Cosco’s stake in the Port of Hamburg is still pending. The deadline for an agreement has long since expired. This raises two questions in particular: If deadlines do not matter in this context, why do we set them at all? But even more intriguing is the question of why Cosco is not swooping in?

After all, the Chinese state-owned shipping company stands to gain a 24.9 percent stake in a terminal. But now it hesitates. The reasons are anyone’s guess. Could it be that Cosco does not want to spend the money if it cannot influence the decision of the port administration? A tiny fraction of shares is missing for that.

One conclusion could be that the state-owned company is only interested in political influence rather than in the prospect of good business after all. This provides valuable clues about the intentions behind future investments from China in critical German, but also European infrastructure. And it provides food for thought for the future. Because politics still has no clear line, as Christiane Kuehl writes.

Michael Radunkski, on the other hand, is once again busy with balloons today. It is quite comical to see who is now spotting such spy objects in the skies above their territory and where. From zero to one hundred in less than a week. It is not only that Taiwan casually explains that such balloons are sighted almost every week.

China portrays itself as the biggest victim. Beijing is now accusing the USA of using its technical superiority against them. It complains about an uneven espionage playing field, so to speak. Hence the following proposal: China provides fair market access for foreign companies and in return, the Americans turn a blind lens to foreign snooping.

The deal should originally have been closed by New Year’s Eve. But even after the contractual deadline expired on December 31, 2022, it is still uncertain whether China’s state-owned Cosco will invest in the Hamburg Container Terminal Tollerort (CTT) or not.

The Hong Kong-listed terminal division of the company, Cosco Shipping Ports Limited (CSPL), declared in a stock exchange announcement earlier this year that not all conditions for its entry into CTT had yet been met, as the German broadcaster NDR reported. Among other things, the conditions for the entry were still being discussed with the German Ministry of Economic Affairs. There is no guarantee that the deal will be finalized.

The terminal operator, Hamburger Hafen Logistik AG, or HHLA for short, sounded much more optimistic on January 6: A spokeswoman confirmed “objective, constructive talks” between HHLA, CSPL and the German Federal Ministry for Economic Affairs and Climate Action (BMWK), during which “it has been possible to agree on concrete conditions for CSPL’s participation in HHLA Container Terminal Tollerort GmbH”. Final details are reportedly being worked out at the moment. HHLA and CSPL were aiming to “finalize the transaction soon”. There is no information on possible sticking points. And since then, nothing but silence.

The wait for Cosco’s decision is a new phase in the Hamburg port saga. A quick recap: Hamburg and its Logistik AG want the acquisition to happen. Numerous German ministries, including the BMWK, warned of security risks. In the end, the German government, under pressure from Chancellor Scholz, approved the stake in October 2022 but limited the terms for Cosco by issuing a so-called partial ban.

Cosco is now only entitled to a maximum 24.9 percent stake in Tollerort, instead of the 35 percent originally agreed upon with HHLA. The ongoing negotiations indicate that Cosco is displeased with these conditions: Below 25 percent, it has no formal influence on any business decisions. Berlin has ruled out a later share increase.

The hard-fought compromise may ultimately break the deal. This would be tantamount to a ban, which the Chancellery had shied away from. The only difference is that the blame for the failed deal could easily be passed on to Cosco.

But the fundamental question remains. How will we deal with future investment offers from China? “I assume that Hamburg marks a turning point in how Chinese direct investments are handled. They will probably be scrutinized more closely in the future,” Sebastian Bersick from the Ruhr University in Bochum told China.Table. Bersick is the author of a chapter for an upcoming volume of essays, comparing Chinese port investments in Europe, Central and South America. “This means that corporate interests take a relative step back against political and geopolitical considerations.”

HHLA and the City of Hamburg have repeatedly stressed that a long-term bond with the shipping giant Cosco is essential in the face of growing competition for cargo with the three other North Range ports of Rotterdam, Antwerp and Zeebrugge. In Zeebrugge, CSPL holds 90 percent of the sole container terminal and thus controls the management. The terminal has since become the fastest-growing hub in Cosco’s global network. Antwerp and Rotterdam both have Chinese minority stakes in terminals. Hamburg sees itself under pressure.

Bersick believes that the core of the much-needed debate is the question of how a possible economic dependence on China can be measured in the future and how a feared political influence could be defined. “What we increasingly lack is trust in Chinese business partners: Even if these are motivated purely by business considerations, it can never be ruled out that later actions will follow geopolitical interests – especially if it is a state-owned company.”

The current impression of a lack of transparency is not particularly helpful in this respect. According to a minor interpellation by the CDU/CSU parliamentary group on the status of the Cosco deal, the Press Office of the German Parliament stated on January 10 that the German government refused to give public answers citing “constitutionally protected business secrets”. The information was classified as “VS–Confidential“.

Investigative teams from the German broadcasters WDR and NDR recently uncovered references in internal German government documents to further joint projects between HHLA and Cosco in other European countries, for example in the Baltic Sea or the Mediterranean. Agreements have reportedly already been signed. HHLA declined any comment.

On Monday, China turned the tables – and raised serious espionage allegations: Allegedly, the United States had illegally sent balloons over China more than ten times last year alone, said a spokesperson for the Chinese Foreign Ministry in Beijing. Accordingly, the US should stop accusing others of spying. “It’s quite clear to the global community which country is the number one spy empire in the world,” Wang Wenbin said.

As the week starts, it quickly becomes clear that the conflict between the USA and China over suspected flying spy objects is intensifying. Beijing wants to reclaim the initiative by making accusations of its own in order to switch from the defensive to the offensive. But reports from Taiwan are disrupting this maneuver. Chinese balloons have apparently overflown the island repeatedly in the past. The true extent of the Chinese campaign will probably only reveal itself in the weeks and months to come.

