The International Motor Show (IAA) was once the showcase for the German automotive industry. However, this time, the focus for many German visitors is on models from a completely different country: China. These models are certainly worth a look, as noted by Julia Fiedler, who attended the presentation shows in Munich.

Chinese competitors are not only attractive in terms of price but also impress with functional IT, sleek design and excellent craftsmanship. The once-dominant players in the field are starting to feel the heat.

The mood is no better among German auto suppliers in Munich. They, too, were heavyweight contenders. However, competition from the Far East is catching up significantly with the electrification trend. And time is of the essence, warns Carsten Huebner in his Feature. Those who do not hurry in their transformation from combustion engines to electric mobility will quickly lose their financial flexibility. “China speed” is the defining factor at the IAA in Munich.

Who has the bigger exhibition stand – Volkswagen or BYD? It’s not easy to determine without a measuring tape. A paradigm shift is taking place before the eyes of industry professionals in the Munich exhibition halls. BYD is unveiling its premiere vehicle, the Seal, in front of a gigantic screen displaying natural spectacles. Inside the cockpit, the rotating mega-display ignites the curiosity of attendees. The sporty midsize sedan, comparable to the Tesla Model 3, is surrounded by people all day long.

On the other hand, VW has brought its moderately popular ID models. The brand’s electric vision is tucked away behind a barricade in the second row: The sleek GTI Concept is currently just a concept vehicle, a mere display piece to present ideas. VW aims to evoke emotions with it; tradition and youthful memories are intended to serve as selling points. Many visitors perceive this as a symbol of the automotive industry, with some companies being aggressive while others cling to past successes.

The sobering impression inside the exhibition halls is somewhat deceiving. A significant part of the exhibition has moved to the city center as an “open space”. The showcase of the German automotive industry has become a giant street festival, and the familiar, massive exhibition stands still exist. Although Volkswagen has a second stand at Odeonsplatz, just across the way, BYD has set up another stand as well.

Before the exhibition, CEOs of German automakers seemed relaxed. Oliver Zipse, CEO of BMW, expressed it in an interview with Handelsblatt: “Ambition does not automatically equate to success.” He stated that it remains to be seen how well the new players meet the needs and tastes of European customers.

Zipse doubts whether digital services from Chinese competitors are already tailored to European requirements or whether the “complex processes for sales, service and parts supply” are in place. “In the automotive industry, you have to prove yourself in many ways – especially in a new market.” However, it immediately raises the question of how long such reassurances will hold for companies with such a steep learning curve as BYD and Nio.

Some of the Chinese manufacturers seem to be meeting the taste of the German audience. A first encounter with Chinese electric cars at the XPeng stand goes like this: Two young engineers from a German premium manufacturer get into the sporty XPeng P7 High Performance sedan, which features upward-swinging gullwing doors.

The first thing they notice is the massive display in the cockpit, followed by the touch of the high-quality leather seats, which are adorned with bright green stitching, matching the color of the seat belts. Doors are slammed shut multiple times: impressive sound! They tap on the door panels: soundproof and no cheap plastic! They notice a small fold in the leather on the seat, and as they run their fingers along the dashboard from below, they feel a slight imperfection.

The two engineers have a positive conclusion – especially when they hear the price of the vehicle, which will be available in Germany from 2024: starting at 59,000 euros. Power: 473 horsepower, but gullwing doors come at an additional cost. A model from Mercedes in a similar class and quality, the EQE sedan, would cost nearly 90,000 euros with slightly lower power. One of the young men says, “Nothing here is cheap; it’s definitely not ‘made in China’. But it is. We might need to rethink ‘made in China’ in the future.”

ADAC, the German automobile club, has tested Chinese manufacturers already available in Germany, including MG Motors, BYD, Aiways and Nio. The assessment by ADAC’s e-mobility expert, Matthias Vogt, is generally positive. “The quality of workmanship has proven to be very decent. Many vehicles from established brands are manufactured in China and sold here. The quality in the factories is quite good; we haven’t found any negative anomalies. What surprised me in some cases was the perceived quality of the materials.” He also praised their driving characteristics.

However, Vogt noted that, especially concerning high-speed stability and evasive maneuvers, there can be “a little difference from the established competition”. “These are nuances where experienced drivers or car testers would notice differences,” he added.

Safety has improved significantly, especially regarding passive safety. While the first crash test nearly 20 years ago failed at the crash barrier, Chinese cars now perform at a high level. “Passive safety is good, and they are quite well-equipped with assistance systems for active safety. However, in everyday driving, many Chinese vehicles are often filled with warning tones and beeps, which can be annoying.”

One concern shared by the ADAC expert and BMW CEO Zipse is the availability of service centers, repair distances, dealer friendliness, and spare parts supply. “These are all things that can be genuinely annoying in everyday life,” says Vogt.

Hui Zhang, Europe Chief of Nio, speaks fluent German. He earned his master’s degree in Germany and worked for German companies for many years. In start-up fashion, Hui Zhang takes a seat on a small stool next to a coffee stand and shares the strategy of the Chinese automaker, often dubbed the “Chinese Tesla“.

Nio has been in the German market since 2022 with three premium models. The company’s initial steps into Germany began in 2015 with a design headquarters in Munich. Last year, they established a vehicle development team there, and this summer, they opened the Nio Berlin Innovation Center. This is where adaptations of models for Europe are planned.

Why the focus on Germany? Hui Zhang responds that it’s related to talent acquisition. “Engineers from Germany are world-renowned in the automotive industry,” says Zhang. “Wherever we find talent, we establish our engineering centers. Many Silicon Valley companies like Amazon and Microsoft also have campuses in Berlin.” For German automotive engineering, this means it will continue, but in the future, it might increasingly end up in Chinese cars.

In its strategy for Germany, Nio is relying on its own charging infrastructure. Nio’s unique selling proposition is Battery Swap Stations, where you can exchange the entire battery within five minutes instead of plugging in your car. The company has installed 1,800 such stations, mostly in China, at a cost of millions. Nio plans to make significant investments in infrastructure in Europe as well – evidence of the company’s long-term ambitions.

