We have been familiar with the term since the time leading up to the war in Ukraine: hybrid warfare refers to activities below the threshold of an attack, but clearly outside of legal and moral norms. Now, a spokesperson for the Taiwanese ruling party DPP has accused China of “gray zone tactics” in the waters around the island of Kinmen, just off the coast of the mainland. The term is certainly a verbal escalation. But nerves were on edge in Taiwan – given an obvious change of policy on China’s part, which Finn Mayer-Kuckuk analyzes. After all, the silent agreements that have drawn the borders between China and Taiwan in the turbulent coastal waters for over 30 years no longer seem to apply to Beijing.

On Monday and Tuesday, China blocked the path of Taiwanese vessels even though they were traversing waters that are de facto under Taiwanese control. This is seen as a response to the pursuit of a Chinese fishing boat with two dead, which the Taiwanese coastguard had picked up in its own waters. It is still unknown whether this is a temporary retaliatory measure or China has once again permanently shifted the status quo.

Many young Chinese women have long been obsessed with being slim. The social pressure to be lean is even higher for women there than in the West – fuelled by trends on social media. Many women pin their hopes on weight loss drugs such as Ozempic, as Fabian Peltsch writes. The drug is actually used to treat type 2 diabetes, but the weight-loss craze has given rise to a highly profitable black market on e-commerce sites. And there are now several Chinese generics on the market. It’s time for a little more body positivity – a concept that many in China consider too feminist.

The chain of confrontations between China and Taiwan continued on Tuesday. Taiwan’s coast guard intercepted another Chinese vessel that had entered Taiwanese waters. Nerves have been on edge ever since China’s coastguard boarded a Taiwanese tourist boat on Monday. The official responsible for maritime borders in Taipei spoke of “panic” on the Taiwanese side in light of the Chinese behavior.

China has recently started to insist that it is also entitled to monitor shipping traffic in waters that have been assigned to Taiwan under a decades-old agreement. This marks a policy change. In the past, China had respected “restricted sea areas” that were de facto under Taiwan’s control. It is still unclear whether the policy change is a temporary reaction to recent events or intended to be permanent.

The boarding of the Taiwanese tourist boat occurred on Monday off the island of Kinmen. China’s coast guard stopped the small boat, boarded it and inspected the crew’s identity, the government in Taipei announced. “Such actions risk unintentional clashes and an unnecessary escalation of tensions in the Taiwan Strait,” wrote Wen Lii, foreign policy spokesperson for the ruling DPP party, on X. He calls the Chinese approach “gray zone tactics”: increasing pressure even without military action.

The inspection of the tourist boat was preceded by an incident in which two Chinese citizens drowned. Last Wednesday, the Taiwanese coastguard had taken up the pursuit of a fishing boat in its own waters. It then capsized during its escape. Two of the crew of four died.

On the weekend, China subsequently announced increased inspections around Kinmen. The coast guard has now taken action. This is the third clash within a week.

Following the “panic” statement, Taiwan’s government attempted to downplay the incident and not contribute to any further escalation. The island’s Defence Minister stressed that the military would not actively intervene. “Let’s handle the matter peacefully,” said Chiu Kuo-cheng.

At the same time, however, Taiwan made it clear that it would continue to protect the areas in question. “We will continue to protect these sea areas to ensure safety in our territorial waters and the rights of our fishermen,” said Taiwan’s Prime Minister Chen Chien-jen.

Kinmen is located directly off the Chinese coast and, therefore, much closer to the People’s Republic than Taiwan. All recent incidents have occurred around this frontline island. The circumstances there are somewhat unclear: Small boats constantly scurry back and forth between the islands. So what has changed is less the reality on the water and more its political interpretation.

From the Chinese point of view, there are no Taiwanese waters as Taiwan belongs to China. According to this fiction, both the fishermen last week and the coast guard vessels had every right to enter the waters around Taiwan earlier this week.

Taiwan sees things differently. The island has been self-governing since 1949. The current government is increasingly adamant about being seen as a “sovereign and independent nation.” The Taiwanese government defined “restricted waters” back in the early 1990s. They were intended to define where China ends and Taiwan begins.

Since 1992, coast guard vessels from both sides have quietly respected these lines. Although China has not recognized Taiwanese waters, it has treated them as if they were valid.

China has now abandoned this consensus. And it is doing so by openly stating what the People’s Republic previously believed was legally valid, but was handled differently in practice for the sake of peace. “There has never been such a thing as ‘off-limit’ or ‘restricted’ waters in the zones,” said Zhu Fenglian, spokesperson for the Taiwan Affairs Office of the State Council, according to state media on Saturday.

She said that Chinese fishermen had every right to be in the sea off Kinmen. China will now “take further measures, the consequences of which shall be borne by the Taiwan side.” This is in line with China’s recent approach of more aggressively enforcing its own interpretation of the one-China policy internationally.

At this year’s Spring Festival, young women in China must have once again felt anxious about their bodies at the sight of so much food and may even have refused to partake in the feast. Surveys show that the pressure to be slim is even stronger in China than in the West. The popularity of video and streaming platforms such as Douyin and Xiaohongshu, which propagate almost unattainable female beauty standards, is partly to blame.

For example, young women participate in challenges where they try to hide their waistline behind an A4 paper sheet or balance coins on their protruding collarbones. The message: if you can’t present anything under the corresponding hashtags #A4腰 or #锁骨放硬币, you can officially feel too fat. It is fitting that Chinese celebrities are often judged on their weight gain and loss. For example, comedy director and actress Jia Ling was recently celebrated online for losing 50 kilos in six months, even though she admitted that it had been a very exhausting experience.

China’s netizens share diet tips and weight loss tricks online, such as skimming the fat from a soup with a handkerchief. Meanwhile, data shows that the Chinese middle class consumes more fat and eats more unhealthily than ever before. Half of adults are either overweight or obese according to BMI standards – which translates into an increase in heart disease.

The government is also concerned. In 2016, it launched the “Healthy China 2030” campaign. So-called weight-loss camps popped up all over the country, where children, young people and adults can lose their pounds.

However, nutritional counseling that takes mental health and illnesses such as anorexia into account is still rare. Eating disorders are still considered a Western phenomenon and body positivity as feminist – and thus potentially a threat to social peace.

