Whether it’s Art021 in Shanghai or the West Bund Art & Design Art Fair – China’s art market is booming. The People’s Republic has long been one of the largest markets for contemporary art, with billions of dollars in sales every year. So far, it’s mainly foreign galleries and artists who have profited from this, but a strong artist scene has long since established itself in China as well, as Ning Wang shows in her analysis of the Chinese art market. However, during her investigation, she has also encountered discord and concerns among gallery owners. Above all, the campaigns of state and party leader Xi Jinping could ruin the current boom.

Today, our Beijing author team takes you into the depths of a true political thriller. In October 2018, the first Chinese head of Interpol suddenly disappeared. There was no trace of him, and it took several days before the leadership in Beijing stated they had arrested Meng Hongwei for corruption. Now Meng’s wife is speaking out publicly. In a spectacular interview, she explains that her husband fell victim to a purge by head of state Xi Jinping. The party does not even show away from arresting internationally visible officials.

The introduction of a digital central bank currency has been discussed for a long time. But what is behind it: the internationalization of the yuan? The replacement of the US dollar as the reserve currency? Frank Sieren has taken a look at what the Chinese central bank chief has to say about the goals behind such a huge step. Our author in Beijing takes stock: Above all, China’s leadership wants to break the market power of internet giants.

I hope you enjoy today’s issue!

The rush was big: More than 400 galleries had applied to participate in the Shanghai art fair Art021. Only about a quarter of applicants were accepted, as David Chau, one of the co-founders of the art fair launched in 2012, explains. Art021 focuses on contemporary art. Foreign exhibitors, some of whom were unable to attend in person due to China’s strict travel regulations, were represented by their Chinese offshoots.

The West Bund Art & Design art fair, which was taking place at the same time, was also swarmed by galleries willing to participate: The fair even had to expand and move to the West Bund Dome, a former cement factory. Around 120 galleries and art institutions, 48 of them from overseas, were represented there. “The pandemic has made Art021 and the West Bund the ‘bridgeheads’ of the Chinese market,” says Ray Dong, who heads the Art Market Research Center at the prestigious Central Academy of Fine Arts (CAFA) in Beijing. “Because people can’t go overseas, we have to come [to Shanghai]. Its position in the market and in the minds of Chinese collectors is becoming more and more important” Dong told The Art Newspaper. Several private museums in Shanghai, such as the Yuz and the Long Museum, are also currently attracting visitors with new exhibition openings.

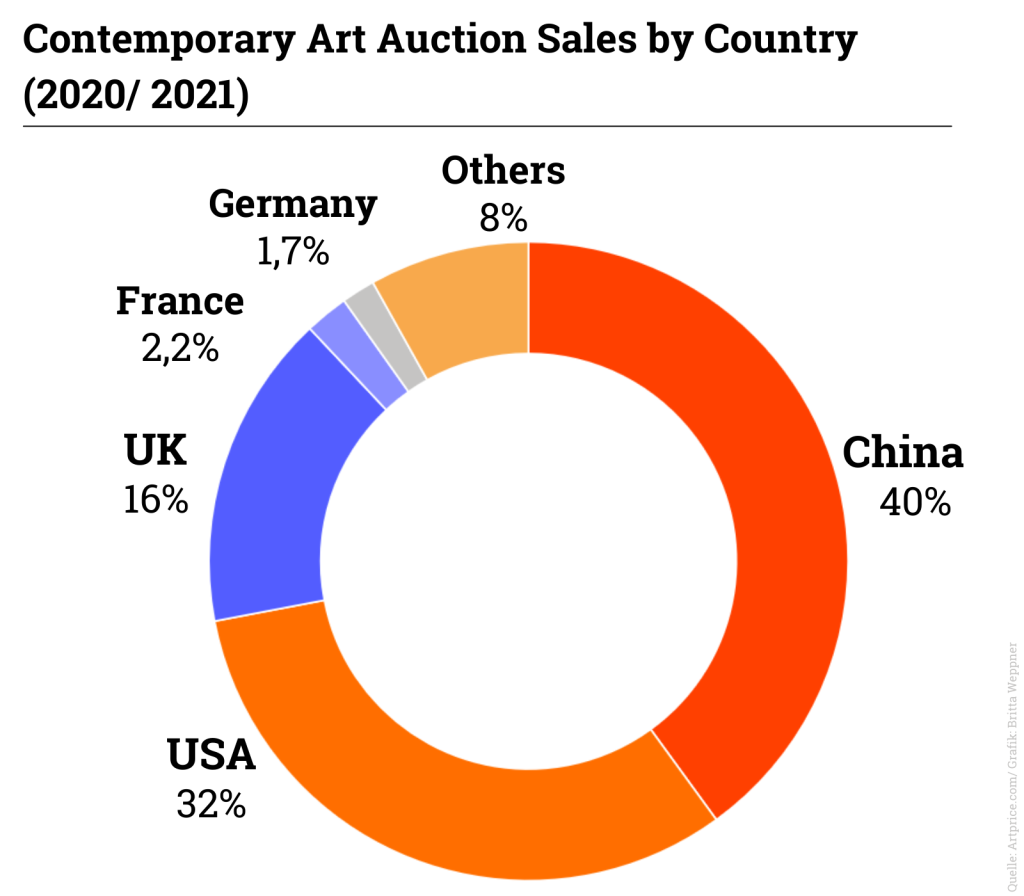

The fact that these fairs and exhibitions are booming is not surprising. China is now among the top three countries with the largest market for contemporary art, just after the US and the UK, according to industry platform artprice.com. “After a very difficult year in 2020, China, Hong Kong, and Taiwan all posted outstanding performances in the latter half of the year and the first half of 2021. Their combined contribution to the global Contemporary market (approximately $1 billion) represented 40% of its value,” artprice states. “The Asian market has therefore effectively become the world’s primary zone for the exchange of Contemporary artworks, and not just for Asian artists, but also for a growing number of Western artists,” according to one of the key statements of the Contemporary Art Market Report 2021.

The mood at the art fairs in Shanghai was nevertheless chastened. While gallery owners, artists, and collectors were still happy last year that the fairs, openings, and exhibitions were finally taking place once again after the harsh lockdowns in China, this year’s art fairs were overshadowed by several events.

Not only did the recently tightened Covid restrictions in the country dampen the mood: The fair could only be attended with a negative test and a green QR code on the phone, which didn’t stop the local art scene – but international visitors were missing. PU invitation letters, which gallery owners would have needed to enter the People’s Republic, were also not issued by the relevant authorities. In addition, there is still a three-week quarantine.

But gallery owners and artists also observed the 6th Plenum, which met almost simultaneously in Beijing (China.Table reports), with mixed feelings. Especially the fact that state and party leader Xi Jinping will continue to hold the reins as “helmsman” of both party and country until 2027 caused uncertainty.

