Hamas, Fatah, and twelve other Palestinian organizations have found a common line – and China apparently brokered this accord. A remarkable success for Beijing, writes Michael Radunski in his analysis. If the “Beijing Declaration” holds, it could also have far-reaching global repercussions: China is clearly gaining more and more prestige and influence as a mediator – much to the dismay of the West. However, things are not quite that far yet. Fatah and Hamas have already declared their unity in the past – and yet continued to quarrel.

There is no doubt about it: China’s green growth is massive. Last year alone, the Chinese invested as much in solar and wind power as the rest of the world combined. Yet, the country remains the largest emitter of climate-damaging CO2 by far.

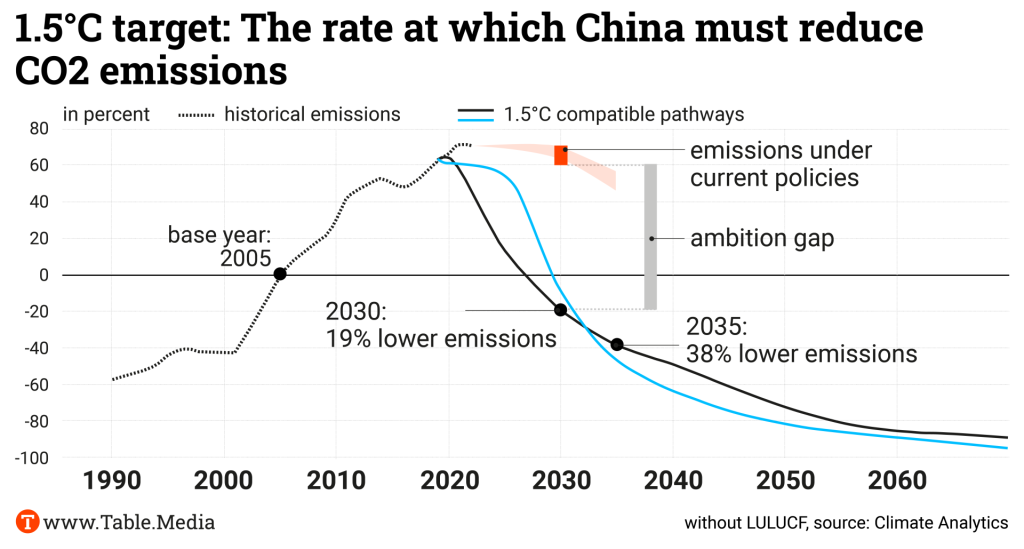

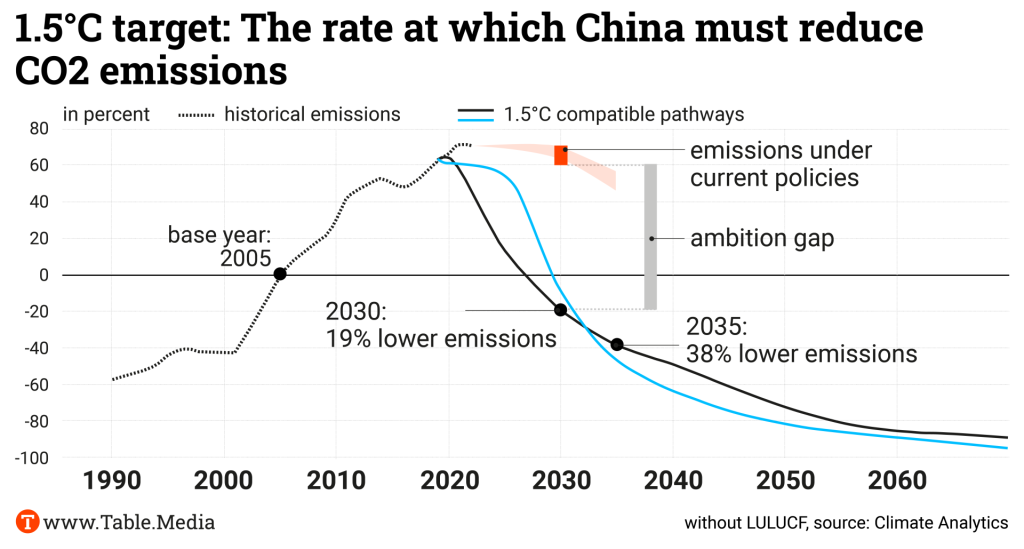

And despite the fact that the leadership in Beijing once again stressed the importance of climate action at its all-important “Third Plenum” last week and presented a new climate plan, the targets set are nowhere near enough to limit global warming to 1.5 degrees, as Nico Beckert analyzes.