So it’s no surprise that the weight loss drug Ozempic is also selling like hotcakes in China. Even before its approval in April 2021, it was considered a miracle injection for the rich and famous 网红减肥针. This is thanks in part to Elon Musk, who, unlike many Hollywood stars, openly admitted to regularly injecting himself with the drug.

Ozempic was developed by Danish pharmaceutical company Novo Nordisk – just like the even higher-dose Wegovy, which is recommended for weight loss and was approved in the USA in 2017 and in the EU in 2018 – and was originally developed for patients with type 2 diabetes. It mimics the hormone GLP-1, which is released in the intestine following food intake. The insulin-regulating drug is injected once a week, giving the user a longer feeling of being full. Novo Nordisk’s biggest competitor to date is the US manufacturer Eli Lilly.

Until recently, Ozempic was only officially approved in China for the treatment of type 2 diabetes. However, a black market quickly developed with horrendous prices on e-commerce sites such as Taobao and JD.com. When users searched for the drug on the platform Xiaohongshu, a pop-up warning even appeared at times, asking them to “seek treatment at an official medical center.” Fraud involving fake prescriptions and counterfeit goods was also reported.

According to Novo Nordisk, Ozempic generated sales of 44 million US dollars within nine months of its market launch in China. According to CNN, sales increased more than sevenfold to 316 million dollars the following year. Supply bottlenecks then occurred in late 2022, as reported by the state health newspaper People’s Daily Health.

In 2022, the China National Intellectual Property Administration declared all of Ozempic’s so-called core patents in China invalid – a ruling that Novo Nordisk has appealed against. A legal dispute is currently ongoing before the Beijing Intellectual Property Court of the Supreme People’s Court.

However, the Danish company’s GLP-1 patents will expire in 2026 anyway. Several Chinese companies have therefore already accelerated the development of their own versions, above all Huadong Medicine from Hangzhou, Innovent Biologics from Suzhou and Shanghai Benemae Pharmaceutical. They have already presented their own injections, which are also aimed at improving insulin secretion and curbing appetite. Beijing granted the first marketing authorizations for the generics last September.

As the business newspaper Caixin reports, citing data from Insight, there are 42 ongoing GLP-1 projects in China from domestic and international pharmaceutical companies. Some analysts fear that a bubble could soon form in China’s market for GLP-1 drugs as more and more suppliers enter the market.

China is the second-largest healthcare market in the world. According to forecasts by Chinese brokerage firms Caitong Securities and Citic Securities, GLP-1 weight loss drugs could grow into a market worth tens of billions of yuan in China in the coming years.

However, foreign companies may not necessarily benefit from this. Since 2017, pharmaceutical manufacturers seeking to have their products covered by China’s state-funded health insurance system have had to negotiate their prices directly with the government.

On average, the price of Ozempic syringes in China is much lower than in the USA, for example. Still, the sheer size of the Chinese market will compensate for the lower revenue per dose, or so the global pharmaceutical companies hope.

