Joe Biden will soon embark on his first visit to Asia as US president. His first stops will be his close allies Japan and South Korea. Yesterday, he already welcomed the heads of state and government of the ASEAN group at a special summit in Washington. China’s leaders will be keeping a keen eye on all this. After all, China and the US are vying for influence in Asia and especially in the Indo-Pacific. The People’s Republic has made advances in the region in recent years with its Silk Road. China takes a less friendly approach in the South China Sea. Washington has already made the region a focal point of its foreign policy under Barack Obama. What can Biden offer its nations to grow closer to the US? Christiane Kuehl has the answers.

The awarding of the International Human Rights Award of the German city of Nuremberg is also fraught with conflict. After it was announced that the prize was to go to a Chinese woman who witnessed human rights violations in Xinjiang, there were protests from China, as was to be expected. A city partnership suffered as a result. There were threats that Nuremberg companies would face economic repercussions for the awarding. But fortunately, the organizers did not give in to intimidation. Sayragul Sauytbay, who was one of the first to draw attention to torture, imprisonment and the oppression of the Uyghurs, will receive the Human Rights Award on Sunday.

China’s companies have caught up massively in recent decades. In many areas, they are now on par with their Western competitors, even surpassing them in some others. Thirty or forty years ago, this was almost unimaginable. But what is often overlooked is that it was German experts who helped build China’s industry, as Johnny Erling reveals in today’s column. At times, the Germans were revered as heroes – Werner Gerich, for example. A monument was even built in his honor in Wuhan. For two years, he headed an engine factory in the city. Reform politicians followed his every word when he criticized the lax production processes. At the time, industrial experts were not dispatched out of pure altruism. Rather, they wanted to develop new export markets for German industrial goods. Were they sometimes too naive and strengthened a future competitor and systemic rival?

Between May 20 and 24, Biden has several state visits scheduled during his Asia trip. First, he will visit allies South Korea and Japan. There, in addition to security issues, Biden is expected to flesh out his administration’s economic agenda for the Indo-Pacific region. Xi Jinping is likely to keep a close eye on the US president during this visit. Competition with China is a central focus of Biden’s visit to the region.

Currently, both nations strive to fill “blind spots” in their strategies, writes James Crabtree, Executive Director of the International Institute for Strategic Studies-Asia. The US has so far lacked an economic proposal to Asian countries. Their economic integration with China is steadily increasing, for example through the new Regional Comprehensive Economic Partnership (RCEP). Apart from China, RCEP also includes Australia, Japan and Korea – but not the USA.

By the same token, Beijing has yet to come up with a convincing response to the web of overlapping security alliances, such as Quad or AUKUS, that Washington forges in the Indo-Pacific. China alarms its neighbors with the expansion of military bases in the South China Sea and plans for a possible naval presence in the Solomon Islands – while the US offers them security guarantees. (China.Table reported).

Biden’s visit to Japan and South Korea will be the launching pad for a new US economic strategy, according to Japan’s ambassador to the US, Koji Tomita. Washington has lacked an economic presence in the region since the US under former President Donald Trump abandoned the Trans-Pacific Partnership (TPP) trade pact. In response, the Biden administration announced the so-called Indo-Pacific Economic Framework (IPEF) in October 2021. IPEF is said to cover trade, digital standards, labor issues, clean energy and infrastructure. However, it will not take the form of a “typical free trade deal,” according to US Commerce Secretary Gina Raimondo.

For domestic political reasons, Biden will not or cannot offer true market liberalization. Trade agreements require ratification by the US Congress, and Biden has promised to protect US jobs. Corruption, taxes or rules on trade will also be covered by the IPEF, Crabtree writes. “Traditionally, emerging nations such as those of ASEAN sign up to these kinds of onerous requirements because they get the sweetener of tariff cuts and market access in return,” the analyst says. But what if these are not on offer at all? More likely, developed partners South Korea and Japan are candidates for IPEF. For them, US security guarantees play an even greater role than for ASEAN.

Against this backdrop, China’s leader Xi Jinping announced plans for a Global Security Initiative (GSI) at the Boao Forum for Asia in April. This should help “build a balanced, effective and sustainable security architecture” and “reject the Cold War mentality, oppose unilateralism, and say no to group politics and bloc confrontation,” Xi said there. Details remained scarce, as is often the case with China’s new initiatives.

“Why China has decided it needs such a plan is obvious,” writes Crabtree. Beijing is “genuinely alarmed at the direction of the global order post-Ukraine.” Given its rivalry with the United States, Beijing saw no option but to support Russia, he says. “Where Washington recently produced a new Indo-Pacific strategy to counter Beijing, so Beijing now feels it needs a new global strategy to counter Washington.”

Vice Foreign Minister Le Yucheng recently announced that China would soon “take active steps to operationalize the GSI”. It is said to be directed against “unilateral sanctions” – an allusion to the West’s sanctions against Russia, which Beijing has rejected, but which have so far probably not been undermined.

“This suggests China will position the GSI to draw together its varied efforts to win global friends while, at the same time, pushing back against US attempts to target China via groupings like the Quadrilateral Security Dialogue,” Crabtree notes. China’s success in replacing the US as a security guarantor in the world or in Asia through the GSI, on the other hand, is unlikely, given its other actions in the South China Sea, for example.

It seems that for Washington and Beijing, the other is always at the center of foreign policy activities. For the US, this is probably true in the long term, despite the Ukraine war. Conversely, there is a growing concern in China about Washington’s containment policy. The People’s Republic sees the Russian campaign in Ukraine primarily through the lens of the conflict with the USA: Beijing’s foreign office spokespersons never tire of blaming the USA and NATO for the Ukraine war.

Washington increasingly perceives China’s authoritarian system as a threat to world order, so the hawks push a harder and harder line on China. “Chinese pronouncements about the country’s global ambitions are notoriously vague, forcing US policymakers to interpret them for hints of Beijing’s strategy,” says renowned China expert Andrew J. Nathan of Columbia University. That China seeks to challenge the US’s privileged position in Asia is beyond doubt, believes Nathan. “But does China intend to go even further – to replace the United States as the global hegemon, remake the liberal international order, and threaten freedom and democracy everywhere? And if so, does Beijing have the resources to do it?” The answer to these questions determines future US strategy toward China and the entire region.

For now, Biden heads to Asia to reassure allies. Or, to put it in the words of his spokeswoman Jen Psaki, to advance “rock-solid commitment to a free and open Indo-Pacific and to US treaty alliances with the Republic of Korea and Japan.”

For Sayragul Sauytbay, the award is a tribute to her courage. She has not only risked her freedom, but also her life, when she exposed the systematic human rights crimes committed by Chinese authorities in the autonomous region of Xinjiang. Sauytbay will be officially honored at the city’s Opera House next Sunday morning.

The 45-year-old worked as a civil service teacher for Kazakh-born prisoners in a detention camp in Xinjiang, while living in prison-like conditions herself. There, she witnessed torture by Chinese officials. In 2018, she managed to flee to Kazakhstan. Her husband and children had already left two years earlier, as developments in Xinjiang caused great distress to the family. Sauytbay herself, however, was unable to legally leave China because she did not have a passport. The authorities had seized her passport.

In the book “The Chief Witness”, German journalist Alexandra Cavelius describes Sauytbay’s experiences in the camp and gives a detailed account of the oppression of the Muslim population in Xinjiang.

The Nuremberg Human Rights Award is not Sauytbay’s first commendation: In 2020, the US State Department honored her with the International Women of Courage Award. In the fall of the same year, she was given a hearing by the Human Rights Committee of the German Bundestag.

The awarding of the Nuremberg Human Rights Prize, which takes place every two years, was actually scheduled for 2021, but was postponed due to the Covid pandemic. When the laureate was announced, it provoked knee-jerk protests from China’s embassy in Germany. The Consul General in Munich tried to convince the city of Nuremberg that Sauytbay was a terrorist and a fraud who was spreading lies. However, Nuremberg did not share this account.

In response, the Chinese side scaled back its involvement in the city partnership between Nuremberg and Shenzhen to a minimum. The plans for the celebrations of the upcoming 25th anniversary of the relationship are currently on hold, it is said. The Chinese side has also hinted at possible damage to the business interests of Nuremberg companies in the People’s Republic, as is common in such cases.

However, the city of Nuremberg does not want to make the Chinese reactions a topic of discussion. This would only draw attention away from the award winner. However, the city did in fact make a small concession to the diplomats. After consulting with the German Foreign Office in Berlin, it refrained from using the term East Turkestan for Xinjiang in its public communications. By doing so, Nuremberg did not buckle as much in the face of Chinese outrage, as is normally the customary international standard. “The entire leadership of the city of Nuremberg stands behind the jury’s decision. Nothing will change that,” the head of Nuremberg’s human rights office, Martina Mittenhuber told China.Table.

