The BRICS summit is dominating the global political debate these days. Since yesterday, Tuesday, the heads of state and governments of five large emerging countries have been meeting in Johannesburg, demanding more say in the global order: China, India, Russia, Brazil and South Africa. They see themselves as advocates of the Global South, which is increasingly raising its voice in the growing discussion about the role of the “West.” China is the economic and political heavyweight of this heterogeneous group. The coming days will show whether it will exert its influence on the BRICS or whether the five countries will reach an equal agreement, for example on a method for admitting more countries.

In any case, the summit will mark the end of an era, as Frank Sieren analyzes: A period in which the minority of the Global North was able to set the rules for the majority of the rest of the world. The BRICS countries want to be involved in the shaping of the world order and its rules.

And even if not all of them consider themselves opponents of the United States, they are relatively united in their criticism, for example, of the Bretton Woods financial system of the World Bank and the International Monetary Fund, dominated by the US and Europe. That is why a key focus of the group is the so-called de-dollarization: Settling global trade flows in other currencies instead of the US dollar. Finn Mayer-Kuckuk explains what the BRICS are trying to achieve and why the Chinese yuan will not become the reserve currency for the time being.

We will be closely following the summit through Thursday and hope you enjoy reading,

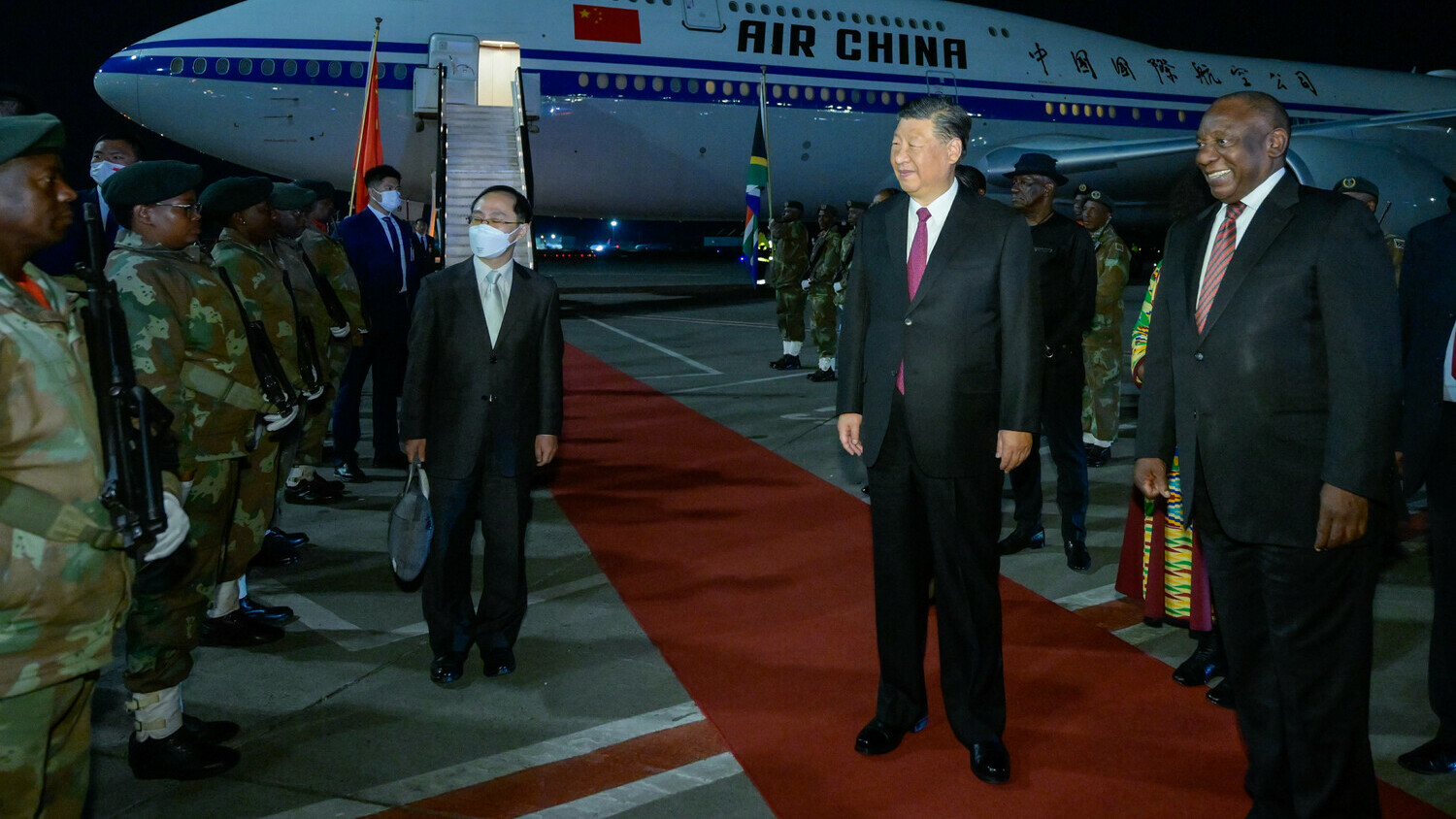

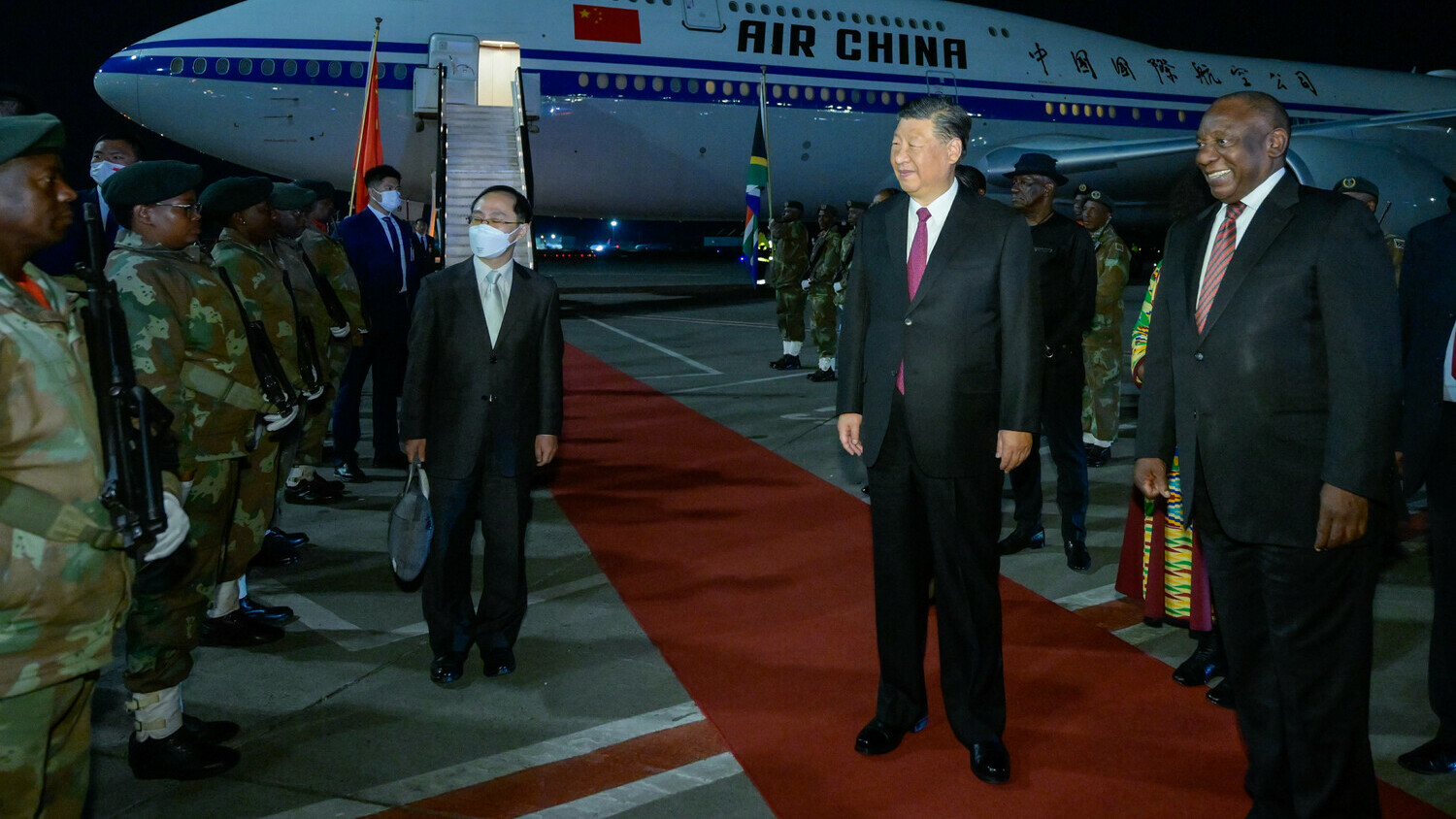

Tuesday was just a warm-up before the big summit of the BRICS countries China, India, Russia, Brazil and host South Africa in Johannesburg. The summit’s goal is to give the group new momentum in its push to give itself and other countries of the Global South a greater say in global politics. A central concern of President Xi Jinping at the meeting with South Africa’s President Cyril Ramaphosa: The enlargement of the group to include new members.

According to South Africa, 40 countries are generally interested, and 23 have explicitly voiced their interest. There is no list of candidates, but names such as Saudi Arabia, Egypt, Indonesia or Argentina are circulating. Countries are “knocking on the door of the BRICS,” Xi wrote in a guest article published in several South African media outlets on Monday. “China, together with its BRICS partners, would like to take the lead in making the framework of cooperation play an even more important role internationally and make the BRICS’ voice even louder,” the article said.

Enlargement is likely to become a core topic of the summit. Above all, China and Russia are pushing for enlargement in order to create a counterweight to the G7 alliance of the leading Western developed countries. India, Brazil and South Africa, which maintain closer relations with Western countries, are somewhat more cautious. “We do not want to be a counterpoint to the G7, G20 or the United States,” Brazilian President Luiz Inácio Lula da Silva said on Tuesday. The BRICS group is not meant to challenge other international coalitions or the US.

