How much longer will prices continue to fall in China? This is a crucial question for the economic development of the People’s Republic. Japan grappled with a prolonged period of deflation from 1995 until last year, a consequence of a stock market bubble. In China, the current issue is a real estate bubble.

However, even though a comparison might be tempting, China is at a different point in its development. In the short term, policymakers in Beijing could indeed manage to combat deflation. They are receiving unwanted assistance from climate change, which is destroying crops and driving up food prices.

The fear that Big Brother is watching us has been with us since 1984. In China, this is now a certainty. Cameras are ubiquitous. Yet, there is no longer a human behind them; it’s artificial intelligence that won’t let any subversive behavior slip through. Marcel Grzanna describes in the latest installment of our AI series what conclusions AI can already draw from these images.

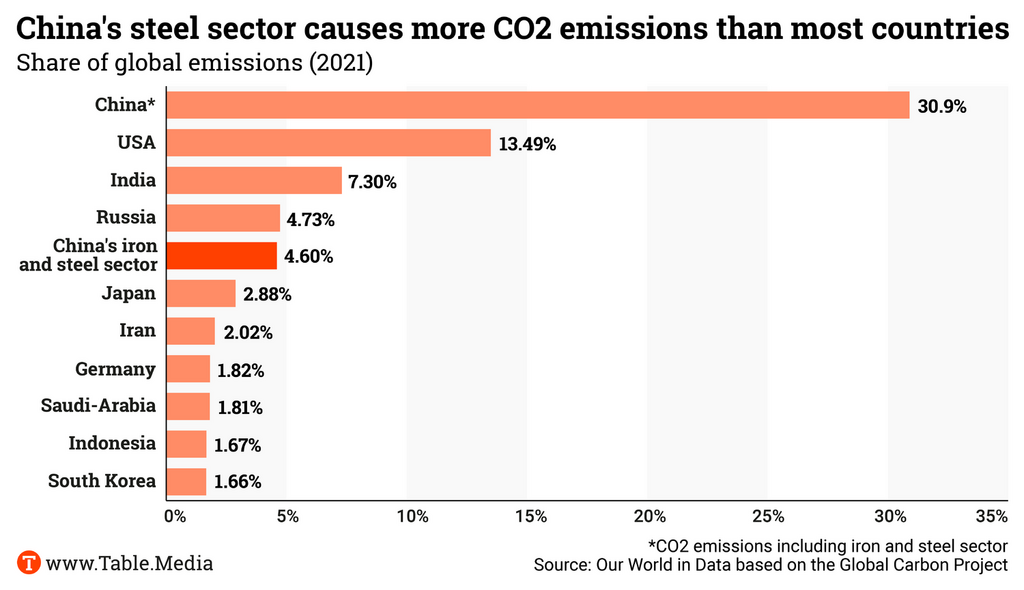

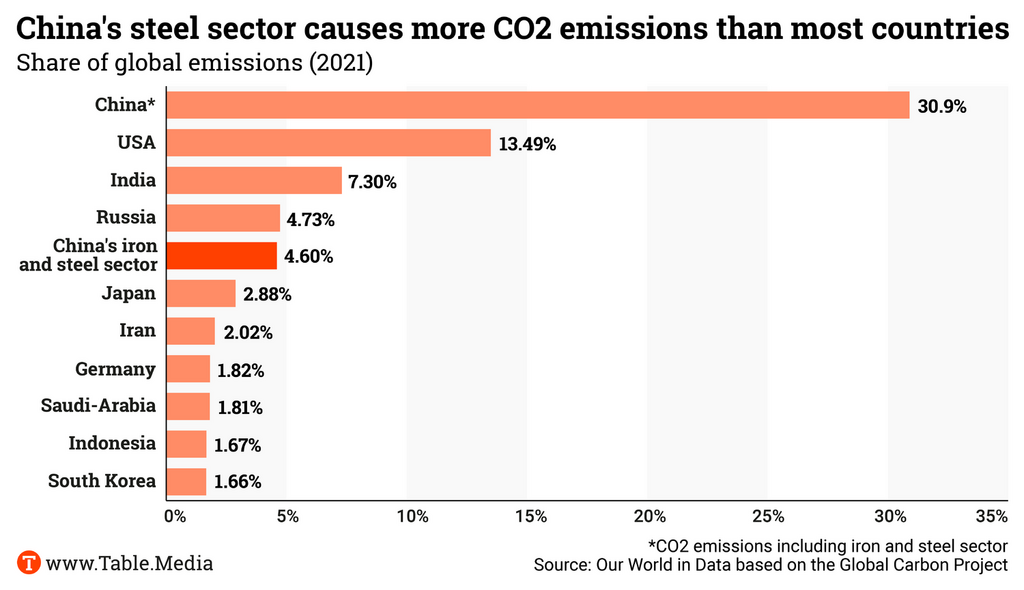

Steel production consumes a significant amount of coal, emitting a considerable amount of climate-harming gases. Alternatives like hydrogen, however, are expensive and still under development. It’s no wonder that China’s steel industry contributes very little to the fight against climate change. Nevertheless, as Nico Beckert illustrates, there are already initial projects underway in China.