Nevertheless, China has strong arguments to support its claim that the US has far greater espionage capabilities at its disposal. Foreign Office spokesman Wang specified China’s accusations: The United States would by no means limit itself to balloons, but would also dispatch aircraft and warships to gather intelligence on China: Beijing registered 657 close reconnaissance flights last year and 64 missions in the South China Sea in January 2023 alone. However, it should be noted here that China lays claim to a large part of the South China Sea. The international arbitration court in The Hague, on the other hand, rejected these claims in 2016.

But despite the exaggerations of its own argumentation, there is a nugget of truth in the Chinese narrative. Take the actions of the NSA, for example. The NSA also wiretapped Chancellor Angela Merkel from an unregistered site in the US Embassy at the Pariser Platz in Berlin. Merkel was on the US list of spy targets between 2002 and 2013, as were the heads of government of other European countries at various times.

In the overall picture, it looks as if both sides are fully utilizing all technical reconnaissance capabilities. The balloons have then become the focus of attention. But not only the US is currently reporting suspected Chinese spy balloons. Dozens of Chinese military balloons have allegedly also been sighted over Taiwan in recent years. This was reported by the British Financial Times on Monday. “They come very frequently, the last one just a few weeks ago,” a senior Taiwanese official said according to the report. Such incursions would occur once a month on average.

That would be far more than known to date: Previously, Taiwan’s Ministry of Defence confirmed only one incident. Last February, several Chinese balloons were detected over the north of the country.

However, the Chinese balloons over Taiwan are said to be very different from the downed version over the US: These balloons would fly at an altitude of around 6,000 meters, as opposed to around 20 kilometers above the USA. Furthermore, they were made of a different material.

But due to their size and the devices on board, they too were definitely not weather balloons that would be allowed to enter the airspace of other countries without prior permission. Rather, they are believed to have gathered data needed for the use of radar and missile systems, like those China would need for potential operations in the waters and airspace east of Taiwan.

These could be preparations for an attack. Since Nancy Pelosi’s visit to Taiwan, Beijing has massively intensified the pressure on Taipei. Xi Jinping has repeatedly threatened to annex the island to the People’s Republic – by force if necessary. US military officials, therefore, expect a Chinese assault on Taiwan, possibly as early as 2025. However, Xi does not seem to have yet made a decision to this effect.

The assessment of the situation has been complicated by the sudden increase in balloon sightings. The US military has shot down four flying objects over North America in the past few days: one Chinese balloon and three other unidentified flying objects, although no information on them has surfaced so far. Above all, it is unknown where they came from.

The events of the past few days have exposed a vulnerability in US air defense, Malcolm Davis told China.Table. The scientist from the renowned Australian Strategic Policy Institute expects further discoveries – also over the USA. The North American Aerospace Defense Command has since recalibrated its sensors to allow the discovery of slow-moving objects such as balloons, Davis explained.

Davis is convinced that the situation is a serious security crisis. He claims that the Chinese spy balloon collected data near the US base in Montana. Through SIGINT and ELINT – long-range and electronic reconnaissance – the Chinese balloon may have been able to intercept radio and satellite communications, as well as spy on radar data. In an extreme case, this would “allow them to ensure greater accuracy for their ICBMs in any nuclear attack on the US,” Davis explained.

Davis expects that the true extent of Chinese espionage will only become clear in the coming weeks and months. In recent days, he said, it has become apparent that China’s balloons are operating at high altitudes over an intercontinental range, gathering sensitive information. But it will not stop there, he said. “These balloons are clearly vulnerable to being shot down, so a more sophisticated capability could be based around advanced high altitude drones and long-endurance lighter-than-air craft, such as airships.”

However, like in the case of espionage, there should be no illusions. Such high-tech objects are being developed by China – but also by the US military in several current and discontinued programs. The idea is also neither new nor original. Even the German armed forces have commissioned a “flying eye” from Rheinmetall.

