As was to be expected, Beijing’s zero-covid strategy also impairs the economy in the face of rising Covid cases. Companies like Bosch already have to suspend production at some of their sites to comply with the Chinese government’s strict regulations.

One contingency plan that more and more companies currently resort to is the so-called “closed loop”: Instead of working from home, employees stay on company premises. Those who cannot leave can’t bring in a virus, so the simple calculation goes – and the Winter Olympics are used as a prime example. But it’s not quite that simple, explains Christiane Kuehl. A closed loop only works if companies have access to sufficient preliminary products. And that is rarely the case in times of just-in-time production and meticulously timed deliveries.

New strategies are also needed for the Chinese car market. One in three car dealers is currently posting losses. An increase of online sales is expected to restart growth. EV customers in particular may be more willing to order their car on the Internet, writes Christian Domke-Seidel. However, there is still a long way to go before business runs smoothly. At present, just five percent of all new car sales in China are made over the Internet. Companies like Tesla and NIO, however, are already well ahead of the curve. This also inspires German manufacturers such as VW, BMW and Mercedes to set up digital showrooms.

The so-called “closed-loop” has become the saving grace for many companies in China. Faced with the threat of lockdowns across the country, they are setting up a closed-loop in which employees work, live, and sleep on specially purchased beds in the office for several days isolated from the rest of society. This is intended to keep their factories free of viruses and production running as smoothly as possible.

Automotive supplier Bosch, for example, announced on Tuesday that one auto parts plant each in Shanghai and the neighboring city of Taicang were currently operating in a closed-loop. However, the company also said it had to halt production at a Bosch thermotechnology plant in Shanghai and at an automotive components site in closed-off Changchun. “We are currently seeing temporary effects on logistics and supply chain sourcing,” Bosch said in the statement. “In this situation, we are doing everything we can to maintain the supply chains as much as possible and to serve the demands of our customers.”

Bosch thus also identifies a fundamental problem of the closed-loop: It only works as long as authorities permit continued production. In addition, companies must either have enough preliminary products in stock – or still be supplied with them.

In our world of “just-in-time” production with decentralized supply chains and precisely tailored delivery, however, hardly any companies still stockpile large quantities of preliminary products. This means that companies are also dependent on local access regulations for logistics providers: Are drivers from out of town allowed to enter the city, are they allowed to bring goods into the closed-loop plants? In total, Covid restrictions are now in place in more than 70 Chinese cities. And these are slightly different everywhere. As a result, it is currently particularly tricky for companies in Shanghai and the northeast to obtain parts.

Shanghai has even managed to render its own closed loops at its ports unfeasible. While closed Covid bubbles allow for 24-hour operations at the ports of Yangshan or Waigaoqiao to continue, hardly anything is outbound. After all, it would have to leave the loop in the process. Truck drivers, on the other hand, are not allowed to drive within Shanghai limits without a special permit, nor are they allowed to enter or leave the surrounding provinces. “Barge traffic, which is common in the region, has also been suspended,” says economist Chris Rogers of Flexport, a digital freight forwarder that operates an office in Shanghai. “This poses challenges for importers and exporters alike.”

When Shanghai’s eastern Pudong district was placed under lockdown in March, city authorities themselves suggested isolated overnight housing in the office. Information leaflets recommended what employees should bring for temporary living in the office. The Shanghai Stock Exchange instructed compliance officials and technicians to sleep on-site to keep the world’s second-largest capital market running. Banks and investment fund companies urged their employees to camp out in the office before the lockdown began. According to agency reports, one fund manager said he and his colleagues had deliberately blocked a floor drain to prevent viruses from entering there. Earlier, some people on the floor above had tested positive, but could not be sent to a quarantine center right away because capacities had reached their limits.

But not many Shanghai companies were able to maintain production till today. “Only a few companies have permission to continue production,” said Bettina Schoen-Behanzin, Vice President of the EU Chamber of Commerce in China. These included companies in the pharmaceutical, food or chemical sectors. “You can’t just shut down a chemical plant.” Furthermore, supply chains are also a problem in Shanghai. “It’s difficult to find drivers and get the required permits,” Schoen-Behanzin told a chamber media panel. “We also hear that fewer and fewer workers are volunteering for the closed loops.” At least no one is likely to be forced at European companies.

The bubble concept is not new. When Xi’an in China’s northwest was sealed off at the end of 2021, for example, two Samsung factories in the city continued to operate in a closed loop. In Europe, closed bubbles were used for winter sports World Cups, for example. The largest Covid bubble was then created by the Beijing Olympic hosts during the Winter Games in February.

The concept then became more popular as the Omicron wave rolled in. In Shenzhen, Taiwanese electronics manufacturer and Apple supplier Foxconn, among others, managed to quickly start closed-loop production during the brief lockdown in March. In Changchun, which has been locked down for some time now, some companies have already been operating in a closed loop system for four weeks, according to Harald Kumpfert, Chair of the EU Chamber for northeast China.

But in the meantime, concerns about supply chains have become dominant there as well. The BMW joint venture in Shenyang, for example, produced for as long as it could, says Kumpfert. Then the supply shortage hit. Every insider understands this immediately. “It only takes one missing part for production to stop,” says a German car manager in China. A closed loop is more suited for regions that have not yet undergone a complete lockdown, or for cities that allow regular transport of goods despite a lockdown.

Most recently, Chinese battery giant Contemporary Amperex Technology (CATL) announced that it introduced closed-loop management at its main plant in Ningde, in southern China. The move was intended to maintain production. On the same day, the Fujian province had reported nine new cases, including one in Ningde. As a result, the province imposed travel restrictions. CATL stated that the company had “strengthened communication with the local government.”

