Most buzzwords sound flashier than what they actually describe. This also applies to de-risking, which means nothing more than good old risk limitation. By investing in the Chinese market, automotive supplier Continental is trying to brace itself against the uncertainties looming in its home market, writes Christian Domke Seidel. For the large medium-sized company, de-risking means heavy investment in the People’s Republic. Find out in today’s China.Table issue what the company expects to gain from this and what risks this strategy could entail.

Michael Radunski also looked at unrecognized risks in his analysis. He took a closer look at the decisions Vladimir Putin and Xi Jinping reached at their last meeting when they deepened their supposedly borderless friendship. Among other things, they discussed the People’s Republic’s access to the Sea of Japan – which, in the long term, however, promises a route to the Arctic, which could be ice-free in a few decades. This has implications for Beijing’s vision of a polar Silk Road and the region’s power balance.

Things are currently not going well for Continental in Europe. Business in China is expected to compensate for this. Continental is planning to invest billions in China, while the company is cutting costs in Germany. This is part of the company’s de-risking strategy. The supplier wants to use sales and partnerships in the People’s Republic to compensate for what is falling away elsewhere. Chinese manufacturers now account for a significant – and growing – proportion of sales. Continental is also aligning its research and development accordingly. But there are risks along the way.

Continental has hardly made any positive headlines in recent months, at least in Germany. The supplier has been undergoing a cost-reduction program since 2019. At the Annual General Meeting in April 2024, employee representatives criticized the Executive Board, saying there was no discernible strategy. In parallel, the investment bank Jefferies pointed out that 2024 will be a very risky year. Partly due to disappointing business performance in the first quarter.

In addition, the German business newspaper Handelsblatt reported on a dispute between Continental and BMW concerning defective brake systems. Continental will also be merging its German plants in Schwalbach and Wetzlar in 2025, which will result in around 1,200 layoffs. The company also reportedly wants to cut jobs in Frankfurt-Babenhausen.

China appears to be exempt from this austerity program. “In the past ten years, Continental has invested more than three billion euros in China. We are planning investments at a similar level for the coming years,” a company spokesperson told Table.Briefings. One part of this investment strategy is the development hub for software and systems in Chongqing, for example. It was opened in 2021 – two years after the company’s top management approved the cost-cutting program.

This makes sense from Continental’s point of view. In the past financial year, Continental generated 12 percent of its global sales in China, and the trend is rising. This is because the supplier is increasingly supplying purely Chinese manufacturers. “In 2023, we were able to achieve a significant proportion of our order intake in China with Chinese car manufacturers. We are therefore confident that we will also grow with local Chinese manufacturers in the future,” the company spokesperson explains. A strategy that competitor ZF Friedrichshafen is also pursuing.

This is an important step in the local business strategy. As electric cars are booming, German brands are increasingly losing market share in China. However, this was largely the reason why suppliers set up plants in the People’s Republic to supply the well-known OEMs. A business that is now crumbling. This means that for suppliers, de-risking means focusing more on their China business. In the Asia-Pacific region, Continental now supplies the top five highest-volume EV manufacturers, as the company spokesperson explains.

De-risking is not synonymous with withdrawing from China due to political risks. On the contrary. “Making a local site in China more resilient in order to remain globally and locally competitive requires investment in China, but can be part of a de-risking strategy,” says Philipp Boeing, explaining the strategy. He is Professor of Empirical Innovation Research with a focus on China at Goethe University Frankfurt and ZEW Mannheim.

He believes it is important to be consistent here. “If a company decides to be active in China, it must adhere to certain standards in order to benefit from this commitment,” Boeing continues. So this means: investing!

In light of the planned mobility transition and the transformation towards a green economy, research and development are essential. Accordingly, spending in this area has increased massively at large companies. In 2023, the DAX companies increased their R&D spending by seven percent. At Continental, however, spending declined (at least when looking at the company as a whole). The focus here appears to be on China.

But that alone is not enough, Boeing explains. “It’s about not only remaining competitive locally, but also scaling the capabilities gained – in other words, benefiting from them in other markets too. The development should not only bring local advantages, but can also be used on other platforms.” Whether this works depends heavily on the individual case, he added. Although China is known as a “fitness center” for the automotive industry, there is no guarantee that local demands and tastes can be globalized.

Especially as German manufacturers are not being outpaced in their core competencies as quickly as is often portrayed. “German companies are generally active in medium to high-tech industries. Particularly in mechanical engineering and the automotive industry. These are technologies in which China would certainly be able to substitute the products, but German manufacturers still have slight advantages in some areas – in research and development, production and through many years of experience and specialization,” Boeing explains.

And China’s catch-up race is not as swift as many people make it out to be. Companies from the People’s Republic are indeed registering more and more patents, says Boeing. Since 2010, China has been the world leader in the number of total patent filings. And since 2019, it has even been leading in the number of so-called “world patents” – particularly valuable international patents. But these figures are deceiving. The Communist Party heavily subsidizes patent applications. According to Boeing, that means that the quantity is right, but the quality is not. Only rarely do the filed inventions actually lead to more innovations.

At least Continental sees itself on the right track. It started production of a new high-performance computer for a Chinese car manufacturer in the first quarter. New business areas are also to be rolled out here in the future. “We also see the potential to grow with Chinese manufacturers outside of China. Should they plan to expand into other markets, we are ready to support them – with our technologies and our global production facilities,” the press spokesperson says. In Continental’s case, de-risking compensates for weaknesses in the domestic market.