Either way, the 15th BRICS Summit is historic. Because an era is coming to an end in South Africa. An age in which the Western minority could dictate the rules that governed the majority of the world. This era started with the colonial era. For a long time, the Europeans had global supremacy, most recently the British Empire, which ruled a quarter of the world just 100 years ago. By the middle of the 20th century at the latest, dominance shifted to the United States, which rose to become the sole world power in the late 20th century after the collapse of the Soviet Union.

The USA remained the only global power for the following three decades. That was the time when China was still preoccupied with itself. Although the People’s Republic was already the world’s workbench, it had little influence on the global rules. Even today, China’s influence would still be limited if the emerging countries had not joined forces in the BRICS.

These countries could hardly be more different: Russia and China have authoritarian systems; India, Brazil and South Africa are democracies. Their level of development differs greatly. China’s economy is larger than the four others combined: It accounts for 18 percent of the world economy. Russia, not even three percent. China is a high-tech and manufacturing power, South Africa is a resource power. China, Russia and India own nuclear weapons, the other two do not.

But one thing unites them: They want more global co-determination and, thus, a true end to the colonial era. They want a world order that no longer reflects the power relations of 70 years past, but those of today. They want the end of a world that could afford not to confront the colonial era.

The fact that the BRICS countries have moved closer together in the shadow of the Ukraine war, of all things, is a bitter irony of history. Vladimir Putin is virtually present at the table. He did not enter the country for fear of arrest: As a member of the International Criminal Court, South Africa would have had to execute the arrest warrant against Putin in connection with the war.

The other BRICS members want to achieve peace in Ukraine not through sanctions or Russia’s exclusion from the global community, but through negotiations. United in this way, they gather for the first time in person after three virtual COVID years. This is irritating and bitter for an EU that would prefer to see Russia as an outsider.

The actions of Russia’s four BRICS partners are certainly a bit defiant. They want to do things differently from the established developed countries. They are not for China and against the USA, but they want to have a say. They want to have a choice. The fact that they are now powerful enough to do so feels good to them. There is a spirit of optimism.

After all, the BRICS have suddenly become a serious counter-movement to the G7, the club of rich industrialized nations. Founded in 1973, the G7 (USA, Canada, Germany, France, Great Britain, Italy and Japan) now represent 10 percent of the global population and 27 percent of the global economy, and the trend is declining. However, the average per capita income of the G7 is three times above the global average. After a temporary enlargement to the G8 through the inclusion of Russia, the club reverted to the G7 in 2014 because Russia was expelled in 2014 due to the annexation of Crimea.

When Goldman Sachs executive Jim O’Neill coined the term “Bric” in 2001, the four – initially without South Africa – were developing countries with exciting investment opportunities. China was admitted to the WTO in the same year – at that time, on its way to becoming the world’s workbench, and by no means considered a competitor.

