The snap elections in Germany will also be closely observed in Beijing. Amid numerous global challenges and an unpredictable US partnership under Trump, Germany’s strategic alignment towards China becomes a crucial factor that no political party can ignore. Manuel Liu asked the parliamentary groups in the German Bundestag which China policy direction they want to take: Is it the same old, in line with the existing China strategy, or a new course that takes current developments into account?

One thing became clear: the far-right AfD and the Left are swimming against the tide. Both parties emphasize the economic benefits of a deeper partnership with China. The AfD even calls for abolishing the Supply Chain Act and total restraint in the Indo-Pacific. The Left also advocates closer relations to tackle global challenges such as climate change or the war in Ukraine. Our overview shows what the others think and what positions they take.

Maximilian Fichtner, a battery expert from the Helmholtz Institute in Ulm, explains in an interview with our ESG colleague Carsten Hübner that the German car manufacturers made a clear mistake by not focusing on their own battery production. While the German companies, after tentative attempts, resorted to the idea that batteries could also be purchased, the Chinese “shoveled mud for five years” to achieve acceptable results. Some of them are now world market leaders. The former top dogs from Mercedes and Co. have become supplicants.

Fichtner concludes that the fundamental problem underlying their misjudgments still prevails today: They don’t want to take any risks and, above all, seek short-term profits. But it takes time to build up the necessary know-how. The EU tariffs could provide a final small buffer to catch up after all. “The only question is how this time will be used.”

Whoever wins the upcoming snap election in Germany will face many challenges from day one: The German economy is slowing down, the war in Ukraine is entering its third year, and Donald Trump’s return to the White House raises many geopolitical questions. Sooner or later, developments in all these problem areas will also depend on China. This makes it more important than ever in this parliamentary election campaign how the various political parties position their China policy.

How do they want to shape Sino-German relations? Which aspects of the current government’s China strategy do they want to retain, which do they want to adjust, and which do they want to abandon, Table.Briefings asked the parliamentary groups in the Bundestag. The conclusion: the Social Democratic Party (SPD) and the Green Party want to build on the existing China strategy, the Free Democratic Party (FDP) and the Christian Democratic Union (CDU/CSU) take a more critical view of current relations, while the far-right AfD and the Left Party want to expand partnership with China.

For the SPD, the China strategy adopted in 2023 is a very good basis “for our China policy – regardless of the outcome of the parliamentary elections,” says Nils Schmid, foreign policy spokesperson for the SPD parliamentary group in the Bundestag. The party continues to rely on de-risking. Schmid says: “If we continue this de-risking, we can better manage the risks while maintaining economic contacts with China, but on a more secure basis.”

The goal of minimizing risk was an important part of the German national China strategy and European China policy. However, Chancellor Olaf Scholz attempted to secure market access and orders for German companies in China in parallel, a move reminiscent of Germany’s China policy over the past three decades.

Schmid sees less need for de-risking at companies and instead focuses on critical infrastructure. The SPD would like to create common rules in the EU for areas such as the rail network, 5G/6G networks, artificial intelligence, quantum computing and goods for military use. Regarding the latter, Schmid proposes outbound investment screening at the EU level. The SPD also wants to work with the EU to protect supply chains – for example, of active medical ingredients – and diversify sources of raw materials such as rare earths.

Moreover, the Social Democrats in the EU want a “strategically oriented and coordinated industrial and innovation policy,” says Schmid, in order to gain an innovative and technological edge in certain core areas, as the United States and China have done. The aim is to eliminate expensive patenting, market fragmentation, slow standardization and a lack of expertise, which are seen as obstacles to innovation.

The SPD also plans to improve support along the entire innovation development chain. The aim is to “kick-start” the transfer between state-funded research and marketable production and, ultimately, value creation in Germany and Europe, says Schmid. However, he acknowledges that much depends on the EU. He therefore calls for expanding the EU’s global partnerships, such as the Mercosur agreement with four South American countries.

The SPD also wants to expand relations with countries in the Indo-Pacific. The parliamentary group unanimously adopted a corresponding position paper on Tuesday, in which the region is described as the “decisive center of gravity of the world order of today and tomorrow.” Accordingly, the SPD wants to expand its expertise on both China and the Indo-Pacific.

The Green Party also wants to stick to its current China policy. “With the China strategy, we have laid the foundation for a new, more realistic China policy,” says deputy parliamentary group leader Agnieszka Brugger. “After the naive glossing over of the Grand Coalition, the China strategy of this federal government focuses on our security, protecting our infrastructure and working for a rules-based international order and human rights.”

Brugger emphasizes the cooperation in the Indo-Pacific, such as the passage of the Taiwan Strait by the frigate “Baden-Württemberg” and the supply vessel “Frankfurt am Main.” These “consistent actions” would bring the “clever words” of the China strategy to life, Brugger continues. According to Brugger, “reducing vulnerabilities and taking a clear stance” is more important than revising the strategy. The Greens would also like to represent their own values and interests with Europe in a joint China policy.

The FDP intends to adapt the China strategy to highlight China’s role as Europe’s rival more clearly, says Ulrich Lechte, foreign policy spokesperson for the FDP parliamentary group in the Bundestag. One reason for this is Trump’s re-election and the resulting geopolitical changes. The FDP wants to prevent Germany and Europe from falling into a “tariff spiral” between the United States and China.

To this end, the party aims to reduce dependencies. To achieve this, the economic liberals remain committed to de-risking, particularly in critical infrastructure, diversifying supply chains and building up competencies in Europe. In addition to competition and system rivalry, the FDP wants to “reflect our own attitude towards China even more intensively, and consistently fill the China strategy with life,” says Lechte.

When asked, the CDU/CSU faction referred to its China strategy published in 2023, its proposal for a China commission in the Bundestag and its election manifesto, which is yet to be published. The proposed China Commission is supposed to review “security-relevant economic relations” with China.

In the 2023 position paper, the CDU/CSU presents China with the EU’s familiar triad of partner, systemic competitor and economic rival. In order to counter a Sinocentric global order, the CDU and CSU want, for example, to develop a strategically oriented transatlantic China policy between the USA and the EU, focus on reciprocity in the tense trade relations and establish a national security council within the Federal Chancellery to “ensure coherence in China policy.”

