German Chancellor Olaf Scholz plans to visit Beijing in early November. It will be the first bilateral meeting in China between a European politician and Xi since the start of the pandemic. Expectations for the visit are correspondingly high, especially since Germany is currently working on a China strategy. From this perspective, the timing of Scholz’s trip is not ideal, writes Amelie Richter. After the party congress, Xi Jinping will be at the height of his power. A visit by the German chancellor seems like an honor here.

“Scholz’s visit ahead of the G20 meeting shows that the world is returning to China,” confirms Joerg Wuttke, head of the EU Chamber of Commerce. The big question now is what issues Scholz will put on the table. Meanwhile, the China strategy of the German government coalition partners will probably take until 2023.

Analysts from the Canadian platform Techinsights surprised the world with the new discovery of a 7-nanometer chip made in China: a breakthrough in semiconductor technology. Previously, the assumption was that the Chinese industry, spearheaded by the state-owned company SMIC, was not yet capable of producing such finely constructed semiconductors, Frank Sieren reports.

Even if the chip seems more like a copy of a Taiwanese product, it shows that the Chinese manufacturer is still technically able, despite sanctions. But the chip sanctions imposed by the Americans are not the only problem right now. On top of that, there is a worldwide slump in demand. SMIC, too, could be affected by canceled orders and declining capacity utilization. Experts even fear that growth at the Chinese chip powerhouse could fall by as much as 50 percent. On a positive note, this means the chip shortage is over for many industries.

After a Covid break of just over three years, a German government leader will once again travel to China. Social democratic Chancellor Olaf Scholz’s (SPD) stopover in Beijing in early November is expected to be the official starting signal for a resumption of face-to-face diplomacy between the European Union and the People’s Republic – and thus also an opportunity to recalibrate relations.

However, Scholz’s first visit will probably not result in any major changes in Germany’s posture vis-à-vis China. The duration of the trip is too short, and the timing just after the CP Congress is problematic. And the biggest problem: Neither Berlin nor Brussels currently speaks with a unified voice.

At the engineering summit of the German Mechanical Engineering Industry Association (VDMA) on Tuesday, the Chancellor spoke out clearly against decoupling from the People’s Republic: “Globalization has been a success story that enabled prosperity for many people. We must defend it,” said Scholz. A policy change, as some voices in the coalition partners are urging, sounds different.

The right answer, according to Scholz, is diversification. “I say emphatically we must continue to do business with China. But we also have to ensure that we trade with the rest of the world, look at the rest of Asia, Africa, South America – that’s the opportunity.” Executive Vice President of the European Commission, Valdis Dombrovskis, on Tuesday also urged European Companies not to withdraw from the Chinese market. “Decoupling from China is not an option for companies in the European Union: China is an important growth market and an important supplier of affordable inputs.”

Similar tones are coming from the German Foreign Office, where the first China strategy of the German government is currently being drafted. “Reducing economic dependencies does not mean that we want to completely decouple ourselves from China,” explains Petra Sigmund, head of the Asia department, according to the German business newspaper Handelsblatt. “It’s about risk management, not decoupling.” Accordingly, Sigmund stresses that Germany wants to continue working with China. “But we agree in the German government that there will be no simple ‘carry on like this.’” So far, so united.

On other issues, however, such as the position toward Taiwan, the ideas within the German “traffic light” government differ greatly: While the Greens and the liberal FDP are rhetorically taking up arms against China, the chancellor’s office blocks any significant change of course. It remains to be seen how this will reflect in the China strategy. The paper is not expected until spring 2023 at the earliest. The conservative CDU/CSU parliamentary group in the German parliament submitted a minor interpellation on Tuesday about the current progress on the strategy.

The last German delegation visited Wuhan in September 2019 with then Chancellor Angela Merkel. During the pandemic, there were no stand-alone bilateral meetings in China with the EU. Poland’s President Andrzej Duda was the only EU leader to travel to the opening ceremony of the Winter Olympics in February this year. Besides Duda, Serbia’s President Aleksandar Vučić and the Grand Duke of Luxembourg, Henri, also arrived from Europe. The EU-China video summit in April proved fruitless. For the time being, personal trips by high-ranking Brussels representatives to the People’s Republic are not planned, according to EU circles.

Because in Brussels, too, opinions are currently divided on the bloc’s China strategy. While Economic Affairs Commissioner Dombrovskis opposes decoupling, Josep Borrell, the EU’s foreign policy chief, gave what is, by EU standards, an almost fiery and unusually direct speech about a world in which cooperation with China can no longer be expected. The EU has relied too much on cheap energy from Russia and the huge market in the People’s Republic, Borrell said.

“People are not aware of that but the fact that Russia and China are no longer the ones that [they] were for our economic development will require a strong restructuring of our economy,” Borrell told the present EU ambassadors on Monday. “China and Russia – provided the basis of our prosperity. This is a world that is no longer there.” Borrell also warned about a general tendency toward autocracies around the world. Europe can no longer rely on US protection in this regard, either, he said.

Whether Borrell’s remarkable speech will also translate into practice will show in the coming week: EU foreign ministers will meet next Monday, with China on the agenda – coinciding with the start of the CP Congress in Beijing on Sunday. The ministers are also expected to take a look at the EU’s China strategy. On Thursday and Friday, EU leaders will then have “Asia” on their agenda at the summit. According to EU circles, there was not enough time to prepare for a more in-depth debate on China.

The fact that Scholz visited Beijing alone and not with EU representatives or French President Emmanuel Macron to show greater unity was not a good decision in general, believes Alicia García-Herrero, China expert at the Brussels-based think tank Bruegel, in conversation with China.Table. The appearance and timing for the visit were not well-thought-out, she said. Right after the CP Congress, Scholz’s visit seems like courting Xi Jinping. “Of course he’s going to have to congratulate him on being confirmed in office,” García-Herrero says. “Why didn’t he just meet him on the sidelines of the G20 summit in Bali, like US President Biden did, for example?”

