When the Winter Olympics in Beijing kicks off on February 4, the logo of one particular company will pop up almost everywhere: Anta. As the official Olympic outfitter, staff will be wearing Anta uniforms, the Chinese team will also be equipped by Anta – and even President Xi Jinping wore an Anta coat during his inspection tours of the Olympic venues.

The Chinese sporting goods manufacturer has achieved spectacular growth in its domestic market and is giving their Western competitors Adidas and Nike a run for their money. The company is riding a “national wave”: In part, China’s consumers consciously prefer domestic brands. Our Beijing team analyzes how Anta is benefiting from its ties to the Chinese leadership – and the downside of this success.

In our second analysis, we turn our attention to Central Asia: When violent protests broke out in Kazakhstan a few weeks ago, the cause seemed to be found quickly: The poverty-stricken population was suffering under the rise in energy prices. Yet Kazakhstan is in fact rich, thanks to natural resources, reforms and its geostrategic location. China and Russia are well aware of this. In his analysis, Frank Sieren shows how the unrest in Kazakhstan is affecting relations between Beijing and Moscow.

I hope you enjoy today’s issue!

Chinese sporting goods company Anta Sports is having a good run. In the first half of 2021, the revenue of the company from Xiamen in eastern China shot up by 56 percent to ¥23 billion (€3 billion). Nike and Adidas, on the other hand, lost ground, which allowed Anta to further narrow the gap to the two market leaders in China. It seems to be only a matter of time before Anta will leap from third rank all the way to the top of its domestic market.

Most recently, Anta has benefited from the fact that Western companies have faced increasing pressure. As members of the Better Cotton Initiative (BCI), they were criticized. In 2020, a BCI study had identified an increased risk of forced labor on cotton farms in the western Chinese region of Xinjiang. After the allegations came to light, numerous companies issued statements expressing their concerns about forced labor and that they no longer sourced cotton from Xinjiang – or had never done so in the first place.

What was met with approval from Western human rights activists had the opposite effect in China. State media led the critics’ march: The tenor was, companies that want to sell us shoes and clothing but do not use our cotton have no business here. The nationalistic tones were apparently met with approval among Chinese consumers, who bought less Adidas and Nike. Instead, they turned their attention more to domestic brands such as Anta. The company speaks of a “national wave” that has helped the group to further boost its already respectable growth over the past few years.

When the Winter Olympics begin in Beijing on February 4, Anta’s logo is likely to be omnipresent. Not only did the company sign a contract with the IOC in 2019 as the official supplier of the Games, providing staff uniforms, the Chinese athletic team will also be supplied with equipment from Anta. The company’s stock price repeatedly surged over the past few years every time China’s President Xi Jinping inspected Olympic construction sites around Beijing, wearing coats from the Group’s brands.

Close ties to the Chinese leadership may help Anta in its domestic market. But there is also the other side of the coin: The more nationalistic Anta presents itself in China, the harder its future international expansion could be. For example, the Olympics: Unlike in China, the IOC’s decision to pick Anta despite the situation in Xinjiang was highly criticized in the West. Good publicity looks different.

In essence, Adidas, Nike, and Anta share the same problem, but with different factors: All companies strive to be successful in both the West and China, but rising political tensions are complicating these plans. While Anta may benefit in China from sourcing cotton from Xinjiang, the US has introduced laws to ban the import of products containing cotton from Xinjiang (China.Table reported).

So it is no wonder that Anta is trying to strike a different tone outside of China. The Finnish Amer Group, in which Anta secured a majority stake of 52 percent for €4.6 billion three years ago, has responded quite differently to the Xinjiang issue. Amer remains a member of the BCI cotton initiative. After the boycott calls began to grow louder in China, the parent company of well-known brands such as Salomon, Arc’teryx, and Wilson immediately stressed that, as an independent company, it does not condone forced labor and does not include cotton from Xinjiang in its products.

Anta already took a similarly pragmatic approach to the 2019 NBA scandal. At that time, the then-manager of the Houston Rockets, Daryl Morey, had called for the support of the democracy movement in Hong Kong on Twitter – which was met with outrage in China. Back then, Anta also quickly issued a statement expressing its disappointment over the NBA’s criticism. The company put negotiations on new sponsorship contracts on hold. Three years later, the dust has long since settled and Anta now has more NBA deals than ever before. Gregor Koppenburg/ Joern Petring

It was no coincidence when China’s head of state and party leader Xi Jinping announced the plans for his ambitious Belt and Road project during a state visit to Kazakhstan in 2013. The world’s ninth-largest country is a vital neighbor of China in the west. The largest and most prosperous economy in Central Asia is rich in natural resources such as oil and gas, zinc, uranium, and titanium. And Kazakhstan was the country in Central Asia that emerged most stable, prosperous, and independent from the collapse of the Soviet Union.

All that seems a long time ago. In early January, violent mass protests erupted across the country. President Kassym-Shomart Tokayev spoke of an “attempted coup” by organized “terrorist” forces and ordered the ruthless suppression of the protests. Moscow sent “peacekeepers” to assist. According to authorities, a total of 225 people were killed during the protests, and 970 people are currently in custody. While the situation seems to have calmed down by now, the geopolitical implications of the unrest are far-reaching.

The unrest also has an impact on Russian-Chinese relations in Central Asia. Despite some rivalries, the two countries are moving closer. This is because both nations share considerable interests in their vast neighbor with its abundant natural resources.

However, the country’s wealth has only partially reached the population. Around 70 percent of the population lives below the poverty line, even though the country has made considerable progress since the 1990s. Since the country opened up, foreign investment alone amounted to $380 billion. Among the investors are the Italian oil company ENI, the French Air Liquide, and the German company Linde. In the first half of last year, foreign investment alone totaled more than $11 billion.

