While masses of new electric cars are hitting the roads in China, many older battery models are nearing the end of their lives. If an EV battery falls below 70 percent of its capacity, it must be replaced. At first, a second life awaits, for example as battery storage. However, at some point, it really is time for the end of the cycle – and a new beginning. Most of the valuable raw materials can be recovered.

Battery recycling is booming in China. The country’s quotas for recovering the valuable raw materials used in batteries are very ambitious. As the big wave of discarded batteries will only arrive in Germany and Europe with some delay, it is worth looking eastwards, writes Christian Domke Seidel. Apart from ecological aspects, recycling also offers considerable economic opportunities.

The ice in the far north is melting faster than expected, and large parts of the Arctic could be ice-free as early as 2035. This will significantly change the dynamics in the region. In 2020, Sweden’s government spoke of a “new military dynamic in the Arctic region” and increased its defense budget by around 40 percent.

A particular concern in the Arctic is Russia, which produces 90 percent of its gas and 60 percent of its oil here, and for which the Arctic is also a key military region for deterrence and defense. This month, the Chinese Coast Guard joined Russian ships on a patrol in the Arctic for the first time, although analysts believe this was more symbolic than anything else. Russia and China are cooperating in the Arctic primarily for practical reasons, particularly in gas and oil production and the expansion of the Northern Sea Route.

Although the economic interests coincide for the time being, the relationship remains tense. Russia views China’s growing presence in the Arctic, including research stations and military interests, with suspicion and fears losing influence in the long term. Fabian Peltsch is in Reykjavík at the Arctic Circle Assembly and analyzes the balance of power and ambitions in the Arctic.

The Arctic ice is melting dramatically – large areas could be ice-free as early as 2035, far earlier than researchers estimated ten years ago. This also means new sea routes and mineral resources can be accessed in the far north. This spurs traditional Arctic states, as well as so-called observer states, into action. China defined itself as a state “close to the Arctic” in a foreign policy white paper back in 2018 – even though Dalian, China’s northernmost port, is some 5,700 kilometers from the North Pole. China’s Arctic plans also include Beijing talking about a “Polar Silk Road.”

China is primarily interested in mining resources such as rare earths and uranium, for example, in Greenland, which China has long been wooing with infrastructure projects. However, ice-free sea routes across the Arctic Ocean are also of high interest to China as alternative and supplementary routes to the Strait of Malacca and the Suez Canal. 80 percent of Chinese oil imports currently have to pass through the Strait of Malacca, a bottleneck that the USA and other countries could easily block in the event of a conflict.

On a geopolitical level, the Arctic has been a place of cooperation since the end of the Cold War, which has been reflected above all in joint research, for example, on biodiversity and climate change. Problems were solved in the Arctic Council, an intergovernmental forum consisting of Iceland, Norway, Finland, Russia, the USA, Canada and – because of Greenland – Denmark. Security policy is still not part of the Arctic Council’s mandate. Yet since Russia annexed Crimea and the invasion of Ukraine, security issues have also been a pressing issue here.

The Arctic is vital to Russia’s superpower claim and a key military region for deterrence and defense. Russia has the longest Arctic border of all neighboring states, and the Arctic and sub-Arctic cover a fifth of its land territory. Around 90 percent of Russia’s gas and 60 percent of its oil production are located there, as well as around 60 percent of its gas and oil reserves. Russia also regards the polar region as part of its continental shelf, i.e., as a seamless continuation of its underwater territory, creating additional territorial disputes.

In recent years, Moscow has continued ramping up its Arctic military activities. Russia conducts large-scale military drills in the north almost every year involving thousands of soldiers, aircraft, heavy equipment, underwater drones and submarines. Reactivated military bases from the Cold War can launch S-400 medium-range missiles that can reach Greenland and Alaska. MiG-31 fighter jets and other fighter-bombers can also take off from the Arctic Ocean from Russian-claimed archipelagos such as Franz Josef Land.

In a 2020 strategy paper, Sweden’s government spoke of a “new military dynamic in the Arctic” and increased its defense budget by around 40 percent. Since then, countries such as Finland and Norway have also shifted closer to the USA and NATO. As a result of its rearmament, Russia has also isolated itself in the Arctic when it comes to security policy. While the country is still part of the Arctic Council, contacts have been reduced to a minimum or severed. For example, there is hardly any research cooperation anymore. This benefits China, as Russia is opening up more and more access to its ports and territories.

“Since the invasion of Ukraine in 2022, Russia has become increasingly isolated internationally. This isolation weakens Russia as a superpower, which China, as an extremely status-conscious nation, is well aware of,” Erdem Lamazhapov from the Fridtjof Nansen Institute told Table.Briefings on the sidelines of the Arctic Circle Assembly currently being held in Iceland. “In this time of weakness, China has helped Russia save face. This includes a coast guard cooperation agreement in Murmansk, as well as increased military cooperation, including joint naval drills,” says the analyst, who specializes in Sino-Russian relations in the Arctic.

This month, the Chinese Coast Guard joined Russian ships on a patrol in the Arctic for the first time. According to state broadcaster CCTV, China’s Coast Guard explained that this has “effectively expanded the scope of the Coast Guard’s navigation at sea, thoroughly tested the vessels’ ability to carry out missions in unfamiliar waters.” According to analyst Lamazhapov, however, “ultimately, these things have a larger symbolic rather than security dimension.”

Nevertheless, a Pentagon strategy report explicitly warns of increased Sino-Russian cooperation in the polar region, including the dual-use utilization of research findings that China has been gathering in the Arctic for many years as part of its “scientific diplomacy.” At the Arctic Circle in Iceland, Lisa Murkowski, US Senator for the State of Alaska, spoke of a “new cold breeze” and the danger of an “icy curtain” in the Arctic. In early October, Mike Sfraga became the first-ever Ambassador-at-Large for Arctic Affairs. China, in turn, counters that a US-dominated NATO is increasingly expanding into Arctic waters. From a nuclear strategic perspective, the Arctic indeed represents a vulnerable northern flank for China. In the event of war, the routes of American intercontinental missiles against China cross the Arctic Ocean, which is why Beijing is interested in developing early warning systems in the Arctic, among other things.