Xi’s announcements raised concerns that the numerous “campaigns” in the country could once again gain traction and then spread to the art market. For more than a year, Beijing has been imposing tougher rules on the entertainment industry, the online education sector, and especially the tech and real estate sectors, in order to regulate its previously unchecked growth and bring it under state control (China.Table reported).

And China’s art market is one of the largest unregulated markets, which is also worth billions. Xi Jinping’s mantra-like invocation of “common prosperity” is supposed to narrow the gap between rich and poor (China.Table reported). But 45 percent of luxury goods sold worldwide are purchased by Chinese consumers. If China’s wealthy will be financially burdened by higher taxes or levies to implement Xi’s goals, this will also have an impact on the art market, many in the art scene fear.

The development of the Chinese art market is exemplified by the biography of Liu Yiqian. The former taxi driver and his wife Wang Wei not only opened three private museums in Shanghai and Chongqing within a few years. Today, he is also one of the most prominent Chinese collectors. He has gained attention well beyond the borders of the People’s Republic, not only since he acquired Amedeo Modigliani’s “Nu Couché” for more than $170 million in 2015. Liu is thus one of the collectors who are fuelling the art market.

After all, China plays a major role in the global market: last year, the People’s Republic accounted for 21 percent of the international art and antiques trade, which is worth around $50 billion. Ten years ago, China’s share of the global art market was even larger, ahead of that of the USA. But the bubble burst. This was in part because domestic auction houses such as Poly Auction Beijing and Guardian failed to identify copies and many auction bids were never paid for by the bidders.

In recent years, the Chinese art market has largely recovered from such setbacks. Rising profits from the real estate market led to increased investment in art due to a lack of investment alternatives. However, the current real estate crisis, triggered by the payment shortfalls of real estate developer Evergrande (China.Table reported), left many wondering whether auctions will continue to receive so much money.

According to Dawn Zhu, Thaddaeus Ropaq Gallery’s Asia Director, artworks in the $150,000 to $200,000 price range sold easily at art fairs in Shanghai. Once prices reached $1 million, however, there was hesitation and people requested more time to consider, she said. “These works were not so easy to sell,” says Zhu. The main benefit was that buyers no longer travel abroad and therefore spend more on domestic art. “The Chinese art market in Shanghai is showing robustness,” said an industry insider involved in organizing art fairs.

Especially many young collectors joined the scene, who also increasingly collect young and diverse artists, as well as other art forms such as NFT. So-called non-fungible tokens can also be a work of art. But so-called blue-chip art by renowned and well-known artists is also in demand among young collectors. For example, at the evening auctions in New York in the middle of last week, 31-year-old crypto entrepreneur Justin Sun bought “Le Nez” – a rare Giacometti bronze figure for $68 million at Sotheby’s auction house. Sun thus showed how much money he makes with his crypto company. He did not hide his newest acquisition for long: Sun announced that he was the new owner on Twitter.

In October 2018, a whodunit played out before the eyes of the world. In the leading role: Meng Hongwei, the then head of the powerful international police organization Interpol. The then 64-year-old was the first Chinese to hold the post. But then he suddenly disappeared. Overnight.

For almost 14 days, his own agency was on the lookout for him. All that was known was that Meng had traveled to his native China. Then Beijing revealed the secret of his whereabouts. The Ministry of Public Security announced that the Interpol chief was being investigated on suspicion of “taking bribes” and involvement in illegal activities. Following this announcement, Interpol immediately received a letter allegedly drafted by Meng, in which he declared his immediate resignation.

As a last sign of life from China, Meng Hongwei sent his wife Grace Meng an emoji pictogram with a knife as a message to her mobile phone. Maybe because he knew that the game was over.

For the first time since her husband’s arrest, Grace Meng has now given an extensive interview to US news agency AP, in which she makes serious accusations against both Interpol and the Chinese government. She has not heard a word from her husband since the last text message about three years ago, she said in the interview. Letters from her lawyers to the Chinese authorities have also gone unanswered, she said. She is not even sure if her husband is still alive.

According to official information, Meng Hongwei had been convicted to 13 years and 6 months in prison in January 2020 for accepting bribes worth more than two million dollars. The court stated that he had pleaded guilty and expressed regret. His wife, who called China’s leadership a “monster” during the interview with AP, said she has not received a single letter from her husband ever since.

His wife also expressed outrage that Interpol simply accepted her husband’s resignation and did not launch an investigation. “Can someone who has been forcibly disappeared write a resignation letter of their own free will?” she asked. The police organization and its member states should not have simply bowed to the version spread by Beijing. The allegations of corruption against her husband are fictitious. Rather, she says, he was eliminated because he used his senior position to push for change.

“It’s an example of a political disagreement being turned into a criminal affair,” Grace Meng says. And further, “The extent of corruption in China today is extremely serious. It’s everywhere. But there are two different opinions about how to solve corruption. One is the method used now. The other is to move toward constitutional democracy, to solve the problem at its roots.”

Grace Meng thus implies that her husband was the victim of a power struggle. It’s a theory that was also voiced by many observers shortly after the former Interpol chief’s disappearance. If Meng had merely been corrupt, China’s leadership would hardly have taken the shameful step of ousting her husband, who had just been installed at the head of Interpol. “I think it’s more than corruption,” said Zhang Lifan, a critical historian, for instance, at the time. “There is a political power struggle behind this.” According to his information, other representatives of the police ministry were also arrested at the time.

Many have pointed out that Meng Hongwei started his career in Beijing’s police ministry. At the time, the ministry was still under the leadership of chief of security Zhou Yongkang, who was later overthrown and sentenced to life in 2015 and was considered a dangerous rival of state and party leader Xi Jinping. Meng Hongwei, it was assumed, could thus have been the victim of a widespread purge with which Xi wanted to further consolidate his power.

Grace Meng and her family have been through traumatic years, she said. Her children, in particular, are suffering. “Whenever the children hear someone knocking on the door, they always go to look. I know that they’re hoping that the person coming inside will be their father. But each time, when they realize that it isn’t, they silently lower their heads.” Joern Petring/Gregor Koppenburg

China’s central bank digital currency has reached new milestones on its way to being adopted in everyday life. Yi Gang, Governor of the People’s Bank of China (PBoC), went into details of the launch for the first time at an online conference marking the 30th anniversary of the Bank of Finland Institute for Emerging Economics last week. The central bank chief revealed current figures and bluntly revealed the project’s most important goal: The leadership wants to further contain the power of Internet corporations.

According to Yi, over 123 million digital e-yuan wallets have already been opened in China. Combined, they amount to a total transaction volume of ¥56 billion ($9 billion). However, this is supposed to be just the beginning.