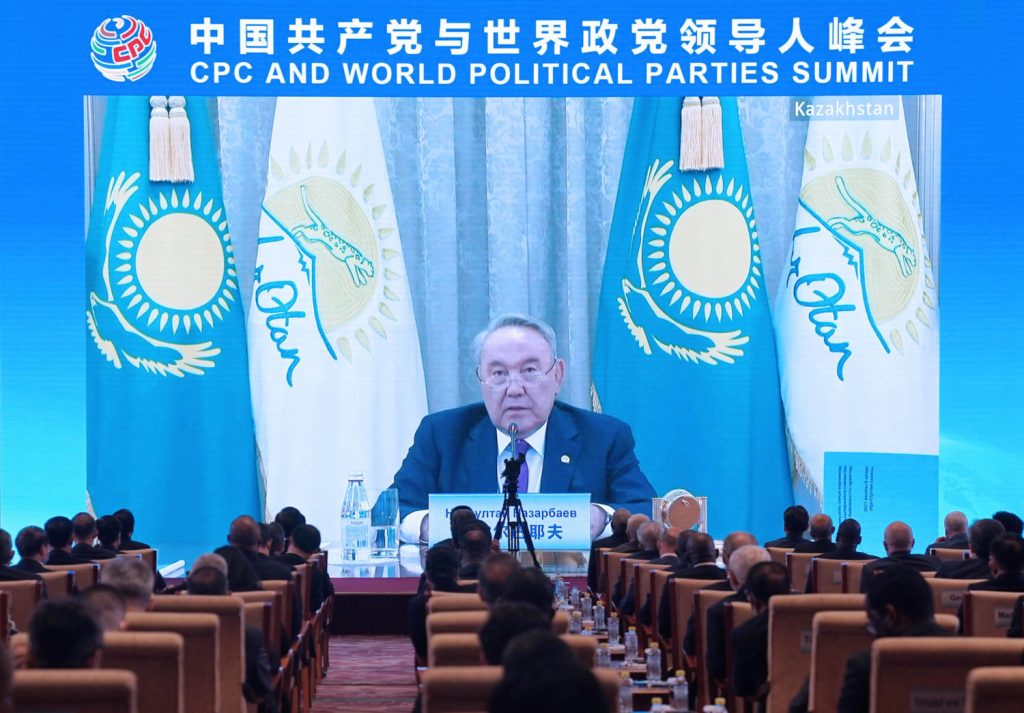

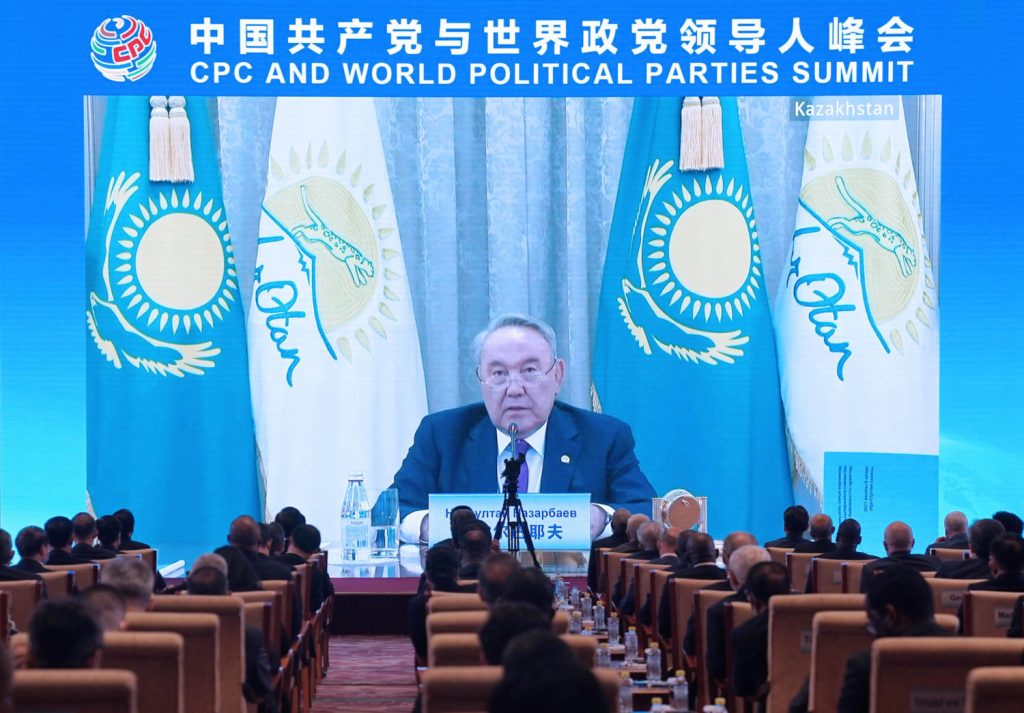

However, the catalyst for unrest is not only the increased gas prices and general discontent among the population but more likely a power struggle between long-time president Nursultan Nazarbayev and his successor Tokayev. Nazarbayev may no longer be president, but he is the “Yelbassy” (leader of the nation) for life. Thus, he continues to be active in politics, which causes Tokayev’s patience to grow thin. After the heavy riots at the beginning of the year, several of Nazarbayev’s trusted associates resigned from their positions.

Nazarbayev may have close ties to Beijing, but his position begins to weaken for the moment: Since December, he had disappeared off the face of the earth – until he resurfaced again last Tuesday with a video message. In it, however, Nazarbayev did not clarify whether he had voluntarily handed over the chairmanship of the National Security Council to Tokayev on January 5th. Instead, he insisted that there was “no conflict and no dispute among the elite.” That could mean that he is back in power once again. That is not certain, however. Either way, Beijing and Moscow are equally concerned about the uncertainty of the situation.

Russia and China share a mutual interest: Both want stability in the region at any cost, especially given the uncertain situation in Afghanistan. But also because the “stans” between Afghanistan and Kazakhstan, i.e. Turkmenistan, Uzbekistan, Tajikistan, and Kyrgyzstan, have developed less stable and generally worse than Kazakhstan since the collapse of the Soviet Union. Kazakhstan accounts for half of the region’s GDP. Kazakhstan is one of the most important transit countries for Beijing’s New Silk Road; From here, Chinese goods are directly shipped to Iran, Turkey, and Russia. China and Kazakhstan share a border of more than 1,700 kilometers.