To achieve this target, the huge country would have to cut its emissions by almost 60 percent over the next ten years. Not likely as long as China is not prepared to begin the ecological transformation of its industry. After all, that could cost growth.

On Tuesday, various Palestinian groups agreed to form a “national interim government of reconciliation” in Beijing. In total, 14 groups – including the bitterly opposed Hamas and Fatah – met in Beijing to find a solution under China’s leadership.

China’s Foreign Minister Wang Yi spoke of a “historic moment for the cause of Palestine’s liberation.” And indeed, if the “Beijing Declaration” holds, it could have two far-reaching repercussions for international politics:

China’s Foreign Minister took the opportunity to present the outcome personally. “The most prominent highlight is the agreement to form an interim national reconciliation government around the governance of post-war Gaza,” said Wang. “The core outcome is that the PLO is the sole legitimate representative of all Palestinian people.”

The Palestine Liberation Organisation (PLO) is a coalition of parties that signed a peace treaty with Israel in 1993 and formed a new government in the Palestinian Authority (PA).

Fatah and Hamas look back on years of bitter enmity. Palestinian President Mahmoud Abbas’ Fatah controls the Palestinian Authority and governs the Israeli-occupied West Bank. However, it only has limited power there. In the Gaza Strip, on the other hand, the Islamist Hamas has had sole control – since 2007, when the Fatah party was ousted by force.

Both had made several attempts to reach an agreement to unite the two separate Palestinian territories under one government structure. In 2017, the moment of unity seemed to have come: However, the agreement at the time fell through shortly after it was signed.

And so it must be noted: It is indeed a historic success. China has obviously managed to bring the rivals Hamas and Fatah to the table in Beijing. What’s more, an agreement has even been reached. It was not easy for China either. A meeting of high-ranking representatives had already taken place in April – but without any concrete results at the time.

However, Wang’s remarks leave some room for interpretation. For example, it is not clear what role Hamas – which is not part of the PLO – will play in a future reconciliation government. Wang also speaks of the time “post-war Gaza.” It remains unclear what direct impact the agreement will have on current events in the Middle East.

There are also actors such as the USA and Israel. In its charter, Hamas calls for the destruction of the state of Israel and the violent creation of an Islamic State of Palestine from the Jordan to the Mediterranean. Moreover, the “Beijing Declaration“ has yet to face the test of the complicated and violent reality of the Middle East. It was often believed that a breakthrough in the Middle East was imminent.

China’s Foreign Minister was correspondingly cautious on Tuesday in Beijing. He said that reconciliation was “an internal matter for the Palestinian factions.” However, “it cannot be achieved without the support of the international community.”

And this is where China comes in – and the potential economic and diplomatic payoff. In recent years, China has vastly expanded its influence in the Middle East – in a region where the USA has traditionally been seen as the dominant power. Economically, the region is developing into an important hub for “New Silk Road” projects. Ports, railway lines, airports and industrial parks are being expanded. It is easier to conclude contracts with a new peacekeeping power.

But the “Beijing Declaration” is also a diplomatic success. Wang said that his country wanted to play a constructive role in securing peace and stability in the Middle East. What he did not say on this Tuesday – but otherwise likes to mention – is that China is unlike the USA, which constantly pours fresh oil into the world’s hot spots.

However, China does not want to win over the USA, but countries that have been summarized under the term “Global South” for a while now. And China’s support for the Palestinian cause is very welcome there. This also includes the fact that Beijing has still not condemned the Hamas terrorist attack of October 7.

Can China really position itself as a new international peace mediator? Wang Yi tried verbally in Munich. In fact, he achieved it last year when he brokered an agreement between arch-enemies Iran and Saudi Arabia – putting the US in the awkward position of welcoming an important Middle East agreement negotiated by its biggest geopolitical rival of all.

Beijing’s attempts to mediate in the Ukraine war with similar success have so far been extremely limited: a loose 12-point proposal and its absence from the peace conference in Switzerland. But perhaps it will happen in time. Ukrainian Foreign Minister Dmytro Kuleba traveled to Beijing on Tuesday. It would be a diplomatic achievement for China that everyone would love to see.

China’s new climate plan (NDC) is currently underway, but experts believe it will hardly put the country on the 1.5-degree path. It is true that the government has just named the reduction of CO2 emissions as an important goal for the first time in the final document of the so-called “Third Plenum.” According to analysts, this is an important sign and “takes China’s fight against climate change to a new level.” However, the document does not specify any new political goals or measures. China’s climate policy is being held back by

In order for the global community to limit global warming to 1.5 degrees, China would have to reduce its emissions by 38 percent by 2035 compared to 2005 and by 59 percent compared to 2015. This would require a drastic turnaround in emissions and unprecedented efforts. The boom in renewable energies and a possible peak in CO2 emissions should not obscure the difficulties China is facing. For a 1.5°C-compatible NDC, the People’s Republic would have to accelerate the coal phase-out immensely and implement major efforts in the industrial sector.

