Will German car manufacturers become China’s stepping stones to Europe? That was the question in yesterday’s editorial after the uproar surrounding Mercedes CEO Ola Kallenius, who expressly rejects EU punitive tariffs against Chinese EVs and faced considerable backlash.

For today’s issue, I passed the question on to Daniel Kirchert, who has almost 20 years of China experience in the automotive industry, including a management position at BMW and as founder of the EV start-up Byton. He agrees with Kallenius’ stance. This is despite his rather bleak forecasts for the German and European automotive industry. However, they can only improve if we invest in innovation instead of closing ourselves off, says Kirchert. And shows how German car manufacturers can still remain successful.

Nico Beckert’s analysis of China’s electricity storage systems also focuses on the green transformation. China has been experiencing a renewables boom for years, and recently, there has been a boom in electricity storage systems. But they are a costly safety net. The flaws in China’s energy grid are making rapid expansion necessary.

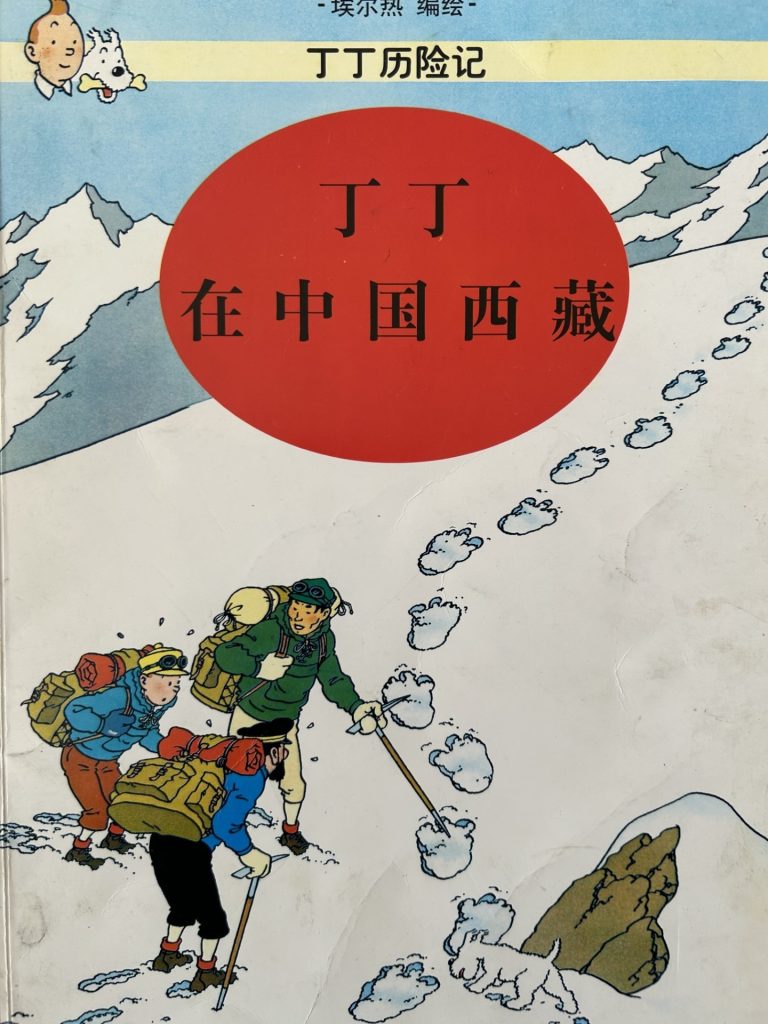

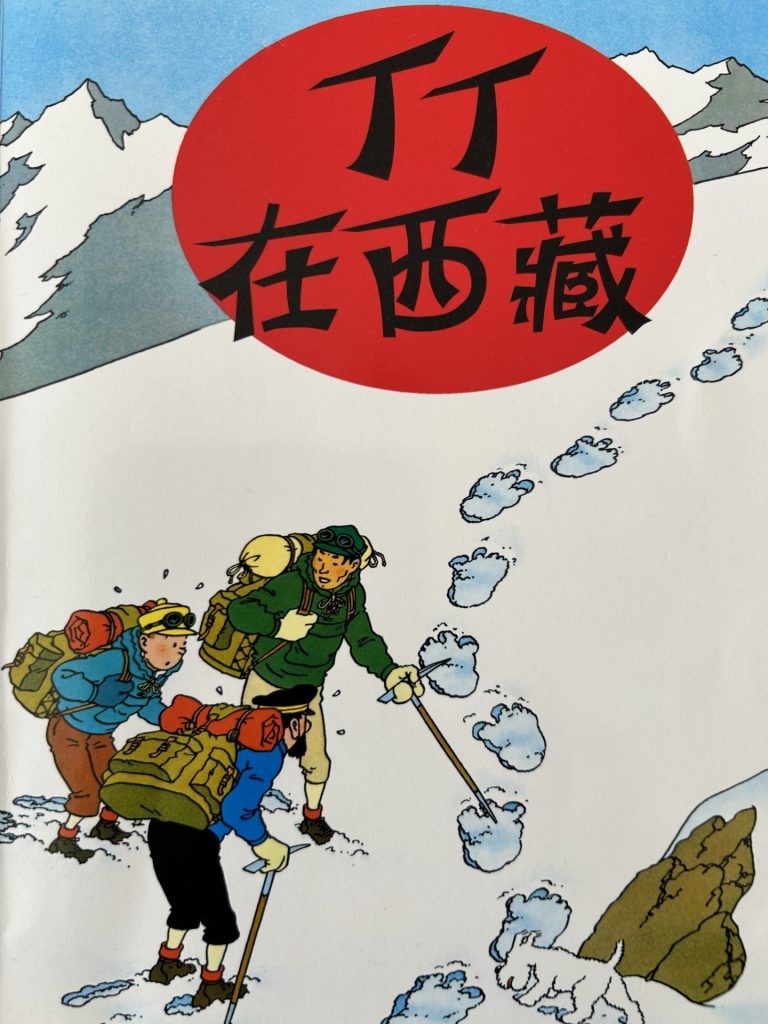

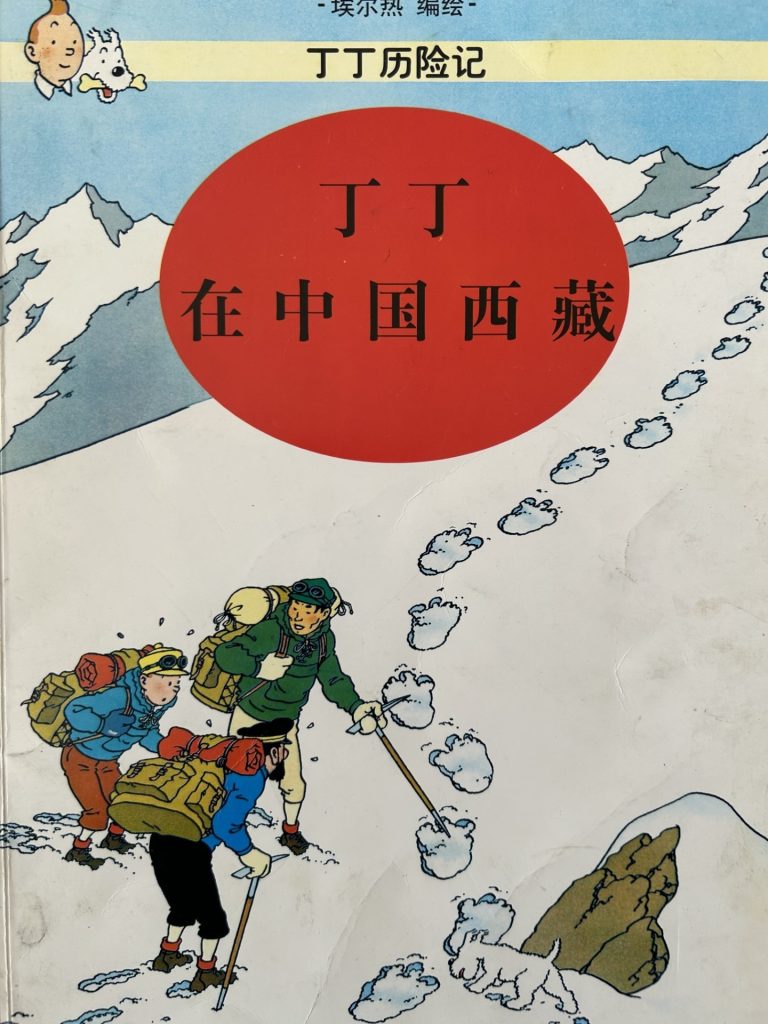

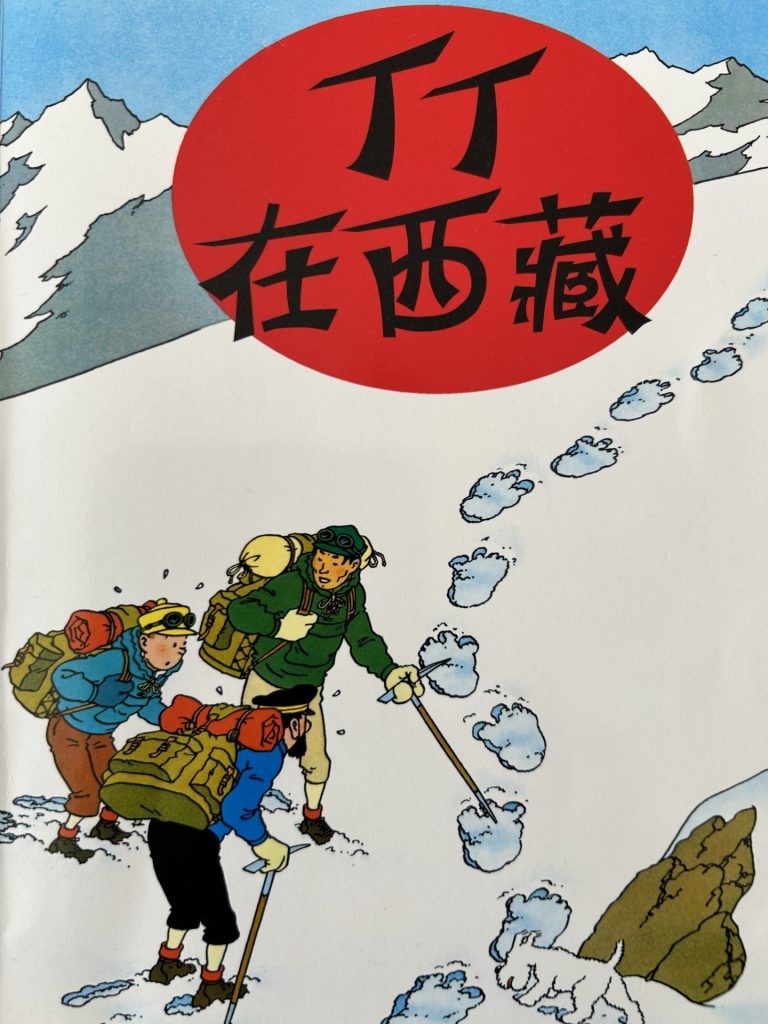

Children and adults worldwide treasure the cartoon character Tintin for his daring adventures. That includes China, where the hero is called Dingding. One particular volume of the comic series has a special story, ‘Tintin in Tibet.’

Johnny Erling’s column tells the story of the bizarre dispute over the book’s title, which Hergé’s widow surprisingly won. The publisher, who was loyal to the regime, had simply renamed the title “Tintin in China’s Xizang.” His widow managed to have the reference to China dropped. But this is only a small part of the propaganda attempts to internationally replace Tibet with the name “Xizang.”

Mercedes CEO Ola Källenius has called on the EU Commission to lower tariffs on Chinese EVs instead of considering increasing them further. Is this demand naive?

I agree with him on that. It is completely wrong to come up with regulations and trade barriers instead of pursuing a solid industrial policy. It is important that we have a free market and that the EU promotes innovation and competition. This also includes supporting companies so that they can make faster progress in the field of electromobility.

Kallenius is accused of pursuing his own interests with his statement because he has Mercedes-Benz sales in China in mind.

That’s certainly not entirely wrong. If the EU imposes high punitive tariffs on Chinese EVs, there is bound to be a massive backlash from China, which may depress EU manufacturers’ sales in China. I believe it is very important that punitive tariffs do not prevent the EU from strengthening its own companies.

How will Chinese manufacturers deal with possible punitive tariffs?

But I believe that the manufacturers going to Europe are already looking very closely at the issue. Beijing has also said that now is the time to make EVs a global issue in times of a declining reputation and a difficult economic situation. But that is also normal. The Chinese automotive industry is lagging behind in globalization. Automotive companies from all countries try to go global at some point. The Chinese have long slept on this, or at least only managed it in some regions such as Africa. It is long overdue for their companies to globalize properly.

