There has been no shortage of critical words in the annual position paper of the European Chamber of Commerce in Beijing in recent years. But the paper has never sounded as negative as it did now: “Ideology trumps the economy,” is the central statement, alluding to China’s adherence to zero-Covid, which no longer has any scientific basis. Also criticized is the general poorer climate between China and Europe.

The exodus of European companies from China has so far failed to materialize. And yet the Chamber of Commerce warns: confidence has waned and could be permanently damaged. European companies are already looking for alternatives in Southeast Asia and India, Christiane Kuehl quotes from the paper in her analysis. And: EU Chamber President Joerg Wuttke believes that an opening of the country in 2023 is by no means certain.

Equally disillusioning is that coal-fired power plants are built with the help of Chinese money around the globe. It was considered a “milestone in climate protection” when, exactly one year ago, Xi Jinping announced at the UN General Assembly, as the last major state donor to do so, that China would no longer finance coal-fired projects. The good news is that China’s wind and solar companies are also involved in numerous projects through foreign direct investment – and the trend is rising, as Nico Beckert writes in his analysis.

The opening words alone tell the reader all about the mood: “Although Europe and China already sit at opposite ends of a shared continent, it seems they are drifting further and further apart,” writes EU Chamber President Joerg Wuttke in this year’s position paper of the EU Chamber of Commerce in China. The paper’s central message is that “Ideology Trumps the Economy”.

According to the paper presented in Beijing on Wednesday, the focus of the debate in the European headquarters of many companies has shifted significantly when it comes to evaluating China in the past year. While discussions used to revolve primarily around investment opportunities in China, they now focus on problems: risk management, stable supply chains even outside China, or the difficulty of ensuring global compliance in the People’s Republic. And the Chamber asks, almost aghast, “How could China, author of the greatest growth story in history, lose its appeal as an investment destination so quickly?”

The paper also laments the situation based on current figures. China’s National Bureau of Statistics reported year-on-year growth of just 0.4 percent for the second quarter of 2022. In July 2022, the unemployment rate for 16- to 24-year-olds reached 19.9 percent – falling slightly to 18.7 percent in August. “Other significant internal challenges include China’s debt crisis, which has been exacerbated by the COVID-19 pandemic as lending accelerated to help businesses recover.”

The situation is further exacerbated by the growing geopolitical tension, which is due both to China’s trade conflict with the US and the dispute over Chinese human rights violations. Especially when it comes to the issue of human rights, the companies themselves are increasingly coming into the crosshairs of critics – especially if, like VW or BASF, they have invested in Xinjiang, where China is holding large numbers of the Muslim Uyghurs in re-education camps.

The state-owned Chinese newspaper Global Times immediately reacted in its usual outraged fashion. The report is “full of one-sided interpretations and distortions against the Chinese market” the paper writes, citing unnamed “experts”. In it, the Chamber would distort facts and badmouth the Chinese business environment “to justify European firms’ internal business woes and lack of confidence in ensuring supply chain stability.”

Doing business in China has never been easy, but business opportunities and profits have always outweighed the obstacles. Position papers like those of the EU Chamber were critical but had an optimistic tone. But for years, Europe became thoughtful towards China; the expectation that China is opening up further is visibly waning. “China is no longer as attractive as it used to be,” Wuttke said during the presentation of the paper. “There are a lot of problems in the system and we’re losing predictability, reliability and efficiency.”

The chamber urged China to return to the path of liberalization and reform. “Companies are also crying out for transparency in the business environment, as they must now align their China operations with both corporate pledges and new supply-chain legislation in the EU and the United States,” Wuttke said. Overall, the paper makes nearly 1,000 recommendations across industries. As always, it is handing over these demands to government agencies in China and the EU in Brussels.

Many companies continue to do good business despite all criticism of China. However, the last survey of EU companies in June revealed growing problems and a loss of confidence (China.Table reported). As a result, more and more companies are considering future investments in other countries. But withdrawing existing operations is out of the question for the overwhelming majority. However, there is an ongoing debate in the corporate community and among economists about how big the risks of doing business in China are today – and whether the stakes are still worth those risks (China.Table reported).

While large corporations – including German companies such as Volkswagen, Daimler, BMW, and BASF – continue to invest there, despite the discussion about too much dependence on China, many others are holding back. “There are no new European companies,” Wuttke said. Many went directly to other countries that appear more attractive and less problematic.

The paper also speaks of a deep disappointment of the companies. The economy had long been a priority in China and had been predictable, Wuttke said. “But suddenly we have a chain of unfortunate circumstances.” Head of State Xi Jinping increasingly appears like someone who cares more about politics, power, and stability than his country’s economic successes.

In this context, the position paper identifies five key problems for the business environment of EU companies in China:

The attitude toward China in the EU is very negative, Wuttke said in advance. “Even in Hungary and Greece, there is a pretty bad opinion of China.” Both countries are considered comparatively China-friendly. The problem also exists in reverse, Wuttke lamented: “Young people in China also have a more negative attitude toward Europe.”

But how to solve the problem? “In the past, China would have met these challenges with the same kind of pragmatism that has accelerated its development so much over the decades,” writes the Chamber – which is apparently very skeptical that Beijing would still be able to do so today.

In addition, there are real obstacles due to Covid. Expecting an opening in 2023 is already considered optimistic, Wuttke said. “There is no herd immunity in China; they have reasons to keep it closed.” EU firms won’t be able to change that with their criticism. Hope remains for a long-term normalization of the situation – and thus for a return of good business opportunities. Collaboration: Amelie Richter

The announcement in New York was considered a milestone in climate protection: “China will not build new coal-fired power projects abroad” – that was Xi Jinping’s promise at the last UN General Assembly. Until then, the People’s Republic had been the last major state donor for coal projects. Between 2000 and 2019, China’s biggest development banks injected nearly $52 billion into 66 coal-fired power plants abroad after Western development banks gradually exited the business (China. Table reported).