The interests of the Arctic partnership, which was born out of necessity, still coincide, most recently agreed in May with a joint declaration. The intention is to jointly extract resources, currently primarily gas. Far eastern areas of Russia and north-eastern Chinese provinces such as Heilongjiang and Jilin are also to be better integrated into the commercial exploitation of the Arctic. In the long term, however, Russia, the far more experienced and better equipped Arctic state, could lose out to China.

In fact, when China applied for observer status in the Arctic Council in 2013, Moscow rejected the idea. Even today, Russia wants to influence Chinese activities in the region and views Chinese research stations and the growing presence of Chinese Xuelong icebreakers with suspicion. Beijing does not always voluntarily share military information that would give Russia a strategic advantage. There are also known cases of Chinese espionage against Russia.

In addition, China is steadily increasing its independence from Russia through targeted investment and upgrading its ice-going naval and research vessels. With maintenance contracts for icebreakers and the expansion of Russian ports by Chinese companies, China is even well on the way to making Russia dependent on it in some areas. This dynamic could soon turn Russia into a junior partner in the Arctic – something that Moscow will hardly accept, as Marc Lanteigne, geopolitics expert at the Arctic University of Norway, explains to Table.Briefings. “This is not a relationship that I think will last in the long term, as Russia is claiming prerogatives as an Arctic state, while Beijing sees the Arctic as a new strategic frontier.”

Should China cross certain red lines, the partnership in the Arctic will soon be a thing of the past, believes Lanteigne. “China would cross this line for the Russian partner if it began to insist on greater access to the waters off Siberia or more access to the Russian Arctic coast. Even if Beijing develops a kind of independent Arctic policy in which Russia experiences a kind of devaluation, cooperation could even degenerate into hostility.”

China’s new energy vehicle (NEV) market has seen almost explosive growth in recent years. This development has also been a driver for battery recycling in the People’s Republic, as the industry faces a veritable wave of used batteries. While only 294 kilotons of used batteries were recycled in 2021, this figure will rise to around 3,000 kilotons in 2030, according to calculations by the China Automotive Technology and Research Center. According to the China Automotive Technology and Research Center, the Chinese recycling market is expected to be worth around 17 billion euros in 2030.

Industry and politics in China are prepared and could serve as a blueprint for Europe. Due to the rather homeopathic EV sales in Germany and Europe, the need for recycling will only arrive here with a delay. The good news is that, as the number of batteries sold and their life expectancy are known, it is possible to plan ahead for recycling.

A large proportion of valuable raw materials can be recovered. In an interview with Table Briefings, Thomas Schmaltz, Head of the Industrial Technologies business unit at the Fraunhofer Institute for Systems and Innovation Research ISI, expects demand for recycling to rise sharply. “These are enormous quantities that are coming our way. With many critical raw materials that are important for industry.”

During recycling, the relevant plants are divided into spokes and hubs according to their recycling depth:

The black mass contains the majority of the valuable materials. These can be processed pyrometallurgically or hydrometallurgically – i.e., in a smelting furnace or wet-chemically. The black mass can also be exported without any problems.

However, the European lithium battery recycling industry is still developing tentatively, as it depends on the return of used EV batteries. This year, around 50 kilotons of used batteries will be recycled in Europe. By 2030, the figure is expected to be around 420 kilotons.

By comparison, battery manufacturer CATL alone recycled around 100 kilotons in China in 2023, twice as much as in Europe. In a speech at the New Energy Vehicles Congress in early October, Zeng Yuqun, founder and CEO of CATL, emphasized that his company’s recycling capacity would be 270 kilotons in 2024. The company plans to reach 1,000 kilotons “in the near future.” Recycling is set to become a profitable line of business for CATL. However, the figures should be treated with caution due to the underlying technical process.

