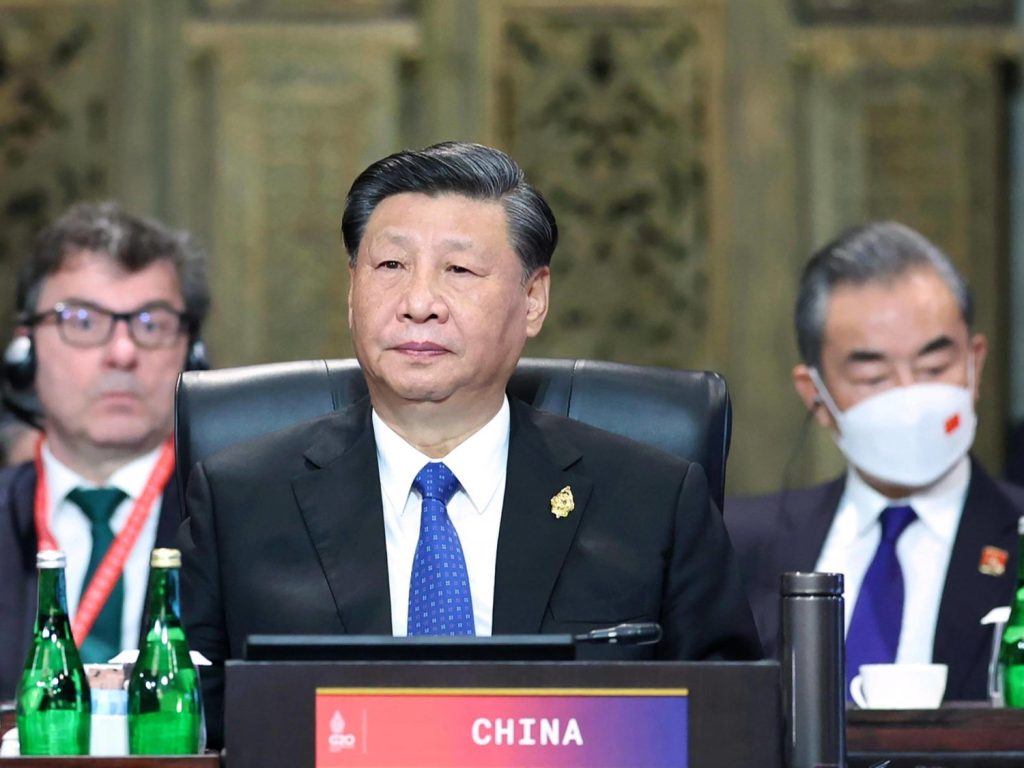

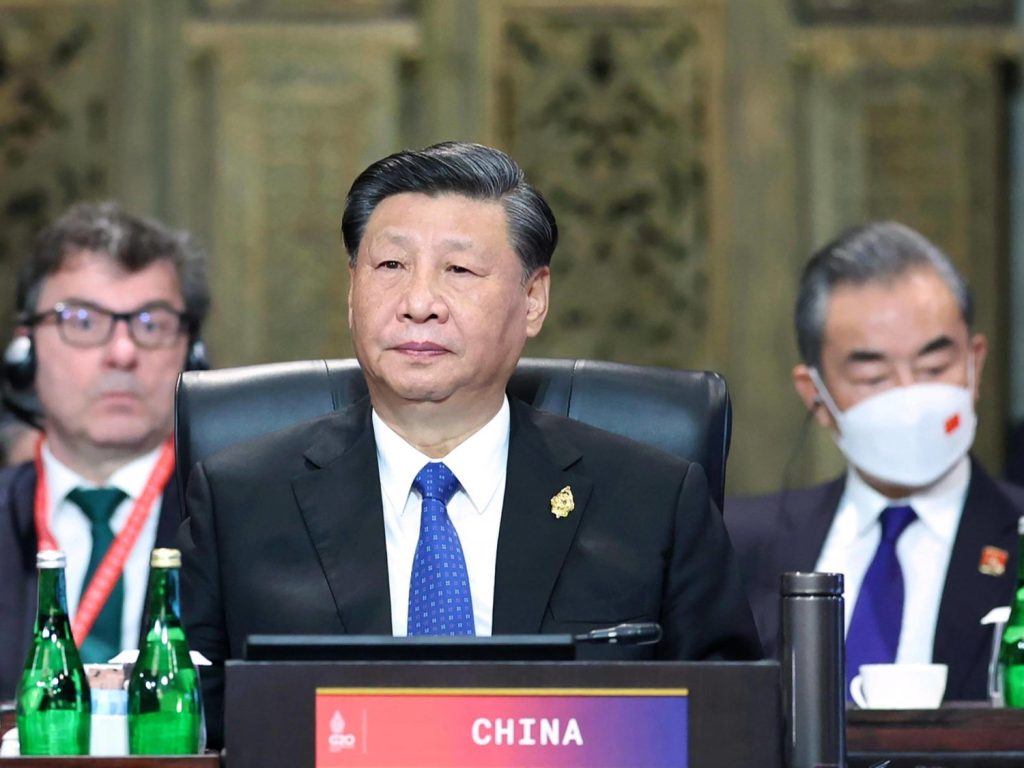

Xi Jinping’s schedule at the G20 meeting in Bali was ambitious. Yesterday alone, he met with the leaders of Australia, France, the Netherlands, Spain, and Italy for bilateral talks. As Michael Radunski writes in his article on the summit, China’s president clearly wants to return to the pre-pandemic days. By the beginning of 2020, Xi had visited so many countries in such a short time that he eclipsed every other Chinese head of state before him. He even paid a visit to small island nations like Fiji. Party documents say that Xi believes a “period of strategic opportunism” has dawned. He must make up more diplomatic ground than ever before to achieve his foreign policy goals. In doing so, he is also relying on compromise instead of confrontation.