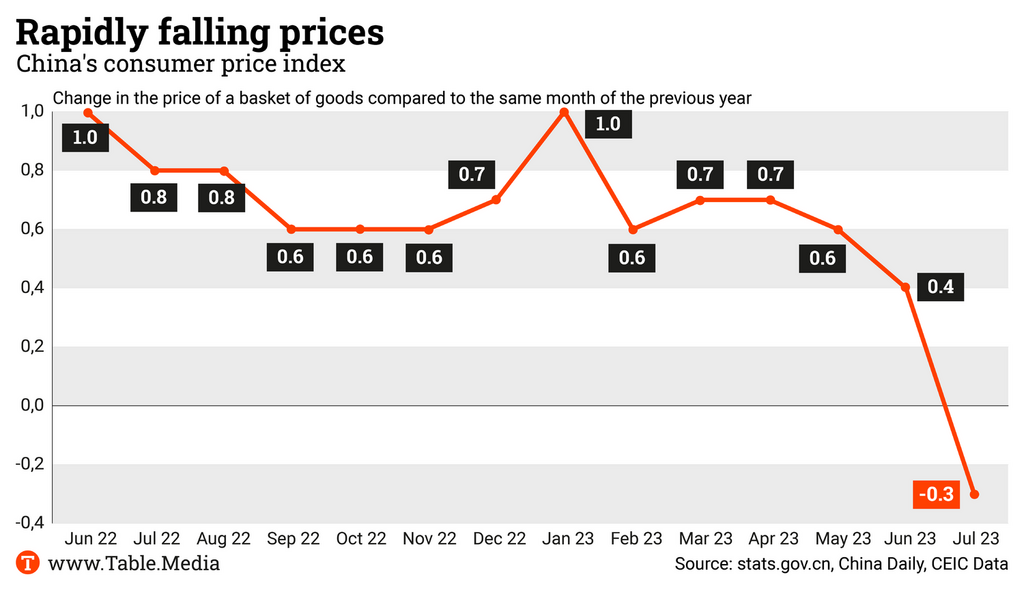

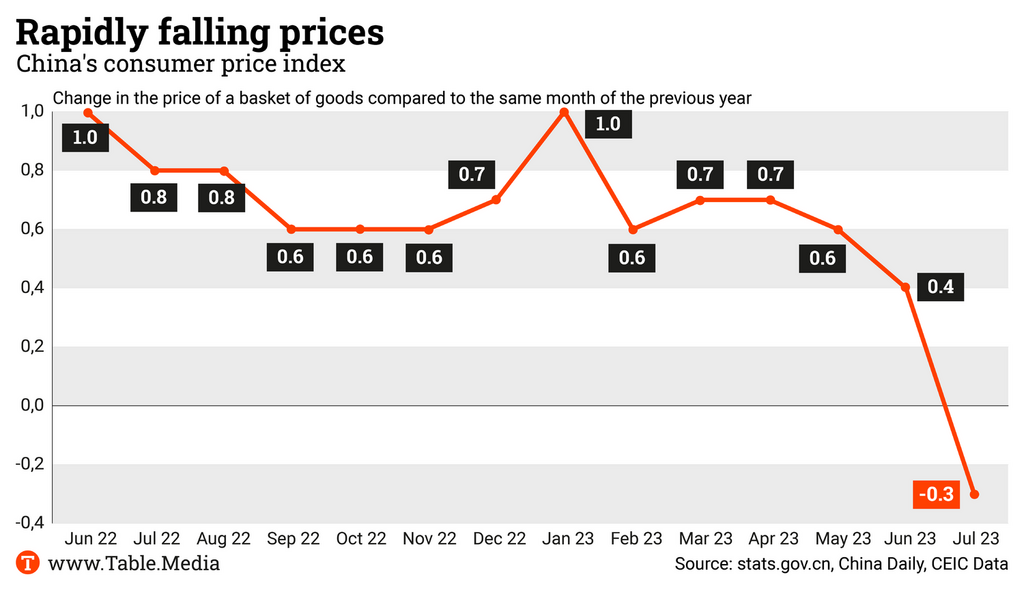

As feared, inflation in China has slipped below zero. It stood at minus 0.3 percent in July. This officially marks a state of deflation, where prices are falling. Economists consider this in many ways more dangerous than inflation. Deflation incentivizes postponing purchases. The current Chinese economy is particularly suffering due to consumer reluctance to buy, compounded by weakening exports, which fell by 14.5 percent in July.

However, there’s a counter-trend hidden behind the deflation data. The comparison with prices from the previous year was at a high level, making a negative percentage value easier to achieve. The monthly comparison shows that the rate of price decline has slowed since June. Additionally, the service sector is still seeing higher prices overall.

Analysts at Nomura, a securities firm, therefore expect prices to continue falling next month. However, this downward trend will likely slow down, probably reaching minus 0.1 percent in August. Prices could even rise again thereafter. Poor harvests due to heat and floods will almost certainly drive up food prices and thus increase the overall cost of the consumer basket.

Soochow Securities in Beijing also anticipates only a short phase of deflation. “Following the Politburo meeting in July, China initiated intensive economic stimulus measures,” says analyst Tao Chuan. There will be better access to cheap credit and general interest rate cuts in the future. The effect could become visible as early as the end of the year, he adds.

In July, it was primarily the drop in pork prices that brought down the costs of the standard consumer basket. Pork had become 7.2 percent cheaper. However, Nomura has already noted a slight price increase by the end of July. Due to high pig stocks on farms, the experts do not expect a swift return to higher prices.