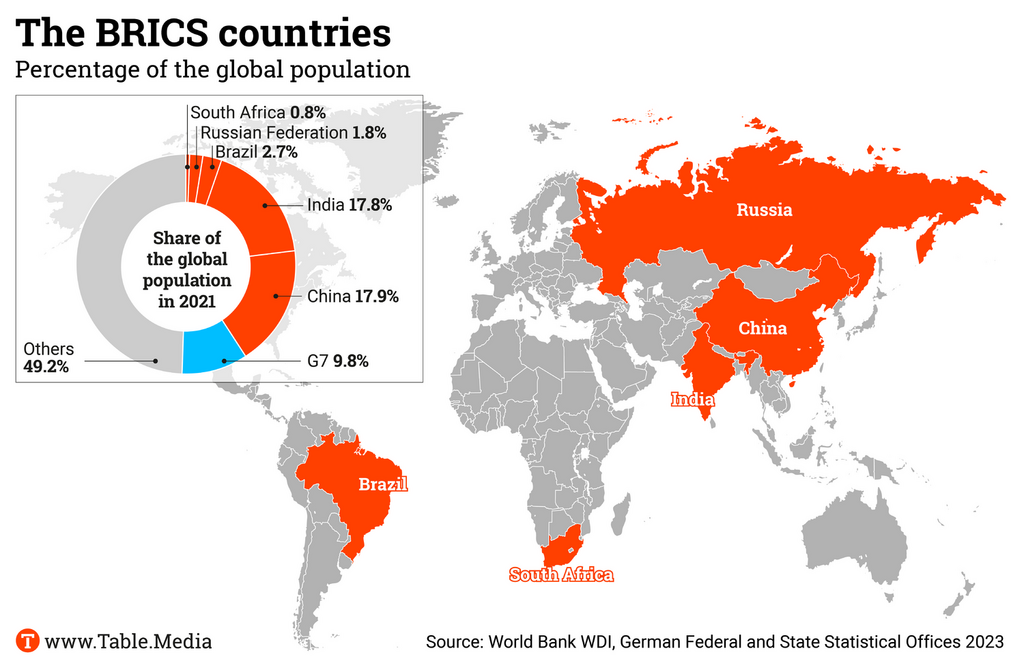

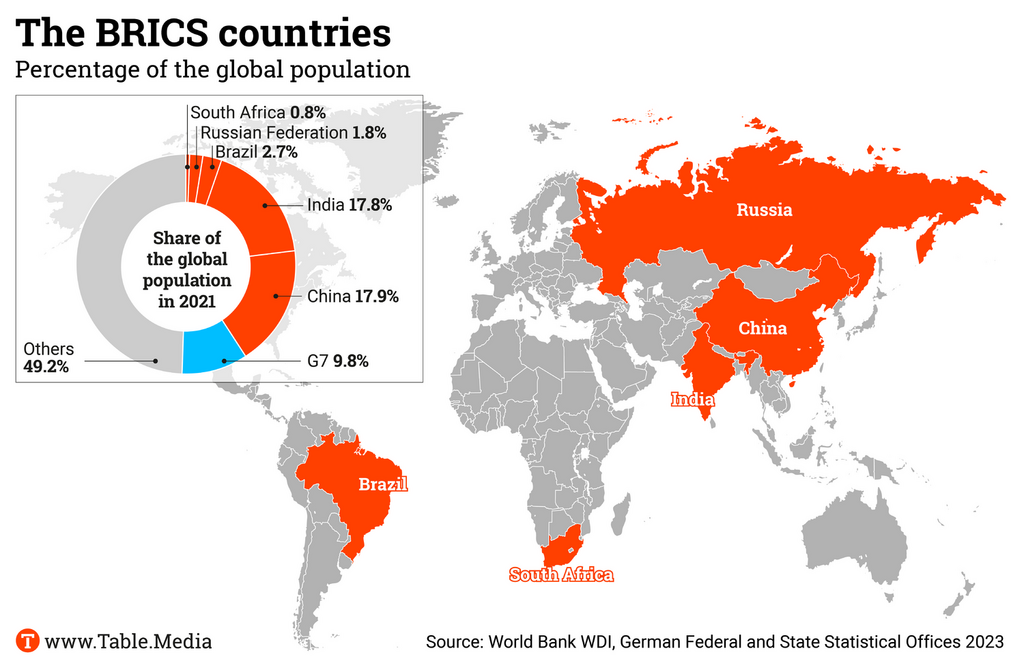

In 2009, the BRIC countries convened for the first time at the level of heads of state and government; a year later, South Africa joined them, making the group the “BRICS.” In the meantime, these once-small countries are big and economically strong: They represent 40 percent of the global population – far more than the G7 – and, according to calculations by the International Monetary Fund (IMF), contribute 32 percent to the global economy, more than the G7. The trend is likely irreversible: The IMF expects a ratio of 27.8 percent (G7) to 35 percent (BRICS) for 2028.

From their perspective, the G7 represents the free, prosperous, benevolent and progressive world that wants to cooperate to create a fairer, greener and more prosperous future. They have long been able to prevail against the upstarts, even though they are a global minority.

But in the eyes of some representatives of the global majority, they represent only a wealthy, often arrogant global minority of former colonial powers. Powerless, confused and opinionated, with outdated views, characterized by double standards. The BRICS states are rising up against it. They want mutual respect, understanding, equality and solidarity – according to the BRICS Declaration of 2022.

This fits into a currently swelling global debate about the role of the West. Other large emerging countries, including democracies, have an ambivalent relationship with the Global North due to colonialism or the climate sins of the developed countries.

And this is not just about narratives, but also about power and concrete interests. The long list of candidate countries shows how attractive this is. And by its own words, BRICS wants to be an “open, inclusive and consensus-oriented” South-South cooperation. The concerns of such South-South cooperation are gaining significance. In order for the United Nations or the G20 to remain functional, the West will have to compromise with the BRICS countries from now on. Because without them, there are no more majorities.

Although many scenarios are conceivable in which the BRICS countries clash and the Americans once again have the last laugh, it is more likely that a new world order will emerge that is no longer characterized by the rule of law of a powerful minority but by the consensus of a relative majority of different compositions. It will then – hopefully – also tame the autocratic yearnings of the ever-stronger superpower China. Collaboration: Christiane Kuehl

Those who own the world’s reserve currency have enormous advantages. The US, for instance, can take on unlimited debt because there is unlimited demand for dollars. This means that they can also sustain a trade deficit of any size.

But the dream of the Global South to replace the dollar as the reserve currency also has political-psychological reasons. The constant use of the dollar for business, even far from the United States, is a constant reminder of who is still the dominant economy on the planet.

There are now two options for replacing the US dollar. China is quite openly encouraging its trading partners to use its currency and is proposing a transition to the yuan in the BRICS framework as well. Other BRICS countries, on the other hand, prefer the idea of an entirely new currency because they do not want to replace a focus on the United States with a focus on China. Instead, their goal is true diversity.

