Andrij Melnyk, Ukraine’s former ambassador to Germany and since November 2022 deputy foreign minister, has urged a re-evaluation of Ukraine-Chinese relations. His remarks have caused quite a stir. Formally, Kyiv and Beijing have maintained a “strategic partnership” and extensive economic cooperation since 2011. However, given China’s pro-Russia stance since Putin’s Assault on Ukraine, not much is left of all this, as Michael Radunski analyzes. Instead, Ukraine is now beginning to look more toward Taiwan.

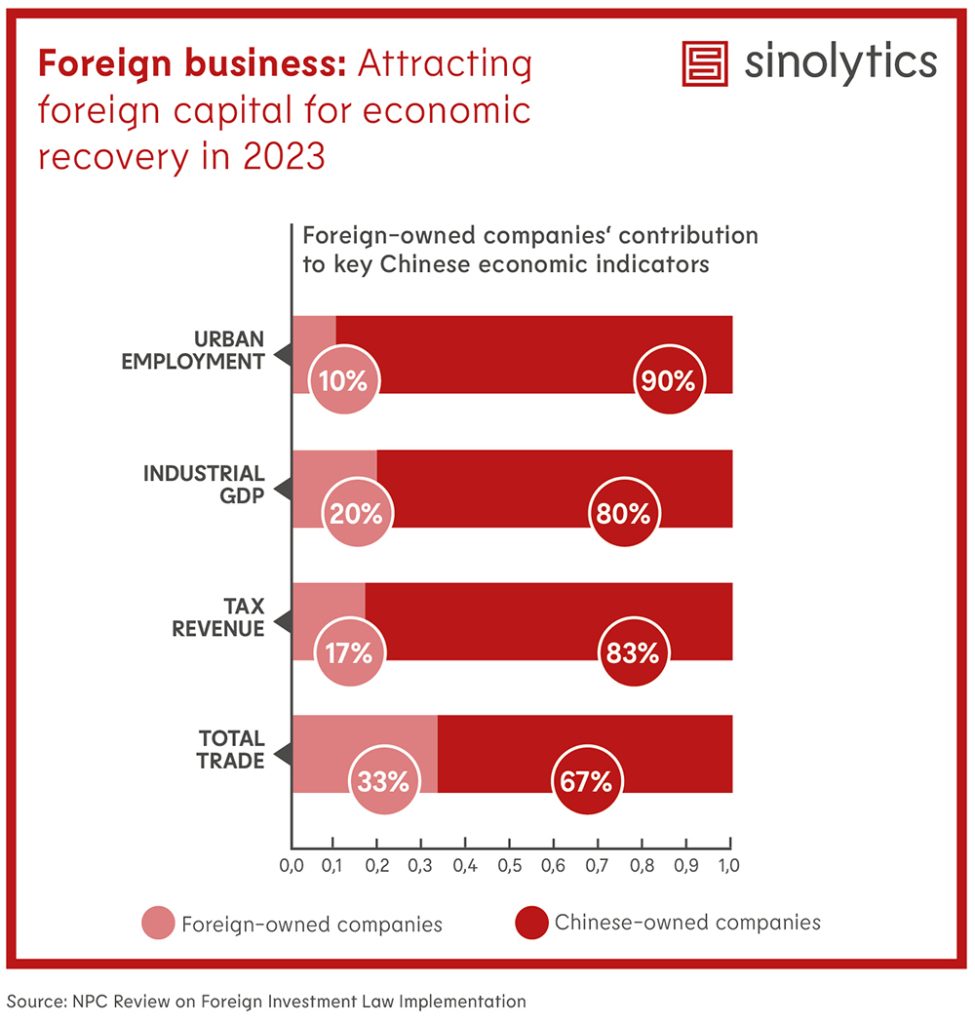

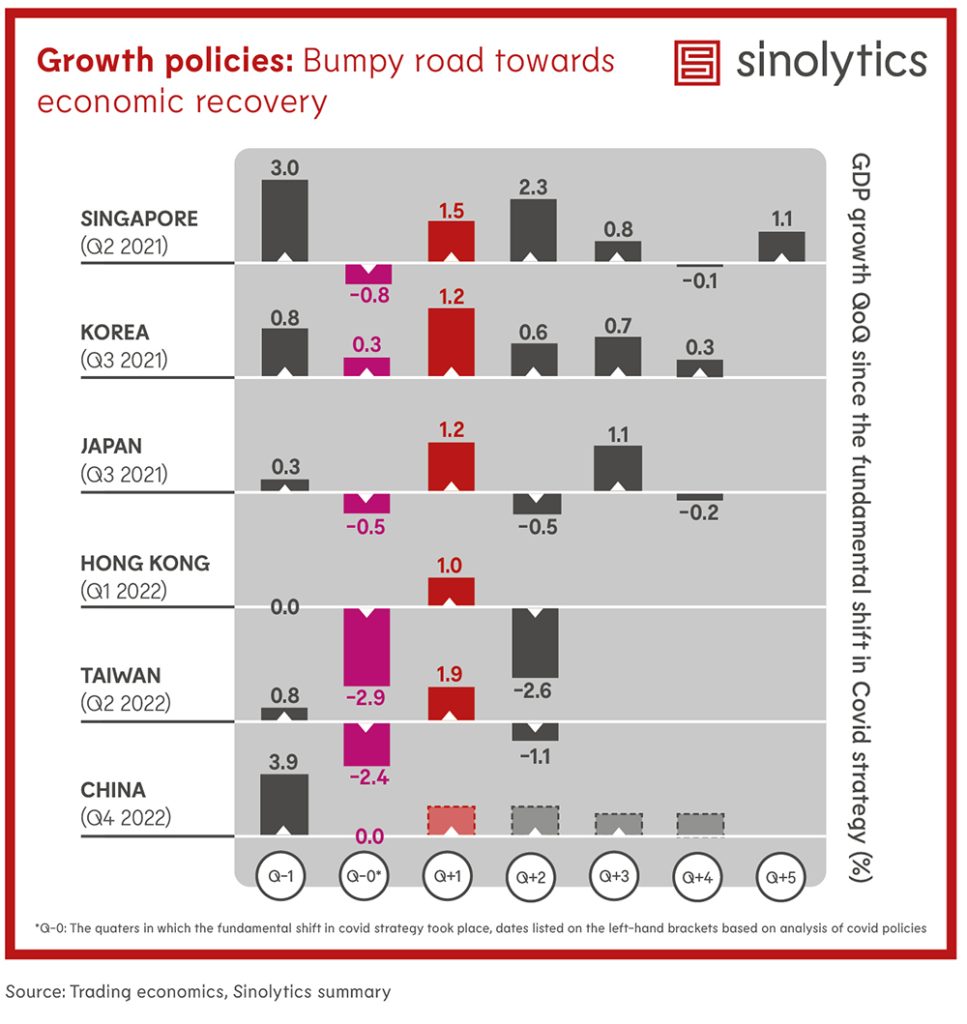

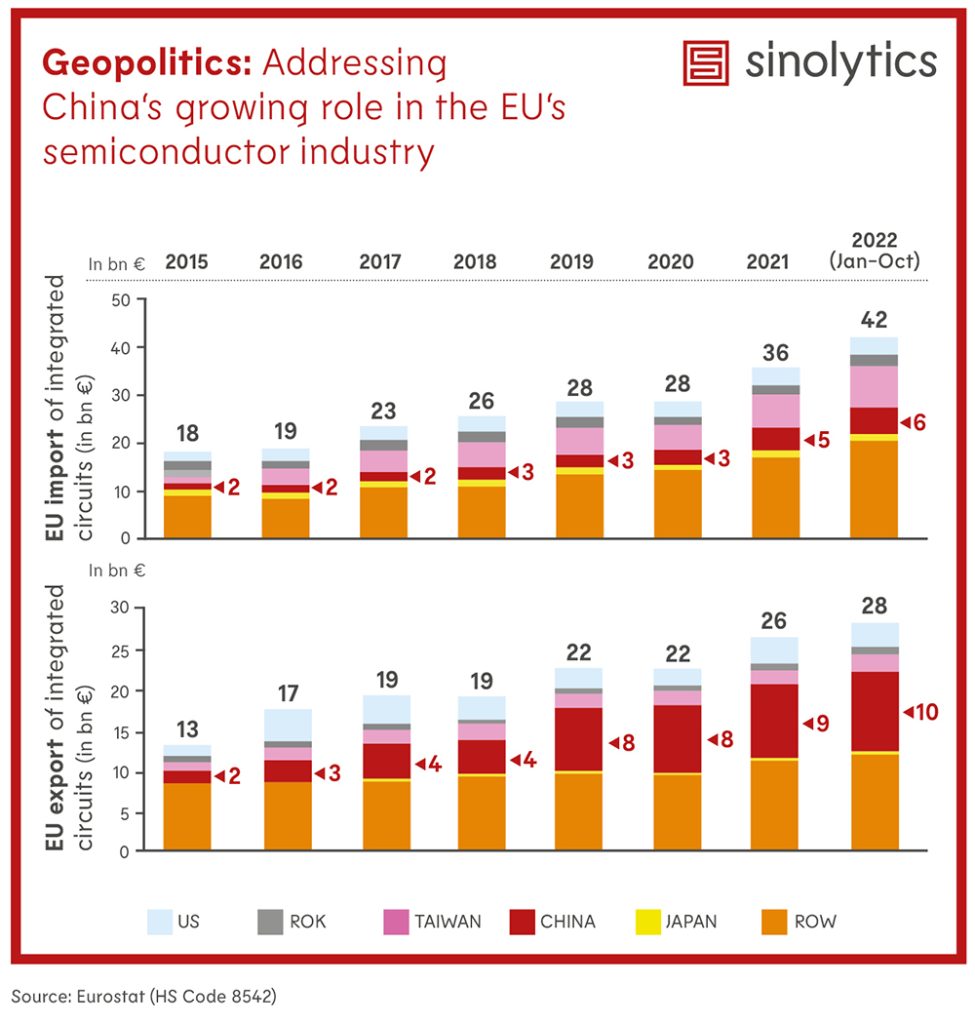

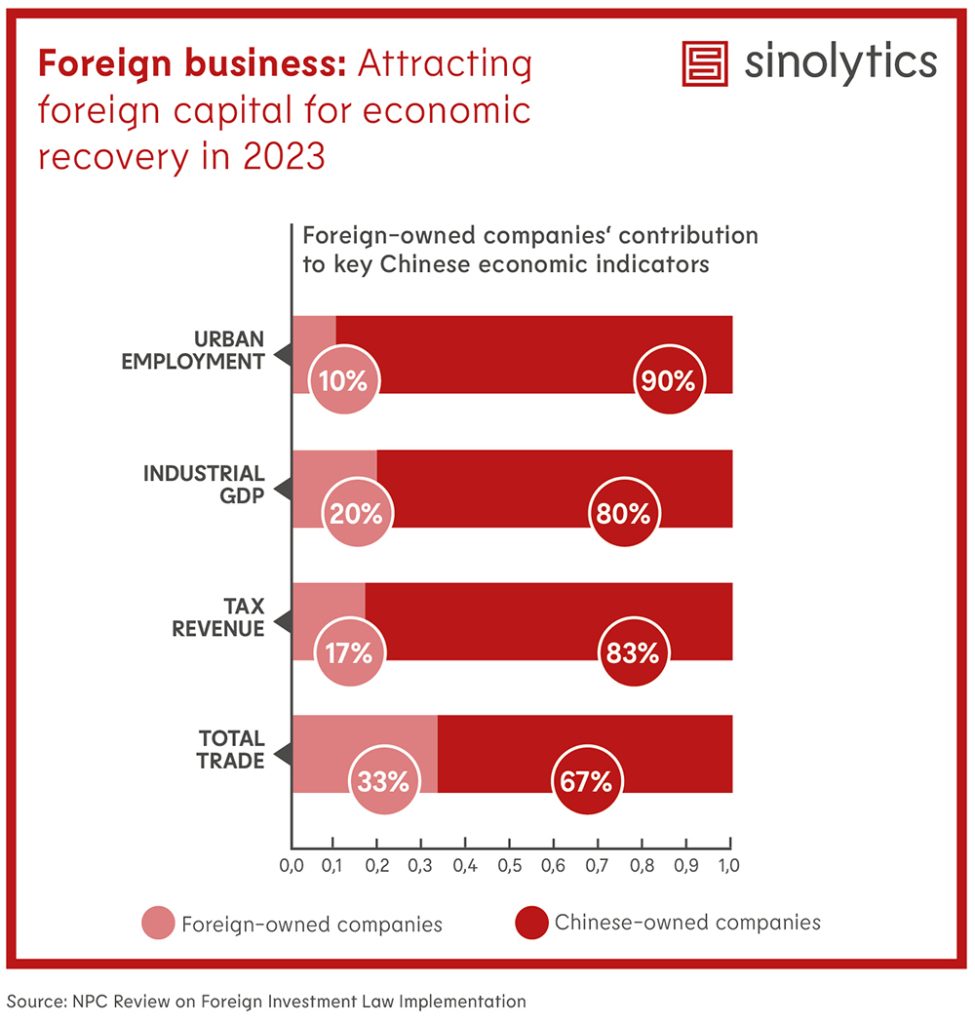

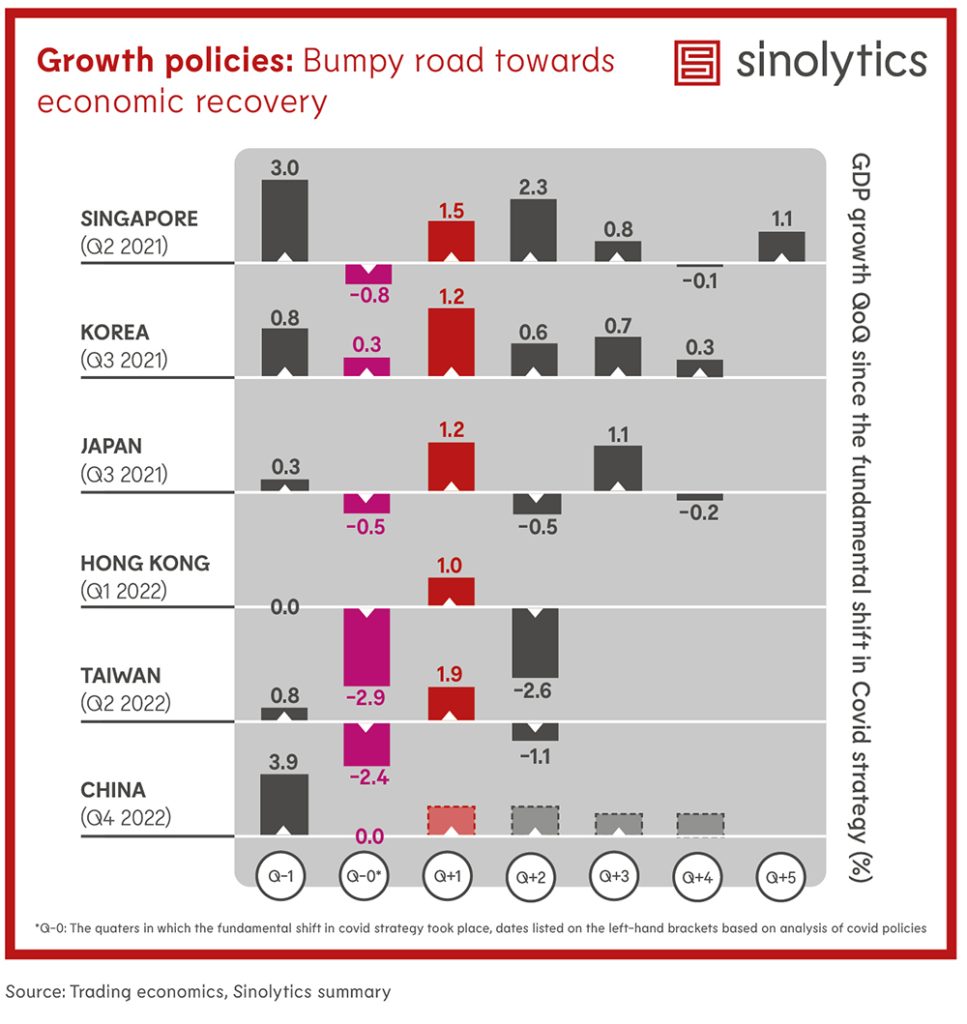

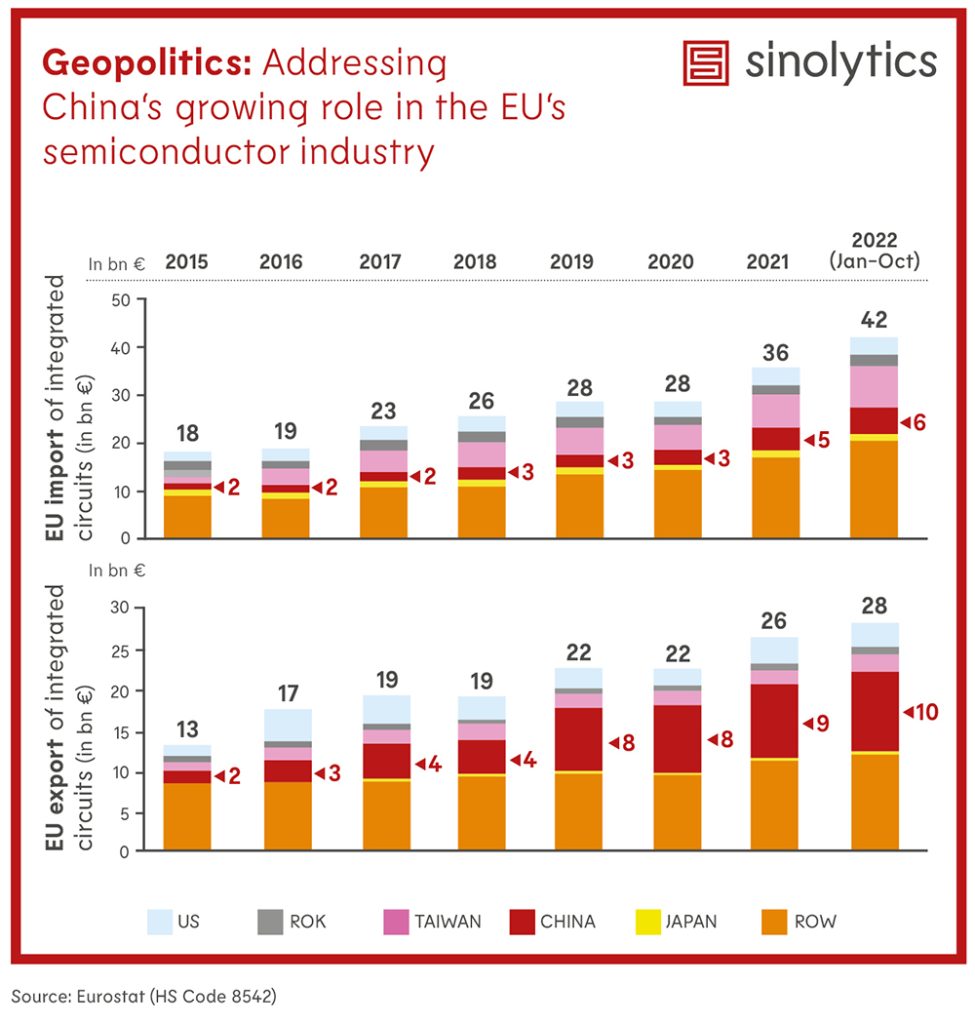

Meanwhile, China’s New Year celebrations continue, with today’s fourth day of the Year of the Rabbit traditionally honoring the Kitchen God. We also take a look into the new year: In cooperation with our partner, the consulting firm Sinolytics, which specializes in China, we present you three forecasts for the Year of the Rabbit covering the most important areas:

