China is the biggest sales market for many European companies. However, working in China is becoming harder and harder: Lockdowns, supply chain problems, and, above all, largely closed borders are just a few better-known problems European companies currently have to face in China.

Our author team in Beijing took a closer look at the latest survey by the EU Chamber of Commerce in China and asked what the leadership in Beijing could do to restore the economic environment in the People’s Republic. One thing is clear, after all: Business confidence is worse than ever before. Some companies were apparently already asking themselves how much they still want to rely on China in the future.

Who or what to rely on in the future – this question is currently also true for energy supply. Since the Ukraine war at the latest, this issue has risen to the top of the political agenda of many governments. But while Germany’s Minister for Economic Affairs Robert Habeck is trying to win over Qatar and Saudi Arabia as new gas suppliers, China is turning to a different type of fossil fuel: coal.

An astounding four billion tons were mined in China last year – more than ever before. In addition, dozens of new coal-fired power plants are being built across the country. And all this despite the fact that Xi Jinping likes to herald his country as a future climate protection power. Nico Beckert found out what’s behind China’s coal boom, why many power plants are being built near wind and solar farms – and why leading climate experts don’t see the Chinese coal boom in such a negative light.

The European Union Chamber of Commerce in China has urged the Chinese government to finally relax its strict Covid measures. “China must open its borders. It has all the means for a great comeback,” said Chamber Vice President Bettina Schoen-Behanzin on Monday at the presentation of the new Business Confidence Survey 2022.

China must ease the fears of companies and “win back confidence with a clear plan,” said Schoen-Behanzin. The situation cannot be brought under control with mass testing and lockdowns. The appeal was prompted by the results of the annual survey. In it, it becomes clear how much the sentiment of European companies in China has fallen since the start of the war in Ukraine and the lockdowns in several economic centers of the country.

Grim prospects for their own business, supply chain problems, staff shortages – these are all consequences of the geopolitical and health crises, weighing on the business climate in the second-largest economy. The BCS of the European Chamber of Commerce in China reveals the growing concerns among the 620 companies that responded to the annual survey. Three-quarters of members reported that the strict Covid containment measures have negatively affected their business. 92 percent complained about supply chain problems caused, for example, by port closures and rising shipping costs.

The situation had deteriorated so quickly that parts of this year’s BCS were already outdated while the chamber was still in the process of evaluating the questionnaires. This was because the deadline for responses was several months ago and had not yet taken into account recent developments. The chamber tried to map the impact of the war and lockdowns with a separate flash survey at the end of April.

Thus, the results were “significantly destabilizing effects on the China activities of European companies“. Measures such as recent port closures in China, the downturn in road transport and rising maritime shipping costs are expected to negatively impact balance sheets. Sixty percent of respondents to the Flash survey have lowered their revenue forecast for the current fiscal year.

Another major challenge is to attract new employees from Europe. “It’s difficult to find people who still want to travel to China,” Schön-Behanzin said. Lockdowns, long quarantine periods, as well as fewer and fewer available flights have caused a veritable “exodus”. Twenty-three percent of companies reported considering putting new investments in the People’s Republic on hold. “Recent events have caused many companies to ask themselves how far they want to go on the China map in the future.”

Compared with the latest business confidence report, last year’s survey sounded like downright mania. European companies had expressed great satisfaction and confidence over the initial success of the zero-Covid strategy. Last June, companies benefited from the fact that the People’s Republic had initially managed to keep the Coronavirus at bay. But that was before the Omicron outbreak. When the much more contagious variant of the virus reached the country, authorities resorted to far more drastic containment measures than those used elsewhere in the world.

According to the Chamber, an overwhelming majority of companies are still willing to stick to China despite all the troubles. This is hardly surprising, because, despite the current problems, the People’s Republic also continues to offer reasons for optimism. According to the survey, the growing middle class is an important reason for companies to remain. Opportunities would also arise from the rapidly increasing R&D activities in the country.

But in order to benefit fully from this, numerous other factors still stand in the way of European companies, which have been causing headaches for many years. The immediate consequences of the war and Covid have shifted priorities for the time being. However, they continue to have a lasting impact on the business climate.

But for business in China to change for the better, the Covid crisis needs to be addressed first. To ease the situation in China, the Chamber of Commerce recommends that the government focus on more effective mRNA vaccines. Schön-Behanzin suggests that the People’s Republic should look more to the Singapore model. The Southeast Asian city-state initially also imposed very strict measures after the Covid pandemic began more than two years ago. However, after a high vaccination rate was achieved, Singapore steadily returned to normality, which turned out to be a great relief for the economy. Joern Petring/ Gregor Koppenburg

Electricity comes from the socket, heat from the heater – this certainty has quietly accompanied us for decades. But the war in Ukraine has turned the supply of power and energy into a crucial issue. Europe is frantically searching for new energy suppliers. Energy security is also high on China’s agenda. After all, the People’s Republic already went through a serious power crisis last year. For weeks, factories had to operate at half power (China.Table reported). The central government in Beijing has sent out a clear message: The power crisis must not be repeated under any circumstances.