China must submit the new NDC to the UN by Feb. 10, 2025. The government is currently organizing a ministerial meeting with more than 14 ministries to develop the NDC. According to Guoguang Wu from the Asia Society, many political developments in recent years point to a rather weaker climate policy in the coming years:

China’s immense growth in solar and wind power should not obscure the challenges. China’s growth rates in renewables far exceed those of other countries. But the People’s Republic also consumes a good 30 percent of the world’s electricity. The electrification of the industrial and transportation sectors will further increase the demand for electricity. Despite progress, coal-fired power is currently being phased out of the electricity mix too slowly.

In order to achieve its share of the 1.5-degree target, China would have to reduce the proportion of coal-fired power in its electricity mix from the current 53 percent to two to three percent by 2035. However, “the provincial governments and state-owned companies in China’s coal provinces are putting the brakes on the coal phase-out,” says Martin Voss, China expert at the environment and development organization Germanwatch. “Some of their arguments are based on assumptions that have been outdated in Germany for 20 years: The electricity grid will become unstable if too much renewable energy is added, and coal can provide both base load and flexibility.” In addition, the coal sector provides jobs for millions of low-skilled workers and accounts for a large proportion of economic output in some provinces.

There is currently little to suggest that China will phase out coal any time soon. However, the political leadership adopted an action plan in mid-July to reduce CO2 emissions from coal-fired power plants. Biomass and green ammonia are soon to be burned in pilot power plants and CCS is to be used to reduce CO2 emissions from power plants to the level of gas-fired power plants. However, these measures are expensive and partly untested. Experts such as Xinyi Shen from the Centre for Research on Energy and Clean Air also doubt that there is enough high-quality biomass.

China will therefore probably reduce emissions in the coming years, but not enough to keep the 1.5-degree target within reach. According to Martin Voss, “the Chinese government does not yet have the confidence to make the decisive push in the next NDC to reduce emissions quickly. This threatens to slip into the NDC after next”.

Significant reductions could be achieved if “existing political measures are tightened further,” calculates analyst Lauri Myllyvirta from the Centre for Research on Energy and Clean Air. That would be possible:

According to Myllyvirta, China could then reduce its CO2 emissions by 30 percent by 2035 compared to 2020. Emissions of other greenhouse gases such as methane could also be reduced by 20 percent.

Voss demands that “the EU should urge China to jointly publish an ambitious NDC, if possible at the start of COP29.” Ideally, this would mean “reducing emissions by up to 30 percent in absolute terms by 2035. That would give the COP process new momentum.” And also put pressure on other emerging economies to make concrete commitments.

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

The Chinese car manufacturer SAIC has criticized the EU Commission’s handling of its investigation into subsidies for Chinese EV manufacturers. In a statement published on its website on Monday, SAIC claimed that the Brussels agency had made mistakes in its investigation and, for instance, erroneously included a foreign joint venture for purchase financing as a subsidiary in its calculations. SAIC also accused the EU Commission of ignoring submitted documents. SAIC thus indirectly disagrees with the EU Commission, which had stated in its justification for the extra tariff for the Chinese company that it refused to cooperate with the investigation.

Brussels set the highest rate of 38.1 percent of provisional additional tariffs on SAIC. After negotiations, this was reduced slightly to 37.6 percent. At a hearing in Brussels last week, SAIC stated that the investigation was “beyond the scope of regular investigations” by demanding the disclosure of “commercially sensitive information” such as “battery-related chemical formulations.” The EU Commission did not initially comment on the allegation. ari

VW brand boss Thomas Schaefer calls Africa the latest growth market of significant importance for the automotive industry. Schaefer, who in addition to his role at Volkswagen also chairs the Sub-Saharan Africa Initiative of German Business (SAFRI), made the statement during a visit to the Table.Briefings editorial office.

Schaefer welcomed the growing competition with Chinese manufacturers on the continent and called the competition positive: “We are stepping up to this challenge,” he said. He also advised against playing down the Chinese approach: “China has developed thanks to political will and industrial courage. Africa needs that, too.” He said China could not be blamed for making headway in Africa with major infrastructure projects, while German and European companies were left behind. He added that it was up to the relevant players in Europe to change this.

