Today’s edition of China.Table focuses on our live event China Strategy 2022 on Tuesday, which hosted various experts and market practitioners. Our three features present the key discussion topics of the event:

Among others, you will find assessments by Reinhard Bütikofer, Member of the European Parliament, Wolfgang Niedermark (BDI), Wolf-Henning Scheider (Zeppelin) and Gu Xuewu (University of Bonn).

However, the equipment at our conference was sadly unable to cope with the influx of several hundred registered attendees plus an additional 22 speakers. As a result, many listeners experienced poor sound quality. We would like to apologize for the technical difficulties. And we would also like to apologize to our partners and speakers who put a lot of effort into the preparation. However, we won’t simply abandon the topics of the event. Instead, we will discuss them in more depth on different channels here at China.Table. Not one part of the event’s program will go to waste.

However, despite the difficulties, several trends emerged at the event. These also overlap to some extent. German business continues to show great interest in the Chinese market. But they are struggling with an increasingly challenging business environment. Above all, increasing regulation is forcing the formation of parallel organizations. As interest in international brands is also waning, local subsidiaries of German companies are presenting themselves as more Chinese. In other words, it’s about increasingly separate entities that have less and less in common with their parent company.

Meanwhile, Russia’s incursion into Ukraine’s territories is raising China’s concerns in its very own way. Xi Jinping quite literally sided with his autocrat colleague Vladimir Putin at the Olympic kickoff, making a certain commitment. Putin then just waited for the end of the Olympics and is now, as expected, fueling discord on the global stage – and thus puts China on the spot. After all, China is long past the point of non-interference, as it always demands, or respect for territorial integrity. On the other hand, if Putin gets away with his maneuver, Xi could take it as an invitation to grab Taiwan.

We at China.Table also continue to shed light on China’s role in foreign policy crises. While the hopes that China, as a stronger economic partner, could effectively restrain its Russian neighbor have been shattered, China still has no interest in a massive war in Europe – the ideal scenario for Xi would be a territorial takeover without the use of force. It is now expected that he will call on Putin to show restraint from now on.

China avoided taking a clear position in the escalating Ukraine-Russia crisis on Tuesday. Following Russia’s advance to recognize the eastern Ukrainian territories as independent republics, China’s Foreign Minister Wang Yi spoke on the phone with his US counterpart Antony Blinken. Following the phone call, Wang announced that China once again calls on all parties to exercise restraint and to de-escalate the situation. According to Wang, the differences between the parties could only be resolved through dialogue and negotiations.

Earlier, China’s UN Ambassador Zhang Jun urged the Security Council’s emergency meeting to address each other’s concerns based on equality and mutual respect. “We believe that all countries should solve international disputes by peaceful means in line with the purposes and principles of the UN Charter.”

The Ukraine-Russia crisis was also an important discussion topic at the China Strategy 2022 live briefing. On the geopolitics panel, Mikko Huotari assessed Beijing’s stance as ambivalent. “In every statement, China’s double game becomes clear: On the one hand, support for Moscow and, on the other hand, recognition of UN principles such as sovereignty and territorial integrity of nations,” said the director of the Berlin-based China Research Institute Merics in an interview with editorial director Finn Mayer-Kuckuk. Huotari is convinced that “Beijing has maneuvered itself into a trap here.”

When Putin traveled to Beijing for the opening of the Winter Olympics, it seemed as if both authoritarian superpowers could hardly move any closer (China.Table reported). Xi and Putin signed energy contracts and even referred to each other as long-time friends. When China clearly spoke out against the eastward expansion of NATO for the first time, some thought that Beijing was giving its partner in Moscow carte blanche for the confrontation with Ukraine. “Beijing will regret this open step toward Moscow,” Huotari said at the China.Table conference.

“Now China has to figure out how to get out of this difficult communicative situation if it doesn’t want to seem as clearly on Russia’s side.” As things stand today, it appears that China is ready to make considerable sacrifices for its affiliation with Moscow. “If so, this must have far-reaching consequences for German and European China policy,” Huotari demands.

Later at the China.Table conference Reinhard Bütikofer said, “Wang Yi’s statement to Blinken is, after all, could hardly be any more cynical.” Over the past few years, the Green MEP observed, that China under President Xi Jinping no longer seems to be interested in a strategic partnership with the EU. “Otherwise, China wouldn’t be attacking the European single market in the Lithuania conflict,” Bütikofer argues, demanding, “We must finally make realpolitik and stop chasing some dream.”

Wolfgang Niedermark shared his impressions from China as a local practitioner in the conference discussion. Niedermark is a member of the Executive Board of the Federation of German Industries (BDI). “As a leading association, we can help create strategic unity in Europe,” Niedermark said. “We are in a very difficult position with China. That’s why we need to speak with one voice, including small countries like Lithuania. It certainly would have been better if you had taken a second to coordinate with the others.”

The Asia coordinator of the Asia-Pacific Committee of German Business notes that the leadership in Beijing is reacting rather irritated to Europe’s new China approach. “We are told that Europe’s attitude is schizophrenic. You can either be a partner or a rival. Not both.” But Niedermark warns against allowing Beijing’s tough stance to divide Europe. “We have to make it through this difficult phase: Offer cooperation, but clearly address critical issues at the same time.” China will then have to learn to deal with that.

However, Niedermark firmly rejects a decoupling from China, as is currently being discussed, especially in the US. “We would be limiting ourselves if we abandoned markets of this quality and size.” They are also vital for the stability of our own economy and thus our society, he says.

Klaus Muehlhahn also makes a strong case for more commitment to China at the China.Table conference. “We are in a situation where we know particularly little about China.” The president of Zeppelin University in Friedrichshafen calls the state of affairs a “major epistemological crisis” when it comes to understanding and analyzing China. The times of political and pandemic compartmentalization, require new methods, such as Big Data and social media. “Because the information that China generates even in isolation is enormous. We just need to make proper use of it. In addition, we have to maintain our contacts,” Muehlhahn cautions in an interview with Mayer-Kuckuk. Muehlhahn is the co-organizer of the event.

Sigrun Abels from the Berlin-based Center for Cultural Studies on Science and Technology in China explains at the end of the live briefing: “Whether as a threat, an opportunity or a challenge – we can’t make China the way we’d like it to be.” Europe, and Germany too, need to do their homework first. She calls for expanding China expertise in all areas. “Not only at universities, but in the general public, in business, in politics.” This is the only way to better understand China and its actions.

At the end of the China.Table conference, it became clear why China is torn between its de facto partner Russia and its efforts to not alienate Europe completely. But: Simultaneously defending the sovereignty and territoriality of individual states such as Ukraine and defending Russia’s behavior – since this Tuesday, this has become problematic, even with the greatest Chinese dialectic. This is where politics needs to come into play.

The Olympics are over and the Year of the Tiger has begun. Time to look ahead to a year that is still full of uncertainties. How will China’s market develop in the face of high commodity prices, semiconductor shortages, a reeling real estate sector, the unresolved trade conflict with the US, and the pandemic still looming over the world like a shadow? Which sectors can expect growth in this uncertain environment?

Party leaders had warned in their annual economic meeting in December that economic growth was facing “triple pressure” from shrinking demand, supply shocks, and weaker growth expectations. The phrase has since become something of a mantra in political Beijing.

