Many European consumers do not even know the brand names of young Chinese car manufacturers. This means, in turn, that despite good products and affordable prices, there is still a lot of room for improvement.

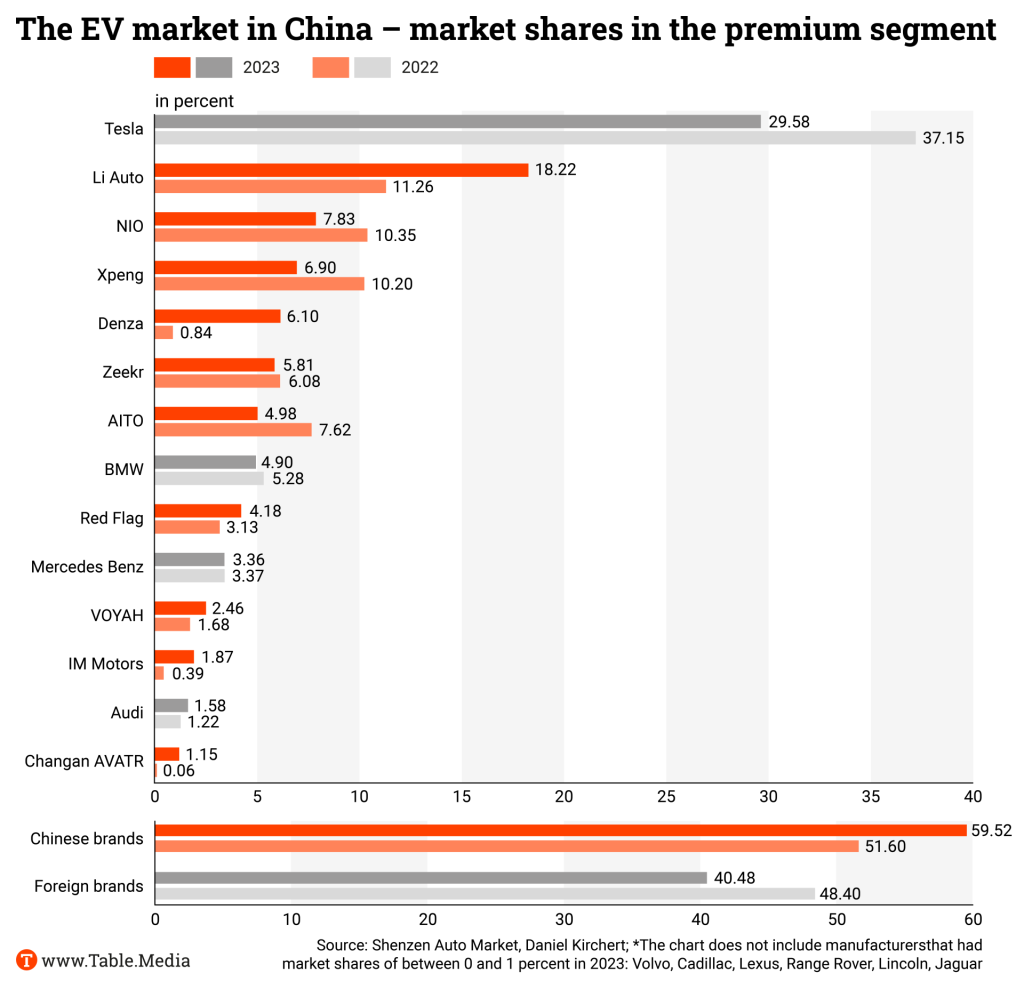

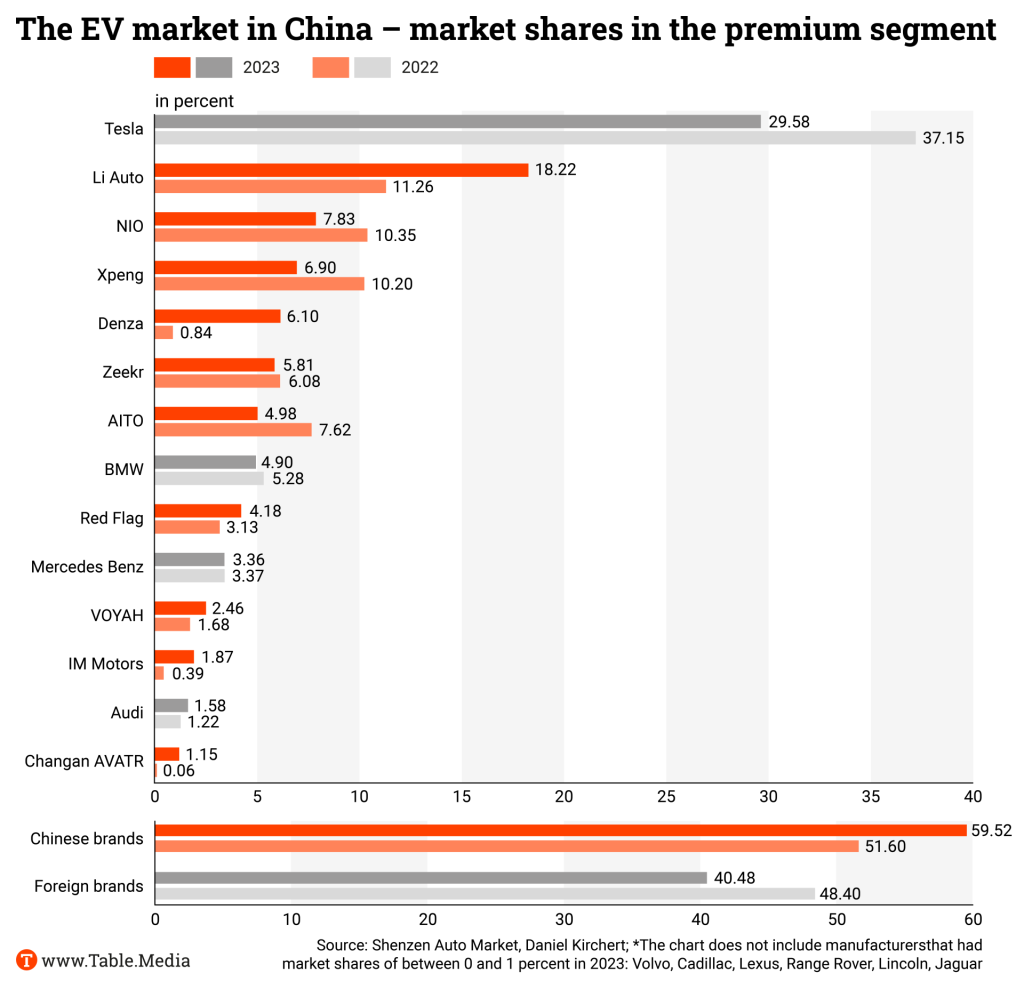

For a long time, German premium manufacturers considered themselves untouchable, even in the Chinese market, especially when it came to higher-end models. But this is a misconception, analyzes Julia Fiedler. The share of EVs in the premium segment in China is growing rapidly. This segment is primarily served by domestic manufacturers, with technically and visually sophisticated cars that no longer have the reputation of being inferior. At least not as far as their image is concerned. At the same time, the price war has also reached expensive cars – a Chinese premium car is already available for as little as 30,000 euros. That seems too cheap for the German competitors to take seriously. Buyers see it differently.

Many German SMEs have had good experiences with Chinese investors. However, this is not the case for the employees of the recycling company SRW Metalfloat near Leipzig. They have been on strike for nearly 100 days. However, the Chinese parent company, Chiho, refuses to improve working conditions, increase wages, or even negotiate with its employees. Christian Domke-Seidel describes the difficult situation, which could go on for months.

German car manufacturers face fierce competition from domestic producers in China’s premium car segment. For a long time, they believed their dominance in the premium segment was certain. However, domestic car brands now also consider themselves premium. They are stirring up the EV segment – and their products are attracting more and more customers.

In 2023, Audi sold 730,000, Mercedes-Benz 737,000 and BMW 825,000 cars in China. This means that the German premium triad, also known in China by the three letters ABB – Audi, Benz and BMW – continued to dominate its traditional turf. How large their market share actually is, however, depends on how the segment is defined.

Because there is no clear definition of premium. The discount battle in China’s car market has led to massive shifts in one key characteristic, the price – even in the premium segment. In China, car prices in this segment start at around 30,000 euros: Zeekr’s 007 electric saloon, for example, starts at 210,000 RMB in the People’s Republic, the equivalent of about 27,000 euros.