Sauytbay’s decision to speak out publicly has set off a wave that puts the Chinese Communist Party under increasing pressure to explain itself. The number of Uyghurs, Kazakhs and other ethnic minorities in Xinjiang publicly accusing China of crimes against humanity, up to and including genocide, has grown significantly. Some also have given testimony in the new book by Cavelius and Sauytbay. It is called “China Protokolle” (China Protocols) and was published in 2021. In it, numerous voices describe their witnesses to murder, torture, forced sterilization, organ theft, forced labor and rape.

“In my 40 years of living in East Turkestan, I have seen the brutality of the CCP with my own eyes. Few people understand the way this political organization thinks as well as we Witnesses do,” Sauytbay writes in the book. And urges people to pay attention to the testimonies.

While working on “China Protocols,” author Cavelius also had experienced China’s influence. A Kazakh translator stopped his work midway through the interviews of the protagonists concerned and began to defame the author. “I suspect that the man was put under pressure and switched sides out of fear,” says Cavelius.

Only a small fraction of German companies in China are able to continue operations under current Covid measures. This was the result of a flash survey conducted by the Chamber of Foreign Trade in China. 460 companies took part in the survey at the beginning of May. Almost three-quarters are currently affected by more or less stringent Covid measures.

In areas that have been placed under lockdown, around 19 percent of German companies continue to operate, albeit in what is known as the closed-loop system. As a result of the measures, they only reach an average of 46 percent of their usual capacity. According to the companies, the reasons for this are logistical problems, a lack of raw materials and prefabricated parts, uncertainty due to frequently changing political guidelines, and employees who are unable to leave their residential complex or district to go to work.

More than 25 percent of the German companies surveyed in China would be willing to continue operations, but are unable to do so. They cite lengthy and difficult application processes, requirements that are difficult to meet and risks that are perceived as too high as reasons.

Companies are yet to face another problem: Almost a third (28 percent) of foreign employees in China plan to leave the country due to the strict Covid measures. While 18 percent still want to wait until their employment contract expires, 10 percent plan to return to their home country prematurely despite a valid employment contract. It is likely to be difficult for companies to replace these employees with new staff from abroad, especially considering China’s Covid measures, warns Maximilian Butek of the DAHK in Shanghai. jul

China’s authorities plan to tighten entry and exit regulations. The government will severely restrict “unnecessary” outbound activities by Chinese citizens, the National Immigration Administration announced. The issuance of passports is to be more tightly controlled, Caixin reported. More precise details were not provided. According to the authorities, these measures are intended to curb the Covid pandemic.

These new measures already seem to have an impact. At the airport in Guangzhou, security forces are reported to have tightened controls on arriving Chinese and questioned them about the reasons for their travel. In some cases, passports are said to have been invalidated in the process, Radio Free Asia reports. The government reportedly also suspended permission for minors to attend schools overseas. Students who wanted to leave the country to study abroad were also reportedly prevented from doing so.

In February, China’s National Immigration Administration already announced plans to stop issuing passports for travel that was not absolutely necessary. However, Chinese students who study abroad should still be able to do so. The same goes for employees and business travelers. nib

Real estate developer Sunac China can no longer meet its payment obligations, the group announced on Thursday. The company has failed to service interest payments on an overseas bond, Nikkei Asia reports.

Delays had already occurred last month. Now, after a 30-day deadline, Sunac had to announce the default. At issue are the interest payments on a $750 million bond. Sunac is one of the largest real estate developers in the People’s Republic. The company has to repay more than $3 billion in bonds domestically and abroad by June 2023.

Sunac’s chairman blamed the “dramatic changes to the macro environment in the property sector in China,” according to the report. Sales figures slumped last year. The government had cracked down on the high debt levels of real estate groups, with lockdowns further worsening the business environment.

Just a few days ago, real estate developer Shimao also requested a deferral of payments. A 70-million bond is not to be serviced until next year. nib

China has postponed the extension of its national emissions trading scheme (ETS) to the cement, steel and aluminum sectors until 2023. Trading of emission allowances for these three sectors is not even scheduled to start until 2025. The reason given is “data quality problems”.

Only fossil-fuel power plants, mostly coal-fired piles, are required to participate in the current emissions trading system. The introduction of the current system has already been delayed for years. At the beginning of 2016, there were also plans to include the chemical and refinery industries, cement production, steel, pulp and paper production, and even air traffic in emissions trading. Analysts believe the climate impact of China’s emissions trading to be low at present (China.Table reported).

The postponement of the extension of emissions trading to important industrial sectors could be related to the currently faltering economic momentum. The central government recently announced new infrastructure and construction spending to boost growth. Integrating the cement, steel and aluminum sectors into emissions trading would be a new burden for many companies, in addition to the Covid lockdowns. nib

China has urged provinces to ensure power supplies to enterprises. During a State Council meeting, Premier Li Keqiang said power outages should never be tolerated. The southern provinces called on coal-fired power plants to continue stockpiling. The backdrop is a projected increase in power demand at the end of the month should regional lockdowns end. In addition, there could be a shortage of coal supplies if shipments from northern parts of the country are disrupted by heavy rains, Bloomberg reports. However, the predicted heavy rains could also take pressure off coal-fired power plants as more power could be produced through hydropower.

Last fall, several provinces experienced prolonged power outages and rationing. At that time, coal-fired power plants did not have enough coal in stock due to high commodity prices (China.Table reported). This was followed by reforms. For example, electricity rates were adjusted to ensure that power plants no longer had to operate at a loss when coal prices were high. Domestic coal production was also increased. The China Coal Transportation and Distribution Association expects China to produce 4.35 billion tons of coal this year. That would be an increase of seven percent over the previous year. nib

The EU is urged to quickly rethink its supply chains for green energy technologies and reduce its dependence on China in some areas. This is what the think tanks European Council on Foreign Relations (ECFR) and Rhodium Group formulate in a policy paper. What is needed, they say, is a stronger domestic policy and greater cooperation with key partners and allies. However, keeping China completely out of the supply chain is neither possible nor desirable.

The paper summarizes key risks in the supply chain of green energy technologies. The paper argues that the EU and other customer countries rely on countries like China for many essential steps in the supply chain. These include, for example, the mining and processing of raw materials and the manufacture of intermediate and final products. Geopolitical tensions, such as currently involving Russia, or operational disruptions in the manufacturing country can therefore affect the entire supply chain and limit access to technologies. The lack of know-how in buyer countries and cybersecurity are also a risk.

Risks vary depending on the industry in which renewable energy technologies are used, the analysis says. The energy storage industry, for example, which is important for both power grids and EVs, would pose high risks along the entire supply chain: The production of batteries requires raw materials that are both scarce and geographically concentrated, such as cobalt, nickel and lithium.

In the solar industry, the risks related to critical minerals are the lowest, “because the raw materials that form the bulk of most solar panels, particularly silica, are globally abundant.” On the other hand, the risk of geographic concentration is even higher here, since most of the production chain is located in China. Seven of the top ten polysilicon producers are Chinese, and 97 percent of global ingot and wafer production is in China (China.Table reported).

The risks for critical minerals in the wind industry are also high, as rare earth elements such as neodymium are required for the production of wind turbines, which are primarily mined and refined in China. By contrast, European and other Western companies remain competitive in the production of intermediate and final products. The EU, for example, “is the global leader in exports of wind turbine generator sets”.

The risks for the green hydrogen industry could not yet be fully identified, as the supply chains are not yet firmly established. However, electrolyzers and fuel cells require rare minerals such as platinum and iridium, the largest deposits of which are located in Russia and South Africa. European companies are currently competitive in the production of electrolyzers. However, China’s massive investments in this area could create risks similar to those in the solar industry in the future, the paper said.

ECFR and Rhodium Group also formulate strategies for the EU to reduce its dependence on China. First, they say, the EU must conduct a “thorough and realistic assessment of risks across supply chains” and treat green energy technologies as part of critical infrastructure. Dependence on China should be reduced, and local supply chains with other economic partners should be established instead. China should not and cannot be completely excluded; “in areas where security concerns are least acute,” supply chains should be selectively retained.

A complete reshoring of the production processes is not an option, as this would involve enormous costs and ultimately even delay the energy transition. Reshoring should therefore only be considered for the processes with the greatest safety risks, it says. In any case, the EU should diversify its supply sources and use targeted incentives such as subsidies or tax breaks to do so. It should also seek to harmonize norms and standards with like-minded partners. Greater stockpiling is also feasible for certain goods and materials.

It would take years and “significant public and private investment” to mitigate risks in supply chains. The EU must therefore improve the competitiveness of domestic companies and ensure predictability and continuity in its policies. At the same time, high environmental and ethical standards must be maintained to ensure that technologies achieve sustainability goals. leo

China received considerable foreign assistance in building up its own economy. Beijing benefited particularly from the Senior Experts Service (SES), which was established in 1983 as a foundation of German industry for international cooperation. Until 2019, it sent retired volunteer experts and executives to 160 countries some 60,000 times. China, as the number one beneficiary, received 6,663 SES assignments, six times as much development aid as India.

Werner Gerich, a retired mechanical engineer, was one of the first specialists to travel to Wuhan in 1984. The local state-owned enterprise, which he whipped into shape, went bankrupt after his departure. But the German still rose to legend. After he died in 2003, Wuhan erected a monument in his honor and coined the slogan: “Let’s create many new Gerichs among us.”