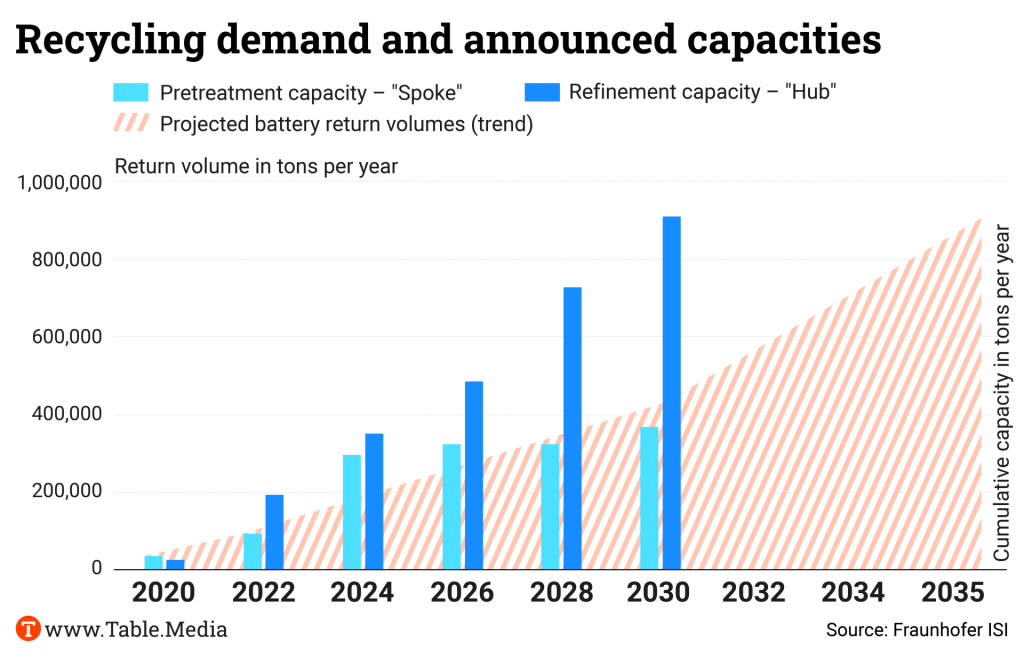

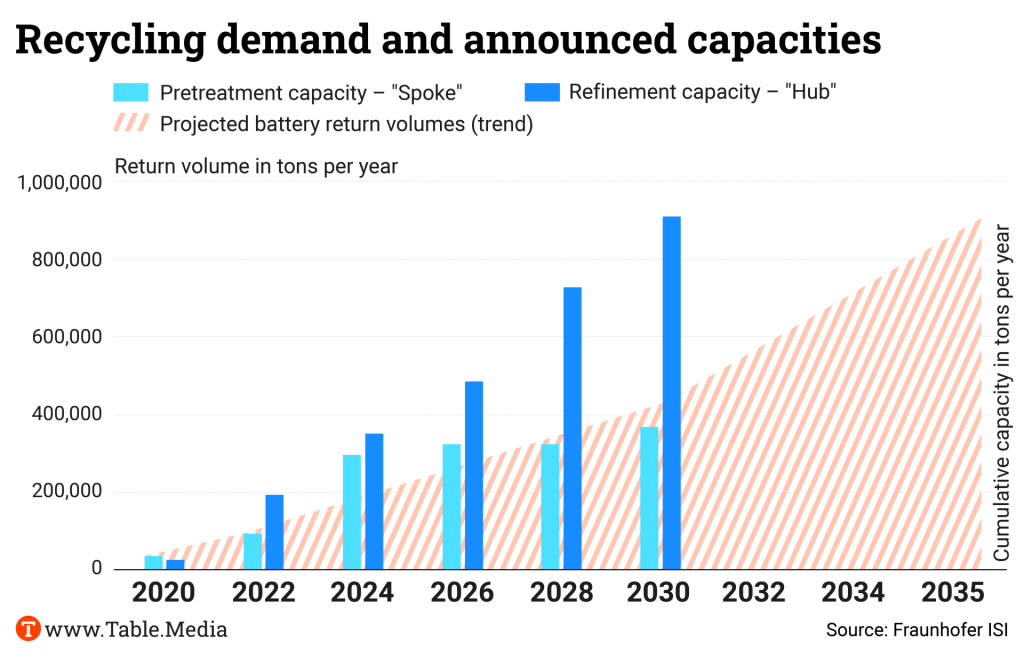

As the Fraunhofer Institute has calculated, European recycling capacity currently significantly exceeds demand. The annual capacity of hubs is around 350 kilotons, while that of spokes is a good 300 kilotons, almost twice as much as in the previous year. This contrasts with a battery return volume of barely 200 kilotons. However: “The capacities also include announced projects. How many of these will be implemented is another question. We assume that not everything will be realized,” Thomas Schmaltz points out.

At present, production waste is the primary source of recycled material. “Ramping up production and stopping processes is not simple. It produces tons of batteries that simply go straight into the scrap. It takes a relatively long time until a product emerges that the customer wants,” explains Schmaltz. Once production is ramped up, waste is reduced, but the number of batteries returning from the EV market increases.

Political targets play a decisive role in developing the recycling industry, as seen in China. Since 2018, car manufacturers have been required to have a tracking system to ensure that the use of batteries can be monitored and their recycling ensured. When batteries return after use in the car, many are initially reused – so-called “2nd-life use,” in forklift trucks or as stationary energy storage devices. Only then does the actual recycling process begin.

The Communist Party has set high quotas here to ensure it is one of the international leaders. The recovery rate for batteries has been set at least 98 percent for nickel, cobalt, and manganese and at least 85 percent for lithium, according to the scientific service of the German Parliament. According to Zeng Yuqun, CATL clearly exceeds these values. The battery manufacturer recovers 91 percent of lithium and as much as 99.6 percent of nickel, cobalt and manganese.

In Europe, the Battery Regulation will take over this task. “This regulation is important in order to create concrete framework conditions. When it comes to recycling, the balance between what is technically feasible and what makes economic sense is crucial,” says Schmaltz. “And the upper limit must be implemented to get the most out of it from an ecological perspective.”

The European version is less strict than the Chinese requirements, but still ambitious. It demands that 90 percent of the cobalt, copper, lead and nickel contained in the batteries be recovered from 2027 – and 95 percent from 2031. Initially, only 50 percent of lithium must be recycled and 80 percent by 2031.

October 21, 2024; 10 p.m. CEST (4 a.m. Beijing Time)

Center for Strategic and International Studies, Webinar: “On Xi Jinping” with Ambassador Kevin Rudd More

October 22, 2024; 3 p.m. Beijing Time

China Europe International Business School and others, conference (in Brussels and Shanghai): 10th Europe Forum 2024 – Transformative Leadership for Challenging Times: Cultivating China-EU Business Leaders More

October 23 2024; 9 a.m. CEST (3 p.m. Beijing Time)

China Macro Group, Webinar: Staying in Dialogue with China: Economic Globalization More

October 23 2024; 9 a.m. CEST (3 p.m. Beijing Time)

German Chamber of Commerce China, Webinar: How suppliers can reduce the risk of under-amortization and deadstock loss in face of shrinking sales in the vehicle market More

October 24-26, 2024

German Ministry of Economic Affairs and others, conference (in New Delhi; media partner: China.Table): 18th Asia-Pacific Conference of German Business More

October 24, 2024; 3 p.m. Beijing Time

Shaohe Lawfirm, hybrid lecture (in Taicang): EU Supply Chain Law More

October 25, 2024; 2 p.m. Beijing Time

German Chamber of Commerce East China, Lecture (in Shanghai): GCC Knowledge Hub: How to Manage the Tax Risk in China More

October 25 2024; 10 a.m. CEST (4 p.m. Beijing Time)

European Chamber Nanjing and EU SME Center, hybrid lecture (in Nanjing): Making the Right Move: Compliance Considerations for Manufacturing SMEs in China More

German Economy Minister Robert Habeck, wind farm developers and manufacturers are putting together a protection package for the German and European wind industry. Following a meeting with the industry on Thursday, the ministry announced that the package is intended to help maintain and expand the domestic industry and ensure fair competitive conditions. The industry fears Chinese competition increasingly pushing into the growth market. A follow-up meeting with resolutions on the implementation of new regulations is scheduled for early 2025.