But a year later, the balance of this promise is dim: Due to loopholes and gray areas in the regulation, 18 new coal-fired power plants with a capacity of 19.2 gigawatts could be built, even though they contradict Xi’s words, as an analysis by the think tank Centre for Research on Energy and Clean Air shows. According to the report, the coal-fired piles would generate circa 94 million tons of carbon every year. Some of these power plants are built in industrial parks that are promoted as part of the New Silk Road. In addition, power plants are expanded with Chinese support, and projects that were already decided before Xi’s announcement can still be realized.

The analysis shows examples where China continues to finance coal: In Indonesia, a power plant is to be built in an industrial park and supply the nickel and steel industries. The contract was signed on February 14 of this year – a good five months after Xi’s announcement. Another industrial coal-fired power plant in Indonesia is to be expanded with Chinese equipment, the CREA analysis shows.

In Laos, on the other hand, a coal-fired power plant is built which was decided years ago and whose planning was interrupted in the meantime. Another new contract for a construction project was signed on May 24, 2022. Here, too, a Chinese company is the supplier of parts for construction. The 660 MW project is officially called a “clean energy generation project.” However, according to CREA, the published information strongly suggests a coal-fired power plant.

In addition, China remains willing to upgrade existing coal-fired power plants abroad to meet new emission standards. This would limit sulfur and nitrogen oxide emissions and thus reduce air pollution by the power plants. But if the upgrades kept power plants online longer than originally planned, overall carbon emissions could rise, CREA analysts said. This risk exists particularly with old power plants, for example in Indonesia and India, says CREA’s Isabella Suarez.

Despite these loopholes, however, Xi’s announcement is still seen as a needed milestone. China’s ban on building coal-fired power plants abroad “is hugely important for climate protection and the energy transition worldwide,” Suarez told Climate.Table. That’s partly because other sources of financing are increasingly drying up.

Though China was the last major state backer, even before Xi’s announcement, 87 percent of public and private financing to build coal-fired power plants came from outside China, according to calculations by Boston University’s Global Development Policy Center – “most of it from institutional investors and commercial banks from Japan and Western countries,” according to Cecilia Springer, associate director of Boston University’s Global China Initiative.

“Many private financiers have been adopting their own restrictions. Developing countries who still want to build coal struggle to find financing options going forward,” says the Boston University expert. What’s more, boilers, steam turbines, and generators from China have a major cost advantage over offerings from other regions of the world. If this equipment is no longer allowed to be installed abroad, coal-fired power plants will become more expensive and thus less likely to be built, even if private financiers would finance them.

Although China itself plans to rely more heavily on natural gas in the future, Springer says there is little evidence of major investment by Chinese development banks in gas projects in the global South. “China has provided hardly any development finance for gas power plants to date,” Springer says. Nor is investment expected to increase, she adds. That’s because “China’s domestic natural gas industry is small, and lacks incentives to go global like China’s domestic coal and hydropower industries.” However, Chinese companies are making outward direct investments in the gas sector, which are driven by demand from host countries, not by China’s strategic interests, she said.

Natural gas plays hardly any role in the revised policy guidelines for financing and investment abroad that followed Xi’s UN announcement, Springer said. Instead, renewable energies are emphasized there. After all, Xi also emphasized in his UN speech, “China will step up support for other developing countries in developing green and low-carbon energy.”

So far, China’s development banks have been reluctant to get involved in wind and solar energy. They have “considered the risk of affordability too high. And the demand from host countries for renewables has been lacking. They preferred traditional energy sources,” Springer says. But the Boston University scholar is optimistic. Should China overcome its own economic problems and once again approve more development financing, it will invest more in renewables, she said.

China’s wind and solar companies have been involved in numerous wind and solar projects through foreign direct investment in recent years. They have financed the majority of the 20 gigawatts of wind and solar capacity financed by China. Suarez is also optimistic: “We’re very much expecting the number of renewable energy projects abroad to increase and be made systematic in the way that the financing and export of coal technology was.”

Just how difficult it is for China to stop using fossil fuels is demonstrated by the joint statement issued with Russia and India at the Shanghai Cooperation Organization (SCO) summit in Samarkand on September 15 and 16. In it, members of the economic and security alliance, which are among the biggest carbon polluters, insist on the right of emerging economies to use oil and gas for their economic development. SCO members call for a “balanced approach between emissions reduction and development” by nations.

The leaders called for increased investment in oil and gas production and exploration. In doing so, they directly contradict calculations by the International Energy Agency (IEA), which warns that no new fossil fuel infrastructure should be built worldwide with immediate effect to meet the 1.5-degree target.

Following Kremlin leader Vladimir Putin’s announcement of the partial mobilization of Russian reservists in the war against Ukraine, China has called for resolving “the issue through dialogue and negotiations.” Beijing has not changed its position on the matter, Chinese Foreign Ministry spokesman Wang Wenbin said Thursday. However, the AFP news agency also quoted Wang saying that Beijing called on all parties to “realize a ceasefire through dialogue and consultations.” This would have been the first time China has directly called for a laying down of arms in the war. However, a subsequently released transcript of the press conference did not mention the word “ceasefire.”

Putin had earlier announced in a televised address the partial mobilization of Russians of military age and threatened to use nuclear weapons. According to Defense Minister Sergei Shoigu, 300,000 reservists are to reinforce Russian and separatist forces in southern and eastern Ukraine. In addition, “referendums” on annexation to Russia are to be held in several Ukrainian territories. China has always supported “all countries’ sovereignty, independence, and territorial integrity” and adherence to the UN Charter, Wang said. His country is ready to play a “constructive part in deescalation efforts” together with the international community, he said.