Elon Musk said a few weeks ago that Chinese EV manufacturers will ‘demolish’ most other car companies…

I believe that the situation is extremely dramatic. The ship has more or less sailed, and there really will be a wave here in Europe. It is absolutely possible that Chinese brands will grab 20 to 30 percent of the market in a few years – even with punitive tariffs.

How many brands will come?

I expect around 25 Chinese brands. From a consumer perspective, this is, of course, totally confusing, and some will fail, not because they have bad cars but because they fail to position their brand with the customer and create good branding or successfully build up their distribution structure. After-sales are crucial and often underestimated by many Chinese manufacturers. However, manufacturers must gain customer trust by establishing good service structures before selling cars. That is why I founded the start-up Noyo, which offers Chinese manufacturers this customer service for Swiss customers.

The fact that Europe urgently needs affordable cars to boost electromobility could benefit them. Will the Chinese fill this gap?

I think some Chinese cars in the 20,000 to 25,000 euro range will be launched on the European market this year. Whether they will all be a perfect fit remains to be seen, but in terms of cost structure, they can keep up with gas-powered cars.

Which cars specifically?

BYD already has the Atto and the Dolphin. Dongfeng has just launched the Nammi in China. Nammi is a separate brand in China, but here, it will run under the Dongfeng brand as the Dongfeng Nano Box. It looks like a cross between a Mini and a Smart, costing around 10,000 euros in China. I have also heard that the Aion Y from Guangzhou-Automotive (GAC) is coming this year. It will cost the equivalent of around 15,000 euros in China. And there will be a new entry-level model from MG. Chery is also coming.

China has enormous overcapacity, and demand is weakening. For months, manufacturers have been offering discounts to boost sales. What impact is this price war having?

This competition is brutal. The cars are sold at prices that result in negative margins, and the volumes are not yet large enough to achieve economies of scale. But it doesn’t work without economies of scale. If you can’t achieve – let’s say – half a million cars, you won’t have a competitive structure in the long term. Some manufacturers, like Porsche or Ferrari, do very well with small quantities. But these are extremely powerful brands in the premium and luxury segment. The law of size and volume applies to everything that is not luxury in order to bring costs down.

Is it all a matter of cost?

The current stage is not just about costs but also about product power and branding. Companies need to launch attractive, competitive vehicles on the market, which is why players like XPeng and NIO, which are still relatively small with their 140,000 and 160,000 vehicles sold in 2023, respectively, should not be written off. They simply have incredibly good products.

Will the Chinese market consolidate soon?

Many start-ups have already disappeared in the last five years. The theory is that five manufacturers will remain in the end. However, I do not share this opinion due to the specific structure of these companies in China.

Why not?