“We must continue improving conditions to keep this industry competitive and ensure future value creation within Germany and Europe,” Economy Minister Robert Habeck said. The German Wind Energy Association (BWE) praised the package for improving the financing conditions for the industry. “The announced hedging and guarantee instruments must now be implemented quickly. Given the solid increase in surcharge volumes and approval figures, it is important to prepare the capacities now,” said BWE President Bärbel Heidebroek. The head of the European association WindEurope, Giles Dickson, emphasized: “In Europe, there is no room for unfairly subsidized prices or distorting financing conditions.”

The joint paper from the ministry and the industry mentions the expansion of cybersecurity requirements. The German government plans to use existing EU tools like the Foreign Subsidies Regulation and traditional trade protection measures, such as anti-dumping and anti-subsidy regulations, to ensure fair competition. The plan also aims to reduce dependency on China for critical components like permanent magnets. There is also a demand for hedging and guarantee instruments for investments of 16 billion euros. To this end, the state KfW Bank is to set up a program. The export promotion programs of Germany and Europe should also be reviewed concerning the financing of Chinese companies. Changes would have to be made if these ran counter to national and European interests in industrial policy. rtr

The EU screened more Chinese investments in Europe last year. This is revealed in the EU Commission’s annual foreign direct investments report to the European Parliament. Six percent of the transactions examined last year as part of the EU’s FDI screening tool came from China or Hong Kong. In the year before, the figure was 5.4 percent. This puts China and Hong Kong in fourth place in 2023. Around 33 percent were from the USA, twelve percent from the UK and seven percent from the United Arab Emirates. In 2023, a total of 488 reports were submitted for screening from 18 member states, with China and Hong Kong accounting for around 30 percent. Seven member states, Austria, Denmark, France, Germany, Italy, Romania and Spain, were responsible for 85 percent of the reports. ari

Ahead of British Foreign Secretary David Lammy’s trip to China, his ruling party has backtracked on its plans to push for formal recognition of China’s treatment of the Uyghurs as genocide. This was reported by The Guardian on Thursday. A government source told the British newspaper that “genocide is a determination for competent international courts to decide.”

As the opposition party at the time, the Labour Party had called on the British government to seek formal recognition of genocide, including at the United Nations. Stephen Kinnock, then Shadow Minister for Asia, said in 2021 that it was not enough to leave the matter to international courts. In April 2021, the British Parliament voted in favor of a declaration calling Beijing’s treatment of the Uyghurs in Xinjiang province genocide.

Foreign Minister Lammy is traveling to Beijing and Shanghai on Friday for high-level meetings in the hope of building closer economic ties with China. As part of this change, the government reportedly dropped its tough stance on Beijing’s treatment of the Muslim minority. According to the UK Department of Trade, total trade between the two countries amounted to 86.5 billion pounds (101.1 billion euros) in the four quarters to the end of Q1 2024. This corresponded to a decrease of 21 percent compared to the previous four quarters. mcl

According to insiders, Nokia has laid off about a fifth of its employee base across Greater China. A total of almost 2,000 employees are affected by the measure, said two people familiar with the matter. In Europe, the Finnish telecoms equipment manufacturer plans to cut another 350 jobs. A Nokia spokesperson confirmed the company had opened consultations relating to laying off 350 employees in Europe but declined to comment on Greater China.

Insiders say the cuts are related to the cost-cutting measures announced last year. In October 2023, Nokia announced plans to cut up to 14,000 jobs due to weak demand.

Thanks to strict cost control and improved business in profitable markets, Nokia announced a surprisingly strong profit increase in the third quarter. The company increased its operating profit by nine percent to 454 million euros, although sales shrank by eight percent to 4.33 billion euros. rtr

The United States on Thursday sanctioned two Chinese companies and a Russian affiliate involved in making and shipping attack drones. Increasing cooperation between Russia and other countries, including China, is hindering the West’s efforts to stop Russia’s war efforts in Ukraine.

According to the US Department of the Treasury, the sanctioned companies include the Chinese company Xiamen Limbach Aircraft Engine Co Ltd, which manufactures an engine for Russia’s Garpiya series of long-range unmanned aerial vehicles. China-based Redlepus Vector Industry Shenzhen Co Ltd is also on the list for its role in supplying drones. rtr

Xi Jinping has made an abrupt U-turn again, this time with economic management. After two years of ignoring calls for substantial measures to boost consumption to aid sagging growth, he chaired an unexpected top-level meeting late last month, announcing the decision for intensified proactive fiscal policy and “forceful” relaxed monetary policy. This was perfectly reminiscent of the Covid lockdowns’ sudden ending in late 2022 after almost three years of draconian restrictions.

As late as June, Premier Li Qiang, obviously interpreting Xi’s thoughts, was still saying that “strong medicine” for the economy should be avoided. Only three months later, Xi himself was calling for a “sense of urgency” for better economic management at a September 26 meeting of the all-powerful politburo of the Communist Party’s Central Committee.

While it is positive that he has changed his mind, as this could help avoid a full-scale economic collapse, this latest episode also serves as yet another reminder that the nation of 1.4 billion is governed by the whims of one single man.

Despite the intention to drag the economy out of the doldrums, the guidelines didn’t give real significance to private consumption, which holds the key to sustained growth. Instead, they focused on bailing out debt-ridden local governments and stimulating the stock market.

Assistance to the municipalities will defuse financial risks and free the local governments’ hands for more investing activities. However, with chronic weak consumption unaddressed, the benefits of this new policy package will most likely be short-lived.

Bad news about the Chinese economy has been trickling out one after another this year: the real estate industry stayed listless despite relaxed control; major trade partners imposed punitive tariffs on Chinese products; youth unemployment soared. But, to people outside the very core circle of Xi’s advisors, which factors have eventually prompted the policy turnaround is a mystery.

Xi once said that governing a country requires the ability “to control and relax adeptly.” (收放自如). But he never offered further details about his art of control and relax. Indeed, under Xi, decision-making has become increasingly opaque and unpredictable.