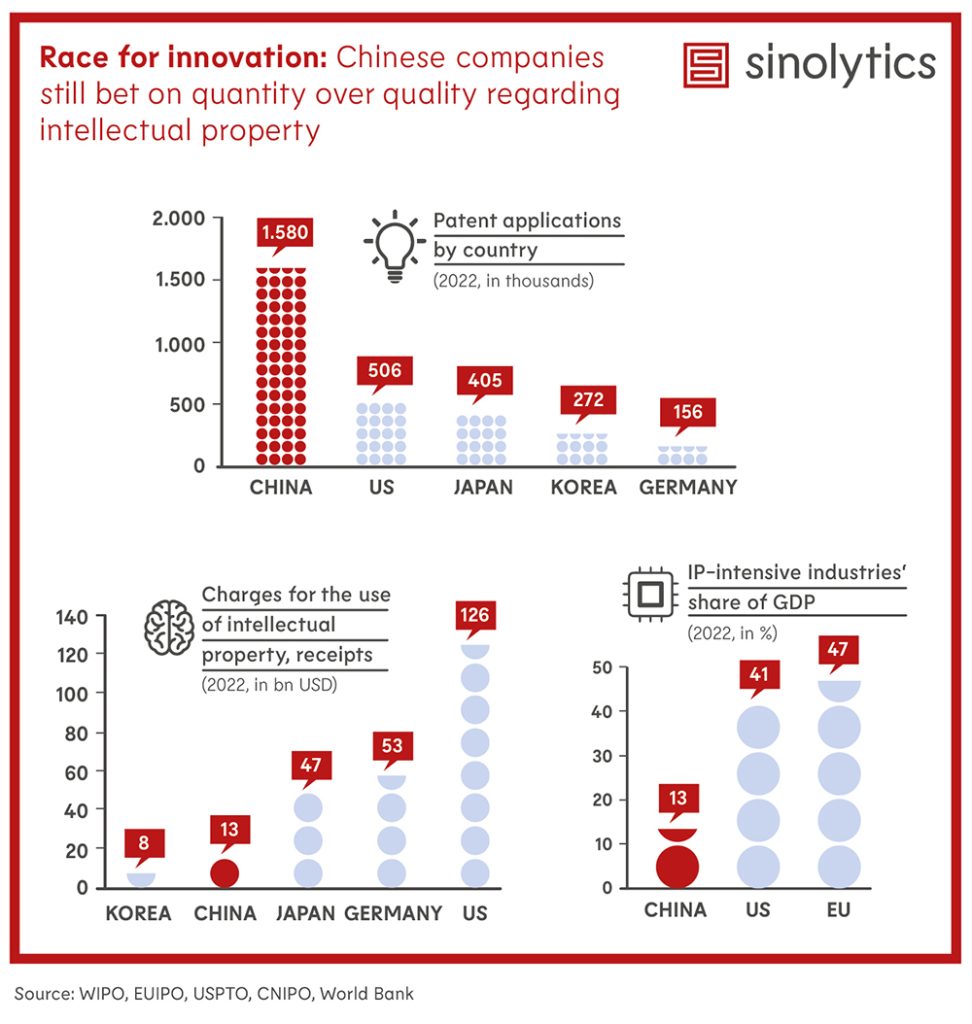

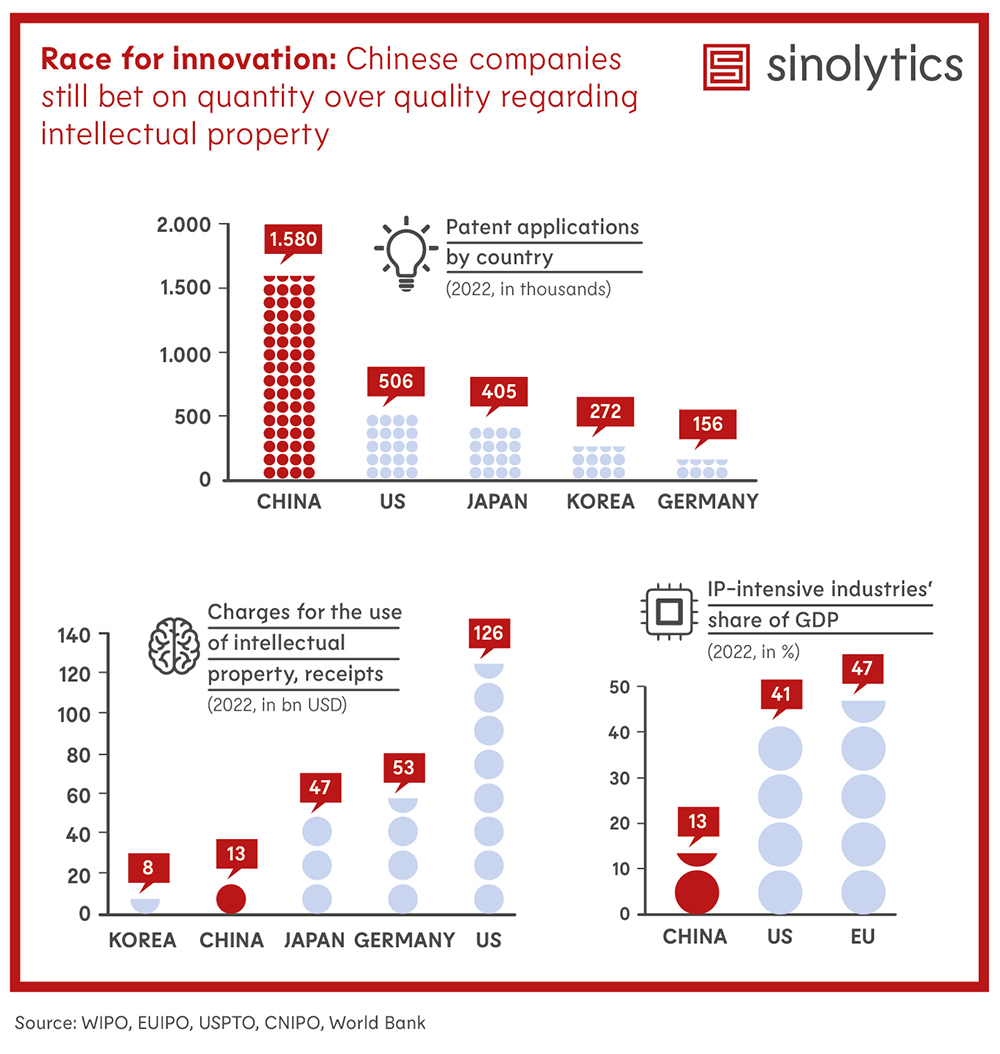

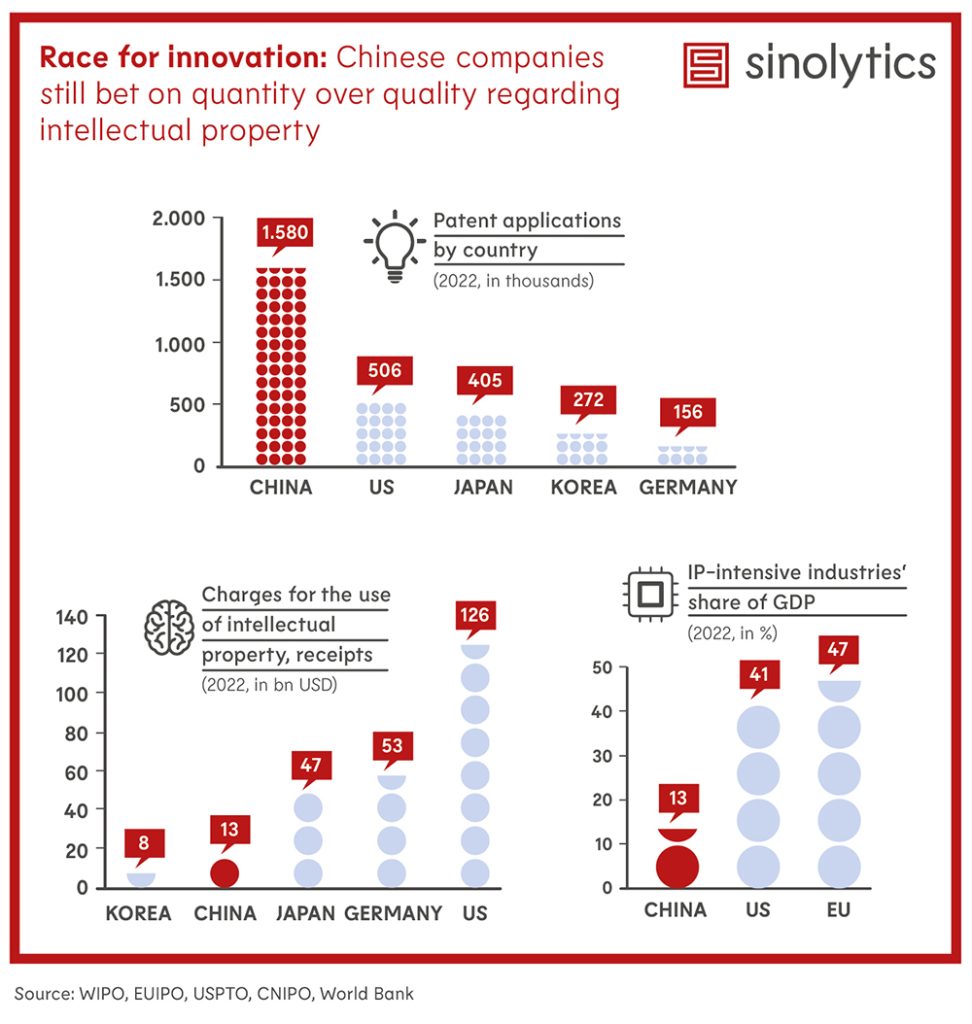

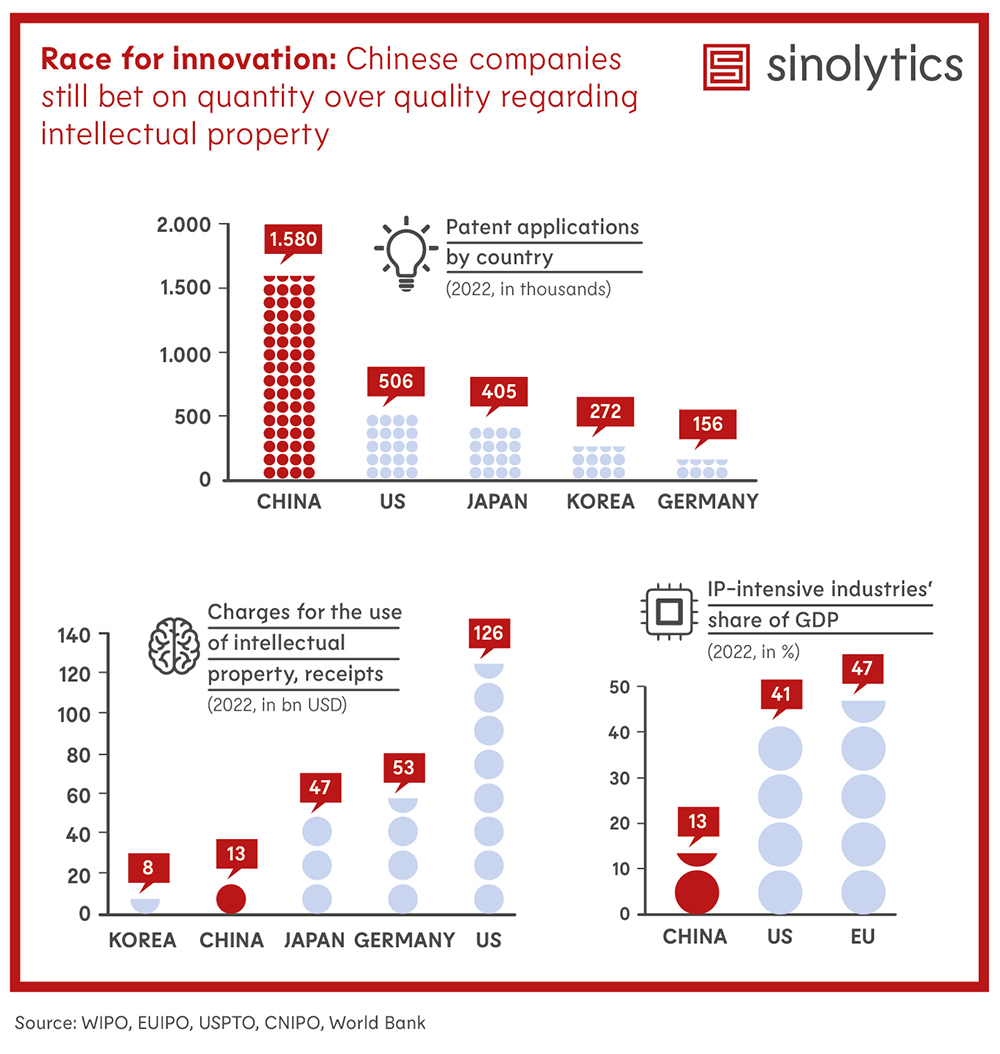

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

The Chinese central bank lowered the five-year reference interest rate for mortgages (Loan Prime Rate/LPR) by 25 basis points from 4.20 to 3.95 percent on Tuesday in an attempt to support the struggling property market. It is the biggest interest rate cut ever in this segment – significantly larger than market observers had expected in a Reuters survey. The LPR is normally granted to the banks’ prime customers and is set on a monthly basis. China last lowered the five-year LPR by 10 basis points in June 2023. It was only introduced in 2019.

It had also been expected that the bank would lower its one-year mortgage reference rate of 3.45 percent in order to reduce lending costs for companies. However, this interest rate was left unchanged. Most new and outstanding loans in China are based on the one-year LPR, while most mortgages are valued and priced based on the five-year LPR.

The large interest cut for the five-year LPR is a signal of genuine concern among policymakers in Beijing that the gradual “slow easing of monetary policy has had little effect,” Japanese newspaper Nikkei Asia quoted economist Louise Loo from the consultancy firm Oxford Economics as saying. The move shows “how determined Beijing is to stabilize the property market,” US economist Michael Pettis at the Carnegie Endowment wrote on X.