Only a handful of the “traditional” car manufacturers in China, i.e., those that are 20 years or older, are privately owned. These include BYD and Geely, for example. Most are state-owned corporations: Dongfeng, FAW, and Changan are under the central government, and all others are under provincial governments. The big provincial companies are unlikely to go bankrupt or consolidate because they are backed by strong local interests. That is why I believe that in the event of consolidation, 25 or 35 companies will be left in the end, simply because each province will do everything it can to keep its automotive industry running, even if that doesn’t make sense from a market-economy competition perspective.

Let’s return to Europe and Ola Kallenius. How aware of reality are the bosses of European car manufacturers?

As one of the big European players, Stellantis has invested a huge sum of 1.5 billion euros in Leapmotor. That shows that the awareness is there. BMW and Mercedes have not yet formed such partnerships, but I think they are taking the situation seriously. However, I don’t know whether they have fully grasped it.

How do you see the current situation?

If the volume of a large premium manufacturer that sells two to three million cars a year suddenly drops by 10 percent or even 15 to 20 percent, then that is difficult to compensate for. The companies are still highly profitable, but this is also because we have a lag effect of four to five years between development and sales.

What does difficult to compensate mean?

If the volume goes down, that means that massive numbers of people will have to be laid off and plants closed. Hardly anyone will be able to avoid that. If BMW, Audi and Mercedes sales figures in China, which were between 700,000 and 800,000 vehicles in 2023, drop to 500,000 or 400,000 in a few years, this will have a massive impact on the German economy. And so far we’ve only looked at sales in China and haven’t even talked about sales in Europe. If some Chinese manufacturers enter the European market, not just the premium brands but also the volume brands that compete with the core brands of Volkswagen and Stellantis, things will get nasty.

How could German and European manufacturers manage to maintain their position?

First of all, you must take an honest look in the mirror and admit you are late. And then press a radical reset button and redefine yourself. All these German companies have led the automotive world for over 100 years, and they have always been innovation leaders. And now they have slipped into the role of followers. How do you go from being a follower to a leader again? That’s damn hard, and there’s no simple answer. Self-awareness and a sense of urgency are the most important things.

What could such a redefinition look like?

The German car manufacturers have fantastic people. You have to start at the top with the management and allow radical innovation. We won’t beat the Chinese on the cost side. I generally see two options for Europe. One is genuine sustainability. Switching from gasoline to electric cars and then having no more emissions is only part of the sustainability story. What we really need are cars with 100 percent circular materials, smaller and sustainable batteries that are lighter and manufactured with a zero carbon footprint. This kind of genuine, sustainable mobility concept really ought to come from Europe. But I’m not so optimistic, because most companies are engaged in brutal greenwashing. It’s purely a PR ploy, it doesn’t come from a deeper insight at management level.

And what is the second option?

I also think that if you want to turn things around, you must create new structures. You actually have to create start-up structures in large companies. In other words, create spin-offs, set up small new units and send your best people there. They need the support of the headquarters and a firewall, because many innovations and changes are stopped in large corporations. In order to become faster, more agile and more innovative, you have to create such pockets that can be run like start-ups. You have to be open to radical ideas. Reinvent yourself, redefine yourself, from customer experience, the entire sales process, the products, real sustainability. When it comes to sustainability in particular, Europe has a chance.

Dr Daniel Kirchert held various management positions in China for 18 years, including at BMW’s joint venture with Brilliance and in the top management of Nissan’s premium brand Infiniti. He later founded the EV start-up BYTON, which, however, failed. After his return to Germany, he founded NOYO Mobility AG, a platform designed to help Chinese manufacturers sell their EVs in Europe.

Over the past year, China built more solar plants (217 gigawatts of new capacity) than the United States installed solar power plants (175 GW). However, the Chinese boom highlights the design flaws of the national energy system. According to some energy sector managers, China will have to significantly curtail wind and solar power production this year compared to previous years.

In theory, an overproduction of renewables could be balanced out quite well through electricity trading: If the wind is very strong in the country’s west, the electricity could be consumed in the industrial hubs in the east. However, many Chinese provinces reject importing electricity from their neighbors. Reforms to the inflexible electricity market have been delayed for 20 years. Instead, massive amounts of energy storage are now being built to reduce the curtailment of renewables, meaning that fewer solar and wind power plants have to be switched off if they generate too much electricity overall. But this makes the energy transition more expensive. And these storage facilities have hardly been used so far, meaning they hardly fulfill their purpose.

“The massive expansion of energy storage is a very costly approach” for connecting more renewables to the Chinese grid, Anders Hove, researcher at the Oxford Institute for Energy Studies, told Table.Briefings. In 2023, China increased its energy storage capacity by 45 percent. A total of 86.5 gigawatts of pumped storage power plants and batteries are now in place. Although a decarbonized energy system requires storage, excessive storage makes the energy transition unnecessarily costly.

According to Hove, improving electricity trading across provincial borders would be a cheaper option. However, the provinces have so far tended to rely on their own electricity supply and are reluctant to rely on neighboring provinces. On top of this, there are economic considerations: State-owned power plant operators prefer to use coal from their own province rather than green electricity from their neighbors. This secures jobs in their power plants and mines.

Hove also points to the EU and the United States. They require less storage because they prioritize “well-functioning electricity markets and the power grid expansion.” Although China is also investing heavily in its power grid, its rigid electricity trading system poses a significant challenge for the energy transition.

Government regulations are driving the expansion of electricity storage. Since 2020, 23 of the 34 Chinese provinces have mandated their construction when new, extensive wind and solar plants (“utility-scale”) are built. The project developers – often grid operators and energy companies – are required to install energy storage systems with a capacity of 10 to 20 percent of the newly constructed renewable energy capacity. The problem: There is no actual business model for energy storage systems. Between 2019 and 2021, investment in storage declined as grid operators were not allowed to pass on the costs of building storage systems to their customers. Investments only increased again after the government announced price reforms.

However, there is still no functioning business model. Analysts from the consultancy Trivium China write that the rates for electricity from storage systems are too low, meaning that storage systems are hardly profitable.

The lack of a business model means that the capacity of existing storage facilities is not being utilized. “The current utilization of energy storage in the grid is only 27 to 32 percent of the intended hours,” said Kevin Shang, an energy storage technology and renewables analyst at energy consultancy Wood Mackenzie. The financial returns are low, Shang told Table.Briefings. The low storage utilization undermines its purpose of supplying the grid with more flexibility.

Moreover, 10 to 20 percent of the energy is lost during storage and subsequent “emptying,” says Anders Hove. As long as no price mechanism compensates producers for this loss, storage is a worse business model than selling the electricity directly. Hove criticizes: Passing on the costs of the inefficiency of the Chinese electricity system “to renewables – either through higher curtailment or mandatory storage – increases the cost of the energy transition” in China.

There is a small ray of hope for the industry: Batteries and energy storage systems are expected to become even cheaper in 2024. Heavy investment by battery manufacturers has led to overcapacity. “Cheap and plentiful batteries, mostly LFP-type from China, will be widely available,” writes an analyst on X.

March 18, 2024; 2 p.m. CET (9 p.m. Beijing Time)

SOAS London, Webinar: China after Xi: Pathways to succession under one-man rule More

March 19, 2024; 8 a.m. CET (3 p.m. Beijing Time)

EUSME Center, Lecture (Hybrid, in Beijing): Green Supply Chain Management: Empowering SME Suppliers More

March 19, 2024; 9 a.m. Beijing Time

EUSME Center, lecture (in Beijing): A Two Sessions Roundup with Neil Thomas and Dan Wang More

March 19, 2024; 5 p.m. CET (March 20, 12 a.m. Beijing Time)

Dezan Shira & Associates, Webinar: Doing Business in China 2024 – Navigating the Changing Business Landscape More

March 20, 2024; 10:30 a.m. CET (5:30 p.m. Beijing Time)

EUSME Center, Webinar: Exporting from Ireland to China: China Market Update More

March 22, 2024; 12 p.m. CET (7 p.m. Beijing Time)

Confucius Institute at the FU Berlin, Digital Lecture Series: Chinese Perspectives: China and the World through the Eyes of Scholars More

March 22, 2024; 5 p.m. CET (March 23, 12:00 a.m. Beijing Time)

Dezan Shira & Associates, Webinar: Decoding China’s 2024 Two Sessions: Takeaways for Businesses More

The city of Sanhe issued an apology for preventing a CCTV crew from reporting live on a gas explosion. The city said the police officers’ behavior was due to “poor communication skills” and “rough methods.”

