The US government is banning certain investments in China’s tech sector. President Joe Biden cites national security concerns. What is more concerning to Europe than the measure itself is its tone and direction, analyzes Finn Mayer-Kuckuk. The US and China continue to split the global market, and with each new turn of the trade conflict, the agency of international companies shrinks.

If you wanted to get – halfway – decent coffee for your machine at home in China, there was no getting around the US coffee chain Starbucks. There was little to choose from to get coffee powder in a cosmopolitan city like Shanghai. However, the current coffee chain leader from abroad has been overtaken on the domestic market: Luckin Coffee is the top-selling coffee company. Joern Petring writes about how Luckin managed this.

And today’s China Perspective column is about the true ruler of China. And it is not the party.

The White House has decreed: Capital investments by US investors in Chinese high-tech companies will no longer be possible as of next year. The founding of joint ventures is also prohibited. The following sectors are affected:

The executive order officially affects “Countries of Concern,” meaning China. For instance, a US investment house like Goldman Sachs can no longer put money into a Chinese AI company like Baidu or Alibaba. The US will also no longer be able to provide funding for Chinese start-ups. Previously, such investments were routine.

The measure itself is not what causes the most concern in Europe. Its immediate impact will be limited, especially since it will not have a retroactive effect. European companies are not directly affected.

But indirectly, the indefinite continuation of the trade conflict will have global repercussions. China, in turn, will respond with a trade measure, as it has done every time after US sanctions. The Ministry of Foreign Affairs in Beijing already complained on Thursday about being the victim of “economic coercion” by the United States.

Moreover, the tone of the decree does not bode well for the development of global trade in the coming years. Biden explicitly does not justify the measure on economic grounds, but as a political matter of national security. He presents the investment stop as self-defense against the rise of China as a technological rival.

The decrees reveal with astonishing candor that the president considers the mere existence of a technically equal great power dangerous in itself, that the USA should and must defend its lead by all means. This confirms the Chinese perception of the West trying to keep its own country down, as the Foreign Ministry spokesperson also clearly stated.

EU trade politician Bernd Lange from the German Social Democratic Party (SPD) views the sanctions quite critically. Lange, a Member of the European Parliament, is concerned about the arbitrary use of national security as a justification for trade barriers. “A completely unspecific use of this justification naturally opens the door to protectionism.” Lange sees a continuation of Donald Trump’s practices in this.

The EU Commission announced that it would closely examine the planned restrictions. “We are in close contact with the US government and look forward to further cooperation in this area,” a spokesperson said, adding that the Commission is aware of the importance of the issue. The EU and member states also have a common interest in preventing capital and expertise of European companies from enhancing military and intelligence capabilities of actors “who may use them to undermine international peace and security.”

However, with each new round of the trade conflict, the agency of internationally operating companies shrinks. And the more consistently both sides reject their opponents’ technical products, the less European companies can offer uniform devices for the global market. If the basic version of a product contains high-quality US chips, a company must develop a version with Chinese chips for China. This risks splitting the global market.

Lange sees the decree as the next step in the escalation between the US and China and even “a new dimension.” He does not believe that Brussels should follow suit: “We in the EU have our own interests, and to that extent, we should not let ourselves be pressured and pursue our strategy autonomously.”

However, Lange believes that the measure makes sense from the US perspective: It brings Biden closer to two of his goals. He combines “the economic interests of limiting China’s competition to the USA as a business location with the geopolitical intention of depriving China of certain technological opportunities for political expansion.”

According to the statements of his officials, Biden indeed wants to achieve two things:

The new investment ban fits seamlessly into the White House’s list of trade measures. It also unmistakably bears Biden’s signature. While Donald Trump still focuses on old-economy products such as washing machines and steel, Biden primarily focuses on high tech.

However, there is also the question of who is hurting whom more. After all, the US financial sector has also invested in the fast-growing Chinese tech sector out of self-interest. China also tends to be inaccessible, but Western investments, in particular, have opened doors for decades and maintained the West’s information level about what is happening in China. Banning investment in Chinese tech companies almost sounds more like a sanction China could have imposed on the US.

There is a surprising change at the top of the Chinese coffee market: For the first time, Starbucks is no longer the best-selling company in China, but the domestic aggressor Luckin Coffee. The Xiamen-based company turned over 6.2 billion yuan (783 million euros) between April and June, up 88 percent year-on-year. Profit was 999 million yuan (126 million euros). Starbucks also recorded strong growth of 51 percent in the same period. On the bottom line, however, turnover in China was just behind Luckin at 5.9 billion yuan.

Luckin caused quite a stir after its founding in 2017 and quickly gained market share from its American competitors in China. But then a major scandal ensued: Luckin admitted to falsifying its business figures. The fraud even cost Luckin its listing on the New York Stock Exchange.

Against expectations, however, the chain managed to turn itself around. The company’s management was changed, and business was restructured. Luckin was able to close the gap to Starbucks mainly thanks to the Covid pandemic. The business model of the two competitors is very different.

Starbucks focuses on how much time customers spend in its coffee shops. The company sees itself as a premium provider. Most drinks are sold for over 30 RMB. Luckin, on the other hand, focuses on takeaway and delivery services. The branches offer hardly any places to sit. They mainly serve as a drop-off point for delivery drivers, who bring the drinks to the customers on their electric scooters. Prices tend to be in the 20 RMB range – with discounts, they tend to be even cheaper.