The biggest step was the final declaration of the G20 summit, which now states that “most members strongly condemned the war in Ukraine.” Without Xi Jinping’s approval, such a formulation would not have been possible – until now, China’s diplomats and the state media were forbidden to use the word “war” in this context. Instead, they spoke of a “special military operation” in line with Putin. The change of direction indicates that Beijing is slowly moving away from its shoulder-to-shoulder relationship with Moscow – albeit in small steps.

Slowly, the long-dreaded social credit system is being addressed, which was more or less put on hold due to the Covid pandemic in China. Several Chinese authorities have submitted a joint draft of a law that is intended to link and bundle the previously differently weighted points systems. With a centralized “Credit Reporting System” as well as “Unified Social Credit Codes,” the door would indeed be opened to total surveillance. In the draft, however, much lies in a sorry state, analyzes Finn Mayer Kuckuk. A well-thought-out law that can be implemented unambiguously and uniformly looks different.

Australia’s Anthony Albanese, France’s Emmanuel Macron, Marc Rutte of the Netherlands, then Spain’s Pedro Sánchez, and finally Italy’s Giorgia Meloni. Not to mention US President Joe Biden. It is a small glimpse into Xi Jinping’s schedule of talks at the G20 summit in Bali. It quickly becomes clear: China’s president is back on the diplomatic stage – and with vigor. His goal: to regain diplomatic ground. Cooperation instead of confrontation.

In return, Xi seems willing to make compromises. This was most evident in the negotiations on the joint G20 final declaration. Many member states wanted to condemn Russia’s war of aggression against Ukraine. But with Russia and China in the room, the chances of such a declaration were extremely poor. Until the very end, diplomats implied that Beijing was standing unwaveringly by Moscow’s side in the preliminary talks for the summit, agreeing on a joint declaration almost impossible. The summit is still in progress. But the word from Bali is that difficult negotiations have succeeded in finding a text that everyone can sign.

EU Council President Charles Michel expressed his relief on Tuesday. The agreement was a great success. This summit was one of the most difficult in the history of the G20, Michel said. One likes to believe him.

The agreed draft of a joint G20 statement now includes a pointed way of condemning Russia’s aggression but giving skeptical members such as China a bit of leeway. “Most members strongly condemn the war in Ukraine,” the relevant draft reads. It also calls on Moscow to cease hostilities and withdraw its troops from Ukraine immediately.

Not only the clarity of the statement is remarkable but also the choice of words: war in Ukraine – instead of “special military operation” as given by Russia’s President Vladimir Putin. So far, China’s diplomats have stuck to this and generally do not refer to the campaign as an invasion either (China.Table reported). Russia’s stance is reflected in the document as follows: “There were other views and different assessments of the situation and sanctions.”

But how was it possible to agree on such a formulation in the first place? Not without the approval of Xi Jinping. China is Russia’s most important ally. Time and again, Beijing has referred to Russia’s “legitimate security interests.” Instead of criticizing Putin’s incursion, Beijing identified the US and NATO as the real arsonists (China.Table reported).

But China is now moving away from Russia – very slowly, in tiny steps. But diplomacy has always been a laborious business. Sometimes even minimal changes can be considered a success.

Even before the G20 summit, there were initial signs that the boundless friendship between China and Russia is no longer quite so boundless. According to research by the British newspaper “Financial Times,” Beijing is not well disposed toward Russia. “Putin didn’t tell Xi the truth,” the paper quotes a Chinese official as saying. “If he had told us, we wouldn’t have been in such an awkward position.” After all, “We had more than 6,000 Chinese nationals living in Ukraine and some of them died during the evacuation, but we can’t make that public.”

Added to this are Russia’s military defeats on the battlefields of Ukraine and the surprisingly united stance of the West. All of this should have given Xi food for thought.

Last but not least, there were Putin’s nuclear threats. On the one hand, China could no longer nonchalantly ignore the nuclear saber-rattling. On the other hand, it also offers Xi a way out of his diplomatic aberration. Russian use of nuclear weapons would deeply hurt China’s own interests: This would be tantamount to opening Pandora’s box – with direct consequences in China’s immediate neighborhood. There are two nuclear powers: Pakistan to the west, and North Korea to the east. Both are officially considered China’s allies, but it is sometimes difficult for Beijing to keep them under control.

That is why the Western camp should not get too excited: China’s diplomats will want to sell Xi Jinping’s statements in Bali and his agreement to the joint G20 final declaration as a step toward the West. But Xi is acting in China’s interests.

It is against this background that Xi Jinping’s daily schedule in Bali must be evaluated. On Tuesday alone, he met with the heads of state of Australia, France, the Netherlands, Spain, and Italy. Again, it is interesting to note how skillfully Xi proceeded: Canada’s Justin Trudeau, who has recently taken a hard line toward China, did not meet with Xi as well as the two EU representatives Ursula von der Leyen or Charles Michel.

What seems like a diplomatic marathon is actually more like the return of the diplomatic jack-of-all-trades from Zhongnanhai. One should not forget: In the three years prior to the Covid pandemic Xi had visited more than 40 countries – a record by which Xi eclipsed all his predecessors. China’s president even took the time to visit countries such as Fiji (881,000 inhabitants), the Maldives (345,000 inhabitants), and Trinidad and Tobago (1.3 million inhabitants).

The reason: Xi Jinping sees the arrival of a “period of strategic opportunity.” But to achieve his foreign policy goals internationally, Xi must act. Before the pandemic, he succeeded in convincing many countries – sometimes with diplomatic charm, sometimes with economic incentives. Or simply with political pressure. It seems that China’s president wants to pick up where he left off.

