“We need to rethink our trade policy,” declared Economics Minister Habeck right at the opening podium of the Asia-Pacific Conference of German Business in Singapore on Saturday. What he meant above all was: In order to be more independent from China, Germany needs new partners – especially in Asia. Malte Kreuzfeldt is on the ground in Singapore to see how offensive and at the same time value-based the free trade offensive in the region can actually be. His conclusion: The wheels of diversification grind slowly. A free trade agreement between the EU and India remains a tough nut to crack in terms of negotiations. Countries like Pakistan or the Philippines are still a long way from meeting European human rights standards. Plus: Even if one day Germany is more broadly positioned, China will remain very important for German companies.

The establishment of the Asian Infrastructure Investment Bank (AIIB) in June 2016 was the first creation of a new World Bank-style global institution since World War II. And the first global institution to originate from China. Since then, the ever-expanding institution has been seen, especially in the West, as Beijing’s tool to push its own interests and undermine the established global financial system around the World Bank and IMF. In an interview with Frank Sieren, Ludger Schuknecht, Vice Chairman of the AIIB, vehemently disagrees. The AIIB is not a cover for China to realize New Silk Road projects with debt traps. It is first and foremost “a climate bank” that is not dominated by any party, country, or group of countries. What is true, however, is that it offers emerging economies in Asia, Africa, and South America the opportunity to emancipate themselves from the US and Europe, he said. “Our customers are fed up with camp thinking,” said Schuknecht, who served as Chief Economist under then Finance Minister Wolfgang Schäuble.

By the way: Tomorrow, our colleagues from Security.Table, headed by Marco Seliger, will start with their first issue. The editorial team also includes Thomas Wiegold, Nana Brink, and Viktor Funk. They report not just on the turning point in the Bundeswehr but also analyze changes in global security and defense policy. After all, Ukraine will be an area of conflict in the long term – in addition, the overall global balance of power is shifting: China versus the USA, autocracies versus democracies. You can test the service free of charge here.

We wish you a good start into the new week!

Mr. Schuknecht, the G20 summit is taking place in Bali this week. As the newest multinational development bank, how does the AIIB view the summit? Is it a yakking session without any real dialogue?

No, on the contrary: After sanctions, war, and Covid, the G20 members need to talk more directly with each other again. There is no other way to solve global problems. As a result, the global economy is suffering. And the more countries and private companies are busy with crisis management, the less money and time they have for future projects in infrastructure and climate change. That’s why the G20 is more important than ever.

How important was Scholz’s trip to Beijing the week before last?

I really welcomed this visit, because talking is better than silence after a long time without direct contact, especially before the G20 summit. This has also helped those in Beijing who are campaigning for more multilateralism. Now Germany and the West and China and Asia can make faster progress at the summit.

At the same time, interests couldn’t be more different at the moment. Where do you stand? Is the AIIB the infrastructure bank of the Chinese?

No. It is the bank of our member countries with a focus on Asia. Importantly, unlike some other international organizations, the AIIB is not dominated by any party, country, or group of countries. China has about a quarter of the voting shares, and Western industrialized countries hold a quarter. Emerging Asia holds nearly half, with a few non-Asian members. That means to make a decision, each of the three needs another to get a majority. Neither the West nor China can rule through. That is a big step forward.

But aren’t the emerging Asian economies doing what China wants anyway?

Not in our experience. On the contrary. Emerging markets are looking to the AIIB for international quality standards. These are also important for cooperation with other international financial partners. And with us, there is a lot of emphasis on consensus among all members.

Consensus – that sounds like a very lengthy process?

On the contrary. We are still small and thus very nimble and agile. We have 460 employees. The World Bank has about 16,000. The International Monetary Fund has 2,700. Our shareholders don’t have big offices here and we don’t have big offices in the respective countries.

Nevertheless, China initiated the bank. And it is no coincidence that its headquarters are in Beijing.

The location lends itself to this. China is the world’s second-largest economy. But no international institution is based there, while the World Bank and the IMF are based in Washington. The bank is thus located in a region that will have the greatest need for infrastructure in the coming decades. A bank that is lean, green, and clean, i.e. operates sustainably, is small and nimble, yet also principled, is very important for the region.

The US and Japan were not enthusiastic about the initiative from Beijing.

The bank discovered a gap in the market. 105 member countries speak for themselves. Of these, 26 are in Europe and 20 in Africa.

Didn’t it also play a role that Washington dominated the ADB, IMF, and World Bank and didn’t want to give Beijing more power?

That also played a role. And in the end, they created a new competitor as a result. That’s good for customers. With the AIIB, we have shown that in the 21st century, a bank can meet high standards even if it is not dominated by a majority of Western countries. This is an important development because industrialized countries will lose their dominance in the global economy.

What about the goal of a “world currency yuan”?

China does not yet have open capital movements. That is one of the big disadvantages. On the other hand, I think from a monetary policy point of view it is not bad if there is not just one but several stable, well-managed currencies without one dominating. The yuan plays a central role here. Despite the current economic weakness, the yuan is fundamentally based on macroeconomic stability.

The AIIB was founded shortly after the Belt and Road Initiative was announced. Did Beijing need an international bank to push through projects under its guise?

We are not a cover, but we set the highest international standards. We are more like a kind of security check for infrastructure projects.

How many BRI projects did the AIIB finance?

To my knowledge, none. Nevertheless, we have an influence in China as well. This is because it turned out that lower standards in project implementation lead to problems, which in turn can cause political upsets between Beijing and the respective countries. Beijing wants to avoid that. That’s why the AIIB is also important for Beijing.

When the bank was founded in 2016, you were Finance Minister Wolfgang Schäuble’s Chief Economist, and you convinced him to participate. In terms of the industrialized countries losing power, hasn’t Germany given in too soon?

No. We analyzed it very soberly. There were two decisive reasons for this: We have agreed on standards in the G7, the club of industrialized nations. These include, for example, check and balance in the bank’s governance and sustainability. We applied these standards and, during the negotiations, found out that the AIIB wants to comply with them. The second reason was simply: being there is better than not being there. With the AIIB, there is now one more opportunity to assert our global interests. We knew that the West did not have the majority. But we also knew that no other group has a majority. Nevertheless, as the fourth largest shareholder, we have a leadership role in the bank. That is appropriate as one of the most important explorations in the world.

Thus, you have come to a different assessment than the US, which, like Japan, is still not a member.

I regret that. But it was perhaps too difficult to convince domestically that the world power USA could only become a junior partner in this bank.

What products does the bank focus on?

We are a climate bank. We are a bank that wants to mobilize the private sector, and we are a bank of connectivity in two ways: we build infrastructure that connects Asian countries more closely. We have the goal to do at least 50 percent of our financing for the climate by 2025. In 2021, we were already at 48 percent. We also want to be at 50 percent in private sector finance by 2030. In new business, we are at around 30 percent this year.