As far as the content of the bilateral meeting is concerned, the analyst has no high expectations. Scholz is expected to travel without a large delegation. “The question is what Scholz will put on the table there. Will he warn that China is losing European companies?” But that would require Scholz to be invited to Beijing to “speak and not just listen,” according to García-Herrero. The chancellor will meet a Chinese president who does not actually have to listen to anyone at the moment. After the party congress, Xi will be at the pinnacle of power.

According to media reports, Xi had already extended the invitation to Scholz for November back in July. The reactions to this were rather reserved, as Xi is theoretically not supposed to be confirmed in office until October. Beijing definitely wanted the visit, says Joerg Wuttke, head of the EU Chamber of Commerce. The intention was to show that China is once again playing “in the concert of the big players.” “The Scholz visit before the G20 meeting shows that the world is returning to China,” says Wuttke. He also points to the personal sacrifices China’s representatives have to make for the chancellor’s one-day trip: “What is not mentioned, of course, is that Chinese dignitaries are thus burdened with a seven-day quarantine.” Collaboration: Till Hoppe

The semiconductor sector experienced several heavy economic fluctuations since its beginnings. After demand exceeded capacity over many months, the situation may now turn around again. First trade media report that the chip shortage is over. What sounds like the much-longed-for relief for industry and consumers, however, is far too sudden for manufacturers. Because the boom is now followed by recession.

In China, the state-backed chipmaker Semiconductor Manufacturing International (SMIC) is at the center of events here. It reports canceled orders and declining capacity utilization. Especially the electronics industry suddenly sits on full stocks amid inflation and cuts back production and thus semiconductor orders. SMIC CEO Zhao Haijun spoke to the business newspaper Nikkei of a “severe correction”, especially in smartphones and consumer electronics such as televisions.

By international comparison, SMIC is particularly affected. The Chinese market accounts for 70 percent of the state-owned company’s revenue. The pandemic situation affects business quite significantly, Zhao said. Added to this are US sanctions against China’s semiconductor industry, which are intended to prevent a rise to the top league (China.Table reported).

Yet SMIC, in particular, catches up fast. Since last year, the company has been able to produce 7-nanometer chips (China.Table reported). This is a real breakthrough – despite US sanctions against China’s semiconductor industry.

However, the 7-nanometer chips manufactured in China are not yet able to replace the high-end products from the Taiwanese market leader TSMC. This has several reasons:

Nevertheless, manufacturers climb the ladder precisely thanks to such copycat successes as the 7-nanometer chip. Consequently, the IT industry service Heise calls the development a “major milestone.” And the online magazine Computer Base also analyzes: “Although Taiwan’s TSMC and Samsung’s processes are now much more advanced, not only in 7-nm, SMIC’s success cannot be downplayed.”

In only two years, SMIC managed to do what took the South Korean manufacturer Samsung five years, Techinsights points out. Intel had even struggled with the technology leap for quite a while two years ago.

So SMIC has done everything right – and still runs into difficult waters now. In an interview with Nikkei, company CEO Zhao cited global inflation as another factor alongside geopolitical conflict and the pandemic. Now that people have stocked up on PCs and game consoles during the lockdowns, they are holding on to their money.

The newly toughened US sanctions could also significantly impact the industry. On Tuesday, semiconductor shares dropped sharply across the globe. US companies, which are now no longer allowed to supply their Chinese business partners with high-quality equipment, also found themselves in the maelstrom. The Chinese Foreign Ministry called the measures “unfair” and spoke of “a blow to global industrial and supply chains and world economic recovery.” Analysts at Bloomberg Intelligence now fear that SMIC’s growth could slump by 50 percent.

The automotive industry could also continue to suffer for a while, even if chip supply for other industries already begins to recover (China.Table reported). Cars primarily use simpler models with a structure width of more than 28 nanometers. However, according to Porsche Consulting, there is hardly any investment in this technology. So the shortage could continue here. However, the more sophisticated car electronics are, the better the supply will be in the future – an advantage for manufacturers of particularly smart cars.

In the meantime, China will continue to invest in particularly advanced chip technology, as will the EU, by the way, which will also attract factories for particularly small structural widths. Despite economic fluctuations, SMIC can easily carry the high investments because it is a financial success story: The company posted a 61 percent increase in sales in 2021. Even during the 2nd quarter of this year, which was marked by lockdowns, SMIC managed to increase profits by over 80 percent year-on-year to a good €750 million.

Part of the revenue is to flow into new semiconductor factories for a total of $5 billion. The US will get none of these investments. The Californian company Nvidia alone, one of the largest developers of graphics processors and chipsets for personal computers, servers and game consoles, expects to lose $400 million in sales in 2022 due to the recently imposed export restrictions.