Starbucks’ business slumped during the pandemic, while Luckin was able to keep its sales largely stable – and even gain new customers. Luckin has not only overtaken Starbucks in turnover for the first time, but now also owns more shops than Starbucks in China. More than 1,300 new shops opened in the first quarter alone. In June, the 10,000 shop mark was surpassed. By comparison, Starbucks currently operates around 6,000 shops in more than 230 Chinese cities.

Luckin was founded in 2017 as a trendy and affordable alternative to traditional coffee shops like Starbucks and quickly gained a foothold by offering unbeatable discounts. In 2019, the company celebrated a grand debut on New York’s Nasdaq with a 600 million US dollar IPO.

But less than a year later, the Chinese coffee chain had to withdraw its index listing after admitting that its profits were exaggerated. As a result, Luckin fired its president and CEO and had to pay 180 million dollars in fines. “We have taken many measures to clean up our own house,” Guo Jinyi, Luckin’s new CEO, said in a recent interview.

In the race against Starbucks, Luckin now, at least for the time being, has knocked a foreign brand off its throne that was synonymous with coffee in China for more than two decades. Until the 1990s, coffee was hard to come by in China, except in luxury hotels for foreigners. Starbucks opened its first branch in mainland China in Beijing in 1999, a risky venture for the international coffee giant. Coffee in the land of tea drinkers – not all analysts were thrilled with the idea.

But coffee gained massive popularity, especially among young people in the big cities. According to forecasts, the market is expected to grow to a volume of 219 billion yuan (28 billion euros) by 2025. And yet the sector is only in its infancy. At present, per capita coffee consumption in China is estimated at only nine to ten cups per year. In Germany, for example, the figure is four cups – but per day.

Luckin’s successful restructuring is also paying off for investors. Although the company’s shares are no longer listed on Nasdaq, they can still be traded over the counter. Since bottoming out after delisting three years ago, the shares have surged more than 2,000 percent, and are still up about 40 percent since the company went public in 2019. Starbucks has gained about 27 percent over the same period. However, Starbucks is still ahead in terms of market capitalization: While Starbucks was most recently valued at around 115 billion dollars, Luckin has a valuation of just 7.5 billion dollars.

August 15, 2023; 9 a.m. CEST (3 p.m. CST)

Yusof Ishak Institute (ISEAS), Webinar: China’s BRI in Southeast Asia: A Tale of Two Railways More

August 16, 2023; 4 p.m. CEST (10 p.m. CST)

World Scientific Publishing, Webinar: China and the World Forum: The Belt and Road Initiative More

August 17, 2023; 3-6 p.m. Beijing

AHK Greater China, Innovation Dialogue: Revolutionizing Manufacturing – The Power of AI and Smart Manufacturing More

August 17, 2023; 8 p.m. CEST (2 a.m. CST)

Issues in Science and Technology, Webinar: What Happens to Global Science if the United States and China Quit Collaborating? More

Last year, China’s carbon emissions were a positive surprise: They had dropped for several quarters in a row, in some cases sharply. Now, the trend points in the other direction- quite considerably. Carbon emissions in the second quarter were ten percent higher than in the same period of the previous year.

The development is revealed in a recent Carbon Brief report, which analyzed official statistics and commercial data. The current value is one percent above the previous peak in 2021.

The biggest influence on the higher emissions came from coal-fired electricity generation, with an increase of 15 percent, and oil consumption, among other things, for diesel production, with an 18 percent increase. Steel and cement production, on the other hand, declined, due to the crisis in the real estate sector. However, the increase is due to one-off rather than structural factors.

Carbon Brief reports that two main factors were responsible for the sharp increase. First, the reference value of 2022 was particularly low because Shanghai and many other cities were under strict lockdowns at that time. In the second quarter of 2022, China’s carbon emissions were eight percent below the level of the second quarter of 2021. This makes the current ten percent increase seem particularly severe, but in fact, it is not.

In addition, the output of China’s hydropower plants is severely reduced due to an ongoing drought, which requires ramping up other power plants that burn coal, for example.

Therefore, the direction of carbon emissions over the next few years is uncertain. The slow recovery of China’s economy after the Covid pandemic continues, and new economic stimulus measures could further fuel emissions, for example, through subsidies for the real estate sector with its energy-intensive cement production.

The construction of coal-fired power plants also continues to boom: Since the beginning of the year, an average of two new power plants per week have been approved and started construction. However, most of the investments are expected to be completed within the 15th Five-Year Plan by 2030. From then on, China has committed to reducing its emissions and reaching net zero carbon emissions by 2060.

But investments in low-carbon energies are also growing rapidly, for example, in solar and wind power, nuclear power plants and hydropower plants. The expansion can cover a growth in electricity consumption of four percent per year, currently, it is at five percent. If the expansion forecasts are met, China could meet the expected growth in its electricity demand and reach its emissions peak in as little as two years. jul

China has lifted pandemic restrictions on group tourism for 70 more countries, including Germany, the UK, the US, Japan, South Korea and Australia. However, travel restrictions for Canada, with which China’s relations are currently strained, remain in place. The Chinese Ministry of Culture and Tourism announced the decision on Thursday, and it is effective immediately.

