The bounties placed on Hong Kong exiles are, above all, a domestic warning: Anyone who rebels against the power of the CCP will be pursued for the rest of their lives. Today, Marcel Grzanna again shows the contradictions and absurdities of the arrest warrants against dedicated citizens. The reward offered for their capture is ten times higher than for sex offenders.

One is accused of “collaborating with foreign forces” – even though they are not Hong Kong or Chinese, but an Australian citizen. What is clear, however, is that wanted individuals should no longer enter countries that would extradite them to China.

The isolation also continues economically: Beijing places two much-needed industrial metals under export controls. The world’s largest producer can now cut off specific customers from the supply of gallium and germanium. Gallium, in particular, however, is essential for numerous future and environmental technologies, from electric cars to solar panels. The new restrictions have not come unprovoked, however. The Ministry of Commerce responds to the long list of technology sanctions imposed on China by Washington.

Hong Kong’s Chief Executive John Lee revealed on Tuesday what is going on in his head. The governor by Beijing’s grace made Wild West-style threats against the political opposition in overseas exile. “The only way to end their destiny of being an abscondee who will be pursued for life is to surrender,” Lee said.

The threat was mainly directed at seven men and one woman against whom arrest warrants had been issued the day earlier. The police issued bounties of one million Hong Kong dollars (120,000 euros) each. The former MPs, lawyers, journalists, ex-student leaders and trade unionists are charged with violating Beijing’s National Security Law (NSL). Specifically, they are accused of collaborating with foreign forces to destabilize the city. The individuals in question face life imprisonment if convicted.

The NSL has kept dissent in the city at bay for three years now. Article 38 claims extraterritorial reach. This means that anybody working against the political regime outside Hong Kong will also be liable to prosecution, according to Hong Kong authorities – irrespective of citizenship.

Australian lawyer Kevin Yam is also on the list. “It’s a bit absurd,” Yam told China.Table. “I am accused of collaborating with foreign forces. Yet I am one of those foreign forces.” As a child, Yam moved to Australia with his parents and has been an Australian citizen for many years. As such, he had met the foreign minister and his country’s parliament members.

“Hong Kong’s government wants to signal that it doesn’t care that other states grant their residents civil rights that it doesn’t grant itself. It wants to tell us that it can target anyone,” says Yam.

The Australian government representatives were correspondingly clear in their defense of the right to freedom of expression. It applies not only to its own citizens but also to exiles like Ted Hui, who enjoys political asylum in Australia. “These bounties show how powerless the Chinese Communist Party is against the Hong Kong diaspora who are campaigning for freedom and democracy. But it also illustrates that China is poised to become increasingly authoritarian and poses a threat to the world,” Hui told China.Table in writing.

In the UK, Foreign Secretary James Cleverly also rejected Chinese accusations that his country was offering protection to “fugitive” activists from Hong Kong. Two years ago, among others, the co-founder of the Democratic Demosisto Party, Nathan Law, was granted asylum in the UK. An arrest warrant has now been issued for him as well. The Chinese embassy in London called it a “crude interference in Hong Kong’s rule of law and China’s internal affairs.”

The role of the United Kingdom as a former colonial power is a special one. Hong Kong’s judiciary still has organs in which Commonwealth judges have jurisdiction. However, the influence of foreign judges is now severely curtailed. In cases involving the National Security Law, Chief Executive John Lee can appoint a judge for the trial.

These arrest warrants and bounties are making waves in liberal democracies, although they are more symbolic now. After all, the wanted individuals are not hiding, but live openly in Australia, the United States and the United Kingdom. All three states – as well as Germany – have suspended their extradition treaties with the former British Crown Colony. This prevents Hong Kong from getting a hold of them via international arrest warrants.

However, wanted individuals must think carefully about which countries they will set foot in, even if it is just for an airport layover. This is because many nations still maintain a valid extradition treaty with Hong Kong or China. Political interests could also put them at risk in some states. Nevertheless, large parts of the political West remain safe havens.

Government Chief Executive Lee, formerly chief of the Hong Kong Police, advised the wanted individuals in question to turn themselves in to get their sentences reduced. Otherwise, they would “have to live in fear and worry daily that they might be arrested”.

Ted Hui, who is also wanted, is apparently not intimidated by these strong statements. There are already other arrest warrants out for him. He said the bounty would not change his personal situation and does not affect his safety.

At one million Hong Kong dollars, the bounty is about ten times higher than for the capture of a sex offender. Lawyer Yam considers this “absolute madness”. For that reason, he sees the bounties also as a domestic warning. During the press conference at which he and the seven others were prominently placed on the wanted list, the police also warned the city’s citizens to think very carefully about what they say on social media.

China’s Ministry of Commerce Mofcom has made exports of the key industrial metals gallium and germanium subject to approval. As of August 1, exporters will require a license to ship these elements to other countries. The basis for the ministry’s directive is the Export Control Law of 2020. According to the ministry, the purpose of the controls is to protect “national security”.

“This mirrors the strategic use of export control measures by the US,” writes Mathieu Duchâtel, an expert on the Chinese economy at the French think tank Institut Montaigne. So far, however, it is not an export ban: Any exporter can still request a license.

Nevertheless, “European semiconductor companies will consider themselves again in the crossfire of US-China competition,” adds Duchâtel. After all, China is the biggest producer of both metals. The new regulation already creates uncertainty about availability and prices. Gallium is particularly vital for a new, more cost-effective generation of semiconductors.

Germany has a high interest in the availability of both metals. This is because gallium is a raw material for power semiconductor devices, which are necessary for the automotive industry. Power semiconductors are chips capable of switching high current voltages, thus an essential part of EV electronics. They can adjust the current seamlessly and are not affected by high temperatures.

Power semiconductors can also be made from silicon, the traditional material for microchips. However, gallium nitride is currently becoming very attractive as a cost-effective and energy-saving alternative. One important manufacturer of gallium nitride-based power semiconductors is Infineon. The company already operates a plant for power semiconductors in Malaysia. It has now also absorbed Canadian special manufacturer GaN Systems to strengthen this area.

