The German economy’s biggest China debate is currently about the heated topic of decoupling from its major trading partner in the Far East. Some say that the Russia shock should not be followed by a double China shock. China remains the growth market par excellence – we have to stay on it, say others.

Our analysis shows: German companies are as divided on this issue as economists and politicians. Some have already begun to gradually withdraw, while others are even expanding their activities, as Nico Beckert writes. The bottom line is that Germany’s investments in China continue to grow. But more and more guests are quietly sneaking away from the party. The geopolitical tensions have long since spoiled the mood.

Today we also test a car. The Xpeng P7 from the eponymous start-up is a typical example of China’s new generation of EVs. With this model, the company, which has so far been largely unknown to the public in Europe, definitely has a chance to gain attention, writes Christian Domke Seidel.

Younger customers in particular will appreciate the car’s many digital functions. The price is low, the range is above average, safety and materials are decent. Customers who do not care about the prestige of a well-known brand will certainly find their money’s worth. Several Chinese brands want to enter the difficult EU market with precisely this strategy.

China’s Vice Premier, Han Zheng, usually has more important things to do than inaugurate new factories. But Han made an exception for BASF. As the chemical giant celebrated the start of production at its ten-billion-euro Verbund site in Zhanjiang (China.Table reported), Han dropped by for an event in Beijing. The high-profile visit was meant to send a signal: China welcomes foreign investors.

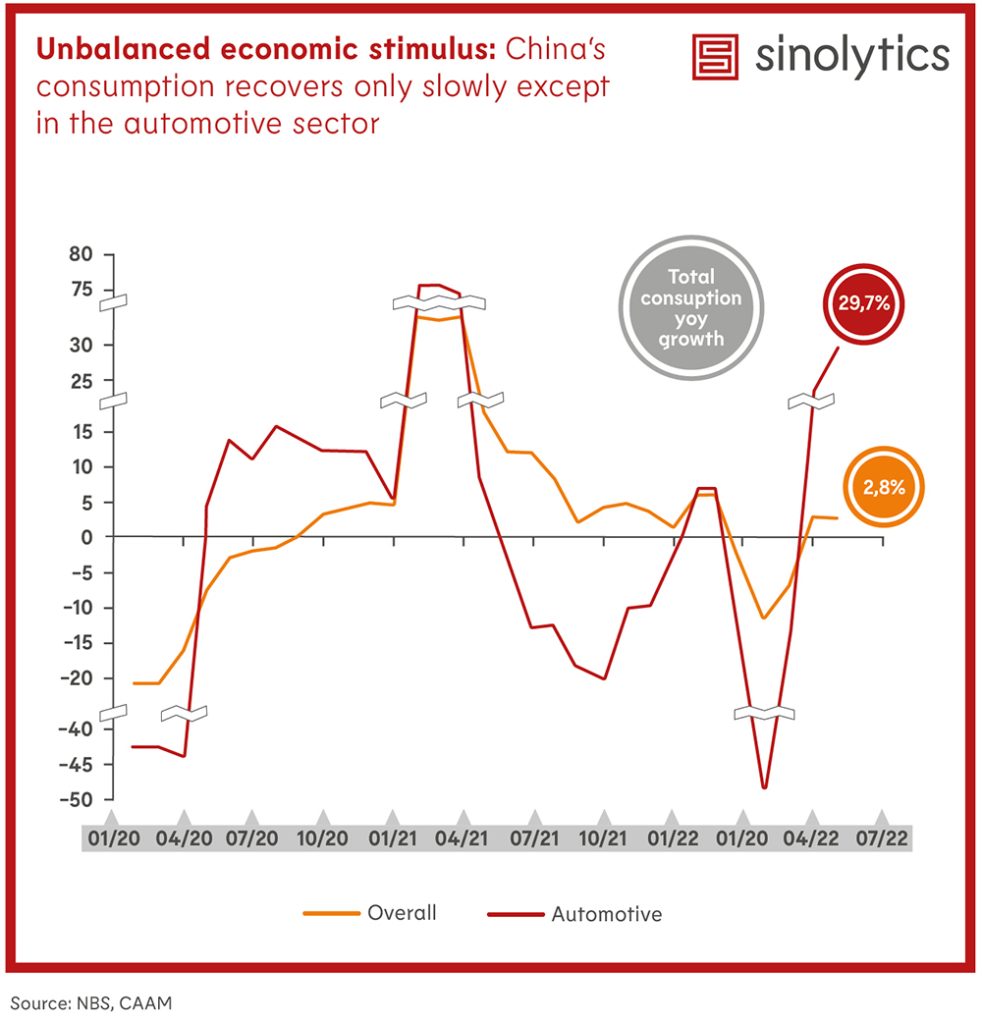

Actually, the People’s Republic does not even have to woo German companies. Apart from BASF, the automotive industry continues to be one of the biggest investors in the country. In 2020, Volkswagen announced plans to invest €15 billion in electric mobility with its Chinese joint venture partners by 2024.

After European countries and the United States, China is the biggest target market for German companies. They have made a total of over 90 billion in investments there – more than a third of which came from the automotive industry.

Economists believe, however, that major investments by the German industry in China are no longer as low-risk as they were a few years ago. The People’s Republic remains a growth market. But for how much longer? The government in Beijing is pursuing a clear medium-term strategy: Catching up technologically and turning its own champions into market leaders. “German producers have to brace themselves for being replaced by domestic companies. They are in the hands of the government,” says Rolf Langhammer of the Kiel Institute for the World Economy (IfW). The trade expert warns, “Anyone who runs a business in China knows that these investments are only temporary.”

But is China growing so fast that even investments in the billions will yield quick profits with correspondingly low business risk? According to Langhammer, there are definitely risks: “It may well be that large German companies will have to adjust their forecasts for the Chinese market again in the future and revise them downward“.

Moreover, China’s growth is cooling noticeably. Zero-Covid and geopolitical tensions are further added to the mix. “China is likely to become a more difficult market for all foreign companies in the coming years,” says Noah Barkin of the analysis firm Rhodium Group. The cost-benefit ratio “is tipping in an unfavorable direction,” he estimates. According to Barkin, it cannot be ruled out that European companies will be forced to accept large financial losses on their investments in China.

Deutsche Bank’s CEO also voiced concern about dependencies. “The country’s increasing isolation and growing tensions, especially with the US, pose a significant risk for Germany,” Christian Sewing said. Some economists demand a fundamental rethinking. After all, shareholders and creditors of companies with a strong China focus could also be affected by increasing China risks, said Juergen Matthes of the German Economic Institute (IW) in Cologne. Because of geopolitical tensions, “it’s about looking at risk exposure and making sure the company can survive in case of escalation.” The head of the Global and Regional Markets cluster at the IW assumes that “the financial market will also demand greater transparency about China risks.”