Beijing’s hope is that the significant interest rate cut for the five-year LPR will lower the cost of an average residential property mortgage. According to Nikkei Asia, the state-run newspaper Beijing Daily calculated that the interest cut could save 31,888 yuan (4,116 euros) in total interest on a loan of one million yuan over a repayment period of 20 years. However, Michael Pettis expects the move to have little impact. “Property prices in China are still too high, and rental yields too low,” he wrote on X. “It only makes sense to buy rather than rent if you think housing prices will begin rising rapidly again, something I don’t think Beijing wants to see.” ck

China seeks to deepen its relations with the European Union (EU). “As long as China and the EU strengthen solidarity and cooperation, bloc confrontation will not arise,” said Chinese Foreign Minister Wang Yi at a meeting with Spanish Prime Minister Pedro Sanchez in Madrid on Monday. The aim of cooperation is to uphold free trade, practice multilateralism and promote an equal and orderly multipolar world and inclusive economic globalization, he said.

China regards the EU as “an important force in the multi-polar pattern,” and supports European integration, and the development and growth of the EU as well as achieving strategic autonomy

The EU is currently working to reduce its economic dependence on China. In January, the European Commission presented plans to increase the EU’s economic security through closer scrutiny of foreign investment and more coordinated screening of exports and technology transfers to rivals such as China. rtr

Six people have been arrested in Istanbul on suspicion of spying for the Chinese intelligence service. This was reported by the news agency dpa citing the Turkish state broadcaster TRT. The suspects are accused of gathering information on Uyghur individuals and organizations in Turkey for the Chinese authorities, it added.

According to TRT, the public prosecutor’s office has ordered the arrest of another suspect. No further details were known for the time being.