At their meeting in Beijing in May, Russian President Vladimir Putin and China’s ruler Xi Jinping agreed on a joint declaration to deepen their strategic partnership. Amid all their raving against the United States, the West and its “destructive and hostile pressure,” many an important decision go unnoticed – especially when they come across as inconspicuous as the following resolution:

What sounds to some like a subsidy program for local fisheries could have far-reaching implications – for Japan, for South Korea, even for the Arctic.

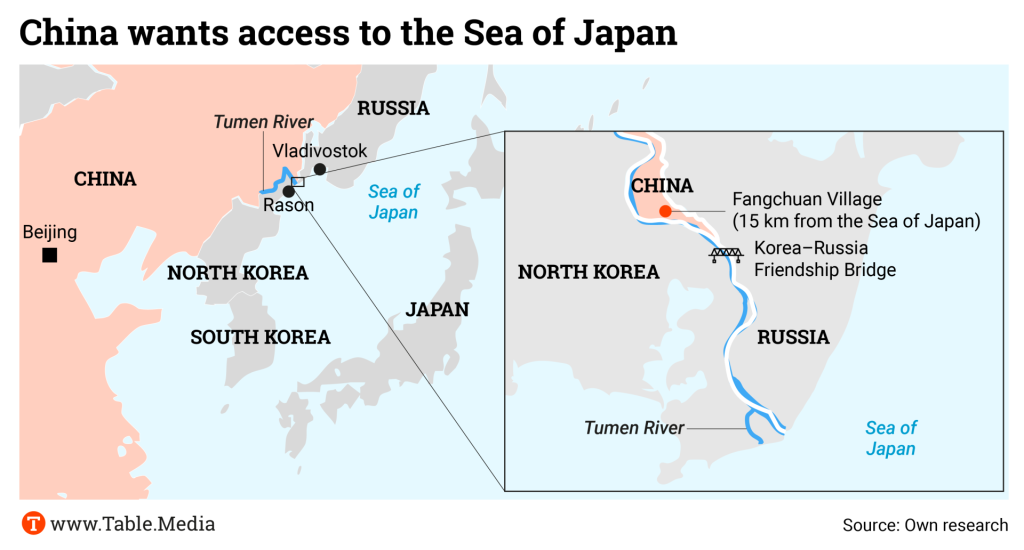

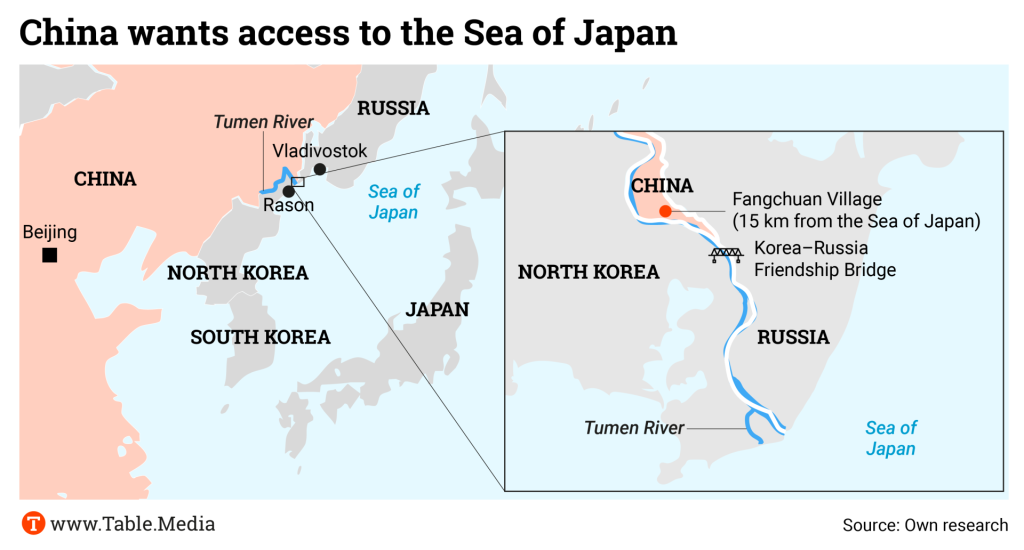

The Tumen River forms the border between China and North Korea, but downstream it becomes the border river between North Korea and Russia before it flows into the Sea of Japan. This means that Chinese vessels can only navigate the Tumen freely up to Fangchuan, the eastern end of the inland province of Jilin. Both Russia and North Korea must give their approval for the remaining 15 kilometers to the Sea of Japan. Another obstacle is the approximately seven-meter-high Korean-Russian Friendship Bridge dating back to the Soviet era, blocking the passage of larger ships.

China has long been trying to overcome these problems – sometimes by obtaining general transit permits for Chinese ships, sometimes by establishing a special economic zone along the banks of the Tumen or by acquiring a stake in piers in the North Korean port of Rason. The goal is obvious: China wants to gain access to the Sea of Japan through the Tumen River. Chinese foreign policy expert Shi Yuanhua puts it this way: China could finally achieve freedom of navigation in the Sea of Japan via the Tumen (实现中国对于日本海的’自由航行’).

Japan is concerned because this would shift the strategic balance of power vis-à-vis China to its disadvantage. Chisako Masuo, professor of Chinese foreign policy at Kyushu University in Fukuoka, is convinced that the larger ships that China wants to steer directly into the Sea of Japan via the Tumen would also include Chinese Coast Guard patrol vessels.