How green are the Asian financial markets?

They are on an amazingly good path. And we are trying to support them. For example, with our AIIB Asia ESG Enhanced Credit Managed Portfolio, a 500 million bond portfolio designed to help strengthen sustainable capital markets in Asia. Or the Asia Climate Bond Portfolio, which aims to develop climate bond markets. The idea is to be able to offer emerging markets money as cheaply as possible for private, market-based, but climate-friendly financing with a AAA rating.

With this, you are a competitor of China.

On the contrary, we are even moving toward working with Chinese banks. We have partnerships not only with the German KfW but also, for example, with the Chinese Eximbank, China’s most important international financier.

But it is certainly not dependent on their money.

True. But if they partner with us and adhere to our standards, they improve their projects and their reputation in the world. In a way, the AIIB is their seal of approval. In that respect, China is changing. Policymakers are now paying more attention to the quality of their engagement. That’s where we’re happy to help.

How does the AIIB view cooperation with autocratic systems?

Basically, our members have very different political systems. We do not want to exclude anyone, as long as – and this is important – the members adhere to our standards and values. This means that if a country or a customer undertakes a solar project with us, then of course this has to be done without the help of forced labor or other human rights violations they have committed themselves and they will be checked. We demand transparency and if we don’t get it, we don’t do the project.

Has any country ever failed?

We put our business with our founding member Russia on hold shortly after the war in Ukraine began. And we are not doing anything in Myanmar at the moment either. North Korea is not a member.

You have also worked in OECD and other institutions. Has the AIIB succeeded in creating a different mindset with its new structures? Or, does it not matter which global bank has just hired you?

Because of our structure, we are forced to put ourselves in each other’s perspective. This is important and a strength, even in the face of the pandemic, during which the respective echo chambers have intensified. That’s when one was less aware of how others think, of their interests, and sometimes even their feelings. After all, we have different cultures and sensitivities. Our members and customers in Asia, Africa, and South America in particular no longer want to have to choose between the USA, Europe, or China. They are fed up with camp thinking; instead, they want a bank that balances different interests and arrives at a pragmatic, professional solution. This also means holding a mirror up to each other.

Ludger Schuknecht has been Vice President and Corporate Secretary of the Asian Infrastructure Investment Bank (AIIB), the newest multilateral development bank with a climate and Asia focus, since 2021.

105 countries worldwide are members. They represent a good 80 percent of the world’s population. The bank was created at China’s initiative and is headquartered in Beijing. Schuknecht became known as Chief Economist to Finance Minister Wolfgang Schäuble (CDU) and Co-chair of the G20’s Infrastructure Investment Group. He previously held senior positions at the European Central Bank (ECB) but has also worked at the International Monetary Fund (IMF) and the World Trade Organization (WTO).