Not only the focus on the price, but also the brand perception has changed. Although China is the biggest market for traditional premium and luxury brands in the automotive sector, the appeal of these brands is in danger of losing significance. “Five years ago, it would have been unthinkable for anyone with some standing in society to buy a Chinese brand. They had a cheap image and symbolized poor quality. That has changed, and in a very short time,” says Daniel Kirchert, a car expert with over 20 years of experience in management positions in China, who recently founded the company Noyo, which helps Chinese EVs enter the Swiss market.

“Until a few years ago, ‘brand for face’ and status were extremely important in China. That’s why BMW, Mercedes, Audi and even more exclusive luxury brands have always sold extremely well. However, status and branding seem less important today, especially among the young Y and Z generations,” says Kirchert. Brand names such as NIO, Zeekr and Li Auto sound highly appealing to young Chinese, promising digital innovations, the latest technology and an excellent customer experience. It almost goes without saying that the cars now also look good.

The majority of premium vehicles sold in China are still gas-powered. However, the share of EVs in the premium segment is growing rapidly, and young Chinese brands dominate here. Expert Kirchert estimates that the share of EVs in the premium segment was around 31 percent in 2022, having risen sharply to 42 percent in 2023, according to his calculations. Kirchert counts the following Chinese EV brands as part of the premium segment:

Germany’s car manufacturers seem unwilling to see the rapid change, even in the upper segment. A Mercedes-Benz spokesperson says: “In the upper market segment, which is decisive for Mercedes-Benz, the EV market is only in its initial phase. In this segment, many customers still prefer the S-Class with a high-tech combustion engine – often as a Maybach.”

Kirchert sees things differently. “The German premium brands are playing up their position,” he fears. Many Chinese brands now belong to the premium segment, but according to the definition of German manufacturers, these brands are not premium. And this is reflected in the segmentation and market share reports the executive board receives at the headquarters. From the customer’s perspective, however, there is no doubt at all that these Chinese brands play in the premium segment, Kirchert concludes.

Mercedes-Benz Head of Technology Markus Schaefer also said at an online discussion hosted by management consultants PwC last July: “The price war in China is dramatic, especially in the volume segment.” However, he said that Mercedes-Benz focuses on the premium and luxury segment and continues to be successful in China.