Kazakhstan also holds enormous geostrategic value for Russia. Although Russia has dramatically lost its influence to China since the 1990s – the country was a Soviet republic, after all, relations remain close nonetheless. The Russian population is still high at twenty percent.

Since Kazakhstan’s independence in 1991, a division of labor has emerged between China and Russia: Moscow provides military security, while Beijing boosts the economy through investment. China has invested tens of billions of dollars in Kazakhstan and the rest of Central Asia over the past decade, much of it in the oil, gas, and mining sectors, with a full 80 percent of Chinese investment in the region going to Kazakhstan. China holds about 24 percent of Kazakhstan’s oil production and 13 percent of its gas production. An oil pipeline runs from Kazakhstan directly to the western Chinese province of Xinjiang.

Even though Russia sees China’s growing influence in Central Asia with concern, both nations continue to rely on close cooperation in Kazakhstan. Mutual support was also evident in the recent unrest. The Russian-dominated Collective Security Treaty Organization (CSTO) had dispatched so-called peacekeepers to the Central Asian country at the request of the Kazakhs to restore order. Beijing welcomed the action: As a fraternal neighbor and strategic partner of Kazakhstan, “China supports all efforts that help the Kazakh authorities end the chaos as soon as possible,” said Foreign Office spokesman Wang Wenbin (China.Table reported).

At present, it is not clear which of the two rival rulers has turned to Russia for aid. Since the protests called for Nazarbayev’s ouster, he may have appealed to Moscow while his challenger fueled the unrest. That would be in Beijing’s interest. After all, the Chinese had maintained good relations with Nazarbayev over the past decades, so good, in fact, that there have already been protests among the population about China’s growing influence in Kazakhstan. One thing Moscow and Beijing want to prevent in any case is a pro-democracy revolution like in Ukraine or Georgia. Or the ungovernability of the country.

Beijing also fears that supporters of the Uyghur freedom movement could be recruited in Central Asia and recommends the Kazakh government to follow the Chinese model in dealing with the Muslim minority. Kazakhstan is home to hundreds of thousands of ethnic Uyghurs, who have migrated from Chinese territories since the 19th century. In recent years, there have been repeated protests outside China’s diplomatic missions in Kazakhstan. The China-initiated and led Shanghai Cooperation Organization (SCO), which includes Russia and several Central Asian states, is focusing on security training in the region to fight terrorism.

Chinese People’s Armed Police units have already been deployed to remote parts of Tajikistan – a region that connects Afghanistan and Xinjiang. Since Russia annexed Crimea in 2014, cooperation between China and Russia has steadily deepened, including arms deliveries. Nevertheless, both countries continue to compete with each other for influence in Central Asia. One thing is certain: Russia is more dependent on China than China is on Russia, despite Russia’s military strength, which it has now once again displayed in Kazakhstan.

The organizers of the Beijing Winter Olympics have changed the strict requirements for Covid tests in China. According to the rules published on Monday by the International Olympic Committee (IOC), the so-called CT value for a positive test will be lowered to below 35. The “CT value” (Cycle Threshold) indicates how infectious a person is: the lower the value, the more infectious a person is considered. In Germany, according to the Robert Koch Institute, a positive result is only given if the CT value is below 30. In China, on the other hand, the limit has so far been a value of 40.

This difference had led to heated debates about Covid testing at the Winter Games. Athletes and officials are concerned that athletes who tested negative before their departure could suddenly test positive upon their arrival in China.

Meanwhile, six other Olympic athletes were tested positive for the Coronavirus at Beijing airport. This was reported by the South China Morning Post on Monday. This brings the number of “Olympic cases” to 78, and it is not clear whether the new cases are athletes or officials. According to the IOC, those who tested positive have been isolated, and their contacts traced.

Individuals who are tested positive at the Beijing Games will initially have to check into an isolation facility. Release is only possible after two negative PCR tests. Alternatively, after ten days in quarantine, one negative PCR test is sufficient – even then with the newly defined threshold value. In addition, individuals cannot exhibit any symptoms. Following quarantine, infected participants are initially listed as close contacts and tested twice daily.

The Beijing Winter Olympics begin February 4 through February 20. rad

The German economy warns of the consequences the Omicron wave could have on China. In its “Global Growth Outlook” published on Monday, the Federation of German Industries (BDI) warns of severe consequences for domestic companies and a rapid rise in prices. “If the Omicron variant also spreads more quickly and easily in China, it could once again cause a bottleneck for global supply chains and fuel a recession in certain areas of the German economy,” the BDI report states.

Severe effects similar to those that followed the first lockdown at the beginning of 2020 are considered unlikely, as companies have learned from what happened and are now able to respond better to the Chinese government’s pandemic measures. However, the BDI expects further government restrictions in light of the start of the Winter Olympics on February 4 in Beijing. The leadership in Beijing could not only implement stricter measures but also apply them for a longer period and on a larger scale, warns the BDI. These restrictions could pose new challenges for producers and exporters, as well as companies at the end of supply chains.

It is not yet possible to predict the extent to which logistical disruptions at Chinese plants or partial closures at Chinese ports will impact global supply chains and supply in Europe during the year, the BDI admits in its report. “Nevertheless, there are concerns that the lockdowns could affect global supply chains.”

Bottlenecks would likely be followed by higher prices, which would further fuel inflation, the BDI warns. “The Covid development in China thus poses a risk to the industry’s recovery process.” Companies should therefore prepare for different scenarios and take appropriate precautions.

The International Monetary Fund (IMF) had previously called on the government in Beijing to abandon its strict zero-covid strategy. These Restrictions are proving to be a burden – both for the Chinese and the global economy, IMF chief Kristalina Georgieva said.