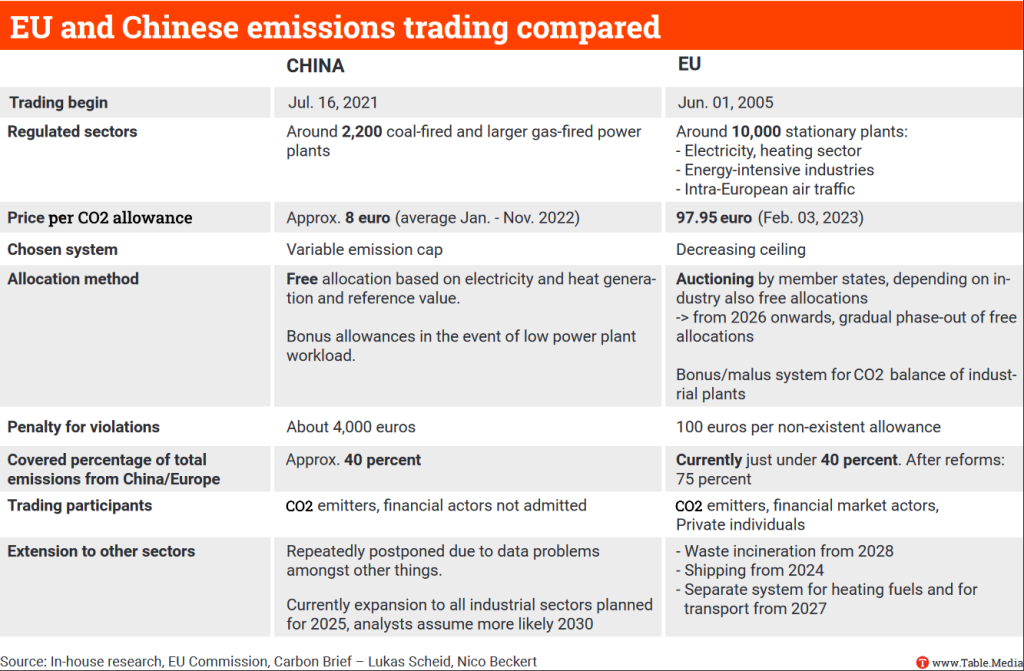

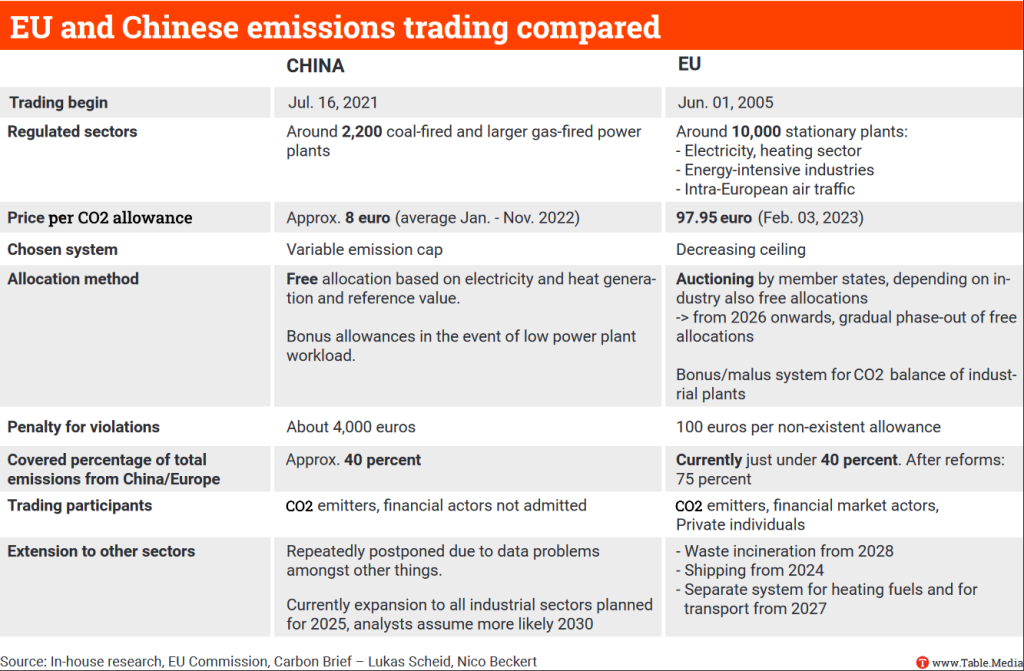

China’s Emissions Trading System (ETS) launched in the summer of 2021 with high hopes. It is the largest ETS in the world and covers 40 percent of all Chinese emissions – 4.5 billion tonnes of carbon per year. Unfortunately, however, the system is plagued by design flaws that at best improve the efficiency of power plants, but cannot help reduce emissions. And frequent problems arise with the submitted emissions data. Analysts predict that it will take until the end of the decade before China’s emissions trading is effectively revised.

Almost 80 percent of all data reported by companies participating in the ETS have been found to be deficient, according to the Chinese Ministry of Ecology and Environment. The authorities now want to improve data gathering and monitoring with new guidelines.

Emissions from coal and gas-fired power plants are not measured directly. Instead, the plants calculate them based on the coal used to generate electricity and the efficiency of the plants. Authorities do not sufficiently monitor companies in this process. This is the reason for several data scandals in the past:

These scandals have increased pressure on the authorities to close loopholes, says Yan Qin, an analyst at Refinitiv, a provider of financial market data. The new regulations are “stricter in terms of checking the coal used”, she says. But controls themselves have not been tightened. The guidelines “do not provide for more spot checks, nor do they change the penalties for non-compliance with the requirements of the emissions trading system”, says Zhibin Chen, Senior Manager at the research and consulting institute Adelphi.

This leaves two major problems:

Reliable data is also important for the expansion of emissions trading to other sectors. So far, only larger coal and gas-fired power plants are included. The expansion to steel, cement and aluminum has been postponed repeatedly, partly due to the lack of reliable data.

Another problem is the flawed design of China’s emissions trading system. There is no cap on allowances, as is the case with the European ETS. Instead, emission allowances are allocated under a complicated benchmark system, which is based on emission intensity:

This energy intensity-focused ETS “can only improve the overall efficiency of the coal plants but cannot cap the emission of the power sector”, says Qin. Instead, this wrong focus “incentivize the build out of newer coal plants“.

So far, China’s emissions trading system has only finished its trial phase. Trading mechanisms have been established and participating companies have developed an awareness that emissions will cost money (in the future), says journalist Xiaoying You.

Projections for the expansion of the ETS to other sectors vary:

Qin also predicts that it will take at least until 2028 before China switches to a fixed allowance cap. A transition from the flexible to the fixed cap will be easier once allowance trading is established. She also believes that energy demand will continue to rise until late in the 2020s. “Therefore, it is difficult to set a fixed cap for the ETS too early.” So China’s emissions trading will continue to have hardly any climate impact in the near future.

The unreliable data situation of Chinese ETS participants could also become a problem for the measurement of climate tariffs for Chinese producers. This is because, in theory, the Carbon Border Adjustment Mechanism (CBAM) applies to importers to Europe: Those who pay a carbon price on their products in the country of production will be credited in the calculation of the climate tariff CBAM. This applies to all products covered by CBAM: cement, fertilizer, electricity, hydrogen, iron and steel, and aluminum.

In practice, this means that instead of paying the full EU carbon price on steel imports, for example, foreign steel producers are granted a discount on the local carbon price. However, foreign steel producers must prove to the European authorities how much carbon dioxide was actually emitted during production.

“It remains to be seen how much external scrutiny China will allow,” says Verena Graichen, ETS expert and senior researcher for energy and climate protection at the Oeko-Institut. It is true that the Clean Development Mechanism (CDM) – a climate action instrument from the Kyoto Protocol – has an international verification system that also works in China. But Graichen says that China does not like granting others a deeper look into its own systems. This means that European authorities will probably have a hard time reconstructing the data provided by China. Collaboration: Lukas Scheid

China’s chief diplomat Wang Yi is expected to attend the Munich Security Conference (Feb. 17-19) this weekend. This was confirmed by the Chinese Foreign Ministry on Monday. It is the first attendance of a senior Chinese politician since the start of the Covid pandemic in 2020.