In addition to a plant in South Africa and assembly plants in Kenya, Ghana and Rwanda, Volkswagen recently signed a declaration of intent with Egypt regarding an assembly plant. Africa is of particular interest to Volkswagen as a potential developing sales market, also due to the announced combustion engine bans in the Global North. Furthermore, large countries such as Egypt, Ethiopia and Nigeria need their own car industry, Schaefer said. ajs

TikTok plans to launch its in-app shopping platform in Spain and Ireland as early as October. The social media company, which is owned by ByteDance, has asked its partners, including retailers and creative agencies, in recent weeks to prepare for the launch of TikTok Shop in the two countries, Bloomberg reported, citing people familiar with the matter. TikTok Shop reportedly hired a team of about 40 employees in Spain, making it one of the company’s largest e-commerce outposts in Europe.

Reports suggest that the launch of the shopping platform will be smaller than originally planned. In parallel, preparations are underway to launch the portal in other parts of Europe next year. A TikTok spokesperson declined to comment on the plans. TikTok originally planned to launch the shop function in Spain, Germany, Italy, France, and Ireland earlier this year but postponed the expansion in favor of focusing on the United States. TikTok Shop is the app’s fastest-growing feature.

The plan for a smaller launch in Europe could indicate that the company is trying to avoid further regulatory investigations as it expands. Just a few days ago, TikTok failed to win a lawsuit against stricter regulation at the General Court of the European Union (EGC). The introduction of the Digital Markets Act (DMA) in the EU is intended to impose stricter regulation on online giants. Large companies that are categorized as so-called “gatekeepers” under the DMA will be subject to special regulations. The EU Commission includes TikTok in this category, and the company was unable to legally challenge it. cyb

In May, US President Joe Biden’s administration accused China of “flooding global markets” with “artificially low-priced exports.” Such accusations are not new, nor are they likely to stop any time soon. But many of those complaining about Chinese overcapacity overlook a critical fact: China’s net exports have been falling relative to GDP since 2008, and its trade surplus in goods has shrunk to less than 2 percent of GDP.

For years, China has been committed to rebalancing its economy and reducing its dependence on exports by boosting domestic demand, not through increased investment, which it has been discouraging, but rather through higher household consumption. And yet, despite rising labor income, which constitutes the bulk of household disposable income and accounts for about 56 percent today compared to 48 percent in 2007, household consumption expenditure has remained stubbornly low. According to official figures, total household consumption accounts for just 38 percent of GDP, compared to 60-70 percent in most developed countries.

But, as anyone who has studied China’s economy can attest when using official figures, international comparisons can be misleading. For example, in a 2015 study, Tian Zhu and I found that official figures underestimate Chinese households’ consumption expenditure on housing (as a share of GDP) by at least six percentage points.

Moreover, as Asian Development Bank (ADB) senior economist Juzhong Zhuang recently showed, China’s total household consumption expenditure appears much smaller than that of high-income economies (as a share of GDP) largely because of differences in services consumption. Using input-output data compiled by the OECD and the ADB, he found that services consumption amounted to only 67 percent of total household final consumption expenditure in China in 2018-19, equivalent to about 26 percent of GDP. Compare that with the share of services consumption in the United States (more than 80 percent, or about 55 percent of GDP); the European Union (72 percent, or 38 percent of GDP); and 75 percent, on average, in East Asia’s three high-income economies, Taiwan, Japan, and South Korea (about 38-39 percent of GDP). Even in Asia’s five major developing economies – India, Indonesia, Malaysia, Thailand, and the Philippines – services consumption accounted for more than 54 percent of total household final consumption expenditure, on average, equivalent to 33 percent of GDP.

China’s underestimation of services consumption is further compounded by large price distortions in services. According to the World Bank’s International Comparison Program, services prices in China at purchasing power parity are lower, on average, than overall prices. In other words, when Chinese households are purchasing services, their expenditure on them appears lower, complicating cross-country comparisons.

Further disparities might also arise from the fact that the Chinese government provides many services that households elsewhere might have to purchase themselves. A significant share of the recent growth in Chinese public expenditure represents in-kind transfers to households, including spending more on education, health care, and pensions, as well as social services like cultural facilities. Given this, in making cross-country comparisons of household consumption expenditure, it might well be worth including government consumption expenditure, which in China amounts to about 16 percent of GDP, in accounting that of households.

If we exclude government transfers to households, the disposable income of Chinese households amounts to about 60 percent of national income. This is 10-15 percentage points lower than in most high-income countries, where in-kind social transfers are included in household disposable incomes. But if one removes such transfers, the levels of disposable income in Japan, South Korea, Germany, and the eurozone as a whole fall to Chinese levels. In 2020, household disposable income in Denmark was even lower than that in China.

Therefore, when it comes to the real level of the household consumption-to-GDP ratio, China is probably not lagging as far behind other major economies as it seems. Nonetheless, as the relative importance of capital accumulation declines, and returns on investment continue to fall, more must be done through policy changes to support consumer spending. For policymakers, this means not only channeling more income and transfers toward households, but also increasing subsidized or free in-kind transfers to them.