The EU currently promotes the development of gallium-based electronic components. Apart from vehicle manufacturing, gallium nitride chips are also used in many other advanced technologies, for example, in

At present, around 98 percent of the gallium consumed worldwide is imported from China. The EU imports over 70 percent of its gallium and almost half of its germanium from China. But the reason for this is not that the metal is not found elsewhere – gallium is also found in Japan, South Korea, Russia or Kazakhstan. The decisive factor for the high market share is China’s low export price.

Germany also used to be a gallium producer but ceased production in 2016 as it was no longer lucrative given the surpluses on the global market. However, plans to resume producing gallium emerged in late 2021 as part of efforts to reduce strategic dependencies.

Research is currently underway on how to achieve this. But it will take time before a significant yield can be achieved. Experts believe Europe will require another ten years to reduce its dependence on industrial metals.

The Chinese export controls are part of the trade dispute between the US and China. Presidents Trump and Biden have imposed a long list of sanctions on China’s tech companies. On the one hand, they are hardly allowed to do business in the US anymore; on the other hand, Washington has cut off the Chinese economy from advanced US semiconductors and their production facilities.

China now responds by using the leverage at its disposal. If the United States no longer supplies chips, China, in turn, no longer supplies raw materials. However, the US is completely dependent on imported metals. In this respect, China’s controls are not new. The export of rare earth elements has already been regulated since 2010.

Due to the technical and industrial significance of gallium and germanium, both elements are included on the EU’s list of strategic raw materials for the digital economy and the energy transition. On Tuesday, a spokesperson for the Commission in Brussels expressed “concern” about the Chinese trade measure.

The EU urged China to only deny export licenses over “genuine security concerns”. The Brussels authority currently examines the impact of China’s decision – and whether it is compatible with WTO trade rules.

The Federation of German Industries (BDI) regards the new regulations as a wake-up call to accelerate de-risking. “Beijing’s announced export control measures for the raw materials gallium and germanium, which are important for the semiconductor industry, illustrate the urgency of quickly reducing dependence on critical raw materials now,” according to Wolfgang Niedermark, member of the BDI’s Executive Board. This is why it is positive that the EU is progressing toward securing the supply of critical raw materials. he said.

Companies seeking to apply for export licenses in China must specify the country of destination and the intended industrial application of the shipment. This allows Mofcom to very precisely regulate the export restrictions. For instance, exports to certain EU countries could be denied and permitted to others. However, the law’s main addressee is the United States, which buys almost all its gallium on the global market.