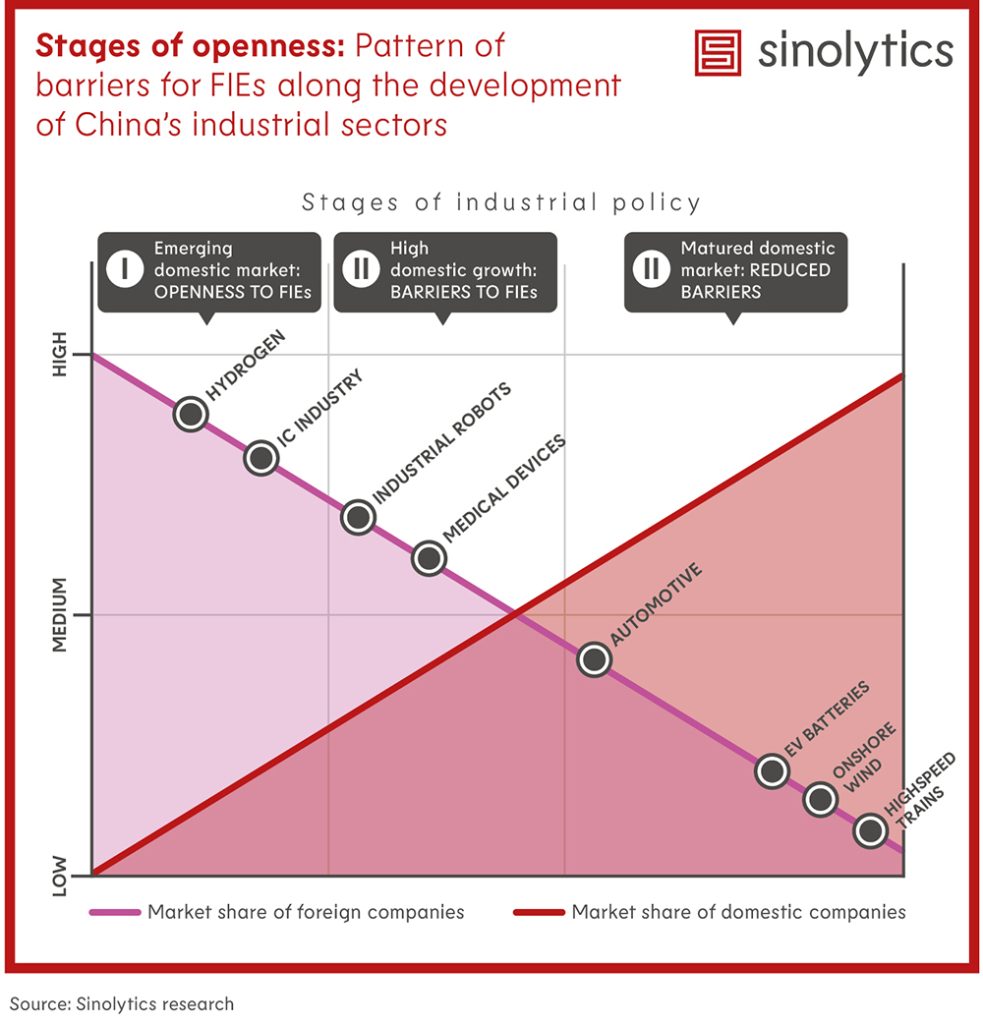

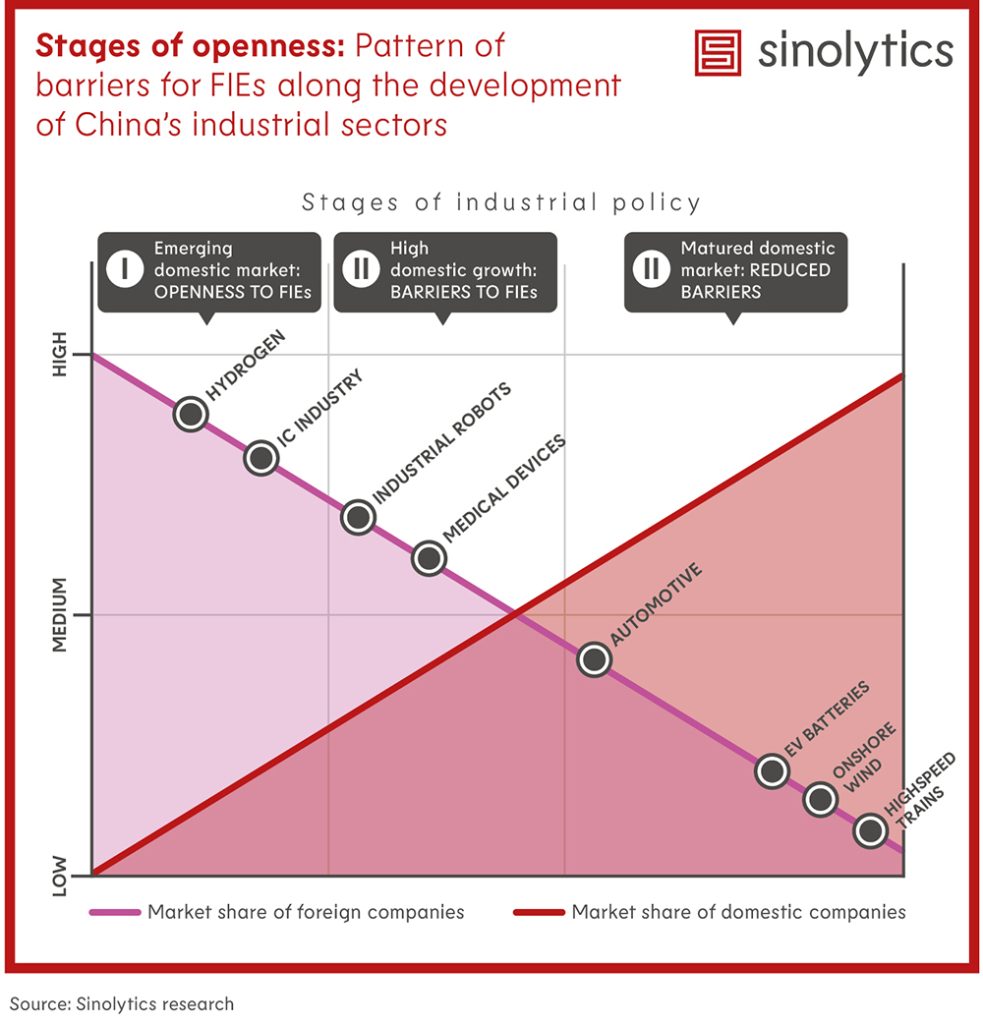

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

To secure the water supply, Shanghai took emergency measures. Following the contamination of two large reservoirs by salt water, the water supply for the coastal city’s 25 million inhabitants had to be temporarily suspended. Qingcaosha, the city’s largest reservoir, supplies water to some 13 million residents in 11 of the 16 districts. Chenhang is the drinking water source for five districts, home to more than 7 million people.

Faced with a water shortage, the authorities now take action. According to the municipal water authority, reservoirs began to store fresh water in preparation for the next flood, which could flush saltwater inland. In the meantime, water from other regions is piped into Shanghai to ensure the city’s normal water supply.