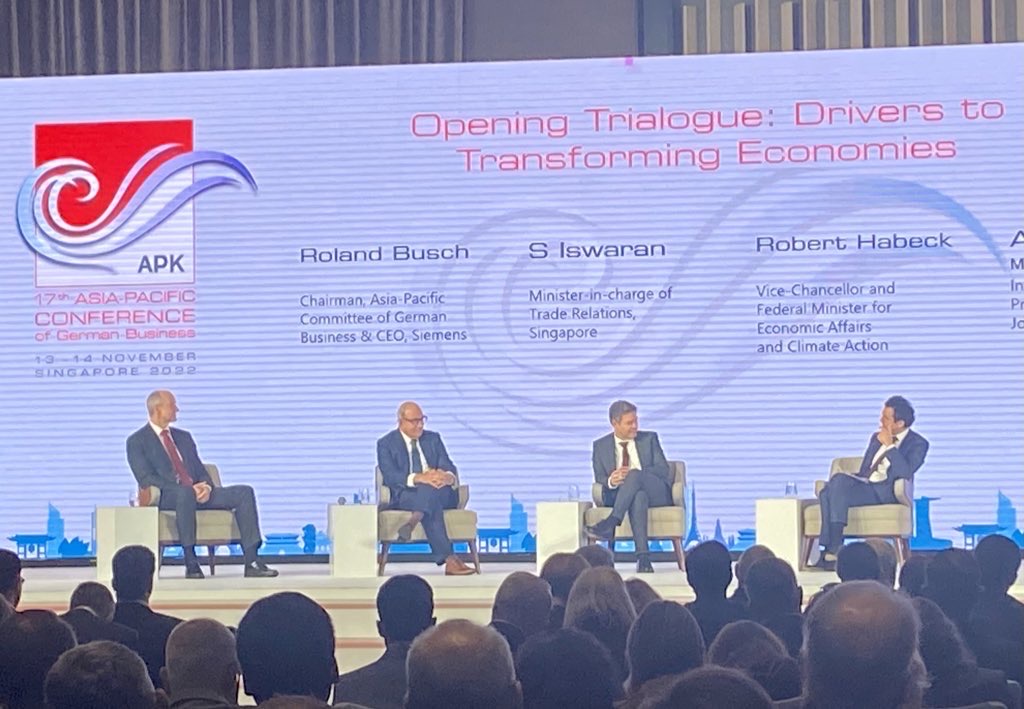

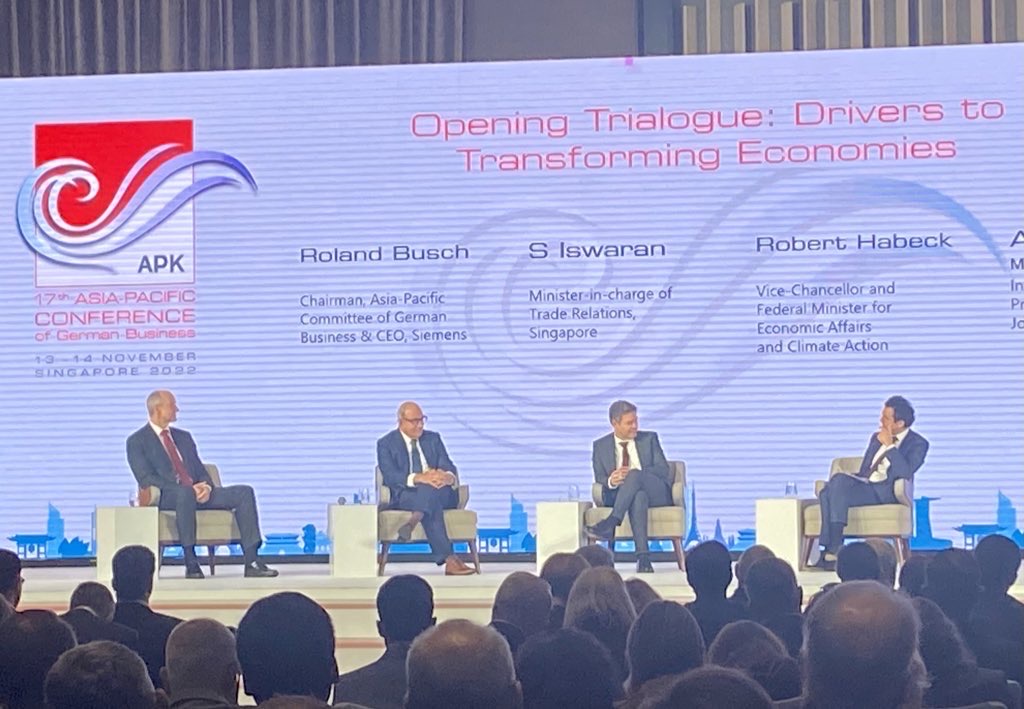

The timing could hardly have been better for Economics Minister Robert Habeck. While he was sitting in the government plane on Friday evening on his way to the Asia-Pacific Conference of German Business in Singapore, the coalition factions in Berlin reported a breakthrough in trade policy: on the one hand, the SPD, Greens, and FDP agreed to bring the long-disputed CETA agreement between the EU and Canada fully into force. Secondly, new free trade agreements with Mexico and Chile are now to be launched swiftly. This is “a milestone in trade policy,” said Habeck, commenting on the agreement, which is based on his initiative.

This is unlikely to meet with enthusiasm from free trade critics, who are traditionally close to the Greens. But among Germany’s export-oriented business community, which is gathering in Singapore on Sunday and Monday for the 17th Asia-Pacific Conference (APK), the Economics Minister scored points with this commitment to free trade. However, the commitments to CETA and the ambitions for agreements with Latin American countries also show: Berlin is currently looking intensively for paths leading away from China.

“For 30 years, we have made this apolitical view of China the principle of our trade policy, now there is an extremely political view of China,” Habeck said in Singapore. “We need to rebalance our trade policy. We need other countries, other partners.” The direction in which this could move was demonstrated by a decision from Habeck’s ministry last week: Shortly before the APK, it was announced that in the future, foreign investments can only be state-backed up to a cap of €3 billion per company and country and that the fees will increase if more than 20 percent of the sum is accounted for by one country (China.Table reported) – both make investments in China more difficult. In addition, Habeck’s ministry prohibited the participation of Chinese investors in two German manufacturers of microchips (China.Table reported).

In Singapore, the Vice Chancellor countered the impression that his policy is aimed at withdrawing the economy from China. “Nobody in their right mind is talking about completely isolating the markets,” Habeck said on the sidelines of the conference. Instead of “decoupling,” i.e., completely decoupling the markets, he said, what is needed is greater diversification. But that is urgently needed, he added. “We have a great dependence on China in certain sectors that may prove critical,” Habeck said. That was not a problem as long as economic relations were stable, he said. But it can not be assumed anymore. “There is no such thing as apolitical trade anymore,” the Economics Minister said at the opening podium in Singapore.

In the search for alternatives, Habeck said the Asia-Pacific Conference, which is taking place as a live event with around 500 participants from 20 countries for the first time after a three-year Covid break, could play an important role. “We are in the right place at the right time.” But he did not hold out the prospect of a new free trade agreement for the region, despite recent successes elsewhere. It would be “too long of a way” before an agreement could be concluded between the EU and the Asean states, Habeck said. In the process, “criteria of the rule of law, human rights, would also have high value,” and these were “not yet guaranteed in all states according to European standards.”

Therefore, in addition to cooperation agreements between individual companies, only a framework declaration on sustainability and innovation was signed in Singapore, in which Singapore and Germany agreed on a “regular structured exchange between the two ministries on all foreign trade policy issues.” But here, in particular, the need for action does not seem so great: According to the local Chamber of Foreign Trade, more than 1,000 German companies are already based in the island state with its 5.5 million inhabitants.

And this is not the end: According to a survey conducted by the German Chamber of Commerce Abroad, the economic outlook for the Asean region is positive among German companies – more positive than for the People’s Republic. On average, around one in four companies (22 percent) in the Asia-Pacific region expects stronger economic development in the countries, according to a special evaluation of the current AHK World Business Outlook among more than 500 companies surveyed in the region. In China, only 14 percent of the companies operating there expect the country’s economy to pick up.

Companies in the Asia-Pacific region are also more hopeful about the development of their own business. Almost half of the companies (44 percent) in the Asia-Pacific region expect a positive development over the next twelve months, while 17 percent expect business to deteriorate. According to the survey, only 28 percent of companies in China are optimistic about the coming year, while 23 percent expect business to deteriorate.

“Those looking for alternative locations for necessary diversification outside China will already find good conditions beyond the borders. So the region remains attractive for German companies,” said the President of the Association of German Chambers of Industry and Commerce, Peter Adrian, before the APK in Singapore. One name that keeps coming up in the diversification debate is Vietnam.

Chancellor Olaf Scholz traveled there on Sunday. Vietnam is the first stop on the Chancellor’s trip to Asia. Scholz will also attend the APK today, Monday. Then it goes on to the G20 summit on the Indonesian island of Bali. The visit to Hanoi will focus on one aspect: what opportunities does Vietnam offer to reduce Germany’s dependence on China.

After the Russian invasion of Ukraine, “we are experiencing a turning point,” Scholz said in Hanoi, according to the Reuters news agency. “As a consequence, we have to expand our sales markets, our supply chains, our sources of raw materials and production sites so that we are not dependent on individual countries. Vietnam plays a very, very important role in this.” In return, Germany wants to support Vietnam’s path to climate neutrality. Stronger cooperation in the energy field was also a topic of discussion with Prime Minister Pham Minh Chinh, he said.

However, Vietnam, a socialist republic with a one-party system, is also a prime example of how difficult a realignment in the Indo-Pacific region could become. Relations with its large neighbor China are close. Like the People’s Republic, Vietnam abstained from voting at the United Nations General Assembly and did not condemn Russia’s war of aggression in Ukraine. Malte Kreutzfeldt/Amelie Richter

Ahead of today’s G20 summit kick-off on the Indonesian island of Bali, US President Joe Biden and China’s President Xi Jinping will meet for their first bilateral meeting since Biden took office. The relationship between the world’s two largest economies is strained. “I don’t think that the two leaders are going to sit down and be able to solve all their differences or problems,” a senior US government official said, referring to the meeting, according to agency reports. Rather, she said, it will be an “in-depth and extensive strategic communication” aimed at “clearing up misunderstandings.” A joint statement was not planned.