A strong social safety net is particularly important in China, where decades of family-planning policies have encouraged households to save at exceptionally high rates, partly in anticipation of supporting parents and, ultimately, themselves in old age. If households can be certain that they will have strong family-based support and welfare programs from governments, so that they don’t need to save so much today, they are likely to consume more and might even have more children, thereby helping to stem China’s demographic decline. (The current fertility rate – about 1.1 births per woman – is well below the replacement level).

Ultimately, China must shift to a growth model that supports the growth of household disposable incomes, rather than continuing on the path of excessive capital accumulation. To that end, the government must encourage higher-wage economic activities, such as in the service sector, and strengthen the business environment, not least by expanding the decisive role of market forces in resource allocation.

Zhang Jun is Dean of the School of Economics at Fudan University and Director of the China Center for Economic Studies, a Shanghai-based think tank.

Copyright: Project Syndicate, 2024.

www.project-syndicate.org

Sakti Ranjan Ghatuari has been Head of Body Electronics and Systems at Zeekr Technology Europe since June. He has worked for the Chinese car manufacturer for four years and was Senior Lead Engineer for Mercedes in India prior to that. Ghatuari is based in Gothenburg.

Hao Yu has been Project Director China at Axinom since July. The German software company provides information and communication technology for the aerospace and media industries. Hao Yu previously worked at Henkel for five years.

Is something changing in your organization? Let us know at heads@table.media!

French luxury brand Louis Vuitton has long wanted to offer more than just fashion and leather goods: jewelry, watches, perfume. Since the merger with spirits manufacturer Moët Hennessy in the 1980s, LVMH has also offered champagne and brandy. So why not chocolate?

Consequently, the company has opened its first chocolate boutique in Shanghai. The chocolates and bars are presented on the counters like jewelry – at appropriately hefty prices. Appearance is more important than taste.

Hamas, Fatah, and twelve other Palestinian organizations have found a common line – and China apparently brokered this accord. A remarkable success for Beijing, writes Michael Radunski in his analysis. If the “Beijing Declaration” holds, it could also have far-reaching global repercussions: China is clearly gaining more and more prestige and influence as a mediator – much to the dismay of the West. However, things are not quite that far yet. Fatah and Hamas have already declared their unity in the past – and yet continued to quarrel.

There is no doubt about it: China’s green growth is massive. Last year alone, the Chinese invested as much in solar and wind power as the rest of the world combined. Yet, the country remains the largest emitter of climate-damaging CO2 by far.

And despite the fact that the leadership in Beijing once again stressed the importance of climate action at its all-important “Third Plenum” last week and presented a new climate plan, the targets set are nowhere near enough to limit global warming to 1.5 degrees, as Nico Beckert analyzes.

To achieve this target, the huge country would have to cut its emissions by almost 60 percent over the next ten years. Not likely as long as China is not prepared to begin the ecological transformation of its industry. After all, that could cost growth.

On Tuesday, various Palestinian groups agreed to form a “national interim government of reconciliation” in Beijing. In total, 14 groups – including the bitterly opposed Hamas and Fatah – met in Beijing to find a solution under China’s leadership.

China’s Foreign Minister Wang Yi spoke of a “historic moment for the cause of Palestine’s liberation.” And indeed, if the “Beijing Declaration” holds, it could have two far-reaching repercussions for international politics:

China’s Foreign Minister took the opportunity to present the outcome personally. “The most prominent highlight is the agreement to form an interim national reconciliation government around the governance of post-war Gaza,” said Wang. “The core outcome is that the PLO is the sole legitimate representative of all Palestinian people.”

The Palestine Liberation Organisation (PLO) is a coalition of parties that signed a peace treaty with Israel in 1993 and formed a new government in the Palestinian Authority (PA).

Fatah and Hamas look back on years of bitter enmity. Palestinian President Mahmoud Abbas’ Fatah controls the Palestinian Authority and governs the Israeli-occupied West Bank. However, it only has limited power there. In the Gaza Strip, on the other hand, the Islamist Hamas has had sole control – since 2007, when the Fatah party was ousted by force.

Both had made several attempts to reach an agreement to unite the two separate Palestinian territories under one government structure. In 2017, the moment of unity seemed to have come: However, the agreement at the time fell through shortly after it was signed.

And so it must be noted: It is indeed a historic success. China has obviously managed to bring the rivals Hamas and Fatah to the table in Beijing. What’s more, an agreement has even been reached. It was not easy for China either. A meeting of high-ranking representatives had already taken place in April – but without any concrete results at the time.

However, Wang’s remarks leave some room for interpretation. For example, it is not clear what role Hamas – which is not part of the PLO – will play in a future reconciliation government. Wang also speaks of the time “post-war Gaza.” It remains unclear what direct impact the agreement will have on current events in the Middle East.