The All-China Journalists Association previously issued a statement insisting on the right to report from the scene of disasters. “The public rightly expects to be able to find out details about such an incident,” the media representatives wrote. Instead of creating unrest, as the emergency crews claimed, professional journalists “report truthfully on the situation on the ground,” adding that an official press release is no substitute for live reports. “How should the public find answers without journalists?.”

Apparently, the government also had a serious word with the provincial authority. CCTV is a pure propaganda organization of the Communist Party. Its editors have expressly sworn allegiance to the Party and Xi Jinping, so there was no reason to worry about critical reports. Chinese and international journalists, on the other hand, have often experienced that the role of the press is completely alien to provincial police forces. What is new is that the municipality sees this as a mistake.

A CCTV reporter had set up in front of the rubble of the house destroyed by the gas explosion. While she was commenting on the scene, a police officer and several burly colleagues surrounded the journalist, separated her from her camera person and finally pushed her away. It all happened live. fin

The Chinese government has defended TikTok against US criticism. “If so-called national security reasons can be used to willfully suppress other countries’ superior companies, there would be no fairness to speak of,” a Chinese foreign ministry spokesman said on Thursday. “The US increasing the (serious) handling of this matter lets the world see clearly whether the United States’ so-called rules-based competition is beneficial to the world or is only self-serving.”

The reason for these statements is the overwhelming approval by the US House of Representatives of a bill that forces TikTok’s parent company ByteDance to sell the app within six months. Otherwise, the platform, which is particularly popular with young people, could be banned nationwide. A decision by the US Senate is still pending. President Joe Biden urged to deal with the issue quickly. He previously signaled his intention to sign the bill.

TikTok has criticized the bill as a de facto ban. “We are hopeful that the Senate will consider the facts, listen to their constituents, and realize the impact on the economy, 7 million small businesses, and the 170 million Americans who use our service.” The dispute has become a major election campaign issue in the US. Members of both parties have reported receiving calls from angry teenage TikTok users opposing the bill. rad/rtr

According to reports, the Chinese car manufacturer Great Wall Motor plans to build a plant in southern Hungary. The plant and the associated infrastructure are to be built near Pécs, close to the Croatian border, according to the website of the Hungarian-Chinese Chamber of Commerce, citing informed sources.

The plan reportedly involves the development of an area of around 600 hectares. The amount of the investment was not initially disclosed. Hungary is the main recipient of Chinese investment along the EV value chain of Chinese manufacturers. CATL is building an EV battery factory in Hungary’s second-largest city, Debrecen. ari

Vietnam criticized China’s claims in the Gulf of Tonkin on Thursday. In response to Beijing’s new baselines, a spokesperson for the Vietnamese Foreign Ministry urged that international law and the rights and interests of other countries be respected. China’s government delineated the baseline in the Gulf of Tonkin, known in Chinese as Beibu Gulf, using straight lines far from the coast earlier this month.

The Gulf of Tonkin is an arm of the South China Sea. It is called Vịnh Bắc Bộ in Vietnam and Běibù Wān 北部湾 in China.

“Vietnam holds that coastal countries abide by the UNCLOS 1982 when determining the baseline for measuring their territorial waters,” said the Vietnamese Foreign Ministry in Hanoi. UNCLOS is the United Nations Convention on the Law of the Sea. According to UNCLOS, the drawing of straight baselines “must not depart to any appreciable extent from the general direction of the coast.”

Baselines are used to determine the boundaries of territorial waters and exclusive economic zones. This is a particularly contentious issue in the South China Sea, as China, Vietnam and other states have different claims. In contrast, Vietnam and China have so far maintained amicable relations in the Gulf of Tonkin. During Chinese President Xi Jinping’s visit to Hanoi in December, the two countries even agreed to carry out joint patrols. rad

As the supervisory authority for the largest providers operating in the EU, the Commission has now initiated formal proceedings against AliExpress. The online marketplace of the Chinese B2B provider Alibaba is also very well-known in Europe, with 104 million users in the EU according to its own figures.

As the Commission announced on Thursday, the investigation focuses on possible violations of product safety regulations applicable in the European Union and infringements of copyright and trademark law. This is the third case to be opened under the DSA, but the first against an online marketplace.

The Commission suspects that AliExpress violated the regulations for identifying and managing systemic risks. Large providers must verify whether specific risks are associated with their business model. In the case of marketplace operators, these usually involve sellers offering unauthorized goods. In Alibaba’s case, these include toys, counterfeit pharmaceuticals and food supplements.

Marketplace operators must carry out regular spot checks against illegally offered goods under the DSA. They must also provide the option of reporting illegal listings and then review whether offers need to be blocked. In addition, the operators are obliged to collect the sellers’ complete and genuine contact details. The Commission is currently investigating whether all of these requirements have been met.

The Commission also examines whether AliExpress is violating regulations against surreptitious advertising by running an influencer program and whether the platform’s recommendation systems comply with DSA requirements. Among other things, the DSA mandates non-personalized, non-algorithmically generated content. If the suspicions prove accurate, AliExpress faces heavy fines. fst

Tintin, the famous young comic strip hero by Belgian illustrator Georges Remi (Hergé), is called Dingding (丁丁) in the People’s Republic. Two of his adventures are set in China: the “Blue Lotus” and the 1960 story “Tintin in Tibet.” With his dog Snowy and Captain Haddock, reporter Tintin sets out to find his Chinese friend Chang Chong-Chen, who has gone missing while flying over the Himalayas. With the help of Tibetan monks, he finds his friend under the protection of the Yeti, who saved his life after the crash.

However, Beijing’s censors did not find the title politically correct enough. Although the comic was published in 31 languages as “Tintin in Tibet,” Beijing had it changed to “Tintin in China’s Tibet” when it was published in 2001. This was done to show the country’s claim over Tibet.

However, the widow of the illustrator, who died in 1981, his foundation Hergé, and the publisher Casterman protested and threatened to terminate the license. China gave in, and all new editions were published under the original title: “Tintin in Tibet.” This is the only case I know of where a determined protest caused Beijing’s censors to back down.

China’s regulators, who ignore copyright contracts when manipulating translations for political reasons, rely on foreign publishers to keep quiet so they don’t lose the market. The International Pen Center warned that many authors do not even know their books have been wrongly translated. However, the situation was different with Hergé, whose 22 comic adventures became bestsellers in China.

Whether this would still be possible today is debatable. Beijing is currently trying to internationalize its claim over Tibet through the back door. China’s Latin pinyin transcription, “Xizang,” for the two characters Tibet 西藏 is supposed to replace and displace the disliked word. First in all foreign-language state media of the People’s Republic, but since late 2023, in diplomacy and the translations of speeches, documents and treaties of the Beijing Foreign Ministry.

In January, the Wall Street Journal wrote: “China Doesn’t Want You to Say Tibet’ Anymore” and commented: “Yearslong shift toward the Chinese name ‘Xizang’ is accelerating as Beijing prepares for Dalai Lama succession battle.”