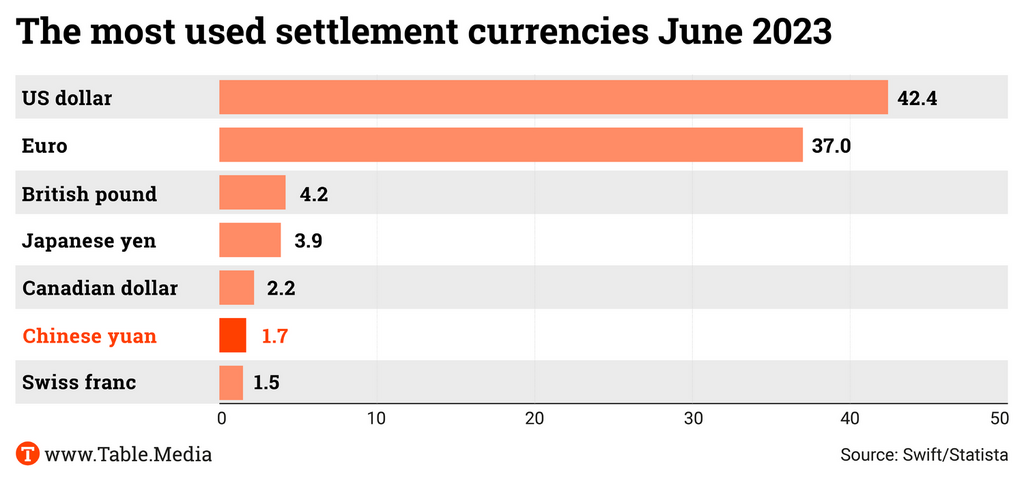

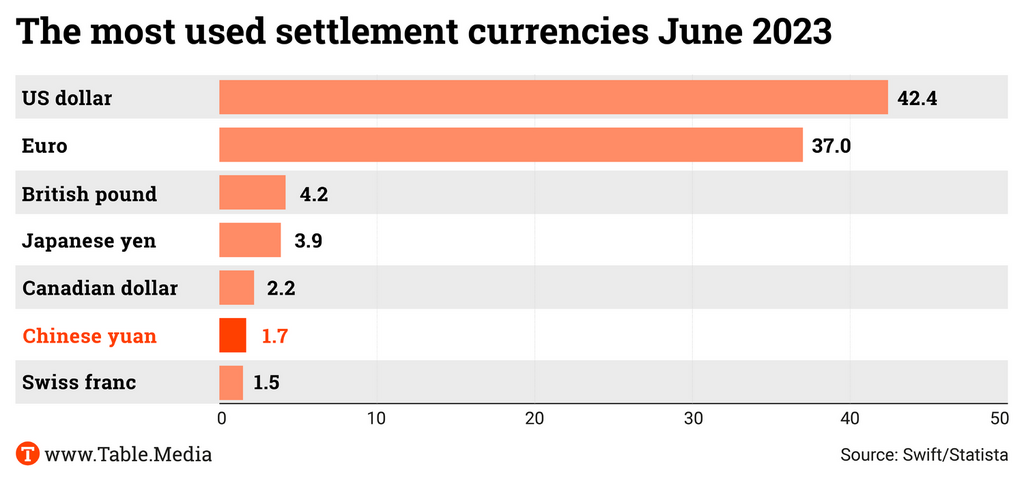

But this discussion concerns a distant future. In fact, the dollar currently accounts for just over 40 percent of all transactions in the Swift international payment system, followed by the euro at somewhere between 30 and 40 percent. The British pound and the Japanese yen account for single-digit percentages, and the yuan accounts for around two percent of the transaction volume.

The exact values fluctuate monthly. For instance, when Germany purchases a shipment of liquefied natural gas from Qatar and pays for it, the transaction is denominated in dollars. This applies to virtually all cross and lateral relationships in global trade, even without American involvement.

That has not changed even after China brought the yuan into play as an alternative. Separate programs have existed for this since about 2010, and there is an ongoing discussion about the progress of tradability. Beijing has high hopes for overseas yuan trading hubs, such as Frankfurt.

The yuan has now become the most important currency for direct trade with China, which is a success for Chinese foreign exchange policy. But in this case, trading partners use, for instance, yuan earned from the sale of raw materials to buy industrial products from China in return. Unlike the dollar, the yuan plays no role unless its home country participates.

This is because the yuan is not freely tradable. The USA, Japan or the Europeans have the self-confidence to leave their currency to the free play of the market. Any currency trader in the world can buy and sell the dollar in any quantity. In the process, market prices constantly arise in comparison to other currencies. In the process, a crash also happens occasionally, as is the case now with the yen.

As a result, China cannot and will not make its socialist “people’s currency,” which is directly translated as renminbi, freely tradable. President Xi Jinping wants to market the yuan as an international trading currency, but he also wants to maintain control over the domestic financial sector. Both are not possible.

The CCP is well aware of why it has chosen this course. If the yuan were freely tradable, a rapid flight from China’s financial markets would have occurred with the start of the real estate crisis. This is because local banks and local governments have been caught in the spiral of falling property valuations. Consequently, the yuan would experience a rapid decline in value and, thus, a loss of confidence. The Chinese economy would lack money on every level.

But none of this can happen. Because the Chinese central bank sets the exchange rate globally every day within a fixed fluctuation range. This means that the currency is still controlled and not freely convertible. It is also impossible to freely transfer money to other countries. Corporate finance departments must submit requests for large sums. All of this means that the yuan is not part of the global currency trade. So as long as China is unwilling to accept capital flight and exchange rate fluctuations, the yuan will not become the world’s reserve currency.

However, currencies play a role not only in trade, but also as foreign exchange reserves. This phenomenon has only emerged with the end of the gold standards. Before that, central banks stocked up on gold to stabilize their own exchange rates in crises.

Today, money is a mere computer game – and the dollar has largely replaced the role of gold, because it is accepted everywhere in the world. According to 2022 figures from the International Monetary Fund, the dollar dominates global foreign exchange reserves with a share of just under 60 percent, followed by the euro with just under 20 percent. The renminbi was at 2.9 percent.

However, the high global dollar reserves are also due to the gigantic US trade deficit. The deficit inevitably means that the United States receives more goods than its business partners abroad – and the latter are stuck with their dollars in return. This is also true for China and its companies.

And those who hold dollars must invest them in dollar-denominated monetary assets. These are primarily US government bonds. When China generates a trade surplus with the United States, it not only supplies quasi-free products to America, but also finances the US budget. In May, China held nearly 847,000 billion dollars in US bonds alone, according to data provider CEIC Data. While that is significantly less than the 1,300 billion in November 2013, it is still quite a lot.

No wonder China is also keen to free itself from this toxic relationship. But that proves difficult. China’s exporters create valuable jobs in American trade. For this reason, a shift of reserves away from the dollar is underway. But this does not change its dominance.

The euro might rank second due to the size and depth of the European economic area, but it is also no threat to the dollar’s supremacy. Yet this was once one of the hopes attached to the introduction of the European currency.

However, a common BRICS currency would have good prospects of competing with the dollar, at least in the Global South, as a foreign exchange currency for setting trade and reserve building. If the BRICS countries all pull together and firmly launch such a project, the dollar and euro areas can do little to prevent their declining significance.

The plan brings back memories of the ECU. The European Currency Unit was a precursor to the euro when each member state still had its own foreign currencies, such as deutschmarks and francs. Another comparison that comes to mind is the International Monetary Fund’s special drawing rights, which can also partly be used like money without displacing national currencies.

However, the question arises about how far the BRICS countries will put aside their own interests to pave the way for a joint project. Their anger at the old West may unite them, but that is not enough of an economic policy program. Will Russia, India, China and Brazil really limit their financial freedom for the benefit of others?