During his eight-day Europe tour, Wang will also visit numerous European capitals and meet with local senior government officials. The former foreign minister is expected to visit Moscow, among other places. Two weeks ago, rumors already circulated about a possible meeting with Russia’s President Vladimir Putin. Beijing stands by Moscow despite Russia’s attack on Ukraine. Other stations on Wang’s trip will be France, Italy and Hungary. grz

The mask mandate at Beijing schools and kindergartens has been lifted. Local education authorities on Monday declared an end to all Covid restrictions and regulations previously in place. For years, teachers and students were required to wear face masks. Body temperature was measured daily before students could enter school grounds. Even high school students were not allowed to leave the school premises during recess.

When the end of the measures was announced late Monday morning at the German school in the diplomatic quarter of Sanlitun, the announcement was drowned out by the cheers of the students. Some students ripped apart their masks in joy. “With this, our school life regains the informality that was taken for granted before the Covid pandemic,” commented school principal Andreas Merzhaeuser in a memo.

The restrictions had extremely limited the room for extracurricular activities. Parents or other visitors were only allowed to enter the school premises in special cases. No outside spectators were allowed at events. Now, concerts, theater performances and festivals can once again be attended without restriction. Next Friday, the German school will celebrate carnival. The library is also now open again to outside visitors. frs

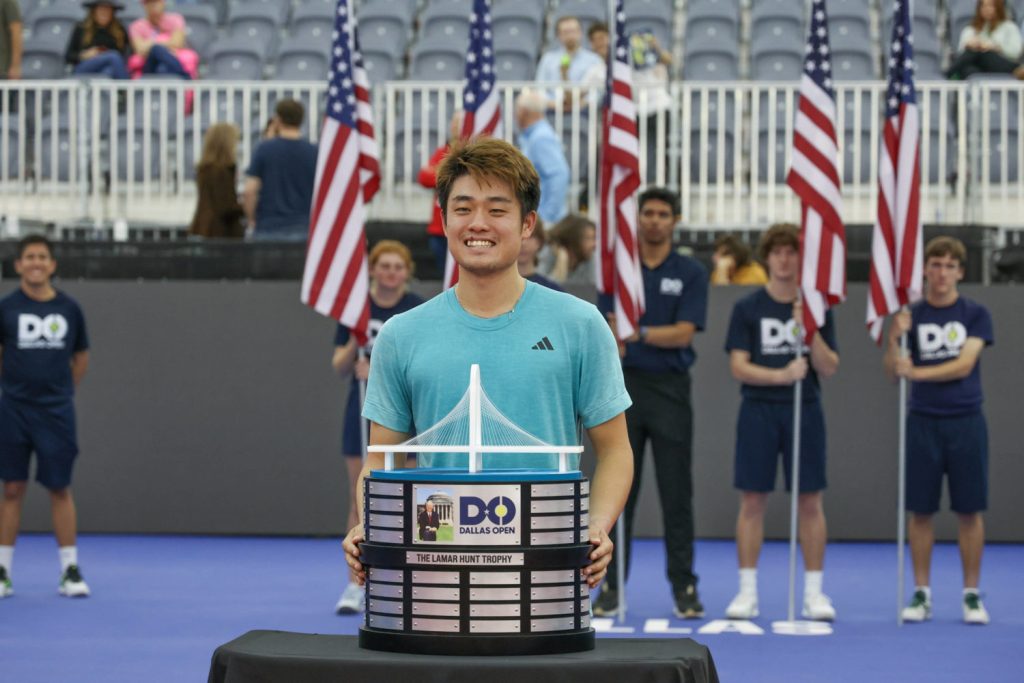

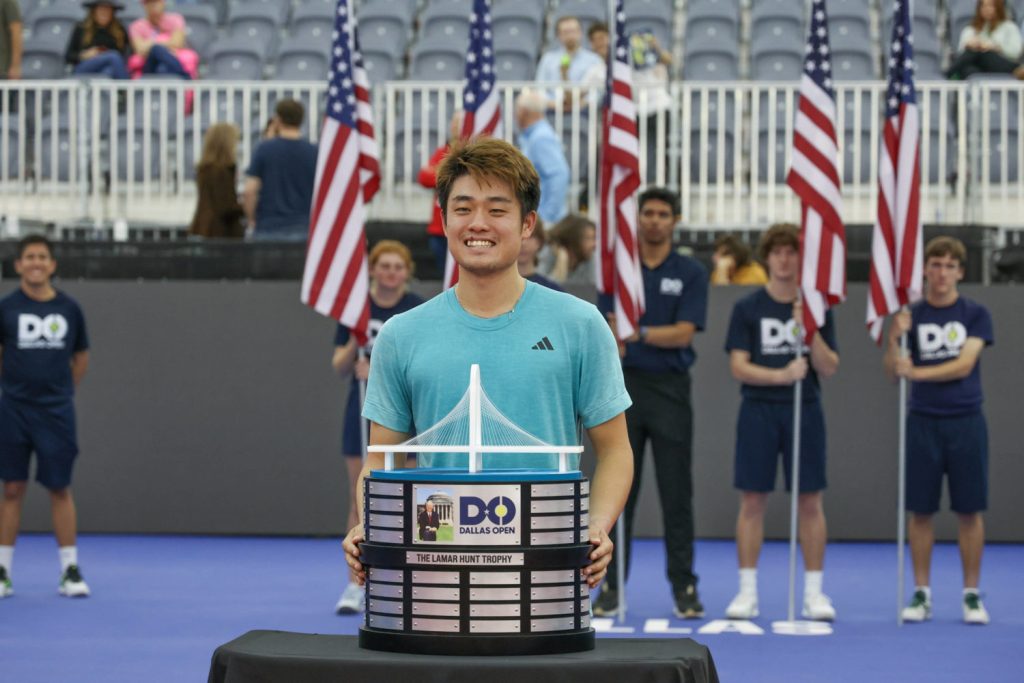

For the first time in history, a Chinese tennis professional has won an ATP tournament. Wu Yibing from Hangzhou crowned his winning streak in Dallas/Texas with a surprising final victory over former top ten player John Isner (6:7, 7:6, 7:6). The 23-year-old Wu already made history with his semi-final victory and was the first to represent the Chinese colors in a final on the professional tour.