An estimated 50,000 Turkish-speaking and predominantly Muslim Uyghurs live in Turkey. Many of them have fled the oppression in China. Uyghur activists in Turkey have long complained of being intimidated by suspected Chinese agents in Turkey. cyb

.

Car manufacturer BYD has unveiled a plan to further improve its brand image and expand its global influence. This was reported by Caixin on Tuesday. According to the plan, the company aims to strengthen its position as the world’s leading EV manufacturer and gain overseas customers.

BYD plans to launch a range of high-end luxury models as early as this year to gain a larger share of the premium car market, the company said in a stock exchange announcement on Sunday. In the same announcement, BYD announced plans to buy back more shares. BYD’s share price had sunk to a 15-month low earlier this month, partly because investors fear another price war in the car market. cyb

As the wars in Ukraine and Gaza show, energy markets are highly vulnerable to geopolitical developments. At the same time, energy is the main driver of global geopolitical competition – a point that Helen Thompson of the University of Cambridge has often highlighted. The rivalry between the United States and China is no exception.

The relationship between energy and geopolitics came to the fore during the Industrial Revolution. Western countries harnessed wind, coal, and steam power to increase productivity sharply and achieve unprecedented prosperity at home, while colonizing faraway lands and appropriating their resources. It was control over energy that enabled the West to consolidate its economic, political, military, and scientific dominance over the rest of the world.

Geopolitical competition has since amounted essentially to a fight over human capital and natural resources – especially energy resources. For Germany and Japan, World War II was partly about securing vital oil resources in southeastern Europe and Southeast Asia, respectively. A number of other conflicts – from the two Gulf Wars to Russia’s current war against Ukraine – can be considered largely energy wars.

Energy has been a pillar of US global hegemony. The discovery of oil resources in the nineteenth century helped to propel America’s rise as an industrial power. The creation of the petrodollar system in 1973 – when the US and Saudi Arabia agreed that oil would be priced and traded in dollars – was another boon for US global dominance. The shale boom, which began in 2010, cemented America’s energy supremacy.

All of this means that America’s “exorbitant privilege” is even greater than that enjoyed by other reserve-currency countries. The US can not only service its foreign debt, but also pay for all of its imports, including of oil (though it has plenty of its own), in its own currency. Other economies that issue reserve currencies – such as China, the eurozone, and Japan – can also do so to some extent, but they still must operate within the petrodollar system, and they remain major oil importers.

China’s rise, by contrast, has entailed an energy dilemma. Despite vast coal reserves, China has always been vulnerable on the energy front – a weakness that became apparent when the US imposed a trade embargo on China in 1950, during the Korean War. China managed to find ways around this vulnerability during its decades of rapid growth and industrialization: since its 2001 accession to the World Trade Organization, the country has met its rapidly growing energy demand with imports. But climate change, combined with recent geopolitical tensions, have complicated matters considerably.

China became the world’s largest carbon dioxide emitter in 2006. But it has gradually changed its energy mix over the years, first to reduce pollution and then, more recently, to advance net-zero-emissions goals. In 2016, Chinese natural-gas consumption took off, and in 2021, Chinese imports of liquefied natural gas increased by 15 percent year-on-year, making China the world’s largest LNG importer.

Renewables – such as solar, wind, hydro, and nuclear – have also increasingly featured in China’s energy mix, not only to increase environmental sustainability, but also to boost energy security by reducing dependence on foreign oil and gas. Efforts to diversify sources of fossil-fuel imports further reflect China’s commitment to increasing its energy security – an imperative that deteriorating relations with the US have made even more urgent.

Though oil prices subsequently receded slightly, BP’s latest Statistical Review of World Energy predicts that energy prices may well continue to rise this year. In fact, from December 12 to January 12, the natural-gas futures price index surged from 2.1 to 2.7, driven partly by the escalating war in Gaza.

Although oil prices subsequently fell slightly, BP’s latest “Statistical Review of World Energy” predicts that energy prices could well continue to rise this year. In fact, the price index for natural gas futures climbed from 2.1 to 2.7 between December 12 and January 12, partly due to the escalating war in Gaza.

At a time when China is grappling with deflation – over the last two years, the producer price index dropped from 110 to 97, and the consumer price index fell from 101.5 to 99.7 – an energy-price spike is the last thing it needs. The combination of rising global energy prices and Chinese deflation could well undermine corporate profits, weakening investment, and might also spur China’s trade partners to double down on protectionist policies. Already, the European Commission has launched an anti-subsidy investigation into Chinese battery electric vehicles, setting the stage for possible “anti-subsidy” duties on Chinese BEVs.

Renminbi depreciation could add fuel to the protectionism fire and is already causing capital outflows to rise. Over the last year, as the renminbi’s dollar exchange rate has depreciated from 6.7 to 7.17, 84.5 billion US dollars (net) has exited Chinese stock and bond markets – a 44 percent increase compared to 2022.

Meanwhile, GDP growth continues to slow. With the rest of the global economy also struggling to achieve strong growth, the risk is rising that a vicious cycle will begin, with slowing global growth (and, thus, falling global demand) exacerbating China’s own slowdown and undermining global growth further. As higher energy prices fuel inflation globally, a period of stagflation in many parts of the world could follow.

China cannot singlehandedly lower global energy prices, but it can tackle deflation at home. A virtuous cycle of domestic and global growth is within reach. After years of maintaining a conservative macroeconomic policy stance, the time has come for China to launch a new round of fiscal and monetary expansion. This would go a long way toward increasing the private sector’s confidence – and willingness to invest – thereby reversing the deflationary trend and boosting growth in China and the rest of the world.

Andrew Sheng is a distinguished fellow at the Asia Global Institute at the University of Hong Kong.

Xiao Geng, Chairman of the Hong Kong Institution for International Finance, is a professor and Director of the Institute of Policy and Practice at the Shenzhen Finance Institute at The Chinese University of Hong Kong, Shenzhen.

Copyright: Project Syndicate, 2024.

www.project-syndicate.org

Grant Chum was promoted to new CEO and President at Sands China in January. Chum had previously served as COO Chief Operating Officer (COO) of the gambling operator since February 2020.

Joy Cheng has been appointed the new Head of Citi Commercial Bank (CCB) for Hong Kong. Cheng, who has worked in the banking business for 30 years, was most recently Head of Corporate Banking in Hong Kong at the bank.

