers in Henan experienced is not an isolated case in China. There are always irregularities in the banking system, even though the government started cleaning up the financial system years ago. Perhaps this is precisely why there are more scandals. Like, in 2019 with Mongolia’s Baoshang Bank, where the state took control because of “serious credit risks” (China.Table reported). The bailout made headlines around the world, with funding costs for smaller Chinese banks jumping and Chinese bank stocks plummeting.

The financial markets are generally less concerned about the actual economic damage because both Baoshang Bank and the institutions now affected in Henan have relatively small balance sheets. Rather, there is a fear that the problems of individual institutions could be just the tip of an iceberg. For years, doubt has been cast over the official figures, particularly on the share of non-performing loans (NPLs) in banks’ outstanding receivables. Across all banks in China, this recently stood at just 1.9 percent. That would be a similar level to that in the very developed financial markets of the USA and the EU.

However, international rating agencies have long expressed the suspicion that the mountain of bad loans in China is actually much larger. The high debts are a consequence of economic and monetary policy decisions taken after the 2008 banking crisis. The Chinese government launched a huge stimulus program to support the economy during the downturn. In addition, banks loosened their lending policies at the time. Bank managers took bribes and concealed risks, many of which may not have come to light even today.

Beijing is admittedly eager to push ahead with debt reduction. The authorities are merging small regional banks into larger institutions that are easier to control. But local governments, in particular, always have to weigh the pros and cons: How much can they turn off the credit tap, and how closely can they control it so as not to depress an already weakening economy?

Beijing also admits that not all problems have been resolved yet. Although the financial risks associated with small and medium-sized banks are “generally controllable,” China’s Banking and Insurance Regulatory Commission (CBIRC) announced just a few days ago that some lenders are suspected of having committed crimes, according to Xiao Yuanqi, the agency’s Vice Chief.

The country’s relatively economically weak northeast is notorious for banking corruption and its troubled financial institutions. Last year, in Liaoning province alone, authorities initiated disciplinary action against 63 executives of small and medium-sized banks. The province has 75 regional institutions. Even according to official statistics, non-performing loans currently account for 5.11 of their books – far more than the national average.

The latent problems were recently compounded by pandemic-related difficulties in Henan. The profitability of the mini-institutions in the countryside is low. They do play an important role by granting loans to small and medium-sized companies. But according to analysts at the Australian banking firm ANZ, the return on investment with this business model is well below one percent. They did not have a buffer for fluctuations resulting from COVID measures. Joern Petring/Gregor Koppenburg

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

After a break of about two years, a trade dialogue between the EU and China will take place next week. Commissioner for Trade and EU Executive Vice-President Valdis Dombrovskis will meet with China’s Vice Premier Liu He in a video conference on July 19, the EU Directorate-General for Trade confirmed. Commissioner for Financial Services Mairead McGuinness and representatives of several EU Directorates-General and Chinese ministries will also participate.

According to the Trade Directorate, the agenda includes topics such as the global energy and food crises. Supply chains and “bilateral trade and investment relations” will be discussed. There is a whole range of unresolved issues between the EU and the People’s Republic:

The last trade dialogue took place in July 2020. The EU-China summit in April this year was a failure: Brussels wanted to talk about China’s role in the war against Ukraine, and Beijing about trade.

Last week, EU Climate Commissioner Frans Timmermans and Vice Premier Han Zheng already met for an online summit. “There are many opportunities for the EU and China to work more closely together“, Timmermans tweeted after the meeting. For example, on clean energy and hydrogen, and carbon markets. The latter is particularly interesting given the EU’s planned carbon border adjustment. Negotiations on this are currently underway between the European Parliament, the Commission, and the EU Council. ari

Taiwanese Vice President Lai Ching-te (William Lai) attended the funeral of assassinated top Japanese politician Shinzo Abe. Lai described the visit to the neighboring country as a private “show of respect for a friend.” Foreign trips by Taiwanese officials are rare, especially since Taiwan does not maintain official diplomatic relations with most countries. Lai is a possible candidate to succeed incumbent President Tsai Ing-wen.

China protested the visit. “After the assassination attempt on former Prime Minister Shinzo Abe, Taiwan authorities latched onto the opportunity for political manipulation,” a Foreign Ministry spokesman said. Taiwan cannot have a vice president at all because it is part of the People’s Republic of China, he said. fin

Foreign companies tend to react very differently to public criticism in China. There are subtle differences for which controversies they apologize for and for which they do not, according to a study by the Stockholm-based National China Centre. The independent think tank found that 80 percent of companies publicly apologize more often for statements about the territorial integrity of Taiwan, Hong Kong, and Tibet than for criticism related to human rights violations in Xinjiang. According to the study, only about one-third of the companies there apologize publicly after a shitstorm.

The think tank attributes the difference in apology rates in part to the fact that the forced labor issue in Xinjiang has recently shifted into the focus of politics in Europe and North America (China.Table reported). While companies could cope with a loss of image in the West over Taiwan’s sovereignty, “it is much harder to imagine that they would be comfortable with accusations of being implicated in what some western parliaments and governments have labeled genocide,” the study said.

