the speculations are over, let the speculations begin.

Now that, after months of guesswork, we finally know how the Politburo Standing Committee will go into the next five years, the game continues at the next level. After the who, the next question is how.

How will the Party’s closest power circle, which President Xi brilliantly assembled over ten years at the head of the CP, shape the country’s politics? Because the inner workings of the Party remain a mystery even to those who have spent years studying the country and its people, language and culture, the scope for precise political predictions become smaller.

Investors on Chinese stock exchanges, especially those in Hong Kong, apparently suspect that the idea of more market and openness is in for a bad time. The stock exchange prices of the tech sector collapsed because the composition of the Standing Committee suggests that the rough ride for companies like Alibaba will continue in the future, writes Joern Petring from Beijing.

But even those who do not want to multiply their money in Chinese financial hubs foresee bad things from a Committee that lacks balance and where members are primarily loyal rather than critical of their secretary general. Its ideological governance, reflected in the Committee’s selection, will likely trouble German business as well, notes Finn Mayer-Kuckuk.

Moreover: Where no one dares to disagree anymore and decisions are placed in the hands of a single individual, the probability of bad decisions increases. Given China’s importance for the global economy, peace in the world, or the fight against climate change, not just 1.4 billion Chinese would suffer as a result of wrong decisions, but the rest of the world as well. Where exactly the greatest risks lie is barely comprehensible to outsiders.

All is up for speculation.

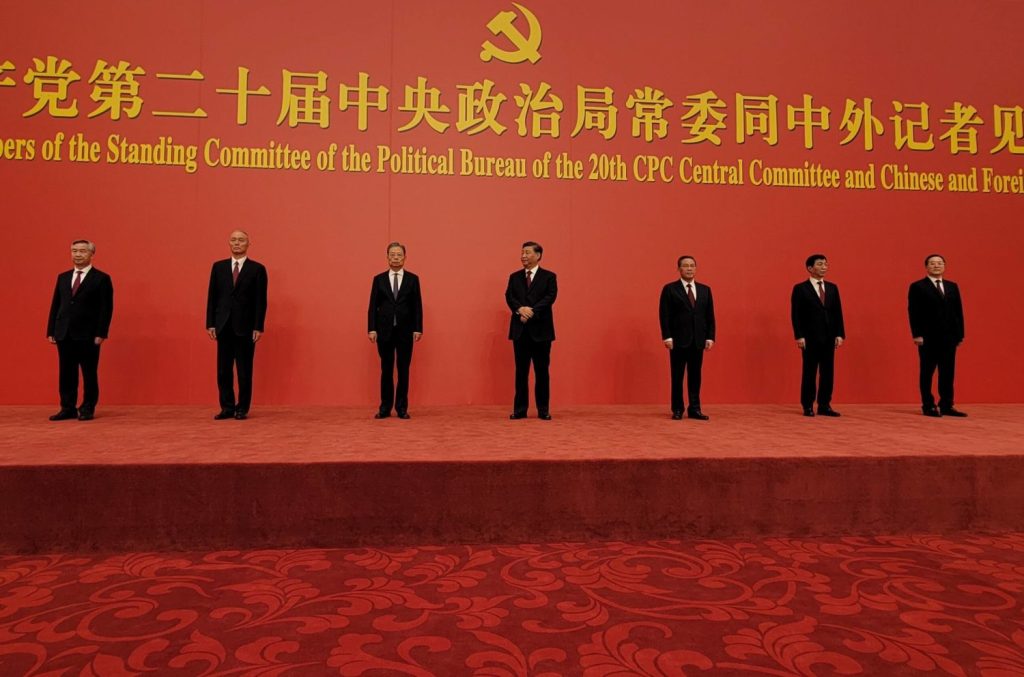

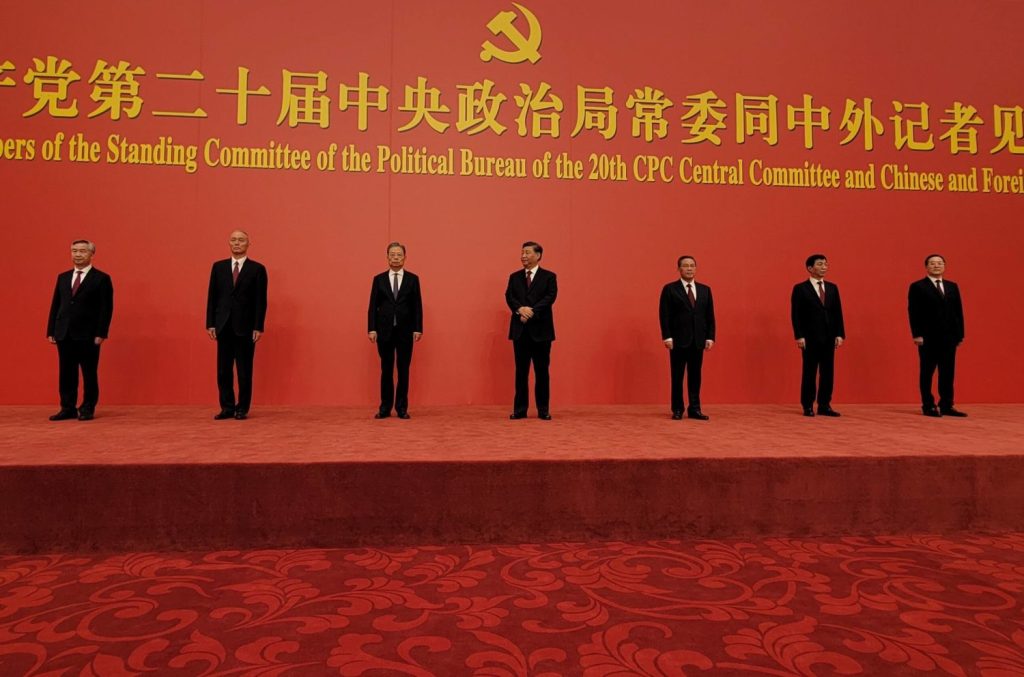

The stock markets in China and Hong Kong were in for a rude awakening on Monday. Investors were clearly anything but happy with the composition of the new CP leadership, which had presented itself to the public the day before. Contrary to what business representatives had hoped for in advance, Xi Jinping’s seven-member Standing Committee is exclusively made up of loyal followers (China.Table reported). Not a single economic reformer made it onto the country’s most powerful committee.

While the leading index in Shanghai lost around two percent, prices on the Hong Kong stock exchange fell drastically by over six percent on Monday. This shows that international investors in particular, who have easier access to Hong Kong than to the markets of the People’s Republic, see the change of direction in Beijing as an alarm signal for future market development.

The shares of Chinese tech companies were hit particularly hard after they were already the target of regulators over the past two years and have since lost a considerable amount of value. Online retail giant Alibaba lost around ten percent on Monday. Internet group Tencent lost more than eleven percent.