The extent to which Xi Jinping’s diplomatic charm seems to be catching on in Bali is demonstrated by the new British Prime Minister Rishi Sunak. On Tuesday, he announced that he would not classify China as a “threat” to national security, as his predecessor Liz Truss announced just a few weeks ago. Instead, he will continue to view the People’s Republic as a “rival.” And Sunak also emphasized in Bali how much he hopes for an opportunity to speak with Xi in person.

A number of Chinese authorities have published their joint draft of a new social credit law on Weibo (an unofficial translation can be found here). This way, the state is gathering feedback from interested members of the public. Thus, it is only an initial trial balloon. The text may still change considerably before it is passed by the National People’s Congress.

Nevertheless, the draft is worthy of attention. It amounts to linking and bundling various points systems that have emerged in parallel in recent years. The social credit system has not yet evolved into dystopian total surveillance because there was no centralized point collection agency. With the draft, however, the legislature is now expected to move in the direction of centralized data management. Article 71 states the goal of a “credit reporting system that covers the entire society.”

According to the preamble, however, the object of the law is not primarily the citizen – but the authorities. The “credibility of government action” is to be strengthened by the system, followed immediately by “creditworthiness in economic transactions” and then “social creditworthiness.” All of this is supposed to “stabilize the socialist market economy” and punish unreliable behavior. Justice is also mentioned. In the future, there are to be points for judges, as detailed in Chapter V of the draft.

At the outset, there is much talk of coordination, which can be understood as a possible end of the chaos of the various parallel systems. Accordingly, central administration is to lie with two authorities of ministerial rank: the National Development and Reform Commission NDRC and the central bank PBoC (Article 4). All authorities are required to collect social credit data in the areas they manage. They are then to share it among relevant agencies and find applications for the information (Article 5).

However, even if the topic of standardization is the starting point, in the further course of the draft text the handwriting of many different players can be recognized. Chapters two to five of the draft deal with “establishing creditworthiness,” and here it seems that many cooks had something to contribute.

Some of the text paragraphs are from regional and industry social credit systems. There are many truisms that seem out of place in national law. On the subject of the media, for example, Article 50 states, “We want to encourage the implementation of activities to promote creditworthiness so that various types of mass media activities unfold, providing guidance to the public on examples of creditworthiness and examples of lack of creditworthiness so that honesty becomes a conscious goal of society as a whole.”

The same phrases about creditworthiness are repeated over and over again in Articles 12 to 57. A concise law written by skilled lawyers looks different. In part, the draft is too general in its moral exhortations, and in part, it goes deeply into the implementation of the law. The following social sectors and occupational groups are mentioned in detail:

In short, all areas of life are covered and their institutions are to come up with ways to collect minus and plus points for their players. The ordinary citizen is not explicitly mentioned. But since all sectors of the economy are listed, a majority of the population will be part of the assessment, at least in their professional role.

The data are to be explicitly collected in a personalized manner. There are to be database keys for the cross-sectoral identification of individuals (Articles 58 and 59). A “uniform social credit number” is to be introduced for this purpose. Shortly thereafter, however, it is stated that the existing citizen number should also fill this role. Where no citizen number exists, the relevant authorities are to assign one. All institutions are also to be identified by their social credit number.

Explicitly prohibited (Article 62) are excessive inquiries into how the score came about, use of the data beyond the social credit system, and theft and manipulation of the data. The information is to be “stored for the long term.” They are used for “public assessment of the trustworthiness” of the institutions and individuals assessed.