Currently, there are only a few in Europe, with three in Germany and 26 in total. They aim to have 100 by the end of the year. Users won’t have to wait in line; from January to July 2023, only 394 Nios were registered in Germany. Nonetheless, Hui Zhang thinks big: “We have two factories in China with a production capacity of approximately 300,000 units. We have the capacity to sell more cars.”

Nio Houses are part of this plan, styled like pop-up stores in pedestrian zones. They offer community events and co-working spaces. They already exist in Frankfurt, Berlin and Duesseldorf, with a Hamburg location coming soon. They also aim to penetrate the premium corporate car market through collaborations with companies.

Chinese heavyweight BYD, which has produced more than 5 million vehicles by now, relies on a strong partner: Car rental company Sixt announced last year that it plans to acquire a total of 100,000 BYD vehicles by 2028. Before making larger-scale purchases, Sixt is naturally familiarizing itself with the quality, according to a company spokesperson. They are convinced of BYD’s quality. The sales performance of BYD also suggests that the company is a serious contender.

For the Chinese manufacturer, the partnership is a good strategy to enter the market. Through Sixt, potential buyers get to know the vehicles and have the opportunity to test them. Brand recognition remains a challenge, admits Penny Peng, Marketing Director for Europe. According to statistics from the Federal Motor Transport Authority, BYD had only 632 registrations in Germany from January to July 2023. BYDs are sold through established auto dealers who also handle service and parts supply.

BYD was founded in 1995 as a battery manufacturer, and in 1998, the company opened a location in the Netherlands, initially selling electric buses for city transport. In 2021, BYD unveiled its first passenger car for the European market at the Paris Auto Show. Since then, six models are available in Germany. The “Dolphin” starts at 36,000 euros, making it one of the cheapest EVs in the German market. Penny Peng says, “Because our strategy revolves around battery technology, we are not just an automotive company. We understand the entire ecosystem because we manufacture the battery, motor and motor control ourselves.”

BYD is open to collaborations with other manufacturers, according to Peng. With Toyota, for example, they have already developed a vehicle and provided the entire platform. The result of a 2011 partnership with Mercedes-Benz stands at the stand – or rather, the new version: The Denza flopped, and Mercedes reduced its stake in the joint venture to 10 percent. Now, BYD has reissued the premium van as the D9, and there are already many preorders.

Chinese cars are still exotic in Germany. According to the Federal Motor Transport Authority, their share of new registrations from January to July 2023 was 0.9 percent, or 15,364 vehicles. Most of these were MG Motors. Even though it may sound small, sales increased by 125.9 percent compared to 2022. And it could become even more significant.

According to a recent McKinsey study, vehicle buyers are not as loyal as established manufacturers in Germany hope. Fifty-one percent of buyers would switch brands for the right assistive features. According to Professor Andreas Herrmann from the Institute for Mobility at the University of St. Gallen, Chinese manufacturers have a good position in the market because they offer many digital entertainment features. “They always think about their cars from a digital perspective rather than a hardware perspective. That’s why I believe they have enormous growth opportunities in many segments of the market.“

One speaker at an IAA panel put it this way: “Mobility is a given“. Herrmann agrees: “Mobility is the basic service; it’s always there and is offered by everyone. Differentiation is achieved through the digital aspects. The Chinese are good at this because they cross industry boundaries and collaborate heavily with tech giants like Huawei, Baidu and others.” Unlike German manufacturers, who rely on in-house developments for their entertainment systems, which often can’t match the high standards of Alexa and others.

Professor Herrmann also concludes that German manufacturers need to reduce their optimization drive. “A German car is certainly tested in all respects; it’s almost flawless. Chinese vehicles may still have vulnerabilities in software, but these can be updated. It’s an entirely different mentality when it comes to approaching car manufacturing.” The Chinese approach presents “an enormous challenge” for German manufacturers.

A visitor at the IAA summarizes it this way: The young Chinese companies have slimmer structures compared to the giant German automakers. Their founders are here in Munich today with a vision. In contrast, the founders of German manufacturers are depicted in pictures in museums. So, who will be the driving force of change?

IAA Mobility reflects the magnitude of the transformation occurring in the automotive supplier industry towards electric mobility. German suppliers find themselves in the midst of this transition, struggling through a challenging transformation landscape. Even though Bosch, ZF Friedrichshafen and Continental still top the list of the largest automotive suppliers globally, their profit margins have not been favorable despite rising revenues. According to strategy consultants at Berylls, the average margin in 2022 was a mere 3.5 percent.

Three main reasons contribute to this: firstly, significantly increased input prices. In 2022, German suppliers had to absorb price increases of 33 percent in wages, energy and raw materials compared to the previous year, which they couldn’t fully pass on to manufacturers. Secondly, the shortage of skilled labor and rising interest rates are becoming increasingly noticeable.

Furthermore, thirdly, many German suppliers, like their customers, are just at the beginning of their transformation. This means a significant need for investment is coupled with low production quantities, which inevitably affects margins negatively. Chinese and Korean competitors, along with Tesla, are already benefiting from initial economies of scale, stemming from their strong market positions in China and battery production. Batteries still account for up to 40 percent of the production costs of an EV.

The low margins, in turn, make restructuring more difficult. Transformation is costly, and according to strategy consultants at Oliver Wyman, suppliers often struggle to access fresh capital, even though they shouldn’t. The reason for this is the industry’s rapidly declining ratings since the COVID-19 crisis, which have yet to recover. Even leading companies haven’t achieved a BB+ rating.

“Given this rating, which is considered speculative, German suppliers face a very tough time with banks – and often, this is unjust,” says Lutz Jaede, Head of Turnaround & Restructuring in Europe at Oliver Wyman. While there are companies that haven’t adequately responded to challenges or whose business models are at risk, many of these firms are highly profitable, drive crucial innovation, and are well-positioned for the transition to electromobility, he says.