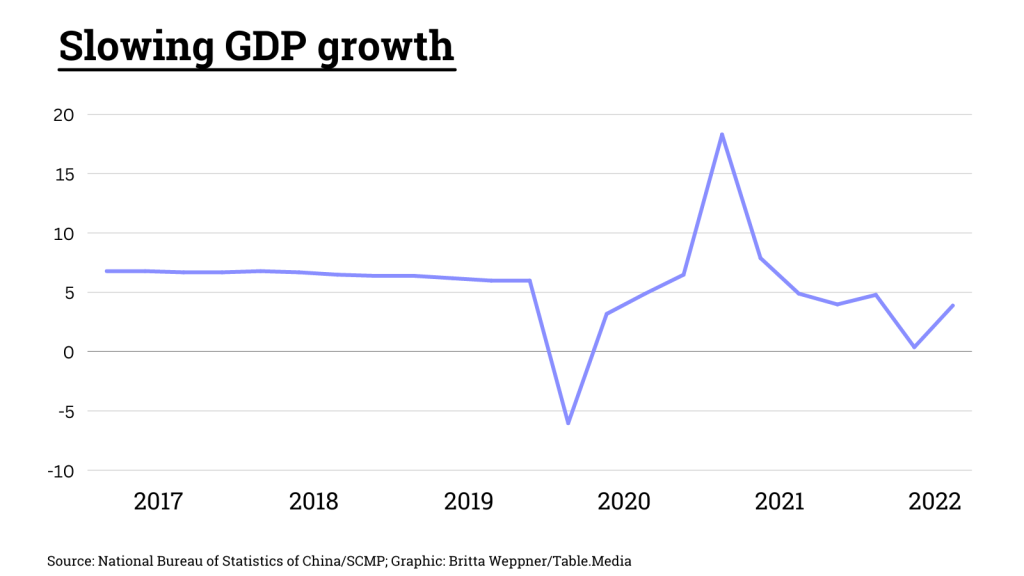

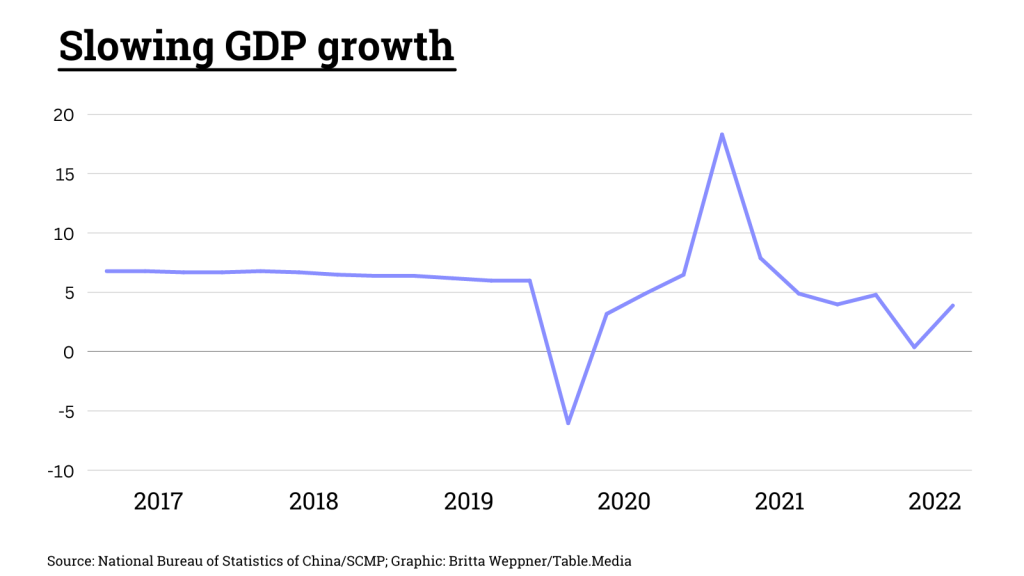

But the economic figures published on Monday did not look too bad. According to official figures, the economy grew by 3.9 percent in the third quarter, which was stronger than analysts had expected. In the second quarter, growth was only 0.4 percent, mainly due to strict Covid restrictions.

Originally, the data should have been published last week. No reason was given for the delay. However, observers assumed that all attention was supposed to focus on the CP Congress (China.Table reported). Other economic data on Monday painted a mixed picture: While industrial production rose a substantial 6.3 percent in September, retail sales growth was slower than expected at 2.5 percent. The official urban unemployment rate also increased for the first time in four months, rising 0.2 percentage points to 5.5 percent.

Meanwhile, weak global demand further slowed China’s export growth. Exports in September grew by only 5.7 percent year-on-year in US dollar figures, China Customs reported on Monday. Exports already lost momentum in the previous month, growing only 7.1 percent. Imports also grew by only 0.3 percent in September, the same as the previous month. Exports performed only slightly better than experts had predicted, while imports were slightly worse. Therefore, the economic recovery remains on shaky ground.

Strict disease control will continue to be an economic driver. “There is no sign that China will lift its zero-Covid policy in the near future,” says economist Julian Evans-Pritchard of Capital Economics. He does not expect an end to ever-new lockdowns until 2024. “So we can expect continued significant disruptions to personal activity,” and thus a corresponding strain on growth. Economist Iris Pang of banking firm ING also believes that dealing with the pandemic will be critical for the foreseeable future. “Even if the Covid measures become more flexible, the lockdowns remain a major factor of uncertainty, especially against the backdrop of the housing crisis,” Pang says.

The situation on the real estate market remains critical indeed. Since the dragged-out bankruptcy of market leader Evergrande (China.Table reported), the industry has been unable to get on its feet, with prices continuing to drop. In the past, home construction has been the ace up the sleeve of China’s economic policymakers. Whenever they issued more mortgage loans, construction activity went up – and growth picked up.

But neither households nor real estate developers are currently in a position to take on the risks of new projects. Even the military-like orders to build more have failed to give the sector a boost, nor have abundant financial injections. Instead, state banks now buy up the properties to support prices. Since the confidence in perpetually rising prices has been lost, the bubble of the past years continues to shrink inexorably. Key sectors such as the steel industry also suffer as a result.

Analysts surveyed by Reuters, therefore, expect only 3.2 percent growth in the current year. That would be well below the target of around 5.5 percent originally set by the government in Beijing (China.Table reported). Particularly frustrating for the Party: The 50 economic stimulus programs it introduced in the spring had no significant effect, despite huge investments by the government. And youth unemployment also remains high, which probably poses the greatest potential for social unrest along with the situation on the real estate market. Joern Petring/rtr/fin

The 20th Party Congress is over. The Chinese leadership can finally get back to politics after months of wrestling over staffing issues and formulations. Surprises are to be expected, because the new team around Xi Jinping is now largely free of domestic political constraints. The profiles of the six members of the Politburo Standing Committee allow us to draw the first assumptions about the developments to come.

The German economy eagerly longs for signals of opening up to foreign trade and market liberalization. However, things do not look too bright in this regard. The most likely candidate for the office of premier, Li Qiang, is a lockdown fanatic. His destructive methods surrounding the lockdown of Shanghai were politically motivated and came at the expense of the economy and foreign trade (see today’s Profile).

Experts and observers, therefore, expect China to continue its course of repression, centralization and striving for autarky. The head of the China Research Institute Merics, Mikko Huotari, considers Xi to be a fighter, not a networker. The Party leader sees China’s rise as a series of battles, not as a cooperative project. Accordingly, he is preparing China for more conflicts in the future, which are supposed to the country as little as possible.

To achieve this, China must, among other things, reduce its dependence on the international economy: self-sufficiency above opening up, and more domestic value creation. The distrust toward Western countries and their representatives is now palpable everywhere in China. The domestic economy will be increasingly favored.

Likewise, further militarization is to be expected. The issue of security policy appeared more often in Xi Jinping’s speech than in previous Party Congress speeches, while the words “reform” and “market” were mentioned more rarely than before. Xi calls the excesses of capitalism “barbaric.” On Sunday, he did briefly talk up economic liberalization. In his detailed opening speech at the CP Congress, however, more of his true thoughts shone through. There, he called for “frugality” in terms of national interests and a “balance between development and security interests.” Xi is not an economic pragmatist, but a man on a historic quest to which businessmen have to submit. Now he has assembled the right politburo for his fight.