Even China’s patriotic researchers, strategists and nationalists agreed. The official WeChat account (统战新语微信公众号) of the Communist United Front, which is subordinate to CCP leadership, criticizes the misconception of foreign countries which are geographically misled by the word “Tibet.” They claim that Tibet does not refer to the current autonomous region of the People’s Republic within the borders set by Beijing but to a larger area that includes Tibetan prefectures and regions of Qinghai, Sichuan, Gansu, and Yunnan. (“‘Tibet’一词代表 “西藏” 的大量语境里,其引申意不仅包括西藏还涵盖了青海、四川、甘肃、云南四省涉藏州县”)

They further claim this “geographical territory” is also part of the “Greater Tibet” 大藏区 propagated by the 14th Dalai Lama. The translation “Xizang” could “help give the voice of the People’s Republic a superior weight in the international discourse on Tibet and in the debate with the ‘Dalai Lama gang,’” says Harbin University lecturer and Marxism lecturer Wang Linping, one of the spokespeople in the language debate. It is a matter of who has the “international right” to speak for Tibet, said Xia Yan from the official ‘China-Tibet Information Center.’ Calling Tibet “Xizang” “will help to restore the image of (China’s) Tibet.”

China’s Communist Party wages fierce campaigns over terms and words of Chinese names, definitions or designations whenever new interpretations and reinterpretations help to linguistically enforce its political, historical, geographical or strategic interests. This often reaches grotesque and absurd levels. But there is a method to it, and it goes back to Confucius.

The German sinologist Richard Wilhelm published the wisdom of Master Kung in his 1910 translation of the Analects of Confucius, “Lunyu.” Confucius’ students collected the advice he once offered to the prince of the nation of We on his travels through China. When the ruler asked him what he must do first to govern his state, Confucius replied: “Set the meaning of words right again. If the concepts are not right, the words will not be right either. But if the words are not right, there will be no deeds… The superior man is modest in his speech but exceeds in his actions.” Wilhelm translated and explained this passage on one and a half pages in Book 13/3 of the Analects.

China’s propaganda authorities first attempted to change the translated word Tibet in 2019 when they instructed their party media and agencies – including the English Global Times, People’s Daily, Xinhua News Agency, and the TV station CGTN – to write “Xizang” instead of Tibet.

Beijing made a more systematic attempt to enforce the new term in 2022, hoping that the rest of the world would also adopt it. China analyst David Bandurski writes in his China Media Project that the widely circulated party newspaper “Global Times” replaced Tibet with “Xizang” more than 200 times in the first half of 2022 alone. Aside from asserting its territorial claim, Beijing also hopes that “Xizang” will displace the name Tibet, which has negative connotations for China’s reputation in the West. According to Bandurski, the word “has long been synonymous with the struggle for its freedom, culture, and identity, and of course with the region’s exiled spiritual leader, the Dalai Lama.”

Linguists defend Beijing’s move to replace Tibet with “Xizang” by pointing out that the Chinese word originates from a term used or spoken by locals, whereas Tibet is a Western adaptation. Bandurski argues that this is not true. Xizang (literally: Western treasury) is a Chinese word. In the local language, the Roof of the World was called “bod” (བོད་).

So it’s just Beijing’s political strategy to displace the international word Tibet with “Xizang.” Just like what happened with the term “Tibet issue” 西藏问题, which has been taboo since the unrest in Lhasa around 2008 and 2009. According to researcher Hu Yan 胡岩 from the Party University, it has since been replaced and suppressed by the phrase “issues concerning Tibet” 涉藏问题. He says that China does not have a “Tibet issue,” a term that can imply or raise fundamental questions of religion, independence and sovereignty.

All controversial new creations or linguistic transliterations are meant to help Beijing set the tone in national and international discourse. One problem is that Beijing has yet to clearly and legally regulate the use of its pinyin transcription of Chinese words. In 1977, the United Nations agreed to standardize Chinese geographical names by using and transcribing them in pinyin. In September 1978, the Beijing State Council decided to adopt pinyin for spelling names of people and places, arguing that it was suitable for writing in all languages of the Latin alphabet, “including English, French, German and Spanish.” But there are too many exceptions.

Beijing jumped over its shadow once when it was forced to reverse its silly manipulation of the title “Tintin in China’s Tibet.” It was even more annoyed when the Dalai Lama posthumously honored Hergé and his sensitively drawn comic “Tintin in Tibet” with the “Light of Truth Award” in Belgium in June 2006. He presented the prestigious Tibetan award to the cartoonist’s widow and the Hergé Foundation “for promoting understanding of Tibetan culture.”

Beijing was furious but still permits “Tintin in Tibet” to be sold unchanged to this day. Perhaps it hopes that China’s propaganda will succeed in getting the new spelling “Xizang” for Tibet accepted in other countries, too. Then the comic title would one day read: “Tintin in Xizang.” The censors would then no longer need to put the word “China” in front of it.

Dominik Benzinger is the new Head of Risk Provisioning Calculation, Reporting, and portfolio Analytics at Mercedes. Until February, Benzinger was the Head of Financial Reporting AAP & China and IFRS Methods at Mercedes.

Milad Jalal has been a strategic advisor at Volkswagen China Technology Company in Hefei since the beginning of the month. He was previously Data Compliance Manager at Volkswagen since 2020.

Is something changing in your organization? Let us know at heads@table.media!

With the first rays of sunshine of the new year, the pink cherry blossoms provide a popular photo backdrop. And when they are joined by such pretty parasols, like here in Nanjing, every angle turns into a photographer’s delight.

Will German car manufacturers become China’s stepping stones to Europe? That was the question in yesterday’s editorial after the uproar surrounding Mercedes CEO Ola Kallenius, who expressly rejects EU punitive tariffs against Chinese EVs and faced considerable backlash.

For today’s issue, I passed the question on to Daniel Kirchert, who has almost 20 years of China experience in the automotive industry, including a management position at BMW and as founder of the EV start-up Byton. He agrees with Kallenius’ stance. This is despite his rather bleak forecasts for the German and European automotive industry. However, they can only improve if we invest in innovation instead of closing ourselves off, says Kirchert. And shows how German car manufacturers can still remain successful.

Nico Beckert’s analysis of China’s electricity storage systems also focuses on the green transformation. China has been experiencing a renewables boom for years, and recently, there has been a boom in electricity storage systems. But they are a costly safety net. The flaws in China’s energy grid are making rapid expansion necessary.

Children and adults worldwide treasure the cartoon character Tintin for his daring adventures. That includes China, where the hero is called Dingding. One particular volume of the comic series has a special story, ‘Tintin in Tibet.’

Johnny Erling’s column tells the story of the bizarre dispute over the book’s title, which Hergé’s widow surprisingly won. The publisher, who was loyal to the regime, had simply renamed the title “Tintin in China’s Xizang.” His widow managed to have the reference to China dropped. But this is only a small part of the propaganda attempts to internationally replace Tibet with the name “Xizang.”

Mercedes CEO Ola Källenius has called on the EU Commission to lower tariffs on Chinese EVs instead of considering increasing them further. Is this demand naive?

I agree with him on that. It is completely wrong to come up with regulations and trade barriers instead of pursuing a solid industrial policy. It is important that we have a free market and that the EU promotes innovation and competition. This also includes supporting companies so that they can make faster progress in the field of electromobility.

Kallenius is accused of pursuing his own interests with his statement because he has Mercedes-Benz sales in China in mind.

That’s certainly not entirely wrong. If the EU imposes high punitive tariffs on Chinese EVs, there is bound to be a massive backlash from China, which may depress EU manufacturers’ sales in China. I believe it is very important that punitive tariffs do not prevent the EU from strengthening its own companies.

How will Chinese manufacturers deal with possible punitive tariffs?

But I believe that the manufacturers going to Europe are already looking very closely at the issue. Beijing has also said that now is the time to make EVs a global issue in times of a declining reputation and a difficult economic situation. But that is also normal. The Chinese automotive industry is lagging behind in globalization. Automotive companies from all countries try to go global at some point. The Chinese have long slept on this, or at least only managed it in some regions such as Africa. It is long overdue for their companies to globalize properly.