The ATP is the world tennis federation that organizes the world’s largest and most lucrative men’s tournaments. In less than a year, Wu climbed from 1,869th in the world rankings to 97th and will climb even higher thanks to his tournament victory. He first attracted attention to his great potential last fall at the US Open, one of the four Grand Slam tournaments. There, he reached the round of the last 32.

However, China’s men’s tennis still lags far behind the women’s successes. With nine titles on the professional tour, Li Na is by far the country’s all-time best player. She won her two Grand Slam titles in Paris in 2011 and Melbourne in 2014. She made it to number two in the world rankings.

China’s most prominent player, however, is Wimbledon doubles champion Peng Shuai. In the fall of 2021, Peng raised rape allegations against former Vice Premier Zhang Gaoli. After a few public appearances with Chinese officials by her side, she completely disappeared from the public eye. Search results in Chinese online media have been censored ever since. grz

Liu Zhengrong was Head of Human Resources at Beiersdorf in Hamburg for almost ten years. Now he is retiring and allowing himself a six-month break. Time to reflect, as he says. After all, the 55-year-old has had an eventful few years.

Born in Shanghai in 1968, Liu first studied Chinese as a second language and then, from 1990, education and political science in Cologne. To finance his life in Germany, he gave Chinese classes, worked in canteens and worked night shifts in a print shop.

For Liu, these jobs were even more influential than his studies, he says. Certainly also because, as a language teacher, he forged contacts with executives of German companies who were sent to China in the 1990s. But above all, because he was able to observe and experience the everyday life, culture and mentality of Germany as a business location from the grassroots in German canteens and during night shifts.

This helped him in his later role as HR manager to better understand the concerns, needs and worries of employees. And it helped him optimize his German – certainly not a disadvantage for his later ambitions for a job as head of HR of a German DAX company.

Back in China, the still young man’s German expertise quickly paid off. One of his former Chinese students offered him a job as a local employee at the Bayer Group in Beijing. From there, he quickly climbed up the corporate ladder. Within six years, Liu rose to the post of Deputy Managing Director for China and Head of Human Resources for Asia at Bayer Polymers.

In 2004, he returned to Germany to join Lanxess in Leverkusen. As Deputy Head of Human Resources, Liu played an important role in rebuilding the company’s global human resources management system. In the city on the Rhine, he helped promote Chinese courses at a local high school. In 2013, as Head of HR, he eventually left the company for Beiersdorf.

As the man responsible, ten years in a company’s HR work would have allowed him to ensure a healthy balance between continuity and renewal. Liu Zhengrong is convinced that only three or four years are usually not enough for actual change. On the other hand, he says, under normal circumstances, no one should be given a “permanent subscription” on the board of a DAX-listed company. So at the end of 2021, he decided to leave Beiersdorf after two terms and look for a new field.

On the boards of major German companies, Liu Zhengrong is virtually alone with his Chinese roots. Given China’s importance for German business, this is a troubling phenomenon, he says. When he took the job at Lanxess 20 years ago, he hoped that he would soon no longer be portrayed as the “model Chinese”. At the time, he was sure that many interesting individuals from China would make a career as business leaders in Germany. However, that obviously did not come true.

As for his – therefore still – extraordinary career, he considers it mainly a series of lucky coincidences. The trust placed in him by his respective superiors has played a decisive role, he says. As for himself, he says, he merely tried to perform the tasks assigned to him to the best of his ability. Clemens Ruben

Gu Kaman accepted another function at China Southern Airlines at the Frankfurt/Main branch at the beginning of the year. In addition to her role as Business Development Manager, she has also been Deputy Cargo Sales Manager since January. Gu has been working for the airline from Guangzhou in southern China for almost ten years.

Is something changing in your organization? Let us know at heads@table.media!

Wandering in a maze of ice and snow: Visitors to the Snow and Ice Festival in Hohhot, the capital of Inner Mongolia.

Cosco’s stake in the Port of Hamburg is still pending. The deadline for an agreement has long since expired. This raises two questions in particular: If deadlines do not matter in this context, why do we set them at all? But even more intriguing is the question of why Cosco is not swooping in?

After all, the Chinese state-owned shipping company stands to gain a 24.9 percent stake in a terminal. But now it hesitates. The reasons are anyone’s guess. Could it be that Cosco does not want to spend the money if it cannot influence the decision of the port administration? A tiny fraction of shares is missing for that.

One conclusion could be that the state-owned company is only interested in political influence rather than in the prospect of good business after all. This provides valuable clues about the intentions behind future investments from China in critical German, but also European infrastructure. And it provides food for thought for the future. Because politics still has no clear line, as Christiane Kuehl writes.

Michael Radunkski, on the other hand, is once again busy with balloons today. It is quite comical to see who is now spotting such spy objects in the skies above their territory and where. From zero to one hundred in less than a week. It is not only that Taiwan casually explains that such balloons are sighted almost every week.

China portrays itself as the biggest victim. Beijing is now accusing the USA of using its technical superiority against them. It complains about an uneven espionage playing field, so to speak. Hence the following proposal: China provides fair market access for foreign companies and in return, the Americans turn a blind lens to foreign snooping.