Does anyone still disagree with Xi? Probably not. Unchecked power increases the risk that even his worst ideas will be turned into reality with great consistency. If Taiwan is attacked, all optimistic forecasts for exchanges with China will suddenly cease to exist. From then on, interaction would be characterized by lasting hostility. Trade would come to a standstill, and the disaster for the German economy would be almost unimaginable.

If Xi is indeed so deep in his bubble that he sees the conquest of Taiwan as a promising venture, after which the Western countries will surely come back to his side, he would urgently need a corrector among his closest advisers. The same applies to all other issues. Does Xi realize the side effects of the endlessly drawn-out zero-Covid policy? Clearly, he believes it to be a good idea. However, the citizens and companies affected would beg to differ.

With a politburo of accomplices, the risk that Xi will lose his way increases dangerously. So far, he appears rational and stable. But throughout history, all autocrats have inevitably grown more and more detached from reality the longer no one has opposed them.

The increasing lack of transparency also damages international relations. Decision-making in the People’s Republic has always been shrouded, which is part of the DNA of communist systems. But while more insight had been possible in the past, the degree of secrecy and refusal to engage in dialogue is now almost limitless. The example of Hu Jintao shows how quickly wild and contradictory speculations sprout in the absence of credible explanations. Economic partners also increasingly feel left out.

The weakened position of economic expertise is also readily apparent in the new Politburo and its Standing Committee. The members of the inner circle may have very different academic and administrative backgrounds and also bring a wealth of experience in managing the Chinese economy, after all, they all held leadership positions in metropolises and provinces that have dimensions of individual European states. But there is actually precious little other systematic economic knowledge among the members of the Standing Committee.

Li Qiang at least took some courses in world economics parallel to his career at the Central Party School. But in essence, the members of the Standing Committee are all humanities scholars or technicians. Zhao studied philosophy, Wang: French, Cai: politics. At least two of them have a technical background: Ding Xuexiang is an engineer, Li Qiang is an industrial engineer.

In the last Standing Committee, Li Keqiang, who holds a Ph.D. in economics and law, held the top position, and Han Zheng, a second trained economist, held the role of first vice premier. Due to generational factors, many other members lacked a university education. In any case, economic interest was generally far more pronounced in the previous Standing Committee. With this Party Congress, Xi not only turned his back on the political architecture inherited from Deng Xiaoping, but also his concept of giving precedence to economic policy.

This raises the question of whether there is still the competence to promote provincial development and keep the state’s overall development on track. The current woes of the real estate market, for example, will require some very skillful interventions. Weakness in the consumer market could compound the problems caused by autarky aspirations and the mistakes of an autocrat. An ideology-driven re-centralization of the economy would cost a lot of dynamics.

Green Party politician Anton Hofreiter made his criticism clear on Monday, arguing that the German government must immediately stop the planned entry of the Chinese shipping company Cosco into the logistics group HHLA’s Tollerort container terminal in the Port of Hamburg. “Even the reduction of a Cosco stake to 24.9 percent in the operating company does not make the deal any better,” the Chairman of the European Affairs Committee in the Bundestag told Reuters.

Hofreiter referred to a possible compromise exclusively reported by China.Table on Monday: Under the new deal, Cosco would acquire only 24.9 percent of the shares – instead of 35 percent as previously planned. This would reduce Chinese influence, as shareholders only have a veto right above a 25 percent share.

But Hofreiter made it clear: The dangers are clear. “China is threatening that the Port of Hamburg or German companies will suffer disadvantages if the entry does not materialize.” It is the political pressure from Beijing that worries not only Hofreiter.

Green Party leader Omid Nouripour also stressed on Monday that the issue “must be discussed” at the cabinet meeting on Wednesday. Nouripour cited the halted gas deliveries from Russia as the reason. He said that it must now finally be understood that critical infrastructure cannot simply be sold to a country “that we all know is willing to exploit our dependency, including politically, without batting an eye.”

China researcher Mareike Ohlberg recognizes such patterns in Beijing’s behavior. Together with Clive Hamilton, the sinologist has conducted intensive research on Chinese investments in North America and Europe. The very title of their joint book leaves no doubt about their findings: “Hidden Hand: Exposing How the Chinese Communist Party is Reshaping the World.” Both Ohlberg and Hamilton conclude that supposedly purely economic decisions are often guided by political intentions directly from Beijing.

“Beijing asserts that it merely wants to promote trade by taking over ports, but the People’s Republic is pursuing a long-term plan to build strategic pressure,” Ohlberg writes. Under the term “yi shang bi zheng“, instrumentalization of domestic companies abroad is taking place. The aim is to exert pressure on the respective government. And indeed, China uses economic dependencies to demand political loyalties – also in Europe.

For example, in Greece, Cosco leased half of the container port in Piraeus for 35 years in October 2009 in the wake of the Greek financial crisis. A purely economic decision? Doubtful. Since then, the government in Athens repeatedly and noticeably adopted China’s position in EU decisions – be it out of pressure, favor, or simply out of inner conviction.

In any case, the case is clear for Anton Hofreiter. He demands that China return the port in Piraeus to Greece. Because since the purchase, he argues, the Greek government has “suddenly developed a strange sympathy for Chinese positions” in EU debates. “A commercial deal has turned into political influence. This is dangerous. The port of Piraeus must be sold again,” says the Chairman of the European Affairs Committee in the German Bundestag.

But there is an economic development that cannot be denied. Since Cosco also holds the majority of shares in Piraeus, the Chinese-operated terminal is said to generate considerable profits, made possible by increased efficiency and wage reductions. Thus, the ailing anchorage of Piraeus once again developed into one of the fastest-growing Mediterranean ports.

But the opposition in the German Bundestag apparently doesn’t want to hear about that either. Vice chairman of the conservative CDU/CSU parliamentary group Spahn told German public broadcaster ARD that a majority in the German Bundestag opposed the deal. “We are ready to meet in the Bundestag this week and decide.” Spahn called on the liberal FDP and Greens to oppose Chancellor Scholz in a vote. “We are ready for that.”

Spahn warned that the issue was whether Germany will become more dependent on a Chinese state-owned company. Anyone who had observed the Communist Party Congress in China could not possibly want this, he said. He also asked why a German company should not be allowed to invest in Chinese ports. In fact, however, there is no such restriction in China (China.Table reported). On the contrary, as China.Table learned from Hainan sources, HHLA and other Western port operators are even in talks about a stake in the port project in Haikou, where a new port is to be built for $1.5 billion.

But time is running out in the dispute over the Hamburg container port. A review period expires on October 31, by which time the German government could block the deal. However, if the deadline passes without objection, the sale may proceed.

And this could actually happen – at least according to government spokesman Steffen Hebestreit. On Monday, he said in Berlin that the issue would be dealt with in the federal cabinet “if it is decided to take action against a possible sale of shares.” However, “if it is said that it will be allowed to go through, then not.” A delicate detail: A few days after the deadline, Scholz will travel to China to meet Xi Jinping. It is hard to imagine that Scholz will bring Xi a no as a gift for the inaugural visit. At the EU summit on Friday, Scholz had already rejected any criticism of possible Chinese participation.

Simply sitting it out would be an extremely odd solution to the Hamburg port dispute. Because if Scholz were to be saved by the bell, it would once again dodge the fundamental decision on how to deal with the partner, rival or competitor China. This is a situation that Europe’s largest economic power can no longer afford.

Even almost three years after the outbreak of the Covid pandemic, the origin of the Sars-CoV-2 virus is still unclear. Does it have a natural origin, or did it escape from a laboratory in the Chinese metropolis of Wuhan by accident?