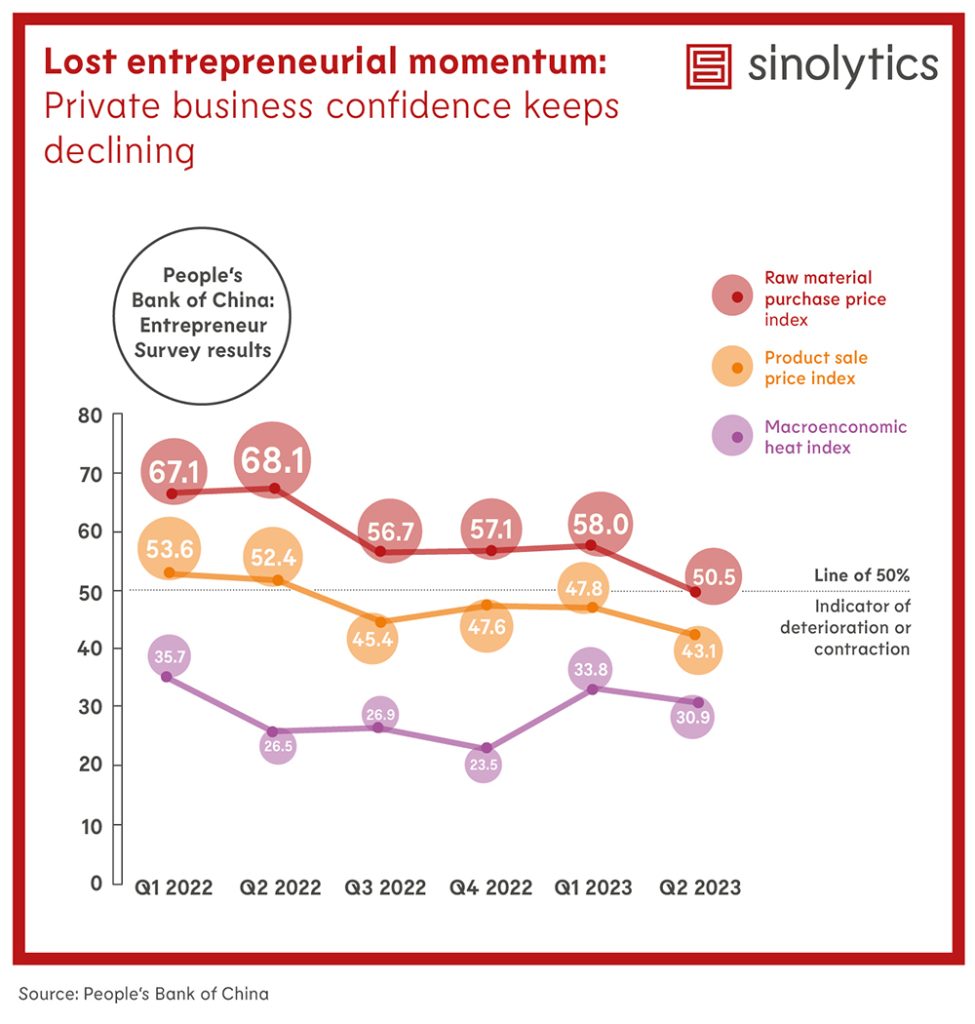

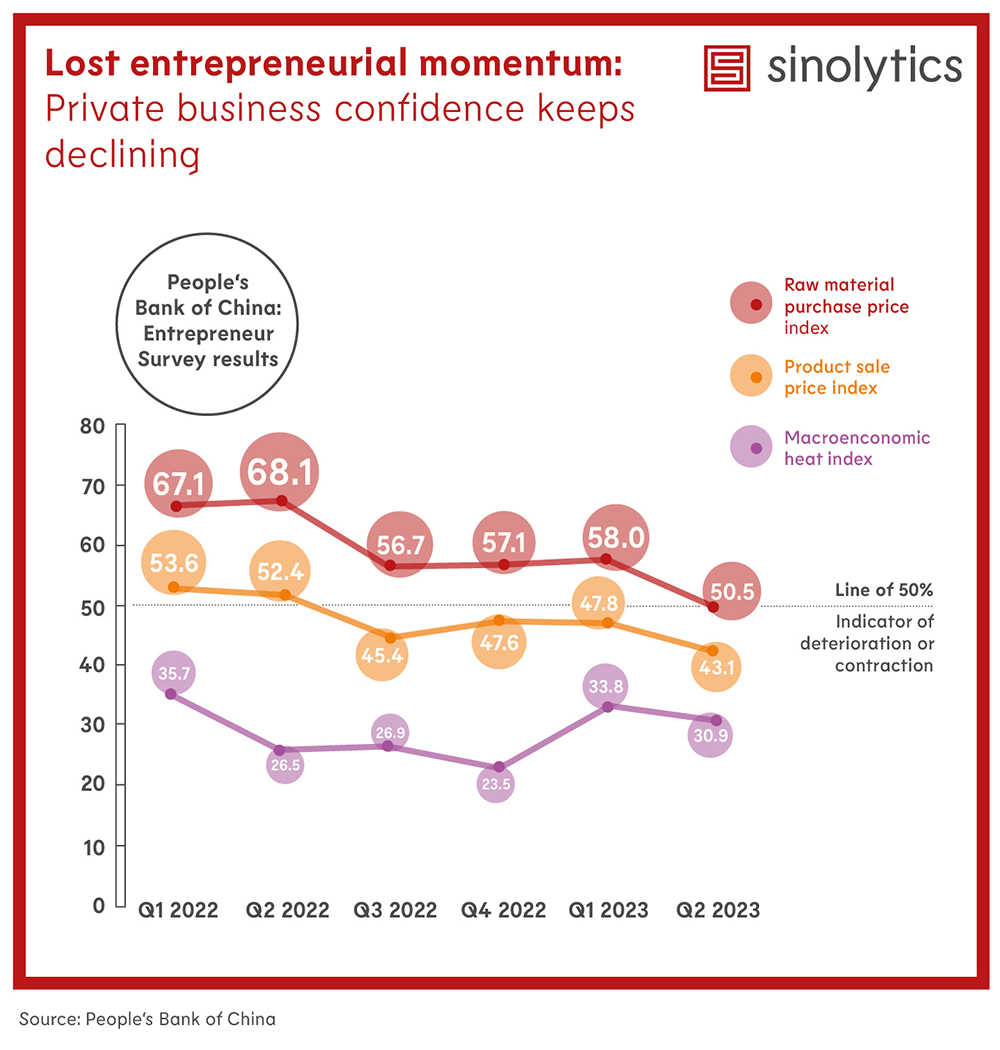

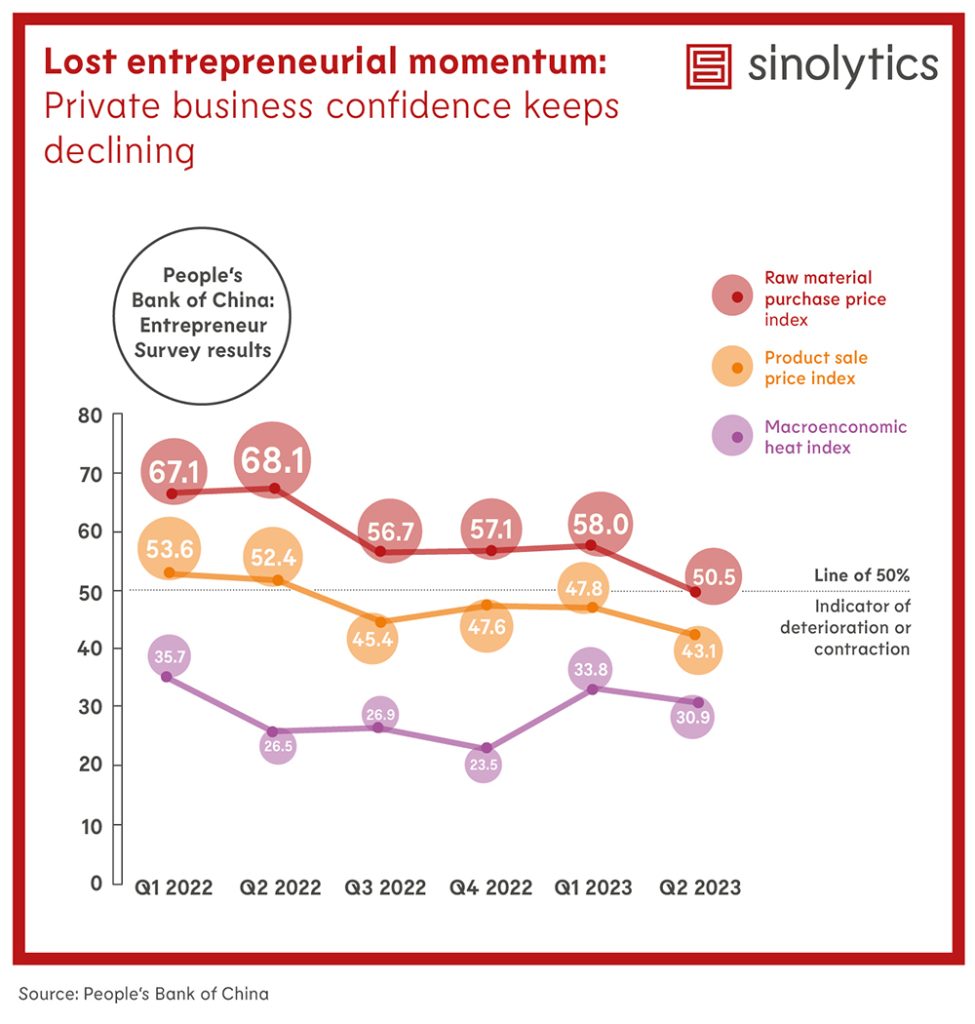

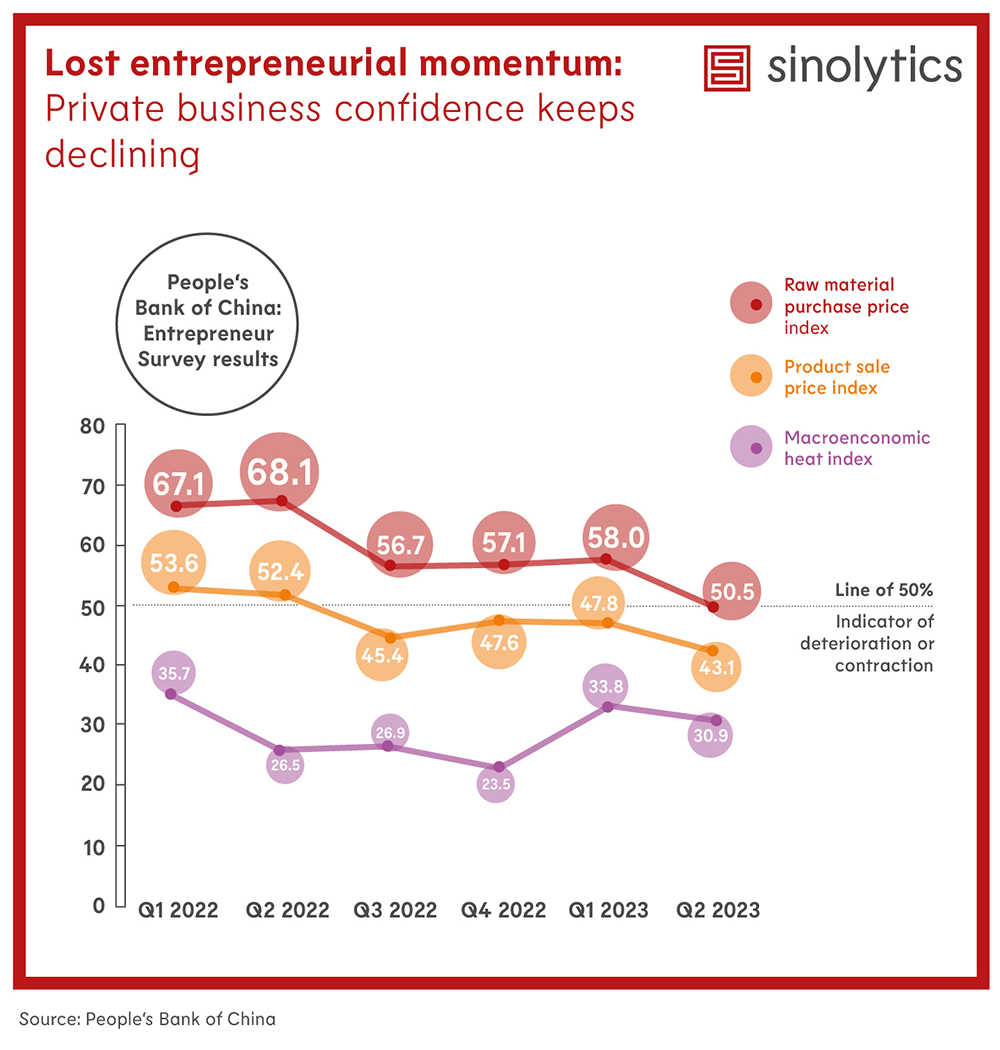

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

The Chinese government has once again postponed a scheduled visit to Beijing by EU High Representative for Foreign Affairs, Josep Borrell, next week, a spokesman for Borrell said on Tuesday. Initially, no reasons were given. The trip, which was originally scheduled for April, had to be postponed to July after Borrell contracted Covid.

Borrell was due to arrive in Beijing next Monday. The main focus of the trip was supposed to be a meeting with Chinese Foreign Minister Qin Gang. According to an EU spokesperson, Chinese interlocutors have now informed the EU that the scheduled date is no longer possible.

Borrell’s visit would have followed that of Frans Timmermans. The EU climate envoy will meet with Chinese officials this week to discuss climate, biodiversity and eco-conservation. It is also his second attempt: Timmermans originally had to postpone his trip because of a Covid infection. rtr/ari

Russia’s President Vladimir Putin used the Shanghai Cooperation Organisation (SCO) summit to display unity and strength shortly after the Wagner rebellion. He thanked the countries of the Alliance, including China, for their support during the insurrection of Wagner chief Yevgeny Prigozhin and his mercenaries, who advanced as far as 200 kilometers outside Moscow last week. He called the Russian nation “united as never before”.

At the SCO summit, Putin addressed a sympathetic audience that, unlike most Western countries, does not view Russia as an outsider but as a partner. The Beijing-based organization includes China, India, Kazakhstan, Kyrgyzstan, Pakistan, Tajikistan and Uzbekistan. At the summit, Putin also spoke out in favor of a “speedy settlement” of Belarus’ application to become an SCO member.