A massive problem for the Japanese Navy. Because: “If China Coast Guard ships become active in the Sea of Japan, Japan will need to divert its own coast guard vessels that are currently monitoring waters near the Senkaku Islands,” Masuo said. “This could weaken surveillance in the East China Sea.” The dispute there concerns the Senkaku Islands, which are under Japanese administration and which China claims under the name Diaoyu. The activity of Chinese government ships in the waters around the islands has recently picked up again.

There are likely to be similar concerns in South Korea. Chinese vessels would reach the Korean peninsula from both sides in the future. In addition, both Japan and South Korea are close US allies. A deteriorating security situation – even if only perceived – would have an impact on the plans of US forces.

In any case, Putin and Xi’s joint statement hints at plans for expanded joint military exercises as well as joint naval and air patrols. Chinese and Russian forces already conduct joint naval and air exercises in the Sea of Japan. An increased presence of the Chinese Coast Guard would probably further increase the scope of such activities.

However, China’s attempts to gain access to the Sea of Japan pursue a much more far-reaching goal: a route to the Arctic. Chinese scientists from Dalian Maritime University argue in an essay published in May 2024 that access to the Sea of Japan would improve China’s position in the Arctic and significantly advance Beijing’s vision of a polar Silk Road.

Should the Arctic actually be largely ice-free by the middle of the century, this would open up completely new sea routes for China’s shipping industry. Currently, most of China’s trade has to pass through the narrow Strait of Malacca between Indonesia and Malaysia. A blockade of the strait would dramatically jeopardize China’s energy security.

In addition, an ice-free Arctic would shorten the existing sea routes from Asia to Europe by around 8,000 kilometers and to North America by 4,500 kilometers. The mineral resources stored in Arctic soil are also of particular interest. American geologists believe that up to 13 percent of undiscovered oil and 30 percent of natural gas deposits are hidden under the ice.

Russia and North Korea have so far been extremely skeptical of China’s plans. Moscow feared that China’s influence in North-East Asia would increase. However, Western sanctions in response to the invasion of Ukraine have made Moscow increasingly dependent on China.

North Korea, on the other hand, shies away from the costs of the necessary dredging of the Tumen. Pyongyang also fears that Chinese investment in its ports could decline if Chinese ships were allowed free passage. However, the war in Ukraine has led to a new affinity and a new division of labor between the three countries.

Zhao Leji, number three in the hierarchy of the Chinese Communist Party, met with North Korean leader Kim Jong-un in Pyongyang. Chinese experts expect North Korea to begin talks on the Tumen River soon. Russia’s approval is now also on the table – in the form of a supposedly inconspicuous line in the joint statement by Putin and Xi.

July 1, 2024; 6 a.m. Beijing time:

EU SME Center, SME Roundtable in Guangzhou: Insights into China’s Policy Updates More

July 3, 2024; 10 a.m. (4 p.m. Beijing time)

German Chamber of Commerce – North China, Webinar GCC Knowledge Hub: New guidance on cross-border salaries for German citizens More

July 3, 2024; 10 a.m. (4 p.m. Beijing time)

EU SME Center, presentation and panel discussion: Sustainable Transition for SMEs: Prospects for Business Growth and Challenges in Change Management More

July 8, 2024; 4 p.m. (10 p.m. Beijing time)

Center for Strategic & International Studies, Webcast: Is It Me or the Economic System? Changing Chinese Attitudes Toward Inequality: A Big Data China Event More

The Chinese Ministry of Commerce has questioned the legal basis of the Foreign Subsidies Regulation (FSR). The ministry announced on Thursday that it was investigating complaints from the Chinese Machinery Industry Association (CCCME) about the EU instrument. The CCCME is a semi-official machinery and electronics trade organization representing car manufacturers and solar panel producers, among others.

According to the ministry, the central question is whether the FSR presumably constitutes trade barriers against Chinese companies, which it calls “biased practices” of the European Union. The EU’s FSR is intended to prevent foreign companies in the EU from gaining an advantage through subsidies from their home country.

According to ministry spokesperson He, Beijing’s assessment, which could result in further countermeasures, is ongoing. Details will be announced in due course. “We are paying close attention to the anti-subsidy regulation of the EU, which has had huge impact on Chinese companies that export and invest in the bloc“, He said. The Chinese Chamber of Commerce in the EU welcomed the move in a statement.

According to the South China Morning Post, the CCCME expressed “strong dissatisfaction” with the EU’s extra tariffs on Chinese electric vehicles in mid-June and openly questioned the outcome of the Brussels investigation. Negotiations between the EU and China on the extra tariffs are still ongoing. Ministry spokesperson He says that working groups from both sides are in close contact. A solution must be found by July 4 otherwise the provisional extra tariffs will take effect.

According to media reports, German Chancellor Olaf Scholz has proposed equally high tariffs on car imports on both sides. This was reported by Handelsblatt and AFP, citing government and EU circles. A tariff rate of 15 percent is said to be under discussion, but the amount could still change. However, the EU Commission reportedly considers the idea unsuitable. ari

The exact date has now been set: The leadership of the Chinese Communist Party will convene for its long-anticipated third plenum on July 15-18, as reported by the South China Morning Post, among others. This meeting of China’s most powerful figures, which is crucial for the economic course of the next five to ten years, has been overdue since last fall for unclear reasons. Since late April, the third plenum has been scheduled for July.