The last time Werner Gerich (格里希) visited Wuhan was in June 2000. The German technician from Bretten near the city of Karlsruhe was 81 years old. He wanted to visit his old stomping ground: The Wuhan diesel engine plant, known as Wuchai (武柴) for short. The German pensioner had been the director for the local factory for two years until 1986 – as the first foreigner since the founding of the People’s Republic. Wuhan’s hosts, who otherwise hurried to fulfill Gerich’s every wish, were somewhat embarrassed. Road construction would obstruct all access routes, making a visit to the plant too inconvenient for the “venerable Mr. Ge” (格老).

It was a polite lie, an online report revealed 20 years later under the title, “Foreign director’s departure also brought end to Wuchai” (洋厂长走了,结果武柴没了). The state-owned company, managed and reorganized by Gerich until 1986 and employing 2,100 people, “started losing money in 1993. In 1998, it filed for bankruptcy. All employees lost their jobs; the plants were restructured.” Gerich was not given a tour of the factory because it no longer existed.

Naturally, the German had known for a long time that the state-owned company would not be able to hold its own in the market. But he hoped, as he told me on two occasions, that the plant would manage without privatization under conditions of competition. But China’s CP has proven to be incapable of setting the necessary framework for a genuine market economy. Under Xi Jinping, it deviates even further from the path.

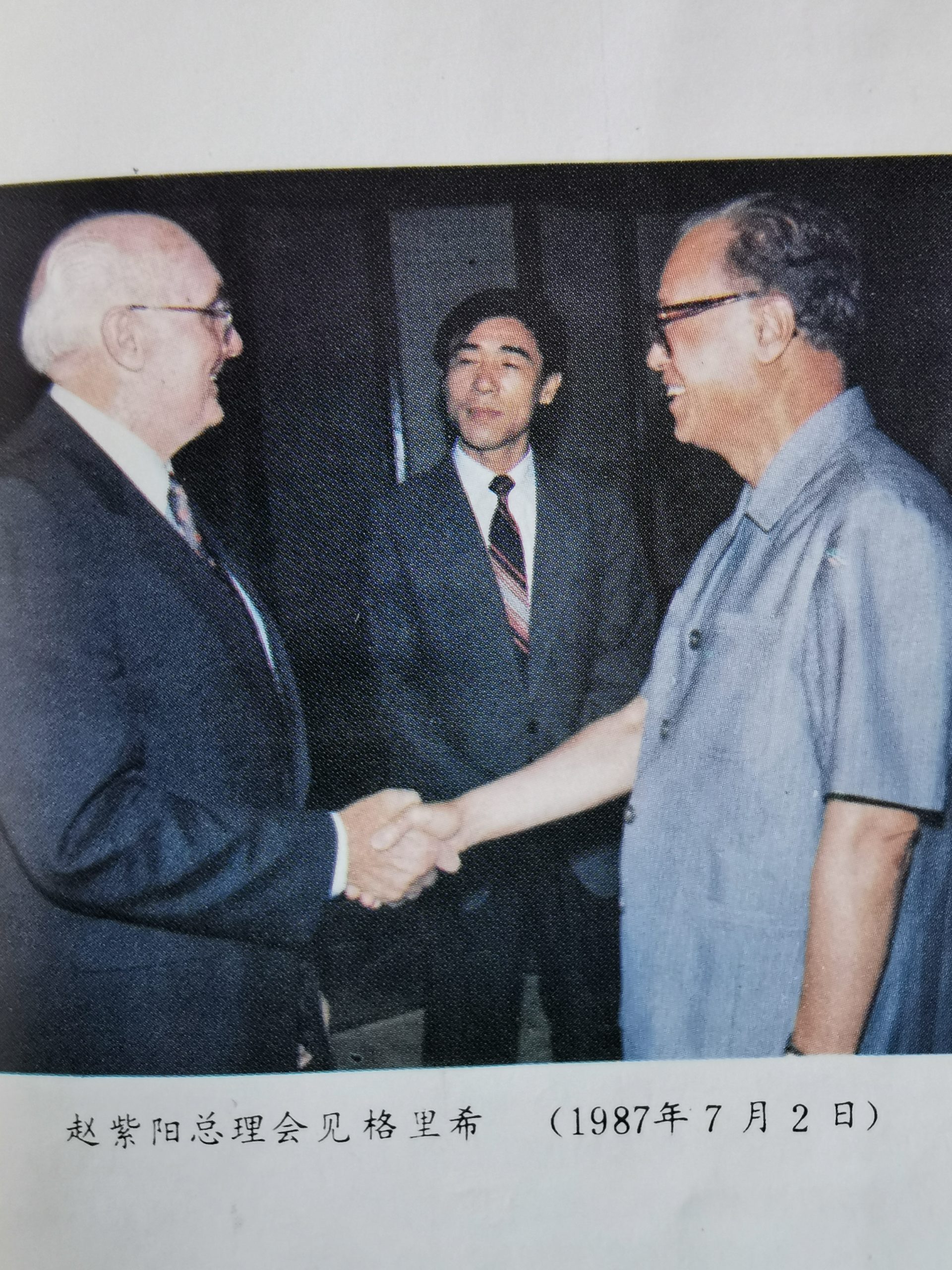

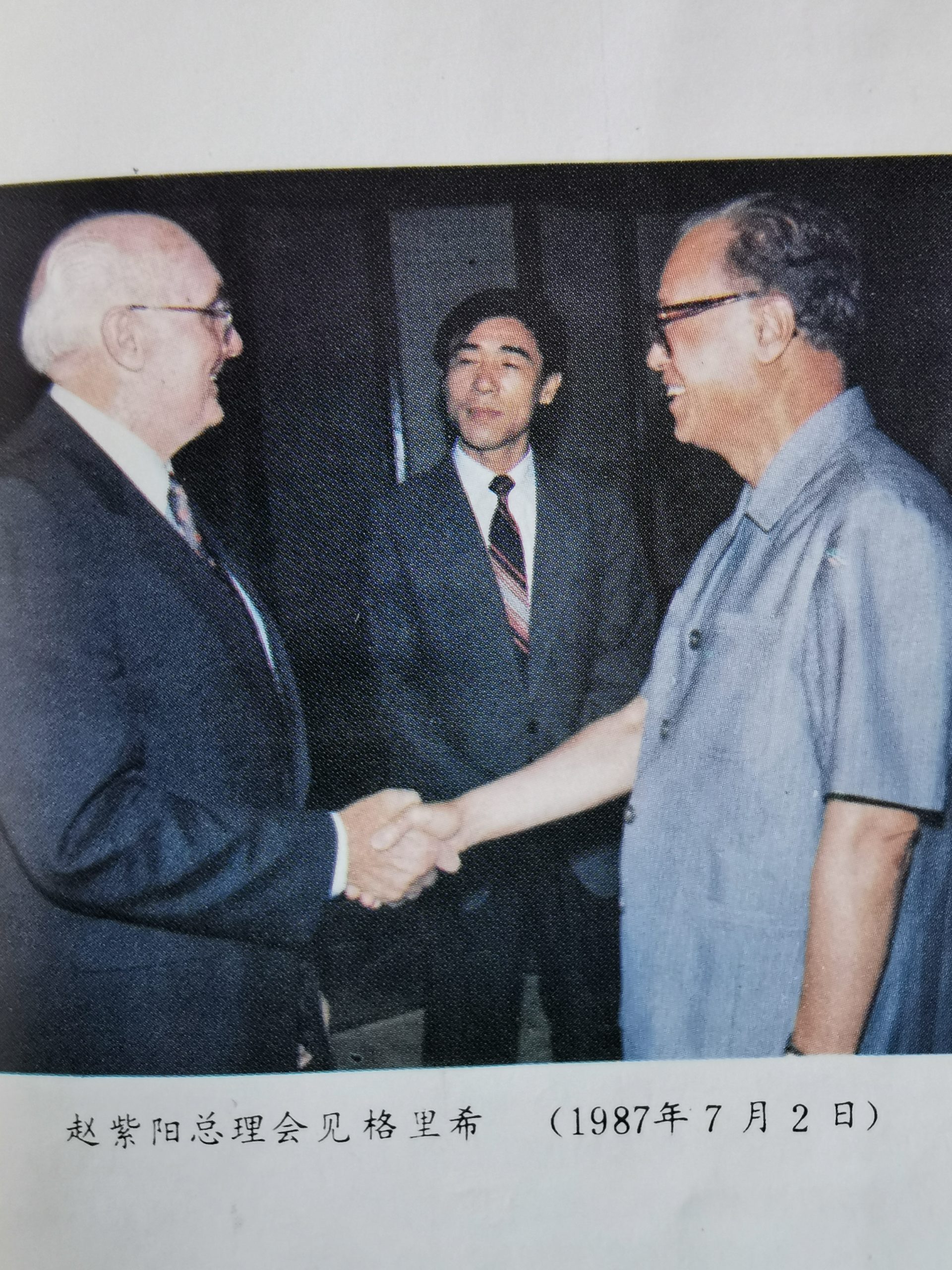

Gerich came to China at a time when there were political innovators within the Beijing leadership who also wanted to tackle systemic reforms. They made him their foreign figurehead: a German engineer who wanted to help selflessly. Gerich was passed around Beijing. In a demonstrative gesture, “liberal” Politburo members such as Wan Li (万里), Hu Qili (胡启立) and Tian Jiyun (田纪云) invited him as the fourth in the group to play tennis doubles at the Diaoyutao State Guest House. Economic leaders such as Vice Premier Yao Yilin (姚依林) and State Councilor Zhang Jinfu (张劲夫) met him several times. China’s then-premier and later Party leader Zhao Ziyang (赵紫阳), who was overthrown within the Party in 1989 and remained under house arrest until his death, told Gerich in July 1987 that it was more important for China to be able to bring people like him “into the country than to import capital and equipment”.

