Images evoke emotions far better than words can. It is simply easier to imagine something that our eyes can see. But what if there aren’t many pictures – like of the horrors in Xinjiang’s internment camps?

Journalist Walter Hickey and illustrator Fahmida Azim have chosen an unusual way to tell the story of Uyghur Zumrat Dawut. Their powerful report about the ordeal of the young woman from Xinjiang, who was held and abused for two years in a re-education camp, has been published as a graphic novel. Their drawings have made fear, hope and the hard-to-grasp cruelty of the system remarkably tangible. For this, they were awarded the Pulitzer Prize. Fabian Peltsch describes how the authors created it.

Even without pictures, the growth figures presented today by the National Bureau of Statistics of China will probably trigger emotions. For the second quarter, a meager growth of between 1 and 1.4 percent is predicted. It appears that the government’s ambitious annual target of 5.5 percent growth will be maintained nonetheless. How could this still be achieved? Apparently through tried and true methods: To boost the economy, local governments have been given permission to issue significantly more infrastructure bonds – while they were actually supposed to save money. Our team in Beijing analyzes the measures and prospects.

When China’s statistics bureau will present its second-quarter growth figures this Friday, it won’t have any good news in store, most analysts believe. The Shanghai lockdown and tough Covid measures in many other parts of the country have hit the economy hard. Meager growth of between 1 and 1.4 percent is expected. It would be the lowest quarterly GDP since the beginning of the pandemic when the Chinese economy suffered a massive slump and even shrank. In the first quarter of the year, the economy still grew by 4.8 percent.

Beijing is now entering a race against time. It seems that the leadership intends to stick to its ambitious growth target of around 5.5 percent, despite the economic downturn in the first half of the year. China will “step up macroeconomic policy adjustment, and adopt more forceful measures to deliver the economic and social development goals for the whole year,” President Xi Jinping vowed in late June. However, this can only succeed if exuberant growth of between 7 and 8 percent is achieved in both the third and fourth quarters. But where is this supposed to come from?

It is already apparent where the path is headed by looking at the behavior of regional governments. In June alone, they issued a record sum of ¥1.94 trillion (€289 billion) in new bonds. This represents a year-on-year increase of 143 percent. The money is to be used to finance new infrastructure projects.

Actually, Beijing had imposed austerity and debt reduction on the often highly indebted provinces. But now it appears that priorities have changed again. To boost the economy, local governments have been given permission to issue considerably more infrastructure bonds. Far more than the quota would have predicted for this year. This was reported by Reuters, citing individuals familiar with the process. The originally planned quota of ¥3.65 trillion is practically already spent. The financial service Bloomberg calculated in a Thursday report that a total of up to $1.1 trillion could be earmarked for new infrastructure projects.

Beijing’s economic planners set out to turn domestic consumption in particular into a growth engine. The idea was to rely less on foreign trade and infrastructure spending as pillars of growth. However, “the recent growth headwinds stemmed from Omicron outbreak and lockdown measures again brings infrastructure investment from back to the front,” analyze economists Jinyue Dong and Le Xia of Spain’s BBVA Bank. For decades, Beijing has seen municipal bonds as the most efficient way to control growth during economic downturns, the duo noted.

Difficult decisions are on the horizon. On the one hand, it is necessary to ensure that debt does not spiral completely out of control. But it is also important how the money is spent. Officials must choose between “old infrastructure” such as more rail lines, roads and airports, or so-called “new infrastructure“. This includes the expansion of artificial intelligence, blockchain, cloud computing, Big Data and 5G. Although precisely such spending would be in line with Beijing’s Five-Year Plan, the two economists argue that past experience has shown that conventional infrastructure is capable of boosting growth more in the short term. Tech infrastructure, on the other hand, has a much greater multiplier effect in the long run. Jinyue Dong and Le Xia believe Beijing’s efforts could be sufficient to ultimately achieve 4.5 percent growth.

In the end, the government’s ability to approach the growth target will also depend on whether foreign trade and consumption, as economic engines, are able to keep up. China’s exports indeed increased by 17.9 percent in June, the strongest growth in five months. But this is likely to be a case of catch-up effects now that Shanghai has awoken from the lockdown. With growth of just 1 percent, import growth was once again poor.