Yi lamented that mobile and digital payment services in China have so far been offered mainly by private companies. Until now, the market has been dominated by Alipay and WeChat Pay. This poses a “risk of privacy violation,” Yi said. While he welcomed the popularity of digital payment; it is already reaching 86 percent market penetration in China. “It has made people’s daily lives much easier,” Yi said. However, the state would be seeking better control over financial flows. So Yi blatantly announced further curbs on the influence of tech corporations.

The reason for the split between two private players lies in the history of mobile payments in China. With the proliferation of smartphones, Alipay and WeChat Pay, which are backed by tech giants Alibaba and Tencent, became China’s duopoly in digital payment and fintech services within a few years. This increasingly includes the credit business. Thus, tech companies made inroads into the financial sector.

With its e-yuan, the state now aims to curb the power of these companies. “Digital central bank currencies allow central banks to continue to provide a credible and secure means of payment in the digital age while improving the efficiency and integrity of the payment system,” Yi said. The benefits for the government are obvious: The e-yuan enables authorities to better trace large payment flows and where debts are being incurred. The e-yuan is also expected to be used offline. That would be an advantage over existing mobile payment services in China, which rely on an active Internet connection.

The PBoC has been working on a “Central Bank Digital Currency” (CBDC) since 2014. In the cities of Shenzhen, Chengdu, and Suzhou, it has already been possible to exchange cash for the digital yuan in pilot projects. At the China International Import Expo (CIIE) in Shanghai, China’s most important import fair, the e-yuan could be used in restaurants and at vending machines. Discounts of between “30 to 50 percent” were granted to boost business. The currency is to undergo its next large-scale field test at the 2022 Winter Olympics. There, Foreigners will also be allowed to use the currency for the first time.

Beijing had originally planned to introduce the currency nationwide before the major sporting event. However, that was obviously too ambitious a goal. A new date for the nationwide launch of its digital currency has not yet been set.

The October 23rd version of a draft revision of China’s central bank law includes paragraphs on the e-yuan. They are intended to establish the necessary legal framework for the digital currency. Accordingly, the legislator grants it the same legal status as the physical yuan.

Central bank chief Yi also admitted that his bank’s computer scientists are still working on a few problems. Above all, protection against hackers is still a concern. The interfaces to the real world are also not all perfected yet. “We are striving to establish a management model for the e-yuan modeled on cash and bank accounts, which will improve efficiency, privacy, and anti-counterfeiting, and increase interoperability with existing payment tools,” Yi said in his speech. New encryption algorithms are expected to raise security standards.

Accordingly, personal data would only be traceable by the state in case of “large transactions”. Upper limits on the wallet balance and limited transaction amounts will be introduced. The e-yuan is not the end of cash, Yi countered people’s concerns: “As long as there is demand for cash, we will continue to offer cash.”

Until the Bahamas unveiled its “sand dollar” in October 2020, China had made the most progress on state central bank currencies. However, only 400,000 people live in the Bahamas. Compared to the 123 million wallets that already exist in China, it is a relatively small project.

In Europe, only Sweden and EU accession candidate Ukraine have so far launched serious pilot projects. The Russian central bank also plans to test a digital ruble during a pilot phase next year, Russia’s central bank chief Elvira Nabiullina explained. The Covid pandemic has accelerated the pace of development. The share of contactless payments in global card transactions rose to more than 33 percent in March, up from about 27 percent six months prior to the Covdi outbreak, according to the Bank for International Settlements (BIS).

The PBoC’s push is also aimed at making the digital currency usable across borders. “We would like to strengthen cooperation with other central banks and international organizations on CBDC.” Several institutions have already launched a multilateral cooperation project to explore the role of central bank digital currencies in cross-border payments:

During the conference, Yi announced the introduction of another cooperation: “We also have regular technological exchanges with the European Central Bank.”

Moreover, the e-yuan is seen as a decisive step by China in building a global currency to rival the US dollar. “How China’s digital currency could challenge the almighty Dollar,” headlines the US magazine Time. And Japan’s business daily Nikkei is already wondering, “Will China’s digital yuan vanquish the dollar?.” According to Nikkei, a new era of international financial systems could be dawning 50 years after the Nixon shock. In August 1971, US President Richard Nixon had unpegged the US dollar from gold. In doing so, he ended a system of fixed exchange rates that also included the German Mark. The era of international non-coordinated printing of US dollars began.

If Beijing has its way, the digital yuan will naturally also play a significant role in trade with the countries of the New Silk Road. But China’s strict capital controls remain a hurdle. The “cross-border use of central bank digital currencies involves more complicated issues, such as anti-money laundering,” Yi said. Security and financial stability still come first for Beijing.

While during this first phase of implementation, the e-yuan is to be limited to domestic payment transactions, including, for example, bill payments, grocery shopping, or government services, in a second stage, the internationalization of the e-Yuan is planned. To avoid uncontrollable payment flows, as with Bitcoin, an international e-yuan is to be introduced. This allows the state to control exchange rates. The e-yuan is considered a game-changer.

Car manufacturer Great Wall Motor (GWM) has opened its new European headquarters in Munich. This will make the German city the central location for the continental European market, the company announced. “As one of the most successful automobile manufacturers in China, we have already successfully established a foothold in many international markets. The launch in Europe is an important milestone for Great Wall Motor. We have ambitious goals for this market as well,” said Qiao Xianghua, CEO of GWM Europe Around 300 employees are to work at the headquarters in the Bavarian capital from next year.

GWM intends to present its car brands Wey and Ora to customers (China.Table reported). The Group presented the two brands at the IAA in September. Both brands are to convince above all through their user orientation. An app is planned for Ora and Wey as well, with which users can interact with the brand and its products. The goal is to create a “lifestyle ecosystem for European users”, including a charging service and a maintenance and repair service, GWM said. “We want to make the car an emotional, intelligent, and convenient third mobile space,” Qiao said. The connectivity of vehicles and mobile devices is growing in significance (China.Table reported).

China’s head of state and party leader Xi Jinping has once again declared that he is not engaged in power politics. The People’s Republic wants to get along peacefully with its neighbors, never seeks domination and, as a big country, does not bully smaller states, Xi assured at a virtual meeting with ASEAN leaders on Monday. “China will always be ASEAN’s good neighbor, friend, and partner,” Chinese state media quoted Xi as saying. The occasion for the summit was the 30th anniversary of China’s cooperation with the grouping.

Xi said, according to media reports, that China and ASEAN countries “shed the Cold War gloom” and are working together to maintain regional stability. Xi’s speech was preceded by several disputes between China and ASEAN members the Philippines, Malaysia, and Vietnam in maritime areas where China’s territorial claims clash with those of neighboring countries. Xi’s speech thus addresses concrete fears of his southern neighbors.