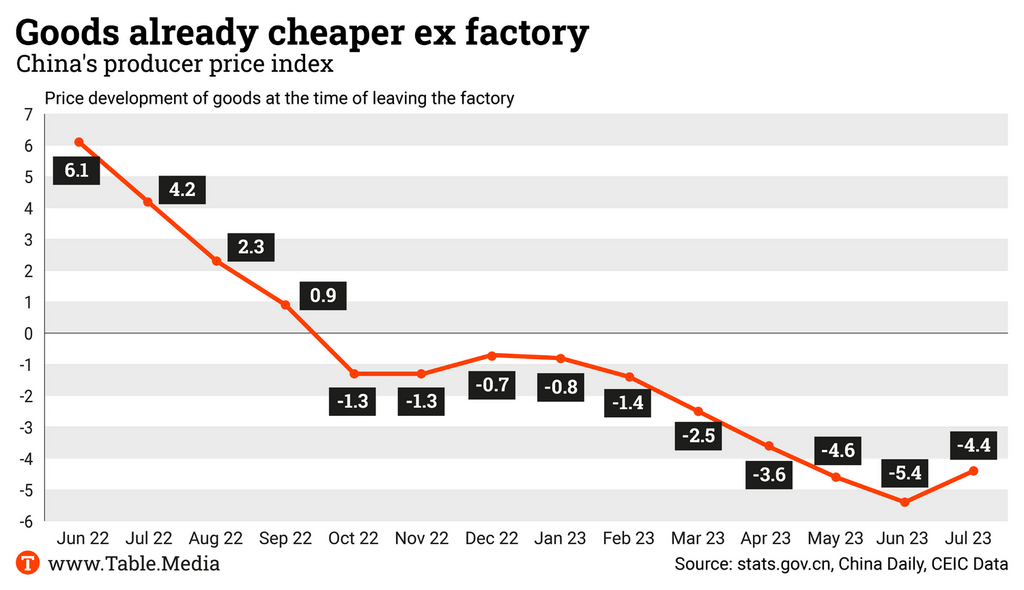

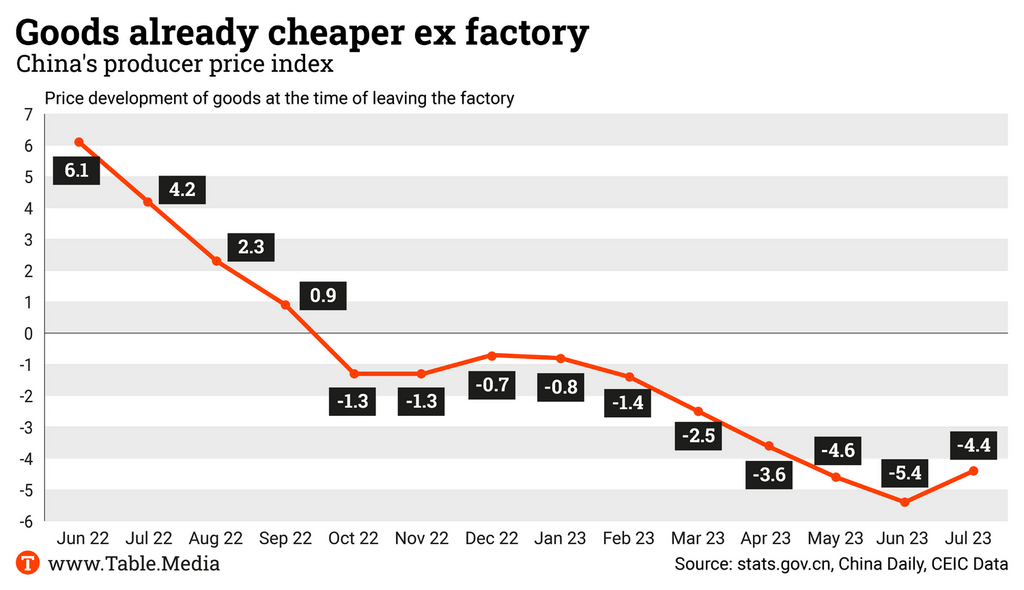

Consumer prices overall are still lagging behind the so-called producer prices. These had already foreshadowed the trend towards deflation. The producer price index reflects the cost of newly manufactured goods before they enter the market. These factory prices have been falling for months. Weak overall demand and low energy prices are the reasons behind this.

This holds good news for Germany. Affordable producer prices in China have global repercussions, given that China is the largest production location. Cheap goods from the Far East could contribute to dampening the still high inflation in the Eurozone.

Even producer prices saw a slight turnaround in July, albeit remaining in negative territory. The decline in producer prices has slowed from minus 5.4 percent to 4.4 percent. However, there is still a considerable distance to go until reaching the zero line, indicating stagnant prices.

Facial recognition technology is a lucrative market in China. Around 8,000 companies have been founded in the past ten years. The pie has been sufficiently large to cater to all competitors so far. Three million public contracts were awarded in the same period. Demand is expected to rise in the near future. China’s surveillance network is tightening, and the Party’s obsession with control is growing.

The Covid-19 pandemic has consistently been used by Beijing to justify increasingly stringent measures under the guise of health policy urgency. Facial recognition is a central element of China’s state surveillance. With the aid of Artificial Intelligence (AI), it’s becoming more sophisticated and precise.

The sophistication of the software now used by Chinese authorities for surveillance is evident in the “one person, one file” technology. This is an advancement of conventional software systems and is capable of identifying individuals with minimal biometric data and linking them in real time with other datasets. Even masks covering the mouth and nose are no longer sufficient to evade identification by this technology.

However, it’s just one component of a technological ecosystem meant to help the autocratic Beijing government enforce its authoritarian policies in the long run. Beijing claims that surveillance is crucial for crime prevention. Human rights organizations like Human Rights Watch, on the other hand, assert that the country is building a surveillance state that intrudes deeply into citizens’ privacy and aims to closely monitor ethnic groups like the Uyghurs.

Big Data is the key. Nowhere else in the world does a government have access to such vast amounts of data and information about citizens as in China. People are becoming entirely transparent actors whose behavior can not only be predicted to some extent but also manipulated.

This may sound like science fiction, but it’s astonishingly real. “By predicting how individuals might respond to incentives, autocrats can use AI technology for behavior manipulation,” said David Yang from Harvard University during a panel discussion in Washington. Yang is one of the authors of the study AI-tocracy, which focuses on the use of AI by autocratic systems.

Political dissent, social unrest, or the development of civic movements are already being identified and eliminated in the early stages. All of this helps an elite defend its monopoly of power over more than a billion people.

For example, protests. Camera systems by Dahua Technology called “Jinn” are now capable of alerting authorities when a person is spotted unfurling a banner. This software has been available since May. It struck a chord, especially after a man managed to attach a banner to a Beijing highway bridge last year, calling for the end of dictatorship.

The continuous optimization of surveillance systems results from close collaboration between the state and technology companies. Companies provide authorities with the necessary software to expand their control capabilities. In return, the state supplies its suppliers with datasets that no one else has access to.

“The company providing AI services to the government can use this data to develop new technologies, with government data serving as input for innovation,” says the co-author of the Harvard study, Noam Yuchtman. Entrepreneurs don’t want to undermine a state that provides them access to valuable data for their innovations. Both sides benefit from this arrangement.

What should be alarming for any democrat is the fact that Chinese AI technologies are already an export success. Half of the global trade in AI facial recognition technology is dominated by shipments from China. “China’s export is highly oriented toward weak democracies or strong autocracies. This is a very different pattern from traditional border technologies, where democratic countries are buyers of these technologies,” says Yuchtman.

China is becoming a roadblock to worldwide efforts for a more climate-friendly steel sector, according to a new report from the Global Energy Monitor. “Coal-based steel production is on the decline, but not quickly enough,” concludes the Global Energy Monitor. China, as the largest steel producer, faces significant challenges:

So far, the climate goals for China’s steel sector aren’t very ambitious. By 2030, it is to achieve a (undefined) emission peak. However, emissions have been slowly decreasing for the past two years, according to Xinyi Shen, a steel expert at the Centre for Research on Energy and Clean Air (CREA). The cause is a reduced demand in the construction and infrastructure sectors, not stricter regulations.

Reducing emissions in sectors like steel and cement production is one of the biggest challenges in climate policy. Yet, there is hope: “Steel has moved from inertia to progress.” states the Global Energy Monitor. Presently, 43 percent of newly planned steel capacities are based on lower-emission electric arc furnaces. Although 57 percent of planned steel plants still rely on coal-based blast furnaces, this number was 67 percent in 2022.

In Europe, three major subsidy packages recently made headlines:

To keep up with the EU’s advanced measures, China’s government has taken some steps to reduce the sector’s emissions in the medium term:

However, many of these measures have loopholes. Caitlin Swalec from the Global Energy Monitor criticizes that some companies are replacing inactive steel plants with new capacities anyway.