The mixed outlook is also causing concern among German companies. “The foreign trade numbers present a mixed picture. While exports are continuing to recover in light of the improved logistics situation, the once again very low import growth indicates a weakening economy,” says Jens Hildebrandt, Executive Member of the Board of the German Chamber of Commerce in China (AHK). The Chinese government’s fight against the pandemic would also cause relatively high unemployment rates and weak consumer confidence. Uncertainty remains high. Joern Petring/Gregor Koppenburg

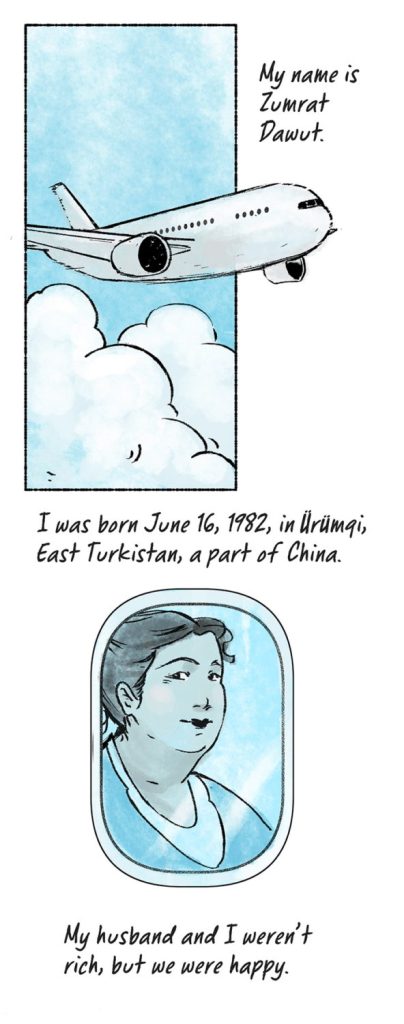

On March 31, 2018, Zumrat Dawut is ordered to the police station in her hometown of Urumqi. At first, the young woman and mother of three thinks it’s just an identity check, as they now frequently happen in the Muslim-majority province of Xinjiang. But then everything happens very quickly: Zumrat is strapped into one of the notorious tiger chairs, a seating device equipped with iron snares from which there is no escape. She is interrogated for a day and a night, and is expected to testify about every phone call and every trip abroad. In between, the police beat her with clubs. It is the beginning of a martyrdom in a Chinese re-education camp, which ultimately ends two years later with Zumrat’s escape from China.

The story of Zumrat Dawut, born in 1982, can be experienced in all its tragedy in the graphic novel “l escaped a Chinese internment camp,” which received the Pulitzer Prize for Illustrated Reporting and Commentary in May. The “Illustrated Reporting” looks like a comic, but attempts to document and categorize real events just like a journalistic report would.

“The problem we face in reporting on the genocide in Xinjiang is that we have no photographic records to document the extent of the atrocity,” explains Walter Hickey. The editor of the US magazine Insider was responsible for the journalistic execution of the project. He interviewed Zumrat and tried to reconstruct the circumstances of her imprisonment as detailed as possible, so that illustrator Fahmida Azim could then reproduce the story accurately. “Visual details played a bigger role than in a normal interview” explains Hickey. “If it said, ‘I was thrown in the back seat of a car,’ then we had to figure out: ‘Was it a sedan, was it a van, was it an SUV?’ The colors of the walls also mattered, or the fact that the detention facility had previously served as an elementary school.”

It is rare to be so close to the fate of the Uyghurs as in “I escaped a Chinese internment camp”. The inside life of the inmates is mirrored with sparingly used shades of blue and red. Sometimes full of hope, like when Zumrat shares her bread ration with an elderly woman. Sometimes full of agony, as at the moment when a fellow inmate confesses to her that she wants to commit suicide by biting her own wrists. Zumrat’s story exemplifies all the “mechanisms of violence” the Chinese government forces on the Uyghur minority, Hickey says. From total surveillance to medical interventions to infiltration of Uyghur families by Han Chinese “guests”.

The Xinjiang Police Files, the largest data leak to date documenting Uyghur persecution, also relies in part on illustrations to visualize individual fates. “Sometimes people need to see things to believe they are actually happening,” Hickey says. This is another reason he believes comic book reporting is a very promising medium. “The fact that we won the Pulitzer Prize for our story made me believe that even more.”