Group travel is very popular with Chinese tourists, who spend more money on overseas trips than tourists from other countries: in 2019, it was 255 billion dollars, an estimated 60 percent of which was spent on group travel. Many tourism-dependent businesses worldwide are thus expected to benefit from the relaxations.

Group travel was already permitted for 60 countries, including Thailand, Cuba and Russia, at the beginning of the year. Beijing did not provide an explanation for the gradual approval procedure, but analysts see a connection with the state of the respective political relations.

How quickly Chinese travel will return to pre-pandemic levels remains to be seen. By July, international air travel to and from China had only recovered to 53 percent of 2019 levels. However, Trip.com, China’s largest travel agency, said that news of the lifted restrictions already led to a surge in searches for destinations such as Australia and Japan.

Analysts also see positive signs. “Despite a cooling overall economy, 40 percent of (Chinese) people say they will spend more on travel,” said Steve Saxon, a partner at McKinsey & Co. “People want to spend the money they’ve saved during COVID on international travel.” rtr/jul

According to its Ministry of Commerce, China wants to deepen trade and investment cooperation with South Africa. In addition, South African exports to China are to be promoted, as the ministry announced in a statement late on Wednesday. Cooperation will be intensified, for instance, in mining, agriculture and new energies. Chinese Commerce Minister Wang Wentao met with South African Vice President Paul Mashatile in the capital Pretoria on Wednesday. A summit meeting of the BRICS countries will also take place from 21 August. rtr/ari

While political experts still disagree on the risk of a Chinese attack on Taiwan and the potential timeframe, insurers already attempt to assess the financial risk of damage from a military attack. According to a Reuters report, Lloyd’s of London underwriters are leading insurers in raising rates and cutting the amount of cover they offer for risks involving Taiwan as concerns grow over possible military action by China.

Accordingly, some insurers are already imposing exclusions on Taiwan in political risk or political violence policies. Such policies are usually sold as an add-on to property insurance, and cover property damage and business interruption losses for issues including terrorism, sabotage and war.

“Political risk and credit capacity for both China and Taiwan has been restricted since Q3 last year, and insurers are generally seeking to reduce aggregate (total) exposure where possible,” said Nick Robson, Global Chairman, Credit Specialties with broker Marsh.

Several industry sources said the restrictions were also feeding into the marine market for Taiwan, and one of them added that one US insurer was introducing exclusions for ships sailing to Taiwanese waters.

The Lloyd’s of London insurance market, which has around 100 syndicate members, asked members in January to identify potential exposure to so-called realistic disaster scenarios related to conflict in Taiwan in insurance classes including marine, aviation and political risk. Such risk assessment by members is nothing unusual, however.

The scenarios were drawn up by insurance broker CHC Global, according to the documents. A CHC spokesperson confirmed the report. The scenarios could play out over the next 10 years.

The scenarios ranged from a Chinese naval quarantine of the country, to China seizing outlying Taiwanese islands and, in the most extreme scenario, a Chinese attempt to take Taiwan by force. This could result in some aircraft and ships at Taiwanese airports and ports being damaged or destroyed, and the imposition of wide-ranging, economically-damaging Western sanctions against China.

Shih Chiung-hwa, Director General of the Insurance Bureau of Taiwan’s Financial Supervisory Commission, told Reuters she was not aware of the Lloyd’s review of Taiwanese insurance cover, but noted the market had been tightening coverage more broadly over the last 2-3 years, mainly in response to climate change and geopolitical risks, such as those posed by the Russia-Ukraine conflict. rtr/jul

Global law firm Dentons is divesting its China business to comply with the data protection requirements of the so-called “anti-espionage law”. The law provides for a massive expansion of the powers of state security, which in the future will be able to more easily carry out raids and arrests without a court order if information leaks are suspected. The China branch will be taken over in full by partner Beijing Dacheng Law Offices, the Financial Times and Bloomberg reported, citing a statement to clients.

The law has made companies in China nervous since it was adopted. It redefines the criminal offense of espionage: Not only are state secrets to be protected, but also all documents or files affecting “national interests.” However, the latter is formulated so loosely that it gives the authorities leeway for arbitrary application. ari

China is, in name, a communist country with 97 million Communist Party members. But what really prevails in the world’s second-biggest economy and second-most populous country is cynicism.

There are 97 million party members in the People’s Republic, plus Buddhists, Muslims, Christians, and underground followers of Falun Gong. They are generally not only atheists but also skeptical about many things, for example, altruism, justice and democracy, among others.

In everyday life, domestic politics, and international relations, Chinese cynicism manifests itself in different ways.

There have been some signs showing Chinese are a bit nicer to strangers than before, particularly in subway and buses, where the elderly, little children and pregnant women are often offered seats. In big cities, people with the same interests find each other and meet offline for activities. Volunteer groups help people in need, for example, in last week’s big floods in Beijing.

However, people are generally still indifferent to what happens to strangers and even stay alerted to kindness from strangers for fear of traps. The old tradition of the acquaintance society – a term coined by the pioneering Chinese sociologist Fei Xiaotong (1910 – 2005) – in which ethics are only about the people they know still lingers.

The situation improved between roughly 2000 – 2013. Discussions about public issues were active both online and offline. Non-profit organizations for public interests and volunteer work in different areas mushroomed. A civil society seemed to be burgeoning.