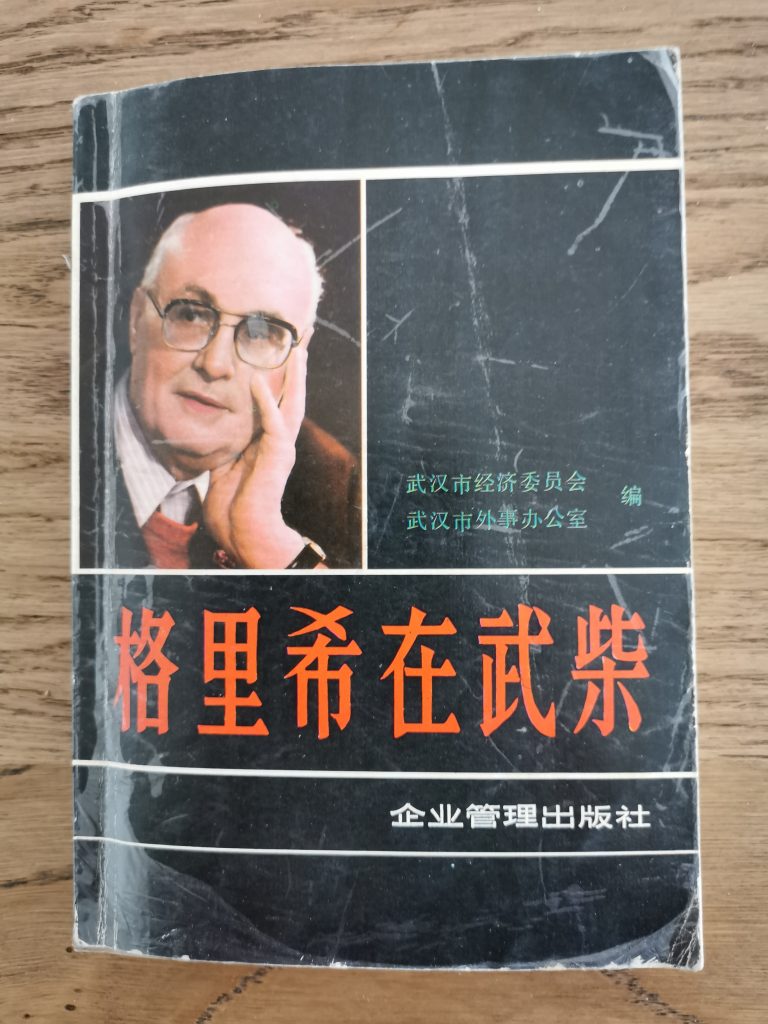

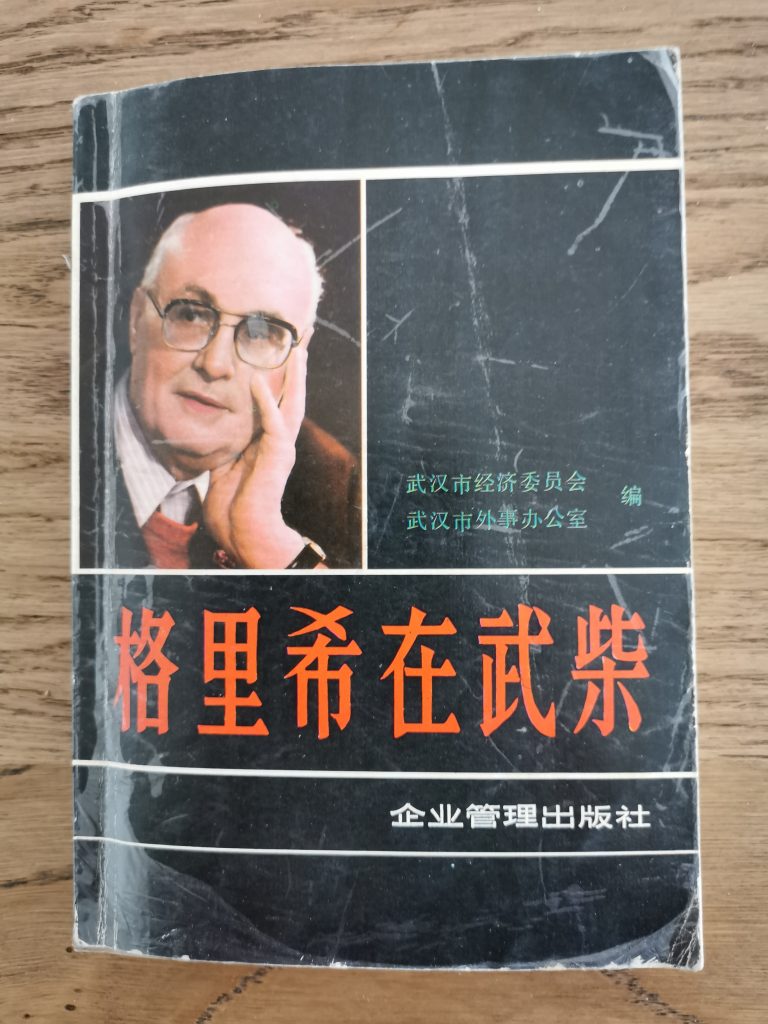

Shanghai’s Mayor Zhu Rongji (朱镕基) made Gerich an iconic figure. China’s future premier praised his “strict hand in production”. He had Gerich’s experiences at the Wuhan diesel engine factory printed in book form as mandatory literature for corporate executives, and wrote the foreword himself for this lesson in “Chinese socialist business management.” Zhu assigned Gerich to spend one month putting 17 Shanghai state-owned companies through their paces. On November 29, 1988, he discussed his findings with him. Gerich did not mince words: At one piston manufacturer, it looked “like Germany in 1945, five minutes after the end of the Second World War”. On December 1st, Zhu ordered 1,200 Shanghai company bosses to be lectured by Gerich on how they could run their companies better. In closing remarks, he said that one character was enough to describe Gerich’s verdict on Shanghai’s state-owned enterprises: “脏”: a pile of dirt. Zhu demanded reform: “Quality must become Shanghai’s life norm”.

Zhu had the eight-page transcript of his memorable conversation with Gerich included in his selection of “speeches” published in 2013. The ex-premier thus set a monument to the German.

The saga of the SES expert began with his arrival in Wuhan. At 65, the former quality inspector at the Karlsruhe Nuclear Research Institute had felt too young for retirement. And so he was one of the first to sign up with the newly founded Bonn Senior Expert Service for an assignment in China.