What also encouraged Hickey was the fact that the Chinese government has publicly commented on the Zumrat case several times. After the young Uighur, who now lives in Washington, testified before the United Nations Human Rights Council, the Chinese Foreign Ministry called her “an actor and a tool for anti-China forces’ attacks on and hyping up of Xinjiang”.

“The viciousness of the attacks speaks volumes,” Hickey said. He counters that Zumrat’s story is consistent and largely verifiable. “Zumrat Dawut was very enthusiastic about her experiences being made available to a wider audience this way. And that’s what you want as a journalist: To reach as many people as possible.”

For the third time within a short period, Shanghai has issued a heat warning of the highest level. The metropolis expects temperatures of at least 40 degrees on Friday. The warning is intended to alert residents. For example, construction work or other outdoor activities should be suspended. Shanghai has already issued three top-level alerts in the last five days, according to Reuters. A particularly large number of alarms for such a short: The city has issued only 17 such alarms since weather recording began in 1873. On Wednesday, temperatures already reached a record high of 40.9 degrees.

Extreme temperatures have persisted in some parts of China for more than a month. The heat wave is affecting more than 900 million people and a total area of 5.02 million square kilometers, Shao Sun, Senior Researcher at the National Climate Center, told the state-run Global Times newspaper on Wednesday.

In Zhejiang, temperatures even climbed to 42 degrees, Bloomberg reported. The neighboring coastal provinces of Jiangsu and Fujian also have suffered under intense heat. In Henan, Sichuan and Heilongjiang, many people were admitted to the hospital with heatstrokes. The death toll caused by the heat was not initially available.

In the manufacturing hub of Zhejiang, concerns also surfaced about possible power rationing: Polyester and textile mills, as well as printing and dyeing plants in the eastern Chinese province, had received notices of power rationing this week after a meeting of the local energy administration, according to media reports. Zhejiang already reported a record power consumption of more than 100 million kilowatts on Monday. With higher demand for air conditioning, China’s maximum electricity load reached an all-time high of 1.22 billion kilowatts on Tuesday, the National Development and Reform Commission announced on Thursday. ari/rtr

Numerous Chinese homebuyers have stopped making their monthly mortgage payments in protest. Analysts at the US-based Jefferies Financial Group Inc. reported that 28 construction projects were affected on Monday, 58 on Tuesday and as many as 100 on Wednesday.

The homebuyers are protesting against project developers’ failure to meet schedules, Caixin Global reports. According to the report, angry homebuyers in several Chinese cities have sent petitions to local authorities demanding that construction companies continue building projects and complete them on time. The letters have been shared widely on the Internet in recent days.

It is common practice in China to buy homes before construction begins. However, construction companies across the country do not meet the deadlines for construction projects. As a result, homebuyers pay monthly installments without being able to move into their apartments. However, due to the downturn on the real estate market, project developers are in trouble themselves, which adds to the delays.

According to a Bloomberg report, China’s banks are also affected by the missed payments. State-owned Agricultural Bank of China claims to have ¥660 million (about €100 million) in overdue installments outstanding, while Industrial Bank Co. has ¥1.6 billion in overdue installments. China Construction Bank called its own risk manageable. jul

The Prime Minister of the Solomon Islands explicitly ruled out the presence of a Chinese military base in his country. In an interview with the Guardian, Manasseh Sogavare said such a deal would undermine security in the region and make the Solomon Islands an enemy of other countries in the Indo-Pacific region. He added that it would make his country and its people a potential target for military strikes.

Sogavare instead mentioned Australia as the partner of choice. Should security problems arise in the region, the country would request Canberra’s support. Military assistance from China would only be considered if Australia were unable to provide it.

At the annual Pacific Islands Forum leaders’ summit held in Fiji this week, Sogavare stressed his country would not put any member of the Pacific family at risk. A week ago, however, he still called China a valuable partner and reiterated his desire for China to play a permanent role in police training in the Solomon Islands.