The saltwater flood was caused by typhoons in early September. Tides, wind and waves pushed seawater into the Yangtze. Salt tides are not uncommon in Shanghai. Since the city is located near the mouth of the Yangtze River, this phenomenon occurs frequently.

Shanghai was already hit by a salt tide in August, when the record drought caused the level of the Yangtze River to drop. The current was no longer strong enough to build up sufficient pressure against the seawater. As a result, it flowed upstream, according to a statement from the water authority. China has significantly less water available than the world average (China.Table reported). About 7 percent of global freshwater resources have to sustain about 20 percent of the global population. mw

The recently booming Chinese car market lost momentum in September. Sales of cars, buses and trucks in the world’s largest auto market rose 25.7 percent last month to 2.61 million vehicles – slower than in previous months – according to data from the manufacturers’ association CAAM. Government incentives for EVs spurred growth in previous months, but now analysts see signs of slowing demand (China.Table reported). Strict Covid measures in Shanghai and other cities had already affected sales in the first half of the year.

In contrast, sales of electric, hybrid and hydrogen vehicles surged by almost 94 percent year-on-year in September. Electric vehicle manufacturer Tesla, for example, set a sales record in China in September (China.Table reported).

However, the recovery trend is below the expectation of the CPCA passenger car association. China’s car market and the performance of foreign car brands are relatively weak, CPCA Secretary General Cui Dongshu said. “Tougher COVID restrictions in many cities prevented people from attending auto shows and promotional events, discouraging sales,” he added. As a result, Chinese automakers step up their efforts to sell EVs overseas, especially in Southeast Asia and Europe. In recent weeks, BYD and NIO announced plans to bring more models to the European market (China.Table reported).

Signs of slowing demand could intensify competition and lead to price cuts for cars, including EVs, said analyst Shi Ji of China Merchants Bank. He said this was especially true given the high industry-wide inventory levels that have persisted since July. mw/rtr

The director of Britain’s GCHQ intelligence service has warned of the risks posed by the growing influence of the People’s Republic of China. While the Communist Party has been building their country’s economic strength, it has simultaneously introduced draconian security laws and a culture of surveillance, Jeremy Fleming said.

To expand its influence, China used digital currencies, satellite systems, and technological products, among other things. Through exports, these spread around the world. Yet such Chinese technologies have “hidden costs,” Fleming warned. He called on the domestic science and technology sector to become less dependent on China and create alternative, competitive offers.

According to a media report, the British government plans to officially reclassify China as a “threat” to the United Kingdom on Wednesday. Prime Minister Liz Truss will present a new strategic assessment listing “Britain’s enemies,” British tabloid The Sun reported. Previously, London classified China as a “systemic competitor.” mw/ari

German Research Minister Bettina Stark-Watzinger urged vigilance on the 50th anniversary of the establishment of diplomatic relations with China. “German-Chinese relations must always be critically scrutinized, especially with regard to research cooperation,” the liberal FDP politician said. China has increasingly gone from being a strategic partner to a tough competitor and systemic rival for Germany and the EU, she added.

When it comes to global challenges such as climate change, the minister sees Beijing as a partner that must be actively called into duty. In sensitive areas, she advocated clear boundaries. Here, Stark-Watzinger mentioned artificial intelligence, “which China is abusing to monitor its citizens,” or cooperation involving “dual-use risks” – for example, joint research where results could also be used for unwelcome purposes. “That’s why we’re canceling topics and cooperations with China, especially in key technologies that we deem unjustifiable.”

In the summer, the German Federal Ministry of Education and Research announced plans to “critically examine” research cooperation with China (China.Table reported). The background to the reviews was repeated reports of human rights violations in Xinjiang. With regard to the Confucius Institutes, Stark-Watzinger stated that she opposes any direct or indirect political influence by China on our teaching and science. “Here the universities are called upon to decide whether they will tolerate institutes that are co-financed by Beijing and are politically oriented.” mw

The establishment of diplomatic relations between two states is a historically significant event. Milestone anniversaries are celebrated in a ceremonial and ritualized manner, i.e. following diplomatic customs. Efforts are made to avoid discord, to praise the current relationship where possible, and to give each other a straightened history of past relations.

And there are good reasons for all of this. The absence of diplomatic relations is generally regarded as unfavorable, even potentially dangerous, and the termination of relations is regarded as an escalation and ultima ratio.

This year marks the 50th anniversary of diplomatic relations between Germany and China. As is common in liberal democracies, such an occasion also provides an opportunity for numerous actors from civil society, the media, universities and business to comment. Depending on their interests and agendas, these actors also tend to behave “diplomatically,” or otherwise, in deliberate demarcation, in a decidedly critical manner.

The fact that the People’s Republic of China is not a liberal democracy but, according to the constitution, “a socialist state under the people’s democratic dictatorship,” and that a largely Leninist-organized Communist Party continues to rule the country, with corresponding resources for political activities abroad, complicates matters considerably.

The global political situation and tensions with the People’s Republic of China over its treatment of Hong Kong, Tibetan, Uyghur or other minorities, dissidents, human rights lawyers or journalists, as well as what has been apostrophized as a newly emerging self-confidence, and attempts to exert political influence in other countries have reignited discussions on a credible value-based foreign policy.

At their core, some of these discussions revolve around a fundamental dilemma when dealing with authoritarian regimes. First, diplomatic relations represent nothing more than formal recognition of one state by another. It is through the lived practice of relations that interests arise, which could be harmed by any deterioration in relations.

This poses the risk that, over time, formal recognition will be followed by material recognition. So how can a liberal democracy position itself vis-à-vis an authoritarian regime without normalizing and thus leveling the fundamentally divisive, normative political difference through its own actions and words? Perhaps even undermining one’s own set of values?

As long as China’s democratization was expected, overcoming political differences seemed only a matter of time. Now that the change has failed to materialize, however, political difference has once again moved to the center. Furthermore, internally authoritarian movements have gained ground in European societies, which have a dividing effect and fundamentally call the values of liberal democracies into question.