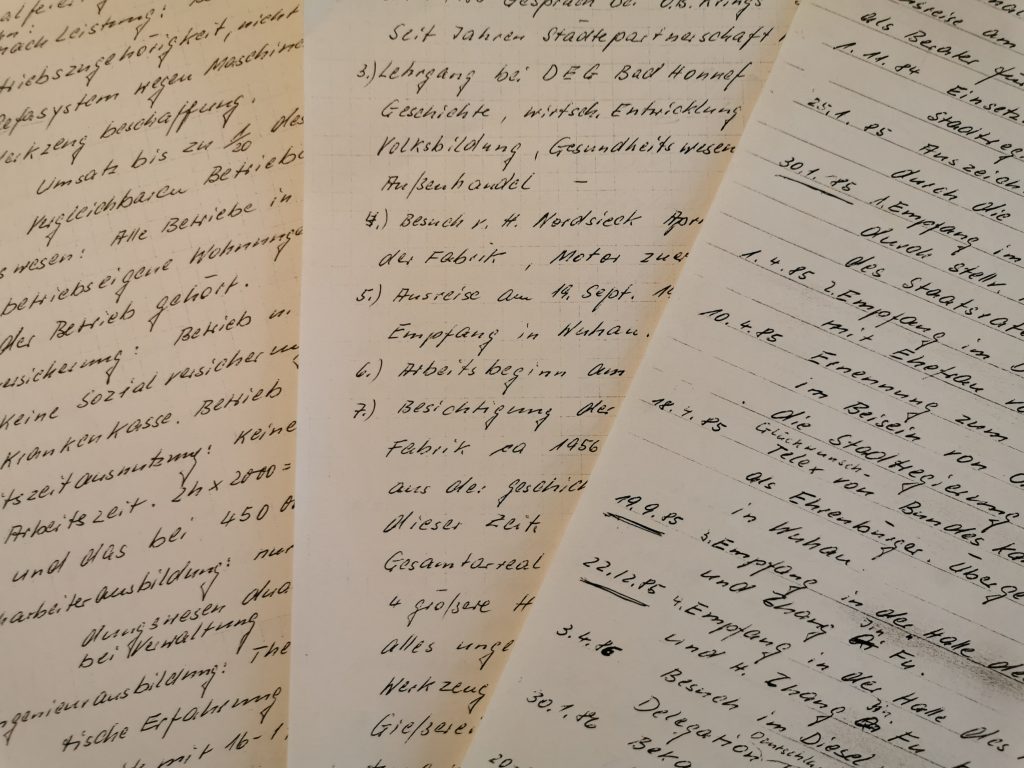

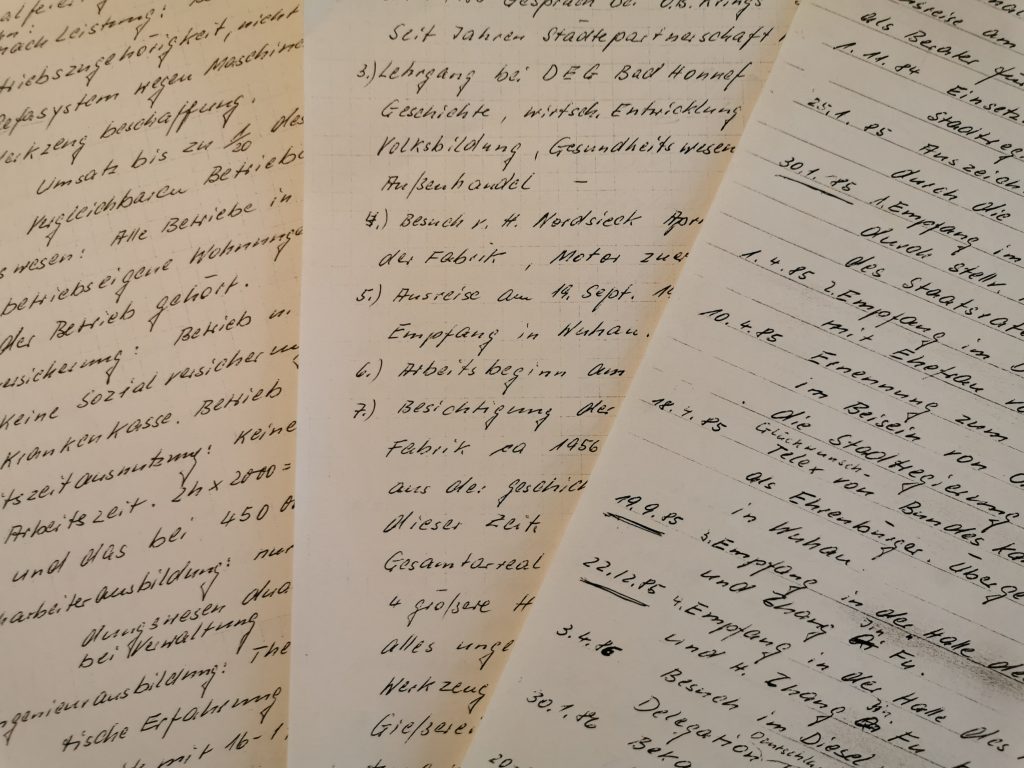

Gerich noted in his own handwriting: “Without any Xiuxi” (without a break), he began his consulting work “limited to two to three months” with an accompanying interpreter “the very next day” after his arrival. He wanted to “improve the quality of the 18,000 water-cooled single-cylinder diesel engines annually produced by 2,000 employees”. The halls and sheds horrified him, according to these notes: “Everything is unheated, at +41 degrees C and -11 degrees C in winter, 88 percent humidity. Machine tools from 1960 and older and 3x depreciated. The foundry: Europe 1935-grade, with a scrap rate of about 45 percent (in Germany, the scrap rate is about 2.5 percent). No window panes in halls and offices… The plant seemed extremely desolate”. The engine warehouse was a “mess like cabbage and turnips without a plastic cover … covered with rust”. Quality control was non-existent. He mocked the department in charge as a “nursing home for the old and sick, a harbor for the lazy, a sanatorium for people with vitamin B”.

Gerich listed 38 changes necessary to get operations, management, and quality control in order “without additional investment”. He loudly complained that things would be different if he were in charge of the place. This was brought to the attention of the city government. They wanted to start a reform experiment and were just looking for an opportunity, according to a biography published in Wuhan, “Gerich and the Gerichians” (格里希与 格里希们), one of six volumes in a new book series, “Research on the foreign factory boss” (中国 洋厂长 研究丛书).

In his handwritten CV, Gerich wrote down the two dates that changed his life one below the other, as if nothing had happened in between: 16.9.1984 Departure for Wuhan Diesel Engine Plant as consultant for manufacturing and quality. 1.11.1984 Appointed as General Director by the Wuhan Municipal Government at the Wuhan Diesel Engine Plant.

As the first foreign factory boss since 1949, he took action. He had the quality supervisor fired along with the plant’s chief engineer – unheard of for a socialist company. This also caused some bad blood. After two years, he resigned from his job as director.

Gerich first lived in the Soviet zone of Berlin after 1945 and first moved to Jena. He worked in Karl-Marx-Stadt as an engineer at engine plants before resettling in West Berlin in 1961. His work in Wuhan benefitted, as his son Bernd recalled, from “the situation my father had experienced in 1945 and in the 1950s in the German Democratic Republic was similar to the pre-1978 period in China”.

Until 2000, Gerich traveled to China almost every year. His name opened many doors for him in Chinese companies, which he introduced to German companies. He was showered with honors from all sides, from honorary citizenship and honorary professorship of Wuhan to the Order of Merit of the Federal Republic of Germany.

Very few foreigners managed to follow in Gerich’s footsteps and make a “pure to China” impact. While Beijing announced many plans to recruit foreign executives to turn China’s state-owned corporations into global players, most of them fell through, as Hong Kong’s South China Morning Post discovered. In today’s pandemic, foreigners are on the run again: this time, however, away from China.

Jens Drewes will be the new Head of Logistics for Europe at logistics company Kuehne+Nagel. Drewes has held management positions at Kuehne+Nagel in Asia since 1997. Since 2013, he was in charge of the Asia-Pacific region.