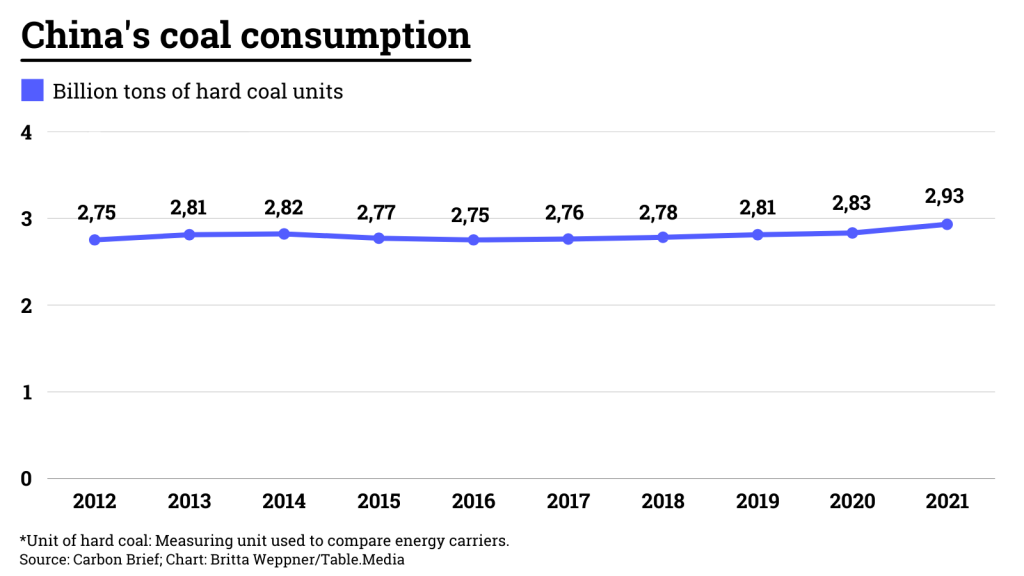

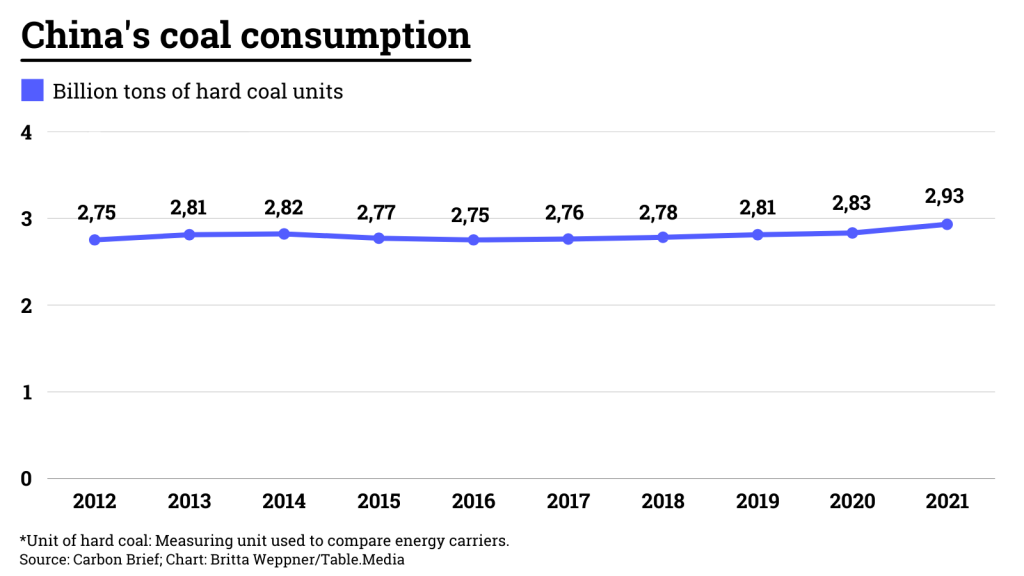

To secure supplies, authorities primarily rely on coal:

But what does this new focus on coal mean for the achievement of Chinese and global climate targets? Is the People’s Republic just obstructing the energy transition?