So what are the options?

One simple measure concerns the choice of words when dealing with the People’s Republic. It should make one’s own set of values unmistakably clear. In addition to standing up for democracy, human rights and the rule of law, more subtle levels of communication must also be taken into account. In particular, it is important to avoid leveling vocabulary. These are words on which both sides can agree in apparent consensus.

For example, it should be avoided, like a member of the Swiss government has done, to speak of “popular participation” when referring to semi-direct democracy on the Swiss side and Leninist democratic centralism on the Chinese side. The respective degrees of participation are worlds apart, after all.

Nor is it helpful to speak of “human dignity” when what is actually meant is “human rights”. And given China’s attempts to turn the core meaning of human rights on its head, it would also be necessary to differentiate and pay attention to a more precise formulation here. It is more adequate to use different words that indicate a political difference in interactions wherever possible.

It is also important to prevent false equivalences. The All-China Federation of Industry and Commerce (ACFIC, 中华全国工商业联合会), for example, is by no means a counterpart to the Federation of German Industries (BDI), but an organ of the United Front at the tail of the Communist Party.

A communication based on differences also conveys to the Chinese counterpart that one is familiar with the political system. Ultimately, it is important to avoid vocabulary that is commonly used in the propaganda and United Front activities of the Communist Party. This includes subtle expressions like “friends” or “bridge,” more obvious “win-win cooperation” or “a new era”. Instead of a “dialogue” pursued by civil society forces, one might prefer to speak of maintaining “contacts” or communicating one’s “position”.

The People’s Republic uses language in an extremely differentiated and deliberate manner. Adequate knowledge of the terminology used by the Chinese party state, as well as its inner structures and methods, is a prerequisite for representing one’s own positions credibly and with specifically chosen vocabulary.

Obviously, the choice of words alone will not be enough to turn the global political situation and the tensions with China to one’s own advantage. Apart from well-considered words, this will certainly require equally well-thought-out actions. But language always also communicates inwards, to the population that constitutes the state.

If the 50th anniversary of the establishment of diplomatic relations is now celebrated as it should be, then, despite the desire to express oneself “diplomatically,” there is certainly room for maneuver that can be filled accordingly to signal the fundamentally political difference between the “Federal Republic” and the “People’s Republic.”

This text is a translated and abridged version of the original first published on the website of the German-Chinese Dialogue Forum.

Ralph Weber is an Associate Professor of European Global Studies at the University of Basel in Switzerland. His research fields include Chinese political philosophy, modern Confucianism, and Chinese politics. He focuses on European-Chinese relations and published a widely acclaimed study on the influence of the Chinese party-state in Switzerland in December 2020.

Wei Xiaoxue took over the position of managing director at Neuberger Berman China on October 10. In the Shanghai-based subsidiary of the US investment firm, Wei’s responsibilities will include driving investment strategy development, leading the equity research team and overseeing portfolio risk management.

Christina Gruschka joined Porsche China this month as Manager of Charging Strategy. Gruschka is an expert in the field of smart mobility. Most recently, she helped shape the rollout of Porsche Connect for Porsche in Ludwigsburg. Her new place of work is Shanghai.

Is something changing in your organization? Why not let us know at heads@table.media!

Near the city of Zunyi in the province of Guizhou, a farmer proudly picks the yield from her pomelo trees.

German Chancellor Olaf Scholz plans to visit Beijing in early November. It will be the first bilateral meeting in China between a European politician and Xi since the start of the pandemic. Expectations for the visit are correspondingly high, especially since Germany is currently working on a China strategy. From this perspective, the timing of Scholz’s trip is not ideal, writes Amelie Richter. After the party congress, Xi Jinping will be at the height of his power. A visit by the German chancellor seems like an honor here.

“Scholz’s visit ahead of the G20 meeting shows that the world is returning to China,” confirms Joerg Wuttke, head of the EU Chamber of Commerce. The big question now is what issues Scholz will put on the table. Meanwhile, the China strategy of the German government coalition partners will probably take until 2023.

Analysts from the Canadian platform Techinsights surprised the world with the new discovery of a 7-nanometer chip made in China: a breakthrough in semiconductor technology. Previously, the assumption was that the Chinese industry, spearheaded by the state-owned company SMIC, was not yet capable of producing such finely constructed semiconductors, Frank Sieren reports.

Even if the chip seems more like a copy of a Taiwanese product, it shows that the Chinese manufacturer is still technically able, despite sanctions. But the chip sanctions imposed by the Americans are not the only problem right now. On top of that, there is a worldwide slump in demand. SMIC, too, could be affected by canceled orders and declining capacity utilization. Experts even fear that growth at the Chinese chip powerhouse could fall by as much as 50 percent. On a positive note, this means the chip shortage is over for many industries.

After a Covid break of just over three years, a German government leader will once again travel to China. Social democratic Chancellor Olaf Scholz’s (SPD) stopover in Beijing in early November is expected to be the official starting signal for a resumption of face-to-face diplomacy between the European Union and the People’s Republic – and thus also an opportunity to recalibrate relations.

However, Scholz’s first visit will probably not result in any major changes in Germany’s posture vis-à-vis China. The duration of the trip is too short, and the timing just after the CP Congress is problematic. And the biggest problem: Neither Berlin nor Brussels currently speaks with a unified voice.

At the engineering summit of the German Mechanical Engineering Industry Association (VDMA) on Tuesday, the Chancellor spoke out clearly against decoupling from the People’s Republic: “Globalization has been a success story that enabled prosperity for many people. We must defend it,” said Scholz. A policy change, as some voices in the coalition partners are urging, sounds different.

The right answer, according to Scholz, is diversification. “I say emphatically we must continue to do business with China. But we also have to ensure that we trade with the rest of the world, look at the rest of Asia, Africa, South America – that’s the opportunity.” Executive Vice President of the European Commission, Valdis Dombrovskis, on Tuesday also urged European Companies not to withdraw from the Chinese market. “Decoupling from China is not an option for companies in the European Union: China is an important growth market and an important supplier of affordable inputs.”