A study by the Munich-based consulting firm Berylls Strategy Advisors also comes to a different conclusion here. The study shows that the price war not only rages in the volume segment, but also strongly impacts the premium segment. The study “Quo Vadis China 2024 – a rat race with no end in sight” states that Tesla has permanently shifted the pricing baseline in China downwards through its discounts. This has influenced customer perceptions of how much premium should cost.

NIO is a prime example of how Chinese competitors win over customers thanks to a compelling customer experience. With 160,038 vehicles sold in 2023, the manufacturer may not yet have achieved a huge volume, but it has the support of a community of loyal fans thanks to its first-class customer service in case of problems with the vehicle. These fans interact on the NIO app – a social media platform where founder William Li is also present. He enjoys putting himself in the media spotlight, most recently in December, when he spent 14 hours behind the wheel to personally demonstrate the ET7’s battery range of 1,000 kilometers.

However, for Chinese customers, premium also means entertainment. The Aito M9 takes this to the extreme. Aito is a joint venture between the EV manufacturer Seres and technology group Huawei. Last year, the brand sold 101,631 cars. The new M9 SUV can project movies onto a surface up to 2.5 meters in front of the car with its headlights. There is also a projector above the third seat row inside the car and a fold-out screen above the front seats for movie nights in the back seat.

The Li Auto L7 premium SUV, in turn, taps into the camping enthusiasm of young city folk. Li Auto has big ambitions. Founded in 2015, the company already sold 376,030 EVs in 2023 – around half as many as Audi or Mercedes-Benz. The L7 also has a large, fold-down display for watching films or playing video games. But the car can do much more. The seats, including the front ones, can be folded down completely flat to create an even surface, which gives room for a tailor-made air mattress. This turns the car into a sleeping area. An adapter can also be used to convert the vehicle’s charging socket into a power socket. It can then power a hotplate using the car battery, for example.

It is clear to Chinese customers: technology, entertainment and experiences like these are premium. And Chinese start-ups are clearly ahead of the game here. Sixty percent of premium EVs are Chinese brands, with Tesla accounting for just under 30 percent of the segment. German manufacturers, on the other hand, do not even account for 10 percent of EVs.

Berylls consultants also predict that given car prices, which are likely to fall even further, new Chinese EV brands could also favor the premium segment, further intensifying competition.

The strike at SRW Metalfloat in Germany near Leipzig is nearing its 100th day. However, the Chinese parent company Chiho has so far refused to improve working conditions or raise wages. Negotiations have not yet taken place, nor are they in sight. The German metalworkers’ union IG Metall has planned larger rallies for the 180 employees to mark the 100th day of the strike on Thursday next week.

German companies, employees and trade unions have generally had positive experiences with Chinese investors. However, this is not the case with SRW Metalfloat. The Leipzig-based company is a wholly owned subsidiary of Scholz Recycling GmbH. In 2016, the Chinese Chiho Environmental Group acquired the heavily indebted company at the time for a symbolic euro. Scholz Recycling generates an annual revenue of around 1.6 billion euros. A quarter of this comes from SRW Metalfloat.

What happens with the money is unclear. Although Chiho Environmental is headquartered in Hong Kong, it is listed on the British Cayman Islands. The majority shareholder of Chiho is USUM Investment Group, which in turn is a subsidiary of Chongqing-based Loncin Group. Among other things, it manufactures motorbikes, agricultural equipment and generators. The task of the USUM Group is to promote its international activities and partnerships.

Since Chiho Environmental took over Scholz Recycling, Yongming Qin has been its CEO. He has forbidden the upper management of SRW Metalfloat from negotiating a collective labor agreement. However, he has also stayed away from the negotiating table himself. “I believe that the strike will reach Hong Kong. Mr Qin is surely well-informed about what is happening in Germany. The strike is having an economic impact, after all. The company is no longer making any money here,” Michael Hecker told Table Media. He is the chief negotiator for IG Metall.

The strike has already lasted an entire financial quarter. The company has already lost around 100 million euros as a result. The work stoppages could go on for months.

This extended strike comes as no surprise. “We have seen time and again in the past that promises made, such as pay rises, were not kept. The critical point was that the employees wanted legal and planning certainty,” says Hecker. However, this planning security can only be achieved with a collective labor agreement.

There have only been wage increases at SRW Metalfloat when the company would otherwise have paid below the legal minimum wage. Employees currently earn 13.68 euros per hour, one euro above the minimum wage. However, the work is extremely exhausting. “We are dealing with a company trying to prevent employee participation and dictate working conditions,” Hecker stressed.

Improving working conditions has turned out to be a Sisyphean task in recent years. People stand in a converted container where a conveyor belt transports the waste. The employees have to sort out individual steel parts weighing up to 18 kilograms by hand. This requires the operation of heavy machinery, for which SRW Metalfloat relies on specialized workers.

The company SRW Metalfloat operates in the recycling sector. Its workers sort metal waste and shredder residues to obtain so-called secondary raw materials – i.e. aluminum, stainless steel, copper granulate, plastic or heavy metals. These products are then sent to the relevant smelters or directly to manufacturing companies – in Leipzig, for example, Volkswagen.

In summer, temperatures in the container reach around 40 degrees – the air conditioning systems purchased did not have enough power to cool the workplaces adequately. In winter, temperatures below the conveyor belts drop below zero. The mushroom heaters provided regularly broke.

Considering these working conditions, the employee demands appear fairly modest. They demand an eight percent pay rise, a Christmas and holiday bonus of 1,500 euros instead of the current 1,000, and reduced weekly working hours from 40 to 38.