China produced a record amount of coal last year. In total, a staggering 4.13 billion tons were mined. This year, this amount could be surpassed. The State Council has ordered mines to expand production by 300 million tons. However, an industry association close to the state doubts that this target will be achieved. China could realize only 100 million tons of new capacity this year, according to an analyst with the China Coal Transportation and Distribution Association (China.Table reported).

Coal consumption increased slightly in 2021 and is at an all-time high. “Coal-fired power generation increased in China in 2021 for the sixth year in a row,” write analysts at the Center for Research on Energy and Clean Air (CREA).

Last year also saw the construction of new coal-fired power plants with a capacity of 33 gigawatts, the largest increase since 2016. Since the beginning of 2022, China has advanced 23 large coal-fired power plant projects with a total capacity of more than 30 gigawatts. These figures seem to speak a clear language.

And yet, climate and energy analysts are not as pessimistic as the data suggest. “Most experts agree that the ramp-up of coal is a short-term policy adjustment and does not represent a “walk back” by China on its long-term climate commitments,” summarizes trade portal Carbon Brief.

This assessment is based on several factors. The construction of new coal-fired power plants is partly coupled with the decommissioning of older, less efficient power plants. The bottom line is that power plant capacity increases while power plants run more efficiently, which means they consume less coal. It goes without saying that this is not yet a way out of the climate dilemma.

The greater climate benefit could come from a different measure: Some of the new power plants will serve as backups for wind and solar power plants and run at a lower capacity. China massively expands its renewable energies. Some new coal-fired power plants are located near planned huge solar and wind power plants in China’s deserts (China.Table reported). They are intended to complement the renewable power plants as they can be used flexibly and can serve demand spikes. Coal-fired power is to become a bridge technology, so to speak, until renewables can meet the main load of power demand.

But China pursues a different economic strategy than Western countries. Planners do not seem to be concerned by the fact that these power plants will not operate at high capacity and that investments do not seem to make much economic sense. Energy expert and independent consultant Liu Hongqiao believes that Chinese policymakers see new coal projects as bearable costs of the energy transition.

According to Xie Chunping, energy economist at the Grantham Research Institute on Climate Change and the Environment, the government sees new coal plants as “flexible resources or capacity” that will not run at full capacity. So building new coal plants would not necessarily be accompanied by an increase in carbon emissions.

However, it remains to be seen whether the goal of flexible power plant operation will actually be implemented in practice. Additional coal-fired power plants could also encourage provinces to generate more power to reduce dependence on other provinces, as energy expert Lauri Myllyvirta writes.

Other experts also remain skeptical. China has not set a target for the maximum level of emissions it is allowed to emit. There are also no targets for coal consumption regarding the maximum amount of coal that may be consumed and by when. Accordingly, this leaves room for higher coal consumption in the years ahead.

In addition, a distinction must be made between China’s climate goals and the Paris climate goals. Even if China consumes less coal in the medium term and achieves its own climate targets in spite of the addition of coal-fired power plants, the pace of the coal phase-out could be too slow to achieve the Paris climate targets. This is because China’s climate targets are not ambitious enough. To achieve the Paris climate targets, the People’s Republic would have to increase its ambitions.

If the country is to contribute its share to meeting the Paris climate targets, the share of coal-fired power has to be cut to 35 percent by 2030, according to calculations by the Climate Action Tracker. Currently, it still stands at 64 percent. The tracker analyzes the climate policies of key countries and is compiled by scientists from the think tanks Carbon Analytics and New Climate Institute. The experts even calculate that China should no longer use any coal at all for power generation before 2040.

Currently, China’s energy policy is based on the combined expansion of coal-fired power and renewable energies. What appears to make little sense at first glance in terms of climate policy is justified on the grounds of the flexibility of coal-fired power. The big climate question is whether it will be possible to quickly build up a sufficiently functioning system of renewable energies, a flexible power grid, and – in the medium term – sufficient power storage facilities to force coal out of the grid. China faces a monumental task.

Russia sold more oil to China in May than ever before, becoming the largest oil supplier to the People’s Republic. China imported nearly 8.42 million tons of crude oil from Russia last month alone, according to the customs authority in Beijing on Monday. That is nearly two million barrels per day (bpd) – and an increase of 55 percent over last year.

For the first time in 19 months, Russia has thus surpassed Saudi Arabia as China’s largest oil supplier. Chinese companies such as the refinery giant Sinopec benefited from substantial price cuts after Western oil companies and trading houses withdrew from the Russian market due to sanctions imposed over the Ukraine war.

Saudi Arabia supplied China with 7.82 million tons in May. This is 9 percent more oil than in the previous year. Compared to April, however, Saudi deliveries were down by around 15 percent.