Philippine President Rodrigo Duterte reportedly stressed that he “abhors” the dispute and that the rule of law is the only way out. Indonesia’s President Duterte referred to the 2016 international arbitration ruling, which determined that China’s maritime claim had no legal basis. Beijing, however, is ignoring the ruling. “This does not speak well of the relations between our nations,“ Duterte remarked. Last week, the Philippines had condemned the deployment of three Chinese coast guard vessels. These are said to have used water cannons against Philippine supply boats.

Duterte is actually considered pro-China, and since taking office in 2016 the controversial head of state has repeatedly sought to close ranks with Beijing in the hope of attracting investment and trade deals. In his speech, Xi also pledged $1.5 billion in development aid over three years to ASEAN countries to fight the pandemic and revitalize their economies. China also plans to donate 150 million vaccine doses. ari

A severe crisis in the Chinese real estate market would also hit the German economy. This is the conclusion of an analysis by the German Bundesbank. A corresponding simulation shows that such a crisis could have noticeable effects on the real economy in Germany and other countries, writes the Bundesbank in its November monthly report published on Monday (page 14).

According to the simulation, China’s imports would drop by a fifth. Germany as an exporter could feel the effects significantly. Gross domestic product (GDP) would decline by 0.6 percent due to falling demand from China alone. However, the authors point out that their model probably underestimates the impact. After all, events in China also affect all of Germany’s other trading partners, which are then likely to order less as well. “For some economies with higher trade dependence on China, the GDP losses are even larger,” the report says. For Japan, the GDP losses in the model are nearly one percent, and for South Korea, they are even more than two percent. For Australia, they would be around 1.6 percent.

The Bundesbank’s scenario is based on the real estate crisis in the US between 2006 and 2009 and assumes, among other things, that housing investment in China will halve. It also assumes that Chinese real estate prices will fall by a fifth.

The payment difficulties of the Chinese real estate group Evergrande had recently sparked fears of a real estate crisis in China. Most recently, the group had bought itself some time with surprising interest repayments (China.Table reported). rad

The International Table Tennis World Federation ITTF announced a “historic moment” on Monday: Athletes from China and the US will compete together at the World Championships, which begin Tuesday in Houston. This will mark the 50th anniversary of the so-called Ping-Pong Diplomacy.

Chinese Lin Gaoyuan and American Lily Zhang will play together while Wang Manyu will compete with Kanak Jha in the mixed doubles. The Wang/Jha duo could face German European champions Dang Qiu and Nina Mittelham in the second round.

The president of the Chinese Table Tennis Association, Liu Guoliang, was enthusiastic: the extraordinary pairings would “build on the China-US friendship”. They would open “a new chapter of Ping-Pong Diplomacy in this new era.”

The so-called Ping-Pong Diplomacy refers to a series of friendly matches between Chinese and American teams in 1971, which paved the way for diplomatic relations between Washington and then internationally isolated China. rad

Chinese technology company Build Your Dreams (BYD) has shipped electric buses to Deutsche Bahn AG in Germany. The handover of the five electric 12-meter buses took place in Ettlingen near Karlsruhe, BYD announced on Monday. DB had signed a framework agreement with BYD in March 2021 to introduce electric buses in 2021 and beyond. The electric buses were driven from Oosterhout in the Netherlands to their destination. They are to begin operations in the Karlsruhe district. According to BYD, one charge of the 422-KWh battery will have a range of around 400 kilometers. ari

When chemical giant BASF revealed its first financial figures of the year back in May, the optimism coming from its headquarters in Ludwigshafen was clearly audible. The targets for 2021 were raised, thanks above all to the Chinese market. Sales in the People’s Republic rose by 43 percent compared to the first quarter of 2020. In Europe, the increase was only three percent.

BASF is currently investing around ten billion euros in the construction of a new chemical site in the southern Chinese province of Guangdong. An expansion of battery production has also been announced. The Ludwigshafen-based company hopes that its business in China will continue to boom for a long time to come. At the center of the activities is Group CEO Martin Brudermueller. Between 2006 and 2015, he managed business activities in Asia from his headquarters in Hong Kong.

The 60-year-old is considered an outspoken China devotee. “Chinese culture is one of the oldest and, for me, most fascinating in the world. I find it incredibly impressive,” says Brudermueller. “I also like the Chinese mentality. It’s open and direct, which suits me and fits in well with the German mentality: the long-term, strategic thinking, the technological orientation.”

After returning from Hong Kong, Brudermueller rose to the position of Chief Technology Officer before taking over as Chairman of BASF in 2018. His professional career is closely linked to East Asia, and China, in particular. Because of his affection for China, Brudermueller is often attacked by critics. “Perhaps he lacks the appropriate reserve that a CEO should show toward all business areas. In the long term, the People’s Republic could prove to be the group’s dangerous Achilles’ heel,” says former Handelsblatt chief Bernd Ziesemer.

But Brudermueller will not allow himself to be dissuaded from his line. “My response to these critics is that if they want to be among the world’s leading chemical companies, they can’t afford to ignore China. With a share of more than 40 percent, China is already the world’s largest chemical market and determines the growth of global chemical production,” says the Swabian. The share is expected to rise to around 50 percent by 2030 and more than two-thirds of global chemical growth will come from China in the next ten years, he added. “BASF has been active in China since 1885. We have already participated in the country’s development in the past and plan to do so in the future,” Brudermueller proclaimed.

Although China increasingly wants to decouple itself from foreign technology imports, the chemist with a doctorate sees a future for BASF in the People’s Republic. “The chemical industry is also a key industry for China and an important prerequisite for the competitiveness of the entire manufacturing sector. China wants to become more sustainable and reduce its carbon footprint – chemistry is indispensable there,” he argues. “BASF is welcome there as an investor that brings world-class technologies, sustainability and safety standards.”

Brudermueller has fond memories of his time in China, not only of the well-known major metropolises such as Beijing, but also of other cities with millions of inhabitants. “I find Chongqing exciting; I was able to closely follow the development of the city during my time in China and experience it in person. I was very happy that Chongqing awarded me honorary citizenship back then,” he says.

Meanwhile, the pandemic has had a negative impact on his personal relations in the People’s Republic. “In my more than ten years in China, I have built up trusting contacts in politics, industry, and society. But because of Corona, many of these regularly cultivated personal relationships have suffered. Unfortunately, I have also not been able to visit many of the friends I have in Hong Kong since 2019.” Constantin Eckner

Joy Fan will become President and CEO of US cosmetics group Estée Lauder Companies for China in February 2022.

Just let yourself be pulled: In Harbin, a saucer sled is the preferred mode of transportation for this pink snow bunny. Blizzards blanketed northeast China’s Heilongjiang province with snow at the start of the week.