The German Federal Ministry for Economic Affairs and Climate Action also considered exercising more control. Investments by German companies in China should be subject to greater scrutiny. But after fierce criticism from the business community, the ministry appears to abandon these plans, as Reuters reports.

However, there are also economists who are more positive about the situation. “The investment opportunities in China are still great,” says Horst Loechel, head of the Sino-German Center at the Frankfurt School of Finance & Management. “If you compare the opportunities to the potential risks – geopolitical and otherwise – it is still reasonable to be invested in China.” He remains optimistic that bridges between the People’s Republic and the West will not be burned. “The peak of geopolitical tensions is very likely already behind us.”

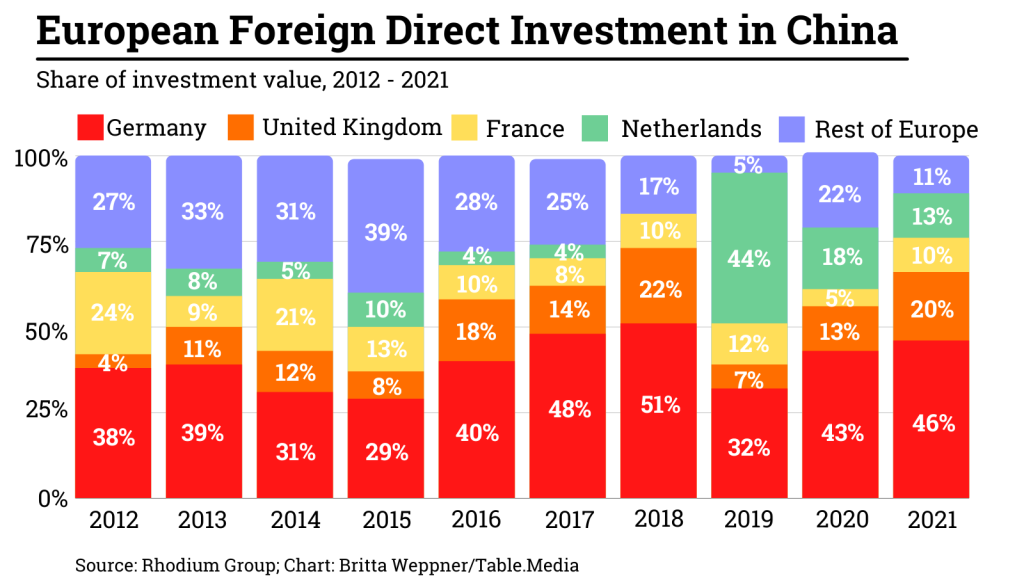

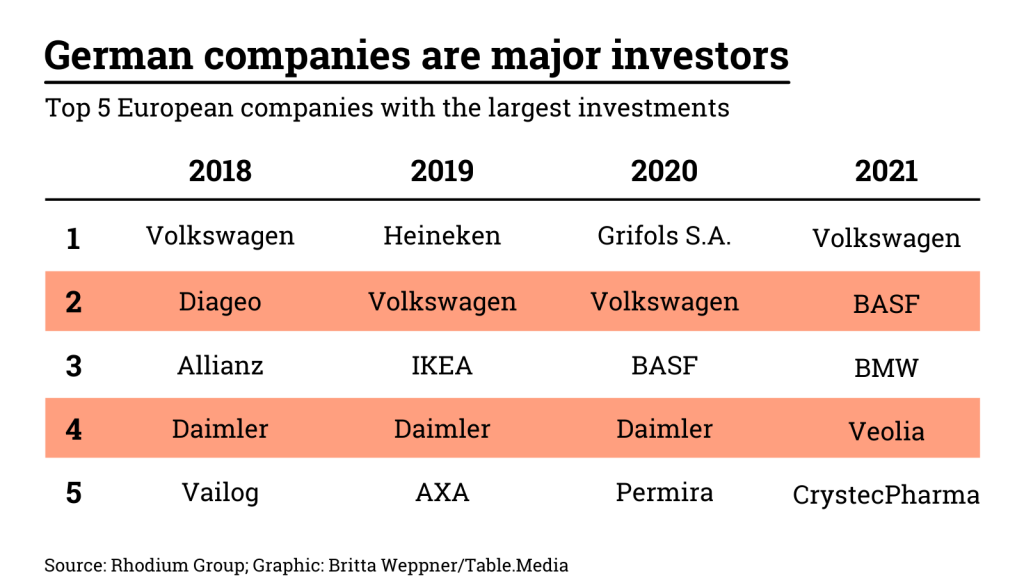

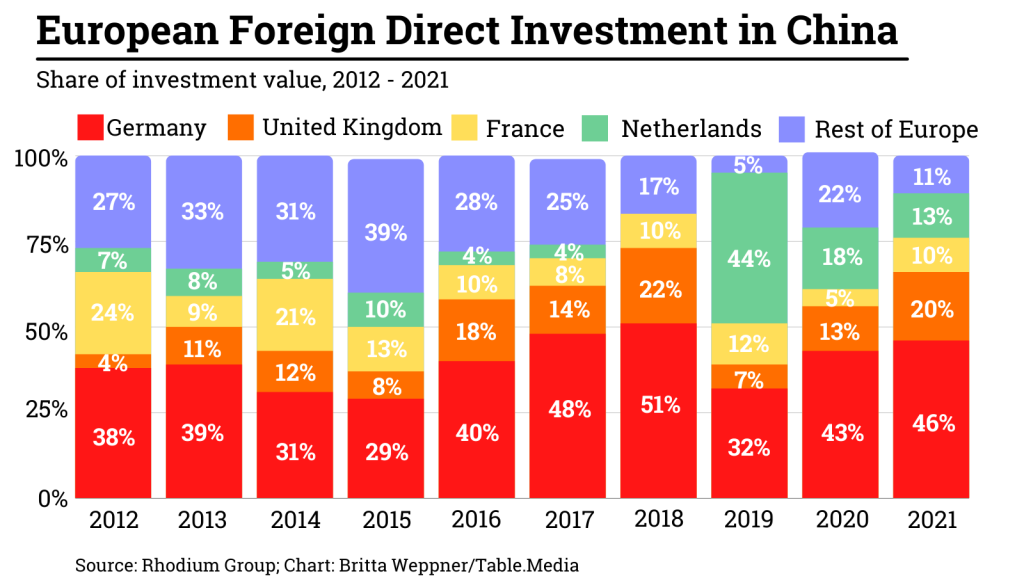

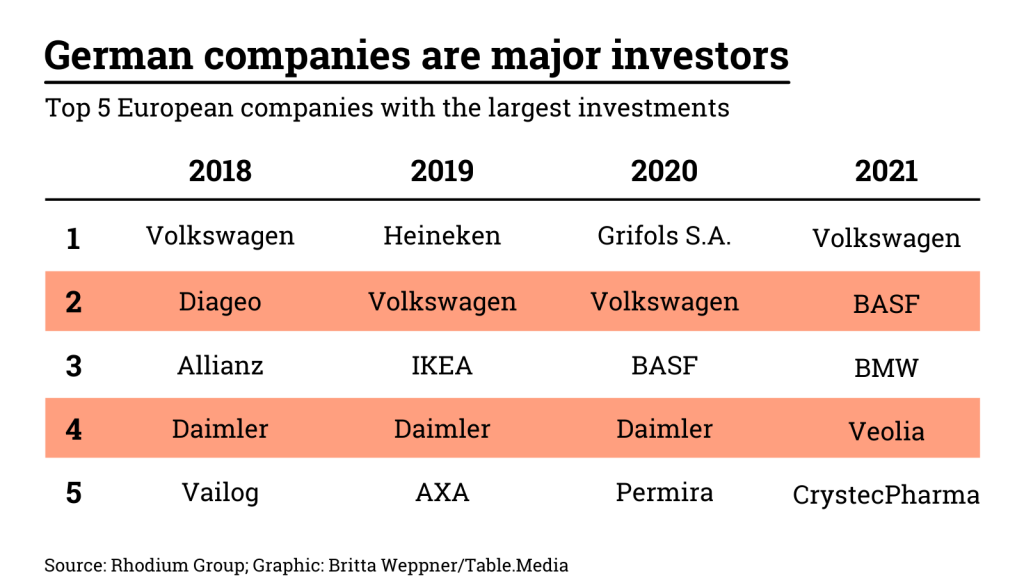

Yet, the number of companies that continue to show unlimited enthusiasm for China is steadily declining. While investments in the People’s Republic are growing in volume, the majority of the money comes from fewer and larger companies. The top ten European investors in China have accounted for an average of nearly 80 percent of all investments over the past four years, according to a new analysis by Rhodium Group. German conglomerates rank among the top investors.

Volkswagen, BMW, Daimler and BASF alone accounted for about 34 percent of all European investments in China between 2018 and 2021, according to Rhodium. “Our findings point to a widening gap in how European firms perceive the balance of risks and opportunities in the Chinese market,” the authors conclude.

BASF, for example, points out the opportunities. When asked about potential investment risks, a company spokeswoman commented that China remains an important growth market. “By 2030, China will account for more than two-thirds of global chemical production growth. China will then account for 50 percent of the global market.” Developing additional markets in the People’s Republic would be “of high strategic and economic value,” the spokeswoman said. The company monitors geopolitical developments and takes measures to safeguard investments, she added.

Some companies pursue a rather surprising strategy to cope with the risks. They are “investing even more in China, but to make their local business more independent of their global operations,” Mikko Huotari, director of the Merics research institute, told Reuters. China, he said, is considered a separate business entity. Workforce, supply chains and data flows are becoming increasingly localized, the Rhodium research also notes. That would reduce risks, the report says. In the event of any sanctions against the People’s Republic, there would then be fewer exchanges with company units in other countries.

Huotari believes companies act “logically” in the short term. “Many are trying to do good business in China for at least another 10, 15, maybe 20 years.” The important question here is whether companies will be able to find the right time to jump ship. The situation with Russia, for example, has shown that escalation can happen fairly abruptly. Huotari warns, “Some companies underestimate not only the downward pressure of the Chinese economy, but above all geopolitical risks of the location.”

So how can the risks of major investments in China be reduced? Matthes of the IW suggests that companies “should be obligated in their financial statement to report on geopolitical cluster risks and on potential operating losses in the realization of these risks.” This would make the risks of doing business in China more transparent. Company leaders would then possibly calculate differently.