A new study claims to have found clear evidence that the virus did in fact originate from a laboratory. In the recent online pre-publication, a team of researchers led by German immunologist Valentin Bruttel concludes that Sars-CoV-2 is a deliberately genetically modified virus. The paper states that 99.9 percent of the virus originated in a laboratory.

According to Bruttel, who works at the University Hospital of Wuerzburg, the first abnormalities in the genome of Sars-CoV-2 were identified as early as the summer of 2021. He subsequently investigated these clues further with US colleagues Alex Washburn and Antonius VanDongen. Now the three researchers claim to have discovered a kind of “fingerprint” for deliberate manipulation in the genome of Sars-CoV-2. They believe this to be a regularly recurring pattern in the virus’s genome.

So far, the paper was only published as a so-called preprint, which means that it has not yet gone through a scientific peer review process.

In the scientific world, however, the thesis is met with rejection by many experts. The immunologist Kristian Andersen criticizes the work as “nonsense”, saying that the study is “so flawed that it would not even pass in a molecular biology kindergarten”, Andersen wrote on Twitter. His conclusion: In the genetic material of Sars-CoV-2, only “random noise” is recognizable.

Other researchers are also critical. The German virologist Friedemann Weber from the Institute of Virology at the University of Giessen expressed his skepticism in a detailed Twitter thread: In his opinion, a manipulation like the one demonstrated by Bruttel and Co. is possible, but far too complicated. rad

China and the Vatican reached an agreement. As was announced over the weekend, a secret agreement from 2018 was extended. In it, the Vatican allows the Chinese government to elect bishops on the Mainland which will then be approved by Rome. According to reports, the deal has been extended for two years.

“After appropriate consultation and assessment, the Holy See and the People’s Republic of China have agreed to extend for another two years the Provisional Agreement regarding the appointment of Bishops,” a Vatican press office statement said.

The agreement is intended to bring Catholics in China closer together. This is because Christians in the People’s Republic are divided between the official state-supported church and an underground movement loyal to Rome and the pope as the church’s supreme leader. According to estimates, China has a Catholic community of about ten million people.

Normally, the pope has the say in bishop appointments. Therefore, critics fear that China interferes in religion. They also complain that the agreement in no way improves the lives of Catholic Christians in the People’s Republic. On the contrary, members of the so-called underground church would be further marginalized as a result.

The agreement between China and the Vatican was signed in September 2018 and subsequently extended for the first time in October 2020. Since then, “the first six ‘clandestine’ bishops have also succeeded in being registered,” Cardinal Pietro Parolin, Vatican Secretary of State, explained in an interview with Vatican News.

According to observers, the extension of the agreement had been open for a long time due to the arrest of 90-year-old Cardinal Joseph Zen in Hong Kong. Zen is one of the highest-ranking Catholic clergy in Asia and was arrested in early May (China.Table reported). The Hong Kong cardinal is accused of violating security law by conspiring with foreign forces against the city’s national interests. The background for the accusation was Zen’s role as a trustee of the “612 Humanitarian Relief Fund,” which had raised money to finance legal assistance for accused members of Hong Kong’s opposition protest movement (China.Table reported).

Zen is currently facing trial in Hong Kong along with five other defendants. In July, the EU Parliament called for the case against Zen and other supporters of the democracy movement to be dropped. rad

Tesla lowers prices in China. The US EV manufacturer announced this on its China page on Monday. The reason for the falling prices is the weaker demand on the Chinese car market. The reduction applies to all variants of Model 3 and Model Y in China, according to the configurator, the reduction will be between 5 percent and 10 percent. China.Table already reported two weeks ago about possible price drops at Tesla.

Last week, Tesla CEO Elon Musk also spoke about the fact that “a kind of recession” was underway in China and Europe. Accordingly, the planned increase in sales of 50 percent this year will probably be narrowly missed.

The entry-level price for the Model 3 with rear-wheel drive in China is now ¥265,900, which is equivalent to around €37,200. Previously, customers had to pay around €2,000 more for it. The basic version of the Model Y now also falls below the ¥300,000 mark. As a result, the model qualifies for the Chinese government’s EV subsidy.

However, analysts have been warning of an oversaturation of the Chinese car market for some time now. Overall, car sales declined in September – even sales of highly popular EVs have not risen as rapidly as in the previous months.

Tesla recently set a new record in China: In September, the US EV company sold 83,135 vehicles. The main reason for this is the increased capacity at the local Gigafactory in Shanghai (China.Table reported). As a result, waiting times for newly ordered vehicles became much shorter. Monday’s price reduction suggests a shrinking order backlog.

Tesla is currently the third-largest EV manufacturer in China after BYD and SAIC, and the only foreign supplier in the top 15 in China. rad

For the second time in one month, a delegation of the German Bundestag arrived in Taiwan. In addition to the current security and economic situation, the six members of the Human Rights Committee also want to get a picture of the human rights situation.

In light of the 20th Party Congress of the Communist Party of China and Xi Jinping’s repeated threat to take Taiwan by force, delegation leader Peter Heidt (FDP) said he and his colleagues would stand by Taiwan’s side. “From our point of view, Taiwan is at the center of the systems competition,” the liberal FDP politician said during a reception at the presidential office on Monday.

After a meeting with anti-death penalty activists on Sunday, however, Heidt did not refrain from criticizing President Tsai Ing-wen. The death penalty, which is still in place in Taiwan, was a deeply inhumane form of punishment, Heidt said. Since Tsai took office in 2016, a total of two death sentences have been carried out. Tsai herself had described the abolition of the death penalty as a universal goal in the past.

The Taiwan trip of the human rights committee had to be canceled in 2020 due to Covid. Instead, the deputies invited the Taiwanese representative in Germany to the parliament and exchanged views with ministers in Taipei via video link. The Chinese embassy had strongly criticized the meeting at that time. Beijing has so far remained silent on the current visit of the deputies.

In addition to delegation leader Heidt, Derya Tuerk-Nachbaur (SPD), Heike Engelhardt (SPD), Michael Brand (CDU/CSU), Dr. Carsten Brodesser (CDU/CSU) and Boris Mijatović (Bündnis 90/Die Grünen) are also part of the delegation. On Tuesday evening, the MPs will fly on to Japan. An originally planned side trip to Hong Kong had to be canceled. David Demes

German Chancellor Olaf Scholz will not spend the night in the People’s Republic during his visit to China in early November. The trip to the People’s Republic will be “very short,” effectively a “day trip,” government spokesman Steffen Hebestreit said in Berlin on Monday. “There is no overnight stay planned in China.” He acknowledged that planning the visit was “very complicated” because of the Covid restrictions in place in China.

However, according to the plan, Scholz will be accompanied by a business delegation, as is customary on such trips. According to reports, VW CEO Oliver Blume will also join the delegation. Blume’s goal will be to keep the world’s largest car market open for VW since the group sells 40 percent of its cars there. Last year, however, VW sales in China fell by 4.5 percent. Experts attribute that to the global chip shortage and a lack of digital features in VW vehicles, which Chinese customers come to expect (China.Table reported).

Government spokesman Hebestreit rejected criticism of the trip. Recently, doubts about Scholz’s economic trip to China were raised: The chancellor must speak frankly in Beijing about China’s support for Putin, about the Taiwan conflict and about Xi Jinping’s disastrous zero-Covid policy, which left the country completely sealed off and internationally isolated since the outbreak of the pandemic (China.Table reported).

Since Scholz will visit China immediately after the CP Party Congress, the timing of the visit is also seen critically. Hebestreit pointed out that Scholz had already made his inaugural visit to Japan in April. Scholz considers it “absolutely necessary and right to make his inaugural visit to the Chinese president as well.”