One new member was already welcomed at this summit: The organization accepted Iran into its ranks as its ninth member. The host of the virtual summit of heads of state and government of member countries, India’s Prime Minister Narendra Modi, officially announced the accession. “New countries joining the group underlines the importance of the group,” Modi said.

Iran has held observer status at the SCO since 2005. The accession represents a new step in the country’s efforts to break out of its diplomatic isolation. Previously, Tehran had already strengthened relations with China and Russia and resumed diplomatic ties with Saudi Arabia – also with the help of successful mediation efforts by China.

During his speech at the summit, China’s President Xi Jinping called for pragmatic cooperation and accelerating economic recovery. jul

German Minister of Justice Marco Buschmann received his Taiwanese counterpart Ching-Hsiang Tsai in Berlin on Tuesday. Germany and Taiwan had already agreed in March on mutual legal assistance in criminal matters.

According to the Ministry of Justice in Berlin, the visit adhered to the European Union’s One-China policy. Under Germany’s interpretation of the One China principle, only high-ranking politicians such as the president, the chancellor, and the foreign and defense ministers are barred from direct contact with Taiwan. Meetings with other ministers are possible.

“The talks focused in particular on cooperation in the field of legal assistance in criminal matters,” said the ministry. They also exchanged views on Internet fraud and extradition issues, it added in a statement.

In March, a visit by German Education Minister Bettina Stark-Watzinger to Taiwan had sparked angry reactions from Beijing. The visit by the liberal FDP politician was the first by a member of a German government in more than 25 years.