Politics should also scale back existing incentives for doing business in China, Matthes said. The German Ministry of Economics is already considering scaling back government investment and export guarantees and China loans granted by the German development bank KfW (China.Table reported). In addition, trade relations are to be diversified and agreements signed with other countries in the region.

The Xpeng P7 clearly shows what it means to build an electric smart car. The Chinese startup requires around 2,000 semiconductors to produce just one of these electric sports sedans. Among other things, the microchips process the data supplied by 47 sensors, cameras, and microphones installed in the interior alone. Exterior cameras and LiDAR technology for autonomous driving are not even included in the number.

When the car travels along a country road at 80 km/h with the windows up, and the passenger tells the voice control system to close the window, the car instantly knows which window is meant. Despite wind noise and music, the voice assistance system detects the seat from which the command came. The test car had a female voice for this.

The Xpeng P7 shows from which flank China’s car manufacturers will attack Germany’s heavyweights. They are far more digital – and at the same time significantly cheaper. They boast swift acceleration thanks to their powerful electric motors. Its other specs, like safety and comfort, are not stellar, but they are perfectly fine. The battery made by the Chinese industry leader CATL, on the other hand, is excellent. This combination will attract many young customers.

The current generation of vehicles from Geely, Nio, Xpeng, and other Chinese electric attackers thus marks a turning point in automotive history. For the first time since the entry of the Korean brand Hyundai at the turn of the millennium, new players from the Far East once again appear in Europe. Hyundai first entered the German market in 1995. In 2012, the brand broke the 100,000 car sales mark. The Japanese market leader Toyota was the last to venture into Germany in the 1970s, after a difficult start in other foreign markets.

However, the P7 still has a long way to go before it will reach mass sales in Germany. The model is expected to be shipped to European customers in the second quarter of 2023. The service network in Denmark is also expected to be ready by then. If and when the brand will come to Germany is still unclear (China.Table reported).

The Xpeng P7 is a sports sedan. The four-door car is 4.88 meters long and thus in the size class of a Tesla Model S. However, it costs between just €45,000 and €55,000, depending on the model. That is significantly cheaper than the Tesla Model S, which starts at around €140,000. Two variants are to be available. The entry-level is a 266-horsepower version with rear-wheel drive. Thanks to the CATL battery with a capacity of 81 kilowatt-hours, the car will manage around 700 kilometers on one charge. The 430-horsepower version has two motors – one in the front, one in the rear – which gives the sedan all-wheel drive. Here, the battery only lasts 530 kilometers.

Getting into the Xpeng P7 is unspectacular in the best sense of the word. There is nothing that needs getting used to, is unusual or complicated. Only customers who expected something more exotic from the “Chinese electric car” label will be disappointed. Instead, there is now a kind of global standard for electromobility – just like BYD and NIO also embody. Anyone who has driven a car before will also be able to handle the P7.