A production stop at the market leader for EV batteries would hit virtually the entire sector: CATL supplies BMW, Daimler, VW, Hyundai, Honda, PSA, Tesla, Toyota, Volvo, NIO, Li Auto and XPeng, among others. CATL employees now shuttle between their dormitories and the factory in a special bus. This shows that it is much easier to quickly switch to closed loops if employees already live in factory-owned dormitories. This is common practice in southern China. Foxconn also benefited from this in Shenzhen. Nevertheless, CATL also has to be careful that the supply chain will hold.

Until a few weeks ago, Alessandro Pavanello was still one of those types of adventurers who have been magically attracted to Shanghai for decades: A millennial with a three-day beard from Italy who works at a music agency by day and tours the city’s clubs as a DJ by night. Someone whose hedonistic lifestyle knows no other problems than deciding in which of the many hip rooftop bars to start the weekend. But since March 26, Pavanello’s privileged life is over.

Testing positive for the virus in China is not just bad news, it entails a great deal of dread. Normally, it only takes a few minutes for the health workers to arrive at the door in their protective suits to pick up the infected individual. In Alessandro’s case, however, nothing happened at first. Only one man came to his apartment to mist all the rooms with a disinfectant spray like some kind of exterminator.

Has he dodged the bullet? Obviously, the overwhelmed authorities no longer could cart each of the now more than 150,000 covid cases to the isolation centers. But Alessandro Pavanello’s happiness turned out to be false: Barely two weeks later, when the young man had long since tested negative again, a bus from the epidemic authority suddenly appeared at his front door.

In a Kafkaesque odyssey, Pavanello is now carted between various facilities for almost 14 hours. Nobody wants to take in the European; obviously, since the Italian does not speak Chinese. In a quarantine center, a doctor tells him, “This is not a good place for a foreigner, the conditions in here are very bad.” To which Pavanello replies, “What about the Chinese, do you think the conditions are good for them?”.

But going back home is not an option either. His landlord sent him a blunt message on his cell phone: “I don’t accept you here anymore, all residents are against it. Just so you know: We will not open the door.” The fear that the “leper” could carry the virus is too great.

It’s already two o’clock in the morning by the time Alessandro finally finds a place to stay – in a huge exhibition hall, where the DJ and music producer now sleeps packed close together next to a thousand other infected people. “I can show you my room,” Pavanello says with a laugh that shows through his red face mask.

On Instagram, he has devoted himself to informing the public about his everyday life in the quarantine center – with humor, but also a lot of cynicism. He films the meager camping bed with his smartphone camera, which causes back pain just by looking at it. Many of the people sitting next to him have mounted cardboard tarpaulins over their beds so that they at least have a little darkness and privacy at night.

Pavanello then shows the sanitary facilities of the quarantine center, but they are also anything but attractive. Patients have to wash their bodies with a small rag; there are no showers. The toilets are outhouses, most of which still contain feces from previous users. It is hard to imagine what the facilities look like that turned away the Italian because of “poor conditions”.

Pavanello now tries to make the best of the situation. But he doesn’t want to sugarcoat the whole thing either: “We are treated like cattle here,” says the Italian in an online chat: “As a foreigner, I am only a guest in China and have to abide by the country’s rules. But I no longer feel safe here, and I am thinking about leaving China.”

But his girlfriend has it much worse, says Alessandro. She has already been housed in another isolation center for two weeks. She has already tested negative twice in a row and should actually be allowed back into her apartment. Nobody really knows why she’s not being allowed to do that. “It’s madness,” Pavanello says into his cellphone camera and says goodbye. Now he wants to go and see if he can catch some fresh air in a cordoned-off area – if he’s lucky, he can still see the evening sun. Fabian Kretschmer

China’s car trade has a particularly fragmented structure. The hundred largest car dealer groups combined are responsible for just 30 percent of car sales in the People’s Republic, as calculated by the management consultancy McKinsey. In recent years, enormous growth rates saved the industry from major bankruptcies. But now pressure grows. Even the manufacturers react to the change in customer behavior.

One in three car dealerships in China is currently operating at a loss. Although the country is still the largest car market in the world, growth has declined sharply. New cars now spend an average of one and a half months at dealerships. In addition, customers also like to order online. Electric vehicles in particular are sold this way. Tesla offers direct sales, and NIO has also been highly successful with a virtual sales model. Brands that also represent the future of mobility for many customers.

Even though some car dealerships and dealer groups are experiencing difficulties, pure online sales are still a long way off. Currently, just five percent of all new car sales in China are made over the Internet. The remaining 95 percent of customers prefer to go to a car dealership. And for good reasons, as car expert Ferdinand Dudenhoeffer told China.Table: “Cars are high-value products. They cost 30,000 to 60,000 euros. At that price, the customer wants certain risks to be excluded.” The car must do what the customer wants, repairs must be uncomplicated, resale has to work.” These risks could be excluded because there are car dealerships. They’re a kind of insurance.”

Meanwhile, car dealers now merge online retail and physical sales. BMW told China.Table, “In China, we are relying on our established sales channels through retail, complemented by digital and offers specifically tailored to the purchasing habits of our Chinese customers, such as a cooperation between MINI China and Alibaba during the Double 11 Shopping Festival last year.”

Mercedes China also expects the online component to become more important: “We believe that many processes will soon be digitized. We are therefore working hard to create high-quality digital touchpoints. Such as digital showrooms on WeChat, websites or apps,” explained a Group spokeswoman.

A strategy that Volkswagen also pursues. It is difficult to measure the share of online presentations in sales because the digital and physical worlds are too closely intertwined. Two out of three Volkswagen customers reportedly also wish they had the option to buy a car online. However, this is only the last step in the sales process. Before that, customers want to sit in the car, a spokesperson for the Wolfsburg-based company told China.Table.

According to Volkswagen, customers feel the need to try out a car first, especially when buying electric cars. For decades, the company has sold vehicles with combustion engines. Customers would not simply buy electric vehicles without a test drive. But the Covid crisis has also shown what is possible in online retailing, the VW spokesman said. Purchase interactions on the companies’ websites had risen by 80 percent.