China views democratically governed Taiwan as its own territory and has ramped up military, political and economic pressure to assert those claims. The visit by Taiwan’s justice minister comes at a time when Berlin is reassessing its previously close relations with China. rtr/jul

The European Union has identified seven companies likely to be classified as key digital companies, or gatekeepers in EU terminology. Among them is ByteDance, the operator of the video app Tiktok, which is wildly popular with young people. Gatekeepers may be regulated separately under the Digital Markets Act (DMA). However, queries for additional information from concerned companies are still underway. By September 6, the Commission will decide whether they are indeed gatekeepers.

Under the DMA, which took effect last November, companies with more than 45 million monthly active users and a market capitalization of 75 billion euros are considered gatekeepers that provide a central platform service. Other affected companies include Google, Apple and Amazon.

The Commission still examines other companies that have not been on its radar so far. If it identifies these companies as de facto gatekeepers, despite falling below the thresholds by a few euros, for example, the Commission could retroactively classify them as gatekeepers. One example is Alibaba. vis/fin

The EU Commission has imposed anti-dumping duties on recyclable stainless steel kegs from China. Stainless steel kegs are used to hold beverages, including beer that can be attached to beer taps. The countervailing duties will be in place for five years, amounting to between 62.6 percent and 69.6 percent. According to the Brussels authority, the decision was based on an investigation. It found that barrels from the People’s Republic had been sold at dumping prices on the EU market. This had harmed barrel manufacturers in the EU. ari

China’s growth model is undergoing fundamental change. After decades of relying primarily on external demand to drive growth, the government has embraced a “dual circulation” model, driven by both internal and external demand. The goal is to make China’s economy more resilient and less vulnerable to external shocks, but the structural transformation has run up against major roadblocks.

When Deng Xiaoping launched his “reform and opening up” in 1978, China pursued a development strategy modeled after successful East Asian economies like Japan and South Korea: Welcome foreign direct investment, expand cross-border trade linkages, leverage low labor costs to bolster the manufacturing sector, and take advantage of external demand to drive growth. Over the last four decades, FDI flows – about two-thirds of which came through Hong Kong – enabled China to transform Guangdong and other coastal provinces into global supply-chain hubs.

As industrialization progressed, incomes and wealth increased, and Chinese workers became consumers of both goods and services. As a result, the foreign-trade-to-GDP ratio declined, from a peak of 67 percent in 2006 to around 35 percent today, though China still relies on the jobs provided by its export industries.

As China built up its manufacturing sector, it also invested heavily in expanding its construction and financial industries, thereby laying the foundations for a dynamic real-estate market. Over the last decade, the nominal average annual growth rate of the construction sector and the financial and real-estate industries reached 13 percent, 14.8 percent, and 10.5 percent, respectively.

In 2021, China’s construction sector contributed 13.8 percent to China’s GDP, with the real-estate industry’s value-added reaching 6.8 percent of GDP, though it fell to 6.1% in 2022. Today, real-estate assets account for about 70 percent of household wealth, with important implications for consumption. Moreover, real-estate loans account for 27 percent of total bank credit, meaning a thriving real-estate market is also critical to financial stability.

The real-estate market’s rapid growth was driven partly by a financing innovation that originated in Hong Kong. Rather than completing projects, and then recouping their investment, residential housing developers began selling units before completion. This enabled them to use down-payments from home-buyers – in addition to the funds released by lending institutions as construction progressed (construction drawdowns) – to finance projects. From 2015 to 2022, the share of down payments and mortgages in total developer funding increased from 62.4 percent to 80.4 percent.

But this approach carried risks. By striking deals before construction was completed, developers and home-buyers left themselves exposed to interest-rate increases and slowdowns in price growth.

Developers who had borrowed heavily using US dollar bonds were particularly vulnerable – a reality that became painfully clear when surging inflation in the United States compelled the Federal Reserve to begin aggressively raising interest rates. Last year brought a series of defaults by major real-estate developers, which forced local governments to intervene to protect the rights of the affected home-buyers.

The real-estate sector’s travails have generated considerable fiscal challenges. In 2021, direct real-estate taxes accounted for 16.9 percent of national tax revenue, and 24 percent of local-government tax revenue. But falling real-estate prices have squeezed those revenues. In 2022, income from state-owned land sales decreased by 23.2 percent, causing China’s national budget revenue to fall by 20.6 percent. Declining revenue is also undermining local governments’ ability to support growth, such as by financing urban investment platforms.

The deterioration of US-China relations, and the disruptions caused by the COVID-19 pandemic, have further impeded China’s structural transformation. In fact, the economy’s internal and external circulation have both slowed significantly, damaging the balance sheets of households, enterprises, and all levels of government.

Both imports and exports fell last month, by 4.5 percent and 7.5 percent, respectively. Within China, jobs are not being created fast enough to absorb the supply of new graduates: as of last month, some six million young people (aged 16-24) – 20.8 percent – were unemployed. Housing and stock prices remain under pressure.

But there is reason to hope that China will bounce back from its current struggles. US Secretary of State Antony Blinken’s recent visit to China may augur stabilization of the US-China relationship – or, at least, a respite from further deterioration.

In any case, China’s government is committed to stimulating employment, stabilizing the housing sector, managing financial risks, supporting technological innovation, and encouraging green and inclusive growth. The market seems to be anticipating a comprehensive and forceful stimulus package that supports these objectives.

The rest of the world has an obvious stake in the outcome. China’s success in managing the challenges ahead could be the difference between a global recovery and a global recession.

Andrew Sheng is a distinguished fellow at the Asia Global Institute at the University of Hong Kong. Xiao Geng, Chairman of the Hong Kong Institution for International Finance, is a professor and Director of the Institute of Policy and Practice at the Shenzhen Finance Institute at The Chinese University of Hong Kong, Shenzhen.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Thomas Fauth has been Senior Manager eDrive Integration & RTM Development at Mercedes-Benz Group China in Beijing since May. He previously worked as Team Leader Networking Powertrain at Mercedes-Benz AG in Sindelfingen, Germany.

Alexandra Holub joined Aiko Energy, a Chinese manufacturer of photovoltaic cells, as Head of Marketing DACH/UK/Nordics at the beginning of the month. She was previously employed by EnOcean in Munich.