Andriy Melnyk has called for Ukraine to rethink its relations with China. “China’s position is becoming less and less acceptable to us,” Ukraine’s deputy foreign minister said last Thursday at the event Ukraine and the World in 2023. “We need to prepare a new strategy for relations with Beijing,” Melnyk said in Kyiv.

The reason for these considerations is China’s stance on the war in Ukraine. It is a breathtaking balancing act: On the one hand, China claims to be neutral. On the other hand, it praises its “boundless friendship” with Moscow and blames the USA and NATO for the war. According to a Bloomberg report, the US has evidence that Chinese state-owned enterprises are even providing non-military aid to Russia’s war in Ukraine. The Biden administration reportedly has confronted Beijing with corresponding indications in order to first find out whether the Chinese government was aware of these activities.

In any case, China’s ambivalence now has consequences. Ukraine starts to turn its back on its long-time partner China – and instead turns to a new ally in Asia: Taiwan.

Melnyk argued at the panel discussion in Kyiv that China’s position truly can no longer be called neutral, as Beijing has voted against resolutions on Ukraine’s sovereignty and territorial integrity in the UN, among other things. “I am not sure that these relations can still be strategic,” Melnyk said.

After all, since 2011, China and Ukraine have formally maintained just that: a strategic partnership. The Chinese Foreign Ministry’s website proudly states: China respects Ukraine’s sovereignty, independence and territorial integrity and is one of the first countries to recognize Ukraine’s independence (中国尊重乌主权、独立和领土完整, 是最早承认乌独立的国家之一).

For Yurii Poita, Melnyk’s words are a step in the right direction. “China’s behavior is simply not a strategic partnership! On the contrary. China doesn’t give a damn about Ukraine’s fate, whether it’s the country’s territorial integrity or people’s survival,” said the head of the Asia-Pacific group of the Kyiv-based think tank New Geopolitics Research Network in conversation with China.Table. “We need to review our relations with China and revoke the status of a strategic partnership with all the consequences.”

It was not always the case, Volodymyr Solovian recalls. “Relations between Ukraine and China have developed quite dynamically since the first years of Ukrainian independence,” Head of Foreign Policy at the Centre for Army, Conversion, and Disarmament Studies (CACDS) in Kyiv told China.Table. China’s main interest was mainly in the military complex: The acquisition of weapon and missile technologies, which Ukraine possessed after the collapse of the Soviet Union.

As an example, Solovian cited the sale of the aircraft carrier Varyag in 1999: “According to the documents, the ship was sold to a private company from Macau for commercial use (hotel and casino). Soon after, the ship came under the jurisdiction of the PRC and was accepted into the PLA Navy as the Liaoning aircraft carrier in 2012.”

Until the early 2010s, China bought more weapons and military technology from Ukraine than almost any other country – so much so that at one point, Ukraine could barely meet Chinese demand. As a result, the trade focus shifted to wheat and other agricultural products. Then came the Russian invasion of Ukraine – and nothing has been the same since.