The fact that trade in China works differently than in Europe was something Volkswagen had to learn painfully with its ID models. It was only with the opening of special ID stores that sales increased. In 2021, Volkswagen has opened well over 100 EV stores. In shopping malls and shopping streets. Chinese customers simply buy an electric car right after they are done shopping for groceries. In ID stores, the conversion rate – the rate at which an interest turns into a purchase – is far higher than at traditional dealers.

However, manufacturers do not want to abandon dealers completely. For Mercedes, they are a “central instrument” for providing high-quality customer service. Volkswagen also explicitly emphasizes that a strong dealer network is a clear competitive advantage.

Dudenhoeffer believes that the success of online retailing is primarily related to the product that is being sold: “You need the right product. It hasn’t proven viable to simply place an ad and then sell the car online. This is because you leave the customer alone with the risks he’s not willing to take online.” He is alluding to subscription models in particular. Volkswagen, for example, wants to change its business model: Away from a car manufacturer to a provider of mobility. As early as 2030, between 20 and 30 percent of sales are to be generated from subscription models and similar concepts.

A change that could set in much sooner in China. “In China, financial services are still capable of development. There are many restrictions imposed by the state in the banking sector. Car banks and the corresponding licenses have not existed in China for very long. In Europe, it’s already very developed. Thanks to companies like NIO and Xpeng, however, the Chinese market has begun to break open very quickly,” explains Dudenhoeffer.

The People’s Republic has already proven in the promotion of EVs that it can pull a global market along with it. The same could happen with the digitization of trade in view of upcoming domestic brands. Dudenhoeffer: “At the moment, Europe has advantages, but the Chinese are damn fast, willing to learn and adapt. The question is always what regulations the Communist Party will impose.” The industry “has to set itself up, be designed in such a way that it can develop.”

The Shanghai municipal government seeks a balance between cautious opening and containing the Covid pandemic. On Tuesday, the first few citizens in virus-free planned squares were allowed to step outside their doors within their housing complexes. But they still cannot move freely throughout the city. Meanwhile, the psychological and economic costs continue to escalate. Several companies report not being able to maintain production despite the introduction of a closed loop, including Apple supplier Pegatron.

The government tried to explain its strategy at a press conference of the State Council’s disease control group on Tuesday. Chief epidemiology expert of the Chinese Center for Disease Control and Prevention, Wu Zunyou, reiterated the familiar narrative: “The dynamic zero-covid policy best suits the actual conditions in China.” It would be “the best choice” of all pandemic strategies. The epidemic continues in full swing and is also on the upswing in Shanghai. Relaxing measures would not be possible now.

At least the daily rise of positive tests seems to have somewhat slowed down. On Tuesday, authorities reported only 22,342 new infections. On Monday, it was still more than 26,000. The seventh round of mass testing is in progress. The city has classified residential districts using a traffic light system:

The city portrayed the introduction of “parent-child compartments” in quarantine centers as a major step forward. Accompanied by upbeat piano music, video clips showed cubicles made of plastic walls where 2- to 18-year-olds could spend their quarantine time with a parent. However, these accommodations seemed rather bleak otherwise, despite the option to bring a stuffed animal. They are still considered an improvement over the previous practice of separating children from their parents.

In the city of Jilin, the capital of the eponymous province, another improvised quarantine hospital was opened on Tuesday. Simultaneously, a new round of mass testing also began here from Wednesday to Thursday. This was due to the continuous emergence of new cases. But authorities spoke of a “downward trend” in the numbers. In the province, about 1,000 new infections are found every day.

Hong Kong proudly reports a drop in infection numbers to around the same level. On Tuesday, voluntary mass testing returned fewer than 1,000 positive results. According to the Infection Control Department, 0.2 percent of the population is currently actively infected. Researchers at Hong Kong Polytechnic University, meanwhile, revealed a measuring tool that is able to detect coronaviruses in samples with exceptional accuracy and ease. However, it is ultimately a highly automated nucleic acid test. It is suitable for evaluating swabs from human mucous membranes and from surfaces such as tabletops. fin

Germany has reacted to the suspected delivery of a Chinese ground-to-air defense system to Serbia with a warning: The German government expects all EU accession candidates to participate in the European Union’s common foreign and security policy in order to align themselves with the EU, the Federal Press Office announced. Over the weekend, six Y-20 transport aircraft of the Chinese Air Force had been spotted in Belgrade (China.Table reported). According to media reports, these aircraft had delivered parts of the FK-3 ground-to-air defense system to Belgrade. The delivery is yet to be confirmed by Serbian authorities.

According to a Reuters report, Serbia had already signed the deal in 2019. In 2020, the deal, which also includes the purchase of Chinese combat drones, then became public. Serbia is the first European country to buy a Chinese air defense system. FK-3 is the scaled-down export version of the HQ-22 system, which was put into service by the Chinese armed forces in 2017. The system for defense against aircraft, missiles and drones is reportedly based on the Russian S-300.

On Monday, German Foreign Minister Annalena Baerbock reiterated her call on Serbia to join sanctions imposed by the EU, the United States and other countries against Russia. Belgrade has voted against Russia three times in United Nations votes, but has not yet imposed sanctions. If Serbia wants to become a member of the EU, it is essential to follow EU foreign policy here as well, Baerbrock said. rtr/ari

For the first time since the summer of 2021, China is again issuing licenses for video games. On Monday, regulators announced plans to release 45 games developed in China on the market. Developers include major tech companies such as Bilibili Inc and NetEase, according to a Reuters report. Following the announcement, the premarket value of US-listed shares rose by 8 and 8.6 percent, respectively.

Beijing issued the ban on new games last August, along with restrictions on playing time for minors (China.Table reported). Beijing intended to counter a growing addiction to video games among young people. The authorities also spoke of “spiritual opium” in this context.