Accordingly, the agenda of the meeting includes the following topics:

Five times Biden and Xi had spoken in the past two years, but only in video conferences. However, the two met several times when Joe Biden was US Vice President. “I know him well. He knows me. I’ve spent more time with him than any other world leader,” Biden said in advance of the meeting. There have always been straightforward discussions and very little misunderstanding between them, he said, which is crucial for the two countries’ relations.

China’s foreign office spokesman Zhao Lijian said in advance that Beijing hoped for an improvement in the troubled relationship. China seeks mutual respect, peaceful coexistence, and cooperation but is determined to defend its “legitimate rights and interests,” he said. Differences must be dealt with appropriately and relations must be put back on the “right track,” Zhao said. fpe

On Saturday, China’s National Health Commission reported the highest number of new Covid infections since April. According to the report, some 11,950 new cases were registered – up from 10,729 infections the previous day. 1,504 cases were symptomatic and 10,446 cases were asymptomatic infections, it said.

Despite rising numbers of cases, China relaxed quarantine and entry rules on Friday. The health protection authority announced the following rule changes.

The new arrangement comes after a Politburo meeting chaired by Xi Jinping. It seems to have been approved from the very top. This is probably necessary because it goes against the trend. In Beijing and Zhengzhou, the authorities are registering record numbers of new infections. fin

Hundreds of solar energy components are stuck in US ports. Customs officials told Reuters news agency that US Customs seized 1,053 shipments between June 21 and Oct. 25. Releases have not yet been issued, they said.

The reason for the blockade is the Uyghur Forced Labor Prevention Act (UFLPA), which went into effect in June. The US law requires importers to prove that goods or components of products from the Xinjiang region were not produced using forced labor (China.Table reported).

According to the Reuters report, the products include panels and polysilicon cells, which would be manufactured primarily by three Chinese companies: Longi Green Energy Technology, Trina Solar, and JinkoSolar. Jinko said in an email that the company is working with US Customs to document that its shipments are not linked to forced labor. The company said it is “confident that the shipments will be approved.”

According to Reuters, US Customs would not comment on how long the shipments have been held and when and if they would be released. “Ultimately, it is contingent upon how quickly an importer is able to submit sufficient documentation,” a spokeswoman said.

The supply problems are also stalling US President Joe Biden’s climate policy. He has resolved to push ahead with the expansion of environmentally friendly energy sources in the USA as quickly as possible. rtr

China’s state media reported Sunday that Yin Li replaces Cai Qi, newly appointed to the Standing Committee, as the top secretary of the Beijing Municipal Government. The 60-year-old is one of the 24 members of the Politburo. He was previously party secretary of Fujian province. His successor there will be 57-year-old geophysicist Zhou Zuyi.

According to the state news agency Xinhua, the Central Committee of the Communist Party of China has decided that Li’s predecessor Cai Qi would not be allowed to be secretary, standing committee member, and member of the CCP Beijing Municipal Committee at the same time. Cai Qi surprisingly moved up at the 20th Party Congress to the Politburo Standing Committee, the real power center of the CP (China.Table reported).

Li is considered an expert in the field of health care. He has completed relevant studies in Russia and the United States. His appointment could be a signal that the party leadership in the capital wants to rely on a technocratic, science-based style of leadership to contain the pandemic. fpe

“The exciting thing about Taiwanese society is that many pre-modern cultural contents and values have been preserved and are still lived today,” says freelance artist Andreas Walther enthusiastically. During his studies at the Hochschule für Künste in Bremen, he made contact with students from Taipei and traveled to Taiwan for the first time in the late 1990s. “In the years that followed, the desire grew to relate the different lifestyles of my homeland and the Far East to each other as meaningfully as possible.” Walther traveled there again and again, and his artistic works are an expression of intercultural dialogue. His quiet nature photographs, with their misty voids, are reminiscent of Chinese ink paintings.

But in the fields of video, graphics, and installation, Walther also traces what cannot be put into concrete words between worlds, but which art can capture. “Sometimes a trip to another European country is enough to experience how much your personal constitution changes when you move outside the familiar.” Walther believes this experience of disconnectedness, in which a person can reconnect in the unfamiliar, is elemental. “You can imagine how profound this experience is once you find yourself in a culture that fundamentally breaks with the familiar.”

To this day, he is a committed promoter of intercultural exchange between Taiwan and Germany, developed corresponding curatorial projects, and invites Taiwanese artists to present their work in his hometown of Giessen every year. He also shows German artists in Taiwan. “Every culture holds its very own insights and values, of which sometimes not even an inkling exists in other cultures,” says Walther.

“What I personally found in Taiwan is the concept of nature in Daoism.” In Daoism, humans as physical beings are considered part of nature; the central Daoist idea assumes a natural way of things and beings, a being-from-itself. “For me, that means trusting in nature, including my own,” Walther says. “At this realization, the ego can calm down, which is constantly being worn down anew in our performance-oriented world.” His works and curatorial projects seek to convey the Daoist concept of nature to Europe and to question the primacy of mind over body that has been established in modernity.

Polar constellations such as between body and mind or the named and the unnamed are recurring themes in Walther’s work. The concrete reality of his life also tells of these opposites. He lives between Germany and Taiwan, spending three to six months in each country before returning to the other.

“For me, the greatest enrichment comes from the constant change between cultures,” says Walther. The length of his stays is deliberately chosen: He never immerses himself so deeply in the culture that its peculiarities become commonplace, almost imperceptible to him. “From the experience of the constant change in the realities of my life, a lot can be learned about ‘being a human being in the world.’” Svenja Napp

René Scheerat is Executive Assistant at Audi China. For the position, the strategic planner and team coordinator is moving from Ingolstadt to Beijing, where he will support Jürgen Unser, President of Audi China.

Cordula Blochinger has taken on the role of Head of Active Talent Sourcing at Steinkellner China Search. Steinkellner China is a globally active headhunter with a focus on the Chinese market. Blochinger is expected to recruit primarily executives in the automotive, technology, pharma/life science and medical technology sectors for the Austrian company.

Is something changing in your organization? Why not send a note for our staff section to heads@table.media!

Do you have a caring streak? Or even a helper syndrome? Then you can really let off steam in China (at least linguistically). Because in the Middle Kingdom, you’ll be nurtured for all you’re worth. Responsible for this course of cuddling is the verb 养 yǎng – an amazing all-rounder among the caring verbs. The semantic heart of this word chameleon beats in tune with German to-do-words like “to raise” and “to bring up” (e.g., children – 养孩子yǎng háizi). However, it is also understood in the sense of “to keep, care for, breed” (e.g., dog and cat – 养狗 yǎng gǒu and 养猫 yǎng māo – or plant -养花 yǎng huā). However, Chinese nurture professionals do not stop there by a long shot.