Helena Wisbert, Director of the Center Automotive Research (CAR), confirms this. Suppliers that have early investments in technologies such as increasingly important sensors or electric motors are doing well and are innovation leaders in some cases, she says. “For mid-sized suppliers who specialized in supplying parts for combustion engine vehicles and now can’t financially manage the transformation, the road ahead looks thin in the coming years.” The consequences are tangible. Between 2018 and 2022, suppliers lost 37,000 jobs. Currently, the average number of employees stands at just under 274,000.

Nevertheless, the German Association of the Automotive Industry (VDA) praises the transformation efforts of the industry. “The supplier industry is driving change and at the same time delivering top products for current vehicles,” said a spokesperson. According to VDA, the German automotive industry will invest around 250 billion euros in research and development worldwide from 2023 to 2027. Additionally, 130 billion euros will be allocated to the construction and reconstruction of factories. “This underscores the commitment to rapidly make climate-neutral mobility a reality.”

Anton Pieper, Coordinator for Business and Human Rights at the organization World Economy, Ecology & Development (WEED), doesn’t find this sufficient. “Only when the mobility transition and raw materials transition are considered together can electric mobility become a sustainable component of the transport sector’s transformation.” Battery production comes with significant impacts on people and the environment, especially in global South countries. “Furthermore, recycling capacities are not yet sufficiently developed, even though there are increasingly battery recycling facilities in Europe.”

However, a recently released EconPol Policy Brief from the Munich-based Ifo Institute is much more optimistic. This is especially true when it comes to qualifications and innovation potential. According to the report, the proportion of employees qualified for electric motors or battery cells in Germany is higher than in France, Italy, Spain or the United States. Germany is also far ahead of all other economic nations in “green” patents in electromobility or fuel cell technology.

The study was based on patent applications in the EU, Japan, and the USA, as well as profiles of more than half a million employees in the automotive industry on the online network LinkedIn. Co-author Oliver Falck, head of the Ifo Center for Industrial Economics and New Technologies, sees this as clear evidence that the German automotive industry is at the forefront not only in internal combustion engines but also in electromobility.

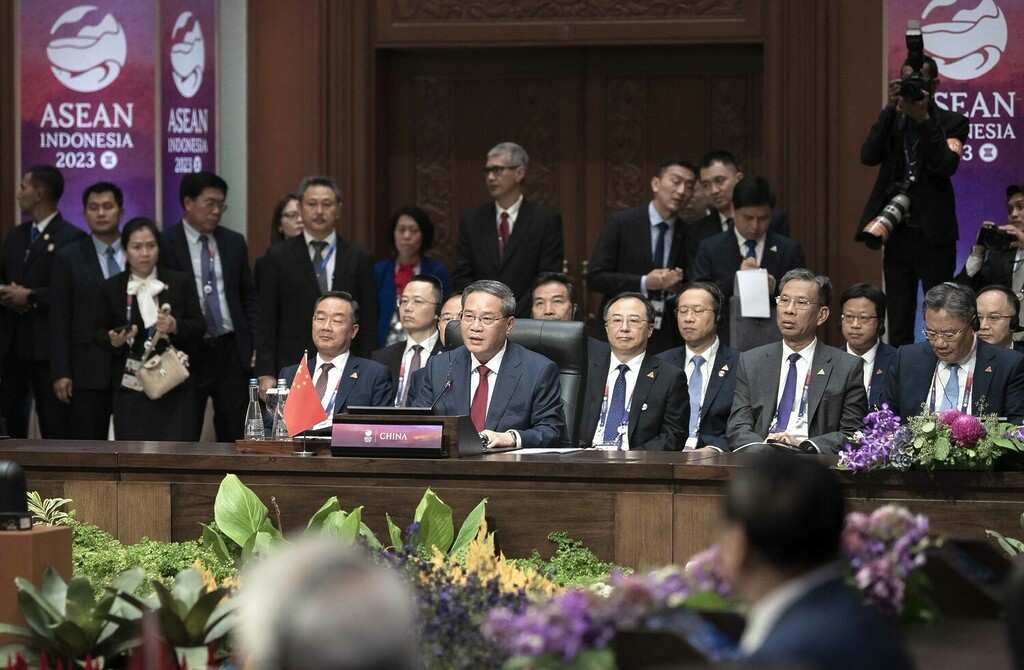

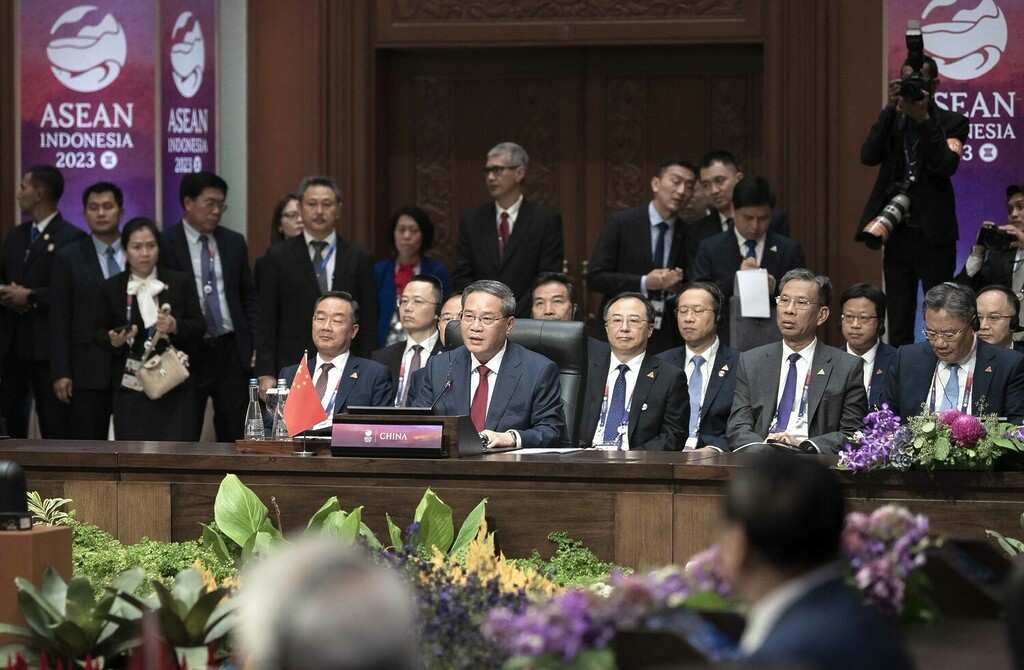

Amid escalating tensions in the Asia-Pacific region, China has warned the international community to prevent partisanship, bloc confrontation and a new Cold War, according to Prime Minister Li Qiang at a meeting of the Southeast Asian group ASEAN and China in the Indonesian capital, Jakarta.