All major parties currently rule out a coalition with the AfD, which is why it will probably continue to pursue its China policy goals as part of the opposition. The AfD sees no clear positioning of Sino-German relations in the government’s China strategy, a lack of action plans and inadequate involvement of the business community.

The AfD would prefer to strengthen Germany’s partnership with China as an essential trading partner, says deputy parliamentary group leader Stefan Keuter. This includes abolishing the Supply Chain Act. Instead, the party wants to place “great emphasis” on market access, reciprocity, protection of intellectual property and equal opportunities. The AfD also wants to reduce the German military presence in the Indo-Pacific.

The Left Party fights for a place in the Bundestag. MP Gregor Gysi aims to promote “good relations” with China, which he says are necessary to end the war in Ukraine, defeat world hunger, achieve climate targets and resolve the Taiwan question peacefully.

The Sahra Wagenknecht Alliance did not respond to Table.Briefings’ question regarding its China policy focus.

Mr. Fichtner, the crisis at Northvolt reinforces the impression that Europe is struggling to catch up with China in battery production. Does the European automotive industry even need its own battery production?

In-house battery production is important because the battery is the part of the electric car with the greatest added value. We are talking about around a third of the car price. Meanwhile, batteries have become cheaper and are somewhere between 6,000 and 8,000 euros. But there is still a margin. If that is lost, you have to look at how you can still produce the rest of the vehicle economically.

It is hard to imagine that the German car manufacturers have failed to notice this.

This has actually been ignored in the past. Instead, in the 2010s, they said that batteries are bought-in parts, and a car manufacturer doesn’t need to bother with them. In hindsight, that was a clear misjudgment.

Is it so difficult to build EV batteries?

When a battery manufacturer sets up a new production line, it turns out that many cells are good. Others, however, are faulty or do not have the desired performance. They are then rejected. This is known as the scrap rate.

The scrap rate is what can kill the whole thing. Ultimately, the scrap rate must fall to a low single-digit percentage. All battery manufacturers had to go through this, including the Chinese. They shoveled mud for five years, but they pulled through. They ended up becoming the global market leader.

Couldn’t German companies have done the same?

In the 2010s, we had an entire battery cell production facility at Li-Tec Battery in Kamenz. The company was then partially acquired by Daimler AG (now the Mercedes-Benz Group). There were initial problems there, too. Because the company was only in the black in single figures, Daimler eventually said: It’s not profitable, we’re closing it down. I believe that with a little more time, something great could have been achieved here.

The problem is that they don’t want to take risks and generate short-term profits. But building up the necessary expertise and fine-tuning these tiny adjustments to achieve something close to perfection takes time. That doesn’t happen overnight. If we don’t think more long-term, then others will supply us for everything that is similar in some way.

Is there a realistic chance of Europe catching up in battery production?

A cutthroat price war is currently raging in China. From the outside, the Chinese economy always looks relatively homogeneous. But internally, competition is fierce. This has led to an undercutting race and overproduction.

In some cases, the price of battery cells is now well below 100 US dollars per kilowatt-hour. This has always been regarded as the limit at which an electric car can be cheaper than a gasoline car of the same size. This is actually good news. In China, two-thirds of electric cars are now cheaper than comparable gasoline cars.

However, this makes it harder for Europeans to enter the market. Especially as we have different framework conditions here, such as higher energy prices. Labor costs are also higher, although the latter does not play such a major role. Partly because production is largely automated and because skilled workers in China now also earn quite well.

Do the tariffs imposed by the EU on EVs from China have any effect in this context?

The tariffs can help buy some time. The only question is how to use this time. Do the automotive industry and investors have the perseverance to get through the difficult transition phase? Then, in my view, they could also become competitive. If they remain largely stuck in the gasoline car sector, they will dwindle in this ever-shrinking niche and eventually disappear.

Incidentally, Brussels was already thinking about how to keep up with the Chinese five years ago. I was involved in these deliberations. The result was to focus on green battery cells. In other words, battery cells that meet certain minimum standards in terms of CO2 footprint, composition and the like.

Isn’t Northvolt heading in this direction?

Exactly. The carbon footprint of their battery cell in 2020 was between 120 and 150 kilograms of CO2 per kilowatt-hour. As far as I know, Northvolt is now at 30 or 40 kilograms of CO2 per kilowatt-hour and is expected to reach 10 next year. That means it will no longer take 20,000 or 30,000 kilometers of driving, but perhaps only 2,000 or 3,000 kilometers until the carbon footprint of an electric car is better than that of a gasoline car over its life cycle. That is excellent work.

But now they have stumbled. One reason is that the scrap rate is apparently still comparatively high, which is a typical ramp-up effect. They have to sell their cells at too high a price and are not yet able to deliver reliably. It has simply taken longer. I don’t think Northvolt is really to blame here. The matter is simply complex.

But in the end, BMW withdrew its two-billion-euro order. BMW now sources its battery cells from Chinese and Korean manufacturers, some of which produce in Hungary.

Maximilian Fichtner is Professor of Solid State Chemistry at the University of Ulm and has been Managing Director of the Helmholtz Institute Ulm for Electrochemical Energy Storage since October 2021. He is also spokesperson for the Battery Cluster of Excellence POLiS (Post Lithium Energy Storage). With 20 patent applications and 450 publications, he is considered one of Germany’s leading battery researchers.