In addition, open criticism of economic policy, together with criticism of Xi on other issues, has become almost a taboo because it is seen as undermining confidence in economic prospects as well as challenging the “central leadership’s” authority.

Prior to the September meeting, there was no indication of major policy change. After the meeting, top officials of two government agencies held follow-up press conferences. However, they gave either empty or vague statements that were by far not strong enough to back up the guidelines pronounced by Xi.

There was a clear lack of coordination, something already seen at the end of the Covid pandemic. In December 2022, the central government suddenly announced its abandoning of lockdowns, but local governments and hospitals were all unprepared, which caused massive deaths.

Xi and other top Chinese officials have been calling for a boost in confidence since last year. Nevertheless, pessimism among consumers and investors persisted without convincing policy changes.

Interestingly, stock market sentiment appeared to be taken as an important element in Xi’s latest attempt to bolster morale. In his remarks at the September meeting, he called for measures to “invigorate and enhance” the capital market and promised to facilitate smoother access to the stock market for institutional investors.

China’s highly speculative stock market never served as a meaningful barometer for the economy as it should be. During the past few years, however, the mood in the market was exceptionally in line with general economic sentiment as all the indices spiraled down.

However, Xi’s remarks on September 26 immediately galvanized the market. New individual investors swarmed to open stock-trading accounts for quick earnings. Indices rocketed at first but tumbled after the October 1-7 national day holidays because of the absence of substantial follow-up steps. As it is not backed by profitable companies, the artificial stock market craze is most likely doomed to another crash, which could further damage the government’s credibility.

Yifan Li took over the position of Head of Marketing, Greater China at Bayer in September. In Beijing, his tasks include product, go-to-market and digital strategies for the German pharmaceutical giant.

Laurent Falque has been HMI 3D designer at Ford in Shanghai since October. The industrial designer, who trained in Brussels and Paris, previously worked for the EV manufacturer NIO for six years.

Is something changing in your organization? Let us know at heads@table.media!

It’s that time of year again when new and unusual pizza creations appear. Before Pizza Hut returns with a spooky pizza for Halloween, Domino’s presents a new product for October. After enjoying success in Japan and Taiwan, the cheese volcano pizza is now also available in Hong Kong and China. The crater in the middle, filled to the brim with cheese, serves as a dip bowl.

While masses of new electric cars are hitting the roads in China, many older battery models are nearing the end of their lives. If an EV battery falls below 70 percent of its capacity, it must be replaced. At first, a second life awaits, for example as battery storage. However, at some point, it really is time for the end of the cycle – and a new beginning. Most of the valuable raw materials can be recovered.

Battery recycling is booming in China. The country’s quotas for recovering the valuable raw materials used in batteries are very ambitious. As the big wave of discarded batteries will only arrive in Germany and Europe with some delay, it is worth looking eastwards, writes Christian Domke Seidel. Apart from ecological aspects, recycling also offers considerable economic opportunities.

The ice in the far north is melting faster than expected, and large parts of the Arctic could be ice-free as early as 2035. This will significantly change the dynamics in the region. In 2020, Sweden’s government spoke of a “new military dynamic in the Arctic region” and increased its defense budget by around 40 percent.

A particular concern in the Arctic is Russia, which produces 90 percent of its gas and 60 percent of its oil here, and for which the Arctic is also a key military region for deterrence and defense. This month, the Chinese Coast Guard joined Russian ships on a patrol in the Arctic for the first time, although analysts believe this was more symbolic than anything else. Russia and China are cooperating in the Arctic primarily for practical reasons, particularly in gas and oil production and the expansion of the Northern Sea Route.

Although the economic interests coincide for the time being, the relationship remains tense. Russia views China’s growing presence in the Arctic, including research stations and military interests, with suspicion and fears losing influence in the long term. Fabian Peltsch is in Reykjavík at the Arctic Circle Assembly and analyzes the balance of power and ambitions in the Arctic.

The Arctic ice is melting dramatically – large areas could be ice-free as early as 2035, far earlier than researchers estimated ten years ago. This also means new sea routes and mineral resources can be accessed in the far north. This spurs traditional Arctic states, as well as so-called observer states, into action. China defined itself as a state “close to the Arctic” in a foreign policy white paper back in 2018 – even though Dalian, China’s northernmost port, is some 5,700 kilometers from the North Pole. China’s Arctic plans also include Beijing talking about a “Polar Silk Road.”

China is primarily interested in mining resources such as rare earths and uranium, for example, in Greenland, which China has long been wooing with infrastructure projects. However, ice-free sea routes across the Arctic Ocean are also of high interest to China as alternative and supplementary routes to the Strait of Malacca and the Suez Canal. 80 percent of Chinese oil imports currently have to pass through the Strait of Malacca, a bottleneck that the USA and other countries could easily block in the event of a conflict.

On a geopolitical level, the Arctic has been a place of cooperation since the end of the Cold War, which has been reflected above all in joint research, for example, on biodiversity and climate change. Problems were solved in the Arctic Council, an intergovernmental forum consisting of Iceland, Norway, Finland, Russia, the USA, Canada and – because of Greenland – Denmark. Security policy is still not part of the Arctic Council’s mandate. Yet since Russia annexed Crimea and the invasion of Ukraine, security issues have also been a pressing issue here.

The Arctic is vital to Russia’s superpower claim and a key military region for deterrence and defense. Russia has the longest Arctic border of all neighboring states, and the Arctic and sub-Arctic cover a fifth of its land territory. Around 90 percent of Russia’s gas and 60 percent of its oil production are located there, as well as around 60 percent of its gas and oil reserves. Russia also regards the polar region as part of its continental shelf, i.e., as a seamless continuation of its underwater territory, creating additional territorial disputes.

In recent years, Moscow has continued ramping up its Arctic military activities. Russia conducts large-scale military drills in the north almost every year involving thousands of soldiers, aircraft, heavy equipment, underwater drones and submarines. Reactivated military bases from the Cold War can launch S-400 medium-range missiles that can reach Greenland and Alaska. MiG-31 fighter jets and other fighter-bombers can also take off from the Arctic Ocean from Russian-claimed archipelagos such as Franz Josef Land.