The European Union decided in May to impose a far-reaching import ban on Russian oil. However, this only applies to oil tanker transports by sea; pipeline oil was excluded from the embargo at the insistence of Hungary in particular. The EU embargo is also to take effect with transitional periods. rtr

China has successfully tested an anti-missile system. The tested system is said to be a ground-based interception system with medium-range missiles located within China’s borders, according to the Ministry of Defense in Beijing. The test was necessary for national defense and security and met expected targets, it added. However, no country should worry, it said. “This test was defensive and not aimed at any country” the Chinese Ministry of Defense stated.

According to a Global Times report, it is China’s sixth known test of a ground-based anti-ballistic missile. The country has been conducting such tests since 2010. The last known tests took place in 2018 and in February 2021.

Military expert Shao Yongling told state broadcaster CCTV on Monday that the technology is intended to protect the country’s nuclear capabilities.

Further details were not announced. Hence, it is also not clear which system and which missile type was tested. Given the parameters such as the size of the airspace, it could be a system similar to the US system Thaad (Terminal High Altitude Area Defense) in South Korea.

China – along with Russia – had repeatedly opposed the deployment of Thaad in South Korea in the past. Although Thaad is aimed at North Korea, Beijing has criticized the facility’s powerful radar for being able to penetrate its territory. Foreign Minister Wang Yi had therefore called Thaad a challenge to China’s national security interests. rad

China’s district of Beidaihe plans to ban Tesla EVs from its roads as of next month. From July 1, cars made by the US manufacturer will be banned from passing through the region for at least two months, a representative of the local traffic police told Reuters on Monday. The police officer did not provide a reason for the decision. He only said it was a matter of state affairs. Tesla was initially unavailable for comment.

Beidaihe is located east of the capital Beijing. It is home to a renowned seaside resort where the Communist Party’s ruling elite meets behind closed doors every year to discuss and balance individual interests. The timing of the upcoming meeting before the upcoming CP party congress in the fall coincides with the rumored Tesla ban.

The authorities’ action in Beidaihe is not the first decision of this kind: Just a few weeks ago, Tesla vehicles were banned from driving on some streets in downtown Chengdu. Back then, there were also no official reasons for these measures, but it coincided with a visit to the city by Chinese President Xi Jinping.

China’s military had already banned Tesla cars from accessing some areas last year. At the time, there were rumors about security concerns regarding cameras in Tesla’s vehicles. Musk assured at the time that Tesla’s cars were not spying in China or elsewhere, and that the company would be shut down if that were the case. rad/rtr

UN negotiations to finalize a global pact to protect nature (COP15) is to be moved to Canada in December. China, as the actual host, agreed to the relocation on Monday. The UN summit was scheduled to take place in Kunming in the third quarter of 2022. There, 195 nations planned to adopt a new agreement to halt and reverse damage to plants, animals and ecosystems as quickly as possible. The conference was already postponed several times due to the Covid pandemic.

But with China’s borders closed due to its zero-Covid strategy, the host country proposed last month that the talks, already postponed four times, should now finally be scheduled for 2023. However, a postponement to next year was rejected. Now, the move to Montreal is expected to finally make the summit possible.

Li Shuo of Greenpeace China confirmed to Reuters that the COP15 conference will be held there from December 5 to 17. Officially, the relocation is to be announced this week after final consultations.

Like the COP15, the AFC Asian Cup will not be hosted by China. The tournament was originally scheduled to be held in China in June and July next year. Instead, South Korea has applied to host the Asian Cup in 2023. rad

For François Chimits, the People’s Republic of China is not accessible through its language. He never consistently learned Mandarin. Instead, his translation tools are numbers. At the Mercator Institute for China Studies in Berlin, he takes a bird’s eye view of China’s economy and analyzes its importance to Europe.

The path began with studies in development economics at the University Dauphine in his birthplace of Paris. “Politics was first just a hobby for me to do on the side. As a student, I wanted to learn a hard science,” Chimits says. A two-year stint in Beijing followed, where he worked for the French Embassy as a macroeconomic and financial systems analyst. He then took on the post of deputy head of the trade policy department at the French Ministry of Finance. Chimits also lectured on China’s economy for several years at the renowned Sciences Po University in Paris.

Chimits particularly focuses on the question of the origins of wealth and poverty. “There is no recipe if a country wants to develop. But some conditions must be met, such as stability, education, training and openness.” And this is where China faces daunting challenges, believes Chimits. With the pandemic, the People’s Republic has deliberately detached itself from the world. “This is very concerning for the most populous and economically powerful country in the world.”

China managed to get through the pandemic well last year. Chinese outbound direct investment, exports and high-tech investment, in particular, were up in 2021. But in the long run, an isolated China, which has suffered productivity losses for months due to harsh lockdowns across the country, is at risk of losing prosperity.