Whether it’s Art021 in Shanghai or the West Bund Art & Design Art Fair – China’s art market is booming. The People’s Republic has long been one of the largest markets for contemporary art, with billions of dollars in sales every year. So far, it’s mainly foreign galleries and artists who have profited from this, but a strong artist scene has long since established itself in China as well, as Ning Wang shows in her analysis of the Chinese art market. However, during her investigation, she has also encountered discord and concerns among gallery owners. Above all, the campaigns of state and party leader Xi Jinping could ruin the current boom.

Today, our Beijing author team takes you into the depths of a true political thriller. In October 2018, the first Chinese head of Interpol suddenly disappeared. There was no trace of him, and it took several days before the leadership in Beijing stated they had arrested Meng Hongwei for corruption. Now Meng’s wife is speaking out publicly. In a spectacular interview, she explains that her husband fell victim to a purge by head of state Xi Jinping. The party does not even show away from arresting internationally visible officials.

The introduction of a digital central bank currency has been discussed for a long time. But what is behind it: the internationalization of the yuan? The replacement of the US dollar as the reserve currency? Frank Sieren has taken a look at what the Chinese central bank chief has to say about the goals behind such a huge step. Our author in Beijing takes stock: Above all, China’s leadership wants to break the market power of internet giants.

I hope you enjoy today’s issue!

The rush was big: More than 400 galleries had applied to participate in the Shanghai art fair Art021. Only about a quarter of applicants were accepted, as David Chau, one of the co-founders of the art fair launched in 2012, explains. Art021 focuses on contemporary art. Foreign exhibitors, some of whom were unable to attend in person due to China’s strict travel regulations, were represented by their Chinese offshoots.

The West Bund Art & Design art fair, which was taking place at the same time, was also swarmed by galleries willing to participate: The fair even had to expand and move to the West Bund Dome, a former cement factory. Around 120 galleries and art institutions, 48 of them from overseas, were represented there. “The pandemic has made Art021 and the West Bund the ‘bridgeheads’ of the Chinese market,” says Ray Dong, who heads the Art Market Research Center at the prestigious Central Academy of Fine Arts (CAFA) in Beijing. “Because people can’t go overseas, we have to come [to Shanghai]. Its position in the market and in the minds of Chinese collectors is becoming more and more important” Dong told The Art Newspaper. Several private museums in Shanghai, such as the Yuz and the Long Museum, are also currently attracting visitors with new exhibition openings.

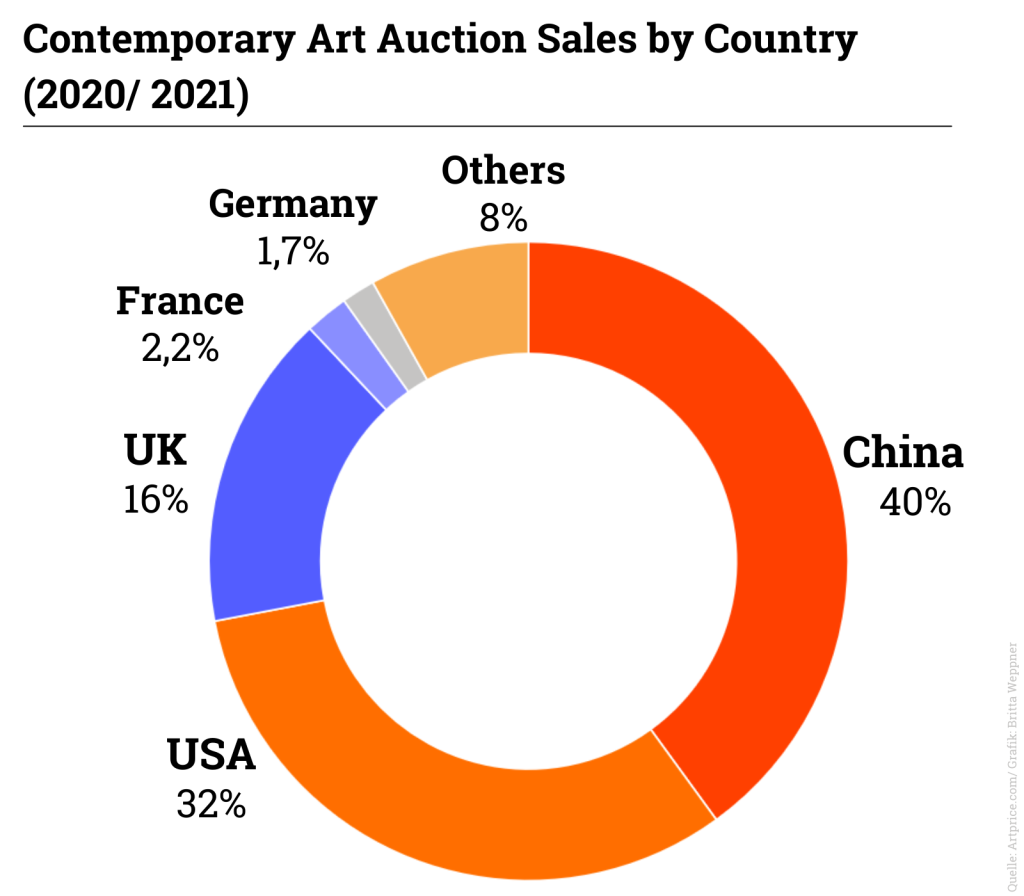

The fact that these fairs and exhibitions are booming is not surprising. China is now among the top three countries with the largest market for contemporary art, just after the US and the UK, according to industry platform artprice.com. “After a very difficult year in 2020, China, Hong Kong, and Taiwan all posted outstanding performances in the latter half of the year and the first half of 2021. Their combined contribution to the global Contemporary market (approximately $1 billion) represented 40% of its value,” artprice states. “The Asian market has therefore effectively become the world’s primary zone for the exchange of Contemporary artworks, and not just for Asian artists, but also for a growing number of Western artists,” according to one of the key statements of the Contemporary Art Market Report 2021.

The mood at the art fairs in Shanghai was nevertheless chastened. While gallery owners, artists, and collectors were still happy last year that the fairs, openings, and exhibitions were finally taking place once again after the harsh lockdowns in China, this year’s art fairs were overshadowed by several events.

Not only did the recently tightened Covid restrictions in the country dampen the mood: The fair could only be attended with a negative test and a green QR code on the phone, which didn’t stop the local art scene – but international visitors were missing. PU invitation letters, which gallery owners would have needed to enter the People’s Republic, were also not issued by the relevant authorities. In addition, there is still a three-week quarantine.

But gallery owners and artists also observed the 6th Plenum, which met almost simultaneously in Beijing (China.Table reports), with mixed feelings. Especially the fact that state and party leader Xi Jinping will continue to hold the reins as “helmsman” of both party and country until 2027 caused uncertainty.