The exact date was announced on Thursday at a meeting of the Politburo, the party’s 24-member decision-making body. The Third Plenum, which traditionally sets the economic course for the coming years, is considered the most important of the seven party meetings held between the CP’s five-yearly congresses.

Over 370 full and deputy members of the Central Committee will attend the session. Over the past four decades, the third plenary sessions have usually been held in October or November. cyb

China’s Communist Party expelled former Defense Minister Li Shangfu and his predecessor Wei Fenghe for “serious breaches of discipline” – a euphemism for corruption. This is reported by the state news agency Xinhua. The decisions to strip Li and Wei of their party membership were approved by the seven-member Politburo, the Communist Party’s apex of power, on Thursday. The Politburo also transferred both their cases to military prosecutors.

Li was also stripped of his membership of the national legislature after being removed from the Central Military Commission, China’s top military body, earlier this year. Wei was also removed from the legislative body.

The report states, citing the Central Committee of the Communist Party, which ordered the investigation, that Li is suspected of having received “huge sums of money” in bribes and of bribing others. An investigation revealed that he “did not fulfill political responsibilities” and “sought personnel benefits for himself and others.”

“As a senior leading cadre of the party and the army, Li Shangfu betrayed his original mission … betrayed the trust of the Party Central Committee and Central Military Commission … and caused great damage to the party cause and national defense,” the report continues.

Li Shangfu was mysteriously ousted as defense minister last October without explanation after he disappeared for two months. This is the first time China has explicitly confirmed that Li was under investigation, including details of the nature of his crimes. Wei Fenghe, Li’s predecessor, had disappeared from the public eye since he was replaced in March last year as part of a planned cabinet reshuffle. Wei served as chief of the People’s Liberation Army’s Strategic Rocket Force from 2015 to 2017.

The decision will be confirmed during the Party’s Third Plenum to be held 15-18 July, when removals from the Central Committee will be formally announced. Ousted former foreign minister Qin Gang still remains a member of the Central Committee. rtr

The Chinese Chamber of Commerce in Brussels announced on X that the Chinese electric truck manufacturer Windrose will establish its European headquarters and its first plant in Belgium and aim to create around 3,000 jobs. The plans include an assembly plant in Antwerp, where 10,000 electric trucks will be produced annually by 2027.

According to the Chamber of Commerce’s post, Windrose has also set its sights on France for a possible battery plant. In April, the Belgian newspaper De Tijd reported that Antwerp was trying to attract the company, which was founded in 2022. In an interview with the French newspaper Le Monde in March, Windrose founder Wen Han said that talks on the construction of the European headquarters and an assembly plant were at an advanced stage. He stated that the investment is expected to total 300 million euros. cyb

China gave a measured positive evaluation of Robert Habeck’s three-day visit to the country. However, it was still an awkward visit by a politician from a country with which China has an awkward relationship, reflected by the cancellation of a planned meeting between Habeck and Premier Li Qiang and by Chinese official media’s economical, somewhat weird coverage.

Asked to comment on the visit’s result in a routine press briefing on June 24, one day after the visit, foreign ministry spokeswoman Mao Ning said, “China and Germany have this year … been sending signals of jointly opposing protectionism,” alluding to European Union’s anti-subsidy tariff over China-made electric autos. At the same time, Mao also had to answer a question from the same journalist, representing the Russian news agency Tass, who, most likely with a shade of Schadenfreude, asked why Habeck was not arranged to meet a top Chinese leader. Mao said she had “no knowledge about the arrangement.”

In name, Habeck’s Chinese counterpart should be Vice Premier He Lifeng, a key lieutenant of Xi Jinping for economic affairs. However, as Premier Li’s mandate is also pretty much limited to the economy, a meeting between Li and Habeck would have also been appropriate. Such a meeting was originally pre-scheduled but canceled at the last minute. Habeck ended up being met by two ministerial-level bureaucrats.

The real reason for the snub is anybody’s guess. Unofficial commentators believed Habeck’s harsh words about China’s role in Ukraine irritated his Chinese hosts. During the first day of his visit, Habeck said that China’s support for Russia in the war had damaged German-China relations and would have economic consequences. Unofficial Chinese commentators said Habeck’s words were “full of arrogance and rudery.”

In comparison, Polish president Andrzej Duda, who visited Beijing following Habeck’s heels, was treated warmly. In his meetings with his hosts, Duda also talked about Russia and Belarus, both Poland’s enemies but friends of China, but he was careful enough not to rub the Chinese the wrong way by criticizing China.

China’s foreign ministry and government propaganda officials always give directives to set the tone for official news outlets’ reporting of major diplomatic events. After hearing Habeck’s blunt remarks, they seemed to have decided to instruct the mouthpieces to keep the coverage of the visit low-profile.

The state television station CCTV reported very briefly on Habeck’s meetings with the commerce minister and the NDRC chairman. The official Xinhua News Agency ran only one short piece for the three-day visit, which was about his visit to BMW’s Shanghai Research and Development Centre. The piece’s source is BMW’s press release.

The Chinese People’s Daily, the mouthpiece of the Communist Party, did not even report on the visit, but merely mentioned Habeck and Transport Minister Volker Wissing in a lengthy commentary that criticized “protectionism in the new energy sector.” The article published on the last day of Habeck’s trip quoted him as saying: “It would be really bad if tariffs are used as a protectionist tool and if we enter into a tariff competition with China, then the baby would be thrown out with the bathwater.”