In Chinese, cars and roads can also be “nurtured” (养车 yǎng chē and 养路 yǎng lù) – we would probably speak soberly of “maintenance” or “servicing” here. And for those who love good food, China even nurtures their frying pan (养锅 yǎng guō) – no joke. To “keepers” of cast-iron cooking pots, Chinese kitchen professionals advise caring pan care for the optimal cooking experience – with special greasing rituals.

One can nurture financially, too, in Chinese – for example, by (under)keeping a family (养家 yǎngjiā) or a shopping-crazed partner (养女友 yǎng nǚyǒu or 养男友 yǎng nányǒu “to financially sustain/feed one’s girlfriend/boyfriend”), if not a mistress (养小三 yǎng xiǎosān). Meanwhile, the state nurtures the army (养兵 yǎngbīng “maintain an army”).

But the most beautiful task is probably to nurture yourself. In Chinese, health care means “life nurturing” (养生 yǎngshēng) – and this includes wellness vocabulary such as stomach (intestinal) nurturing (养胃yǎngwèi), eye maintenance (养眼 yǎngyǎn) or facial care (养颜 yǎngyán). And if you want to nurture your deepest inner self, it’s best to prophylactically nurture your mind (养神 yǎngshén “to recover mentally, to switch off inwardly”), and please do so before burnout sets in. Otherwise, it is called diseases and wounds “nurture”, pardon: cure (养病 yǎngbìng and 养伤 yǎngshāng).

And as if that weren’t enough, a (rather unpopular) little data animal has recently joined the Chinese daily routine, which also wants to be nurtured and screeches daily for professional care – namely the health code of the Covid app, in Chinese 健康码 jiànkāngmǎ. To prevent the dreaded window (弹窗 tánchuāng) from suddenly popping up in the application, restricting your freedom of movement, or sending you off to the Covid test, you have to care for the green code in Tamagotchi style (remember: Tamagotchi – those egg-shaped Japanese mini electric toys that were popular at the end of the nineties). For example, targeted stays in areas with low Covid risk, a generally code-friendly travel history, or, as the last option, stoic couch potatoeism are suitable for species-appropriate code care. 养码 yǎngmǎ – “nurturing the health code” is the new Chinese web jargon for such a procedure – another (ironic) language creation under the sign of Covid.

Verena Menzel runs the online language school New Chinese in Beijing.

“We need to rethink our trade policy,” declared Economics Minister Habeck right at the opening podium of the Asia-Pacific Conference of German Business in Singapore on Saturday. What he meant above all was: In order to be more independent from China, Germany needs new partners – especially in Asia. Malte Kreuzfeldt is on the ground in Singapore to see how offensive and at the same time value-based the free trade offensive in the region can actually be. His conclusion: The wheels of diversification grind slowly. A free trade agreement between the EU and India remains a tough nut to crack in terms of negotiations. Countries like Pakistan or the Philippines are still a long way from meeting European human rights standards. Plus: Even if one day Germany is more broadly positioned, China will remain very important for German companies.

The establishment of the Asian Infrastructure Investment Bank (AIIB) in June 2016 was the first creation of a new World Bank-style global institution since World War II. And the first global institution to originate from China. Since then, the ever-expanding institution has been seen, especially in the West, as Beijing’s tool to push its own interests and undermine the established global financial system around the World Bank and IMF. In an interview with Frank Sieren, Ludger Schuknecht, Vice Chairman of the AIIB, vehemently disagrees. The AIIB is not a cover for China to realize New Silk Road projects with debt traps. It is first and foremost “a climate bank” that is not dominated by any party, country, or group of countries. What is true, however, is that it offers emerging economies in Asia, Africa, and South America the opportunity to emancipate themselves from the US and Europe, he said. “Our customers are fed up with camp thinking,” said Schuknecht, who served as Chief Economist under then Finance Minister Wolfgang Schäuble.

By the way: Tomorrow, our colleagues from Security.Table, headed by Marco Seliger, will start with their first issue. The editorial team also includes Thomas Wiegold, Nana Brink, and Viktor Funk. They report not just on the turning point in the Bundeswehr but also analyze changes in global security and defense policy. After all, Ukraine will be an area of conflict in the long term – in addition, the overall global balance of power is shifting: China versus the USA, autocracies versus democracies. You can test the service free of charge here.

We wish you a good start into the new week!

Mr. Schuknecht, the G20 summit is taking place in Bali this week. As the newest multinational development bank, how does the AIIB view the summit? Is it a yakking session without any real dialogue?

No, on the contrary: After sanctions, war, and Covid, the G20 members need to talk more directly with each other again. There is no other way to solve global problems. As a result, the global economy is suffering. And the more countries and private companies are busy with crisis management, the less money and time they have for future projects in infrastructure and climate change. That’s why the G20 is more important than ever.

How important was Scholz’s trip to Beijing the week before last?

I really welcomed this visit, because talking is better than silence after a long time without direct contact, especially before the G20 summit. This has also helped those in Beijing who are campaigning for more multilateralism. Now Germany and the West and China and Asia can make faster progress at the summit.

At the same time, interests couldn’t be more different at the moment. Where do you stand? Is the AIIB the infrastructure bank of the Chinese?

No. It is the bank of our member countries with a focus on Asia. Importantly, unlike some other international organizations, the AIIB is not dominated by any party, country, or group of countries. China has about a quarter of the voting shares, and Western industrialized countries hold a quarter. Emerging Asia holds nearly half, with a few non-Asian members. That means to make a decision, each of the three needs another to get a majority. Neither the West nor China can rule through. That is a big step forward.

But aren’t the emerging Asian economies doing what China wants anyway?

Not in our experience. On the contrary. Emerging markets are looking to the AIIB for international quality standards. These are also important for cooperation with other international financial partners. And with us, there is a lot of emphasis on consensus among all members.

Consensus – that sounds like a very lengthy process?

On the contrary. We are still small and thus very nimble and agile. We have 460 employees. The World Bank has about 16,000. The International Monetary Fund has 2,700. Our shareholders don’t have big offices here and we don’t have big offices in the respective countries.

Nevertheless, China initiated the bank. And it is no coincidence that its headquarters are in Beijing.

The location lends itself to this. China is the world’s second-largest economy. But no international institution is based there, while the World Bank and the IMF are based in Washington. The bank is thus located in a region that will have the greatest need for infrastructure in the coming decades. A bank that is lean, green, and clean, i.e. operates sustainably, is small and nimble, yet also principled, is very important for the region.

The US and Japan were not enthusiastic about the initiative from Beijing.

The bank discovered a gap in the market. 105 member countries speak for themselves. Of these, 26 are in Europe and 20 in Africa.