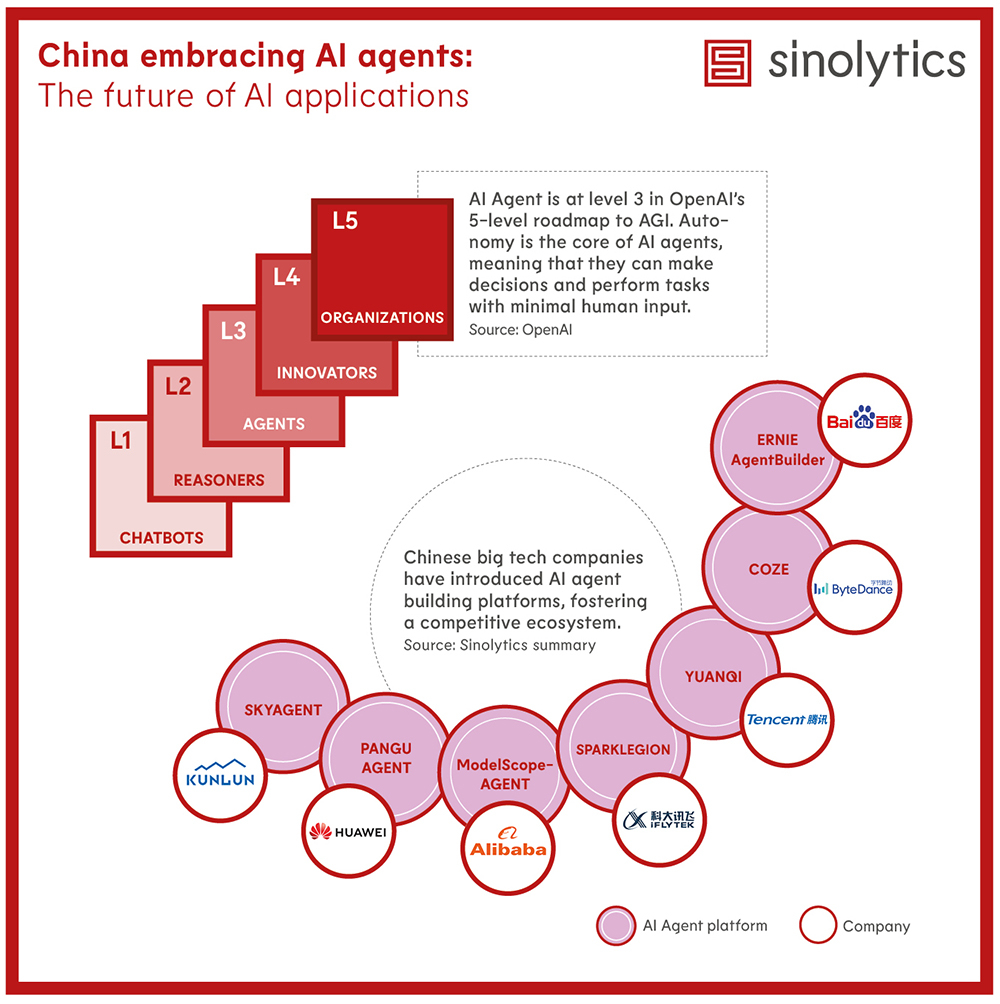

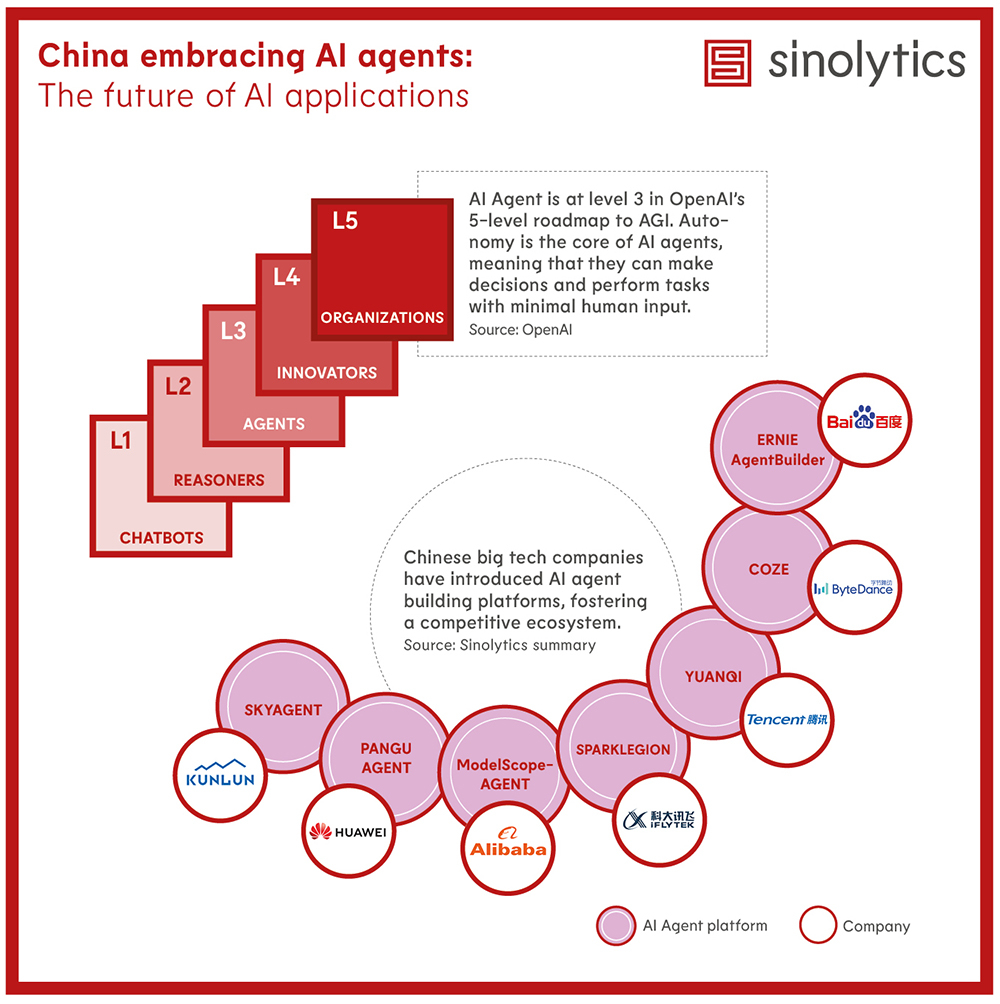

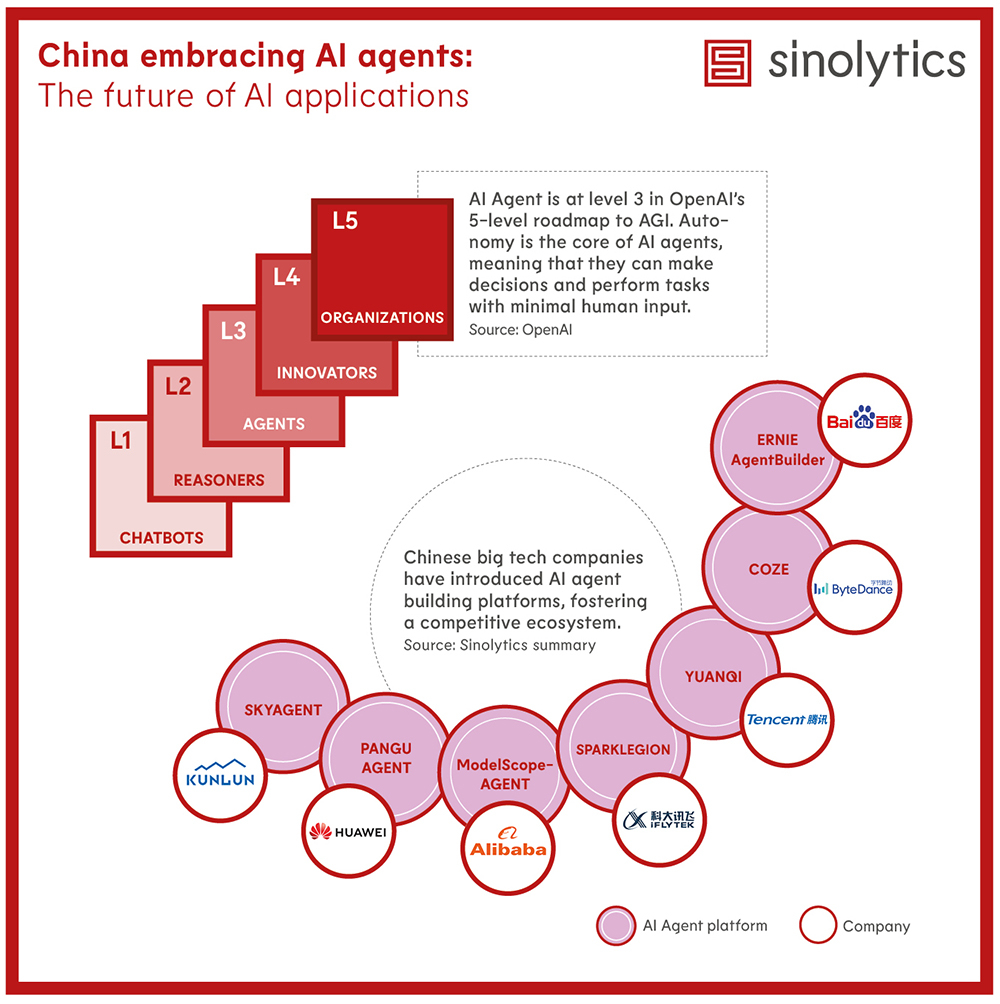

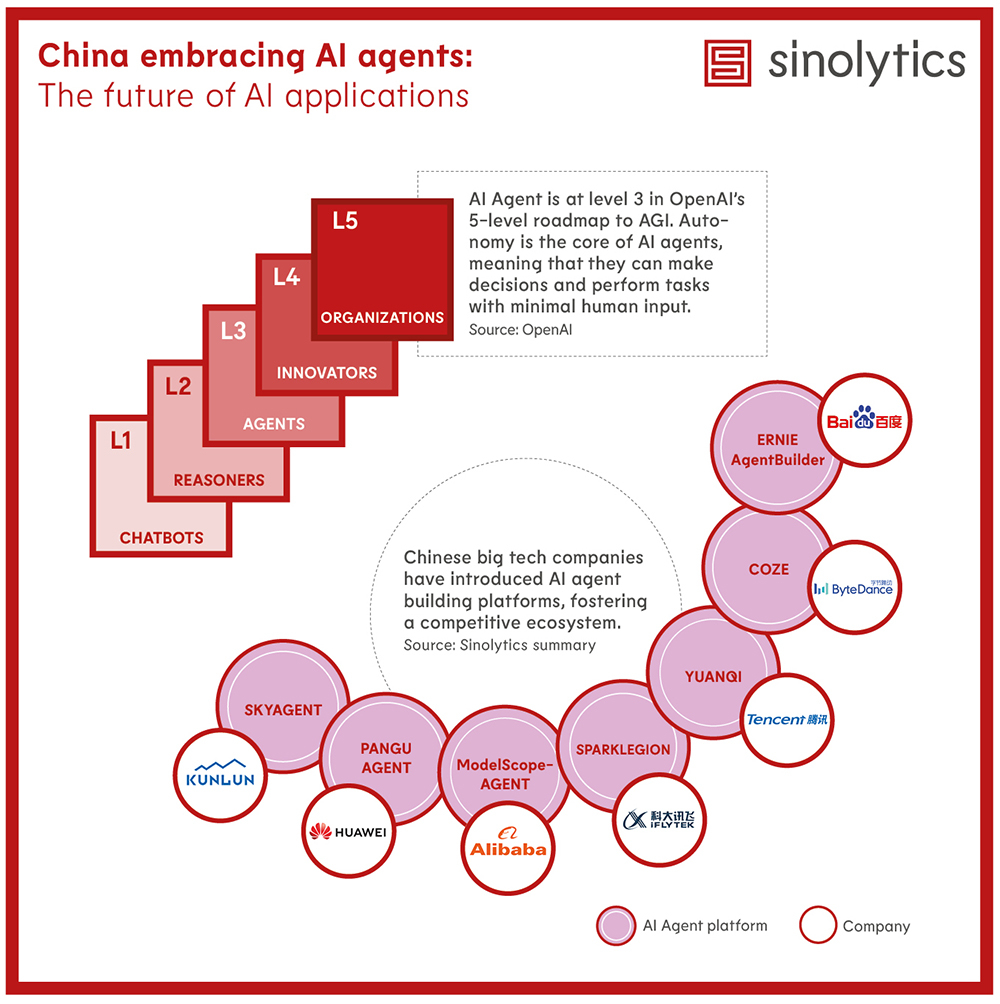

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

For the first time in 40 years, a South Korean president has declared martial law. Late on Tuesday evening (local time), President Yoon Suk Yeol accused the opposition of sympathizing with North Korea. His announcement was immediately met with fierce resistance. The head of parliament declared the move invalid, the parliament itself voted in favor of lifting martial law, and opposition leaders and the head of Yoon’s own party declared martial law unconstitutional. According to the news agency Yonhap, President Yoon lifted martial law just a few hours later after parliament voted against it.