Wissing was quoted as saying that vehicles in the EU should become cheaper through “more competition, open markets, and significantly better location conditions” and “not through trade wars and market isolation.” The article also cited executives from the German auto industry and dignitaries from other Western countries.

While the official media restrained themselves from writing much on the visit, unofficial or semi-official outlets focusing on international affairs wouldn’t miss the opportunity to comment. However, the Global Times, the most influential nationalist tabloid, was unusually mild this time, urging Habeck to “bring what he learned in China back to Europe.”

An article on CCTV’s unofficial social media account was more original. The author sought to find the root of the EU’s mentality in launching the anti-subsidy probe, concluding that Americans are ultimately to blame. Think tanks and US media created the hype about China’s subsidies on its EV sector, it said. The EU’s Chief Trade Enforcement Officer, Denis Redonnet, actually learned how to use anti-subsidy as a tool from Americans. The accompanying cartoon was funny but not so original, though.

Andrew Ko has been appointed Executive Director for Hong Kong at Oneglobal Broking. In his new position, he will lead the business in Hong Kong and Greater China. Ko was most recently CEO of AJG China since December 2021.

Xiaoming Liu has taken over the position of Teamleader integrated procurement management at Waldaschaff Automotive. The German automotive supplier is part of the Lingyun Industrial Group. Liu has previously lived and worked in China, Germany and Switzerland.

Is something changing in your organization? Let us know at heads@table.media!

China calls her the “female Yao Ming”: Zhang Ziyu is 2.20 meters tall. The basketball player from Shandong Province towered above her rivals on the court at the FIBA U18 Women’s Asian Cup in Shenzhen earlier this week. The 17-year-old exceptional talent made her international tournament debut and proved to be a scoring guarantor against Indonesia, Japan and New Zealand.

Most buzzwords sound flashier than what they actually describe. This also applies to de-risking, which means nothing more than good old risk limitation. By investing in the Chinese market, automotive supplier Continental is trying to brace itself against the uncertainties looming in its home market, writes Christian Domke Seidel. For the large medium-sized company, de-risking means heavy investment in the People’s Republic. Find out in today’s China.Table issue what the company expects to gain from this and what risks this strategy could entail.

Michael Radunski also looked at unrecognized risks in his analysis. He took a closer look at the decisions Vladimir Putin and Xi Jinping reached at their last meeting when they deepened their supposedly borderless friendship. Among other things, they discussed the People’s Republic’s access to the Sea of Japan – which, in the long term, however, promises a route to the Arctic, which could be ice-free in a few decades. This has implications for Beijing’s vision of a polar Silk Road and the region’s power balance.

Things are currently not going well for Continental in Europe. Business in China is expected to compensate for this. Continental is planning to invest billions in China, while the company is cutting costs in Germany. This is part of the company’s de-risking strategy. The supplier wants to use sales and partnerships in the People’s Republic to compensate for what is falling away elsewhere. Chinese manufacturers now account for a significant – and growing – proportion of sales. Continental is also aligning its research and development accordingly. But there are risks along the way.

Continental has hardly made any positive headlines in recent months, at least in Germany. The supplier has been undergoing a cost-reduction program since 2019. At the Annual General Meeting in April 2024, employee representatives criticized the Executive Board, saying there was no discernible strategy. In parallel, the investment bank Jefferies pointed out that 2024 will be a very risky year. Partly due to disappointing business performance in the first quarter.

In addition, the German business newspaper Handelsblatt reported on a dispute between Continental and BMW concerning defective brake systems. Continental will also be merging its German plants in Schwalbach and Wetzlar in 2025, which will result in around 1,200 layoffs. The company also reportedly wants to cut jobs in Frankfurt-Babenhausen.

China appears to be exempt from this austerity program. “In the past ten years, Continental has invested more than three billion euros in China. We are planning investments at a similar level for the coming years,” a company spokesperson told Table.Briefings. One part of this investment strategy is the development hub for software and systems in Chongqing, for example. It was opened in 2021 – two years after the company’s top management approved the cost-cutting program.

This makes sense from Continental’s point of view. In the past financial year, Continental generated 12 percent of its global sales in China, and the trend is rising. This is because the supplier is increasingly supplying purely Chinese manufacturers. “In 2023, we were able to achieve a significant proportion of our order intake in China with Chinese car manufacturers. We are therefore confident that we will also grow with local Chinese manufacturers in the future,” the company spokesperson explains. A strategy that competitor ZF Friedrichshafen is also pursuing.

This is an important step in the local business strategy. As electric cars are booming, German brands are increasingly losing market share in China. However, this was largely the reason why suppliers set up plants in the People’s Republic to supply the well-known OEMs. A business that is now crumbling. This means that for suppliers, de-risking means focusing more on their China business. In the Asia-Pacific region, Continental now supplies the top five highest-volume EV manufacturers, as the company spokesperson explains.

De-risking is not synonymous with withdrawing from China due to political risks. On the contrary. “Making a local site in China more resilient in order to remain globally and locally competitive requires investment in China, but can be part of a de-risking strategy,” says Philipp Boeing, explaining the strategy. He is Professor of Empirical Innovation Research with a focus on China at Goethe University Frankfurt and ZEW Mannheim.

He believes it is important to be consistent here. “If a company decides to be active in China, it must adhere to certain standards in order to benefit from this commitment,” Boeing continues. So this means: investing!