Elon Musk said a few weeks ago that Chinese EV manufacturers will ‘demolish’ most other car companies…

I believe that the situation is extremely dramatic. The ship has more or less sailed, and there really will be a wave here in Europe. It is absolutely possible that Chinese brands will grab 20 to 30 percent of the market in a few years – even with punitive tariffs.

How many brands will come?

I expect around 25 Chinese brands. From a consumer perspective, this is, of course, totally confusing, and some will fail, not because they have bad cars but because they fail to position their brand with the customer and create good branding or successfully build up their distribution structure. After-sales are crucial and often underestimated by many Chinese manufacturers. However, manufacturers must gain customer trust by establishing good service structures before selling cars. That is why I founded the start-up Noyo, which offers Chinese manufacturers this customer service for Swiss customers.

The fact that Europe urgently needs affordable cars to boost electromobility could benefit them. Will the Chinese fill this gap?

I think some Chinese cars in the 20,000 to 25,000 euro range will be launched on the European market this year. Whether they will all be a perfect fit remains to be seen, but in terms of cost structure, they can keep up with gas-powered cars.

Which cars specifically?

BYD already has the Atto and the Dolphin. Dongfeng has just launched the Nammi in China. Nammi is a separate brand in China, but here, it will run under the Dongfeng brand as the Dongfeng Nano Box. It looks like a cross between a Mini and a Smart, costing around 10,000 euros in China. I have also heard that the Aion Y from Guangzhou-Automotive (GAC) is coming this year. It will cost the equivalent of around 15,000 euros in China. And there will be a new entry-level model from MG. Chery is also coming.

China has enormous overcapacity, and demand is weakening. For months, manufacturers have been offering discounts to boost sales. What impact is this price war having?

This competition is brutal. The cars are sold at prices that result in negative margins, and the volumes are not yet large enough to achieve economies of scale. But it doesn’t work without economies of scale. If you can’t achieve – let’s say – half a million cars, you won’t have a competitive structure in the long term. Some manufacturers, like Porsche or Ferrari, do very well with small quantities. But these are extremely powerful brands in the premium and luxury segment. The law of size and volume applies to everything that is not luxury in order to bring costs down.

Is it all a matter of cost?

The current stage is not just about costs but also about product power and branding. Companies need to launch attractive, competitive vehicles on the market, which is why players like XPeng and NIO, which are still relatively small with their 140,000 and 160,000 vehicles sold in 2023, respectively, should not be written off. They simply have incredibly good products.

Will the Chinese market consolidate soon?

Many start-ups have already disappeared in the last five years. The theory is that five manufacturers will remain in the end. However, I do not share this opinion due to the specific structure of these companies in China.

Why not?

Only a handful of the “traditional” car manufacturers in China, i.e., those that are 20 years or older, are privately owned. These include BYD and Geely, for example. Most are state-owned corporations: Dongfeng, FAW, and Changan are under the central government, and all others are under provincial governments. The big provincial companies are unlikely to go bankrupt or consolidate because they are backed by strong local interests. That is why I believe that in the event of consolidation, 25 or 35 companies will be left in the end, simply because each province will do everything it can to keep its automotive industry running, even if that doesn’t make sense from a market-economy competition perspective.

Let’s return to Europe and Ola Kallenius. How aware of reality are the bosses of European car manufacturers?

As one of the big European players, Stellantis has invested a huge sum of 1.5 billion euros in Leapmotor. That shows that the awareness is there. BMW and Mercedes have not yet formed such partnerships, but I think they are taking the situation seriously. However, I don’t know whether they have fully grasped it.

How do you see the current situation?

If the volume of a large premium manufacturer that sells two to three million cars a year suddenly drops by 10 percent or even 15 to 20 percent, then that is difficult to compensate for. The companies are still highly profitable, but this is also because we have a lag effect of four to five years between development and sales.

What does difficult to compensate mean?

If the volume goes down, that means that massive numbers of people will have to be laid off and plants closed. Hardly anyone will be able to avoid that. If BMW, Audi and Mercedes sales figures in China, which were between 700,000 and 800,000 vehicles in 2023, drop to 500,000 or 400,000 in a few years, this will have a massive impact on the German economy. And so far we’ve only looked at sales in China and haven’t even talked about sales in Europe. If some Chinese manufacturers enter the European market, not just the premium brands but also the volume brands that compete with the core brands of Volkswagen and Stellantis, things will get nasty.

How could German and European manufacturers manage to maintain their position?

First of all, you must take an honest look in the mirror and admit you are late. And then press a radical reset button and redefine yourself. All these German companies have led the automotive world for over 100 years, and they have always been innovation leaders. And now they have slipped into the role of followers. How do you go from being a follower to a leader again? That’s damn hard, and there’s no simple answer. Self-awareness and a sense of urgency are the most important things.

What could such a redefinition look like?

The German car manufacturers have fantastic people. You have to start at the top with the management and allow radical innovation. We won’t beat the Chinese on the cost side. I generally see two options for Europe. One is genuine sustainability. Switching from gasoline to electric cars and then having no more emissions is only part of the sustainability story. What we really need are cars with 100 percent circular materials, smaller and sustainable batteries that are lighter and manufactured with a zero carbon footprint. This kind of genuine, sustainable mobility concept really ought to come from Europe. But I’m not so optimistic, because most companies are engaged in brutal greenwashing. It’s purely a PR ploy, it doesn’t come from a deeper insight at management level.

And what is the second option?

I also think that if you want to turn things around, you must create new structures. You actually have to create start-up structures in large companies. In other words, create spin-offs, set up small new units and send your best people there. They need the support of the headquarters and a firewall, because many innovations and changes are stopped in large corporations. In order to become faster, more agile and more innovative, you have to create such pockets that can be run like start-ups. You have to be open to radical ideas. Reinvent yourself, redefine yourself, from customer experience, the entire sales process, the products, real sustainability. When it comes to sustainability in particular, Europe has a chance.

Dr Daniel Kirchert held various management positions in China for 18 years, including at BMW’s joint venture with Brilliance and in the top management of Nissan’s premium brand Infiniti. He later founded the EV start-up BYTON, which, however, failed. After his return to Germany, he founded NOYO Mobility AG, a platform designed to help Chinese manufacturers sell their EVs in Europe.

Over the past year, China built more solar plants (217 gigawatts of new capacity) than the United States installed solar power plants (175 GW). However, the Chinese boom highlights the design flaws of the national energy system. According to some energy sector managers, China will have to significantly curtail wind and solar power production this year compared to previous years.

In theory, an overproduction of renewables could be balanced out quite well through electricity trading: If the wind is very strong in the country’s west, the electricity could be consumed in the industrial hubs in the east. However, many Chinese provinces reject importing electricity from their neighbors. Reforms to the inflexible electricity market have been delayed for 20 years. Instead, massive amounts of energy storage are now being built to reduce the curtailment of renewables, meaning that fewer solar and wind power plants have to be switched off if they generate too much electricity overall. But this makes the energy transition more expensive. And these storage facilities have hardly been used so far, meaning they hardly fulfill their purpose.

“The massive expansion of energy storage is a very costly approach” for connecting more renewables to the Chinese grid, Anders Hove, researcher at the Oxford Institute for Energy Studies, told Table.Briefings. In 2023, China increased its energy storage capacity by 45 percent. A total of 86.5 gigawatts of pumped storage power plants and batteries are now in place. Although a decarbonized energy system requires storage, excessive storage makes the energy transition unnecessarily costly.

According to Hove, improving electricity trading across provincial borders would be a cheaper option. However, the provinces have so far tended to rely on their own electricity supply and are reluctant to rely on neighboring provinces. On top of this, there are economic considerations: State-owned power plant operators prefer to use coal from their own province rather than green electricity from their neighbors. This secures jobs in their power plants and mines.

Hove also points to the EU and the United States. They require less storage because they prioritize “well-functioning electricity markets and the power grid expansion.” Although China is also investing heavily in its power grid, its rigid electricity trading system poses a significant challenge for the energy transition.