Wang also rejected German Chancellor Olaf Scholz’s call to follow the UN Human Rights Commissioner’s recommendations for better treatment of the Uyghurs. He said the UN report on the situation in the Xinjiang region was “a patchwork of disinformation.” It is a “political tool” to serve some Western countries that want to keep China down, Wang said.

In his speech to the UN General Assembly in New York, the chancellor had earlier called on the Chinese side to implement the recommendations in the UN report. “That would be a sign of sovereignty and strength and a guarantee of change for the better.” China is currently scheduled to speak at the General Assembly on Saturday. On the list of speakers is Foreign Minister Wang Yi. Whether the latter has arrived with a video message from President Xi Jinping is still unknown. Also speaking on Saturday will be Russia. The Russian war against Ukraine has been the dominant theme of the UN General Assembly, which continues until next Monday. ari

Despite an emerging economic crisis, German exports to countries outside the EU rose significantly in August. The Federal Statistical Office reported on Wednesday, that exports, adjusted for calendar and seasonal effects, grew by 4.0 percent compared to the previous month to €60.3 billion in total. In July, there had still been a decline after previously three increases in a row.

Exports to the US in particular increased. Companies from Germany shipped goods worth €13.4 billion to the US – an increase of 42.3 percent year on year. China followed in second place. Exports to the People’s Republic totaled €8.9 billion, an increase of 17.2 percent. The increase was due, among other things, to higher prices and a lower-valued euro compared with the dollar and yuan.

Even if the US remains Germany’s biggest customer, China remains the Germans’ most important trading partner. This is because, other than from the US, Germans purchase many goods from the Middle Kingdom. According to the Federal Statistical Office, goods worth €245.9 billion were traded between Germany and the People’s Republic of China in 2021. flee

The number of Chinese millionaires could double by 2026, according to the “Global Wealth Report” of the Swiss bank Credit Suisse, published on Tuesday. Last year, their number in China had already risen by more than one million to a total of 6.2 million, corresponding to an increase of around 20 percent. If the trend continues, there will be 12.2 million millionaires in 2026, according to the study.

It is a declared goal of Xi Jinping’s government to distribute wealth in the country more fairly and evenly. According to Credit Suisse, the total wealth of private households in China stood at $85.1 trillion last year – that would be 15.1 percent or $11.2 trillion more than in 2020.

The number of millionaires around the world rose by 5.2 million last year. In Germany, however, their number is declining. According to Credit Suisse, there were just under 2.7 million millionaires in Germany at the end of 2021, a decline of 58,000 from the previous year. The total wealth of Germans has also shrunk from $18.3 trillion to $17.5 trillion in this period. fpe

China and the United Arab Emirates are planning a joint mission to the moon. As reported by the South China Morning Post, the respective space agencies signed a memorandum of understanding to this effect in Dubai last week.

During the mission planned for 2026, the unmanned Chinese lunar probe Chang’e 7 is to take the rover Rashid 2 of the United Arab Emirates to the surface of the moon’s southern polar region. China will provide the Emirates with data transmission and monitoring services in return for research results from Rashid 2. Among other tasks, the mission will provide new insights into water and ice deposits on the moon.

China has made rapid progress as a space power in recent years. The People’s Republic was the first nation to reach the far side of the moon, with Tianwen-1 China’s space agency sending a mission to Mars (China.Table reported), and the Chang’e mission successfully collected rock samples on the moon last December. Since June of this year, China has also operated a permanently manned space station in low-Earth orbit. Because of the US, the People’s Republic has been excluded from cross-state collaborations such as the International Space Station (ISS). fpe

China’s best-known live streaming influencer, Li Jiaqi, has returned to screens after an apparently involuntary hiatus. On Tuesday, the 25-year-old hosted a sales show on Taobao, China’s largest e-commerce platform, for two hours without prior notice. Li had disappeared from all online platforms for three months.

Li, who is also known as the “lipstick brother” in China due to his sales talent for cosmetic products, held an ice cream cake in the shape of a tank up to the camera on the eve of the anniversary of the Tiananmen massacre this year (China.Table reported). The stream of his broadcast ended shortly after. Li later apologized on his social media channels that there had been technical problems. Whether he had intentionally referenced the events of June 4, 1989, remains unclear to this day. Li also did not comment on his three-month disappearance on Tuesday.

Li was China’s most commercially successful live streamer until his disappearance, especially after his biggest rival Viya was fined ¥1.34 billion (€190 million) for tax evasion in December. Last year, Li sold $1.9 billion worth of goods in one broadcast on his channel alone. Foreign companies such as Apple and Shiseido also used his popularity to market their products in China. fpe

With provisions to cut US emissions by 40% from 2005 levels by 2030, the Inflation Reduction Act has revived America’s global climate leadership. Since most of these reductions will come from a cleaner electricity sector – which is projected to be 70-85% carbon-free by 2030 – the United States will be well positioned to collaborate with others on decarbonization of the power sector, starting with China.

True, in response to House Speaker Nancy Pelosi’s recent visit to Taiwan, China has suspended its diplomatic engagement with the US, including on climate issues. And yet, the climate threat is not unlike the threat posed by nuclear proliferation during the Cold War. The two superpowers (both economically and in terms of emissions) have a shared interest in reducing their fossil-fuel “arsenals,” even amid worsening bilateral relations. By acting decisively this decade, both can deliver greater economic, health, and security benefits for their own populations and the rest of the world.

Owing to its reliance on coal, which supplies two-thirds of its electricity, China now emits more greenhouse gases per year than any other country, with its electricity-related emissions alone roughly equaling those for the entire US economy. At the same time, China’s renewable-energy capacity is soaring. In 2020, it added three times more wind and solar capacity than the US did; and just in the first half of 2022, it invested another $100 billion in solar and wind.