Moreover, there are illegally operated, unregistered steel plants that aren’t covered by such “replacement programs”. The government aimed to reduce production capacity to under a billion tons by 2020. However, 1.065 billion tons of steel were produced in the same year, according to expert Xinyi Shen, who estimates that the steel capacity is about 200 million tons higher than planned.

Nevertheless, there are signs of hope. According to Shen, since 2021, the focus of the exchange program has been on low-emission technologies. Between 2021 and the first half of 2023, there have been “promising advancements”. Since 2021, the share of lower-emission electric arc furnaces in the total new capacity has risen to 30 to 40 percent, according to a new CREA analysis.

The world’s first ironworks using hydrogen for direct reduction were built in China, and a hydrogen-based steel plant is currently under construction, with more in the pipeline, says Kevin Tu from Agora Energiewende China. Additionally, some provinces are leading the way with innovative approaches. In Fujian, 90 percent of the state’s revenue from electricity payments by iron and steel manufacturers is reinvested in the sector for electric arc furnaces, energy saving, or CO2 capture. In Sichuan, there are tax incentives for electric arc furnaces, which, unlike other steel plants, are allowed to continue production on days with high pollution, according to Tu.

However, critics say that the investments are insufficient. “Comparing the size of China’s steel industry to the scale of investments in research and development and technological transformation, China lags far behind Europe and the US,” says Caitlin Swalec from the Global Energy Monitor. Data confirms this: In the US and Germany, a similar number of lower-emission steel capacities are set to be created as in China, even though the steel sector in both states is much smaller.

Many Chinese steel companies are holding back from further investments because lower-emission technologies are not yet mature. Moreover, the demand for green steel is not sufficient to incentivize investments, says Shen. Tu adds that carbon capture and storage (CCS) in coal-based blast furnaces is progressing very slowly. Furthermore, in addition to a few major companies, there are numerous small steel producers that lack the necessary resources for investments due to overcapacity and low steel prices, making it difficult to implement climate protection measures.

Pressure could arise from existing energy efficiency requirements. Steel plants that do not meet the prescribed efficiency values by 2025 are to be shut down. According to Kevin Tu, the requirements should lead to 30 percent of current iron and steel capacity being shut down or modernized in the next two years. However, the shutdown of steel plants has not been strictly enforced in the past, says Bin Yan from consulting firm Sinolytics.

China also aims to reduce sector emissions by increased steel scrap recycling. The government plans to “increase the share of scrap-based steel production from ten percent in 2022 to 15 percent in 2025 and further to 20 percent in 2030,” says Kevin Tu. This will “significantly reduce” sector CO2 emissions. By using electric arc furnaces, emissions per ton of steel could be reduced by 70 percent, according to Shen from CREA. However, Caitlin Swalec from the Global Energy Monitor notes that concrete measures for achieving these targets are still lacking.

To curb foreign demand and thus reduce emissions, China’s government has increased export tariffs and reduced tax benefits since 2021. However, due to the weak yuan and low production costs, China’s exports are still highly competitive and recently reached a seven-year high, according to Shen.

“More decisive policy incentives are urgently needed” to lower emissions, says Tu. The high costs and lack of incentives are currently deterring companies from voluntary decarbonization, says Shen. The government needs to “set emission reduction goals, provide financial support and create market incentives to persuade steel manufacturers to change their production methods,” says CREA’s expert.

The latter could be achieved by including the steel sector in China’s emissions trading scheme. From the outside, the EU’s Carbon Border Adjustment Mechanism could also put pressure on Chinese producers, according to Swalec.

The ongoing heavy rains and floods in parts of China are threatening crucial grain-producing regions. The extreme precipitation has persisted since late July. Due to the floods, more than one million people have been forced to leave their homes; at least 62 people have died. The actual number of casualties is likely higher, as many cities do not report victim figures consistently.

Many areas in the key cultivation regions of Heilongjiang, Jilin, and Liaoning provinces have been inundated. These three provinces account for over 20 percent of China’s grain production, as reported by CNN. Already in May, heavy rainfall reportedly destroyed a portion of the harvests in Henan province, leading to the first decline in summer wheat harvest in seven years. The subsequent heatwave affected the new seedlings and hindered their growth. Last summer, extreme weather events had already impacted China’s harvests.

According to Wei Ke from the Chinese Academy of Sciences, climate change is likely partly responsible for the current extreme precipitation. Global warming accelerates the water cycle and increases rainfall worldwide, stated the deputy director of the Monsoon System Research Center to the Chinese newspaper Caixin.

Until now, China has reported very little on potential connections between extreme weather events and climate change. Similarly, climate change is contributing to poor harvests in India, the USA, Canada, and parts of the EU. nib

The United States enjoys greater soft power and popularity in Southeast Asia than China. This is the conclusion of a survey analysis released on Tuesday by the Center for Strategic and International Studies (CSIS) in Washington. Titled “Assessing US and Chinese Influence in Southeast Asia,” the report states that a majority of societies in the region trust US policies and intentions more than those of China. This is particularly true for populous countries like Indonesia, the Philippines and Vietnam. Currently, a dispute between China and the Philippines over the use of Chinese water cannons against Philippine boats is escalating.

The US think tank concludes that Washington has a significant advantage in the strategically important region due to its popularity. Often, the US can form alliances more easily as a result. At the very least, American popularity among the populations prevents these respective states from aligning themselves with Beijing to the detriment of Washington.

The growing concerns about China’s behavior and intentions provide the US with diplomatic and economic opportunities throughout the region, the report further states. “Washington should pursue a positive political, security, and economic agenda to address the situation,” recommends CSIS to the United States. rad

China’s state television broadcaster, CCTV, has released a new documentary series designed to showcase the country’s preparations for a potential attack on Taiwan. The eight-part series titled “Chasing Dreams” (逐梦) premiered this week on the occasion of the 96th anniversary of the People’s Liberation Army. The series features maneuvers and interviews with soldiers who express their willingness to sacrifice their lives for the reunification of Taiwan with the mainland.

Some of the military exercises shown in the film were previously featured in propaganda broadcasts on state television, according to the news agency AP. The documentary particularly emphasizes the aircraft carrier “Shandong”, one of China’s three aircraft carriers, dramatically depicted in formation with other warships. The ship has been repeatedly sighted in the Taiwan Strait in recent months. fpe

He views his role as that of a translator. That’s how it has been since his studies in Chinese regional studies at the University of Cologne, says Matthias Heger. However, he could have never imagined the unconventional paths he would take to fulfill his translation mission.