The summit, held primarily to address concerns over China’s territorial claims in the South China Sea, took place just after Beijing released a map featuring a “Ten-Dash Line” that extends China’s claims in the South China Sea. Several ASEAN members had rejected these claims. Philippine President Ferdinand Marcos stated that his country wasn’t seeking conflict but had a duty to respond if the Philippines’ sovereignty was challenged.

This week, ASEAN countries held discussions with China on expediting negotiations for a long-debated code of conduct for the waterway, according to Retno Marsudi, the foreign minister of host country Indonesia. The topic was also discussed during the ASEAN-Japan summit, with state and government leaders agreeing on the importance of maintaining regional stability, particularly on the Korean Peninsula and in the South China Sea, she said.

The draft closing statement of the ASEAN-China summit mentioned the need for the international community to “strengthen maritime stability in our region … and explore new initiatives for this purpose”. Lina Alexandra, a political analyst at the CSIS think tank, noted that the draft was “very weak regarding South China Sea issues”. The analyst explained that the Philippines had lost patience with ASEAN countries regarding their approach to China’s presence in the region.

On the sidelines of the summit, Li announced the promotion of enhanced cooperation with Indonesia. On Wednesday, Li participated in the trial operation of Southeast Asia’s first high-speed railway, a 142-kilometer rail line funded by China that connects Jakarta and the city of Bandung. Indonesian Minister Luhut Pandjaitan told reporters that he was discussing further expansion of the line to Surabaya, at the eastern end of Java Island. rtr/ari

Chinese state media are announcing increased stimulus measures. The government may support the real estate sector and allocate more funds to infrastructure projects, as reported by China Daily on Wednesday. Simultaneously, it published an article suggesting boosting consumption as a way out of economic weakness. CCTV, the state propaganda channel, also addressed the topic of new stimulus programs with a focus on reviving the private sector.

While China Daily primarily cited economists in its announcement of these scenarios, such an article about expectations of government action would not appear in controlled press without concrete plans in the background. Economist Michael Pettis of the Carnegie Endowment think tank thus regards the media reports as clear signs of further economic measures.

Observers have noted with surprise how passive Beijing has been in response to declining economic indicators. This is seen as a decision to prevent further growth in the debt of local governments. fin

According to a newspaper report, the Chinese leadership is banning state employees from using foreign smartphones. Employees of some government agencies are no longer allowed to bring Apple iPhones and devices from certain other manufacturers to the workplace, according to the Wall Street Journal, citing insiders. However, it is unclear how many employees have received this directive and which providers, in addition to Apple, are affected. Chinese authorities were not immediately available for comment.

In recent years, the People’s Republic has enacted some new laws due to concerns about data protection. At the same time, it called on domestic companies to reduce their dependence on foreign technologies.

Western states, on the other hand, banned the products of some Chinese companies due to potential espionage by the Beijing government. TikTok is the most well-known example. State employees are not allowed to use the short-video app on their work phones. rtr/flee

Heavy rains from the remnants of Typhoon Haikui have caused extensive flooding in southeastern China. Cities in Fujian province had to suspend subway services, close schools and evacuate residents, according to authorities on Wednesday. More than 36,000 people were evacuated from their homes.

Meteorologists stated that the rains broke a twelve-year record in the city of Fuzhou overnight, triggering official warnings that 49 reservoirs had exceeded their flood limits.

In Fujian, six more cities, including Putian and Quanzhou, were classified as threatened by flash floods and landslides. The provincial government has instructed local authorities to prepare for the evacuation of the most severely affected areas. Rainfall in central and southern parts of Fujian is expected to continue until Friday.

According to media reports, the rainfall was more intense than during Typhoon Doksuri. It passed over the province at the end of July, causing flooding with torrential rains. Several people died, and hundreds of thousands were evacuated. The direct economic damages were estimated at around 2 billion dollars. rtr/flee

“You just want to make me cry,” said Tony Leung at the 80th Venice International Film Festival when director Ang Lee presented him with a Golden Lion for his lifetime achievement. As he held the trophy in his arms, he couldn’t hold back his tears. At 61, Leung is the youngest filmmaker ever to receive this honor. He now joins an illustrious group of cinema giants like Hayao Miyazaki, Clint Eastwood and Martin Scorsese.

To call Tony Leung Chiu-wai, his full name, a legend is by no means an exaggeration. Few other actors can boast such a diverse filmography. From lavish martial arts dramas to melancholic arthouse productions, he has mastered almost everything in the realm of method acting. He is one of the few Asian actors whose face is recognizable even to those not particularly interested in Asian cinema. Leung has worked closely with Ang Lee and Wong Kar-wai, whose films are also considered classics of modern cinema in Europe and the USA. Some of Leung’s most famous works include “Lust, Caution”, “In the Mood for Love” and “Chungking Express”.

Leung still feels a deep connection with the cinema of his homeland, Hong Kong, as he reiterated in Venice: “I am so grateful to have grown up in Hong Kong and to have been nurtured by the Hong Kong film industry,” said Leung visibly moved to the audience. “I want to share this honor with all the wonderful people I have worked with over the past 41 years because this is also a tribute to them – and, of course, to Hong Kong cinema.”

The love is mutual. No one has been awarded the “Best Actor” prize at the Hong Kong Film Awards as many times as Leung.