In a 2020 strategy paper, Sweden’s government spoke of a “new military dynamic in the Arctic” and increased its defense budget by around 40 percent. Since then, countries such as Finland and Norway have also shifted closer to the USA and NATO. As a result of its rearmament, Russia has also isolated itself in the Arctic when it comes to security policy. While the country is still part of the Arctic Council, contacts have been reduced to a minimum or severed. For example, there is hardly any research cooperation anymore. This benefits China, as Russia is opening up more and more access to its ports and territories.

“Since the invasion of Ukraine in 2022, Russia has become increasingly isolated internationally. This isolation weakens Russia as a superpower, which China, as an extremely status-conscious nation, is well aware of,” Erdem Lamazhapov from the Fridtjof Nansen Institute told Table.Briefings on the sidelines of the Arctic Circle Assembly currently being held in Iceland. “In this time of weakness, China has helped Russia save face. This includes a coast guard cooperation agreement in Murmansk, as well as increased military cooperation, including joint naval drills,” says the analyst, who specializes in Sino-Russian relations in the Arctic.

This month, the Chinese Coast Guard joined Russian ships on a patrol in the Arctic for the first time. According to state broadcaster CCTV, China’s Coast Guard explained that this has “effectively expanded the scope of the Coast Guard’s navigation at sea, thoroughly tested the vessels’ ability to carry out missions in unfamiliar waters.” According to analyst Lamazhapov, however, “ultimately, these things have a larger symbolic rather than security dimension.”

Nevertheless, a Pentagon strategy report explicitly warns of increased Sino-Russian cooperation in the polar region, including the dual-use utilization of research findings that China has been gathering in the Arctic for many years as part of its “scientific diplomacy.” At the Arctic Circle in Iceland, Lisa Murkowski, US Senator for the State of Alaska, spoke of a “new cold breeze” and the danger of an “icy curtain” in the Arctic. In early October, Mike Sfraga became the first-ever Ambassador-at-Large for Arctic Affairs. China, in turn, counters that a US-dominated NATO is increasingly expanding into Arctic waters. From a nuclear strategic perspective, the Arctic indeed represents a vulnerable northern flank for China. In the event of war, the routes of American intercontinental missiles against China cross the Arctic Ocean, which is why Beijing is interested in developing early warning systems in the Arctic, among other things.

The interests of the Arctic partnership, which was born out of necessity, still coincide, most recently agreed in May with a joint declaration. The intention is to jointly extract resources, currently primarily gas. Far eastern areas of Russia and north-eastern Chinese provinces such as Heilongjiang and Jilin are also to be better integrated into the commercial exploitation of the Arctic. In the long term, however, Russia, the far more experienced and better equipped Arctic state, could lose out to China.

In fact, when China applied for observer status in the Arctic Council in 2013, Moscow rejected the idea. Even today, Russia wants to influence Chinese activities in the region and views Chinese research stations and the growing presence of Chinese Xuelong icebreakers with suspicion. Beijing does not always voluntarily share military information that would give Russia a strategic advantage. There are also known cases of Chinese espionage against Russia.

In addition, China is steadily increasing its independence from Russia through targeted investment and upgrading its ice-going naval and research vessels. With maintenance contracts for icebreakers and the expansion of Russian ports by Chinese companies, China is even well on the way to making Russia dependent on it in some areas. This dynamic could soon turn Russia into a junior partner in the Arctic – something that Moscow will hardly accept, as Marc Lanteigne, geopolitics expert at the Arctic University of Norway, explains to Table.Briefings. “This is not a relationship that I think will last in the long term, as Russia is claiming prerogatives as an Arctic state, while Beijing sees the Arctic as a new strategic frontier.”

Should China cross certain red lines, the partnership in the Arctic will soon be a thing of the past, believes Lanteigne. “China would cross this line for the Russian partner if it began to insist on greater access to the waters off Siberia or more access to the Russian Arctic coast. Even if Beijing develops a kind of independent Arctic policy in which Russia experiences a kind of devaluation, cooperation could even degenerate into hostility.”

China’s new energy vehicle (NEV) market has seen almost explosive growth in recent years. This development has also been a driver for battery recycling in the People’s Republic, as the industry faces a veritable wave of used batteries. While only 294 kilotons of used batteries were recycled in 2021, this figure will rise to around 3,000 kilotons in 2030, according to calculations by the China Automotive Technology and Research Center. According to the China Automotive Technology and Research Center, the Chinese recycling market is expected to be worth around 17 billion euros in 2030.

Industry and politics in China are prepared and could serve as a blueprint for Europe. Due to the rather homeopathic EV sales in Germany and Europe, the need for recycling will only arrive here with a delay. The good news is that, as the number of batteries sold and their life expectancy are known, it is possible to plan ahead for recycling.

A large proportion of valuable raw materials can be recovered. In an interview with Table Briefings, Thomas Schmaltz, Head of the Industrial Technologies business unit at the Fraunhofer Institute for Systems and Innovation Research ISI, expects demand for recycling to rise sharply. “These are enormous quantities that are coming our way. With many critical raw materials that are important for industry.”

During recycling, the relevant plants are divided into spokes and hubs according to their recycling depth:

The black mass contains the majority of the valuable materials. These can be processed pyrometallurgically or hydrometallurgically – i.e., in a smelting furnace or wet-chemically. The black mass can also be exported without any problems.

However, the European lithium battery recycling industry is still developing tentatively, as it depends on the return of used EV batteries. This year, around 50 kilotons of used batteries will be recycled in Europe. By 2030, the figure is expected to be around 420 kilotons.

By comparison, battery manufacturer CATL alone recycled around 100 kilotons in China in 2023, twice as much as in Europe. In a speech at the New Energy Vehicles Congress in early October, Zeng Yuqun, founder and CEO of CATL, emphasized that his company’s recycling capacity would be 270 kilotons in 2024. The company plans to reach 1,000 kilotons “in the near future.” Recycling is set to become a profitable line of business for CATL. However, the figures should be treated with caution due to the underlying technical process.