Then came the crackdown from the government, in evident fear of the society’s self-organizing, which could pose a challenge to the government.

At the same time, China is already using the term created by Václav Havel, a post-totalitarian society. It is still a cruel authoritarian regime, but people no longer believe in the Party and the government. But they wouldn’t openly express their mistrust. They would also say something in line with the Party’s current slogans when needed.

In the words of Perry Link, a scholar on China at the University of California, Riverside, the Communist Party of China can no longer brainwash the Chinese people as it did in the Mao era. Now the Party could only “mouthwash” them.

However, the Party’s brainwashing effort has been successful, at least on one issue: denigrating democracy. Many Chinese believe politics in all countries are similarly dirty and that in Western countries, politics is run by the rich. So although many Chinese are not happy with the Communist Party, they don’t see other options. Even if China democratizes, it would be impossible to have fair elections because China is too complex, and many Chinese would be easily manipulated, they believe.

So life goes on like this. And the people must behave, otherwise, they will get punished. Some of them not only comply, they even navigate the system of lies and schemes and benefit from it. In a country with an unreliable social safety net and a government that could easily change its mind and policy, money has become the true faith for the whole nation.

Idealists had always been a rare species in the all-powerful system of Party, government and state companies. However, some of the competent ones did manage to survive and accomplish something before the Xi era. Now, they are extinct. Anybody harboring the ambition to climb higher in the system must be prepared to put on a perfect mask and throw themselves into political dogfights.

When it comes to international relations, the Chinese are firm believers in realism and social Darwinism. To them, we live in a cold world. Friendship and justice don’t exist. In peacetime, interest and money are in control; When real conflicts arise, sheer military power is what really counts.

“There are no eternal friends, nor eternal enemies. There are only eternal interest.” This assertion and its variations are frequently quoted in Chinese articles on diplomacy. It is a simplified version of a statement by British politician Henry Palmerston (1784-1865), but it is often falsely attributed to Winston Churchill.

Another statement that has become a mantra for the Chinese is, “Those who fall behind will get beaten.” Very few know it’s a quote from Stalin, who doesn’t have a very negative image in China anyway.

The Chinese faith in money also applies to their opinion in world politics. They believe the Chinese market is vital to many countries. So business can be used as a weapon in international relations.

Benjamin Becker has moved to the University of Hong Kong as a new professor. Becker previously worked at the University of Bonn and Cologne, among others. He researches and teaches cognitive and affective neuroscience.

Guido Maune joined Maersk Container Industry in Qingdao as Managing Director in early July. Maune previously held the position of General Manager at Melitta in Shenzhen.

Is something changing in your organization? Let us know at heads@table.media!