Leung was born in 1962 into modest circumstances. His father, the manager of a nightclub, left the family when Leung was seven – a loss that further intensified his introverted character. As a young man, Leung worked as a household appliance salesman. His career as an actor only began after his good friend, future star director Stephen Chow, urged him to apply as a comedy performer at the local TVB station. In the early 1990s, Leung shone in John Woo’s thrillers “Bullet in the Head” and “Hard Boiled”, which Quentin Tarantino repeatedly praised as influential on his own work.

Like many other Hong Kong actors, Leung attempted a music career in the 1990s, singing sweet Mando and Cantopop songs. He almost gave up acting at the time, as he later revealed in interviews. It was his encounter with Wong Kar-wai that reignited his passion. With Wong, Leung played taciturn but highly complex roles. They made seven films together, turning Leung into an internationally acclaimed character actor.

In China, Hong Kong and Taiwan, Leung is equally revered, perhaps because he never tried to ingratiate himself with Hollywood. In Taiwan, the devout Buddhist is especially respected for his leading role in Hou Hsiao-hsien’s film “A City of Sadness”, which addressed Taiwanese identity issues in 1989 and was re-released this year in a restored version with significant media coverage.

Taiwanese director Ang Lee said of Leung that he can communicate more with a single glance than other actors can in long monologues. However, he consistently stayed out of political debates. His long-standing relationship with actress Carina Lau Kar-ling spared him from scandals in the tabloids.

A few weeks ago, Leung made a surprising appearance in a music video by the young K-pop group NewJeans. His appearance lasted only a few seconds. Nevertheless, the video immediately went viral. Leung’s fame seems to be secure even with the new generation, and his life’s work is far from over despite receiving a Lifetime Achievement Award. Fabian Peltsch

Richard Tsoi is the new vice director of the non-governmental organization China Labor Bulletin. The NGO campaigns for the rights of workers in the People’s Republic. It is based in Hong Kong and was founded there in 1994 by labor activist Han Dongfang. Tsoi previously worked as a spokesman for the Hong Kong Coalition to Monitor Public Transport and Utilities.

Is something changing in your organization? Let us know at heads@table.media!

This cat has achieved fame. As the furriest employee of the paper store in the Bund Financial Center in Shanghai, he even has his own desk calendar. Fans can also purrchase posters. The cat is said to have lived in the store ever since the staff started feeding him as a stray kitten.

The International Motor Show (IAA) was once the showcase for the German automotive industry. However, this time, the focus for many German visitors is on models from a completely different country: China. These models are certainly worth a look, as noted by Julia Fiedler, who attended the presentation shows in Munich.

Chinese competitors are not only attractive in terms of price but also impress with functional IT, sleek design and excellent craftsmanship. The once-dominant players in the field are starting to feel the heat.

The mood is no better among German auto suppliers in Munich. They, too, were heavyweight contenders. However, competition from the Far East is catching up significantly with the electrification trend. And time is of the essence, warns Carsten Huebner in his Feature. Those who do not hurry in their transformation from combustion engines to electric mobility will quickly lose their financial flexibility. “China speed” is the defining factor at the IAA in Munich.

Who has the bigger exhibition stand – Volkswagen or BYD? It’s not easy to determine without a measuring tape. A paradigm shift is taking place before the eyes of industry professionals in the Munich exhibition halls. BYD is unveiling its premiere vehicle, the Seal, in front of a gigantic screen displaying natural spectacles. Inside the cockpit, the rotating mega-display ignites the curiosity of attendees. The sporty midsize sedan, comparable to the Tesla Model 3, is surrounded by people all day long.

On the other hand, VW has brought its moderately popular ID models. The brand’s electric vision is tucked away behind a barricade in the second row: The sleek GTI Concept is currently just a concept vehicle, a mere display piece to present ideas. VW aims to evoke emotions with it; tradition and youthful memories are intended to serve as selling points. Many visitors perceive this as a symbol of the automotive industry, with some companies being aggressive while others cling to past successes.

The sobering impression inside the exhibition halls is somewhat deceiving. A significant part of the exhibition has moved to the city center as an “open space”. The showcase of the German automotive industry has become a giant street festival, and the familiar, massive exhibition stands still exist. Although Volkswagen has a second stand at Odeonsplatz, just across the way, BYD has set up another stand as well.

Before the exhibition, CEOs of German automakers seemed relaxed. Oliver Zipse, CEO of BMW, expressed it in an interview with Handelsblatt: “Ambition does not automatically equate to success.” He stated that it remains to be seen how well the new players meet the needs and tastes of European customers.

Zipse doubts whether digital services from Chinese competitors are already tailored to European requirements or whether the “complex processes for sales, service and parts supply” are in place. “In the automotive industry, you have to prove yourself in many ways – especially in a new market.” However, it immediately raises the question of how long such reassurances will hold for companies with such a steep learning curve as BYD and Nio.

Some of the Chinese manufacturers seem to be meeting the taste of the German audience. A first encounter with Chinese electric cars at the XPeng stand goes like this: Two young engineers from a German premium manufacturer get into the sporty XPeng P7 High Performance sedan, which features upward-swinging gullwing doors.

The first thing they notice is the massive display in the cockpit, followed by the touch of the high-quality leather seats, which are adorned with bright green stitching, matching the color of the seat belts. Doors are slammed shut multiple times: impressive sound! They tap on the door panels: soundproof and no cheap plastic! They notice a small fold in the leather on the seat, and as they run their fingers along the dashboard from below, they feel a slight imperfection.

The two engineers have a positive conclusion – especially when they hear the price of the vehicle, which will be available in Germany from 2024: starting at 59,000 euros. Power: 473 horsepower, but gullwing doors come at an additional cost. A model from Mercedes in a similar class and quality, the EQE sedan, would cost nearly 90,000 euros with slightly lower power. One of the young men says, “Nothing here is cheap; it’s definitely not ‘made in China’. But it is. We might need to rethink ‘made in China’ in the future.”