SRW Metalfloat belongs to a future-oriented sector that would be enormously important for the transformation of the industrial sector: “If we are talking about the transformation of the economy and a functioning circular economy, then this change starts here. This strike has a political dimension,” Hecker believes.

And indeed, several politicians from the German government were already on the ground. However, they declined to comment on the issue when asked by Table.Media. Scholz Recycling and the Chiho Group left all inquiries unanswered.

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

Germany and Mongolia will sign a strategic partnership today, Wednesday. As Table.Media has learned exclusively from the Office of the Federal President, the partnership will be signed during Federal President Frank-Walter Steinmeier’s trip to Mongolia. Tobias Lindner, State Secretary at the Federal Foreign Office, will travel to Ulaanbaatar, where he will sign the agreement with Mongolian Foreign Minister Battsetseg Batmunkh.

The strategic partnership is an important step towards reducing Germany’s dependence on China and Russia: Mongolia is rich in raw materials, including copper, gold and rare earth elements. At the same time, the agreement sends a clear signal to Mongolia’s two authoritarian neighbors that Germany supports democracies worldwide and aims to become more involved in Asia in the future. rad

After allegations against a Chinese partner of German chemical giant BASF surfaced, 30 MPs from various countries have now called for the company to withdraw from Xinjiang. “If BASF’s cooperation partner in China is now caught bragging on their own website that they are part of this oppressive regime, then BASF must pull the plug,” German public broadcaster ZDF quotes MEP Reinhard Buetikofer as saying. Forced labor crosses a red line, beyond which the behavior of companies is no longer tolerable, he said.

The Inter-Parliamentary Alliance on China (IPAC) consists of members of various parliaments around the world. The German Bundestag, for example, is represented by conservative CDU member Michael Brand. Other members include representatives from Belgium, the UK, Canada, Japan and Australia. The IPAC has been founded in 2020.

Speaking with ZDF, Brand drew a connection between BASF’s Nazi past and its special responsibility for human rights in the present. BASF’s controversial partner is called Xinjiang Markor Chemical Industry. According to a report by German media, employees of the company are said to have been involved in the monitoring of the Muslim minority. They visited Uyghur families and monitored them in their homes. Some Uyghurs were arrested as a result. fin

China will hold joint naval exercises with Iran and Russia in the coming weeks, reports the South China Morning Post. Russian and Iranian media quoted Commander of the Iranian Navy Rear Admiral Shahram Irani as saying that the drills would be held before the end of March and serve “regional security.”

According to Iran’s news agency Tasnim, which described the drills as a “war game,” Irani said several other countries had been invited to participate in the drill. The reports did not specify where the drills would take place, but the navies of the three countries conducted trilateral exercises in the Gulf of Oman last March.

This year’s drills come at a time of simmering tensions in the Middle East. On Saturday, a US-led coalition launched a third round of attacks against Houthi targets in Yemen. The attacks were in response to earlier attacks by the Houthi rebel group on merchant ships in the Red Sea. China has not formally condemned the Houthis. However, according to Reuters, Chinese officials have asked their Iranian counterparts to help contain the group’s attacks on ships in the Red Sea.

The news agency of the Islamic Republic of Iran first reported on the joint exercise with Russia and China in December. At the time, however, the government in Tehran did not specify when the exercises would take place. The Iranian commander said at the time that Pakistan, Brazil, Oman, India and South Africa were among the countries invited as observers. There has been no official announcement of this year’s exercise from either China or Russia. rtr

The Biden administration has sent five senior US Treasury officials to Beijing this week for economic talks that will include China’s “non-market” policies that are adding excess industrial capacity, a Treasury official said on Monday.

The delegation, led by Treasury Undersecretary for International Affairs Jay Shambaugh, planned to hold frank conversations on Monday and Tuesday as part of the US-China Economic Working Group about Beijing subsidies that the US says encourage overproduction of goods, potentially flooding global markets. Affected industries include electric vehicles, a sector whose development in the United States the Biden administration is trying to boost with its own tax subsidies.

In parallel to the talks, the Biden administration is continuing to review the US tariffs that former President Donald Trump imposed on Chinese imports. Trump, the likely Republican presidential nominee, has indicated that he would impose even tougher tariffs if elected. Biden is expected to take a tough but more nuanced stance on China.

The meeting is the third since Yellen and her Chinese counterpart, Vice Premier He Lifeng, launched the group in September alongside the parallel Financial Working Group. rtr

Guatemala wishes to establish formal trade relations with China while maintaining its existing relations with Taiwan. “We are going to continue working with Taiwan at the levels we have been doing,” said Guatemala’s Foreign Minister Carlos Ramiro Martínez. “But the president has pointed out that we cannot ignore the weight and power China represents.”

The Central American country is one of Taiwan’s few remaining allies. More and more countries around the world are siding with the world’s second-largest economy, which claims democratically governed Taiwan as its territory. “We are interested in approaching them to try and develop some relationship around trade,” Martinez said, saying this could materialize as an “office of trade interests” that would help find a Chinese market for Guatemalan products. “We are making it public, this is not an ambush against Taiwan or the United States,” he added. flee/rtr

Jens Ruebbert has lived in Asia for over 20 years, with a few interruptions, and is a veteran of the German-Asian banking scene. Since 2018, the business economist has been Managing Director & Regional Head Asia/Pacific of the LBBW Singapore branch. He shares numerous professional and private contacts with China. And he keeps a close eye on developments in the People’s Republic.