Is something changing in your organization? Let us know at heads@table.media!

The New Year break is over and these second-graders in the port city of Lianyungang in Jiangsu province are waiting to receive their new school books. They get balloons and a beverage. But the classroom is not warm: traditionally, there is little to no air conditioning in Southern China in winter.

We have been familiar with the term since the time leading up to the war in Ukraine: hybrid warfare refers to activities below the threshold of an attack, but clearly outside of legal and moral norms. Now, a spokesperson for the Taiwanese ruling party DPP has accused China of “gray zone tactics” in the waters around the island of Kinmen, just off the coast of the mainland. The term is certainly a verbal escalation. But nerves were on edge in Taiwan – given an obvious change of policy on China’s part, which Finn Mayer-Kuckuk analyzes. After all, the silent agreements that have drawn the borders between China and Taiwan in the turbulent coastal waters for over 30 years no longer seem to apply to Beijing.

On Monday and Tuesday, China blocked the path of Taiwanese vessels even though they were traversing waters that are de facto under Taiwanese control. This is seen as a response to the pursuit of a Chinese fishing boat with two dead, which the Taiwanese coastguard had picked up in its own waters. It is still unknown whether this is a temporary retaliatory measure or China has once again permanently shifted the status quo.

Many young Chinese women have long been obsessed with being slim. The social pressure to be lean is even higher for women there than in the West – fuelled by trends on social media. Many women pin their hopes on weight loss drugs such as Ozempic, as Fabian Peltsch writes. The drug is actually used to treat type 2 diabetes, but the weight-loss craze has given rise to a highly profitable black market on e-commerce sites. And there are now several Chinese generics on the market. It’s time for a little more body positivity – a concept that many in China consider too feminist.

The chain of confrontations between China and Taiwan continued on Tuesday. Taiwan’s coast guard intercepted another Chinese vessel that had entered Taiwanese waters. Nerves have been on edge ever since China’s coastguard boarded a Taiwanese tourist boat on Monday. The official responsible for maritime borders in Taipei spoke of “panic” on the Taiwanese side in light of the Chinese behavior.

China has recently started to insist that it is also entitled to monitor shipping traffic in waters that have been assigned to Taiwan under a decades-old agreement. This marks a policy change. In the past, China had respected “restricted sea areas” that were de facto under Taiwan’s control. It is still unclear whether the policy change is a temporary reaction to recent events or intended to be permanent.

The boarding of the Taiwanese tourist boat occurred on Monday off the island of Kinmen. China’s coast guard stopped the small boat, boarded it and inspected the crew’s identity, the government in Taipei announced. “Such actions risk unintentional clashes and an unnecessary escalation of tensions in the Taiwan Strait,” wrote Wen Lii, foreign policy spokesperson for the ruling DPP party, on X. He calls the Chinese approach “gray zone tactics”: increasing pressure even without military action.

The inspection of the tourist boat was preceded by an incident in which two Chinese citizens drowned. Last Wednesday, the Taiwanese coastguard had taken up the pursuit of a fishing boat in its own waters. It then capsized during its escape. Two of the crew of four died.

On the weekend, China subsequently announced increased inspections around Kinmen. The coast guard has now taken action. This is the third clash within a week.

Following the “panic” statement, Taiwan’s government attempted to downplay the incident and not contribute to any further escalation. The island’s Defence Minister stressed that the military would not actively intervene. “Let’s handle the matter peacefully,” said Chiu Kuo-cheng.

At the same time, however, Taiwan made it clear that it would continue to protect the areas in question. “We will continue to protect these sea areas to ensure safety in our territorial waters and the rights of our fishermen,” said Taiwan’s Prime Minister Chen Chien-jen.

Kinmen is located directly off the Chinese coast and, therefore, much closer to the People’s Republic than Taiwan. All recent incidents have occurred around this frontline island. The circumstances there are somewhat unclear: Small boats constantly scurry back and forth between the islands. So what has changed is less the reality on the water and more its political interpretation.

From the Chinese point of view, there are no Taiwanese waters as Taiwan belongs to China. According to this fiction, both the fishermen last week and the coast guard vessels had every right to enter the waters around Taiwan earlier this week.

Taiwan sees things differently. The island has been self-governing since 1949. The current government is increasingly adamant about being seen as a “sovereign and independent nation.” The Taiwanese government defined “restricted waters” back in the early 1990s. They were intended to define where China ends and Taiwan begins.

Since 1992, coast guard vessels from both sides have quietly respected these lines. Although China has not recognized Taiwanese waters, it has treated them as if they were valid.

China has now abandoned this consensus. And it is doing so by openly stating what the People’s Republic previously believed was legally valid, but was handled differently in practice for the sake of peace. “There has never been such a thing as ‘off-limit’ or ‘restricted’ waters in the zones,” said Zhu Fenglian, spokesperson for the Taiwan Affairs Office of the State Council, according to state media on Saturday.

She said that Chinese fishermen had every right to be in the sea off Kinmen. China will now “take further measures, the consequences of which shall be borne by the Taiwan side.” This is in line with China’s recent approach of more aggressively enforcing its own interpretation of the one-China policy internationally.

At this year’s Spring Festival, young women in China must have once again felt anxious about their bodies at the sight of so much food and may even have refused to partake in the feast. Surveys show that the pressure to be slim is even stronger in China than in the West. The popularity of video and streaming platforms such as Douyin and Xiaohongshu, which propagate almost unattainable female beauty standards, is partly to blame.

For example, young women participate in challenges where they try to hide their waistline behind an A4 paper sheet or balance coins on their protruding collarbones. The message: if you can’t present anything under the corresponding hashtags #A4腰 or #锁骨放硬币, you can officially feel too fat. It is fitting that Chinese celebrities are often judged on their weight gain and loss. For example, comedy director and actress Jia Ling was recently celebrated online for losing 50 kilos in six months, even though she admitted that it had been a very exhausting experience.

China’s netizens share diet tips and weight loss tricks online, such as skimming the fat from a soup with a handkerchief. Meanwhile, data shows that the Chinese middle class consumes more fat and eats more unhealthily than ever before. Half of adults are either overweight or obese according to BMI standards – which translates into an increase in heart disease.