There are also actors such as the USA and Israel. In its charter, Hamas calls for the destruction of the state of Israel and the violent creation of an Islamic State of Palestine from the Jordan to the Mediterranean. Moreover, the “Beijing Declaration“ has yet to face the test of the complicated and violent reality of the Middle East. It was often believed that a breakthrough in the Middle East was imminent.

China’s Foreign Minister was correspondingly cautious on Tuesday in Beijing. He said that reconciliation was “an internal matter for the Palestinian factions.” However, “it cannot be achieved without the support of the international community.”

And this is where China comes in – and the potential economic and diplomatic payoff. In recent years, China has vastly expanded its influence in the Middle East – in a region where the USA has traditionally been seen as the dominant power. Economically, the region is developing into an important hub for “New Silk Road” projects. Ports, railway lines, airports and industrial parks are being expanded. It is easier to conclude contracts with a new peacekeeping power.

But the “Beijing Declaration” is also a diplomatic success. Wang said that his country wanted to play a constructive role in securing peace and stability in the Middle East. What he did not say on this Tuesday – but otherwise likes to mention – is that China is unlike the USA, which constantly pours fresh oil into the world’s hot spots.

However, China does not want to win over the USA, but countries that have been summarized under the term “Global South” for a while now. And China’s support for the Palestinian cause is very welcome there. This also includes the fact that Beijing has still not condemned the Hamas terrorist attack of October 7.

Can China really position itself as a new international peace mediator? Wang Yi tried verbally in Munich. In fact, he achieved it last year when he brokered an agreement between arch-enemies Iran and Saudi Arabia – putting the US in the awkward position of welcoming an important Middle East agreement negotiated by its biggest geopolitical rival of all.

Beijing’s attempts to mediate in the Ukraine war with similar success have so far been extremely limited: a loose 12-point proposal and its absence from the peace conference in Switzerland. But perhaps it will happen in time. Ukrainian Foreign Minister Dmytro Kuleba traveled to Beijing on Tuesday. It would be a diplomatic achievement for China that everyone would love to see.

China’s new climate plan (NDC) is currently underway, but experts believe it will hardly put the country on the 1.5-degree path. It is true that the government has just named the reduction of CO2 emissions as an important goal for the first time in the final document of the so-called “Third Plenum.” According to analysts, this is an important sign and “takes China’s fight against climate change to a new level.” However, the document does not specify any new political goals or measures. China’s climate policy is being held back by

In order for the global community to limit global warming to 1.5 degrees, China would have to reduce its emissions by 38 percent by 2035 compared to 2005 and by 59 percent compared to 2015. This would require a drastic turnaround in emissions and unprecedented efforts. The boom in renewable energies and a possible peak in CO2 emissions should not obscure the difficulties China is facing. For a 1.5°C-compatible NDC, the People’s Republic would have to accelerate the coal phase-out immensely and implement major efforts in the industrial sector.

China must submit the new NDC to the UN by Feb. 10, 2025. The government is currently organizing a ministerial meeting with more than 14 ministries to develop the NDC. According to Guoguang Wu from the Asia Society, many political developments in recent years point to a rather weaker climate policy in the coming years:

China’s immense growth in solar and wind power should not obscure the challenges. China’s growth rates in renewables far exceed those of other countries. But the People’s Republic also consumes a good 30 percent of the world’s electricity. The electrification of the industrial and transportation sectors will further increase the demand for electricity. Despite progress, coal-fired power is currently being phased out of the electricity mix too slowly.

In order to achieve its share of the 1.5-degree target, China would have to reduce the proportion of coal-fired power in its electricity mix from the current 53 percent to two to three percent by 2035. However, “the provincial governments and state-owned companies in China’s coal provinces are putting the brakes on the coal phase-out,” says Martin Voss, China expert at the environment and development organization Germanwatch. “Some of their arguments are based on assumptions that have been outdated in Germany for 20 years: The electricity grid will become unstable if too much renewable energy is added, and coal can provide both base load and flexibility.” In addition, the coal sector provides jobs for millions of low-skilled workers and accounts for a large proportion of economic output in some provinces.

There is currently little to suggest that China will phase out coal any time soon. However, the political leadership adopted an action plan in mid-July to reduce CO2 emissions from coal-fired power plants. Biomass and green ammonia are soon to be burned in pilot power plants and CCS is to be used to reduce CO2 emissions from power plants to the level of gas-fired power plants. However, these measures are expensive and partly untested. Experts such as Xinyi Shen from the Centre for Research on Energy and Clean Air also doubt that there is enough high-quality biomass.