His professional journey began at a consulting company in Munich. There, Heger was involved in forest investments in China. Once he delved into the subject, he switched to Beijing with a scholarship from the Mercator Foundation to work with the World Bank and GIZ in the field of finance. After a stint at DEG, Matthias Heger led the German-Chinese Energy Dialogue at GIZ in Beijing on behalf of the Federal Ministry for Economic Affairs.

During this time, a whimsical idea emerged, stemming from a project during his studies. As a fun experiment, Matthias Heger had tried his hand at entrepreneurship, but the idea of creating a trendy brand of grain spirits to modernize the old-fashioned reputation of schnapps had yet to take off. Many bottles of grain spirits were still sitting in the Cologne cellar, gathering dust. Matthias Heger had the idea to open a bar in Beijing to sell the spirits there.

However, another spirit came into play: Baijiu, China’s grain-based national spirit. The decisive impulse came from a lecture by Baijiu expert Derek Sandhaus. He passionately extolled the vast range of 12 different Baijiu styles and the unique regional production methods. A tasting impressed Heger, as these Baijiu varieties were unlike any other spirits he had known. And so, the idea emerged to introduce other Westerners to China’s high-proof spirits: in a Baijiu bar. In Beijing!

Baijiu is the world’s largest category of spirits, but it is hardly known outside of China. The spirit is often mistakenly referred to as rice wine, but it is actually made from sorghum and has a higher alcohol content than wine. The flavors differ dramatically, similar to how gin is different from tequila or rum from whisky, explains Matthias Heger. There are four major categories:

Capital Spirits in Beijing was named Bar of the Year. The secret: the “translation work”. Because Matthias Heger’s bar and his partners’ bar combined Chinese spirits with Western cocktail culture for the first time. Baijiu is exclusively consumed as a spirit, whereas in Europe, most spirits end up in cocktails and mixed drinks. The Chinese found it amusing that foreigners were explaining their national spirit to them. Older expats with traumatic Baijiu experiences were skeptical, while younger ones without such experiences were very interested.

An article in The Wall Street Journal brought the breakthrough – not only in terms of customers: Capital Spirits quickly became a popular topic for journalists, both international and local. And through the media coverage in Chinese newspapers and TV shows, Baijiu distilleries also took notice.

State President Xi Jinping’s anti-corruption campaign had hit premium Baijiu brands hard. Expensive bottles of Maotai and others, which could cost several thousand euros, had always been popular as bribes and were a staple at banquets hosted by local governments. The premium brands suffered a significant loss in revenue due to the crackdown on corrupt officials. However, the foreigners with the bar in Beijing suddenly started selling Baijiu to many new target groups, including young Chinese, women and foreigners. This piqued the interest of the manufacturers. Suddenly, representatives from major state-owned enterprises were at their doorstep, wanting to work with Capital Spirits and promote their brands in the bar.

But Matthias Heger and his partners had a different idea: to use their own consulting company to pave the way for Baijiu brands to enter foreign markets. Baijiu expert Derek Sandhaus was on board, and Luzhou Laojiao, China’s oldest distillery, soon expressed interest. The Sichuan Provincial Government at that time aimed to internationalize Baijiu as a traditional product. State-owned distilleries were tasked with achieving this goal – no easy task, as they lacked an understanding of their target markets. The foreigners with the Baijiu business were in the right place at the right time. However, the collaboration took a different direction than planned: Luzhou Laojiao wanted to make Matthias Heger and his partners not only consultants but also partners.

Thus began what was likely the first joint venture between individual foreigners and a billion-dollar Chinese state-owned conglomerate. The negotiations lasted nearly three years, during which flavors were coordinated with the distillery and bartenders in the US to create a taste that would appeal to both Chinese and Western customers. The name was chosen to work in both China and the West. In the end, Ming River emerged as a Baijiu brand for the international market. And for Matthias Heger, it was off to Berlin, where he was to build the European business. But there was another twist for the culture translator. The pandemic slowed down the gastronomy industry and, initially, also the young Baijiu brand. Yet, the pandemic also led to the next chapter in cultural translation work.

A Chinese restaurateur from Berlin called Matthias Heger. He wanted to buy a final bottle of Baijiu and share it with Matthias before he had to close his restaurant due to the pandemic. The evening ended in a brainstorming session about ways to completely redefine Chinese cuisine in Germany and make the Chinese community more visible in Germany. Outside major cities, many Germans still know Chinese food from the same old buffet dishes, but the diversity is hardly recognized. And the Chinese community is not very present either.

From a popup stand with Chinese dumplings at the Streetfood Festival in Berlin’s Markthalle Neun, the Bao Gao Club restaurant emerged, offering Baozi, Jiaozi, Wontons, Soup Dumplings and other small dishes. In the future, Matthias Heger and his partners Wing Liew and Kachun To aim to bring dumplings as frozen convenience products to the German market.

Matthias Heger believes that China is not a monolithic entity but possesses many cultures, which can be well expressed through its food culture. While China polarizes due to politics and cultural unfamiliarity, the country holds genuine soft power in its cuisine. Introducing the various provinces and minorities through Jiaozi fillings represents an unusual form of translation work between cultures but a particularly flavorful one at that. Julia Fiedler

Andy Haslam will be the new Regional President for Greater China at Aston Martin. Haslam has been with the British sports car manufacturer since 2005 and has extensive experience in product development and sales at the company, most recently as head of project management. He will be supported in the region by the appointment of Bernd Pichler as Managing Director. Pichler’s previous roles include Managing Director for Bentley Motors in mainland China, Hong Kong and Macau.

Is something changing in your organization? Let us know at heads@table.media!

Advice for young mothers and the display of proud parental happiness are currently trending in China’s social media sphere. As a substitute for real babies, a stuffed toy monkey from Ikea is becoming increasingly popular. Under the hashtag #宜家猩猩 (Ikea Gorilla), users are posting pictures of their monkeys dressed in cute clothing or on summer vacations perched on their shoulders. Even ultrasound images featuring a photoshopped cuddly toy placed in the uterus are making the rounds. Many view this internet trend as veiled social commentary. Due to high living and education costs and a challenging work environment, particularly for young mothers, the government, which aims to boost population growth, seems to have to settle for plush primates.

How much longer will prices continue to fall in China? This is a crucial question for the economic development of the People’s Republic. Japan grappled with a prolonged period of deflation from 1995 until last year, a consequence of a stock market bubble. In China, the current issue is a real estate bubble.

However, even though a comparison might be tempting, China is at a different point in its development. In the short term, policymakers in Beijing could indeed manage to combat deflation. They are receiving unwanted assistance from climate change, which is destroying crops and driving up food prices.