China will need a massive increase in productivity to be able to absorb its aging society. And that can only be done through innovation, technology and social openness. That is why Chinese companies are now refraining from swooping in on Russian companies hard-pressed by the war, Chimits explains. “Russia only offers resources, not innovation.”

Is this good news for Europe? Not at all. Because even though China has nothing to gain from Russia, it is clinging to its partnership with the country. “This is economically very costly. And it shows that Beijing is even willing to accept economic losses to achieve its geopolitical goals.” As a result, the EU must now step up to become a serious geopolitical player, Chimits argues.

And here a parallel to Chimit’s hobby, boxing, becomes apparent. For what is true in pugilism can also be useful in China politics: Only a good defense can keep you standing in the ring. “Influencing China’s political objectives is becoming harder for us. But I urge our politicians: Do your job! Use the tools you are currently building. And then prepare for a long haul to represent our preferences and values in the world.”

To all China-savvy students sitting disappointed in their dorm rooms right now, he has some advice: “Don’t worry, there’s enough to read and study to pass the time until you can go back to China.” Still, Chimits thinks with concern about the lack of contact with China. “We are losing sight of China’s diversity. China is becoming more homogeneous from a distance. That won’t happen to you in Beijing, Hong Kong, or in a village in Yunnan.” Jonathan Lehrer

Steven Xu will become President for China and Asia Pacific at Munich-based fashion retailer Mytheresa on July 1. He will be in charge of all customer-related activities of the company in China and the region. Xu was already responsible for the Asia-Pacific region at US fashion house Ralph Lauren as Vice President of Digital Marketing and E-Commerce.

Since this Monday, high-speed trains between Beijing and Wuhan have been speeding along the tracks at 350 kilometers per hour. Previously, trains were allowed to travel at “only” 310 kilometers per hour on the section of the north-south link between Beijing and Guangzhou. The increased speed is expected to increase transport capacity between the capital and Wuhan by seven percent.

China is the biggest sales market for many European companies. However, working in China is becoming harder and harder: Lockdowns, supply chain problems, and, above all, largely closed borders are just a few better-known problems European companies currently have to face in China.

Our author team in Beijing took a closer look at the latest survey by the EU Chamber of Commerce in China and asked what the leadership in Beijing could do to restore the economic environment in the People’s Republic. One thing is clear, after all: Business confidence is worse than ever before. Some companies were apparently already asking themselves how much they still want to rely on China in the future.

Who or what to rely on in the future – this question is currently also true for energy supply. Since the Ukraine war at the latest, this issue has risen to the top of the political agenda of many governments. But while Germany’s Minister for Economic Affairs Robert Habeck is trying to win over Qatar and Saudi Arabia as new gas suppliers, China is turning to a different type of fossil fuel: coal.

An astounding four billion tons were mined in China last year – more than ever before. In addition, dozens of new coal-fired power plants are being built across the country. And all this despite the fact that Xi Jinping likes to herald his country as a future climate protection power. Nico Beckert found out what’s behind China’s coal boom, why many power plants are being built near wind and solar farms – and why leading climate experts don’t see the Chinese coal boom in such a negative light.

The European Union Chamber of Commerce in China has urged the Chinese government to finally relax its strict Covid measures. “China must open its borders. It has all the means for a great comeback,” said Chamber Vice President Bettina Schoen-Behanzin on Monday at the presentation of the new Business Confidence Survey 2022.

China must ease the fears of companies and “win back confidence with a clear plan,” said Schoen-Behanzin. The situation cannot be brought under control with mass testing and lockdowns. The appeal was prompted by the results of the annual survey. In it, it becomes clear how much the sentiment of European companies in China has fallen since the start of the war in Ukraine and the lockdowns in several economic centers of the country.

Grim prospects for their own business, supply chain problems, staff shortages – these are all consequences of the geopolitical and health crises, weighing on the business climate in the second-largest economy. The BCS of the European Chamber of Commerce in China reveals the growing concerns among the 620 companies that responded to the annual survey. Three-quarters of members reported that the strict Covid containment measures have negatively affected their business. 92 percent complained about supply chain problems caused, for example, by port closures and rising shipping costs.

The situation had deteriorated so quickly that parts of this year’s BCS were already outdated while the chamber was still in the process of evaluating the questionnaires. This was because the deadline for responses was several months ago and had not yet taken into account recent developments. The chamber tried to map the impact of the war and lockdowns with a separate flash survey at the end of April.

Thus, the results were “significantly destabilizing effects on the China activities of European companies“. Measures such as recent port closures in China, the downturn in road transport and rising maritime shipping costs are expected to negatively impact balance sheets. Sixty percent of respondents to the Flash survey have lowered their revenue forecast for the current fiscal year.