The deal should originally have been closed by New Year’s Eve. But even after the contractual deadline expired on December 31, 2022, it is still uncertain whether China’s state-owned Cosco will invest in the Hamburg Container Terminal Tollerort (CTT) or not.

The Hong Kong-listed terminal division of the company, Cosco Shipping Ports Limited (CSPL), declared in a stock exchange announcement earlier this year that not all conditions for its entry into CTT had yet been met, as the German broadcaster NDR reported. Among other things, the conditions for the entry were still being discussed with the German Ministry of Economic Affairs. There is no guarantee that the deal will be finalized.

The terminal operator, Hamburger Hafen Logistik AG, or HHLA for short, sounded much more optimistic on January 6: A spokeswoman confirmed “objective, constructive talks” between HHLA, CSPL and the German Federal Ministry for Economic Affairs and Climate Action (BMWK), during which “it has been possible to agree on concrete conditions for CSPL’s participation in HHLA Container Terminal Tollerort GmbH”. Final details are reportedly being worked out at the moment. HHLA and CSPL were aiming to “finalize the transaction soon”. There is no information on possible sticking points. And since then, nothing but silence.

The wait for Cosco’s decision is a new phase in the Hamburg port saga. A quick recap: Hamburg and its Logistik AG want the acquisition to happen. Numerous German ministries, including the BMWK, warned of security risks. In the end, the German government, under pressure from Chancellor Scholz, approved the stake in October 2022 but limited the terms for Cosco by issuing a so-called partial ban.

Cosco is now only entitled to a maximum 24.9 percent stake in Tollerort, instead of the 35 percent originally agreed upon with HHLA. The ongoing negotiations indicate that Cosco is displeased with these conditions: Below 25 percent, it has no formal influence on any business decisions. Berlin has ruled out a later share increase.

The hard-fought compromise may ultimately break the deal. This would be tantamount to a ban, which the Chancellery had shied away from. The only difference is that the blame for the failed deal could easily be passed on to Cosco.

But the fundamental question remains. How will we deal with future investment offers from China? “I assume that Hamburg marks a turning point in how Chinese direct investments are handled. They will probably be scrutinized more closely in the future,” Sebastian Bersick from the Ruhr University in Bochum told China.Table. Bersick is the author of a chapter for an upcoming volume of essays, comparing Chinese port investments in Europe, Central and South America. “This means that corporate interests take a relative step back against political and geopolitical considerations.”

HHLA and the City of Hamburg have repeatedly stressed that a long-term bond with the shipping giant Cosco is essential in the face of growing competition for cargo with the three other North Range ports of Rotterdam, Antwerp and Zeebrugge. In Zeebrugge, CSPL holds 90 percent of the sole container terminal and thus controls the management. The terminal has since become the fastest-growing hub in Cosco’s global network. Antwerp and Rotterdam both have Chinese minority stakes in terminals. Hamburg sees itself under pressure.

Bersick believes that the core of the much-needed debate is the question of how a possible economic dependence on China can be measured in the future and how a feared political influence could be defined. “What we increasingly lack is trust in Chinese business partners: Even if these are motivated purely by business considerations, it can never be ruled out that later actions will follow geopolitical interests – especially if it is a state-owned company.”

The current impression of a lack of transparency is not particularly helpful in this respect. According to a minor interpellation by the CDU/CSU parliamentary group on the status of the Cosco deal, the Press Office of the German Parliament stated on January 10 that the German government refused to give public answers citing “constitutionally protected business secrets”. The information was classified as “VS–Confidential“.

Investigative teams from the German broadcasters WDR and NDR recently uncovered references in internal German government documents to further joint projects between HHLA and Cosco in other European countries, for example in the Baltic Sea or the Mediterranean. Agreements have reportedly already been signed. HHLA declined any comment.

On Monday, China turned the tables – and raised serious espionage allegations: Allegedly, the United States had illegally sent balloons over China more than ten times last year alone, said a spokesperson for the Chinese Foreign Ministry in Beijing. Accordingly, the US should stop accusing others of spying. “It’s quite clear to the global community which country is the number one spy empire in the world,” Wang Wenbin said.

As the week starts, it quickly becomes clear that the conflict between the USA and China over suspected flying spy objects is intensifying. Beijing wants to reclaim the initiative by making accusations of its own in order to switch from the defensive to the offensive. But reports from Taiwan are disrupting this maneuver. Chinese balloons have apparently overflown the island repeatedly in the past. The true extent of the Chinese campaign will probably only reveal itself in the weeks and months to come.

Nevertheless, China has strong arguments to support its claim that the US has far greater espionage capabilities at its disposal. Foreign Office spokesman Wang specified China’s accusations: The United States would by no means limit itself to balloons, but would also dispatch aircraft and warships to gather intelligence on China: Beijing registered 657 close reconnaissance flights last year and 64 missions in the South China Sea in January 2023 alone. However, it should be noted here that China lays claim to a large part of the South China Sea. The international arbitration court in The Hague, on the other hand, rejected these claims in 2016.

But despite the exaggerations of its own argumentation, there is a nugget of truth in the Chinese narrative. Take the actions of the NSA, for example. The NSA also wiretapped Chancellor Angela Merkel from an unregistered site in the US Embassy at the Pariser Platz in Berlin. Merkel was on the US list of spy targets between 2002 and 2013, as were the heads of government of other European countries at various times.

In the overall picture, it looks as if both sides are fully utilizing all technical reconnaissance capabilities. The balloons have then become the focus of attention. But not only the US is currently reporting suspected Chinese spy balloons. Dozens of Chinese military balloons have allegedly also been sighted over Taiwan in recent years. This was reported by the British Financial Times on Monday. “They come very frequently, the last one just a few weeks ago,” a senior Taiwanese official said according to the report. Such incursions would occur once a month on average.

That would be far more than known to date: Previously, Taiwan’s Ministry of Defence confirmed only one incident. Last February, several Chinese balloons were detected over the north of the country.