Communication with Beijing came to a complete standstill. “Since the first days of the full-scale invasion of Russia, the Ukrainian authorities appealed to China, but without success,” Solovian explains. This even went as far as Ukraine’s President Volodymyr Zelenskyj addressing his Chinese counterpart Xi Jinping in a newspaper interview. “I would like to directly,” Zelenskyj told the South China Morning Post in August. Since the Russian invasion of his country, there have been several inquiries to Beijing, however, there has been no communication so far, Zelenskyj revealed, adding, “I believe that would be helpful.”

But it is a difficult balancing act for Ukraine. On the one hand, the country seeks to claim the partnership promised by Beijing; on the other hand, the embattled country cannot afford to alienate such a globally important actor as China. In this respect, Melnyk was not quite as outspoken last week as he was during his time in Berlin. Weighing things up, he said, “China’s position now does not become more favorable for Ukraine.” Only to immediately add: “At the same time, it is important that it does not get worse.”

But what is clear is that Ukraine has begun to rethink its position vis-à-vis China. Before the war, Ukrainians knew little about China, so they maintained neutrality towards it, Inna Sovsun told China.Table. But after China assumed neutrality and de facto supported Russia’s war against Ukraine, Ukrainians began to have a very negative attitude towards China, explained the Ukrainian politician, who served as deputy minister of education and science from 2014 to 2016. “Now, there are almost no relations between China and Ukraine. They continue to exist on paper, and that’s all.”

Sovsun belongs to a group of Ukrainian MPs who have spotted a new ally on the diplomatic map: Taiwan – the small island off the coast of China that is also threatened by an overbearing neighbor. As a result, “the only thing we hear now from China are threats due to the fact that we are establishing contacts with Taiwan, which, unlike China, has supported Ukraine in all possible ways and continues to do so.”

Poita also believes the time has come for a fundamental change: “in my opinion, the conditions have been created for the activation of economic and technological relations between Ukraine and Taiwan, which will be beneficial to both sides. And then Taiwan will get a new reliable partner in Ukraine.” It remains to be seen how strategically Beijing will respond to this challenge.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Chinese automaker BYD is apparently in negotiations over the purchase of a Ford plant in Saarlouis in the Saarland region of Germany. Representatives of Ford’s management in Germany will travel to China next week to discuss the deal, the Wall Street Journal reported on Tuesday, citing anonymous sources. Talks are reported to be at an early stage, and the deal could still fall through. The report did not give details on the price. Ford could not initially be reached for comment.

The Ford Focus currently rolls off the production line at the plant in Saarlouis. However, Ford plans to cease production there in 2025. According to the works council, only about 500 to 700 of the current 4,500 jobs at Ford will remain. According to media reports, Ford has sought talks with 15 interested buyers.

BYD is currently preparing to launch its electric models on the European market. In October, the Shenzhen-based company named seven central dealerships for Germany, which are to establish a nationwide EV dealership network. rtr/ck

Europe could end its dependence on Chinese lithium-ion batteries by 2027, according to a study. The EU is on track to fully meet domestic demand for EVs and energy storage by then, according to a forecast by Transport & Environment (T&E), an NGO umbrella organization for sustainable transport. The organization analyzed announcements from battery manufacturers for its report.

However, Brussels would lack a political strategy to counter newly introduced US subsidies under the Inflation Reduction Acts (IRA). This is because these could prompt battery manufacturers such as Tesla or Northvolt to postpone their investments in Europe. “More funding needs to be provided in Europe or we risk losing planned battery factories and jobs to America,” said Sebastian Bock, director of T&E in Germany.

The report also says that two-thirds of Europe’s demand for cathodes could be produced in the EU by 2027. Planned cathode production projects include a BASF plant under construction in Schwarzheide, Germany, for example, T&E explains.

The organization predicts that dependence on China for refining and processing battery metals could also decrease noticeably: By 2030, more than 50 percent of Europe’s demand for refined lithium could come from European production. The report cites RockTech Lithium and Vulcan Energy Resources in Germany as examples of this. Materials could be sourced from mines in other EU countries or directly from European projects. In Sweden, for example, a large deposit of rare earth minerals was recently discovered. ari

A few weeks after his state visit to Beijing, Philippine President Ferdinand Marcos Jr. wants to hold concrete negotiations with China to resolve conflicts in disputed maritime areas. He has proposed talks between the foreign ministries of the two countries for this purpose, according to a report by the AP news agency. The idea is to be able to quickly resolve incidents between boats from both sides in the South China Sea. China’s President Xi Jinping agreed to his proposal at the Beijing summit in early January, Marcos said in an interview with Philippine TV stations. The two sides reportedly are now working out the details.

Both countries already launched a bilateral consultation mechanism in 2017 to discuss incidents in the disputed waters and prevent escalations. Nevertheless, clashes between Chinese and Filipino boats occur frequently – mostly in Philippine-controlled waters claimed by China. Manila has recently reacted to interference by Chinese fishing boats or coast guard vessels with growing resentment. ck

The US video game company Activision Blizzard suspended its game services in China on Tuesday. This also affects famous games such as Diablo III and World of Warcraft. This means that millions of gamers from China will forever lose their accounts, some of which have taken years to build. The reason for the suspension is the parting of ways with the game publisher Netease, with which Blizzard had entered into a joint venture for the Chinese market 14 years ago. As a local publishing partner, Netease was responsible, among other things, for promoting the games on the strictly regulated Chinese market and helping them get through censorship.

The breakup between the two companies followed lengthy negotiations over a contract extension. An anonymous source with ties to Blizzard told Reuters that the negotiations failed over commercial details. For example, Netease allegedly wanted to modify the deal so that Blizzard would have to give up some of its control over its own brands. Netease, in turn, accuses Blizzard of making one-sided, unfair and “economically illogical” proposals during the negotiations. NetEase is said to have now laid off much of the staff that handled games such as World of Warcraft in China. Meanwhile, Blizzard is looking for a new publisher to continue its services in China.