Xi’s announcements raised concerns that the numerous “campaigns” in the country could once again gain traction and then spread to the art market. For more than a year, Beijing has been imposing tougher rules on the entertainment industry, the online education sector, and especially the tech and real estate sectors, in order to regulate its previously unchecked growth and bring it under state control (China.Table reported).

And China’s art market is one of the largest unregulated markets, which is also worth billions. Xi Jinping’s mantra-like invocation of “common prosperity” is supposed to narrow the gap between rich and poor (China.Table reported). But 45 percent of luxury goods sold worldwide are purchased by Chinese consumers. If China’s wealthy will be financially burdened by higher taxes or levies to implement Xi’s goals, this will also have an impact on the art market, many in the art scene fear.

The development of the Chinese art market is exemplified by the biography of Liu Yiqian. The former taxi driver and his wife Wang Wei not only opened three private museums in Shanghai and Chongqing within a few years. Today, he is also one of the most prominent Chinese collectors. He has gained attention well beyond the borders of the People’s Republic, not only since he acquired Amedeo Modigliani’s “Nu Couché” for more than $170 million in 2015. Liu is thus one of the collectors who are fuelling the art market.

After all, China plays a major role in the global market: last year, the People’s Republic accounted for 21 percent of the international art and antiques trade, which is worth around $50 billion. Ten years ago, China’s share of the global art market was even larger, ahead of that of the USA. But the bubble burst. This was in part because domestic auction houses such as Poly Auction Beijing and Guardian failed to identify copies and many auction bids were never paid for by the bidders.

In recent years, the Chinese art market has largely recovered from such setbacks. Rising profits from the real estate market led to increased investment in art due to a lack of investment alternatives. However, the current real estate crisis, triggered by the payment shortfalls of real estate developer Evergrande (China.Table reported), left many wondering whether auctions will continue to receive so much money.

According to Dawn Zhu, Thaddaeus Ropaq Gallery’s Asia Director, artworks in the $150,000 to $200,000 price range sold easily at art fairs in Shanghai. Once prices reached $1 million, however, there was hesitation and people requested more time to consider, she said. “These works were not so easy to sell,” says Zhu. The main benefit was that buyers no longer travel abroad and therefore spend more on domestic art. “The Chinese art market in Shanghai is showing robustness,” said an industry insider involved in organizing art fairs.

Especially many young collectors joined the scene, who also increasingly collect young and diverse artists, as well as other art forms such as NFT. So-called non-fungible tokens can also be a work of art. But so-called blue-chip art by renowned and well-known artists is also in demand among young collectors. For example, at the evening auctions in New York in the middle of last week, 31-year-old crypto entrepreneur Justin Sun bought “Le Nez” – a rare Giacometti bronze figure for $68 million at Sotheby’s auction house. Sun thus showed how much money he makes with his crypto company. He did not hide his newest acquisition for long: Sun announced that he was the new owner on Twitter.

In October 2018, a whodunit played out before the eyes of the world. In the leading role: Meng Hongwei, the then head of the powerful international police organization Interpol. The then 64-year-old was the first Chinese to hold the post. But then he suddenly disappeared. Overnight.

For almost 14 days, his own agency was on the lookout for him. All that was known was that Meng had traveled to his native China. Then Beijing revealed the secret of his whereabouts. The Ministry of Public Security announced that the Interpol chief was being investigated on suspicion of “taking bribes” and involvement in illegal activities. Following this announcement, Interpol immediately received a letter allegedly drafted by Meng, in which he declared his immediate resignation.

As a last sign of life from China, Meng Hongwei sent his wife Grace Meng an emoji pictogram with a knife as a message to her mobile phone. Maybe because he knew that the game was over.

For the first time since her husband’s arrest, Grace Meng has now given an extensive interview to US news agency AP, in which she makes serious accusations against both Interpol and the Chinese government. She has not heard a word from her husband since the last text message about three years ago, she said in the interview. Letters from her lawyers to the Chinese authorities have also gone unanswered, she said. She is not even sure if her husband is still alive.

According to official information, Meng Hongwei had been convicted to 13 years and 6 months in prison in January 2020 for accepting bribes worth more than two million dollars. The court stated that he had pleaded guilty and expressed regret. His wife, who called China’s leadership a “monster” during the interview with AP, said she has not received a single letter from her husband ever since.

His wife also expressed outrage that Interpol simply accepted her husband’s resignation and did not launch an investigation. “Can someone who has been forcibly disappeared write a resignation letter of their own free will?” she asked. The police organization and its member states should not have simply bowed to the version spread by Beijing. The allegations of corruption against her husband are fictitious. Rather, she says, he was eliminated because he used his senior position to push for change.

“It’s an example of a political disagreement being turned into a criminal affair,” Grace Meng says. And further, “The extent of corruption in China today is extremely serious. It’s everywhere. But there are two different opinions about how to solve corruption. One is the method used now. The other is to move toward constitutional democracy, to solve the problem at its roots.”

Grace Meng thus implies that her husband was the victim of a power struggle. It’s a theory that was also voiced by many observers shortly after the former Interpol chief’s disappearance. If Meng had merely been corrupt, China’s leadership would hardly have taken the shameful step of ousting her husband, who had just been installed at the head of Interpol. “I think it’s more than corruption,” said Zhang Lifan, a critical historian, for instance, at the time. “There is a political power struggle behind this.” According to his information, other representatives of the police ministry were also arrested at the time.

Many have pointed out that Meng Hongwei started his career in Beijing’s police ministry. At the time, the ministry was still under the leadership of chief of security Zhou Yongkang, who was later overthrown and sentenced to life in 2015 and was considered a dangerous rival of state and party leader Xi Jinping. Meng Hongwei, it was assumed, could thus have been the victim of a widespread purge with which Xi wanted to further consolidate his power.

Grace Meng and her family have been through traumatic years, she said. Her children, in particular, are suffering. “Whenever the children hear someone knocking on the door, they always go to look. I know that they’re hoping that the person coming inside will be their father. But each time, when they realize that it isn’t, they silently lower their heads.” Joern Petring/Gregor Koppenburg

China’s central bank digital currency has reached new milestones on its way to being adopted in everyday life. Yi Gang, Governor of the People’s Bank of China (PBoC), went into details of the launch for the first time at an online conference marking the 30th anniversary of the Bank of Finland Institute for Emerging Economics last week. The central bank chief revealed current figures and bluntly revealed the project’s most important goal: The leadership wants to further contain the power of Internet corporations.

According to Yi, over 123 million digital e-yuan wallets have already been opened in China. Combined, they amount to a total transaction volume of ¥56 billion ($9 billion). However, this is supposed to be just the beginning.