The majority of China’s population is vaccinated – but with domestic vaccines. And Chinese vaccines in particular appear significantly less effective against the highly contagious Omicron than the mRNA vaccines administered in Germany, for example. “[Omicron] has left the Chinese vaccines even more ineffective against the threat posed by Covid,” said Nicholas Thomas, Associate Professor at the City University of Hong Kong who specializes in health security in Asia. German virologist Christian Drosten had also recently cited China as his current biggest concern. rad

The ailing real estate giant Evergrande is to receive support from the Guangdong provincial government, according to a media report. The financial information service REDD Intelligence reports that the local authorities want to take care of the restructuring of the virtually bankrupt group. Among other things, the new administration is expected to divest the group’s overseas properties. The proceeds could be used to settle debts to international investors. In addition, independent consultants are to be sent to the company to assist with the reorganization.

The Guangdong government is responsible, as Evergrande is headquartered in Shenzhen. As the REDD announcement is the first indication that the government is no longer keeping the company in the dark and is now beginning to resolve the situation, share prices in Asia rose on Monday. Evergrande had collapsed under the weight of heavy debt during the pandemic (China.Table reported). On one hand, the woes of a real estate group that manages half a billion square meters of residential space in China pose a systemic risk. On the other hand, economists and markets expect the Chinese government to prevent systemic crises through intervention and aid. fin

Lim Kok Thay has resigned as Chairman and Chief Executive of bankrupt cruise group and MV Shipyards owner Genting Hong Kong. Liquidators are now to draw up a restructuring plan for the company, the group told the Hong Kong Stock Exchange on Monday. In addition, Au Fook Yew resigned as Vice Chairman and President of the group. According to the stock exchange notice, neither Lim nor Au had any disagreements with the board of directors. The company is looking for suitable candidates to fill the positions, the statement added.

Malaysian billionaire Lim holds 76 percent of Genting. A court in Bermuda appointed liquidators last week (China.Table reported). The liquidation of Genting Hong Kong is a further setback for the German MV Werften. Negotiations on a joint rescue package by the German government and the federal state of Mecklenburg-Western Pomerania had failed shortly before. ari

Currently, all attention is focused on e-mobility. But for the foreseeable future, gasoline-powered cars will still make up the majority of new registrations. China is therefore now also providing incentives to at least buy particularly fuel-efficient cars during the transition phase. Light, small, and clean gasoline engines will receive a “reasonable” subsidy, as the National Economic Commission NDRC has announced. However, the priority remains clear: EVs have priority and enjoy “vigorous” promotion. To this end, the infrastructure, in particular, is to be improved. Authorities plan to quickly build more charging points and battery exchange stations. fin

Chinese tech giant Huawei is suing Sweden at a World Bank arbitration tribunal (ICSID) over its exclusion from the 5G network rollout. A request for arbitration has been filed, according to a release from the International Centre for Settlement of Investment Disputes (ICSID).

Huawei accuses Sweden of excluding the company from the 5G network rollout and thus breaking the bilateral investment agreement between the two countries. In October 2020 Sweden had decided to exclude Chinese providers Huawei and ZTE from network expansion for security reasons. Just over a year ago, Huawei had already threatened such a lawsuit in a letter to then-Swedish Prime Minister Stefan Löfven (China.Table reported). nib

China is actively creating a friendly environment conducive to the growth of small businesses, taking measures to ease the financial burdens and solve financing difficulties for small and micro firms. During the COVID-19 pandemic, these measures have been further enhanced to help affected firms weather the storm.

In this article, we introduce the major tax incentives for small businesses, including

China has recently enhanced its inclusive tax cut policy for small and low-profit enterprises. SLPEs refer to enterprises engaged in non-restrictive and non-prohibited businesses that meet the following three conditions:

All types of SLPEs in China are able to enjoy a reduced corporate income tax (CIT) rate of 20 percent in combination with a reduction of their tax base.

Specifically, SLPEs are subject to:

As a result, for an SLPE’s taxable income amount up to ¥1 million, an effective 2.5 percent CIT rate applies; for the portion of taxable income between ¥1 million and ¥3 million, an effective 10 percent CIT rate applies.

Because the SLPE evaluation is carried out at the entity level (instead of at the group level), small subsidiaries of foreign multinational enterprises (MNEs) in China can also benefit from these CIT cuts.

China offers value-added tax (VAT) benefits to small-scale taxpayers, including reduced VAT levy rate and increased VAT threshold.

Here, small-scale taxpayers normally refer to taxpayers whose annual VAT taxable sales do not exceed ¥5 million (approx. $0.77 million).

However, unincorporated entities, enterprises, and individually owned businesses that do not often incur VAT taxable transactions, even if their annual taxable sales exceed the stipulated standard, can choose to be treated as small-scale taxpayers (instead of being registered as general taxpayers).

China also raised the VAT exemption threshold for small-scale VAT taxpayers from April 1, 2021, to December 31, 2022. The VAT threshold for small-scale taxpayers has been lifted to ¥150,000 (approx. $23,240) per month (or ¥450,000 per quarter, approx. $69,700) from the previous RMB 100,000 (approx. $15,200) per month (or ¥300,000 per quarter, approx. $45,800).

In other words, if the monthly sales amount of the small-scale taxpayer is under ¥150,000 (or the quarterly sales amount is under ¥450,000 for taxpayers who choose one quarter as a tax payment period), the taxpayer will not be subject to VAT.

There is one situation where the taxpayer with monthly sales of over ¥150,000 can still be exempt from VAT. That is when the taxpayer occasionally occurs real estate transactions that month.

The state tax authority has clarified that if a small-scale taxpayer with total monthly sales of more than ¥150,000, but after deducting the sales of real estate, other sales (i.e., the sales of goods, labor, services, and intangible assets) do not exceed ¥150,000, the small-scale taxpayer can still be exempt from VAT.

China’s national and local education surcharges are calculated based on a taxpayer’s actual payment of VAT and consumption tax.

At present taxpayers whose sales amount does not exceed ¥100,000 per month (or ¥300,000 per quarter) will be exempt from education surcharge, local education surcharge, and water conservancy construction fund.