Didn’t it also play a role that Washington dominated the ADB, IMF, and World Bank and didn’t want to give Beijing more power?

That also played a role. And in the end, they created a new competitor as a result. That’s good for customers. With the AIIB, we have shown that in the 21st century, a bank can meet high standards even if it is not dominated by a majority of Western countries. This is an important development because industrialized countries will lose their dominance in the global economy.

What about the goal of a “world currency yuan”?

China does not yet have open capital movements. That is one of the big disadvantages. On the other hand, I think from a monetary policy point of view it is not bad if there is not just one but several stable, well-managed currencies without one dominating. The yuan plays a central role here. Despite the current economic weakness, the yuan is fundamentally based on macroeconomic stability.

The AIIB was founded shortly after the Belt and Road Initiative was announced. Did Beijing need an international bank to push through projects under its guise?

We are not a cover, but we set the highest international standards. We are more like a kind of security check for infrastructure projects.

How many BRI projects did the AIIB finance?

To my knowledge, none. Nevertheless, we have an influence in China as well. This is because it turned out that lower standards in project implementation lead to problems, which in turn can cause political upsets between Beijing and the respective countries. Beijing wants to avoid that. That’s why the AIIB is also important for Beijing.

When the bank was founded in 2016, you were Finance Minister Wolfgang Schäuble’s Chief Economist, and you convinced him to participate. In terms of the industrialized countries losing power, hasn’t Germany given in too soon?

No. We analyzed it very soberly. There were two decisive reasons for this: We have agreed on standards in the G7, the club of industrialized nations. These include, for example, check and balance in the bank’s governance and sustainability. We applied these standards and, during the negotiations, found out that the AIIB wants to comply with them. The second reason was simply: being there is better than not being there. With the AIIB, there is now one more opportunity to assert our global interests. We knew that the West did not have the majority. But we also knew that no other group has a majority. Nevertheless, as the fourth largest shareholder, we have a leadership role in the bank. That is appropriate as one of the most important explorations in the world.

Thus, you have come to a different assessment than the US, which, like Japan, is still not a member.

I regret that. But it was perhaps too difficult to convince domestically that the world power USA could only become a junior partner in this bank.

What products does the bank focus on?

We are a climate bank. We are a bank that wants to mobilize the private sector, and we are a bank of connectivity in two ways: we build infrastructure that connects Asian countries more closely. We have the goal to do at least 50 percent of our financing for the climate by 2025. In 2021, we were already at 48 percent. We also want to be at 50 percent in private sector finance by 2030. In new business, we are at around 30 percent this year.

How green are the Asian financial markets?

They are on an amazingly good path. And we are trying to support them. For example, with our AIIB Asia ESG Enhanced Credit Managed Portfolio, a 500 million bond portfolio designed to help strengthen sustainable capital markets in Asia. Or the Asia Climate Bond Portfolio, which aims to develop climate bond markets. The idea is to be able to offer emerging markets money as cheaply as possible for private, market-based, but climate-friendly financing with a AAA rating.

With this, you are a competitor of China.

On the contrary, we are even moving toward working with Chinese banks. We have partnerships not only with the German KfW but also, for example, with the Chinese Eximbank, China’s most important international financier.

But it is certainly not dependent on their money.

True. But if they partner with us and adhere to our standards, they improve their projects and their reputation in the world. In a way, the AIIB is their seal of approval. In that respect, China is changing. Policymakers are now paying more attention to the quality of their engagement. That’s where we’re happy to help.

How does the AIIB view cooperation with autocratic systems?

Basically, our members have very different political systems. We do not want to exclude anyone, as long as – and this is important – the members adhere to our standards and values. This means that if a country or a customer undertakes a solar project with us, then of course this has to be done without the help of forced labor or other human rights violations they have committed themselves and they will be checked. We demand transparency and if we don’t get it, we don’t do the project.

Has any country ever failed?

We put our business with our founding member Russia on hold shortly after the war in Ukraine began. And we are not doing anything in Myanmar at the moment either. North Korea is not a member.

You have also worked in OECD and other institutions. Has the AIIB succeeded in creating a different mindset with its new structures? Or, does it not matter which global bank has just hired you?

Because of our structure, we are forced to put ourselves in each other’s perspective. This is important and a strength, even in the face of the pandemic, during which the respective echo chambers have intensified. That’s when one was less aware of how others think, of their interests, and sometimes even their feelings. After all, we have different cultures and sensitivities. Our members and customers in Asia, Africa, and South America in particular no longer want to have to choose between the USA, Europe, or China. They are fed up with camp thinking; instead, they want a bank that balances different interests and arrives at a pragmatic, professional solution. This also means holding a mirror up to each other.

Ludger Schuknecht has been Vice President and Corporate Secretary of the Asian Infrastructure Investment Bank (AIIB), the newest multilateral development bank with a climate and Asia focus, since 2021.

105 countries worldwide are members. They represent a good 80 percent of the world’s population. The bank was created at China’s initiative and is headquartered in Beijing. Schuknecht became known as Chief Economist to Finance Minister Wolfgang Schäuble (CDU) and Co-chair of the G20’s Infrastructure Investment Group. He previously held senior positions at the European Central Bank (ECB) but has also worked at the International Monetary Fund (IMF) and the World Trade Organization (WTO).

The timing could hardly have been better for Economics Minister Robert Habeck. While he was sitting in the government plane on Friday evening on his way to the Asia-Pacific Conference of German Business in Singapore, the coalition factions in Berlin reported a breakthrough in trade policy: on the one hand, the SPD, Greens, and FDP agreed to bring the long-disputed CETA agreement between the EU and Canada fully into force. Secondly, new free trade agreements with Mexico and Chile are now to be launched swiftly. This is “a milestone in trade policy,” said Habeck, commenting on the agreement, which is based on his initiative.

This is unlikely to meet with enthusiasm from free trade critics, who are traditionally close to the Greens. But among Germany’s export-oriented business community, which is gathering in Singapore on Sunday and Monday for the 17th Asia-Pacific Conference (APK), the Economics Minister scored points with this commitment to free trade. However, the commitments to CETA and the ambitions for agreements with Latin American countries also show: Berlin is currently looking intensively for paths leading away from China.

“For 30 years, we have made this apolitical view of China the principle of our trade policy, now there is an extremely political view of China,” Habeck said in Singapore. “We need to rebalance our trade policy. We need other countries, other partners.” The direction in which this could move was demonstrated by a decision from Habeck’s ministry last week: Shortly before the APK, it was announced that in the future, foreign investments can only be state-backed up to a cap of €3 billion per company and country and that the fees will increase if more than 20 percent of the sum is accounted for by one country (China.Table reported) – both make investments in China more difficult. In addition, Habeck’s ministry prohibited the participation of Chinese investors in two German manufacturers of microchips (China.Table reported).