Chinese companies like Tencent are some of the most successful and profitable game developers in the world. According to a report by the South China Morning Post, the suspension has mainly affected smaller companies. Around 14,000 game companies had to shut down by the end of December alone. fpe

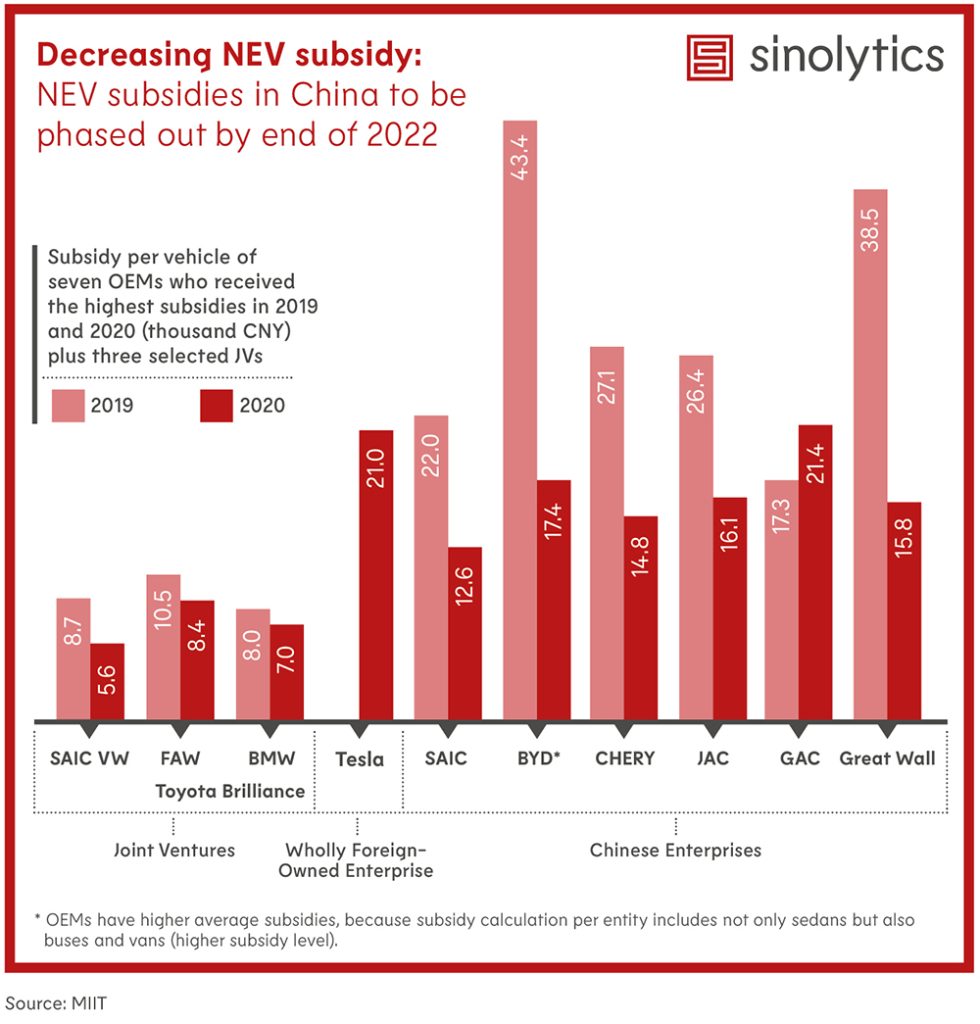

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

When Katja Levy was faced with the choice of a field of study after graduating from school, she purposely chose the greatest possible challenge: “I really wanted to study the most difficult language in the world.” Levy has not regretted this decision – today, the sinologist and political scientist conducts research on social activism in China at the University of Manchester. “I’m fascinated by how people care about others – even in a politically authoritarian system.” To this end, she seeks dialogue with Chinese organizations and scientists – in the past often on the ground in China, since the beginning of the Covid pandemic in online interviews.

Dialogue has been a recurring theme throughout Levy’s career. After her studies in Hamburg and Shanghai, academic positions were very rare at first. Levy worked for Siemens in Shanghai for four years. She loved living in the Chinese metropolis, she says. But working for an international corporation was not the right thing for her in the long run. She then received an offer from the German Bundestag: Levy became a research assistant to Antje Vollmer, a Green Party member and Vice President of the Bundestag at the time, and was responsible for China and Tibet policy.

Her Berlin years were very defining, Levy says today. There was a great sense of optimism in the red-green government. Many policy areas were fundamentally redefined, including China policy. “The goal was a new dialogue,” Levy says. One of the ideas was the foreign policy instrument of the Rule of Law Dialogue: The German and Chinese governments signed an agreement to engage in more dialogue on rule of law and human rights issues – at political, academic and civil society levels. Levy organized and managed the two-way exchange in the background. “It was a perfect time for it: China was very open to legal advice at the time.” In 2001, the People’s Republic joined the World Trade Organization (WTO) and had to align its legal system with international standards.

Levy’s time in Berlin politics ended with the red-green defeat in the 2005 federal elections. She was now writing her thesis, and her subject remained the same: the rule-of-law dialogue with China. She spent entire summers in dusty basements of the Ministry of Justice poring over files, she recalls. “But I loved it: academic work has always been my passion.” Since then, Levy has worked on rotating research projects and universities, studying charity as well as the impact of digitization on China’s society and workforce. Until 2019, she was a junior professor at the Free University of Berlin. In Manchester, she is currently working on a study comparing voluntary work in China and England.

“It’s not as easy to become socially committed in China today,” says Levy. In the 1990s and early 2000s, things were quite different: “Back then, civil society was flourishing, new organizations were springing up.” Today, the state steers involvement in desired directions. While the government is dependent on help, for example in geriatric care or education, when it comes to issues of politics, religion or feminism, social commitment is neither asked for nor permitted. “I’m often amazed at how much happens regardless. People find their niches to show commitment.” And that is despite the high personal pressure that the Chinese working world exerts on many people.