In April, the Solomon Islands signed a controversial security agreement with China (China.Table reported). It stipulates that China will assist the Solomon Islands with social order and security issues. However, there are fears that this could include permission for China to station military vessels off the Solomon Islands. A military base in the strategically located Solomon Islands would be an important step for Beijing to strengthen its own power position in the Pacific. Such a base would be only 2,000 kilometers from Australia’s coast. jul

The White House wants to require U.S. companies to notify the government before investing in certain sectors in China. There is now agreement in principle on legislation to that effect, the Washington Post reports. “The administration supports bipartisan and bicameral efforts in Congress to provide greater transparency on U.S. investments in China and other countries of concern,” National Security Adviser Jake Sullivan reportedly said.

The legislation would primarily address transactions in key sectors that affect national security, technological advancement and supply chain resilience. According to Sullivan, the legislation, with the working title “National Critical Capabilities Defense Act,” could also include a regulation on limiting investment.

The response from the US business community was mixed: Headwinds also came from the Republicans, who stressed that the bill would hurt US competitiveness. “In order to compete in today’s economy, companies must be able to invest internationally,” said John Murphy, Senior Vice President of International Policy at the US Chamber of Commerce. “The idea that the US government might start examining how and where a company might invest is a worrying one,” Murphy said. ari

Carbon capture, utilization, and storage (or sequestration) (CCUS), also termed as carbon capture, utilization, and sequestration, is an important emissions reduction technology that can be applied across the energy system.

CCUS technology involves capturing carbon dioxide (CO2) from fuel combustion or industrial processes, transporting this CO2 via ship or pipeline, using it as a resource to create valuable products or services, or storing it in the form of mineral carbonates in geological formations or in deep ocean masses for an indefinite period of time. Thus, this technology is of high relevance for countries committed to reducing carbon emissions but anticipated to remain dependent on fossil fuels in the short term.

According to the Global Carbon Capture and Storage Industry report released by Global Industry Analysts in February 2022, by 2026, China’s CCUS market size is forecast to reach US$482 million, trailing an annual growth rate of 11.4 percent, and the industrial separation segment is forecast to reach US$293.9 million.

CCUS is still at an early phase of development in China but is bound to gain prominence. Progressive policy frameworks and sustained government support will pivot China to become among the fastest growing regional CCUS markets.

CCUS sectors that are encouraged for foreign investment:

China’s green transition has created new green services industries that benefit the environment or conserve natural resources, such as ecosystem services, contract energy management, contract water conservation management, third-party environmental pollution treatment, and environmental custody services.

As per market consultancy Askci Corporation, the size of China’s energy conservation service industry was ¥582. 6 billion ($90.3 billion) in 2020, with 6,859 companies (showing a growth of 4.8 percent year-on-year) and 760,000 employees (an increase of 25.4 percent year-on-year) engaged in the industry.

Foreign firms with experience and expertise in this area have already been actively participating in the Chinese market. One example is the Veolia Group of France, which has established an office in China to offer environmental services. German and UK companies engaging in green services, such as ALBA Group and ERM, are also trying to promote the export of their technologies to China considering the tremendous growth potential of this sector.

Green services that are encouraged for foreign investment:

Recycling forms an important component of China’s plan to transfer to a green, low-carbon, and circular economy.

On July 7, 2021, the NDRC released the Development Plan for the Circular Economy in the 14th Five-Year Plan Period, which put extra emphasis on recycling as a means of maximizing resources use and the life cycle of products. The plan sets several hard numerical targets for the government to reach by 2025, including:

Moreover, the plan also commits to act on:

For foreign investors, standalone recycling is not economically attractive as yet. However, the sector potential may increase exponentially as local governments raise standards for waste management. Businesses engaging in the upstream and downstream industrial chain of the recycling sector, such as R&D and application of technologies for recycling and manufacturing of equipment for recycling or remanufacturing, should expect greater market scope in the medium to long term.

Recycling sectors that are encouraged for foreign investment:

Energy storage will be crucial in China’s green transition, as the country needs an advanced energy-storage system to respond to the challenge of power-generation fluctuations via renewables and to facilitate the development of the local EV market.

China has set goals to boost its non-pumped hydro energy storage capacity to around 30GW by 2025 and 100GW by 2030. Achieving this goal would require enhanced government supports and vigorous investment to the sector, which is expected to drive the boom of the strategic energy storage industry.

Foreign investors are generally not restricted to access this sector while R&D and application of large energy-storage technologies are especially encouraged for foreign investment.

This article first appeared in Asia Briefing, published by Dezan Shira Associates. The firm advises international investors in Asia and has offices in China, Hong Kong, Indonesia, Singapore, Russia and Vietnam.