In Singapore, the Vice Chancellor countered the impression that his policy is aimed at withdrawing the economy from China. “Nobody in their right mind is talking about completely isolating the markets,” Habeck said on the sidelines of the conference. Instead of “decoupling,” i.e., completely decoupling the markets, he said, what is needed is greater diversification. But that is urgently needed, he added. “We have a great dependence on China in certain sectors that may prove critical,” Habeck said. That was not a problem as long as economic relations were stable, he said. But it can not be assumed anymore. “There is no such thing as apolitical trade anymore,” the Economics Minister said at the opening podium in Singapore.

In the search for alternatives, Habeck said the Asia-Pacific Conference, which is taking place as a live event with around 500 participants from 20 countries for the first time after a three-year Covid break, could play an important role. “We are in the right place at the right time.” But he did not hold out the prospect of a new free trade agreement for the region, despite recent successes elsewhere. It would be “too long of a way” before an agreement could be concluded between the EU and the Asean states, Habeck said. In the process, “criteria of the rule of law, human rights, would also have high value,” and these were “not yet guaranteed in all states according to European standards.”

Therefore, in addition to cooperation agreements between individual companies, only a framework declaration on sustainability and innovation was signed in Singapore, in which Singapore and Germany agreed on a “regular structured exchange between the two ministries on all foreign trade policy issues.” But here, in particular, the need for action does not seem so great: According to the local Chamber of Foreign Trade, more than 1,000 German companies are already based in the island state with its 5.5 million inhabitants.

And this is not the end: According to a survey conducted by the German Chamber of Commerce Abroad, the economic outlook for the Asean region is positive among German companies – more positive than for the People’s Republic. On average, around one in four companies (22 percent) in the Asia-Pacific region expects stronger economic development in the countries, according to a special evaluation of the current AHK World Business Outlook among more than 500 companies surveyed in the region. In China, only 14 percent of the companies operating there expect the country’s economy to pick up.

Companies in the Asia-Pacific region are also more hopeful about the development of their own business. Almost half of the companies (44 percent) in the Asia-Pacific region expect a positive development over the next twelve months, while 17 percent expect business to deteriorate. According to the survey, only 28 percent of companies in China are optimistic about the coming year, while 23 percent expect business to deteriorate.

“Those looking for alternative locations for necessary diversification outside China will already find good conditions beyond the borders. So the region remains attractive for German companies,” said the President of the Association of German Chambers of Industry and Commerce, Peter Adrian, before the APK in Singapore. One name that keeps coming up in the diversification debate is Vietnam.

Chancellor Olaf Scholz traveled there on Sunday. Vietnam is the first stop on the Chancellor’s trip to Asia. Scholz will also attend the APK today, Monday. Then it goes on to the G20 summit on the Indonesian island of Bali. The visit to Hanoi will focus on one aspect: what opportunities does Vietnam offer to reduce Germany’s dependence on China.

After the Russian invasion of Ukraine, “we are experiencing a turning point,” Scholz said in Hanoi, according to the Reuters news agency. “As a consequence, we have to expand our sales markets, our supply chains, our sources of raw materials and production sites so that we are not dependent on individual countries. Vietnam plays a very, very important role in this.” In return, Germany wants to support Vietnam’s path to climate neutrality. Stronger cooperation in the energy field was also a topic of discussion with Prime Minister Pham Minh Chinh, he said.

However, Vietnam, a socialist republic with a one-party system, is also a prime example of how difficult a realignment in the Indo-Pacific region could become. Relations with its large neighbor China are close. Like the People’s Republic, Vietnam abstained from voting at the United Nations General Assembly and did not condemn Russia’s war of aggression in Ukraine. Malte Kreutzfeldt/Amelie Richter

Ahead of today’s G20 summit kick-off on the Indonesian island of Bali, US President Joe Biden and China’s President Xi Jinping will meet for their first bilateral meeting since Biden took office. The relationship between the world’s two largest economies is strained. “I don’t think that the two leaders are going to sit down and be able to solve all their differences or problems,” a senior US government official said, referring to the meeting, according to agency reports. Rather, she said, it will be an “in-depth and extensive strategic communication” aimed at “clearing up misunderstandings.” A joint statement was not planned.

Accordingly, the agenda of the meeting includes the following topics:

Five times Biden and Xi had spoken in the past two years, but only in video conferences. However, the two met several times when Joe Biden was US Vice President. “I know him well. He knows me. I’ve spent more time with him than any other world leader,” Biden said in advance of the meeting. There have always been straightforward discussions and very little misunderstanding between them, he said, which is crucial for the two countries’ relations.

China’s foreign office spokesman Zhao Lijian said in advance that Beijing hoped for an improvement in the troubled relationship. China seeks mutual respect, peaceful coexistence, and cooperation but is determined to defend its “legitimate rights and interests,” he said. Differences must be dealt with appropriately and relations must be put back on the “right track,” Zhao said. fpe

On Saturday, China’s National Health Commission reported the highest number of new Covid infections since April. According to the report, some 11,950 new cases were registered – up from 10,729 infections the previous day. 1,504 cases were symptomatic and 10,446 cases were asymptomatic infections, it said.

Despite rising numbers of cases, China relaxed quarantine and entry rules on Friday. The health protection authority announced the following rule changes.

The new arrangement comes after a Politburo meeting chaired by Xi Jinping. It seems to have been approved from the very top. This is probably necessary because it goes against the trend. In Beijing and Zhengzhou, the authorities are registering record numbers of new infections. fin

Hundreds of solar energy components are stuck in US ports. Customs officials told Reuters news agency that US Customs seized 1,053 shipments between June 21 and Oct. 25. Releases have not yet been issued, they said.

The reason for the blockade is the Uyghur Forced Labor Prevention Act (UFLPA), which went into effect in June. The US law requires importers to prove that goods or components of products from the Xinjiang region were not produced using forced labor (China.Table reported).

According to the Reuters report, the products include panels and polysilicon cells, which would be manufactured primarily by three Chinese companies: Longi Green Energy Technology, Trina Solar, and JinkoSolar. Jinko said in an email that the company is working with US Customs to document that its shipments are not linked to forced labor. The company said it is “confident that the shipments will be approved.”

According to Reuters, US Customs would not comment on how long the shipments have been held and when and if they would be released. “Ultimately, it is contingent upon how quickly an importer is able to submit sufficient documentation,” a spokeswoman said.