The fear that Big Brother is watching us has been with us since 1984. In China, this is now a certainty. Cameras are ubiquitous. Yet, there is no longer a human behind them; it’s artificial intelligence that won’t let any subversive behavior slip through. Marcel Grzanna describes in the latest installment of our AI series what conclusions AI can already draw from these images.

Steel production consumes a significant amount of coal, emitting a considerable amount of climate-harming gases. Alternatives like hydrogen, however, are expensive and still under development. It’s no wonder that China’s steel industry contributes very little to the fight against climate change. Nevertheless, as Nico Beckert illustrates, there are already initial projects underway in China.

As feared, inflation in China has slipped below zero. It stood at minus 0.3 percent in July. This officially marks a state of deflation, where prices are falling. Economists consider this in many ways more dangerous than inflation. Deflation incentivizes postponing purchases. The current Chinese economy is particularly suffering due to consumer reluctance to buy, compounded by weakening exports, which fell by 14.5 percent in July.

However, there’s a counter-trend hidden behind the deflation data. The comparison with prices from the previous year was at a high level, making a negative percentage value easier to achieve. The monthly comparison shows that the rate of price decline has slowed since June. Additionally, the service sector is still seeing higher prices overall.

Analysts at Nomura, a securities firm, therefore expect prices to continue falling next month. However, this downward trend will likely slow down, probably reaching minus 0.1 percent in August. Prices could even rise again thereafter. Poor harvests due to heat and floods will almost certainly drive up food prices and thus increase the overall cost of the consumer basket.

Soochow Securities in Beijing also anticipates only a short phase of deflation. “Following the Politburo meeting in July, China initiated intensive economic stimulus measures,” says analyst Tao Chuan. There will be better access to cheap credit and general interest rate cuts in the future. The effect could become visible as early as the end of the year, he adds.

In July, it was primarily the drop in pork prices that brought down the costs of the standard consumer basket. Pork had become 7.2 percent cheaper. However, Nomura has already noted a slight price increase by the end of July. Due to high pig stocks on farms, the experts do not expect a swift return to higher prices.

Consumer prices overall are still lagging behind the so-called producer prices. These had already foreshadowed the trend towards deflation. The producer price index reflects the cost of newly manufactured goods before they enter the market. These factory prices have been falling for months. Weak overall demand and low energy prices are the reasons behind this.

This holds good news for Germany. Affordable producer prices in China have global repercussions, given that China is the largest production location. Cheap goods from the Far East could contribute to dampening the still high inflation in the Eurozone.

Even producer prices saw a slight turnaround in July, albeit remaining in negative territory. The decline in producer prices has slowed from minus 5.4 percent to 4.4 percent. However, there is still a considerable distance to go until reaching the zero line, indicating stagnant prices.

Facial recognition technology is a lucrative market in China. Around 8,000 companies have been founded in the past ten years. The pie has been sufficiently large to cater to all competitors so far. Three million public contracts were awarded in the same period. Demand is expected to rise in the near future. China’s surveillance network is tightening, and the Party’s obsession with control is growing.

The Covid-19 pandemic has consistently been used by Beijing to justify increasingly stringent measures under the guise of health policy urgency. Facial recognition is a central element of China’s state surveillance. With the aid of Artificial Intelligence (AI), it’s becoming more sophisticated and precise.

The sophistication of the software now used by Chinese authorities for surveillance is evident in the “one person, one file” technology. This is an advancement of conventional software systems and is capable of identifying individuals with minimal biometric data and linking them in real time with other datasets. Even masks covering the mouth and nose are no longer sufficient to evade identification by this technology.

However, it’s just one component of a technological ecosystem meant to help the autocratic Beijing government enforce its authoritarian policies in the long run. Beijing claims that surveillance is crucial for crime prevention. Human rights organizations like Human Rights Watch, on the other hand, assert that the country is building a surveillance state that intrudes deeply into citizens’ privacy and aims to closely monitor ethnic groups like the Uyghurs.

Big Data is the key. Nowhere else in the world does a government have access to such vast amounts of data and information about citizens as in China. People are becoming entirely transparent actors whose behavior can not only be predicted to some extent but also manipulated.

This may sound like science fiction, but it’s astonishingly real. “By predicting how individuals might respond to incentives, autocrats can use AI technology for behavior manipulation,” said David Yang from Harvard University during a panel discussion in Washington. Yang is one of the authors of the study AI-tocracy, which focuses on the use of AI by autocratic systems.

Political dissent, social unrest, or the development of civic movements are already being identified and eliminated in the early stages. All of this helps an elite defend its monopoly of power over more than a billion people.

For example, protests. Camera systems by Dahua Technology called “Jinn” are now capable of alerting authorities when a person is spotted unfurling a banner. This software has been available since May. It struck a chord, especially after a man managed to attach a banner to a Beijing highway bridge last year, calling for the end of dictatorship.

The continuous optimization of surveillance systems results from close collaboration between the state and technology companies. Companies provide authorities with the necessary software to expand their control capabilities. In return, the state supplies its suppliers with datasets that no one else has access to.

“The company providing AI services to the government can use this data to develop new technologies, with government data serving as input for innovation,” says the co-author of the Harvard study, Noam Yuchtman. Entrepreneurs don’t want to undermine a state that provides them access to valuable data for their innovations. Both sides benefit from this arrangement.

What should be alarming for any democrat is the fact that Chinese AI technologies are already an export success. Half of the global trade in AI facial recognition technology is dominated by shipments from China. “China’s export is highly oriented toward weak democracies or strong autocracies. This is a very different pattern from traditional border technologies, where democratic countries are buyers of these technologies,” says Yuchtman.

China is becoming a roadblock to worldwide efforts for a more climate-friendly steel sector, according to a new report from the Global Energy Monitor. “Coal-based steel production is on the decline, but not quickly enough,” concludes the Global Energy Monitor. China, as the largest steel producer, faces significant challenges:

So far, the climate goals for China’s steel sector aren’t very ambitious. By 2030, it is to achieve a (undefined) emission peak. However, emissions have been slowly decreasing for the past two years, according to Xinyi Shen, a steel expert at the Centre for Research on Energy and Clean Air (CREA). The cause is a reduced demand in the construction and infrastructure sectors, not stricter regulations.

Reducing emissions in sectors like steel and cement production is one of the biggest challenges in climate policy. Yet, there is hope: “Steel has moved from inertia to progress.” states the Global Energy Monitor. Presently, 43 percent of newly planned steel capacities are based on lower-emission electric arc furnaces. Although 57 percent of planned steel plants still rely on coal-based blast furnaces, this number was 67 percent in 2022.