The Chinese gaming market is considered the largest in the world, ahead of the USA and Japan. According to the market research company Niko Partners, video games generated sales of over 45 billion US dollars in the People’s Republic in 2022. At the same time, China’s government has increasingly interfered in the market with regulations in recent years. Restricted licensing and restricted playing time were aimed at reducing gaming addiction among young people. Content that would have a harmful influence was also to be kept away from Chinese users. However, there are now growing signs that the crackdown is easing. For example, China’s regulatory authorities recently issued new licenses to domestic and foreign gaming companies. fpe

Today, whistleblower systems are an elementary component of compliance management. Whistleblowing has also been of particular importance in China for some time. Three years of separation between foreign parent companies and their Chinese subsidiaries due to China’s restrictive Covid measures, which were only recently lifted, have certainly played a part in this.

China does not generally require private companies to set up a general whistleblower system. However, there are now numerous legal and administrative regulations that specify the rights of whistleblowers or require the establishment of corresponding systems.

As early as September 2019, the State Council issued guidelines calling on both central and provincial governments to establish whistleblower protection systems. In parallel, a series of regulations were issued to provide financial incentives for whistleblowers. Of key importance here are the Interim Measures for Rewarding Whistleblowing of Major Violations in the Field of Market Regulation issued by the Chinese Ministry of Finance and the State Administration for Market Regulation, which came into force in December 2021. Based on these measures, a whistleblower may receive a reward of up to one million RMB under certain conditions.

The Chinese Civil Code stipulates that companies must issue and implement internal regulations against sexual harassment. These obligations are specified by the amended Law on the Protection of the Rights and Interests of Women, which took effect on January 1, 2023. Under this law, employers are required to set up an internal complaints system including the designation of a responsible contact person.

There is also a need for action in light of the draft German Whistleblower Protection Act (HinSchG) based on the EU Whistleblower Directive, which is expected to come into force in the 2nd quarter of 2023. Companies with generally at least 50 employees will be required, among other things, to set up internal whistleblowing departments. The German Whistleblower Act will affect the entire company group and thus also the Chinese subsidiaries of German companies. This also holds true for the German Supply Chain Act, which has already come into force on January 1, 2023, and also provides for the introduction of a complaint mechanism for human rights violations within the supply chain.

In China, too, mechanisms are now in place to protect whistleblowers. An employer who takes reprisals against a whistleblower can be prosecuted under administrative and criminal law. The whistleblower may also be entitled to reinstatement (with back pay) or compensation. All submitted information must also be treated as confidential. At the same time, whistleblowers are required not to fabricate or distort facts or to make false accusations.

Whistleblowing systems offer opportunities (especially early detection, avoidance and correction of violations; a positive factor in official investigations; strengthening of the internal compliance culture) as well as risks ( particularly costs; risk of abuse; creating a “culture of mistrust” within the company).

Against the background of increasing regulation and the importance of whistleblower systems, however, companies in China are required to set up internal whistleblower systems. Unless otherwise stipulated by law, complaints offices may also be set up by a third party, such as an industry association, lawyer, or at corporate headquarters. The following measures are recommended when setting up a whistleblower system:

Sebastian Wiendieck is a partner and head of Rödl & Partner’s legal practice in China.

Miguel Pereira De Sousa has been Senior Project Manager FLS Eurasia at DB Cargo Transa since January. The company focuses on container transport between Europe and China. De Sousa is a manager with more than 15 years of experience in intermodal and China Rail, on which he also regularly lectures. He is working from Hamburg.

Zifeng Qian took over the post of CTO at Remondis China in January. The Remondis Group is one of the world’s largest private service providers in the field of water and recycling management. Based in Shanghai, the design engineer, who was educated in Hefei and Oldenburg, will oversee the company’s technology and business development.

Is something changing in your organization? Why not let us know at heads@table.media!

On the outskirts of the Tibetan town of Xigaze, a man welcomes the New Year by attaching a chain of prayer flags to a ridge. In the autonomous region, the festival is also known as Losar and is celebrated over a two-week period from December to January.

Andrij Melnyk, Ukraine’s former ambassador to Germany and since November 2022 deputy foreign minister, has urged a re-evaluation of Ukraine-Chinese relations. His remarks have caused quite a stir. Formally, Kyiv and Beijing have maintained a “strategic partnership” and extensive economic cooperation since 2011. However, given China’s pro-Russia stance since Putin’s Assault on Ukraine, not much is left of all this, as Michael Radunski analyzes. Instead, Ukraine is now beginning to look more toward Taiwan.

Meanwhile, China’s New Year celebrations continue, with today’s fourth day of the Year of the Rabbit traditionally honoring the Kitchen God. We also take a look into the new year: In cooperation with our partner, the consulting firm Sinolytics, which specializes in China, we present you three forecasts for the Year of the Rabbit covering the most important areas:

Andriy Melnyk has called for Ukraine to rethink its relations with China. “China’s position is becoming less and less acceptable to us,” Ukraine’s deputy foreign minister said last Thursday at the event Ukraine and the World in 2023. “We need to prepare a new strategy for relations with Beijing,” Melnyk said in Kyiv.

The reason for these considerations is China’s stance on the war in Ukraine. It is a breathtaking balancing act: On the one hand, China claims to be neutral. On the other hand, it praises its “boundless friendship” with Moscow and blames the USA and NATO for the war. According to a Bloomberg report, the US has evidence that Chinese state-owned enterprises are even providing non-military aid to Russia’s war in Ukraine. The Biden administration reportedly has confronted Beijing with corresponding indications in order to first find out whether the Chinese government was aware of these activities.

In any case, China’s ambivalence now has consequences. Ukraine starts to turn its back on its long-time partner China – and instead turns to a new ally in Asia: Taiwan.

Melnyk argued at the panel discussion in Kyiv that China’s position truly can no longer be called neutral, as Beijing has voted against resolutions on Ukraine’s sovereignty and territorial integrity in the UN, among other things. “I am not sure that these relations can still be strategic,” Melnyk said.