ADAC, the German automobile club, has tested Chinese manufacturers already available in Germany, including MG Motors, BYD, Aiways and Nio. The assessment by ADAC’s e-mobility expert, Matthias Vogt, is generally positive. “The quality of workmanship has proven to be very decent. Many vehicles from established brands are manufactured in China and sold here. The quality in the factories is quite good; we haven’t found any negative anomalies. What surprised me in some cases was the perceived quality of the materials.” He also praised their driving characteristics.

However, Vogt noted that, especially concerning high-speed stability and evasive maneuvers, there can be “a little difference from the established competition”. “These are nuances where experienced drivers or car testers would notice differences,” he added.

Safety has improved significantly, especially regarding passive safety. While the first crash test nearly 20 years ago failed at the crash barrier, Chinese cars now perform at a high level. “Passive safety is good, and they are quite well-equipped with assistance systems for active safety. However, in everyday driving, many Chinese vehicles are often filled with warning tones and beeps, which can be annoying.”

One concern shared by the ADAC expert and BMW CEO Zipse is the availability of service centers, repair distances, dealer friendliness, and spare parts supply. “These are all things that can be genuinely annoying in everyday life,” says Vogt.

Hui Zhang, Europe Chief of Nio, speaks fluent German. He earned his master’s degree in Germany and worked for German companies for many years. In start-up fashion, Hui Zhang takes a seat on a small stool next to a coffee stand and shares the strategy of the Chinese automaker, often dubbed the “Chinese Tesla“.

Nio has been in the German market since 2022 with three premium models. The company’s initial steps into Germany began in 2015 with a design headquarters in Munich. Last year, they established a vehicle development team there, and this summer, they opened the Nio Berlin Innovation Center. This is where adaptations of models for Europe are planned.

Why the focus on Germany? Hui Zhang responds that it’s related to talent acquisition. “Engineers from Germany are world-renowned in the automotive industry,” says Zhang. “Wherever we find talent, we establish our engineering centers. Many Silicon Valley companies like Amazon and Microsoft also have campuses in Berlin.” For German automotive engineering, this means it will continue, but in the future, it might increasingly end up in Chinese cars.

In its strategy for Germany, Nio is relying on its own charging infrastructure. Nio’s unique selling proposition is Battery Swap Stations, where you can exchange the entire battery within five minutes instead of plugging in your car. The company has installed 1,800 such stations, mostly in China, at a cost of millions. Nio plans to make significant investments in infrastructure in Europe as well – evidence of the company’s long-term ambitions.

Currently, there are only a few in Europe, with three in Germany and 26 in total. They aim to have 100 by the end of the year. Users won’t have to wait in line; from January to July 2023, only 394 Nios were registered in Germany. Nonetheless, Hui Zhang thinks big: “We have two factories in China with a production capacity of approximately 300,000 units. We have the capacity to sell more cars.”

Nio Houses are part of this plan, styled like pop-up stores in pedestrian zones. They offer community events and co-working spaces. They already exist in Frankfurt, Berlin and Duesseldorf, with a Hamburg location coming soon. They also aim to penetrate the premium corporate car market through collaborations with companies.

Chinese heavyweight BYD, which has produced more than 5 million vehicles by now, relies on a strong partner: Car rental company Sixt announced last year that it plans to acquire a total of 100,000 BYD vehicles by 2028. Before making larger-scale purchases, Sixt is naturally familiarizing itself with the quality, according to a company spokesperson. They are convinced of BYD’s quality. The sales performance of BYD also suggests that the company is a serious contender.

For the Chinese manufacturer, the partnership is a good strategy to enter the market. Through Sixt, potential buyers get to know the vehicles and have the opportunity to test them. Brand recognition remains a challenge, admits Penny Peng, Marketing Director for Europe. According to statistics from the Federal Motor Transport Authority, BYD had only 632 registrations in Germany from January to July 2023. BYDs are sold through established auto dealers who also handle service and parts supply.

BYD was founded in 1995 as a battery manufacturer, and in 1998, the company opened a location in the Netherlands, initially selling electric buses for city transport. In 2021, BYD unveiled its first passenger car for the European market at the Paris Auto Show. Since then, six models are available in Germany. The “Dolphin” starts at 36,000 euros, making it one of the cheapest EVs in the German market. Penny Peng says, “Because our strategy revolves around battery technology, we are not just an automotive company. We understand the entire ecosystem because we manufacture the battery, motor and motor control ourselves.”

BYD is open to collaborations with other manufacturers, according to Peng. With Toyota, for example, they have already developed a vehicle and provided the entire platform. The result of a 2011 partnership with Mercedes-Benz stands at the stand – or rather, the new version: The Denza flopped, and Mercedes reduced its stake in the joint venture to 10 percent. Now, BYD has reissued the premium van as the D9, and there are already many preorders.

Chinese cars are still exotic in Germany. According to the Federal Motor Transport Authority, their share of new registrations from January to July 2023 was 0.9 percent, or 15,364 vehicles. Most of these were MG Motors. Even though it may sound small, sales increased by 125.9 percent compared to 2022. And it could become even more significant.

According to a recent McKinsey study, vehicle buyers are not as loyal as established manufacturers in Germany hope. Fifty-one percent of buyers would switch brands for the right assistive features. According to Professor Andreas Herrmann from the Institute for Mobility at the University of St. Gallen, Chinese manufacturers have a good position in the market because they offer many digital entertainment features. “They always think about their cars from a digital perspective rather than a hardware perspective. That’s why I believe they have enormous growth opportunities in many segments of the market.“

One speaker at an IAA panel put it this way: “Mobility is a given“. Herrmann agrees: “Mobility is the basic service; it’s always there and is offered by everyone. Differentiation is achieved through the digital aspects. The Chinese are good at this because they cross industry boundaries and collaborate heavily with tech giants like Huawei, Baidu and others.” Unlike German manufacturers, who rely on in-house developments for their entertainment systems, which often can’t match the high standards of Alexa and others.

Professor Herrmann also concludes that German manufacturers need to reduce their optimization drive. “A German car is certainly tested in all respects; it’s almost flawless. Chinese vehicles may still have vulnerabilities in software, but these can be updated. It’s an entirely different mentality when it comes to approaching car manufacturing.” The Chinese approach presents “an enormous challenge” for German manufacturers.