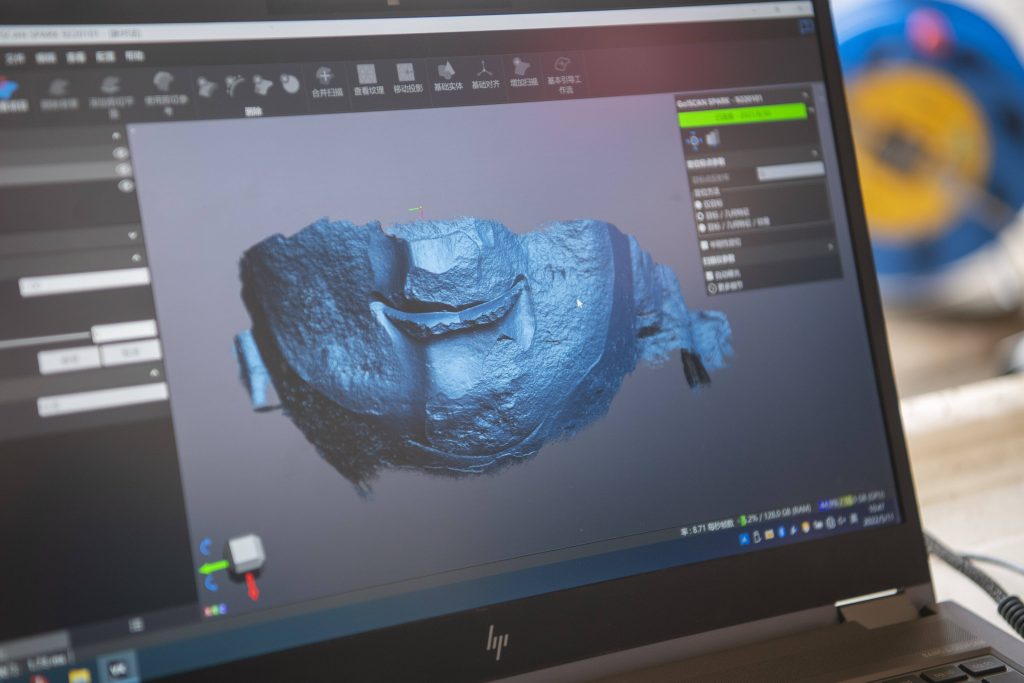

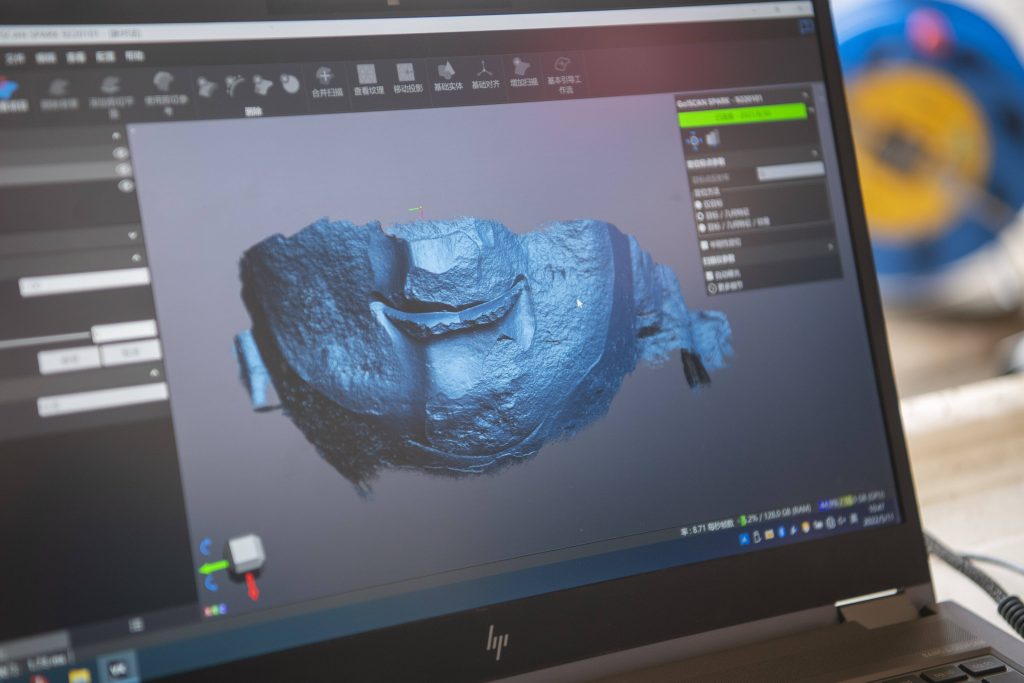

This graphics program achieves excellence: The software captures even the finest details of a rare Buddha statue. Scientists use high-resolution 3D images to preserve the relics of the Yungang Grottoes in Datong, Shanxi Province. A big help for research.

Joe Biden will soon embark on his first visit to Asia as US president. His first stops will be his close allies Japan and South Korea. Yesterday, he already welcomed the heads of state and government of the ASEAN group at a special summit in Washington. China’s leaders will be keeping a keen eye on all this. After all, China and the US are vying for influence in Asia and especially in the Indo-Pacific. The People’s Republic has made advances in the region in recent years with its Silk Road. China takes a less friendly approach in the South China Sea. Washington has already made the region a focal point of its foreign policy under Barack Obama. What can Biden offer its nations to grow closer to the US? Christiane Kuehl has the answers.

The awarding of the International Human Rights Award of the German city of Nuremberg is also fraught with conflict. After it was announced that the prize was to go to a Chinese woman who witnessed human rights violations in Xinjiang, there were protests from China, as was to be expected. A city partnership suffered as a result. There were threats that Nuremberg companies would face economic repercussions for the awarding. But fortunately, the organizers did not give in to intimidation. Sayragul Sauytbay, who was one of the first to draw attention to torture, imprisonment and the oppression of the Uyghurs, will receive the Human Rights Award on Sunday.

China’s companies have caught up massively in recent decades. In many areas, they are now on par with their Western competitors, even surpassing them in some others. Thirty or forty years ago, this was almost unimaginable. But what is often overlooked is that it was German experts who helped build China’s industry, as Johnny Erling reveals in today’s column. At times, the Germans were revered as heroes – Werner Gerich, for example. A monument was even built in his honor in Wuhan. For two years, he headed an engine factory in the city. Reform politicians followed his every word when he criticized the lax production processes. At the time, industrial experts were not dispatched out of pure altruism. Rather, they wanted to develop new export markets for German industrial goods. Were they sometimes too naive and strengthened a future competitor and systemic rival?

Between May 20 and 24, Biden has several state visits scheduled during his Asia trip. First, he will visit allies South Korea and Japan. There, in addition to security issues, Biden is expected to flesh out his administration’s economic agenda for the Indo-Pacific region. Xi Jinping is likely to keep a close eye on the US president during this visit. Competition with China is a central focus of Biden’s visit to the region.

Currently, both nations strive to fill “blind spots” in their strategies, writes James Crabtree, Executive Director of the International Institute for Strategic Studies-Asia. The US has so far lacked an economic proposal to Asian countries. Their economic integration with China is steadily increasing, for example through the new Regional Comprehensive Economic Partnership (RCEP). Apart from China, RCEP also includes Australia, Japan and Korea – but not the USA.

By the same token, Beijing has yet to come up with a convincing response to the web of overlapping security alliances, such as Quad or AUKUS, that Washington forges in the Indo-Pacific. China alarms its neighbors with the expansion of military bases in the South China Sea and plans for a possible naval presence in the Solomon Islands – while the US offers them security guarantees. (China.Table reported).

Biden’s visit to Japan and South Korea will be the launching pad for a new US economic strategy, according to Japan’s ambassador to the US, Koji Tomita. Washington has lacked an economic presence in the region since the US under former President Donald Trump abandoned the Trans-Pacific Partnership (TPP) trade pact. In response, the Biden administration announced the so-called Indo-Pacific Economic Framework (IPEF) in October 2021. IPEF is said to cover trade, digital standards, labor issues, clean energy and infrastructure. However, it will not take the form of a “typical free trade deal,” according to US Commerce Secretary Gina Raimondo.

For domestic political reasons, Biden will not or cannot offer true market liberalization. Trade agreements require ratification by the US Congress, and Biden has promised to protect US jobs. Corruption, taxes or rules on trade will also be covered by the IPEF, Crabtree writes. “Traditionally, emerging nations such as those of ASEAN sign up to these kinds of onerous requirements because they get the sweetener of tariff cuts and market access in return,” the analyst says. But what if these are not on offer at all? More likely, developed partners South Korea and Japan are candidates for IPEF. For them, US security guarantees play an even greater role than for ASEAN.

Against this backdrop, China’s leader Xi Jinping announced plans for a Global Security Initiative (GSI) at the Boao Forum for Asia in April. This should help “build a balanced, effective and sustainable security architecture” and “reject the Cold War mentality, oppose unilateralism, and say no to group politics and bloc confrontation,” Xi said there. Details remained scarce, as is often the case with China’s new initiatives.

“Why China has decided it needs such a plan is obvious,” writes Crabtree. Beijing is “genuinely alarmed at the direction of the global order post-Ukraine.” Given its rivalry with the United States, Beijing saw no option but to support Russia, he says. “Where Washington recently produced a new Indo-Pacific strategy to counter Beijing, so Beijing now feels it needs a new global strategy to counter Washington.”

Vice Foreign Minister Le Yucheng recently announced that China would soon “take active steps to operationalize the GSI”. It is said to be directed against “unilateral sanctions” – an allusion to the West’s sanctions against Russia, which Beijing has rejected, but which have so far probably not been undermined.

“This suggests China will position the GSI to draw together its varied efforts to win global friends while, at the same time, pushing back against US attempts to target China via groupings like the Quadrilateral Security Dialogue,” Crabtree notes. China’s success in replacing the US as a security guarantor in the world or in Asia through the GSI, on the other hand, is unlikely, given its other actions in the South China Sea, for example.

It seems that for Washington and Beijing, the other is always at the center of foreign policy activities. For the US, this is probably true in the long term, despite the Ukraine war. Conversely, there is a growing concern in China about Washington’s containment policy. The People’s Republic sees the Russian campaign in Ukraine primarily through the lens of the conflict with the USA: Beijing’s foreign office spokespersons never tire of blaming the USA and NATO for the Ukraine war.

Washington increasingly perceives China’s authoritarian system as a threat to world order, so the hawks push a harder and harder line on China. “Chinese pronouncements about the country’s global ambitions are notoriously vague, forcing US policymakers to interpret them for hints of Beijing’s strategy,” says renowned China expert Andrew J. Nathan of Columbia University. That China seeks to challenge the US’s privileged position in Asia is beyond doubt, believes Nathan. “But does China intend to go even further – to replace the United States as the global hegemon, remake the liberal international order, and threaten freedom and democracy everywhere? And if so, does Beijing have the resources to do it?” The answer to these questions determines future US strategy toward China and the entire region.

For now, Biden heads to Asia to reassure allies. Or, to put it in the words of his spokeswoman Jen Psaki, to advance “rock-solid commitment to a free and open Indo-Pacific and to US treaty alliances with the Republic of Korea and Japan.”

For Sayragul Sauytbay, the award is a tribute to her courage. She has not only risked her freedom, but also her life, when she exposed the systematic human rights crimes committed by Chinese authorities in the autonomous region of Xinjiang. Sauytbay will be officially honored at the city’s Opera House next Sunday morning.