Government regulations are driving the expansion of electricity storage. Since 2020, 23 of the 34 Chinese provinces have mandated their construction when new, extensive wind and solar plants (“utility-scale”) are built. The project developers – often grid operators and energy companies – are required to install energy storage systems with a capacity of 10 to 20 percent of the newly constructed renewable energy capacity. The problem: There is no actual business model for energy storage systems. Between 2019 and 2021, investment in storage declined as grid operators were not allowed to pass on the costs of building storage systems to their customers. Investments only increased again after the government announced price reforms.

However, there is still no functioning business model. Analysts from the consultancy Trivium China write that the rates for electricity from storage systems are too low, meaning that storage systems are hardly profitable.

The lack of a business model means that the capacity of existing storage facilities is not being utilized. “The current utilization of energy storage in the grid is only 27 to 32 percent of the intended hours,” said Kevin Shang, an energy storage technology and renewables analyst at energy consultancy Wood Mackenzie. The financial returns are low, Shang told Table.Briefings. The low storage utilization undermines its purpose of supplying the grid with more flexibility.

Moreover, 10 to 20 percent of the energy is lost during storage and subsequent “emptying,” says Anders Hove. As long as no price mechanism compensates producers for this loss, storage is a worse business model than selling the electricity directly. Hove criticizes: Passing on the costs of the inefficiency of the Chinese electricity system “to renewables – either through higher curtailment or mandatory storage – increases the cost of the energy transition” in China.

There is a small ray of hope for the industry: Batteries and energy storage systems are expected to become even cheaper in 2024. Heavy investment by battery manufacturers has led to overcapacity. “Cheap and plentiful batteries, mostly LFP-type from China, will be widely available,” writes an analyst on X.

March 18, 2024; 2 p.m. CET (9 p.m. Beijing Time)

SOAS London, Webinar: China after Xi: Pathways to succession under one-man rule More

March 19, 2024; 8 a.m. CET (3 p.m. Beijing Time)

EUSME Center, Lecture (Hybrid, in Beijing): Green Supply Chain Management: Empowering SME Suppliers More

March 19, 2024; 9 a.m. Beijing Time

EUSME Center, lecture (in Beijing): A Two Sessions Roundup with Neil Thomas and Dan Wang More

March 19, 2024; 5 p.m. CET (March 20, 12 a.m. Beijing Time)

Dezan Shira & Associates, Webinar: Doing Business in China 2024 – Navigating the Changing Business Landscape More

March 20, 2024; 10:30 a.m. CET (5:30 p.m. Beijing Time)

EUSME Center, Webinar: Exporting from Ireland to China: China Market Update More

March 22, 2024; 12 p.m. CET (7 p.m. Beijing Time)

Confucius Institute at the FU Berlin, Digital Lecture Series: Chinese Perspectives: China and the World through the Eyes of Scholars More

March 22, 2024; 5 p.m. CET (March 23, 12:00 a.m. Beijing Time)

Dezan Shira & Associates, Webinar: Decoding China’s 2024 Two Sessions: Takeaways for Businesses More

The city of Sanhe issued an apology for preventing a CCTV crew from reporting live on a gas explosion. The city said the police officers’ behavior was due to “poor communication skills” and “rough methods.”

The All-China Journalists Association previously issued a statement insisting on the right to report from the scene of disasters. “The public rightly expects to be able to find out details about such an incident,” the media representatives wrote. Instead of creating unrest, as the emergency crews claimed, professional journalists “report truthfully on the situation on the ground,” adding that an official press release is no substitute for live reports. “How should the public find answers without journalists?.”

Apparently, the government also had a serious word with the provincial authority. CCTV is a pure propaganda organization of the Communist Party. Its editors have expressly sworn allegiance to the Party and Xi Jinping, so there was no reason to worry about critical reports. Chinese and international journalists, on the other hand, have often experienced that the role of the press is completely alien to provincial police forces. What is new is that the municipality sees this as a mistake.

A CCTV reporter had set up in front of the rubble of the house destroyed by the gas explosion. While she was commenting on the scene, a police officer and several burly colleagues surrounded the journalist, separated her from her camera person and finally pushed her away. It all happened live. fin

The Chinese government has defended TikTok against US criticism. “If so-called national security reasons can be used to willfully suppress other countries’ superior companies, there would be no fairness to speak of,” a Chinese foreign ministry spokesman said on Thursday. “The US increasing the (serious) handling of this matter lets the world see clearly whether the United States’ so-called rules-based competition is beneficial to the world or is only self-serving.”

The reason for these statements is the overwhelming approval by the US House of Representatives of a bill that forces TikTok’s parent company ByteDance to sell the app within six months. Otherwise, the platform, which is particularly popular with young people, could be banned nationwide. A decision by the US Senate is still pending. President Joe Biden urged to deal with the issue quickly. He previously signaled his intention to sign the bill.

TikTok has criticized the bill as a de facto ban. “We are hopeful that the Senate will consider the facts, listen to their constituents, and realize the impact on the economy, 7 million small businesses, and the 170 million Americans who use our service.” The dispute has become a major election campaign issue in the US. Members of both parties have reported receiving calls from angry teenage TikTok users opposing the bill. rad/rtr

According to reports, the Chinese car manufacturer Great Wall Motor plans to build a plant in southern Hungary. The plant and the associated infrastructure are to be built near Pécs, close to the Croatian border, according to the website of the Hungarian-Chinese Chamber of Commerce, citing informed sources.

The plan reportedly involves the development of an area of around 600 hectares. The amount of the investment was not initially disclosed. Hungary is the main recipient of Chinese investment along the EV value chain of Chinese manufacturers. CATL is building an EV battery factory in Hungary’s second-largest city, Debrecen. ari

Vietnam criticized China’s claims in the Gulf of Tonkin on Thursday. In response to Beijing’s new baselines, a spokesperson for the Vietnamese Foreign Ministry urged that international law and the rights and interests of other countries be respected. China’s government delineated the baseline in the Gulf of Tonkin, known in Chinese as Beibu Gulf, using straight lines far from the coast earlier this month.

The Gulf of Tonkin is an arm of the South China Sea. It is called Vịnh Bắc Bộ in Vietnam and Běibù Wān 北部湾 in China.

“Vietnam holds that coastal countries abide by the UNCLOS 1982 when determining the baseline for measuring their territorial waters,” said the Vietnamese Foreign Ministry in Hanoi. UNCLOS is the United Nations Convention on the Law of the Sea. According to UNCLOS, the drawing of straight baselines “must not depart to any appreciable extent from the general direction of the coast.”

Baselines are used to determine the boundaries of territorial waters and exclusive economic zones. This is a particularly contentious issue in the South China Sea, as China, Vietnam and other states have different claims. In contrast, Vietnam and China have so far maintained amicable relations in the Gulf of Tonkin. During Chinese President Xi Jinping’s visit to Hanoi in December, the two countries even agreed to carry out joint patrols. rad

As the supervisory authority for the largest providers operating in the EU, the Commission has now initiated formal proceedings against AliExpress. The online marketplace of the Chinese B2B provider Alibaba is also very well-known in Europe, with 104 million users in the EU according to its own figures.

As the Commission announced on Thursday, the investigation focuses on possible violations of product safety regulations applicable in the European Union and infringements of copyright and trademark law. This is the third case to be opened under the DSA, but the first against an online marketplace.

The Commission suspects that AliExpress violated the regulations for identifying and managing systemic risks. Large providers must verify whether specific risks are associated with their business model. In the case of marketplace operators, these usually involve sellers offering unauthorized goods. In Alibaba’s case, these include toys, counterfeit pharmaceuticals and food supplements.

Marketplace operators must carry out regular spot checks against illegally offered goods under the DSA. They must also provide the option of reporting illegal listings and then review whether offers need to be blocked. In addition, the operators are obliged to collect the sellers’ complete and genuine contact details. The Commission is currently investigating whether all of these requirements have been met.