From 2009 to 2014, Ruebbert was Chief Operating Officer for Deutsche Bank in Beijing, responsible for the whole of China. During this time, Deutsche Bank opened three branches in China, including Shanghai. For Ruebbert, it was “a great, exciting and educational time.” He got to know many regions of the country and its people.

He keeps in touch with most of his clients, business partners and friends. He still enjoys traveling to the country, mainly from his current home in Singapore. The 57-year-old is Chairman of the EU-ASEAN Business Council and President of the European Chamber of Commerce Singapore. From 2011 to 2014, he served as Vice President of the European Chamber of Commerce in China.

Towards the end of 2022, Jens Ruebbert opened the first branch in the People’s Republic for his current employer, LBBW, in Shanghai. Its clients are German and European companies, accounting for around 90 percent of its business. LBBW conducts traditional corporate customer business in China, such as investment, trade and export financing.

“We are still in the development phase, but the overall trend is positive,” says Ruebbert. “There is a large pipeline of customers wanting to do business with us and who see us as an alternative to other banks.” He emphasizes that building client relationships is a long-term process. Even opening an account is a complicated process these days due to global regulatory requirements. Yet China does not even have the highest requirements in Asia.

Jens Ruebbert is optimistic about economic development in the People’s Republic. He considers the IMF’s growth forecast of 5.4 percent for 2024 rather positive. “The Chinese economy will continue to grow faster than Western economies in the future. China remains a crucial market for German and European companies, both in terms of investment and trade.” The deteriorating political climate between China and Germany is not helpful, but ultimately not decisive.

In Ruebbert’s eyes, the Chinese real estate crisis is not an unsolvable problem. The economic system in China is “better able to combat such a crisis than is perhaps the case in Western countries.” He does not believe that the property market will collapse, as the means to combat the crisis are available, and the Chinese leadership cannot allow this to happen. According to him, the Chinese government can intervene faster and more directly than European governments, for example. On the other hand, China’s demographic problems are of a longer-term nature and will continue to affect the country for decades to come.

Ruebberts’s personal experiences with Chinese business partners have been positive: “They are good business people and tough negotiators.” Although Chinese negotiators act with a certain amount of finesse, they are less aggressive in negotiations than Anglo-Saxon businesspeople, for example. But with Chinese people, too, it is advantageous not to talk to them from a position of weakness. Mathias von Hofen

Luke Lu is the new head of China at US financial services provider Citigroup. Lu, who previously headed Citi’s corporate client business for large local corporate clients, succeeds Christine Lam.

Ulf Braken-Gulke has been Vice President Asia/Pacific at Truma Geraetetechnik since December. He previously worked as Country Group General Manager China at Webasto from 2016 to 2020.

Is something changing in your organization? Let us know at heads@table.media!

Xi Jinping has repeatedly urged the media and art world to “tell Chinese stories well.” Documentary filmmaker Sun Hong has done this well by taking an authentic approach. Her film “This Is Life 烟火人间” was shown in cinemas across the country in January. 509 ordinary Chinese people talk about their lives in videos they made on their phones. Sun edited together 887 of these clips and divided them into chapters that shed light on everyday concepts such as “food” and “home.” The stories focus primarily on rural China and smaller towns. Their inhabitants like to use the video app Kuaishou, which served as a never-ending source of inspiration for the 37-year-old director.

Many European consumers do not even know the brand names of young Chinese car manufacturers. This means, in turn, that despite good products and affordable prices, there is still a lot of room for improvement.

For a long time, German premium manufacturers considered themselves untouchable, even in the Chinese market, especially when it came to higher-end models. But this is a misconception, analyzes Julia Fiedler. The share of EVs in the premium segment in China is growing rapidly. This segment is primarily served by domestic manufacturers, with technically and visually sophisticated cars that no longer have the reputation of being inferior. At least not as far as their image is concerned. At the same time, the price war has also reached expensive cars – a Chinese premium car is already available for as little as 30,000 euros. That seems too cheap for the German competitors to take seriously. Buyers see it differently.

Many German SMEs have had good experiences with Chinese investors. However, this is not the case for the employees of the recycling company SRW Metalfloat near Leipzig. They have been on strike for nearly 100 days. However, the Chinese parent company, Chiho, refuses to improve working conditions, increase wages, or even negotiate with its employees. Christian Domke-Seidel describes the difficult situation, which could go on for months.

German car manufacturers face fierce competition from domestic producers in China’s premium car segment. For a long time, they believed their dominance in the premium segment was certain. However, domestic car brands now also consider themselves premium. They are stirring up the EV segment – and their products are attracting more and more customers.

In 2023, Audi sold 730,000, Mercedes-Benz 737,000 and BMW 825,000 cars in China. This means that the German premium triad, also known in China by the three letters ABB – Audi, Benz and BMW – continued to dominate its traditional turf. How large their market share actually is, however, depends on how the segment is defined.

Because there is no clear definition of premium. The discount battle in China’s car market has led to massive shifts in one key characteristic, the price – even in the premium segment. In China, car prices in this segment start at around 30,000 euros: Zeekr’s 007 electric saloon, for example, starts at 210,000 RMB in the People’s Republic, the equivalent of about 27,000 euros.