According to a White House spokesperson, the USA is monitoring the situation. China is likely to have been following the situation closely and considering geopolitical opportunities for itself. According to Xinhua, the Chinese embassy in South Korea published a message in the early morning hours (local time), advising Chinese citizens on site to take heightened security precautions. mcl

Promoting Sino-German scientific cooperation is a low priority for the German government. At a two-day meeting between the German Academy of Sciences Leopoldina and researchers from the Chinese Academy of Sciences (CAS) at the end of October, no representatives of the German government attended despite being invited.

“Of course, we had also invited stakeholders from the relevant ministries,” Leopoldina told Table.Briefings. However, active participation in the event was “never planned due to its explicitly scientific focus.” The two-day event in Berlin-Adlershof focused on the scientific exchange between Germany and China on the topic of “carbon neutrality” and was open to the public.

Participants at the event were surprised by the absence of the ministries and interpreted this as a negative attitude towards close scientific cooperation between German and Chinese institutions.

The Federal Ministry of Education and Research (BMBF) “was unable to attend the Leopoldina and CAS conference for scheduling reasons and has therefore sent its DLR Projektträger,” a spokesperson explained. The “DLR Projektträger” is one of the largest project management agencies in Germany and is responsible for the management of funding projects and their technical support on behalf of ministries.

Close scientific cooperation is important in view of the global challenges, particularly in the area of climate neutrality, the statement continues. “It should be noted that China is both a partner and a competitor.” As part of its international relations, the BMBF is primarily in contact with the ministries of the respective countries, “including the relevant Chinese ministries.”

A spokesperson for the Ministry of the Environment referred to the Federal Ministry for Economic Affairs and Climate Action, which is responsible for such matters. “Federal Environment Minister Steffi Lemke was invited, but she canceled her participation for scheduling reasons and due to her different responsibilities,” the statement continued. The Ministry of Economic Affairs, headed by Robert Habeck, did not respond to repeated requests for comment by Table.Briefings. grz

The Chinese chip companies recently placed on a sanctions list by the United States do not expect their business to be significantly affected. Empyrean, a company specializing in software for semiconductor development, announced on Tuesday that it intends to accelerate the process of cutting its ties with foreign suppliers. Jiangsu Nata Opto-Electronic Materials, a supplier of basic materials for chip production, emphasized that its material stocks were well-filled and that it would find domestic replacements for foreign suppliers.

Analysts are divided on the economic impact of the tightened US restrictions on tech exports to the People’s Republic. The current measures are aimed at China’s Achilles heel, warned Martijn Rasser, Managing Director of Datenna, an industry service specializing in the Chinese technology sector. He said that local semiconductor manufacturers heavily depend on machines from foreign suppliers such as ASML from the Netherlands, Applied Materials from the USA and Nikon from Japan.

Other experts pointed out that many Chinese companies had brought forward orders in anticipation of new sanctions. According to the local customs authority, imports of chip production machinery rose by one-third to 24.12 billion US dollars in the first nine months of 2024. According to research firm SemiAnalysis, the additional measures did not affect the business of Chinese companies more than the previous ones. rtr/grz

China plans to ban the export of gallium, germanium, antimony and other materials with potential military applications to the United States. This was announced by the Chinese Ministry of Commerce on Tuesday, one day after Washington’s recent crackdown on the Chinese chip sector. The ministry justified the move on the grounds of protecting national security and interests, among other things.

Gallium and germanium are used in semiconductors, while germanium is also used in infrared technology, fiber optic cables and solar cells. Beijing’s dual-use goods policy, which cites the protection of national security, also requires stricter scrutiny of the end-use of graphite products shipped to the United States.

The curbs strengthen enforcement of existing limits on critical minerals exports that Beijing began rolling out last year, but apply only to the US market. However, Chinese customs data show there have been no shipments of wrought and unwrought germanium or gallium to the US this year through October, although it was the fourth and fifth-largest market for the minerals, respectively, a year earlier. rtr

According to a poll, the people of China consider their country’s relations with Japan far less important than in the past, reports Nikkei Asia. Almost 60 percent of Chinese respondents described relations between Japan and China as either “not important” or “relatively not important.” The figure has also increased significantly compared to last year: In 2023, only 20 percent of respondents rated the relationship of little importance. It is also the worst figure in the 20 years the poll has been conducted, according to its organizers.

The poll was conducted in October and November. The Japanese think tank Genron NPO and the publishing group China International Communications polled citizens of both countries aged 18 and over. They received 1,500 valid responses from China and 1,000 from Japan.

This revealed that bilateral relations are perceived differently in the two countries: 67.1 percent of Japanese respondents rated relations with China as “important” or “relatively important,” while only five percent said they were not important or unimportant.

“Chinese public perceptions toward Japan have deteriorated significantly over the past year,” said Yasushi Kudo, president of Genron, at a press conference in Tokyo on Monday. Gao Anming, editor-in-chief of the China International Communications Group, said that the drastic deterioration in Chinese sentiment towards Japan “cannot be put down to the influence of sudden events. There are doubts on Japan’s strategy regarding a series of issues.”

In addition to the increasing tensions over Taiwan, the imminent return of Donald Trump to the White House also caused uncertainty. When asked how Japan and China should react to the situation between the US and China, 59.3 percent of Chinese responded that “Japan and China should keep their distance from each other.” In contrast, 37.8 percent of Japanese responded that the impact of tensions between China and the US should be “managed to a minimum, and cooperation between Japan and China should be promoted.” jul

Tudor Petru Fabian moves to the European External Action Service (EEAS) after ten years in the European Parliament. There, he will take on a role in the Strategic Communication Department with a focus on combating foreign influence. The political scientist previously specialized in trade policy, EU-China relations and transatlantic trade in Brussels.

Christian Sieling has been Brand Operations Director at the China arm of Porsche Automotive Investment since November. Sieling joined from Chinese EV manufacturer NIO, where he held various roles in Munich and Shanghai, including Head of Europe Market Planning & Strategy.

Is something changing in your organization? Let us know at heads@table.media!