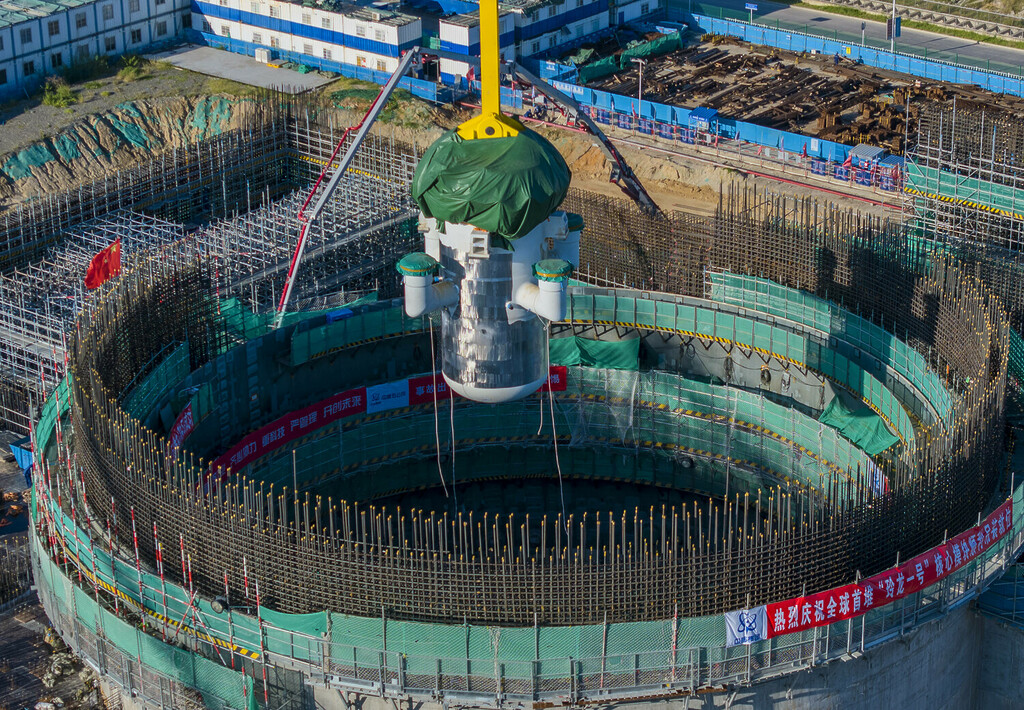

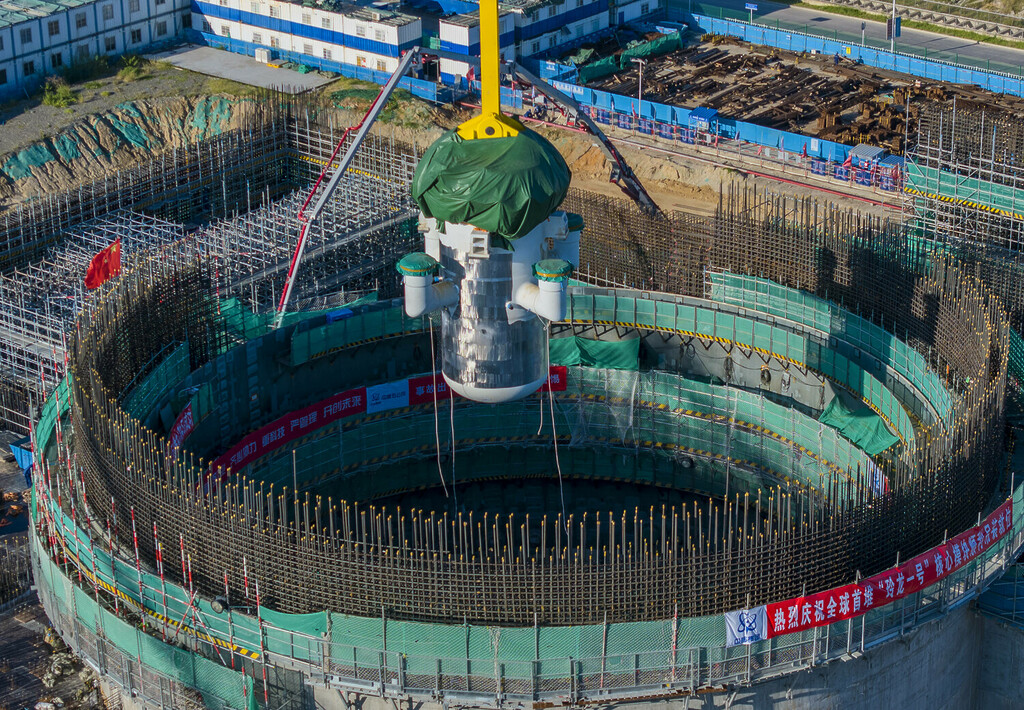

Linglong One receives its core module – an important milestone in the construction of the world’s first commercial small modular reactor (SMR), the China National Nuclear Corporation announced. Linglong One is located in Changjiang in Hainan. The core module consists, among other things, of a pressure vessel and a steam generator as well as other important equipment.

The US government is banning certain investments in China’s tech sector. President Joe Biden cites national security concerns. What is more concerning to Europe than the measure itself is its tone and direction, analyzes Finn Mayer-Kuckuk. The US and China continue to split the global market, and with each new turn of the trade conflict, the agency of international companies shrinks.

If you wanted to get – halfway – decent coffee for your machine at home in China, there was no getting around the US coffee chain Starbucks. There was little to choose from to get coffee powder in a cosmopolitan city like Shanghai. However, the current coffee chain leader from abroad has been overtaken on the domestic market: Luckin Coffee is the top-selling coffee company. Joern Petring writes about how Luckin managed this.

And today’s China Perspective column is about the true ruler of China. And it is not the party.

The White House has decreed: Capital investments by US investors in Chinese high-tech companies will no longer be possible as of next year. The founding of joint ventures is also prohibited. The following sectors are affected:

The executive order officially affects “Countries of Concern,” meaning China. For instance, a US investment house like Goldman Sachs can no longer put money into a Chinese AI company like Baidu or Alibaba. The US will also no longer be able to provide funding for Chinese start-ups. Previously, such investments were routine.

The measure itself is not what causes the most concern in Europe. Its immediate impact will be limited, especially since it will not have a retroactive effect. European companies are not directly affected.

But indirectly, the indefinite continuation of the trade conflict will have global repercussions. China, in turn, will respond with a trade measure, as it has done every time after US sanctions. The Ministry of Foreign Affairs in Beijing already complained on Thursday about being the victim of “economic coercion” by the United States.

Moreover, the tone of the decree does not bode well for the development of global trade in the coming years. Biden explicitly does not justify the measure on economic grounds, but as a political matter of national security. He presents the investment stop as self-defense against the rise of China as a technological rival.

The decrees reveal with astonishing candor that the president considers the mere existence of a technically equal great power dangerous in itself, that the USA should and must defend its lead by all means. This confirms the Chinese perception of the West trying to keep its own country down, as the Foreign Ministry spokesperson also clearly stated.

EU trade politician Bernd Lange from the German Social Democratic Party (SPD) views the sanctions quite critically. Lange, a Member of the European Parliament, is concerned about the arbitrary use of national security as a justification for trade barriers. “A completely unspecific use of this justification naturally opens the door to protectionism.” Lange sees a continuation of Donald Trump’s practices in this.

The EU Commission announced that it would closely examine the planned restrictions. “We are in close contact with the US government and look forward to further cooperation in this area,” a spokesperson said, adding that the Commission is aware of the importance of the issue. The EU and member states also have a common interest in preventing capital and expertise of European companies from enhancing military and intelligence capabilities of actors “who may use them to undermine international peace and security.”

However, with each new round of the trade conflict, the agency of internationally operating companies shrinks. And the more consistently both sides reject their opponents’ technical products, the less European companies can offer uniform devices for the global market. If the basic version of a product contains high-quality US chips, a company must develop a version with Chinese chips for China. This risks splitting the global market.