Yi lamented that mobile and digital payment services in China have so far been offered mainly by private companies. Until now, the market has been dominated by Alipay and WeChat Pay. This poses a “risk of privacy violation,” Yi said. While he welcomed the popularity of digital payment; it is already reaching 86 percent market penetration in China. “It has made people’s daily lives much easier,” Yi said. However, the state would be seeking better control over financial flows. So Yi blatantly announced further curbs on the influence of tech corporations.

The reason for the split between two private players lies in the history of mobile payments in China. With the proliferation of smartphones, Alipay and WeChat Pay, which are backed by tech giants Alibaba and Tencent, became China’s duopoly in digital payment and fintech services within a few years. This increasingly includes the credit business. Thus, tech companies made inroads into the financial sector.

With its e-yuan, the state now aims to curb the power of these companies. “Digital central bank currencies allow central banks to continue to provide a credible and secure means of payment in the digital age while improving the efficiency and integrity of the payment system,” Yi said. The benefits for the government are obvious: The e-yuan enables authorities to better trace large payment flows and where debts are being incurred. The e-yuan is also expected to be used offline. That would be an advantage over existing mobile payment services in China, which rely on an active Internet connection.

The PBoC has been working on a “Central Bank Digital Currency” (CBDC) since 2014. In the cities of Shenzhen, Chengdu, and Suzhou, it has already been possible to exchange cash for the digital yuan in pilot projects. At the China International Import Expo (CIIE) in Shanghai, China’s most important import fair, the e-yuan could be used in restaurants and at vending machines. Discounts of between “30 to 50 percent” were granted to boost business. The currency is to undergo its next large-scale field test at the 2022 Winter Olympics. There, Foreigners will also be allowed to use the currency for the first time.

Beijing had originally planned to introduce the currency nationwide before the major sporting event. However, that was obviously too ambitious a goal. A new date for the nationwide launch of its digital currency has not yet been set.

The October 23rd version of a draft revision of China’s central bank law includes paragraphs on the e-yuan. They are intended to establish the necessary legal framework for the digital currency. Accordingly, the legislator grants it the same legal status as the physical yuan.

Central bank chief Yi also admitted that his bank’s computer scientists are still working on a few problems. Above all, protection against hackers is still a concern. The interfaces to the real world are also not all perfected yet. “We are striving to establish a management model for the e-yuan modeled on cash and bank accounts, which will improve efficiency, privacy, and anti-counterfeiting, and increase interoperability with existing payment tools,” Yi said in his speech. New encryption algorithms are expected to raise security standards.

Accordingly, personal data would only be traceable by the state in case of “large transactions”. Upper limits on the wallet balance and limited transaction amounts will be introduced. The e-yuan is not the end of cash, Yi countered people’s concerns: “As long as there is demand for cash, we will continue to offer cash.”

Until the Bahamas unveiled its “sand dollar” in October 2020, China had made the most progress on state central bank currencies. However, only 400,000 people live in the Bahamas. Compared to the 123 million wallets that already exist in China, it is a relatively small project.

In Europe, only Sweden and EU accession candidate Ukraine have so far launched serious pilot projects. The Russian central bank also plans to test a digital ruble during a pilot phase next year, Russia’s central bank chief Elvira Nabiullina explained. The Covid pandemic has accelerated the pace of development. The share of contactless payments in global card transactions rose to more than 33 percent in March, up from about 27 percent six months prior to the Covdi outbreak, according to the Bank for International Settlements (BIS).

The PBoC’s push is also aimed at making the digital currency usable across borders. “We would like to strengthen cooperation with other central banks and international organizations on CBDC.” Several institutions have already launched a multilateral cooperation project to explore the role of central bank digital currencies in cross-border payments:

During the conference, Yi announced the introduction of another cooperation: “We also have regular technological exchanges with the European Central Bank.”

Moreover, the e-yuan is seen as a decisive step by China in building a global currency to rival the US dollar. “How China’s digital currency could challenge the almighty Dollar,” headlines the US magazine Time. And Japan’s business daily Nikkei is already wondering, “Will China’s digital yuan vanquish the dollar?.” According to Nikkei, a new era of international financial systems could be dawning 50 years after the Nixon shock. In August 1971, US President Richard Nixon had unpegged the US dollar from gold. In doing so, he ended a system of fixed exchange rates that also included the German Mark. The era of international non-coordinated printing of US dollars began.

If Beijing has its way, the digital yuan will naturally also play a significant role in trade with the countries of the New Silk Road. But China’s strict capital controls remain a hurdle. The “cross-border use of central bank digital currencies involves more complicated issues, such as anti-money laundering,” Yi said. Security and financial stability still come first for Beijing.

While during this first phase of implementation, the e-yuan is to be limited to domestic payment transactions, including, for example, bill payments, grocery shopping, or government services, in a second stage, the internationalization of the e-Yuan is planned. To avoid uncontrollable payment flows, as with Bitcoin, an international e-yuan is to be introduced. This allows the state to control exchange rates. The e-yuan is considered a game-changer.

Car manufacturer Great Wall Motor (GWM) has opened its new European headquarters in Munich. This will make the German city the central location for the continental European market, the company announced. “As one of the most successful automobile manufacturers in China, we have already successfully established a foothold in many international markets. The launch in Europe is an important milestone for Great Wall Motor. We have ambitious goals for this market as well,” said Qiao Xianghua, CEO of GWM Europe Around 300 employees are to work at the headquarters in the Bavarian capital from next year.

GWM intends to present its car brands Wey and Ora to customers (China.Table reported). The Group presented the two brands at the IAA in September. Both brands are to convince above all through their user orientation. An app is planned for Ora and Wey as well, with which users can interact with the brand and its products. The goal is to create a “lifestyle ecosystem for European users”, including a charging service and a maintenance and repair service, GWM said. “We want to make the car an emotional, intelligent, and convenient third mobile space,” Qiao said. The connectivity of vehicles and mobile devices is growing in significance (China.Table reported).

China’s head of state and party leader Xi Jinping has once again declared that he is not engaged in power politics. The People’s Republic wants to get along peacefully with its neighbors, never seeks domination and, as a big country, does not bully smaller states, Xi assured at a virtual meeting with ASEAN leaders on Monday. “China will always be ASEAN’s good neighbor, friend, and partner,” Chinese state media quoted Xi as saying. The occasion for the summit was the 30th anniversary of China’s cooperation with the grouping.

Xi said, according to media reports, that China and ASEAN countries “shed the Cold War gloom” and are working together to maintain regional stability. Xi’s speech was preceded by several disputes between China and ASEAN members the Philippines, Malaysia, and Vietnam in maritime areas where China’s territorial claims clash with those of neighboring countries. Xi’s speech thus addresses concrete fears of his southern neighbors.