Perhaps even better. Because the all-wheel drive and the extremely low center of gravity keep the immense power of this electric car comparatively well under control. Of course, the curb weight of around two tons does not make it a sports car, even with its power. But there is simply no situation in everyday life – and even beyond – where this car would not be sufficiently motorized. Even with “only” 266 horsepower.

There are no irritations in the interior either. Nappa leather, the expensive plastic, ambient lighting and high-quality decorative trim are in no way inferior to the German competition when it comes to look and feel. However, the central element is of course the 15-inch touchscreen. Xpeng has developed the operating system Xmart OS. However, the use of third-party apps (and their access to the control elements, if necessary) is possible. A corresponding app store for Europe is currently in development. Over-the-air updates in the background are to ensure constant improvements. The controls are very straightforward. The most commonly used functions, such as music, climate, and navigation, are located on the home screen. The P7 system is operated like a smartphone.

And if something does go wrong, there is always voice control. The brand claims that 99.8 percent of drivers use it at least once a month. This is also because all (!) systems can be operated from here: Air vents for air conditioning, navigation or music, for example. It can also be used to control the car’s cameras. They even allow the driver to look under the car. For example, the cameras record the road surface while the car is parked. If the driver has parked in a handicapped space, he can immediately see this by looking at the monitor.

One weakness of the P7, like with many sedans, is the trunk. Although the volume of 460 liters is quite acceptable, the structure is somewhat inconvenient. The rear seat bench can be folded down, but this does not create a flat load area.

Meanwhile, Xpeng already plans to launch a second model in Europe. The startup’s G9 electric SUV is also scheduled to be available in 2023. It is envisaged as a kind of final market opener for Europe. The G9 comes with an 800-volt electrical system and will then also have a better trunk and rear seat structure.

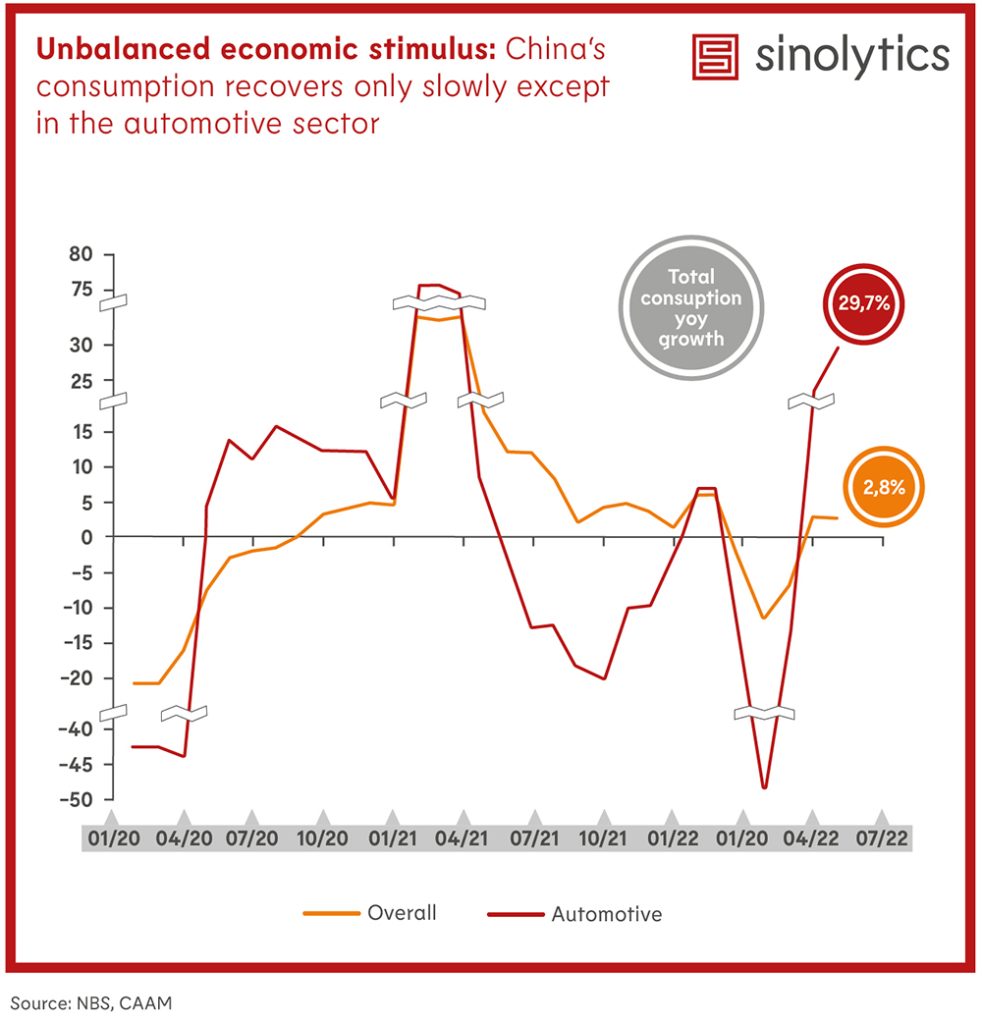

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

China’s Foreign Minister Wang Yi has threatened that China could seize Taiwan under a 2005 anti-secession law. “The more rampant ‘Taiwan independence’ activities are, the less likely it is to resolve the Taiwan question peacefully”, Wang said at a meeting with 99-year-old US diplomatic legend Henry Kissinger in New York. Analysts consider it unusual for the top leadership to bring up the use of the anti-secession law, according to the South China Morning Post.

Wang did not spare strong rhetoric against Taiwan. “There is an old saying in China: it is better to lose a thousand troops than an inch of land,” he said at the meeting with Kissinger. That is also the will of the entire Chinese people, he said. If there are violations of the anti-secession law, China will “take firm actions” to ensure territorial unity, Wang said without going into details.

The anti-secession law dates back to 2005, in which the People’s Congress unilaterally stipulates that Taiwan is part of China and that military action is justified to achieve unification. Taiwan’s government sharply disagrees with this view. Wang’s remarks are to be seen as a reaction to statements by US President Joe Biden. The latter had confirmed Washington’s willingness to defend Taiwan on Wednesday. fin

Wolfgang Niedermark, chief executive of the Federation of German Industries (BDI), has warned against naivety and looking the other way when it comes to business with China. Conflicts are obvious at the moment, Niedermark said at an event organized by the employers’ interest group BusinessEurope on Tuesday. China is siding with Russia and a conflict over Taiwan is imminent, the BDI chief warned. Things are also happening in Xinjiang province “that we cannot accept.” “Companies cannot ignore all this,” Niedermark said. Globalization is in a new stage and tends more toward competition and conflict.