Lange sees the decree as the next step in the escalation between the US and China and even “a new dimension.” He does not believe that Brussels should follow suit: “We in the EU have our own interests, and to that extent, we should not let ourselves be pressured and pursue our strategy autonomously.”

However, Lange believes that the measure makes sense from the US perspective: It brings Biden closer to two of his goals. He combines “the economic interests of limiting China’s competition to the USA as a business location with the geopolitical intention of depriving China of certain technological opportunities for political expansion.”

According to the statements of his officials, Biden indeed wants to achieve two things:

The new investment ban fits seamlessly into the White House’s list of trade measures. It also unmistakably bears Biden’s signature. While Donald Trump still focuses on old-economy products such as washing machines and steel, Biden primarily focuses on high tech.

However, there is also the question of who is hurting whom more. After all, the US financial sector has also invested in the fast-growing Chinese tech sector out of self-interest. China also tends to be inaccessible, but Western investments, in particular, have opened doors for decades and maintained the West’s information level about what is happening in China. Banning investment in Chinese tech companies almost sounds more like a sanction China could have imposed on the US.

There is a surprising change at the top of the Chinese coffee market: For the first time, Starbucks is no longer the best-selling company in China, but the domestic aggressor Luckin Coffee. The Xiamen-based company turned over 6.2 billion yuan (783 million euros) between April and June, up 88 percent year-on-year. Profit was 999 million yuan (126 million euros). Starbucks also recorded strong growth of 51 percent in the same period. On the bottom line, however, turnover in China was just behind Luckin at 5.9 billion yuan.

Luckin caused quite a stir after its founding in 2017 and quickly gained market share from its American competitors in China. But then a major scandal ensued: Luckin admitted to falsifying its business figures. The fraud even cost Luckin its listing on the New York Stock Exchange.

Against expectations, however, the chain managed to turn itself around. The company’s management was changed, and business was restructured. Luckin was able to close the gap to Starbucks mainly thanks to the Covid pandemic. The business model of the two competitors is very different.

Starbucks focuses on how much time customers spend in its coffee shops. The company sees itself as a premium provider. Most drinks are sold for over 30 RMB. Luckin, on the other hand, focuses on takeaway and delivery services. The branches offer hardly any places to sit. They mainly serve as a drop-off point for delivery drivers, who bring the drinks to the customers on their electric scooters. Prices tend to be in the 20 RMB range – with discounts, they tend to be even cheaper.

Starbucks’ business slumped during the pandemic, while Luckin was able to keep its sales largely stable – and even gain new customers. Luckin has not only overtaken Starbucks in turnover for the first time, but now also owns more shops than Starbucks in China. More than 1,300 new shops opened in the first quarter alone. In June, the 10,000 shop mark was surpassed. By comparison, Starbucks currently operates around 6,000 shops in more than 230 Chinese cities.

Luckin was founded in 2017 as a trendy and affordable alternative to traditional coffee shops like Starbucks and quickly gained a foothold by offering unbeatable discounts. In 2019, the company celebrated a grand debut on New York’s Nasdaq with a 600 million US dollar IPO.

But less than a year later, the Chinese coffee chain had to withdraw its index listing after admitting that its profits were exaggerated. As a result, Luckin fired its president and CEO and had to pay 180 million dollars in fines. “We have taken many measures to clean up our own house,” Guo Jinyi, Luckin’s new CEO, said in a recent interview.

In the race against Starbucks, Luckin now, at least for the time being, has knocked a foreign brand off its throne that was synonymous with coffee in China for more than two decades. Until the 1990s, coffee was hard to come by in China, except in luxury hotels for foreigners. Starbucks opened its first branch in mainland China in Beijing in 1999, a risky venture for the international coffee giant. Coffee in the land of tea drinkers – not all analysts were thrilled with the idea.

But coffee gained massive popularity, especially among young people in the big cities. According to forecasts, the market is expected to grow to a volume of 219 billion yuan (28 billion euros) by 2025. And yet the sector is only in its infancy. At present, per capita coffee consumption in China is estimated at only nine to ten cups per year. In Germany, for example, the figure is four cups – but per day.

Luckin’s successful restructuring is also paying off for investors. Although the company’s shares are no longer listed on Nasdaq, they can still be traded over the counter. Since bottoming out after delisting three years ago, the shares have surged more than 2,000 percent, and are still up about 40 percent since the company went public in 2019. Starbucks has gained about 27 percent over the same period. However, Starbucks is still ahead in terms of market capitalization: While Starbucks was most recently valued at around 115 billion dollars, Luckin has a valuation of just 7.5 billion dollars.

August 15, 2023; 9 a.m. CEST (3 p.m. CST)

Yusof Ishak Institute (ISEAS), Webinar: China’s BRI in Southeast Asia: A Tale of Two Railways More

August 16, 2023; 4 p.m. CEST (10 p.m. CST)

World Scientific Publishing, Webinar: China and the World Forum: The Belt and Road Initiative More

August 17, 2023; 3-6 p.m. Beijing

AHK Greater China, Innovation Dialogue: Revolutionizing Manufacturing – The Power of AI and Smart Manufacturing More

August 17, 2023; 8 p.m. CEST (2 a.m. CST)

Issues in Science and Technology, Webinar: What Happens to Global Science if the United States and China Quit Collaborating? More

Last year, China’s carbon emissions were a positive surprise: They had dropped for several quarters in a row, in some cases sharply. Now, the trend points in the other direction- quite considerably. Carbon emissions in the second quarter were ten percent higher than in the same period of the previous year.