The fairly robust growth figures for 2021 were on the one hand owing to a comparatively weak period of early 2020 caused by the pandemic. On the other hand, the surprisingly fast recovery from the Covid slump was another contributing factor. However, growth was already slowing down once again in the fourth quarter of 2021. China’s value added (GDP) grew by 8.1 percent in 2021 – but only by four percent year-on-year in the fourth quarter. Retail trade grew by 16.4 percent in 2021 – and by 12.5 percent in the fourth quarter. Foreign trade, at least, remained largely stable. So what does this mean for the Chinese market? This was a key question at the China.Table China Strategy 2022 conference on Tuesday.

“The Year of the Tiger will see a booming export market, a nervous consumer market, and a flagging real estate market,” expects Xuewu Gu of the Chair of International Relations at the University of Bonn. Gu takes his optimism for exports mainly from the launch of the giant free trade zone RCEP (China.Table reported) and the expectation that demand will soon pick up in the rest of the world as well, bet it because of the end to the pandemic or stimulus packages like those in the United States. There will be no “unexpected economic turbulence,” Gu told China.Table. In fact, he sees light at the end of the tunnel for China’s consumer sector: “If the COVID-19 pandemic turns into an endemic, we can expect explosive growth in consumer markets.”

This is exactly where the crux of the matter lies: Beijing wants consumption to become a cornerstone of the economy. But at the same time, the government is fighting the virus by throwing its zero-covid policy against it – and thus prevents endemicity, at least in the short term. It remains to be seen whether there will be a change of strategy this year. In any case, China wants to increase domestic retail sales to ¥50 trillion (just under €7 trillion) by 2025, up from ¥39.2 trillion in 2020.

Hong Kong think tank Fung Business Intelligence Centre (FBIC) expects the consumer sector to grow six percent. The sector is benefiting from the central government’s efforts to build a modern rural distribution system and promote the green transition, FBIC wrote in a study in January. At the end of 2020, the annual disposable income per capita of rural residents was more than ¥17,000, up from just under ¥6,000 in 2010. The cost of living is lower in rural areas, partly because residents are less burdened by mortgages and rents than in metropolitan areas. There, many consumer segments, including the car market, which is so important for German companies, are on the verge of saturation.

Foreign companies are stepping up local production for Chinese customers, both in the industrial and consumer market. But the latter is not necessarily getting easier for international brands. “Chinese consumers are very demanding, brand-conscious and, above all, very service-conscious,” said Bernhard Weber, China chief representative of the German state of Baden-Württemberg, who is based in Nanjing. There is a clear shift towards Chinese brands, which has to do with nationalism as well as Covid-19’s compartmentalization of the country, Weber said at China Strategy 2022: “But above all, it’s because these brands also bring great products to market with good design and the right marketing.”

When it comes to “white goods”, household appliances ranging from refrigerators to air conditioners, local producers like Haier and Midea have long been market leaders, Weber said. The days when Bosch Siemens Hausgeräte (BSH) was one of the biggest in the market are over. “What is important and interesting for foreign manufacturers is the entire lifestyle, health, eco, and luxury sector. That’s where foreign brands are still in demand and can quickly become successful.” However, entering the market “involves a certain amount of effort and cost.” Foreign companies also have to get used to the peculiarities of selling in China, Weber explained: “In the last ten years, there have been huge shifts from offline to online and back to hybrids. You have to look closely at how you approach it.”

Consumption depends heavily on consumer demand and consequently also on the mood. The pandemic continues to weigh on this segment to this day. In the manufacturing industry, Covid seems to play a minor role. “Regardless of the outcome of the pandemic, e-mobility, robotics, autonomous driving, semiconductor production, and decarbonization technology are likely to form China’s new growth markets at an unprecedented rate,” Xuewu Gu believes. “This is because policymakers want these markets. One should not forget, with all due respect to free-market principles: China’s economic cycle is always determined by the political cycle.” And policymakers are also focusing on growth in these sectors in the Year of the Tiger, Gu said. In other words, subsidies are being channeled into these sectors, for example for research or tax incentives. Industrial policy has never been a dirty word in China.

The fact that the government does not intend to let many submarkets off the leash is evident in the raw materials and power sectors. So far, for example, there are no signs that China will allow further liberalization of coal prices. The price is to remain as low as possible – which means that coal production will continue to be unprofitable. Instead of incentives, the sector is receiving reprimands from the State Council. Premier Li Keqiang called in mid-February for “to increase coal supply and to support coal power companies to produce more electricity up to their full potentials, so as to secure the normal electricity for production and people’s livelihood.” Less coal for climate action? Not in these times.

The real estate sector is not just suffering under high housing prices and over-indebted developers, either. The fact that many companies are currently experiencing problems is also attributable to the fact that Beijing has stepped up regulation of the overheated sector. In the long run, this may well make sense. But it shows that the government is once again stepping in to decide who should succeed and who should not. As a result, a faltering real estate sector is dragging other industries down: The construction sector, for example, and the materials it requires. “Despite build-up of expectations of construction stimulus, China’s steel output continues to plumb lows not seen since the previous 2015 downturn,” energy expert Lauri Myllyvirta posted on Twitter.

Provincial governments are apparently banking on construction incentives as well: “Local governments have posted very high GDP growth targets for this year, averaging well over 6%.,” Myllyvirta says. “These targets rely on even larger increases in spending on infrastructure projects.” Whether that will materialize is an open question. In March, Li Keqiang will present the growth target for the entire country at the plenum of the National People’s Congress and mention which sectors are important to him. That’s when it will show whether Beijing and the provinces are in sync, and which sectors have the best chance of success.

The Chinese government is getting serious. Companies are reprimanded, markets are brutally regulated – anyone who does not want to play by the rules risks being excluded from the huge Chinese market. Beijing’s obsession with regulation is manifesting itself in very different forms for Chinese and foreign companies: There is increased decoupling and data control, as the panel of experts explained at the live briefing China Strategy 2022. European companies are fighting on multiple fronts.

The “Xi system” is an entirely new economic policy, said Sebastian Heilmann, a professor of Chinese politics and economics at the University of Trier. “We have a Chinese economic policy that is very much based on autarky.” Things are getting tougher for foreign suppliers in China, not least because of pressure to localize more and domesticize value chains.

What also makes business more difficult for foreign companies is the fact that China, despite its own successes, continues to make efforts to transfer technology. Lawmakers and courts have even reinforced the framework for this. Since August 2020, for example, Chinese courts have been able to prohibit European patent holders from asserting their rights in foreign courts – should they still choose to do so, they face fines of up to the equivalent of €130,000 a day.

That is why the European Union is now taking the matter to the World Trade Organization (China.Table reported). Journalist and researcher Didi Kirsten Tatlow believes this to be the right move. “China is not allowing European companies to defend their patents in China, and now not even abroad,” Tatlow said. “We need to be able to defend our innovations.” Most affected by court decisions are rights to key technologies, such as telecommunications companies holding patents on mobile standards like 5G.

Margot Schueller, Senior Research Fellow at the GIGA Institute of Asian Studies, still sees a technology gap: China is already further ahead than Europe in many areas. The People’s Republic has caught up considerably, especially in the field of artificial intelligence, says Schueller. This is why exchange with the USA is particularly important for Europe. In order not to lose touch, spending on industrial R&D, especially in the automotive, mechanical engineering, computer and electronics sectors, must be increased. The government is intervening particularly intensively in the tech sector: “Here, they try to maintain data control, for example through the cybersecurity law,” says Schueller. Beijing is exerting ever greater pressure.