The supply problems are also stalling US President Joe Biden’s climate policy. He has resolved to push ahead with the expansion of environmentally friendly energy sources in the USA as quickly as possible. rtr

China’s state media reported Sunday that Yin Li replaces Cai Qi, newly appointed to the Standing Committee, as the top secretary of the Beijing Municipal Government. The 60-year-old is one of the 24 members of the Politburo. He was previously party secretary of Fujian province. His successor there will be 57-year-old geophysicist Zhou Zuyi.

According to the state news agency Xinhua, the Central Committee of the Communist Party of China has decided that Li’s predecessor Cai Qi would not be allowed to be secretary, standing committee member, and member of the CCP Beijing Municipal Committee at the same time. Cai Qi surprisingly moved up at the 20th Party Congress to the Politburo Standing Committee, the real power center of the CP (China.Table reported).

Li is considered an expert in the field of health care. He has completed relevant studies in Russia and the United States. His appointment could be a signal that the party leadership in the capital wants to rely on a technocratic, science-based style of leadership to contain the pandemic. fpe

“The exciting thing about Taiwanese society is that many pre-modern cultural contents and values have been preserved and are still lived today,” says freelance artist Andreas Walther enthusiastically. During his studies at the Hochschule für Künste in Bremen, he made contact with students from Taipei and traveled to Taiwan for the first time in the late 1990s. “In the years that followed, the desire grew to relate the different lifestyles of my homeland and the Far East to each other as meaningfully as possible.” Walther traveled there again and again, and his artistic works are an expression of intercultural dialogue. His quiet nature photographs, with their misty voids, are reminiscent of Chinese ink paintings.

But in the fields of video, graphics, and installation, Walther also traces what cannot be put into concrete words between worlds, but which art can capture. “Sometimes a trip to another European country is enough to experience how much your personal constitution changes when you move outside the familiar.” Walther believes this experience of disconnectedness, in which a person can reconnect in the unfamiliar, is elemental. “You can imagine how profound this experience is once you find yourself in a culture that fundamentally breaks with the familiar.”

To this day, he is a committed promoter of intercultural exchange between Taiwan and Germany, developed corresponding curatorial projects, and invites Taiwanese artists to present their work in his hometown of Giessen every year. He also shows German artists in Taiwan. “Every culture holds its very own insights and values, of which sometimes not even an inkling exists in other cultures,” says Walther.

“What I personally found in Taiwan is the concept of nature in Daoism.” In Daoism, humans as physical beings are considered part of nature; the central Daoist idea assumes a natural way of things and beings, a being-from-itself. “For me, that means trusting in nature, including my own,” Walther says. “At this realization, the ego can calm down, which is constantly being worn down anew in our performance-oriented world.” His works and curatorial projects seek to convey the Daoist concept of nature to Europe and to question the primacy of mind over body that has been established in modernity.

Polar constellations such as between body and mind or the named and the unnamed are recurring themes in Walther’s work. The concrete reality of his life also tells of these opposites. He lives between Germany and Taiwan, spending three to six months in each country before returning to the other.

“For me, the greatest enrichment comes from the constant change between cultures,” says Walther. The length of his stays is deliberately chosen: He never immerses himself so deeply in the culture that its peculiarities become commonplace, almost imperceptible to him. “From the experience of the constant change in the realities of my life, a lot can be learned about ‘being a human being in the world.’” Svenja Napp

René Scheerat is Executive Assistant at Audi China. For the position, the strategic planner and team coordinator is moving from Ingolstadt to Beijing, where he will support Jürgen Unser, President of Audi China.

Cordula Blochinger has taken on the role of Head of Active Talent Sourcing at Steinkellner China Search. Steinkellner China is a globally active headhunter with a focus on the Chinese market. Blochinger is expected to recruit primarily executives in the automotive, technology, pharma/life science and medical technology sectors for the Austrian company.

Is something changing in your organization? Why not send a note for our staff section to heads@table.media!

Do you have a caring streak? Or even a helper syndrome? Then you can really let off steam in China (at least linguistically). Because in the Middle Kingdom, you’ll be nurtured for all you’re worth. Responsible for this course of cuddling is the verb 养 yǎng – an amazing all-rounder among the caring verbs. The semantic heart of this word chameleon beats in tune with German to-do-words like “to raise” and “to bring up” (e.g., children – 养孩子yǎng háizi). However, it is also understood in the sense of “to keep, care for, breed” (e.g., dog and cat – 养狗 yǎng gǒu and 养猫 yǎng māo – or plant -养花 yǎng huā). However, Chinese nurture professionals do not stop there by a long shot.

In Chinese, cars and roads can also be “nurtured” (养车 yǎng chē and 养路 yǎng lù) – we would probably speak soberly of “maintenance” or “servicing” here. And for those who love good food, China even nurtures their frying pan (养锅 yǎng guō) – no joke. To “keepers” of cast-iron cooking pots, Chinese kitchen professionals advise caring pan care for the optimal cooking experience – with special greasing rituals.

One can nurture financially, too, in Chinese – for example, by (under)keeping a family (养家 yǎngjiā) or a shopping-crazed partner (养女友 yǎng nǚyǒu or 养男友 yǎng nányǒu “to financially sustain/feed one’s girlfriend/boyfriend”), if not a mistress (养小三 yǎng xiǎosān). Meanwhile, the state nurtures the army (养兵 yǎngbīng “maintain an army”).

But the most beautiful task is probably to nurture yourself. In Chinese, health care means “life nurturing” (养生 yǎngshēng) – and this includes wellness vocabulary such as stomach (intestinal) nurturing (养胃yǎngwèi), eye maintenance (养眼 yǎngyǎn) or facial care (养颜 yǎngyán). And if you want to nurture your deepest inner self, it’s best to prophylactically nurture your mind (养神 yǎngshén “to recover mentally, to switch off inwardly”), and please do so before burnout sets in. Otherwise, it is called diseases and wounds “nurture”, pardon: cure (养病 yǎngbìng and 养伤 yǎngshāng).

And as if that weren’t enough, a (rather unpopular) little data animal has recently joined the Chinese daily routine, which also wants to be nurtured and screeches daily for professional care – namely the health code of the Covid app, in Chinese 健康码 jiànkāngmǎ. To prevent the dreaded window (弹窗 tánchuāng) from suddenly popping up in the application, restricting your freedom of movement, or sending you off to the Covid test, you have to care for the green code in Tamagotchi style (remember: Tamagotchi – those egg-shaped Japanese mini electric toys that were popular at the end of the nineties). For example, targeted stays in areas with low Covid risk, a generally code-friendly travel history, or, as the last option, stoic couch potatoeism are suitable for species-appropriate code care. 养码 yǎngmǎ – “nurturing the health code” is the new Chinese web jargon for such a procedure – another (ironic) language creation under the sign of Covid.

Verena Menzel runs the online language school New Chinese in Beijing.