After all, since 2011, China and Ukraine have formally maintained just that: a strategic partnership. The Chinese Foreign Ministry’s website proudly states: China respects Ukraine’s sovereignty, independence and territorial integrity and is one of the first countries to recognize Ukraine’s independence (中国尊重乌主权、独立和领土完整, 是最早承认乌独立的国家之一).

For Yurii Poita, Melnyk’s words are a step in the right direction. “China’s behavior is simply not a strategic partnership! On the contrary. China doesn’t give a damn about Ukraine’s fate, whether it’s the country’s territorial integrity or people’s survival,” said the head of the Asia-Pacific group of the Kyiv-based think tank New Geopolitics Research Network in conversation with China.Table. “We need to review our relations with China and revoke the status of a strategic partnership with all the consequences.”

It was not always the case, Volodymyr Solovian recalls. “Relations between Ukraine and China have developed quite dynamically since the first years of Ukrainian independence,” Head of Foreign Policy at the Centre for Army, Conversion, and Disarmament Studies (CACDS) in Kyiv told China.Table. China’s main interest was mainly in the military complex: The acquisition of weapon and missile technologies, which Ukraine possessed after the collapse of the Soviet Union.

As an example, Solovian cited the sale of the aircraft carrier Varyag in 1999: “According to the documents, the ship was sold to a private company from Macau for commercial use (hotel and casino). Soon after, the ship came under the jurisdiction of the PRC and was accepted into the PLA Navy as the Liaoning aircraft carrier in 2012.”

Until the early 2010s, China bought more weapons and military technology from Ukraine than almost any other country – so much so that at one point, Ukraine could barely meet Chinese demand. As a result, the trade focus shifted to wheat and other agricultural products. Then came the Russian invasion of Ukraine – and nothing has been the same since.

Communication with Beijing came to a complete standstill. “Since the first days of the full-scale invasion of Russia, the Ukrainian authorities appealed to China, but without success,” Solovian explains. This even went as far as Ukraine’s President Volodymyr Zelenskyj addressing his Chinese counterpart Xi Jinping in a newspaper interview. “I would like to directly,” Zelenskyj told the South China Morning Post in August. Since the Russian invasion of his country, there have been several inquiries to Beijing, however, there has been no communication so far, Zelenskyj revealed, adding, “I believe that would be helpful.”

But it is a difficult balancing act for Ukraine. On the one hand, the country seeks to claim the partnership promised by Beijing; on the other hand, the embattled country cannot afford to alienate such a globally important actor as China. In this respect, Melnyk was not quite as outspoken last week as he was during his time in Berlin. Weighing things up, he said, “China’s position now does not become more favorable for Ukraine.” Only to immediately add: “At the same time, it is important that it does not get worse.”

But what is clear is that Ukraine has begun to rethink its position vis-à-vis China. Before the war, Ukrainians knew little about China, so they maintained neutrality towards it, Inna Sovsun told China.Table. But after China assumed neutrality and de facto supported Russia’s war against Ukraine, Ukrainians began to have a very negative attitude towards China, explained the Ukrainian politician, who served as deputy minister of education and science from 2014 to 2016. “Now, there are almost no relations between China and Ukraine. They continue to exist on paper, and that’s all.”

Sovsun belongs to a group of Ukrainian MPs who have spotted a new ally on the diplomatic map: Taiwan – the small island off the coast of China that is also threatened by an overbearing neighbor. As a result, “the only thing we hear now from China are threats due to the fact that we are establishing contacts with Taiwan, which, unlike China, has supported Ukraine in all possible ways and continues to do so.”

Poita also believes the time has come for a fundamental change: “in my opinion, the conditions have been created for the activation of economic and technological relations between Ukraine and Taiwan, which will be beneficial to both sides. And then Taiwan will get a new reliable partner in Ukraine.” It remains to be seen how strategically Beijing will respond to this challenge.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Chinese automaker BYD is apparently in negotiations over the purchase of a Ford plant in Saarlouis in the Saarland region of Germany. Representatives of Ford’s management in Germany will travel to China next week to discuss the deal, the Wall Street Journal reported on Tuesday, citing anonymous sources. Talks are reported to be at an early stage, and the deal could still fall through. The report did not give details on the price. Ford could not initially be reached for comment.

The Ford Focus currently rolls off the production line at the plant in Saarlouis. However, Ford plans to cease production there in 2025. According to the works council, only about 500 to 700 of the current 4,500 jobs at Ford will remain. According to media reports, Ford has sought talks with 15 interested buyers.

BYD is currently preparing to launch its electric models on the European market. In October, the Shenzhen-based company named seven central dealerships for Germany, which are to establish a nationwide EV dealership network. rtr/ck

Europe could end its dependence on Chinese lithium-ion batteries by 2027, according to a study. The EU is on track to fully meet domestic demand for EVs and energy storage by then, according to a forecast by Transport & Environment (T&E), an NGO umbrella organization for sustainable transport. The organization analyzed announcements from battery manufacturers for its report.

However, Brussels would lack a political strategy to counter newly introduced US subsidies under the Inflation Reduction Acts (IRA). This is because these could prompt battery manufacturers such as Tesla or Northvolt to postpone their investments in Europe. “More funding needs to be provided in Europe or we risk losing planned battery factories and jobs to America,” said Sebastian Bock, director of T&E in Germany.

The report also says that two-thirds of Europe’s demand for cathodes could be produced in the EU by 2027. Planned cathode production projects include a BASF plant under construction in Schwarzheide, Germany, for example, T&E explains.