Susanne Gildehaus has been Manager Data Analytics & Reporting for Daimler Trucks Asia since May. She previously held several positions at Mercedes-Benz including data analyst.

Rui Yang has been promoted to Senior Sales Financing Manager for Western Europe at Huawei Germany. He was previously Sales Financing Manager for the same region.

Is something changing in your organization? Why not let us know at heads@table.media!

Nocturnal natural phenomenon: A huge moon stands over Beihai Park in Beijing. While some admire the supermoon, it robs others of their sleep. The largest full moon of the year occurred because the distance between the earth and the moon is smaller than usual. A supermoon will also rise in August, but not as brightly as in July.

Images evoke emotions far better than words can. It is simply easier to imagine something that our eyes can see. But what if there aren’t many pictures – like of the horrors in Xinjiang’s internment camps?

Journalist Walter Hickey and illustrator Fahmida Azim have chosen an unusual way to tell the story of Uyghur Zumrat Dawut. Their powerful report about the ordeal of the young woman from Xinjiang, who was held and abused for two years in a re-education camp, has been published as a graphic novel. Their drawings have made fear, hope and the hard-to-grasp cruelty of the system remarkably tangible. For this, they were awarded the Pulitzer Prize. Fabian Peltsch describes how the authors created it.

Even without pictures, the growth figures presented today by the National Bureau of Statistics of China will probably trigger emotions. For the second quarter, a meager growth of between 1 and 1.4 percent is predicted. It appears that the government’s ambitious annual target of 5.5 percent growth will be maintained nonetheless. How could this still be achieved? Apparently through tried and true methods: To boost the economy, local governments have been given permission to issue significantly more infrastructure bonds – while they were actually supposed to save money. Our team in Beijing analyzes the measures and prospects.

When China’s statistics bureau will present its second-quarter growth figures this Friday, it won’t have any good news in store, most analysts believe. The Shanghai lockdown and tough Covid measures in many other parts of the country have hit the economy hard. Meager growth of between 1 and 1.4 percent is expected. It would be the lowest quarterly GDP since the beginning of the pandemic when the Chinese economy suffered a massive slump and even shrank. In the first quarter of the year, the economy still grew by 4.8 percent.

Beijing is now entering a race against time. It seems that the leadership intends to stick to its ambitious growth target of around 5.5 percent, despite the economic downturn in the first half of the year. China will “step up macroeconomic policy adjustment, and adopt more forceful measures to deliver the economic and social development goals for the whole year,” President Xi Jinping vowed in late June. However, this can only succeed if exuberant growth of between 7 and 8 percent is achieved in both the third and fourth quarters. But where is this supposed to come from?

It is already apparent where the path is headed by looking at the behavior of regional governments. In June alone, they issued a record sum of ¥1.94 trillion (€289 billion) in new bonds. This represents a year-on-year increase of 143 percent. The money is to be used to finance new infrastructure projects.

Actually, Beijing had imposed austerity and debt reduction on the often highly indebted provinces. But now it appears that priorities have changed again. To boost the economy, local governments have been given permission to issue considerably more infrastructure bonds. Far more than the quota would have predicted for this year. This was reported by Reuters, citing individuals familiar with the process. The originally planned quota of ¥3.65 trillion is practically already spent. The financial service Bloomberg calculated in a Thursday report that a total of up to $1.1 trillion could be earmarked for new infrastructure projects.

Beijing’s economic planners set out to turn domestic consumption in particular into a growth engine. The idea was to rely less on foreign trade and infrastructure spending as pillars of growth. However, “the recent growth headwinds stemmed from Omicron outbreak and lockdown measures again brings infrastructure investment from back to the front,” analyze economists Jinyue Dong and Le Xia of Spain’s BBVA Bank. For decades, Beijing has seen municipal bonds as the most efficient way to control growth during economic downturns, the duo noted.

Difficult decisions are on the horizon. On the one hand, it is necessary to ensure that debt does not spiral completely out of control. But it is also important how the money is spent. Officials must choose between “old infrastructure” such as more rail lines, roads and airports, or so-called “new infrastructure“. This includes the expansion of artificial intelligence, blockchain, cloud computing, Big Data and 5G. Although precisely such spending would be in line with Beijing’s Five-Year Plan, the two economists argue that past experience has shown that conventional infrastructure is capable of boosting growth more in the short term. Tech infrastructure, on the other hand, has a much greater multiplier effect in the long run. Jinyue Dong and Le Xia believe Beijing’s efforts could be sufficient to ultimately achieve 4.5 percent growth.