The 45-year-old worked as a civil service teacher for Kazakh-born prisoners in a detention camp in Xinjiang, while living in prison-like conditions herself. There, she witnessed torture by Chinese officials. In 2018, she managed to flee to Kazakhstan. Her husband and children had already left two years earlier, as developments in Xinjiang caused great distress to the family. Sauytbay herself, however, was unable to legally leave China because she did not have a passport. The authorities had seized her passport.

In the book “The Chief Witness”, German journalist Alexandra Cavelius describes Sauytbay’s experiences in the camp and gives a detailed account of the oppression of the Muslim population in Xinjiang.

The Nuremberg Human Rights Award is not Sauytbay’s first commendation: In 2020, the US State Department honored her with the International Women of Courage Award. In the fall of the same year, she was given a hearing by the Human Rights Committee of the German Bundestag.

The awarding of the Nuremberg Human Rights Prize, which takes place every two years, was actually scheduled for 2021, but was postponed due to the Covid pandemic. When the laureate was announced, it provoked knee-jerk protests from China’s embassy in Germany. The Consul General in Munich tried to convince the city of Nuremberg that Sauytbay was a terrorist and a fraud who was spreading lies. However, Nuremberg did not share this account.

In response, the Chinese side scaled back its involvement in the city partnership between Nuremberg and Shenzhen to a minimum. The plans for the celebrations of the upcoming 25th anniversary of the relationship are currently on hold, it is said. The Chinese side has also hinted at possible damage to the business interests of Nuremberg companies in the People’s Republic, as is common in such cases.

However, the city of Nuremberg does not want to make the Chinese reactions a topic of discussion. This would only draw attention away from the award winner. However, the city did in fact make a small concession to the diplomats. After consulting with the German Foreign Office in Berlin, it refrained from using the term East Turkestan for Xinjiang in its public communications. By doing so, Nuremberg did not buckle as much in the face of Chinese outrage, as is normally the customary international standard. “The entire leadership of the city of Nuremberg stands behind the jury’s decision. Nothing will change that,” the head of Nuremberg’s human rights office, Martina Mittenhuber told China.Table.

Sauytbay’s decision to speak out publicly has set off a wave that puts the Chinese Communist Party under increasing pressure to explain itself. The number of Uyghurs, Kazakhs and other ethnic minorities in Xinjiang publicly accusing China of crimes against humanity, up to and including genocide, has grown significantly. Some also have given testimony in the new book by Cavelius and Sauytbay. It is called “China Protokolle” (China Protocols) and was published in 2021. In it, numerous voices describe their witnesses to murder, torture, forced sterilization, organ theft, forced labor and rape.

“In my 40 years of living in East Turkestan, I have seen the brutality of the CCP with my own eyes. Few people understand the way this political organization thinks as well as we Witnesses do,” Sauytbay writes in the book. And urges people to pay attention to the testimonies.

While working on “China Protocols,” author Cavelius also had experienced China’s influence. A Kazakh translator stopped his work midway through the interviews of the protagonists concerned and began to defame the author. “I suspect that the man was put under pressure and switched sides out of fear,” says Cavelius.

Only a small fraction of German companies in China are able to continue operations under current Covid measures. This was the result of a flash survey conducted by the Chamber of Foreign Trade in China. 460 companies took part in the survey at the beginning of May. Almost three-quarters are currently affected by more or less stringent Covid measures.

In areas that have been placed under lockdown, around 19 percent of German companies continue to operate, albeit in what is known as the closed-loop system. As a result of the measures, they only reach an average of 46 percent of their usual capacity. According to the companies, the reasons for this are logistical problems, a lack of raw materials and prefabricated parts, uncertainty due to frequently changing political guidelines, and employees who are unable to leave their residential complex or district to go to work.

More than 25 percent of the German companies surveyed in China would be willing to continue operations, but are unable to do so. They cite lengthy and difficult application processes, requirements that are difficult to meet and risks that are perceived as too high as reasons.

Companies are yet to face another problem: Almost a third (28 percent) of foreign employees in China plan to leave the country due to the strict Covid measures. While 18 percent still want to wait until their employment contract expires, 10 percent plan to return to their home country prematurely despite a valid employment contract. It is likely to be difficult for companies to replace these employees with new staff from abroad, especially considering China’s Covid measures, warns Maximilian Butek of the DAHK in Shanghai. jul

China’s authorities plan to tighten entry and exit regulations. The government will severely restrict “unnecessary” outbound activities by Chinese citizens, the National Immigration Administration announced. The issuance of passports is to be more tightly controlled, Caixin reported. More precise details were not provided. According to the authorities, these measures are intended to curb the Covid pandemic.

These new measures already seem to have an impact. At the airport in Guangzhou, security forces are reported to have tightened controls on arriving Chinese and questioned them about the reasons for their travel. In some cases, passports are said to have been invalidated in the process, Radio Free Asia reports. The government reportedly also suspended permission for minors to attend schools overseas. Students who wanted to leave the country to study abroad were also reportedly prevented from doing so.

In February, China’s National Immigration Administration already announced plans to stop issuing passports for travel that was not absolutely necessary. However, Chinese students who study abroad should still be able to do so. The same goes for employees and business travelers. nib

Real estate developer Sunac China can no longer meet its payment obligations, the group announced on Thursday. The company has failed to service interest payments on an overseas bond, Nikkei Asia reports.

Delays had already occurred last month. Now, after a 30-day deadline, Sunac had to announce the default. At issue are the interest payments on a $750 million bond. Sunac is one of the largest real estate developers in the People’s Republic. The company has to repay more than $3 billion in bonds domestically and abroad by June 2023.

Sunac’s chairman blamed the “dramatic changes to the macro environment in the property sector in China,” according to the report. Sales figures slumped last year. The government had cracked down on the high debt levels of real estate groups, with lockdowns further worsening the business environment.

Just a few days ago, real estate developer Shimao also requested a deferral of payments. A 70-million bond is not to be serviced until next year. nib

China has postponed the extension of its national emissions trading scheme (ETS) to the cement, steel and aluminum sectors until 2023. Trading of emission allowances for these three sectors is not even scheduled to start until 2025. The reason given is “data quality problems”.

Only fossil-fuel power plants, mostly coal-fired piles, are required to participate in the current emissions trading system. The introduction of the current system has already been delayed for years. At the beginning of 2016, there were also plans to include the chemical and refinery industries, cement production, steel, pulp and paper production, and even air traffic in emissions trading. Analysts believe the climate impact of China’s emissions trading to be low at present (China.Table reported).

The postponement of the extension of emissions trading to important industrial sectors could be related to the currently faltering economic momentum. The central government recently announced new infrastructure and construction spending to boost growth. Integrating the cement, steel and aluminum sectors into emissions trading would be a new burden for many companies, in addition to the Covid lockdowns. nib

China has urged provinces to ensure power supplies to enterprises. During a State Council meeting, Premier Li Keqiang said power outages should never be tolerated. The southern provinces called on coal-fired power plants to continue stockpiling. The backdrop is a projected increase in power demand at the end of the month should regional lockdowns end. In addition, there could be a shortage of coal supplies if shipments from northern parts of the country are disrupted by heavy rains, Bloomberg reports. However, the predicted heavy rains could also take pressure off coal-fired power plants as more power could be produced through hydropower.

Last fall, several provinces experienced prolonged power outages and rationing. At that time, coal-fired power plants did not have enough coal in stock due to high commodity prices (China.Table reported). This was followed by reforms. For example, electricity rates were adjusted to ensure that power plants no longer had to operate at a loss when coal prices were high. Domestic coal production was also increased. The China Coal Transportation and Distribution Association expects China to produce 4.35 billion tons of coal this year. That would be an increase of seven percent over the previous year. nib

The EU is urged to quickly rethink its supply chains for green energy technologies and reduce its dependence on China in some areas. This is what the think tanks European Council on Foreign Relations (ECFR) and Rhodium Group formulate in a policy paper. What is needed, they say, is a stronger domestic policy and greater cooperation with key partners and allies. However, keeping China completely out of the supply chain is neither possible nor desirable.

The paper summarizes key risks in the supply chain of green energy technologies. The paper argues that the EU and other customer countries rely on countries like China for many essential steps in the supply chain. These include, for example, the mining and processing of raw materials and the manufacture of intermediate and final products. Geopolitical tensions, such as currently involving Russia, or operational disruptions in the manufacturing country can therefore affect the entire supply chain and limit access to technologies. The lack of know-how in buyer countries and cybersecurity are also a risk.

Risks vary depending on the industry in which renewable energy technologies are used, the analysis says. The energy storage industry, for example, which is important for both power grids and EVs, would pose high risks along the entire supply chain: The production of batteries requires raw materials that are both scarce and geographically concentrated, such as cobalt, nickel and lithium.

In the solar industry, the risks related to critical minerals are the lowest, “because the raw materials that form the bulk of most solar panels, particularly silica, are globally abundant.” On the other hand, the risk of geographic concentration is even higher here, since most of the production chain is located in China. Seven of the top ten polysilicon producers are Chinese, and 97 percent of global ingot and wafer production is in China (China.Table reported).