Meanwhile, the social credit system for companies, in which companies are listed and publicly rated, is proving surprisingly useful. “So far, German companies are not particularly concerned about it,” says Andreas Feege of consultancy KPMG in China. Surveys have shown that foreign companies use this data to gain background knowledge about Chinese business partners. If a company has a bad score, people think twice about working with it.

However, Feege also sees one major disadvantage: Data that may no longer be accurate or up to date could lead to incorrect evaluations and thus competitive disadvantages. Feege also criticizes the lack of transparency of the databases. He does not expect companies to create a new position of “social credit manager” in the future. But it will not be easy to control data flows and coordinate them with individual departments within companies.

Increasing regulation also favors China’s decoupling. According to Mirjam Meissner of the consulting firm Sinolytics, however, this does not affect all foreign companies equally. “We see a broad picture; there are significant differences depending on the industry.” According to Meissner, companies will still face some changes, especially in licensing and standards. Regulations, in particular, are the main driver of decoupling. For example, if China has a requirement to keep customer data within the country, companies here will have to build entire dedicated systems. Either they leave the market to the domestic players, or they create separate parallel structures.

Joerg Wuttke, Head of the EU Chamber of Foreign Trade in Beijing, emphasized that decoupling is not an entirely new phenomenon. “China has always been ‘decoupled’ in many areas. But the problem is getting bigger, especially in the cyber sector.” China is a big growth market here, Wuttke said. Decoupling in R&D is also becoming increasingly noticeable. European companies are required to disclose larger data sets.

But decoupling is also taking place in less abstract spheres. Wuttke reported that there are fewer and fewer foreign workers in China – most recently, this development was greatly accelerated by the Corona pandemic. “The proportion of foreign workers in China is declining sharply, but with it, a lot of know-how is going back to headquarters,” Wuttke said.

The fact that significantly fewer foreigners are currently working in China is also becoming noticeable among European companies on the ground, said Claudia Barkowsky, who has headed the China office of the German Engineering Federation (VDMA) since 2016. When it comes to the shortage of skilled workers, German SMEs in China are feeling the pressure more and more. According to Barkowsky, the talent pool is mainly siphoned off by large companies. Medium-sized companies are losing out. There is a strong exodus of foreign talent – and it is also becoming more difficult to get new workers to the People’s Republic. ” This is partly due to the travel restrictions that have already lasted two years, but also due to China’s poor image,” Barkowsky said. Only few employees still dare to take the step and embark to China without a first ‘look and see’. “Professionally, China is still interesting, but the general conditions are simply not right,” Barkowsky summarized.

German exporters outside the EU started the year 2022 with a strong gain, the German Federal Statistical Office reported on Tuesday. In January, exports to so-called third countries rose by 9.4 percent compared to December, adjusted for calendar and seasonal effects. Germany’s most important trading partner in January was once again the United States. Exports to the United States climbed by 17.6 percent to €9.9 billion within a year.

Business with China increased by 7.2 percent to €8.1 billion. Including imports, China was Germany’s most important trading partner for the sixth year in a row last year. Goods worth around €245 billion were traded between the two countries, 15.1 percent more than in the first Covid year 2020, followed in second and third place by the Netherlands with sales of €206 billion (+20.1 percent) and the USA with €194 billion (+13.4 percent). Total exports to countries outside the European Union – not adjusted for calendar and seasonal effects – were 14.6 percent higher than a year ago. rtr/fpe

According to a United Nations expert, China has continued to supply Myanmar’s junta with weapons since last year’s coup. UN Special Rapporteur on the situation of Human Rights in Myanmar, Tom Andrews, called on the UN Security Council to call an emergency meeting to “ban those arms transfers that the Myanmar military are known to use to attack and kill Myanmar civilians” Besides China, Russia and Serbia are also responsible for supplying arms to the junta.

The Special Rapporteur particularly calls on key UN countries to take special responsibility. “Despite the evidence of the military junta’s atrocity crimes being committed with impunity since launching a coup last year, UN Security Council members Russia and China continue to provide the Myanmar military junta with numerous fighter jets, armored vehicles, and in the case of Russia, the promise of further arms,” Andrews said. Serbia allegedly authorized the export of missiles and artillery to the Myanmar military during the same period.

According to the report by the UN Special Rapporteur, China has supplied Myanmar with fighter jets, missiles, and ammunition since 2018. The Myanmar military has, for example, received JF-17M “Thunder” fighter jets from the Chinese state-owned Aviation Industry Corporation of China (AVIC) and Pakistan’s state-owned Pakistan Aeronautical Complex (PAC), among others. “China continued its transfer of military aircraft after the coup. On 15 December 2021, the Myanmar Air Force commissioned additional aircraft manufactured by Chinese state-owned industries,” the report said. By continuing to supply numerous fighter jets, missiles and military transport aircraft after the coup, Beijing is violating “violated international humanitarian law and likely customary international law,” Andrews said. ari

According to the draft legislation, the EU Supply Chain Act will affect only one percent of companies in the European Union. The directive will apply to only about 13,000 EU companies. “Small and medium-sized enterprises, which include micro-enterprises and account for a total of around 99 percent of all companies in the Union, are exempt from due diligence,” the draft, obtained by China.Table on Tuesday, states. The EU Commission plans to unveil the EU supply chain law this Wednesday.

According to the draft, only companies with more than 500 employees and a global net turnover of €150 million are covered by the directive. Companies with more than 250 employees and net sales of more than €40 million are also subject, provided that at least half of their sales come from a high-risk sector such as textiles, mining or agriculture. According to the draft, the EU supply chain law thus has a smaller scope than called for by numerous NGOs and the EU Parliament.

The draft also states that the law, officially known as the European Due Diligence Act, extends to companies from non-EU countries if they generate net sales of at least €150 million or €40 million within the EU, depending on the sector. The EU Commission estimates that the directive will thus cover only about 4,000 non-EU companies.

Furthermore, the draft legislation proposed by the Commission contains provisions for public and private enforcement, namely sanctions and a civil liability regime. The civil liability regime would allow individuals negatively affected by an EU company’s operations to take the company in question to court in an EU member state. The introduction of such a civil liability system has been a key demand of NGOs. However, the scope of civil liability is limited. If EU companies have received contractual assurances from their business partners that they will comply with the company’s code of conduct, EU companies may be protected from civil liability claims.

After the presentation of the proposal on Wednesday, the directive will be discussed and possibly amended by the European Parliament and EU member state governments. Once adopted, member states have two years to implement the directive into national law. ari

Hong Kong’s Chief Executive Carrie Lam has announced nationwide Covid mass testing for the entire city population. Accordingly, all 7.4 million citizens are to be tested in three stages throughout March. Strict distancing rules are to remain in place until at least April 20, as is the ban on flights to and from Australia, the UK, Canada, France, India, Pakistan, the USA and the Philippines. Hong Kong’s schoolchildren will be sent on summer vacation as early as the beginning of March instead of mid-April.