As mentioned above, since April 1 this year, the VAT threshold for small-scale taxpayers has been lifted to ¥50,000/month (or ¥450,000/quarter). However, taxpayers should note that the new VAT threshold will not affect the payment of education surcharge unless the relevant policy is updated.

Aside from the exemption of education surcharges, taxpayers can keep an eye on additional tax and fee relief offered locally.

Local governments are granted authority to reduce levying of six types of taxes and two fees on small-scale taxpayers within the tax base of 50 percent. The six taxes and two fees refer to:

From January 1, 2021, to December 31, 2022, during which period individually owned businesses, sole proprietorships, and partnership enterprises can enjoy some individual income tax (IIT) relief.

For the portion of an individually owned business’ income from a business operation that does not exceed ¥1 million, the business is entitled to a 50 percent reduction of IIT on the basis of the prevailing incentives.

From April 1, 2021, individually owned businesses, sole proprietorship enterprises, partnership enterprises, and individuals will no longer be required to pre-pay IIT at the time of issuance of cargo transport VAT invoices on behalf.

To help small and micro-enterprise raise funds, China exempts financial institutions from paying VAT on their interest income derived from small loans to farmers, small enterprises, micro-enterprises, and individually owned businesses. Besides, loan contracts signed between small or micro-enterprises and financial institutions are exempt from stamp duty.

Both measures are effective until December 31, 2023.

This article first appeared in Asia Briefing, published by Dezan Shira Associates. The firm advises international investors in Asia and has offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam.

Kuno Gschwend is now Managing Director of Swiss Centers China. Swiss Centers supports companies from Switzerland on the Chinese market and operates five locations on the East Coast. Gschwend is based in Shanghai. He was previously Deputy Managing Director at Swiss Centers.

Meng Li has moved from Schneider Optical Machines to the China subsidiary of Denios in Changzhou as Managing Director. Denios AG, based in Bad Oeynhausen, Germany, specializes in equipment for environmental protection and safety equipment. Meng studied mechanical engineering in Karlsruhe.

Stefanie Schoeneborn will take over as head of the “Auslandsjournal” of German public-service television broadcaster ZDF in April. Previously, the seasoned correspondent worked for four years at ZDF’s East Asia studio in Beijing.

Normally, the life of a soldier is serious and dreary. But not so during Chinese New Year. This People’s Liberation Army squad in Jiuquan can no longer hold back their excitement – and has swapped their weapons for poems, lanterns and banners.

When the Winter Olympics in Beijing kicks off on February 4, the logo of one particular company will pop up almost everywhere: Anta. As the official Olympic outfitter, staff will be wearing Anta uniforms, the Chinese team will also be equipped by Anta – and even President Xi Jinping wore an Anta coat during his inspection tours of the Olympic venues.

The Chinese sporting goods manufacturer has achieved spectacular growth in its domestic market and is giving their Western competitors Adidas and Nike a run for their money. The company is riding a “national wave”: In part, China’s consumers consciously prefer domestic brands. Our Beijing team analyzes how Anta is benefiting from its ties to the Chinese leadership – and the downside of this success.

In our second analysis, we turn our attention to Central Asia: When violent protests broke out in Kazakhstan a few weeks ago, the cause seemed to be found quickly: The poverty-stricken population was suffering under the rise in energy prices. Yet Kazakhstan is in fact rich, thanks to natural resources, reforms and its geostrategic location. China and Russia are well aware of this. In his analysis, Frank Sieren shows how the unrest in Kazakhstan is affecting relations between Beijing and Moscow.

I hope you enjoy today’s issue!

Chinese sporting goods company Anta Sports is having a good run. In the first half of 2021, the revenue of the company from Xiamen in eastern China shot up by 56 percent to ¥23 billion (€3 billion). Nike and Adidas, on the other hand, lost ground, which allowed Anta to further narrow the gap to the two market leaders in China. It seems to be only a matter of time before Anta will leap from third rank all the way to the top of its domestic market.

Most recently, Anta has benefited from the fact that Western companies have faced increasing pressure. As members of the Better Cotton Initiative (BCI), they were criticized. In 2020, a BCI study had identified an increased risk of forced labor on cotton farms in the western Chinese region of Xinjiang. After the allegations came to light, numerous companies issued statements expressing their concerns about forced labor and that they no longer sourced cotton from Xinjiang – or had never done so in the first place.

What was met with approval from Western human rights activists had the opposite effect in China. State media led the critics’ march: The tenor was, companies that want to sell us shoes and clothing but do not use our cotton have no business here. The nationalistic tones were apparently met with approval among Chinese consumers, who bought less Adidas and Nike. Instead, they turned their attention more to domestic brands such as Anta. The company speaks of a “national wave” that has helped the group to further boost its already respectable growth over the past few years.

When the Winter Olympics begin in Beijing on February 4, Anta’s logo is likely to be omnipresent. Not only did the company sign a contract with the IOC in 2019 as the official supplier of the Games, providing staff uniforms, the Chinese athletic team will also be supplied with equipment from Anta. The company’s stock price repeatedly surged over the past few years every time China’s President Xi Jinping inspected Olympic construction sites around Beijing, wearing coats from the Group’s brands.

Close ties to the Chinese leadership may help Anta in its domestic market. But there is also the other side of the coin: The more nationalistic Anta presents itself in China, the harder its future international expansion could be. For example, the Olympics: Unlike in China, the IOC’s decision to pick Anta despite the situation in Xinjiang was highly criticized in the West. Good publicity looks different.

In essence, Adidas, Nike, and Anta share the same problem, but with different factors: All companies strive to be successful in both the West and China, but rising political tensions are complicating these plans. While Anta may benefit in China from sourcing cotton from Xinjiang, the US has introduced laws to ban the import of products containing cotton from Xinjiang (China.Table reported).