For her scientific work, she is always on the lookout for contacts that open doors – in charity foundations, for example. To gain authentic insights, it’s important to establish trusted connections, she says. Research has become more difficult – because of the pandemic, but also because of increased political restrictions. “You have to be careful not to put anyone in danger.”

Nevertheless, she insists that scientific relations should not be severed under any circumstances. Levy already discussed this position earlier in an article for China.Table. “We need to keep communication channels open – especially when political dialogue is becoming difficult.” Academic exchanges and on-the-ground research help provide a nuanced picture of China and its diverse and complex society. “It’s important to work with people, not just data on the Internet.” Relationships established in the process are an important asset: “It can take years for someone to gain trust and reveal background information in an interview. Cutting them off would mean a huge loss of knowledge.” Jan Wittenbrink

Dr. Maximilian Laschka takes over the position of Project Lead for the Audi Q8 E-Tron China at AUDI AG in Ingolstadt. The Q8 is Audi’s latest electric SUV, which is said to feature a longer range and greater connectivity. Previously, Laschka served as Project Manager Financial Product Strategy for Audi for over three years.

Aidong Chen will become Board Director, CEO and Chairman of the Board of Directors at Chinese biotech company AnPac Bio-Medical Science. He succeeds Dr. Chris Yu, the company’s founder, who will focus on expanding business in China in a senior management position.

These two little Bengal tigers have three more siblings. The tiger quintuplets were born in Chimelong Safari Park in Guangzhou, Guangdong Province. Last weekend, they made their first public appearance. The five Bengal tiger babies were born during the Spring Festival and are a small sensation – normally a tiger mother gives birth to only two or three cubs.

As was to be expected, Beijing’s zero-covid strategy also impairs the economy in the face of rising Covid cases. Companies like Bosch already have to suspend production at some of their sites to comply with the Chinese government’s strict regulations.

One contingency plan that more and more companies currently resort to is the so-called “closed loop”: Instead of working from home, employees stay on company premises. Those who cannot leave can’t bring in a virus, so the simple calculation goes – and the Winter Olympics are used as a prime example. But it’s not quite that simple, explains Christiane Kuehl. A closed loop only works if companies have access to sufficient preliminary products. And that is rarely the case in times of just-in-time production and meticulously timed deliveries.

New strategies are also needed for the Chinese car market. One in three car dealers is currently posting losses. An increase of online sales is expected to restart growth. EV customers in particular may be more willing to order their car on the Internet, writes Christian Domke-Seidel. However, there is still a long way to go before business runs smoothly. At present, just five percent of all new car sales in China are made over the Internet. Companies like Tesla and NIO, however, are already well ahead of the curve. This also inspires German manufacturers such as VW, BMW and Mercedes to set up digital showrooms.

The so-called “closed-loop” has become the saving grace for many companies in China. Faced with the threat of lockdowns across the country, they are setting up a closed-loop in which employees work, live, and sleep on specially purchased beds in the office for several days isolated from the rest of society. This is intended to keep their factories free of viruses and production running as smoothly as possible.

Automotive supplier Bosch, for example, announced on Tuesday that one auto parts plant each in Shanghai and the neighboring city of Taicang were currently operating in a closed-loop. However, the company also said it had to halt production at a Bosch thermotechnology plant in Shanghai and at an automotive components site in closed-off Changchun. “We are currently seeing temporary effects on logistics and supply chain sourcing,” Bosch said in the statement. “In this situation, we are doing everything we can to maintain the supply chains as much as possible and to serve the demands of our customers.”

Bosch thus also identifies a fundamental problem of the closed-loop: It only works as long as authorities permit continued production. In addition, companies must either have enough preliminary products in stock – or still be supplied with them.

In our world of “just-in-time” production with decentralized supply chains and precisely tailored delivery, however, hardly any companies still stockpile large quantities of preliminary products. This means that companies are also dependent on local access regulations for logistics providers: Are drivers from out of town allowed to enter the city, are they allowed to bring goods into the closed-loop plants? In total, Covid restrictions are now in place in more than 70 Chinese cities. And these are slightly different everywhere. As a result, it is currently particularly tricky for companies in Shanghai and the northeast to obtain parts.

Shanghai has even managed to render its own closed loops at its ports unfeasible. While closed Covid bubbles allow for 24-hour operations at the ports of Yangshan or Waigaoqiao to continue, hardly anything is outbound. After all, it would have to leave the loop in the process. Truck drivers, on the other hand, are not allowed to drive within Shanghai limits without a special permit, nor are they allowed to enter or leave the surrounding provinces. “Barge traffic, which is common in the region, has also been suspended,” says economist Chris Rogers of Flexport, a digital freight forwarder that operates an office in Shanghai. “This poses challenges for importers and exporters alike.”

When Shanghai’s eastern Pudong district was placed under lockdown in March, city authorities themselves suggested isolated overnight housing in the office. Information leaflets recommended what employees should bring for temporary living in the office. The Shanghai Stock Exchange instructed compliance officials and technicians to sleep on-site to keep the world’s second-largest capital market running. Banks and investment fund companies urged their employees to camp out in the office before the lockdown began. According to agency reports, one fund manager said he and his colleagues had deliberately blocked a floor drain to prevent viruses from entering there. Earlier, some people on the floor above had tested positive, but could not be sent to a quarantine center right away because capacities had reached their limits.

But not many Shanghai companies were able to maintain production till today. “Only a few companies have permission to continue production,” said Bettina Schoen-Behanzin, Vice President of the EU Chamber of Commerce in China. These included companies in the pharmaceutical, food or chemical sectors. “You can’t just shut down a chemical plant.” Furthermore, supply chains are also a problem in Shanghai. “It’s difficult to find drivers and get the required permits,” Schoen-Behanzin told a chamber media panel. “We also hear that fewer and fewer workers are volunteering for the closed loops.” At least no one is likely to be forced at European companies.