The fifth Covid wave poses major challenges for Hong Kong. City authorities reported a record of 7,500 confirmed new infections on Monday. By Tuesday, the figure was just over 6,200, bringing total infections in the financial metropolis to nearly 54,000 with 321 deaths, including an 11-month-old infant. Many hospitals are at breaking point because of the highly contagious Omicron variant. Last Tuesday, China’s leader Xi Jinping stepped in. The “overriding mission” must be to stabilize and control the spread of the coronavirus in Hong Kong, Xi urged. To that end, a Covid task force has been dispatched from the mainland to Hong Kong. It is headed by Wang Hesheng, director of the Chinese Center for Disease Control and Prevention, who was also responsible for containing the virus after the first outbreak in Wuhan. fpe

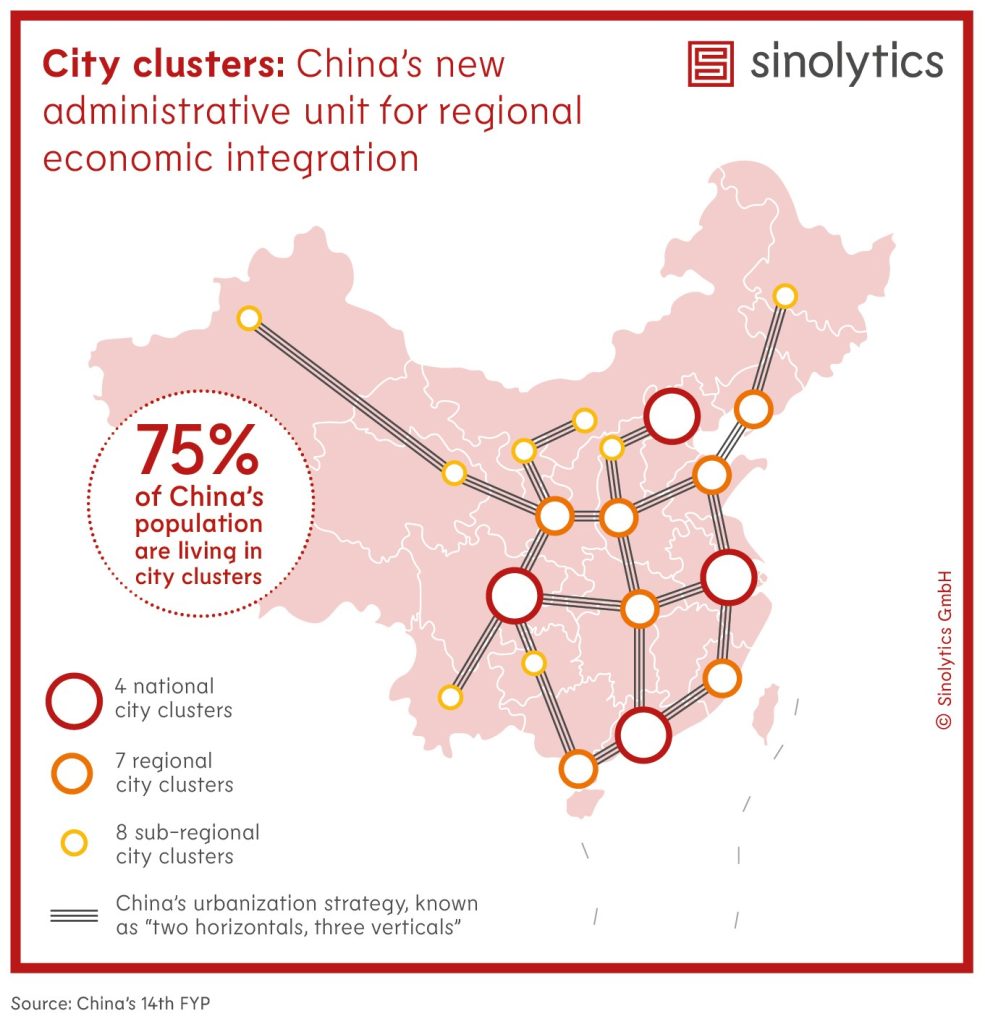

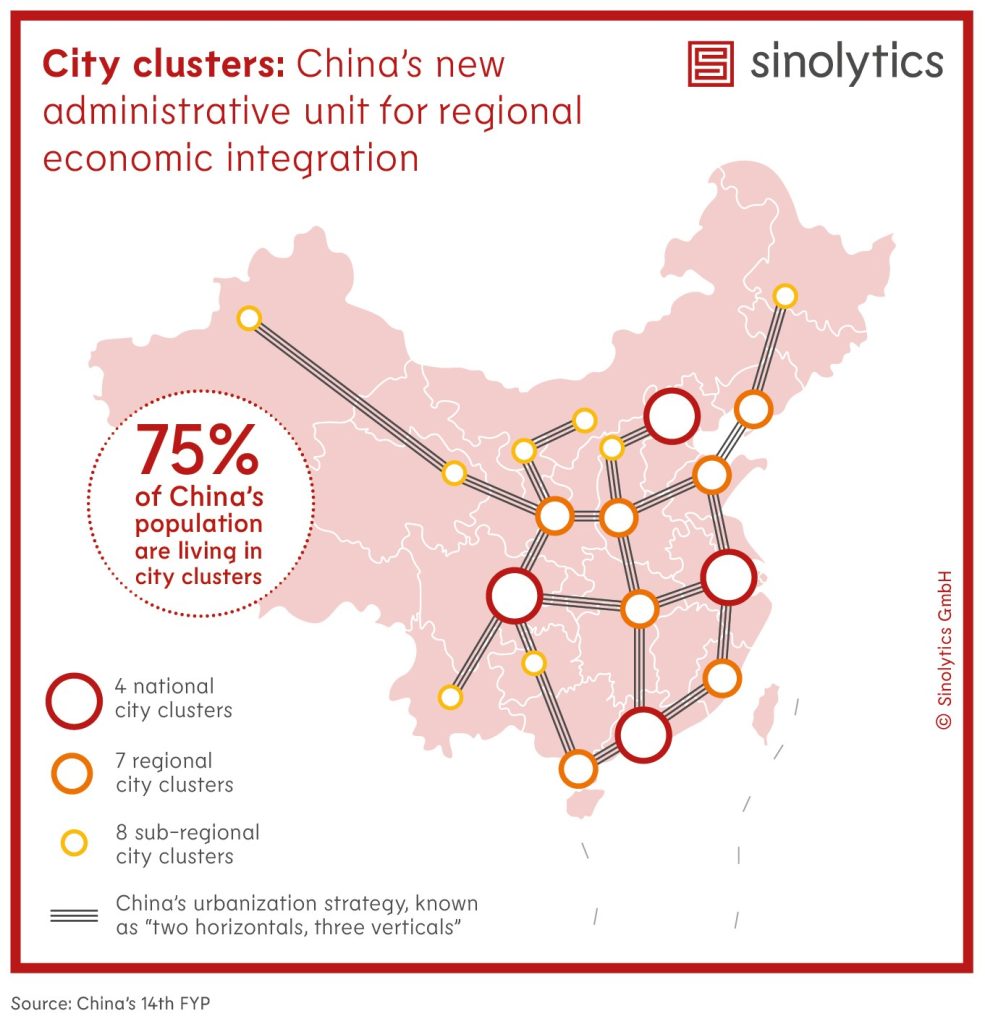

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Dr. Zsuzsa Anna Ferenczy tries to understand Taiwan “from all angles”. Since the summer of 2020, the political scientist has been living on the democratically ruled island threatened by mainland China. Here she is employed as a postdoctoral researcher by the Taiwanese Ministry of Science and Technology. As a lecturer in European Studies, she regularly teaches at National Dong Hwa University in Hualien on subjects such as European foreign policy and EU-Asia relations.