Fishtail wrinkles (鱼尾 yúwěi “fishtail”; 纹 wén “pattern, grain,” here from 皱纹 zhòuwén “wrinkles”) appeal to some, while others fight them with Botox. Be that as it may: In the Western world, we know the small wrinkles in the eye area with their radial structure colloquially as “crow’s feet,” whereas the Chinese tend to refer to them as “fishtails.”

Want more? Go to www.new-chinese.org

The snap elections in Germany will also be closely observed in Beijing. Amid numerous global challenges and an unpredictable US partnership under Trump, Germany’s strategic alignment towards China becomes a crucial factor that no political party can ignore. Manuel Liu asked the parliamentary groups in the German Bundestag which China policy direction they want to take: Is it the same old, in line with the existing China strategy, or a new course that takes current developments into account?

One thing became clear: the far-right AfD and the Left are swimming against the tide. Both parties emphasize the economic benefits of a deeper partnership with China. The AfD even calls for abolishing the Supply Chain Act and total restraint in the Indo-Pacific. The Left also advocates closer relations to tackle global challenges such as climate change or the war in Ukraine. Our overview shows what the others think and what positions they take.

Maximilian Fichtner, a battery expert from the Helmholtz Institute in Ulm, explains in an interview with our ESG colleague Carsten Hübner that the German car manufacturers made a clear mistake by not focusing on their own battery production. While the German companies, after tentative attempts, resorted to the idea that batteries could also be purchased, the Chinese “shoveled mud for five years” to achieve acceptable results. Some of them are now world market leaders. The former top dogs from Mercedes and Co. have become supplicants.

Fichtner concludes that the fundamental problem underlying their misjudgments still prevails today: They don’t want to take any risks and, above all, seek short-term profits. But it takes time to build up the necessary know-how. The EU tariffs could provide a final small buffer to catch up after all. “The only question is how this time will be used.”

Whoever wins the upcoming snap election in Germany will face many challenges from day one: The German economy is slowing down, the war in Ukraine is entering its third year, and Donald Trump’s return to the White House raises many geopolitical questions. Sooner or later, developments in all these problem areas will also depend on China. This makes it more important than ever in this parliamentary election campaign how the various political parties position their China policy.

How do they want to shape Sino-German relations? Which aspects of the current government’s China strategy do they want to retain, which do they want to adjust, and which do they want to abandon, Table.Briefings asked the parliamentary groups in the Bundestag. The conclusion: the Social Democratic Party (SPD) and the Green Party want to build on the existing China strategy, the Free Democratic Party (FDP) and the Christian Democratic Union (CDU/CSU) take a more critical view of current relations, while the far-right AfD and the Left Party want to expand partnership with China.

For the SPD, the China strategy adopted in 2023 is a very good basis “for our China policy – regardless of the outcome of the parliamentary elections,” says Nils Schmid, foreign policy spokesperson for the SPD parliamentary group in the Bundestag. The party continues to rely on de-risking. Schmid says: “If we continue this de-risking, we can better manage the risks while maintaining economic contacts with China, but on a more secure basis.”

The goal of minimizing risk was an important part of the German national China strategy and European China policy. However, Chancellor Olaf Scholz attempted to secure market access and orders for German companies in China in parallel, a move reminiscent of Germany’s China policy over the past three decades.

Schmid sees less need for de-risking at companies and instead focuses on critical infrastructure. The SPD would like to create common rules in the EU for areas such as the rail network, 5G/6G networks, artificial intelligence, quantum computing and goods for military use. Regarding the latter, Schmid proposes outbound investment screening at the EU level. The SPD also wants to work with the EU to protect supply chains – for example, of active medical ingredients – and diversify sources of raw materials such as rare earths.

Moreover, the Social Democrats in the EU want a “strategically oriented and coordinated industrial and innovation policy,” says Schmid, in order to gain an innovative and technological edge in certain core areas, as the United States and China have done. The aim is to eliminate expensive patenting, market fragmentation, slow standardization and a lack of expertise, which are seen as obstacles to innovation.

The SPD also plans to improve support along the entire innovation development chain. The aim is to “kick-start” the transfer between state-funded research and marketable production and, ultimately, value creation in Germany and Europe, says Schmid. However, he acknowledges that much depends on the EU. He therefore calls for expanding the EU’s global partnerships, such as the Mercosur agreement with four South American countries.

The SPD also wants to expand relations with countries in the Indo-Pacific. The parliamentary group unanimously adopted a corresponding position paper on Tuesday, in which the region is described as the “decisive center of gravity of the world order of today and tomorrow.” Accordingly, the SPD wants to expand its expertise on both China and the Indo-Pacific.

The Green Party also wants to stick to its current China policy. “With the China strategy, we have laid the foundation for a new, more realistic China policy,” says deputy parliamentary group leader Agnieszka Brugger. “After the naive glossing over of the Grand Coalition, the China strategy of this federal government focuses on our security, protecting our infrastructure and working for a rules-based international order and human rights.”

Brugger emphasizes the cooperation in the Indo-Pacific, such as the passage of the Taiwan Strait by the frigate “Baden-Württemberg” and the supply vessel “Frankfurt am Main.” These “consistent actions” would bring the “clever words” of the China strategy to life, Brugger continues. According to Brugger, “reducing vulnerabilities and taking a clear stance” is more important than revising the strategy. The Greens would also like to represent their own values and interests with Europe in a joint China policy.

The FDP intends to adapt the China strategy to highlight China’s role as Europe’s rival more clearly, says Ulrich Lechte, foreign policy spokesperson for the FDP parliamentary group in the Bundestag. One reason for this is Trump’s re-election and the resulting geopolitical changes. The FDP wants to prevent Germany and Europe from falling into a “tariff spiral” between the United States and China.

To this end, the party aims to reduce dependencies. To achieve this, the economic liberals remain committed to de-risking, particularly in critical infrastructure, diversifying supply chains and building up competencies in Europe. In addition to competition and system rivalry, the FDP wants to “reflect our own attitude towards China even more intensively, and consistently fill the China strategy with life,” says Lechte.

When asked, the CDU/CSU faction referred to its China strategy published in 2023, its proposal for a China commission in the Bundestag and its election manifesto, which is yet to be published. The proposed China Commission is supposed to review “security-relevant economic relations” with China.