In light of the planned mobility transition and the transformation towards a green economy, research and development are essential. Accordingly, spending in this area has increased massively at large companies. In 2023, the DAX companies increased their R&D spending by seven percent. At Continental, however, spending declined (at least when looking at the company as a whole). The focus here appears to be on China.

But that alone is not enough, Boeing explains. “It’s about not only remaining competitive locally, but also scaling the capabilities gained – in other words, benefiting from them in other markets too. The development should not only bring local advantages, but can also be used on other platforms.” Whether this works depends heavily on the individual case, he added. Although China is known as a “fitness center” for the automotive industry, there is no guarantee that local demands and tastes can be globalized.

Especially as German manufacturers are not being outpaced in their core competencies as quickly as is often portrayed. “German companies are generally active in medium to high-tech industries. Particularly in mechanical engineering and the automotive industry. These are technologies in which China would certainly be able to substitute the products, but German manufacturers still have slight advantages in some areas – in research and development, production and through many years of experience and specialization,” Boeing explains.

And China’s catch-up race is not as swift as many people make it out to be. Companies from the People’s Republic are indeed registering more and more patents, says Boeing. Since 2010, China has been the world leader in the number of total patent filings. And since 2019, it has even been leading in the number of so-called “world patents” – particularly valuable international patents. But these figures are deceiving. The Communist Party heavily subsidizes patent applications. According to Boeing, that means that the quantity is right, but the quality is not. Only rarely do the filed inventions actually lead to more innovations.

At least Continental sees itself on the right track. It started production of a new high-performance computer for a Chinese car manufacturer in the first quarter. New business areas are also to be rolled out here in the future. “We also see the potential to grow with Chinese manufacturers outside of China. Should they plan to expand into other markets, we are ready to support them – with our technologies and our global production facilities,” the press spokesperson says. In Continental’s case, de-risking compensates for weaknesses in the domestic market.

At their meeting in Beijing in May, Russian President Vladimir Putin and China’s ruler Xi Jinping agreed on a joint declaration to deepen their strategic partnership. Amid all their raving against the United States, the West and its “destructive and hostile pressure,” many an important decision go unnoticed – especially when they come across as inconspicuous as the following resolution:

What sounds to some like a subsidy program for local fisheries could have far-reaching implications – for Japan, for South Korea, even for the Arctic.

The Tumen River forms the border between China and North Korea, but downstream it becomes the border river between North Korea and Russia before it flows into the Sea of Japan. This means that Chinese vessels can only navigate the Tumen freely up to Fangchuan, the eastern end of the inland province of Jilin. Both Russia and North Korea must give their approval for the remaining 15 kilometers to the Sea of Japan. Another obstacle is the approximately seven-meter-high Korean-Russian Friendship Bridge dating back to the Soviet era, blocking the passage of larger ships.

China has long been trying to overcome these problems – sometimes by obtaining general transit permits for Chinese ships, sometimes by establishing a special economic zone along the banks of the Tumen or by acquiring a stake in piers in the North Korean port of Rason. The goal is obvious: China wants to gain access to the Sea of Japan through the Tumen River. Chinese foreign policy expert Shi Yuanhua puts it this way: China could finally achieve freedom of navigation in the Sea of Japan via the Tumen (实现中国对于日本海的’自由航行’).

Japan is concerned because this would shift the strategic balance of power vis-à-vis China to its disadvantage. Chisako Masuo, professor of Chinese foreign policy at Kyushu University in Fukuoka, is convinced that the larger ships that China wants to steer directly into the Sea of Japan via the Tumen would also include Chinese Coast Guard patrol vessels.

A massive problem for the Japanese Navy. Because: “If China Coast Guard ships become active in the Sea of Japan, Japan will need to divert its own coast guard vessels that are currently monitoring waters near the Senkaku Islands,” Masuo said. “This could weaken surveillance in the East China Sea.” The dispute there concerns the Senkaku Islands, which are under Japanese administration and which China claims under the name Diaoyu. The activity of Chinese government ships in the waters around the islands has recently picked up again.

There are likely to be similar concerns in South Korea. Chinese vessels would reach the Korean peninsula from both sides in the future. In addition, both Japan and South Korea are close US allies. A deteriorating security situation – even if only perceived – would have an impact on the plans of US forces.

In any case, Putin and Xi’s joint statement hints at plans for expanded joint military exercises as well as joint naval and air patrols. Chinese and Russian forces already conduct joint naval and air exercises in the Sea of Japan. An increased presence of the Chinese Coast Guard would probably further increase the scope of such activities.

However, China’s attempts to gain access to the Sea of Japan pursue a much more far-reaching goal: a route to the Arctic. Chinese scientists from Dalian Maritime University argue in an essay published in May 2024 that access to the Sea of Japan would improve China’s position in the Arctic and significantly advance Beijing’s vision of a polar Silk Road.

Should the Arctic actually be largely ice-free by the middle of the century, this would open up completely new sea routes for China’s shipping industry. Currently, most of China’s trade has to pass through the narrow Strait of Malacca between Indonesia and Malaysia. A blockade of the strait would dramatically jeopardize China’s energy security.

In addition, an ice-free Arctic would shorten the existing sea routes from Asia to Europe by around 8,000 kilometers and to North America by 4,500 kilometers. The mineral resources stored in Arctic soil are also of particular interest. American geologists believe that up to 13 percent of undiscovered oil and 30 percent of natural gas deposits are hidden under the ice.