Yet China could pivot from coal to clean energy even faster, especially if it is willing to work with the US on cleaning up the electricity sector. New research from Lawrence Berkeley National Laboratory (LBNL), Energy Innovation, and the University of California, Berkeley, shows that China could reach 80% carbon-free electricity as early as 2035 without increasing costs or sacrificing reliability. Though China is already on pace to exceed its goal of 1,200 gigawatts of wind and solar by 2030, it could add much more by leveraging its unparalleled renewable-resource endowment and world-leading cleantech supply chain.

Similarly, 11 separate expert studies show that the US can reach President Joe Biden’s goal of 80% carbon-free electricity by 2030 without increasing cost or degrading reliability, largely because new renewables are becoming cheaper than existing coal power. By adding more storage, preserving existing nuclear-power sources, and operating natural gas and hydropower more flexibly, the US can reliably retire its coal plants and quadruple its low-cost renewable electricity by the end of the decade.

Similar market forces are at play in China, which is on track to increase its clean-energy share from 33% today to 50% by 2030, owing to policies supporting the development of wind, solar, nuclear, and hydro-energy sources. With even more effective policy support, including market reforms, China could cut generation and transmission costs as it cleans up its grid

China has already proved capable of rapidly deploying clean-energy infrastructure at scale. To achieve 80% clean electricity by 2035, it would need to sustain and raise its 2020 world-beating pace of wind and solar development. If it can do that, it can push its solar and wind capacity to 3,000 GW, which our research shows would add some 1.2 million clean-energy jobs.

Reliability is a major concern for both China and the US. But pitting renewables against supposedly more dependable fossil fuels is a false choice. In 2021, soon after Texas experienced its worst fossil-fuel-power outage in decades during Winter Storm Uri, China suffered a major supply crisis of its own.

Owing to coal shortages and perverse market incentives, China’s grid operators were forced to ration power to industrial customers. Because power prices had been set administratively, power producers received the wrong economic signal when electricity demand and fuel costs shot up: the more they produced, the more money they lost

In both China and the US, boosting the share of renewable energy will also increase energy independence and reduce the risks associated with fossil fuels’ price volatility. Those risks have been on full display this year. Energy market shocks have driven up natural-gas prices and caused acute economic pain in the US, which relies on gas for roughly 40% of its electricity demand.

Similarly, China relies on coal, oil, and natural-gas imports, all of which have become more volatile since Russia’s invasion of Ukraine. However, LBNL’s power-sector simulations show that with an 80% carbon-free power system, the Chinese grid could serve demand reliably even during a 35-year nadir of wind and solar production.

Because the policies needed to drive carbon-free electricity generation in the US and China are not so different, the two countries could collaborate on power-market reforms, even if they are cooperating on little else. China is already developing a national unified electricity market – a key tool for leveraging diverse wind and solar resources across such a vast area – but it could benefit immensely from the US experience of improving competitive markets over the last 25 years.

American operators lead the world in managing high-renewable grids and integrating new technologies like battery storage, offering many lessons for their Chinese counterparts. And China can leverage renewable-energy growth to help promote development in its coal-dependent provinces, much as the US is doing through the IRA and the 2021 bipartisan infrastructure bill, which provide funding for investment in manufacturing and clean energy in coal-dependent communities.

Despite security tensions, coordination to accelerate the clean-power transition offers many mutual benefits. Beyond exchanging technology and knowhow, China and the US could jointly commit to rapid decarbonization with common but differentiated responsibilities, setting a US goal of 80% clean electricity by 2030, with China following suit by 2035.

By pursuing common interests and opportunities, the US and China can lead the world in decarbonizing their grids. Their leaders must not let their current political disagreements get in the way.

Jiang Lin is an Adjunct Professor at the Department of Agricultural and Resources Economics at the University of California at Berkeley. Michael O’Boyle is Director of Electricity Policy at Energy Innovation.

Copyright: Project Syndicate, 2022.

www.project-syndicate.org

Matthias Weiß has taken over the position of Managing Director China at Wessel-Werk. The medium-sized company from North Rhine-Westphalia specializes in vacuum cleaner nozzles and accessories. Weiß has been working in China since 2010. Most recently, he worked as Operations Manager (COO) at GSS Manufacturing in Shanghai.

Florian Huber has been responsible for Parts & Supply Chain Quality at Daimler Greater China since August. Huber has been in China since July 2021. Most recently, he worked for Daimler as an Expert for Procurement Processes and Methods in Beijing.

Is something changing in your organization? Why not let us know at heads@table.media!

Fire alarm in the Forbidden City – but only a drill. Under a bright blue sky, the Beijing fire department deploys for an operational drill in the palace complex.

There has been no shortage of critical words in the annual position paper of the European Chamber of Commerce in Beijing in recent years. But the paper has never sounded as negative as it did now: “Ideology trumps the economy,” is the central statement, alluding to China’s adherence to zero-Covid, which no longer has any scientific basis. Also criticized is the general poorer climate between China and Europe.

The exodus of European companies from China has so far failed to materialize. And yet the Chamber of Commerce warns: confidence has waned and could be permanently damaged. European companies are already looking for alternatives in Southeast Asia and India, Christiane Kuehl quotes from the paper in her analysis. And: EU Chamber President Joerg Wuttke believes that an opening of the country in 2023 is by no means certain.

Equally disillusioning is that coal-fired power plants are built with the help of Chinese money around the globe. It was considered a “milestone in climate protection” when, exactly one year ago, Xi Jinping announced at the UN General Assembly, as the last major state donor to do so, that China would no longer finance coal-fired projects. The good news is that China’s wind and solar companies are also involved in numerous projects through foreign direct investment – and the trend is rising, as Nico Beckert writes in his analysis.

The opening words alone tell the reader all about the mood: “Although Europe and China already sit at opposite ends of a shared continent, it seems they are drifting further and further apart,” writes EU Chamber President Joerg Wuttke in this year’s position paper of the EU Chamber of Commerce in China. The paper’s central message is that “Ideology Trumps the Economy”.