Is something changing in your organization? Let us know at heads@table.media!

Mosquitoes in the sand? It is all a matter of perspective. A top-down view of the farm of a dairy company in Yinchuan shows a giant herd of cattle. Last year, the People’s Republic produced around 40 million tons of milk. By comparison, Germany produced 2.3 million tons. China also made headlines last winter after researchers announced they had successfully cloned super cows that produce 18 tons of milk a year, twice as much as their normal sisters.

The bounties placed on Hong Kong exiles are, above all, a domestic warning: Anyone who rebels against the power of the CCP will be pursued for the rest of their lives. Today, Marcel Grzanna again shows the contradictions and absurdities of the arrest warrants against dedicated citizens. The reward offered for their capture is ten times higher than for sex offenders.

One is accused of “collaborating with foreign forces” – even though they are not Hong Kong or Chinese, but an Australian citizen. What is clear, however, is that wanted individuals should no longer enter countries that would extradite them to China.

The isolation also continues economically: Beijing places two much-needed industrial metals under export controls. The world’s largest producer can now cut off specific customers from the supply of gallium and germanium. Gallium, in particular, however, is essential for numerous future and environmental technologies, from electric cars to solar panels. The new restrictions have not come unprovoked, however. The Ministry of Commerce responds to the long list of technology sanctions imposed on China by Washington.

Hong Kong’s Chief Executive John Lee revealed on Tuesday what is going on in his head. The governor by Beijing’s grace made Wild West-style threats against the political opposition in overseas exile. “The only way to end their destiny of being an abscondee who will be pursued for life is to surrender,” Lee said.

The threat was mainly directed at seven men and one woman against whom arrest warrants had been issued the day earlier. The police issued bounties of one million Hong Kong dollars (120,000 euros) each. The former MPs, lawyers, journalists, ex-student leaders and trade unionists are charged with violating Beijing’s National Security Law (NSL). Specifically, they are accused of collaborating with foreign forces to destabilize the city. The individuals in question face life imprisonment if convicted.

The NSL has kept dissent in the city at bay for three years now. Article 38 claims extraterritorial reach. This means that anybody working against the political regime outside Hong Kong will also be liable to prosecution, according to Hong Kong authorities – irrespective of citizenship.

Australian lawyer Kevin Yam is also on the list. “It’s a bit absurd,” Yam told China.Table. “I am accused of collaborating with foreign forces. Yet I am one of those foreign forces.” As a child, Yam moved to Australia with his parents and has been an Australian citizen for many years. As such, he had met the foreign minister and his country’s parliament members.

“Hong Kong’s government wants to signal that it doesn’t care that other states grant their residents civil rights that it doesn’t grant itself. It wants to tell us that it can target anyone,” says Yam.

The Australian government representatives were correspondingly clear in their defense of the right to freedom of expression. It applies not only to its own citizens but also to exiles like Ted Hui, who enjoys political asylum in Australia. “These bounties show how powerless the Chinese Communist Party is against the Hong Kong diaspora who are campaigning for freedom and democracy. But it also illustrates that China is poised to become increasingly authoritarian and poses a threat to the world,” Hui told China.Table in writing.

In the UK, Foreign Secretary James Cleverly also rejected Chinese accusations that his country was offering protection to “fugitive” activists from Hong Kong. Two years ago, among others, the co-founder of the Democratic Demosisto Party, Nathan Law, was granted asylum in the UK. An arrest warrant has now been issued for him as well. The Chinese embassy in London called it a “crude interference in Hong Kong’s rule of law and China’s internal affairs.”

The role of the United Kingdom as a former colonial power is a special one. Hong Kong’s judiciary still has organs in which Commonwealth judges have jurisdiction. However, the influence of foreign judges is now severely curtailed. In cases involving the National Security Law, Chief Executive John Lee can appoint a judge for the trial.

These arrest warrants and bounties are making waves in liberal democracies, although they are more symbolic now. After all, the wanted individuals are not hiding, but live openly in Australia, the United States and the United Kingdom. All three states – as well as Germany – have suspended their extradition treaties with the former British Crown Colony. This prevents Hong Kong from getting a hold of them via international arrest warrants.

However, wanted individuals must think carefully about which countries they will set foot in, even if it is just for an airport layover. This is because many nations still maintain a valid extradition treaty with Hong Kong or China. Political interests could also put them at risk in some states. Nevertheless, large parts of the political West remain safe havens.

Government Chief Executive Lee, formerly chief of the Hong Kong Police, advised the wanted individuals in question to turn themselves in to get their sentences reduced. Otherwise, they would “have to live in fear and worry daily that they might be arrested”.

Ted Hui, who is also wanted, is apparently not intimidated by these strong statements. There are already other arrest warrants out for him. He said the bounty would not change his personal situation and does not affect his safety.

At one million Hong Kong dollars, the bounty is about ten times higher than for the capture of a sex offender. Lawyer Yam considers this “absolute madness”. For that reason, he sees the bounties also as a domestic warning. During the press conference at which he and the seven others were prominently placed on the wanted list, the police also warned the city’s citizens to think very carefully about what they say on social media.

China’s Ministry of Commerce Mofcom has made exports of the key industrial metals gallium and germanium subject to approval. As of August 1, exporters will require a license to ship these elements to other countries. The basis for the ministry’s directive is the Export Control Law of 2020. According to the ministry, the purpose of the controls is to protect “national security”.

“This mirrors the strategic use of export control measures by the US,” writes Mathieu Duchâtel, an expert on the Chinese economy at the French think tank Institut Montaigne. So far, however, it is not an export ban: Any exporter can still request a license.

Nevertheless, “European semiconductor companies will consider themselves again in the crossfire of US-China competition,” adds Duchâtel. After all, China is the biggest producer of both metals. The new regulation already creates uncertainty about availability and prices. Gallium is particularly vital for a new, more cost-effective generation of semiconductors.

Germany has a high interest in the availability of both metals. This is because gallium is a raw material for power semiconductor devices, which are necessary for the automotive industry. Power semiconductors are chips capable of switching high current voltages, thus an essential part of EV electronics. They can adjust the current seamlessly and are not affected by high temperatures.