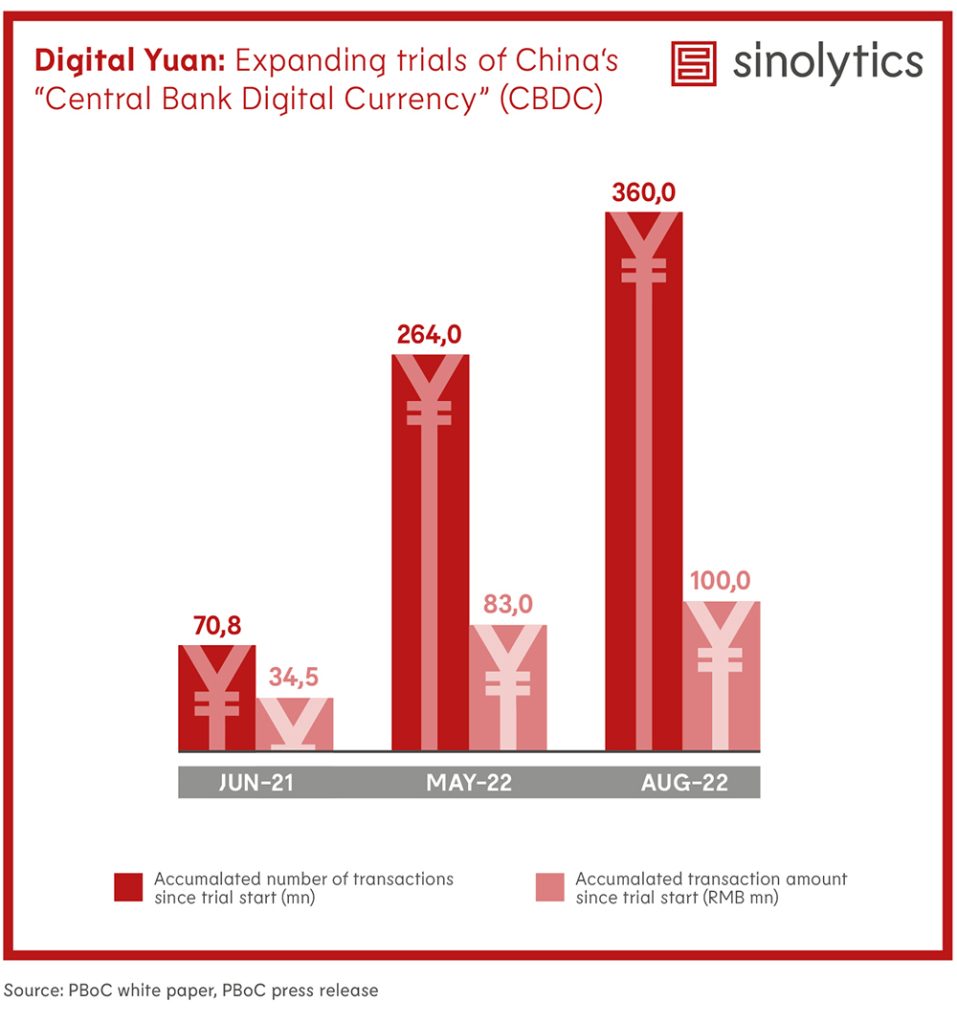

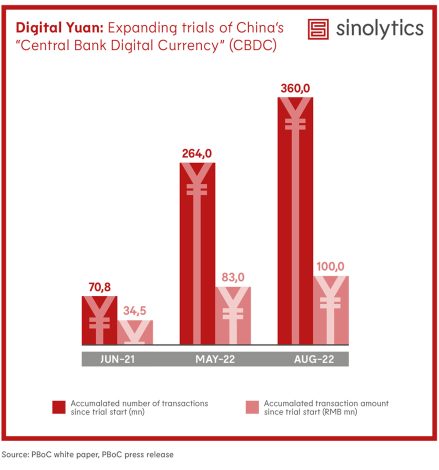

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Amid a sharp rise in Covid cases protests have erupted in Guangzhou. On Monday night, crowds broke through Covid barriers in the city and marched through the streets, according to widely shared videos on Twitter. In some of them, chaotic scenes from late Monday night of people storming through the streets of the city’s Haizhou district and protesting with workers dressed in white protective suits can be seen. Reuters could not independently verify the videos.

According to a report in the business magazine “Caixin,” the background to the riots was anger among migrant workers from the textile industry who had been released from quarantine but were not allowed into their rented apartments because of the significant Covid outbreak in the city.

The number of new local daily infections broke the 5,000 mark for the first time in Guangzhou this week, fueling speculation of an expansion of local lockdowns. The southern metropolis is currently the country’s largest Covid hotspot. On Tuesday morning, several hashtags in the Guangzhou area on the subject of “unrest” were deleted from the microblog platform Weibo. Neither the Guangzhou municipal government nor the Guangdong provincial police could initially be reached for comment.

Chinese authorities had reported 17,772 new infections for the past 24 hours on Tuesday, 1700 more than the previous day and the most since April, just before the Shanghai lockdown. Despite this, many cities are currently tending to scale back Covid measures, such as routine testing of their residents. At the end of last week, the government announced slight relaxations of the strict Covid measures, including shorter quarantines (China.Table reported). rtr/ck

China’s economic recovery is losing momentum due to the recent Covid outbreaks. Fu Linghui, spokesman for the National Bureau of Statistics, acknowledged as much on Tuesday at a press conference in Beijing. The bureau said the country’s retailers reported a drop in sales in October for the first time in five months – down 0.5 percent from a year earlier.

The monthly figures are weaker than expected by experts. Economists polled by Reuters had expected growth of 1.0 percent in the retail sector. There was also negative news from the industry: production grew by 5.0 percent, not only slower than predicted – but also significantly weaker than September with 6.3 percent. China will thus boost demand and consolidate the foundation of its economic recovery, Fu said.

China is currently facing the biggest Covid wave since the spring. A whole series of smaller indicators are therefore pointing in a negative direction. In October and the first 10 days of November, the average number of subway passengers in 18 major Chinese cities fell 19 percent year-on-year, UBS economist Wang Tao wrote in the business magazine Caixin on Tuesday. Property sales went down even further, falling 18 percent in October and 23 percent in the first 10 days of November compared with the same period last year. In response, the government just decided to provide aid to the real estate sector (China.Table reported).

The index for total truckload traffic was down 26 percent from the same period last year, Wang said. Overall, the UBS Composite Activity Index weakened to minus 8.5 percent year-over-year in October and to minus 12 percent year-over-year in early November. ck/rtr

Warren Buffett’s Berkshire Hathaway investment fund has taken a stake of about $5 billion in chipmaker Taiwan Semiconductor Manufacturing (TSMC). This was reported by Bloomberg on Tuesday. According to a report filed with the US Securities and Exchange Commission (SEC), the Omaha-based conglomerate acquired about 60 million American depositary receipts from TSMC in the three months through September. According to the news, shares of the Taiwanese chipmaker rose as much as 9.4 percent, the biggest intraday increase in more than two years.

The legendary 92-year-old investor had long shied away from tech stocks, saying he didn’t want to invest in companies he didn’t fully understand. However, Buffett relaxed this credo in recent years. Berkshire, for example, now also holds just under six percent of Apple shares with a value of around $140 billion.

In addition to TSMC, Buffett’s company bought into US bank Jefferies and building materials manufacturer Louisiana-Pacific Corp in the past quarter. At the same time, he increased his stake in the oil company Occidental Petroleum, which he now owns to just under a third. Berkshire has reduced its exposure to financial stocks by around $4.7 billion. In the period under review, for example, it reduced its holdings in the US financial companies Bancorp and BNY Mellon. fpe

EU member states are expected to adopt their position on the anti-coercion instrument on Thursday, paving the way for final negotiations with the European Parliament. The latest compromise proposal of the Czech Council Presidency has met with approval at the expert level and is now to be adopted by the EU ambassadors, according to the draft decision published by “Contexte.”