The government is also concerned. In 2016, it launched the “Healthy China 2030” campaign. So-called weight-loss camps popped up all over the country, where children, young people and adults can lose their pounds.

However, nutritional counseling that takes mental health and illnesses such as anorexia into account is still rare. Eating disorders are still considered a Western phenomenon and body positivity as feminist – and thus potentially a threat to social peace.

So it’s no surprise that the weight loss drug Ozempic is also selling like hotcakes in China. Even before its approval in April 2021, it was considered a miracle injection for the rich and famous 网红减肥针. This is thanks in part to Elon Musk, who, unlike many Hollywood stars, openly admitted to regularly injecting himself with the drug.

Ozempic was developed by Danish pharmaceutical company Novo Nordisk – just like the even higher-dose Wegovy, which is recommended for weight loss and was approved in the USA in 2017 and in the EU in 2018 – and was originally developed for patients with type 2 diabetes. It mimics the hormone GLP-1, which is released in the intestine following food intake. The insulin-regulating drug is injected once a week, giving the user a longer feeling of being full. Novo Nordisk’s biggest competitor to date is the US manufacturer Eli Lilly.

Until recently, Ozempic was only officially approved in China for the treatment of type 2 diabetes. However, a black market quickly developed with horrendous prices on e-commerce sites such as Taobao and JD.com. When users searched for the drug on the platform Xiaohongshu, a pop-up warning even appeared at times, asking them to “seek treatment at an official medical center.” Fraud involving fake prescriptions and counterfeit goods was also reported.

According to Novo Nordisk, Ozempic generated sales of 44 million US dollars within nine months of its market launch in China. According to CNN, sales increased more than sevenfold to 316 million dollars the following year. Supply bottlenecks then occurred in late 2022, as reported by the state health newspaper People’s Daily Health.

In 2022, the China National Intellectual Property Administration declared all of Ozempic’s so-called core patents in China invalid – a ruling that Novo Nordisk has appealed against. A legal dispute is currently ongoing before the Beijing Intellectual Property Court of the Supreme People’s Court.

However, the Danish company’s GLP-1 patents will expire in 2026 anyway. Several Chinese companies have therefore already accelerated the development of their own versions, above all Huadong Medicine from Hangzhou, Innovent Biologics from Suzhou and Shanghai Benemae Pharmaceutical. They have already presented their own injections, which are also aimed at improving insulin secretion and curbing appetite. Beijing granted the first marketing authorizations for the generics last September.

As the business newspaper Caixin reports, citing data from Insight, there are 42 ongoing GLP-1 projects in China from domestic and international pharmaceutical companies. Some analysts fear that a bubble could soon form in China’s market for GLP-1 drugs as more and more suppliers enter the market.

China is the second-largest healthcare market in the world. According to forecasts by Chinese brokerage firms Caitong Securities and Citic Securities, GLP-1 weight loss drugs could grow into a market worth tens of billions of yuan in China in the coming years.

However, foreign companies may not necessarily benefit from this. Since 2017, pharmaceutical manufacturers seeking to have their products covered by China’s state-funded health insurance system have had to negotiate their prices directly with the government.

On average, the price of Ozempic syringes in China is much lower than in the USA, for example. Still, the sheer size of the Chinese market will compensate for the lower revenue per dose, or so the global pharmaceutical companies hope.

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

The Chinese central bank lowered the five-year reference interest rate for mortgages (Loan Prime Rate/LPR) by 25 basis points from 4.20 to 3.95 percent on Tuesday in an attempt to support the struggling property market. It is the biggest interest rate cut ever in this segment – significantly larger than market observers had expected in a Reuters survey. The LPR is normally granted to the banks’ prime customers and is set on a monthly basis. China last lowered the five-year LPR by 10 basis points in June 2023. It was only introduced in 2019.

It had also been expected that the bank would lower its one-year mortgage reference rate of 3.45 percent in order to reduce lending costs for companies. However, this interest rate was left unchanged. Most new and outstanding loans in China are based on the one-year LPR, while most mortgages are valued and priced based on the five-year LPR.

The large interest cut for the five-year LPR is a signal of genuine concern among policymakers in Beijing that the gradual “slow easing of monetary policy has had little effect,” Japanese newspaper Nikkei Asia quoted economist Louise Loo from the consultancy firm Oxford Economics as saying. The move shows “how determined Beijing is to stabilize the property market,” US economist Michael Pettis at the Carnegie Endowment wrote on X.

Beijing’s hope is that the significant interest rate cut for the five-year LPR will lower the cost of an average residential property mortgage. According to Nikkei Asia, the state-run newspaper Beijing Daily calculated that the interest cut could save 31,888 yuan (4,116 euros) in total interest on a loan of one million yuan over a repayment period of 20 years. However, Michael Pettis expects the move to have little impact. “Property prices in China are still too high, and rental yields too low,” he wrote on X. “It only makes sense to buy rather than rent if you think housing prices will begin rising rapidly again, something I don’t think Beijing wants to see.” ck

China seeks to deepen its relations with the European Union (EU). “As long as China and the EU strengthen solidarity and cooperation, bloc confrontation will not arise,” said Chinese Foreign Minister Wang Yi at a meeting with Spanish Prime Minister Pedro Sanchez in Madrid on Monday. The aim of cooperation is to uphold free trade, practice multilateralism and promote an equal and orderly multipolar world and inclusive economic globalization, he said.

China regards the EU as “an important force in the multi-polar pattern,” and supports European integration, and the development and growth of the EU as well as achieving strategic autonomy

The EU is currently working to reduce its economic dependence on China. In January, the European Commission presented plans to increase the EU’s economic security through closer scrutiny of foreign investment and more coordinated screening of exports and technology transfers to rivals such as China. rtr

Six people have been arrested in Istanbul on suspicion of spying for the Chinese intelligence service. This was reported by the news agency dpa citing the Turkish state broadcaster TRT. The suspects are accused of gathering information on Uyghur individuals and organizations in Turkey for the Chinese authorities, it added.

According to TRT, the public prosecutor’s office has ordered the arrest of another suspect. No further details were known for the time being.

An estimated 50,000 Turkish-speaking and predominantly Muslim Uyghurs live in Turkey. Many of them have fled the oppression in China. Uyghur activists in Turkey have long complained of being intimidated by suspected Chinese agents in Turkey. cyb

.