However, the Chinese balloons over Taiwan are said to be very different from the downed version over the US: These balloons would fly at an altitude of around 6,000 meters, as opposed to around 20 kilometers above the USA. Furthermore, they were made of a different material.

But due to their size and the devices on board, they too were definitely not weather balloons that would be allowed to enter the airspace of other countries without prior permission. Rather, they are believed to have gathered data needed for the use of radar and missile systems, like those China would need for potential operations in the waters and airspace east of Taiwan.

These could be preparations for an attack. Since Nancy Pelosi’s visit to Taiwan, Beijing has massively intensified the pressure on Taipei. Xi Jinping has repeatedly threatened to annex the island to the People’s Republic – by force if necessary. US military officials, therefore, expect a Chinese assault on Taiwan, possibly as early as 2025. However, Xi does not seem to have yet made a decision to this effect.

The assessment of the situation has been complicated by the sudden increase in balloon sightings. The US military has shot down four flying objects over North America in the past few days: one Chinese balloon and three other unidentified flying objects, although no information on them has surfaced so far. Above all, it is unknown where they came from.

The events of the past few days have exposed a vulnerability in US air defense, Malcolm Davis told China.Table. The scientist from the renowned Australian Strategic Policy Institute expects further discoveries – also over the USA. The North American Aerospace Defense Command has since recalibrated its sensors to allow the discovery of slow-moving objects such as balloons, Davis explained.

Davis is convinced that the situation is a serious security crisis. He claims that the Chinese spy balloon collected data near the US base in Montana. Through SIGINT and ELINT – long-range and electronic reconnaissance – the Chinese balloon may have been able to intercept radio and satellite communications, as well as spy on radar data. In an extreme case, this would “allow them to ensure greater accuracy for their ICBMs in any nuclear attack on the US,” Davis explained.

Davis expects that the true extent of Chinese espionage will only become clear in the coming weeks and months. In recent days, he said, it has become apparent that China’s balloons are operating at high altitudes over an intercontinental range, gathering sensitive information. But it will not stop there, he said. “These balloons are clearly vulnerable to being shot down, so a more sophisticated capability could be based around advanced high altitude drones and long-endurance lighter-than-air craft, such as airships.”

However, like in the case of espionage, there should be no illusions. Such high-tech objects are being developed by China – but also by the US military in several current and discontinued programs. The idea is also neither new nor original. Even the German armed forces have commissioned a “flying eye” from Rheinmetall.

China’s Emissions Trading System (ETS) launched in the summer of 2021 with high hopes. It is the largest ETS in the world and covers 40 percent of all Chinese emissions – 4.5 billion tonnes of carbon per year. Unfortunately, however, the system is plagued by design flaws that at best improve the efficiency of power plants, but cannot help reduce emissions. And frequent problems arise with the submitted emissions data. Analysts predict that it will take until the end of the decade before China’s emissions trading is effectively revised.

Almost 80 percent of all data reported by companies participating in the ETS have been found to be deficient, according to the Chinese Ministry of Ecology and Environment. The authorities now want to improve data gathering and monitoring with new guidelines.

Emissions from coal and gas-fired power plants are not measured directly. Instead, the plants calculate them based on the coal used to generate electricity and the efficiency of the plants. Authorities do not sufficiently monitor companies in this process. This is the reason for several data scandals in the past:

These scandals have increased pressure on the authorities to close loopholes, says Yan Qin, an analyst at Refinitiv, a provider of financial market data. The new regulations are “stricter in terms of checking the coal used”, she says. But controls themselves have not been tightened. The guidelines “do not provide for more spot checks, nor do they change the penalties for non-compliance with the requirements of the emissions trading system”, says Zhibin Chen, Senior Manager at the research and consulting institute Adelphi.

This leaves two major problems:

Reliable data is also important for the expansion of emissions trading to other sectors. So far, only larger coal and gas-fired power plants are included. The expansion to steel, cement and aluminum has been postponed repeatedly, partly due to the lack of reliable data.

Another problem is the flawed design of China’s emissions trading system. There is no cap on allowances, as is the case with the European ETS. Instead, emission allowances are allocated under a complicated benchmark system, which is based on emission intensity:

This energy intensity-focused ETS “can only improve the overall efficiency of the coal plants but cannot cap the emission of the power sector”, says Qin. Instead, this wrong focus “incentivize the build out of newer coal plants“.

So far, China’s emissions trading system has only finished its trial phase. Trading mechanisms have been established and participating companies have developed an awareness that emissions will cost money (in the future), says journalist Xiaoying You.

Projections for the expansion of the ETS to other sectors vary:

Qin also predicts that it will take at least until 2028 before China switches to a fixed allowance cap. A transition from the flexible to the fixed cap will be easier once allowance trading is established. She also believes that energy demand will continue to rise until late in the 2020s. “Therefore, it is difficult to set a fixed cap for the ETS too early.” So China’s emissions trading will continue to have hardly any climate impact in the near future.

The unreliable data situation of Chinese ETS participants could also become a problem for the measurement of climate tariffs for Chinese producers. This is because, in theory, the Carbon Border Adjustment Mechanism (CBAM) applies to importers to Europe: Those who pay a carbon price on their products in the country of production will be credited in the calculation of the climate tariff CBAM. This applies to all products covered by CBAM: cement, fertilizer, electricity, hydrogen, iron and steel, and aluminum.

In practice, this means that instead of paying the full EU carbon price on steel imports, for example, foreign steel producers are granted a discount on the local carbon price. However, foreign steel producers must prove to the European authorities how much carbon dioxide was actually emitted during production.