In Europe, three major subsidy packages recently made headlines:

To keep up with the EU’s advanced measures, China’s government has taken some steps to reduce the sector’s emissions in the medium term:

However, many of these measures have loopholes. Caitlin Swalec from the Global Energy Monitor criticizes that some companies are replacing inactive steel plants with new capacities anyway.

Moreover, there are illegally operated, unregistered steel plants that aren’t covered by such “replacement programs”. The government aimed to reduce production capacity to under a billion tons by 2020. However, 1.065 billion tons of steel were produced in the same year, according to expert Xinyi Shen, who estimates that the steel capacity is about 200 million tons higher than planned.

Nevertheless, there are signs of hope. According to Shen, since 2021, the focus of the exchange program has been on low-emission technologies. Between 2021 and the first half of 2023, there have been “promising advancements”. Since 2021, the share of lower-emission electric arc furnaces in the total new capacity has risen to 30 to 40 percent, according to a new CREA analysis.

The world’s first ironworks using hydrogen for direct reduction were built in China, and a hydrogen-based steel plant is currently under construction, with more in the pipeline, says Kevin Tu from Agora Energiewende China. Additionally, some provinces are leading the way with innovative approaches. In Fujian, 90 percent of the state’s revenue from electricity payments by iron and steel manufacturers is reinvested in the sector for electric arc furnaces, energy saving, or CO2 capture. In Sichuan, there are tax incentives for electric arc furnaces, which, unlike other steel plants, are allowed to continue production on days with high pollution, according to Tu.

However, critics say that the investments are insufficient. “Comparing the size of China’s steel industry to the scale of investments in research and development and technological transformation, China lags far behind Europe and the US,” says Caitlin Swalec from the Global Energy Monitor. Data confirms this: In the US and Germany, a similar number of lower-emission steel capacities are set to be created as in China, even though the steel sector in both states is much smaller.

Many Chinese steel companies are holding back from further investments because lower-emission technologies are not yet mature. Moreover, the demand for green steel is not sufficient to incentivize investments, says Shen. Tu adds that carbon capture and storage (CCS) in coal-based blast furnaces is progressing very slowly. Furthermore, in addition to a few major companies, there are numerous small steel producers that lack the necessary resources for investments due to overcapacity and low steel prices, making it difficult to implement climate protection measures.

Pressure could arise from existing energy efficiency requirements. Steel plants that do not meet the prescribed efficiency values by 2025 are to be shut down. According to Kevin Tu, the requirements should lead to 30 percent of current iron and steel capacity being shut down or modernized in the next two years. However, the shutdown of steel plants has not been strictly enforced in the past, says Bin Yan from consulting firm Sinolytics.

China also aims to reduce sector emissions by increased steel scrap recycling. The government plans to “increase the share of scrap-based steel production from ten percent in 2022 to 15 percent in 2025 and further to 20 percent in 2030,” says Kevin Tu. This will “significantly reduce” sector CO2 emissions. By using electric arc furnaces, emissions per ton of steel could be reduced by 70 percent, according to Shen from CREA. However, Caitlin Swalec from the Global Energy Monitor notes that concrete measures for achieving these targets are still lacking.

To curb foreign demand and thus reduce emissions, China’s government has increased export tariffs and reduced tax benefits since 2021. However, due to the weak yuan and low production costs, China’s exports are still highly competitive and recently reached a seven-year high, according to Shen.

“More decisive policy incentives are urgently needed” to lower emissions, says Tu. The high costs and lack of incentives are currently deterring companies from voluntary decarbonization, says Shen. The government needs to “set emission reduction goals, provide financial support and create market incentives to persuade steel manufacturers to change their production methods,” says CREA’s expert.

The latter could be achieved by including the steel sector in China’s emissions trading scheme. From the outside, the EU’s Carbon Border Adjustment Mechanism could also put pressure on Chinese producers, according to Swalec.

The ongoing heavy rains and floods in parts of China are threatening crucial grain-producing regions. The extreme precipitation has persisted since late July. Due to the floods, more than one million people have been forced to leave their homes; at least 62 people have died. The actual number of casualties is likely higher, as many cities do not report victim figures consistently.

Many areas in the key cultivation regions of Heilongjiang, Jilin, and Liaoning provinces have been inundated. These three provinces account for over 20 percent of China’s grain production, as reported by CNN. Already in May, heavy rainfall reportedly destroyed a portion of the harvests in Henan province, leading to the first decline in summer wheat harvest in seven years. The subsequent heatwave affected the new seedlings and hindered their growth. Last summer, extreme weather events had already impacted China’s harvests.

According to Wei Ke from the Chinese Academy of Sciences, climate change is likely partly responsible for the current extreme precipitation. Global warming accelerates the water cycle and increases rainfall worldwide, stated the deputy director of the Monsoon System Research Center to the Chinese newspaper Caixin.

Until now, China has reported very little on potential connections between extreme weather events and climate change. Similarly, climate change is contributing to poor harvests in India, the USA, Canada, and parts of the EU. nib

The United States enjoys greater soft power and popularity in Southeast Asia than China. This is the conclusion of a survey analysis released on Tuesday by the Center for Strategic and International Studies (CSIS) in Washington. Titled “Assessing US and Chinese Influence in Southeast Asia,” the report states that a majority of societies in the region trust US policies and intentions more than those of China. This is particularly true for populous countries like Indonesia, the Philippines and Vietnam. Currently, a dispute between China and the Philippines over the use of Chinese water cannons against Philippine boats is escalating.

The US think tank concludes that Washington has a significant advantage in the strategically important region due to its popularity. Often, the US can form alliances more easily as a result. At the very least, American popularity among the populations prevents these respective states from aligning themselves with Beijing to the detriment of Washington.

The growing concerns about China’s behavior and intentions provide the US with diplomatic and economic opportunities throughout the region, the report further states. “Washington should pursue a positive political, security, and economic agenda to address the situation,” recommends CSIS to the United States. rad

China’s state television broadcaster, CCTV, has released a new documentary series designed to showcase the country’s preparations for a potential attack on Taiwan. The eight-part series titled “Chasing Dreams” (逐梦) premiered this week on the occasion of the 96th anniversary of the People’s Liberation Army. The series features maneuvers and interviews with soldiers who express their willingness to sacrifice their lives for the reunification of Taiwan with the mainland.