The native Hungarian is an expert in this field. For 12 years, Ferenczy worked in the European Parliament’s “Brussels Bubble” as a political advisor on foreign and security policy and human rights. During debates and hearings before the Security, Defense, and Human Rights Committees, she actively participated in European policy-making on Taiwan. A privilege, she says. “The perception of Taiwan and China has evolved quite a bit in our European eyes,” she summarizes this period. “It’s encouraging to see that Europe is finally starting to understand the importance of Taiwan. Not just because Taiwan has become an important player in the US-China geopolitical rivalry, but also because the EU can use Taiwan as an example to show its commitment to democracy and freedom.”

The politically motivated trade embargo on Lithuania was the final wake-up call for Brussels, Ferenczy believes. “What we see in Lithuania’s determination is no anti-China, but pro-democracy behavior.” Vilnius chose to negotiate with the Chinese government at the European level, rather than in the 17 + 1 framework. In this respect, “small” Lithuania is teaching the “big” member states an important lesson about safeguarding democracy.

Other EU member states in Central Eastern Europe, such as Slovakia and the Czech Republic, are now also setting a good example when it comes to taking a stand against Beijing and strengthening Taiwan’s profile in the EU. Now, the big players like Berlin and Paris must follow suit: “Germany can and must contribute to a European China policy that takes the economic interests of all large and small member states into account and places greater emphasis on human rights – just as the German government has promised in its coalition agreement,” explains Ferenczy. Berlin should finally realize that “prioritizing short-term interests has a high price in the long run.”

Ferency is not only interested in Taiwan’s geopolitical significance, but also how Taiwanese perceive themselves. As part of the think tank Taiwan NextGen, she writes guest articles that focus on the characteristics and perspectives of Taiwanese society. “The question of Taiwanese identity will be crucial in shaping Taiwan’s future.”

As Head of Associates Network for the political online discussion platform 9Dashline, she also tries to build a bridge between European countries and democracies in the Indo-Pacific region. Taiwan plays a key role here as well, Ferenczy says. “It’s fascinating to see the region in what is increasingly becoming an Indo-Pacific decade.”

Hiroyuki Shimizu will take up the post of Head of Institutional for the Asia-Pacific region at US investment company Blackrock in the spring. In addition, Shimizu will also take on the role of Japan President. He previously worked in investment management for Morgan Stanley and most recently as Global Co-Head of Private Credit and Equity Distribution.

Xue Bing has been appointed by China’s Ministry of Foreign Affairs as Special Envoy for Horn of Africa Affairs. Xue is an experienced diplomat who has served as ambassador to Papua New Guinea and has been stationed in various countries in Africa, the Americas, and Oceania. The crisis-ridden region is of great importance to China’s economic and strategic interests in Africa.

This couple in Beijing’s Haidian district was one of thousands who said “I do” at a Chinese marriage registry office on Tuesday. Many couples who wanted to get married had specifically chosen the date of 22.2.2022. Because in Mandarin, the number 2 sounds so like the Chinese word for love. A marriage sealed on this day is considered to be fulfilling and long-lasting.

Today’s edition of China.Table focuses on our live event China Strategy 2022 on Tuesday, which hosted various experts and market practitioners. Our three features present the key discussion topics of the event:

Among others, you will find assessments by Reinhard Bütikofer, Member of the European Parliament, Wolfgang Niedermark (BDI), Wolf-Henning Scheider (Zeppelin) and Gu Xuewu (University of Bonn).

However, the equipment at our conference was sadly unable to cope with the influx of several hundred registered attendees plus an additional 22 speakers. As a result, many listeners experienced poor sound quality. We would like to apologize for the technical difficulties. And we would also like to apologize to our partners and speakers who put a lot of effort into the preparation. However, we won’t simply abandon the topics of the event. Instead, we will discuss them in more depth on different channels here at China.Table. Not one part of the event’s program will go to waste.

However, despite the difficulties, several trends emerged at the event. These also overlap to some extent. German business continues to show great interest in the Chinese market. But they are struggling with an increasingly challenging business environment. Above all, increasing regulation is forcing the formation of parallel organizations. As interest in international brands is also waning, local subsidiaries of German companies are presenting themselves as more Chinese. In other words, it’s about increasingly separate entities that have less and less in common with their parent company.

Meanwhile, Russia’s incursion into Ukraine’s territories is raising China’s concerns in its very own way. Xi Jinping quite literally sided with his autocrat colleague Vladimir Putin at the Olympic kickoff, making a certain commitment. Putin then just waited for the end of the Olympics and is now, as expected, fueling discord on the global stage – and thus puts China on the spot. After all, China is long past the point of non-interference, as it always demands, or respect for territorial integrity. On the other hand, if Putin gets away with his maneuver, Xi could take it as an invitation to grab Taiwan.

We at China.Table also continue to shed light on China’s role in foreign policy crises. While the hopes that China, as a stronger economic partner, could effectively restrain its Russian neighbor have been shattered, China still has no interest in a massive war in Europe – the ideal scenario for Xi would be a territorial takeover without the use of force. It is now expected that he will call on Putin to show restraint from now on.

China avoided taking a clear position in the escalating Ukraine-Russia crisis on Tuesday. Following Russia’s advance to recognize the eastern Ukrainian territories as independent republics, China’s Foreign Minister Wang Yi spoke on the phone with his US counterpart Antony Blinken. Following the phone call, Wang announced that China once again calls on all parties to exercise restraint and to de-escalate the situation. According to Wang, the differences between the parties could only be resolved through dialogue and negotiations.

Earlier, China’s UN Ambassador Zhang Jun urged the Security Council’s emergency meeting to address each other’s concerns based on equality and mutual respect. “We believe that all countries should solve international disputes by peaceful means in line with the purposes and principles of the UN Charter.”

The Ukraine-Russia crisis was also an important discussion topic at the China Strategy 2022 live briefing. On the geopolitics panel, Mikko Huotari assessed Beijing’s stance as ambivalent. “In every statement, China’s double game becomes clear: On the one hand, support for Moscow and, on the other hand, recognition of UN principles such as sovereignty and territorial integrity of nations,” said the director of the Berlin-based China Research Institute Merics in an interview with editorial director Finn Mayer-Kuckuk. Huotari is convinced that “Beijing has maneuvered itself into a trap here.”

When Putin traveled to Beijing for the opening of the Winter Olympics, it seemed as if both authoritarian superpowers could hardly move any closer (China.Table reported). Xi and Putin signed energy contracts and even referred to each other as long-time friends. When China clearly spoke out against the eastward expansion of NATO for the first time, some thought that Beijing was giving its partner in Moscow carte blanche for the confrontation with Ukraine. “Beijing will regret this open step toward Moscow,” Huotari said at the China.Table conference.

“Now China has to figure out how to get out of this difficult communicative situation if it doesn’t want to seem as clearly on Russia’s side.” As things stand today, it appears that China is ready to make considerable sacrifices for its affiliation with Moscow. “If so, this must have far-reaching consequences for German and European China policy,” Huotari demands.