The Situation is not easy for companies, Niedermark said – but, “There are no wishes being formulated here. We have to accept the geopolitical reality.” The BDI head nevertheless called for careful cooperation in areas of innovation, such as medical technology or electric mobility. Not cooperating in technology areas, he said, would more likely harm the European economy. Markus Beyrer, Director General of BusinessEurope, called for closer cooperation with China, especially in climate protection and standardization.

At the event, MEP Reinhard Bütikofer (Greens) stressed that in this context, however, the rules of such cooperation would have to be carefully examined. Otherwise, foreign companies ran the risk of being exploited. As examples, Bütikofer cited the railroad industry, which had cooperated “intensively” with China and was now being squeezed out of external markets by China Railway Construction.

Bütikofer and EU Deputy Director-General of the Directorate-General for Trade, Maria Martin-Prat, concurred that greater consistency in the EU member states’ approach to China had emerged in recent months. For example, even EU states that had previously been rather indifferent to FDI screening are now showing more ambition to closely scrutinize investments from China, Martin-Prat said.

The EU Chamber in China will present its annual position paper on the business environment for EU companies in the People’s Republic today, Wednesday. ari

China’s exports of solar modules to Europe have surged this year. From January to July 2022, Chinese manufacturers exported photovoltaic modules with a total capacity of 51.5 gigawatts to Europe. That was 25.9 percent more than in all of 2022, reports business magazine Caixin, citing data from energy consultancy Infolink Consulting. According to the report, Chinese photovoltaic industry trade with Europe – including countries outside the EU – accounted for 55 percent of the country’s total solar module exports between January and July. In 2021 as a whole, Europe’s share had been 46 percent.

These figures show the rapidly growing demand for alternative energy sources in Europe. Due to gas shortages, the EU announced in May that it would more than double its solar capacity by 2025 and reach a total of 600 gigawatts of installed capacity by 2030, more than four times the amount at the end of 2020. “These long-term, supportive policy frameworks sustain Europe as the biggest market for Chinese modules,” Albert Hsieh of Infolink, pointed out in a study.

In total, China supplies over 80 percent of global photovoltaic products, according to Caixin. It is one of the few industries that continues to grow rapidly, with photovoltaic module production increasing 74.3 percent year-on-year to 78.6 gigawatts in the first half of 2022. Production of other products in the supply chain – polysilicon, wafers and cells – rose more than 45 percent… China’s Jinko Power Technology, Trina Solar and Longi Green Energy Technology were the world’s top three suppliers of solar modules in the first half of the year, according to Infolink. ck

Several international private equity and venture capital funds indicated a departure from China at a conference in Singapore on Tuesday. According to Bloomberg, speakers from investment firms such as Partners Group, Hamilton Lane and others that collectively invest billions of dollars in the region said they were reducing their holdings in the once-booming economy.

They say the reason is that their customers reassess the risks in China due to the rapidly changing environment there – and apparently increasingly negatively. The news shows that skepticism is also growing in the financial world in the face of economic problems and zero-Covid – even if there is no talk of a rapid withdrawal of capital yet. Investors at the Super Return Asia conference, for example, also stressed that they continued to believe in China’s long-term growth. “We represent people and they define the kind of risk they want us to take,” Bloomberg quoted Emmanuel Pitsilis, co-head of Asia Pacific at investment firm Partners Capital, as saying.

Even though Partners Capital believes in the rise of China, “there’s been a rotation and a desire from clients to diversify away from China.” The firm has shifted from an investment program heavily weighted toward China and venture-focused programs to an approach that is “much broader spread across different sectors and more geographically diverse,” Pitsilis said. Countries that could benefit from a redirection of cash flows include India and Singapore, according to Bloomberg. ck

“Books are my source for new thoughts and other perspectives,” says Nora Gantert, who grew up in the German city of Freiburg im Breisgau as the daughter of a bookseller. “They make you curious about the world, about the different – and at the same time show that this different doesn’t have to be foreign to us.”

Nora Gantert studied sinology and art history in her hometown. She was quickly bothered by the fact that the two could hardly be combined. There were no lectures on art in sinology, and no subjects on Chinese art in art history. “There was a split between us in Europe and the others, the foreigners in China,” Nora says. “It’s not fair, I thought at the time, that we hardly talk about or belittle such a great country, with such a great history and such incredible art and cultural riches.”

The ambition for equality, which developed through literature and in the first years of her studies, is still the focus of Gantant’s work today. As a curator and author, she is primarily devoted to the transcultural aspect in art. “I wish we would put this othering to rest and perceive the individuals. We naturally perceive every American artist, every French artist, individually. With Chinese artists, most people see China first.”

Her curated exhibitions seek to show that people around the globe have universal experiences, which only manifest themselves differently in different societies. As an example, she cites the representation of motherhood in art. “Here you realize that women struggle with the same patriarchal structures, be it in China or in Germany.”

From 2017 to 2021, she developed the art space of the Confucius Institute Nuremberg-Erlangen and was responsible for the curatorial program there. During this time, she helped to realize group exhibitions on cultural relations between China and Africa and on transcultural art between China and Germany. She also initiated a publicly accessible specialist library for contemporary Chinese art. It is the first of its kind in Germany and is now hosted by the Institute of Modern Art in Nuremberg.

Anyone who carefully peruses the exhibition catalogs of the art space curated by Gantert will notice it features almost exclusively female exhibitors. This is no coincidence. “I try to advance the cause of women in everything I do.” In her role as curator, she sees herself as a feminist. “I am committed to making female art more visible. Most of the art that comes to Germany from China is made by men.”

Gantert recently curated a solo exhibition with Lu Yang at the Kunstpalais Erlangen. She is currently writing a research paper about depictions of the future in contemporary Chinese art. “It’s totally exciting that it’s mainly women who are working on this topic,” she says with a smile. “The future is feminine.” Svenja Napp

Jorge Toledo Albiñana has submitted his accreditation as the new EU ambassador to China. “In times of complex geopolitical challenges, I shall work to strengthen bilateral relations & foster EU-China dialogue in all areas,” Albiñana wrote on Twitter as he took office. He succeeds Frenchman Nicolas Chapuis.

Erik Ackner is the new mentor for China relations at German Accelerator, a government support program for startups, in Munich. Ackner primarily serves as president of Mercku, a Canadian-based provider of Wi-Fi technology. He also teaches sustainable entrepreneurship in Germany and China at the Ingolstadt School of Management.