Not only the focus on the price, but also the brand perception has changed. Although China is the biggest market for traditional premium and luxury brands in the automotive sector, the appeal of these brands is in danger of losing significance. “Five years ago, it would have been unthinkable for anyone with some standing in society to buy a Chinese brand. They had a cheap image and symbolized poor quality. That has changed, and in a very short time,” says Daniel Kirchert, a car expert with over 20 years of experience in management positions in China, who recently founded the company Noyo, which helps Chinese EVs enter the Swiss market.

“Until a few years ago, ‘brand for face’ and status were extremely important in China. That’s why BMW, Mercedes, Audi and even more exclusive luxury brands have always sold extremely well. However, status and branding seem less important today, especially among the young Y and Z generations,” says Kirchert. Brand names such as NIO, Zeekr and Li Auto sound highly appealing to young Chinese, promising digital innovations, the latest technology and an excellent customer experience. It almost goes without saying that the cars now also look good.

The majority of premium vehicles sold in China are still gas-powered. However, the share of EVs in the premium segment is growing rapidly, and young Chinese brands dominate here. Expert Kirchert estimates that the share of EVs in the premium segment was around 31 percent in 2022, having risen sharply to 42 percent in 2023, according to his calculations. Kirchert counts the following Chinese EV brands as part of the premium segment:

Germany’s car manufacturers seem unwilling to see the rapid change, even in the upper segment. A Mercedes-Benz spokesperson says: “In the upper market segment, which is decisive for Mercedes-Benz, the EV market is only in its initial phase. In this segment, many customers still prefer the S-Class with a high-tech combustion engine – often as a Maybach.”

Kirchert sees things differently. “The German premium brands are playing up their position,” he fears. Many Chinese brands now belong to the premium segment, but according to the definition of German manufacturers, these brands are not premium. And this is reflected in the segmentation and market share reports the executive board receives at the headquarters. From the customer’s perspective, however, there is no doubt at all that these Chinese brands play in the premium segment, Kirchert concludes.

Mercedes-Benz Head of Technology Markus Schaefer also said at an online discussion hosted by management consultants PwC last July: “The price war in China is dramatic, especially in the volume segment.” However, he said that Mercedes-Benz focuses on the premium and luxury segment and continues to be successful in China.

A study by the Munich-based consulting firm Berylls Strategy Advisors also comes to a different conclusion here. The study shows that the price war not only rages in the volume segment, but also strongly impacts the premium segment. The study “Quo Vadis China 2024 – a rat race with no end in sight” states that Tesla has permanently shifted the pricing baseline in China downwards through its discounts. This has influenced customer perceptions of how much premium should cost.

NIO is a prime example of how Chinese competitors win over customers thanks to a compelling customer experience. With 160,038 vehicles sold in 2023, the manufacturer may not yet have achieved a huge volume, but it has the support of a community of loyal fans thanks to its first-class customer service in case of problems with the vehicle. These fans interact on the NIO app – a social media platform where founder William Li is also present. He enjoys putting himself in the media spotlight, most recently in December, when he spent 14 hours behind the wheel to personally demonstrate the ET7’s battery range of 1,000 kilometers.

However, for Chinese customers, premium also means entertainment. The Aito M9 takes this to the extreme. Aito is a joint venture between the EV manufacturer Seres and technology group Huawei. Last year, the brand sold 101,631 cars. The new M9 SUV can project movies onto a surface up to 2.5 meters in front of the car with its headlights. There is also a projector above the third seat row inside the car and a fold-out screen above the front seats for movie nights in the back seat.

The Li Auto L7 premium SUV, in turn, taps into the camping enthusiasm of young city folk. Li Auto has big ambitions. Founded in 2015, the company already sold 376,030 EVs in 2023 – around half as many as Audi or Mercedes-Benz. The L7 also has a large, fold-down display for watching films or playing video games. But the car can do much more. The seats, including the front ones, can be folded down completely flat to create an even surface, which gives room for a tailor-made air mattress. This turns the car into a sleeping area. An adapter can also be used to convert the vehicle’s charging socket into a power socket. It can then power a hotplate using the car battery, for example.

It is clear to Chinese customers: technology, entertainment and experiences like these are premium. And Chinese start-ups are clearly ahead of the game here. Sixty percent of premium EVs are Chinese brands, with Tesla accounting for just under 30 percent of the segment. German manufacturers, on the other hand, do not even account for 10 percent of EVs.

Berylls consultants also predict that given car prices, which are likely to fall even further, new Chinese EV brands could also favor the premium segment, further intensifying competition.

The strike at SRW Metalfloat in Germany near Leipzig is nearing its 100th day. However, the Chinese parent company Chiho has so far refused to improve working conditions or raise wages. Negotiations have not yet taken place, nor are they in sight. The German metalworkers’ union IG Metall has planned larger rallies for the 180 employees to mark the 100th day of the strike on Thursday next week.

German companies, employees and trade unions have generally had positive experiences with Chinese investors. However, this is not the case with SRW Metalfloat. The Leipzig-based company is a wholly owned subsidiary of Scholz Recycling GmbH. In 2016, the Chinese Chiho Environmental Group acquired the heavily indebted company at the time for a symbolic euro. Scholz Recycling generates an annual revenue of around 1.6 billion euros. A quarter of this comes from SRW Metalfloat.

What happens with the money is unclear. Although Chiho Environmental is headquartered in Hong Kong, it is listed on the British Cayman Islands. The majority shareholder of Chiho is USUM Investment Group, which in turn is a subsidiary of Chongqing-based Loncin Group. Among other things, it manufactures motorbikes, agricultural equipment and generators. The task of the USUM Group is to promote its international activities and partnerships.