Later at the China.Table conference Reinhard Bütikofer said, “Wang Yi’s statement to Blinken is, after all, could hardly be any more cynical.” Over the past few years, the Green MEP observed, that China under President Xi Jinping no longer seems to be interested in a strategic partnership with the EU. “Otherwise, China wouldn’t be attacking the European single market in the Lithuania conflict,” Bütikofer argues, demanding, “We must finally make realpolitik and stop chasing some dream.”

Wolfgang Niedermark shared his impressions from China as a local practitioner in the conference discussion. Niedermark is a member of the Executive Board of the Federation of German Industries (BDI). “As a leading association, we can help create strategic unity in Europe,” Niedermark said. “We are in a very difficult position with China. That’s why we need to speak with one voice, including small countries like Lithuania. It certainly would have been better if you had taken a second to coordinate with the others.”

The Asia coordinator of the Asia-Pacific Committee of German Business notes that the leadership in Beijing is reacting rather irritated to Europe’s new China approach. “We are told that Europe’s attitude is schizophrenic. You can either be a partner or a rival. Not both.” But Niedermark warns against allowing Beijing’s tough stance to divide Europe. “We have to make it through this difficult phase: Offer cooperation, but clearly address critical issues at the same time.” China will then have to learn to deal with that.

However, Niedermark firmly rejects a decoupling from China, as is currently being discussed, especially in the US. “We would be limiting ourselves if we abandoned markets of this quality and size.” They are also vital for the stability of our own economy and thus our society, he says.

Klaus Muehlhahn also makes a strong case for more commitment to China at the China.Table conference. “We are in a situation where we know particularly little about China.” The president of Zeppelin University in Friedrichshafen calls the state of affairs a “major epistemological crisis” when it comes to understanding and analyzing China. The times of political and pandemic compartmentalization, require new methods, such as Big Data and social media. “Because the information that China generates even in isolation is enormous. We just need to make proper use of it. In addition, we have to maintain our contacts,” Muehlhahn cautions in an interview with Mayer-Kuckuk. Muehlhahn is the co-organizer of the event.

Sigrun Abels from the Berlin-based Center for Cultural Studies on Science and Technology in China explains at the end of the live briefing: “Whether as a threat, an opportunity or a challenge – we can’t make China the way we’d like it to be.” Europe, and Germany too, need to do their homework first. She calls for expanding China expertise in all areas. “Not only at universities, but in the general public, in business, in politics.” This is the only way to better understand China and its actions.

At the end of the China.Table conference, it became clear why China is torn between its de facto partner Russia and its efforts to not alienate Europe completely. But: Simultaneously defending the sovereignty and territoriality of individual states such as Ukraine and defending Russia’s behavior – since this Tuesday, this has become problematic, even with the greatest Chinese dialectic. This is where politics needs to come into play.

The Olympics are over and the Year of the Tiger has begun. Time to look ahead to a year that is still full of uncertainties. How will China’s market develop in the face of high commodity prices, semiconductor shortages, a reeling real estate sector, the unresolved trade conflict with the US, and the pandemic still looming over the world like a shadow? Which sectors can expect growth in this uncertain environment?

Party leaders had warned in their annual economic meeting in December that economic growth was facing “triple pressure” from shrinking demand, supply shocks, and weaker growth expectations. The phrase has since become something of a mantra in political Beijing.

The fairly robust growth figures for 2021 were on the one hand owing to a comparatively weak period of early 2020 caused by the pandemic. On the other hand, the surprisingly fast recovery from the Covid slump was another contributing factor. However, growth was already slowing down once again in the fourth quarter of 2021. China’s value added (GDP) grew by 8.1 percent in 2021 – but only by four percent year-on-year in the fourth quarter. Retail trade grew by 16.4 percent in 2021 – and by 12.5 percent in the fourth quarter. Foreign trade, at least, remained largely stable. So what does this mean for the Chinese market? This was a key question at the China.Table China Strategy 2022 conference on Tuesday.

“The Year of the Tiger will see a booming export market, a nervous consumer market, and a flagging real estate market,” expects Xuewu Gu of the Chair of International Relations at the University of Bonn. Gu takes his optimism for exports mainly from the launch of the giant free trade zone RCEP (China.Table reported) and the expectation that demand will soon pick up in the rest of the world as well, bet it because of the end to the pandemic or stimulus packages like those in the United States. There will be no “unexpected economic turbulence,” Gu told China.Table. In fact, he sees light at the end of the tunnel for China’s consumer sector: “If the COVID-19 pandemic turns into an endemic, we can expect explosive growth in consumer markets.”

This is exactly where the crux of the matter lies: Beijing wants consumption to become a cornerstone of the economy. But at the same time, the government is fighting the virus by throwing its zero-covid policy against it – and thus prevents endemicity, at least in the short term. It remains to be seen whether there will be a change of strategy this year. In any case, China wants to increase domestic retail sales to ¥50 trillion (just under €7 trillion) by 2025, up from ¥39.2 trillion in 2020.

Hong Kong think tank Fung Business Intelligence Centre (FBIC) expects the consumer sector to grow six percent. The sector is benefiting from the central government’s efforts to build a modern rural distribution system and promote the green transition, FBIC wrote in a study in January. At the end of 2020, the annual disposable income per capita of rural residents was more than ¥17,000, up from just under ¥6,000 in 2010. The cost of living is lower in rural areas, partly because residents are less burdened by mortgages and rents than in metropolitan areas. There, many consumer segments, including the car market, which is so important for German companies, are on the verge of saturation.

Foreign companies are stepping up local production for Chinese customers, both in the industrial and consumer market. But the latter is not necessarily getting easier for international brands. “Chinese consumers are very demanding, brand-conscious and, above all, very service-conscious,” said Bernhard Weber, China chief representative of the German state of Baden-Württemberg, who is based in Nanjing. There is a clear shift towards Chinese brands, which has to do with nationalism as well as Covid-19’s compartmentalization of the country, Weber said at China Strategy 2022: “But above all, it’s because these brands also bring great products to market with good design and the right marketing.”

When it comes to “white goods”, household appliances ranging from refrigerators to air conditioners, local producers like Haier and Midea have long been market leaders, Weber said. The days when Bosch Siemens Hausgeräte (BSH) was one of the biggest in the market are over. “What is important and interesting for foreign manufacturers is the entire lifestyle, health, eco, and luxury sector. That’s where foreign brands are still in demand and can quickly become successful.” However, entering the market “involves a certain amount of effort and cost.” Foreign companies also have to get used to the peculiarities of selling in China, Weber explained: “In the last ten years, there have been huge shifts from offline to online and back to hybrids. You have to look closely at how you approach it.”

Consumption depends heavily on consumer demand and consequently also on the mood. The pandemic continues to weigh on this segment to this day. In the manufacturing industry, Covid seems to play a minor role. “Regardless of the outcome of the pandemic, e-mobility, robotics, autonomous driving, semiconductor production, and decarbonization technology are likely to form China’s new growth markets at an unprecedented rate,” Xuewu Gu believes. “This is because policymakers want these markets. One should not forget, with all due respect to free-market principles: China’s economic cycle is always determined by the political cycle.” And policymakers are also focusing on growth in these sectors in the Year of the Tiger, Gu said. In other words, subsidies are being channeled into these sectors, for example for research or tax incentives. Industrial policy has never been a dirty word in China.