The euro shows how much coordination a joint currency project requires. It spans a comparatively homogeneous economic area and is still repeatedly plagued by problems. The euro’s existence is the product of a historical constellation in which all participants were willing to make significant concessions and surrendered financial sovereignty.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

According to the words of Foreign Minister Annalena Baerbock, Germany intends to work more closely with nations such as Australia to de-escalate tensions in the Indo-Pacific region. China posed a challenge to the “fundamentals of how we live together in this world,” Baerbock said Tuesday. “China has changed, and that’s why our policy towards China also needs to change.”

“What we see is the emergence of a world of increasing systemic rivalry, in which some autocratic regimes seek to bend the international order to increase their spheres of influence, using not only military might but also economic clout,” the minister said in her video address to the Australian think tank Lowy Institute. Baerbock originally planned to attend the event in person. But she was forced to cancel her trip to Australia, New Zealand and Fiji due to problems with the government plane.

Australia’s experience with trade bans imposed by China had influenced Germany’s policy shift toward Beijing, the minister stressed. “We learned painfully how vulnerable our one-sided dependencies on Russian energy imports made us. We don’t want to repeat that mistake.”

Germany wants to establish a direct supply of rare earths and lithium from Australia. The “risky detour” via China, where most Australian lithium is processed, must be reduced in the process, she added. Australia, which produces half of the world’s lithium, is seeking foreign investment to establish local processing and has blocked two Chinese investments in rare earth companies this year.

According to Baerbock, many countries are turning to China for lack of alternatives, and Germany wanted to help change that. Germany would not promote a new confrontation between the blocs, but diversify its trading partners and reduce risks.

Baerbock also reacted calmly on Tuesday to the meeting about a possible enlargement of the BRICS group (see our analysis above): “I am neither disappointed nor do I see a split or weakening of G20.” rtr/cyb

The Hong Kong High Court has ruled that prison sentences imposed under the National Security Law cannot be reduced. When defining the length of sentences, the law “imposed minimum jail terms for serious offenses,” the judges said, according to AFP.

Earlier, Lui Sai-yu, a student sentenced to five years in prison for “inciting secession,” appealed the decision. He asked for a reduced sentence for pleading guilty. This was previously a common practice in Hong Kong law.

However, according to the ruling of the highest judges, the National Security Law must be strictly applied. This law provides for sentences of a minimum of five and a maximum of ten years for “incitement to secession.” flee

China has fined US due diligence firm Mintz Group. As Bloomberg reported, the company must pay the equivalent of about 1.5 million US dollars for illegally gathering statistics, the National Bureau of Statistics in Beijing said on Tuesday.

Mintz allegedly violated laws on 37 projects between March 2019 and July 2022. It conducted “foreign-related statistics and surveys” without obtaining the appropriate licenses for such activities, the authorities’ statement said. Mintz was initially unavailable for comment.

In the wake of a tightening of China’s “counter-espionage law” in the spring, authorities are also clamping down on US consulting firms in particular. In March, officials searched Mintz offices in Beijing and arrested five Chinese company employees. The State Department said that the company was suspected of conducting illegal business at the time. The China subsidiary of US management consulting firm Bain was also raided in the spring. ck

With youth unemployment high, military academies are reporting record enrollments, the South China Morning Post reports, citing the official newspaper of the People’s Liberation Army. This year, for instance, 17,000 school graduates enrolled at 27 academies in total, the highest number since 2017 and 2,000 more than last year.

At the same time, youth unemployment has also reached an all-time high. According to official figures, more than one out of every five 16- to 24-year-olds in the country’s urban areas was unemployed in June. Beijing stopped publishing monthly youth unemployment data last week, citing the need to “further improve and optimize” labor force statistics.

China’s Ministry of Defense announced in June that new students at military academies would be offered a wide range of subjects “focused on the development of future wars.” cyb

A North Korean Air Koryo plane landed in Beijing for the first time since the COVID-19 pandemic. Flight JS151 from Pyongyang arrived in China’s capital at 9:17 a.m. local time Tuesday, just ahead of its scheduled arrival time. North Korea is currently slowly reopening itself. The country, which is already one of the most politically and economically isolated in the world, had completely isolated itself during Covid. Freight train and ship traffic had already picked up again last year. rtr

From think tanker, to policymaker and back again: Abigaël Vasselier has joined the European think tank focusing on China, MERICS, as research director and head of the foreign relations team a few weeks ago. In her new position, the Frenchwoman will focus on China’s foreign policy, with a particular focus on the EU’s policy on China. As former deputy head of the division for China, Hong Kong, Macao, Taiwan and Mongolia at the European External Action Service (EEAS), she has been actively involved in shaping this until very recently. Prior to that, Vasselier had her first think tank job at the European Council on Foreign Relations (ECFR).

Abigaël sees this “revolving door” principle of swapping from administration to think-tank as very valuable for her work and important for policy-making as well as think-tanking. She explained that “once you’ve worked in the administration itself, you formulate policy recommendations differently than you did before.” Having “been involved in the system yourself,” she says, gives you a better appreciation of what can be expected from an apparatus like the sprawling yet detailed EU administration, the political cost attached to actions, what is needed, and what can realistically be done. “You know much better at what level debates need to be held and which stakeholders and actors need to be brought together.”

After five years at EEAS, she felt the need to go back into a space that would allow more time to reflect and space for new ideas. As an official working in an administration, this is sometimes restricted. In her opinion, there is a lot of potentials for more people to benefit from these revolving doors and explore the other aspects of the work: “That would help European policy-makers to think more ‘out of the box,’ to have new ideas, and to be more proactive. That also applies to the China issue.” Thanks to her time as a European diplomat at EEAS, she is now approaching her contribution to MERICS work on China differently than before.

That she would one day work in the think tank world with a focus on China and Asia was not a given when she started learning Mandarin. Born in 1989, Abigaël grew up in Fos-sur-Mer, the city hosting the Port of Marseille in southern France. At her lycée in Istres, there was the option to learn a third foreign language: Chinese. “I would have preferred to learn Arabic because that’s what all my friends spoke, but there was no choice. That’s how it became Mandarin,” and the journey started. This was when she visited China for the first time on a class trip to Beijing.

Like her start in Mandarin, the rest of the journey was a series of coincidences. For her studies in international relations at Sciences Po Aix-en-Provence, she had to choose between Spanish or Mandarin again. To deepen her language skills, she spent a year at China Foreign Affairs University in Beijing during her studies. She finished her studies with fulfilling her dream of studying at a British university with a master’s degree in Asian Studies at SOAS in London.

There is one aspect of her work that she remains committed to throughout the years: Europe. While her path toward becoming a China expert was a series of coincidences, her commitment to Europe has been a priority from the beginning of her career. She explained that “the realization that China can’t just be looked at from a national perspective came pretty early on.” After her master’s degree, her work already took on a European focus: In the pan-European think tank ECFR, Abigaël worked closely with François Godement, a renowned French sinologist to establish an Asia programme. Francois Godement became her mentor, and together they published the book “China at the gates: a new power audit of EU-China relations.”