The risks for critical minerals in the wind industry are also high, as rare earth elements such as neodymium are required for the production of wind turbines, which are primarily mined and refined in China. By contrast, European and other Western companies remain competitive in the production of intermediate and final products. The EU, for example, “is the global leader in exports of wind turbine generator sets”.

The risks for the green hydrogen industry could not yet be fully identified, as the supply chains are not yet firmly established. However, electrolyzers and fuel cells require rare minerals such as platinum and iridium, the largest deposits of which are located in Russia and South Africa. European companies are currently competitive in the production of electrolyzers. However, China’s massive investments in this area could create risks similar to those in the solar industry in the future, the paper said.

ECFR and Rhodium Group also formulate strategies for the EU to reduce its dependence on China. First, they say, the EU must conduct a “thorough and realistic assessment of risks across supply chains” and treat green energy technologies as part of critical infrastructure. Dependence on China should be reduced, and local supply chains with other economic partners should be established instead. China should not and cannot be completely excluded; “in areas where security concerns are least acute,” supply chains should be selectively retained.

A complete reshoring of the production processes is not an option, as this would involve enormous costs and ultimately even delay the energy transition. Reshoring should therefore only be considered for the processes with the greatest safety risks, it says. In any case, the EU should diversify its supply sources and use targeted incentives such as subsidies or tax breaks to do so. It should also seek to harmonize norms and standards with like-minded partners. Greater stockpiling is also feasible for certain goods and materials.

It would take years and “significant public and private investment” to mitigate risks in supply chains. The EU must therefore improve the competitiveness of domestic companies and ensure predictability and continuity in its policies. At the same time, high environmental and ethical standards must be maintained to ensure that technologies achieve sustainability goals. leo

China received considerable foreign assistance in building up its own economy. Beijing benefited particularly from the Senior Experts Service (SES), which was established in 1983 as a foundation of German industry for international cooperation. Until 2019, it sent retired volunteer experts and executives to 160 countries some 60,000 times. China, as the number one beneficiary, received 6,663 SES assignments, six times as much development aid as India.

Werner Gerich, a retired mechanical engineer, was one of the first specialists to travel to Wuhan in 1984. The local state-owned enterprise, which he whipped into shape, went bankrupt after his departure. But the German still rose to legend. After he died in 2003, Wuhan erected a monument in his honor and coined the slogan: “Let’s create many new Gerichs among us.”

The last time Werner Gerich (格里希) visited Wuhan was in June 2000. The German technician from Bretten near the city of Karlsruhe was 81 years old. He wanted to visit his old stomping ground: The Wuhan diesel engine plant, known as Wuchai (武柴) for short. The German pensioner had been the director for the local factory for two years until 1986 – as the first foreigner since the founding of the People’s Republic. Wuhan’s hosts, who otherwise hurried to fulfill Gerich’s every wish, were somewhat embarrassed. Road construction would obstruct all access routes, making a visit to the plant too inconvenient for the “venerable Mr. Ge” (格老).

It was a polite lie, an online report revealed 20 years later under the title, “Foreign director’s departure also brought end to Wuchai” (洋厂长走了,结果武柴没了). The state-owned company, managed and reorganized by Gerich until 1986 and employing 2,100 people, “started losing money in 1993. In 1998, it filed for bankruptcy. All employees lost their jobs; the plants were restructured.” Gerich was not given a tour of the factory because it no longer existed.

Naturally, the German had known for a long time that the state-owned company would not be able to hold its own in the market. But he hoped, as he told me on two occasions, that the plant would manage without privatization under conditions of competition. But China’s CP has proven to be incapable of setting the necessary framework for a genuine market economy. Under Xi Jinping, it deviates even further from the path.

Gerich came to China at a time when there were political innovators within the Beijing leadership who also wanted to tackle systemic reforms. They made him their foreign figurehead: a German engineer who wanted to help selflessly. Gerich was passed around Beijing. In a demonstrative gesture, “liberal” Politburo members such as Wan Li (万里), Hu Qili (胡启立) and Tian Jiyun (田纪云) invited him as the fourth in the group to play tennis doubles at the Diaoyutao State Guest House. Economic leaders such as Vice Premier Yao Yilin (姚依林) and State Councilor Zhang Jinfu (张劲夫) met him several times. China’s then-premier and later Party leader Zhao Ziyang (赵紫阳), who was overthrown within the Party in 1989 and remained under house arrest until his death, told Gerich in July 1987 that it was more important for China to be able to bring people like him “into the country than to import capital and equipment”.

Shanghai’s Mayor Zhu Rongji (朱镕基) made Gerich an iconic figure. China’s future premier praised his “strict hand in production”. He had Gerich’s experiences at the Wuhan diesel engine factory printed in book form as mandatory literature for corporate executives, and wrote the foreword himself for this lesson in “Chinese socialist business management.” Zhu assigned Gerich to spend one month putting 17 Shanghai state-owned companies through their paces. On November 29, 1988, he discussed his findings with him. Gerich did not mince words: At one piston manufacturer, it looked “like Germany in 1945, five minutes after the end of the Second World War”. On December 1st, Zhu ordered 1,200 Shanghai company bosses to be lectured by Gerich on how they could run their companies better. In closing remarks, he said that one character was enough to describe Gerich’s verdict on Shanghai’s state-owned enterprises: “脏”: a pile of dirt. Zhu demanded reform: “Quality must become Shanghai’s life norm”.

Zhu had the eight-page transcript of his memorable conversation with Gerich included in his selection of “speeches” published in 2013. The ex-premier thus set a monument to the German.

The saga of the SES expert began with his arrival in Wuhan. At 65, the former quality inspector at the Karlsruhe Nuclear Research Institute had felt too young for retirement. And so he was one of the first to sign up with the newly founded Bonn Senior Expert Service for an assignment in China.

Gerich noted in his own handwriting: “Without any Xiuxi” (without a break), he began his consulting work “limited to two to three months” with an accompanying interpreter “the very next day” after his arrival. He wanted to “improve the quality of the 18,000 water-cooled single-cylinder diesel engines annually produced by 2,000 employees”. The halls and sheds horrified him, according to these notes: “Everything is unheated, at +41 degrees C and -11 degrees C in winter, 88 percent humidity. Machine tools from 1960 and older and 3x depreciated. The foundry: Europe 1935-grade, with a scrap rate of about 45 percent (in Germany, the scrap rate is about 2.5 percent). No window panes in halls and offices… The plant seemed extremely desolate”. The engine warehouse was a “mess like cabbage and turnips without a plastic cover … covered with rust”. Quality control was non-existent. He mocked the department in charge as a “nursing home for the old and sick, a harbor for the lazy, a sanatorium for people with vitamin B”.

Gerich listed 38 changes necessary to get operations, management, and quality control in order “without additional investment”. He loudly complained that things would be different if he were in charge of the place. This was brought to the attention of the city government. They wanted to start a reform experiment and were just looking for an opportunity, according to a biography published in Wuhan, “Gerich and the Gerichians” (格里希与 格里希们), one of six volumes in a new book series, “Research on the foreign factory boss” (中国 洋厂长 研究丛书).

In his handwritten CV, Gerich wrote down the two dates that changed his life one below the other, as if nothing had happened in between: 16.9.1984 Departure for Wuhan Diesel Engine Plant as consultant for manufacturing and quality. 1.11.1984 Appointed as General Director by the Wuhan Municipal Government at the Wuhan Diesel Engine Plant.

As the first foreign factory boss since 1949, he took action. He had the quality supervisor fired along with the plant’s chief engineer – unheard of for a socialist company. This also caused some bad blood. After two years, he resigned from his job as director.

Gerich first lived in the Soviet zone of Berlin after 1945 and first moved to Jena. He worked in Karl-Marx-Stadt as an engineer at engine plants before resettling in West Berlin in 1961. His work in Wuhan benefitted, as his son Bernd recalled, from “the situation my father had experienced in 1945 and in the 1950s in the German Democratic Republic was similar to the pre-1978 period in China”.

Until 2000, Gerich traveled to China almost every year. His name opened many doors for him in Chinese companies, which he introduced to German companies. He was showered with honors from all sides, from honorary citizenship and honorary professorship of Wuhan to the Order of Merit of the Federal Republic of Germany.

Very few foreigners managed to follow in Gerich’s footsteps and make a “pure to China” impact. While Beijing announced many plans to recruit foreign executives to turn China’s state-owned corporations into global players, most of them fell through, as Hong Kong’s South China Morning Post discovered. In today’s pandemic, foreigners are on the run again: this time, however, away from China.

Jens Drewes will be the new Head of Logistics for Europe at logistics company Kuehne+Nagel. Drewes has held management positions at Kuehne+Nagel in Asia since 1997. Since 2013, he was in charge of the Asia-Pacific region.

This graphics program achieves excellence: The software captures even the finest details of a rare Buddha statue. Scientists use high-resolution 3D images to preserve the relics of the Yungang Grottoes in Datong, Shanxi Province. A big help for research.