The bubble concept is not new. When Xi’an in China’s northwest was sealed off at the end of 2021, for example, two Samsung factories in the city continued to operate in a closed loop. In Europe, closed bubbles were used for winter sports World Cups, for example. The largest Covid bubble was then created by the Beijing Olympic hosts during the Winter Games in February.

The concept then became more popular as the Omicron wave rolled in. In Shenzhen, Taiwanese electronics manufacturer and Apple supplier Foxconn, among others, managed to quickly start closed-loop production during the brief lockdown in March. In Changchun, which has been locked down for some time now, some companies have already been operating in a closed loop system for four weeks, according to Harald Kumpfert, Chair of the EU Chamber for northeast China.

But in the meantime, concerns about supply chains have become dominant there as well. The BMW joint venture in Shenyang, for example, produced for as long as it could, says Kumpfert. Then the supply shortage hit. Every insider understands this immediately. “It only takes one missing part for production to stop,” says a German car manager in China. A closed loop is more suited for regions that have not yet undergone a complete lockdown, or for cities that allow regular transport of goods despite a lockdown.

Most recently, Chinese battery giant Contemporary Amperex Technology (CATL) announced that it introduced closed-loop management at its main plant in Ningde, in southern China. The move was intended to maintain production. On the same day, the Fujian province had reported nine new cases, including one in Ningde. As a result, the province imposed travel restrictions. CATL stated that the company had “strengthened communication with the local government.”

A production stop at the market leader for EV batteries would hit virtually the entire sector: CATL supplies BMW, Daimler, VW, Hyundai, Honda, PSA, Tesla, Toyota, Volvo, NIO, Li Auto and XPeng, among others. CATL employees now shuttle between their dormitories and the factory in a special bus. This shows that it is much easier to quickly switch to closed loops if employees already live in factory-owned dormitories. This is common practice in southern China. Foxconn also benefited from this in Shenzhen. Nevertheless, CATL also has to be careful that the supply chain will hold.

Until a few weeks ago, Alessandro Pavanello was still one of those types of adventurers who have been magically attracted to Shanghai for decades: A millennial with a three-day beard from Italy who works at a music agency by day and tours the city’s clubs as a DJ by night. Someone whose hedonistic lifestyle knows no other problems than deciding in which of the many hip rooftop bars to start the weekend. But since March 26, Pavanello’s privileged life is over.

Testing positive for the virus in China is not just bad news, it entails a great deal of dread. Normally, it only takes a few minutes for the health workers to arrive at the door in their protective suits to pick up the infected individual. In Alessandro’s case, however, nothing happened at first. Only one man came to his apartment to mist all the rooms with a disinfectant spray like some kind of exterminator.

Has he dodged the bullet? Obviously, the overwhelmed authorities no longer could cart each of the now more than 150,000 covid cases to the isolation centers. But Alessandro Pavanello’s happiness turned out to be false: Barely two weeks later, when the young man had long since tested negative again, a bus from the epidemic authority suddenly appeared at his front door.

In a Kafkaesque odyssey, Pavanello is now carted between various facilities for almost 14 hours. Nobody wants to take in the European; obviously, since the Italian does not speak Chinese. In a quarantine center, a doctor tells him, “This is not a good place for a foreigner, the conditions in here are very bad.” To which Pavanello replies, “What about the Chinese, do you think the conditions are good for them?”.

But going back home is not an option either. His landlord sent him a blunt message on his cell phone: “I don’t accept you here anymore, all residents are against it. Just so you know: We will not open the door.” The fear that the “leper” could carry the virus is too great.

It’s already two o’clock in the morning by the time Alessandro finally finds a place to stay – in a huge exhibition hall, where the DJ and music producer now sleeps packed close together next to a thousand other infected people. “I can show you my room,” Pavanello says with a laugh that shows through his red face mask.

On Instagram, he has devoted himself to informing the public about his everyday life in the quarantine center – with humor, but also a lot of cynicism. He films the meager camping bed with his smartphone camera, which causes back pain just by looking at it. Many of the people sitting next to him have mounted cardboard tarpaulins over their beds so that they at least have a little darkness and privacy at night.

Pavanello then shows the sanitary facilities of the quarantine center, but they are also anything but attractive. Patients have to wash their bodies with a small rag; there are no showers. The toilets are outhouses, most of which still contain feces from previous users. It is hard to imagine what the facilities look like that turned away the Italian because of “poor conditions”.

Pavanello now tries to make the best of the situation. But he doesn’t want to sugarcoat the whole thing either: “We are treated like cattle here,” says the Italian in an online chat: “As a foreigner, I am only a guest in China and have to abide by the country’s rules. But I no longer feel safe here, and I am thinking about leaving China.”

But his girlfriend has it much worse, says Alessandro. She has already been housed in another isolation center for two weeks. She has already tested negative twice in a row and should actually be allowed back into her apartment. Nobody really knows why she’s not being allowed to do that. “It’s madness,” Pavanello says into his cellphone camera and says goodbye. Now he wants to go and see if he can catch some fresh air in a cordoned-off area – if he’s lucky, he can still see the evening sun. Fabian Kretschmer

China’s car trade has a particularly fragmented structure. The hundred largest car dealer groups combined are responsible for just 30 percent of car sales in the People’s Republic, as calculated by the management consultancy McKinsey. In recent years, enormous growth rates saved the industry from major bankruptcies. But now pressure grows. Even the manufacturers react to the change in customer behavior.

One in three car dealerships in China is currently operating at a loss. Although the country is still the largest car market in the world, growth has declined sharply. New cars now spend an average of one and a half months at dealerships. In addition, customers also like to order online. Electric vehicles in particular are sold this way. Tesla offers direct sales, and NIO has also been highly successful with a virtual sales model. Brands that also represent the future of mobility for many customers.