According to the paper presented in Beijing on Wednesday, the focus of the debate in the European headquarters of many companies has shifted significantly when it comes to evaluating China in the past year. While discussions used to revolve primarily around investment opportunities in China, they now focus on problems: risk management, stable supply chains even outside China, or the difficulty of ensuring global compliance in the People’s Republic. And the Chamber asks, almost aghast, “How could China, author of the greatest growth story in history, lose its appeal as an investment destination so quickly?”

The paper also laments the situation based on current figures. China’s National Bureau of Statistics reported year-on-year growth of just 0.4 percent for the second quarter of 2022. In July 2022, the unemployment rate for 16- to 24-year-olds reached 19.9 percent – falling slightly to 18.7 percent in August. “Other significant internal challenges include China’s debt crisis, which has been exacerbated by the COVID-19 pandemic as lending accelerated to help businesses recover.”

The situation is further exacerbated by the growing geopolitical tension, which is due both to China’s trade conflict with the US and the dispute over Chinese human rights violations. Especially when it comes to the issue of human rights, the companies themselves are increasingly coming into the crosshairs of critics – especially if, like VW or BASF, they have invested in Xinjiang, where China is holding large numbers of the Muslim Uyghurs in re-education camps.

The state-owned Chinese newspaper Global Times immediately reacted in its usual outraged fashion. The report is “full of one-sided interpretations and distortions against the Chinese market” the paper writes, citing unnamed “experts”. In it, the Chamber would distort facts and badmouth the Chinese business environment “to justify European firms’ internal business woes and lack of confidence in ensuring supply chain stability.”

Doing business in China has never been easy, but business opportunities and profits have always outweighed the obstacles. Position papers like those of the EU Chamber were critical but had an optimistic tone. But for years, Europe became thoughtful towards China; the expectation that China is opening up further is visibly waning. “China is no longer as attractive as it used to be,” Wuttke said during the presentation of the paper. “There are a lot of problems in the system and we’re losing predictability, reliability and efficiency.”

The chamber urged China to return to the path of liberalization and reform. “Companies are also crying out for transparency in the business environment, as they must now align their China operations with both corporate pledges and new supply-chain legislation in the EU and the United States,” Wuttke said. Overall, the paper makes nearly 1,000 recommendations across industries. As always, it is handing over these demands to government agencies in China and the EU in Brussels.

Many companies continue to do good business despite all criticism of China. However, the last survey of EU companies in June revealed growing problems and a loss of confidence (China.Table reported). As a result, more and more companies are considering future investments in other countries. But withdrawing existing operations is out of the question for the overwhelming majority. However, there is an ongoing debate in the corporate community and among economists about how big the risks of doing business in China are today – and whether the stakes are still worth those risks (China.Table reported).

While large corporations – including German companies such as Volkswagen, Daimler, BMW, and BASF – continue to invest there, despite the discussion about too much dependence on China, many others are holding back. “There are no new European companies,” Wuttke said. Many went directly to other countries that appear more attractive and less problematic.

The paper also speaks of a deep disappointment of the companies. The economy had long been a priority in China and had been predictable, Wuttke said. “But suddenly we have a chain of unfortunate circumstances.” Head of State Xi Jinping increasingly appears like someone who cares more about politics, power, and stability than his country’s economic successes.

In this context, the position paper identifies five key problems for the business environment of EU companies in China:

The attitude toward China in the EU is very negative, Wuttke said in advance. “Even in Hungary and Greece, there is a pretty bad opinion of China.” Both countries are considered comparatively China-friendly. The problem also exists in reverse, Wuttke lamented: “Young people in China also have a more negative attitude toward Europe.”

But how to solve the problem? “In the past, China would have met these challenges with the same kind of pragmatism that has accelerated its development so much over the decades,” writes the Chamber – which is apparently very skeptical that Beijing would still be able to do so today.

In addition, there are real obstacles due to Covid. Expecting an opening in 2023 is already considered optimistic, Wuttke said. “There is no herd immunity in China; they have reasons to keep it closed.” EU firms won’t be able to change that with their criticism. Hope remains for a long-term normalization of the situation – and thus for a return of good business opportunities. Collaboration: Amelie Richter

The announcement in New York was considered a milestone in climate protection: “China will not build new coal-fired power projects abroad” – that was Xi Jinping’s promise at the last UN General Assembly. Until then, the People’s Republic had been the last major state donor for coal projects. Between 2000 and 2019, China’s biggest development banks injected nearly $52 billion into 66 coal-fired power plants abroad after Western development banks gradually exited the business (China. Table reported).

But a year later, the balance of this promise is dim: Due to loopholes and gray areas in the regulation, 18 new coal-fired power plants with a capacity of 19.2 gigawatts could be built, even though they contradict Xi’s words, as an analysis by the think tank Centre for Research on Energy and Clean Air shows. According to the report, the coal-fired piles would generate circa 94 million tons of carbon every year. Some of these power plants are built in industrial parks that are promoted as part of the New Silk Road. In addition, power plants are expanded with Chinese support, and projects that were already decided before Xi’s announcement can still be realized.

The analysis shows examples where China continues to finance coal: In Indonesia, a power plant is to be built in an industrial park and supply the nickel and steel industries. The contract was signed on February 14 of this year – a good five months after Xi’s announcement. Another industrial coal-fired power plant in Indonesia is to be expanded with Chinese equipment, the CREA analysis shows.

In Laos, on the other hand, a coal-fired power plant is built which was decided years ago and whose planning was interrupted in the meantime. Another new contract for a construction project was signed on May 24, 2022. Here, too, a Chinese company is the supplier of parts for construction. The 660 MW project is officially called a “clean energy generation project.” However, according to CREA, the published information strongly suggests a coal-fired power plant.