So it is no wonder that Anta is trying to strike a different tone outside of China. The Finnish Amer Group, in which Anta secured a majority stake of 52 percent for €4.6 billion three years ago, has responded quite differently to the Xinjiang issue. Amer remains a member of the BCI cotton initiative. After the boycott calls began to grow louder in China, the parent company of well-known brands such as Salomon, Arc’teryx, and Wilson immediately stressed that, as an independent company, it does not condone forced labor and does not include cotton from Xinjiang in its products.

Anta already took a similarly pragmatic approach to the 2019 NBA scandal. At that time, the then-manager of the Houston Rockets, Daryl Morey, had called for the support of the democracy movement in Hong Kong on Twitter – which was met with outrage in China. Back then, Anta also quickly issued a statement expressing its disappointment over the NBA’s criticism. The company put negotiations on new sponsorship contracts on hold. Three years later, the dust has long since settled and Anta now has more NBA deals than ever before. Gregor Koppenburg/ Joern Petring

It was no coincidence when China’s head of state and party leader Xi Jinping announced the plans for his ambitious Belt and Road project during a state visit to Kazakhstan in 2013. The world’s ninth-largest country is a vital neighbor of China in the west. The largest and most prosperous economy in Central Asia is rich in natural resources such as oil and gas, zinc, uranium, and titanium. And Kazakhstan was the country in Central Asia that emerged most stable, prosperous, and independent from the collapse of the Soviet Union.

All that seems a long time ago. In early January, violent mass protests erupted across the country. President Kassym-Shomart Tokayev spoke of an “attempted coup” by organized “terrorist” forces and ordered the ruthless suppression of the protests. Moscow sent “peacekeepers” to assist. According to authorities, a total of 225 people were killed during the protests, and 970 people are currently in custody. While the situation seems to have calmed down by now, the geopolitical implications of the unrest are far-reaching.

The unrest also has an impact on Russian-Chinese relations in Central Asia. Despite some rivalries, the two countries are moving closer. This is because both nations share considerable interests in their vast neighbor with its abundant natural resources.

However, the country’s wealth has only partially reached the population. Around 70 percent of the population lives below the poverty line, even though the country has made considerable progress since the 1990s. Since the country opened up, foreign investment alone amounted to $380 billion. Among the investors are the Italian oil company ENI, the French Air Liquide, and the German company Linde. In the first half of last year, foreign investment alone totaled more than $11 billion.

However, the catalyst for unrest is not only the increased gas prices and general discontent among the population but more likely a power struggle between long-time president Nursultan Nazarbayev and his successor Tokayev. Nazarbayev may no longer be president, but he is the “Yelbassy” (leader of the nation) for life. Thus, he continues to be active in politics, which causes Tokayev’s patience to grow thin. After the heavy riots at the beginning of the year, several of Nazarbayev’s trusted associates resigned from their positions.

Nazarbayev may have close ties to Beijing, but his position begins to weaken for the moment: Since December, he had disappeared off the face of the earth – until he resurfaced again last Tuesday with a video message. In it, however, Nazarbayev did not clarify whether he had voluntarily handed over the chairmanship of the National Security Council to Tokayev on January 5th. Instead, he insisted that there was “no conflict and no dispute among the elite.” That could mean that he is back in power once again. That is not certain, however. Either way, Beijing and Moscow are equally concerned about the uncertainty of the situation.

Russia and China share a mutual interest: Both want stability in the region at any cost, especially given the uncertain situation in Afghanistan. But also because the “stans” between Afghanistan and Kazakhstan, i.e. Turkmenistan, Uzbekistan, Tajikistan, and Kyrgyzstan, have developed less stable and generally worse than Kazakhstan since the collapse of the Soviet Union. Kazakhstan accounts for half of the region’s GDP. Kazakhstan is one of the most important transit countries for Beijing’s New Silk Road; From here, Chinese goods are directly shipped to Iran, Turkey, and Russia. China and Kazakhstan share a border of more than 1,700 kilometers.

Kazakhstan also holds enormous geostrategic value for Russia. Although Russia has dramatically lost its influence to China since the 1990s – the country was a Soviet republic, after all, relations remain close nonetheless. The Russian population is still high at twenty percent.

Since Kazakhstan’s independence in 1991, a division of labor has emerged between China and Russia: Moscow provides military security, while Beijing boosts the economy through investment. China has invested tens of billions of dollars in Kazakhstan and the rest of Central Asia over the past decade, much of it in the oil, gas, and mining sectors, with a full 80 percent of Chinese investment in the region going to Kazakhstan. China holds about 24 percent of Kazakhstan’s oil production and 13 percent of its gas production. An oil pipeline runs from Kazakhstan directly to the western Chinese province of Xinjiang.

Even though Russia sees China’s growing influence in Central Asia with concern, both nations continue to rely on close cooperation in Kazakhstan. Mutual support was also evident in the recent unrest. The Russian-dominated Collective Security Treaty Organization (CSTO) had dispatched so-called peacekeepers to the Central Asian country at the request of the Kazakhs to restore order. Beijing welcomed the action: As a fraternal neighbor and strategic partner of Kazakhstan, “China supports all efforts that help the Kazakh authorities end the chaos as soon as possible,” said Foreign Office spokesman Wang Wenbin (China.Table reported).

At present, it is not clear which of the two rival rulers has turned to Russia for aid. Since the protests called for Nazarbayev’s ouster, he may have appealed to Moscow while his challenger fueled the unrest. That would be in Beijing’s interest. After all, the Chinese had maintained good relations with Nazarbayev over the past decades, so good, in fact, that there have already been protests among the population about China’s growing influence in Kazakhstan. One thing Moscow and Beijing want to prevent in any case is a pro-democracy revolution like in Ukraine or Georgia. Or the ungovernability of the country.

Beijing also fears that supporters of the Uyghur freedom movement could be recruited in Central Asia and recommends the Kazakh government to follow the Chinese model in dealing with the Muslim minority. Kazakhstan is home to hundreds of thousands of ethnic Uyghurs, who have migrated from Chinese territories since the 19th century. In recent years, there have been repeated protests outside China’s diplomatic missions in Kazakhstan. The China-initiated and led Shanghai Cooperation Organization (SCO), which includes Russia and several Central Asian states, is focusing on security training in the region to fight terrorism.