Power semiconductors can also be made from silicon, the traditional material for microchips. However, gallium nitride is currently becoming very attractive as a cost-effective and energy-saving alternative. One important manufacturer of gallium nitride-based power semiconductors is Infineon. The company already operates a plant for power semiconductors in Malaysia. It has now also absorbed Canadian special manufacturer GaN Systems to strengthen this area.

The EU currently promotes the development of gallium-based electronic components. Apart from vehicle manufacturing, gallium nitride chips are also used in many other advanced technologies, for example, in

At present, around 98 percent of the gallium consumed worldwide is imported from China. The EU imports over 70 percent of its gallium and almost half of its germanium from China. But the reason for this is not that the metal is not found elsewhere – gallium is also found in Japan, South Korea, Russia or Kazakhstan. The decisive factor for the high market share is China’s low export price.

Germany also used to be a gallium producer but ceased production in 2016 as it was no longer lucrative given the surpluses on the global market. However, plans to resume producing gallium emerged in late 2021 as part of efforts to reduce strategic dependencies.

Research is currently underway on how to achieve this. But it will take time before a significant yield can be achieved. Experts believe Europe will require another ten years to reduce its dependence on industrial metals.

The Chinese export controls are part of the trade dispute between the US and China. Presidents Trump and Biden have imposed a long list of sanctions on China’s tech companies. On the one hand, they are hardly allowed to do business in the US anymore; on the other hand, Washington has cut off the Chinese economy from advanced US semiconductors and their production facilities.

China now responds by using the leverage at its disposal. If the United States no longer supplies chips, China, in turn, no longer supplies raw materials. However, the US is completely dependent on imported metals. In this respect, China’s controls are not new. The export of rare earth elements has already been regulated since 2010.

Due to the technical and industrial significance of gallium and germanium, both elements are included on the EU’s list of strategic raw materials for the digital economy and the energy transition. On Tuesday, a spokesperson for the Commission in Brussels expressed “concern” about the Chinese trade measure.

The EU urged China to only deny export licenses over “genuine security concerns”. The Brussels authority currently examines the impact of China’s decision – and whether it is compatible with WTO trade rules.

The Federation of German Industries (BDI) regards the new regulations as a wake-up call to accelerate de-risking. “Beijing’s announced export control measures for the raw materials gallium and germanium, which are important for the semiconductor industry, illustrate the urgency of quickly reducing dependence on critical raw materials now,” according to Wolfgang Niedermark, member of the BDI’s Executive Board. This is why it is positive that the EU is progressing toward securing the supply of critical raw materials. he said.

Companies seeking to apply for export licenses in China must specify the country of destination and the intended industrial application of the shipment. This allows Mofcom to very precisely regulate the export restrictions. For instance, exports to certain EU countries could be denied and permitted to others. However, the law’s main addressee is the United States, which buys almost all its gallium on the global market.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

The Chinese government has once again postponed a scheduled visit to Beijing by EU High Representative for Foreign Affairs, Josep Borrell, next week, a spokesman for Borrell said on Tuesday. Initially, no reasons were given. The trip, which was originally scheduled for April, had to be postponed to July after Borrell contracted Covid.

Borrell was due to arrive in Beijing next Monday. The main focus of the trip was supposed to be a meeting with Chinese Foreign Minister Qin Gang. According to an EU spokesperson, Chinese interlocutors have now informed the EU that the scheduled date is no longer possible.

Borrell’s visit would have followed that of Frans Timmermans. The EU climate envoy will meet with Chinese officials this week to discuss climate, biodiversity and eco-conservation. It is also his second attempt: Timmermans originally had to postpone his trip because of a Covid infection. rtr/ari

Russia’s President Vladimir Putin used the Shanghai Cooperation Organisation (SCO) summit to display unity and strength shortly after the Wagner rebellion. He thanked the countries of the Alliance, including China, for their support during the insurrection of Wagner chief Yevgeny Prigozhin and his mercenaries, who advanced as far as 200 kilometers outside Moscow last week. He called the Russian nation “united as never before”.

At the SCO summit, Putin addressed a sympathetic audience that, unlike most Western countries, does not view Russia as an outsider but as a partner. The Beijing-based organization includes China, India, Kazakhstan, Kyrgyzstan, Pakistan, Tajikistan and Uzbekistan. At the summit, Putin also spoke out in favor of a “speedy settlement” of Belarus’ application to become an SCO member.

One new member was already welcomed at this summit: The organization accepted Iran into its ranks as its ninth member. The host of the virtual summit of heads of state and government of member countries, India’s Prime Minister Narendra Modi, officially announced the accession. “New countries joining the group underlines the importance of the group,” Modi said.

Iran has held observer status at the SCO since 2005. The accession represents a new step in the country’s efforts to break out of its diplomatic isolation. Previously, Tehran had already strengthened relations with China and Russia and resumed diplomatic ties with Saudi Arabia – also with the help of successful mediation efforts by China.

During his speech at the summit, China’s President Xi Jinping called for pragmatic cooperation and accelerating economic recovery. jul

German Minister of Justice Marco Buschmann received his Taiwanese counterpart Ching-Hsiang Tsai in Berlin on Tuesday. Germany and Taiwan had already agreed in March on mutual legal assistance in criminal matters.

According to the Ministry of Justice in Berlin, the visit adhered to the European Union’s One-China policy. Under Germany’s interpretation of the One China principle, only high-ranking politicians such as the president, the chancellor, and the foreign and defense ministers are barred from direct contact with Taiwan. Meetings with other ministers are possible.

“The talks focused in particular on cooperation in the field of legal assistance in criminal matters,” said the ministry. They also exchanged views on Internet fraud and extradition issues, it added in a statement.

In March, a visit by German Education Minister Bettina Stark-Watzinger to Taiwan had sparked angry reactions from Beijing. The visit by the liberal FDP politician was the first by a member of a German government in more than 25 years.

China views democratically governed Taiwan as its own territory and has ramped up military, political and economic pressure to assert those claims. The visit by Taiwan’s justice minister comes at a time when Berlin is reassessing its previously close relations with China. rtr/jul

The European Union has identified seven companies likely to be classified as key digital companies, or gatekeepers in EU terminology. Among them is ByteDance, the operator of the video app Tiktok, which is wildly popular with young people. Gatekeepers may be regulated separately under the Digital Markets Act (DMA). However, queries for additional information from concerned companies are still underway. By September 6, the Commission will decide whether they are indeed gatekeepers.