The fact that the government does not intend to let many submarkets off the leash is evident in the raw materials and power sectors. So far, for example, there are no signs that China will allow further liberalization of coal prices. The price is to remain as low as possible – which means that coal production will continue to be unprofitable. Instead of incentives, the sector is receiving reprimands from the State Council. Premier Li Keqiang called in mid-February for “to increase coal supply and to support coal power companies to produce more electricity up to their full potentials, so as to secure the normal electricity for production and people’s livelihood.” Less coal for climate action? Not in these times.

The real estate sector is not just suffering under high housing prices and over-indebted developers, either. The fact that many companies are currently experiencing problems is also attributable to the fact that Beijing has stepped up regulation of the overheated sector. In the long run, this may well make sense. But it shows that the government is once again stepping in to decide who should succeed and who should not. As a result, a faltering real estate sector is dragging other industries down: The construction sector, for example, and the materials it requires. “Despite build-up of expectations of construction stimulus, China’s steel output continues to plumb lows not seen since the previous 2015 downturn,” energy expert Lauri Myllyvirta posted on Twitter.

Provincial governments are apparently banking on construction incentives as well: “Local governments have posted very high GDP growth targets for this year, averaging well over 6%.,” Myllyvirta says. “These targets rely on even larger increases in spending on infrastructure projects.” Whether that will materialize is an open question. In March, Li Keqiang will present the growth target for the entire country at the plenum of the National People’s Congress and mention which sectors are important to him. That’s when it will show whether Beijing and the provinces are in sync, and which sectors have the best chance of success.

The Chinese government is getting serious. Companies are reprimanded, markets are brutally regulated – anyone who does not want to play by the rules risks being excluded from the huge Chinese market. Beijing’s obsession with regulation is manifesting itself in very different forms for Chinese and foreign companies: There is increased decoupling and data control, as the panel of experts explained at the live briefing China Strategy 2022. European companies are fighting on multiple fronts.

The “Xi system” is an entirely new economic policy, said Sebastian Heilmann, a professor of Chinese politics and economics at the University of Trier. “We have a Chinese economic policy that is very much based on autarky.” Things are getting tougher for foreign suppliers in China, not least because of pressure to localize more and domesticize value chains.

What also makes business more difficult for foreign companies is the fact that China, despite its own successes, continues to make efforts to transfer technology. Lawmakers and courts have even reinforced the framework for this. Since August 2020, for example, Chinese courts have been able to prohibit European patent holders from asserting their rights in foreign courts – should they still choose to do so, they face fines of up to the equivalent of €130,000 a day.

That is why the European Union is now taking the matter to the World Trade Organization (China.Table reported). Journalist and researcher Didi Kirsten Tatlow believes this to be the right move. “China is not allowing European companies to defend their patents in China, and now not even abroad,” Tatlow said. “We need to be able to defend our innovations.” Most affected by court decisions are rights to key technologies, such as telecommunications companies holding patents on mobile standards like 5G.

Margot Schueller, Senior Research Fellow at the GIGA Institute of Asian Studies, still sees a technology gap: China is already further ahead than Europe in many areas. The People’s Republic has caught up considerably, especially in the field of artificial intelligence, says Schueller. This is why exchange with the USA is particularly important for Europe. In order not to lose touch, spending on industrial R&D, especially in the automotive, mechanical engineering, computer and electronics sectors, must be increased. The government is intervening particularly intensively in the tech sector: “Here, they try to maintain data control, for example through the cybersecurity law,” says Schueller. Beijing is exerting ever greater pressure.

Meanwhile, the social credit system for companies, in which companies are listed and publicly rated, is proving surprisingly useful. “So far, German companies are not particularly concerned about it,” says Andreas Feege of consultancy KPMG in China. Surveys have shown that foreign companies use this data to gain background knowledge about Chinese business partners. If a company has a bad score, people think twice about working with it.

However, Feege also sees one major disadvantage: Data that may no longer be accurate or up to date could lead to incorrect evaluations and thus competitive disadvantages. Feege also criticizes the lack of transparency of the databases. He does not expect companies to create a new position of “social credit manager” in the future. But it will not be easy to control data flows and coordinate them with individual departments within companies.

Increasing regulation also favors China’s decoupling. According to Mirjam Meissner of the consulting firm Sinolytics, however, this does not affect all foreign companies equally. “We see a broad picture; there are significant differences depending on the industry.” According to Meissner, companies will still face some changes, especially in licensing and standards. Regulations, in particular, are the main driver of decoupling. For example, if China has a requirement to keep customer data within the country, companies here will have to build entire dedicated systems. Either they leave the market to the domestic players, or they create separate parallel structures.

Joerg Wuttke, Head of the EU Chamber of Foreign Trade in Beijing, emphasized that decoupling is not an entirely new phenomenon. “China has always been ‘decoupled’ in many areas. But the problem is getting bigger, especially in the cyber sector.” China is a big growth market here, Wuttke said. Decoupling in R&D is also becoming increasingly noticeable. European companies are required to disclose larger data sets.

But decoupling is also taking place in less abstract spheres. Wuttke reported that there are fewer and fewer foreign workers in China – most recently, this development was greatly accelerated by the Corona pandemic. “The proportion of foreign workers in China is declining sharply, but with it, a lot of know-how is going back to headquarters,” Wuttke said.

The fact that significantly fewer foreigners are currently working in China is also becoming noticeable among European companies on the ground, said Claudia Barkowsky, who has headed the China office of the German Engineering Federation (VDMA) since 2016. When it comes to the shortage of skilled workers, German SMEs in China are feeling the pressure more and more. According to Barkowsky, the talent pool is mainly siphoned off by large companies. Medium-sized companies are losing out. There is a strong exodus of foreign talent – and it is also becoming more difficult to get new workers to the People’s Republic. ” This is partly due to the travel restrictions that have already lasted two years, but also due to China’s poor image,” Barkowsky said. Only few employees still dare to take the step and embark to China without a first ‘look and see’. “Professionally, China is still interesting, but the general conditions are simply not right,” Barkowsky summarized.

German exporters outside the EU started the year 2022 with a strong gain, the German Federal Statistical Office reported on Tuesday. In January, exports to so-called third countries rose by 9.4 percent compared to December, adjusted for calendar and seasonal effects. Germany’s most important trading partner in January was once again the United States. Exports to the United States climbed by 17.6 percent to €9.9 billion within a year.

Business with China increased by 7.2 percent to €8.1 billion. Including imports, China was Germany’s most important trading partner for the sixth year in a row last year. Goods worth around €245 billion were traded between the two countries, 15.1 percent more than in the first Covid year 2020, followed in second and third place by the Netherlands with sales of €206 billion (+20.1 percent) and the USA with €194 billion (+13.4 percent). Total exports to countries outside the European Union – not adjusted for calendar and seasonal effects – were 14.6 percent higher than a year ago. rtr/fpe

According to a United Nations expert, China has continued to supply Myanmar’s junta with weapons since last year’s coup. UN Special Rapporteur on the situation of Human Rights in Myanmar, Tom Andrews, called on the UN Security Council to call an emergency meeting to “ban those arms transfers that the Myanmar military are known to use to attack and kill Myanmar civilians” Besides China, Russia and Serbia are also responsible for supplying arms to the junta.