Chinese People’s Armed Police units have already been deployed to remote parts of Tajikistan – a region that connects Afghanistan and Xinjiang. Since Russia annexed Crimea in 2014, cooperation between China and Russia has steadily deepened, including arms deliveries. Nevertheless, both countries continue to compete with each other for influence in Central Asia. One thing is certain: Russia is more dependent on China than China is on Russia, despite Russia’s military strength, which it has now once again displayed in Kazakhstan.

The organizers of the Beijing Winter Olympics have changed the strict requirements for Covid tests in China. According to the rules published on Monday by the International Olympic Committee (IOC), the so-called CT value for a positive test will be lowered to below 35. The “CT value” (Cycle Threshold) indicates how infectious a person is: the lower the value, the more infectious a person is considered. In Germany, according to the Robert Koch Institute, a positive result is only given if the CT value is below 30. In China, on the other hand, the limit has so far been a value of 40.

This difference had led to heated debates about Covid testing at the Winter Games. Athletes and officials are concerned that athletes who tested negative before their departure could suddenly test positive upon their arrival in China.

Meanwhile, six other Olympic athletes were tested positive for the Coronavirus at Beijing airport. This was reported by the South China Morning Post on Monday. This brings the number of “Olympic cases” to 78, and it is not clear whether the new cases are athletes or officials. According to the IOC, those who tested positive have been isolated, and their contacts traced.

Individuals who are tested positive at the Beijing Games will initially have to check into an isolation facility. Release is only possible after two negative PCR tests. Alternatively, after ten days in quarantine, one negative PCR test is sufficient – even then with the newly defined threshold value. In addition, individuals cannot exhibit any symptoms. Following quarantine, infected participants are initially listed as close contacts and tested twice daily.

The Beijing Winter Olympics begin February 4 through February 20. rad

The German economy warns of the consequences the Omicron wave could have on China. In its “Global Growth Outlook” published on Monday, the Federation of German Industries (BDI) warns of severe consequences for domestic companies and a rapid rise in prices. “If the Omicron variant also spreads more quickly and easily in China, it could once again cause a bottleneck for global supply chains and fuel a recession in certain areas of the German economy,” the BDI report states.

Severe effects similar to those that followed the first lockdown at the beginning of 2020 are considered unlikely, as companies have learned from what happened and are now able to respond better to the Chinese government’s pandemic measures. However, the BDI expects further government restrictions in light of the start of the Winter Olympics on February 4 in Beijing. The leadership in Beijing could not only implement stricter measures but also apply them for a longer period and on a larger scale, warns the BDI. These restrictions could pose new challenges for producers and exporters, as well as companies at the end of supply chains.

It is not yet possible to predict the extent to which logistical disruptions at Chinese plants or partial closures at Chinese ports will impact global supply chains and supply in Europe during the year, the BDI admits in its report. “Nevertheless, there are concerns that the lockdowns could affect global supply chains.”

Bottlenecks would likely be followed by higher prices, which would further fuel inflation, the BDI warns. “The Covid development in China thus poses a risk to the industry’s recovery process.” Companies should therefore prepare for different scenarios and take appropriate precautions.

The International Monetary Fund (IMF) had previously called on the government in Beijing to abandon its strict zero-covid strategy. These Restrictions are proving to be a burden – both for the Chinese and the global economy, IMF chief Kristalina Georgieva said.

The majority of China’s population is vaccinated – but with domestic vaccines. And Chinese vaccines in particular appear significantly less effective against the highly contagious Omicron than the mRNA vaccines administered in Germany, for example. “[Omicron] has left the Chinese vaccines even more ineffective against the threat posed by Covid,” said Nicholas Thomas, Associate Professor at the City University of Hong Kong who specializes in health security in Asia. German virologist Christian Drosten had also recently cited China as his current biggest concern. rad

The ailing real estate giant Evergrande is to receive support from the Guangdong provincial government, according to a media report. The financial information service REDD Intelligence reports that the local authorities want to take care of the restructuring of the virtually bankrupt group. Among other things, the new administration is expected to divest the group’s overseas properties. The proceeds could be used to settle debts to international investors. In addition, independent consultants are to be sent to the company to assist with the reorganization.

The Guangdong government is responsible, as Evergrande is headquartered in Shenzhen. As the REDD announcement is the first indication that the government is no longer keeping the company in the dark and is now beginning to resolve the situation, share prices in Asia rose on Monday. Evergrande had collapsed under the weight of heavy debt during the pandemic (China.Table reported). On one hand, the woes of a real estate group that manages half a billion square meters of residential space in China pose a systemic risk. On the other hand, economists and markets expect the Chinese government to prevent systemic crises through intervention and aid. fin

Lim Kok Thay has resigned as Chairman and Chief Executive of bankrupt cruise group and MV Shipyards owner Genting Hong Kong. Liquidators are now to draw up a restructuring plan for the company, the group told the Hong Kong Stock Exchange on Monday. In addition, Au Fook Yew resigned as Vice Chairman and President of the group. According to the stock exchange notice, neither Lim nor Au had any disagreements with the board of directors. The company is looking for suitable candidates to fill the positions, the statement added.

Malaysian billionaire Lim holds 76 percent of Genting. A court in Bermuda appointed liquidators last week (China.Table reported). The liquidation of Genting Hong Kong is a further setback for the German MV Werften. Negotiations on a joint rescue package by the German government and the federal state of Mecklenburg-Western Pomerania had failed shortly before. ari

Currently, all attention is focused on e-mobility. But for the foreseeable future, gasoline-powered cars will still make up the majority of new registrations. China is therefore now also providing incentives to at least buy particularly fuel-efficient cars during the transition phase. Light, small, and clean gasoline engines will receive a “reasonable” subsidy, as the National Economic Commission NDRC has announced. However, the priority remains clear: EVs have priority and enjoy “vigorous” promotion. To this end, the infrastructure, in particular, is to be improved. Authorities plan to quickly build more charging points and battery exchange stations. fin

Chinese tech giant Huawei is suing Sweden at a World Bank arbitration tribunal (ICSID) over its exclusion from the 5G network rollout. A request for arbitration has been filed, according to a release from the International Centre for Settlement of Investment Disputes (ICSID).