Under the DMA, which took effect last November, companies with more than 45 million monthly active users and a market capitalization of 75 billion euros are considered gatekeepers that provide a central platform service. Other affected companies include Google, Apple and Amazon.

The Commission still examines other companies that have not been on its radar so far. If it identifies these companies as de facto gatekeepers, despite falling below the thresholds by a few euros, for example, the Commission could retroactively classify them as gatekeepers. One example is Alibaba. vis/fin

The EU Commission has imposed anti-dumping duties on recyclable stainless steel kegs from China. Stainless steel kegs are used to hold beverages, including beer that can be attached to beer taps. The countervailing duties will be in place for five years, amounting to between 62.6 percent and 69.6 percent. According to the Brussels authority, the decision was based on an investigation. It found that barrels from the People’s Republic had been sold at dumping prices on the EU market. This had harmed barrel manufacturers in the EU. ari

China’s growth model is undergoing fundamental change. After decades of relying primarily on external demand to drive growth, the government has embraced a “dual circulation” model, driven by both internal and external demand. The goal is to make China’s economy more resilient and less vulnerable to external shocks, but the structural transformation has run up against major roadblocks.

When Deng Xiaoping launched his “reform and opening up” in 1978, China pursued a development strategy modeled after successful East Asian economies like Japan and South Korea: Welcome foreign direct investment, expand cross-border trade linkages, leverage low labor costs to bolster the manufacturing sector, and take advantage of external demand to drive growth. Over the last four decades, FDI flows – about two-thirds of which came through Hong Kong – enabled China to transform Guangdong and other coastal provinces into global supply-chain hubs.

As industrialization progressed, incomes and wealth increased, and Chinese workers became consumers of both goods and services. As a result, the foreign-trade-to-GDP ratio declined, from a peak of 67 percent in 2006 to around 35 percent today, though China still relies on the jobs provided by its export industries.

As China built up its manufacturing sector, it also invested heavily in expanding its construction and financial industries, thereby laying the foundations for a dynamic real-estate market. Over the last decade, the nominal average annual growth rate of the construction sector and the financial and real-estate industries reached 13 percent, 14.8 percent, and 10.5 percent, respectively.

In 2021, China’s construction sector contributed 13.8 percent to China’s GDP, with the real-estate industry’s value-added reaching 6.8 percent of GDP, though it fell to 6.1% in 2022. Today, real-estate assets account for about 70 percent of household wealth, with important implications for consumption. Moreover, real-estate loans account for 27 percent of total bank credit, meaning a thriving real-estate market is also critical to financial stability.

The real-estate market’s rapid growth was driven partly by a financing innovation that originated in Hong Kong. Rather than completing projects, and then recouping their investment, residential housing developers began selling units before completion. This enabled them to use down-payments from home-buyers – in addition to the funds released by lending institutions as construction progressed (construction drawdowns) – to finance projects. From 2015 to 2022, the share of down payments and mortgages in total developer funding increased from 62.4 percent to 80.4 percent.

But this approach carried risks. By striking deals before construction was completed, developers and home-buyers left themselves exposed to interest-rate increases and slowdowns in price growth.

Developers who had borrowed heavily using US dollar bonds were particularly vulnerable – a reality that became painfully clear when surging inflation in the United States compelled the Federal Reserve to begin aggressively raising interest rates. Last year brought a series of defaults by major real-estate developers, which forced local governments to intervene to protect the rights of the affected home-buyers.

The real-estate sector’s travails have generated considerable fiscal challenges. In 2021, direct real-estate taxes accounted for 16.9 percent of national tax revenue, and 24 percent of local-government tax revenue. But falling real-estate prices have squeezed those revenues. In 2022, income from state-owned land sales decreased by 23.2 percent, causing China’s national budget revenue to fall by 20.6 percent. Declining revenue is also undermining local governments’ ability to support growth, such as by financing urban investment platforms.

The deterioration of US-China relations, and the disruptions caused by the COVID-19 pandemic, have further impeded China’s structural transformation. In fact, the economy’s internal and external circulation have both slowed significantly, damaging the balance sheets of households, enterprises, and all levels of government.

Both imports and exports fell last month, by 4.5 percent and 7.5 percent, respectively. Within China, jobs are not being created fast enough to absorb the supply of new graduates: as of last month, some six million young people (aged 16-24) – 20.8 percent – were unemployed. Housing and stock prices remain under pressure.

But there is reason to hope that China will bounce back from its current struggles. US Secretary of State Antony Blinken’s recent visit to China may augur stabilization of the US-China relationship – or, at least, a respite from further deterioration.

In any case, China’s government is committed to stimulating employment, stabilizing the housing sector, managing financial risks, supporting technological innovation, and encouraging green and inclusive growth. The market seems to be anticipating a comprehensive and forceful stimulus package that supports these objectives.

The rest of the world has an obvious stake in the outcome. China’s success in managing the challenges ahead could be the difference between a global recovery and a global recession.

Andrew Sheng is a distinguished fellow at the Asia Global Institute at the University of Hong Kong. Xiao Geng, Chairman of the Hong Kong Institution for International Finance, is a professor and Director of the Institute of Policy and Practice at the Shenzhen Finance Institute at The Chinese University of Hong Kong, Shenzhen.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Thomas Fauth has been Senior Manager eDrive Integration & RTM Development at Mercedes-Benz Group China in Beijing since May. He previously worked as Team Leader Networking Powertrain at Mercedes-Benz AG in Sindelfingen, Germany.

Alexandra Holub joined Aiko Energy, a Chinese manufacturer of photovoltaic cells, as Head of Marketing DACH/UK/Nordics at the beginning of the month. She was previously employed by EnOcean in Munich.

Is something changing in your organization? Let us know at heads@table.media!

Mosquitoes in the sand? It is all a matter of perspective. A top-down view of the farm of a dairy company in Yinchuan shows a giant herd of cattle. Last year, the People’s Republic produced around 40 million tons of milk. By comparison, Germany produced 2.3 million tons. China also made headlines last winter after researchers announced they had successfully cloned super cows that produce 18 tons of milk a year, twice as much as their normal sisters.