Since Chiho Environmental took over Scholz Recycling, Yongming Qin has been its CEO. He has forbidden the upper management of SRW Metalfloat from negotiating a collective labor agreement. However, he has also stayed away from the negotiating table himself. “I believe that the strike will reach Hong Kong. Mr Qin is surely well-informed about what is happening in Germany. The strike is having an economic impact, after all. The company is no longer making any money here,” Michael Hecker told Table Media. He is the chief negotiator for IG Metall.

The strike has already lasted an entire financial quarter. The company has already lost around 100 million euros as a result. The work stoppages could go on for months.

This extended strike comes as no surprise. “We have seen time and again in the past that promises made, such as pay rises, were not kept. The critical point was that the employees wanted legal and planning certainty,” says Hecker. However, this planning security can only be achieved with a collective labor agreement.

There have only been wage increases at SRW Metalfloat when the company would otherwise have paid below the legal minimum wage. Employees currently earn 13.68 euros per hour, one euro above the minimum wage. However, the work is extremely exhausting. “We are dealing with a company trying to prevent employee participation and dictate working conditions,” Hecker stressed.

Improving working conditions has turned out to be a Sisyphean task in recent years. People stand in a converted container where a conveyor belt transports the waste. The employees have to sort out individual steel parts weighing up to 18 kilograms by hand. This requires the operation of heavy machinery, for which SRW Metalfloat relies on specialized workers.

The company SRW Metalfloat operates in the recycling sector. Its workers sort metal waste and shredder residues to obtain so-called secondary raw materials – i.e. aluminum, stainless steel, copper granulate, plastic or heavy metals. These products are then sent to the relevant smelters or directly to manufacturing companies – in Leipzig, for example, Volkswagen.

In summer, temperatures in the container reach around 40 degrees – the air conditioning systems purchased did not have enough power to cool the workplaces adequately. In winter, temperatures below the conveyor belts drop below zero. The mushroom heaters provided regularly broke.

Considering these working conditions, the employee demands appear fairly modest. They demand an eight percent pay rise, a Christmas and holiday bonus of 1,500 euros instead of the current 1,000, and reduced weekly working hours from 40 to 38.

SRW Metalfloat belongs to a future-oriented sector that would be enormously important for the transformation of the industrial sector: “If we are talking about the transformation of the economy and a functioning circular economy, then this change starts here. This strike has a political dimension,” Hecker believes.

And indeed, several politicians from the German government were already on the ground. However, they declined to comment on the issue when asked by Table.Media. Scholz Recycling and the Chiho Group left all inquiries unanswered.

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

Germany and Mongolia will sign a strategic partnership today, Wednesday. As Table.Media has learned exclusively from the Office of the Federal President, the partnership will be signed during Federal President Frank-Walter Steinmeier’s trip to Mongolia. Tobias Lindner, State Secretary at the Federal Foreign Office, will travel to Ulaanbaatar, where he will sign the agreement with Mongolian Foreign Minister Battsetseg Batmunkh.

The strategic partnership is an important step towards reducing Germany’s dependence on China and Russia: Mongolia is rich in raw materials, including copper, gold and rare earth elements. At the same time, the agreement sends a clear signal to Mongolia’s two authoritarian neighbors that Germany supports democracies worldwide and aims to become more involved in Asia in the future. rad

After allegations against a Chinese partner of German chemical giant BASF surfaced, 30 MPs from various countries have now called for the company to withdraw from Xinjiang. “If BASF’s cooperation partner in China is now caught bragging on their own website that they are part of this oppressive regime, then BASF must pull the plug,” German public broadcaster ZDF quotes MEP Reinhard Buetikofer as saying. Forced labor crosses a red line, beyond which the behavior of companies is no longer tolerable, he said.

The Inter-Parliamentary Alliance on China (IPAC) consists of members of various parliaments around the world. The German Bundestag, for example, is represented by conservative CDU member Michael Brand. Other members include representatives from Belgium, the UK, Canada, Japan and Australia. The IPAC has been founded in 2020.

Speaking with ZDF, Brand drew a connection between BASF’s Nazi past and its special responsibility for human rights in the present. BASF’s controversial partner is called Xinjiang Markor Chemical Industry. According to a report by German media, employees of the company are said to have been involved in the monitoring of the Muslim minority. They visited Uyghur families and monitored them in their homes. Some Uyghurs were arrested as a result. fin

China will hold joint naval exercises with Iran and Russia in the coming weeks, reports the South China Morning Post. Russian and Iranian media quoted Commander of the Iranian Navy Rear Admiral Shahram Irani as saying that the drills would be held before the end of March and serve “regional security.”

According to Iran’s news agency Tasnim, which described the drills as a “war game,” Irani said several other countries had been invited to participate in the drill. The reports did not specify where the drills would take place, but the navies of the three countries conducted trilateral exercises in the Gulf of Oman last March.

This year’s drills come at a time of simmering tensions in the Middle East. On Saturday, a US-led coalition launched a third round of attacks against Houthi targets in Yemen. The attacks were in response to earlier attacks by the Houthi rebel group on merchant ships in the Red Sea. China has not formally condemned the Houthis. However, according to Reuters, Chinese officials have asked their Iranian counterparts to help contain the group’s attacks on ships in the Red Sea.