Sheng Fuxin and Winston Chen are the latest departees from China’s sovereign wealth fund China Investment Corp (CIC), which is currently suffering an exodus of executives. Sheng was in charge of infrastructure, Chen of technology. CIC is one of the world’s largest sovereign wealth funds. It manages the equivalent of over €1 trillion in Chinese foreign exchange reserves.

Is something changing in your organization? Why not let us know at heads@table.media!

Finally enjoying some delicious hotpot in a restaurant again, even if it’s only with your own stuffed animal. After two weeks of zero-Covid lockdown in Chengdu, the capital of Sichuan and stronghold of spicy cuisine, restrictions have finally been relaxed and restaurants are open once again. Citizens immediately seized the opportunity.

The German economy’s biggest China debate is currently about the heated topic of decoupling from its major trading partner in the Far East. Some say that the Russia shock should not be followed by a double China shock. China remains the growth market par excellence – we have to stay on it, say others.

Our analysis shows: German companies are as divided on this issue as economists and politicians. Some have already begun to gradually withdraw, while others are even expanding their activities, as Nico Beckert writes. The bottom line is that Germany’s investments in China continue to grow. But more and more guests are quietly sneaking away from the party. The geopolitical tensions have long since spoiled the mood.

Today we also test a car. The Xpeng P7 from the eponymous start-up is a typical example of China’s new generation of EVs. With this model, the company, which has so far been largely unknown to the public in Europe, definitely has a chance to gain attention, writes Christian Domke Seidel.

Younger customers in particular will appreciate the car’s many digital functions. The price is low, the range is above average, safety and materials are decent. Customers who do not care about the prestige of a well-known brand will certainly find their money’s worth. Several Chinese brands want to enter the difficult EU market with precisely this strategy.

China’s Vice Premier, Han Zheng, usually has more important things to do than inaugurate new factories. But Han made an exception for BASF. As the chemical giant celebrated the start of production at its ten-billion-euro Verbund site in Zhanjiang (China.Table reported), Han dropped by for an event in Beijing. The high-profile visit was meant to send a signal: China welcomes foreign investors.

Actually, the People’s Republic does not even have to woo German companies. Apart from BASF, the automotive industry continues to be one of the biggest investors in the country. In 2020, Volkswagen announced plans to invest €15 billion in electric mobility with its Chinese joint venture partners by 2024.

After European countries and the United States, China is the biggest target market for German companies. They have made a total of over 90 billion in investments there – more than a third of which came from the automotive industry.

Economists believe, however, that major investments by the German industry in China are no longer as low-risk as they were a few years ago. The People’s Republic remains a growth market. But for how much longer? The government in Beijing is pursuing a clear medium-term strategy: Catching up technologically and turning its own champions into market leaders. “German producers have to brace themselves for being replaced by domestic companies. They are in the hands of the government,” says Rolf Langhammer of the Kiel Institute for the World Economy (IfW). The trade expert warns, “Anyone who runs a business in China knows that these investments are only temporary.”

But is China growing so fast that even investments in the billions will yield quick profits with correspondingly low business risk? According to Langhammer, there are definitely risks: “It may well be that large German companies will have to adjust their forecasts for the Chinese market again in the future and revise them downward“.

Moreover, China’s growth is cooling noticeably. Zero-Covid and geopolitical tensions are further added to the mix. “China is likely to become a more difficult market for all foreign companies in the coming years,” says Noah Barkin of the analysis firm Rhodium Group. The cost-benefit ratio “is tipping in an unfavorable direction,” he estimates. According to Barkin, it cannot be ruled out that European companies will be forced to accept large financial losses on their investments in China.

Deutsche Bank’s CEO also voiced concern about dependencies. “The country’s increasing isolation and growing tensions, especially with the US, pose a significant risk for Germany,” Christian Sewing said. Some economists demand a fundamental rethinking. After all, shareholders and creditors of companies with a strong China focus could also be affected by increasing China risks, said Juergen Matthes of the German Economic Institute (IW) in Cologne. Because of geopolitical tensions, “it’s about looking at risk exposure and making sure the company can survive in case of escalation.” The head of the Global and Regional Markets cluster at the IW assumes that “the financial market will also demand greater transparency about China risks.”

The German Federal Ministry for Economic Affairs and Climate Action also considered exercising more control. Investments by German companies in China should be subject to greater scrutiny. But after fierce criticism from the business community, the ministry appears to abandon these plans, as Reuters reports.

However, there are also economists who are more positive about the situation. “The investment opportunities in China are still great,” says Horst Loechel, head of the Sino-German Center at the Frankfurt School of Finance & Management. “If you compare the opportunities to the potential risks – geopolitical and otherwise – it is still reasonable to be invested in China.” He remains optimistic that bridges between the People’s Republic and the West will not be burned. “The peak of geopolitical tensions is very likely already behind us.”

Yet, the number of companies that continue to show unlimited enthusiasm for China is steadily declining. While investments in the People’s Republic are growing in volume, the majority of the money comes from fewer and larger companies. The top ten European investors in China have accounted for an average of nearly 80 percent of all investments over the past four years, according to a new analysis by Rhodium Group. German conglomerates rank among the top investors.

Volkswagen, BMW, Daimler and BASF alone accounted for about 34 percent of all European investments in China between 2018 and 2021, according to Rhodium. “Our findings point to a widening gap in how European firms perceive the balance of risks and opportunities in the Chinese market,” the authors conclude.

BASF, for example, points out the opportunities. When asked about potential investment risks, a company spokeswoman commented that China remains an important growth market. “By 2030, China will account for more than two-thirds of global chemical production growth. China will then account for 50 percent of the global market.” Developing additional markets in the People’s Republic would be “of high strategic and economic value,” the spokeswoman said. The company monitors geopolitical developments and takes measures to safeguard investments, she added.

Some companies pursue a rather surprising strategy to cope with the risks. They are “investing even more in China, but to make their local business more independent of their global operations,” Mikko Huotari, director of the Merics research institute, told Reuters. China, he said, is considered a separate business entity. Workforce, supply chains and data flows are becoming increasingly localized, the Rhodium research also notes. That would reduce risks, the report says. In the event of any sanctions against the People’s Republic, there would then be fewer exchanges with company units in other countries.

Huotari believes companies act “logically” in the short term. “Many are trying to do good business in China for at least another 10, 15, maybe 20 years.” The important question here is whether companies will be able to find the right time to jump ship. The situation with Russia, for example, has shown that escalation can happen fairly abruptly. Huotari warns, “Some companies underestimate not only the downward pressure of the Chinese economy, but above all geopolitical risks of the location.”

So how can the risks of major investments in China be reduced? Matthes of the IW suggests that companies “should be obligated in their financial statement to report on geopolitical cluster risks and on potential operating losses in the realization of these risks.” This would make the risks of doing business in China more transparent. Company leaders would then possibly calculate differently.