The agenda for her new position is already filled: Among other things, it includes looking at EU engagement with China, notably in view of the high-level dialogues and possibly the upcoming EU-China summit. In her work at MERICS and as a true European, she says it is important for her to bring the French touch. “The Franco-German engine is important for Europe, notably vis-a-vis China.” After Brussels, Berlin will now be her new home. She is not a complete foreigner to Germany. She is married to a German, after all.

John Thornton, US businessman and China expert, has been appointed as an independent non-executive director and a member of the company’s Nomination and Governance Committee at Lenovo Group. Thornton’s previous positions included co-president and director of Goldman Sachs until 2003.

Is something changing in your organization? Let us know at heads@table.media!

Smog-free on the SUP: The former cesspool on the Liangma River in Beijing has been transformed into an attractive recreational area. On Tuesday, water sports enthusiasts again enjoyed their time on the water. The renaturation park stretches from the 3rd to the 4th ring.

The BRICS summit is dominating the global political debate these days. Since yesterday, Tuesday, the heads of state and governments of five large emerging countries have been meeting in Johannesburg, demanding more say in the global order: China, India, Russia, Brazil and South Africa. They see themselves as advocates of the Global South, which is increasingly raising its voice in the growing discussion about the role of the “West.” China is the economic and political heavyweight of this heterogeneous group. The coming days will show whether it will exert its influence on the BRICS or whether the five countries will reach an equal agreement, for example on a method for admitting more countries.

In any case, the summit will mark the end of an era, as Frank Sieren analyzes: A period in which the minority of the Global North was able to set the rules for the majority of the rest of the world. The BRICS countries want to be involved in the shaping of the world order and its rules.

And even if not all of them consider themselves opponents of the United States, they are relatively united in their criticism, for example, of the Bretton Woods financial system of the World Bank and the International Monetary Fund, dominated by the US and Europe. That is why a key focus of the group is the so-called de-dollarization: Settling global trade flows in other currencies instead of the US dollar. Finn Mayer-Kuckuk explains what the BRICS are trying to achieve and why the Chinese yuan will not become the reserve currency for the time being.

We will be closely following the summit through Thursday and hope you enjoy reading,

Tuesday was just a warm-up before the big summit of the BRICS countries China, India, Russia, Brazil and host South Africa in Johannesburg. The summit’s goal is to give the group new momentum in its push to give itself and other countries of the Global South a greater say in global politics. A central concern of President Xi Jinping at the meeting with South Africa’s President Cyril Ramaphosa: The enlargement of the group to include new members.

According to South Africa, 40 countries are generally interested, and 23 have explicitly voiced their interest. There is no list of candidates, but names such as Saudi Arabia, Egypt, Indonesia or Argentina are circulating. Countries are “knocking on the door of the BRICS,” Xi wrote in a guest article published in several South African media outlets on Monday. “China, together with its BRICS partners, would like to take the lead in making the framework of cooperation play an even more important role internationally and make the BRICS’ voice even louder,” the article said.

Enlargement is likely to become a core topic of the summit. Above all, China and Russia are pushing for enlargement in order to create a counterweight to the G7 alliance of the leading Western developed countries. India, Brazil and South Africa, which maintain closer relations with Western countries, are somewhat more cautious. “We do not want to be a counterpoint to the G7, G20 or the United States,” Brazilian President Luiz Inácio Lula da Silva said on Tuesday. The BRICS group is not meant to challenge other international coalitions or the US.

Either way, the 15th BRICS Summit is historic. Because an era is coming to an end in South Africa. An age in which the Western minority could dictate the rules that governed the majority of the world. This era started with the colonial era. For a long time, the Europeans had global supremacy, most recently the British Empire, which ruled a quarter of the world just 100 years ago. By the middle of the 20th century at the latest, dominance shifted to the United States, which rose to become the sole world power in the late 20th century after the collapse of the Soviet Union.

The USA remained the only global power for the following three decades. That was the time when China was still preoccupied with itself. Although the People’s Republic was already the world’s workbench, it had little influence on the global rules. Even today, China’s influence would still be limited if the emerging countries had not joined forces in the BRICS.

These countries could hardly be more different: Russia and China have authoritarian systems; India, Brazil and South Africa are democracies. Their level of development differs greatly. China’s economy is larger than the four others combined: It accounts for 18 percent of the world economy. Russia, not even three percent. China is a high-tech and manufacturing power, South Africa is a resource power. China, Russia and India own nuclear weapons, the other two do not.

But one thing unites them: They want more global co-determination and, thus, a true end to the colonial era. They want a world order that no longer reflects the power relations of 70 years past, but those of today. They want the end of a world that could afford not to confront the colonial era.

The fact that the BRICS countries have moved closer together in the shadow of the Ukraine war, of all things, is a bitter irony of history. Vladimir Putin is virtually present at the table. He did not enter the country for fear of arrest: As a member of the International Criminal Court, South Africa would have had to execute the arrest warrant against Putin in connection with the war.

The other BRICS members want to achieve peace in Ukraine not through sanctions or Russia’s exclusion from the global community, but through negotiations. United in this way, they gather for the first time in person after three virtual COVID years. This is irritating and bitter for an EU that would prefer to see Russia as an outsider.

The actions of Russia’s four BRICS partners are certainly a bit defiant. They want to do things differently from the established developed countries. They are not for China and against the USA, but they want to have a say. They want to have a choice. The fact that they are now powerful enough to do so feels good to them. There is a spirit of optimism.

After all, the BRICS have suddenly become a serious counter-movement to the G7, the club of rich industrialized nations. Founded in 1973, the G7 (USA, Canada, Germany, France, Great Britain, Italy and Japan) now represent 10 percent of the global population and 27 percent of the global economy, and the trend is declining. However, the average per capita income of the G7 is three times above the global average. After a temporary enlargement to the G8 through the inclusion of Russia, the club reverted to the G7 in 2014 because Russia was expelled in 2014 due to the annexation of Crimea.

When Goldman Sachs executive Jim O’Neill coined the term “Bric” in 2001, the four – initially without South Africa – were developing countries with exciting investment opportunities. China was admitted to the WTO in the same year – at that time, on its way to becoming the world’s workbench, and by no means considered a competitor.

In 2009, the BRIC countries convened for the first time at the level of heads of state and government; a year later, South Africa joined them, making the group the “BRICS.” In the meantime, these once-small countries are big and economically strong: They represent 40 percent of the global population – far more than the G7 – and, according to calculations by the International Monetary Fund (IMF), contribute 32 percent to the global economy, more than the G7. The trend is likely irreversible: The IMF expects a ratio of 27.8 percent (G7) to 35 percent (BRICS) for 2028.

From their perspective, the G7 represents the free, prosperous, benevolent and progressive world that wants to cooperate to create a fairer, greener and more prosperous future. They have long been able to prevail against the upstarts, even though they are a global minority.

But in the eyes of some representatives of the global majority, they represent only a wealthy, often arrogant global minority of former colonial powers. Powerless, confused and opinionated, with outdated views, characterized by double standards. The BRICS states are rising up against it. They want mutual respect, understanding, equality and solidarity – according to the BRICS Declaration of 2022.