A visitor at the IAA summarizes it this way: The young Chinese companies have slimmer structures compared to the giant German automakers. Their founders are here in Munich today with a vision. In contrast, the founders of German manufacturers are depicted in pictures in museums. So, who will be the driving force of change?

IAA Mobility reflects the magnitude of the transformation occurring in the automotive supplier industry towards electric mobility. German suppliers find themselves in the midst of this transition, struggling through a challenging transformation landscape. Even though Bosch, ZF Friedrichshafen and Continental still top the list of the largest automotive suppliers globally, their profit margins have not been favorable despite rising revenues. According to strategy consultants at Berylls, the average margin in 2022 was a mere 3.5 percent.

Three main reasons contribute to this: firstly, significantly increased input prices. In 2022, German suppliers had to absorb price increases of 33 percent in wages, energy and raw materials compared to the previous year, which they couldn’t fully pass on to manufacturers. Secondly, the shortage of skilled labor and rising interest rates are becoming increasingly noticeable.

Furthermore, thirdly, many German suppliers, like their customers, are just at the beginning of their transformation. This means a significant need for investment is coupled with low production quantities, which inevitably affects margins negatively. Chinese and Korean competitors, along with Tesla, are already benefiting from initial economies of scale, stemming from their strong market positions in China and battery production. Batteries still account for up to 40 percent of the production costs of an EV.

The low margins, in turn, make restructuring more difficult. Transformation is costly, and according to strategy consultants at Oliver Wyman, suppliers often struggle to access fresh capital, even though they shouldn’t. The reason for this is the industry’s rapidly declining ratings since the COVID-19 crisis, which have yet to recover. Even leading companies haven’t achieved a BB+ rating.

“Given this rating, which is considered speculative, German suppliers face a very tough time with banks – and often, this is unjust,” says Lutz Jaede, Head of Turnaround & Restructuring in Europe at Oliver Wyman. While there are companies that haven’t adequately responded to challenges or whose business models are at risk, many of these firms are highly profitable, drive crucial innovation, and are well-positioned for the transition to electromobility, he says.

Helena Wisbert, Director of the Center Automotive Research (CAR), confirms this. Suppliers that have early investments in technologies such as increasingly important sensors or electric motors are doing well and are innovation leaders in some cases, she says. “For mid-sized suppliers who specialized in supplying parts for combustion engine vehicles and now can’t financially manage the transformation, the road ahead looks thin in the coming years.” The consequences are tangible. Between 2018 and 2022, suppliers lost 37,000 jobs. Currently, the average number of employees stands at just under 274,000.

Nevertheless, the German Association of the Automotive Industry (VDA) praises the transformation efforts of the industry. “The supplier industry is driving change and at the same time delivering top products for current vehicles,” said a spokesperson. According to VDA, the German automotive industry will invest around 250 billion euros in research and development worldwide from 2023 to 2027. Additionally, 130 billion euros will be allocated to the construction and reconstruction of factories. “This underscores the commitment to rapidly make climate-neutral mobility a reality.”

Anton Pieper, Coordinator for Business and Human Rights at the organization World Economy, Ecology & Development (WEED), doesn’t find this sufficient. “Only when the mobility transition and raw materials transition are considered together can electric mobility become a sustainable component of the transport sector’s transformation.” Battery production comes with significant impacts on people and the environment, especially in global South countries. “Furthermore, recycling capacities are not yet sufficiently developed, even though there are increasingly battery recycling facilities in Europe.”

However, a recently released EconPol Policy Brief from the Munich-based Ifo Institute is much more optimistic. This is especially true when it comes to qualifications and innovation potential. According to the report, the proportion of employees qualified for electric motors or battery cells in Germany is higher than in France, Italy, Spain or the United States. Germany is also far ahead of all other economic nations in “green” patents in electromobility or fuel cell technology.

The study was based on patent applications in the EU, Japan, and the USA, as well as profiles of more than half a million employees in the automotive industry on the online network LinkedIn. Co-author Oliver Falck, head of the Ifo Center for Industrial Economics and New Technologies, sees this as clear evidence that the German automotive industry is at the forefront not only in internal combustion engines but also in electromobility.

Amid escalating tensions in the Asia-Pacific region, China has warned the international community to prevent partisanship, bloc confrontation and a new Cold War, according to Prime Minister Li Qiang at a meeting of the Southeast Asian group ASEAN and China in the Indonesian capital, Jakarta.

The summit, held primarily to address concerns over China’s territorial claims in the South China Sea, took place just after Beijing released a map featuring a “Ten-Dash Line” that extends China’s claims in the South China Sea. Several ASEAN members had rejected these claims. Philippine President Ferdinand Marcos stated that his country wasn’t seeking conflict but had a duty to respond if the Philippines’ sovereignty was challenged.

This week, ASEAN countries held discussions with China on expediting negotiations for a long-debated code of conduct for the waterway, according to Retno Marsudi, the foreign minister of host country Indonesia. The topic was also discussed during the ASEAN-Japan summit, with state and government leaders agreeing on the importance of maintaining regional stability, particularly on the Korean Peninsula and in the South China Sea, she said.

The draft closing statement of the ASEAN-China summit mentioned the need for the international community to “strengthen maritime stability in our region … and explore new initiatives for this purpose”. Lina Alexandra, a political analyst at the CSIS think tank, noted that the draft was “very weak regarding South China Sea issues”. The analyst explained that the Philippines had lost patience with ASEAN countries regarding their approach to China’s presence in the region.

On the sidelines of the summit, Li announced the promotion of enhanced cooperation with Indonesia. On Wednesday, Li participated in the trial operation of Southeast Asia’s first high-speed railway, a 142-kilometer rail line funded by China that connects Jakarta and the city of Bandung. Indonesian Minister Luhut Pandjaitan told reporters that he was discussing further expansion of the line to Surabaya, at the eastern end of Java Island. rtr/ari

Chinese state media are announcing increased stimulus measures. The government may support the real estate sector and allocate more funds to infrastructure projects, as reported by China Daily on Wednesday. Simultaneously, it published an article suggesting boosting consumption as a way out of economic weakness. CCTV, the state propaganda channel, also addressed the topic of new stimulus programs with a focus on reviving the private sector.