The EU Commission proposed the new anti-coercion instrument last December to enable the EU as a whole to better defend itself against coercive economic measures by third countries. The model case is China’s de facto trade embargo against Lithuania (China.Table reported) after Taiwan was allowed to open an official representation in Vilnius called “Taiwan.” If such a dispute cannot be settled amicably, the EU can impose punitive tariffs or import restrictions and exclude companies from the country in question from public tenders.

During the discussions in the Council, several member states, including Germany, had insisted on being more involved in the decisions given their foreign policy significance. Whether the actions of a third country constitute coercive measures under the new regulation, the Czechs’ proposal now provides for the Council itself to determine. The Commission wanted to reserve this competence for itself. As before, decisions on countermeasures would be taken on the basis of a proposal from the Commission under the comitology procedure.

In the European Parliament, the Council’s amendments are meeting with resistance. “The decision-making procedure will be the major sticking point in the negotiations,” it says. It is unacceptable that the Council claims sole decision-making authority in a communitarian policy area such as trade. The member states wanted to impose that they could decide without the involvement of the Commission and the European Parliament whether China, for example, was exercising economic coercion. In doing so, they made themselves the target of Beijing’s massive influence. It is not yet clear when the trilogue negotiations will begin. tho

“The job can sometimes kill your passion,” admits Kevin Straßmeir. At least that was what he feared before his first internship in the motorcycle sector. But after just two weeks, the Augsburg native was sure: “It definitely has to be the motorcycle industry.”

Today, Straßmeir is Director and General Manager of the Austrian motorcycle manufacturer KTM in China. He discovered his love for machines at 14 when he rode a moped around the farm for the first time while on vacation in the countryside. His motorcycle license at 18 was followed by motorcycle trips through Europe and as far as Istanbul. While studying for a degree in business administration and later media informatics, he left Europe for Shanghai for the first time – lured by the economic opportunities promised by booming China. Once he arrived, he was determined to spend more time in Asia.

During the second study visit to Singapore, the motorcycle was also part of the trip. The return travel, starting in Nepal, took him on his two-wheeler through Pakistan and Xinjiang to Kazakhstan, Russia, and the Baltic States, and finally back to Germany.

After a year of Chinese language lessons in Beijing with the DAAD’s “Language and Practice” program, he finally entered the world of motorized two-wheelers professionally in 2014: first as an intern at BMW Motorcycle in Beijing, then as a sales assistant for KTM. Straßmeir coordinated the cooperation with the local sales partners in East Asia from the very beginning, first and foremost with the motorcycle and quad specialist CFMOTO from Hangzhou. Relations with the Chinese partner went well, and in 2018 a joint venture called CFMOTO-KTMR2R was founded. Since 2020, Straßmeir has also acted as General Manager. In the meantime, there is a joint factory, where, starting in November of this year, the two-cylinder KTM 790 Duke machine will also be produced in China for the global market for the first time.

Addressing the issue of technology transfer to the Chinese partner, Straßmeir is pragmatic. “If you decide to go to market in China and source components locally, then you accept that you will reveal a lot.” With a business strategy designed for technology leadership, you usually only have a lead of three, four, or five years at most before the technology is obsolete, he says. So that you have to share the technology with Chinese partners no longer plays a significant role. To date, Straßmeir is the only German-speaking KTM employee permanently stationed in China.

In general, Straßmeir remains optimistic about the Chinese motorcycle market. Even if there are a few hurdles, for example, the ban on gasoline-powered motorcycles in many major Chinese cities, Straßmeir believes there are initial signs that the legal situation could change significantly in his favor. In any case, he has his own goal firmly in sight: By the end of 2024, his tenth anniversary at KTM, he wants the company’s sales figures in China to have increased tenfold. Clemens Ruben

Theresa Kleinmann changed positions at Festo China. She is now responsible for Global Portfolio Development. Kleinmann has been working for the Esslingen-based manufacturer of control and automation technology in Shanghai for two years. Previously, she was Head of Sales Analytics there.

Timo Tianhao Herrmann took over the position of Lead Project Manager Europe Business at Nio in November. The former Porsche manager, who trained in Cologne and Lund, will help shape the Chinese EV maker’s expansion into Europe. He will be based in Shanghai.

Is something changing in your organization? Why not send a note for our staff section to heads@table.media!

Uncomfortable: Over the weekend, the first snowfalls of the beginning winter fell over parts of China’s northeastern province of Jilin. Here, a food delivery man rolls over the slippery streets of Changchun city, his hands protected by giant gloves.

Xi Jinping’s schedule at the G20 meeting in Bali was ambitious. Yesterday alone, he met with the leaders of Australia, France, the Netherlands, Spain, and Italy for bilateral talks. As Michael Radunski writes in his article on the summit, China’s president clearly wants to return to the pre-pandemic days. By the beginning of 2020, Xi had visited so many countries in such a short time that he eclipsed every other Chinese head of state before him. He even paid a visit to small island nations like Fiji. Party documents say that Xi believes a “period of strategic opportunism” has dawned. He must make up more diplomatic ground than ever before to achieve his foreign policy goals. In doing so, he is also relying on compromise instead of confrontation.

The biggest step was the final declaration of the G20 summit, which now states that “most members strongly condemned the war in Ukraine.” Without Xi Jinping’s approval, such a formulation would not have been possible – until now, China’s diplomats and the state media were forbidden to use the word “war” in this context. Instead, they spoke of a “special military operation” in line with Putin. The change of direction indicates that Beijing is slowly moving away from its shoulder-to-shoulder relationship with Moscow – albeit in small steps.