The development is revealed in a recent Carbon Brief report, which analyzed official statistics and commercial data. The current value is one percent above the previous peak in 2021.

The biggest influence on the higher emissions came from coal-fired electricity generation, with an increase of 15 percent, and oil consumption, among other things, for diesel production, with an 18 percent increase. Steel and cement production, on the other hand, declined, due to the crisis in the real estate sector. However, the increase is due to one-off rather than structural factors.

Carbon Brief reports that two main factors were responsible for the sharp increase. First, the reference value of 2022 was particularly low because Shanghai and many other cities were under strict lockdowns at that time. In the second quarter of 2022, China’s carbon emissions were eight percent below the level of the second quarter of 2021. This makes the current ten percent increase seem particularly severe, but in fact, it is not.

In addition, the output of China’s hydropower plants is severely reduced due to an ongoing drought, which requires ramping up other power plants that burn coal, for example.

Therefore, the direction of carbon emissions over the next few years is uncertain. The slow recovery of China’s economy after the Covid pandemic continues, and new economic stimulus measures could further fuel emissions, for example, through subsidies for the real estate sector with its energy-intensive cement production.

The construction of coal-fired power plants also continues to boom: Since the beginning of the year, an average of two new power plants per week have been approved and started construction. However, most of the investments are expected to be completed within the 15th Five-Year Plan by 2030. From then on, China has committed to reducing its emissions and reaching net zero carbon emissions by 2060.

But investments in low-carbon energies are also growing rapidly, for example, in solar and wind power, nuclear power plants and hydropower plants. The expansion can cover a growth in electricity consumption of four percent per year, currently, it is at five percent. If the expansion forecasts are met, China could meet the expected growth in its electricity demand and reach its emissions peak in as little as two years. jul

China has lifted pandemic restrictions on group tourism for 70 more countries, including Germany, the UK, the US, Japan, South Korea and Australia. However, travel restrictions for Canada, with which China’s relations are currently strained, remain in place. The Chinese Ministry of Culture and Tourism announced the decision on Thursday, and it is effective immediately.

Group travel is very popular with Chinese tourists, who spend more money on overseas trips than tourists from other countries: in 2019, it was 255 billion dollars, an estimated 60 percent of which was spent on group travel. Many tourism-dependent businesses worldwide are thus expected to benefit from the relaxations.

Group travel was already permitted for 60 countries, including Thailand, Cuba and Russia, at the beginning of the year. Beijing did not provide an explanation for the gradual approval procedure, but analysts see a connection with the state of the respective political relations.

How quickly Chinese travel will return to pre-pandemic levels remains to be seen. By July, international air travel to and from China had only recovered to 53 percent of 2019 levels. However, Trip.com, China’s largest travel agency, said that news of the lifted restrictions already led to a surge in searches for destinations such as Australia and Japan.

Analysts also see positive signs. “Despite a cooling overall economy, 40 percent of (Chinese) people say they will spend more on travel,” said Steve Saxon, a partner at McKinsey & Co. “People want to spend the money they’ve saved during COVID on international travel.” rtr/jul

According to its Ministry of Commerce, China wants to deepen trade and investment cooperation with South Africa. In addition, South African exports to China are to be promoted, as the ministry announced in a statement late on Wednesday. Cooperation will be intensified, for instance, in mining, agriculture and new energies. Chinese Commerce Minister Wang Wentao met with South African Vice President Paul Mashatile in the capital Pretoria on Wednesday. A summit meeting of the BRICS countries will also take place from 21 August. rtr/ari

While political experts still disagree on the risk of a Chinese attack on Taiwan and the potential timeframe, insurers already attempt to assess the financial risk of damage from a military attack. According to a Reuters report, Lloyd’s of London underwriters are leading insurers in raising rates and cutting the amount of cover they offer for risks involving Taiwan as concerns grow over possible military action by China.

Accordingly, some insurers are already imposing exclusions on Taiwan in political risk or political violence policies. Such policies are usually sold as an add-on to property insurance, and cover property damage and business interruption losses for issues including terrorism, sabotage and war.

“Political risk and credit capacity for both China and Taiwan has been restricted since Q3 last year, and insurers are generally seeking to reduce aggregate (total) exposure where possible,” said Nick Robson, Global Chairman, Credit Specialties with broker Marsh.

Several industry sources said the restrictions were also feeding into the marine market for Taiwan, and one of them added that one US insurer was introducing exclusions for ships sailing to Taiwanese waters.

The Lloyd’s of London insurance market, which has around 100 syndicate members, asked members in January to identify potential exposure to so-called realistic disaster scenarios related to conflict in Taiwan in insurance classes including marine, aviation and political risk. Such risk assessment by members is nothing unusual, however.

The scenarios were drawn up by insurance broker CHC Global, according to the documents. A CHC spokesperson confirmed the report. The scenarios could play out over the next 10 years.