Even though some car dealerships and dealer groups are experiencing difficulties, pure online sales are still a long way off. Currently, just five percent of all new car sales in China are made over the Internet. The remaining 95 percent of customers prefer to go to a car dealership. And for good reasons, as car expert Ferdinand Dudenhoeffer told China.Table: “Cars are high-value products. They cost 30,000 to 60,000 euros. At that price, the customer wants certain risks to be excluded.” The car must do what the customer wants, repairs must be uncomplicated, resale has to work.” These risks could be excluded because there are car dealerships. They’re a kind of insurance.”

Meanwhile, car dealers now merge online retail and physical sales. BMW told China.Table, “In China, we are relying on our established sales channels through retail, complemented by digital and offers specifically tailored to the purchasing habits of our Chinese customers, such as a cooperation between MINI China and Alibaba during the Double 11 Shopping Festival last year.”

Mercedes China also expects the online component to become more important: “We believe that many processes will soon be digitized. We are therefore working hard to create high-quality digital touchpoints. Such as digital showrooms on WeChat, websites or apps,” explained a Group spokeswoman.

A strategy that Volkswagen also pursues. It is difficult to measure the share of online presentations in sales because the digital and physical worlds are too closely intertwined. Two out of three Volkswagen customers reportedly also wish they had the option to buy a car online. However, this is only the last step in the sales process. Before that, customers want to sit in the car, a spokesperson for the Wolfsburg-based company told China.Table.

According to Volkswagen, customers feel the need to try out a car first, especially when buying electric cars. For decades, the company has sold vehicles with combustion engines. Customers would not simply buy electric vehicles without a test drive. But the Covid crisis has also shown what is possible in online retailing, the VW spokesman said. Purchase interactions on the companies’ websites had risen by 80 percent.

The fact that trade in China works differently than in Europe was something Volkswagen had to learn painfully with its ID models. It was only with the opening of special ID stores that sales increased. In 2021, Volkswagen has opened well over 100 EV stores. In shopping malls and shopping streets. Chinese customers simply buy an electric car right after they are done shopping for groceries. In ID stores, the conversion rate – the rate at which an interest turns into a purchase – is far higher than at traditional dealers.

However, manufacturers do not want to abandon dealers completely. For Mercedes, they are a “central instrument” for providing high-quality customer service. Volkswagen also explicitly emphasizes that a strong dealer network is a clear competitive advantage.

Dudenhoeffer believes that the success of online retailing is primarily related to the product that is being sold: “You need the right product. It hasn’t proven viable to simply place an ad and then sell the car online. This is because you leave the customer alone with the risks he’s not willing to take online.” He is alluding to subscription models in particular. Volkswagen, for example, wants to change its business model: Away from a car manufacturer to a provider of mobility. As early as 2030, between 20 and 30 percent of sales are to be generated from subscription models and similar concepts.

A change that could set in much sooner in China. “In China, financial services are still capable of development. There are many restrictions imposed by the state in the banking sector. Car banks and the corresponding licenses have not existed in China for very long. In Europe, it’s already very developed. Thanks to companies like NIO and Xpeng, however, the Chinese market has begun to break open very quickly,” explains Dudenhoeffer.

The People’s Republic has already proven in the promotion of EVs that it can pull a global market along with it. The same could happen with the digitization of trade in view of upcoming domestic brands. Dudenhoeffer: “At the moment, Europe has advantages, but the Chinese are damn fast, willing to learn and adapt. The question is always what regulations the Communist Party will impose.” The industry “has to set itself up, be designed in such a way that it can develop.”

The Shanghai municipal government seeks a balance between cautious opening and containing the Covid pandemic. On Tuesday, the first few citizens in virus-free planned squares were allowed to step outside their doors within their housing complexes. But they still cannot move freely throughout the city. Meanwhile, the psychological and economic costs continue to escalate. Several companies report not being able to maintain production despite the introduction of a closed loop, including Apple supplier Pegatron.

The government tried to explain its strategy at a press conference of the State Council’s disease control group on Tuesday. Chief epidemiology expert of the Chinese Center for Disease Control and Prevention, Wu Zunyou, reiterated the familiar narrative: “The dynamic zero-covid policy best suits the actual conditions in China.” It would be “the best choice” of all pandemic strategies. The epidemic continues in full swing and is also on the upswing in Shanghai. Relaxing measures would not be possible now.

At least the daily rise of positive tests seems to have somewhat slowed down. On Tuesday, authorities reported only 22,342 new infections. On Monday, it was still more than 26,000. The seventh round of mass testing is in progress. The city has classified residential districts using a traffic light system:

The city portrayed the introduction of “parent-child compartments” in quarantine centers as a major step forward. Accompanied by upbeat piano music, video clips showed cubicles made of plastic walls where 2- to 18-year-olds could spend their quarantine time with a parent. However, these accommodations seemed rather bleak otherwise, despite the option to bring a stuffed animal. They are still considered an improvement over the previous practice of separating children from their parents.

In the city of Jilin, the capital of the eponymous province, another improvised quarantine hospital was opened on Tuesday. Simultaneously, a new round of mass testing also began here from Wednesday to Thursday. This was due to the continuous emergence of new cases. But authorities spoke of a “downward trend” in the numbers. In the province, about 1,000 new infections are found every day.

Hong Kong proudly reports a drop in infection numbers to around the same level. On Tuesday, voluntary mass testing returned fewer than 1,000 positive results. According to the Infection Control Department, 0.2 percent of the population is currently actively infected. Researchers at Hong Kong Polytechnic University, meanwhile, revealed a measuring tool that is able to detect coronaviruses in samples with exceptional accuracy and ease. However, it is ultimately a highly automated nucleic acid test. It is suitable for evaluating swabs from human mucous membranes and from surfaces such as tabletops. fin

Germany has reacted to the suspected delivery of a Chinese ground-to-air defense system to Serbia with a warning: The German government expects all EU accession candidates to participate in the European Union’s common foreign and security policy in order to align themselves with the EU, the Federal Press Office announced. Over the weekend, six Y-20 transport aircraft of the Chinese Air Force had been spotted in Belgrade (China.Table reported). According to media reports, these aircraft had delivered parts of the FK-3 ground-to-air defense system to Belgrade. The delivery is yet to be confirmed by Serbian authorities.