“It remains to be seen how much external scrutiny China will allow,” says Verena Graichen, ETS expert and senior researcher for energy and climate protection at the Oeko-Institut. It is true that the Clean Development Mechanism (CDM) – a climate action instrument from the Kyoto Protocol – has an international verification system that also works in China. But Graichen says that China does not like granting others a deeper look into its own systems. This means that European authorities will probably have a hard time reconstructing the data provided by China. Collaboration: Lukas Scheid

China’s chief diplomat Wang Yi is expected to attend the Munich Security Conference (Feb. 17-19) this weekend. This was confirmed by the Chinese Foreign Ministry on Monday. It is the first attendance of a senior Chinese politician since the start of the Covid pandemic in 2020.

During his eight-day Europe tour, Wang will also visit numerous European capitals and meet with local senior government officials. The former foreign minister is expected to visit Moscow, among other places. Two weeks ago, rumors already circulated about a possible meeting with Russia’s President Vladimir Putin. Beijing stands by Moscow despite Russia’s attack on Ukraine. Other stations on Wang’s trip will be France, Italy and Hungary. grz

The mask mandate at Beijing schools and kindergartens has been lifted. Local education authorities on Monday declared an end to all Covid restrictions and regulations previously in place. For years, teachers and students were required to wear face masks. Body temperature was measured daily before students could enter school grounds. Even high school students were not allowed to leave the school premises during recess.

When the end of the measures was announced late Monday morning at the German school in the diplomatic quarter of Sanlitun, the announcement was drowned out by the cheers of the students. Some students ripped apart their masks in joy. “With this, our school life regains the informality that was taken for granted before the Covid pandemic,” commented school principal Andreas Merzhaeuser in a memo.

The restrictions had extremely limited the room for extracurricular activities. Parents or other visitors were only allowed to enter the school premises in special cases. No outside spectators were allowed at events. Now, concerts, theater performances and festivals can once again be attended without restriction. Next Friday, the German school will celebrate carnival. The library is also now open again to outside visitors. frs

For the first time in history, a Chinese tennis professional has won an ATP tournament. Wu Yibing from Hangzhou crowned his winning streak in Dallas/Texas with a surprising final victory over former top ten player John Isner (6:7, 7:6, 7:6). The 23-year-old Wu already made history with his semi-final victory and was the first to represent the Chinese colors in a final on the professional tour.

The ATP is the world tennis federation that organizes the world’s largest and most lucrative men’s tournaments. In less than a year, Wu climbed from 1,869th in the world rankings to 97th and will climb even higher thanks to his tournament victory. He first attracted attention to his great potential last fall at the US Open, one of the four Grand Slam tournaments. There, he reached the round of the last 32.

However, China’s men’s tennis still lags far behind the women’s successes. With nine titles on the professional tour, Li Na is by far the country’s all-time best player. She won her two Grand Slam titles in Paris in 2011 and Melbourne in 2014. She made it to number two in the world rankings.

China’s most prominent player, however, is Wimbledon doubles champion Peng Shuai. In the fall of 2021, Peng raised rape allegations against former Vice Premier Zhang Gaoli. After a few public appearances with Chinese officials by her side, she completely disappeared from the public eye. Search results in Chinese online media have been censored ever since. grz

Liu Zhengrong was Head of Human Resources at Beiersdorf in Hamburg for almost ten years. Now he is retiring and allowing himself a six-month break. Time to reflect, as he says. After all, the 55-year-old has had an eventful few years.

Born in Shanghai in 1968, Liu first studied Chinese as a second language and then, from 1990, education and political science in Cologne. To finance his life in Germany, he gave Chinese classes, worked in canteens and worked night shifts in a print shop.

For Liu, these jobs were even more influential than his studies, he says. Certainly also because, as a language teacher, he forged contacts with executives of German companies who were sent to China in the 1990s. But above all, because he was able to observe and experience the everyday life, culture and mentality of Germany as a business location from the grassroots in German canteens and during night shifts.

This helped him in his later role as HR manager to better understand the concerns, needs and worries of employees. And it helped him optimize his German – certainly not a disadvantage for his later ambitions for a job as head of HR of a German DAX company.

Back in China, the still young man’s German expertise quickly paid off. One of his former Chinese students offered him a job as a local employee at the Bayer Group in Beijing. From there, he quickly climbed up the corporate ladder. Within six years, Liu rose to the post of Deputy Managing Director for China and Head of Human Resources for Asia at Bayer Polymers.

In 2004, he returned to Germany to join Lanxess in Leverkusen. As Deputy Head of Human Resources, Liu played an important role in rebuilding the company’s global human resources management system. In the city on the Rhine, he helped promote Chinese courses at a local high school. In 2013, as Head of HR, he eventually left the company for Beiersdorf.

As the man responsible, ten years in a company’s HR work would have allowed him to ensure a healthy balance between continuity and renewal. Liu Zhengrong is convinced that only three or four years are usually not enough for actual change. On the other hand, he says, under normal circumstances, no one should be given a “permanent subscription” on the board of a DAX-listed company. So at the end of 2021, he decided to leave Beiersdorf after two terms and look for a new field.

On the boards of major German companies, Liu Zhengrong is virtually alone with his Chinese roots. Given China’s importance for German business, this is a troubling phenomenon, he says. When he took the job at Lanxess 20 years ago, he hoped that he would soon no longer be portrayed as the “model Chinese”. At the time, he was sure that many interesting individuals from China would make a career as business leaders in Germany. However, that obviously did not come true.

As for his – therefore still – extraordinary career, he considers it mainly a series of lucky coincidences. The trust placed in him by his respective superiors has played a decisive role, he says. As for himself, he says, he merely tried to perform the tasks assigned to him to the best of his ability. Clemens Ruben

Gu Kaman accepted another function at China Southern Airlines at the Frankfurt/Main branch at the beginning of the year. In addition to her role as Business Development Manager, she has also been Deputy Cargo Sales Manager since January. Gu has been working for the airline from Guangzhou in southern China for almost ten years.

Is something changing in your organization? Let us know at heads@table.media!

Wandering in a maze of ice and snow: Visitors to the Snow and Ice Festival in Hohhot, the capital of Inner Mongolia.