China will therefore probably reduce emissions in the coming years, but not enough to keep the 1.5-degree target within reach. According to Martin Voss, “the Chinese government does not yet have the confidence to make the decisive push in the next NDC to reduce emissions quickly. This threatens to slip into the NDC after next”.

Significant reductions could be achieved if “existing political measures are tightened further,” calculates analyst Lauri Myllyvirta from the Centre for Research on Energy and Clean Air. That would be possible:

According to Myllyvirta, China could then reduce its CO2 emissions by 30 percent by 2035 compared to 2020. Emissions of other greenhouse gases such as methane could also be reduced by 20 percent.

Voss demands that “the EU should urge China to jointly publish an ambitious NDC, if possible at the start of COP29.” Ideally, this would mean “reducing emissions by up to 30 percent in absolute terms by 2035. That would give the COP process new momentum.” And also put pressure on other emerging economies to make concrete commitments.

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

The Chinese car manufacturer SAIC has criticized the EU Commission’s handling of its investigation into subsidies for Chinese EV manufacturers. In a statement published on its website on Monday, SAIC claimed that the Brussels agency had made mistakes in its investigation and, for instance, erroneously included a foreign joint venture for purchase financing as a subsidiary in its calculations. SAIC also accused the EU Commission of ignoring submitted documents. SAIC thus indirectly disagrees with the EU Commission, which had stated in its justification for the extra tariff for the Chinese company that it refused to cooperate with the investigation.

Brussels set the highest rate of 38.1 percent of provisional additional tariffs on SAIC. After negotiations, this was reduced slightly to 37.6 percent. At a hearing in Brussels last week, SAIC stated that the investigation was “beyond the scope of regular investigations” by demanding the disclosure of “commercially sensitive information” such as “battery-related chemical formulations.” The EU Commission did not initially comment on the allegation. ari

VW brand boss Thomas Schaefer calls Africa the latest growth market of significant importance for the automotive industry. Schaefer, who in addition to his role at Volkswagen also chairs the Sub-Saharan Africa Initiative of German Business (SAFRI), made the statement during a visit to the Table.Briefings editorial office.

Schaefer welcomed the growing competition with Chinese manufacturers on the continent and called the competition positive: “We are stepping up to this challenge,” he said. He also advised against playing down the Chinese approach: “China has developed thanks to political will and industrial courage. Africa needs that, too.” He said China could not be blamed for making headway in Africa with major infrastructure projects, while German and European companies were left behind. He added that it was up to the relevant players in Europe to change this.

In addition to a plant in South Africa and assembly plants in Kenya, Ghana and Rwanda, Volkswagen recently signed a declaration of intent with Egypt regarding an assembly plant. Africa is of particular interest to Volkswagen as a potential developing sales market, also due to the announced combustion engine bans in the Global North. Furthermore, large countries such as Egypt, Ethiopia and Nigeria need their own car industry, Schaefer said. ajs

TikTok plans to launch its in-app shopping platform in Spain and Ireland as early as October. The social media company, which is owned by ByteDance, has asked its partners, including retailers and creative agencies, in recent weeks to prepare for the launch of TikTok Shop in the two countries, Bloomberg reported, citing people familiar with the matter. TikTok Shop reportedly hired a team of about 40 employees in Spain, making it one of the company’s largest e-commerce outposts in Europe.

Reports suggest that the launch of the shopping platform will be smaller than originally planned. In parallel, preparations are underway to launch the portal in other parts of Europe next year. A TikTok spokesperson declined to comment on the plans. TikTok originally planned to launch the shop function in Spain, Germany, Italy, France, and Ireland earlier this year but postponed the expansion in favor of focusing on the United States. TikTok Shop is the app’s fastest-growing feature.

The plan for a smaller launch in Europe could indicate that the company is trying to avoid further regulatory investigations as it expands. Just a few days ago, TikTok failed to win a lawsuit against stricter regulation at the General Court of the European Union (EGC). The introduction of the Digital Markets Act (DMA) in the EU is intended to impose stricter regulation on online giants. Large companies that are categorized as so-called “gatekeepers” under the DMA will be subject to special regulations. The EU Commission includes TikTok in this category, and the company was unable to legally challenge it. cyb

In May, US President Joe Biden’s administration accused China of “flooding global markets” with “artificially low-priced exports.” Such accusations are not new, nor are they likely to stop any time soon. But many of those complaining about Chinese overcapacity overlook a critical fact: China’s net exports have been falling relative to GDP since 2008, and its trade surplus in goods has shrunk to less than 2 percent of GDP.