The Special Rapporteur particularly calls on key UN countries to take special responsibility. “Despite the evidence of the military junta’s atrocity crimes being committed with impunity since launching a coup last year, UN Security Council members Russia and China continue to provide the Myanmar military junta with numerous fighter jets, armored vehicles, and in the case of Russia, the promise of further arms,” Andrews said. Serbia allegedly authorized the export of missiles and artillery to the Myanmar military during the same period.

According to the report by the UN Special Rapporteur, China has supplied Myanmar with fighter jets, missiles, and ammunition since 2018. The Myanmar military has, for example, received JF-17M “Thunder” fighter jets from the Chinese state-owned Aviation Industry Corporation of China (AVIC) and Pakistan’s state-owned Pakistan Aeronautical Complex (PAC), among others. “China continued its transfer of military aircraft after the coup. On 15 December 2021, the Myanmar Air Force commissioned additional aircraft manufactured by Chinese state-owned industries,” the report said. By continuing to supply numerous fighter jets, missiles and military transport aircraft after the coup, Beijing is violating “violated international humanitarian law and likely customary international law,” Andrews said. ari

According to the draft legislation, the EU Supply Chain Act will affect only one percent of companies in the European Union. The directive will apply to only about 13,000 EU companies. “Small and medium-sized enterprises, which include micro-enterprises and account for a total of around 99 percent of all companies in the Union, are exempt from due diligence,” the draft, obtained by China.Table on Tuesday, states. The EU Commission plans to unveil the EU supply chain law this Wednesday.

According to the draft, only companies with more than 500 employees and a global net turnover of €150 million are covered by the directive. Companies with more than 250 employees and net sales of more than €40 million are also subject, provided that at least half of their sales come from a high-risk sector such as textiles, mining or agriculture. According to the draft, the EU supply chain law thus has a smaller scope than called for by numerous NGOs and the EU Parliament.

The draft also states that the law, officially known as the European Due Diligence Act, extends to companies from non-EU countries if they generate net sales of at least €150 million or €40 million within the EU, depending on the sector. The EU Commission estimates that the directive will thus cover only about 4,000 non-EU companies.

Furthermore, the draft legislation proposed by the Commission contains provisions for public and private enforcement, namely sanctions and a civil liability regime. The civil liability regime would allow individuals negatively affected by an EU company’s operations to take the company in question to court in an EU member state. The introduction of such a civil liability system has been a key demand of NGOs. However, the scope of civil liability is limited. If EU companies have received contractual assurances from their business partners that they will comply with the company’s code of conduct, EU companies may be protected from civil liability claims.

After the presentation of the proposal on Wednesday, the directive will be discussed and possibly amended by the European Parliament and EU member state governments. Once adopted, member states have two years to implement the directive into national law. ari

Hong Kong’s Chief Executive Carrie Lam has announced nationwide Covid mass testing for the entire city population. Accordingly, all 7.4 million citizens are to be tested in three stages throughout March. Strict distancing rules are to remain in place until at least April 20, as is the ban on flights to and from Australia, the UK, Canada, France, India, Pakistan, the USA and the Philippines. Hong Kong’s schoolchildren will be sent on summer vacation as early as the beginning of March instead of mid-April.

The fifth Covid wave poses major challenges for Hong Kong. City authorities reported a record of 7,500 confirmed new infections on Monday. By Tuesday, the figure was just over 6,200, bringing total infections in the financial metropolis to nearly 54,000 with 321 deaths, including an 11-month-old infant. Many hospitals are at breaking point because of the highly contagious Omicron variant. Last Tuesday, China’s leader Xi Jinping stepped in. The “overriding mission” must be to stabilize and control the spread of the coronavirus in Hong Kong, Xi urged. To that end, a Covid task force has been dispatched from the mainland to Hong Kong. It is headed by Wang Hesheng, director of the Chinese Center for Disease Control and Prevention, who was also responsible for containing the virus after the first outbreak in Wuhan. fpe

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Dr. Zsuzsa Anna Ferenczy tries to understand Taiwan “from all angles”. Since the summer of 2020, the political scientist has been living on the democratically ruled island threatened by mainland China. Here she is employed as a postdoctoral researcher by the Taiwanese Ministry of Science and Technology. As a lecturer in European Studies, she regularly teaches at National Dong Hwa University in Hualien on subjects such as European foreign policy and EU-Asia relations.

The native Hungarian is an expert in this field. For 12 years, Ferenczy worked in the European Parliament’s “Brussels Bubble” as a political advisor on foreign and security policy and human rights. During debates and hearings before the Security, Defense, and Human Rights Committees, she actively participated in European policy-making on Taiwan. A privilege, she says. “The perception of Taiwan and China has evolved quite a bit in our European eyes,” she summarizes this period. “It’s encouraging to see that Europe is finally starting to understand the importance of Taiwan. Not just because Taiwan has become an important player in the US-China geopolitical rivalry, but also because the EU can use Taiwan as an example to show its commitment to democracy and freedom.”

The politically motivated trade embargo on Lithuania was the final wake-up call for Brussels, Ferenczy believes. “What we see in Lithuania’s determination is no anti-China, but pro-democracy behavior.” Vilnius chose to negotiate with the Chinese government at the European level, rather than in the 17 + 1 framework. In this respect, “small” Lithuania is teaching the “big” member states an important lesson about safeguarding democracy.

Other EU member states in Central Eastern Europe, such as Slovakia and the Czech Republic, are now also setting a good example when it comes to taking a stand against Beijing and strengthening Taiwan’s profile in the EU. Now, the big players like Berlin and Paris must follow suit: “Germany can and must contribute to a European China policy that takes the economic interests of all large and small member states into account and places greater emphasis on human rights – just as the German government has promised in its coalition agreement,” explains Ferenczy. Berlin should finally realize that “prioritizing short-term interests has a high price in the long run.”

Ferency is not only interested in Taiwan’s geopolitical significance, but also how Taiwanese perceive themselves. As part of the think tank Taiwan NextGen, she writes guest articles that focus on the characteristics and perspectives of Taiwanese society. “The question of Taiwanese identity will be crucial in shaping Taiwan’s future.”

As Head of Associates Network for the political online discussion platform 9Dashline, she also tries to build a bridge between European countries and democracies in the Indo-Pacific region. Taiwan plays a key role here as well, Ferenczy says. “It’s fascinating to see the region in what is increasingly becoming an Indo-Pacific decade.”

Hiroyuki Shimizu will take up the post of Head of Institutional for the Asia-Pacific region at US investment company Blackrock in the spring. In addition, Shimizu will also take on the role of Japan President. He previously worked in investment management for Morgan Stanley and most recently as Global Co-Head of Private Credit and Equity Distribution.

Xue Bing has been appointed by China’s Ministry of Foreign Affairs as Special Envoy for Horn of Africa Affairs. Xue is an experienced diplomat who has served as ambassador to Papua New Guinea and has been stationed in various countries in Africa, the Americas, and Oceania. The crisis-ridden region is of great importance to China’s economic and strategic interests in Africa.

This couple in Beijing’s Haidian district was one of thousands who said “I do” at a Chinese marriage registry office on Tuesday. Many couples who wanted to get married had specifically chosen the date of 22.2.2022. Because in Mandarin, the number 2 sounds so like the Chinese word for love. A marriage sealed on this day is considered to be fulfilling and long-lasting.