In the end, the government’s ability to approach the growth target will also depend on whether foreign trade and consumption, as economic engines, are able to keep up. China’s exports indeed increased by 17.9 percent in June, the strongest growth in five months. But this is likely to be a case of catch-up effects now that Shanghai has awoken from the lockdown. With growth of just 1 percent, import growth was once again poor.

The mixed outlook is also causing concern among German companies. “The foreign trade numbers present a mixed picture. While exports are continuing to recover in light of the improved logistics situation, the once again very low import growth indicates a weakening economy,” says Jens Hildebrandt, Executive Member of the Board of the German Chamber of Commerce in China (AHK). The Chinese government’s fight against the pandemic would also cause relatively high unemployment rates and weak consumer confidence. Uncertainty remains high. Joern Petring/Gregor Koppenburg

On March 31, 2018, Zumrat Dawut is ordered to the police station in her hometown of Urumqi. At first, the young woman and mother of three thinks it’s just an identity check, as they now frequently happen in the Muslim-majority province of Xinjiang. But then everything happens very quickly: Zumrat is strapped into one of the notorious tiger chairs, a seating device equipped with iron snares from which there is no escape. She is interrogated for a day and a night, and is expected to testify about every phone call and every trip abroad. In between, the police beat her with clubs. It is the beginning of a martyrdom in a Chinese re-education camp, which ultimately ends two years later with Zumrat’s escape from China.

The story of Zumrat Dawut, born in 1982, can be experienced in all its tragedy in the graphic novel “l escaped a Chinese internment camp,” which received the Pulitzer Prize for Illustrated Reporting and Commentary in May. The “Illustrated Reporting” looks like a comic, but attempts to document and categorize real events just like a journalistic report would.

“The problem we face in reporting on the genocide in Xinjiang is that we have no photographic records to document the extent of the atrocity,” explains Walter Hickey. The editor of the US magazine Insider was responsible for the journalistic execution of the project. He interviewed Zumrat and tried to reconstruct the circumstances of her imprisonment as detailed as possible, so that illustrator Fahmida Azim could then reproduce the story accurately. “Visual details played a bigger role than in a normal interview” explains Hickey. “If it said, ‘I was thrown in the back seat of a car,’ then we had to figure out: ‘Was it a sedan, was it a van, was it an SUV?’ The colors of the walls also mattered, or the fact that the detention facility had previously served as an elementary school.”

It is rare to be so close to the fate of the Uyghurs as in “I escaped a Chinese internment camp”. The inside life of the inmates is mirrored with sparingly used shades of blue and red. Sometimes full of hope, like when Zumrat shares her bread ration with an elderly woman. Sometimes full of agony, as at the moment when a fellow inmate confesses to her that she wants to commit suicide by biting her own wrists. Zumrat’s story exemplifies all the “mechanisms of violence” the Chinese government forces on the Uyghur minority, Hickey says. From total surveillance to medical interventions to infiltration of Uyghur families by Han Chinese “guests”.

The Xinjiang Police Files, the largest data leak to date documenting Uyghur persecution, also relies in part on illustrations to visualize individual fates. “Sometimes people need to see things to believe they are actually happening,” Hickey says. This is another reason he believes comic book reporting is a very promising medium. “The fact that we won the Pulitzer Prize for our story made me believe that even more.”

What also encouraged Hickey was the fact that the Chinese government has publicly commented on the Zumrat case several times. After the young Uighur, who now lives in Washington, testified before the United Nations Human Rights Council, the Chinese Foreign Ministry called her “an actor and a tool for anti-China forces’ attacks on and hyping up of Xinjiang”.

“The viciousness of the attacks speaks volumes,” Hickey said. He counters that Zumrat’s story is consistent and largely verifiable. “Zumrat Dawut was very enthusiastic about her experiences being made available to a wider audience this way. And that’s what you want as a journalist: To reach as many people as possible.”