Another major challenge is to attract new employees from Europe. “It’s difficult to find people who still want to travel to China,” Schön-Behanzin said. Lockdowns, long quarantine periods, as well as fewer and fewer available flights have caused a veritable “exodus”. Twenty-three percent of companies reported considering putting new investments in the People’s Republic on hold. “Recent events have caused many companies to ask themselves how far they want to go on the China map in the future.”

Compared with the latest business confidence report, last year’s survey sounded like downright mania. European companies had expressed great satisfaction and confidence over the initial success of the zero-Covid strategy. Last June, companies benefited from the fact that the People’s Republic had initially managed to keep the Coronavirus at bay. But that was before the Omicron outbreak. When the much more contagious variant of the virus reached the country, authorities resorted to far more drastic containment measures than those used elsewhere in the world.

According to the Chamber, an overwhelming majority of companies are still willing to stick to China despite all the troubles. This is hardly surprising, because, despite the current problems, the People’s Republic also continues to offer reasons for optimism. According to the survey, the growing middle class is an important reason for companies to remain. Opportunities would also arise from the rapidly increasing R&D activities in the country.

But in order to benefit fully from this, numerous other factors still stand in the way of European companies, which have been causing headaches for many years. The immediate consequences of the war and Covid have shifted priorities for the time being. However, they continue to have a lasting impact on the business climate.

But for business in China to change for the better, the Covid crisis needs to be addressed first. To ease the situation in China, the Chamber of Commerce recommends that the government focus on more effective mRNA vaccines. Schön-Behanzin suggests that the People’s Republic should look more to the Singapore model. The Southeast Asian city-state initially also imposed very strict measures after the Covid pandemic began more than two years ago. However, after a high vaccination rate was achieved, Singapore steadily returned to normality, which turned out to be a great relief for the economy. Joern Petring/ Gregor Koppenburg

Electricity comes from the socket, heat from the heater – this certainty has quietly accompanied us for decades. But the war in Ukraine has turned the supply of power and energy into a crucial issue. Europe is frantically searching for new energy suppliers. Energy security is also high on China’s agenda. After all, the People’s Republic already went through a serious power crisis last year. For weeks, factories had to operate at half power (China.Table reported). The central government in Beijing has sent out a clear message: The power crisis must not be repeated under any circumstances.

To secure supplies, authorities primarily rely on coal:

But what does this new focus on coal mean for the achievement of Chinese and global climate targets? Is the People’s Republic just obstructing the energy transition?

China produced a record amount of coal last year. In total, a staggering 4.13 billion tons were mined. This year, this amount could be surpassed. The State Council has ordered mines to expand production by 300 million tons. However, an industry association close to the state doubts that this target will be achieved. China could realize only 100 million tons of new capacity this year, according to an analyst with the China Coal Transportation and Distribution Association (China.Table reported).

Coal consumption increased slightly in 2021 and is at an all-time high. “Coal-fired power generation increased in China in 2021 for the sixth year in a row,” write analysts at the Center for Research on Energy and Clean Air (CREA).

Last year also saw the construction of new coal-fired power plants with a capacity of 33 gigawatts, the largest increase since 2016. Since the beginning of 2022, China has advanced 23 large coal-fired power plant projects with a total capacity of more than 30 gigawatts. These figures seem to speak a clear language.

And yet, climate and energy analysts are not as pessimistic as the data suggest. “Most experts agree that the ramp-up of coal is a short-term policy adjustment and does not represent a “walk back” by China on its long-term climate commitments,” summarizes trade portal Carbon Brief.

This assessment is based on several factors. The construction of new coal-fired power plants is partly coupled with the decommissioning of older, less efficient power plants. The bottom line is that power plant capacity increases while power plants run more efficiently, which means they consume less coal. It goes without saying that this is not yet a way out of the climate dilemma.

The greater climate benefit could come from a different measure: Some of the new power plants will serve as backups for wind and solar power plants and run at a lower capacity. China massively expands its renewable energies. Some new coal-fired power plants are located near planned huge solar and wind power plants in China’s deserts (China.Table reported). They are intended to complement the renewable power plants as they can be used flexibly and can serve demand spikes. Coal-fired power is to become a bridge technology, so to speak, until renewables can meet the main load of power demand.

But China pursues a different economic strategy than Western countries. Planners do not seem to be concerned by the fact that these power plants will not operate at high capacity and that investments do not seem to make much economic sense. Energy expert and independent consultant Liu Hongqiao believes that Chinese policymakers see new coal projects as bearable costs of the energy transition.