While China Daily primarily cited economists in its announcement of these scenarios, such an article about expectations of government action would not appear in controlled press without concrete plans in the background. Economist Michael Pettis of the Carnegie Endowment think tank thus regards the media reports as clear signs of further economic measures.

Observers have noted with surprise how passive Beijing has been in response to declining economic indicators. This is seen as a decision to prevent further growth in the debt of local governments. fin

According to a newspaper report, the Chinese leadership is banning state employees from using foreign smartphones. Employees of some government agencies are no longer allowed to bring Apple iPhones and devices from certain other manufacturers to the workplace, according to the Wall Street Journal, citing insiders. However, it is unclear how many employees have received this directive and which providers, in addition to Apple, are affected. Chinese authorities were not immediately available for comment.

In recent years, the People’s Republic has enacted some new laws due to concerns about data protection. At the same time, it called on domestic companies to reduce their dependence on foreign technologies.

Western states, on the other hand, banned the products of some Chinese companies due to potential espionage by the Beijing government. TikTok is the most well-known example. State employees are not allowed to use the short-video app on their work phones. rtr/flee

Heavy rains from the remnants of Typhoon Haikui have caused extensive flooding in southeastern China. Cities in Fujian province had to suspend subway services, close schools and evacuate residents, according to authorities on Wednesday. More than 36,000 people were evacuated from their homes.

Meteorologists stated that the rains broke a twelve-year record in the city of Fuzhou overnight, triggering official warnings that 49 reservoirs had exceeded their flood limits.

In Fujian, six more cities, including Putian and Quanzhou, were classified as threatened by flash floods and landslides. The provincial government has instructed local authorities to prepare for the evacuation of the most severely affected areas. Rainfall in central and southern parts of Fujian is expected to continue until Friday.

According to media reports, the rainfall was more intense than during Typhoon Doksuri. It passed over the province at the end of July, causing flooding with torrential rains. Several people died, and hundreds of thousands were evacuated. The direct economic damages were estimated at around 2 billion dollars. rtr/flee

“You just want to make me cry,” said Tony Leung at the 80th Venice International Film Festival when director Ang Lee presented him with a Golden Lion for his lifetime achievement. As he held the trophy in his arms, he couldn’t hold back his tears. At 61, Leung is the youngest filmmaker ever to receive this honor. He now joins an illustrious group of cinema giants like Hayao Miyazaki, Clint Eastwood and Martin Scorsese.

To call Tony Leung Chiu-wai, his full name, a legend is by no means an exaggeration. Few other actors can boast such a diverse filmography. From lavish martial arts dramas to melancholic arthouse productions, he has mastered almost everything in the realm of method acting. He is one of the few Asian actors whose face is recognizable even to those not particularly interested in Asian cinema. Leung has worked closely with Ang Lee and Wong Kar-wai, whose films are also considered classics of modern cinema in Europe and the USA. Some of Leung’s most famous works include “Lust, Caution”, “In the Mood for Love” and “Chungking Express”.

Leung still feels a deep connection with the cinema of his homeland, Hong Kong, as he reiterated in Venice: “I am so grateful to have grown up in Hong Kong and to have been nurtured by the Hong Kong film industry,” said Leung visibly moved to the audience. “I want to share this honor with all the wonderful people I have worked with over the past 41 years because this is also a tribute to them – and, of course, to Hong Kong cinema.”

The love is mutual. No one has been awarded the “Best Actor” prize at the Hong Kong Film Awards as many times as Leung.

Leung was born in 1962 into modest circumstances. His father, the manager of a nightclub, left the family when Leung was seven – a loss that further intensified his introverted character. As a young man, Leung worked as a household appliance salesman. His career as an actor only began after his good friend, future star director Stephen Chow, urged him to apply as a comedy performer at the local TVB station. In the early 1990s, Leung shone in John Woo’s thrillers “Bullet in the Head” and “Hard Boiled”, which Quentin Tarantino repeatedly praised as influential on his own work.

Like many other Hong Kong actors, Leung attempted a music career in the 1990s, singing sweet Mando and Cantopop songs. He almost gave up acting at the time, as he later revealed in interviews. It was his encounter with Wong Kar-wai that reignited his passion. With Wong, Leung played taciturn but highly complex roles. They made seven films together, turning Leung into an internationally acclaimed character actor.

In China, Hong Kong and Taiwan, Leung is equally revered, perhaps because he never tried to ingratiate himself with Hollywood. In Taiwan, the devout Buddhist is especially respected for his leading role in Hou Hsiao-hsien’s film “A City of Sadness”, which addressed Taiwanese identity issues in 1989 and was re-released this year in a restored version with significant media coverage.

Taiwanese director Ang Lee said of Leung that he can communicate more with a single glance than other actors can in long monologues. However, he consistently stayed out of political debates. His long-standing relationship with actress Carina Lau Kar-ling spared him from scandals in the tabloids.

A few weeks ago, Leung made a surprising appearance in a music video by the young K-pop group NewJeans. His appearance lasted only a few seconds. Nevertheless, the video immediately went viral. Leung’s fame seems to be secure even with the new generation, and his life’s work is far from over despite receiving a Lifetime Achievement Award. Fabian Peltsch

Richard Tsoi is the new vice director of the non-governmental organization China Labor Bulletin. The NGO campaigns for the rights of workers in the People’s Republic. It is based in Hong Kong and was founded there in 1994 by labor activist Han Dongfang. Tsoi previously worked as a spokesman for the Hong Kong Coalition to Monitor Public Transport and Utilities.

Is something changing in your organization? Let us know at heads@table.media!

This cat has achieved fame. As the furriest employee of the paper store in the Bund Financial Center in Shanghai, he even has his own desk calendar. Fans can also purrchase posters. The cat is said to have lived in the store ever since the staff started feeding him as a stray kitten.