For the third time within a short period, Shanghai has issued a heat warning of the highest level. The metropolis expects temperatures of at least 40 degrees on Friday. The warning is intended to alert residents. For example, construction work or other outdoor activities should be suspended. Shanghai has already issued three top-level alerts in the last five days, according to Reuters. A particularly large number of alarms for such a short: The city has issued only 17 such alarms since weather recording began in 1873. On Wednesday, temperatures already reached a record high of 40.9 degrees.

Extreme temperatures have persisted in some parts of China for more than a month. The heat wave is affecting more than 900 million people and a total area of 5.02 million square kilometers, Shao Sun, Senior Researcher at the National Climate Center, told the state-run Global Times newspaper on Wednesday.

In Zhejiang, temperatures even climbed to 42 degrees, Bloomberg reported. The neighboring coastal provinces of Jiangsu and Fujian also have suffered under intense heat. In Henan, Sichuan and Heilongjiang, many people were admitted to the hospital with heatstrokes. The death toll caused by the heat was not initially available.

In the manufacturing hub of Zhejiang, concerns also surfaced about possible power rationing: Polyester and textile mills, as well as printing and dyeing plants in the eastern Chinese province, had received notices of power rationing this week after a meeting of the local energy administration, according to media reports. Zhejiang already reported a record power consumption of more than 100 million kilowatts on Monday. With higher demand for air conditioning, China’s maximum electricity load reached an all-time high of 1.22 billion kilowatts on Tuesday, the National Development and Reform Commission announced on Thursday. ari/rtr

Numerous Chinese homebuyers have stopped making their monthly mortgage payments in protest. Analysts at the US-based Jefferies Financial Group Inc. reported that 28 construction projects were affected on Monday, 58 on Tuesday and as many as 100 on Wednesday.

The homebuyers are protesting against project developers’ failure to meet schedules, Caixin Global reports. According to the report, angry homebuyers in several Chinese cities have sent petitions to local authorities demanding that construction companies continue building projects and complete them on time. The letters have been shared widely on the Internet in recent days.

It is common practice in China to buy homes before construction begins. However, construction companies across the country do not meet the deadlines for construction projects. As a result, homebuyers pay monthly installments without being able to move into their apartments. However, due to the downturn on the real estate market, project developers are in trouble themselves, which adds to the delays.

According to a Bloomberg report, China’s banks are also affected by the missed payments. State-owned Agricultural Bank of China claims to have ¥660 million (about €100 million) in overdue installments outstanding, while Industrial Bank Co. has ¥1.6 billion in overdue installments. China Construction Bank called its own risk manageable. jul

The Prime Minister of the Solomon Islands explicitly ruled out the presence of a Chinese military base in his country. In an interview with the Guardian, Manasseh Sogavare said such a deal would undermine security in the region and make the Solomon Islands an enemy of other countries in the Indo-Pacific region. He added that it would make his country and its people a potential target for military strikes.

Sogavare instead mentioned Australia as the partner of choice. Should security problems arise in the region, the country would request Canberra’s support. Military assistance from China would only be considered if Australia were unable to provide it.

At the annual Pacific Islands Forum leaders’ summit held in Fiji this week, Sogavare stressed his country would not put any member of the Pacific family at risk. A week ago, however, he still called China a valuable partner and reiterated his desire for China to play a permanent role in police training in the Solomon Islands.

In April, the Solomon Islands signed a controversial security agreement with China (China.Table reported). It stipulates that China will assist the Solomon Islands with social order and security issues. However, there are fears that this could include permission for China to station military vessels off the Solomon Islands. A military base in the strategically located Solomon Islands would be an important step for Beijing to strengthen its own power position in the Pacific. Such a base would be only 2,000 kilometers from Australia’s coast. jul

The White House wants to require U.S. companies to notify the government before investing in certain sectors in China. There is now agreement in principle on legislation to that effect, the Washington Post reports. “The administration supports bipartisan and bicameral efforts in Congress to provide greater transparency on U.S. investments in China and other countries of concern,” National Security Adviser Jake Sullivan reportedly said.

The legislation would primarily address transactions in key sectors that affect national security, technological advancement and supply chain resilience. According to Sullivan, the legislation, with the working title “National Critical Capabilities Defense Act,” could also include a regulation on limiting investment.