The scenarios ranged from a Chinese naval quarantine of the country, to China seizing outlying Taiwanese islands and, in the most extreme scenario, a Chinese attempt to take Taiwan by force. This could result in some aircraft and ships at Taiwanese airports and ports being damaged or destroyed, and the imposition of wide-ranging, economically-damaging Western sanctions against China.

Shih Chiung-hwa, Director General of the Insurance Bureau of Taiwan’s Financial Supervisory Commission, told Reuters she was not aware of the Lloyd’s review of Taiwanese insurance cover, but noted the market had been tightening coverage more broadly over the last 2-3 years, mainly in response to climate change and geopolitical risks, such as those posed by the Russia-Ukraine conflict. rtr/jul

Global law firm Dentons is divesting its China business to comply with the data protection requirements of the so-called “anti-espionage law”. The law provides for a massive expansion of the powers of state security, which in the future will be able to more easily carry out raids and arrests without a court order if information leaks are suspected. The China branch will be taken over in full by partner Beijing Dacheng Law Offices, the Financial Times and Bloomberg reported, citing a statement to clients.

The law has made companies in China nervous since it was adopted. It redefines the criminal offense of espionage: Not only are state secrets to be protected, but also all documents or files affecting “national interests.” However, the latter is formulated so loosely that it gives the authorities leeway for arbitrary application. ari

China is, in name, a communist country with 97 million Communist Party members. But what really prevails in the world’s second-biggest economy and second-most populous country is cynicism.

There are 97 million party members in the People’s Republic, plus Buddhists, Muslims, Christians, and underground followers of Falun Gong. They are generally not only atheists but also skeptical about many things, for example, altruism, justice and democracy, among others.

In everyday life, domestic politics, and international relations, Chinese cynicism manifests itself in different ways.

There have been some signs showing Chinese are a bit nicer to strangers than before, particularly in subway and buses, where the elderly, little children and pregnant women are often offered seats. In big cities, people with the same interests find each other and meet offline for activities. Volunteer groups help people in need, for example, in last week’s big floods in Beijing.

However, people are generally still indifferent to what happens to strangers and even stay alerted to kindness from strangers for fear of traps. The old tradition of the acquaintance society – a term coined by the pioneering Chinese sociologist Fei Xiaotong (1910 – 2005) – in which ethics are only about the people they know still lingers.

The situation improved between roughly 2000 – 2013. Discussions about public issues were active both online and offline. Non-profit organizations for public interests and volunteer work in different areas mushroomed. A civil society seemed to be burgeoning.

Then came the crackdown from the government, in evident fear of the society’s self-organizing, which could pose a challenge to the government.

At the same time, China is already using the term created by Václav Havel, a post-totalitarian society. It is still a cruel authoritarian regime, but people no longer believe in the Party and the government. But they wouldn’t openly express their mistrust. They would also say something in line with the Party’s current slogans when needed.

In the words of Perry Link, a scholar on China at the University of California, Riverside, the Communist Party of China can no longer brainwash the Chinese people as it did in the Mao era. Now the Party could only “mouthwash” them.

However, the Party’s brainwashing effort has been successful, at least on one issue: denigrating democracy. Many Chinese believe politics in all countries are similarly dirty and that in Western countries, politics is run by the rich. So although many Chinese are not happy with the Communist Party, they don’t see other options. Even if China democratizes, it would be impossible to have fair elections because China is too complex, and many Chinese would be easily manipulated, they believe.

So life goes on like this. And the people must behave, otherwise, they will get punished. Some of them not only comply, they even navigate the system of lies and schemes and benefit from it. In a country with an unreliable social safety net and a government that could easily change its mind and policy, money has become the true faith for the whole nation.

Idealists had always been a rare species in the all-powerful system of Party, government and state companies. However, some of the competent ones did manage to survive and accomplish something before the Xi era. Now, they are extinct. Anybody harboring the ambition to climb higher in the system must be prepared to put on a perfect mask and throw themselves into political dogfights.

When it comes to international relations, the Chinese are firm believers in realism and social Darwinism. To them, we live in a cold world. Friendship and justice don’t exist. In peacetime, interest and money are in control; When real conflicts arise, sheer military power is what really counts.

“There are no eternal friends, nor eternal enemies. There are only eternal interest.” This assertion and its variations are frequently quoted in Chinese articles on diplomacy. It is a simplified version of a statement by British politician Henry Palmerston (1784-1865), but it is often falsely attributed to Winston Churchill.

Another statement that has become a mantra for the Chinese is, “Those who fall behind will get beaten.” Very few know it’s a quote from Stalin, who doesn’t have a very negative image in China anyway.

The Chinese faith in money also applies to their opinion in world politics. They believe the Chinese market is vital to many countries. So business can be used as a weapon in international relations.

Benjamin Becker has moved to the University of Hong Kong as a new professor. Becker previously worked at the University of Bonn and Cologne, among others. He researches and teaches cognitive and affective neuroscience.

Guido Maune joined Maersk Container Industry in Qingdao as Managing Director in early July. Maune previously held the position of General Manager at Melitta in Shenzhen.

Is something changing in your organization? Let us know at heads@table.media!

Linglong One receives its core module – an important milestone in the construction of the world’s first commercial small modular reactor (SMR), the China National Nuclear Corporation announced. Linglong One is located in Changjiang in Hainan. The core module consists, among other things, of a pressure vessel and a steam generator as well as other important equipment.