Huawei accuses Sweden of excluding the company from the 5G network rollout and thus breaking the bilateral investment agreement between the two countries. In October 2020 Sweden had decided to exclude Chinese providers Huawei and ZTE from network expansion for security reasons. Just over a year ago, Huawei had already threatened such a lawsuit in a letter to then-Swedish Prime Minister Stefan Löfven (China.Table reported). nib

China is actively creating a friendly environment conducive to the growth of small businesses, taking measures to ease the financial burdens and solve financing difficulties for small and micro firms. During the COVID-19 pandemic, these measures have been further enhanced to help affected firms weather the storm.

In this article, we introduce the major tax incentives for small businesses, including

China has recently enhanced its inclusive tax cut policy for small and low-profit enterprises. SLPEs refer to enterprises engaged in non-restrictive and non-prohibited businesses that meet the following three conditions:

All types of SLPEs in China are able to enjoy a reduced corporate income tax (CIT) rate of 20 percent in combination with a reduction of their tax base.

Specifically, SLPEs are subject to:

As a result, for an SLPE’s taxable income amount up to ¥1 million, an effective 2.5 percent CIT rate applies; for the portion of taxable income between ¥1 million and ¥3 million, an effective 10 percent CIT rate applies.

Because the SLPE evaluation is carried out at the entity level (instead of at the group level), small subsidiaries of foreign multinational enterprises (MNEs) in China can also benefit from these CIT cuts.

China offers value-added tax (VAT) benefits to small-scale taxpayers, including reduced VAT levy rate and increased VAT threshold.

Here, small-scale taxpayers normally refer to taxpayers whose annual VAT taxable sales do not exceed ¥5 million (approx. $0.77 million).

However, unincorporated entities, enterprises, and individually owned businesses that do not often incur VAT taxable transactions, even if their annual taxable sales exceed the stipulated standard, can choose to be treated as small-scale taxpayers (instead of being registered as general taxpayers).

China also raised the VAT exemption threshold for small-scale VAT taxpayers from April 1, 2021, to December 31, 2022. The VAT threshold for small-scale taxpayers has been lifted to ¥150,000 (approx. $23,240) per month (or ¥450,000 per quarter, approx. $69,700) from the previous RMB 100,000 (approx. $15,200) per month (or ¥300,000 per quarter, approx. $45,800).

In other words, if the monthly sales amount of the small-scale taxpayer is under ¥150,000 (or the quarterly sales amount is under ¥450,000 for taxpayers who choose one quarter as a tax payment period), the taxpayer will not be subject to VAT.

There is one situation where the taxpayer with monthly sales of over ¥150,000 can still be exempt from VAT. That is when the taxpayer occasionally occurs real estate transactions that month.

The state tax authority has clarified that if a small-scale taxpayer with total monthly sales of more than ¥150,000, but after deducting the sales of real estate, other sales (i.e., the sales of goods, labor, services, and intangible assets) do not exceed ¥150,000, the small-scale taxpayer can still be exempt from VAT.

China’s national and local education surcharges are calculated based on a taxpayer’s actual payment of VAT and consumption tax.

At present taxpayers whose sales amount does not exceed ¥100,000 per month (or ¥300,000 per quarter) will be exempt from education surcharge, local education surcharge, and water conservancy construction fund.

As mentioned above, since April 1 this year, the VAT threshold for small-scale taxpayers has been lifted to ¥50,000/month (or ¥450,000/quarter). However, taxpayers should note that the new VAT threshold will not affect the payment of education surcharge unless the relevant policy is updated.

Aside from the exemption of education surcharges, taxpayers can keep an eye on additional tax and fee relief offered locally.

Local governments are granted authority to reduce levying of six types of taxes and two fees on small-scale taxpayers within the tax base of 50 percent. The six taxes and two fees refer to:

From January 1, 2021, to December 31, 2022, during which period individually owned businesses, sole proprietorships, and partnership enterprises can enjoy some individual income tax (IIT) relief.

For the portion of an individually owned business’ income from a business operation that does not exceed ¥1 million, the business is entitled to a 50 percent reduction of IIT on the basis of the prevailing incentives.

From April 1, 2021, individually owned businesses, sole proprietorship enterprises, partnership enterprises, and individuals will no longer be required to pre-pay IIT at the time of issuance of cargo transport VAT invoices on behalf.

To help small and micro-enterprise raise funds, China exempts financial institutions from paying VAT on their interest income derived from small loans to farmers, small enterprises, micro-enterprises, and individually owned businesses. Besides, loan contracts signed between small or micro-enterprises and financial institutions are exempt from stamp duty.

Both measures are effective until December 31, 2023.

This article first appeared in Asia Briefing, published by Dezan Shira Associates. The firm advises international investors in Asia and has offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam.

Kuno Gschwend is now Managing Director of Swiss Centers China. Swiss Centers supports companies from Switzerland on the Chinese market and operates five locations on the East Coast. Gschwend is based in Shanghai. He was previously Deputy Managing Director at Swiss Centers.

Meng Li has moved from Schneider Optical Machines to the China subsidiary of Denios in Changzhou as Managing Director. Denios AG, based in Bad Oeynhausen, Germany, specializes in equipment for environmental protection and safety equipment. Meng studied mechanical engineering in Karlsruhe.

Stefanie Schoeneborn will take over as head of the “Auslandsjournal” of German public-service television broadcaster ZDF in April. Previously, the seasoned correspondent worked for four years at ZDF’s East Asia studio in Beijing.

Normally, the life of a soldier is serious and dreary. But not so during Chinese New Year. This People’s Liberation Army squad in Jiuquan can no longer hold back their excitement – and has swapped their weapons for poems, lanterns and banners.