This fits into a currently swelling global debate about the role of the West. Other large emerging countries, including democracies, have an ambivalent relationship with the Global North due to colonialism or the climate sins of the developed countries.

And this is not just about narratives, but also about power and concrete interests. The long list of candidate countries shows how attractive this is. And by its own words, BRICS wants to be an “open, inclusive and consensus-oriented” South-South cooperation. The concerns of such South-South cooperation are gaining significance. In order for the United Nations or the G20 to remain functional, the West will have to compromise with the BRICS countries from now on. Because without them, there are no more majorities.

Although many scenarios are conceivable in which the BRICS countries clash and the Americans once again have the last laugh, it is more likely that a new world order will emerge that is no longer characterized by the rule of law of a powerful minority but by the consensus of a relative majority of different compositions. It will then – hopefully – also tame the autocratic yearnings of the ever-stronger superpower China. Collaboration: Christiane Kuehl

Those who own the world’s reserve currency have enormous advantages. The US, for instance, can take on unlimited debt because there is unlimited demand for dollars. This means that they can also sustain a trade deficit of any size.

But the dream of the Global South to replace the dollar as the reserve currency also has political-psychological reasons. The constant use of the dollar for business, even far from the United States, is a constant reminder of who is still the dominant economy on the planet.

There are now two options for replacing the US dollar. China is quite openly encouraging its trading partners to use its currency and is proposing a transition to the yuan in the BRICS framework as well. Other BRICS countries, on the other hand, prefer the idea of an entirely new currency because they do not want to replace a focus on the United States with a focus on China. Instead, their goal is true diversity.

But this discussion concerns a distant future. In fact, the dollar currently accounts for just over 40 percent of all transactions in the Swift international payment system, followed by the euro at somewhere between 30 and 40 percent. The British pound and the Japanese yen account for single-digit percentages, and the yuan accounts for around two percent of the transaction volume.

The exact values fluctuate monthly. For instance, when Germany purchases a shipment of liquefied natural gas from Qatar and pays for it, the transaction is denominated in dollars. This applies to virtually all cross and lateral relationships in global trade, even without American involvement.

That has not changed even after China brought the yuan into play as an alternative. Separate programs have existed for this since about 2010, and there is an ongoing discussion about the progress of tradability. Beijing has high hopes for overseas yuan trading hubs, such as Frankfurt.

The yuan has now become the most important currency for direct trade with China, which is a success for Chinese foreign exchange policy. But in this case, trading partners use, for instance, yuan earned from the sale of raw materials to buy industrial products from China in return. Unlike the dollar, the yuan plays no role unless its home country participates.

This is because the yuan is not freely tradable. The USA, Japan or the Europeans have the self-confidence to leave their currency to the free play of the market. Any currency trader in the world can buy and sell the dollar in any quantity. In the process, market prices constantly arise in comparison to other currencies. In the process, a crash also happens occasionally, as is the case now with the yen.

As a result, China cannot and will not make its socialist “people’s currency,” which is directly translated as renminbi, freely tradable. President Xi Jinping wants to market the yuan as an international trading currency, but he also wants to maintain control over the domestic financial sector. Both are not possible.

The CCP is well aware of why it has chosen this course. If the yuan were freely tradable, a rapid flight from China’s financial markets would have occurred with the start of the real estate crisis. This is because local banks and local governments have been caught in the spiral of falling property valuations. Consequently, the yuan would experience a rapid decline in value and, thus, a loss of confidence. The Chinese economy would lack money on every level.

But none of this can happen. Because the Chinese central bank sets the exchange rate globally every day within a fixed fluctuation range. This means that the currency is still controlled and not freely convertible. It is also impossible to freely transfer money to other countries. Corporate finance departments must submit requests for large sums. All of this means that the yuan is not part of the global currency trade. So as long as China is unwilling to accept capital flight and exchange rate fluctuations, the yuan will not become the world’s reserve currency.

However, currencies play a role not only in trade, but also as foreign exchange reserves. This phenomenon has only emerged with the end of the gold standards. Before that, central banks stocked up on gold to stabilize their own exchange rates in crises.

Today, money is a mere computer game – and the dollar has largely replaced the role of gold, because it is accepted everywhere in the world. According to 2022 figures from the International Monetary Fund, the dollar dominates global foreign exchange reserves with a share of just under 60 percent, followed by the euro with just under 20 percent. The renminbi was at 2.9 percent.

However, the high global dollar reserves are also due to the gigantic US trade deficit. The deficit inevitably means that the United States receives more goods than its business partners abroad – and the latter are stuck with their dollars in return. This is also true for China and its companies.

And those who hold dollars must invest them in dollar-denominated monetary assets. These are primarily US government bonds. When China generates a trade surplus with the United States, it not only supplies quasi-free products to America, but also finances the US budget. In May, China held nearly 847,000 billion dollars in US bonds alone, according to data provider CEIC Data. While that is significantly less than the 1,300 billion in November 2013, it is still quite a lot.

No wonder China is also keen to free itself from this toxic relationship. But that proves difficult. China’s exporters create valuable jobs in American trade. For this reason, a shift of reserves away from the dollar is underway. But this does not change its dominance.

The euro might rank second due to the size and depth of the European economic area, but it is also no threat to the dollar’s supremacy. Yet this was once one of the hopes attached to the introduction of the European currency.

However, a common BRICS currency would have good prospects of competing with the dollar, at least in the Global South, as a foreign exchange currency for setting trade and reserve building. If the BRICS countries all pull together and firmly launch such a project, the dollar and euro areas can do little to prevent their declining significance.

The plan brings back memories of the ECU. The European Currency Unit was a precursor to the euro when each member state still had its own foreign currencies, such as deutschmarks and francs. Another comparison that comes to mind is the International Monetary Fund’s special drawing rights, which can also partly be used like money without displacing national currencies.

However, the question arises about how far the BRICS countries will put aside their own interests to pave the way for a joint project. Their anger at the old West may unite them, but that is not enough of an economic policy program. Will Russia, India, China and Brazil really limit their financial freedom for the benefit of others?

The euro shows how much coordination a joint currency project requires. It spans a comparatively homogeneous economic area and is still repeatedly plagued by problems. The euro’s existence is the product of a historical constellation in which all participants were willing to make significant concessions and surrendered financial sovereignty.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

According to the words of Foreign Minister Annalena Baerbock, Germany intends to work more closely with nations such as Australia to de-escalate tensions in the Indo-Pacific region. China posed a challenge to the “fundamentals of how we live together in this world,” Baerbock said Tuesday. “China has changed, and that’s why our policy towards China also needs to change.”

“What we see is the emergence of a world of increasing systemic rivalry, in which some autocratic regimes seek to bend the international order to increase their spheres of influence, using not only military might but also economic clout,” the minister said in her video address to the Australian think tank Lowy Institute. Baerbock originally planned to attend the event in person. But she was forced to cancel her trip to Australia, New Zealand and Fiji due to problems with the government plane.