Furthermore, the chancellor announced that he would also visit Vietnam and Singapore in the region in November. Scholz and China’s President Xi Jinping would then meet again at the G20 summit in Indonesia in mid-November, Hebestreit added. And the German-Chinese government consultations in Berlin are also scheduled for January. rad

The premier-designate of the People’s Republic of China and the Party leader for life already came very close in the past. A nearly 20-year-old photo shows Li Qiang and Xi Jinping side by side in front of the cliffs of Nanji Island. The island is located off the coast of Zhejiang, where the two politicians once spent parts of their careers together.

When Xi led the Party’s affairs in Zhejiang, Li initially represented CP interests in its economic center of Wenzhou. Later, Li served as general secretary of the provincial-level party committee for many years. And when Xi moved on to Shanghai a long time ago to prepare for his rise to the top of the state, Li Qiang had to be patient.

The CP’s powerful Organizing Department, which maneuvers its cadres from post to post so they can prove themselves for higher assignments nationwide, parked the now 63-year-old in Zhejiang for years. His rapid ascent, which culminated on Sunday with his appointment as number two on the Politburo Standing Committee, only became apparent after Xi Jinping was elected general secretary.

But even this post in an illustrious circle of 25 mostly male members over the past four decades would not have qualified him for the office of head of government. Because traditionally, promotions ultimately went to former vice premiers.

With Li’s appointment to the Politburo in 2017 and as party secretary in Shanghai, Xi paved the way for his disciple to join his side in the first place. However, Li cannot be officially appointed premier before next year, when the National People’s Congress convenes as the organ of the state. Officially, the Party and the state are still two different entities. In practice, however, the Party occupies all nerve cells of the state.

Since Sunday, there has now been speculation about the future sphere of influence of the future premier. His shortened career path without the stage of vice-premier means two things. First, Li Qiang lacks experience on the international stage, which is at least a challenge given China’s growing status in the world.

On the other hand, Li obviously has Xi Jinping to thank for the fact that he will soon be where everyone thinks he is now. This also means that he is dependent on the general secretary. “Li has had no special political achievement to back him up, so he is very clear that he owes his position to Xi. So whatever Xi tells him to do, he will implement it,” Willy Lam of the Jamestown Foundation in Washington told the British daily The Guardian.

While the still incumbent Premier Li Keqiang could count on the support of his now virtually irrelevant CP Youth League, Li Qiang has no support whatsoever from any notable faction in the Party’s power structure. This significantly reduces the likelihood that he will be able to emancipate himself from Xi Jinping under these circumstances.

The new Li brings other qualities that Xi needs. He proved this when he rigorously placed the megacity of Shanghai under lockdown in the spring. Against all odds, Li kept the city closed for months. Because of the large number of foreigners in Shanghai, who shared their bad, sometimes dramatic experiences with the whole world on social media, the pressure on Li was particularly high. But he apparently continued the instructions of the head of state, regardless of the consequences.

“Li has proven himself as a loyal enforcer of Xi’s zero-Covid policy,” says political scientist Chen Daoyin, a former professor at Shanghai University of Political Science and Law. However, some reports also say Li faltered when it came to the consistent enforcement of the lockdown. It is said that this is the reason why Vice Premier Sun Chunlan traveled from Beijing to Shanghai in the first place. How great the dissent between Beijing and Shanghai really was, is a matter of speculation. However, it is highly doubtful if Li would actually have been considered as premier if he had strongly called for a different policy.

During his time in Zhejiang, and later in Jiangsu and Shanghai, Li Qiang also earned a reputation as a doer who appeals to the interests of the middle class. In Zhejiang, he launched an initiative to help make the country’s smaller cities more attractive to entrepreneurs. Such approaches appeal to Xi. He wants to distribute income more evenly in China to avoid social unrest. So the economic development of small cities seems like a good idea. grz

Xu Shouben and Wang Weidong have been appointed as new vice presidents of the China Development Bank (CBD). The CDB is the country’s largest policy lender. Xu previously served as vice president of Industrial and Commercial Bank of China Ltd, and Wang worked as president of CDB’s Jiangsu branch.

Is something changing in your organization? Why not let us know at heads@table.media!

Autumn in Harbin: The colorful aesthetics of golden October shine in Zhaolin Park.

the speculations are over, let the speculations begin.

Now that, after months of guesswork, we finally know how the Politburo Standing Committee will go into the next five years, the game continues at the next level. After the who, the next question is how.

How will the Party’s closest power circle, which President Xi brilliantly assembled over ten years at the head of the CP, shape the country’s politics? Because the inner workings of the Party remain a mystery even to those who have spent years studying the country and its people, language and culture, the scope for precise political predictions become smaller.

Investors on Chinese stock exchanges, especially those in Hong Kong, apparently suspect that the idea of more market and openness is in for a bad time. The stock exchange prices of the tech sector collapsed because the composition of the Standing Committee suggests that the rough ride for companies like Alibaba will continue in the future, writes Joern Petring from Beijing.

But even those who do not want to multiply their money in Chinese financial hubs foresee bad things from a Committee that lacks balance and where members are primarily loyal rather than critical of their secretary general. Its ideological governance, reflected in the Committee’s selection, will likely trouble German business as well, notes Finn Mayer-Kuckuk.

Moreover: Where no one dares to disagree anymore and decisions are placed in the hands of a single individual, the probability of bad decisions increases. Given China’s importance for the global economy, peace in the world, or the fight against climate change, not just 1.4 billion Chinese would suffer as a result of wrong decisions, but the rest of the world as well. Where exactly the greatest risks lie is barely comprehensible to outsiders.

All is up for speculation.

The stock markets in China and Hong Kong were in for a rude awakening on Monday. Investors were clearly anything but happy with the composition of the new CP leadership, which had presented itself to the public the day before. Contrary to what business representatives had hoped for in advance, Xi Jinping’s seven-member Standing Committee is exclusively made up of loyal followers (China.Table reported). Not a single economic reformer made it onto the country’s most powerful committee.

While the leading index in Shanghai lost around two percent, prices on the Hong Kong stock exchange fell drastically by over six percent on Monday. This shows that international investors in particular, who have easier access to Hong Kong than to the markets of the People’s Republic, see the change of direction in Beijing as an alarm signal for future market development.

The shares of Chinese tech companies were hit particularly hard after they were already the target of regulators over the past two years and have since lost a considerable amount of value. Online retail giant Alibaba lost around ten percent on Monday. Internet group Tencent lost more than eleven percent.

But the economic figures published on Monday did not look too bad. According to official figures, the economy grew by 3.9 percent in the third quarter, which was stronger than analysts had expected. In the second quarter, growth was only 0.4 percent, mainly due to strict Covid restrictions.

Originally, the data should have been published last week. No reason was given for the delay. However, observers assumed that all attention was supposed to focus on the CP Congress (China.Table reported). Other economic data on Monday painted a mixed picture: While industrial production rose a substantial 6.3 percent in September, retail sales growth was slower than expected at 2.5 percent. The official urban unemployment rate also increased for the first time in four months, rising 0.2 percentage points to 5.5 percent.

Meanwhile, weak global demand further slowed China’s export growth. Exports in September grew by only 5.7 percent year-on-year in US dollar figures, China Customs reported on Monday. Exports already lost momentum in the previous month, growing only 7.1 percent. Imports also grew by only 0.3 percent in September, the same as the previous month. Exports performed only slightly better than experts had predicted, while imports were slightly worse. Therefore, the economic recovery remains on shaky ground.