For years, China has been committed to rebalancing its economy and reducing its dependence on exports by boosting domestic demand, not through increased investment, which it has been discouraging, but rather through higher household consumption. And yet, despite rising labor income, which constitutes the bulk of household disposable income and accounts for about 56 percent today compared to 48 percent in 2007, household consumption expenditure has remained stubbornly low. According to official figures, total household consumption accounts for just 38 percent of GDP, compared to 60-70 percent in most developed countries.

But, as anyone who has studied China’s economy can attest when using official figures, international comparisons can be misleading. For example, in a 2015 study, Tian Zhu and I found that official figures underestimate Chinese households’ consumption expenditure on housing (as a share of GDP) by at least six percentage points.

Moreover, as Asian Development Bank (ADB) senior economist Juzhong Zhuang recently showed, China’s total household consumption expenditure appears much smaller than that of high-income economies (as a share of GDP) largely because of differences in services consumption. Using input-output data compiled by the OECD and the ADB, he found that services consumption amounted to only 67 percent of total household final consumption expenditure in China in 2018-19, equivalent to about 26 percent of GDP. Compare that with the share of services consumption in the United States (more than 80 percent, or about 55 percent of GDP); the European Union (72 percent, or 38 percent of GDP); and 75 percent, on average, in East Asia’s three high-income economies, Taiwan, Japan, and South Korea (about 38-39 percent of GDP). Even in Asia’s five major developing economies – India, Indonesia, Malaysia, Thailand, and the Philippines – services consumption accounted for more than 54 percent of total household final consumption expenditure, on average, equivalent to 33 percent of GDP.

China’s underestimation of services consumption is further compounded by large price distortions in services. According to the World Bank’s International Comparison Program, services prices in China at purchasing power parity are lower, on average, than overall prices. In other words, when Chinese households are purchasing services, their expenditure on them appears lower, complicating cross-country comparisons.

Further disparities might also arise from the fact that the Chinese government provides many services that households elsewhere might have to purchase themselves. A significant share of the recent growth in Chinese public expenditure represents in-kind transfers to households, including spending more on education, health care, and pensions, as well as social services like cultural facilities. Given this, in making cross-country comparisons of household consumption expenditure, it might well be worth including government consumption expenditure, which in China amounts to about 16 percent of GDP, in accounting that of households.

If we exclude government transfers to households, the disposable income of Chinese households amounts to about 60 percent of national income. This is 10-15 percentage points lower than in most high-income countries, where in-kind social transfers are included in household disposable incomes. But if one removes such transfers, the levels of disposable income in Japan, South Korea, Germany, and the eurozone as a whole fall to Chinese levels. In 2020, household disposable income in Denmark was even lower than that in China.

Therefore, when it comes to the real level of the household consumption-to-GDP ratio, China is probably not lagging as far behind other major economies as it seems. Nonetheless, as the relative importance of capital accumulation declines, and returns on investment continue to fall, more must be done through policy changes to support consumer spending. For policymakers, this means not only channeling more income and transfers toward households, but also increasing subsidized or free in-kind transfers to them.

A strong social safety net is particularly important in China, where decades of family-planning policies have encouraged households to save at exceptionally high rates, partly in anticipation of supporting parents and, ultimately, themselves in old age. If households can be certain that they will have strong family-based support and welfare programs from governments, so that they don’t need to save so much today, they are likely to consume more and might even have more children, thereby helping to stem China’s demographic decline. (The current fertility rate – about 1.1 births per woman – is well below the replacement level).

Ultimately, China must shift to a growth model that supports the growth of household disposable incomes, rather than continuing on the path of excessive capital accumulation. To that end, the government must encourage higher-wage economic activities, such as in the service sector, and strengthen the business environment, not least by expanding the decisive role of market forces in resource allocation.

Zhang Jun is Dean of the School of Economics at Fudan University and Director of the China Center for Economic Studies, a Shanghai-based think tank.

Copyright: Project Syndicate, 2024.

www.project-syndicate.org

Sakti Ranjan Ghatuari has been Head of Body Electronics and Systems at Zeekr Technology Europe since June. He has worked for the Chinese car manufacturer for four years and was Senior Lead Engineer for Mercedes in India prior to that. Ghatuari is based in Gothenburg.

Hao Yu has been Project Director China at Axinom since July. The German software company provides information and communication technology for the aerospace and media industries. Hao Yu previously worked at Henkel for five years.

Is something changing in your organization? Let us know at heads@table.media!

French luxury brand Louis Vuitton has long wanted to offer more than just fashion and leather goods: jewelry, watches, perfume. Since the merger with spirits manufacturer Moët Hennessy in the 1980s, LVMH has also offered champagne and brandy. So why not chocolate?

Consequently, the company has opened its first chocolate boutique in Shanghai. The chocolates and bars are presented on the counters like jewelry – at appropriately hefty prices. Appearance is more important than taste.