Similar tones are coming from the German Foreign Office, where the first China strategy of the German government is currently being drafted. “Reducing economic dependencies does not mean that we want to completely decouple ourselves from China,” explains Petra Sigmund, head of the Asia department, according to the German business newspaper Handelsblatt. “It’s about risk management, not decoupling.” Accordingly, Sigmund stresses that Germany wants to continue working with China. “But we agree in the German government that there will be no simple ‘carry on like this.’” So far, so united.

On other issues, however, such as the position toward Taiwan, the ideas within the German “traffic light” government differ greatly: While the Greens and the liberal FDP are rhetorically taking up arms against China, the chancellor’s office blocks any significant change of course. It remains to be seen how this will reflect in the China strategy. The paper is not expected until spring 2023 at the earliest. The conservative CDU/CSU parliamentary group in the German parliament submitted a minor interpellation on Tuesday about the current progress on the strategy.

The last German delegation visited Wuhan in September 2019 with then Chancellor Angela Merkel. During the pandemic, there were no stand-alone bilateral meetings in China with the EU. Poland’s President Andrzej Duda was the only EU leader to travel to the opening ceremony of the Winter Olympics in February this year. Besides Duda, Serbia’s President Aleksandar Vučić and the Grand Duke of Luxembourg, Henri, also arrived from Europe. The EU-China video summit in April proved fruitless. For the time being, personal trips by high-ranking Brussels representatives to the People’s Republic are not planned, according to EU circles.

Because in Brussels, too, opinions are currently divided on the bloc’s China strategy. While Economic Affairs Commissioner Dombrovskis opposes decoupling, Josep Borrell, the EU’s foreign policy chief, gave what is, by EU standards, an almost fiery and unusually direct speech about a world in which cooperation with China can no longer be expected. The EU has relied too much on cheap energy from Russia and the huge market in the People’s Republic, Borrell said.

“People are not aware of that but the fact that Russia and China are no longer the ones that [they] were for our economic development will require a strong restructuring of our economy,” Borrell told the present EU ambassadors on Monday. “China and Russia – provided the basis of our prosperity. This is a world that is no longer there.” Borrell also warned about a general tendency toward autocracies around the world. Europe can no longer rely on US protection in this regard, either, he said.

Whether Borrell’s remarkable speech will also translate into practice will show in the coming week: EU foreign ministers will meet next Monday, with China on the agenda – coinciding with the start of the CP Congress in Beijing on Sunday. The ministers are also expected to take a look at the EU’s China strategy. On Thursday and Friday, EU leaders will then have “Asia” on their agenda at the summit. According to EU circles, there was not enough time to prepare for a more in-depth debate on China.

The fact that Scholz visited Beijing alone and not with EU representatives or French President Emmanuel Macron to show greater unity was not a good decision in general, believes Alicia García-Herrero, China expert at the Brussels-based think tank Bruegel, in conversation with China.Table. The appearance and timing for the visit were not well-thought-out, she said. Right after the CP Congress, Scholz’s visit seems like courting Xi Jinping. “Of course he’s going to have to congratulate him on being confirmed in office,” García-Herrero says. “Why didn’t he just meet him on the sidelines of the G20 summit in Bali, like US President Biden did, for example?”

As far as the content of the bilateral meeting is concerned, the analyst has no high expectations. Scholz is expected to travel without a large delegation. “The question is what Scholz will put on the table there. Will he warn that China is losing European companies?” But that would require Scholz to be invited to Beijing to “speak and not just listen,” according to García-Herrero. The chancellor will meet a Chinese president who does not actually have to listen to anyone at the moment. After the party congress, Xi will be at the pinnacle of power.

According to media reports, Xi had already extended the invitation to Scholz for November back in July. The reactions to this were rather reserved, as Xi is theoretically not supposed to be confirmed in office until October. Beijing definitely wanted the visit, says Joerg Wuttke, head of the EU Chamber of Commerce. The intention was to show that China is once again playing “in the concert of the big players.” “The Scholz visit before the G20 meeting shows that the world is returning to China,” says Wuttke. He also points to the personal sacrifices China’s representatives have to make for the chancellor’s one-day trip: “What is not mentioned, of course, is that Chinese dignitaries are thus burdened with a seven-day quarantine.” Collaboration: Till Hoppe

The semiconductor sector experienced several heavy economic fluctuations since its beginnings. After demand exceeded capacity over many months, the situation may now turn around again. First trade media report that the chip shortage is over. What sounds like the much-longed-for relief for industry and consumers, however, is far too sudden for manufacturers. Because the boom is now followed by recession.

In China, the state-backed chipmaker Semiconductor Manufacturing International (SMIC) is at the center of events here. It reports canceled orders and declining capacity utilization. Especially the electronics industry suddenly sits on full stocks amid inflation and cuts back production and thus semiconductor orders. SMIC CEO Zhao Haijun spoke to the business newspaper Nikkei of a “severe correction”, especially in smartphones and consumer electronics such as televisions.

By international comparison, SMIC is particularly affected. The Chinese market accounts for 70 percent of the state-owned company’s revenue. The pandemic situation affects business quite significantly, Zhao said. Added to this are US sanctions against China’s semiconductor industry, which are intended to prevent a rise to the top league (China.Table reported).

Yet SMIC, in particular, catches up fast. Since last year, the company has been able to produce 7-nanometer chips (China.Table reported). This is a real breakthrough – despite US sanctions against China’s semiconductor industry.

However, the 7-nanometer chips manufactured in China are not yet able to replace the high-end products from the Taiwanese market leader TSMC. This has several reasons:

Nevertheless, manufacturers climb the ladder precisely thanks to such copycat successes as the 7-nanometer chip. Consequently, the IT industry service Heise calls the development a “major milestone.” And the online magazine Computer Base also analyzes: “Although Taiwan’s TSMC and Samsung’s processes are now much more advanced, not only in 7-nm, SMIC’s success cannot be downplayed.”