Strict disease control will continue to be an economic driver. “There is no sign that China will lift its zero-Covid policy in the near future,” says economist Julian Evans-Pritchard of Capital Economics. He does not expect an end to ever-new lockdowns until 2024. “So we can expect continued significant disruptions to personal activity,” and thus a corresponding strain on growth. Economist Iris Pang of banking firm ING also believes that dealing with the pandemic will be critical for the foreseeable future. “Even if the Covid measures become more flexible, the lockdowns remain a major factor of uncertainty, especially against the backdrop of the housing crisis,” Pang says.

The situation on the real estate market remains critical indeed. Since the dragged-out bankruptcy of market leader Evergrande (China.Table reported), the industry has been unable to get on its feet, with prices continuing to drop. In the past, home construction has been the ace up the sleeve of China’s economic policymakers. Whenever they issued more mortgage loans, construction activity went up – and growth picked up.

But neither households nor real estate developers are currently in a position to take on the risks of new projects. Even the military-like orders to build more have failed to give the sector a boost, nor have abundant financial injections. Instead, state banks now buy up the properties to support prices. Since the confidence in perpetually rising prices has been lost, the bubble of the past years continues to shrink inexorably. Key sectors such as the steel industry also suffer as a result.

Analysts surveyed by Reuters, therefore, expect only 3.2 percent growth in the current year. That would be well below the target of around 5.5 percent originally set by the government in Beijing (China.Table reported). Particularly frustrating for the Party: The 50 economic stimulus programs it introduced in the spring had no significant effect, despite huge investments by the government. And youth unemployment also remains high, which probably poses the greatest potential for social unrest along with the situation on the real estate market. Joern Petring/rtr/fin

The 20th Party Congress is over. The Chinese leadership can finally get back to politics after months of wrestling over staffing issues and formulations. Surprises are to be expected, because the new team around Xi Jinping is now largely free of domestic political constraints. The profiles of the six members of the Politburo Standing Committee allow us to draw the first assumptions about the developments to come.

The German economy eagerly longs for signals of opening up to foreign trade and market liberalization. However, things do not look too bright in this regard. The most likely candidate for the office of premier, Li Qiang, is a lockdown fanatic. His destructive methods surrounding the lockdown of Shanghai were politically motivated and came at the expense of the economy and foreign trade (see today’s Profile).

Experts and observers, therefore, expect China to continue its course of repression, centralization and striving for autarky. The head of the China Research Institute Merics, Mikko Huotari, considers Xi to be a fighter, not a networker. The Party leader sees China’s rise as a series of battles, not as a cooperative project. Accordingly, he is preparing China for more conflicts in the future, which are supposed to the country as little as possible.

To achieve this, China must, among other things, reduce its dependence on the international economy: self-sufficiency above opening up, and more domestic value creation. The distrust toward Western countries and their representatives is now palpable everywhere in China. The domestic economy will be increasingly favored.

Likewise, further militarization is to be expected. The issue of security policy appeared more often in Xi Jinping’s speech than in previous Party Congress speeches, while the words “reform” and “market” were mentioned more rarely than before. Xi calls the excesses of capitalism “barbaric.” On Sunday, he did briefly talk up economic liberalization. In his detailed opening speech at the CP Congress, however, more of his true thoughts shone through. There, he called for “frugality” in terms of national interests and a “balance between development and security interests.” Xi is not an economic pragmatist, but a man on a historic quest to which businessmen have to submit. Now he has assembled the right politburo for his fight.

Does anyone still disagree with Xi? Probably not. Unchecked power increases the risk that even his worst ideas will be turned into reality with great consistency. If Taiwan is attacked, all optimistic forecasts for exchanges with China will suddenly cease to exist. From then on, interaction would be characterized by lasting hostility. Trade would come to a standstill, and the disaster for the German economy would be almost unimaginable.

If Xi is indeed so deep in his bubble that he sees the conquest of Taiwan as a promising venture, after which the Western countries will surely come back to his side, he would urgently need a corrector among his closest advisers. The same applies to all other issues. Does Xi realize the side effects of the endlessly drawn-out zero-Covid policy? Clearly, he believes it to be a good idea. However, the citizens and companies affected would beg to differ.

With a politburo of accomplices, the risk that Xi will lose his way increases dangerously. So far, he appears rational and stable. But throughout history, all autocrats have inevitably grown more and more detached from reality the longer no one has opposed them.

The increasing lack of transparency also damages international relations. Decision-making in the People’s Republic has always been shrouded, which is part of the DNA of communist systems. But while more insight had been possible in the past, the degree of secrecy and refusal to engage in dialogue is now almost limitless. The example of Hu Jintao shows how quickly wild and contradictory speculations sprout in the absence of credible explanations. Economic partners also increasingly feel left out.

The weakened position of economic expertise is also readily apparent in the new Politburo and its Standing Committee. The members of the inner circle may have very different academic and administrative backgrounds and also bring a wealth of experience in managing the Chinese economy, after all, they all held leadership positions in metropolises and provinces that have dimensions of individual European states. But there is actually precious little other systematic economic knowledge among the members of the Standing Committee.

Li Qiang at least took some courses in world economics parallel to his career at the Central Party School. But in essence, the members of the Standing Committee are all humanities scholars or technicians. Zhao studied philosophy, Wang: French, Cai: politics. At least two of them have a technical background: Ding Xuexiang is an engineer, Li Qiang is an industrial engineer.

In the last Standing Committee, Li Keqiang, who holds a Ph.D. in economics and law, held the top position, and Han Zheng, a second trained economist, held the role of first vice premier. Due to generational factors, many other members lacked a university education. In any case, economic interest was generally far more pronounced in the previous Standing Committee. With this Party Congress, Xi not only turned his back on the political architecture inherited from Deng Xiaoping, but also his concept of giving precedence to economic policy.

This raises the question of whether there is still the competence to promote provincial development and keep the state’s overall development on track. The current woes of the real estate market, for example, will require some very skillful interventions. Weakness in the consumer market could compound the problems caused by autarky aspirations and the mistakes of an autocrat. An ideology-driven re-centralization of the economy would cost a lot of dynamics.

Green Party politician Anton Hofreiter made his criticism clear on Monday, arguing that the German government must immediately stop the planned entry of the Chinese shipping company Cosco into the logistics group HHLA’s Tollerort container terminal in the Port of Hamburg. “Even the reduction of a Cosco stake to 24.9 percent in the operating company does not make the deal any better,” the Chairman of the European Affairs Committee in the Bundestag told Reuters.

Hofreiter referred to a possible compromise exclusively reported by China.Table on Monday: Under the new deal, Cosco would acquire only 24.9 percent of the shares – instead of 35 percent as previously planned. This would reduce Chinese influence, as shareholders only have a veto right above a 25 percent share.

But Hofreiter made it clear: The dangers are clear. “China is threatening that the Port of Hamburg or German companies will suffer disadvantages if the entry does not materialize.” It is the political pressure from Beijing that worries not only Hofreiter.

Green Party leader Omid Nouripour also stressed on Monday that the issue “must be discussed” at the cabinet meeting on Wednesday. Nouripour cited the halted gas deliveries from Russia as the reason. He said that it must now finally be understood that critical infrastructure cannot simply be sold to a country “that we all know is willing to exploit our dependency, including politically, without batting an eye.”

China researcher Mareike Ohlberg recognizes such patterns in Beijing’s behavior. Together with Clive Hamilton, the sinologist has conducted intensive research on Chinese investments in North America and Europe. The very title of their joint book leaves no doubt about their findings: “Hidden Hand: Exposing How the Chinese Communist Party is Reshaping the World.” Both Ohlberg and Hamilton conclude that supposedly purely economic decisions are often guided by political intentions directly from Beijing.