According to a Reuters report, Serbia had already signed the deal in 2019. In 2020, the deal, which also includes the purchase of Chinese combat drones, then became public. Serbia is the first European country to buy a Chinese air defense system. FK-3 is the scaled-down export version of the HQ-22 system, which was put into service by the Chinese armed forces in 2017. The system for defense against aircraft, missiles and drones is reportedly based on the Russian S-300.

On Monday, German Foreign Minister Annalena Baerbock reiterated her call on Serbia to join sanctions imposed by the EU, the United States and other countries against Russia. Belgrade has voted against Russia three times in United Nations votes, but has not yet imposed sanctions. If Serbia wants to become a member of the EU, it is essential to follow EU foreign policy here as well, Baerbrock said. rtr/ari

For the first time since the summer of 2021, China is again issuing licenses for video games. On Monday, regulators announced plans to release 45 games developed in China on the market. Developers include major tech companies such as Bilibili Inc and NetEase, according to a Reuters report. Following the announcement, the premarket value of US-listed shares rose by 8 and 8.6 percent, respectively.

Beijing issued the ban on new games last August, along with restrictions on playing time for minors (China.Table reported). Beijing intended to counter a growing addiction to video games among young people. The authorities also spoke of “spiritual opium” in this context.

Chinese companies like Tencent are some of the most successful and profitable game developers in the world. According to a report by the South China Morning Post, the suspension has mainly affected smaller companies. Around 14,000 game companies had to shut down by the end of December alone. fpe

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

When Katja Levy was faced with the choice of a field of study after graduating from school, she purposely chose the greatest possible challenge: “I really wanted to study the most difficult language in the world.” Levy has not regretted this decision – today, the sinologist and political scientist conducts research on social activism in China at the University of Manchester. “I’m fascinated by how people care about others – even in a politically authoritarian system.” To this end, she seeks dialogue with Chinese organizations and scientists – in the past often on the ground in China, since the beginning of the Covid pandemic in online interviews.

Dialogue has been a recurring theme throughout Levy’s career. After her studies in Hamburg and Shanghai, academic positions were very rare at first. Levy worked for Siemens in Shanghai for four years. She loved living in the Chinese metropolis, she says. But working for an international corporation was not the right thing for her in the long run. She then received an offer from the German Bundestag: Levy became a research assistant to Antje Vollmer, a Green Party member and Vice President of the Bundestag at the time, and was responsible for China and Tibet policy.

Her Berlin years were very defining, Levy says today. There was a great sense of optimism in the red-green government. Many policy areas were fundamentally redefined, including China policy. “The goal was a new dialogue,” Levy says. One of the ideas was the foreign policy instrument of the Rule of Law Dialogue: The German and Chinese governments signed an agreement to engage in more dialogue on rule of law and human rights issues – at political, academic and civil society levels. Levy organized and managed the two-way exchange in the background. “It was a perfect time for it: China was very open to legal advice at the time.” In 2001, the People’s Republic joined the World Trade Organization (WTO) and had to align its legal system with international standards.

Levy’s time in Berlin politics ended with the red-green defeat in the 2005 federal elections. She was now writing her thesis, and her subject remained the same: the rule-of-law dialogue with China. She spent entire summers in dusty basements of the Ministry of Justice poring over files, she recalls. “But I loved it: academic work has always been my passion.” Since then, Levy has worked on rotating research projects and universities, studying charity as well as the impact of digitization on China’s society and workforce. Until 2019, she was a junior professor at the Free University of Berlin. In Manchester, she is currently working on a study comparing voluntary work in China and England.

“It’s not as easy to become socially committed in China today,” says Levy. In the 1990s and early 2000s, things were quite different: “Back then, civil society was flourishing, new organizations were springing up.” Today, the state steers involvement in desired directions. While the government is dependent on help, for example in geriatric care or education, when it comes to issues of politics, religion or feminism, social commitment is neither asked for nor permitted. “I’m often amazed at how much happens regardless. People find their niches to show commitment.” And that is despite the high personal pressure that the Chinese working world exerts on many people.

For her scientific work, she is always on the lookout for contacts that open doors – in charity foundations, for example. To gain authentic insights, it’s important to establish trusted connections, she says. Research has become more difficult – because of the pandemic, but also because of increased political restrictions. “You have to be careful not to put anyone in danger.”

Nevertheless, she insists that scientific relations should not be severed under any circumstances. Levy already discussed this position earlier in an article for China.Table. “We need to keep communication channels open – especially when political dialogue is becoming difficult.” Academic exchanges and on-the-ground research help provide a nuanced picture of China and its diverse and complex society. “It’s important to work with people, not just data on the Internet.” Relationships established in the process are an important asset: “It can take years for someone to gain trust and reveal background information in an interview. Cutting them off would mean a huge loss of knowledge.” Jan Wittenbrink

Dr. Maximilian Laschka takes over the position of Project Lead for the Audi Q8 E-Tron China at AUDI AG in Ingolstadt. The Q8 is Audi’s latest electric SUV, which is said to feature a longer range and greater connectivity. Previously, Laschka served as Project Manager Financial Product Strategy for Audi for over three years.

Aidong Chen will become Board Director, CEO and Chairman of the Board of Directors at Chinese biotech company AnPac Bio-Medical Science. He succeeds Dr. Chris Yu, the company’s founder, who will focus on expanding business in China in a senior management position.

These two little Bengal tigers have three more siblings. The tiger quintuplets were born in Chimelong Safari Park in Guangzhou, Guangdong Province. Last weekend, they made their first public appearance. The five Bengal tiger babies were born during the Spring Festival and are a small sensation – normally a tiger mother gives birth to only two or three cubs.