Car manufacturer BYD has unveiled a plan to further improve its brand image and expand its global influence. This was reported by Caixin on Tuesday. According to the plan, the company aims to strengthen its position as the world’s leading EV manufacturer and gain overseas customers.

BYD plans to launch a range of high-end luxury models as early as this year to gain a larger share of the premium car market, the company said in a stock exchange announcement on Sunday. In the same announcement, BYD announced plans to buy back more shares. BYD’s share price had sunk to a 15-month low earlier this month, partly because investors fear another price war in the car market. cyb

As the wars in Ukraine and Gaza show, energy markets are highly vulnerable to geopolitical developments. At the same time, energy is the main driver of global geopolitical competition – a point that Helen Thompson of the University of Cambridge has often highlighted. The rivalry between the United States and China is no exception.

The relationship between energy and geopolitics came to the fore during the Industrial Revolution. Western countries harnessed wind, coal, and steam power to increase productivity sharply and achieve unprecedented prosperity at home, while colonizing faraway lands and appropriating their resources. It was control over energy that enabled the West to consolidate its economic, political, military, and scientific dominance over the rest of the world.

Geopolitical competition has since amounted essentially to a fight over human capital and natural resources – especially energy resources. For Germany and Japan, World War II was partly about securing vital oil resources in southeastern Europe and Southeast Asia, respectively. A number of other conflicts – from the two Gulf Wars to Russia’s current war against Ukraine – can be considered largely energy wars.

Energy has been a pillar of US global hegemony. The discovery of oil resources in the nineteenth century helped to propel America’s rise as an industrial power. The creation of the petrodollar system in 1973 – when the US and Saudi Arabia agreed that oil would be priced and traded in dollars – was another boon for US global dominance. The shale boom, which began in 2010, cemented America’s energy supremacy.

All of this means that America’s “exorbitant privilege” is even greater than that enjoyed by other reserve-currency countries. The US can not only service its foreign debt, but also pay for all of its imports, including of oil (though it has plenty of its own), in its own currency. Other economies that issue reserve currencies – such as China, the eurozone, and Japan – can also do so to some extent, but they still must operate within the petrodollar system, and they remain major oil importers.

China’s rise, by contrast, has entailed an energy dilemma. Despite vast coal reserves, China has always been vulnerable on the energy front – a weakness that became apparent when the US imposed a trade embargo on China in 1950, during the Korean War. China managed to find ways around this vulnerability during its decades of rapid growth and industrialization: since its 2001 accession to the World Trade Organization, the country has met its rapidly growing energy demand with imports. But climate change, combined with recent geopolitical tensions, have complicated matters considerably.

China became the world’s largest carbon dioxide emitter in 2006. But it has gradually changed its energy mix over the years, first to reduce pollution and then, more recently, to advance net-zero-emissions goals. In 2016, Chinese natural-gas consumption took off, and in 2021, Chinese imports of liquefied natural gas increased by 15 percent year-on-year, making China the world’s largest LNG importer.

Renewables – such as solar, wind, hydro, and nuclear – have also increasingly featured in China’s energy mix, not only to increase environmental sustainability, but also to boost energy security by reducing dependence on foreign oil and gas. Efforts to diversify sources of fossil-fuel imports further reflect China’s commitment to increasing its energy security – an imperative that deteriorating relations with the US have made even more urgent.

Though oil prices subsequently receded slightly, BP’s latest Statistical Review of World Energy predicts that energy prices may well continue to rise this year. In fact, from December 12 to January 12, the natural-gas futures price index surged from 2.1 to 2.7, driven partly by the escalating war in Gaza.

Although oil prices subsequently fell slightly, BP’s latest “Statistical Review of World Energy” predicts that energy prices could well continue to rise this year. In fact, the price index for natural gas futures climbed from 2.1 to 2.7 between December 12 and January 12, partly due to the escalating war in Gaza.

At a time when China is grappling with deflation – over the last two years, the producer price index dropped from 110 to 97, and the consumer price index fell from 101.5 to 99.7 – an energy-price spike is the last thing it needs. The combination of rising global energy prices and Chinese deflation could well undermine corporate profits, weakening investment, and might also spur China’s trade partners to double down on protectionist policies. Already, the European Commission has launched an anti-subsidy investigation into Chinese battery electric vehicles, setting the stage for possible “anti-subsidy” duties on Chinese BEVs.

Renminbi depreciation could add fuel to the protectionism fire and is already causing capital outflows to rise. Over the last year, as the renminbi’s dollar exchange rate has depreciated from 6.7 to 7.17, 84.5 billion US dollars (net) has exited Chinese stock and bond markets – a 44 percent increase compared to 2022.

Meanwhile, GDP growth continues to slow. With the rest of the global economy also struggling to achieve strong growth, the risk is rising that a vicious cycle will begin, with slowing global growth (and, thus, falling global demand) exacerbating China’s own slowdown and undermining global growth further. As higher energy prices fuel inflation globally, a period of stagflation in many parts of the world could follow.

China cannot singlehandedly lower global energy prices, but it can tackle deflation at home. A virtuous cycle of domestic and global growth is within reach. After years of maintaining a conservative macroeconomic policy stance, the time has come for China to launch a new round of fiscal and monetary expansion. This would go a long way toward increasing the private sector’s confidence – and willingness to invest – thereby reversing the deflationary trend and boosting growth in China and the rest of the world.

Andrew Sheng is a distinguished fellow at the Asia Global Institute at the University of Hong Kong.

Xiao Geng, Chairman of the Hong Kong Institution for International Finance, is a professor and Director of the Institute of Policy and Practice at the Shenzhen Finance Institute at The Chinese University of Hong Kong, Shenzhen.

Copyright: Project Syndicate, 2024.

www.project-syndicate.org

Grant Chum was promoted to new CEO and President at Sands China in January. Chum had previously served as COO Chief Operating Officer (COO) of the gambling operator since February 2020.

Joy Cheng has been appointed the new Head of Citi Commercial Bank (CCB) for Hong Kong. Cheng, who has worked in the banking business for 30 years, was most recently Head of Corporate Banking in Hong Kong at the bank.

Is something changing in your organization? Let us know at heads@table.media!

The New Year break is over and these second-graders in the port city of Lianyungang in Jiangsu province are waiting to receive their new school books. They get balloons and a beverage. But the classroom is not warm: traditionally, there is little to no air conditioning in Southern China in winter.