As the Fraunhofer Institute has calculated, European recycling capacity currently significantly exceeds demand. The annual capacity of hubs is around 350 kilotons, while that of spokes is a good 300 kilotons, almost twice as much as in the previous year. This contrasts with a battery return volume of barely 200 kilotons. However: “The capacities also include announced projects. How many of these will be implemented is another question. We assume that not everything will be realized,” Thomas Schmaltz points out.

At present, production waste is the primary source of recycled material. “Ramping up production and stopping processes is not simple. It produces tons of batteries that simply go straight into the scrap. It takes a relatively long time until a product emerges that the customer wants,” explains Schmaltz. Once production is ramped up, waste is reduced, but the number of batteries returning from the EV market increases.

Political targets play a decisive role in developing the recycling industry, as seen in China. Since 2018, car manufacturers have been required to have a tracking system to ensure that the use of batteries can be monitored and their recycling ensured. When batteries return after use in the car, many are initially reused – so-called “2nd-life use,” in forklift trucks or as stationary energy storage devices. Only then does the actual recycling process begin.

The Communist Party has set high quotas here to ensure it is one of the international leaders. The recovery rate for batteries has been set at least 98 percent for nickel, cobalt, and manganese and at least 85 percent for lithium, according to the scientific service of the German Parliament. According to Zeng Yuqun, CATL clearly exceeds these values. The battery manufacturer recovers 91 percent of lithium and as much as 99.6 percent of nickel, cobalt and manganese.

In Europe, the Battery Regulation will take over this task. “This regulation is important in order to create concrete framework conditions. When it comes to recycling, the balance between what is technically feasible and what makes economic sense is crucial,” says Schmaltz. “And the upper limit must be implemented to get the most out of it from an ecological perspective.”

The European version is less strict than the Chinese requirements, but still ambitious. It demands that 90 percent of the cobalt, copper, lead and nickel contained in the batteries be recovered from 2027 – and 95 percent from 2031. Initially, only 50 percent of lithium must be recycled and 80 percent by 2031.

October 21, 2024; 10 p.m. CEST (4 a.m. Beijing Time)

Center for Strategic and International Studies, Webinar: “On Xi Jinping” with Ambassador Kevin Rudd More

October 22, 2024; 3 p.m. Beijing Time

China Europe International Business School and others, conference (in Brussels and Shanghai): 10th Europe Forum 2024 – Transformative Leadership for Challenging Times: Cultivating China-EU Business Leaders More

October 23 2024; 9 a.m. CEST (3 p.m. Beijing Time)

China Macro Group, Webinar: Staying in Dialogue with China: Economic Globalization More

October 23 2024; 9 a.m. CEST (3 p.m. Beijing Time)

German Chamber of Commerce China, Webinar: How suppliers can reduce the risk of under-amortization and deadstock loss in face of shrinking sales in the vehicle market More

October 24-26, 2024

German Ministry of Economic Affairs and others, conference (in New Delhi; media partner: China.Table): 18th Asia-Pacific Conference of German Business More

October 24, 2024; 3 p.m. Beijing Time

Shaohe Lawfirm, hybrid lecture (in Taicang): EU Supply Chain Law More

October 25, 2024; 2 p.m. Beijing Time

German Chamber of Commerce East China, Lecture (in Shanghai): GCC Knowledge Hub: How to Manage the Tax Risk in China More

October 25 2024; 10 a.m. CEST (4 p.m. Beijing Time)

European Chamber Nanjing and EU SME Center, hybrid lecture (in Nanjing): Making the Right Move: Compliance Considerations for Manufacturing SMEs in China More

German Economy Minister Robert Habeck, wind farm developers and manufacturers are putting together a protection package for the German and European wind industry. Following a meeting with the industry on Thursday, the ministry announced that the package is intended to help maintain and expand the domestic industry and ensure fair competitive conditions. The industry fears Chinese competition increasingly pushing into the growth market. A follow-up meeting with resolutions on the implementation of new regulations is scheduled for early 2025.

“We must continue improving conditions to keep this industry competitive and ensure future value creation within Germany and Europe,” Economy Minister Robert Habeck said. The German Wind Energy Association (BWE) praised the package for improving the financing conditions for the industry. “The announced hedging and guarantee instruments must now be implemented quickly. Given the solid increase in surcharge volumes and approval figures, it is important to prepare the capacities now,” said BWE President Bärbel Heidebroek. The head of the European association WindEurope, Giles Dickson, emphasized: “In Europe, there is no room for unfairly subsidized prices or distorting financing conditions.”

The joint paper from the ministry and the industry mentions the expansion of cybersecurity requirements. The German government plans to use existing EU tools like the Foreign Subsidies Regulation and traditional trade protection measures, such as anti-dumping and anti-subsidy regulations, to ensure fair competition. The plan also aims to reduce dependency on China for critical components like permanent magnets. There is also a demand for hedging and guarantee instruments for investments of 16 billion euros. To this end, the state KfW Bank is to set up a program. The export promotion programs of Germany and Europe should also be reviewed concerning the financing of Chinese companies. Changes would have to be made if these ran counter to national and European interests in industrial policy. rtr

The EU screened more Chinese investments in Europe last year. This is revealed in the EU Commission’s annual foreign direct investments report to the European Parliament. Six percent of the transactions examined last year as part of the EU’s FDI screening tool came from China or Hong Kong. In the year before, the figure was 5.4 percent. This puts China and Hong Kong in fourth place in 2023. Around 33 percent were from the USA, twelve percent from the UK and seven percent from the United Arab Emirates. In 2023, a total of 488 reports were submitted for screening from 18 member states, with China and Hong Kong accounting for around 30 percent. Seven member states, Austria, Denmark, France, Germany, Italy, Romania and Spain, were responsible for 85 percent of the reports. ari

Ahead of British Foreign Secretary David Lammy’s trip to China, his ruling party has backtracked on its plans to push for formal recognition of China’s treatment of the Uyghurs as genocide. This was reported by The Guardian on Thursday. A government source told the British newspaper that “genocide is a determination for competent international courts to decide.”