According to Xie Chunping, energy economist at the Grantham Research Institute on Climate Change and the Environment, the government sees new coal plants as “flexible resources or capacity” that will not run at full capacity. So building new coal plants would not necessarily be accompanied by an increase in carbon emissions.

However, it remains to be seen whether the goal of flexible power plant operation will actually be implemented in practice. Additional coal-fired power plants could also encourage provinces to generate more power to reduce dependence on other provinces, as energy expert Lauri Myllyvirta writes.

Other experts also remain skeptical. China has not set a target for the maximum level of emissions it is allowed to emit. There are also no targets for coal consumption regarding the maximum amount of coal that may be consumed and by when. Accordingly, this leaves room for higher coal consumption in the years ahead.

In addition, a distinction must be made between China’s climate goals and the Paris climate goals. Even if China consumes less coal in the medium term and achieves its own climate targets in spite of the addition of coal-fired power plants, the pace of the coal phase-out could be too slow to achieve the Paris climate targets. This is because China’s climate targets are not ambitious enough. To achieve the Paris climate targets, the People’s Republic would have to increase its ambitions.

If the country is to contribute its share to meeting the Paris climate targets, the share of coal-fired power has to be cut to 35 percent by 2030, according to calculations by the Climate Action Tracker. Currently, it still stands at 64 percent. The tracker analyzes the climate policies of key countries and is compiled by scientists from the think tanks Carbon Analytics and New Climate Institute. The experts even calculate that China should no longer use any coal at all for power generation before 2040.

Currently, China’s energy policy is based on the combined expansion of coal-fired power and renewable energies. What appears to make little sense at first glance in terms of climate policy is justified on the grounds of the flexibility of coal-fired power. The big climate question is whether it will be possible to quickly build up a sufficiently functioning system of renewable energies, a flexible power grid, and – in the medium term – sufficient power storage facilities to force coal out of the grid. China faces a monumental task.

Russia sold more oil to China in May than ever before, becoming the largest oil supplier to the People’s Republic. China imported nearly 8.42 million tons of crude oil from Russia last month alone, according to the customs authority in Beijing on Monday. That is nearly two million barrels per day (bpd) – and an increase of 55 percent over last year.

For the first time in 19 months, Russia has thus surpassed Saudi Arabia as China’s largest oil supplier. Chinese companies such as the refinery giant Sinopec benefited from substantial price cuts after Western oil companies and trading houses withdrew from the Russian market due to sanctions imposed over the Ukraine war.

Saudi Arabia supplied China with 7.82 million tons in May. This is 9 percent more oil than in the previous year. Compared to April, however, Saudi deliveries were down by around 15 percent.

The European Union decided in May to impose a far-reaching import ban on Russian oil. However, this only applies to oil tanker transports by sea; pipeline oil was excluded from the embargo at the insistence of Hungary in particular. The EU embargo is also to take effect with transitional periods. rtr

China has successfully tested an anti-missile system. The tested system is said to be a ground-based interception system with medium-range missiles located within China’s borders, according to the Ministry of Defense in Beijing. The test was necessary for national defense and security and met expected targets, it added. However, no country should worry, it said. “This test was defensive and not aimed at any country” the Chinese Ministry of Defense stated.

According to a Global Times report, it is China’s sixth known test of a ground-based anti-ballistic missile. The country has been conducting such tests since 2010. The last known tests took place in 2018 and in February 2021.

Military expert Shao Yongling told state broadcaster CCTV on Monday that the technology is intended to protect the country’s nuclear capabilities.

Further details were not announced. Hence, it is also not clear which system and which missile type was tested. Given the parameters such as the size of the airspace, it could be a system similar to the US system Thaad (Terminal High Altitude Area Defense) in South Korea.

China – along with Russia – had repeatedly opposed the deployment of Thaad in South Korea in the past. Although Thaad is aimed at North Korea, Beijing has criticized the facility’s powerful radar for being able to penetrate its territory. Foreign Minister Wang Yi had therefore called Thaad a challenge to China’s national security interests. rad

China’s district of Beidaihe plans to ban Tesla EVs from its roads as of next month. From July 1, cars made by the US manufacturer will be banned from passing through the region for at least two months, a representative of the local traffic police told Reuters on Monday. The police officer did not provide a reason for the decision. He only said it was a matter of state affairs. Tesla was initially unavailable for comment.

Beidaihe is located east of the capital Beijing. It is home to a renowned seaside resort where the Communist Party’s ruling elite meets behind closed doors every year to discuss and balance individual interests. The timing of the upcoming meeting before the upcoming CP party congress in the fall coincides with the rumored Tesla ban.