Politics should also scale back existing incentives for doing business in China, Matthes said. The German Ministry of Economics is already considering scaling back government investment and export guarantees and China loans granted by the German development bank KfW (China.Table reported). In addition, trade relations are to be diversified and agreements signed with other countries in the region.

The Xpeng P7 clearly shows what it means to build an electric smart car. The Chinese startup requires around 2,000 semiconductors to produce just one of these electric sports sedans. Among other things, the microchips process the data supplied by 47 sensors, cameras, and microphones installed in the interior alone. Exterior cameras and LiDAR technology for autonomous driving are not even included in the number.

When the car travels along a country road at 80 km/h with the windows up, and the passenger tells the voice control system to close the window, the car instantly knows which window is meant. Despite wind noise and music, the voice assistance system detects the seat from which the command came. The test car had a female voice for this.

The Xpeng P7 shows from which flank China’s car manufacturers will attack Germany’s heavyweights. They are far more digital – and at the same time significantly cheaper. They boast swift acceleration thanks to their powerful electric motors. Its other specs, like safety and comfort, are not stellar, but they are perfectly fine. The battery made by the Chinese industry leader CATL, on the other hand, is excellent. This combination will attract many young customers.

The current generation of vehicles from Geely, Nio, Xpeng, and other Chinese electric attackers thus marks a turning point in automotive history. For the first time since the entry of the Korean brand Hyundai at the turn of the millennium, new players from the Far East once again appear in Europe. Hyundai first entered the German market in 1995. In 2012, the brand broke the 100,000 car sales mark. The Japanese market leader Toyota was the last to venture into Germany in the 1970s, after a difficult start in other foreign markets.

However, the P7 still has a long way to go before it will reach mass sales in Germany. The model is expected to be shipped to European customers in the second quarter of 2023. The service network in Denmark is also expected to be ready by then. If and when the brand will come to Germany is still unclear (China.Table reported).

The Xpeng P7 is a sports sedan. The four-door car is 4.88 meters long and thus in the size class of a Tesla Model S. However, it costs between just €45,000 and €55,000, depending on the model. That is significantly cheaper than the Tesla Model S, which starts at around €140,000. Two variants are to be available. The entry-level is a 266-horsepower version with rear-wheel drive. Thanks to the CATL battery with a capacity of 81 kilowatt-hours, the car will manage around 700 kilometers on one charge. The 430-horsepower version has two motors – one in the front, one in the rear – which gives the sedan all-wheel drive. Here, the battery only lasts 530 kilometers.

Getting into the Xpeng P7 is unspectacular in the best sense of the word. There is nothing that needs getting used to, is unusual or complicated. Only customers who expected something more exotic from the “Chinese electric car” label will be disappointed. Instead, there is now a kind of global standard for electromobility – just like BYD and NIO also embody. Anyone who has driven a car before will also be able to handle the P7.

Perhaps even better. Because the all-wheel drive and the extremely low center of gravity keep the immense power of this electric car comparatively well under control. Of course, the curb weight of around two tons does not make it a sports car, even with its power. But there is simply no situation in everyday life – and even beyond – where this car would not be sufficiently motorized. Even with “only” 266 horsepower.

There are no irritations in the interior either. Nappa leather, the expensive plastic, ambient lighting and high-quality decorative trim are in no way inferior to the German competition when it comes to look and feel. However, the central element is of course the 15-inch touchscreen. Xpeng has developed the operating system Xmart OS. However, the use of third-party apps (and their access to the control elements, if necessary) is possible. A corresponding app store for Europe is currently in development. Over-the-air updates in the background are to ensure constant improvements. The controls are very straightforward. The most commonly used functions, such as music, climate, and navigation, are located on the home screen. The P7 system is operated like a smartphone.

And if something does go wrong, there is always voice control. The brand claims that 99.8 percent of drivers use it at least once a month. This is also because all (!) systems can be operated from here: Air vents for air conditioning, navigation or music, for example. It can also be used to control the car’s cameras. They even allow the driver to look under the car. For example, the cameras record the road surface while the car is parked. If the driver has parked in a handicapped space, he can immediately see this by looking at the monitor.

One weakness of the P7, like with many sedans, is the trunk. Although the volume of 460 liters is quite acceptable, the structure is somewhat inconvenient. The rear seat bench can be folded down, but this does not create a flat load area.

Meanwhile, Xpeng already plans to launch a second model in Europe. The startup’s G9 electric SUV is also scheduled to be available in 2023. It is envisaged as a kind of final market opener for Europe. The G9 comes with an 800-volt electrical system and will then also have a better trunk and rear seat structure.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

China’s Foreign Minister Wang Yi has threatened that China could seize Taiwan under a 2005 anti-secession law. “The more rampant ‘Taiwan independence’ activities are, the less likely it is to resolve the Taiwan question peacefully”, Wang said at a meeting with 99-year-old US diplomatic legend Henry Kissinger in New York. Analysts consider it unusual for the top leadership to bring up the use of the anti-secession law, according to the South China Morning Post.

Wang did not spare strong rhetoric against Taiwan. “There is an old saying in China: it is better to lose a thousand troops than an inch of land,” he said at the meeting with Kissinger. That is also the will of the entire Chinese people, he said. If there are violations of the anti-secession law, China will “take firm actions” to ensure territorial unity, Wang said without going into details.

The anti-secession law dates back to 2005, in which the People’s Congress unilaterally stipulates that Taiwan is part of China and that military action is justified to achieve unification. Taiwan’s government sharply disagrees with this view. Wang’s remarks are to be seen as a reaction to statements by US President Joe Biden. The latter had confirmed Washington’s willingness to defend Taiwan on Wednesday. fin

Wolfgang Niedermark, chief executive of the Federation of German Industries (BDI), has warned against naivety and looking the other way when it comes to business with China. Conflicts are obvious at the moment, Niedermark said at an event organized by the employers’ interest group BusinessEurope on Tuesday. China is siding with Russia and a conflict over Taiwan is imminent, the BDI chief warned. Things are also happening in Xinjiang province “that we cannot accept.” “Companies cannot ignore all this,” Niedermark said. Globalization is in a new stage and tends more toward competition and conflict.

The Situation is not easy for companies, Niedermark said – but, “There are no wishes being formulated here. We have to accept the geopolitical reality.” The BDI head nevertheless called for careful cooperation in areas of innovation, such as medical technology or electric mobility. Not cooperating in technology areas, he said, would more likely harm the European economy. Markus Beyrer, Director General of BusinessEurope, called for closer cooperation with China, especially in climate protection and standardization.