Russia and North Korea have so far been extremely skeptical of China’s plans. Moscow feared that China’s influence in North-East Asia would increase. However, Western sanctions in response to the invasion of Ukraine have made Moscow increasingly dependent on China.

North Korea, on the other hand, shies away from the costs of the necessary dredging of the Tumen. Pyongyang also fears that Chinese investment in its ports could decline if Chinese ships were allowed free passage. However, the war in Ukraine has led to a new affinity and a new division of labor between the three countries.

Zhao Leji, number three in the hierarchy of the Chinese Communist Party, met with North Korean leader Kim Jong-un in Pyongyang. Chinese experts expect North Korea to begin talks on the Tumen River soon. Russia’s approval is now also on the table – in the form of a supposedly inconspicuous line in the joint statement by Putin and Xi.

July 1, 2024; 6 a.m. Beijing time:

EU SME Center, SME Roundtable in Guangzhou: Insights into China’s Policy Updates More

July 3, 2024; 10 a.m. (4 p.m. Beijing time)

German Chamber of Commerce – North China, Webinar GCC Knowledge Hub: New guidance on cross-border salaries for German citizens More

July 3, 2024; 10 a.m. (4 p.m. Beijing time)

EU SME Center, presentation and panel discussion: Sustainable Transition for SMEs: Prospects for Business Growth and Challenges in Change Management More

July 8, 2024; 4 p.m. (10 p.m. Beijing time)

Center for Strategic & International Studies, Webcast: Is It Me or the Economic System? Changing Chinese Attitudes Toward Inequality: A Big Data China Event More

The Chinese Ministry of Commerce has questioned the legal basis of the Foreign Subsidies Regulation (FSR). The ministry announced on Thursday that it was investigating complaints from the Chinese Machinery Industry Association (CCCME) about the EU instrument. The CCCME is a semi-official machinery and electronics trade organization representing car manufacturers and solar panel producers, among others.

According to the ministry, the central question is whether the FSR presumably constitutes trade barriers against Chinese companies, which it calls “biased practices” of the European Union. The EU’s FSR is intended to prevent foreign companies in the EU from gaining an advantage through subsidies from their home country.

According to ministry spokesperson He, Beijing’s assessment, which could result in further countermeasures, is ongoing. Details will be announced in due course. “We are paying close attention to the anti-subsidy regulation of the EU, which has had huge impact on Chinese companies that export and invest in the bloc“, He said. The Chinese Chamber of Commerce in the EU welcomed the move in a statement.

According to the South China Morning Post, the CCCME expressed “strong dissatisfaction” with the EU’s extra tariffs on Chinese electric vehicles in mid-June and openly questioned the outcome of the Brussels investigation. Negotiations between the EU and China on the extra tariffs are still ongoing. Ministry spokesperson He says that working groups from both sides are in close contact. A solution must be found by July 4 otherwise the provisional extra tariffs will take effect.

According to media reports, German Chancellor Olaf Scholz has proposed equally high tariffs on car imports on both sides. This was reported by Handelsblatt and AFP, citing government and EU circles. A tariff rate of 15 percent is said to be under discussion, but the amount could still change. However, the EU Commission reportedly considers the idea unsuitable. ari

The exact date has now been set: The leadership of the Chinese Communist Party will convene for its long-anticipated third plenum on July 15-18, as reported by the South China Morning Post, among others. This meeting of China’s most powerful figures, which is crucial for the economic course of the next five to ten years, has been overdue since last fall for unclear reasons. Since late April, the third plenum has been scheduled for July.

The exact date was announced on Thursday at a meeting of the Politburo, the party’s 24-member decision-making body. The Third Plenum, which traditionally sets the economic course for the coming years, is considered the most important of the seven party meetings held between the CP’s five-yearly congresses.

Over 370 full and deputy members of the Central Committee will attend the session. Over the past four decades, the third plenary sessions have usually been held in October or November. cyb

China’s Communist Party expelled former Defense Minister Li Shangfu and his predecessor Wei Fenghe for “serious breaches of discipline” – a euphemism for corruption. This is reported by the state news agency Xinhua. The decisions to strip Li and Wei of their party membership were approved by the seven-member Politburo, the Communist Party’s apex of power, on Thursday. The Politburo also transferred both their cases to military prosecutors.

Li was also stripped of his membership of the national legislature after being removed from the Central Military Commission, China’s top military body, earlier this year. Wei was also removed from the legislative body.

The report states, citing the Central Committee of the Communist Party, which ordered the investigation, that Li is suspected of having received “huge sums of money” in bribes and of bribing others. An investigation revealed that he “did not fulfill political responsibilities” and “sought personnel benefits for himself and others.”

“As a senior leading cadre of the party and the army, Li Shangfu betrayed his original mission … betrayed the trust of the Party Central Committee and Central Military Commission … and caused great damage to the party cause and national defense,” the report continues.

Li Shangfu was mysteriously ousted as defense minister last October without explanation after he disappeared for two months. This is the first time China has explicitly confirmed that Li was under investigation, including details of the nature of his crimes. Wei Fenghe, Li’s predecessor, had disappeared from the public eye since he was replaced in March last year as part of a planned cabinet reshuffle. Wei served as chief of the People’s Liberation Army’s Strategic Rocket Force from 2015 to 2017.