Australia’s experience with trade bans imposed by China had influenced Germany’s policy shift toward Beijing, the minister stressed. “We learned painfully how vulnerable our one-sided dependencies on Russian energy imports made us. We don’t want to repeat that mistake.”

Germany wants to establish a direct supply of rare earths and lithium from Australia. The “risky detour” via China, where most Australian lithium is processed, must be reduced in the process, she added. Australia, which produces half of the world’s lithium, is seeking foreign investment to establish local processing and has blocked two Chinese investments in rare earth companies this year.

According to Baerbock, many countries are turning to China for lack of alternatives, and Germany wanted to help change that. Germany would not promote a new confrontation between the blocs, but diversify its trading partners and reduce risks.

Baerbock also reacted calmly on Tuesday to the meeting about a possible enlargement of the BRICS group (see our analysis above): “I am neither disappointed nor do I see a split or weakening of G20.” rtr/cyb

The Hong Kong High Court has ruled that prison sentences imposed under the National Security Law cannot be reduced. When defining the length of sentences, the law “imposed minimum jail terms for serious offenses,” the judges said, according to AFP.

Earlier, Lui Sai-yu, a student sentenced to five years in prison for “inciting secession,” appealed the decision. He asked for a reduced sentence for pleading guilty. This was previously a common practice in Hong Kong law.

However, according to the ruling of the highest judges, the National Security Law must be strictly applied. This law provides for sentences of a minimum of five and a maximum of ten years for “incitement to secession.” flee

China has fined US due diligence firm Mintz Group. As Bloomberg reported, the company must pay the equivalent of about 1.5 million US dollars for illegally gathering statistics, the National Bureau of Statistics in Beijing said on Tuesday.

Mintz allegedly violated laws on 37 projects between March 2019 and July 2022. It conducted “foreign-related statistics and surveys” without obtaining the appropriate licenses for such activities, the authorities’ statement said. Mintz was initially unavailable for comment.

In the wake of a tightening of China’s “counter-espionage law” in the spring, authorities are also clamping down on US consulting firms in particular. In March, officials searched Mintz offices in Beijing and arrested five Chinese company employees. The State Department said that the company was suspected of conducting illegal business at the time. The China subsidiary of US management consulting firm Bain was also raided in the spring. ck

With youth unemployment high, military academies are reporting record enrollments, the South China Morning Post reports, citing the official newspaper of the People’s Liberation Army. This year, for instance, 17,000 school graduates enrolled at 27 academies in total, the highest number since 2017 and 2,000 more than last year.

At the same time, youth unemployment has also reached an all-time high. According to official figures, more than one out of every five 16- to 24-year-olds in the country’s urban areas was unemployed in June. Beijing stopped publishing monthly youth unemployment data last week, citing the need to “further improve and optimize” labor force statistics.

China’s Ministry of Defense announced in June that new students at military academies would be offered a wide range of subjects “focused on the development of future wars.” cyb

A North Korean Air Koryo plane landed in Beijing for the first time since the COVID-19 pandemic. Flight JS151 from Pyongyang arrived in China’s capital at 9:17 a.m. local time Tuesday, just ahead of its scheduled arrival time. North Korea is currently slowly reopening itself. The country, which is already one of the most politically and economically isolated in the world, had completely isolated itself during Covid. Freight train and ship traffic had already picked up again last year. rtr

From think tanker, to policymaker and back again: Abigaël Vasselier has joined the European think tank focusing on China, MERICS, as research director and head of the foreign relations team a few weeks ago. In her new position, the Frenchwoman will focus on China’s foreign policy, with a particular focus on the EU’s policy on China. As former deputy head of the division for China, Hong Kong, Macao, Taiwan and Mongolia at the European External Action Service (EEAS), she has been actively involved in shaping this until very recently. Prior to that, Vasselier had her first think tank job at the European Council on Foreign Relations (ECFR).

Abigaël sees this “revolving door” principle of swapping from administration to think-tank as very valuable for her work and important for policy-making as well as think-tanking. She explained that “once you’ve worked in the administration itself, you formulate policy recommendations differently than you did before.” Having “been involved in the system yourself,” she says, gives you a better appreciation of what can be expected from an apparatus like the sprawling yet detailed EU administration, the political cost attached to actions, what is needed, and what can realistically be done. “You know much better at what level debates need to be held and which stakeholders and actors need to be brought together.”

After five years at EEAS, she felt the need to go back into a space that would allow more time to reflect and space for new ideas. As an official working in an administration, this is sometimes restricted. In her opinion, there is a lot of potentials for more people to benefit from these revolving doors and explore the other aspects of the work: “That would help European policy-makers to think more ‘out of the box,’ to have new ideas, and to be more proactive. That also applies to the China issue.” Thanks to her time as a European diplomat at EEAS, she is now approaching her contribution to MERICS work on China differently than before.

That she would one day work in the think tank world with a focus on China and Asia was not a given when she started learning Mandarin. Born in 1989, Abigaël grew up in Fos-sur-Mer, the city hosting the Port of Marseille in southern France. At her lycée in Istres, there was the option to learn a third foreign language: Chinese. “I would have preferred to learn Arabic because that’s what all my friends spoke, but there was no choice. That’s how it became Mandarin,” and the journey started. This was when she visited China for the first time on a class trip to Beijing.

Like her start in Mandarin, the rest of the journey was a series of coincidences. For her studies in international relations at Sciences Po Aix-en-Provence, she had to choose between Spanish or Mandarin again. To deepen her language skills, she spent a year at China Foreign Affairs University in Beijing during her studies. She finished her studies with fulfilling her dream of studying at a British university with a master’s degree in Asian Studies at SOAS in London.

There is one aspect of her work that she remains committed to throughout the years: Europe. While her path toward becoming a China expert was a series of coincidences, her commitment to Europe has been a priority from the beginning of her career. She explained that “the realization that China can’t just be looked at from a national perspective came pretty early on.” After her master’s degree, her work already took on a European focus: In the pan-European think tank ECFR, Abigaël worked closely with François Godement, a renowned French sinologist to establish an Asia programme. Francois Godement became her mentor, and together they published the book “China at the gates: a new power audit of EU-China relations.”

The agenda for her new position is already filled: Among other things, it includes looking at EU engagement with China, notably in view of the high-level dialogues and possibly the upcoming EU-China summit. In her work at MERICS and as a true European, she says it is important for her to bring the French touch. “The Franco-German engine is important for Europe, notably vis-a-vis China.” After Brussels, Berlin will now be her new home. She is not a complete foreigner to Germany. She is married to a German, after all.

John Thornton, US businessman and China expert, has been appointed as an independent non-executive director and a member of the company’s Nomination and Governance Committee at Lenovo Group. Thornton’s previous positions included co-president and director of Goldman Sachs until 2003.

Is something changing in your organization? Let us know at heads@table.media!

Smog-free on the SUP: The former cesspool on the Liangma River in Beijing has been transformed into an attractive recreational area. On Tuesday, water sports enthusiasts again enjoyed their time on the water. The renaturation park stretches from the 3rd to the 4th ring.