The Commission also examines whether AliExpress is violating regulations against surreptitious advertising by running an influencer program and whether the platform’s recommendation systems comply with DSA requirements. Among other things, the DSA mandates non-personalized, non-algorithmically generated content. If the suspicions prove accurate, AliExpress faces heavy fines. fst

Tintin, the famous young comic strip hero by Belgian illustrator Georges Remi (Hergé), is called Dingding (丁丁) in the People’s Republic. Two of his adventures are set in China: the “Blue Lotus” and the 1960 story “Tintin in Tibet.” With his dog Snowy and Captain Haddock, reporter Tintin sets out to find his Chinese friend Chang Chong-Chen, who has gone missing while flying over the Himalayas. With the help of Tibetan monks, he finds his friend under the protection of the Yeti, who saved his life after the crash.

However, Beijing’s censors did not find the title politically correct enough. Although the comic was published in 31 languages as “Tintin in Tibet,” Beijing had it changed to “Tintin in China’s Tibet” when it was published in 2001. This was done to show the country’s claim over Tibet.

However, the widow of the illustrator, who died in 1981, his foundation Hergé, and the publisher Casterman protested and threatened to terminate the license. China gave in, and all new editions were published under the original title: “Tintin in Tibet.” This is the only case I know of where a determined protest caused Beijing’s censors to back down.

China’s regulators, who ignore copyright contracts when manipulating translations for political reasons, rely on foreign publishers to keep quiet so they don’t lose the market. The International Pen Center warned that many authors do not even know their books have been wrongly translated. However, the situation was different with Hergé, whose 22 comic adventures became bestsellers in China.

Whether this would still be possible today is debatable. Beijing is currently trying to internationalize its claim over Tibet through the back door. China’s Latin pinyin transcription, “Xizang,” for the two characters Tibet 西藏 is supposed to replace and displace the disliked word. First in all foreign-language state media of the People’s Republic, but since late 2023, in diplomacy and the translations of speeches, documents and treaties of the Beijing Foreign Ministry.

In January, the Wall Street Journal wrote: “China Doesn’t Want You to Say Tibet’ Anymore” and commented: “Yearslong shift toward the Chinese name ‘Xizang’ is accelerating as Beijing prepares for Dalai Lama succession battle.”

Even China’s patriotic researchers, strategists and nationalists agreed. The official WeChat account (统战新语微信公众号) of the Communist United Front, which is subordinate to CCP leadership, criticizes the misconception of foreign countries which are geographically misled by the word “Tibet.” They claim that Tibet does not refer to the current autonomous region of the People’s Republic within the borders set by Beijing but to a larger area that includes Tibetan prefectures and regions of Qinghai, Sichuan, Gansu, and Yunnan. (“‘Tibet’一词代表 “西藏” 的大量语境里,其引申意不仅包括西藏还涵盖了青海、四川、甘肃、云南四省涉藏州县”)

They further claim this “geographical territory” is also part of the “Greater Tibet” 大藏区 propagated by the 14th Dalai Lama. The translation “Xizang” could “help give the voice of the People’s Republic a superior weight in the international discourse on Tibet and in the debate with the ‘Dalai Lama gang,’” says Harbin University lecturer and Marxism lecturer Wang Linping, one of the spokespeople in the language debate. It is a matter of who has the “international right” to speak for Tibet, said Xia Yan from the official ‘China-Tibet Information Center.’ Calling Tibet “Xizang” “will help to restore the image of (China’s) Tibet.”

China’s Communist Party wages fierce campaigns over terms and words of Chinese names, definitions or designations whenever new interpretations and reinterpretations help to linguistically enforce its political, historical, geographical or strategic interests. This often reaches grotesque and absurd levels. But there is a method to it, and it goes back to Confucius.

The German sinologist Richard Wilhelm published the wisdom of Master Kung in his 1910 translation of the Analects of Confucius, “Lunyu.” Confucius’ students collected the advice he once offered to the prince of the nation of We on his travels through China. When the ruler asked him what he must do first to govern his state, Confucius replied: “Set the meaning of words right again. If the concepts are not right, the words will not be right either. But if the words are not right, there will be no deeds… The superior man is modest in his speech but exceeds in his actions.” Wilhelm translated and explained this passage on one and a half pages in Book 13/3 of the Analects.

China’s propaganda authorities first attempted to change the translated word Tibet in 2019 when they instructed their party media and agencies – including the English Global Times, People’s Daily, Xinhua News Agency, and the TV station CGTN – to write “Xizang” instead of Tibet.

Beijing made a more systematic attempt to enforce the new term in 2022, hoping that the rest of the world would also adopt it. China analyst David Bandurski writes in his China Media Project that the widely circulated party newspaper “Global Times” replaced Tibet with “Xizang” more than 200 times in the first half of 2022 alone. Aside from asserting its territorial claim, Beijing also hopes that “Xizang” will displace the name Tibet, which has negative connotations for China’s reputation in the West. According to Bandurski, the word “has long been synonymous with the struggle for its freedom, culture, and identity, and of course with the region’s exiled spiritual leader, the Dalai Lama.”

Linguists defend Beijing’s move to replace Tibet with “Xizang” by pointing out that the Chinese word originates from a term used or spoken by locals, whereas Tibet is a Western adaptation. Bandurski argues that this is not true. Xizang (literally: Western treasury) is a Chinese word. In the local language, the Roof of the World was called “bod” (བོད་).

So it’s just Beijing’s political strategy to displace the international word Tibet with “Xizang.” Just like what happened with the term “Tibet issue” 西藏问题, which has been taboo since the unrest in Lhasa around 2008 and 2009. According to researcher Hu Yan 胡岩 from the Party University, it has since been replaced and suppressed by the phrase “issues concerning Tibet” 涉藏问题. He says that China does not have a “Tibet issue,” a term that can imply or raise fundamental questions of religion, independence and sovereignty.

All controversial new creations or linguistic transliterations are meant to help Beijing set the tone in national and international discourse. One problem is that Beijing has yet to clearly and legally regulate the use of its pinyin transcription of Chinese words. In 1977, the United Nations agreed to standardize Chinese geographical names by using and transcribing them in pinyin. In September 1978, the Beijing State Council decided to adopt pinyin for spelling names of people and places, arguing that it was suitable for writing in all languages of the Latin alphabet, “including English, French, German and Spanish.” But there are too many exceptions.

Beijing jumped over its shadow once when it was forced to reverse its silly manipulation of the title “Tintin in China’s Tibet.” It was even more annoyed when the Dalai Lama posthumously honored Hergé and his sensitively drawn comic “Tintin in Tibet” with the “Light of Truth Award” in Belgium in June 2006. He presented the prestigious Tibetan award to the cartoonist’s widow and the Hergé Foundation “for promoting understanding of Tibetan culture.”

Beijing was furious but still permits “Tintin in Tibet” to be sold unchanged to this day. Perhaps it hopes that China’s propaganda will succeed in getting the new spelling “Xizang” for Tibet accepted in other countries, too. Then the comic title would one day read: “Tintin in Xizang.” The censors would then no longer need to put the word “China” in front of it.

Dominik Benzinger is the new Head of Risk Provisioning Calculation, Reporting, and portfolio Analytics at Mercedes. Until February, Benzinger was the Head of Financial Reporting AAP & China and IFRS Methods at Mercedes.

Milad Jalal has been a strategic advisor at Volkswagen China Technology Company in Hefei since the beginning of the month. He was previously Data Compliance Manager at Volkswagen since 2020.

Is something changing in your organization? Let us know at heads@table.media!

With the first rays of sunshine of the new year, the pink cherry blossoms provide a popular photo backdrop. And when they are joined by such pretty parasols, like here in Nanjing, every angle turns into a photographer’s delight.