In addition, China remains willing to upgrade existing coal-fired power plants abroad to meet new emission standards. This would limit sulfur and nitrogen oxide emissions and thus reduce air pollution by the power plants. But if the upgrades kept power plants online longer than originally planned, overall carbon emissions could rise, CREA analysts said. This risk exists particularly with old power plants, for example in Indonesia and India, says CREA’s Isabella Suarez.

Despite these loopholes, however, Xi’s announcement is still seen as a needed milestone. China’s ban on building coal-fired power plants abroad “is hugely important for climate protection and the energy transition worldwide,” Suarez told Climate.Table. That’s partly because other sources of financing are increasingly drying up.

Though China was the last major state backer, even before Xi’s announcement, 87 percent of public and private financing to build coal-fired power plants came from outside China, according to calculations by Boston University’s Global Development Policy Center – “most of it from institutional investors and commercial banks from Japan and Western countries,” according to Cecilia Springer, associate director of Boston University’s Global China Initiative.

“Many private financiers have been adopting their own restrictions. Developing countries who still want to build coal struggle to find financing options going forward,” says the Boston University expert. What’s more, boilers, steam turbines, and generators from China have a major cost advantage over offerings from other regions of the world. If this equipment is no longer allowed to be installed abroad, coal-fired power plants will become more expensive and thus less likely to be built, even if private financiers would finance them.

Although China itself plans to rely more heavily on natural gas in the future, Springer says there is little evidence of major investment by Chinese development banks in gas projects in the global South. “China has provided hardly any development finance for gas power plants to date,” Springer says. Nor is investment expected to increase, she adds. That’s because “China’s domestic natural gas industry is small, and lacks incentives to go global like China’s domestic coal and hydropower industries.” However, Chinese companies are making outward direct investments in the gas sector, which are driven by demand from host countries, not by China’s strategic interests, she said.

Natural gas plays hardly any role in the revised policy guidelines for financing and investment abroad that followed Xi’s UN announcement, Springer said. Instead, renewable energies are emphasized there. After all, Xi also emphasized in his UN speech, “China will step up support for other developing countries in developing green and low-carbon energy.”

So far, China’s development banks have been reluctant to get involved in wind and solar energy. They have “considered the risk of affordability too high. And the demand from host countries for renewables has been lacking. They preferred traditional energy sources,” Springer says. But the Boston University scholar is optimistic. Should China overcome its own economic problems and once again approve more development financing, it will invest more in renewables, she said.

China’s wind and solar companies have been involved in numerous wind and solar projects through foreign direct investment in recent years. They have financed the majority of the 20 gigawatts of wind and solar capacity financed by China. Suarez is also optimistic: “We’re very much expecting the number of renewable energy projects abroad to increase and be made systematic in the way that the financing and export of coal technology was.”

Just how difficult it is for China to stop using fossil fuels is demonstrated by the joint statement issued with Russia and India at the Shanghai Cooperation Organization (SCO) summit in Samarkand on September 15 and 16. In it, members of the economic and security alliance, which are among the biggest carbon polluters, insist on the right of emerging economies to use oil and gas for their economic development. SCO members call for a “balanced approach between emissions reduction and development” by nations.

The leaders called for increased investment in oil and gas production and exploration. In doing so, they directly contradict calculations by the International Energy Agency (IEA), which warns that no new fossil fuel infrastructure should be built worldwide with immediate effect to meet the 1.5-degree target.

Following Kremlin leader Vladimir Putin’s announcement of the partial mobilization of Russian reservists in the war against Ukraine, China has called for resolving “the issue through dialogue and negotiations.” Beijing has not changed its position on the matter, Chinese Foreign Ministry spokesman Wang Wenbin said Thursday. However, the AFP news agency also quoted Wang saying that Beijing called on all parties to “realize a ceasefire through dialogue and consultations.” This would have been the first time China has directly called for a laying down of arms in the war. However, a subsequently released transcript of the press conference did not mention the word “ceasefire.”

Putin had earlier announced in a televised address the partial mobilization of Russians of military age and threatened to use nuclear weapons. According to Defense Minister Sergei Shoigu, 300,000 reservists are to reinforce Russian and separatist forces in southern and eastern Ukraine. In addition, “referendums” on annexation to Russia are to be held in several Ukrainian territories. China has always supported “all countries’ sovereignty, independence, and territorial integrity” and adherence to the UN Charter, Wang said. His country is ready to play a “constructive part in deescalation efforts” together with the international community, he said.

Wang also rejected German Chancellor Olaf Scholz’s call to follow the UN Human Rights Commissioner’s recommendations for better treatment of the Uyghurs. He said the UN report on the situation in the Xinjiang region was “a patchwork of disinformation.” It is a “political tool” to serve some Western countries that want to keep China down, Wang said.

In his speech to the UN General Assembly in New York, the chancellor had earlier called on the Chinese side to implement the recommendations in the UN report. “That would be a sign of sovereignty and strength and a guarantee of change for the better.” China is currently scheduled to speak at the General Assembly on Saturday. On the list of speakers is Foreign Minister Wang Yi. Whether the latter has arrived with a video message from President Xi Jinping is still unknown. Also speaking on Saturday will be Russia. The Russian war against Ukraine has been the dominant theme of the UN General Assembly, which continues until next Monday. ari

Despite an emerging economic crisis, German exports to countries outside the EU rose significantly in August. The Federal Statistical Office reported on Wednesday, that exports, adjusted for calendar and seasonal effects, grew by 4.0 percent compared to the previous month to €60.3 billion in total. In July, there had still been a decline after previously three increases in a row.

Exports to the US in particular increased. Companies from Germany shipped goods worth €13.4 billion to the US – an increase of 42.3 percent year on year. China followed in second place. Exports to the People’s Republic totaled €8.9 billion, an increase of 17.2 percent. The increase was due, among other things, to higher prices and a lower-valued euro compared with the dollar and yuan.