The organization predicts that dependence on China for refining and processing battery metals could also decrease noticeably: By 2030, more than 50 percent of Europe’s demand for refined lithium could come from European production. The report cites RockTech Lithium and Vulcan Energy Resources in Germany as examples of this. Materials could be sourced from mines in other EU countries or directly from European projects. In Sweden, for example, a large deposit of rare earth minerals was recently discovered. ari

A few weeks after his state visit to Beijing, Philippine President Ferdinand Marcos Jr. wants to hold concrete negotiations with China to resolve conflicts in disputed maritime areas. He has proposed talks between the foreign ministries of the two countries for this purpose, according to a report by the AP news agency. The idea is to be able to quickly resolve incidents between boats from both sides in the South China Sea. China’s President Xi Jinping agreed to his proposal at the Beijing summit in early January, Marcos said in an interview with Philippine TV stations. The two sides reportedly are now working out the details.

Both countries already launched a bilateral consultation mechanism in 2017 to discuss incidents in the disputed waters and prevent escalations. Nevertheless, clashes between Chinese and Filipino boats occur frequently – mostly in Philippine-controlled waters claimed by China. Manila has recently reacted to interference by Chinese fishing boats or coast guard vessels with growing resentment. ck

The US video game company Activision Blizzard suspended its game services in China on Tuesday. This also affects famous games such as Diablo III and World of Warcraft. This means that millions of gamers from China will forever lose their accounts, some of which have taken years to build. The reason for the suspension is the parting of ways with the game publisher Netease, with which Blizzard had entered into a joint venture for the Chinese market 14 years ago. As a local publishing partner, Netease was responsible, among other things, for promoting the games on the strictly regulated Chinese market and helping them get through censorship.

The breakup between the two companies followed lengthy negotiations over a contract extension. An anonymous source with ties to Blizzard told Reuters that the negotiations failed over commercial details. For example, Netease allegedly wanted to modify the deal so that Blizzard would have to give up some of its control over its own brands. Netease, in turn, accuses Blizzard of making one-sided, unfair and “economically illogical” proposals during the negotiations. NetEase is said to have now laid off much of the staff that handled games such as World of Warcraft in China. Meanwhile, Blizzard is looking for a new publisher to continue its services in China.

The Chinese gaming market is considered the largest in the world, ahead of the USA and Japan. According to the market research company Niko Partners, video games generated sales of over 45 billion US dollars in the People’s Republic in 2022. At the same time, China’s government has increasingly interfered in the market with regulations in recent years. Restricted licensing and restricted playing time were aimed at reducing gaming addiction among young people. Content that would have a harmful influence was also to be kept away from Chinese users. However, there are now growing signs that the crackdown is easing. For example, China’s regulatory authorities recently issued new licenses to domestic and foreign gaming companies. fpe

Today, whistleblower systems are an elementary component of compliance management. Whistleblowing has also been of particular importance in China for some time. Three years of separation between foreign parent companies and their Chinese subsidiaries due to China’s restrictive Covid measures, which were only recently lifted, have certainly played a part in this.

China does not generally require private companies to set up a general whistleblower system. However, there are now numerous legal and administrative regulations that specify the rights of whistleblowers or require the establishment of corresponding systems.

As early as September 2019, the State Council issued guidelines calling on both central and provincial governments to establish whistleblower protection systems. In parallel, a series of regulations were issued to provide financial incentives for whistleblowers. Of key importance here are the Interim Measures for Rewarding Whistleblowing of Major Violations in the Field of Market Regulation issued by the Chinese Ministry of Finance and the State Administration for Market Regulation, which came into force in December 2021. Based on these measures, a whistleblower may receive a reward of up to one million RMB under certain conditions.

The Chinese Civil Code stipulates that companies must issue and implement internal regulations against sexual harassment. These obligations are specified by the amended Law on the Protection of the Rights and Interests of Women, which took effect on January 1, 2023. Under this law, employers are required to set up an internal complaints system including the designation of a responsible contact person.

There is also a need for action in light of the draft German Whistleblower Protection Act (HinSchG) based on the EU Whistleblower Directive, which is expected to come into force in the 2nd quarter of 2023. Companies with generally at least 50 employees will be required, among other things, to set up internal whistleblowing departments. The German Whistleblower Act will affect the entire company group and thus also the Chinese subsidiaries of German companies. This also holds true for the German Supply Chain Act, which has already come into force on January 1, 2023, and also provides for the introduction of a complaint mechanism for human rights violations within the supply chain.

In China, too, mechanisms are now in place to protect whistleblowers. An employer who takes reprisals against a whistleblower can be prosecuted under administrative and criminal law. The whistleblower may also be entitled to reinstatement (with back pay) or compensation. All submitted information must also be treated as confidential. At the same time, whistleblowers are required not to fabricate or distort facts or to make false accusations.

Whistleblowing systems offer opportunities (especially early detection, avoidance and correction of violations; a positive factor in official investigations; strengthening of the internal compliance culture) as well as risks ( particularly costs; risk of abuse; creating a “culture of mistrust” within the company).

Against the background of increasing regulation and the importance of whistleblower systems, however, companies in China are required to set up internal whistleblower systems. Unless otherwise stipulated by law, complaints offices may also be set up by a third party, such as an industry association, lawyer, or at corporate headquarters. The following measures are recommended when setting up a whistleblower system:

Sebastian Wiendieck is a partner and head of Rödl & Partner’s legal practice in China.

Miguel Pereira De Sousa has been Senior Project Manager FLS Eurasia at DB Cargo Transa since January. The company focuses on container transport between Europe and China. De Sousa is a manager with more than 15 years of experience in intermodal and China Rail, on which he also regularly lectures. He is working from Hamburg.

Zifeng Qian took over the post of CTO at Remondis China in January. The Remondis Group is one of the world’s largest private service providers in the field of water and recycling management. Based in Shanghai, the design engineer, who was educated in Hefei and Oldenburg, will oversee the company’s technology and business development.

Is something changing in your organization? Why not let us know at heads@table.media!

On the outskirts of the Tibetan town of Xigaze, a man welcomes the New Year by attaching a chain of prayer flags to a ridge. In the autonomous region, the festival is also known as Losar and is celebrated over a two-week period from December to January.