The authorities’ action in Beidaihe is not the first decision of this kind: Just a few weeks ago, Tesla vehicles were banned from driving on some streets in downtown Chengdu. Back then, there were also no official reasons for these measures, but it coincided with a visit to the city by Chinese President Xi Jinping.

China’s military had already banned Tesla cars from accessing some areas last year. At the time, there were rumors about security concerns regarding cameras in Tesla’s vehicles. Musk assured at the time that Tesla’s cars were not spying in China or elsewhere, and that the company would be shut down if that were the case. rad/rtr

UN negotiations to finalize a global pact to protect nature (COP15) is to be moved to Canada in December. China, as the actual host, agreed to the relocation on Monday. The UN summit was scheduled to take place in Kunming in the third quarter of 2022. There, 195 nations planned to adopt a new agreement to halt and reverse damage to plants, animals and ecosystems as quickly as possible. The conference was already postponed several times due to the Covid pandemic.

But with China’s borders closed due to its zero-Covid strategy, the host country proposed last month that the talks, already postponed four times, should now finally be scheduled for 2023. However, a postponement to next year was rejected. Now, the move to Montreal is expected to finally make the summit possible.

Li Shuo of Greenpeace China confirmed to Reuters that the COP15 conference will be held there from December 5 to 17. Officially, the relocation is to be announced this week after final consultations.

Like the COP15, the AFC Asian Cup will not be hosted by China. The tournament was originally scheduled to be held in China in June and July next year. Instead, South Korea has applied to host the Asian Cup in 2023. rad

For François Chimits, the People’s Republic of China is not accessible through its language. He never consistently learned Mandarin. Instead, his translation tools are numbers. At the Mercator Institute for China Studies in Berlin, he takes a bird’s eye view of China’s economy and analyzes its importance to Europe.

The path began with studies in development economics at the University Dauphine in his birthplace of Paris. “Politics was first just a hobby for me to do on the side. As a student, I wanted to learn a hard science,” Chimits says. A two-year stint in Beijing followed, where he worked for the French Embassy as a macroeconomic and financial systems analyst. He then took on the post of deputy head of the trade policy department at the French Ministry of Finance. Chimits also lectured on China’s economy for several years at the renowned Sciences Po University in Paris.

Chimits particularly focuses on the question of the origins of wealth and poverty. “There is no recipe if a country wants to develop. But some conditions must be met, such as stability, education, training and openness.” And this is where China faces daunting challenges, believes Chimits. With the pandemic, the People’s Republic has deliberately detached itself from the world. “This is very concerning for the most populous and economically powerful country in the world.”

China managed to get through the pandemic well last year. Chinese outbound direct investment, exports and high-tech investment, in particular, were up in 2021. But in the long run, an isolated China, which has suffered productivity losses for months due to harsh lockdowns across the country, is at risk of losing prosperity.

China will need a massive increase in productivity to be able to absorb its aging society. And that can only be done through innovation, technology and social openness. That is why Chinese companies are now refraining from swooping in on Russian companies hard-pressed by the war, Chimits explains. “Russia only offers resources, not innovation.”

Is this good news for Europe? Not at all. Because even though China has nothing to gain from Russia, it is clinging to its partnership with the country. “This is economically very costly. And it shows that Beijing is even willing to accept economic losses to achieve its geopolitical goals.” As a result, the EU must now step up to become a serious geopolitical player, Chimits argues.

And here a parallel to Chimit’s hobby, boxing, becomes apparent. For what is true in pugilism can also be useful in China politics: Only a good defense can keep you standing in the ring. “Influencing China’s political objectives is becoming harder for us. But I urge our politicians: Do your job! Use the tools you are currently building. And then prepare for a long haul to represent our preferences and values in the world.”

To all China-savvy students sitting disappointed in their dorm rooms right now, he has some advice: “Don’t worry, there’s enough to read and study to pass the time until you can go back to China.” Still, Chimits thinks with concern about the lack of contact with China. “We are losing sight of China’s diversity. China is becoming more homogeneous from a distance. That won’t happen to you in Beijing, Hong Kong, or in a village in Yunnan.” Jonathan Lehrer

Steven Xu will become President for China and Asia Pacific at Munich-based fashion retailer Mytheresa on July 1. He will be in charge of all customer-related activities of the company in China and the region. Xu was already responsible for the Asia-Pacific region at US fashion house Ralph Lauren as Vice President of Digital Marketing and E-Commerce.

Since this Monday, high-speed trains between Beijing and Wuhan have been speeding along the tracks at 350 kilometers per hour. Previously, trains were allowed to travel at “only” 310 kilometers per hour on the section of the north-south link between Beijing and Guangzhou. The increased speed is expected to increase transport capacity between the capital and Wuhan by seven percent.