Even if the US remains Germany’s biggest customer, China remains the Germans’ most important trading partner. This is because, other than from the US, Germans purchase many goods from the Middle Kingdom. According to the Federal Statistical Office, goods worth €245.9 billion were traded between Germany and the People’s Republic of China in 2021. flee

The number of Chinese millionaires could double by 2026, according to the “Global Wealth Report” of the Swiss bank Credit Suisse, published on Tuesday. Last year, their number in China had already risen by more than one million to a total of 6.2 million, corresponding to an increase of around 20 percent. If the trend continues, there will be 12.2 million millionaires in 2026, according to the study.

It is a declared goal of Xi Jinping’s government to distribute wealth in the country more fairly and evenly. According to Credit Suisse, the total wealth of private households in China stood at $85.1 trillion last year – that would be 15.1 percent or $11.2 trillion more than in 2020.

The number of millionaires around the world rose by 5.2 million last year. In Germany, however, their number is declining. According to Credit Suisse, there were just under 2.7 million millionaires in Germany at the end of 2021, a decline of 58,000 from the previous year. The total wealth of Germans has also shrunk from $18.3 trillion to $17.5 trillion in this period. fpe

China and the United Arab Emirates are planning a joint mission to the moon. As reported by the South China Morning Post, the respective space agencies signed a memorandum of understanding to this effect in Dubai last week.

During the mission planned for 2026, the unmanned Chinese lunar probe Chang’e 7 is to take the rover Rashid 2 of the United Arab Emirates to the surface of the moon’s southern polar region. China will provide the Emirates with data transmission and monitoring services in return for research results from Rashid 2. Among other tasks, the mission will provide new insights into water and ice deposits on the moon.

China has made rapid progress as a space power in recent years. The People’s Republic was the first nation to reach the far side of the moon, with Tianwen-1 China’s space agency sending a mission to Mars (China.Table reported), and the Chang’e mission successfully collected rock samples on the moon last December. Since June of this year, China has also operated a permanently manned space station in low-Earth orbit. Because of the US, the People’s Republic has been excluded from cross-state collaborations such as the International Space Station (ISS). fpe

China’s best-known live streaming influencer, Li Jiaqi, has returned to screens after an apparently involuntary hiatus. On Tuesday, the 25-year-old hosted a sales show on Taobao, China’s largest e-commerce platform, for two hours without prior notice. Li had disappeared from all online platforms for three months.

Li, who is also known as the “lipstick brother” in China due to his sales talent for cosmetic products, held an ice cream cake in the shape of a tank up to the camera on the eve of the anniversary of the Tiananmen massacre this year (China.Table reported). The stream of his broadcast ended shortly after. Li later apologized on his social media channels that there had been technical problems. Whether he had intentionally referenced the events of June 4, 1989, remains unclear to this day. Li also did not comment on his three-month disappearance on Tuesday.

Li was China’s most commercially successful live streamer until his disappearance, especially after his biggest rival Viya was fined ¥1.34 billion (€190 million) for tax evasion in December. Last year, Li sold $1.9 billion worth of goods in one broadcast on his channel alone. Foreign companies such as Apple and Shiseido also used his popularity to market their products in China. fpe

With provisions to cut US emissions by 40% from 2005 levels by 2030, the Inflation Reduction Act has revived America’s global climate leadership. Since most of these reductions will come from a cleaner electricity sector – which is projected to be 70-85% carbon-free by 2030 – the United States will be well positioned to collaborate with others on decarbonization of the power sector, starting with China.

True, in response to House Speaker Nancy Pelosi’s recent visit to Taiwan, China has suspended its diplomatic engagement with the US, including on climate issues. And yet, the climate threat is not unlike the threat posed by nuclear proliferation during the Cold War. The two superpowers (both economically and in terms of emissions) have a shared interest in reducing their fossil-fuel “arsenals,” even amid worsening bilateral relations. By acting decisively this decade, both can deliver greater economic, health, and security benefits for their own populations and the rest of the world.

Owing to its reliance on coal, which supplies two-thirds of its electricity, China now emits more greenhouse gases per year than any other country, with its electricity-related emissions alone roughly equaling those for the entire US economy. At the same time, China’s renewable-energy capacity is soaring. In 2020, it added three times more wind and solar capacity than the US did; and just in the first half of 2022, it invested another $100 billion in solar and wind.