Slowly, the long-dreaded social credit system is being addressed, which was more or less put on hold due to the Covid pandemic in China. Several Chinese authorities have submitted a joint draft of a law that is intended to link and bundle the previously differently weighted points systems. With a centralized “Credit Reporting System” as well as “Unified Social Credit Codes,” the door would indeed be opened to total surveillance. In the draft, however, much lies in a sorry state, analyzes Finn Mayer Kuckuk. A well-thought-out law that can be implemented unambiguously and uniformly looks different.

Australia’s Anthony Albanese, France’s Emmanuel Macron, Marc Rutte of the Netherlands, then Spain’s Pedro Sánchez, and finally Italy’s Giorgia Meloni. Not to mention US President Joe Biden. It is a small glimpse into Xi Jinping’s schedule of talks at the G20 summit in Bali. It quickly becomes clear: China’s president is back on the diplomatic stage – and with vigor. His goal: to regain diplomatic ground. Cooperation instead of confrontation.

In return, Xi seems willing to make compromises. This was most evident in the negotiations on the joint G20 final declaration. Many member states wanted to condemn Russia’s war of aggression against Ukraine. But with Russia and China in the room, the chances of such a declaration were extremely poor. Until the very end, diplomats implied that Beijing was standing unwaveringly by Moscow’s side in the preliminary talks for the summit, agreeing on a joint declaration almost impossible. The summit is still in progress. But the word from Bali is that difficult negotiations have succeeded in finding a text that everyone can sign.

EU Council President Charles Michel expressed his relief on Tuesday. The agreement was a great success. This summit was one of the most difficult in the history of the G20, Michel said. One likes to believe him.

The agreed draft of a joint G20 statement now includes a pointed way of condemning Russia’s aggression but giving skeptical members such as China a bit of leeway. “Most members strongly condemn the war in Ukraine,” the relevant draft reads. It also calls on Moscow to cease hostilities and withdraw its troops from Ukraine immediately.

Not only the clarity of the statement is remarkable but also the choice of words: war in Ukraine – instead of “special military operation” as given by Russia’s President Vladimir Putin. So far, China’s diplomats have stuck to this and generally do not refer to the campaign as an invasion either (China.Table reported). Russia’s stance is reflected in the document as follows: “There were other views and different assessments of the situation and sanctions.”

But how was it possible to agree on such a formulation in the first place? Not without the approval of Xi Jinping. China is Russia’s most important ally. Time and again, Beijing has referred to Russia’s “legitimate security interests.” Instead of criticizing Putin’s incursion, Beijing identified the US and NATO as the real arsonists (China.Table reported).

But China is now moving away from Russia – very slowly, in tiny steps. But diplomacy has always been a laborious business. Sometimes even minimal changes can be considered a success.

Even before the G20 summit, there were initial signs that the boundless friendship between China and Russia is no longer quite so boundless. According to research by the British newspaper “Financial Times,” Beijing is not well disposed toward Russia. “Putin didn’t tell Xi the truth,” the paper quotes a Chinese official as saying. “If he had told us, we wouldn’t have been in such an awkward position.” After all, “We had more than 6,000 Chinese nationals living in Ukraine and some of them died during the evacuation, but we can’t make that public.”

Added to this are Russia’s military defeats on the battlefields of Ukraine and the surprisingly united stance of the West. All of this should have given Xi food for thought.

Last but not least, there were Putin’s nuclear threats. On the one hand, China could no longer nonchalantly ignore the nuclear saber-rattling. On the other hand, it also offers Xi a way out of his diplomatic aberration. Russian use of nuclear weapons would deeply hurt China’s own interests: This would be tantamount to opening Pandora’s box – with direct consequences in China’s immediate neighborhood. There are two nuclear powers: Pakistan to the west, and North Korea to the east. Both are officially considered China’s allies, but it is sometimes difficult for Beijing to keep them under control.

That is why the Western camp should not get too excited: China’s diplomats will want to sell Xi Jinping’s statements in Bali and his agreement to the joint G20 final declaration as a step toward the West. But Xi is acting in China’s interests.

It is against this background that Xi Jinping’s daily schedule in Bali must be evaluated. On Tuesday alone, he met with the heads of state of Australia, France, the Netherlands, Spain, and Italy. Again, it is interesting to note how skillfully Xi proceeded: Canada’s Justin Trudeau, who has recently taken a hard line toward China, did not meet with Xi as well as the two EU representatives Ursula von der Leyen or Charles Michel.

What seems like a diplomatic marathon is actually more like the return of the diplomatic jack-of-all-trades from Zhongnanhai. One should not forget: In the three years prior to the Covid pandemic Xi had visited more than 40 countries – a record by which Xi eclipsed all his predecessors. China’s president even took the time to visit countries such as Fiji (881,000 inhabitants), the Maldives (345,000 inhabitants), and Trinidad and Tobago (1.3 million inhabitants).

The reason: Xi Jinping sees the arrival of a “period of strategic opportunity.” But to achieve his foreign policy goals internationally, Xi must act. Before the pandemic, he succeeded in convincing many countries – sometimes with diplomatic charm, sometimes with economic incentives. Or simply with political pressure. It seems that China’s president wants to pick up where he left off.

The extent to which Xi Jinping’s diplomatic charm seems to be catching on in Bali is demonstrated by the new British Prime Minister Rishi Sunak. On Tuesday, he announced that he would not classify China as a “threat” to national security, as his predecessor Liz Truss announced just a few weeks ago. Instead, he will continue to view the People’s Republic as a “rival.” And Sunak also emphasized in Bali how much he hopes for an opportunity to speak with Xi in person.

A number of Chinese authorities have published their joint draft of a new social credit law on Weibo (an unofficial translation can be found here). This way, the state is gathering feedback from interested members of the public. Thus, it is only an initial trial balloon. The text may still change considerably before it is passed by the National People’s Congress.