In only two years, SMIC managed to do what took the South Korean manufacturer Samsung five years, Techinsights points out. Intel had even struggled with the technology leap for quite a while two years ago.

So SMIC has done everything right – and still runs into difficult waters now. In an interview with Nikkei, company CEO Zhao cited global inflation as another factor alongside geopolitical conflict and the pandemic. Now that people have stocked up on PCs and game consoles during the lockdowns, they are holding on to their money.

The newly toughened US sanctions could also significantly impact the industry. On Tuesday, semiconductor shares dropped sharply across the globe. US companies, which are now no longer allowed to supply their Chinese business partners with high-quality equipment, also found themselves in the maelstrom. The Chinese Foreign Ministry called the measures “unfair” and spoke of “a blow to global industrial and supply chains and world economic recovery.” Analysts at Bloomberg Intelligence now fear that SMIC’s growth could slump by 50 percent.

The automotive industry could also continue to suffer for a while, even if chip supply for other industries already begins to recover (China.Table reported). Cars primarily use simpler models with a structure width of more than 28 nanometers. However, according to Porsche Consulting, there is hardly any investment in this technology. So the shortage could continue here. However, the more sophisticated car electronics are, the better the supply will be in the future – an advantage for manufacturers of particularly smart cars.

In the meantime, China will continue to invest in particularly advanced chip technology, as will the EU, by the way, which will also attract factories for particularly small structural widths. Despite economic fluctuations, SMIC can easily carry the high investments because it is a financial success story: The company posted a 61 percent increase in sales in 2021. Even during the 2nd quarter of this year, which was marked by lockdowns, SMIC managed to increase profits by over 80 percent year-on-year to a good €750 million.

Part of the revenue is to flow into new semiconductor factories for a total of $5 billion. The US will get none of these investments. The Californian company Nvidia alone, one of the largest developers of graphics processors and chipsets for personal computers, servers and game consoles, expects to lose $400 million in sales in 2022 due to the recently imposed export restrictions.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

To secure the water supply, Shanghai took emergency measures. Following the contamination of two large reservoirs by salt water, the water supply for the coastal city’s 25 million inhabitants had to be temporarily suspended. Qingcaosha, the city’s largest reservoir, supplies water to some 13 million residents in 11 of the 16 districts. Chenhang is the drinking water source for five districts, home to more than 7 million people.

Faced with a water shortage, the authorities now take action. According to the municipal water authority, reservoirs began to store fresh water in preparation for the next flood, which could flush saltwater inland. In the meantime, water from other regions is piped into Shanghai to ensure the city’s normal water supply.

The saltwater flood was caused by typhoons in early September. Tides, wind and waves pushed seawater into the Yangtze. Salt tides are not uncommon in Shanghai. Since the city is located near the mouth of the Yangtze River, this phenomenon occurs frequently.

Shanghai was already hit by a salt tide in August, when the record drought caused the level of the Yangtze River to drop. The current was no longer strong enough to build up sufficient pressure against the seawater. As a result, it flowed upstream, according to a statement from the water authority. China has significantly less water available than the world average (China.Table reported). About 7 percent of global freshwater resources have to sustain about 20 percent of the global population. mw

The recently booming Chinese car market lost momentum in September. Sales of cars, buses and trucks in the world’s largest auto market rose 25.7 percent last month to 2.61 million vehicles – slower than in previous months – according to data from the manufacturers’ association CAAM. Government incentives for EVs spurred growth in previous months, but now analysts see signs of slowing demand (China.Table reported). Strict Covid measures in Shanghai and other cities had already affected sales in the first half of the year.

In contrast, sales of electric, hybrid and hydrogen vehicles surged by almost 94 percent year-on-year in September. Electric vehicle manufacturer Tesla, for example, set a sales record in China in September (China.Table reported).

However, the recovery trend is below the expectation of the CPCA passenger car association. China’s car market and the performance of foreign car brands are relatively weak, CPCA Secretary General Cui Dongshu said. “Tougher COVID restrictions in many cities prevented people from attending auto shows and promotional events, discouraging sales,” he added. As a result, Chinese automakers step up their efforts to sell EVs overseas, especially in Southeast Asia and Europe. In recent weeks, BYD and NIO announced plans to bring more models to the European market (China.Table reported).

Signs of slowing demand could intensify competition and lead to price cuts for cars, including EVs, said analyst Shi Ji of China Merchants Bank. He said this was especially true given the high industry-wide inventory levels that have persisted since July. mw/rtr

The director of Britain’s GCHQ intelligence service has warned of the risks posed by the growing influence of the People’s Republic of China. While the Communist Party has been building their country’s economic strength, it has simultaneously introduced draconian security laws and a culture of surveillance, Jeremy Fleming said.

To expand its influence, China used digital currencies, satellite systems, and technological products, among other things. Through exports, these spread around the world. Yet such Chinese technologies have “hidden costs,” Fleming warned. He called on the domestic science and technology sector to become less dependent on China and create alternative, competitive offers.

According to a media report, the British government plans to officially reclassify China as a “threat” to the United Kingdom on Wednesday. Prime Minister Liz Truss will present a new strategic assessment listing “Britain’s enemies,” British tabloid The Sun reported. Previously, London classified China as a “systemic competitor.” mw/ari

German Research Minister Bettina Stark-Watzinger urged vigilance on the 50th anniversary of the establishment of diplomatic relations with China. “German-Chinese relations must always be critically scrutinized, especially with regard to research cooperation,” the liberal FDP politician said. China has increasingly gone from being a strategic partner to a tough competitor and systemic rival for Germany and the EU, she added.

When it comes to global challenges such as climate change, the minister sees Beijing as a partner that must be actively called into duty. In sensitive areas, she advocated clear boundaries. Here, Stark-Watzinger mentioned artificial intelligence, “which China is abusing to monitor its citizens,” or cooperation involving “dual-use risks” – for example, joint research where results could also be used for unwelcome purposes. “That’s why we’re canceling topics and cooperations with China, especially in key technologies that we deem unjustifiable.”