Philippine President Rodrigo Duterte reportedly stressed that he “abhors” the dispute and that the rule of law is the only way out. Indonesia’s President Duterte referred to the 2016 international arbitration ruling, which determined that China’s maritime claim had no legal basis. Beijing, however, is ignoring the ruling. “This does not speak well of the relations between our nations,“ Duterte remarked. Last week, the Philippines had condemned the deployment of three Chinese coast guard vessels. These are said to have used water cannons against Philippine supply boats.

Duterte is actually considered pro-China, and since taking office in 2016 the controversial head of state has repeatedly sought to close ranks with Beijing in the hope of attracting investment and trade deals. In his speech, Xi also pledged $1.5 billion in development aid over three years to ASEAN countries to fight the pandemic and revitalize their economies. China also plans to donate 150 million vaccine doses. ari

A severe crisis in the Chinese real estate market would also hit the German economy. This is the conclusion of an analysis by the German Bundesbank. A corresponding simulation shows that such a crisis could have noticeable effects on the real economy in Germany and other countries, writes the Bundesbank in its November monthly report published on Monday (page 14).

According to the simulation, China’s imports would drop by a fifth. Germany as an exporter could feel the effects significantly. Gross domestic product (GDP) would decline by 0.6 percent due to falling demand from China alone. However, the authors point out that their model probably underestimates the impact. After all, events in China also affect all of Germany’s other trading partners, which are then likely to order less as well. “For some economies with higher trade dependence on China, the GDP losses are even larger,” the report says. For Japan, the GDP losses in the model are nearly one percent, and for South Korea, they are even more than two percent. For Australia, they would be around 1.6 percent.

The Bundesbank’s scenario is based on the real estate crisis in the US between 2006 and 2009 and assumes, among other things, that housing investment in China will halve. It also assumes that Chinese real estate prices will fall by a fifth.

The payment difficulties of the Chinese real estate group Evergrande had recently sparked fears of a real estate crisis in China. Most recently, the group had bought itself some time with surprising interest repayments (China.Table reported). rad

The International Table Tennis World Federation ITTF announced a “historic moment” on Monday: Athletes from China and the US will compete together at the World Championships, which begin Tuesday in Houston. This will mark the 50th anniversary of the so-called Ping-Pong Diplomacy.

Chinese Lin Gaoyuan and American Lily Zhang will play together while Wang Manyu will compete with Kanak Jha in the mixed doubles. The Wang/Jha duo could face German European champions Dang Qiu and Nina Mittelham in the second round.

The president of the Chinese Table Tennis Association, Liu Guoliang, was enthusiastic: the extraordinary pairings would “build on the China-US friendship”. They would open “a new chapter of Ping-Pong Diplomacy in this new era.”

The so-called Ping-Pong Diplomacy refers to a series of friendly matches between Chinese and American teams in 1971, which paved the way for diplomatic relations between Washington and then internationally isolated China. rad

Chinese technology company Build Your Dreams (BYD) has shipped electric buses to Deutsche Bahn AG in Germany. The handover of the five electric 12-meter buses took place in Ettlingen near Karlsruhe, BYD announced on Monday. DB had signed a framework agreement with BYD in March 2021 to introduce electric buses in 2021 and beyond. The electric buses were driven from Oosterhout in the Netherlands to their destination. They are to begin operations in the Karlsruhe district. According to BYD, one charge of the 422-KWh battery will have a range of around 400 kilometers. ari

When chemical giant BASF revealed its first financial figures of the year back in May, the optimism coming from its headquarters in Ludwigshafen was clearly audible. The targets for 2021 were raised, thanks above all to the Chinese market. Sales in the People’s Republic rose by 43 percent compared to the first quarter of 2020. In Europe, the increase was only three percent.

BASF is currently investing around ten billion euros in the construction of a new chemical site in the southern Chinese province of Guangdong. An expansion of battery production has also been announced. The Ludwigshafen-based company hopes that its business in China will continue to boom for a long time to come. At the center of the activities is Group CEO Martin Brudermueller. Between 2006 and 2015, he managed business activities in Asia from his headquarters in Hong Kong.

The 60-year-old is considered an outspoken China devotee. “Chinese culture is one of the oldest and, for me, most fascinating in the world. I find it incredibly impressive,” says Brudermueller. “I also like the Chinese mentality. It’s open and direct, which suits me and fits in well with the German mentality: the long-term, strategic thinking, the technological orientation.”

After returning from Hong Kong, Brudermueller rose to the position of Chief Technology Officer before taking over as Chairman of BASF in 2018. His professional career is closely linked to East Asia, and China, in particular. Because of his affection for China, Brudermueller is often attacked by critics. “Perhaps he lacks the appropriate reserve that a CEO should show toward all business areas. In the long term, the People’s Republic could prove to be the group’s dangerous Achilles’ heel,” says former Handelsblatt chief Bernd Ziesemer.

But Brudermueller will not allow himself to be dissuaded from his line. “My response to these critics is that if they want to be among the world’s leading chemical companies, they can’t afford to ignore China. With a share of more than 40 percent, China is already the world’s largest chemical market and determines the growth of global chemical production,” says the Swabian. The share is expected to rise to around 50 percent by 2030 and more than two-thirds of global chemical growth will come from China in the next ten years, he added. “BASF has been active in China since 1885. We have already participated in the country’s development in the past and plan to do so in the future,” Brudermueller proclaimed.

Although China increasingly wants to decouple itself from foreign technology imports, the chemist with a doctorate sees a future for BASF in the People’s Republic. “The chemical industry is also a key industry for China and an important prerequisite for the competitiveness of the entire manufacturing sector. China wants to become more sustainable and reduce its carbon footprint – chemistry is indispensable there,” he argues. “BASF is welcome there as an investor that brings world-class technologies, sustainability and safety standards.”

Brudermueller has fond memories of his time in China, not only of the well-known major metropolises such as Beijing, but also of other cities with millions of inhabitants. “I find Chongqing exciting; I was able to closely follow the development of the city during my time in China and experience it in person. I was very happy that Chongqing awarded me honorary citizenship back then,” he says.

Meanwhile, the pandemic has had a negative impact on his personal relations in the People’s Republic. “In my more than ten years in China, I have built up trusting contacts in politics, industry, and society. But because of Corona, many of these regularly cultivated personal relationships have suffered. Unfortunately, I have also not been able to visit many of the friends I have in Hong Kong since 2019.” Constantin Eckner

Joy Fan will become President and CEO of US cosmetics group Estée Lauder Companies for China in February 2022.

Just let yourself be pulled: In Harbin, a saucer sled is the preferred mode of transportation for this pink snow bunny. Blizzards blanketed northeast China’s Heilongjiang province with snow at the start of the week.