Nevertheless, the draft is worthy of attention. It amounts to linking and bundling various points systems that have emerged in parallel in recent years. The social credit system has not yet evolved into dystopian total surveillance because there was no centralized point collection agency. With the draft, however, the legislature is now expected to move in the direction of centralized data management. Article 71 states the goal of a “credit reporting system that covers the entire society.”

According to the preamble, however, the object of the law is not primarily the citizen – but the authorities. The “credibility of government action” is to be strengthened by the system, followed immediately by “creditworthiness in economic transactions” and then “social creditworthiness.” All of this is supposed to “stabilize the socialist market economy” and punish unreliable behavior. Justice is also mentioned. In the future, there are to be points for judges, as detailed in Chapter V of the draft.

At the outset, there is much talk of coordination, which can be understood as a possible end of the chaos of the various parallel systems. Accordingly, central administration is to lie with two authorities of ministerial rank: the National Development and Reform Commission NDRC and the central bank PBoC (Article 4). All authorities are required to collect social credit data in the areas they manage. They are then to share it among relevant agencies and find applications for the information (Article 5).

However, even if the topic of standardization is the starting point, in the further course of the draft text the handwriting of many different players can be recognized. Chapters two to five of the draft deal with “establishing creditworthiness,” and here it seems that many cooks had something to contribute.

Some of the text paragraphs are from regional and industry social credit systems. There are many truisms that seem out of place in national law. On the subject of the media, for example, Article 50 states, “We want to encourage the implementation of activities to promote creditworthiness so that various types of mass media activities unfold, providing guidance to the public on examples of creditworthiness and examples of lack of creditworthiness so that honesty becomes a conscious goal of society as a whole.”

The same phrases about creditworthiness are repeated over and over again in Articles 12 to 57. A concise law written by skilled lawyers looks different. In part, the draft is too general in its moral exhortations, and in part, it goes deeply into the implementation of the law. The following social sectors and occupational groups are mentioned in detail:

In short, all areas of life are covered and their institutions are to come up with ways to collect minus and plus points for their players. The ordinary citizen is not explicitly mentioned. But since all sectors of the economy are listed, a majority of the population will be part of the assessment, at least in their professional role.

The data are to be explicitly collected in a personalized manner. There are to be database keys for the cross-sectoral identification of individuals (Articles 58 and 59). A “uniform social credit number” is to be introduced for this purpose. Shortly thereafter, however, it is stated that the existing citizen number should also fill this role. Where no citizen number exists, the relevant authorities are to assign one. All institutions are also to be identified by their social credit number.

Explicitly prohibited (Article 62) are excessive inquiries into how the score came about, use of the data beyond the social credit system, and theft and manipulation of the data. The information is to be “stored for the long term.” They are used for “public assessment of the trustworthiness” of the institutions and individuals assessed.

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Amid a sharp rise in Covid cases protests have erupted in Guangzhou. On Monday night, crowds broke through Covid barriers in the city and marched through the streets, according to widely shared videos on Twitter. In some of them, chaotic scenes from late Monday night of people storming through the streets of the city’s Haizhou district and protesting with workers dressed in white protective suits can be seen. Reuters could not independently verify the videos.

According to a report in the business magazine “Caixin,” the background to the riots was anger among migrant workers from the textile industry who had been released from quarantine but were not allowed into their rented apartments because of the significant Covid outbreak in the city.

The number of new local daily infections broke the 5,000 mark for the first time in Guangzhou this week, fueling speculation of an expansion of local lockdowns. The southern metropolis is currently the country’s largest Covid hotspot. On Tuesday morning, several hashtags in the Guangzhou area on the subject of “unrest” were deleted from the microblog platform Weibo. Neither the Guangzhou municipal government nor the Guangdong provincial police could initially be reached for comment.

Chinese authorities had reported 17,772 new infections for the past 24 hours on Tuesday, 1700 more than the previous day and the most since April, just before the Shanghai lockdown. Despite this, many cities are currently tending to scale back Covid measures, such as routine testing of their residents. At the end of last week, the government announced slight relaxations of the strict Covid measures, including shorter quarantines (China.Table reported). rtr/ck

China’s economic recovery is losing momentum due to the recent Covid outbreaks. Fu Linghui, spokesman for the National Bureau of Statistics, acknowledged as much on Tuesday at a press conference in Beijing. The bureau said the country’s retailers reported a drop in sales in October for the first time in five months – down 0.5 percent from a year earlier.

The monthly figures are weaker than expected by experts. Economists polled by Reuters had expected growth of 1.0 percent in the retail sector. There was also negative news from the industry: production grew by 5.0 percent, not only slower than predicted – but also significantly weaker than September with 6.3 percent. China will thus boost demand and consolidate the foundation of its economic recovery, Fu said.

China is currently facing the biggest Covid wave since the spring. A whole series of smaller indicators are therefore pointing in a negative direction. In October and the first 10 days of November, the average number of subway passengers in 18 major Chinese cities fell 19 percent year-on-year, UBS economist Wang Tao wrote in the business magazine Caixin on Tuesday. Property sales went down even further, falling 18 percent in October and 23 percent in the first 10 days of November compared with the same period last year. In response, the government just decided to provide aid to the real estate sector (China.Table reported).

The index for total truckload traffic was down 26 percent from the same period last year, Wang said. Overall, the UBS Composite Activity Index weakened to minus 8.5 percent year-over-year in October and to minus 12 percent year-over-year in early November. ck/rtr

Warren Buffett’s Berkshire Hathaway investment fund has taken a stake of about $5 billion in chipmaker Taiwan Semiconductor Manufacturing (TSMC). This was reported by Bloomberg on Tuesday. According to a report filed with the US Securities and Exchange Commission (SEC), the Omaha-based conglomerate acquired about 60 million American depositary receipts from TSMC in the three months through September. According to the news, shares of the Taiwanese chipmaker rose as much as 9.4 percent, the biggest intraday increase in more than two years.