As the opposition party at the time, the Labour Party had called on the British government to seek formal recognition of genocide, including at the United Nations. Stephen Kinnock, then Shadow Minister for Asia, said in 2021 that it was not enough to leave the matter to international courts. In April 2021, the British Parliament voted in favor of a declaration calling Beijing’s treatment of the Uyghurs in Xinjiang province genocide.

Foreign Minister Lammy is traveling to Beijing and Shanghai on Friday for high-level meetings in the hope of building closer economic ties with China. As part of this change, the government reportedly dropped its tough stance on Beijing’s treatment of the Muslim minority. According to the UK Department of Trade, total trade between the two countries amounted to 86.5 billion pounds (101.1 billion euros) in the four quarters to the end of Q1 2024. This corresponded to a decrease of 21 percent compared to the previous four quarters. mcl

According to insiders, Nokia has laid off about a fifth of its employee base across Greater China. A total of almost 2,000 employees are affected by the measure, said two people familiar with the matter. In Europe, the Finnish telecoms equipment manufacturer plans to cut another 350 jobs. A Nokia spokesperson confirmed the company had opened consultations relating to laying off 350 employees in Europe but declined to comment on Greater China.

Insiders say the cuts are related to the cost-cutting measures announced last year. In October 2023, Nokia announced plans to cut up to 14,000 jobs due to weak demand.

Thanks to strict cost control and improved business in profitable markets, Nokia announced a surprisingly strong profit increase in the third quarter. The company increased its operating profit by nine percent to 454 million euros, although sales shrank by eight percent to 4.33 billion euros. rtr

The United States on Thursday sanctioned two Chinese companies and a Russian affiliate involved in making and shipping attack drones. Increasing cooperation between Russia and other countries, including China, is hindering the West’s efforts to stop Russia’s war efforts in Ukraine.

According to the US Department of the Treasury, the sanctioned companies include the Chinese company Xiamen Limbach Aircraft Engine Co Ltd, which manufactures an engine for Russia’s Garpiya series of long-range unmanned aerial vehicles. China-based Redlepus Vector Industry Shenzhen Co Ltd is also on the list for its role in supplying drones. rtr

Xi Jinping has made an abrupt U-turn again, this time with economic management. After two years of ignoring calls for substantial measures to boost consumption to aid sagging growth, he chaired an unexpected top-level meeting late last month, announcing the decision for intensified proactive fiscal policy and “forceful” relaxed monetary policy. This was perfectly reminiscent of the Covid lockdowns’ sudden ending in late 2022 after almost three years of draconian restrictions.

As late as June, Premier Li Qiang, obviously interpreting Xi’s thoughts, was still saying that “strong medicine” for the economy should be avoided. Only three months later, Xi himself was calling for a “sense of urgency” for better economic management at a September 26 meeting of the all-powerful politburo of the Communist Party’s Central Committee.

While it is positive that he has changed his mind, as this could help avoid a full-scale economic collapse, this latest episode also serves as yet another reminder that the nation of 1.4 billion is governed by the whims of one single man.

Despite the intention to drag the economy out of the doldrums, the guidelines didn’t give real significance to private consumption, which holds the key to sustained growth. Instead, they focused on bailing out debt-ridden local governments and stimulating the stock market.

Assistance to the municipalities will defuse financial risks and free the local governments’ hands for more investing activities. However, with chronic weak consumption unaddressed, the benefits of this new policy package will most likely be short-lived.

Bad news about the Chinese economy has been trickling out one after another this year: the real estate industry stayed listless despite relaxed control; major trade partners imposed punitive tariffs on Chinese products; youth unemployment soared. But, to people outside the very core circle of Xi’s advisors, which factors have eventually prompted the policy turnaround is a mystery.

Xi once said that governing a country requires the ability “to control and relax adeptly.” (收放自如). But he never offered further details about his art of control and relax. Indeed, under Xi, decision-making has become increasingly opaque and unpredictable.

In addition, open criticism of economic policy, together with criticism of Xi on other issues, has become almost a taboo because it is seen as undermining confidence in economic prospects as well as challenging the “central leadership’s” authority.

Prior to the September meeting, there was no indication of major policy change. After the meeting, top officials of two government agencies held follow-up press conferences. However, they gave either empty or vague statements that were by far not strong enough to back up the guidelines pronounced by Xi.

There was a clear lack of coordination, something already seen at the end of the Covid pandemic. In December 2022, the central government suddenly announced its abandoning of lockdowns, but local governments and hospitals were all unprepared, which caused massive deaths.

Xi and other top Chinese officials have been calling for a boost in confidence since last year. Nevertheless, pessimism among consumers and investors persisted without convincing policy changes.

Interestingly, stock market sentiment appeared to be taken as an important element in Xi’s latest attempt to bolster morale. In his remarks at the September meeting, he called for measures to “invigorate and enhance” the capital market and promised to facilitate smoother access to the stock market for institutional investors.

China’s highly speculative stock market never served as a meaningful barometer for the economy as it should be. During the past few years, however, the mood in the market was exceptionally in line with general economic sentiment as all the indices spiraled down.

However, Xi’s remarks on September 26 immediately galvanized the market. New individual investors swarmed to open stock-trading accounts for quick earnings. Indices rocketed at first but tumbled after the October 1-7 national day holidays because of the absence of substantial follow-up steps. As it is not backed by profitable companies, the artificial stock market craze is most likely doomed to another crash, which could further damage the government’s credibility.

Yifan Li took over the position of Head of Marketing, Greater China at Bayer in September. In Beijing, his tasks include product, go-to-market and digital strategies for the German pharmaceutical giant.

Laurent Falque has been HMI 3D designer at Ford in Shanghai since October. The industrial designer, who trained in Brussels and Paris, previously worked for the EV manufacturer NIO for six years.

Is something changing in your organization? Let us know at heads@table.media!

It’s that time of year again when new and unusual pizza creations appear. Before Pizza Hut returns with a spooky pizza for Halloween, Domino’s presents a new product for October. After enjoying success in Japan and Taiwan, the cheese volcano pizza is now also available in Hong Kong and China. The crater in the middle, filled to the brim with cheese, serves as a dip bowl.