The decision will be confirmed during the Party’s Third Plenum to be held 15-18 July, when removals from the Central Committee will be formally announced. Ousted former foreign minister Qin Gang still remains a member of the Central Committee. rtr

The Chinese Chamber of Commerce in Brussels announced on X that the Chinese electric truck manufacturer Windrose will establish its European headquarters and its first plant in Belgium and aim to create around 3,000 jobs. The plans include an assembly plant in Antwerp, where 10,000 electric trucks will be produced annually by 2027.

According to the Chamber of Commerce’s post, Windrose has also set its sights on France for a possible battery plant. In April, the Belgian newspaper De Tijd reported that Antwerp was trying to attract the company, which was founded in 2022. In an interview with the French newspaper Le Monde in March, Windrose founder Wen Han said that talks on the construction of the European headquarters and an assembly plant were at an advanced stage. He stated that the investment is expected to total 300 million euros. cyb

China gave a measured positive evaluation of Robert Habeck’s three-day visit to the country. However, it was still an awkward visit by a politician from a country with which China has an awkward relationship, reflected by the cancellation of a planned meeting between Habeck and Premier Li Qiang and by Chinese official media’s economical, somewhat weird coverage.

Asked to comment on the visit’s result in a routine press briefing on June 24, one day after the visit, foreign ministry spokeswoman Mao Ning said, “China and Germany have this year … been sending signals of jointly opposing protectionism,” alluding to European Union’s anti-subsidy tariff over China-made electric autos. At the same time, Mao also had to answer a question from the same journalist, representing the Russian news agency Tass, who, most likely with a shade of Schadenfreude, asked why Habeck was not arranged to meet a top Chinese leader. Mao said she had “no knowledge about the arrangement.”

In name, Habeck’s Chinese counterpart should be Vice Premier He Lifeng, a key lieutenant of Xi Jinping for economic affairs. However, as Premier Li’s mandate is also pretty much limited to the economy, a meeting between Li and Habeck would have also been appropriate. Such a meeting was originally pre-scheduled but canceled at the last minute. Habeck ended up being met by two ministerial-level bureaucrats.

The real reason for the snub is anybody’s guess. Unofficial commentators believed Habeck’s harsh words about China’s role in Ukraine irritated his Chinese hosts. During the first day of his visit, Habeck said that China’s support for Russia in the war had damaged German-China relations and would have economic consequences. Unofficial Chinese commentators said Habeck’s words were “full of arrogance and rudery.”

In comparison, Polish president Andrzej Duda, who visited Beijing following Habeck’s heels, was treated warmly. In his meetings with his hosts, Duda also talked about Russia and Belarus, both Poland’s enemies but friends of China, but he was careful enough not to rub the Chinese the wrong way by criticizing China.

China’s foreign ministry and government propaganda officials always give directives to set the tone for official news outlets’ reporting of major diplomatic events. After hearing Habeck’s blunt remarks, they seemed to have decided to instruct the mouthpieces to keep the coverage of the visit low-profile.

The state television station CCTV reported very briefly on Habeck’s meetings with the commerce minister and the NDRC chairman. The official Xinhua News Agency ran only one short piece for the three-day visit, which was about his visit to BMW’s Shanghai Research and Development Centre. The piece’s source is BMW’s press release.

The Chinese People’s Daily, the mouthpiece of the Communist Party, did not even report on the visit, but merely mentioned Habeck and Transport Minister Volker Wissing in a lengthy commentary that criticized “protectionism in the new energy sector.” The article published on the last day of Habeck’s trip quoted him as saying: “It would be really bad if tariffs are used as a protectionist tool and if we enter into a tariff competition with China, then the baby would be thrown out with the bathwater.”

Wissing was quoted as saying that vehicles in the EU should become cheaper through “more competition, open markets, and significantly better location conditions” and “not through trade wars and market isolation.” The article also cited executives from the German auto industry and dignitaries from other Western countries.

While the official media restrained themselves from writing much on the visit, unofficial or semi-official outlets focusing on international affairs wouldn’t miss the opportunity to comment. However, the Global Times, the most influential nationalist tabloid, was unusually mild this time, urging Habeck to “bring what he learned in China back to Europe.”

An article on CCTV’s unofficial social media account was more original. The author sought to find the root of the EU’s mentality in launching the anti-subsidy probe, concluding that Americans are ultimately to blame. Think tanks and US media created the hype about China’s subsidies on its EV sector, it said. The EU’s Chief Trade Enforcement Officer, Denis Redonnet, actually learned how to use anti-subsidy as a tool from Americans. The accompanying cartoon was funny but not so original, though.

Andrew Ko has been appointed Executive Director for Hong Kong at Oneglobal Broking. In his new position, he will lead the business in Hong Kong and Greater China. Ko was most recently CEO of AJG China since December 2021.

Xiaoming Liu has taken over the position of Teamleader integrated procurement management at Waldaschaff Automotive. The German automotive supplier is part of the Lingyun Industrial Group. Liu has previously lived and worked in China, Germany and Switzerland.

Is something changing in your organization? Let us know at heads@table.media!

China calls her the “female Yao Ming”: Zhang Ziyu is 2.20 meters tall. The basketball player from Shandong Province towered above her rivals on the court at the FIBA U18 Women’s Asian Cup in Shenzhen earlier this week. The 17-year-old exceptional talent made her international tournament debut and proved to be a scoring guarantor against Indonesia, Japan and New Zealand.