At the event, MEP Reinhard Bütikofer (Greens) stressed that in this context, however, the rules of such cooperation would have to be carefully examined. Otherwise, foreign companies ran the risk of being exploited. As examples, Bütikofer cited the railroad industry, which had cooperated “intensively” with China and was now being squeezed out of external markets by China Railway Construction.

Bütikofer and EU Deputy Director-General of the Directorate-General for Trade, Maria Martin-Prat, concurred that greater consistency in the EU member states’ approach to China had emerged in recent months. For example, even EU states that had previously been rather indifferent to FDI screening are now showing more ambition to closely scrutinize investments from China, Martin-Prat said.

The EU Chamber in China will present its annual position paper on the business environment for EU companies in the People’s Republic today, Wednesday. ari

China’s exports of solar modules to Europe have surged this year. From January to July 2022, Chinese manufacturers exported photovoltaic modules with a total capacity of 51.5 gigawatts to Europe. That was 25.9 percent more than in all of 2022, reports business magazine Caixin, citing data from energy consultancy Infolink Consulting. According to the report, Chinese photovoltaic industry trade with Europe – including countries outside the EU – accounted for 55 percent of the country’s total solar module exports between January and July. In 2021 as a whole, Europe’s share had been 46 percent.

These figures show the rapidly growing demand for alternative energy sources in Europe. Due to gas shortages, the EU announced in May that it would more than double its solar capacity by 2025 and reach a total of 600 gigawatts of installed capacity by 2030, more than four times the amount at the end of 2020. “These long-term, supportive policy frameworks sustain Europe as the biggest market for Chinese modules,” Albert Hsieh of Infolink, pointed out in a study.

In total, China supplies over 80 percent of global photovoltaic products, according to Caixin. It is one of the few industries that continues to grow rapidly, with photovoltaic module production increasing 74.3 percent year-on-year to 78.6 gigawatts in the first half of 2022. Production of other products in the supply chain – polysilicon, wafers and cells – rose more than 45 percent… China’s Jinko Power Technology, Trina Solar and Longi Green Energy Technology were the world’s top three suppliers of solar modules in the first half of the year, according to Infolink. ck

Several international private equity and venture capital funds indicated a departure from China at a conference in Singapore on Tuesday. According to Bloomberg, speakers from investment firms such as Partners Group, Hamilton Lane and others that collectively invest billions of dollars in the region said they were reducing their holdings in the once-booming economy.

They say the reason is that their customers reassess the risks in China due to the rapidly changing environment there – and apparently increasingly negatively. The news shows that skepticism is also growing in the financial world in the face of economic problems and zero-Covid – even if there is no talk of a rapid withdrawal of capital yet. Investors at the Super Return Asia conference, for example, also stressed that they continued to believe in China’s long-term growth. “We represent people and they define the kind of risk they want us to take,” Bloomberg quoted Emmanuel Pitsilis, co-head of Asia Pacific at investment firm Partners Capital, as saying.

Even though Partners Capital believes in the rise of China, “there’s been a rotation and a desire from clients to diversify away from China.” The firm has shifted from an investment program heavily weighted toward China and venture-focused programs to an approach that is “much broader spread across different sectors and more geographically diverse,” Pitsilis said. Countries that could benefit from a redirection of cash flows include India and Singapore, according to Bloomberg. ck

“Books are my source for new thoughts and other perspectives,” says Nora Gantert, who grew up in the German city of Freiburg im Breisgau as the daughter of a bookseller. “They make you curious about the world, about the different – and at the same time show that this different doesn’t have to be foreign to us.”

Nora Gantert studied sinology and art history in her hometown. She was quickly bothered by the fact that the two could hardly be combined. There were no lectures on art in sinology, and no subjects on Chinese art in art history. “There was a split between us in Europe and the others, the foreigners in China,” Nora says. “It’s not fair, I thought at the time, that we hardly talk about or belittle such a great country, with such a great history and such incredible art and cultural riches.”

The ambition for equality, which developed through literature and in the first years of her studies, is still the focus of Gantant’s work today. As a curator and author, she is primarily devoted to the transcultural aspect in art. “I wish we would put this othering to rest and perceive the individuals. We naturally perceive every American artist, every French artist, individually. With Chinese artists, most people see China first.”

Her curated exhibitions seek to show that people around the globe have universal experiences, which only manifest themselves differently in different societies. As an example, she cites the representation of motherhood in art. “Here you realize that women struggle with the same patriarchal structures, be it in China or in Germany.”

From 2017 to 2021, she developed the art space of the Confucius Institute Nuremberg-Erlangen and was responsible for the curatorial program there. During this time, she helped to realize group exhibitions on cultural relations between China and Africa and on transcultural art between China and Germany. She also initiated a publicly accessible specialist library for contemporary Chinese art. It is the first of its kind in Germany and is now hosted by the Institute of Modern Art in Nuremberg.

Anyone who carefully peruses the exhibition catalogs of the art space curated by Gantert will notice it features almost exclusively female exhibitors. This is no coincidence. “I try to advance the cause of women in everything I do.” In her role as curator, she sees herself as a feminist. “I am committed to making female art more visible. Most of the art that comes to Germany from China is made by men.”

Gantert recently curated a solo exhibition with Lu Yang at the Kunstpalais Erlangen. She is currently writing a research paper about depictions of the future in contemporary Chinese art. “It’s totally exciting that it’s mainly women who are working on this topic,” she says with a smile. “The future is feminine.” Svenja Napp

Jorge Toledo Albiñana has submitted his accreditation as the new EU ambassador to China. “In times of complex geopolitical challenges, I shall work to strengthen bilateral relations & foster EU-China dialogue in all areas,” Albiñana wrote on Twitter as he took office. He succeeds Frenchman Nicolas Chapuis.

Erik Ackner is the new mentor for China relations at German Accelerator, a government support program for startups, in Munich. Ackner primarily serves as president of Mercku, a Canadian-based provider of Wi-Fi technology. He also teaches sustainable entrepreneurship in Germany and China at the Ingolstadt School of Management.

Sheng Fuxin and Winston Chen are the latest departees from China’s sovereign wealth fund China Investment Corp (CIC), which is currently suffering an exodus of executives. Sheng was in charge of infrastructure, Chen of technology. CIC is one of the world’s largest sovereign wealth funds. It manages the equivalent of over €1 trillion in Chinese foreign exchange reserves.

Is something changing in your organization? Why not let us know at heads@table.media!

Finally enjoying some delicious hotpot in a restaurant again, even if it’s only with your own stuffed animal. After two weeks of zero-Covid lockdown in Chengdu, the capital of Sichuan and stronghold of spicy cuisine, restrictions have finally been relaxed and restaurants are open once again. Citizens immediately seized the opportunity.