In the summer, the German Federal Ministry of Education and Research announced plans to “critically examine” research cooperation with China (China.Table reported). The background to the reviews was repeated reports of human rights violations in Xinjiang. With regard to the Confucius Institutes, Stark-Watzinger stated that she opposes any direct or indirect political influence by China on our teaching and science. “Here the universities are called upon to decide whether they will tolerate institutes that are co-financed by Beijing and are politically oriented.” mw

The establishment of diplomatic relations between two states is a historically significant event. Milestone anniversaries are celebrated in a ceremonial and ritualized manner, i.e. following diplomatic customs. Efforts are made to avoid discord, to praise the current relationship where possible, and to give each other a straightened history of past relations.

And there are good reasons for all of this. The absence of diplomatic relations is generally regarded as unfavorable, even potentially dangerous, and the termination of relations is regarded as an escalation and ultima ratio.

This year marks the 50th anniversary of diplomatic relations between Germany and China. As is common in liberal democracies, such an occasion also provides an opportunity for numerous actors from civil society, the media, universities and business to comment. Depending on their interests and agendas, these actors also tend to behave “diplomatically,” or otherwise, in deliberate demarcation, in a decidedly critical manner.

The fact that the People’s Republic of China is not a liberal democracy but, according to the constitution, “a socialist state under the people’s democratic dictatorship,” and that a largely Leninist-organized Communist Party continues to rule the country, with corresponding resources for political activities abroad, complicates matters considerably.

The global political situation and tensions with the People’s Republic of China over its treatment of Hong Kong, Tibetan, Uyghur or other minorities, dissidents, human rights lawyers or journalists, as well as what has been apostrophized as a newly emerging self-confidence, and attempts to exert political influence in other countries have reignited discussions on a credible value-based foreign policy.

At their core, some of these discussions revolve around a fundamental dilemma when dealing with authoritarian regimes. First, diplomatic relations represent nothing more than formal recognition of one state by another. It is through the lived practice of relations that interests arise, which could be harmed by any deterioration in relations.

This poses the risk that, over time, formal recognition will be followed by material recognition. So how can a liberal democracy position itself vis-à-vis an authoritarian regime without normalizing and thus leveling the fundamentally divisive, normative political difference through its own actions and words? Perhaps even undermining one’s own set of values?

As long as China’s democratization was expected, overcoming political differences seemed only a matter of time. Now that the change has failed to materialize, however, political difference has once again moved to the center. Furthermore, internally authoritarian movements have gained ground in European societies, which have a dividing effect and fundamentally call the values of liberal democracies into question.

So what are the options?

One simple measure concerns the choice of words when dealing with the People’s Republic. It should make one’s own set of values unmistakably clear. In addition to standing up for democracy, human rights and the rule of law, more subtle levels of communication must also be taken into account. In particular, it is important to avoid leveling vocabulary. These are words on which both sides can agree in apparent consensus.

For example, it should be avoided, like a member of the Swiss government has done, to speak of “popular participation” when referring to semi-direct democracy on the Swiss side and Leninist democratic centralism on the Chinese side. The respective degrees of participation are worlds apart, after all.

Nor is it helpful to speak of “human dignity” when what is actually meant is “human rights”. And given China’s attempts to turn the core meaning of human rights on its head, it would also be necessary to differentiate and pay attention to a more precise formulation here. It is more adequate to use different words that indicate a political difference in interactions wherever possible.

It is also important to prevent false equivalences. The All-China Federation of Industry and Commerce (ACFIC, 中华全国工商业联合会), for example, is by no means a counterpart to the Federation of German Industries (BDI), but an organ of the United Front at the tail of the Communist Party.

A communication based on differences also conveys to the Chinese counterpart that one is familiar with the political system. Ultimately, it is important to avoid vocabulary that is commonly used in the propaganda and United Front activities of the Communist Party. This includes subtle expressions like “friends” or “bridge,” more obvious “win-win cooperation” or “a new era”. Instead of a “dialogue” pursued by civil society forces, one might prefer to speak of maintaining “contacts” or communicating one’s “position”.

The People’s Republic uses language in an extremely differentiated and deliberate manner. Adequate knowledge of the terminology used by the Chinese party state, as well as its inner structures and methods, is a prerequisite for representing one’s own positions credibly and with specifically chosen vocabulary.

Obviously, the choice of words alone will not be enough to turn the global political situation and the tensions with China to one’s own advantage. Apart from well-considered words, this will certainly require equally well-thought-out actions. But language always also communicates inwards, to the population that constitutes the state.

If the 50th anniversary of the establishment of diplomatic relations is now celebrated as it should be, then, despite the desire to express oneself “diplomatically,” there is certainly room for maneuver that can be filled accordingly to signal the fundamentally political difference between the “Federal Republic” and the “People’s Republic.”

This text is a translated and abridged version of the original first published on the website of the German-Chinese Dialogue Forum.

Ralph Weber is an Associate Professor of European Global Studies at the University of Basel in Switzerland. His research fields include Chinese political philosophy, modern Confucianism, and Chinese politics. He focuses on European-Chinese relations and published a widely acclaimed study on the influence of the Chinese party-state in Switzerland in December 2020.

Wei Xiaoxue took over the position of managing director at Neuberger Berman China on October 10. In the Shanghai-based subsidiary of the US investment firm, Wei’s responsibilities will include driving investment strategy development, leading the equity research team and overseeing portfolio risk management.

Christina Gruschka joined Porsche China this month as Manager of Charging Strategy. Gruschka is an expert in the field of smart mobility. Most recently, she helped shape the rollout of Porsche Connect for Porsche in Ludwigsburg. Her new place of work is Shanghai.

Is something changing in your organization? Why not let us know at heads@table.media!

Near the city of Zunyi in the province of Guizhou, a farmer proudly picks the yield from her pomelo trees.