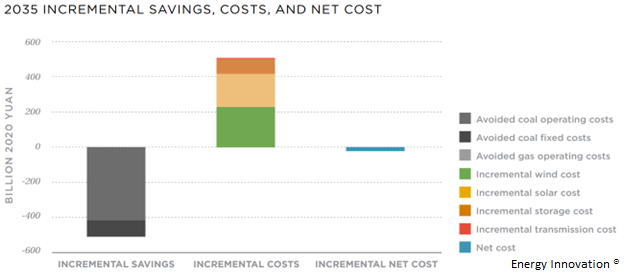

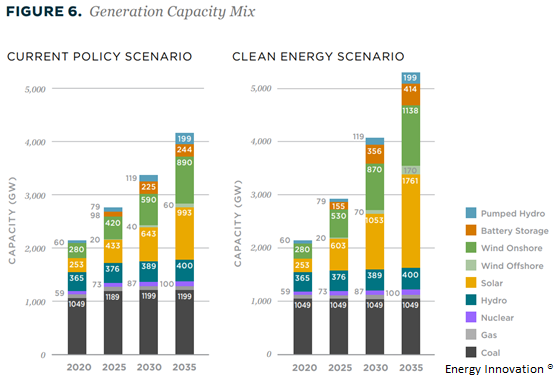

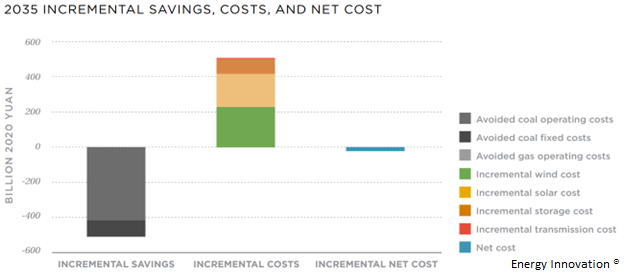

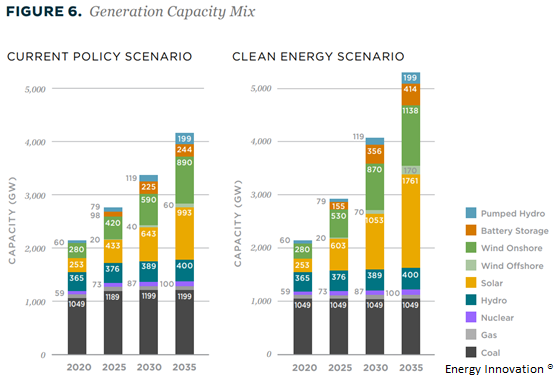

Yet China could pivot from coal to clean energy even faster, especially if it is willing to work with the US on cleaning up the electricity sector. New research from Lawrence Berkeley National Laboratory (LBNL), Energy Innovation, and the University of California, Berkeley, shows that China could reach 80% carbon-free electricity as early as 2035 without increasing costs or sacrificing reliability. Though China is already on pace to exceed its goal of 1,200 gigawatts of wind and solar by 2030, it could add much more by leveraging its unparalleled renewable-resource endowment and world-leading cleantech supply chain.

Similarly, 11 separate expert studies show that the US can reach President Joe Biden’s goal of 80% carbon-free electricity by 2030 without increasing cost or degrading reliability, largely because new renewables are becoming cheaper than existing coal power. By adding more storage, preserving existing nuclear-power sources, and operating natural gas and hydropower more flexibly, the US can reliably retire its coal plants and quadruple its low-cost renewable electricity by the end of the decade.

Similar market forces are at play in China, which is on track to increase its clean-energy share from 33% today to 50% by 2030, owing to policies supporting the development of wind, solar, nuclear, and hydro-energy sources. With even more effective policy support, including market reforms, China could cut generation and transmission costs as it cleans up its grid

China has already proved capable of rapidly deploying clean-energy infrastructure at scale. To achieve 80% clean electricity by 2035, it would need to sustain and raise its 2020 world-beating pace of wind and solar development. If it can do that, it can push its solar and wind capacity to 3,000 GW, which our research shows would add some 1.2 million clean-energy jobs.

Reliability is a major concern for both China and the US. But pitting renewables against supposedly more dependable fossil fuels is a false choice. In 2021, soon after Texas experienced its worst fossil-fuel-power outage in decades during Winter Storm Uri, China suffered a major supply crisis of its own.

Owing to coal shortages and perverse market incentives, China’s grid operators were forced to ration power to industrial customers. Because power prices had been set administratively, power producers received the wrong economic signal when electricity demand and fuel costs shot up: the more they produced, the more money they lost

In both China and the US, boosting the share of renewable energy will also increase energy independence and reduce the risks associated with fossil fuels’ price volatility. Those risks have been on full display this year. Energy market shocks have driven up natural-gas prices and caused acute economic pain in the US, which relies on gas for roughly 40% of its electricity demand.

Similarly, China relies on coal, oil, and natural-gas imports, all of which have become more volatile since Russia’s invasion of Ukraine. However, LBNL’s power-sector simulations show that with an 80% carbon-free power system, the Chinese grid could serve demand reliably even during a 35-year nadir of wind and solar production.

Because the policies needed to drive carbon-free electricity generation in the US and China are not so different, the two countries could collaborate on power-market reforms, even if they are cooperating on little else. China is already developing a national unified electricity market – a key tool for leveraging diverse wind and solar resources across such a vast area – but it could benefit immensely from the US experience of improving competitive markets over the last 25 years.

American operators lead the world in managing high-renewable grids and integrating new technologies like battery storage, offering many lessons for their Chinese counterparts. And China can leverage renewable-energy growth to help promote development in its coal-dependent provinces, much as the US is doing through the IRA and the 2021 bipartisan infrastructure bill, which provide funding for investment in manufacturing and clean energy in coal-dependent communities.

Despite security tensions, coordination to accelerate the clean-power transition offers many mutual benefits. Beyond exchanging technology and knowhow, China and the US could jointly commit to rapid decarbonization with common but differentiated responsibilities, setting a US goal of 80% clean electricity by 2030, with China following suit by 2035.

By pursuing common interests and opportunities, the US and China can lead the world in decarbonizing their grids. Their leaders must not let their current political disagreements get in the way.

Jiang Lin is an Adjunct Professor at the Department of Agricultural and Resources Economics at the University of California at Berkeley. Michael O’Boyle is Director of Electricity Policy at Energy Innovation.

Copyright: Project Syndicate, 2022.

www.project-syndicate.org

Matthias Weiß has taken over the position of Managing Director China at Wessel-Werk. The medium-sized company from North Rhine-Westphalia specializes in vacuum cleaner nozzles and accessories. Weiß has been working in China since 2010. Most recently, he worked as Operations Manager (COO) at GSS Manufacturing in Shanghai.

Florian Huber has been responsible for Parts & Supply Chain Quality at Daimler Greater China since August. Huber has been in China since July 2021. Most recently, he worked for Daimler as an Expert for Procurement Processes and Methods in Beijing.

Is something changing in your organization? Why not let us know at heads@table.media!

Fire alarm in the Forbidden City – but only a drill. Under a bright blue sky, the Beijing fire department deploys for an operational drill in the palace complex.