In the 2023 position paper, the CDU/CSU presents China with the EU’s familiar triad of partner, systemic competitor and economic rival. In order to counter a Sinocentric global order, the CDU and CSU want, for example, to develop a strategically oriented transatlantic China policy between the USA and the EU, focus on reciprocity in the tense trade relations and establish a national security council within the Federal Chancellery to “ensure coherence in China policy.”

All major parties currently rule out a coalition with the AfD, which is why it will probably continue to pursue its China policy goals as part of the opposition. The AfD sees no clear positioning of Sino-German relations in the government’s China strategy, a lack of action plans and inadequate involvement of the business community.

The AfD would prefer to strengthen Germany’s partnership with China as an essential trading partner, says deputy parliamentary group leader Stefan Keuter. This includes abolishing the Supply Chain Act. Instead, the party wants to place “great emphasis” on market access, reciprocity, protection of intellectual property and equal opportunities. The AfD also wants to reduce the German military presence in the Indo-Pacific.

The Left Party fights for a place in the Bundestag. MP Gregor Gysi aims to promote “good relations” with China, which he says are necessary to end the war in Ukraine, defeat world hunger, achieve climate targets and resolve the Taiwan question peacefully.

The Sahra Wagenknecht Alliance did not respond to Table.Briefings’ question regarding its China policy focus.

Mr. Fichtner, the crisis at Northvolt reinforces the impression that Europe is struggling to catch up with China in battery production. Does the European automotive industry even need its own battery production?

In-house battery production is important because the battery is the part of the electric car with the greatest added value. We are talking about around a third of the car price. Meanwhile, batteries have become cheaper and are somewhere between 6,000 and 8,000 euros. But there is still a margin. If that is lost, you have to look at how you can still produce the rest of the vehicle economically.

It is hard to imagine that the German car manufacturers have failed to notice this.

This has actually been ignored in the past. Instead, in the 2010s, they said that batteries are bought-in parts, and a car manufacturer doesn’t need to bother with them. In hindsight, that was a clear misjudgment.

Is it so difficult to build EV batteries?

When a battery manufacturer sets up a new production line, it turns out that many cells are good. Others, however, are faulty or do not have the desired performance. They are then rejected. This is known as the scrap rate.

The scrap rate is what can kill the whole thing. Ultimately, the scrap rate must fall to a low single-digit percentage. All battery manufacturers had to go through this, including the Chinese. They shoveled mud for five years, but they pulled through. They ended up becoming the global market leader.

Couldn’t German companies have done the same?

In the 2010s, we had an entire battery cell production facility at Li-Tec Battery in Kamenz. The company was then partially acquired by Daimler AG (now the Mercedes-Benz Group). There were initial problems there, too. Because the company was only in the black in single figures, Daimler eventually said: It’s not profitable, we’re closing it down. I believe that with a little more time, something great could have been achieved here.

The problem is that they don’t want to take risks and generate short-term profits. But building up the necessary expertise and fine-tuning these tiny adjustments to achieve something close to perfection takes time. That doesn’t happen overnight. If we don’t think more long-term, then others will supply us for everything that is similar in some way.

Is there a realistic chance of Europe catching up in battery production?

A cutthroat price war is currently raging in China. From the outside, the Chinese economy always looks relatively homogeneous. But internally, competition is fierce. This has led to an undercutting race and overproduction.

In some cases, the price of battery cells is now well below 100 US dollars per kilowatt-hour. This has always been regarded as the limit at which an electric car can be cheaper than a gasoline car of the same size. This is actually good news. In China, two-thirds of electric cars are now cheaper than comparable gasoline cars.

However, this makes it harder for Europeans to enter the market. Especially as we have different framework conditions here, such as higher energy prices. Labor costs are also higher, although the latter does not play such a major role. Partly because production is largely automated and because skilled workers in China now also earn quite well.

Do the tariffs imposed by the EU on EVs from China have any effect in this context?

The tariffs can help buy some time. The only question is how to use this time. Do the automotive industry and investors have the perseverance to get through the difficult transition phase? Then, in my view, they could also become competitive. If they remain largely stuck in the gasoline car sector, they will dwindle in this ever-shrinking niche and eventually disappear.

Incidentally, Brussels was already thinking about how to keep up with the Chinese five years ago. I was involved in these deliberations. The result was to focus on green battery cells. In other words, battery cells that meet certain minimum standards in terms of CO2 footprint, composition and the like.

Isn’t Northvolt heading in this direction?

Exactly. The carbon footprint of their battery cell in 2020 was between 120 and 150 kilograms of CO2 per kilowatt-hour. As far as I know, Northvolt is now at 30 or 40 kilograms of CO2 per kilowatt-hour and is expected to reach 10 next year. That means it will no longer take 20,000 or 30,000 kilometers of driving, but perhaps only 2,000 or 3,000 kilometers until the carbon footprint of an electric car is better than that of a gasoline car over its life cycle. That is excellent work.

But now they have stumbled. One reason is that the scrap rate is apparently still comparatively high, which is a typical ramp-up effect. They have to sell their cells at too high a price and are not yet able to deliver reliably. It has simply taken longer. I don’t think Northvolt is really to blame here. The matter is simply complex.

But in the end, BMW withdrew its two-billion-euro order. BMW now sources its battery cells from Chinese and Korean manufacturers, some of which produce in Hungary.

Maximilian Fichtner is Professor of Solid State Chemistry at the University of Ulm and has been Managing Director of the Helmholtz Institute Ulm for Electrochemical Energy Storage since October 2021. He is also spokesperson for the Battery Cluster of Excellence POLiS (Post Lithium Energy Storage). With 20 patent applications and 450 publications, he is considered one of Germany’s leading battery researchers.

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

For the first time in 40 years, a South Korean president has declared martial law. Late on Tuesday evening (local time), President Yoon Suk Yeol accused the opposition of sympathizing with North Korea. His announcement was immediately met with fierce resistance. The head of parliament declared the move invalid, the parliament itself voted in favor of lifting martial law, and opposition leaders and the head of Yoon’s own party declared martial law unconstitutional. According to the news agency Yonhap, President Yoon lifted martial law just a few hours later after parliament voted against it.