The legendary 92-year-old investor had long shied away from tech stocks, saying he didn’t want to invest in companies he didn’t fully understand. However, Buffett relaxed this credo in recent years. Berkshire, for example, now also holds just under six percent of Apple shares with a value of around $140 billion.

In addition to TSMC, Buffett’s company bought into US bank Jefferies and building materials manufacturer Louisiana-Pacific Corp in the past quarter. At the same time, he increased his stake in the oil company Occidental Petroleum, which he now owns to just under a third. Berkshire has reduced its exposure to financial stocks by around $4.7 billion. In the period under review, for example, it reduced its holdings in the US financial companies Bancorp and BNY Mellon. fpe

EU member states are expected to adopt their position on the anti-coercion instrument on Thursday, paving the way for final negotiations with the European Parliament. The latest compromise proposal of the Czech Council Presidency has met with approval at the expert level and is now to be adopted by the EU ambassadors, according to the draft decision published by “Contexte.”

The EU Commission proposed the new anti-coercion instrument last December to enable the EU as a whole to better defend itself against coercive economic measures by third countries. The model case is China’s de facto trade embargo against Lithuania (China.Table reported) after Taiwan was allowed to open an official representation in Vilnius called “Taiwan.” If such a dispute cannot be settled amicably, the EU can impose punitive tariffs or import restrictions and exclude companies from the country in question from public tenders.

During the discussions in the Council, several member states, including Germany, had insisted on being more involved in the decisions given their foreign policy significance. Whether the actions of a third country constitute coercive measures under the new regulation, the Czechs’ proposal now provides for the Council itself to determine. The Commission wanted to reserve this competence for itself. As before, decisions on countermeasures would be taken on the basis of a proposal from the Commission under the comitology procedure.

In the European Parliament, the Council’s amendments are meeting with resistance. “The decision-making procedure will be the major sticking point in the negotiations,” it says. It is unacceptable that the Council claims sole decision-making authority in a communitarian policy area such as trade. The member states wanted to impose that they could decide without the involvement of the Commission and the European Parliament whether China, for example, was exercising economic coercion. In doing so, they made themselves the target of Beijing’s massive influence. It is not yet clear when the trilogue negotiations will begin. tho

“The job can sometimes kill your passion,” admits Kevin Straßmeir. At least that was what he feared before his first internship in the motorcycle sector. But after just two weeks, the Augsburg native was sure: “It definitely has to be the motorcycle industry.”

Today, Straßmeir is Director and General Manager of the Austrian motorcycle manufacturer KTM in China. He discovered his love for machines at 14 when he rode a moped around the farm for the first time while on vacation in the countryside. His motorcycle license at 18 was followed by motorcycle trips through Europe and as far as Istanbul. While studying for a degree in business administration and later media informatics, he left Europe for Shanghai for the first time – lured by the economic opportunities promised by booming China. Once he arrived, he was determined to spend more time in Asia.

During the second study visit to Singapore, the motorcycle was also part of the trip. The return travel, starting in Nepal, took him on his two-wheeler through Pakistan and Xinjiang to Kazakhstan, Russia, and the Baltic States, and finally back to Germany.

After a year of Chinese language lessons in Beijing with the DAAD’s “Language and Practice” program, he finally entered the world of motorized two-wheelers professionally in 2014: first as an intern at BMW Motorcycle in Beijing, then as a sales assistant for KTM. Straßmeir coordinated the cooperation with the local sales partners in East Asia from the very beginning, first and foremost with the motorcycle and quad specialist CFMOTO from Hangzhou. Relations with the Chinese partner went well, and in 2018 a joint venture called CFMOTO-KTMR2R was founded. Since 2020, Straßmeir has also acted as General Manager. In the meantime, there is a joint factory, where, starting in November of this year, the two-cylinder KTM 790 Duke machine will also be produced in China for the global market for the first time.

Addressing the issue of technology transfer to the Chinese partner, Straßmeir is pragmatic. “If you decide to go to market in China and source components locally, then you accept that you will reveal a lot.” With a business strategy designed for technology leadership, you usually only have a lead of three, four, or five years at most before the technology is obsolete, he says. So that you have to share the technology with Chinese partners no longer plays a significant role. To date, Straßmeir is the only German-speaking KTM employee permanently stationed in China.

In general, Straßmeir remains optimistic about the Chinese motorcycle market. Even if there are a few hurdles, for example, the ban on gasoline-powered motorcycles in many major Chinese cities, Straßmeir believes there are initial signs that the legal situation could change significantly in his favor. In any case, he has his own goal firmly in sight: By the end of 2024, his tenth anniversary at KTM, he wants the company’s sales figures in China to have increased tenfold. Clemens Ruben

Theresa Kleinmann changed positions at Festo China. She is now responsible for Global Portfolio Development. Kleinmann has been working for the Esslingen-based manufacturer of control and automation technology in Shanghai for two years. Previously, she was Head of Sales Analytics there.

Timo Tianhao Herrmann took over the position of Lead Project Manager Europe Business at Nio in November. The former Porsche manager, who trained in Cologne and Lund, will help shape the Chinese EV maker’s expansion into Europe. He will be based in Shanghai.

Is something changing in your organization? Why not send a note for our staff section to heads@table.media!

Uncomfortable: Over the weekend, the first snowfalls of the beginning winter fell over parts of China’s northeastern province of Jilin. Here, a food delivery man rolls over the slippery streets of Changchun city, his hands protected by giant gloves.