The response from the US business community was mixed: Headwinds also came from the Republicans, who stressed that the bill would hurt US competitiveness. “In order to compete in today’s economy, companies must be able to invest internationally,” said John Murphy, Senior Vice President of International Policy at the US Chamber of Commerce. “The idea that the US government might start examining how and where a company might invest is a worrying one,” Murphy said. ari

Carbon capture, utilization, and storage (or sequestration) (CCUS), also termed as carbon capture, utilization, and sequestration, is an important emissions reduction technology that can be applied across the energy system.

CCUS technology involves capturing carbon dioxide (CO2) from fuel combustion or industrial processes, transporting this CO2 via ship or pipeline, using it as a resource to create valuable products or services, or storing it in the form of mineral carbonates in geological formations or in deep ocean masses for an indefinite period of time. Thus, this technology is of high relevance for countries committed to reducing carbon emissions but anticipated to remain dependent on fossil fuels in the short term.

According to the Global Carbon Capture and Storage Industry report released by Global Industry Analysts in February 2022, by 2026, China’s CCUS market size is forecast to reach US$482 million, trailing an annual growth rate of 11.4 percent, and the industrial separation segment is forecast to reach US$293.9 million.

CCUS is still at an early phase of development in China but is bound to gain prominence. Progressive policy frameworks and sustained government support will pivot China to become among the fastest growing regional CCUS markets.

CCUS sectors that are encouraged for foreign investment:

China’s green transition has created new green services industries that benefit the environment or conserve natural resources, such as ecosystem services, contract energy management, contract water conservation management, third-party environmental pollution treatment, and environmental custody services.

As per market consultancy Askci Corporation, the size of China’s energy conservation service industry was ¥582. 6 billion ($90.3 billion) in 2020, with 6,859 companies (showing a growth of 4.8 percent year-on-year) and 760,000 employees (an increase of 25.4 percent year-on-year) engaged in the industry.

Foreign firms with experience and expertise in this area have already been actively participating in the Chinese market. One example is the Veolia Group of France, which has established an office in China to offer environmental services. German and UK companies engaging in green services, such as ALBA Group and ERM, are also trying to promote the export of their technologies to China considering the tremendous growth potential of this sector.

Green services that are encouraged for foreign investment:

Recycling forms an important component of China’s plan to transfer to a green, low-carbon, and circular economy.

On July 7, 2021, the NDRC released the Development Plan for the Circular Economy in the 14th Five-Year Plan Period, which put extra emphasis on recycling as a means of maximizing resources use and the life cycle of products. The plan sets several hard numerical targets for the government to reach by 2025, including:

Moreover, the plan also commits to act on:

For foreign investors, standalone recycling is not economically attractive as yet. However, the sector potential may increase exponentially as local governments raise standards for waste management. Businesses engaging in the upstream and downstream industrial chain of the recycling sector, such as R&D and application of technologies for recycling and manufacturing of equipment for recycling or remanufacturing, should expect greater market scope in the medium to long term.

Recycling sectors that are encouraged for foreign investment:

Energy storage will be crucial in China’s green transition, as the country needs an advanced energy-storage system to respond to the challenge of power-generation fluctuations via renewables and to facilitate the development of the local EV market.

China has set goals to boost its non-pumped hydro energy storage capacity to around 30GW by 2025 and 100GW by 2030. Achieving this goal would require enhanced government supports and vigorous investment to the sector, which is expected to drive the boom of the strategic energy storage industry.

Foreign investors are generally not restricted to access this sector while R&D and application of large energy-storage technologies are especially encouraged for foreign investment.

This article first appeared in Asia Briefing, published by Dezan Shira Associates. The firm advises international investors in Asia and has offices in China, Hong Kong, Indonesia, Singapore, Russia and Vietnam.

Susanne Gildehaus has been Manager Data Analytics & Reporting for Daimler Trucks Asia since May. She previously held several positions at Mercedes-Benz including data analyst.

Rui Yang has been promoted to Senior Sales Financing Manager for Western Europe at Huawei Germany. He was previously Sales Financing Manager for the same region.

Is something changing in your organization? Why not let us know at heads@table.media!

Nocturnal natural phenomenon: A huge moon stands over Beihai Park in Beijing. While some admire the supermoon, it robs others of their sleep. The largest full moon of the year occurred because the distance between the earth and the moon is smaller than usual. A supermoon will also rise in August, but not as brightly as in July.