According to a White House spokesperson, the USA is monitoring the situation. China is likely to have been following the situation closely and considering geopolitical opportunities for itself. According to Xinhua, the Chinese embassy in South Korea published a message in the early morning hours (local time), advising Chinese citizens on site to take heightened security precautions. mcl

Promoting Sino-German scientific cooperation is a low priority for the German government. At a two-day meeting between the German Academy of Sciences Leopoldina and researchers from the Chinese Academy of Sciences (CAS) at the end of October, no representatives of the German government attended despite being invited.

“Of course, we had also invited stakeholders from the relevant ministries,” Leopoldina told Table.Briefings. However, active participation in the event was “never planned due to its explicitly scientific focus.” The two-day event in Berlin-Adlershof focused on the scientific exchange between Germany and China on the topic of “carbon neutrality” and was open to the public.

Participants at the event were surprised by the absence of the ministries and interpreted this as a negative attitude towards close scientific cooperation between German and Chinese institutions.

The Federal Ministry of Education and Research (BMBF) “was unable to attend the Leopoldina and CAS conference for scheduling reasons and has therefore sent its DLR Projektträger,” a spokesperson explained. The “DLR Projektträger” is one of the largest project management agencies in Germany and is responsible for the management of funding projects and their technical support on behalf of ministries.

Close scientific cooperation is important in view of the global challenges, particularly in the area of climate neutrality, the statement continues. “It should be noted that China is both a partner and a competitor.” As part of its international relations, the BMBF is primarily in contact with the ministries of the respective countries, “including the relevant Chinese ministries.”

A spokesperson for the Ministry of the Environment referred to the Federal Ministry for Economic Affairs and Climate Action, which is responsible for such matters. “Federal Environment Minister Steffi Lemke was invited, but she canceled her participation for scheduling reasons and due to her different responsibilities,” the statement continued. The Ministry of Economic Affairs, headed by Robert Habeck, did not respond to repeated requests for comment by Table.Briefings. grz

The Chinese chip companies recently placed on a sanctions list by the United States do not expect their business to be significantly affected. Empyrean, a company specializing in software for semiconductor development, announced on Tuesday that it intends to accelerate the process of cutting its ties with foreign suppliers. Jiangsu Nata Opto-Electronic Materials, a supplier of basic materials for chip production, emphasized that its material stocks were well-filled and that it would find domestic replacements for foreign suppliers.

Analysts are divided on the economic impact of the tightened US restrictions on tech exports to the People’s Republic. The current measures are aimed at China’s Achilles heel, warned Martijn Rasser, Managing Director of Datenna, an industry service specializing in the Chinese technology sector. He said that local semiconductor manufacturers heavily depend on machines from foreign suppliers such as ASML from the Netherlands, Applied Materials from the USA and Nikon from Japan.

Other experts pointed out that many Chinese companies had brought forward orders in anticipation of new sanctions. According to the local customs authority, imports of chip production machinery rose by one-third to 24.12 billion US dollars in the first nine months of 2024. According to research firm SemiAnalysis, the additional measures did not affect the business of Chinese companies more than the previous ones. rtr/grz

China plans to ban the export of gallium, germanium, antimony and other materials with potential military applications to the United States. This was announced by the Chinese Ministry of Commerce on Tuesday, one day after Washington’s recent crackdown on the Chinese chip sector. The ministry justified the move on the grounds of protecting national security and interests, among other things.

Gallium and germanium are used in semiconductors, while germanium is also used in infrared technology, fiber optic cables and solar cells. Beijing’s dual-use goods policy, which cites the protection of national security, also requires stricter scrutiny of the end-use of graphite products shipped to the United States.

The curbs strengthen enforcement of existing limits on critical minerals exports that Beijing began rolling out last year, but apply only to the US market. However, Chinese customs data show there have been no shipments of wrought and unwrought germanium or gallium to the US this year through October, although it was the fourth and fifth-largest market for the minerals, respectively, a year earlier. rtr

According to a poll, the people of China consider their country’s relations with Japan far less important than in the past, reports Nikkei Asia. Almost 60 percent of Chinese respondents described relations between Japan and China as either “not important” or “relatively not important.” The figure has also increased significantly compared to last year: In 2023, only 20 percent of respondents rated the relationship of little importance. It is also the worst figure in the 20 years the poll has been conducted, according to its organizers.

The poll was conducted in October and November. The Japanese think tank Genron NPO and the publishing group China International Communications polled citizens of both countries aged 18 and over. They received 1,500 valid responses from China and 1,000 from Japan.

This revealed that bilateral relations are perceived differently in the two countries: 67.1 percent of Japanese respondents rated relations with China as “important” or “relatively important,” while only five percent said they were not important or unimportant.

“Chinese public perceptions toward Japan have deteriorated significantly over the past year,” said Yasushi Kudo, president of Genron, at a press conference in Tokyo on Monday. Gao Anming, editor-in-chief of the China International Communications Group, said that the drastic deterioration in Chinese sentiment towards Japan “cannot be put down to the influence of sudden events. There are doubts on Japan’s strategy regarding a series of issues.”

In addition to the increasing tensions over Taiwan, the imminent return of Donald Trump to the White House also caused uncertainty. When asked how Japan and China should react to the situation between the US and China, 59.3 percent of Chinese responded that “Japan and China should keep their distance from each other.” In contrast, 37.8 percent of Japanese responded that the impact of tensions between China and the US should be “managed to a minimum, and cooperation between Japan and China should be promoted.” jul

Tudor Petru Fabian moves to the European External Action Service (EEAS) after ten years in the European Parliament. There, he will take on a role in the Strategic Communication Department with a focus on combating foreign influence. The political scientist previously specialized in trade policy, EU-China relations and transatlantic trade in Brussels.

Christian Sieling has been Brand Operations Director at the China arm of Porsche Automotive Investment since November. Sieling joined from Chinese EV manufacturer NIO, where he held various roles in Munich and Shanghai, including Head of Europe Market Planning & Strategy.

Is something changing in your organization? Let us know at heads@table.media!

Fishtail wrinkles (鱼尾 yúwěi “fishtail”; 纹 wén “pattern, grain,” here from 皱纹 zhòuwén “wrinkles”) appeal to some, while others fight them with Botox. Be that as it may: In the Western world, we know the small wrinkles in the eye area with their radial structure colloquially as “crow’s feet,” whereas the Chinese tend to refer to them as “fishtails.”

Want more? Go to www.new-chinese.org