“Beijing asserts that it merely wants to promote trade by taking over ports, but the People’s Republic is pursuing a long-term plan to build strategic pressure,” Ohlberg writes. Under the term “yi shang bi zheng“, instrumentalization of domestic companies abroad is taking place. The aim is to exert pressure on the respective government. And indeed, China uses economic dependencies to demand political loyalties – also in Europe.

For example, in Greece, Cosco leased half of the container port in Piraeus for 35 years in October 2009 in the wake of the Greek financial crisis. A purely economic decision? Doubtful. Since then, the government in Athens repeatedly and noticeably adopted China’s position in EU decisions – be it out of pressure, favor, or simply out of inner conviction.

In any case, the case is clear for Anton Hofreiter. He demands that China return the port in Piraeus to Greece. Because since the purchase, he argues, the Greek government has “suddenly developed a strange sympathy for Chinese positions” in EU debates. “A commercial deal has turned into political influence. This is dangerous. The port of Piraeus must be sold again,” says the Chairman of the European Affairs Committee in the German Bundestag.

But there is an economic development that cannot be denied. Since Cosco also holds the majority of shares in Piraeus, the Chinese-operated terminal is said to generate considerable profits, made possible by increased efficiency and wage reductions. Thus, the ailing anchorage of Piraeus once again developed into one of the fastest-growing Mediterranean ports.

But the opposition in the German Bundestag apparently doesn’t want to hear about that either. Vice chairman of the conservative CDU/CSU parliamentary group Spahn told German public broadcaster ARD that a majority in the German Bundestag opposed the deal. “We are ready to meet in the Bundestag this week and decide.” Spahn called on the liberal FDP and Greens to oppose Chancellor Scholz in a vote. “We are ready for that.”

Spahn warned that the issue was whether Germany will become more dependent on a Chinese state-owned company. Anyone who had observed the Communist Party Congress in China could not possibly want this, he said. He also asked why a German company should not be allowed to invest in Chinese ports. In fact, however, there is no such restriction in China (China.Table reported). On the contrary, as China.Table learned from Hainan sources, HHLA and other Western port operators are even in talks about a stake in the port project in Haikou, where a new port is to be built for $1.5 billion.

But time is running out in the dispute over the Hamburg container port. A review period expires on October 31, by which time the German government could block the deal. However, if the deadline passes without objection, the sale may proceed.

And this could actually happen – at least according to government spokesman Steffen Hebestreit. On Monday, he said in Berlin that the issue would be dealt with in the federal cabinet “if it is decided to take action against a possible sale of shares.” However, “if it is said that it will be allowed to go through, then not.” A delicate detail: A few days after the deadline, Scholz will travel to China to meet Xi Jinping. It is hard to imagine that Scholz will bring Xi a no as a gift for the inaugural visit. At the EU summit on Friday, Scholz had already rejected any criticism of possible Chinese participation.

Simply sitting it out would be an extremely odd solution to the Hamburg port dispute. Because if Scholz were to be saved by the bell, it would once again dodge the fundamental decision on how to deal with the partner, rival or competitor China. This is a situation that Europe’s largest economic power can no longer afford.

Even almost three years after the outbreak of the Covid pandemic, the origin of the Sars-CoV-2 virus is still unclear. Does it have a natural origin, or did it escape from a laboratory in the Chinese metropolis of Wuhan by accident?

A new study claims to have found clear evidence that the virus did in fact originate from a laboratory. In the recent online pre-publication, a team of researchers led by German immunologist Valentin Bruttel concludes that Sars-CoV-2 is a deliberately genetically modified virus. The paper states that 99.9 percent of the virus originated in a laboratory.

According to Bruttel, who works at the University Hospital of Wuerzburg, the first abnormalities in the genome of Sars-CoV-2 were identified as early as the summer of 2021. He subsequently investigated these clues further with US colleagues Alex Washburn and Antonius VanDongen. Now the three researchers claim to have discovered a kind of “fingerprint” for deliberate manipulation in the genome of Sars-CoV-2. They believe this to be a regularly recurring pattern in the virus’s genome.

So far, the paper was only published as a so-called preprint, which means that it has not yet gone through a scientific peer review process.

In the scientific world, however, the thesis is met with rejection by many experts. The immunologist Kristian Andersen criticizes the work as “nonsense”, saying that the study is “so flawed that it would not even pass in a molecular biology kindergarten”, Andersen wrote on Twitter. His conclusion: In the genetic material of Sars-CoV-2, only “random noise” is recognizable.

Other researchers are also critical. The German virologist Friedemann Weber from the Institute of Virology at the University of Giessen expressed his skepticism in a detailed Twitter thread: In his opinion, a manipulation like the one demonstrated by Bruttel and Co. is possible, but far too complicated. rad

China and the Vatican reached an agreement. As was announced over the weekend, a secret agreement from 2018 was extended. In it, the Vatican allows the Chinese government to elect bishops on the Mainland which will then be approved by Rome. According to reports, the deal has been extended for two years.

“After appropriate consultation and assessment, the Holy See and the People’s Republic of China have agreed to extend for another two years the Provisional Agreement regarding the appointment of Bishops,” a Vatican press office statement said.

The agreement is intended to bring Catholics in China closer together. This is because Christians in the People’s Republic are divided between the official state-supported church and an underground movement loyal to Rome and the pope as the church’s supreme leader. According to estimates, China has a Catholic community of about ten million people.

Normally, the pope has the say in bishop appointments. Therefore, critics fear that China interferes in religion. They also complain that the agreement in no way improves the lives of Catholic Christians in the People’s Republic. On the contrary, members of the so-called underground church would be further marginalized as a result.

The agreement between China and the Vatican was signed in September 2018 and subsequently extended for the first time in October 2020. Since then, “the first six ‘clandestine’ bishops have also succeeded in being registered,” Cardinal Pietro Parolin, Vatican Secretary of State, explained in an interview with Vatican News.

According to observers, the extension of the agreement had been open for a long time due to the arrest of 90-year-old Cardinal Joseph Zen in Hong Kong. Zen is one of the highest-ranking Catholic clergy in Asia and was arrested in early May (China.Table reported). The Hong Kong cardinal is accused of violating security law by conspiring with foreign forces against the city’s national interests. The background for the accusation was Zen’s role as a trustee of the “612 Humanitarian Relief Fund,” which had raised money to finance legal assistance for accused members of Hong Kong’s opposition protest movement (China.Table reported).

Zen is currently facing trial in Hong Kong along with five other defendants. In July, the EU Parliament called for the case against Zen and other supporters of the democracy movement to be dropped. rad

Tesla lowers prices in China. The US EV manufacturer announced this on its China page on Monday. The reason for the falling prices is the weaker demand on the Chinese car market. The reduction applies to all variants of Model 3 and Model Y in China, according to the configurator, the reduction will be between 5 percent and 10 percent. China.Table already reported two weeks ago about possible price drops at Tesla.

Last week, Tesla CEO Elon Musk also spoke about the fact that “a kind of recession” was underway in China and Europe. Accordingly, the planned increase in sales of 50 percent this year will probably be narrowly missed.

The entry-level price for the Model 3 with rear-wheel drive in China is now ¥265,900, which is equivalent to around €37,200. Previously, customers had to pay around €2,000 more for it. The basic version of the Model Y now also falls below the ¥300,000 mark. As a result, the model qualifies for the Chinese government’s EV subsidy.

However, analysts have been warning of an oversaturation of the Chinese car market for some time now. Overall, car sales declined in September – even sales of highly popular EVs have not risen as rapidly as in the previous months.