The think tank examined boycott incidents between 2008 and 2021, with companies from the US, Japan, and France being the most affected. Companies that publicly kowtowed included Walmart, Daimler, and Nike (China.Table reported). Most calls for boycotts were in the food sector, luxury goods, and the automotive industry – in particular sectors with strong local alternatives.

In addition to a general exacerbation of nationalism among China’s consumers (China.Table reported), the study also found that boycotts peaked in 2019 during the trade dispute with Donald Trump and that China’s government added fuel to the fire in at least one-third of cases with state media reports. fpe

Hydropower is currently providing welcome relief in the fight against emissions in China: Thanks to abundant rain, the reservoirs are well filled, and the turbines are achieving record output. In the first five months of the year, electricity production at dams in southern China rose by 18 percent, Greenpeace China reports. In May, hydropower electricity generation jumped 27 percent nationwide. In 2021 alone, 23 gigawatts of hydropower capacity have been added through the construction of new dams. Southern China experienced its heaviest rainfall in 60 years in March and May. fin/rtr

India could overtake China as the world’s most populous country as early as next year. This is according to the World Population Prospects, an annual demographic report on the state of the world’s population, published by the UN on Monday. India and China would then each have more than 1.4 billion inhabitants. In China, population growth is stagnating at a low level, while in India it is falling from a high level. India’s population is therefore still growing, while it may already be shrinking in China. In a 2022 census in India, the population was still 1.21 billion.

China’s birth rate is at its lowest level since the founding of the People’s Republic in 1949. According to official figures, the number of newborns fell by 11.5 percent to 10.6 million in 2021 (China.Table reported). Soon, the country may not have enough workers to care for a growing number of elderly. India’s birth rate is also already declining. However, since India’s population is still quite young, it continues to grow rapidly.

According to United Nations estimates, the world’s population will reach a new record high of eight billion by November 15 this year. If there is no change in global striving rates, there could then be 8.5 billion people by 2030 and over 10 billion by 2100. According to the UN report, the world’s future population growth through 2050 will be concentrated primarily in eight countries: the Democratic Republic of Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines, and Tanzania. fpe

“I’m interested in many things,” says Maja Linnemann, “but cemeteries have always had a special effect on me.” Two years ago, Linnemann’s book “Letzte Dinge. Tod und Bestattungskultur in China” was published by Drachenhaus Verlag, the same year she started the blog “Friedhofswelten.” “The ancient culture of China permeates everywhere, including in the way death is dealt with.”

Linnemann studied sinology in Bremen, Chengdu, Hamburg, and London and lived in Beijing for 14 years. During this time, she worked, among other things, as editor-in-chief of CHINA Nachrichten and a German-Chinese online feuilleton of the Goethe-Institut. When a neighbor of her Chinese father-in-law died a little more than ten years ago, she attended a traditional village funeral for the first time. “I will never forget that experience,” she says today.

She remembers almost life-sized colorful paper figurines representing horses, cars, and other things that were carried through the village in a procession. “Everything that people thought the dead person would need in the afterlife,” she explains. “The most strange thing for me was the big celebration in the evening on the village sports field. There were performances and live music, children played in the middle of it, it was loud and boisterous.”

Many of China’s burial traditions have been carried out in just this way for more than 1,000 years, dating back to Chinese philosopher Zhu Xi’s collection of writings called “Family Rituals,” which was widely read. “The ancient traditions, however, are contrasted by a government that now also regulates dying,” Linnemann says.

In cities such as Beijing or Shanghai, burial in the ground has been banned for reasons of space, and the same is true in many rural regions. “There are some Chinese who resist this and bury their relatives on their own land. Time and again, this leads to heavy fines or even public agencies digging up the buried again.”

The fact that government-imposed changes in China sometimes have a radical effect and often happen rapidly was something Linnemann also had to experience when she lived in Beijing. “I loved this city, but then large parts of the traditional, single-story buildings were torn down and entire neighborhoods disappeared.” Small alleys were replaced by wide streets, and car traffic increased massively after the turn of the millennium. “I always thought of Beijing as a bicycle city. The many cars and the noise were a big reason why I didn’t want to live there anymore.”

Today, Linnemann says she has lost her adopted home. In 2013, she returned to Bremen and built up the Confucius Institute there as Executive Director. “Even if I went back, it just wouldn’t be the same.” For the past four years, she has worked independently as a translator and author. In a few weeks, the novel she translated, “Compassion,” by author Lu Nei, will be published by Drachenhaus Verlag. Later this year, one of her translations will also be published as part of the Max Planck Institute’s research project “China – Norms, Ideas, Practices.” Svenja Napp

Angela Wei Dong is moving up the board at US cosmetics company Estée Lauder. Dong currently serves as Managing Director of Nike China. Previously, she worked at Coca-Cola.

Ben Yue has moved up from Head of Fixed Income to Chief Financial Officer (CIO) at the Bank of China in Hong Kong. Yue has previously worked for HSBC and USB.

Is something changing in your organization? Why not let us know at heads@table.media!

On shaky legs, a tiger cub born in April made its first public appearance at the South China Tiger Breeding Station in Suzhou on Monday. In the wild, there has been no trace of the South China tiger “Panthera tigris amoyensis” for more than 20 years.