The news agency of the Islamic Republic of Iran first reported on the joint exercise with Russia and China in December. At the time, however, the government in Tehran did not specify when the exercises would take place. The Iranian commander said at the time that Pakistan, Brazil, Oman, India and South Africa were among the countries invited as observers. There has been no official announcement of this year’s exercise from either China or Russia. rtr

The Biden administration has sent five senior US Treasury officials to Beijing this week for economic talks that will include China’s “non-market” policies that are adding excess industrial capacity, a Treasury official said on Monday.

The delegation, led by Treasury Undersecretary for International Affairs Jay Shambaugh, planned to hold frank conversations on Monday and Tuesday as part of the US-China Economic Working Group about Beijing subsidies that the US says encourage overproduction of goods, potentially flooding global markets. Affected industries include electric vehicles, a sector whose development in the United States the Biden administration is trying to boost with its own tax subsidies.

In parallel to the talks, the Biden administration is continuing to review the US tariffs that former President Donald Trump imposed on Chinese imports. Trump, the likely Republican presidential nominee, has indicated that he would impose even tougher tariffs if elected. Biden is expected to take a tough but more nuanced stance on China.

The meeting is the third since Yellen and her Chinese counterpart, Vice Premier He Lifeng, launched the group in September alongside the parallel Financial Working Group. rtr

Guatemala wishes to establish formal trade relations with China while maintaining its existing relations with Taiwan. “We are going to continue working with Taiwan at the levels we have been doing,” said Guatemala’s Foreign Minister Carlos Ramiro Martínez. “But the president has pointed out that we cannot ignore the weight and power China represents.”

The Central American country is one of Taiwan’s few remaining allies. More and more countries around the world are siding with the world’s second-largest economy, which claims democratically governed Taiwan as its territory. “We are interested in approaching them to try and develop some relationship around trade,” Martinez said, saying this could materialize as an “office of trade interests” that would help find a Chinese market for Guatemalan products. “We are making it public, this is not an ambush against Taiwan or the United States,” he added. flee/rtr

Jens Ruebbert has lived in Asia for over 20 years, with a few interruptions, and is a veteran of the German-Asian banking scene. Since 2018, the business economist has been Managing Director & Regional Head Asia/Pacific of the LBBW Singapore branch. He shares numerous professional and private contacts with China. And he keeps a close eye on developments in the People’s Republic.

From 2009 to 2014, Ruebbert was Chief Operating Officer for Deutsche Bank in Beijing, responsible for the whole of China. During this time, Deutsche Bank opened three branches in China, including Shanghai. For Ruebbert, it was “a great, exciting and educational time.” He got to know many regions of the country and its people.

He keeps in touch with most of his clients, business partners and friends. He still enjoys traveling to the country, mainly from his current home in Singapore. The 57-year-old is Chairman of the EU-ASEAN Business Council and President of the European Chamber of Commerce Singapore. From 2011 to 2014, he served as Vice President of the European Chamber of Commerce in China.

Towards the end of 2022, Jens Ruebbert opened the first branch in the People’s Republic for his current employer, LBBW, in Shanghai. Its clients are German and European companies, accounting for around 90 percent of its business. LBBW conducts traditional corporate customer business in China, such as investment, trade and export financing.

“We are still in the development phase, but the overall trend is positive,” says Ruebbert. “There is a large pipeline of customers wanting to do business with us and who see us as an alternative to other banks.” He emphasizes that building client relationships is a long-term process. Even opening an account is a complicated process these days due to global regulatory requirements. Yet China does not even have the highest requirements in Asia.

Jens Ruebbert is optimistic about economic development in the People’s Republic. He considers the IMF’s growth forecast of 5.4 percent for 2024 rather positive. “The Chinese economy will continue to grow faster than Western economies in the future. China remains a crucial market for German and European companies, both in terms of investment and trade.” The deteriorating political climate between China and Germany is not helpful, but ultimately not decisive.

In Ruebbert’s eyes, the Chinese real estate crisis is not an unsolvable problem. The economic system in China is “better able to combat such a crisis than is perhaps the case in Western countries.” He does not believe that the property market will collapse, as the means to combat the crisis are available, and the Chinese leadership cannot allow this to happen. According to him, the Chinese government can intervene faster and more directly than European governments, for example. On the other hand, China’s demographic problems are of a longer-term nature and will continue to affect the country for decades to come.

Ruebberts’s personal experiences with Chinese business partners have been positive: “They are good business people and tough negotiators.” Although Chinese negotiators act with a certain amount of finesse, they are less aggressive in negotiations than Anglo-Saxon businesspeople, for example. But with Chinese people, too, it is advantageous not to talk to them from a position of weakness. Mathias von Hofen

Luke Lu is the new head of China at US financial services provider Citigroup. Lu, who previously headed Citi’s corporate client business for large local corporate clients, succeeds Christine Lam.

Ulf Braken-Gulke has been Vice President Asia/Pacific at Truma Geraetetechnik since December. He previously worked as Country Group General Manager China at Webasto from 2016 to 2020.

Is something changing in your organization? Let us know at heads@table.media!

Xi Jinping has repeatedly urged the media and art world to “tell Chinese stories well.” Documentary filmmaker Sun Hong has done this well by taking an authentic approach. Her film “This Is Life 烟火人间” was shown in cinemas across the country in January. 509 ordinary Chinese people talk about their lives in videos they made on their phones. Sun edited together 887 of these clips and divided them into chapters that shed light on everyday concepts such as “food” and “home.” The stories focus primarily on rural China and smaller towns. Their inhabitants like to use the video app Kuaishou, which served as a never-ending source of inspiration for the 37-year-old director.