Tesla recently set a new record in China: In September, the US EV company sold 83,135 vehicles. The main reason for this is the increased capacity at the local Gigafactory in Shanghai (China.Table reported). As a result, waiting times for newly ordered vehicles became much shorter. Monday’s price reduction suggests a shrinking order backlog.

Tesla is currently the third-largest EV manufacturer in China after BYD and SAIC, and the only foreign supplier in the top 15 in China. rad

For the second time in one month, a delegation of the German Bundestag arrived in Taiwan. In addition to the current security and economic situation, the six members of the Human Rights Committee also want to get a picture of the human rights situation.

In light of the 20th Party Congress of the Communist Party of China and Xi Jinping’s repeated threat to take Taiwan by force, delegation leader Peter Heidt (FDP) said he and his colleagues would stand by Taiwan’s side. “From our point of view, Taiwan is at the center of the systems competition,” the liberal FDP politician said during a reception at the presidential office on Monday.

After a meeting with anti-death penalty activists on Sunday, however, Heidt did not refrain from criticizing President Tsai Ing-wen. The death penalty, which is still in place in Taiwan, was a deeply inhumane form of punishment, Heidt said. Since Tsai took office in 2016, a total of two death sentences have been carried out. Tsai herself had described the abolition of the death penalty as a universal goal in the past.

The Taiwan trip of the human rights committee had to be canceled in 2020 due to Covid. Instead, the deputies invited the Taiwanese representative in Germany to the parliament and exchanged views with ministers in Taipei via video link. The Chinese embassy had strongly criticized the meeting at that time. Beijing has so far remained silent on the current visit of the deputies.

In addition to delegation leader Heidt, Derya Tuerk-Nachbaur (SPD), Heike Engelhardt (SPD), Michael Brand (CDU/CSU), Dr. Carsten Brodesser (CDU/CSU) and Boris Mijatović (Bündnis 90/Die Grünen) are also part of the delegation. On Tuesday evening, the MPs will fly on to Japan. An originally planned side trip to Hong Kong had to be canceled. David Demes

German Chancellor Olaf Scholz will not spend the night in the People’s Republic during his visit to China in early November. The trip to the People’s Republic will be “very short,” effectively a “day trip,” government spokesman Steffen Hebestreit said in Berlin on Monday. “There is no overnight stay planned in China.” He acknowledged that planning the visit was “very complicated” because of the Covid restrictions in place in China.

However, according to the plan, Scholz will be accompanied by a business delegation, as is customary on such trips. According to reports, VW CEO Oliver Blume will also join the delegation. Blume’s goal will be to keep the world’s largest car market open for VW since the group sells 40 percent of its cars there. Last year, however, VW sales in China fell by 4.5 percent. Experts attribute that to the global chip shortage and a lack of digital features in VW vehicles, which Chinese customers come to expect (China.Table reported).

Government spokesman Hebestreit rejected criticism of the trip. Recently, doubts about Scholz’s economic trip to China were raised: The chancellor must speak frankly in Beijing about China’s support for Putin, about the Taiwan conflict and about Xi Jinping’s disastrous zero-Covid policy, which left the country completely sealed off and internationally isolated since the outbreak of the pandemic (China.Table reported).

Since Scholz will visit China immediately after the CP Party Congress, the timing of the visit is also seen critically. Hebestreit pointed out that Scholz had already made his inaugural visit to Japan in April. Scholz considers it “absolutely necessary and right to make his inaugural visit to the Chinese president as well.”

Furthermore, the chancellor announced that he would also visit Vietnam and Singapore in the region in November. Scholz and China’s President Xi Jinping would then meet again at the G20 summit in Indonesia in mid-November, Hebestreit added. And the German-Chinese government consultations in Berlin are also scheduled for January. rad

The premier-designate of the People’s Republic of China and the Party leader for life already came very close in the past. A nearly 20-year-old photo shows Li Qiang and Xi Jinping side by side in front of the cliffs of Nanji Island. The island is located off the coast of Zhejiang, where the two politicians once spent parts of their careers together.

When Xi led the Party’s affairs in Zhejiang, Li initially represented CP interests in its economic center of Wenzhou. Later, Li served as general secretary of the provincial-level party committee for many years. And when Xi moved on to Shanghai a long time ago to prepare for his rise to the top of the state, Li Qiang had to be patient.

The CP’s powerful Organizing Department, which maneuvers its cadres from post to post so they can prove themselves for higher assignments nationwide, parked the now 63-year-old in Zhejiang for years. His rapid ascent, which culminated on Sunday with his appointment as number two on the Politburo Standing Committee, only became apparent after Xi Jinping was elected general secretary.

But even this post in an illustrious circle of 25 mostly male members over the past four decades would not have qualified him for the office of head of government. Because traditionally, promotions ultimately went to former vice premiers.

With Li’s appointment to the Politburo in 2017 and as party secretary in Shanghai, Xi paved the way for his disciple to join his side in the first place. However, Li cannot be officially appointed premier before next year, when the National People’s Congress convenes as the organ of the state. Officially, the Party and the state are still two different entities. In practice, however, the Party occupies all nerve cells of the state.

Since Sunday, there has now been speculation about the future sphere of influence of the future premier. His shortened career path without the stage of vice-premier means two things. First, Li Qiang lacks experience on the international stage, which is at least a challenge given China’s growing status in the world.

On the other hand, Li obviously has Xi Jinping to thank for the fact that he will soon be where everyone thinks he is now. This also means that he is dependent on the general secretary. “Li has had no special political achievement to back him up, so he is very clear that he owes his position to Xi. So whatever Xi tells him to do, he will implement it,” Willy Lam of the Jamestown Foundation in Washington told the British daily The Guardian.

While the still incumbent Premier Li Keqiang could count on the support of his now virtually irrelevant CP Youth League, Li Qiang has no support whatsoever from any notable faction in the Party’s power structure. This significantly reduces the likelihood that he will be able to emancipate himself from Xi Jinping under these circumstances.

The new Li brings other qualities that Xi needs. He proved this when he rigorously placed the megacity of Shanghai under lockdown in the spring. Against all odds, Li kept the city closed for months. Because of the large number of foreigners in Shanghai, who shared their bad, sometimes dramatic experiences with the whole world on social media, the pressure on Li was particularly high. But he apparently continued the instructions of the head of state, regardless of the consequences.

“Li has proven himself as a loyal enforcer of Xi’s zero-Covid policy,” says political scientist Chen Daoyin, a former professor at Shanghai University of Political Science and Law. However, some reports also say Li faltered when it came to the consistent enforcement of the lockdown. It is said that this is the reason why Vice Premier Sun Chunlan traveled from Beijing to Shanghai in the first place. How great the dissent between Beijing and Shanghai really was, is a matter of speculation. However, it is highly doubtful if Li would actually have been considered as premier if he had strongly called for a different policy.

During his time in Zhejiang, and later in Jiangsu and Shanghai, Li Qiang also earned a reputation as a doer who appeals to the interests of the middle class. In Zhejiang, he launched an initiative to help make the country’s smaller cities more attractive to entrepreneurs. Such approaches appeal to Xi. He wants to distribute income more evenly in China to avoid social unrest. So the economic development of small cities seems like a good idea. grz

Xu Shouben and Wang Weidong have been appointed as new vice presidents of the China Development Bank (CBD). The CDB is the country’s largest policy lender. Xu previously served as vice president of Industrial and Commercial Bank of China Ltd, and Wang worked as president of CDB’s Jiangsu branch.

Is something changing in your organization? Why not let us know at heads@table.media!

Autumn in Harbin: The colorful aesthetics of golden October shine in Zhaolin Park.