Some of the military exercises shown in the film were previously featured in propaganda broadcasts on state television, according to the news agency AP. The documentary particularly emphasizes the aircraft carrier “Shandong”, one of China’s three aircraft carriers, dramatically depicted in formation with other warships. The ship has been repeatedly sighted in the Taiwan Strait in recent months. fpe

He views his role as that of a translator. That’s how it has been since his studies in Chinese regional studies at the University of Cologne, says Matthias Heger. However, he could have never imagined the unconventional paths he would take to fulfill his translation mission.

His professional journey began at a consulting company in Munich. There, Heger was involved in forest investments in China. Once he delved into the subject, he switched to Beijing with a scholarship from the Mercator Foundation to work with the World Bank and GIZ in the field of finance. After a stint at DEG, Matthias Heger led the German-Chinese Energy Dialogue at GIZ in Beijing on behalf of the Federal Ministry for Economic Affairs.

During this time, a whimsical idea emerged, stemming from a project during his studies. As a fun experiment, Matthias Heger had tried his hand at entrepreneurship, but the idea of creating a trendy brand of grain spirits to modernize the old-fashioned reputation of schnapps had yet to take off. Many bottles of grain spirits were still sitting in the Cologne cellar, gathering dust. Matthias Heger had the idea to open a bar in Beijing to sell the spirits there.

However, another spirit came into play: Baijiu, China’s grain-based national spirit. The decisive impulse came from a lecture by Baijiu expert Derek Sandhaus. He passionately extolled the vast range of 12 different Baijiu styles and the unique regional production methods. A tasting impressed Heger, as these Baijiu varieties were unlike any other spirits he had known. And so, the idea emerged to introduce other Westerners to China’s high-proof spirits: in a Baijiu bar. In Beijing!

Baijiu is the world’s largest category of spirits, but it is hardly known outside of China. The spirit is often mistakenly referred to as rice wine, but it is actually made from sorghum and has a higher alcohol content than wine. The flavors differ dramatically, similar to how gin is different from tequila or rum from whisky, explains Matthias Heger. There are four major categories:

Capital Spirits in Beijing was named Bar of the Year. The secret: the “translation work”. Because Matthias Heger’s bar and his partners’ bar combined Chinese spirits with Western cocktail culture for the first time. Baijiu is exclusively consumed as a spirit, whereas in Europe, most spirits end up in cocktails and mixed drinks. The Chinese found it amusing that foreigners were explaining their national spirit to them. Older expats with traumatic Baijiu experiences were skeptical, while younger ones without such experiences were very interested.

An article in The Wall Street Journal brought the breakthrough – not only in terms of customers: Capital Spirits quickly became a popular topic for journalists, both international and local. And through the media coverage in Chinese newspapers and TV shows, Baijiu distilleries also took notice.

State President Xi Jinping’s anti-corruption campaign had hit premium Baijiu brands hard. Expensive bottles of Maotai and others, which could cost several thousand euros, had always been popular as bribes and were a staple at banquets hosted by local governments. The premium brands suffered a significant loss in revenue due to the crackdown on corrupt officials. However, the foreigners with the bar in Beijing suddenly started selling Baijiu to many new target groups, including young Chinese, women and foreigners. This piqued the interest of the manufacturers. Suddenly, representatives from major state-owned enterprises were at their doorstep, wanting to work with Capital Spirits and promote their brands in the bar.

But Matthias Heger and his partners had a different idea: to use their own consulting company to pave the way for Baijiu brands to enter foreign markets. Baijiu expert Derek Sandhaus was on board, and Luzhou Laojiao, China’s oldest distillery, soon expressed interest. The Sichuan Provincial Government at that time aimed to internationalize Baijiu as a traditional product. State-owned distilleries were tasked with achieving this goal – no easy task, as they lacked an understanding of their target markets. The foreigners with the Baijiu business were in the right place at the right time. However, the collaboration took a different direction than planned: Luzhou Laojiao wanted to make Matthias Heger and his partners not only consultants but also partners.

Thus began what was likely the first joint venture between individual foreigners and a billion-dollar Chinese state-owned conglomerate. The negotiations lasted nearly three years, during which flavors were coordinated with the distillery and bartenders in the US to create a taste that would appeal to both Chinese and Western customers. The name was chosen to work in both China and the West. In the end, Ming River emerged as a Baijiu brand for the international market. And for Matthias Heger, it was off to Berlin, where he was to build the European business. But there was another twist for the culture translator. The pandemic slowed down the gastronomy industry and, initially, also the young Baijiu brand. Yet, the pandemic also led to the next chapter in cultural translation work.

A Chinese restaurateur from Berlin called Matthias Heger. He wanted to buy a final bottle of Baijiu and share it with Matthias before he had to close his restaurant due to the pandemic. The evening ended in a brainstorming session about ways to completely redefine Chinese cuisine in Germany and make the Chinese community more visible in Germany. Outside major cities, many Germans still know Chinese food from the same old buffet dishes, but the diversity is hardly recognized. And the Chinese community is not very present either.

From a popup stand with Chinese dumplings at the Streetfood Festival in Berlin’s Markthalle Neun, the Bao Gao Club restaurant emerged, offering Baozi, Jiaozi, Wontons, Soup Dumplings and other small dishes. In the future, Matthias Heger and his partners Wing Liew and Kachun To aim to bring dumplings as frozen convenience products to the German market.

Matthias Heger believes that China is not a monolithic entity but possesses many cultures, which can be well expressed through its food culture. While China polarizes due to politics and cultural unfamiliarity, the country holds genuine soft power in its cuisine. Introducing the various provinces and minorities through Jiaozi fillings represents an unusual form of translation work between cultures but a particularly flavorful one at that. Julia Fiedler

Andy Haslam will be the new Regional President for Greater China at Aston Martin. Haslam has been with the British sports car manufacturer since 2005 and has extensive experience in product development and sales at the company, most recently as head of project management. He will be supported in the region by the appointment of Bernd Pichler as Managing Director. Pichler’s previous roles include Managing Director for Bentley Motors in mainland China, Hong Kong and Macau.

Is something changing in your organization? Let us know at heads@table.media!

Advice for young mothers and the display of proud parental happiness are currently trending in China’s social media sphere. As a substitute for real babies, a stuffed toy monkey from Ikea is becoming increasingly popular. Under the hashtag #宜家猩猩 (Ikea Gorilla), users are posting pictures of their monkeys dressed in cute clothing or on summer vacations perched on their shoulders. Even ultrasound images featuring a photoshopped cuddly toy placed in the uterus are making the rounds. Many view this internet trend as veiled social commentary. Due to high living and education costs and a challenging work environment, particularly for young mothers, the government, which aims to boost population growth, seems to have to settle for plush primates.